Mohammed Abdulwadud Soubra / 个人资料

- 信息

|

8+ 年

经验

|

7

产品

|

1086

演示版

|

|

134

工作

|

1

信号

|

1

订阅者

|

我从2005年开始涉足外汇交易。

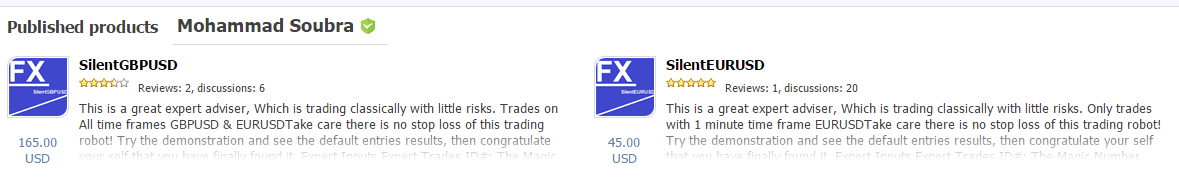

查看此产品:

https://www.mql5.com/en/users/soubra2003/seller

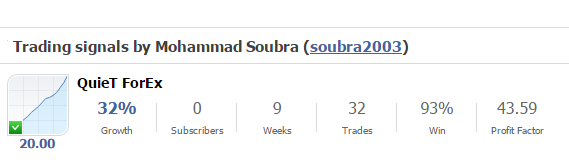

有关US30和美国股票的有希望的交易信号:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

如需即时支持,请加入此WhatsApp群组:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

查看此产品:

https://www.mql5.com/en/users/soubra2003/seller

有关US30和美国股票的有希望的交易信号:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

如需即时支持,请加入此WhatsApp群组:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Mohammed Abdulwadud Soubra

no one can completely expect the future in the Forex !!

https://www.mql5.com/en/signals/180865

I am optimistic of the Bullish of GBPUSD today

https://www.mql5.com/en/signals/180865

I am optimistic of the Bullish of GBPUSD today

Mohammed Abdulwadud Soubra

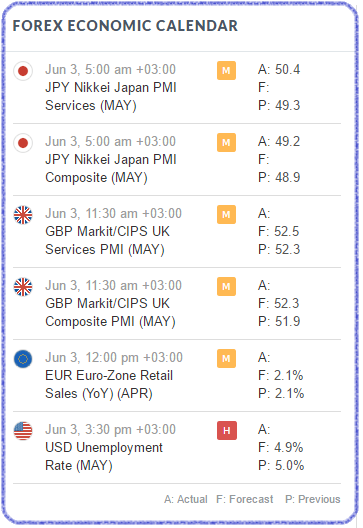

NEWS

Thursday, Jun 2, 2016 3:01 pm +03:00

EUR/USD Little Changed as ECB Opts For Status Quo as Expected

The Euro was little changed versus other majors after the ECB kept policy unchanged, in line with expectations, with focus now on Draghi

Continue Reading

Thursday, Jun 2, 2016 12:59 pm +03:00

USD/CAD Short Term Levels Ahead of OPEC, Crude Oil Inventories

Thursday, Jun 2, 2016 10:59 am +03:00

ECB Rate Decision May Matter More for Sentiment vs. the Euro

Wednesday, Jun 1, 2016 8:56 pm +03:00

EUR/JPY Technical Analysis: Descending Wedge on Daily

Thursday, Jun 2, 2016 3:01 pm +03:00

EUR/USD Little Changed as ECB Opts For Status Quo as Expected

The Euro was little changed versus other majors after the ECB kept policy unchanged, in line with expectations, with focus now on Draghi

