Muhammad Syamil Bin Abdullah / Профиль

- Информация

|

10+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

I'm self-taught trader started trading since 2007. Trading in major currency pairs, gold and some US indices.

I am using RoboForex as main broker for all my trade.

I am using RoboForex as main broker for all my trade.

Muhammad Syamil Bin Abdullah

Investors poured money into China's stock market Monday on the first day of trading in a program that opened up the country's markets to trading through Hong Kong.

Global investors snapped up a total of 6.9 billion yuan ($1.12 billion) of Chinese stocks in the premarket session, representing 54% of the $2.1 billion daily quota. By the midday trading break Monday, 82% of the daily quota had been filled.

Demand for Hong Kong stocks from mainland investors was more limited, with just 11% of the quota used by midday.

The Shanghai-Hong Kong Stock Connect trading link opens up mainland Chinese markets to global capital, allowing international investors access to shares traded in Shanghai, while also granting wealthy Chinese individuals access to Hong Kong-listed equities.

China's Shanghai Composite was up 0.7% at 2495.80 after rising as much as 1.2% in early trading. The Hang Seng Index was down 0.5% at 23974.17 and the Hang Seng China Enterprises Index--which tracks mainland shares listed in the city--fell 0.9% to 10664.31.

Investors focused on some of the largest and most liquid names in Shanghai, including auto maker SAIC Motor Corp., which rose 2.2%. Drinks maker Kweichow Moutai Co. Ltd.--a popular bet on China's rising domestic consumption--gained 4.7%.

Also trading higher in Shanghai was state-owned railway operator Daqin Railway Co. Ltd., which jumped 8.1%. The company is China's largest rail transporter of coal by shipment volume.

The scheme permits up to $49 billion of inflows into Shanghai and $40.8 billion into Hong Kong in total. A daily quota also applies, limiting daily net inflows of $2.1 billion and $1.7 billion respectively.

The program "is a new opportunity to invest, a new partnership model and is really the beginning of a new era" for Hong Kong's relationship with the mainland, said Charles Li, chief executive of Hong Kong Exchanges and Clearing.

Following a glitzy ceremony in Hong Kong attended by the city's chief executive, Leung Chun-ying, early trading appeared to proceed smoothly.

Asked about the relatively muted gains of the first day of trade, Mr. Li said the program was "a massive bridge" that will be here for decades.

"At this point, safety and smooth travel is much more important than how many cars have actually crossed the bridge," Mr. Li said.

Stock Connect expands access beyond the handpicked group of fund managers who until Monday were the only foreigners China's communist government had permitted to invest in domestic financial instruments, including stocks and bonds. Such investment has totaled $112 billion since 2003.

Mia Lamar

Global investors snapped up a total of 6.9 billion yuan ($1.12 billion) of Chinese stocks in the premarket session, representing 54% of the $2.1 billion daily quota. By the midday trading break Monday, 82% of the daily quota had been filled.

Demand for Hong Kong stocks from mainland investors was more limited, with just 11% of the quota used by midday.

The Shanghai-Hong Kong Stock Connect trading link opens up mainland Chinese markets to global capital, allowing international investors access to shares traded in Shanghai, while also granting wealthy Chinese individuals access to Hong Kong-listed equities.

China's Shanghai Composite was up 0.7% at 2495.80 after rising as much as 1.2% in early trading. The Hang Seng Index was down 0.5% at 23974.17 and the Hang Seng China Enterprises Index--which tracks mainland shares listed in the city--fell 0.9% to 10664.31.

Investors focused on some of the largest and most liquid names in Shanghai, including auto maker SAIC Motor Corp., which rose 2.2%. Drinks maker Kweichow Moutai Co. Ltd.--a popular bet on China's rising domestic consumption--gained 4.7%.

Also trading higher in Shanghai was state-owned railway operator Daqin Railway Co. Ltd., which jumped 8.1%. The company is China's largest rail transporter of coal by shipment volume.

The scheme permits up to $49 billion of inflows into Shanghai and $40.8 billion into Hong Kong in total. A daily quota also applies, limiting daily net inflows of $2.1 billion and $1.7 billion respectively.

The program "is a new opportunity to invest, a new partnership model and is really the beginning of a new era" for Hong Kong's relationship with the mainland, said Charles Li, chief executive of Hong Kong Exchanges and Clearing.

Following a glitzy ceremony in Hong Kong attended by the city's chief executive, Leung Chun-ying, early trading appeared to proceed smoothly.

Asked about the relatively muted gains of the first day of trade, Mr. Li said the program was "a massive bridge" that will be here for decades.

"At this point, safety and smooth travel is much more important than how many cars have actually crossed the bridge," Mr. Li said.

Stock Connect expands access beyond the handpicked group of fund managers who until Monday were the only foreigners China's communist government had permitted to invest in domestic financial instruments, including stocks and bonds. Such investment has totaled $112 billion since 2003.

Mia Lamar

Muhammad Syamil Bin Abdullah

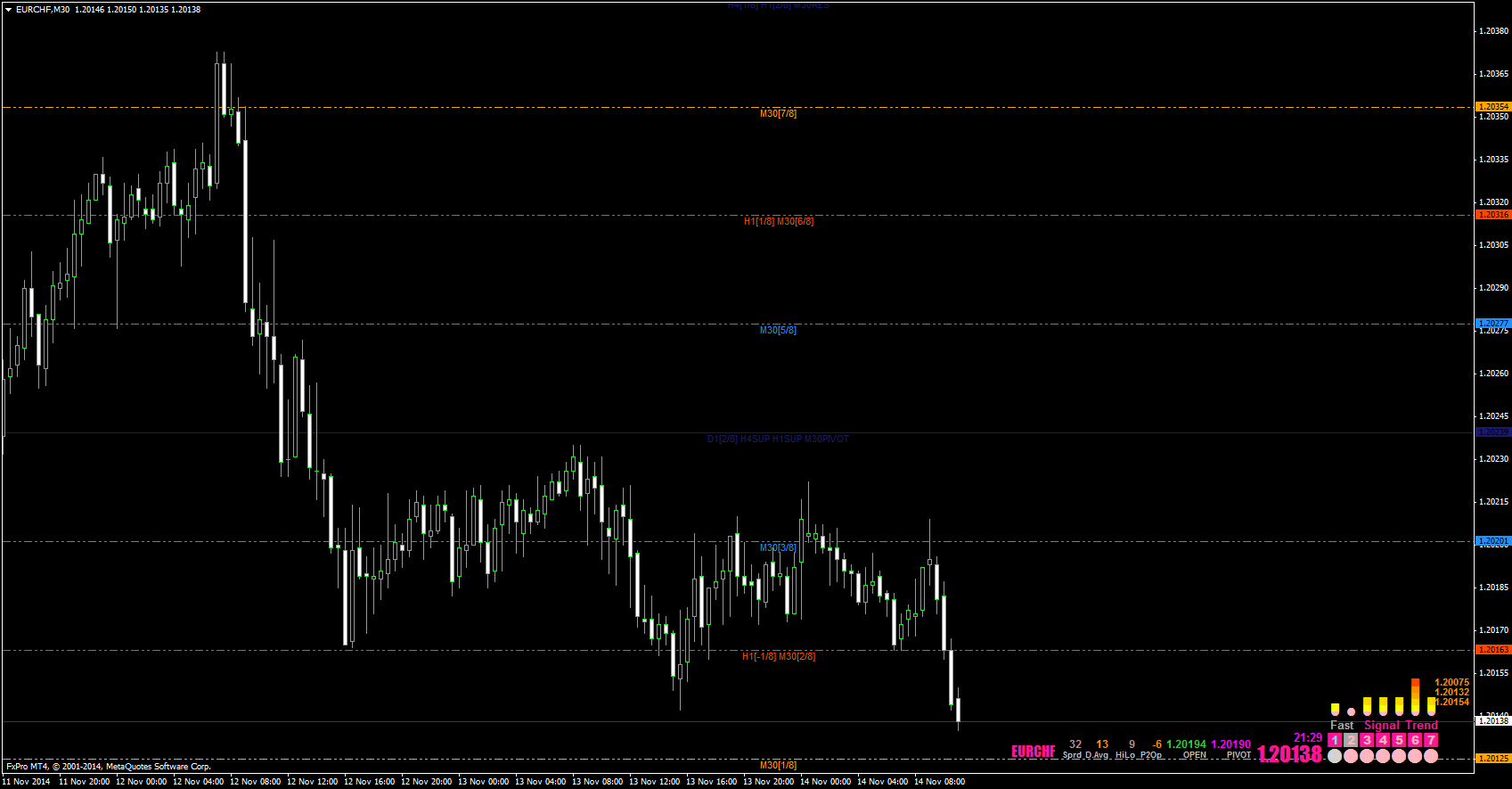

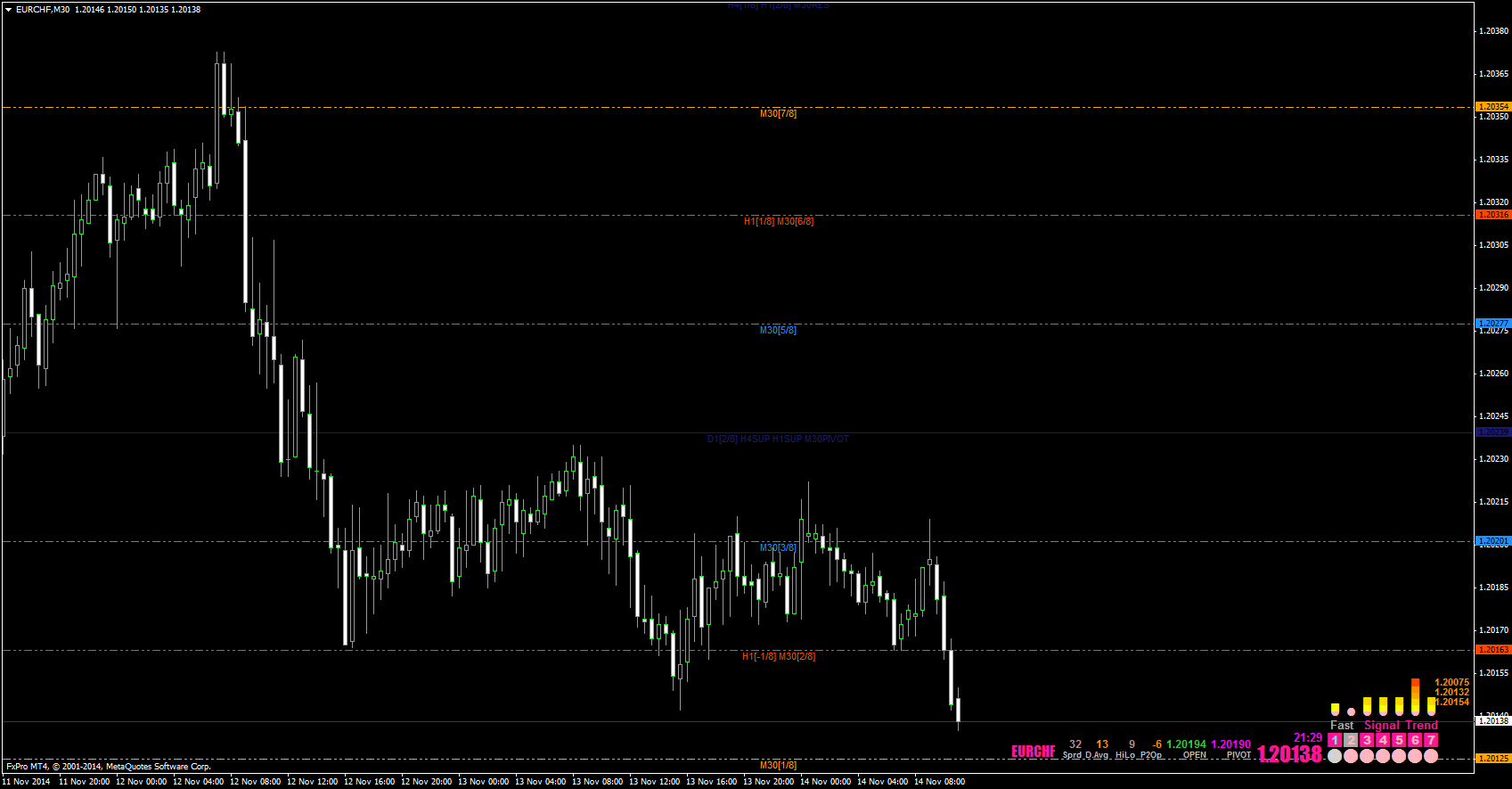

0900 GMT If you're one of the brave souls selling EUR/CHF, be advised that Citigroup mentioned to its clients Monday that there was a huge bid resting at 1.20. A person familiar with the matter said it was close to EUR10 billion but that the depth of book visible on trading systems now doesn't allow a view that far down. Still, reasonable to assume there's strong buying interest below here. Friday, Citi notes that actual trading flows in EUR/CHF are very thin. Spot now at 1.2016. (matthew.cowley@wsj.com)

Muhammad Syamil Bin Abdullah

甜蜜蜜

你笑得甜蜜蜜

好像花兒開在春風裡

開在春風裡

在哪裡在哪裡見過你

你的笑容這樣熟悉

我一時想不起

啊~~在夢裡

夢裡夢裡見過你

甜蜜笑得多甜蜜

是你~是你~夢見的就是你

在哪裡在哪裡見過你

你的笑容這樣熟悉

我一時想不起

啊~~在夢裡

在哪裡在哪裡見過你

你的笑容這樣熟悉

我一時想不起

啊~~在夢裡

夢裡夢裡見過你

甜蜜笑得多甜蜜

是你~是你~夢見的就是你

在哪裡在哪裡見過你

你的笑容這樣熟悉

我一時想不起

啊~~在夢裡

你笑得甜蜜蜜

好像花兒開在春風裡

開在春風裡

在哪裡在哪裡見過你

你的笑容這樣熟悉

我一時想不起

啊~~在夢裡

夢裡夢裡見過你

甜蜜笑得多甜蜜

是你~是你~夢見的就是你

在哪裡在哪裡見過你

你的笑容這樣熟悉

我一時想不起

啊~~在夢裡

在哪裡在哪裡見過你

你的笑容這樣熟悉

我一時想不起

啊~~在夢裡

夢裡夢裡見過你

甜蜜笑得多甜蜜

是你~是你~夢見的就是你

在哪裡在哪裡見過你

你的笑容這樣熟悉

我一時想不起

啊~~在夢裡

dingustb

2015.01.04

do you also like this song? this is a very beautiful song, I like it very much. haha

Muhammad Syamil Bin Abdullah

Being recognized as one of the most beautiful islands in the world, Bora Bora truly lives up to its namesake. Pristine beaches, incredible sights, this island of dreams can be found 155 miles northeast of Tahiti, in French Polynesia.

Muhammad Syamil Bin Abdullah

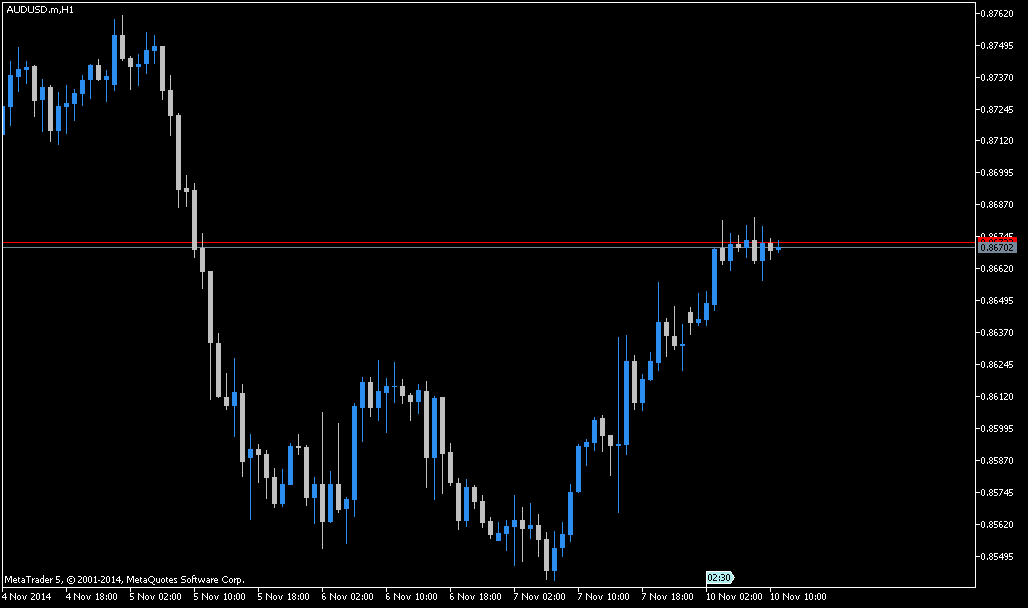

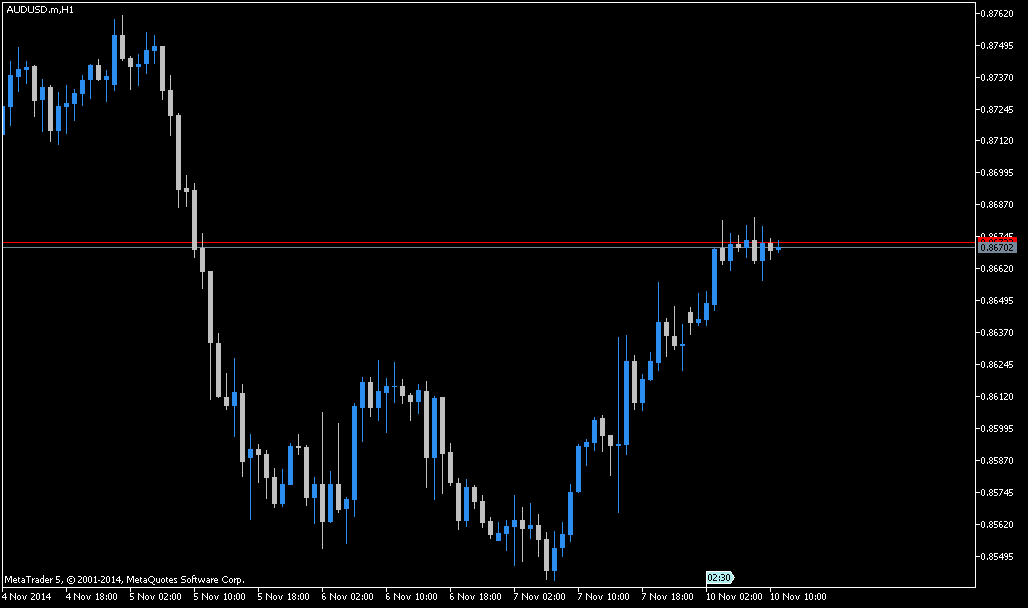

The Australian dollar rose against its U.S. counterpart on Monday, as investors locked in profits on the greenback after the release of mostly positive U.S. employment data on Friday.

AUD/USD hit 0.8683 during late Asian trade, the pair’s highest since November 5; the pair subsequently consolidated at 0.8677, gaining 0.50%.

The pair was likely to find support at 0.8538, Friday’s low and a four-month low and resistance at 0.8764, the high of November 5.

On Friday, the Labor Department reported that the U.S. economy added 214,000 jobs in October, missing expectations for jobs growth of 231,000.

September’s figure was revised up to 256,000 from a previously reported 248,000 and August’s figure was also revised up to 203,000 from 180,000 pointing to underlying strength in the labor market.

The U.S. unemployment rate ticked down to a fresh six-year low of 5.8% from 5.9% in September.

The data prompted investors to sell the greenback to lock in gains following its recent rally, but did little to alter expectations that the Federal Reserve will raise interest rates ahead of its other major peers.

In Australia, data on Monday showed that home loans fell 0.7% in September, confounding expectations for a 0.3% downtick, after a 0.9% decline the previous month.

The Aussie was higher against the euro, with EUR/AUD shedding 0.29% to 1.4383.

FxPro Blog.

AUD/USD hit 0.8683 during late Asian trade, the pair’s highest since November 5; the pair subsequently consolidated at 0.8677, gaining 0.50%.

The pair was likely to find support at 0.8538, Friday’s low and a four-month low and resistance at 0.8764, the high of November 5.

On Friday, the Labor Department reported that the U.S. economy added 214,000 jobs in October, missing expectations for jobs growth of 231,000.

September’s figure was revised up to 256,000 from a previously reported 248,000 and August’s figure was also revised up to 203,000 from 180,000 pointing to underlying strength in the labor market.

The U.S. unemployment rate ticked down to a fresh six-year low of 5.8% from 5.9% in September.

The data prompted investors to sell the greenback to lock in gains following its recent rally, but did little to alter expectations that the Federal Reserve will raise interest rates ahead of its other major peers.

In Australia, data on Monday showed that home loans fell 0.7% in September, confounding expectations for a 0.3% downtick, after a 0.9% decline the previous month.

The Aussie was higher against the euro, with EUR/AUD shedding 0.29% to 1.4383.

FxPro Blog.

Muhammad Syamil Bin Abdullah

"She would be half a planet away, floating in a turquoise sea, dancing by moonlight to flamenco guitar.” ~Janet Fitch

Artist: Fabian Perez

Artist: Fabian Perez

Muhammad Syamil Bin Abdullah

但願人長久

明月幾時有 把酒問青天

不知天上宮闕 今夕是何年

我欲乘風歸去 唯恐瓊樓玉宇

高處不勝寒 起舞弄清影 何似在人間

轉朱閣低綺戶照無眠

不應有恨何事長向別時圓

人有悲歡離合 月有陰晴圓缺

此事古難全 但願人長久

千里共嬋娟

我欲乘風歸去 唯恐瓊樓玉宇

高處不勝寒 起舞弄清影

何似在人間

轉朱閣低綺戶照無眠

不應有恨何事長向別時圓

人有悲歡離合 月有陰晴圓缺

此事古難全 但願人長久

千里共嬋娟

明月幾時有 把酒問青天

不知天上宮闕 今夕是何年

我欲乘風歸去 唯恐瓊樓玉宇

高處不勝寒 起舞弄清影 何似在人間

轉朱閣低綺戶照無眠

不應有恨何事長向別時圓

人有悲歡離合 月有陰晴圓缺

此事古難全 但願人長久

千里共嬋娟

我欲乘風歸去 唯恐瓊樓玉宇

高處不勝寒 起舞弄清影

何似在人間

轉朱閣低綺戶照無眠

不應有恨何事長向別時圓

人有悲歡離合 月有陰晴圓缺

此事古難全 但願人長久

千里共嬋娟

Muhammad Syamil Bin Abdullah

Currencies across Asia are set for a beating, buffeted by a combination of the G3 central banks, a stronger U.S. dollar and newly volatile Chinese yuan, HSBC said.

"It will be slim pickings in terms of which Asian currencies to like next year. Even the yuan will be predisposed to bouts of higher volatility, which could further upset the region's currencies," HSBC said in a note Thursday. "While we had expected most Asian currencies to trade on the back foot against the U.S. dollar, some are now even starting to underperform the euro."

Many of Asia's currencies have had a tough week since the Bank of Japan (BOJ) announced a fresh batch of stimulus, with the Singapore dollar shedding 1.5 percent against the U.S. dollar, the Thai baht losing 1.1 percent, the Malaysian ringgit dropping 2.2 percent and Indonesia's rupiah slipping 0.7 percent.

Not just the Fed

Currencies with sound external balances, such as the yuan, Korean won, Taiwan dollar and Singapore dollar, were expected to hold up better against the Federal Reserve's tapering of its asset purchases this year, HSBC said.

But it added, "It has become steadily clearer that Asian currencies are held hostage to more than just the Fed. The ECB (European Central Bank) has become increasingly important and suddenly so too has the Bank of Japan."

ECB President Mario Draghi this week indicated the central bank may take further aggressive stimulus measures, with many analysts expecting a quantitative easing program, including bond-buying, is in the works. The ECB is already buying asset-backed securities.

Draghi's comments followed the Bank of Japan's surprise move last Friday to expand an already large stimulus program by increasing asset purchases. It plans to increase purchases of Japanese government bonds (JGBs) to 80 trillion yen annually from the current 50 trillion yen as well as tripling purchases of exchange-traded funds (ETFs) to 3 trillion yen and tripling Japanese real-estate investment trust (REIT) purchases to 90 billion yen.

"This muddies the picture as to which Asian currencies should outperform," HSBC said. "It only fuels a stronger U.S. dollar and even those Asian currencies with sound external balances (the Korean won, the Singapore dollar and the Taiwan dollar) cannot ride out the storm. It is all proving to be a nasty combination for many Asian currencies."

Furthermore, with inflation falling and growth slowing across the region, many policy makers will be less inclined to step in to curb currency weakness, HSBC said.

Will the yuan stand out?

The yuan will be the "elephant in the room," HSBC said.

"So far the redback has been resilient and it continues to be our preferred currency to outperform in the region, on account of prudent policy, strong underlying inflows, high yields and an ongoing reform and internationalization story," it said. But it noted that authorities are set on creating more "two-way" volatility.

"If that starts to happen in an environment when other Asian currencies are already under pressure, as they are now, then it will only upset the apple cart further," it said.

Others also expect Asia's currencies face significant headwinds.

"We remain tactically bullish on global emerging markets," Societe Generale said in a note Thursday. But it added, "In the absence of global growth signals, there is little support for emerging market foreign-exchange exposure from a fundamental perspective, however, especially when one factors in the easing bias of many EM central banks."

But Societe Generale expects Asian currencies will be more resilient to U.S. dollar strength compared with other regions.

"A persistently weaker Japanese yen could act as drag on regional currency performance, but aside from the Korean won, the Malaysian ringgit, and the Singapore dollar (the worst performers since the surprise BOJ easing) the direct impact should be minimal," it said.

In a separate note, Societe Generale noted it doesn't expect significant inflows into emerging Asia from asset-allocation changes by Japan's Government Pension Investment Fund (GPIF). It estimates as much as $14 billion could head to the region based on the fund's equity and bond index benchmarks, but that's dwarfed by the $318 billion that flowed into emerging Asia excluding Hong Kong and Singapore over the past two years.

"It will be slim pickings in terms of which Asian currencies to like next year. Even the yuan will be predisposed to bouts of higher volatility, which could further upset the region's currencies," HSBC said in a note Thursday. "While we had expected most Asian currencies to trade on the back foot against the U.S. dollar, some are now even starting to underperform the euro."

Many of Asia's currencies have had a tough week since the Bank of Japan (BOJ) announced a fresh batch of stimulus, with the Singapore dollar shedding 1.5 percent against the U.S. dollar, the Thai baht losing 1.1 percent, the Malaysian ringgit dropping 2.2 percent and Indonesia's rupiah slipping 0.7 percent.

Not just the Fed

Currencies with sound external balances, such as the yuan, Korean won, Taiwan dollar and Singapore dollar, were expected to hold up better against the Federal Reserve's tapering of its asset purchases this year, HSBC said.

But it added, "It has become steadily clearer that Asian currencies are held hostage to more than just the Fed. The ECB (European Central Bank) has become increasingly important and suddenly so too has the Bank of Japan."

ECB President Mario Draghi this week indicated the central bank may take further aggressive stimulus measures, with many analysts expecting a quantitative easing program, including bond-buying, is in the works. The ECB is already buying asset-backed securities.

Draghi's comments followed the Bank of Japan's surprise move last Friday to expand an already large stimulus program by increasing asset purchases. It plans to increase purchases of Japanese government bonds (JGBs) to 80 trillion yen annually from the current 50 trillion yen as well as tripling purchases of exchange-traded funds (ETFs) to 3 trillion yen and tripling Japanese real-estate investment trust (REIT) purchases to 90 billion yen.

"This muddies the picture as to which Asian currencies should outperform," HSBC said. "It only fuels a stronger U.S. dollar and even those Asian currencies with sound external balances (the Korean won, the Singapore dollar and the Taiwan dollar) cannot ride out the storm. It is all proving to be a nasty combination for many Asian currencies."

Furthermore, with inflation falling and growth slowing across the region, many policy makers will be less inclined to step in to curb currency weakness, HSBC said.

Will the yuan stand out?

The yuan will be the "elephant in the room," HSBC said.

"So far the redback has been resilient and it continues to be our preferred currency to outperform in the region, on account of prudent policy, strong underlying inflows, high yields and an ongoing reform and internationalization story," it said. But it noted that authorities are set on creating more "two-way" volatility.

"If that starts to happen in an environment when other Asian currencies are already under pressure, as they are now, then it will only upset the apple cart further," it said.

Others also expect Asia's currencies face significant headwinds.

"We remain tactically bullish on global emerging markets," Societe Generale said in a note Thursday. But it added, "In the absence of global growth signals, there is little support for emerging market foreign-exchange exposure from a fundamental perspective, however, especially when one factors in the easing bias of many EM central banks."

But Societe Generale expects Asian currencies will be more resilient to U.S. dollar strength compared with other regions.

"A persistently weaker Japanese yen could act as drag on regional currency performance, but aside from the Korean won, the Malaysian ringgit, and the Singapore dollar (the worst performers since the surprise BOJ easing) the direct impact should be minimal," it said.

In a separate note, Societe Generale noted it doesn't expect significant inflows into emerging Asia from asset-allocation changes by Japan's Government Pension Investment Fund (GPIF). It estimates as much as $14 billion could head to the region based on the fund's equity and bond index benchmarks, but that's dwarfed by the $318 billion that flowed into emerging Asia excluding Hong Kong and Singapore over the past two years.

Muhammad Syamil Bin Abdullah

(Reuters) - Honda Motor Co, facing a U.S. safety probe, strengthened its recall of U.S. cars to replace potentially defective Takata Corp air bags linked to several deaths.

Japan's third-biggest carmaker said late on Thursday it was adding to its recall an undisclosed number of cars from model years 2001-2006 that were sold or registered in humid areas where the air bag inflators are thought to be most vulnerable to rupture.

Honda said "it is not aware of any claimed injuries or fatalities that have been confirmed" related to the issue. More than 17 million cars by 10 manufacturers have been recalled worldwide over Takata air bags, which can rupture and send metal shards into the passenger compartment.

The action, upgrading Honda's "safety campaign" to a formal recall, comes a day after U.S. safety regulators, for the second time this week, ordered Honda to provide information under oath about its air bags.

Honda's latest move affects some cars from three previous recalls, including nearly 1 million cars in June and 560,000 cars in April 2013. Honda did not provide a precise total. U.S. dealers will replace the passenger-side air bag inflator, the company said.

At least four deaths, all involving Honda cars, and more than a dozen injuries have been linked to the defect.

Honda is Takata's biggest customer, and the two companies have deep historic ties. Both companies say they are cooperating with the U.S. National Highway Traffic Safety Administration in its investigations.

Honda has recalled nearly 7.6 million cars in the United States since 2008 because of the defective inflators and more than 9.5 million cars globally. Total U.S. recalls over air bags are more than 11 million.

Takata ordered its technicians to destroy results of tests on some of its air bags after finding cracks in air bag inflators, the New York Times said on Friday.

Models in Honda's latest recall include the 2003-05 Honda Accord, 2001-05 Civic, 2002-05 CR-V, 2003-04 Element, 2002-04 Odyssey, 2003-05 Pilot, 2006 Ridgeline, 2003-05 Acura MDX and 2005 Acura RL.

Honda said the cars were sold or registered in high-humidity states or territories, including Alabama, Florida, Georgia, Hawaii, Louisiana, Mississippi, South Carolina, Texas, Puerto Rico, U.S. Virgin Islands, Saipan, Guam and American Samoa.

Japan's third-biggest carmaker said late on Thursday it was adding to its recall an undisclosed number of cars from model years 2001-2006 that were sold or registered in humid areas where the air bag inflators are thought to be most vulnerable to rupture.

Honda said "it is not aware of any claimed injuries or fatalities that have been confirmed" related to the issue. More than 17 million cars by 10 manufacturers have been recalled worldwide over Takata air bags, which can rupture and send metal shards into the passenger compartment.

The action, upgrading Honda's "safety campaign" to a formal recall, comes a day after U.S. safety regulators, for the second time this week, ordered Honda to provide information under oath about its air bags.

Honda's latest move affects some cars from three previous recalls, including nearly 1 million cars in June and 560,000 cars in April 2013. Honda did not provide a precise total. U.S. dealers will replace the passenger-side air bag inflator, the company said.

At least four deaths, all involving Honda cars, and more than a dozen injuries have been linked to the defect.

Honda is Takata's biggest customer, and the two companies have deep historic ties. Both companies say they are cooperating with the U.S. National Highway Traffic Safety Administration in its investigations.

Honda has recalled nearly 7.6 million cars in the United States since 2008 because of the defective inflators and more than 9.5 million cars globally. Total U.S. recalls over air bags are more than 11 million.

Takata ordered its technicians to destroy results of tests on some of its air bags after finding cracks in air bag inflators, the New York Times said on Friday.

Models in Honda's latest recall include the 2003-05 Honda Accord, 2001-05 Civic, 2002-05 CR-V, 2003-04 Element, 2002-04 Odyssey, 2003-05 Pilot, 2006 Ridgeline, 2003-05 Acura MDX and 2005 Acura RL.

Honda said the cars were sold or registered in high-humidity states or territories, including Alabama, Florida, Georgia, Hawaii, Louisiana, Mississippi, South Carolina, Texas, Puerto Rico, U.S. Virgin Islands, Saipan, Guam and American Samoa.

: