Abdalla Mohamed Mahmoud Taha / 个人资料

- 信息

|

6+ 年

经验

|

0

产品

|

0

演示版

|

|

0

工作

|

1

信号

|

0

订阅者

|

my name Abdalla Mohamed, I have more than 11 years experience in forex market .

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

Abdalla Mohamed Mahmoud Taha

USDJPY - H1

Buy the pair around 114.25 with a target price of 114.88

alternative scenario

Selling the pair around 113.88 with a target price of 113.20

comment

Trading above support and averages favors a rise.

Buy the pair around 114.25 with a target price of 114.88

alternative scenario

Selling the pair around 113.88 with a target price of 113.20

comment

Trading above support and averages favors a rise.

分享社交网络 · 1

Abdalla Mohamed Mahmoud Taha

first scenario

Selling the pair around 1.3694 with a target price of 1.3600

alternative scenario

Buy the pair around 1.3755 with a target price of 1.3848

comment

Trading below the resistance and the averages favors the decline

Selling the pair around 1.3694 with a target price of 1.3600

alternative scenario

Buy the pair around 1.3755 with a target price of 1.3848

comment

Trading below the resistance and the averages favors the decline

Abdalla Mohamed Mahmoud Taha

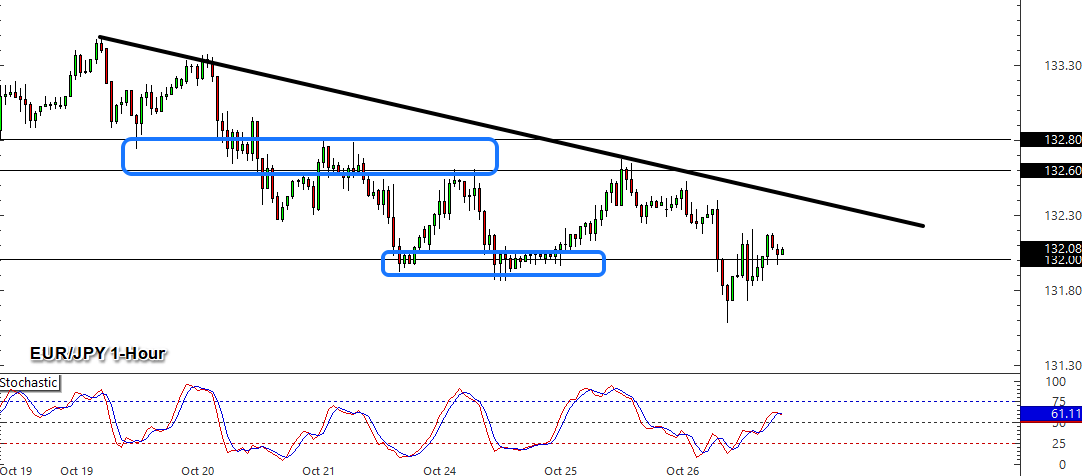

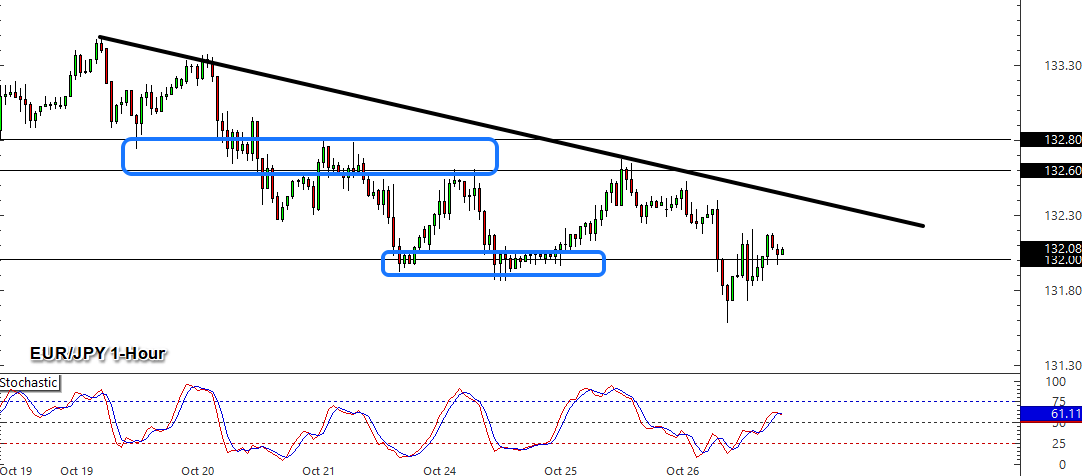

Daily Asia-London Sessions Watchlist: EUR/JPY

We’ve got not one but two central bank events coming around the corner to potentially shake up EUR/JPY. Will the upcoming monetary policy statements from the Bank of Japan and European Central Bank be enough to get both currencies moving?

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at a simple break-and-retest setup on EUR/GBP, so be sure to check that out to see if there is still a potential play!

Intermarket Update:

Equity Markets Bond Yields Commodities & Crypto

DAX: 15705.81 -0.33%

FTSE: 7253.27 -0.33%%

S&P 500: 4551.68 -0.51%

NASDAQ: 15235.84 0.00% US 10-YR: 1.548% -0.07

Bund 10-YR: -0.186% -0.007

UK 10-YR: 0.976% -0.009

JPN 10-YR: 0.084% -0.017 Oil: 82.08 -3.02%

Gold: 1,798.40 +0.28%

Bitcoin: $58,652.88 -5.40%

Ether: $3,962.30 -5.92%

BNB: $451.15 -7.27%

Fresh Market Headlines and Economic Data:

Bank of Canada ends bond-buying program and moves up expectations of rate hike, possibly as early as Q1 2022

U.S. exports drop in September, increasing the merchandise-trade gap to a record $96.3B

New orders for U.S. manufactured durable goods in September decreased $B or 0.4% to $261.3B

U.K. Chancellor Sunak announced £75B of stimulus to boost economy

Tensions rise between the U.K. and France over fishing access

Shiba Inu surges to record as Robinhood petition signups reach 300K signatures

Bitcoin dips below $60K as bullish ETF reaction fades

Upcoming Potential Catalysts on the Economic Calendar

Japan Retail Sales at 11:50 pm GMT

Australia Import & Export Prices at 12:30 am GMT (Oct. 28)

Bank of Japan Monetary Policy Statement at 3:00 am GMT (Oct. 28)

Germany Unemployment Rate at 6:00 am GMT (Oct. 28)

Spain Unemployment Rate, Inflation Rate at 7:00 am GMT (Oct. 28)

Italy Consumer Confidence at 8:00 am GMT (Oct. 28)

Euro Area Economic Sentiment, Consumer Confidence at 9:00 am GMT (Oct. 28)

European Central Bank Monetary Policy Statement at 11:45 am GMT (Oct. 28)

If you’re not familiar with the forex market’s main trading sessions, check out our Forex Market Hours tool.

What to Watch: EUR/JPY

EUR/JPY 1-Hour Forex ChartEUR/JPY 1-Hour Forex Chart

On the one hour chart above of EUR/JPY, we’ve got a pretty clear downtrend in the works over the past week, albeit at a slow and steady pace. Support and resistance levels seem to be clearly defined, with the market now hovering around the strong support area around the 132.00 major psychological level.

Actually, prices seem to be consolidating tightly at the moment, which makes sense given that traders are likely waiting on the sidelines ahead of monetary policy statements from both the Bank of Japan and European Central Bank in the upcoming Thursday session.

Expectations for the BOJ event are for it to be a snoozer as no changes are forecasted, while the ECB may be the event to get EUR/JPY moving as traders will closely watch for the ECB’s comments on current European risks like the energy crisis and supply chain issues.

We think the issues in Europe will likely be the main focus for EUR/JPY traders, and unless the ECB gives some sort of optimistic view that Europe will be able to get past those issues quickly, the trend in EUR/JPY is likely to remain lower as traders price in no rate hikes for the foreseeable future.

In that scenario, any pick up in volatility could turn into a swing or longer-term short position opportunity if the market bounces up to the falling trendline marked on the chart above/previous area of interest (between 132.60 – 132.80). Be on the look out there for bearish reversal candles, especially if the ECB gives a relatively negative outlook on how long it will take Europe to overcome the energy and supply chain challenges.

Also be on the look out for a sustained break of the 132.00 support area as it could draw in momentum sellers if we do get a negative take from the ECB tomorrow, or even if broad market sentiment sours in the upcoming session.

We’ve got not one but two central bank events coming around the corner to potentially shake up EUR/JPY. Will the upcoming monetary policy statements from the Bank of Japan and European Central Bank be enough to get both currencies moving?

Before moving on, ICYMI, today’s Daily U.S. Session Watchlist looked at a simple break-and-retest setup on EUR/GBP, so be sure to check that out to see if there is still a potential play!

Intermarket Update:

Equity Markets Bond Yields Commodities & Crypto

DAX: 15705.81 -0.33%

FTSE: 7253.27 -0.33%%

S&P 500: 4551.68 -0.51%

NASDAQ: 15235.84 0.00% US 10-YR: 1.548% -0.07

Bund 10-YR: -0.186% -0.007

UK 10-YR: 0.976% -0.009

JPN 10-YR: 0.084% -0.017 Oil: 82.08 -3.02%

Gold: 1,798.40 +0.28%

Bitcoin: $58,652.88 -5.40%

Ether: $3,962.30 -5.92%

BNB: $451.15 -7.27%

Fresh Market Headlines and Economic Data:

Bank of Canada ends bond-buying program and moves up expectations of rate hike, possibly as early as Q1 2022

U.S. exports drop in September, increasing the merchandise-trade gap to a record $96.3B

New orders for U.S. manufactured durable goods in September decreased $B or 0.4% to $261.3B

U.K. Chancellor Sunak announced £75B of stimulus to boost economy

Tensions rise between the U.K. and France over fishing access

Shiba Inu surges to record as Robinhood petition signups reach 300K signatures

Bitcoin dips below $60K as bullish ETF reaction fades

Upcoming Potential Catalysts on the Economic Calendar

Japan Retail Sales at 11:50 pm GMT

Australia Import & Export Prices at 12:30 am GMT (Oct. 28)

Bank of Japan Monetary Policy Statement at 3:00 am GMT (Oct. 28)

Germany Unemployment Rate at 6:00 am GMT (Oct. 28)

Spain Unemployment Rate, Inflation Rate at 7:00 am GMT (Oct. 28)

Italy Consumer Confidence at 8:00 am GMT (Oct. 28)

Euro Area Economic Sentiment, Consumer Confidence at 9:00 am GMT (Oct. 28)

European Central Bank Monetary Policy Statement at 11:45 am GMT (Oct. 28)

If you’re not familiar with the forex market’s main trading sessions, check out our Forex Market Hours tool.

What to Watch: EUR/JPY

EUR/JPY 1-Hour Forex ChartEUR/JPY 1-Hour Forex Chart

On the one hour chart above of EUR/JPY, we’ve got a pretty clear downtrend in the works over the past week, albeit at a slow and steady pace. Support and resistance levels seem to be clearly defined, with the market now hovering around the strong support area around the 132.00 major psychological level.

Actually, prices seem to be consolidating tightly at the moment, which makes sense given that traders are likely waiting on the sidelines ahead of monetary policy statements from both the Bank of Japan and European Central Bank in the upcoming Thursday session.

Expectations for the BOJ event are for it to be a snoozer as no changes are forecasted, while the ECB may be the event to get EUR/JPY moving as traders will closely watch for the ECB’s comments on current European risks like the energy crisis and supply chain issues.

We think the issues in Europe will likely be the main focus for EUR/JPY traders, and unless the ECB gives some sort of optimistic view that Europe will be able to get past those issues quickly, the trend in EUR/JPY is likely to remain lower as traders price in no rate hikes for the foreseeable future.

In that scenario, any pick up in volatility could turn into a swing or longer-term short position opportunity if the market bounces up to the falling trendline marked on the chart above/previous area of interest (between 132.60 – 132.80). Be on the look out there for bearish reversal candles, especially if the ECB gives a relatively negative outlook on how long it will take Europe to overcome the energy and supply chain challenges.

Also be on the look out for a sustained break of the 132.00 support area as it could draw in momentum sellers if we do get a negative take from the ECB tomorrow, or even if broad market sentiment sours in the upcoming session.

分享社交网络 · 2

Abdalla Mohamed Mahmoud Taha

5 Physical Habits That Can Improve Your Trading

Because trading can often turn into an intense mental activity, most traders tend to forget their physical well-being.

After all, you don’t really need to have washboard abs or maintain a single-digit body fat percentage to do well in the markets, do you?

Day traders can simply roll right out of bed, eat a Pop Tart, check their trading platforms, stare at the screen all day, grab an energy drink, stay up watching the charts all night… and still manage to make millions!

While this kind of lifestyle works for some, it doesn’t exactly seem sustainable or healthy at all.

In fact, just like any other high-performance sport, your trading skills can benefit from a holistic approach that takes physical well-being into account.

Here are some simple habits that can improve your trading performance:

1. Get enough sleep

Getting the recommended 7 to 9 hours of shut-eye might be a challenge for forex traders who work around a 24-hour market.

It can be tempting to pull an all-nighter to stay awake during an active trading session or catch a top-tier news event!

But constantly staying up all day and night just to watch open positions has its drawbacks, as sleep deprivation can impair cognitive and motor abilities.

Getting enough quality sleep can help you manage your emotions and stay level-headed when making trading decisions, as this ensures your brain muscles have relaxed and your mental state is refreshed regularly.

2. Take screen breaks

In line with getting enough sleep, you should also make it a habit to step away from the screen every now and then.

This means giving your eyes a break from the strain and also stretching your muscles after sitting in front of your computer for long hours.

In doing so, you can release tension from your back, shoulders, and neck that might be negatively affecting your ability to stay focused.

If you’re worried you might miss big market moves the moment you take a break, try to come up with a daily schedule that works around the best timing for your trading strategies.

3. Get proper exercise

This doesn’t necessarily mean starting a Crossfit workout or running a half-marathon!

What’s important is that you allocate some time – it can be as short as 15-30 minutes – to get blood flowing to your muscles and your brain.

Going for a short jog, doing some pushups, or taking your dog out for a walk could be enough to do the trick.

From a physiological standpoint, trading stress gets blood flow redirected away from the cerebral cortex towards the amygdala, which is responsible for the “fight or flight” response.

However, it’s actually the cerebral cortex that is in charge of the calm, reasoning ability to make sound decisions.

Physical exercise gets blood flowing back smoothly to the cerebral cortex, which aids impulse control, planning, and fear management in the long run.

4. Slow down and take deep breaths

Just as it’s essential to get your blood flowing, it’s also equally important to get your oxygen on!

5. Eat well and stay hydrated

Lastly, don’t forget that the body and brain function best when fueled by proper nourishment from water, minerals, and nutrients.

You don’t have to create a fancy diet of organic food and vitamin water, but it’s enough to make sure that you get balanced meals with the right amount of carbs, protein and fiber.

This could mean cutting down on sugary snacks, energy drinks, and instant ramen. Listen to your momma and eat your veggies yo!

And don’t forget to take the recommended 8 glasses of water a day, too.

This is a simple habit you can build into your schedule, along with screen breaks and exercise. If it helps, you can use smartphone apps that remind you to stand up, take deep breaths, stretch, and hydrate.

These aren’t exactly difficult habits to develop or incorporate in your daily routine, but they can go a long way in terms of improving your decision-making, emotional control, and overall trading mindset.

Because trading can often turn into an intense mental activity, most traders tend to forget their physical well-being.

After all, you don’t really need to have washboard abs or maintain a single-digit body fat percentage to do well in the markets, do you?

Day traders can simply roll right out of bed, eat a Pop Tart, check their trading platforms, stare at the screen all day, grab an energy drink, stay up watching the charts all night… and still manage to make millions!

While this kind of lifestyle works for some, it doesn’t exactly seem sustainable or healthy at all.

In fact, just like any other high-performance sport, your trading skills can benefit from a holistic approach that takes physical well-being into account.

Here are some simple habits that can improve your trading performance:

1. Get enough sleep

Getting the recommended 7 to 9 hours of shut-eye might be a challenge for forex traders who work around a 24-hour market.

It can be tempting to pull an all-nighter to stay awake during an active trading session or catch a top-tier news event!

But constantly staying up all day and night just to watch open positions has its drawbacks, as sleep deprivation can impair cognitive and motor abilities.

Getting enough quality sleep can help you manage your emotions and stay level-headed when making trading decisions, as this ensures your brain muscles have relaxed and your mental state is refreshed regularly.

2. Take screen breaks

In line with getting enough sleep, you should also make it a habit to step away from the screen every now and then.

This means giving your eyes a break from the strain and also stretching your muscles after sitting in front of your computer for long hours.

In doing so, you can release tension from your back, shoulders, and neck that might be negatively affecting your ability to stay focused.

If you’re worried you might miss big market moves the moment you take a break, try to come up with a daily schedule that works around the best timing for your trading strategies.

3. Get proper exercise

This doesn’t necessarily mean starting a Crossfit workout or running a half-marathon!

What’s important is that you allocate some time – it can be as short as 15-30 minutes – to get blood flowing to your muscles and your brain.

Going for a short jog, doing some pushups, or taking your dog out for a walk could be enough to do the trick.

From a physiological standpoint, trading stress gets blood flow redirected away from the cerebral cortex towards the amygdala, which is responsible for the “fight or flight” response.

However, it’s actually the cerebral cortex that is in charge of the calm, reasoning ability to make sound decisions.

Physical exercise gets blood flowing back smoothly to the cerebral cortex, which aids impulse control, planning, and fear management in the long run.

4. Slow down and take deep breaths

Just as it’s essential to get your blood flowing, it’s also equally important to get your oxygen on!

5. Eat well and stay hydrated

Lastly, don’t forget that the body and brain function best when fueled by proper nourishment from water, minerals, and nutrients.

You don’t have to create a fancy diet of organic food and vitamin water, but it’s enough to make sure that you get balanced meals with the right amount of carbs, protein and fiber.

This could mean cutting down on sugary snacks, energy drinks, and instant ramen. Listen to your momma and eat your veggies yo!

And don’t forget to take the recommended 8 glasses of water a day, too.

This is a simple habit you can build into your schedule, along with screen breaks and exercise. If it helps, you can use smartphone apps that remind you to stand up, take deep breaths, stretch, and hydrate.

These aren’t exactly difficult habits to develop or incorporate in your daily routine, but they can go a long way in terms of improving your decision-making, emotional control, and overall trading mindset.

分享社交网络 · 3

Abdalla Mohamed Mahmoud Taha

Expected Surprises: How to Deal with Market Shocks

The markets are a dangerous place. Out of the blue, events can cause sudden and violent moves in the markets.

Unfortunately, we’ve all been on the wrong side of one of these. It seems very rare indeed that a surprise suits your market position.

Non-Farm Payroll data*, GDP Numbers*, interest rate changes*, assassinations, terrorist attacks, extreme weather*, profit warnings, resignations, bankruptcies*, technology failures …

Here we look at the nature of shocks. How to survive – and even thrive – from the seemingly random.

Shocks and surprises – they’re not the same

Imagine you have a position in front of a Non-Farm Payroll release. You are living dangerously. You know that the release is often a big surprise.

It can be way off from economists’ estimates and the markets’ expectations. So, under your breath, you count down: 5 – 4 – 3 – 2 – 1.

Finally, the results land, the market spikes and within seconds reverses against the direction of the news and seems determined to stop out all longs and shorts. Does this sound familiar?

But hold on, the number was a shock, but it was not a surprise. We counted down to it.

NFPs are released (usually) on the first Friday of each month at 08:30 EST or 12:30 GMT. The release is as regular as clockwork each month. Hardly a surprise, but they are often way off consensus expectations and shock the market.

Non-Farm Payrolls and all of the * events listed above are not surprises, but they are often shocks. Only in a few cases above are the events both surprises and shocks.

The truly random event is very rare, so market shocks happen less often than most people imagine.

Nonetheless, shocks are rarely pleasant surprises. So, what trading strategies can you apply to avoid or even profit from market shocks?

Living peacefully

Many traders close their positions in front of “big” data releases. The advantage of this is you will never be adversely affected by an expected market shock.

But you are as vulnerable as anyone else to a random event. Moreover, the closing and re-opening of positions are costly, and you may have to re-enter at a terrible price level.

Putting up with it

Is there a way to stay in the market through the violence of data releases?

There is a way, but you need to have your Stop Loss far away from the market – beyond the expected price volatility range of the data releases.

The expected price volatility range at data releases is a measurable thing.

For example, take the hi-lo range of price movements in the 15 minutes following the release of the US GDP numbers.

Sometimes the data releases are in line, and the move is muted. Sometimes they surprise the market, and the price surges and falls.

So look at two things:

The maximum range

The average range

To be moderately conservative, place your Stop beyond the average post-release price swing. To be very conservative, beyond the largest price swing.

To do this, you will probably need to deleverage your position. This means reducing the exposure so you can have such a wide Stop. But unfortunately, this is the price you have to pay for ‘putting up with it.

Do place a Stop, though. They have a purpose. They are there to limit your loss to a controllable amount. It can be good news if your Stop is executed because you were wrongly positioned, and the data release initiates a trend change against you. Consider yourself lucky in getting out of the way cheaply.

Living dangerously

After a data release surprise, volatile price moves are an opportunity, too. There are a couple of things you can be confident about. Firstly, there will be a big move.

Big moves mean s significant potential for profit if you can catch them correctly. Secondly, the first price move following the release is frequently followed by a reaction to the price before the release. After that, the price may rise or fall, but there is very often a pullback.

A strategy that aggressive traders like to use to capitalize on this effect is to enter against the direction of the move following the release and covering on the reaction.

For example, the release is better than expected, and the price jumps. This move is too fast to catch. Do not try to compete with High-Frequency Traders. You will lose.

On the first lower price point, sell for the reaction move. Place a Stop Loss above the high. Take profit at 50% of the distance from the high to the pre-release price.

Using this strategy, you live dangerously but have an excellent chance of making a decent profit in exchange for a modest risk.

Take the fear out of shocks and surprises

We have looked at the nature of shocks and surprises and see that genuine shocks are less frequent than many believe. We have seen that expected shocks can be avoided, lived with, or even engaged head on. By understanding the seemingly unknown, we can fear it less or even learn to love it.

The markets are a dangerous place. Out of the blue, events can cause sudden and violent moves in the markets.

Unfortunately, we’ve all been on the wrong side of one of these. It seems very rare indeed that a surprise suits your market position.

Non-Farm Payroll data*, GDP Numbers*, interest rate changes*, assassinations, terrorist attacks, extreme weather*, profit warnings, resignations, bankruptcies*, technology failures …

Here we look at the nature of shocks. How to survive – and even thrive – from the seemingly random.

Shocks and surprises – they’re not the same

Imagine you have a position in front of a Non-Farm Payroll release. You are living dangerously. You know that the release is often a big surprise.

It can be way off from economists’ estimates and the markets’ expectations. So, under your breath, you count down: 5 – 4 – 3 – 2 – 1.

Finally, the results land, the market spikes and within seconds reverses against the direction of the news and seems determined to stop out all longs and shorts. Does this sound familiar?

But hold on, the number was a shock, but it was not a surprise. We counted down to it.

NFPs are released (usually) on the first Friday of each month at 08:30 EST or 12:30 GMT. The release is as regular as clockwork each month. Hardly a surprise, but they are often way off consensus expectations and shock the market.

Non-Farm Payrolls and all of the * events listed above are not surprises, but they are often shocks. Only in a few cases above are the events both surprises and shocks.

The truly random event is very rare, so market shocks happen less often than most people imagine.

Nonetheless, shocks are rarely pleasant surprises. So, what trading strategies can you apply to avoid or even profit from market shocks?

Living peacefully

Many traders close their positions in front of “big” data releases. The advantage of this is you will never be adversely affected by an expected market shock.

But you are as vulnerable as anyone else to a random event. Moreover, the closing and re-opening of positions are costly, and you may have to re-enter at a terrible price level.

Putting up with it

Is there a way to stay in the market through the violence of data releases?

There is a way, but you need to have your Stop Loss far away from the market – beyond the expected price volatility range of the data releases.

The expected price volatility range at data releases is a measurable thing.

For example, take the hi-lo range of price movements in the 15 minutes following the release of the US GDP numbers.

Sometimes the data releases are in line, and the move is muted. Sometimes they surprise the market, and the price surges and falls.

So look at two things:

The maximum range

The average range

To be moderately conservative, place your Stop beyond the average post-release price swing. To be very conservative, beyond the largest price swing.

To do this, you will probably need to deleverage your position. This means reducing the exposure so you can have such a wide Stop. But unfortunately, this is the price you have to pay for ‘putting up with it.

Do place a Stop, though. They have a purpose. They are there to limit your loss to a controllable amount. It can be good news if your Stop is executed because you were wrongly positioned, and the data release initiates a trend change against you. Consider yourself lucky in getting out of the way cheaply.

Living dangerously

After a data release surprise, volatile price moves are an opportunity, too. There are a couple of things you can be confident about. Firstly, there will be a big move.

Big moves mean s significant potential for profit if you can catch them correctly. Secondly, the first price move following the release is frequently followed by a reaction to the price before the release. After that, the price may rise or fall, but there is very often a pullback.

A strategy that aggressive traders like to use to capitalize on this effect is to enter against the direction of the move following the release and covering on the reaction.

For example, the release is better than expected, and the price jumps. This move is too fast to catch. Do not try to compete with High-Frequency Traders. You will lose.

On the first lower price point, sell for the reaction move. Place a Stop Loss above the high. Take profit at 50% of the distance from the high to the pre-release price.

Using this strategy, you live dangerously but have an excellent chance of making a decent profit in exchange for a modest risk.

Take the fear out of shocks and surprises

We have looked at the nature of shocks and surprises and see that genuine shocks are less frequent than many believe. We have seen that expected shocks can be avoided, lived with, or even engaged head on. By understanding the seemingly unknown, we can fear it less or even learn to love it.

分享社交网络 · 3

Abdalla Mohamed Mahmoud Taha

Why You Should Never Risk More Than 2% Per Trade ??

How much should you risk per trade?

Great question.

Try to limit your risk to 2% per trade.

But that might even be a little high. Especially if you’re a newbie forex trader.

Never Risk More Than 2% Per Forex Trade

Here is an important illustration that will show you the difference between risking a small percentage of your capital per trade compared to risking a higher percentage.

Risking 2% vs. 10% Per Trade

TRADE # TOTAL ACCOUNT 2% RISK ON EACH TRADE TRADE # TOTAL ACCOUNT 10% RISK ON EACH TRADE

1 $20,000 $400 1 $20,000 $2,000

2 $19,600 $392 2 $18,000 $1,800

3 $19,208 $384 3 $16,200 $1,620

4 $18,824 $376 4 $14,580 $1,458

5 $18,447 $369 5 $13,122 $1,312

6 $18,078 $362 6 $11,810 $1,181

7 $17,717 $354 7 $10,629 $1,063

8 $17,363 $347 8 $9,566 $957

9 $17,015 $340 9 $8,609 $861

10 $16,675 $333 10 $7,748 $775

11 $16,341 $327 11 $6,974 $697

12 $16,015 $320 12 $6,276 $628

13 $15,694 $314 13 $5,649 $565

14 $15,380 $308 14 $5,084 $508

15 $15,073 $301 15 $4,575 $458

16 $14,771 $295 16 $4,118 $412

17 $14,476 $290 17 $3,706 $371

18 $14,186 $284 18 $3,335 $334

19 $13,903 $278 19 $3,002 $300

You can see that there is a big difference between risking 2% of your account compared to risking 10% of your account on a single trade!

If you happened to go through a losing streak and lost only 19 trades in a row, you would’ve gone from starting with $20,000 to have only $3,002 left if you risked 10% on each trade.

You would’ve lost over 85% of your account!

If you risked only 2% you would’ve still had $13,903 which is only a 30% loss of your total account.

Of course, the last thing we want to do is to lose 19 trades in a row, but even if you only lost 5 trades in a row, look at the difference between risking 2% and 10%.

If you risked 2% you would still have $18,447.

If you risked 10% you would only have $13,122.

That’s less than what you would’ve had even if you lost all 19 trades and risked only 2% of your account!

The point of this illustration is that you want to set up your risk management rules so that when you do have a drawdown period, you will still have enough capital to stay in the game.

Can you imagine if you lost 85% of your account?!!

You would have to make 566% on what you are left with in order to get back to break even!

Trust us, you do NOT want to be in that position. You’d start looking a lot like Cyclopip. Do you wanna look like Cyclopip? Didn’t think so!

“What Do I Have to Do to Get Back to Breakeven?”

Here is a table that will illustrate what percentage you would have to make to break even if you were to lose a certain percentage of your account.

LOSS OF CAPITAL % REQUIRED TO GET BACK TO BREAKEVEN

10% 11%

20% 25%

30% 43%

40% 67%

50% 100%

60% 150%

70% 233%

80% 400%

90% 900%

You can see that the more you lose, the harder it is to make it back to your original account size.

This is all the more reason that you should do everything you can to PROTECT your account.

Not sure how well (or poorly) your trade went? Use our Gain & Loss Percentage Calculator to help you know what percentage of the account balance you have won or lost. It also estimates a percentage of current balance required to get to the breakeven point again.

By now, we hope you have gotten it drilled into your head that you should only risk a small percentage of your account per trade so that you can survive your losing streaks and also avoid a large drawdown in your account.

Remember, you want to be the casino… NOT the gambler!

Don't Be a Gambler!

How much should you risk per trade?

Great question.

Try to limit your risk to 2% per trade.

But that might even be a little high. Especially if you’re a newbie forex trader.

Never Risk More Than 2% Per Forex Trade

Here is an important illustration that will show you the difference between risking a small percentage of your capital per trade compared to risking a higher percentage.

Risking 2% vs. 10% Per Trade

TRADE # TOTAL ACCOUNT 2% RISK ON EACH TRADE TRADE # TOTAL ACCOUNT 10% RISK ON EACH TRADE

1 $20,000 $400 1 $20,000 $2,000

2 $19,600 $392 2 $18,000 $1,800

3 $19,208 $384 3 $16,200 $1,620

4 $18,824 $376 4 $14,580 $1,458

5 $18,447 $369 5 $13,122 $1,312

6 $18,078 $362 6 $11,810 $1,181

7 $17,717 $354 7 $10,629 $1,063

8 $17,363 $347 8 $9,566 $957

9 $17,015 $340 9 $8,609 $861

10 $16,675 $333 10 $7,748 $775

11 $16,341 $327 11 $6,974 $697

12 $16,015 $320 12 $6,276 $628

13 $15,694 $314 13 $5,649 $565

14 $15,380 $308 14 $5,084 $508

15 $15,073 $301 15 $4,575 $458

16 $14,771 $295 16 $4,118 $412

17 $14,476 $290 17 $3,706 $371

18 $14,186 $284 18 $3,335 $334

19 $13,903 $278 19 $3,002 $300

You can see that there is a big difference between risking 2% of your account compared to risking 10% of your account on a single trade!

If you happened to go through a losing streak and lost only 19 trades in a row, you would’ve gone from starting with $20,000 to have only $3,002 left if you risked 10% on each trade.

You would’ve lost over 85% of your account!

If you risked only 2% you would’ve still had $13,903 which is only a 30% loss of your total account.

Of course, the last thing we want to do is to lose 19 trades in a row, but even if you only lost 5 trades in a row, look at the difference between risking 2% and 10%.

If you risked 2% you would still have $18,447.

If you risked 10% you would only have $13,122.

That’s less than what you would’ve had even if you lost all 19 trades and risked only 2% of your account!

The point of this illustration is that you want to set up your risk management rules so that when you do have a drawdown period, you will still have enough capital to stay in the game.

Can you imagine if you lost 85% of your account?!!

You would have to make 566% on what you are left with in order to get back to break even!

Trust us, you do NOT want to be in that position. You’d start looking a lot like Cyclopip. Do you wanna look like Cyclopip? Didn’t think so!

“What Do I Have to Do to Get Back to Breakeven?”

Here is a table that will illustrate what percentage you would have to make to break even if you were to lose a certain percentage of your account.

LOSS OF CAPITAL % REQUIRED TO GET BACK TO BREAKEVEN

10% 11%

20% 25%

30% 43%

40% 67%

50% 100%

60% 150%

70% 233%

80% 400%

90% 900%

You can see that the more you lose, the harder it is to make it back to your original account size.

This is all the more reason that you should do everything you can to PROTECT your account.

Not sure how well (or poorly) your trade went? Use our Gain & Loss Percentage Calculator to help you know what percentage of the account balance you have won or lost. It also estimates a percentage of current balance required to get to the breakeven point again.

By now, we hope you have gotten it drilled into your head that you should only risk a small percentage of your account per trade so that you can survive your losing streaks and also avoid a large drawdown in your account.

Remember, you want to be the casino… NOT the gambler!

Don't Be a Gambler!

分享社交网络 · 3

Abdalla Mohamed Mahmoud Taha

One Simple Trick to Avoid Overtrading

Most forex newbies often think that taking more trades leads to catching more profits.

The more setups you take, the better your chances of winning, right?

WRONG!

This isn’t the lottery, y’all!

Overtrading refers to taking so many trade setups to the extent that you lose your market edge.

One of my favorite trading psychologists, Dr. Brett Steenbarger, explains that the root of overtrading is the mismatch between one’s profit expectations and market volatility.

In other words, traders often feel the need to catch multiple market moves in order to hit their goals.

While it’s helpful to set trading goals, there’s one major problem with this line of thinking.

The market does not move based on your expectations!

This kind of mindset may lead a trader to overestimate his trading skills in an effort to reach his targets and mentally convince himself that he’s had a good trading day.

While this may work in some cases, it can wind up being harmful to your trading psychology when it makes you feel invincible and overconfident that you can trade in absolutely any market environment.

If you often catch yourself in this situation, don’t beat yourself up! It’s much more common than you think, and it happens even to seasoned traders.

You see, most of us have been conditioned to think that we must work harder and do more in order to achieve better results. While clocking in your 10,000 hours of deliberate practice has its merits, it’s a misconception to think that working harder equates to taking more trades.

Working hard means taking the best (a.k.a. high probability) trade setups.

This could involve waiting patiently or sitting on the sidelines if you have to. Doing nothing and refraining to take a trade when it’s not aligned with your strategy is a trading decision in itself.

Of course this is much easier said than done, so here’s one simple trick that can help you avoid overtrading:

Take only ONE TRADE each day.

That’s right, no exceptions. If you catch a big win, you’re done for the day. If you snag a loss, you’re done for the day.

Day trading coach and author Galen Woods calls this the One Bullet Action Plan.

Setting this absolute one-trade rule forces you to think like you have just one bullet left, which means that you have to aim properly and pull the trigger at the right time in order to make the most out of your only shot.

It sounds so simple, but it requires a lot of work.

You have to comb through the charts and all the available setups to see which ones line up with your strategy, so this addresses the psychological need to “do more.”

You must be extra picky in filtering out the “best” one for the day and at the same time be alert in catching the move.

Keep the wisdom of the great American philosopher Eminem in mind: “You only have one shot, do not miss your chance.”

What about undertrading?

Don’t worry about that just yet. Far more traders wipe out their accounts from overtrading than undertrading.

Once you are able to easily avoid overtrading, you’ll be able to fine-tune your market edge.

From there, sticking to high-probability setups will be like second nature to you, helping you stay consistently profitable in the long run.

Most forex newbies often think that taking more trades leads to catching more profits.

The more setups you take, the better your chances of winning, right?

WRONG!

This isn’t the lottery, y’all!

Overtrading refers to taking so many trade setups to the extent that you lose your market edge.

One of my favorite trading psychologists, Dr. Brett Steenbarger, explains that the root of overtrading is the mismatch between one’s profit expectations and market volatility.

In other words, traders often feel the need to catch multiple market moves in order to hit their goals.

While it’s helpful to set trading goals, there’s one major problem with this line of thinking.

The market does not move based on your expectations!

This kind of mindset may lead a trader to overestimate his trading skills in an effort to reach his targets and mentally convince himself that he’s had a good trading day.

While this may work in some cases, it can wind up being harmful to your trading psychology when it makes you feel invincible and overconfident that you can trade in absolutely any market environment.

If you often catch yourself in this situation, don’t beat yourself up! It’s much more common than you think, and it happens even to seasoned traders.

You see, most of us have been conditioned to think that we must work harder and do more in order to achieve better results. While clocking in your 10,000 hours of deliberate practice has its merits, it’s a misconception to think that working harder equates to taking more trades.

Working hard means taking the best (a.k.a. high probability) trade setups.

This could involve waiting patiently or sitting on the sidelines if you have to. Doing nothing and refraining to take a trade when it’s not aligned with your strategy is a trading decision in itself.

Of course this is much easier said than done, so here’s one simple trick that can help you avoid overtrading:

Take only ONE TRADE each day.

That’s right, no exceptions. If you catch a big win, you’re done for the day. If you snag a loss, you’re done for the day.

Day trading coach and author Galen Woods calls this the One Bullet Action Plan.

Setting this absolute one-trade rule forces you to think like you have just one bullet left, which means that you have to aim properly and pull the trigger at the right time in order to make the most out of your only shot.

It sounds so simple, but it requires a lot of work.

You have to comb through the charts and all the available setups to see which ones line up with your strategy, so this addresses the psychological need to “do more.”

You must be extra picky in filtering out the “best” one for the day and at the same time be alert in catching the move.

Keep the wisdom of the great American philosopher Eminem in mind: “You only have one shot, do not miss your chance.”

What about undertrading?

Don’t worry about that just yet. Far more traders wipe out their accounts from overtrading than undertrading.

Once you are able to easily avoid overtrading, you’ll be able to fine-tune your market edge.

From there, sticking to high-probability setups will be like second nature to you, helping you stay consistently profitable in the long run.

分享社交网络 · 3

Abdalla Mohamed Mahmoud Taha

Daily U.S. Session Watchlist: GBP/USD

Cable is hanging out at a strong area of interest, and the upcoming U.S. flash PMI releases might spur a big move.

Will the support-turned-resistance level hold?

If you’re unfamiliar with forex trading sessions, learn about them with our Forex Market Hours tool.

And don’t forget to check our newly released real-time Currency Strength Meter and Currency Volatility Meter!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Asian markets weighed down by slow vaccination pace, Delta concerns

Taiwan to lower COVID-19 alert level

Sydney lockdown to extend past July

Australia flash manufacturing PMI down from 58.6 to 56.8

Australia flash services PMI slumped from 56.8 to 44.2

U.K. GfK consumer confidence index up from -9 to -7

U.K. retail sales up 0.5% vs. projected 0.2% dip on football season

French flash manufacturing PMI down from 59.0 to 58.1, services PMI down from 57.8 to 57.0

German flash manufacturing PMI up from 65.1 to 65.6, services PMI up from 57.5 to 62.2

U.K. flash manufacturing PMI down from 63.9 to 60.4, services PMI down from 62.4 to 57.8

Upcoming Potential Catalysts on the Economic Calendar:

U.K. retail sales at 6:00 am GMT

Eurozone flash PMI readings starting 7:15 am GMT

Canadian retail sales at 12:30 pm GMT

U.S. Markit flash PMI readings at 1:45 pm GMT

What to Watch: GBP/USD

GBP/USD 1-hour Forex ChartGBP/USD 1-hour Forex Chart

It’s a break-and-retest situation, forex fellas!

Cable is sitting right on the potential support-turned-resistance zone, still deciding whether to make a bounce or a break.

Will sellers defend the ceiling?

The 100 SMA is below the 200 SMA to hint that the path of least resistance is to the downside while Stochastic is already heading south. Price could follow suit since this means that selling pressure is present!

If that’s the case, GBP/USD could slump back to the swing low at 1.3570 or lower.

A break past the 200 SMA dynamic inflection point and 61.8% Fib, on the other hand, could mean that pound bulls are charging again. This could take the pair back up to the next resistance near the 1.3900 handle.

It could all boil down to Uncle Sam’s flash PMI readings, with the manufacturing and services sectors not really slated to post big improvements for July.

Still, an upside surprise might encourage traders to buy up the Greenback, so y’all better keep your eyes peeled for the actual results!

Cable is hanging out at a strong area of interest, and the upcoming U.S. flash PMI releases might spur a big move.

Will the support-turned-resistance level hold?

If you’re unfamiliar with forex trading sessions, learn about them with our Forex Market Hours tool.

And don’t forget to check our newly released real-time Currency Strength Meter and Currency Volatility Meter!

And now for the headlines that rocked the markets in the last trading sessions:

Fresh Market Headlines & Economic Data:

Asian markets weighed down by slow vaccination pace, Delta concerns

Taiwan to lower COVID-19 alert level

Sydney lockdown to extend past July

Australia flash manufacturing PMI down from 58.6 to 56.8

Australia flash services PMI slumped from 56.8 to 44.2

U.K. GfK consumer confidence index up from -9 to -7

U.K. retail sales up 0.5% vs. projected 0.2% dip on football season

French flash manufacturing PMI down from 59.0 to 58.1, services PMI down from 57.8 to 57.0

German flash manufacturing PMI up from 65.1 to 65.6, services PMI up from 57.5 to 62.2

U.K. flash manufacturing PMI down from 63.9 to 60.4, services PMI down from 62.4 to 57.8

Upcoming Potential Catalysts on the Economic Calendar:

U.K. retail sales at 6:00 am GMT

Eurozone flash PMI readings starting 7:15 am GMT

Canadian retail sales at 12:30 pm GMT

U.S. Markit flash PMI readings at 1:45 pm GMT

What to Watch: GBP/USD

GBP/USD 1-hour Forex ChartGBP/USD 1-hour Forex Chart

It’s a break-and-retest situation, forex fellas!

Cable is sitting right on the potential support-turned-resistance zone, still deciding whether to make a bounce or a break.

Will sellers defend the ceiling?

The 100 SMA is below the 200 SMA to hint that the path of least resistance is to the downside while Stochastic is already heading south. Price could follow suit since this means that selling pressure is present!

If that’s the case, GBP/USD could slump back to the swing low at 1.3570 or lower.

A break past the 200 SMA dynamic inflection point and 61.8% Fib, on the other hand, could mean that pound bulls are charging again. This could take the pair back up to the next resistance near the 1.3900 handle.

It could all boil down to Uncle Sam’s flash PMI readings, with the manufacturing and services sectors not really slated to post big improvements for July.

Still, an upside surprise might encourage traders to buy up the Greenback, so y’all better keep your eyes peeled for the actual results!

分享社交网络 · 2

Abdalla Mohamed Mahmoud Taha

3 Ways to Improve Your Trading Confidence : Forex trading is arguably one of the most difficult career paths one could choose. After all, it involves working under conditions that are full of uncertainties.

This means that traders rely on probabilities to come out successful, which could result in unexpected outcomes.

You may be swimming in pips one day and be down in the dumps the next!

Because of the nature of trading and its effects on the psyche, it is important to be mentally strong and have a lot of self-confidence.

In the most basic sense, I believe self-confidence is the ability to ACTIVELY focus on better performance (not success!) and stay away from negative thought patterns such as anxiety and fear.

Take note that I emphasized the word “performance” as focusing on success can make a trader overly cavalier or cocky, possibly leading to bad trade decisions.

But with the market constantly changing and the number of losing trades you will most likely incur, how can you remain self-confident?

1. Focus on the process.

Almost every trader I know chose trading as a profession to make some dough. But as I’ve said in my one of my previous blog posts, being too focused on the returns of your investment can actually be detrimental to your account.

Remember that the market is unpredictable. There’s really no sure way for you to know exactly whether or not your trade is going to win or lose. Instead of focusing on your profit/loss statement, why not pour all that energy into making sure that you stick to your trading plan?

You shouldn’t obsess over the outcome of your trade, but rather, think about all the instances you followed your rules. Each time you follow your rules is a success story in itself.

So give yourself a pat on the back every time you exercise self-discipline in waiting for a candle to close before pulling the trigger or closing your trade before the weekend.

You may not see the results now, but in the long-run, your discipline will translate to consistently avoiding mistakes, which in turn translates into confidence and consistently profitable trading.

2. Practice, practice, and more practice!

Do you know the reason why the world-renowned boxing champion Floyd Mayweather spends weeks and weeks training for a fight that can last 36 minutes at most? It’s because, through preparation, he develops a sense of confidence through mastery.

Mayweather doesn’t know exactly what his opponent’s game plan is to knock him out. However, through deliberate practice, he has mastered fundamental boxing skills, how his body moves, and his own game plan to be prepared for whatever punches may come his way.

As a trader, you will never know what will affect sentiment and how the markets will react. This means that the key to confidence and success is to prepare yourself each day until you know you can handle any scenario the market can throw at you.

3. Look at the brighter side of things.

Ask yourself this question, “Out of all the confident people you have ever met in your life, how many of them had a consistently negative outlook or attitude?” I’ll bet the answer is a very small percentage or maybe even none.

Successful and confident people tend to have a positive or optimistic attitude because when you focus on the positive, you tend to have positive results.

So, instead of feeling bad, sulking in the corner, and eating all the ice cream in the fridge when you’re in the middle of a massive drawdown, be positive and think of how you were able to follow your trade plan properly.

Also remind yourself that if you have a well-tested trade plan and risk management strategy, the law of averages will eventually work in your favor, and you will come out on top.

One way to practice this is by actively focusing on the things you’ve done right with every trade, especially if the trade is going against you.

“Reviewed recent and upcoming economic data?” Check!

“Analyzed the charts?” Check!

“Limited my risk?” Check!

By making sure you’ve prepared all you can and focus on that, you are internalizing that losing trades will come no matter how much you prepare. This reduces your fear of losing trades, which gives you more confidence to take valid trade setups and act on good decisions.

Like developing your trading skills, trading with confidence is easier said than done and won’t come without hard work.

However, I believe that in order to become a successful trader, one has to have a bit of swagger on the charts. After all, you wouldn’t want to be a soldier marching on to battle cowering under your shield, right?

This means that traders rely on probabilities to come out successful, which could result in unexpected outcomes.

You may be swimming in pips one day and be down in the dumps the next!

Because of the nature of trading and its effects on the psyche, it is important to be mentally strong and have a lot of self-confidence.

In the most basic sense, I believe self-confidence is the ability to ACTIVELY focus on better performance (not success!) and stay away from negative thought patterns such as anxiety and fear.

Take note that I emphasized the word “performance” as focusing on success can make a trader overly cavalier or cocky, possibly leading to bad trade decisions.

But with the market constantly changing and the number of losing trades you will most likely incur, how can you remain self-confident?

1. Focus on the process.

Almost every trader I know chose trading as a profession to make some dough. But as I’ve said in my one of my previous blog posts, being too focused on the returns of your investment can actually be detrimental to your account.

Remember that the market is unpredictable. There’s really no sure way for you to know exactly whether or not your trade is going to win or lose. Instead of focusing on your profit/loss statement, why not pour all that energy into making sure that you stick to your trading plan?

You shouldn’t obsess over the outcome of your trade, but rather, think about all the instances you followed your rules. Each time you follow your rules is a success story in itself.

So give yourself a pat on the back every time you exercise self-discipline in waiting for a candle to close before pulling the trigger or closing your trade before the weekend.

You may not see the results now, but in the long-run, your discipline will translate to consistently avoiding mistakes, which in turn translates into confidence and consistently profitable trading.

2. Practice, practice, and more practice!

Do you know the reason why the world-renowned boxing champion Floyd Mayweather spends weeks and weeks training for a fight that can last 36 minutes at most? It’s because, through preparation, he develops a sense of confidence through mastery.

Mayweather doesn’t know exactly what his opponent’s game plan is to knock him out. However, through deliberate practice, he has mastered fundamental boxing skills, how his body moves, and his own game plan to be prepared for whatever punches may come his way.

As a trader, you will never know what will affect sentiment and how the markets will react. This means that the key to confidence and success is to prepare yourself each day until you know you can handle any scenario the market can throw at you.

3. Look at the brighter side of things.

Ask yourself this question, “Out of all the confident people you have ever met in your life, how many of them had a consistently negative outlook or attitude?” I’ll bet the answer is a very small percentage or maybe even none.

Successful and confident people tend to have a positive or optimistic attitude because when you focus on the positive, you tend to have positive results.

So, instead of feeling bad, sulking in the corner, and eating all the ice cream in the fridge when you’re in the middle of a massive drawdown, be positive and think of how you were able to follow your trade plan properly.

Also remind yourself that if you have a well-tested trade plan and risk management strategy, the law of averages will eventually work in your favor, and you will come out on top.

One way to practice this is by actively focusing on the things you’ve done right with every trade, especially if the trade is going against you.

“Reviewed recent and upcoming economic data?” Check!

“Analyzed the charts?” Check!

“Limited my risk?” Check!

By making sure you’ve prepared all you can and focus on that, you are internalizing that losing trades will come no matter how much you prepare. This reduces your fear of losing trades, which gives you more confidence to take valid trade setups and act on good decisions.

Like developing your trading skills, trading with confidence is easier said than done and won’t come without hard work.

However, I believe that in order to become a successful trader, one has to have a bit of swagger on the charts. After all, you wouldn’t want to be a soldier marching on to battle cowering under your shield, right?

分享社交网络 · 3

Abdalla Mohamed Mahmoud Taha

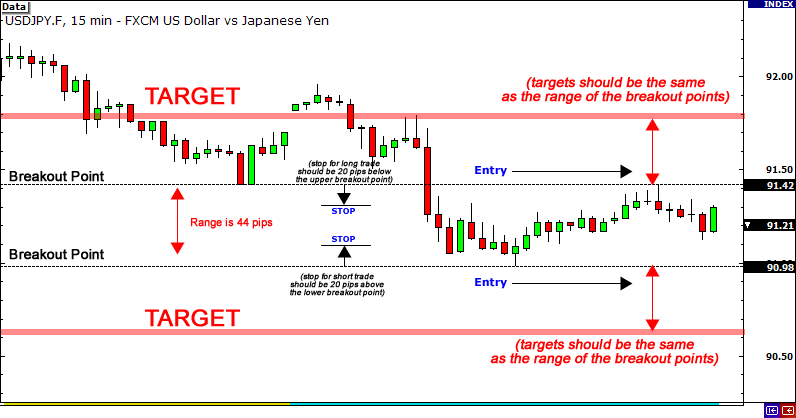

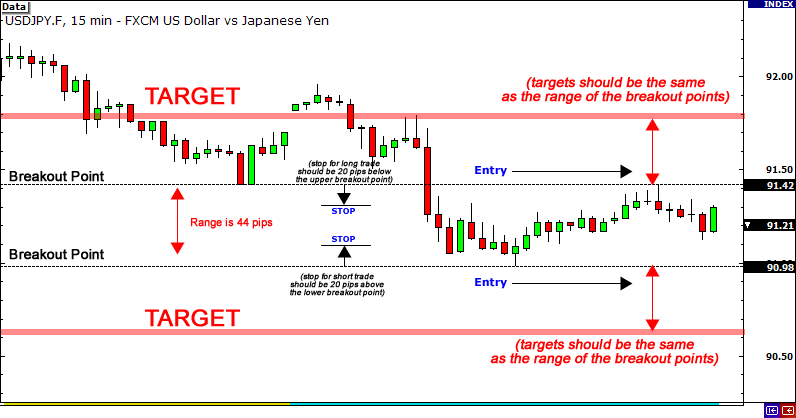

How to Trade the News Using the Straddle Trade Strategy

What if there was a way to make money quickly even if you had no idea whether the market would move up or down?

It’s possible as long as there is sufficient price volatility.

And when can you get this volatility? When news like economic data or central bank announcements is released!

The first thing to consider is which news reports to trade.

Earlier, we discussed the biggest moving news releases.

Ideally, you would want to only trade those reports because there is a high probability the market will make a big move after their release.

The next thing you should do is take a look at the range at least 20 minutes before the actual news release.

The high of that range will be your upper breakout point, and the low of that range will be your lower breakout point.

Note that the smaller the range is the more likely it is you will see a big move from the news report.

The breakout points will be your entry levels.

This is where you want to set your orders. Your stops should be placed approximately 20 pips below and above the breakout points, and your initial targets should be about the same as the range of the breakout levels.

Straddle Trade

This is known as a straddle trade.

You are looking to play BOTH sides of the trades.

It doesn’t matter which direction the price moves, the straddle strategy will have you positioned to take advantage of it.

Now that you’re prepared to enter the market in either direction, all you have to do is wait for the news to come out.

Sometimes you may get triggered in one direction only to find that you get stopped out because the price quickly reverses in the other direction.

However, your other entry will get triggered and if that trade wins, you should recoup your initial losses and come out with a small profit.

A best-case scenario would be that only one of your trades gets triggered and the price continues to move in your favor so that you don’t incur any losses.

Either way, if done correctly you should still end up positive for the day.

One thing that makes a non-directional bias approach attractive is that it eliminates any emotions.

You just want to profit when the move happens.

This allows you to take advantage of more trading opportunities because you will be triggered either way.

As most news events tend to have a limited impact on longer-term price action, setting realistic profit targets should help to increase the number of winning trades.

There are many more strategies for trading the news, but the concepts mentioned in this lesson should always be part of your routine whenever you are working out an approach to taking advantage of news report movements.

What if there was a way to make money quickly even if you had no idea whether the market would move up or down?

It’s possible as long as there is sufficient price volatility.

And when can you get this volatility? When news like economic data or central bank announcements is released!

The first thing to consider is which news reports to trade.

Earlier, we discussed the biggest moving news releases.

Ideally, you would want to only trade those reports because there is a high probability the market will make a big move after their release.

The next thing you should do is take a look at the range at least 20 minutes before the actual news release.

The high of that range will be your upper breakout point, and the low of that range will be your lower breakout point.

Note that the smaller the range is the more likely it is you will see a big move from the news report.

The breakout points will be your entry levels.

This is where you want to set your orders. Your stops should be placed approximately 20 pips below and above the breakout points, and your initial targets should be about the same as the range of the breakout levels.

Straddle Trade

This is known as a straddle trade.

You are looking to play BOTH sides of the trades.

It doesn’t matter which direction the price moves, the straddle strategy will have you positioned to take advantage of it.

Now that you’re prepared to enter the market in either direction, all you have to do is wait for the news to come out.

Sometimes you may get triggered in one direction only to find that you get stopped out because the price quickly reverses in the other direction.

However, your other entry will get triggered and if that trade wins, you should recoup your initial losses and come out with a small profit.

A best-case scenario would be that only one of your trades gets triggered and the price continues to move in your favor so that you don’t incur any losses.

Either way, if done correctly you should still end up positive for the day.

One thing that makes a non-directional bias approach attractive is that it eliminates any emotions.

You just want to profit when the move happens.

This allows you to take advantage of more trading opportunities because you will be triggered either way.

As most news events tend to have a limited impact on longer-term price action, setting realistic profit targets should help to increase the number of winning trades.

There are many more strategies for trading the news, but the concepts mentioned in this lesson should always be part of your routine whenever you are working out an approach to taking advantage of news report movements.

分享社交网络 · 1

Abdalla Mohamed Mahmoud Taha

Set Trading Goals That Work!

Goals are important! Not only do they represent expectations and aspirations, goals also serve as a bridge from reality to the ideal.

The moment you set a goal, you face reality by acknowledging the need to address your shortcomings or maybe simply fulfill your desire to do better.

I mean, you wouldn’t set a goal of finishing a full marathon if you’ve already done it, right? Of course, achieving that goal would be possible if you put some work in your running in the first place.

By putting in a substantial amount of effort that consequently leads to progress, goals keep you grounded when you see that it’s the little things that can make a big difference in the long run.

Small things like adding a minute to your jogging routine, drinking only a cup of coffee instead of your usual two, or moving your stop loss a pip or two above breakeven could have huge rewards down the road.

You then become more aware of yourself and realize your strengths. In this aspect, goals keep you motivated as each step you take gives you a better glimpse of what you’ll be like if you push yourself a little further.

Imagining yourself achieving success gets you closer to the real thing! Just ask Arnold Schwarzenegger who credits his seven Mr. Universe titles to his workout routine which included him just standing in the corner, visualizing himself winning again.

However, proper goal-setting is not as easy as it sounds.

Some traders often become too preoccupied with their desired outcomes, such as making a truckload of pips or bouncing back from their losses, that they overlook the realistic aspect of these goals.

You have to think about whether your goals are achievable depending on your trade plan, your risk management, and even your own personality.

Another reason why some traders fail to achieve their goals is the lack of concrete follow through. It’s not enough to set a particular weekly profit target, think happy thoughts, and expect it to magically become a reality.

Keep in mind that goals must be accompanied by specific steps to attain it, must be realistic, and must be action-oriented.

To facilitate this, one must also figure out which type of goal to aim for.

For beginner traders, it would be wise to set out on goals that focus on the process, as opposed to the outcome.

These types of goals help reinforce and shape your trading skills, so that you learn to trade properly. Whether or not you end up in a loss doesn’t matter – the point is that you trade the right way and focus on the process.

Examples of such process goals can pertain to certain aspects of trading like risk management (choosing the correct lot size) and execution (closing trades when they hit your stop loss). In the long run, it will be highly beneficial to your development as a trader.

On the other hand, if you are a more experienced trader, having outcome-oriented goals may prove to be more effective. Having a monetary or pip target can help remind you of what must be done in order to achieve the goal.

Remember though, you must first have the necessary skills and experience to actually know what process you must go through in order to hit your target.

No matter which type of goal you decide to choose, the goal should help you improve as a trader. The purpose of a goal is not only for you to achieve it; it should breed motivation, learning, and confidence.

By setting goals and striving to achieve them, you can accelerate your forex trading development exponentially.

Goals are important! Not only do they represent expectations and aspirations, goals also serve as a bridge from reality to the ideal.

The moment you set a goal, you face reality by acknowledging the need to address your shortcomings or maybe simply fulfill your desire to do better.

I mean, you wouldn’t set a goal of finishing a full marathon if you’ve already done it, right? Of course, achieving that goal would be possible if you put some work in your running in the first place.

By putting in a substantial amount of effort that consequently leads to progress, goals keep you grounded when you see that it’s the little things that can make a big difference in the long run.

Small things like adding a minute to your jogging routine, drinking only a cup of coffee instead of your usual two, or moving your stop loss a pip or two above breakeven could have huge rewards down the road.

You then become more aware of yourself and realize your strengths. In this aspect, goals keep you motivated as each step you take gives you a better glimpse of what you’ll be like if you push yourself a little further.

Imagining yourself achieving success gets you closer to the real thing! Just ask Arnold Schwarzenegger who credits his seven Mr. Universe titles to his workout routine which included him just standing in the corner, visualizing himself winning again.

However, proper goal-setting is not as easy as it sounds.

Some traders often become too preoccupied with their desired outcomes, such as making a truckload of pips or bouncing back from their losses, that they overlook the realistic aspect of these goals.

You have to think about whether your goals are achievable depending on your trade plan, your risk management, and even your own personality.

Another reason why some traders fail to achieve their goals is the lack of concrete follow through. It’s not enough to set a particular weekly profit target, think happy thoughts, and expect it to magically become a reality.

Keep in mind that goals must be accompanied by specific steps to attain it, must be realistic, and must be action-oriented.

To facilitate this, one must also figure out which type of goal to aim for.

For beginner traders, it would be wise to set out on goals that focus on the process, as opposed to the outcome.

These types of goals help reinforce and shape your trading skills, so that you learn to trade properly. Whether or not you end up in a loss doesn’t matter – the point is that you trade the right way and focus on the process.

Examples of such process goals can pertain to certain aspects of trading like risk management (choosing the correct lot size) and execution (closing trades when they hit your stop loss). In the long run, it will be highly beneficial to your development as a trader.

On the other hand, if you are a more experienced trader, having outcome-oriented goals may prove to be more effective. Having a monetary or pip target can help remind you of what must be done in order to achieve the goal.

Remember though, you must first have the necessary skills and experience to actually know what process you must go through in order to hit your target.

No matter which type of goal you decide to choose, the goal should help you improve as a trader. The purpose of a goal is not only for you to achieve it; it should breed motivation, learning, and confidence.

By setting goals and striving to achieve them, you can accelerate your forex trading development exponentially.

分享社交网络 · 4

Abdalla Mohamed Mahmoud Taha

GBP Weekly Forecast – Brexit Negotiations to Keep the Pound Supported?

Pound bulls remain optimistic that a Brexit deal could be reached. Will we see concrete developments this week?

Check out the top catalysts that might influence your pound trades:

Inflation numbers (Oct 21, 6:00 am GMT)

Dining discounts helped drag consumer prices near their five-year lows in August

The weakness was mostly expected, so traders focused on the risk rally ahead of the Fed’s policy statement

Analysts see the monthly prices rising by 0.3% in September, while the annual figure could remain at a 0.2% growth

Subdued prices can fan discussions of more QE or negative interest rates from the Bank of England (BOE)

Other lower-tier economic releases

Public borrowing (Oct 21, 6:00 am GMT) to clock in at 42.4B vs. 35.9B in September

CBI industrial order trends (Oct 22, 10:00 am GMT) to improve from -48 to -42 in October

GfK consumer confidence (Oct 22, 11:01 pm GMT) seen weakening from -25 to -28 in October

Retail sales (Oct 23, 6:00 am GMT) to see a 1.3% dip (from 0.8% growth) in September

Annualized retail sales could slow down from 2.8% to 1.0%

Manufacturing PMI (Oct 23, 8:30 am GMT) could show manufacturing slowdown (from 54.1 to 53.2) in October

Services PMI (Oct 23, 8:30 am GMT) to print at 53.4 after a 56.1 reading in September

Brexit updates

Ongoing Brexit negotiations should keep the pound somewhat supported throughout the week

U.K. PM Boris Johnson has so far kept the door open for negotiations after his self-imposed October 15 deadline

Bloomberg has reported that U.K. policymakers could take out controversial parts of the Internal Market Bill

Any hints of PM Johnson pulling the plug on negotiations could weigh on the pound

Technical snapshot

The pound has lost value against all of its major counterparts except the Aussie in the last seven days

GBP weakened the most against the dollar, yen, and the Kiwi

Pound bulls remain optimistic that a Brexit deal could be reached. Will we see concrete developments this week?

Check out the top catalysts that might influence your pound trades:

Inflation numbers (Oct 21, 6:00 am GMT)

Dining discounts helped drag consumer prices near their five-year lows in August

The weakness was mostly expected, so traders focused on the risk rally ahead of the Fed’s policy statement

Analysts see the monthly prices rising by 0.3% in September, while the annual figure could remain at a 0.2% growth

Subdued prices can fan discussions of more QE or negative interest rates from the Bank of England (BOE)

Other lower-tier economic releases

Public borrowing (Oct 21, 6:00 am GMT) to clock in at 42.4B vs. 35.9B in September

CBI industrial order trends (Oct 22, 10:00 am GMT) to improve from -48 to -42 in October

GfK consumer confidence (Oct 22, 11:01 pm GMT) seen weakening from -25 to -28 in October

Retail sales (Oct 23, 6:00 am GMT) to see a 1.3% dip (from 0.8% growth) in September

Annualized retail sales could slow down from 2.8% to 1.0%

Manufacturing PMI (Oct 23, 8:30 am GMT) could show manufacturing slowdown (from 54.1 to 53.2) in October

Services PMI (Oct 23, 8:30 am GMT) to print at 53.4 after a 56.1 reading in September

Brexit updates

Ongoing Brexit negotiations should keep the pound somewhat supported throughout the week

U.K. PM Boris Johnson has so far kept the door open for negotiations after his self-imposed October 15 deadline

Bloomberg has reported that U.K. policymakers could take out controversial parts of the Internal Market Bill

Any hints of PM Johnson pulling the plug on negotiations could weigh on the pound

Technical snapshot

The pound has lost value against all of its major counterparts except the Aussie in the last seven days

GBP weakened the most against the dollar, yen, and the Kiwi

分享社交网络 · 1

Abdalla Mohamed Mahmoud Taha

Turn Your Trading Weaknesses into Strengths

Suppose you’ve just experienced a huge losing streak. What will you likely do next? Are you the type of trader who becomes so depressed that you are unable to take clear forex trading signals, or are you the type of trader who’s able to easily shrug it off?

No matter how long you have been trading, there is always the risk of experiencing performance anxiety.

When things do not go your way, there is a chance that you’ll become overly pessimistic and see the situation as a sign that you are a failure. As a result, your trading performance dwindles even more, eventually leading you to quit.

This is obviously a problem. But like all problems, there is also a solution. Instead of focusing your weaknesses, look at it under a new light – a process called positive reevaluation.

For illustrative purposes, let’s take a trader who has a habit of using stops that are way too tight because he’s afraid of losing too much.

As of late, he’s getting stopped out a lot and ends up with a long losing streak. This makes him even more terrified of putting trades on and losing more money. He now finds himself stuck in a very vicious cycle that’s freezing him up.

You could say that this forex trader’s attitude towards trading is negative, but through the process of positive reevaluation, he can actually use this underlying weakness as a strength.

Rather than focusing on the fear of losing, the trader can use this fear to positively reevaluate his trading and see it as a position-sizing problem. He can cut down on his position sizes so he can take even smaller risks while at the same time widening his stops.

If you can twist a perceived negative thought, tendency, or trait into a positive one, you can get it to work for you rather than against you.

Let’s say that as a trader, you’re easily overcome with emotion when your trade starts to go against you. As a result, you tend to widen your stop when your forex trade is losing.

A bit of positive reevaluation can help you shift focus away from how this tendency holds you back and towards how it can help you.

Since you know that these emotions sprout when market conditions become unfavorable for your trade, when you find yourself wanting to widen your stops, you can actually use it as a signal to cut losses or trim your position.

Basically, instead of letting it take over you, you end up using your emotions as a signal to make better trading decisions.

So you see, looking at a problem from a different angle can go a long way in helping you improve your forex trading. It can offer you new insights on how to approach a problem, and heck, it can even help you turn your perceived weaknesses into strengths!

Suppose you’ve just experienced a huge losing streak. What will you likely do next? Are you the type of trader who becomes so depressed that you are unable to take clear forex trading signals, or are you the type of trader who’s able to easily shrug it off?

No matter how long you have been trading, there is always the risk of experiencing performance anxiety.

When things do not go your way, there is a chance that you’ll become overly pessimistic and see the situation as a sign that you are a failure. As a result, your trading performance dwindles even more, eventually leading you to quit.

This is obviously a problem. But like all problems, there is also a solution. Instead of focusing your weaknesses, look at it under a new light – a process called positive reevaluation.

For illustrative purposes, let’s take a trader who has a habit of using stops that are way too tight because he’s afraid of losing too much.

As of late, he’s getting stopped out a lot and ends up with a long losing streak. This makes him even more terrified of putting trades on and losing more money. He now finds himself stuck in a very vicious cycle that’s freezing him up.

You could say that this forex trader’s attitude towards trading is negative, but through the process of positive reevaluation, he can actually use this underlying weakness as a strength.

Rather than focusing on the fear of losing, the trader can use this fear to positively reevaluate his trading and see it as a position-sizing problem. He can cut down on his position sizes so he can take even smaller risks while at the same time widening his stops.

If you can twist a perceived negative thought, tendency, or trait into a positive one, you can get it to work for you rather than against you.

Let’s say that as a trader, you’re easily overcome with emotion when your trade starts to go against you. As a result, you tend to widen your stop when your forex trade is losing.

A bit of positive reevaluation can help you shift focus away from how this tendency holds you back and towards how it can help you.