Continue Reading

Thursday, Jun 2, 2016 12:59 pm +03:00

USD/CAD Short Term Levels Ahead of OPEC, Crude Oil Inventories

Thursday, Jun 2, 2016 10:59 am +03:00

ECB Rate Decision May Matter More for Sentiment vs. the Euro

Wednesday, Jun 1, 2016 8:56 pm +03:00

EUR/JPY Technical Analysis: Descending Wedge on Daily

Mohammed Abdulwadud Soubra

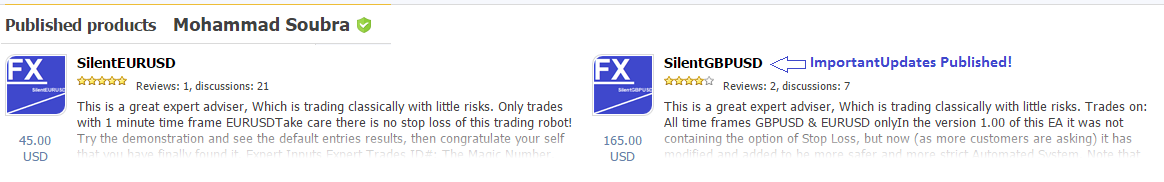

Finally, The version 2.0 has been accepted/published

Version 2.0 - 2016.06.02

Some new features added:

- Stop Loss: Stop Loss in pips. the value of 0 will trade with no stop loss.

- Trailing Stop: The update of Stop Loss in pips. It will be updated when the value of Trailing Start has reached.

- Trailing Step: The Trailing Step is used in conjunction with the Trailing Stop.

- Additional Intervention Options.

- Max. Allowed Spread: This value will not allow the EA to trade when the floated current spread exceeds the predefined value.

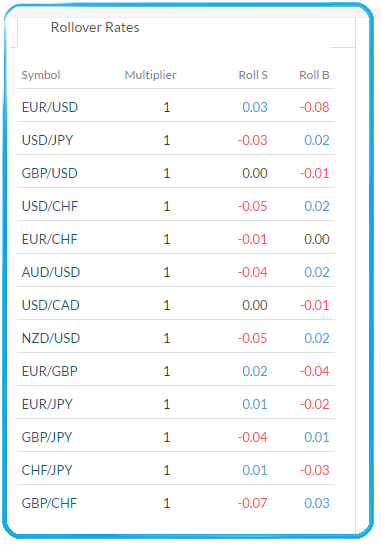

- New Comments on the chart: Current Spread, Buy Swap & Sell Swap.

- Improved Description of Errors (In case of errors).

https://www.mql5.com/en/market/product/16143

Version 2.0 - 2016.06.02

Some new features added:

- Stop Loss: Stop Loss in pips. the value of 0 will trade with no stop loss.

- Trailing Stop: The update of Stop Loss in pips. It will be updated when the value of Trailing Start has reached.

- Trailing Step: The Trailing Step is used in conjunction with the Trailing Stop.

- Additional Intervention Options.

- Max. Allowed Spread: This value will not allow the EA to trade when the floated current spread exceeds the predefined value.

- New Comments on the chart: Current Spread, Buy Swap & Sell Swap.

- Improved Description of Errors (In case of errors).

https://www.mql5.com/en/market/product/16143

分享社交网络 · 1

Mohammed Abdulwadud Soubra

NEWS

Wednesday, Jun 1, 2016 8:56 pm +03:00

EUR/JPY Technical Analysis: Descending Wedge on Daily

EUR/JPY has run up against stubborn support now for the better part of three months, building in a descending wedge formation on the daily c...Continue Reading

Wednesday, Jun 1, 2016 8:25 pm +03:00

USD/CHF Technical Analysis: Range Breaks into Megaphone Pattern

Wednesday, Jun 1, 2016 7:00 pm +03:00

GBP/USD Downward Momentum is Maintained

Wednesday, Jun 1, 2016 9:22 am +03:00

Swiss Franc Slightly Lower as 1Q GDP Data Misses Expectations

Wednesday, Jun 1, 2016 8:56 pm +03:00

EUR/JPY Technical Analysis: Descending Wedge on Daily

EUR/JPY has run up against stubborn support now for the better part of three months, building in a descending wedge formation on the daily c...Continue Reading

Wednesday, Jun 1, 2016 8:25 pm +03:00

USD/CHF Technical Analysis: Range Breaks into Megaphone Pattern

Wednesday, Jun 1, 2016 7:00 pm +03:00

GBP/USD Downward Momentum is Maintained

Wednesday, Jun 1, 2016 9:22 am +03:00

Swiss Franc Slightly Lower as 1Q GDP Data Misses Expectations

Mohammed Abdulwadud Soubra

分享社交网络 · 2

Paolo Ronchetti

2016.06.01

I am making profit with your robot on the demo account I will soon go on the real... compliments

Mohammed Abdulwadud Soubra

Latest News

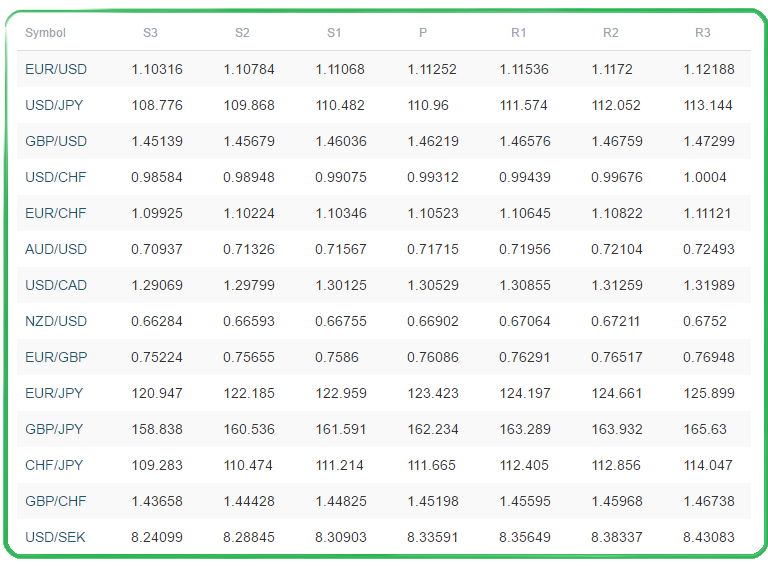

Chinese shares are soaring this morning, with the Shanghai composite currently up over 2%, on rumoured intervention, helping to boost risk-on sentiment. The Yen initially strengthened to 110.80 vs the USD, though has pared gains since then and is currently trading around 111.20, following better than expected macro data which included industrial production and household spending figures. Though year-on-year household spending continues to contract, its seventh decline in the last eight months, the 0.4% decline was better than the market’s expectation of -1.3%. The Aussie meanwhile rose during the Asian session by 0.85% against the USD, after data showed that net exports grew to 0.8% during the last quarter which in turn is raising analysts’ expectations of Q1 GDP which is due to be released on Wednesday. Lastly, oil is trading relatively unchanged this morning, with WTI barely under $50 while Brent is just above the $50 handle, as investors await the OPEC meeting on Thursday. Expectations are currently low for any sort of agreement on a production cut or even production freeze.

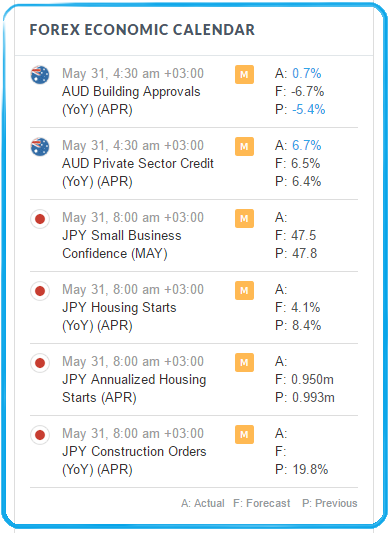

The economic calendar begins to pick up today after both the UK and the US come back online from their bank holidays. Germany is scheduled to publish retail sales and employment figures this morning. The Eurozone will post inflation data which is expected to show the headline figure continue to sit in deflation territory on a year-on-year basis – marking its fourth consecutive month of contracting prices. Core inflation is meanwhile expected to have risen to 0.8% versus 0.7%. The spotlight during the North American session will be when the US releases its PCE Price Index, the FED’s favorite measure of inflation. The core index is forecasted to have risen to 0.2% from 0.1%, while personal spending is anticipated to have jumped to 0.7% from 0.1%. GDP figures out of Canada is projected to have shrunk 0.1% month-on-month, marking their second consecutive decline. Lastly, consumer confidence in the US are estimated to have risen to 96.1 from 94.2 according to the CB’s latest data. Also of note, during the Asian session we will see China publish both its official and Caixin manufacturing/services reports. Both figures are expected to show that activity in the manufacturing sector continues to shrink for the world's second largest economy.

Chinese shares are soaring this morning, with the Shanghai composite currently up over 2%, on rumoured intervention, helping to boost risk-on sentiment. The Yen initially strengthened to 110.80 vs the USD, though has pared gains since then and is currently trading around 111.20, following better than expected macro data which included industrial production and household spending figures. Though year-on-year household spending continues to contract, its seventh decline in the last eight months, the 0.4% decline was better than the market’s expectation of -1.3%. The Aussie meanwhile rose during the Asian session by 0.85% against the USD, after data showed that net exports grew to 0.8% during the last quarter which in turn is raising analysts’ expectations of Q1 GDP which is due to be released on Wednesday. Lastly, oil is trading relatively unchanged this morning, with WTI barely under $50 while Brent is just above the $50 handle, as investors await the OPEC meeting on Thursday. Expectations are currently low for any sort of agreement on a production cut or even production freeze.

The economic calendar begins to pick up today after both the UK and the US come back online from their bank holidays. Germany is scheduled to publish retail sales and employment figures this morning. The Eurozone will post inflation data which is expected to show the headline figure continue to sit in deflation territory on a year-on-year basis – marking its fourth consecutive month of contracting prices. Core inflation is meanwhile expected to have risen to 0.8% versus 0.7%. The spotlight during the North American session will be when the US releases its PCE Price Index, the FED’s favorite measure of inflation. The core index is forecasted to have risen to 0.2% from 0.1%, while personal spending is anticipated to have jumped to 0.7% from 0.1%. GDP figures out of Canada is projected to have shrunk 0.1% month-on-month, marking their second consecutive decline. Lastly, consumer confidence in the US are estimated to have risen to 96.1 from 94.2 according to the CB’s latest data. Also of note, during the Asian session we will see China publish both its official and Caixin manufacturing/services reports. Both figures are expected to show that activity in the manufacturing sector continues to shrink for the world's second largest economy.

分享社交网络 · 1

Mohammed Abdulwadud Soubra

NEWS

Tuesday, May 31, 2016 3:41 am +03:00

USD/JPY Tempts Break, Liquidity Returns with EUR/USD at 200DMA

Holiday trading conditions kept most of the key technical boundaries - like the EUR/USD 200-day moving average as support - in place.

Tuesday, May 31, 2016 2:35 am +03:00

Video: Keeping Track of Deeper Fundamental Currents for the Euro

Monday, May 30, 2016 5:11 pm +03:00

Elliott Wave Patterns: What is a Zigzag?

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

Tuesday, May 31, 2016 3:41 am +03:00

USD/JPY Tempts Break, Liquidity Returns with EUR/USD at 200DMA

Holiday trading conditions kept most of the key technical boundaries - like the EUR/USD 200-day moving average as support - in place.

Tuesday, May 31, 2016 2:35 am +03:00

Video: Keeping Track of Deeper Fundamental Currents for the Euro

Monday, May 30, 2016 5:11 pm +03:00

Elliott Wave Patterns: What is a Zigzag?

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

分享社交网络 · 2

: