Valeriy Brusilovskyy / Профиль

- Информация

|

7+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

Опыт работы в торговле на валютный рынках более 18 лет. Кроме торговли на валютных рынках также работал с ванильными опционами.

Практиковал трейдинг на дивергенциях, который приносил мне 60-80% годовых. Постоянно веду поиск новых валютных пар пригодных для данного метода торговли. После теста в тестере торговых стратегий и получения удовлетворительных результатов ( 4-6 пунктов матожидание) валютная пара ставится на демо-счет и после трехмесячной торговли с результатом не менее 3-х пунктов матожидания на каждую сделку, пара переносится на реальный счет. В то же время не прекращаю мониторинг движения цен уже зарекомендовавших себя валютных пар на соответствие идее торговли. На основании которого вношу изменения в алгоритм, время торговли, при необходимости меняю размер позиции или даже снимаю пару с активной торговли.

В данное время успешно веду торговлю на 6 счетах.

Если мы все еще сомневаетесь на счет меня, я вас приглашаю взглянуть на показатели моих торговых сигналов - https://www.mql5.com/en/signals/author/valera309

Буду очень рад начать работать с вами.

Пожалуйста, не стесняйтесь мне писать в личку или на почту, если у вас возникли какие-либо вопросы. Ни одно обращение не останется без ответа!

Мои лучшие пожелания, Валерий!

Практиковал трейдинг на дивергенциях, который приносил мне 60-80% годовых. Постоянно веду поиск новых валютных пар пригодных для данного метода торговли. После теста в тестере торговых стратегий и получения удовлетворительных результатов ( 4-6 пунктов матожидание) валютная пара ставится на демо-счет и после трехмесячной торговли с результатом не менее 3-х пунктов матожидания на каждую сделку, пара переносится на реальный счет. В то же время не прекращаю мониторинг движения цен уже зарекомендовавших себя валютных пар на соответствие идее торговли. На основании которого вношу изменения в алгоритм, время торговли, при необходимости меняю размер позиции или даже снимаю пару с активной торговли.

В данное время успешно веду торговлю на 6 счетах.

Если мы все еще сомневаетесь на счет меня, я вас приглашаю взглянуть на показатели моих торговых сигналов - https://www.mql5.com/en/signals/author/valera309

Буду очень рад начать работать с вами.

Пожалуйста, не стесняйтесь мне писать в личку или на почту, если у вас возникли какие-либо вопросы. Ни одно обращение не останется без ответа!

Мои лучшие пожелания, Валерий!

Друзья

979

Заявки

Исходящие

Valeriy Brusilovskyy

Здравствуйте, уважаемые друзья форекс трейдеры! Многие из вас слышали о паттернах Гартли: бабочка, краб, летучая мышь, три движения, акула, шифр, а также видели и использовали различные технические индикаторы по их поиску на графиках...

Поделитесь в соцсетях · 5

1612

Valeriy Brusilovskyy

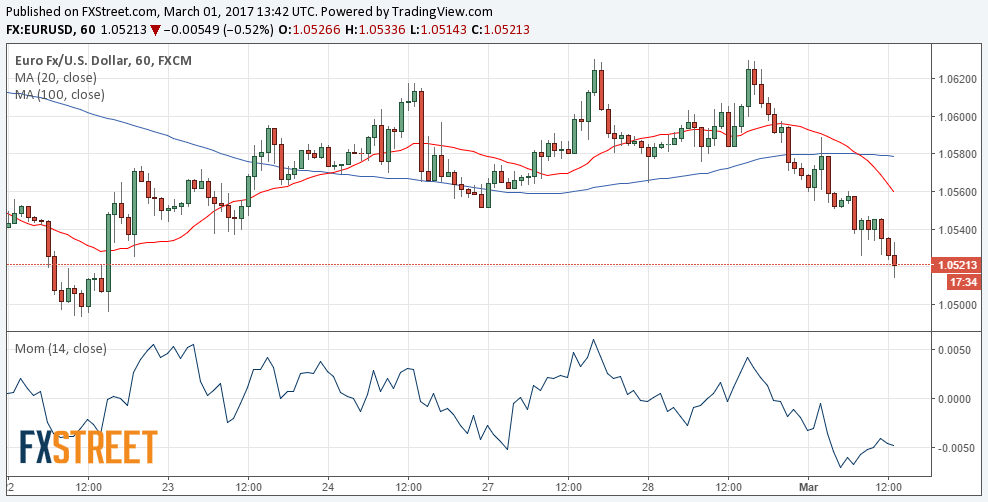

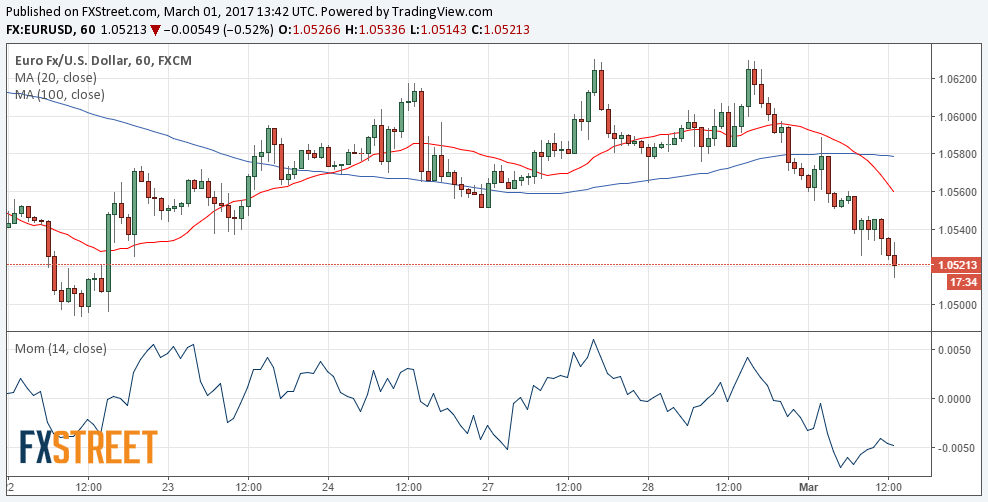

Доллар восстановил позиции против всех своих основных валютных соперников в ходе последних нескольких часов, а EUR/USD отправилась в область свежих 4-дневных минимумов в районе 1.0529, где сейчас и торгуется. На этой неделе пара продолжила снижаться...

Поделитесь в соцсетях · 2

90

Valeriy Brusilovskyy

ECB: Draghi to hold the line on dovish policy outlook - AmpGFX

8 марта 2017, 09:12

According to Greg Gibbs, Director at Amplifying Global FX Capital, headline inflation has jumped sharply to surpass the ECB’s medium-term target for the first time since Jan-2013 which may be generating some thoughts of a less dovish ECB statement on Thursday...

Поделитесь в соцсетях · 3

93

Valeriy Brusilovskyy

The markets trade in mild risk aversion today and the sentiments sent Yen broadly higher. Meanwhile, Dollar regains some ground from Friday's profit taking pull back. The greenback stays supported by firm expectation of a March Fed hike...

Поделитесь в соцсетях · 3

61

Valeriy Brusilovskyy

The U.S. dollar closed on Friday on a weaker note despite the markets showing an increased probability for a rate hike in March. The economic calendar today is light with no major releases lined up. So far, Australia's retail sales figures showed a 0...

Поделитесь в соцсетях · 2

60

Valeriy Brusilovskyy

European Commission Offers 5 Scenarios

Later this month, Europe celebrates the 60th anniversary of the Treaty of Rome, which established the European Economic Community. Very near to the anniversary, which was not one of the original members,the UK will likely begin the process that will lead to its exit. This, coupled with some reluctance of some new members in Eastern and Central Europe to embrace liberal values of the west, and the ongoing economic adjustment in the EMU has posed an existential crisis for European integration.

The European Commission offered a white paper that suggests five future scenarios for the future of Europe. It will be a discussion point in the coming months, with Juncker's State of the Union speech in September will likely focus on it before preliminary conclusions are made at the heads of state summit at the end of the year.

This note is to present the scenarios so that the general framework can be appreciated by investors. The scenarios address the question of what Europe may look like in 2025. They are designed to cover a range of possibilities. They are not mutually exclusive or exhaustive.

1. Carrying on: It is not simply the status quo but assumes the implementation of reform agendas. Free movement of people remains, though security is reinforced. Some border frictions remain.

2. Single Market: EU members do not agree on new policy areas to integrate. The focus is on the single market. Free-movement of people becomes more difficult. This returns the EU to its roots.

3. Multi-Speed: The white paper does not use the multi-speed terminology but discusses "coalitions of the willing" that could pursue greater integration on a range of specific policy areas, such as defense, internal security, or social issues. This is a recognition of different appetites for integration.

4. Narrower Focus: The Commission calls this scenario "Doing Less More Efficiently." Rather than a broad range of activities, the EU narrows its focus to policy areas where it is perceived to add value. This is a smaller form of integration and represents a recognition that some limit has been reached. It is consistent with a strengthening of national identities.

5. Enhanced Integration: More power, resources, and decision-making are shared. Deliberation process is expedited and decisions on the European level are made more quickly and implemented by national authorities.

These scenarios are meant to launch the year-long discussion of the future of the European project. The EC will issue several more discussion (reflection) papers. Some European officials were wary of the white paper ahead of the spate of elections beginning with the Dutch in a couple of weeks. It is possible, and we consider likely, that populist-nationalist forces are not part of the next governments in the Netherlands, France or Germany. The power of national identities should not be under-estimated, and its influence on policy debates may exceed the electoral success.

Populism-nationalism does not appear to be reducible to pure macroeconomic variables. Where it has enjoyed initial success has mostly been in economies that are doing relatively better like Hungary, Poland, and the Czech Republic. The US and UK emerged from the Great Financial Crisis better than most other high income countries. The US and UK economies were larger than ever, and by at least conventional measures, the labor market was well on its way to full employment.

Many had worried that the UK decision to leave the EU was going to lower the barrier to exit and encourage other countries to leave. The elections are still ahead of us, but the opinion polls suggest that to the contrary, support for the EU has risen. The project has been attacked, and it is as if the wagons are circling. Just like the desire for national identity cannot be reduced to a macroeconomic variable, European integration is not simply about economic. Since the Greek crisis first surfaced in 2010, the lack of appreciating the non-economic considerations, especially political will, saw pessimism and cynicism cloud investment decision and led to speculation of the collapse of EMU and the EU.

Later this month, Europe celebrates the 60th anniversary of the Treaty of Rome, which established the European Economic Community. Very near to the anniversary, which was not one of the original members,the UK will likely begin the process that will lead to its exit. This, coupled with some reluctance of some new members in Eastern and Central Europe to embrace liberal values of the west, and the ongoing economic adjustment in the EMU has posed an existential crisis for European integration.

The European Commission offered a white paper that suggests five future scenarios for the future of Europe. It will be a discussion point in the coming months, with Juncker's State of the Union speech in September will likely focus on it before preliminary conclusions are made at the heads of state summit at the end of the year.

This note is to present the scenarios so that the general framework can be appreciated by investors. The scenarios address the question of what Europe may look like in 2025. They are designed to cover a range of possibilities. They are not mutually exclusive or exhaustive.

1. Carrying on: It is not simply the status quo but assumes the implementation of reform agendas. Free movement of people remains, though security is reinforced. Some border frictions remain.

2. Single Market: EU members do not agree on new policy areas to integrate. The focus is on the single market. Free-movement of people becomes more difficult. This returns the EU to its roots.

3. Multi-Speed: The white paper does not use the multi-speed terminology but discusses "coalitions of the willing" that could pursue greater integration on a range of specific policy areas, such as defense, internal security, or social issues. This is a recognition of different appetites for integration.

4. Narrower Focus: The Commission calls this scenario "Doing Less More Efficiently." Rather than a broad range of activities, the EU narrows its focus to policy areas where it is perceived to add value. This is a smaller form of integration and represents a recognition that some limit has been reached. It is consistent with a strengthening of national identities.

5. Enhanced Integration: More power, resources, and decision-making are shared. Deliberation process is expedited and decisions on the European level are made more quickly and implemented by national authorities.

These scenarios are meant to launch the year-long discussion of the future of the European project. The EC will issue several more discussion (reflection) papers. Some European officials were wary of the white paper ahead of the spate of elections beginning with the Dutch in a couple of weeks. It is possible, and we consider likely, that populist-nationalist forces are not part of the next governments in the Netherlands, France or Germany. The power of national identities should not be under-estimated, and its influence on policy debates may exceed the electoral success.

Populism-nationalism does not appear to be reducible to pure macroeconomic variables. Where it has enjoyed initial success has mostly been in economies that are doing relatively better like Hungary, Poland, and the Czech Republic. The US and UK emerged from the Great Financial Crisis better than most other high income countries. The US and UK economies were larger than ever, and by at least conventional measures, the labor market was well on its way to full employment.

Many had worried that the UK decision to leave the EU was going to lower the barrier to exit and encourage other countries to leave. The elections are still ahead of us, but the opinion polls suggest that to the contrary, support for the EU has risen. The project has been attacked, and it is as if the wagons are circling. Just like the desire for national identity cannot be reduced to a macroeconomic variable, European integration is not simply about economic. Since the Greek crisis first surfaced in 2010, the lack of appreciating the non-economic considerations, especially political will, saw pessimism and cynicism cloud investment decision and led to speculation of the collapse of EMU and the EU.

Valeriy Brusilovskyy

Саудовская Аравия по-прежнему старается больше всех - BBG

По информации Bloomberg, лидером среди картеля ОПЕК, исполняющим условия договоренностей в полной мере, является Саудовская Аравия.

• Саудовская Аравия по-прежнему прилагает больше всех усилий к исполнению венских договоренностей по снижению объемов нефтедобычи

• В феврале Эр-Рияд снизил объемы нефтедобычи на 90 тыс. барр. в сутки до 9.78 млн барр.

• Добыча нефти ОПЕК снизилась до 32.17 млн барр. в сутки в феврале, то есть на 65 тыс. барр в сутки с января

• Добычу нефти увеличили Иран, Нигерия и Ливии (на особых условия в рамках соглашения)

• Общий объем добычи нефти ОПЕК находится на 415 тыс. барр. в день выше целевых уровней соглашения, заключенного 30 ноября

• В целом, объем добываемой картелем нефти составляет только 70% от общего необходимого снижения для достижения баланса на рынке

По информации Bloomberg, лидером среди картеля ОПЕК, исполняющим условия договоренностей в полной мере, является Саудовская Аравия.

• Саудовская Аравия по-прежнему прилагает больше всех усилий к исполнению венских договоренностей по снижению объемов нефтедобычи

• В феврале Эр-Рияд снизил объемы нефтедобычи на 90 тыс. барр. в сутки до 9.78 млн барр.

• Добыча нефти ОПЕК снизилась до 32.17 млн барр. в сутки в феврале, то есть на 65 тыс. барр в сутки с января

• Добычу нефти увеличили Иран, Нигерия и Ливии (на особых условия в рамках соглашения)

• Общий объем добычи нефти ОПЕК находится на 415 тыс. барр. в день выше целевых уровней соглашения, заключенного 30 ноября

• В целом, объем добываемой картелем нефти составляет только 70% от общего необходимого снижения для достижения баланса на рынке

Valeriy Brusilovskyy

Dollar continues recent rise on rate hike expectation: Mar 03, 2017

Dollar continues recent rise on rate hike expectation

The greenback continued its recent winning streak and rose against majority of its peers on Thursday after comments from Federal Reserve official Lael Brainard increased expectations of a rate hike in March.

"We are closing in on full employment, inflation is moving gradually toward our target, foreign growth is on more solid footing, and risks to the outlook are as close to balanced as they have been in some time," Brainard said. She added "Assuming continued progress, it will likely be appropriate soon to remove additional accommodation, continuing on a gradual path."

Versus the Japanese yen, the greenback rose to 114.16 at Asian open on Brainard's comments and continued to trade with a firm bias. Intra-day ascent accelerated in Europe and rose to 114.54 in New York morning on dollar's broad-based strength before stabilising, price later hit session highs of 114.59.

The single currency dropped to 1.0529 at Asian open and continued to ratchet lower to 1.0522 at European open before recovering. However, euro met renewed selling at 1.0546 and dropped to 1.0499 in New York morning before staging a recovery to 1.0528 but only to weaken to session lows of 1.0496 in New York afternoon.

The British pound dropped to 1.2262 at Asian open and continued to remain under pressure in Asia and Europe and fell marginally to an intra-day low at 1.2259 in New York morning before staging a rebound, price later weakened to a 6-week bottom of 1.2243.

In other news, Fed's Powell said 'wants to get interest rates well above 0 b4 reducing balance sheet; case for Mar rate hike has come together; fiscal policy likely to be supportive of near term economic growth, not incorporated into his own forecast; we're getting very close to 2% inflation target; rate hike in Mar is on the table for discussion.'

On the data front, The U.S. Department of Labor said the number of individuals filing for initial jobless benefits in the week ending February 25 declined by 19,000 to a seasonally adjusted 223,000 from the previous week's total of 242,000. Analysts expected jobless claims to rise by 1,000 to 243,000 last week.

Dollar continues recent rise on rate hike expectation

The greenback continued its recent winning streak and rose against majority of its peers on Thursday after comments from Federal Reserve official Lael Brainard increased expectations of a rate hike in March.

"We are closing in on full employment, inflation is moving gradually toward our target, foreign growth is on more solid footing, and risks to the outlook are as close to balanced as they have been in some time," Brainard said. She added "Assuming continued progress, it will likely be appropriate soon to remove additional accommodation, continuing on a gradual path."

Versus the Japanese yen, the greenback rose to 114.16 at Asian open on Brainard's comments and continued to trade with a firm bias. Intra-day ascent accelerated in Europe and rose to 114.54 in New York morning on dollar's broad-based strength before stabilising, price later hit session highs of 114.59.

The single currency dropped to 1.0529 at Asian open and continued to ratchet lower to 1.0522 at European open before recovering. However, euro met renewed selling at 1.0546 and dropped to 1.0499 in New York morning before staging a recovery to 1.0528 but only to weaken to session lows of 1.0496 in New York afternoon.

The British pound dropped to 1.2262 at Asian open and continued to remain under pressure in Asia and Europe and fell marginally to an intra-day low at 1.2259 in New York morning before staging a rebound, price later weakened to a 6-week bottom of 1.2243.

In other news, Fed's Powell said 'wants to get interest rates well above 0 b4 reducing balance sheet; case for Mar rate hike has come together; fiscal policy likely to be supportive of near term economic growth, not incorporated into his own forecast; we're getting very close to 2% inflation target; rate hike in Mar is on the table for discussion.'

On the data front, The U.S. Department of Labor said the number of individuals filing for initial jobless benefits in the week ending February 25 declined by 19,000 to a seasonally adjusted 223,000 from the previous week's total of 242,000. Analysts expected jobless claims to rise by 1,000 to 243,000 last week.

Valeriy Brusilovskyy

Каждый год профессор Макс Базерман продает студентам MBA из Harvard Business School двадцатидолларовую купюру намного выше номинала. Его рекорд – продажа $20 за $204. А делает он это следующим образом...

Поделитесь в соцсетях · 6

254

3

Valeriy Brusilovskyy

EUR/USD: снизилась в район 1.0520

Снижение доллара позволило EUR/USD вырасти в район 1.0550 в ходе азиатской сессии, однако паре не хватило импульса, и она снизилась в район 1.0520. Сейчас пара растет впервые за 3 сессии, нащупав достойную поддержку чуть ниже 1.0500.

Спрос на доллар сохраняется, несмотря не небольшое снижение сегодня, на фоне растущих надежд на повышение ставки в марте. А снижение евро компенсирует рост доходности облигаций Германии.

Ставки на фьючерсы по федеральным фондам на CME закладывают 76% вероятность повышения ставки ФРС в марте.

Последние несколько недель на евро оказывали давление позитивные данные американской статистики, Трампономика, а также неопределенность в отношении выборов во Франции.

Сегодня на EUR/USD могут оказать краткосрочное влияние данные еврозоны по PMI в секторе услуг за февраль и отчет по розничным продажам региона, что, однако, маловероятно, потому что все внимание будет приковано к доллару в преддверии отчета по PMI в секторе услуг ISM США и выступлений представителей ФРС Эванса (голосует, голубь), Лэкера (голосует в 2018, ястреб), Пауэлла (постоянно голосует, центрист), Фишера (постоянно голосует, центрист) и выступление главы регулятора Джанет Йеллен.

Важные уровни по EUR/USD

На момент написания пара торговалась с повышением на 0.08% вблизи 1.0514. Прорыв 1.0492 (минимум 2 марта и 22 февраля) нацелит пару на 1.0452 (минимум 11 января), а затем в район 1.0339 (минимум 3 января 2017). Ближайшее сопротивление отмечено в районе 1.0552 (максимум 2 марта), далее в районе 1.0595 (55-дневная sma) и затем вблизи 1.0604 (20-дневная sma).

Снижение доллара позволило EUR/USD вырасти в район 1.0550 в ходе азиатской сессии, однако паре не хватило импульса, и она снизилась в район 1.0520. Сейчас пара растет впервые за 3 сессии, нащупав достойную поддержку чуть ниже 1.0500.

Спрос на доллар сохраняется, несмотря не небольшое снижение сегодня, на фоне растущих надежд на повышение ставки в марте. А снижение евро компенсирует рост доходности облигаций Германии.

Ставки на фьючерсы по федеральным фондам на CME закладывают 76% вероятность повышения ставки ФРС в марте.

Последние несколько недель на евро оказывали давление позитивные данные американской статистики, Трампономика, а также неопределенность в отношении выборов во Франции.

Сегодня на EUR/USD могут оказать краткосрочное влияние данные еврозоны по PMI в секторе услуг за февраль и отчет по розничным продажам региона, что, однако, маловероятно, потому что все внимание будет приковано к доллару в преддверии отчета по PMI в секторе услуг ISM США и выступлений представителей ФРС Эванса (голосует, голубь), Лэкера (голосует в 2018, ястреб), Пауэлла (постоянно голосует, центрист), Фишера (постоянно голосует, центрист) и выступление главы регулятора Джанет Йеллен.

Важные уровни по EUR/USD

На момент написания пара торговалась с повышением на 0.08% вблизи 1.0514. Прорыв 1.0492 (минимум 2 марта и 22 февраля) нацелит пару на 1.0452 (минимум 11 января), а затем в район 1.0339 (минимум 3 января 2017). Ближайшее сопротивление отмечено в районе 1.0552 (максимум 2 марта), далее в районе 1.0595 (55-дневная sma) и затем вблизи 1.0604 (20-дневная sma).

Valeriy Brusilovskyy

The greenback continues to advance, with the key US Dollar Index hovering near seven-week tops amid growing consensus that the Federal Reserve would seriously consider raising interest rates at its March meeting. In addition, Trump-reflation trade seems to have made a comeback, amid renewed hopes for a massive infrastructure spending and tax cuts following Tuesday's address to the Congress, further supported the greenback's strong performance.

On economic data front, the release of US ISM manufacturing PMI topped estimates and rose to 57.5 in February, up from 56 recorded in January. Today's US economic docket features the usual release of initial weekly jobless claims, which is unlikely to distort the strong bullish sentiment surrounding the greenback.

GBP/USD

Apart from the broad based US Dollar strength, Wednesday's disappointing release of UK manufacturing PMI dragged the pair below 1.2300 handle, to six-week lows. The pair traded with bearish bias for the fifth consecutive session as traders now look forward to the release of UK construction PMI print, for some immediate respite during European trading session.

Technically, the pair is hovering around its immediate support near 1.2360-50 region, marking 61.8% Fibonacci retracement level of 1.1987-1.2706 up-swing. Hence, a follow through weakness below this level would confirm extension of the pair’s near-term downward trajectory, initially towards 1.2215-10 intermediate support and eventually towards 1.2155-50 horizontal support.

On the flip side, any recovery attempts above 1.2300 round figure mark might now confront resistance at 50% Fibonacci retracement level near 1.2345 level. Although momentum above 1.2345 level could get extended but should now be capped at an important support break-point, now turned strong resistance near 1.2380-85 zone.

GBPUSD

EUR/USD

The pair has already confirmed break-down through a bearish continuation chart pattern, Flag, but is finding some support near 1.0515 region, nearing 61.8% Fibonacci retracement level of 1.0341-1.0829 recent up-move. Thus, today's release of flash Euro-zone CPI print now becomes a key determinant to see if the pair continues to hold this immediate support or extend the near-term bearish break-down momentum.

A convincing drop below 1.0515 level should accelerate the slide towards mid-1.0400s, en-route its next major support near 1.0400-1.0390 region. A follow through selling pressure below the 1.0400 handle would open room for extension of the pair’s downward trajectory further towards multi-year lows support near 1.0340 level before eventually dropping towards 1.0240 support, representing 61.8% Fibonacci expansion level of 1.1300-1.0340 downslide and subsequent retracement.

Alternatively, rebound from current support area, leading to a subsequent recovery above mid-1.0500s could get extended towards 1.0600 round figure mark. This 1.0600 handle should now restrict any near-term recovery and only a sustained move above the 1.0600 handle would negate any near-term bearish bias.

On economic data front, the release of US ISM manufacturing PMI topped estimates and rose to 57.5 in February, up from 56 recorded in January. Today's US economic docket features the usual release of initial weekly jobless claims, which is unlikely to distort the strong bullish sentiment surrounding the greenback.

GBP/USD

Apart from the broad based US Dollar strength, Wednesday's disappointing release of UK manufacturing PMI dragged the pair below 1.2300 handle, to six-week lows. The pair traded with bearish bias for the fifth consecutive session as traders now look forward to the release of UK construction PMI print, for some immediate respite during European trading session.

Technically, the pair is hovering around its immediate support near 1.2360-50 region, marking 61.8% Fibonacci retracement level of 1.1987-1.2706 up-swing. Hence, a follow through weakness below this level would confirm extension of the pair’s near-term downward trajectory, initially towards 1.2215-10 intermediate support and eventually towards 1.2155-50 horizontal support.

On the flip side, any recovery attempts above 1.2300 round figure mark might now confront resistance at 50% Fibonacci retracement level near 1.2345 level. Although momentum above 1.2345 level could get extended but should now be capped at an important support break-point, now turned strong resistance near 1.2380-85 zone.

GBPUSD

EUR/USD

The pair has already confirmed break-down through a bearish continuation chart pattern, Flag, but is finding some support near 1.0515 region, nearing 61.8% Fibonacci retracement level of 1.0341-1.0829 recent up-move. Thus, today's release of flash Euro-zone CPI print now becomes a key determinant to see if the pair continues to hold this immediate support or extend the near-term bearish break-down momentum.

A convincing drop below 1.0515 level should accelerate the slide towards mid-1.0400s, en-route its next major support near 1.0400-1.0390 region. A follow through selling pressure below the 1.0400 handle would open room for extension of the pair’s downward trajectory further towards multi-year lows support near 1.0340 level before eventually dropping towards 1.0240 support, representing 61.8% Fibonacci expansion level of 1.1300-1.0340 downslide and subsequent retracement.

Alternatively, rebound from current support area, leading to a subsequent recovery above mid-1.0500s could get extended towards 1.0600 round figure mark. This 1.0600 handle should now restrict any near-term recovery and only a sustained move above the 1.0600 handle would negate any near-term bearish bias.

Valeriy Brusilovskyy

Daily Report: Strong Risk Appetite Pushed Stocks to Record, Dollar Strengthened with Hesitation

Strong risk appetite boosted US markets to new record highs overnight. DJIA jumped 303.31 pts, or 1.46%, to close at 21115.55. S&P 500 rose 32.32 pts, or 1.37%, to close to 2395.96. NASDAQ also gained 78.59 pts, or 1.35%, to end at 5904.03. All three indices closed at records. Positive sentiments also pulled treasury yields higher with 10 year yield rose 0.105 to close at 2.463 and revived underlying bullishness. Dollar was boosted by increased speculation of March Fed hike as the Dollar index hitting at high at 101.97. The break of 101.76 in the dollar index confirmed resumption of recent rebound from 99.23. However, development in the currency markets doesn't warrant decisive momentum in the greenback yet. EUR/USD is held above 1.0493 support, AUD/USD above 0.7605 support. USD/CHF is limited below 1.0140 resistance and USD/JPY is held below 114.94 resistance. The strength in the greenback is more apparent in GBP/USD and USD/CAD only. More evidence is needed to confirm bullishness in the greenback.

Fed Brainard: Rate hike appropriate "soon"

Markets continued to raise bet on a rate hike by Fed in March. Fed fund futures are now pricing in 66.4% chance of it, comparing to 65.4% a day ago. Fed governor Lael Brainard said yesterday that "we are closing in on full employment, inflation is moving gradually toward our target, foreign growth is on more solid footing and risks to the outlook are as close to balanced as they have been in some time." She noted "bear-term risks to the United States from abroad appear to have diminished." And, "recoveries are gaining traction in China, Europe and Japan, in part reflecting greater confidence in their respective policy environments." Hence, "assuming continued progress, it will likely be appropriate soon to remove additional accommodation, continuing on a gradual path."

Fed Beige Book positive but not overwhelming

Fed released the Beige Book economic report based on information collected from early January through mid February. The reported noted that some district reported "widening labor shortages." At this point, wages only rose "modestly or moderately" though, in general. A few districts reported "some pickup in the pace of wage growth." Meanwhile, "businesses were generally optimistic about the near-term outlook but to a somewhat lesser degree than in the prior report." Overall, all 12 Fed districts reported "modest-to-moderate" growth and inflation cooled a little bit.

BoC on hold

As widely anticipated, BOC kept its monetary policy unchanged with the overnight rate at 0.5%, the Bank rate at 0.75% and the deposit rate at 0.25%. The central bank acknowledged that both global and domestic economic indicators were consistent with its projection of improving growth laid out in January. It also note Canadian growth in 4q16 came in 'slightly stronger than expected'. However, policymakers maintained a cautious tone noting that 'material excess capacity' remained and that the central bank is 'attentive to the impact of significant uncertainties weighing on the outlook'. Therefore, the risks and slacks in the economy justified leaving the policy rate at exceptionally low level. More in US Tax Reform Plan To Direct BOC Monetary Policy Outlook.

On the data front, Japan monetary base rose 21.4% yoy in February. Australia trade surplus narrowed to AUD 1.3b in January, building approvals rose 1.8% mom. Swiss will release GDP and retail sales in European session. Germany will release import price index. UK will release construction PMI. Eurozone will release PPI, CPI and unemployment rate. US will release Challenger job cuts and jobless claims in US session. Canada will release GDP.

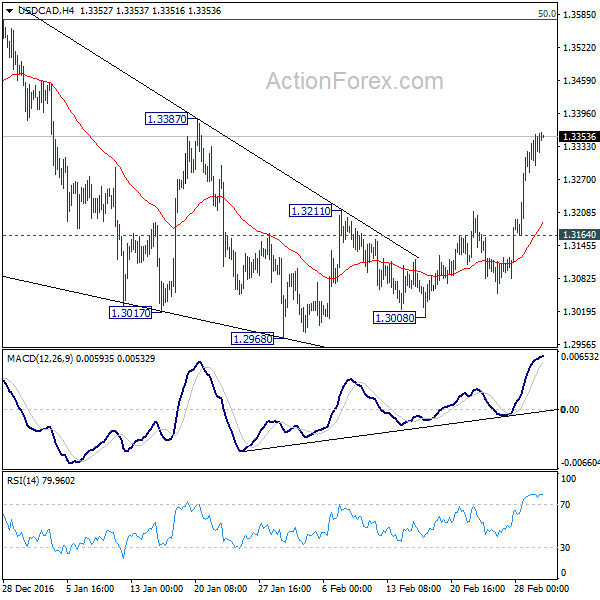

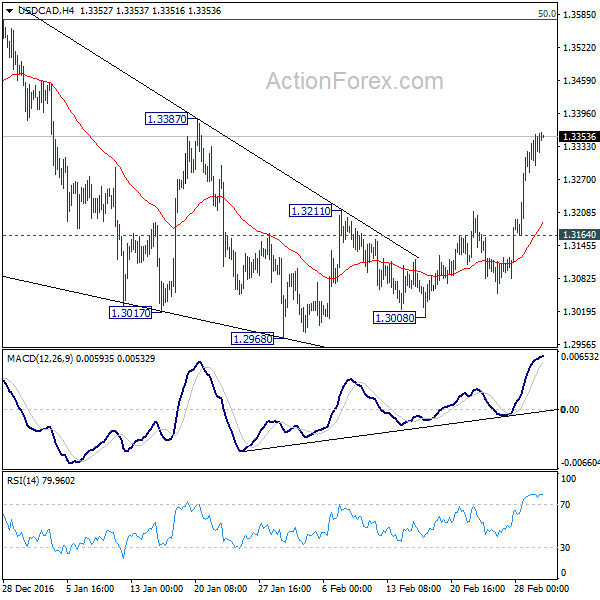

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3286; (P) 1.3322; (R1) 1.3360;

Intraday bias in USD/CAD remains on the upside as rebound from 1.2968 continues. As noted before, pull back from 1.3598 has completed at 1.2968 already. Break of 1.3387 will target a test on 1.3598 resistance next. Also, break there will extend the larger rally from 1.2460 towards next fibonacci level at 1.3838. On the downside, though, below 1.3164 minor support will turn bias back to the downside for 1.2968 support instead.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg is likely still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. We'd look for reversal signal there to start the third leg. Break of 1.2968 wold at least bring at retest of 1.2460 low. However, sustained trading above 1.3838 would pave the way to retest 1.4689 high.

Strong risk appetite boosted US markets to new record highs overnight. DJIA jumped 303.31 pts, or 1.46%, to close at 21115.55. S&P 500 rose 32.32 pts, or 1.37%, to close to 2395.96. NASDAQ also gained 78.59 pts, or 1.35%, to end at 5904.03. All three indices closed at records. Positive sentiments also pulled treasury yields higher with 10 year yield rose 0.105 to close at 2.463 and revived underlying bullishness. Dollar was boosted by increased speculation of March Fed hike as the Dollar index hitting at high at 101.97. The break of 101.76 in the dollar index confirmed resumption of recent rebound from 99.23. However, development in the currency markets doesn't warrant decisive momentum in the greenback yet. EUR/USD is held above 1.0493 support, AUD/USD above 0.7605 support. USD/CHF is limited below 1.0140 resistance and USD/JPY is held below 114.94 resistance. The strength in the greenback is more apparent in GBP/USD and USD/CAD only. More evidence is needed to confirm bullishness in the greenback.

Fed Brainard: Rate hike appropriate "soon"

Markets continued to raise bet on a rate hike by Fed in March. Fed fund futures are now pricing in 66.4% chance of it, comparing to 65.4% a day ago. Fed governor Lael Brainard said yesterday that "we are closing in on full employment, inflation is moving gradually toward our target, foreign growth is on more solid footing and risks to the outlook are as close to balanced as they have been in some time." She noted "bear-term risks to the United States from abroad appear to have diminished." And, "recoveries are gaining traction in China, Europe and Japan, in part reflecting greater confidence in their respective policy environments." Hence, "assuming continued progress, it will likely be appropriate soon to remove additional accommodation, continuing on a gradual path."

Fed Beige Book positive but not overwhelming

Fed released the Beige Book economic report based on information collected from early January through mid February. The reported noted that some district reported "widening labor shortages." At this point, wages only rose "modestly or moderately" though, in general. A few districts reported "some pickup in the pace of wage growth." Meanwhile, "businesses were generally optimistic about the near-term outlook but to a somewhat lesser degree than in the prior report." Overall, all 12 Fed districts reported "modest-to-moderate" growth and inflation cooled a little bit.

BoC on hold

As widely anticipated, BOC kept its monetary policy unchanged with the overnight rate at 0.5%, the Bank rate at 0.75% and the deposit rate at 0.25%. The central bank acknowledged that both global and domestic economic indicators were consistent with its projection of improving growth laid out in January. It also note Canadian growth in 4q16 came in 'slightly stronger than expected'. However, policymakers maintained a cautious tone noting that 'material excess capacity' remained and that the central bank is 'attentive to the impact of significant uncertainties weighing on the outlook'. Therefore, the risks and slacks in the economy justified leaving the policy rate at exceptionally low level. More in US Tax Reform Plan To Direct BOC Monetary Policy Outlook.

On the data front, Japan monetary base rose 21.4% yoy in February. Australia trade surplus narrowed to AUD 1.3b in January, building approvals rose 1.8% mom. Swiss will release GDP and retail sales in European session. Germany will release import price index. UK will release construction PMI. Eurozone will release PPI, CPI and unemployment rate. US will release Challenger job cuts and jobless claims in US session. Canada will release GDP.

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.3286; (P) 1.3322; (R1) 1.3360;

Intraday bias in USD/CAD remains on the upside as rebound from 1.2968 continues. As noted before, pull back from 1.3598 has completed at 1.2968 already. Break of 1.3387 will target a test on 1.3598 resistance next. Also, break there will extend the larger rally from 1.2460 towards next fibonacci level at 1.3838. On the downside, though, below 1.3164 minor support will turn bias back to the downside for 1.2968 support instead.

In the bigger picture, price actions from 1.4689 medium term top are seen as a correction pattern. The first leg has completed at 1.2460. The second leg is likely still in progress and could target 61.8% retracement of 1.4689 to 1.2460 at 1.3838. We'd look for reversal signal there to start the third leg. Break of 1.2968 wold at least bring at retest of 1.2460 low. However, sustained trading above 1.3838 would pave the way to retest 1.4689 high.

Valeriy Brusilovskyy

EUR/USD: dollar's momentum persist

The greenback is back in fashion, backed by US President Trump speech before the Congress. In a joint session, the US president pretty much reiterated his campaign pledges, without much detail on how he will achieve its goals, but anyway that was enough to revived the so-called "Trump-trade," characterized by demand of USD-related assets on hopes the world's largest economy will get a growth boost. Among the most remarkable comments, he confirmed a tax cut for corporations, to make US products more competitive worldwide, while asked the Congress to pass a bill that would lead to $1 trillion in investments in a national infrastructure program.

