ADIKALARAJ / 个人资料

I love a good challenge and I'm as ambitious and dedicated as they come .I work in tandem toward a common goal of success.

ADIKALARAJ

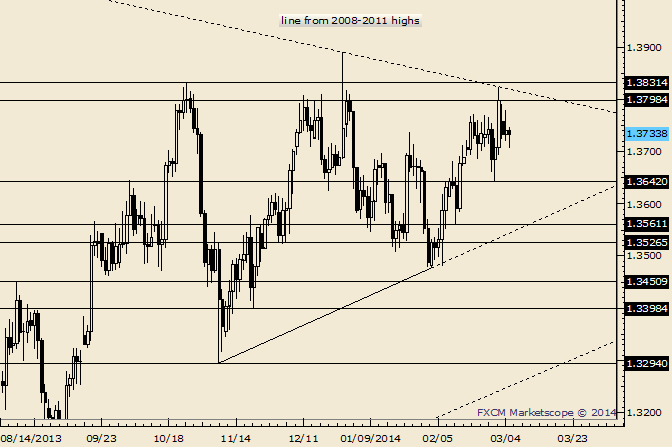

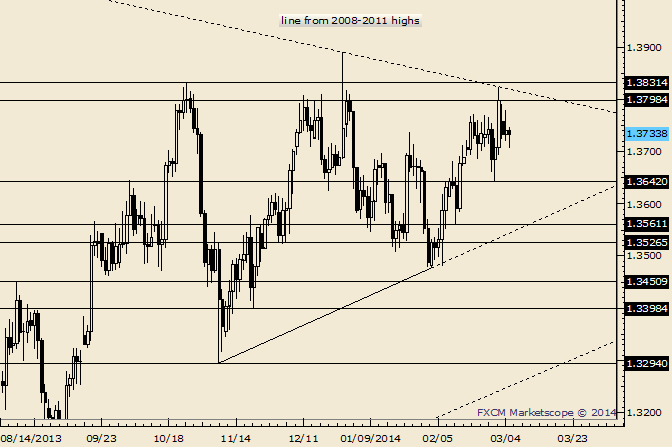

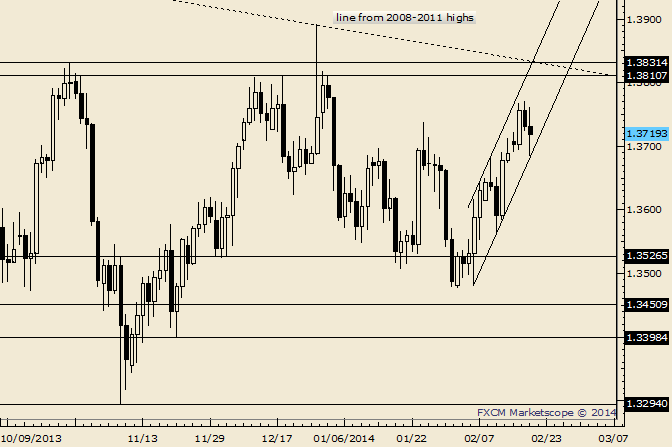

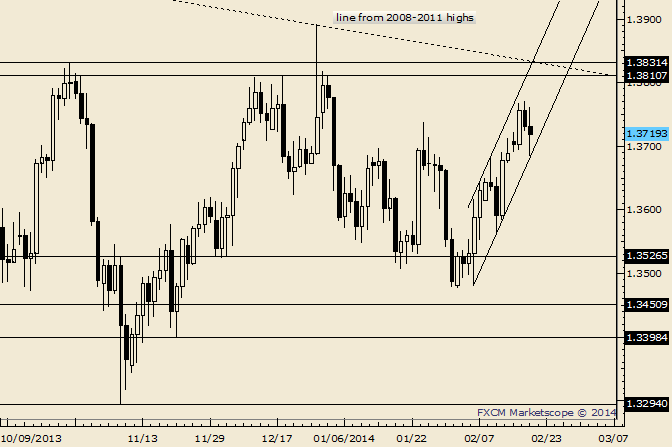

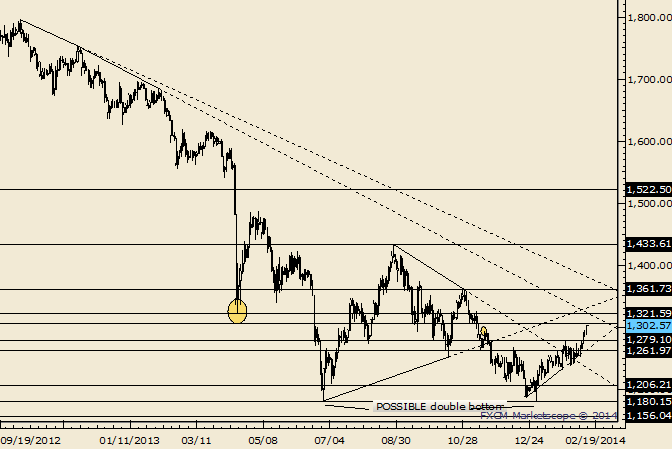

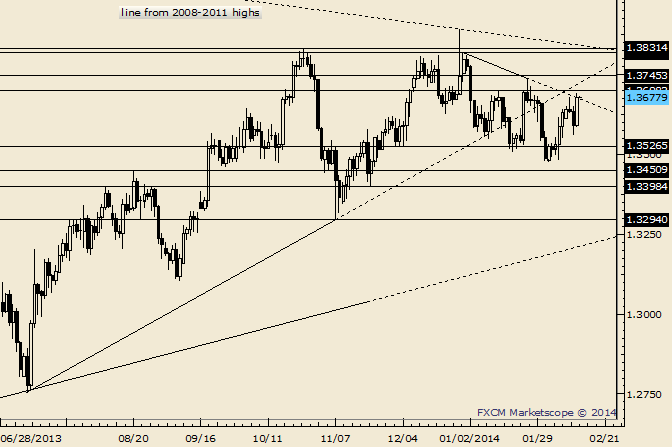

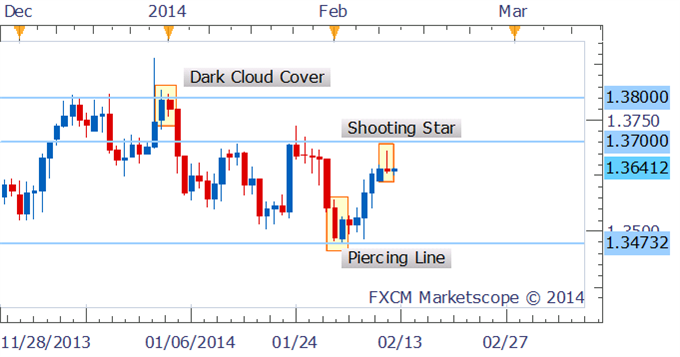

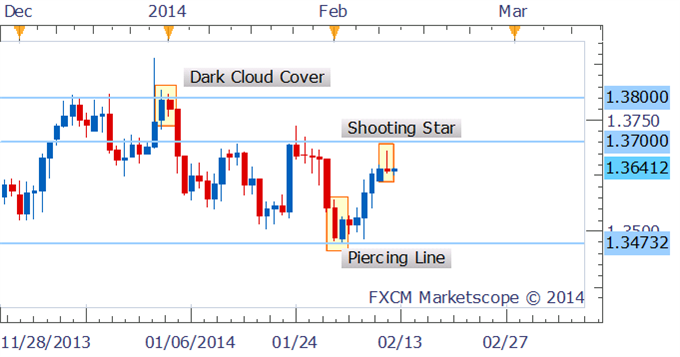

EUR/USD 5 months Triangle :-

Former highs at 1.3811 to 1.3831 and the line that extends off of the 2008, 2011 and December highs remain of interest as a reversal zone if reached.

LEVELS: 1.3593 1.36511.3698 | 1.3798 1.3831 1.3859.

Former highs at 1.3811 to 1.3831 and the line that extends off of the 2008, 2011 and December highs remain of interest as a reversal zone if reached.

LEVELS: 1.3593 1.36511.3698 | 1.3798 1.3831 1.3859.

分享社交网络 · 3

ADIKALARAJ

EUR/USD Technical Strategy:

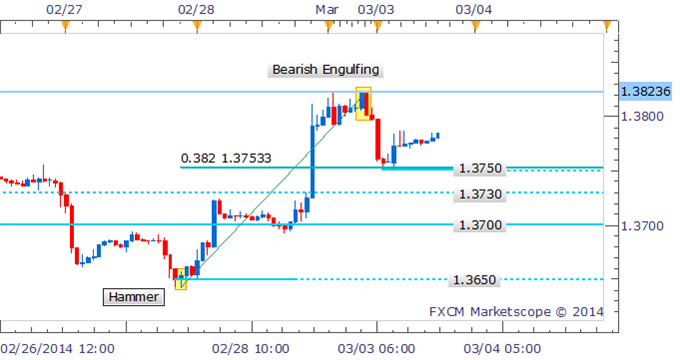

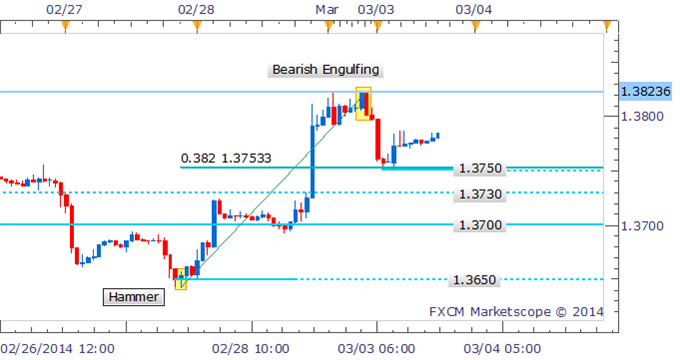

Bearish Engulfing pattern dominates intraday signals

Buyers prepared to support prices at 1.3722.

As noted in yesterday’s candlestick report the Bearish Engulfing formation on the hourly chart for EUR/USD was warning of potential declines ahead for the pair. We’re still yet to see a key reversal pattern emerge that could act as a bullish signal, leaving the bias to the downside for the Euro.

Bearish Engulfing pattern dominates intraday signals

Buyers prepared to support prices at 1.3722.

As noted in yesterday’s candlestick report the Bearish Engulfing formation on the hourly chart for EUR/USD was warning of potential declines ahead for the pair. We’re still yet to see a key reversal pattern emerge that could act as a bullish signal, leaving the bias to the downside for the Euro.

分享社交网络 · 3

ADIKALARAJ

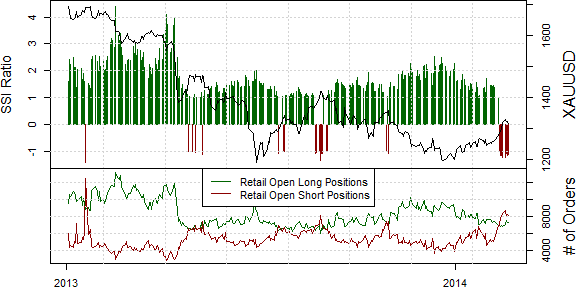

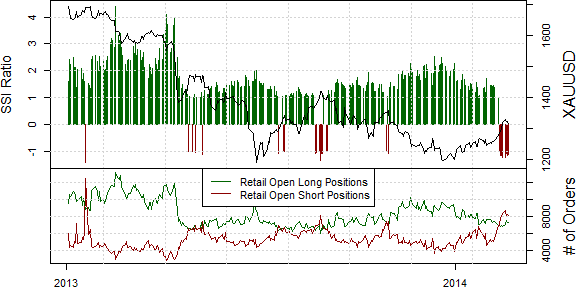

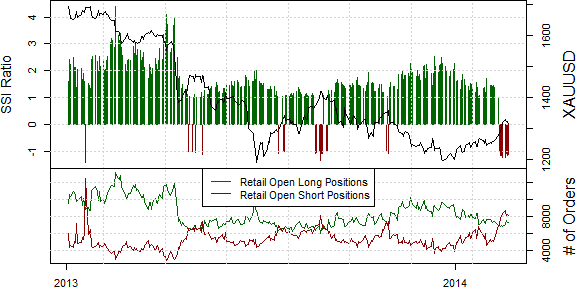

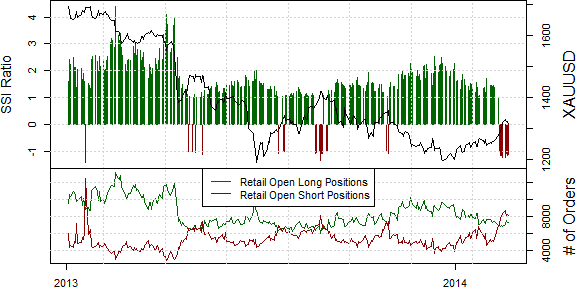

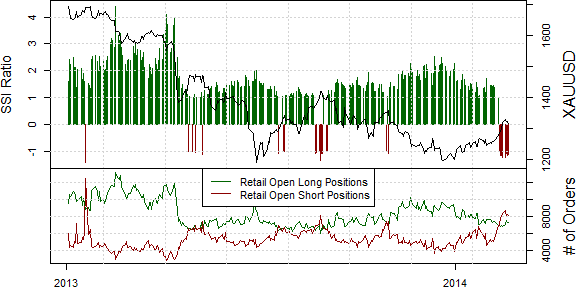

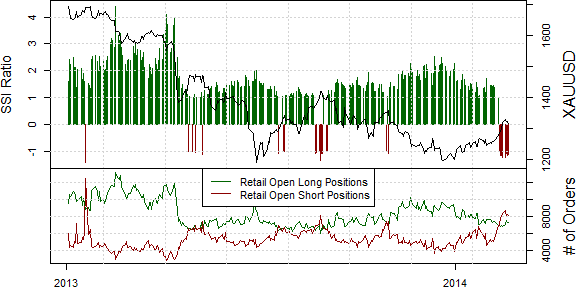

Trade Implications – Gold:

One-sided US Dollar positioning suggests that the Greenback may be near an important turning point. Yet out performance in Gold prices give us pause in calling for a reversal of recent gains. Our bias would change if trading crowds bought into any XAUUSD declines.

One-sided US Dollar positioning suggests that the Greenback may be near an important turning point. Yet out performance in Gold prices give us pause in calling for a reversal of recent gains. Our bias would change if trading crowds bought into any XAUUSD declines.

分享社交网络 · 2

ADIKALARAJ

EUR/USD Technical Strategy:

Bearish Engulfing pattern hinting at a correction.

Buyers likely sitting at nearby 1.3750 mark(also the 38.2% Fib Retracement level) a clearance below that mark is needed before offering a bearish technical bias for the pair.

Bearish Engulfing pattern hinting at a correction.

Buyers likely sitting at nearby 1.3750 mark(also the 38.2% Fib Retracement level) a clearance below that mark is needed before offering a bearish technical bias for the pair.

分享社交网络 · 2

ADIKALARAJ

Trade Implications – Gold:

One-sided US Dollar positioning suggests that the Greenback may be near an important turning point. Yet out performance in Gold prices give us pause in calling for a reversal of recent gains. Our bias would change if trading crowds bought into any XAUUSD declines.

One-sided US Dollar positioning suggests that the Greenback may be near an important turning point. Yet out performance in Gold prices give us pause in calling for a reversal of recent gains. Our bias would change if trading crowds bought into any XAUUSD declines.

分享社交网络 · 1

ADIKALARAJ

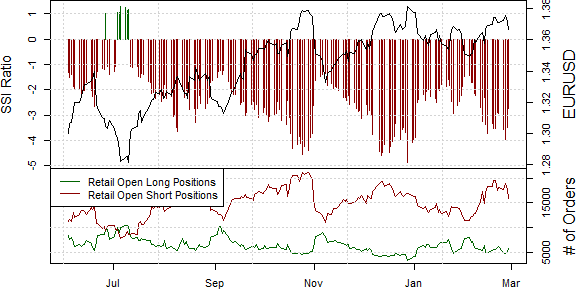

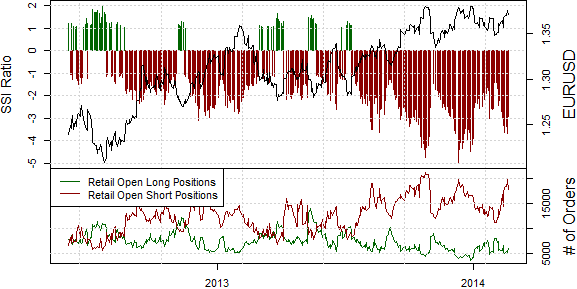

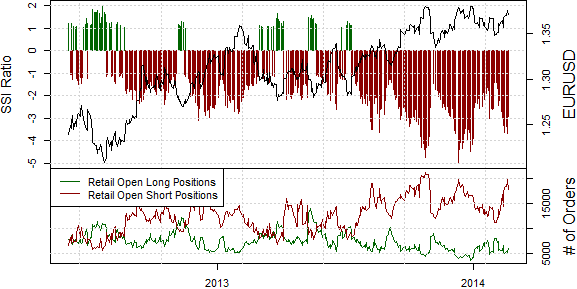

Trade Implications – EURUSD:

The crowd has consistently remained short Euro since it bottomed near $1.28 through July. Yet especially one-sided positions warn that an important extreme may be in place.

The crowd has consistently remained short Euro since it bottomed near $1.28 through July. Yet especially one-sided positions warn that an important extreme may be in place.

分享社交网络 · 1

ADIKALARAJ

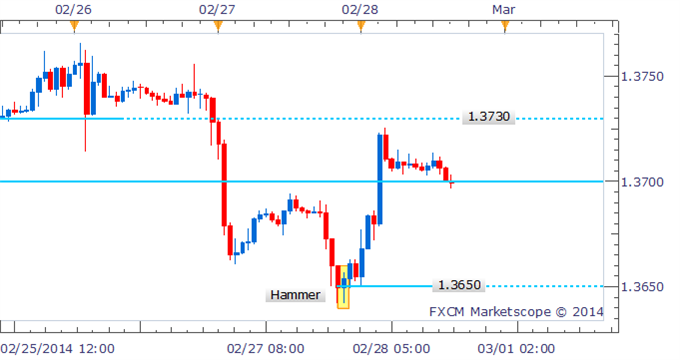

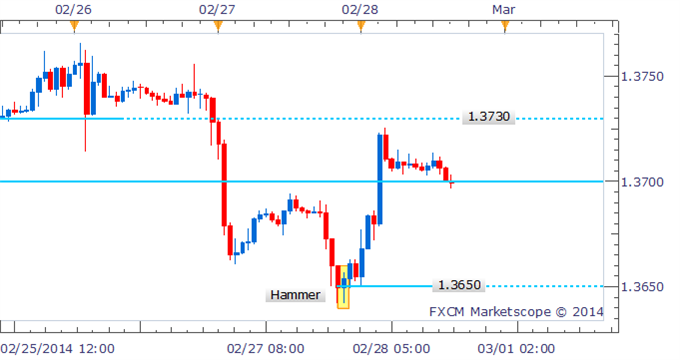

EUR/USD Technical Strategy: Waiting for clearance of 1.3700

Hammer played out with bullish advance in US trading

Break of 1.3700 may see buying support emerge at 1.3650 level

Hammer played out with bullish advance in US trading

Break of 1.3700 may see buying support emerge at 1.3650 level

分享社交网络 · 3

ADIKALARAJ

Trade Implications – Gold: One-sided US Dollar positioning suggests that the Greenback may be near an important turning point. Yet outperformance in Gold prices give us pause in calling for a reversal of recent gains. Our bias would change if trading crowds bought into any XAUUSD declines.

Retail FX traders remain short Gold against the US Dollar for the first time since the metal set an important top near $1430 over six months ago. Our trading bias remains bullish XAUUSD above $1280.

Retail FX traders remain short Gold against the US Dollar for the first time since the metal set an important top near $1430 over six months ago. Our trading bias remains bullish XAUUSD above $1280.

分享社交网络 · 1

ADIKALARAJ

Trade Implications – EURUSD:

We typically go against the crowd; if everyone has sold we prefer to buy. Yet retail traders are often their most short at important tops and their most long at significant lows. The caveat is clear: the sentiment and price extreme is only clear in hindsight.

The fact that these extremes are happening as the pair reverses off of important technical resistance nonetheless suggests that the EURUSD may soon reverse lower. A larger shift towards crowd buying would help confirm the EUR top; our sentiment-based Momentum2 strategy may soon sell if the pair does indeed turn lower.

We typically go against the crowd; if everyone has sold we prefer to buy. Yet retail traders are often their most short at important tops and their most long at significant lows. The caveat is clear: the sentiment and price extreme is only clear in hindsight.

The fact that these extremes are happening as the pair reverses off of important technical resistance nonetheless suggests that the EURUSD may soon reverse lower. A larger shift towards crowd buying would help confirm the EUR top; our sentiment-based Momentum2 strategy may soon sell if the pair does indeed turn lower.

分享社交网络 · 1

ADIKALARAJ

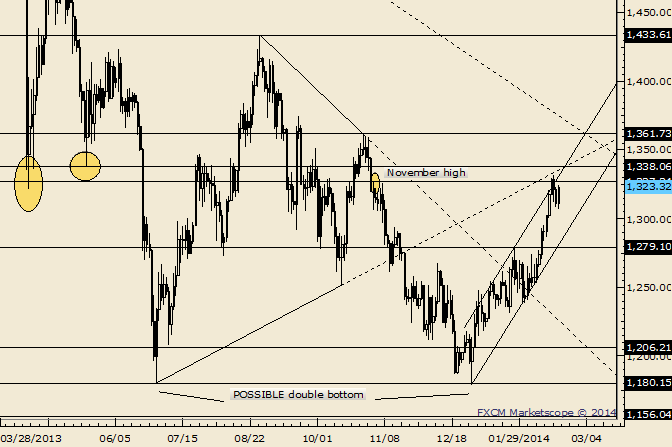

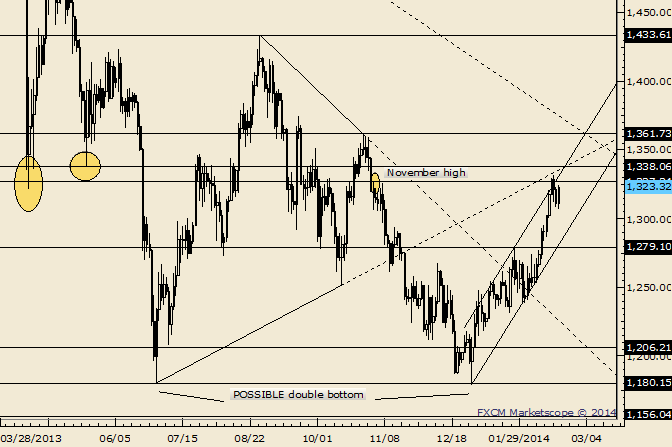

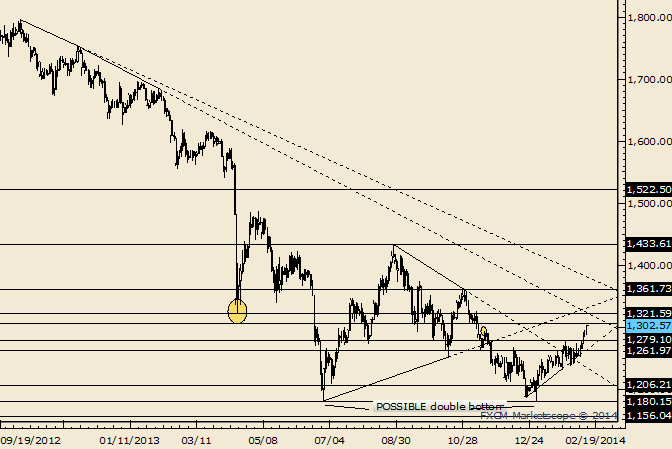

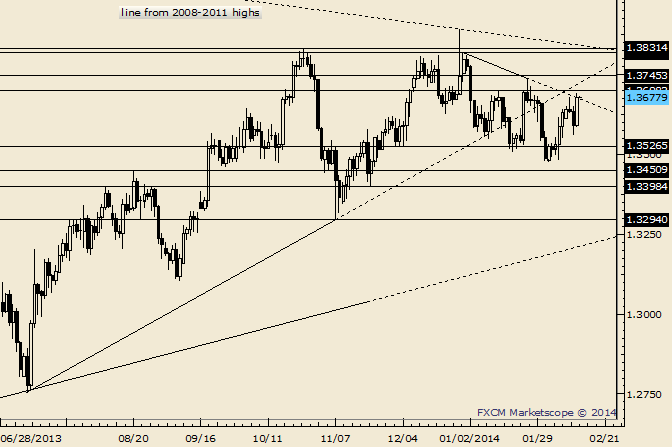

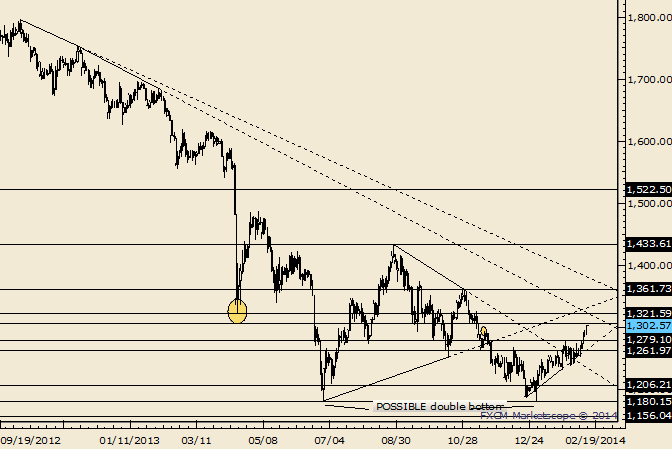

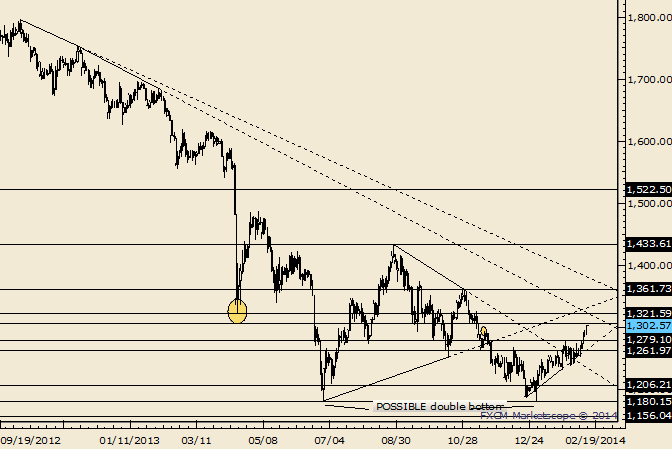

Gold Could Test May 2013 Low before a Bigger Drop:-

The next major resistance is probably the October high at 1362.

LEVELS: 1286 1296 1304 | 1322 1334 1352

The next major resistance is probably the October high at 1362.

LEVELS: 1286 1296 1304 | 1322 1334 1352

分享社交网络 · 3

ADIKALARAJ

EUR/USD Tests Trend line and Former High; 1.3800 Run Coming?

Former highs at 1.3811 to 1.3831 and the line that extends off of the 2008, 2011 and December highs remain of interest as a reversal zone if reached. Trade below 1.3680 (not a spike) would suggest that a top is in for a drop into 1.3500s.

LEVELS: 1.3593 1.36181.3682 | 1.3733 1.3768 1.3813.

Former highs at 1.3811 to 1.3831 and the line that extends off of the 2008, 2011 and December highs remain of interest as a reversal zone if reached. Trade below 1.3680 (not a spike) would suggest that a top is in for a drop into 1.3500s.

LEVELS: 1.3593 1.36181.3682 | 1.3733 1.3768 1.3813.

分享社交网络 · 2

ADIKALARAJ

Gold has responded to the November high, former trend line support (line that extends off of the June and October lows) and channel resistance. The market followed up on Tuesday’s outside day with a down day so respect the potential for additional weakness.

-The next major resistance is probably the October high at 1362.

LEVELS: 1286 1296 1304 | 1322 1334 1352 .

-The next major resistance is probably the October high at 1362.

LEVELS: 1286 1296 1304 | 1322 1334 1352 .

分享社交网络 · 3

ADIKALARAJ

EUR/USD Technical Strategy: Absence of reversal signal leaves upside favored

• Uptrend on daily and clearance of 1.3700 suggests gains to continue

• Psychologically significant 1.3800 mark likely to prompt emergence of sellers

• Uptrend on daily and clearance of 1.3700 suggests gains to continue

• Psychologically significant 1.3800 mark likely to prompt emergence of sellers

分享社交网络 · 4

ADIKALARAJ

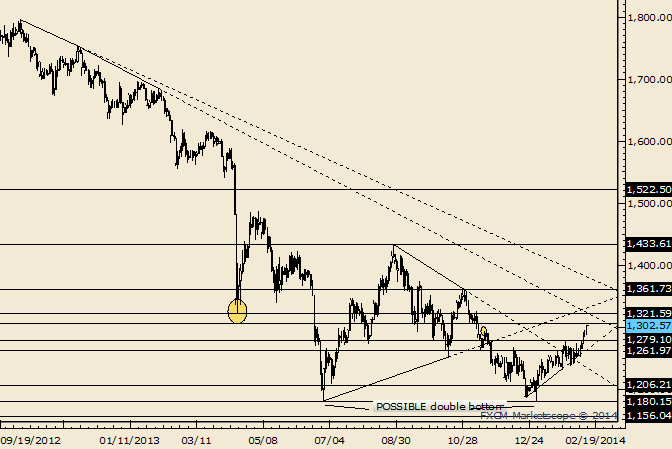

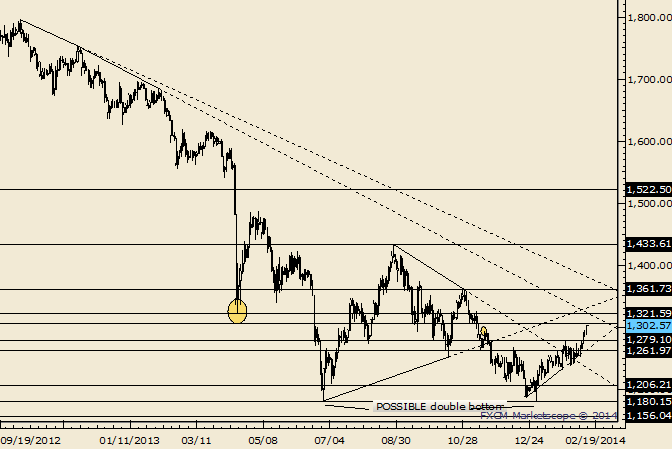

Gold Marches on Towards 1306; 1322 is Bigger:-

The next major resistance is probably the April low at 1321.

LEVELS: 1270 1279 1294 | 1306 1322 1336

The next major resistance is probably the April low at 1321.

LEVELS: 1270 1279 1294 | 1306 1322 1336

分享社交网络 · 3

ADIKALARAJ

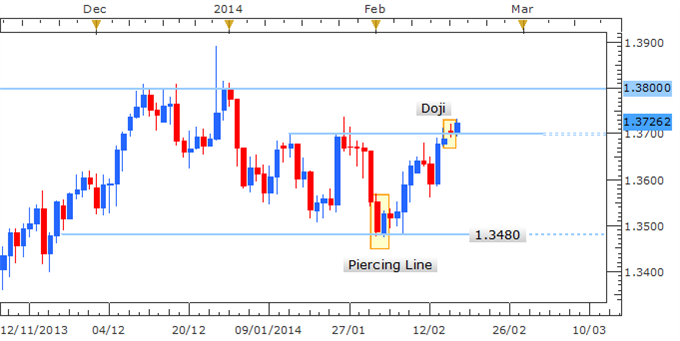

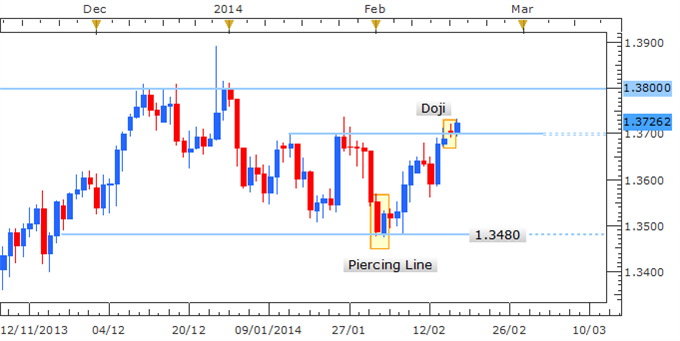

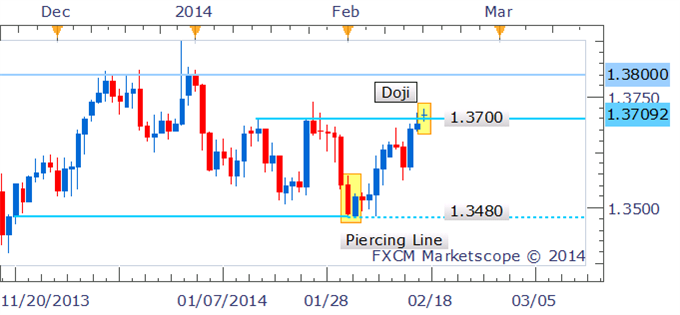

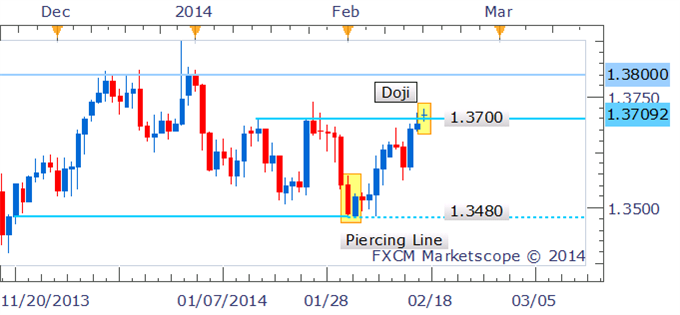

EUR/USD Technical Strategy: Awaiting follow-through to confirm technical bias

• Doji suggests some indecision, but more meaningful reversal signal remains absent

• Clearance of 1.3700 needs additional confirmation to support continued advance

The Euro has extended its recent gains and is wavering around the critical 1.3700 level. While there appears to be some indecision amongst traders as signified by the Doji candle formation on the daily, it may be too soon to suggest a reversal. Indeed caution is suggested here when looking at selling EUR/USD, based on a false reversal signal provided by a Shooting Star formation last week.

• Doji suggests some indecision, but more meaningful reversal signal remains absent

• Clearance of 1.3700 needs additional confirmation to support continued advance

The Euro has extended its recent gains and is wavering around the critical 1.3700 level. While there appears to be some indecision amongst traders as signified by the Doji candle formation on the daily, it may be too soon to suggest a reversal. Indeed caution is suggested here when looking at selling EUR/USD, based on a false reversal signal provided by a Shooting Star formation last week.

分享社交网络 · 4

ADIKALARAJ

Gold Marches on Towards 1306; 1322 is Bigger-

The next major resistance is probably the April low at 1321.

LEVELS: 1270 1279 1294 | 1306 1322 1336

The next major resistance is probably the April low at 1321.

LEVELS: 1270 1279 1294 | 1306 1322 1336

分享社交网络 · 3

ADIKALARAJ

EURUSD is pressing against trend line resistance. This level is minor. 1.3745 is more likely to provoke a reaction. Interestingly, the underside of former trend line support intersects with 1.3745 in the middle of next week).

LEVELS: 1.3585 1.36181.3652 | 1.3699 1.3745 1.3813

LEVELS: 1.3585 1.36181.3652 | 1.3699 1.3745 1.3813

分享社交网络 · 3

ADIKALARAJ

Gold Marches on Towards 1306; 1322 is Bigger:-

Yesterday’s doji hinted at a pullback that never materialized.

-The next major resistance is probably the April low at 1321.

LEVELS: 1270 1279 1294 | 1306 1322 1336 .

Yesterday’s doji hinted at a pullback that never materialized.

-The next major resistance is probably the April low at 1321.

LEVELS: 1270 1279 1294 | 1306 1322 1336 .

分享社交网络 · 1

ADIKALARAJ

EUR/USD Technical Strategy: Shorts preferred following Shooting Star confirmation

• Potential target offered by yearly low near 1.3500 figure

• Sellers emerged at the psychologically significant 1.3700 handle as suggested

As suggested in yesterday’s candlesticks report signs of weakness for the EUR/USD presented a selling opportunity. The Shooting Star formation on the daily chart is hinting at a potential reversal as buyers appear to have lost their grip on the pair. A potential target is offered by the 1.3500 handle, near the 2014 low and would likely prompt some buying support.

• Potential target offered by yearly low near 1.3500 figure

• Sellers emerged at the psychologically significant 1.3700 handle as suggested

As suggested in yesterday’s candlesticks report signs of weakness for the EUR/USD presented a selling opportunity. The Shooting Star formation on the daily chart is hinting at a potential reversal as buyers appear to have lost their grip on the pair. A potential target is offered by the 1.3500 handle, near the 2014 low and would likely prompt some buying support.

分享社交网络 · 3

: