Young Ho Seo / 个人资料

- 信息

|

10+ 年

经验

|

62

产品

|

1170

演示版

|

|

4

工作

|

0

信号

|

0

订阅者

|

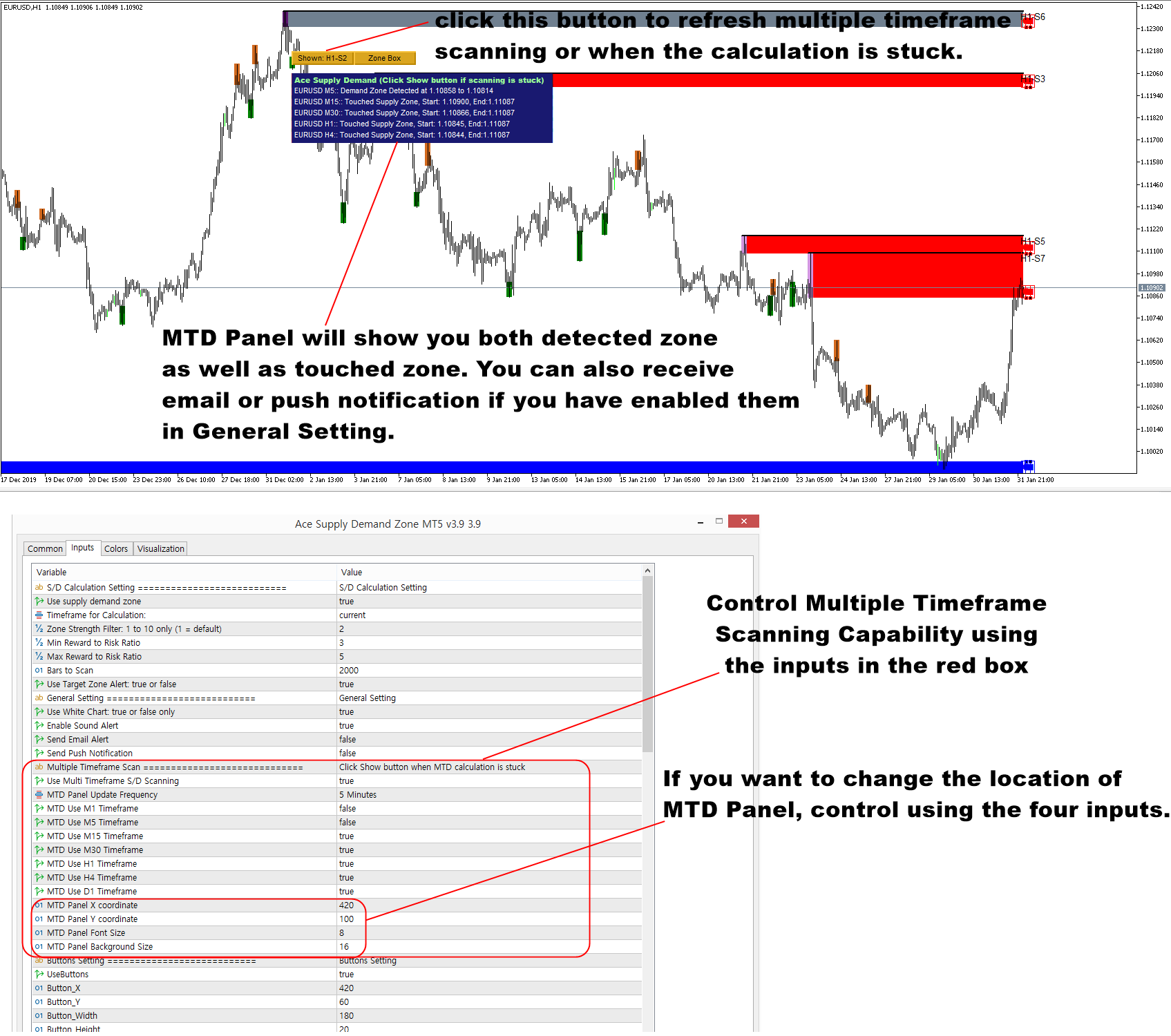

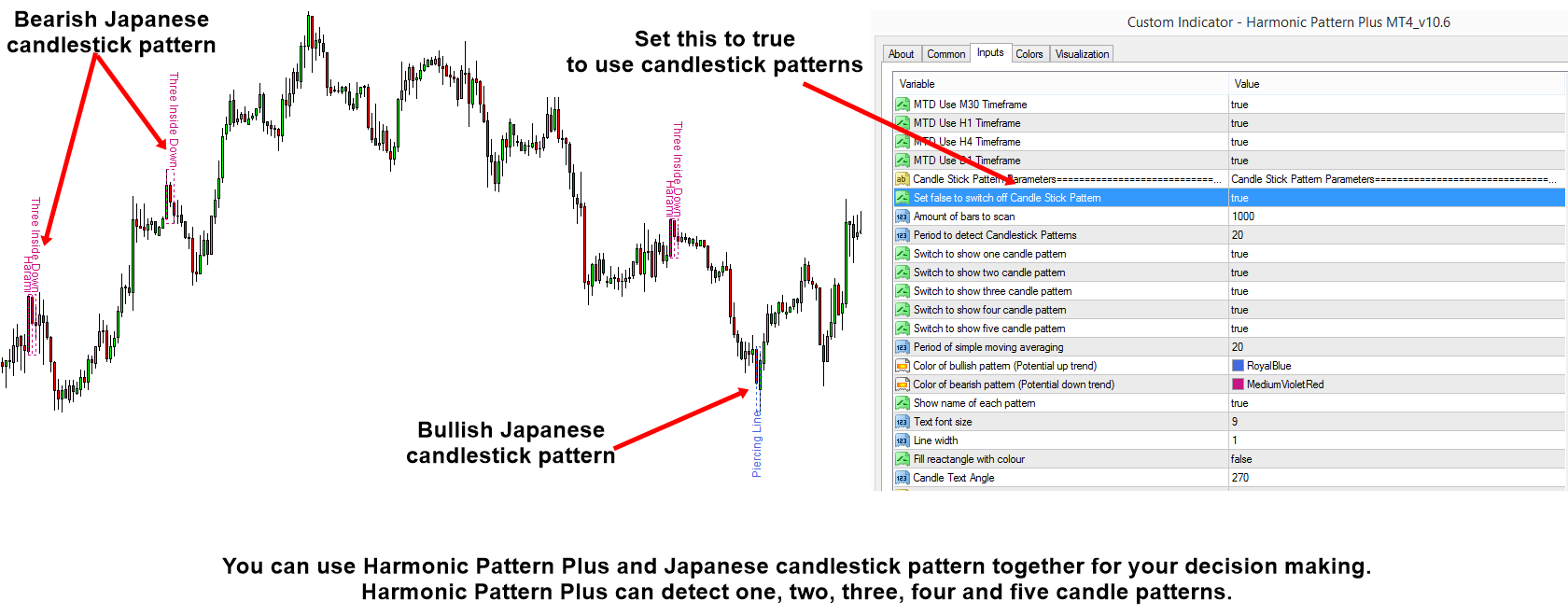

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

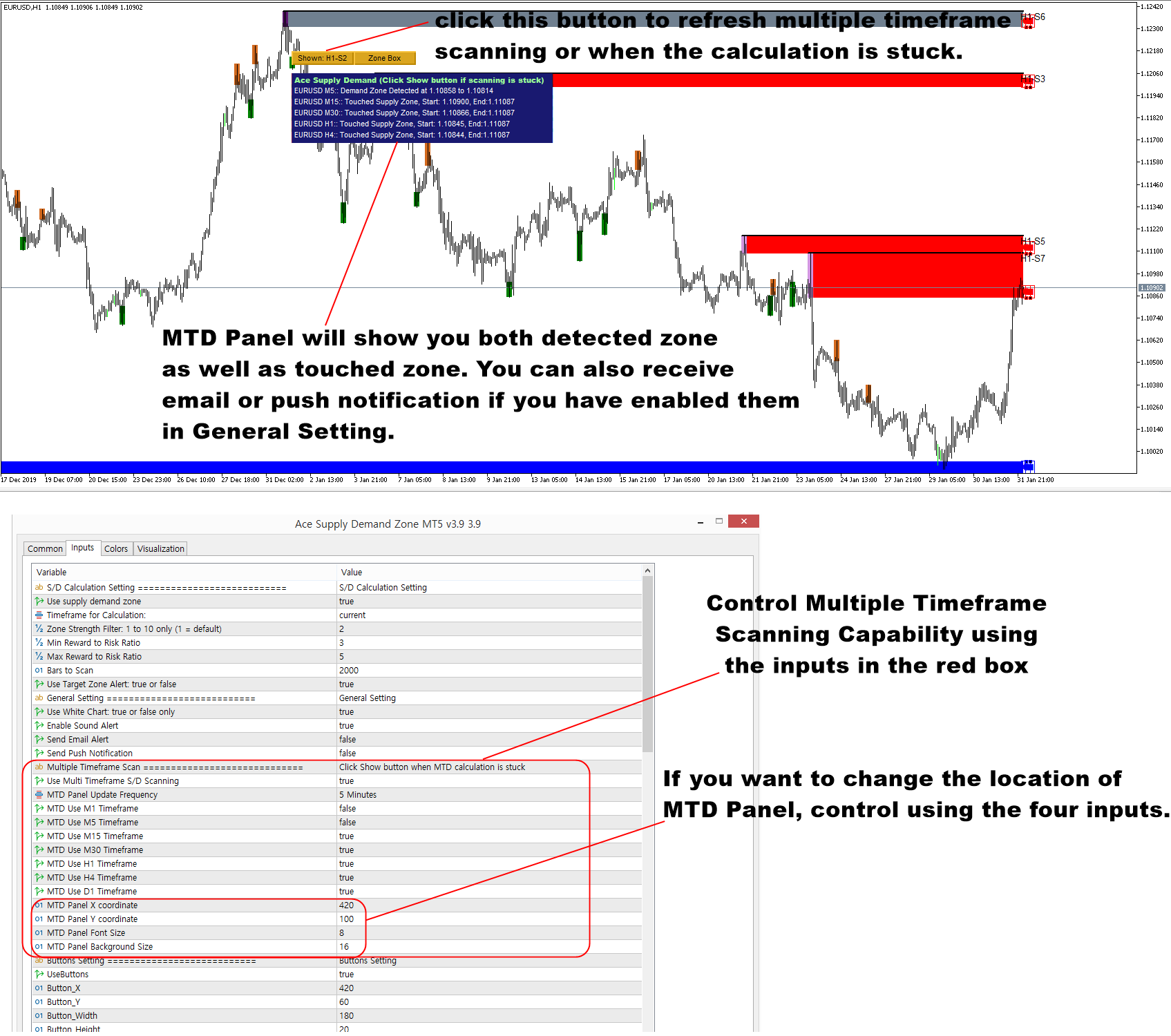

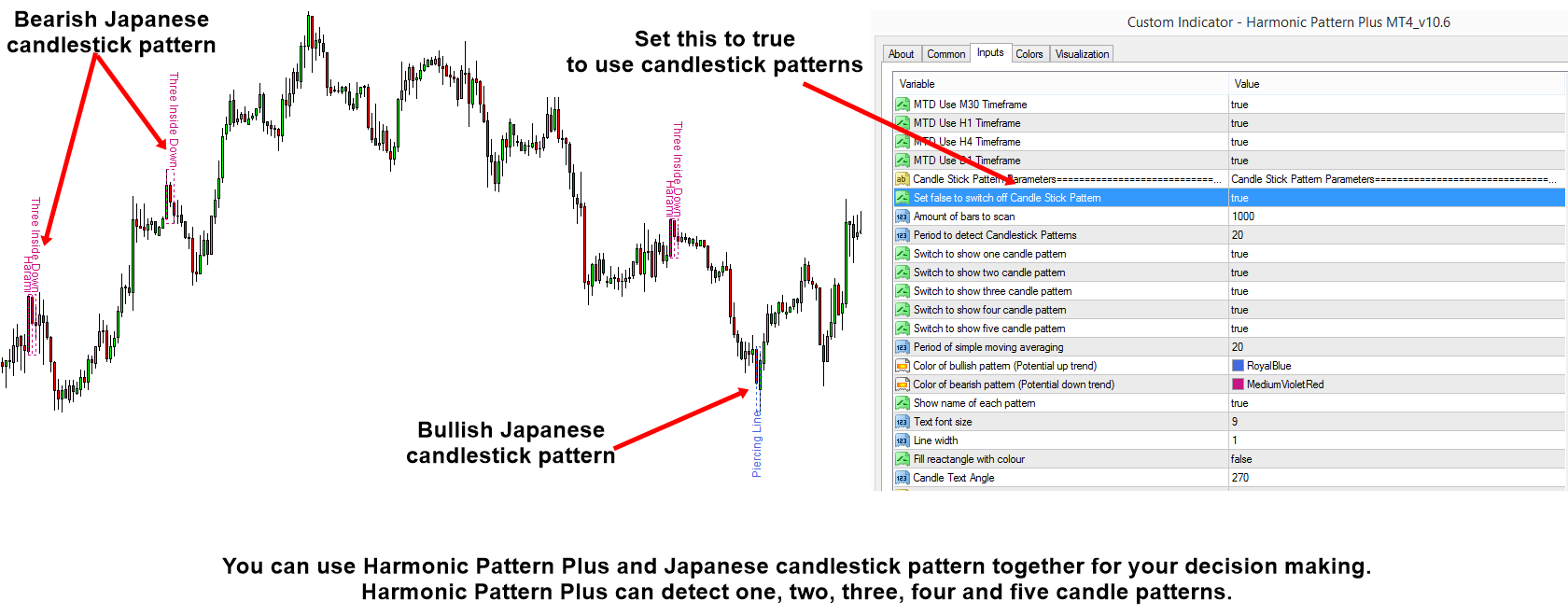

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

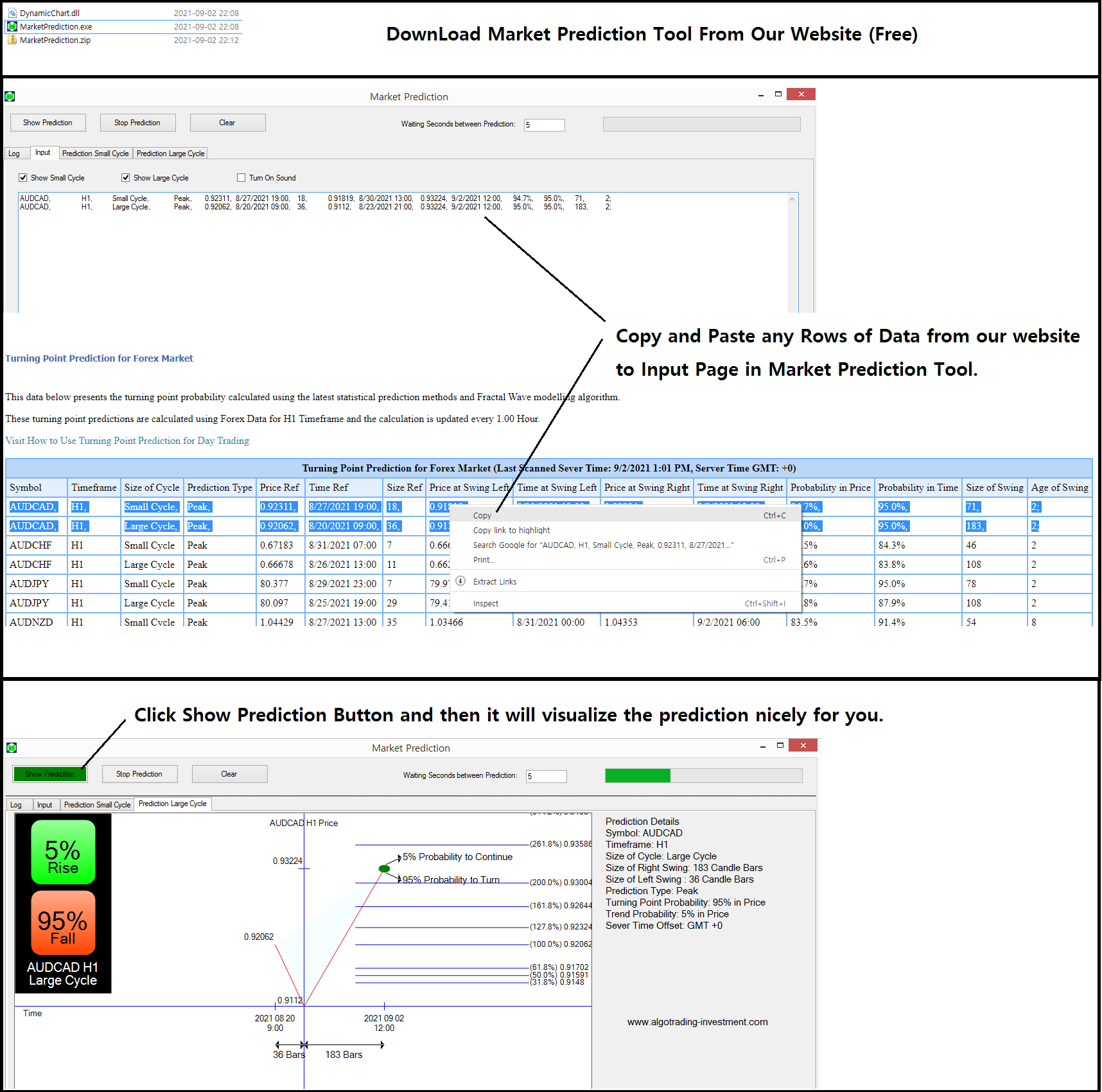

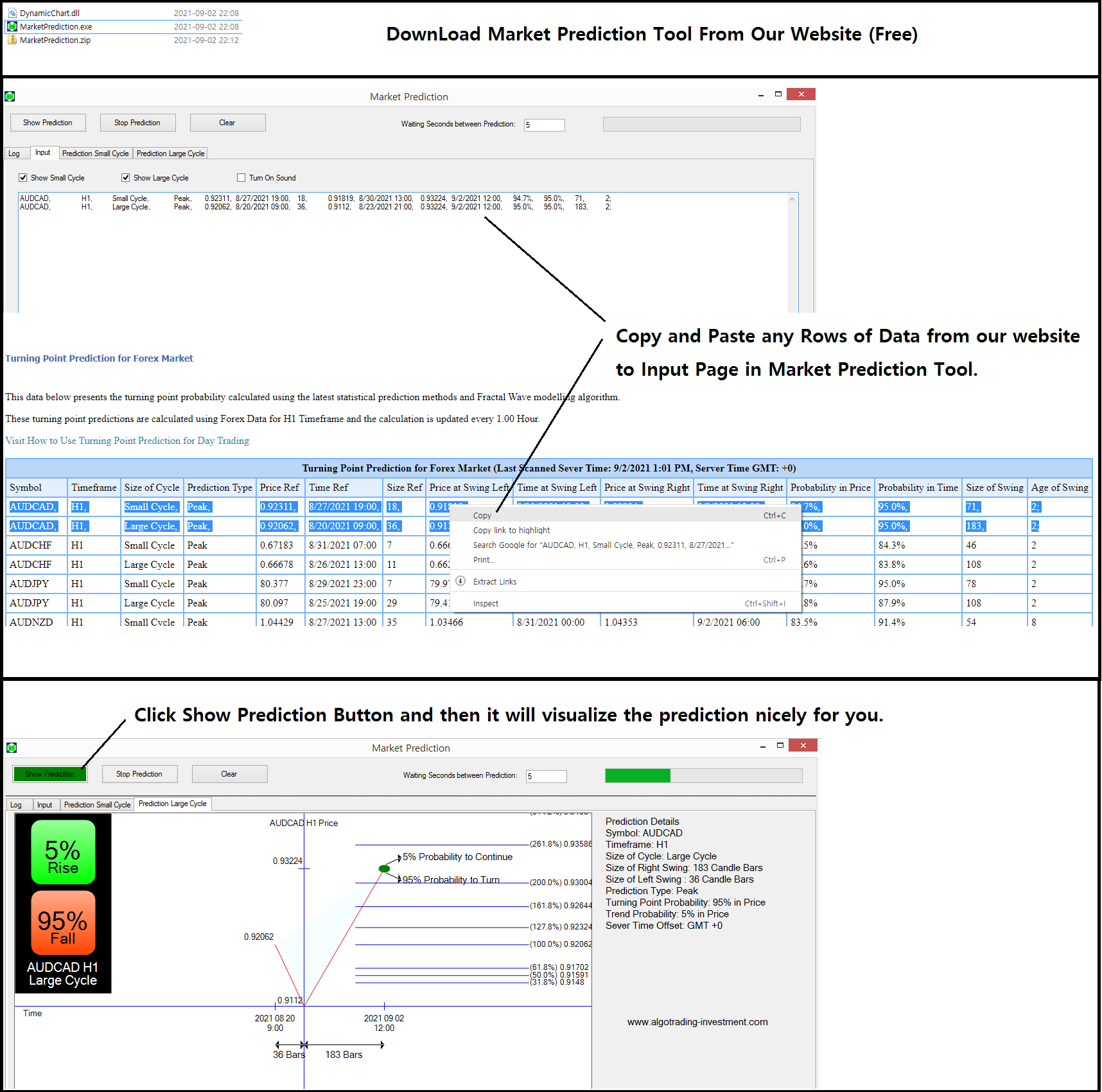

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

How to Identify the Best Buy and Sell Timing

Trading is practical. We trade to make the profits from our trading. Hence, if you are a trader, the most important question to ask is “How do you make profits by trading?”. Say that you and your friend bought the same stock. However, your result can be completely different from your friend. Even if both of you bought the same stock, you could still lose money whereas your friend made money. What makes the difference between you and your friend? It is the entry timing. In another words, the most important factor behind the successful trading is to know the best entry in our trading. This timing question is something that every trader should and must ask. In fact, we can formulate the answer to this question from the market cycle point of view. The simple answer is that this image can visualize such a winning opportunity.

Figure 5-1: Conceptual drawing to demonstrate best buy entry

Say that EURUSD or Bitcoin have the large cycle and small cycle. Your best buy opportunity will be in the area where both small and large cycles are boosted together shown as the dotted line in the image. That is the thin intersection where both short term trader and long term trader are jumping in together. However, this is where most of average traders are stop thinking beyond. There is one problem in this image although its concept is perfectly sound. The problem is that the market does not have the regular cycle, which we can track its peak and trough with fixed time interval as in the sine curve of the Physics text book. Hence, this image is only educational to conceptualize the best buy entry. If it was like that, the money making in Forex or Stock market would have been so much easier buying EURUSD on Monday low and selling at Friday high something like this or similar. In fact, what makes us hard is that the market cycle is not regular but it is stochastic.

Figure 5-2: Market cycle in EURUSD D1 timeframe

Market cycle is irregular. Sometimes, price moves in slow cycle and sometimes price moves in fast cycle. Sometimes price swings around big amplitude and sometimes price swings around only small amplitude. It is the observations we can make every day in Forex and Stock market, the fuzzy and dirty cycles instead of the clean sine curve. Hence, any technical analysis that does not consider this uneven and rough surface of the market is not effective to predict the market.

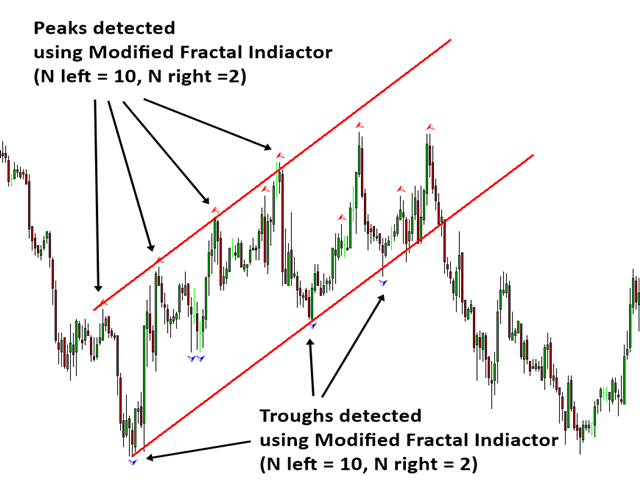

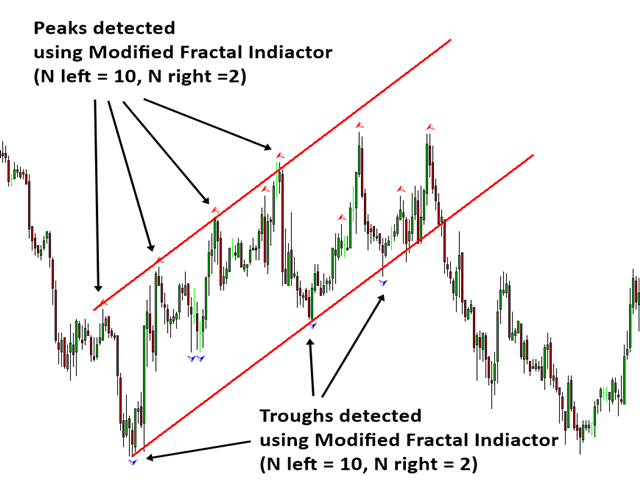

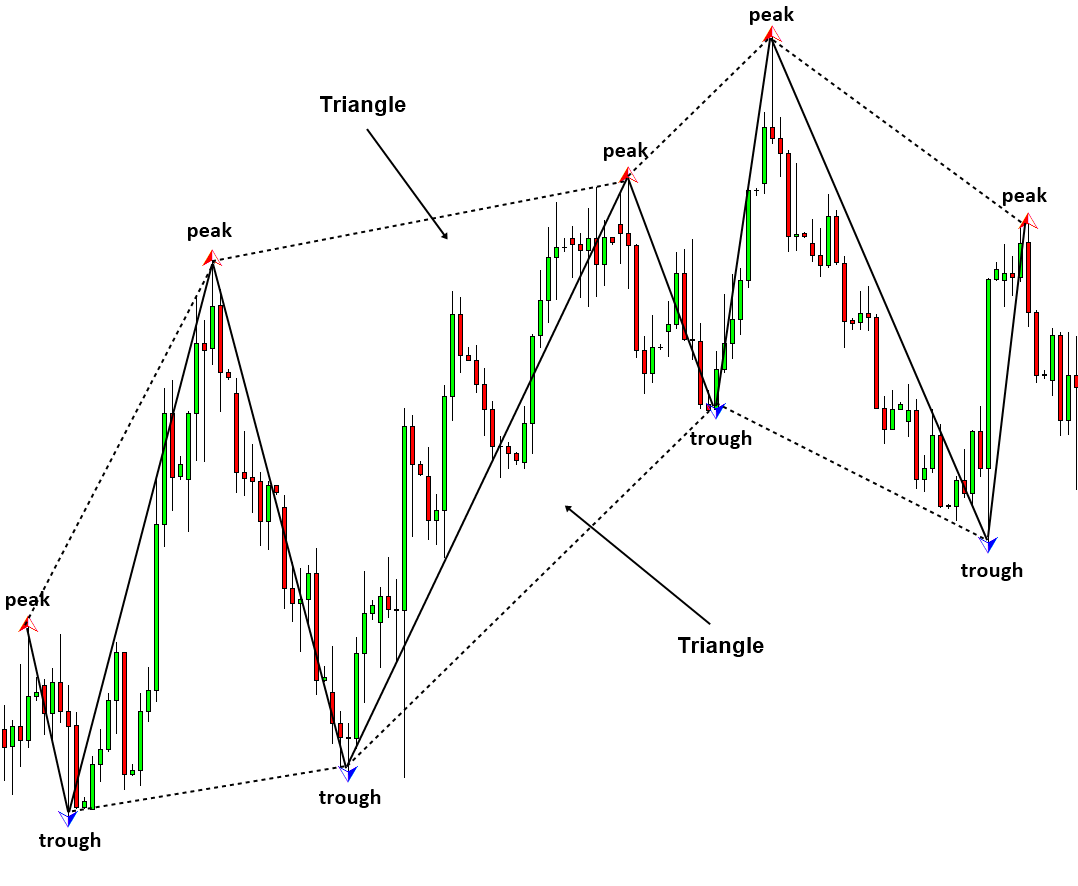

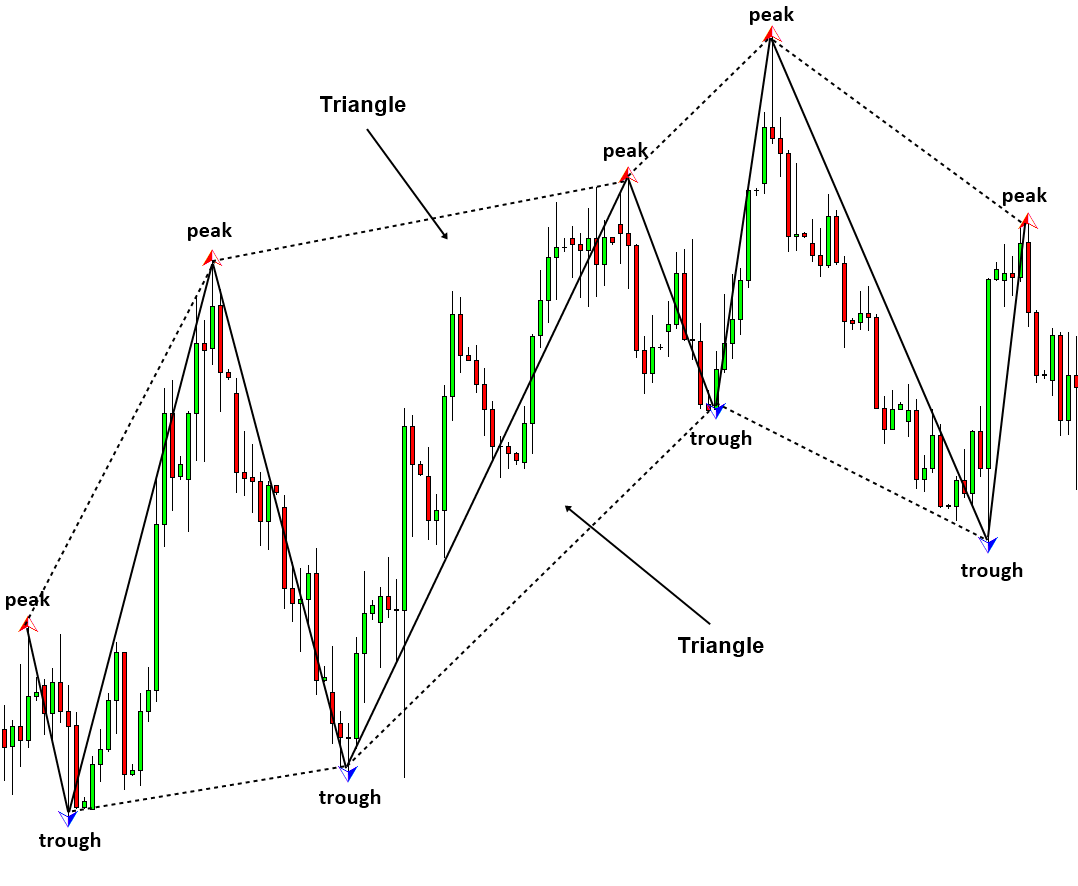

Figure 5-3: Fractal cycle demonstration

The good news is that understanding the fractal wave can help us to predict the market tremendously. It is because fractal wave is the tool that is theoretically designed to work with price data with many uneven cycles. Unlike the fractal wave, many other tools will suffer more with more number of uneven cycles in the price data, for example, like the normal distribution and other cyclic methods designed to operate with regular cycles. Hence, fractal wave is the best tool to predict the fuzzy and dirty cycles in Forex and Stock market. Theoretically, it is one of the best tool to model stochastic cycles in the Forex and Stock market too. The peak trough analysis is the important first step as it visualizes the fuzzy and dirty cycles in the readable form for us. Therefore, the technical analysis making good use of this peak trough analysis is the important tool to predict the market.

Now going back to the entry timing question, how can we catch the moment where the small and large cycles are boosted together using the technical analysis? Although the technical analysis is the good tool to predict the stochastic cycle, it still does not imply that they are designed to capture the multiple cycles. In fact, the answer is pretty straightforward. Catching the timing where the small and large cycles are boosted together can be done by combining two or more techniques to gauge your entry instead of just using one single technique. Combining two or more technical analysis is a good trading strategy as in practice we might need to capture the intersection for more than two cycles. Technically speaking, when you use multiple techniques, you have a high chance to capture the best entry.

In addition, using two or more chart timeframe could add some value to improve your trading performance too. Good mixture of the technical analysis and the chart timeframe will yield the fruitful results. Hence, if you want to become a successful trader, then training and practice are a must requirement. Here is one final note. As the market consists of the probabilistic cycles, your outcome is not going to be bullet proof. Therefore, you should trade with the high probability setup. You need to understand that trading is about quality and not about quantity. In addition, identifying the best sell entry is exactly the same as identifying the best buy entry. We just need to look for the intersection where both small and large cycles are falling together using the two or more technical analysis.

About this Article

This article is the part taken from the draft version of the Book: Technical Analysis in Forex and Stock Market (Supply and Demand Analysis). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

You can also use Ace Supply Demand Zone Indicator in MetaTrader to accomplish your technical analysis. Ace Supply Demand Zone indicator is non repainting and non lagging supply demand zone indicator with a lot of powerful features built on.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Trading is practical. We trade to make the profits from our trading. Hence, if you are a trader, the most important question to ask is “How do you make profits by trading?”. Say that you and your friend bought the same stock. However, your result can be completely different from your friend. Even if both of you bought the same stock, you could still lose money whereas your friend made money. What makes the difference between you and your friend? It is the entry timing. In another words, the most important factor behind the successful trading is to know the best entry in our trading. This timing question is something that every trader should and must ask. In fact, we can formulate the answer to this question from the market cycle point of view. The simple answer is that this image can visualize such a winning opportunity.

Figure 5-1: Conceptual drawing to demonstrate best buy entry

Say that EURUSD or Bitcoin have the large cycle and small cycle. Your best buy opportunity will be in the area where both small and large cycles are boosted together shown as the dotted line in the image. That is the thin intersection where both short term trader and long term trader are jumping in together. However, this is where most of average traders are stop thinking beyond. There is one problem in this image although its concept is perfectly sound. The problem is that the market does not have the regular cycle, which we can track its peak and trough with fixed time interval as in the sine curve of the Physics text book. Hence, this image is only educational to conceptualize the best buy entry. If it was like that, the money making in Forex or Stock market would have been so much easier buying EURUSD on Monday low and selling at Friday high something like this or similar. In fact, what makes us hard is that the market cycle is not regular but it is stochastic.

Figure 5-2: Market cycle in EURUSD D1 timeframe

Market cycle is irregular. Sometimes, price moves in slow cycle and sometimes price moves in fast cycle. Sometimes price swings around big amplitude and sometimes price swings around only small amplitude. It is the observations we can make every day in Forex and Stock market, the fuzzy and dirty cycles instead of the clean sine curve. Hence, any technical analysis that does not consider this uneven and rough surface of the market is not effective to predict the market.

Figure 5-3: Fractal cycle demonstration

The good news is that understanding the fractal wave can help us to predict the market tremendously. It is because fractal wave is the tool that is theoretically designed to work with price data with many uneven cycles. Unlike the fractal wave, many other tools will suffer more with more number of uneven cycles in the price data, for example, like the normal distribution and other cyclic methods designed to operate with regular cycles. Hence, fractal wave is the best tool to predict the fuzzy and dirty cycles in Forex and Stock market. Theoretically, it is one of the best tool to model stochastic cycles in the Forex and Stock market too. The peak trough analysis is the important first step as it visualizes the fuzzy and dirty cycles in the readable form for us. Therefore, the technical analysis making good use of this peak trough analysis is the important tool to predict the market.

Now going back to the entry timing question, how can we catch the moment where the small and large cycles are boosted together using the technical analysis? Although the technical analysis is the good tool to predict the stochastic cycle, it still does not imply that they are designed to capture the multiple cycles. In fact, the answer is pretty straightforward. Catching the timing where the small and large cycles are boosted together can be done by combining two or more techniques to gauge your entry instead of just using one single technique. Combining two or more technical analysis is a good trading strategy as in practice we might need to capture the intersection for more than two cycles. Technically speaking, when you use multiple techniques, you have a high chance to capture the best entry.

In addition, using two or more chart timeframe could add some value to improve your trading performance too. Good mixture of the technical analysis and the chart timeframe will yield the fruitful results. Hence, if you want to become a successful trader, then training and practice are a must requirement. Here is one final note. As the market consists of the probabilistic cycles, your outcome is not going to be bullet proof. Therefore, you should trade with the high probability setup. You need to understand that trading is about quality and not about quantity. In addition, identifying the best sell entry is exactly the same as identifying the best buy entry. We just need to look for the intersection where both small and large cycles are falling together using the two or more technical analysis.

About this Article

This article is the part taken from the draft version of the Book: Technical Analysis in Forex and Stock Market (Supply and Demand Analysis). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

You can also use Ace Supply Demand Zone Indicator in MetaTrader to accomplish your technical analysis. Ace Supply Demand Zone indicator is non repainting and non lagging supply demand zone indicator with a lot of powerful features built on.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

Powerful Non Repainting Supply Demand Zone MetaTrader Indicator

Ace Supply Demand Zone is specially designed non-repainting Supply Demand indicator. Since you have an access to fresh supply and demand zone as well as archived supply demand zone, you can achieve much better profiling on price movement in Forex market.

With the Ability to trade the original supply demand zone trading, you can also perform highly accurate Angled Supply Demand zone trading as a bonus. With a lot of sophisticated gadgets built inside, Ace Supply Demand Zone indicator will provide you unmatched performance against other Supply Demand zone indicator out there.

Here is the link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to accomplish the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Ace Supply Demand Zone is specially designed non-repainting Supply Demand indicator. Since you have an access to fresh supply and demand zone as well as archived supply demand zone, you can achieve much better profiling on price movement in Forex market.

With the Ability to trade the original supply demand zone trading, you can also perform highly accurate Angled Supply Demand zone trading as a bonus. With a lot of sophisticated gadgets built inside, Ace Supply Demand Zone indicator will provide you unmatched performance against other Supply Demand zone indicator out there.

Here is the link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to accomplish the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Young Ho Seo

Introduction to Harmonic Pattern Scenario Planner

The present state of Forex market can go through many different possible price paths to reach its future destination. Future is dynamic. Therefore, planning your trade with possible future scenario is an important step for your success. To meet such a powerful concept, we introduce the Harmonic Pattern Scenario Planner, the first predictive Harmonic Pattern Tool in the world among its kind.

Main Features

Predicting future patterns for scenario analysis

11 Harmonic Pattern Detection

Automatic stop loss and take profit recognition for superb risk management

Pattern Completion Interval for precision trading

Potential Continuation Zone Detection for future price prediction

Potential Reversal Zone Detection for Point D identification

Automatic Channel Detection to go with Harmonic Pattern (Optional)

Multiple timeframe Pattern Analysis

Multiple timeframe Pattern Detection

Guided Trading Instruction for professional traders

Pattern Locking and Unlocking feature in your chart

Even more, please find it out.

Scenario Simulation for Future Harmonic Pattern

There are powerful simulation techniques known to generate possible future price patterns like Monte Carlos Simulation, Brownian motion simulation, etc. To do so, we need to understand the price behavior including distribution and its randomness. Then we repeat the simulation as many times as possible to identify various future price path. Some future price path may be very important for your trading whereas some other price path may be insignificant. Harmonic Pattern Scenario Planner collects those significant price paths only for your advance trading decision.

How to Use

You can run Harmonic Pattern Scenario Planner like Harmonic Pattern Plus to pick up the turning point. At the same time, you can predict the future patterns for the advanced scenario analysis. The predicted pattern can be used for the earlier decision making for your trading.

Reduce commission and slippage using pending orders in advance

Worst case scenario planning before taking position

Early identification of important support and resistance lines automatically in advance

More accurate prediction of entry and exit timing

How to Trade

Each Harmonic Pattern provides you the potential entry for the turning point. You might apply few other filters to improve your trading. Some of the basic filters you can apply include RSI, CCI, MACD, Bollinger Bands, and Moving Average. More advanced filter can include Price Breakout Pattern Scanner, Mean Reversion Supply Demand, Elliott Wave Trend, and Harmonic Volatility Indicator. Please note that the trading performance can vary for your trading experience and trading skills.

Indicator Input

Here we list part of input setting. For full input setting, visit this webpage:

https://algotrading-investment.com/2018/10/25/short-guideline-for-harmonic-pattern-plus-and-harmonic-pattern-scenario-planner/

Harmonic Pattern Parameters 1 ( User Option ) ===========================

These parameters below concerns operations of Harmonic patterns. You can change button size, timeframe to detect patterns and alerts using these parameters. You can change timeframe of pattern detection. However, you cannot use smaller timeframe pattern detection for higher timeframe. For example, you cannot set Timeframe to detect patterns = H1 timeframe while you are using D1 chart.

Timeframe to detect Patterns

Max number of patterns to display

Pattern Index from which to display

Enable sound alert

Send email if pattern is found

Send notification if pattern is found

Display Fibo retracement (DC Future Price Projection)

Fibo Retracement Length

Fibo Retracement Color for pattern

Fibo Retracment Wdith for pattern

Use white background for chart

Amount of bars to scan for pattern search (1500 = default)

Detect Pattern at Every Tick: true or false only

Pattern Update Frequency (Period)

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

The present state of Forex market can go through many different possible price paths to reach its future destination. Future is dynamic. Therefore, planning your trade with possible future scenario is an important step for your success. To meet such a powerful concept, we introduce the Harmonic Pattern Scenario Planner, the first predictive Harmonic Pattern Tool in the world among its kind.

Main Features

Predicting future patterns for scenario analysis

11 Harmonic Pattern Detection

Automatic stop loss and take profit recognition for superb risk management

Pattern Completion Interval for precision trading

Potential Continuation Zone Detection for future price prediction

Potential Reversal Zone Detection for Point D identification

Automatic Channel Detection to go with Harmonic Pattern (Optional)

Multiple timeframe Pattern Analysis

Multiple timeframe Pattern Detection

Guided Trading Instruction for professional traders

Pattern Locking and Unlocking feature in your chart

Even more, please find it out.

Scenario Simulation for Future Harmonic Pattern

There are powerful simulation techniques known to generate possible future price patterns like Monte Carlos Simulation, Brownian motion simulation, etc. To do so, we need to understand the price behavior including distribution and its randomness. Then we repeat the simulation as many times as possible to identify various future price path. Some future price path may be very important for your trading whereas some other price path may be insignificant. Harmonic Pattern Scenario Planner collects those significant price paths only for your advance trading decision.

How to Use

You can run Harmonic Pattern Scenario Planner like Harmonic Pattern Plus to pick up the turning point. At the same time, you can predict the future patterns for the advanced scenario analysis. The predicted pattern can be used for the earlier decision making for your trading.

Reduce commission and slippage using pending orders in advance

Worst case scenario planning before taking position

Early identification of important support and resistance lines automatically in advance

More accurate prediction of entry and exit timing

How to Trade

Each Harmonic Pattern provides you the potential entry for the turning point. You might apply few other filters to improve your trading. Some of the basic filters you can apply include RSI, CCI, MACD, Bollinger Bands, and Moving Average. More advanced filter can include Price Breakout Pattern Scanner, Mean Reversion Supply Demand, Elliott Wave Trend, and Harmonic Volatility Indicator. Please note that the trading performance can vary for your trading experience and trading skills.

Indicator Input

Here we list part of input setting. For full input setting, visit this webpage:

https://algotrading-investment.com/2018/10/25/short-guideline-for-harmonic-pattern-plus-and-harmonic-pattern-scenario-planner/

Harmonic Pattern Parameters 1 ( User Option ) ===========================

These parameters below concerns operations of Harmonic patterns. You can change button size, timeframe to detect patterns and alerts using these parameters. You can change timeframe of pattern detection. However, you cannot use smaller timeframe pattern detection for higher timeframe. For example, you cannot set Timeframe to detect patterns = H1 timeframe while you are using D1 chart.

Timeframe to detect Patterns

Max number of patterns to display

Pattern Index from which to display

Enable sound alert

Send email if pattern is found

Send notification if pattern is found

Display Fibo retracement (DC Future Price Projection)

Fibo Retracement Length

Fibo Retracement Color for pattern

Fibo Retracment Wdith for pattern

Use white background for chart

Amount of bars to scan for pattern search (1500 = default)

Detect Pattern at Every Tick: true or false only

Pattern Update Frequency (Period)

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Young Ho Seo

Profitable Patterns in Financial Market

Price is the data recorded by financial exchange. The financial exchange distributes this real time price to trader electronically during market hours. Then trader will make buy or sell decision depending on their perception of the latest price. If they feel the price is low, then they will buy the currency or stock. If they feel price is too high, then they will sell the currency or stock. Once thing we need to know is that diversified reactions exists about good buying and selling price. We can have millions of different opinions about 200 dollar stock price for Facebook today. Some people will think that 200 dollar is good price to buy and some people will think the opposite. Some people might be neutral. Next price of Facebook will be determined by trading volume of buy and sell orders. If buy-trading volume is dominating over the sell-trading volume, then price will go up. If sell-trading volume is dominating over the buy-trading volume, then price will go down. You can think that each price recorded is in fact the record of the crowd reaction.

For our analysis, financial exchange also records the series of price in regular time interval like hourly, daily, or weekly, etc. Sometimes they record tick-by-tick data. They electronically store these historical data and distribute them to traders. Then trader uses these historical data to draw chart for further analysis of the price. In modern electronic trading environment, it is very rare to make buy and sell decision without looking at chart. Price series contain complex information. If we want to find out any useful information from price series, then we need to work backwards from price series into whatever information we need to seek. Extracting useful information from price series typically requires some mathematical tools.

Depending on what is our question, we need to apply different tools to exam price series. For example, if you want to know the common statistics for Facebook stock price, then you can calculate the mean, median, and standard deviation of the price series. If you want to find out good cycles to trade, then you need to apply Fourier transformation or some sort, to extract the cycles of Facebook price series. Likewise, if we want to find out profitable patterns, then we need to apply Peak Trough transformation or some sort to the price series. When we apply Peak Trough Transformation, we turn price series into the infinitely repeating triangles, which are called Fractal wave. Typically, Zig Zag indicator and Renko chart are used to turn price series into fractal wave.

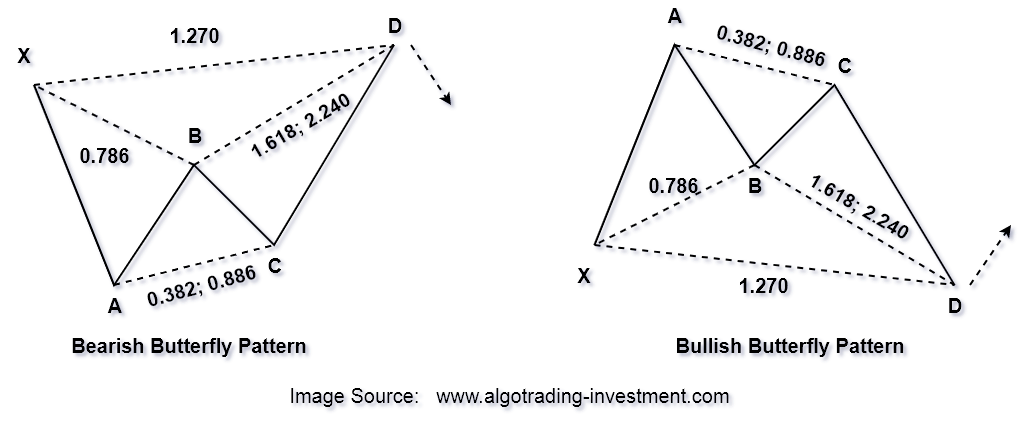

Fractal or Fractal wave is commonly observable in nature like snowflake, in tree leaves, in heartbeat rate, in coastal line. Hence, many traders believe that the identifying profitable patterns in price series are the same as spotting natural order. By definition, Fractal wave is infinitely repeating self-similar patterns in time domain. The main regularity in Fractal wave is the shape of the pattern. Typically, this shape of pattern is referenced for some geometric shapes like triangle, circle, square, etc. In Fractal wave, we can have both strict self-similar and loose self-similar patterns. If the repeating patterns have the same geometric shape and all individual patterns have matching parameters in that shape, we call this as strict self-similarity. If repeating patterns have the same geometric shape but majority of individual patterns have non-matching parameters in that shape, then we call this as loose self-similarity. Fractal wave in Forex and Stock market price series have triangle as the geometric shape. However, individual triangle can be wider, narrower, longer, and shorter than other triangles. Hence, Fractal Wave in Forex and Stock market data possess the loose self–similarity. Loose self-similarity does not mean that all the triangles are non-identical in shape. Even in loose self-similarity, we can have some triangles in identical shape or at least within allowed range in precision.

First important characteristic of fractal wave is the infinite scales. In theory, repeating triangles in forex and stock market can have infinite variation of scales from very small to extremely large triangles. For example, one day we can observe one triangle formed in thirty seconds but another triangle can be formed in thirty days. In our pattern study, scale is an independent factor from geometric shape. As long as triangles are identical in shape, or within allowed range in precision, triangle formed in thirty seconds is treated as identical to the triangle formed in thirty days, regardless of their size. For some practical example, Fibonacci price pattern with 61.8% retracement formed in twenty-candle bar in hourly timeframe is an identical pattern to the other 61.8% retracement pattern formed in thirty six candle bar in daily timeframe.

Second important characteristic about Fractal wave pattern is that many small pattern are jagged together to make bigger patterns. For example, in triangular fractal wave as in financial market, bigger triangle will be made from many small triangles. In our pattern study, we often seek this sort of jagged patterns for our trading opportunity. Especially, in Harmonic pattern, Elliott Wave patterns, and X3 patterns, this sort of jagged pattern are commonly utilized to find the profitable patterns with good success rate.

About this Article

This article is the part taken from the draft version of the Book: Profitable Chart Patterns in Forex and Stock Market: Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern. Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

You can also use Ace Supply Demand Zone Indicator in MetaTrader to accomplish your technical analysis. Ace Supply Demand Zone indicator is non repainting and non lagging supply demand zone indicator with a lot of powerful features built on.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Price is the data recorded by financial exchange. The financial exchange distributes this real time price to trader electronically during market hours. Then trader will make buy or sell decision depending on their perception of the latest price. If they feel the price is low, then they will buy the currency or stock. If they feel price is too high, then they will sell the currency or stock. Once thing we need to know is that diversified reactions exists about good buying and selling price. We can have millions of different opinions about 200 dollar stock price for Facebook today. Some people will think that 200 dollar is good price to buy and some people will think the opposite. Some people might be neutral. Next price of Facebook will be determined by trading volume of buy and sell orders. If buy-trading volume is dominating over the sell-trading volume, then price will go up. If sell-trading volume is dominating over the buy-trading volume, then price will go down. You can think that each price recorded is in fact the record of the crowd reaction.

For our analysis, financial exchange also records the series of price in regular time interval like hourly, daily, or weekly, etc. Sometimes they record tick-by-tick data. They electronically store these historical data and distribute them to traders. Then trader uses these historical data to draw chart for further analysis of the price. In modern electronic trading environment, it is very rare to make buy and sell decision without looking at chart. Price series contain complex information. If we want to find out any useful information from price series, then we need to work backwards from price series into whatever information we need to seek. Extracting useful information from price series typically requires some mathematical tools.

Depending on what is our question, we need to apply different tools to exam price series. For example, if you want to know the common statistics for Facebook stock price, then you can calculate the mean, median, and standard deviation of the price series. If you want to find out good cycles to trade, then you need to apply Fourier transformation or some sort, to extract the cycles of Facebook price series. Likewise, if we want to find out profitable patterns, then we need to apply Peak Trough transformation or some sort to the price series. When we apply Peak Trough Transformation, we turn price series into the infinitely repeating triangles, which are called Fractal wave. Typically, Zig Zag indicator and Renko chart are used to turn price series into fractal wave.

Fractal or Fractal wave is commonly observable in nature like snowflake, in tree leaves, in heartbeat rate, in coastal line. Hence, many traders believe that the identifying profitable patterns in price series are the same as spotting natural order. By definition, Fractal wave is infinitely repeating self-similar patterns in time domain. The main regularity in Fractal wave is the shape of the pattern. Typically, this shape of pattern is referenced for some geometric shapes like triangle, circle, square, etc. In Fractal wave, we can have both strict self-similar and loose self-similar patterns. If the repeating patterns have the same geometric shape and all individual patterns have matching parameters in that shape, we call this as strict self-similarity. If repeating patterns have the same geometric shape but majority of individual patterns have non-matching parameters in that shape, then we call this as loose self-similarity. Fractal wave in Forex and Stock market price series have triangle as the geometric shape. However, individual triangle can be wider, narrower, longer, and shorter than other triangles. Hence, Fractal Wave in Forex and Stock market data possess the loose self–similarity. Loose self-similarity does not mean that all the triangles are non-identical in shape. Even in loose self-similarity, we can have some triangles in identical shape or at least within allowed range in precision.

First important characteristic of fractal wave is the infinite scales. In theory, repeating triangles in forex and stock market can have infinite variation of scales from very small to extremely large triangles. For example, one day we can observe one triangle formed in thirty seconds but another triangle can be formed in thirty days. In our pattern study, scale is an independent factor from geometric shape. As long as triangles are identical in shape, or within allowed range in precision, triangle formed in thirty seconds is treated as identical to the triangle formed in thirty days, regardless of their size. For some practical example, Fibonacci price pattern with 61.8% retracement formed in twenty-candle bar in hourly timeframe is an identical pattern to the other 61.8% retracement pattern formed in thirty six candle bar in daily timeframe.

Second important characteristic about Fractal wave pattern is that many small pattern are jagged together to make bigger patterns. For example, in triangular fractal wave as in financial market, bigger triangle will be made from many small triangles. In our pattern study, we often seek this sort of jagged patterns for our trading opportunity. Especially, in Harmonic pattern, Elliott Wave patterns, and X3 patterns, this sort of jagged pattern are commonly utilized to find the profitable patterns with good success rate.

About this Article

This article is the part taken from the draft version of the Book: Profitable Chart Patterns in Forex and Stock Market: Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern. Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

You can also use Ace Supply Demand Zone Indicator in MetaTrader to accomplish your technical analysis. Ace Supply Demand Zone indicator is non repainting and non lagging supply demand zone indicator with a lot of powerful features built on.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

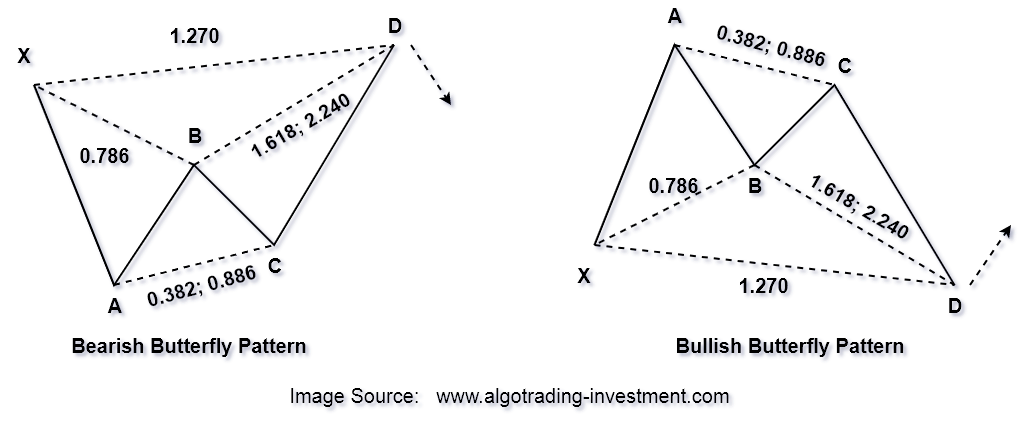

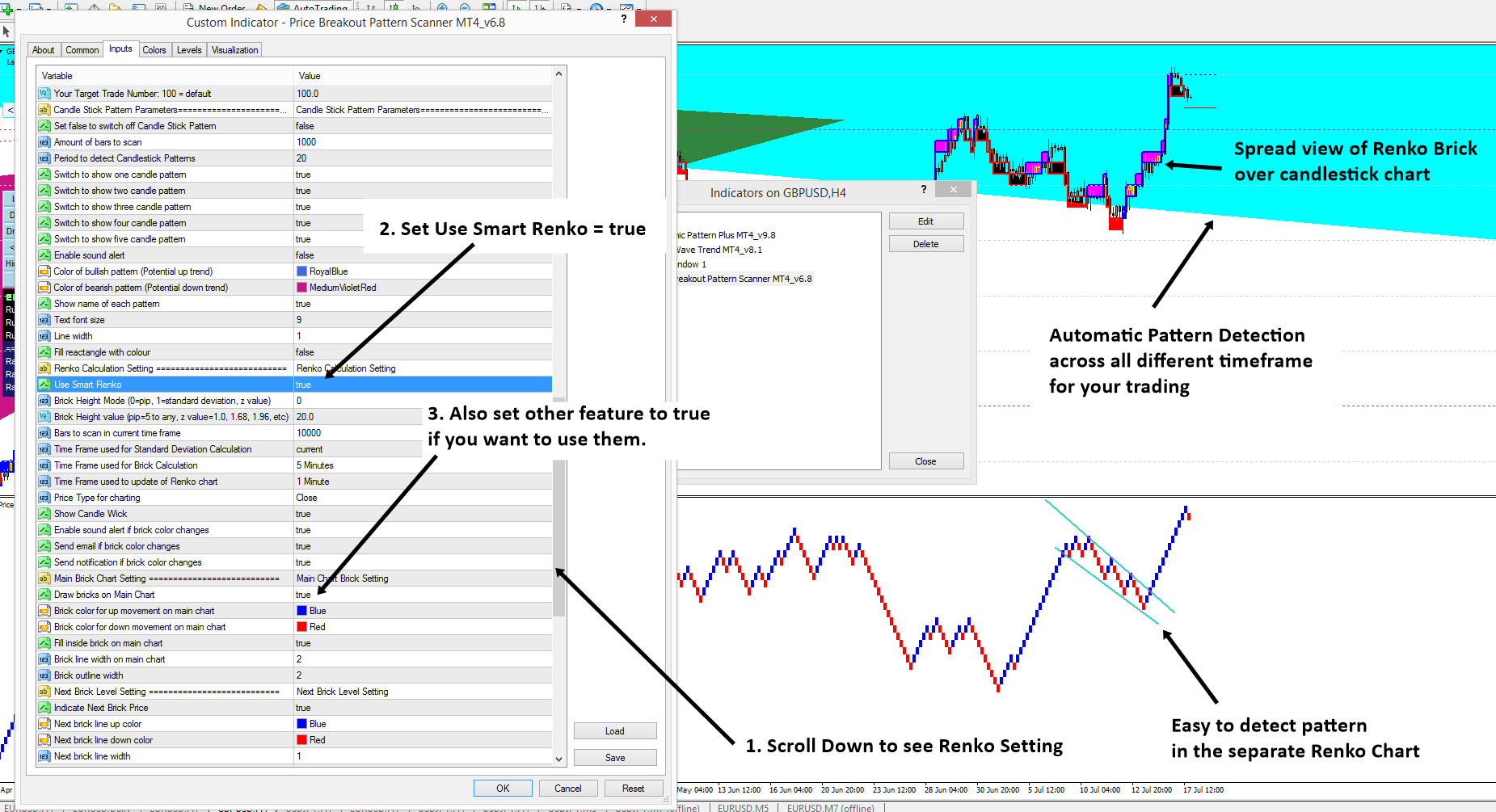

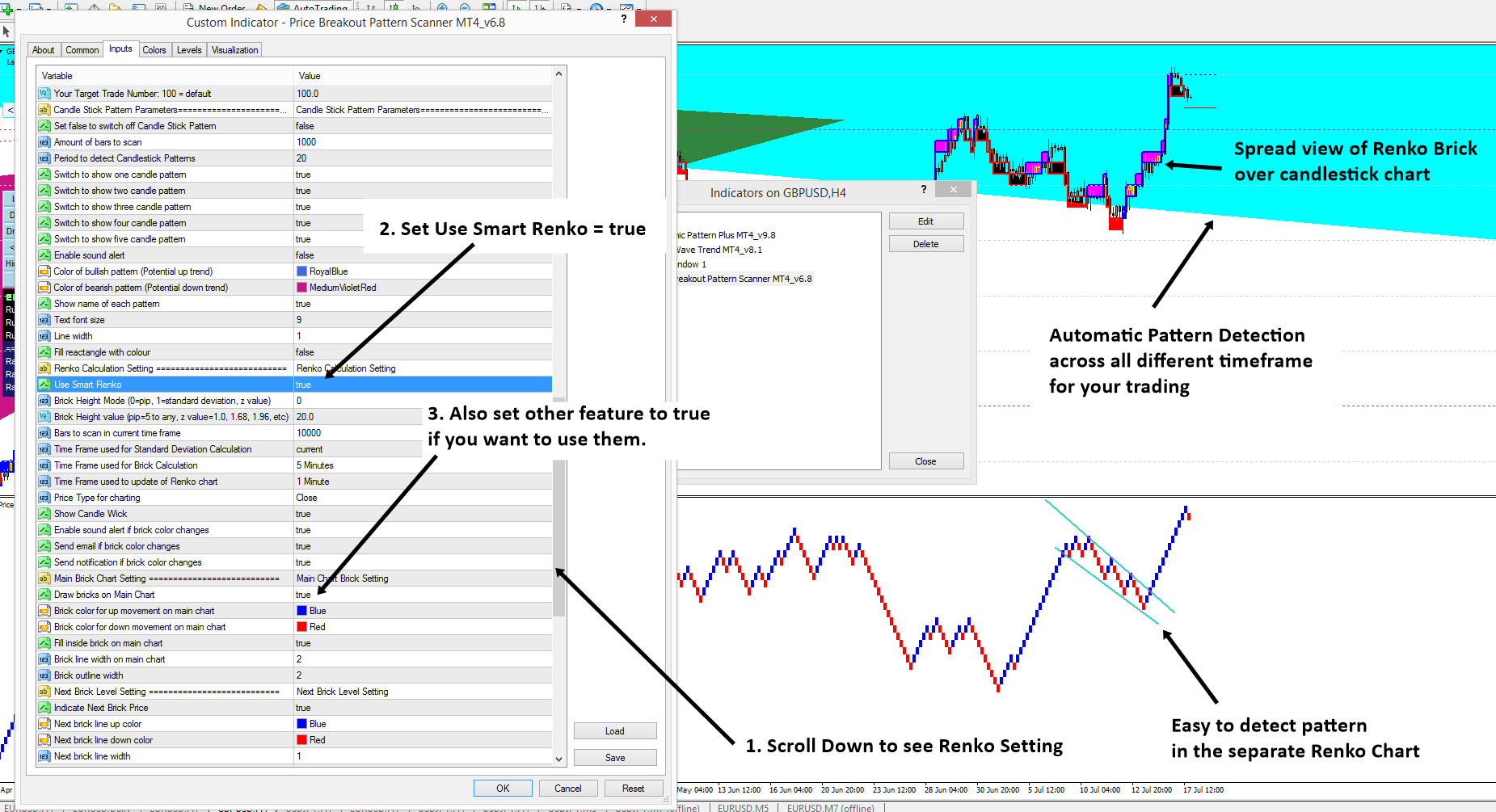

Price Breakout Pattern Scanner and Smart Renko

Our Price breakout pattern scanner is very unique tool in the market because it have built in feature for Smart Renko inside. There is reason for that. Smart Renko is really helpful for any pattern detection in the separate window. So they will reinforce your trading decision. Imagine that in the candlestick chart, Price Breakout Pattern Scanner is automatically detecting the patterns for you. In the indicator window, you can also detect any other important patterns readily. If you can collect evidence for your trading from both candlestick chart and renko chart, you can make very powerful trading decision.

Let us show how to switch on and off the Smart Renko chart from your price breakout pattern Scanner. Before you are using Smart Renko feature enabled, you might download sufficient history in your chart first. Once you have done it, set Use “Smart Renko = true” from your indicator setting. See the screenshots for your better understanding. Some of our customer know that there is great way of trading with Price breakout pattern scanner and our Harmonic Pattern Plus (or Harmonic Pattern Scenario Planner or Profitable Pattern Scanner).

Here are the links for the Price Breakout Pattern Scanner

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Our Price breakout pattern scanner is very unique tool in the market because it have built in feature for Smart Renko inside. There is reason for that. Smart Renko is really helpful for any pattern detection in the separate window. So they will reinforce your trading decision. Imagine that in the candlestick chart, Price Breakout Pattern Scanner is automatically detecting the patterns for you. In the indicator window, you can also detect any other important patterns readily. If you can collect evidence for your trading from both candlestick chart and renko chart, you can make very powerful trading decision.

Let us show how to switch on and off the Smart Renko chart from your price breakout pattern Scanner. Before you are using Smart Renko feature enabled, you might download sufficient history in your chart first. Once you have done it, set Use “Smart Renko = true” from your indicator setting. See the screenshots for your better understanding. Some of our customer know that there is great way of trading with Price breakout pattern scanner and our Harmonic Pattern Plus (or Harmonic Pattern Scenario Planner or Profitable Pattern Scanner).

Here are the links for the Price Breakout Pattern Scanner

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Young Ho Seo

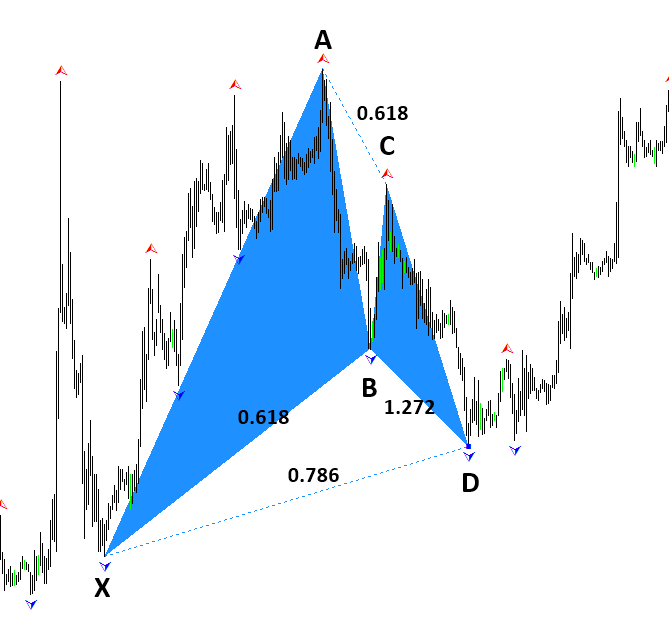

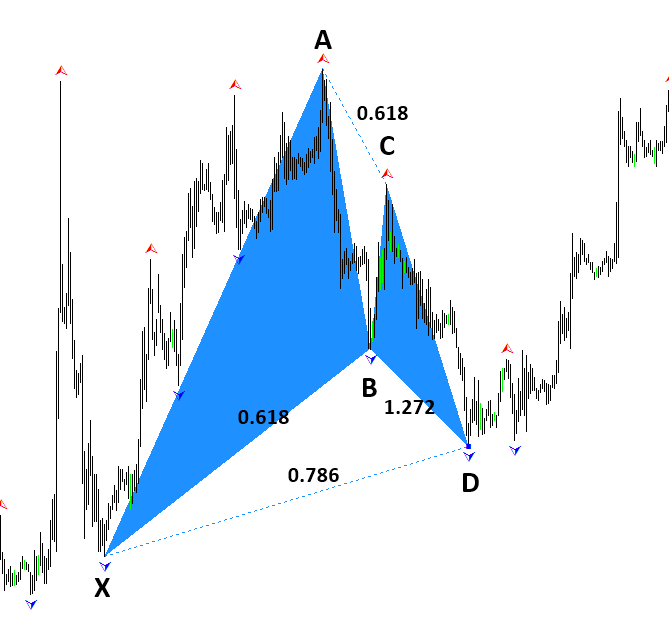

Harmonic Pattern – Predict Turning Point

Before using Harmonic Patterns, it is necessary to ask the rational behind the harmonic pattern. In fact, you will do the same for any trading strategy. You should never blindly trade because some one recommend you any particular strategy or you read some articles on website. You need to take sufficient time to understand the rational behind the trading strategy and then you will move on to the operation with the trading strategy. This article “Patterns are the Good Predictor of Market Turning Point” is such an article helping you to understand the rational behind the harmonic patterns and its trading strategy. If you are harmonic pattern trader, then you must read this article.

https://algotrading-investment.com/2019/07/07/patterns-are-the-good-predictor-of-market-turning-point/

In addition, you can watch the YouTube Video titled feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

=============================

Here are some list of the harmonic pattern indicators available in MetaTrader 4 and MetaTrader 5 platform. We also include some description for each harmonic pattern indicator.

Harmonic Pattern Plus

One of the first automated Harmonic Pattern detection tool released in 2014. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario planner

It is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation. This is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

Both Harmonic pattern plus and Harmonic Pattern Scenario planner are the excellent trading system at affordable cost. However, if you do not like repainting Harmonic pattern indicator, then we also provide the non repainting and non lagging harmonic pattern trading. Indeed, the X3 Chart Pattern Scanner is the most advanced Harmonic Pattern and Elliott Wave pattern scanner. Just check the X3 Chart Pattern Scanner below.

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Before using Harmonic Patterns, it is necessary to ask the rational behind the harmonic pattern. In fact, you will do the same for any trading strategy. You should never blindly trade because some one recommend you any particular strategy or you read some articles on website. You need to take sufficient time to understand the rational behind the trading strategy and then you will move on to the operation with the trading strategy. This article “Patterns are the Good Predictor of Market Turning Point” is such an article helping you to understand the rational behind the harmonic patterns and its trading strategy. If you are harmonic pattern trader, then you must read this article.

https://algotrading-investment.com/2019/07/07/patterns-are-the-good-predictor-of-market-turning-point/

In addition, you can watch the YouTube Video titled feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

=============================

Here are some list of the harmonic pattern indicators available in MetaTrader 4 and MetaTrader 5 platform. We also include some description for each harmonic pattern indicator.

Harmonic Pattern Plus

One of the first automated Harmonic Pattern detection tool released in 2014. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario planner

It is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation. This is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

Both Harmonic pattern plus and Harmonic Pattern Scenario planner are the excellent trading system at affordable cost. However, if you do not like repainting Harmonic pattern indicator, then we also provide the non repainting and non lagging harmonic pattern trading. Indeed, the X3 Chart Pattern Scanner is the most advanced Harmonic Pattern and Elliott Wave pattern scanner. Just check the X3 Chart Pattern Scanner below.

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

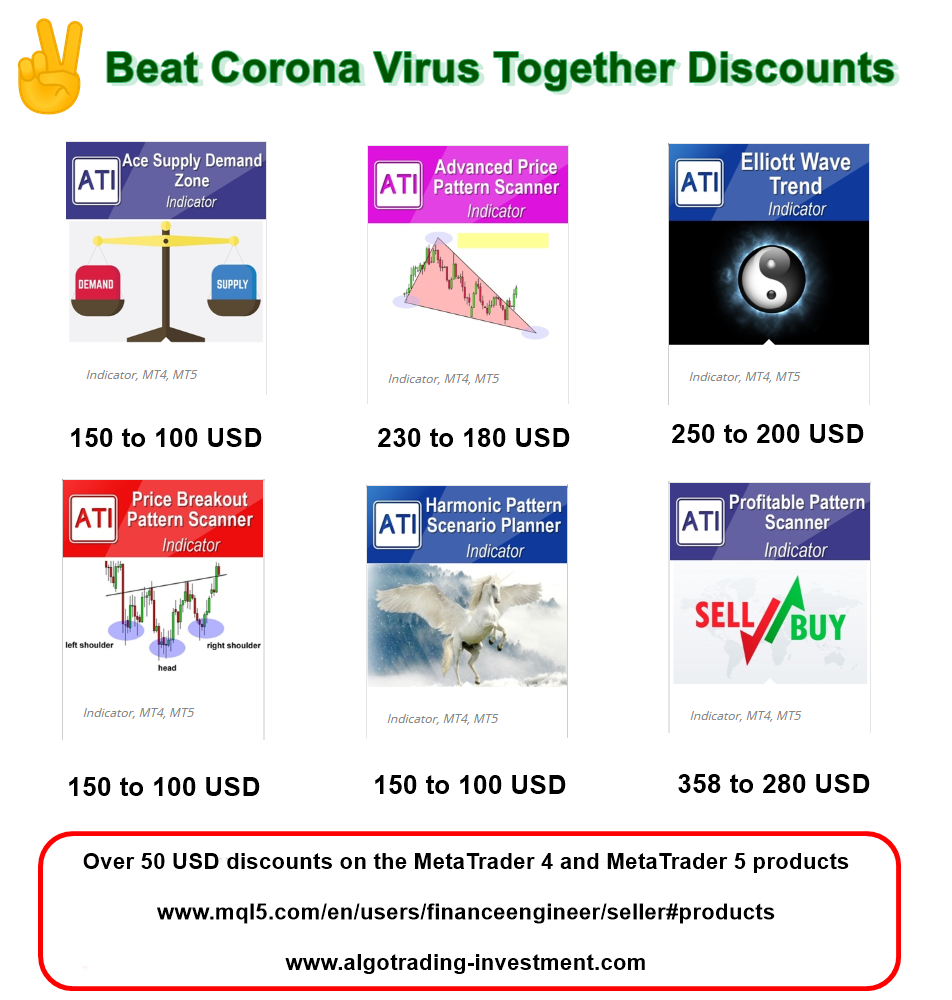

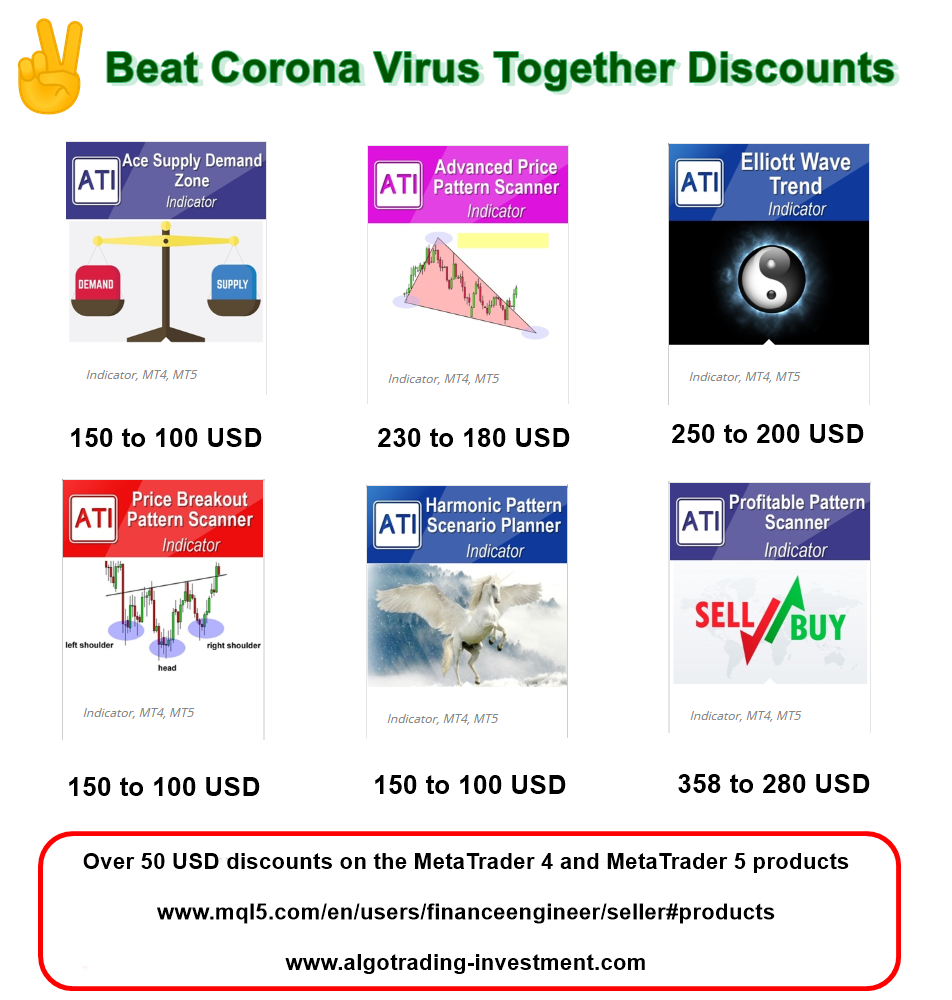

Beat Corona Virus Together Discounts for MetaTrader

Since December 2019, we have observed the loss of lives due to this COVID-19 pandemic. Apart from this, COVID-19 has severely demobilized the global economy. Many of the affected countries have undergone the complete lock down. Life after the COVID 19 is tough for the entire society. We never knew that this will last this long.

During this Covid19 pandemic, we hope everyone is safe and well from this Corona Virus Crisis. We know this affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Here are some simple tips for you to stay safe from this Covid19 Crysis.

Don’t touch your face – Avoid touching your eyes, nose and mouth.

Don’t cough or sneeze into your hands – Cover your mouth and nose with your elbow or tissue when coughing or sneezing. Dispose of used tissue immediately.

Keep your distance – Maintain a distance of at least 2 meter from people who are coughing or sneezing.

Wash, wash, wash your hands

Finally, care the loved one.

Since December 2019, we have observed the loss of lives due to this COVID-19 pandemic. Apart from this, COVID-19 has severely demobilized the global economy. Many of the affected countries have undergone the complete lock down. Life after the COVID 19 is tough for the entire society. We never knew that this will last this long.

During this Covid19 pandemic, we hope everyone is safe and well from this Corona Virus Crisis. We know this affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Here are some simple tips for you to stay safe from this Covid19 Crysis.

Don’t touch your face – Avoid touching your eyes, nose and mouth.

Don’t cough or sneeze into your hands – Cover your mouth and nose with your elbow or tissue when coughing or sneezing. Dispose of used tissue immediately.

Keep your distance – Maintain a distance of at least 2 meter from people who are coughing or sneezing.

Wash, wash, wash your hands

Finally, care the loved one.

Young Ho Seo

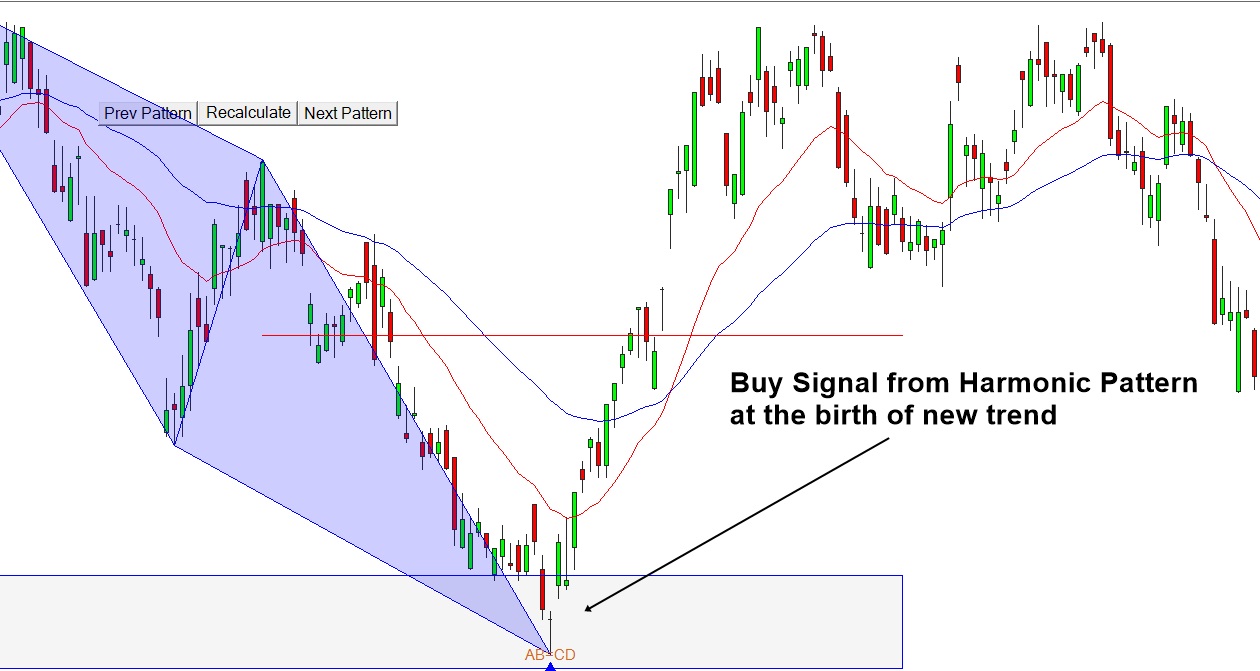

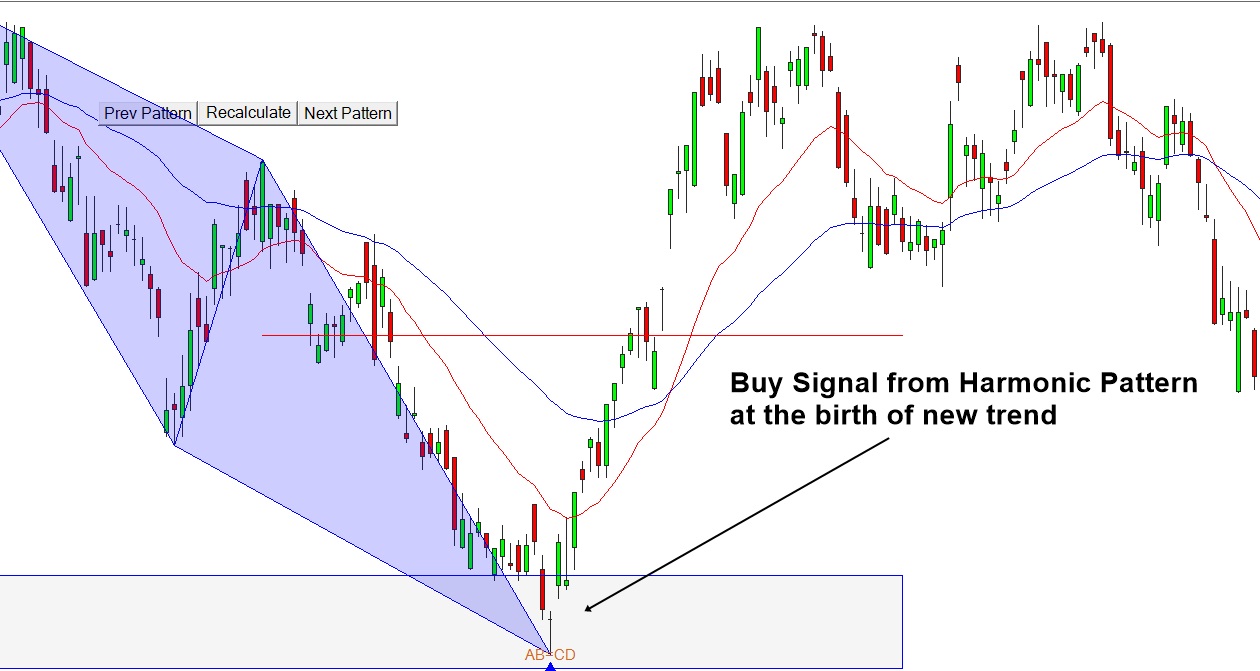

Harmonic Pattern – Turning Point and Trend

This article “Turning Point and Trend” tries to answer you on when to use Harmonic Pattern Trading in terms of the four market cycle including Birth, Growth, Maturity and Death. If you want to become profitable trader, then you need to decide when your capital to dive into the market. The best way is doing it with the market rhythm, i.e. the market cycle. This article will provide you the clear answer on how to tune your entry with the market. This is the first step for any trader in choosing their strategy in fact. You would also revise the pros and cons of the turning point strategy, semi turning point strategy and trend strategy.

https://algotrading-investment.com/2019/07/06/turning-point-and-trend/

Below are the list of automated Harmonic pattern Indicator developed for MetaTrader 4 and MetaTrader 5 platform.

Harmonic Pattern Plus

One of the first automated Harmonic Pattern detection tool released in 2014. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario planner

It is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation. This is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

Both Harmonic pattern plus and Harmonic Pattern Scenario planner are the excellent trading system at affordable cost. However, if you do not like repainting Harmonic pattern indicator, then we also provide the non repainting and non lagging harmonic pattern trading. Just check the X3 Chart Pattern Scanner below.

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

This article “Turning Point and Trend” tries to answer you on when to use Harmonic Pattern Trading in terms of the four market cycle including Birth, Growth, Maturity and Death. If you want to become profitable trader, then you need to decide when your capital to dive into the market. The best way is doing it with the market rhythm, i.e. the market cycle. This article will provide you the clear answer on how to tune your entry with the market. This is the first step for any trader in choosing their strategy in fact. You would also revise the pros and cons of the turning point strategy, semi turning point strategy and trend strategy.

https://algotrading-investment.com/2019/07/06/turning-point-and-trend/

Below are the list of automated Harmonic pattern Indicator developed for MetaTrader 4 and MetaTrader 5 platform.

Harmonic Pattern Plus

One of the first automated Harmonic Pattern detection tool released in 2014. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario planner

It is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation. This is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

Both Harmonic pattern plus and Harmonic Pattern Scenario planner are the excellent trading system at affordable cost. However, if you do not like repainting Harmonic pattern indicator, then we also provide the non repainting and non lagging harmonic pattern trading. Just check the X3 Chart Pattern Scanner below.

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Pattern Scanner List for MetaTrader 4

Pattern detection is an important task for your winning trading. It is one way to solve the puzzle of market geometry, which is often not solvable with technical indicators. How about automatic pattern detection for your trading ?

We provide the list of various pattern scanner for your MetaTrader 4 platform.

1. Harmonic Pattern Plus for MetaTrader 4

Harmonic Pattern Plus is the harmonic pattern scanner. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc.

https://www.mql5.com/en/market/product/4488

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

2. X3 Chart Pattern Scanner for MetaTrader 4

X3 Chart Pattern Scanner is non repainting and non lagging pattern scanner for Harmonic Pattern, Elliott Wave pattern and X3 patterns. As a bonus, this tool can detect around 52 bearish and bullish Japanese candlestick patterns + advanced Channel features. This is the most advanced Harmonic and Elliott wave scanner in the market. You must try.

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

3. Advanced Price Pattern Scanner

Advanced Price Pattern Scanner is the automatic price pattern scanner. It is designed to scan the Triangle, Falling Wedge, Rising Wedge, Double Top, Double Bottom, Head and Shoulder, Reverse of Head and Shoulder, Cup and Handle or Cup with Handle, Reverse of Cup and Handle or Cup with Handle. What is even better? This is non-repainting and non-lagging indicator. Here is link for more information

https://www.mql5.com/en/market/product/24679

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

4. Price Breakout Pattern Scanner

Price Breakout Pattern Scanner is the automatic pattern scanner designed to detect the Triangle, Falling Wedge, Rising Wedge, Double Top, Double Bottom, Head and Shoulder, Reverse of Head and Shoulder. Although this scanner is repainting, this scanner comes with powerful built in features like Japanese candlestick pattern detection + Smart Renko features. With all these features together, this pattern scanner forms the powerful trading system for Forex market.

https://www.mql5.com/en/market/product/4859

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

5. Fractal Pattern Scanner

Fractal Pattern Scanner is our next generation price breakout pattern scanner. Unlike previous two price breakout pattern scanner detect price patterns like triangle and wedge patterns, Fractal Pattern Scanner detect the price breakout pattern using Statistical method with Elliott Wave like concept (i.e. Mother Wave and Child Wave). Hence, there is a huge difference in the detection of breakout patterns in Fractal Pattern Scanner from rest. However, Fractal Pattern Scanner is the powerful breakout pattern scanner as it provides the reversal (i.e. turning point) trading opportunity as well as breakout trading signals. Fractal Pattern Scanner also support Multiple timeframe pattern scanning with fully automated breakout signal generations.

https://www.mql5.com/en/market/product/49170

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Pattern detection is an important task for your winning trading. It is one way to solve the puzzle of market geometry, which is often not solvable with technical indicators. How about automatic pattern detection for your trading ?

We provide the list of various pattern scanner for your MetaTrader 4 platform.

1. Harmonic Pattern Plus for MetaTrader 4

Harmonic Pattern Plus is the harmonic pattern scanner. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc.

https://www.mql5.com/en/market/product/4488

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

2. X3 Chart Pattern Scanner for MetaTrader 4

X3 Chart Pattern Scanner is non repainting and non lagging pattern scanner for Harmonic Pattern, Elliott Wave pattern and X3 patterns. As a bonus, this tool can detect around 52 bearish and bullish Japanese candlestick patterns + advanced Channel features. This is the most advanced Harmonic and Elliott wave scanner in the market. You must try.

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

3. Advanced Price Pattern Scanner

Advanced Price Pattern Scanner is the automatic price pattern scanner. It is designed to scan the Triangle, Falling Wedge, Rising Wedge, Double Top, Double Bottom, Head and Shoulder, Reverse of Head and Shoulder, Cup and Handle or Cup with Handle, Reverse of Cup and Handle or Cup with Handle. What is even better? This is non-repainting and non-lagging indicator. Here is link for more information

https://www.mql5.com/en/market/product/24679

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

4. Price Breakout Pattern Scanner

Price Breakout Pattern Scanner is the automatic pattern scanner designed to detect the Triangle, Falling Wedge, Rising Wedge, Double Top, Double Bottom, Head and Shoulder, Reverse of Head and Shoulder. Although this scanner is repainting, this scanner comes with powerful built in features like Japanese candlestick pattern detection + Smart Renko features. With all these features together, this pattern scanner forms the powerful trading system for Forex market.

https://www.mql5.com/en/market/product/4859

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

5. Fractal Pattern Scanner

Fractal Pattern Scanner is our next generation price breakout pattern scanner. Unlike previous two price breakout pattern scanner detect price patterns like triangle and wedge patterns, Fractal Pattern Scanner detect the price breakout pattern using Statistical method with Elliott Wave like concept (i.e. Mother Wave and Child Wave). Hence, there is a huge difference in the detection of breakout patterns in Fractal Pattern Scanner from rest. However, Fractal Pattern Scanner is the powerful breakout pattern scanner as it provides the reversal (i.e. turning point) trading opportunity as well as breakout trading signals. Fractal Pattern Scanner also support Multiple timeframe pattern scanning with fully automated breakout signal generations.

https://www.mql5.com/en/market/product/49170

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Young Ho Seo

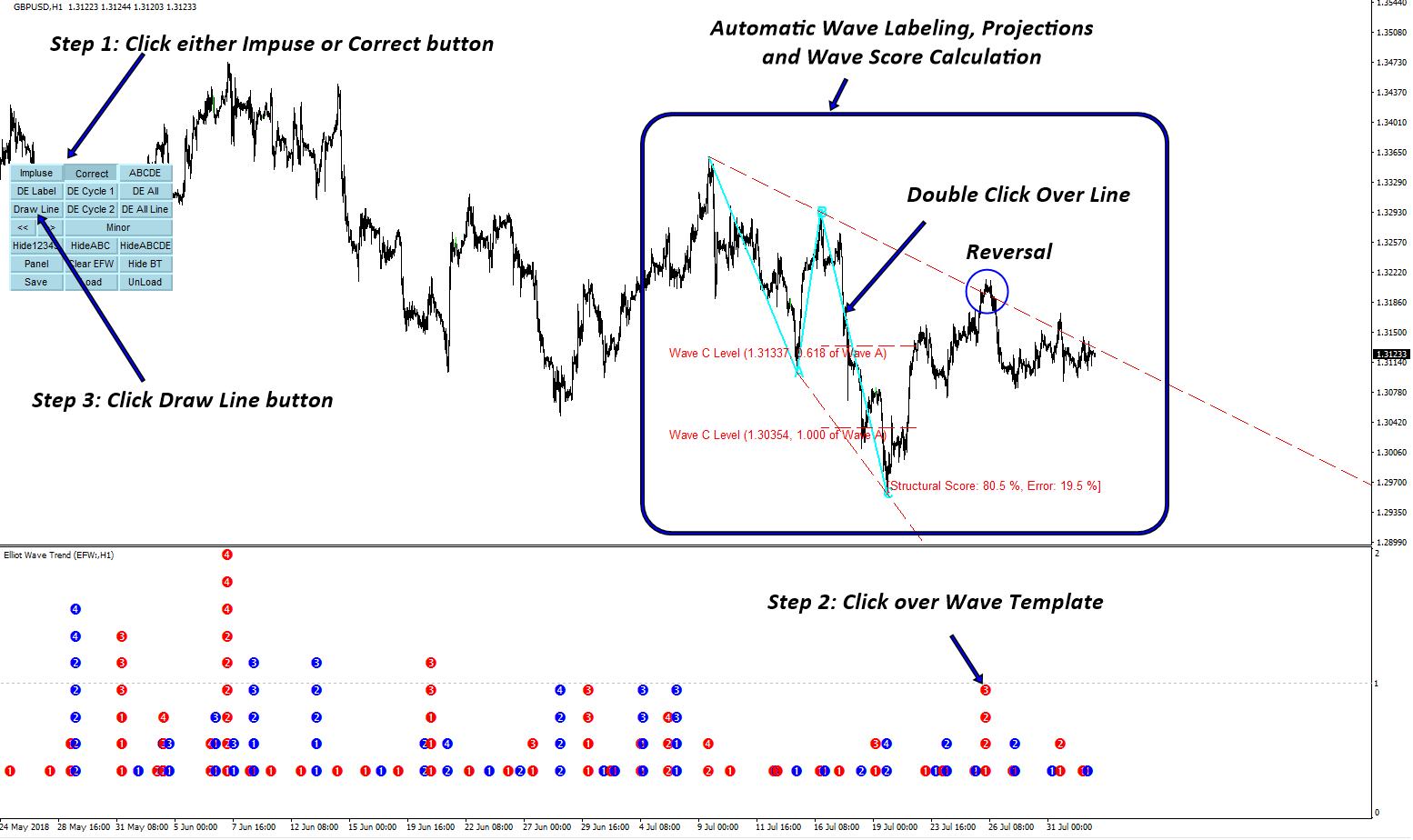

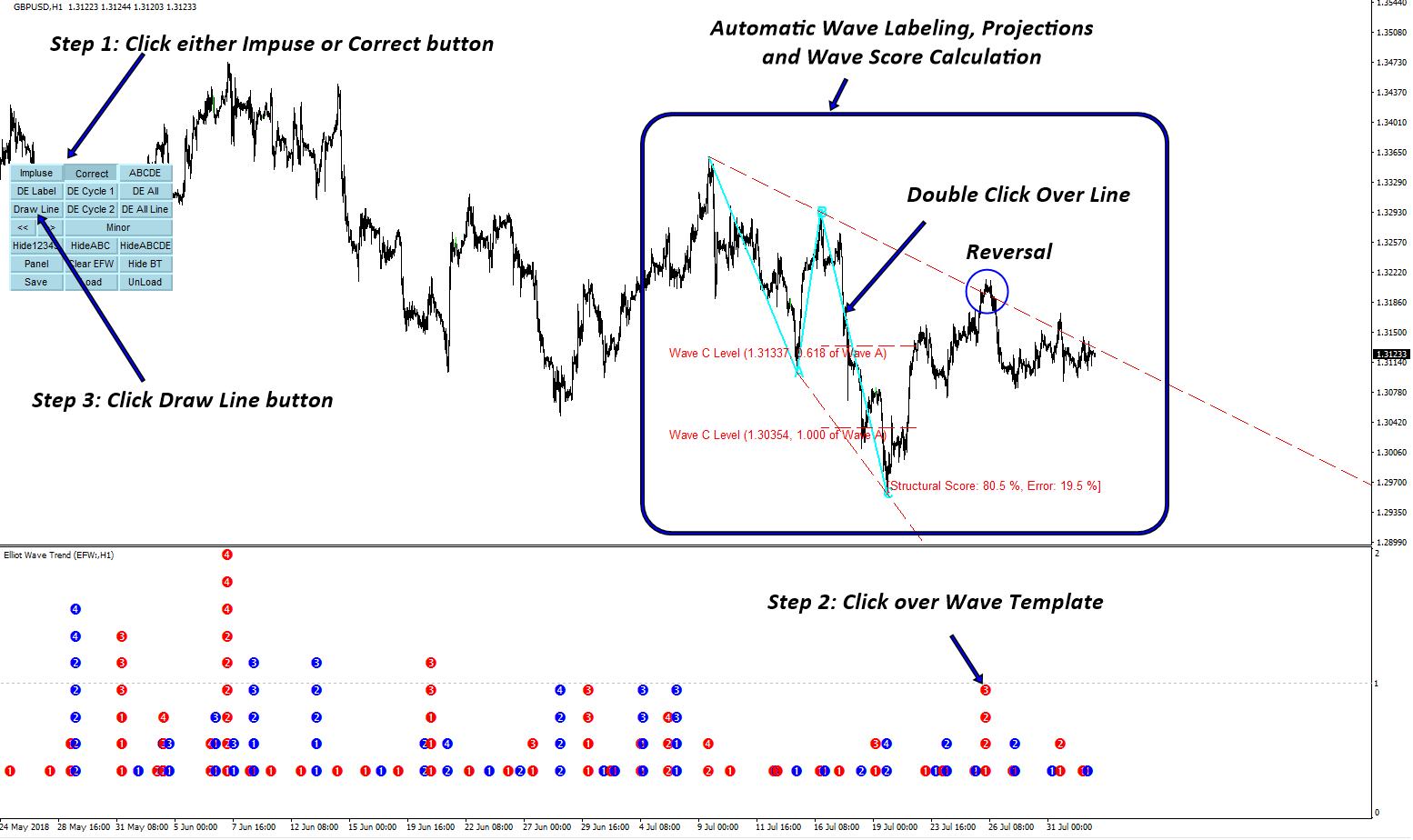

Better way of using Elliott Wave

The advantage of support and resistance is that it can go well with many of trading strategies. Having good support and resistance tools are probably the prime importance for the good trading performance nowadays. Of course, the performance of Elliott wave can be improved marginally when they are combined with good support and resistance tools.

Here is the short article explaining about how to use support and resistance together with Elliott Wave Patterns.

https://algotrading-investment.com/2019/07/18/support-and-resistance-with-elliott-wave-trend/

Here is the links to our Elliott Wave Trend:

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

The advantage of support and resistance is that it can go well with many of trading strategies. Having good support and resistance tools are probably the prime importance for the good trading performance nowadays. Of course, the performance of Elliott wave can be improved marginally when they are combined with good support and resistance tools.

Here is the short article explaining about how to use support and resistance together with Elliott Wave Patterns.

https://algotrading-investment.com/2019/07/18/support-and-resistance-with-elliott-wave-trend/

Here is the links to our Elliott Wave Trend:

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Young Ho Seo

Fibonacci Price Patterns

A Fibonacci analysis is a popular tool among technical traders. It is based on the Fibonacci sequence numbers identified by Leonardo Fibonacci in the 13th century. The Fibonacci sequence numbers are:

0, 1, 1, 2, 3, 5, 8, 13, 21, 34, 55, 89,144, 233, 377, 610, 987, 1597, 2584, 4181, 6765, …………………

As the Fibonacci number become large, the constant relationship is established between neighbouring numbers. For example, every time, when we divide the former number by latter: Fn-1/Fn, we will get nearly 0.618 ratio. Likewise, when we divide the latter number by former: Fn/Fn-1, we will get nearly 1.618. These two Fibonacci ratio 0.618 and 1.618 are considered as the Golden Ratio. We can use these Golden ratios to start our Fibonacci analysis. However, many technical traders use additional Fibonacci ratios derived from the Golden ratio. Since the calculation of each Fibonacci ratio is well known, I have listed all the available Fibonacci ratio calculation in Table 6.1.

In fact, Fibonacci pattern analysis in financial trading is extremely popular. As with support and resistance analysis, Fibonacci analysis is probably the most popular technical analysis among traders. There are two important techniques in Fibonacci analysis. First technique is Fibonacci retracement. Second technique is Fibonacci expansion. In fact, former is just one triangle pattern and latter is two triangle patterns. Hence, you can consider these two as Fibonacci price patterns. These two price patterns share the identical concept to the retracement ratio and expansion ratio.