Early Europe, the release of final February manufacturing PMIs did little for the common currency, as despite figures confirmed steady economic growth in the region, the EUR/USD pair held near 1.0520. Ahead of Wall Street's opening, Germany released its preliminary February inflation figures, showing a strong advance in the month when compared to the previous month, as monthly basis, inflation advanced 0.6% against previous -0.6%, while year-on-year inflation rose by 2.2%, beating expectations of 2.1%. US personal income surged in January, up to 0.4% from previous 0.3%, although spending shrunk to 0.2%, below previous 0.5%. The Fed’s preferred measure of consumer prices, the PCE price index, climbed to 1.9% from a year earlier, not far from the 2% percent target that was last met in April 2012, leading to another round of dollar's buying.

From a technical point of view, the short term picture is clearly bearish, as the price extended to fresh daily lows of 1.0513, and with the 1 hour chart showing that the 20 SMA has accelerated its decline below the 100 and 200 SMAs, and far above the current level, whilst technical indicators maintain strong bearish slopes near oversold readings. In the 4 hours chart, technical indicators maintain a strong bearish momentum, within negative territory, while the price is well below all of its moving averages, in line with further declines.

Support levels: 1.0510 1.0470 1.0440

Resistance levels: 1.0565 1.0600 1.0635

GBP/USD Current price: 1.2299

The GBP/USD sunk below 1.2300 during the European session, weighed by broad dollar's demand and a worse-than-expected UK Markit manufacturing PMI for February, which came in at 54.6, a three month low. Money figures in the UK, however, were encouraging, as during January, Consumer Credit jumped to £1.416B from previous £0.984B in December, beating expectations of £1.400B, while mortgage approvals also rose in the same month, reaching 69.928K. Better-than-expected US consumer inflation sent the pair down to 1.2288, its lowest in six weeks, with the pair now poised to extend its decline, as in the 1 hour chart, a sharply bearish 20 SMA capped the upside at the beginning of the day, while technical indicators keep heading lower, despite the RSI indicator stands at 21. In the 4 hours chart, technical readings also back further declines despite indicators entering oversold territory, moreover after the pair broke below the 50% retracement of the January rally at 1.2345. The 61.8% retracement of the same rally stands at 1.2260 the immediate support and probable bearish target.

Support levels: 1.2260 1.2225 1.2190

Resistance levels: 1.2345 1.2380 1.2520

The greenback is back in fashion, backed by US President Trump speech before the Congress. In a joint session, the US president pretty much reiterated his campaign pledges, without much detail on how he will achieve its goals, but anyway that was enough to revived the so-called "Trump-trade," characterized by demand of USD-related assets on hopes the world's largest economy will get a growth boost. Among the most remarkable comments, he confirmed a tax cut for corporations, to make US products more competitive worldwide, while asked the Congress to pass a bill that would lead to $1 trillion in investments in a national infrastructure program.

Early Europe, the release of final February manufacturing PMIs did little for the common currency, as despite figures confirmed steady economic growth in the region, the EUR/USD pair held near 1.0520. Ahead of Wall Street's opening, Germany released its preliminary February inflation figures, showing a strong advance in the month when compared to the previous month, as monthly basis, inflation advanced 0.6% against previous -0.6%, while year-on-year inflation rose by 2.2%, beating expectations of 2.1%. US personal income surged in January, up to 0.4% from previous 0.3%, although spending shrunk to 0.2%, below previous 0.5%. The Fed’s preferred measure of consumer prices, the PCE price index, climbed to 1.9% from a year earlier, not far from the 2% percent target that was last met in April 2012, leading to another round of dollar's buying.

From a technical point of view, the short term picture is clearly bearish, as the price extended to fresh daily lows of 1.0513, and with the 1 hour chart showing that the 20 SMA has accelerated its decline below the 100 and 200 SMAs, and far above the current level, whilst technical indicators maintain strong bearish slopes near oversold readings. In the 4 hours chart, technical indicators maintain a strong bearish momentum, within negative territory, while the price is well below all of its moving averages, in line with further declines.

Support levels: 1.0510 1.0470 1.0440

Resistance levels: 1.0565 1.0600 1.0635

GBP/USD Current price: 1.2299

The GBP/USD sunk below 1.2300 during the European session, weighed by broad dollar's demand and a worse-than-expected UK Markit manufacturing PMI for February, which came in at 54.6, a three month low. Money figures in the UK, however, were encouraging, as during January, Consumer Credit jumped to £1.416B from previous £0.984B in December, beating expectations of £1.400B, while mortgage approvals also rose in the same month, reaching 69.928K. Better-than-expected US consumer inflation sent the pair down to 1.2288, its lowest in six weeks, with the pair now poised to extend its decline, as in the 1 hour chart, a sharply bearish 20 SMA capped the upside at the beginning of the day, while technical indicators keep heading lower, despite the RSI indicator stands at 21. In the 4 hours chart, technical readings also back further declines despite indicators entering oversold territory, moreover after the pair broke below the 50% retracement of the January rally at 1.2345. The 61.8% retracement of the same rally stands at 1.2260 the immediate support and probable bearish target.

Support levels: 1.2260 1.2225 1.2190

Resistance levels: 1.2345 1.2380 1.2520

Valeriy Brusilovskyy

Китайские власти спешат подмять под себя рынок криптовалют, пока он не уплыл в частные руки

Банк Китая активно прикручивает гайки для своих биткоин-бирж, коих на территории страны больше чем где-либо в мире, а сам между делом разрабатывает собственную цифровую валюту.

Сформировав исследовательскую группу еще в 2014 году, Банк Китая провел первые испытания своего аналога криптовалюты и стал еще на один шаг ближе к статусу одного из первых в мире крупных Центробанков, занимающихся эмиссией цифровых денег, на которые можно приобрести что угодно, начиная с лапши и заканчивая автомобилем.

Для пользователей, осуществляющих транзакции через свои смартфоны, криптовалюта Банка Китая не будет отличаться от существующих способов оплаты, как, например, Alipay или WeChat. А продавцы, которые будут получать цифровые платежи напрямую от покупателей, смогут сократить затраты на транзакцию, минуя посредников. В процессе разработки своей криптовалюты регулятор Поднебесной уделяет пристальное внимание биткиону и активности частных компаний в цифровой индустрии. Эмиссией валют всегда занималось государство, а не частные игроки, и банк не желает уступать экосистему криптовалют компаниям, над которыми у него нет контроля.

Как гласит известная пословица, «не можешь победить – присоединись». «Более полная осведомленность о том, какие объемы кредитов выдают банки, куда идут деньги, и с какой активностью предоставляются кредиты, имеет ключевое значение для борьбы с отмыванием денег и для повышения эффективности кредитно-денежной политики», - уверен Дуан Ксинксинг, вице-президент пекинской OKCoin Co., одной из крупнейших биткоин-бирж в стране. Эмиссия цифровой валюты поможет ЦБ мониторить риски в финансовой системе и отслеживать транзакции в масштабах национальной экономики, добавил г-н Ксинксинг. OKCoin – одна из бирж криптовалют, объявивших недавно о временном прекращении вывода биткоинов в попытке сдержать отток капитала. В январе прошлого года Банк Китая заявил, что «в скором времени» обзаведется собственной криптовалютой, но официальная дата ее запуска до сих пор не анонсирована. Тем временем высокопоставленные чиновники активно ратуют за появление такого актива, включая Фана Йифей, одного из представителей Центробанка.

Банк Китая может возглавить переход к цифровым валютам

На сегодняшний день не только лишь Поднебесная уходит от использования наличных денег. В конце прошлого года премьер-министр Индии Нарендра Моди вывел из обращения две банкноты, которые составляли 86% всех находящихся в обращении рупий. Основные цели, которые преследовали власти – борьба с коррупцией и продвижение использования цифровых платежей. Немалое внимание цифровым валютам в последнее время также уделяют Банк Канады, немецкий Бендесбанк и Денежно-кредитное управление Сингапура.

Печатание денег и борьба с фальшивомонетчиками – дорогое удовольствие для страны с населением 1.4 млрд человек, особенно учитывая затраты на управление обращением денег и транзакциями. Добавление цифровой валюты к наличным деньгам в обращении поможет повысить скорость, уровень удобства и прозрачность транзакций. «Сокращение издержек – очевидная выгода, но эффект от перехода к цифровым деньгам выходит далеко за рамки этого. Криптовалютой можно заплатить любому звену системы, любому банку, любому продавцу напрямую, без посредников. Блокчейн изменит всю инфраструктуру. Мы имеем дело с революционными изменениями», - подчеркнул Ларри Као из CFA Institute в Гонконге.

Если версия цифровой валюты от Банка Китая получит широкое распространение, посредникам в лице банков и платежных сервисов Alipay и WeChat придется несладко. «Я не хочу сказать, что банки и платежные компании исчезнут, но их роль определенно изменится. Им нужно найти новую нишу в новой экосистеме платежей. Возможно, в этом секторе со временем появится инновационная бизнес-модель», - рассуждает Уильям Джи из PwC China в Пекине.

Данные в режиме реального времени

Благодаря технологии блокчейн, на базе которой создан биткоин, Банк Китая сможет отслеживать транзакции и собирать полные, достоверные данные в режиме реального времени, компилируя отдельные денежно-кредитные индикаторы, включая рост денежной массы, подчеркивает Дуан из OKCoin. «Уровень прозрачности экономической деятельности в каждом уголке страны ощутимо повысится. У Центробанка будет беспрецедентная информация о состоянии экономики», - добавляет Дуан. Таким образом, вместо ежемесячных исследований бизнеса и сбора данных из органов статистики, регулятор, а впоследствии и правительство, будут иметь под рукой все показатели в режиме реального времени.

В своем исследовании, опубликованном в прошлом году, Банк Китая обрисовал, каким образом будут работать цифровые деньги:

ЦБ создает криптовалюту и передает ее коммерческим банкам, нуждающимся в повышении уровня ликвидности

Потребители приобретают цифровую валюту в модифицированных банкоматах или кассах банка и хранят ее в криптокошельке на своем смартфоне или другом устройстве

Для совершения покупки потребители переводят криптовалюту со своего кошелька на счет продавца

Продавец вносит криптовалюту на свой счет в коммерческом банке

«Говорить сейчас о масштабах влияния цифровой валюты – все равно, что в 1980-е пытаться предсказать, насколько сильно интернет изменит нашу жизнь. Мы точно знаем, что эффект обещает быть колоссальным. Это полностью изменить экономическую инфраструктуру. Единственное, о чем мы не можем говорить с уверенностью – когда и как свершится эта революция», - резюмировал Дуан Ксинксинг.

Банк Китая активно прикручивает гайки для своих биткоин-бирж, коих на территории страны больше чем где-либо в мире, а сам между делом разрабатывает собственную цифровую валюту.

Сформировав исследовательскую группу еще в 2014 году, Банк Китая провел первые испытания своего аналога криптовалюты и стал еще на один шаг ближе к статусу одного из первых в мире крупных Центробанков, занимающихся эмиссией цифровых денег, на которые можно приобрести что угодно, начиная с лапши и заканчивая автомобилем.

Для пользователей, осуществляющих транзакции через свои смартфоны, криптовалюта Банка Китая не будет отличаться от существующих способов оплаты, как, например, Alipay или WeChat. А продавцы, которые будут получать цифровые платежи напрямую от покупателей, смогут сократить затраты на транзакцию, минуя посредников. В процессе разработки своей криптовалюты регулятор Поднебесной уделяет пристальное внимание биткиону и активности частных компаний в цифровой индустрии. Эмиссией валют всегда занималось государство, а не частные игроки, и банк не желает уступать экосистему криптовалют компаниям, над которыми у него нет контроля.

Как гласит известная пословица, «не можешь победить – присоединись». «Более полная осведомленность о том, какие объемы кредитов выдают банки, куда идут деньги, и с какой активностью предоставляются кредиты, имеет ключевое значение для борьбы с отмыванием денег и для повышения эффективности кредитно-денежной политики», - уверен Дуан Ксинксинг, вице-президент пекинской OKCoin Co., одной из крупнейших биткоин-бирж в стране. Эмиссия цифровой валюты поможет ЦБ мониторить риски в финансовой системе и отслеживать транзакции в масштабах национальной экономики, добавил г-н Ксинксинг. OKCoin – одна из бирж криптовалют, объявивших недавно о временном прекращении вывода биткоинов в попытке сдержать отток капитала. В январе прошлого года Банк Китая заявил, что «в скором времени» обзаведется собственной криптовалютой, но официальная дата ее запуска до сих пор не анонсирована. Тем временем высокопоставленные чиновники активно ратуют за появление такого актива, включая Фана Йифей, одного из представителей Центробанка.

Банк Китая может возглавить переход к цифровым валютам

На сегодняшний день не только лишь Поднебесная уходит от использования наличных денег. В конце прошлого года премьер-министр Индии Нарендра Моди вывел из обращения две банкноты, которые составляли 86% всех находящихся в обращении рупий. Основные цели, которые преследовали власти – борьба с коррупцией и продвижение использования цифровых платежей. Немалое внимание цифровым валютам в последнее время также уделяют Банк Канады, немецкий Бендесбанк и Денежно-кредитное управление Сингапура.

Печатание денег и борьба с фальшивомонетчиками – дорогое удовольствие для страны с населением 1.4 млрд человек, особенно учитывая затраты на управление обращением денег и транзакциями. Добавление цифровой валюты к наличным деньгам в обращении поможет повысить скорость, уровень удобства и прозрачность транзакций. «Сокращение издержек – очевидная выгода, но эффект от перехода к цифровым деньгам выходит далеко за рамки этого. Криптовалютой можно заплатить любому звену системы, любому банку, любому продавцу напрямую, без посредников. Блокчейн изменит всю инфраструктуру. Мы имеем дело с революционными изменениями», - подчеркнул Ларри Као из CFA Institute в Гонконге.

Если версия цифровой валюты от Банка Китая получит широкое распространение, посредникам в лице банков и платежных сервисов Alipay и WeChat придется несладко. «Я не хочу сказать, что банки и платежные компании исчезнут, но их роль определенно изменится. Им нужно найти новую нишу в новой экосистеме платежей. Возможно, в этом секторе со временем появится инновационная бизнес-модель», - рассуждает Уильям Джи из PwC China в Пекине.

Данные в режиме реального времени

Благодаря технологии блокчейн, на базе которой создан биткоин, Банк Китая сможет отслеживать транзакции и собирать полные, достоверные данные в режиме реального времени, компилируя отдельные денежно-кредитные индикаторы, включая рост денежной массы, подчеркивает Дуан из OKCoin. «Уровень прозрачности экономической деятельности в каждом уголке страны ощутимо повысится. У Центробанка будет беспрецедентная информация о состоянии экономики», - добавляет Дуан. Таким образом, вместо ежемесячных исследований бизнеса и сбора данных из органов статистики, регулятор, а впоследствии и правительство, будут иметь под рукой все показатели в режиме реального времени.

В своем исследовании, опубликованном в прошлом году, Банк Китая обрисовал, каким образом будут работать цифровые деньги:

ЦБ создает криптовалюту и передает ее коммерческим банкам, нуждающимся в повышении уровня ликвидности

Потребители приобретают цифровую валюту в модифицированных банкоматах или кассах банка и хранят ее в криптокошельке на своем смартфоне или другом устройстве

Для совершения покупки потребители переводят криптовалюту со своего кошелька на счет продавца

Продавец вносит криптовалюту на свой счет в коммерческом банке

«Говорить сейчас о масштабах влияния цифровой валюты – все равно, что в 1980-е пытаться предсказать, насколько сильно интернет изменит нашу жизнь. Мы точно знаем, что эффект обещает быть колоссальным. Это полностью изменить экономическую инфраструктуру. Единственное, о чем мы не можем говорить с уверенностью – когда и как свершится эта революция», - резюмировал Дуан Ксинксинг.

Valeriy Brusilovskyy

No difference between safe and risk

Market Overview

Investors around the globe continue to watch in awe and disbelief as the stocks continue to climb ever higher. The Dow Jones has posted its tenth straight record-breaking session, something it has not done since the 80s.

Many analysts feel that this has been overdone but most agree that it could very well continue for a while.

Another thing you might notice is that analysts have all but stopped talking about 'risk on' and 'risk off' sentiment in the markets.

The reason being, that stocks are generally considered a 'risk on' trade, but as they just continue to go up without any regard to what's happening in the news or in other markets, this indicator is broken.

Furthermore, Gold and Silver, which are generally considered 'risk off' assets have been flying as well, with Silver on track for its ninth straight weekly gain, and Gold breaking above $1250 an ounce yesterday.

Rex-Mex

The new Secretary of State in the US, Mr. Rex Tillerson is currently in Mexico trying to clean up the mess left by Trump's spat with EPN.

At the moment, it looks like investors are siding with the southern neighbor as the Peso is now at its the strongest level against the US Dollar since the election.

USDMXN

Rex put on a stunning show and made some pretty tall promises but the one tall promise that was not brought up was Trump's wall, which for better or for worse was not raised in the conversation.

Bill for Brexit or Brexit Bill

Updates are coming from the UK very fast and very frequently as they approach May's deadline for triggering Article 50 next month.

Some local elections yesterday yielded surprising results. We'll not get into the nitty gritty, but in short, Theresa May gained ground against the opposition, ground that the opposition had seen as safe ground.

Meanwhile, May's Brexit Bill is still being debated in the House of Lords. Currently, there are two changes that some lords would like to make.

Guaranteeing basic rights for EU citizens.

Putting the final Brexit deal to a vote before it is finalized.

The first is gaining strength and may become law. The second on the other hand seems a bit dangerous as some have argued that this would encourage lawmakers to put forward a bad deal with the goal of getting it shot down. Both proposals will hurt the UKs position going into the negotiations with the EU. Negotiations are always easier when they come without preconditions.

In the meantime, the Pound Sterling has shown some strength and stability as the outlook of Brexit becomes more clear.

Market Overview

Investors around the globe continue to watch in awe and disbelief as the stocks continue to climb ever higher. The Dow Jones has posted its tenth straight record-breaking session, something it has not done since the 80s.

Many analysts feel that this has been overdone but most agree that it could very well continue for a while.

Another thing you might notice is that analysts have all but stopped talking about 'risk on' and 'risk off' sentiment in the markets.

The reason being, that stocks are generally considered a 'risk on' trade, but as they just continue to go up without any regard to what's happening in the news or in other markets, this indicator is broken.

Furthermore, Gold and Silver, which are generally considered 'risk off' assets have been flying as well, with Silver on track for its ninth straight weekly gain, and Gold breaking above $1250 an ounce yesterday.

Rex-Mex

The new Secretary of State in the US, Mr. Rex Tillerson is currently in Mexico trying to clean up the mess left by Trump's spat with EPN.

At the moment, it looks like investors are siding with the southern neighbor as the Peso is now at its the strongest level against the US Dollar since the election.

USDMXN

Rex put on a stunning show and made some pretty tall promises but the one tall promise that was not brought up was Trump's wall, which for better or for worse was not raised in the conversation.

Bill for Brexit or Brexit Bill

Updates are coming from the UK very fast and very frequently as they approach May's deadline for triggering Article 50 next month.

Some local elections yesterday yielded surprising results. We'll not get into the nitty gritty, but in short, Theresa May gained ground against the opposition, ground that the opposition had seen as safe ground.

Meanwhile, May's Brexit Bill is still being debated in the House of Lords. Currently, there are two changes that some lords would like to make.

Guaranteeing basic rights for EU citizens.

Putting the final Brexit deal to a vote before it is finalized.

The first is gaining strength and may become law. The second on the other hand seems a bit dangerous as some have argued that this would encourage lawmakers to put forward a bad deal with the goal of getting it shot down. Both proposals will hurt the UKs position going into the negotiations with the EU. Negotiations are always easier when they come without preconditions.

In the meantime, the Pound Sterling has shown some strength and stability as the outlook of Brexit becomes more clear.

Valeriy Brusilovskyy

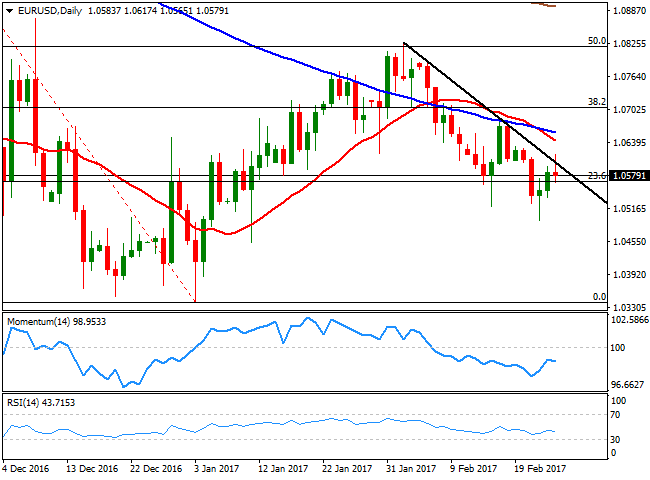

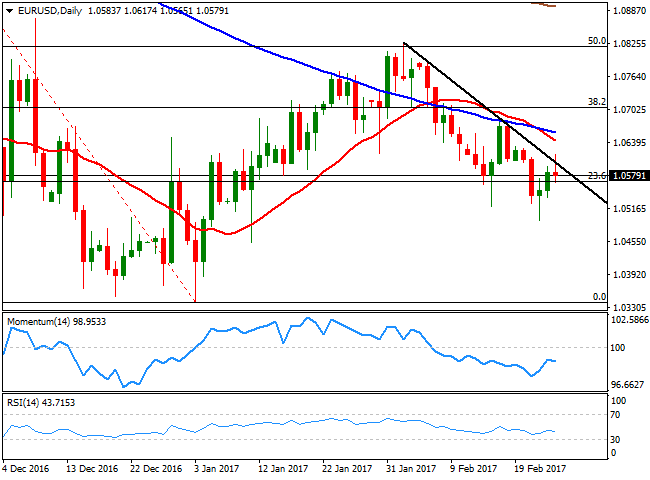

EUR/USD Forecast: no love for the EUR

The EUR/USD pair closed the week in the red sub-1.0600, although off its weekly low of 1.0520, as the dollar lost momentum following FOMC's Minutes and comments from US Treasury Secretary Mnuchin.

Many US policy makers vowed for a rate hike "fairly soon," but market's confidence about a March hike tumbled amid officers' uncertainty about fiscal policies. On Thursday, US Treasury Secretary Mnuchin expressed his concerns about the high levels of US debt, while adding that new policies would have a limited impact on the economy during this 2017. Also, he said that he "hopes" that the tax reform will pass the Congress by August, also cooling down expectations for significant growth during the next few months, referring tax cuts focused on mid-class, with no mentions to corporate rates.

Despite broad dollar's weakness, the common currency was unable to advance beyond the early week high at 1.0632, undermined by political woes in the region, ahead of French, Dutch and German elections.

With no certain catalyst behind the move, the American dollar advanced sharply against all of its major rivals right before Wall Street's opening and ahead of the release of the Michigan Consumer Sentiment index, which resulted better-than-expected for February, up to 96.3 from 95.7 in January. New Home sales for January, however, missed expectations up by 3.7% against a 6.3% advance expected, to an annualized rate of 555,000.

Technical readings indicate that the risk remains towards the downside, as the price failed to advance beyond a daily descendant trend line coming from this year high of 1.0828, whilst the price remained well below its 20 and 100 DMA's both bearish in the 1.0650/60 region. Additionally, technical indicators in the mentioned time frame have pared their advances within negative territory, and turned back south. In the weekly chart a strongly bearish 20 SMA above the current level keeps leading the way lower, while the RSI indicator heads south around 40, and the Momentum hovers around its 100 level, lagging amid reflecting the weekly opening.

There's an ongoing battle between bulls and bears around 1.0565, the 23.6% retracement of the post US-election slide, with the price unable to move too far away from the level. The weekly low of 1.0520 is the immediate support, with a break below opening doors for an extension towards the 1.0400/40 price zone next week, should dollar's recovery persists until today's close.

To the upside, the immediate resistance comes at 1.0630/60, whilst selling interest is aligned between 1.0700 and 1.0720, so it will take a clear break above it to see the pair recovering ground, with the next line of massive selling awaiting in the 1.0800/40 region.

The Pound however, is seen advancing modestly next week, pretty much holding around 1.2500 but with 71% of polled experts aiming for an advance. However, things change in a 1-month view, when PM May is expected to trigger the Brexit process, with bears leading the way towards 1.2280. In the longer view, bears increase to 62%, with the pair, however, seen holding above the 1.2100 region.

As for the USD/JPY pair, bears account for the 58% weekly basis, but the pair is not seen breaking below 110.00. In the longer run, the pair is seen recovering, with bulls jumping to 71% in a 1-month view and targeting 114.30. Interesting, for the 3-month view, bulls still are a majority, but 33% of the polled analyst turn neutral, leaving an average target of 115.20, as chances of a break beyond 116.00 are directly linked to a US rate hike, and seems the market won't get one before June.

The EUR/USD pair closed the week in the red sub-1.0600, although off its weekly low of 1.0520, as the dollar lost momentum following FOMC's Minutes and comments from US Treasury Secretary Mnuchin.

Many US policy makers vowed for a rate hike "fairly soon," but market's confidence about a March hike tumbled amid officers' uncertainty about fiscal policies. On Thursday, US Treasury Secretary Mnuchin expressed his concerns about the high levels of US debt, while adding that new policies would have a limited impact on the economy during this 2017. Also, he said that he "hopes" that the tax reform will pass the Congress by August, also cooling down expectations for significant growth during the next few months, referring tax cuts focused on mid-class, with no mentions to corporate rates.

Despite broad dollar's weakness, the common currency was unable to advance beyond the early week high at 1.0632, undermined by political woes in the region, ahead of French, Dutch and German elections.

With no certain catalyst behind the move, the American dollar advanced sharply against all of its major rivals right before Wall Street's opening and ahead of the release of the Michigan Consumer Sentiment index, which resulted better-than-expected for February, up to 96.3 from 95.7 in January. New Home sales for January, however, missed expectations up by 3.7% against a 6.3% advance expected, to an annualized rate of 555,000.

Technical readings indicate that the risk remains towards the downside, as the price failed to advance beyond a daily descendant trend line coming from this year high of 1.0828, whilst the price remained well below its 20 and 100 DMA's both bearish in the 1.0650/60 region. Additionally, technical indicators in the mentioned time frame have pared their advances within negative territory, and turned back south. In the weekly chart a strongly bearish 20 SMA above the current level keeps leading the way lower, while the RSI indicator heads south around 40, and the Momentum hovers around its 100 level, lagging amid reflecting the weekly opening.

There's an ongoing battle between bulls and bears around 1.0565, the 23.6% retracement of the post US-election slide, with the price unable to move too far away from the level. The weekly low of 1.0520 is the immediate support, with a break below opening doors for an extension towards the 1.0400/40 price zone next week, should dollar's recovery persists until today's close.

To the upside, the immediate resistance comes at 1.0630/60, whilst selling interest is aligned between 1.0700 and 1.0720, so it will take a clear break above it to see the pair recovering ground, with the next line of massive selling awaiting in the 1.0800/40 region.

The Pound however, is seen advancing modestly next week, pretty much holding around 1.2500 but with 71% of polled experts aiming for an advance. However, things change in a 1-month view, when PM May is expected to trigger the Brexit process, with bears leading the way towards 1.2280. In the longer view, bears increase to 62%, with the pair, however, seen holding above the 1.2100 region.

As for the USD/JPY pair, bears account for the 58% weekly basis, but the pair is not seen breaking below 110.00. In the longer run, the pair is seen recovering, with bulls jumping to 71% in a 1-month view and targeting 114.30. Interesting, for the 3-month view, bulls still are a majority, but 33% of the polled analyst turn neutral, leaving an average target of 115.20, as chances of a break beyond 116.00 are directly linked to a US rate hike, and seems the market won't get one before June.

Valeriy Brusilovskyy

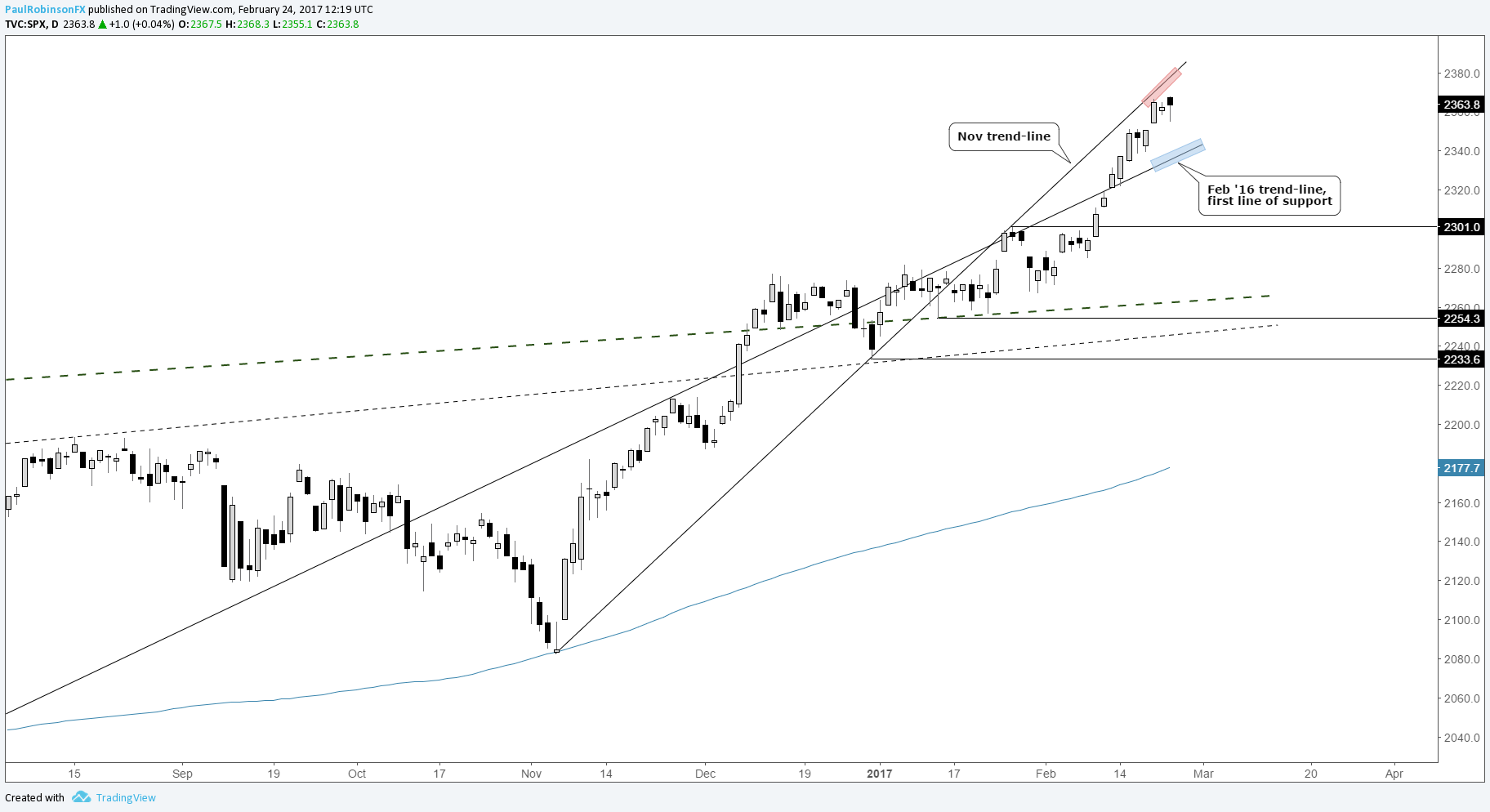

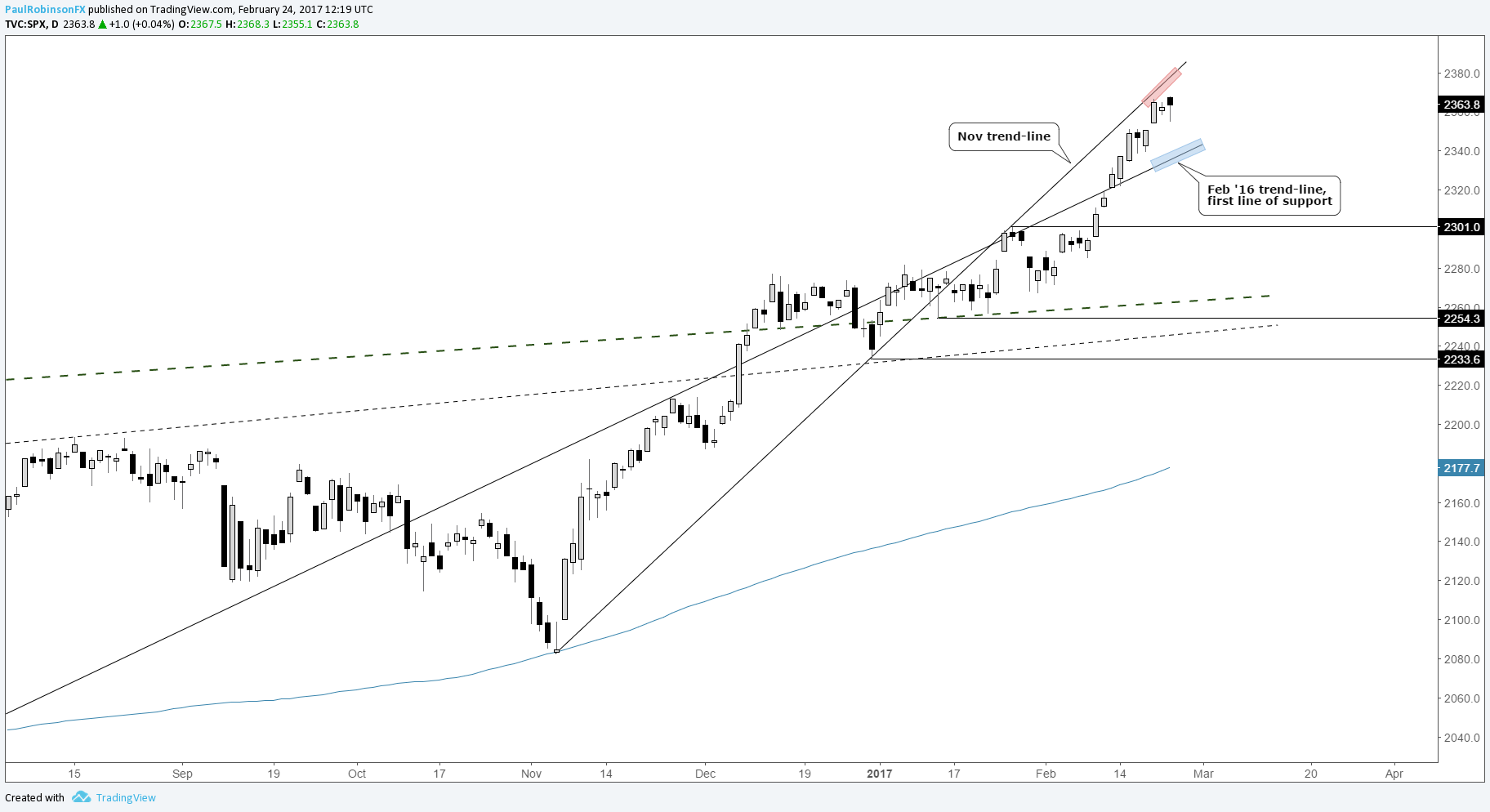

S&P 500: ’Buy the Dip’ May Not Work as We March Towards a New Month

What’s inside:

- U.S. indices showing vulnerability

- Volatility has been compressed, March can often be a volatile month

- Watching closely how the market responds to support for possible change in character; 'buy the dip' could soon become 'sell the rip'

U.S. indices have been on a tear for all of February, but as of yesterday price action became unstable with a sharp morning break and afternoon rebound. The Nasdaq 100 put in an engulfing bar while the S&P 500 suffered a smaller set-back. At the time of this writing, we’re headed for a weaker open. Europe is taking it on the chin, with the DAX leading the way lower by about 1.5%, and the S&P futures following suit by heading lower by 10 handles.

With weakness in the near-term setting in, we’re starting to think about how far the S&P could decline before finding potential support. The first line of interest is the Feb ’16 trend-line about 25 handles lower. For now, all we can do is consider weakness as a pullback within an ongoing uptrend, but with volatility having been compressed for a few months, and March, an often-volatile month just ahead, we could be in for a bumpy ride. The CBOE Volatility Index (VIX) has a tendency of grinding sideways to lower for a few months then popping sharply – now may be the time for another spike to come.

With that in mind, we’ll be paying close attention to how the market reacts to support, as the pattern since the November low has been for weakness to be met quickly by buying. If that pattern begins to change, then we could have seen the best of the market for now. It may not be the ‘buy the dip’ theme we’ve become accustomed to, but rather a 'sell the rip' mantra we'll want to live by.

What’s inside:

- U.S. indices showing vulnerability

- Volatility has been compressed, March can often be a volatile month

- Watching closely how the market responds to support for possible change in character; 'buy the dip' could soon become 'sell the rip'

U.S. indices have been on a tear for all of February, but as of yesterday price action became unstable with a sharp morning break and afternoon rebound. The Nasdaq 100 put in an engulfing bar while the S&P 500 suffered a smaller set-back. At the time of this writing, we’re headed for a weaker open. Europe is taking it on the chin, with the DAX leading the way lower by about 1.5%, and the S&P futures following suit by heading lower by 10 handles.

With weakness in the near-term setting in, we’re starting to think about how far the S&P could decline before finding potential support. The first line of interest is the Feb ’16 trend-line about 25 handles lower. For now, all we can do is consider weakness as a pullback within an ongoing uptrend, but with volatility having been compressed for a few months, and March, an often-volatile month just ahead, we could be in for a bumpy ride. The CBOE Volatility Index (VIX) has a tendency of grinding sideways to lower for a few months then popping sharply – now may be the time for another spike to come.

With that in mind, we’ll be paying close attention to how the market reacts to support, as the pattern since the November low has been for weakness to be met quickly by buying. If that pattern begins to change, then we could have seen the best of the market for now. It may not be the ‘buy the dip’ theme we’ve become accustomed to, but rather a 'sell the rip' mantra we'll want to live by.

: