Gary Comey / 个人资料

- 信息

|

9+ 年

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

3

信号

|

782

订阅者

|

http://www.blackwavetrader.com 自2000年开始为Fexco Stockbroking工作以来,我是一家注册股票经纪人,该公司此后收购了爱尔兰最大的经纪人之一Goodbody。我是爱尔兰银行家协会的成员。我已经在英国的技术分析师协会注册,并且在该行业工作了一段时间,包括在IG Group和Fidelity。

Gary Comey

[ALPINE] Week: Cash +2.11%. Recent oversold conditions have been somewhat rectified allowing me to take some profit in CADJPY as the price of oil somewhat recovered and the fear factor somewhat eased as governments and central banks again print their way out of trouble like they did in 2008/9/10.

The DD is reduced but volatile and sensitive to the pandemic fears. The next shoe to drop could be Italian debt but I guess that's always been a problem. EURCHF is a barometer of fear and stress and while the Franc remains strong the SWAPS in this are not too burdensome for our weekly oversold EURCHF position. What I am thinking here is that the volatility around equity markets and by extension currency markets may give us opportunities. The last time I thought that I bought CADJPY and OPEC collapsed over the weekend weakening the Canadian Dollar so influenced by the price of oil. OPEC is unlikely to collapse again this weekend having already done so and I am long CADJPY again. Indeed if Saudi and Russia come to a truce over a weekend we could benefit from a gap UP. However I am not depending on that but rather just the volatility which in theory at least is good for a grid strategy.

The DD is reduced but volatile and sensitive to the pandemic fears. The next shoe to drop could be Italian debt but I guess that's always been a problem. EURCHF is a barometer of fear and stress and while the Franc remains strong the SWAPS in this are not too burdensome for our weekly oversold EURCHF position. What I am thinking here is that the volatility around equity markets and by extension currency markets may give us opportunities. The last time I thought that I bought CADJPY and OPEC collapsed over the weekend weakening the Canadian Dollar so influenced by the price of oil. OPEC is unlikely to collapse again this weekend having already done so and I am long CADJPY again. Indeed if Saudi and Russia come to a truce over a weekend we could benefit from a gap UP. However I am not depending on that but rather just the volatility which in theory at least is good for a grid strategy.

分享社交网络 · 7

Gary Comey

As you know we closed CADJPY in profit yesterday. Guys, given the Zombie apocalypse etc I am happy if people need to make a 15% withdrawal of equity (assuming you are not leveraging me). I had a look around this morning and I don't see another obvious trade but either way I cannot guarantee to be back at cash by month end. As always it's in the lap of the market Gods.

As I said before in December I won't be making withdrawals but these are strange times indeed.

A small withdrawal will buy Disney + for the kids which is easier than home schooling them.

As I said before in December I won't be making withdrawals but these are strange times indeed.

A small withdrawal will buy Disney + for the kids which is easier than home schooling them.

分享社交网络 · 8

Gary Comey

Closed CADJPY in profit. Not that pleased with it but less positions is safer. Especially when it dawns on the Euro traders that Italy is broke.

Anyway it's more money, more equity etc. The Franc is a little weaker given the rally in the equity markets. Hopefully we've seen the bottom there. If you'd just bought the S&P 500 and month ago you would be down 30% so when we get out of this we will be ahead of the world.

Anyway it's more money, more equity etc. The Franc is a little weaker given the rally in the equity markets. Hopefully we've seen the bottom there. If you'd just bought the S&P 500 and month ago you would be down 30% so when we get out of this we will be ahead of the world.

分享社交网络 · 13

Gary Comey

Decent rally in CADJPY put me close to disposing of those trades today with a little profit which will reduce risk and leave us just with EURCHF. Alas as we come into the close that market has come off a bit. Hopefully we get to close CADJPY next week but patience is paying off. Equity markets are still trying to form a bottom and things remain volatile and driven by the Virus news which if you are Italian is a human catastrophe by now. New York and California are shutting down and what we really need is some news that lets us see through this to the other side. At that point markets stabilise and the Franc move away from it's oversold levels like CADJPY has. All said a better second half to the week with the DD reducing and we even got close to making money.......God forbid!

分享社交网络 · 10

Gecimar Loss

2020.03.21

It was good for you not to close CADJPY, next Monday CADJPY will open upwards, different from last week.

Let us have more patience because this CADJPY will give us a big profit to compensate for the time that we do not make a profit.

🤞🤞🤞🤞🤞

Let us have more patience because this CADJPY will give us a big profit to compensate for the time that we do not make a profit.

🤞🤞🤞🤞🤞

Gary Comey

QUESTION: Hi Gary, thank you for your efforts. I have a question about stop loss—as there is no hard stop, how much will you risk? Do we have maximum? I’m sending this message as my friends are asking about the possible worst outcome. Good day.15:09

ANSWER: The worst case outcome is that developments over a weekend cause us to lose all our money in a major gap in the markets on a Sunday night. Trading is risky. I am finding it difficult to make predictions about what will happen next and so is everyone else with half a brain but I don't believe the U.S will surrender their energy independence so that's the oil question and relates to CADJPY. My reading of the media is that the U.S administration are holding sensitive talks with Saudi Arabia which no doubt is aimed at raising oil prices.

My second reading of the situation relates directly to the S&P500 which has dropped 25% in four weeks. That puts us at Planet Of The Apes by July and I just don't believe that will happen. Right now I am not inclined to close EURCHF or CADJPY because the betting right now is on the end of the world as it was back in 2008 when people we liquidating their pensions is a blind panic. I think it's time to stay calm. Bad luck has been with the CADJPY trade otherwise the DD is well within soft stop loss levels. Even with the CADJPY it's almost touching those levels but not quite. I am inclined to await further developments, I am inclined to follow my instincts and not panic when all about me are.

Right now the S&P500 appears to be attempting to put in a base around current levels with the 2018 low at 2333. That has not been breached....yet. It would not be unsurprising to see it breached in another awful trading day followed by a massive rally with some fundamental development as the excuse. I am not saying it will happen this way but that would be typical. I feel if I close now with still huge equity it will be close to the worst that it got.

ANSWER: The worst case outcome is that developments over a weekend cause us to lose all our money in a major gap in the markets on a Sunday night. Trading is risky. I am finding it difficult to make predictions about what will happen next and so is everyone else with half a brain but I don't believe the U.S will surrender their energy independence so that's the oil question and relates to CADJPY. My reading of the media is that the U.S administration are holding sensitive talks with Saudi Arabia which no doubt is aimed at raising oil prices.

My second reading of the situation relates directly to the S&P500 which has dropped 25% in four weeks. That puts us at Planet Of The Apes by July and I just don't believe that will happen. Right now I am not inclined to close EURCHF or CADJPY because the betting right now is on the end of the world as it was back in 2008 when people we liquidating their pensions is a blind panic. I think it's time to stay calm. Bad luck has been with the CADJPY trade otherwise the DD is well within soft stop loss levels. Even with the CADJPY it's almost touching those levels but not quite. I am inclined to await further developments, I am inclined to follow my instincts and not panic when all about me are.

Right now the S&P500 appears to be attempting to put in a base around current levels with the 2018 low at 2333. That has not been breached....yet. It would not be unsurprising to see it breached in another awful trading day followed by a massive rally with some fundamental development as the excuse. I am not saying it will happen this way but that would be typical. I feel if I close now with still huge equity it will be close to the worst that it got.

分享社交网络 · 16

Gary Comey

Looks like we could end up closing the week not to far from where we began. To be frank the last few months have not gone according to plan. First we had the GBPCHF DD in November and now we seem to have stumbled into the collapse of the equity markets so the usual plan of buy on oversold has been tested with prolonged flight to safety assets such as the Franc. I thought we could skim a little from CADJPY and earn overnight interest while we waited on EURCHF and stumbled into the collapse of OPEC and CAD is hugely affected by the price of Crude Oil. On the same night as the collapse of OPEC North Korea launched a missile strengthening the Yen further. WOW a perfect storm. Today we find that anyone who has ever bet on the end of the world...or me, was wrong...again. Markets are moving away from extreme levels at least as I write this and governments are starting make hard decisions. With one death the Irish government has closed all schools. The Italian government has closed.....well Italy!

I can point to two things. 1. We are alive, and that's saying something given we've had incredible drops in equity markets even before yesterday's biggest drop in the Dow Jones Industrial Average since the 1987 Wall Street crash (I was 12 years old). 2. A recovery in our position puts us head and shoulders above above the S&P500 which has destroyed trillions of dollars in global wealth.

Although it is far from over what we all need to learn from moments like this is what our risk profile is. Are we "High Risk" guys or are we just "High Return" guys because lets face it everyone is high return. Trading Forex is risky to begin with even in the "low risk" account. My bank manager thinks the sharp ratio in the low risk account is incredibly risky though she is comparing it to buying German government bonds. I for one am prepared to risk it because the returns over time have not been achievable anywhere else in my life. As surely as trading conditions have been difficult they will improve again and I for one will still be there.

I can point to two things. 1. We are alive, and that's saying something given we've had incredible drops in equity markets even before yesterday's biggest drop in the Dow Jones Industrial Average since the 1987 Wall Street crash (I was 12 years old). 2. A recovery in our position puts us head and shoulders above above the S&P500 which has destroyed trillions of dollars in global wealth.

Although it is far from over what we all need to learn from moments like this is what our risk profile is. Are we "High Risk" guys or are we just "High Return" guys because lets face it everyone is high return. Trading Forex is risky to begin with even in the "low risk" account. My bank manager thinks the sharp ratio in the low risk account is incredibly risky though she is comparing it to buying German government bonds. I for one am prepared to risk it because the returns over time have not been achievable anywhere else in my life. As surely as trading conditions have been difficult they will improve again and I for one will still be there.

分享社交网络 · 18

显示全部评论 (4)

Onebody

2020.03.13

I guess it's too early to open the champagne. But Yes, today is definitely better than yesterday)

Gary Comey

Not much room left for opening new positions. We need to see a meaningful change in market sentiment before we can do that.

分享社交网络 · 8

Onebody

2020.03.12

Thank you for keeping your cool in the "black Swan" situation.

A balanced, thoughtful, calm approach will definitely help us.

A balanced, thoughtful, calm approach will definitely help us.

Gary Comey

[Alpine] Week: cash +0.35%. Pesky markets insist on panicking over this virus but I guess it did get ahead of itself. With the VIX at 49 it felt a bit like capitulation so I held my nose and bought deeply oversold EURCHF again. Having not blown up like many traders we have the equity so it felt time to be a little brave. Friday’s can be brutal as investors don’t like holding positions into the weekend.

I’m not saying that it’s all sunshine from here but perhaps there will be a few solid plans next week from the U.S administration and the E.U. It appears that the virus is finally stable in China. Perhaps in the summer we will look back at the panic as yet another panic we overcame. I have good hope that we will get out of our CADJPY positions even while we wait for EURCHF. As I write the final positions in both pairs are showing a profit.

I’m not saying that it’s all sunshine from here but perhaps there will be a few solid plans next week from the U.S administration and the E.U. It appears that the virus is finally stable in China. Perhaps in the summer we will look back at the panic as yet another panic we overcame. I have good hope that we will get out of our CADJPY positions even while we wait for EURCHF. As I write the final positions in both pairs are showing a profit.

分享社交网络 · 9

diocanetrader

2020.03.09

I would like to write to you ... I TOLD YOU SO !!! but by now you all will have understood it too ... charts, analysis, waves don't matter now !!! You just have to pray in a miracle

Gary Comey

2020.03.13

@diocanetrader I had a look at your profile to see how an expert trades. Still looking....

Onebody

2020.04.03

@diocanetrader, thanks for your advice! It worked - the prayers really helped. Waiting for new informative and valuable comments.

Gary Comey

分享社交网络 · 9

Gary Comey

2020.03.08

Cheers guys. There’s a few anonymous characters waiting patiently for my demise since the Chinese stock market crash of 2015, BREXIT of 2016 etc etc. Now we are at 2020 and patience is running thin 🤣. Let’s leave them to demo accounts and the latest get rich EA.

chris971

2020.03.08

Wow that situation is becoming very scary...being against CHF and JPY when stock market and oil prices are collapsing doesn't look good. First time in 15 month that I have been copying Alpine and pacific that I really fear for my capital; Hope that Gary will eventually accept to take a loss if situation gets worst and not bust the account like many have done recently

Gary Comey

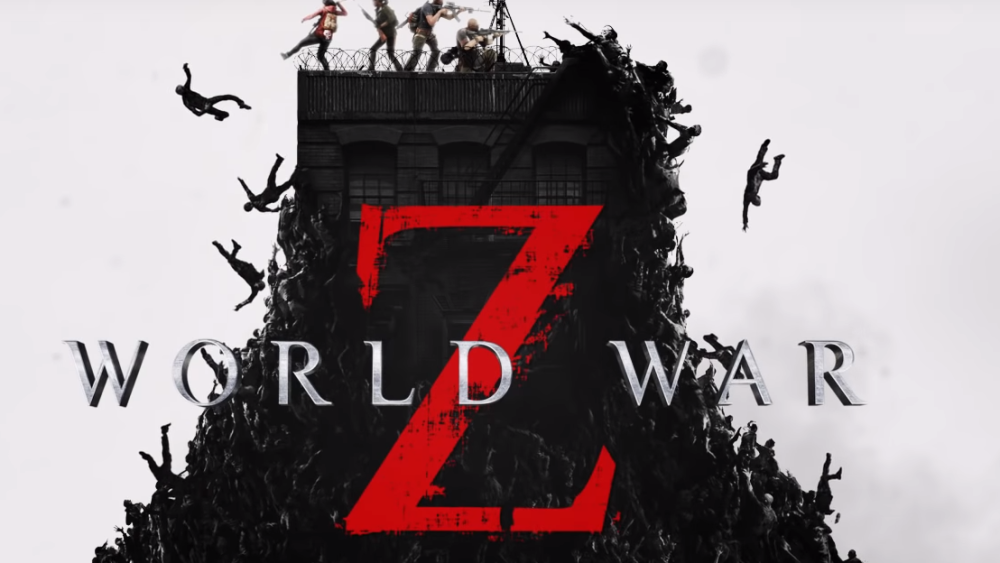

[Alpine] February Cash +1.14%: This represents the worst month since January 2018 and we end it in a DD. Risk correlated assets are having a volatile time but are mostly increased in price. What saves us as always is position size. Individual days are largely random and depending on news flow about the Corona virus. Lets face it this will be a pandemic if it is not already one. Our particular interest is in how it affects financial markets and on that score I feel governments will try to backstop the selling before the stock market itself becomes a systemic risk. A March rate cut by the FED is already fully priced in before they even open their mouths. The S&P 500 sliced through the 200 day M.A and stopped at the next support level being the October 2019 low. In fairness markets had gotten way ahead of themselves so I guess if it was not the Corona virus it would have been something else. I am not a doctor but I know a little about markets and this too shall pass. I don't know what the excuse will be for the retracement, the FED, the White House or some other news flow but all of a sudden prices will look rediculous and the market will retrace because guess what? The markets have gotten a way ahead of themselves on the downside too. I'm glad not to be one of the traders who blew up this week. If I get hit by a bus tomorrow my last two words are "position size".

分享社交网络 · 7

Gary Comey

S&P500 now getting close to significant multi-year support. If the market begins to stablise here perhaps we will see less need to hold Swiss Franc's. The dollar appears to be seen as a safe haven too and so a rally of the Euro against it will also help our EURCHF trade.

As I said before I buy when over sold and sell when over bought so I deliberately get myself into these situations. When a currency is oversold or overbought there is usually an attached headline to tell you why and the headline makes me seem nuts to be doing what I do. :-) The trick as always is position size.

BREXIT being a perfect example.

As I said before I buy when over sold and sell when over bought so I deliberately get myself into these situations. When a currency is oversold or overbought there is usually an attached headline to tell you why and the headline makes me seem nuts to be doing what I do. :-) The trick as always is position size.

BREXIT being a perfect example.

分享社交网络 · 8

Walter Scott

2020.02.28

you are also a poet as well as a great trader better for you... if I were you I would not waste time in these bullshit ... but the fact that the 2 trades that you have opened are recording the negative records of the last 5 years and nobody can know when they will stop ... indeed they will only continue to get worse!

--GARY COMEY

--GARY COMEY

diocanetrader

2020.02.28

i am watching nzdusd mark the new negative record from 2009 to today ... it could be the beginning of a new Age, the Corona Age

Gary Comey

[Alpine] Week: 0.51%. Trading is a funny business and since GBPCHF late last year it's been tougher to make money. This too will pass. This morning's French and German PMI data showed that the Eurozone while definitely not humming along, the state of affairs was not as bad as forecasts suggested. Aside from a brief rally nothing happened until the U.S session kicked off and the Euro found a bid against a few currencies, AUD, JPY, & CAD and it's move against the Greenback allowed us out of our single EURUSD position there. Still a game of two halves because the safe haven CHF did not relent even while the safe haven Yen has been busy dropping several hundred pips against the Euro in the last few days. Frustrated? Annoyed? Impatient? That's understandable but if trading was easy.........

分享社交网络 · 8

Gary Comey

[Alpine] DD 18%. Pacific and California DD's circa 8% and 3% respectively. There's a gap in EUR/USD down to circa 1.0780 however the market is only 15-20 pips away from that support right now. This EURUSD decline is pulling on EURCHF. If 1.0780 holds on EURUSD perhaps......just perhaps we are close to the bottom in EURCHF in spite of the elliot wave analysis doing the rounds.

I have an admittedly small private account where I am now doubling my exposure and buying EURUSD too. Not for the faint hearted. That said I can do a lesser version with the Blackwave accounts with combined $275K.

Therefore given the extended nature of the EURUSD move and despite the correlation I am going to place one EURUSD BUY ORDER and NO MORE.

I have an admittedly small private account where I am now doubling my exposure and buying EURUSD too. Not for the faint hearted. That said I can do a lesser version with the Blackwave accounts with combined $275K.

Therefore given the extended nature of the EURUSD move and despite the correlation I am going to place one EURUSD BUY ORDER and NO MORE.

分享社交网络 · 6

Gary Comey

[Alpine] Week + 0.34%. Obviously the predominant issue is the prolonged position in EURCHF though off the lows today but still deeply oversold. Until the DD improves the focus is capital protection so I’m not likely to open a new pair.

分享社交网络 · 8

Gary Comey

{Alpine} EURCHF is measuring Relative Strength W1-29, D1-25, H4-28, H1-38. The last time EURCHF was this low was February 2017. They say it's down the German political developments plus the diverging economic outlook between E.U and the U.S. Last time EURUSD was this low was September 2019. That said when I am buying a technically oversold pair it's usually because of a negative fundamental reason and the opposite is always true too with technically overbought when I sell. The strategy is after-all contrarian. Even with wall to wall positive or negative news nothing tends to go up or down in a straight line. Would love to say this is the bottom but this is speculation and not crystal ball stuff. DD is about 13.25% which is well within the safe limits for high risk Alpine, for Pacific and California which are medium and low risk the DD is obviously less than the high risk account.

分享社交网络 · 11

Gary Comey

[Alpine] Cash +0.28% This is a case of Dollar strength which is why EURUSD is down and USDCHF is up and USDCAD is up too. Our major position the less correlated EURCHF is down (because the Euro is weak against the buck and therefore weak against the Franc too). So what's the plan? It's the same plan as I've always had, trade the technicals and keep position size in order therefore I buy on oversold and sell on overbought and as long as position sizes are correct this will work again. Worth noting that EURUSD is now Daily oversold too. DD in control and if volatile markets are fun, ranging markets take patience and I have plenty of the later.

分享社交网络 · 9

Walter Scott

2020.02.12

UPDATE

Tomorrow will be 30 days stuck in eur-chf.

Good job

----------------------------------------------------------------------------------------------------------

Walter Scott 2020.01.22 15:27 (modified 2020.01.22 15:30)

... Lucky purchase and closing of eur-chf on 2 previous occasions on 8Gen and 9Gen and now stuck in these trades without the possibility of doing anything.

Tomorrow will be 30 days stuck in eur-chf.

Good job

----------------------------------------------------------------------------------------------------------

Walter Scott 2020.01.22 15:27 (modified 2020.01.22 15:30)

... Lucky purchase and closing of eur-chf on 2 previous occasions on 8Gen and 9Gen and now stuck in these trades without the possibility of doing anything.

Gary Comey

Month 3.33% at least half of what I was hoping for. Nevertheless EURCHF appears to be forming a base on deeply oversold levels. In all likelihood we will benefit from this trade in February and not January. All I can do is follow the script here and await price developments. Would prefer some excitement though. 🙄

分享社交网络 · 10

Gary Comey

[Alpine MAM] Week: Cash +0.14%. EURCHF has now filled the gap down to 1.0718 that I thought initially was a possibility (and said so on Twitter @BlackwaveFX) is trading at RSI 20 Daily which is quite oversold. Indeed it has traded lower as the Euro declined against the buck and cable too. These two other markets are now well off their moving averages too and a rally here may underpin a rally in EURCHF.

In the meantime the DD is well within risk parameters this after noon at about 7% in this high risk account. I continue expect a rally in this very oversold market.

Hopefully we get back to cash in time to book a decent January. 3.3% so far.

Sorry for no update last Friday. I was in Portugal checking on renovations to an apartment.

In the meantime the DD is well within risk parameters this after noon at about 7% in this high risk account. I continue expect a rally in this very oversold market.

Hopefully we get back to cash in time to book a decent January. 3.3% so far.

Sorry for no update last Friday. I was in Portugal checking on renovations to an apartment.

分享社交网络 · 8

diocanetrader

2020.01.28

@Onebody I have not seen any of his provocative comments, however as you say he will certainly be a great "bastard" . And @ Mr. 3555elvis I can assure you that I have no one of chip on my shoulder... it is so curious that all those who defend this trader do nothing that insult other people ... maybe it is a necessary thing here ... insult and treat others as idiots. Keep it up.

Onebody

2020.01.28

I was wrong to use an insult. For the rest, I stand by my opinion. One of the comments was actually deleted. I used the word "bastard"when I answered it. Let him return it if his word is worth anything. Then we'll talk.

Gary Comey

2020.01.28

@diocanetrader was correct last week. Trolling the people who are trolling me seems like a good revenge but it just ultimately invites more deranged comments than ever so I've deleted the screen shot of "Mr Scotts" rant. You were correct and I was wrong.

The original idea behind these posts was to let you see what I am sending the managed clients on a Friday evening as an alternative to responding via instant message to any number of MQL5 traders on a daily basis.

I guess the managed clients don't troll me and in fact I am taking some of them out on Sunday evening so the relationship there is totally different to MQL5. I used to work with some of the managed clients, I know their kids and their wives.

I must obviously be a sensitive little soul to fall for the abusive comments so maybe it's best if I leave the posts to stand for themselves and allow you guys to argue over it. Forgive me if I withdraw to the background. I am sure you would prefer that the trader is not being influenced by destructive comments full of either fear or greed. It's no good for me, or for you and, ironically not good for the people who try to get into my head with those comments. They are apparently happy to try and melt the head of the very person in charge of their money which is not logical.

The original idea behind these posts was to let you see what I am sending the managed clients on a Friday evening as an alternative to responding via instant message to any number of MQL5 traders on a daily basis.

I guess the managed clients don't troll me and in fact I am taking some of them out on Sunday evening so the relationship there is totally different to MQL5. I used to work with some of the managed clients, I know their kids and their wives.

I must obviously be a sensitive little soul to fall for the abusive comments so maybe it's best if I leave the posts to stand for themselves and allow you guys to argue over it. Forgive me if I withdraw to the background. I am sure you would prefer that the trader is not being influenced by destructive comments full of either fear or greed. It's no good for me, or for you and, ironically not good for the people who try to get into my head with those comments. They are apparently happy to try and melt the head of the very person in charge of their money which is not logical.

Gary Comey

[Alpine] Week: +1.76%. One trade open and close to cash. After a week and a half we are more than 3%. I'd like a good start to the year because it sets us up nicely given the nature of compounding. You guys can withdraw if you want but I will be doing my best not to.

分享社交网络 · 7

Gary Comey

{Alpine} For the record then. 2019 100%. December 3.09%. Week: 1.33%. One of the great wonders of the world (according to Einstein) is compound interest. While making no withdrawal ultimately leaves the potential for disaster on the table it also means you get paid for the risk. From 2016 to early 2019 I made hardly any withdrawals but finally relented in mid 2019 and went on something of a splurge buying art and property for both Blackwave and myself. Now I think I'll "cool the jets" again and allow Blackwave funds to go from circa $265K to $500K and therefore renew my faith in myself and my strategy. HAPPY NEW YEAR.

分享社交网络 · 11

: