Evgeniy Piskachev / Профиль

- Информация

|

11+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

На рынке Форекс уже более 5 лет. В торговле используются индикаторы технического анализа, а также экономические и политические новости. Если интересует более консервативная и прибыльная торговля, возможно доверительное управление.

Друзья

3567

Заявки

Исходящие

Evgeniy Piskachev

Lenovo Group Ltd (HK:0992) reported quarterly revenue that missed analyst estimates, with a decline in smartphone sales curbing investor optimism about the world's biggest maker of personal computers (PCs) turning into a force in mobile devices.

Lenovo's earnings came at a time of unprecedented competition in China's smartphone market, with rivals including fast-growing Xiaomi Inc, now the world's No. 3 handset maker. At the same time, the company is pulling ahead in the global PC industry.

The Beijing-based company now has a PC market share of 20 percent and has extended its lead over Hewlett-Packard Co (N:HPQ) and Dell Inc [DI.UL], according to IDC research.

Sales of laptop and desktop computers rose 0.9 percent and 6.4 percent respectively in July-September, helping revenue rise 7 percent to $10.5 billion. That compared with an $11.35 billion estimate of 13 analysts according to Thomson Reuters SmartEstimate, which gives greater emphasis to more accurate analysts.

But mobile device sales fell 6 percent to $1.4 billion in a rare stumble for Chief Executive Yang Yuanqing, who has been determined to muscle his way to the top of the global smartphone market.

"Smartphone revenue was not that exciting, it was a little bit of a problem," Yang told Reuters in an interview after the results. He attributed the fall primarily to an accounting procedure pushing revenue from a significant shipment of phones in late September to the following quarter.

Shares of Lenovo shed 5.1 percent after the results, compared with a 0.2 percent fall in the benchmark Hang Seng index (HSI).

Nomura analyst Leping Huang said a reduction in handset subsidies from Chinese mobile phone networks have adversely affected Lenovo's home market.

"All the smartphone vendors suffer from it," Huang said. "But Lenovo fundamentally looks quite good."

Lenovo said net profit rose 19 percent to $262 million in the second quarter, exceeding the $260 million analyst estimate. It also announced a dividend payment of HK$0.06 ($0.0077) per share.

SMARTPHONES AND SERVERS

The PC market has been shrinking since the advent of tablet computers and smartphones. Lenovo has responded by diversifying, making two multi-billion-dollar acquisitions in quick succession for Google Inc's (O:GOOGL) Motorola handset unit and IBM's (N:IBM) low-end server business.

Last week Lenovo closed its $2.91 billion deal for Motorola, gaining an iconic albeit faded brand that still has a presence in North America and Europe, two markets Lenovo covets.

Speaking on an earnings conference call on Thursday, Yang pledged to prioritize sales growth at Motorola without looking to cut expenses. He said he expected Motorola to turn a profit in four to six quarters, and that margins in Lenovo's smartphone business will be higher after integrating the U.S. unit.

The company also on Thursday named Yahoo! Inc (O:YHOO) co-founder Jerry Yang to its board of directors. Yang, who is also a director at Alibaba Group Holding Ltd (N:BABA), formerly served as a Lenovo board observer.

Lenovo's earnings came at a time of unprecedented competition in China's smartphone market, with rivals including fast-growing Xiaomi Inc, now the world's No. 3 handset maker. At the same time, the company is pulling ahead in the global PC industry.

The Beijing-based company now has a PC market share of 20 percent and has extended its lead over Hewlett-Packard Co (N:HPQ) and Dell Inc [DI.UL], according to IDC research.

Sales of laptop and desktop computers rose 0.9 percent and 6.4 percent respectively in July-September, helping revenue rise 7 percent to $10.5 billion. That compared with an $11.35 billion estimate of 13 analysts according to Thomson Reuters SmartEstimate, which gives greater emphasis to more accurate analysts.

But mobile device sales fell 6 percent to $1.4 billion in a rare stumble for Chief Executive Yang Yuanqing, who has been determined to muscle his way to the top of the global smartphone market.

"Smartphone revenue was not that exciting, it was a little bit of a problem," Yang told Reuters in an interview after the results. He attributed the fall primarily to an accounting procedure pushing revenue from a significant shipment of phones in late September to the following quarter.

Shares of Lenovo shed 5.1 percent after the results, compared with a 0.2 percent fall in the benchmark Hang Seng index (HSI).

Nomura analyst Leping Huang said a reduction in handset subsidies from Chinese mobile phone networks have adversely affected Lenovo's home market.

"All the smartphone vendors suffer from it," Huang said. "But Lenovo fundamentally looks quite good."

Lenovo said net profit rose 19 percent to $262 million in the second quarter, exceeding the $260 million analyst estimate. It also announced a dividend payment of HK$0.06 ($0.0077) per share.

SMARTPHONES AND SERVERS

The PC market has been shrinking since the advent of tablet computers and smartphones. Lenovo has responded by diversifying, making two multi-billion-dollar acquisitions in quick succession for Google Inc's (O:GOOGL) Motorola handset unit and IBM's (N:IBM) low-end server business.

Last week Lenovo closed its $2.91 billion deal for Motorola, gaining an iconic albeit faded brand that still has a presence in North America and Europe, two markets Lenovo covets.

Speaking on an earnings conference call on Thursday, Yang pledged to prioritize sales growth at Motorola without looking to cut expenses. He said he expected Motorola to turn a profit in four to six quarters, and that margins in Lenovo's smartphone business will be higher after integrating the U.S. unit.

The company also on Thursday named Yahoo! Inc (O:YHOO) co-founder Jerry Yang to its board of directors. Yang, who is also a director at Alibaba Group Holding Ltd (N:BABA), formerly served as a Lenovo board observer.

Evgeniy Piskachev

More than 300 companies, including PepsiCo Inc, AIG Inc and Deutsche Bank AG, secured secret deals from Luxembourg to slash their tax bills, the International Consortium of Investigative Journalists (ICIJ) reported, quoting leaked documents.

Companies sign secret tax deals with Luxembourg: reportCompanies sign secret tax deals with Luxembourg: report

The companies appear to have channeled hundreds of billions of dollars through Luxembourg and saved billions of dollars in taxes, the group of investigative journalists said, based on a review of nearly 28,000 pages of confidential documents.

The leaked documents reviewed by ICIJ journalists include hundreds of private tax rulings – known as comfort letters – that Luxembourg provides to corporations seeking favorable tax treatment.

Luxembourg officials denied any "sweetheart deals" in its tax system.

"The Luxembourg system of taxation is competitive – there is nothing unfair or unethical about it," ICIJ quoted Nicolas Mackel, chief executive of Luxembourg for Finance, as saying in an interview.

Pepsi, AIG and Deutsche Bank were not immediately available for comment.

© Reuters. Logos of Deutsche Bank AG are seen in Tokyo© Reuters. Logos of Deutsche Bank AG are seen in Tokyo

EU state aid regulators are investigating Amazon's tax deals with Luxembourg, saying the arrangements could have underestimated the U.S. online retailer's profits and given it an unfair advantage, Reuters reported in October.

Companies sign secret tax deals with Luxembourg: reportCompanies sign secret tax deals with Luxembourg: report

The companies appear to have channeled hundreds of billions of dollars through Luxembourg and saved billions of dollars in taxes, the group of investigative journalists said, based on a review of nearly 28,000 pages of confidential documents.

The leaked documents reviewed by ICIJ journalists include hundreds of private tax rulings – known as comfort letters – that Luxembourg provides to corporations seeking favorable tax treatment.

Luxembourg officials denied any "sweetheart deals" in its tax system.

"The Luxembourg system of taxation is competitive – there is nothing unfair or unethical about it," ICIJ quoted Nicolas Mackel, chief executive of Luxembourg for Finance, as saying in an interview.

Pepsi, AIG and Deutsche Bank were not immediately available for comment.

© Reuters. Logos of Deutsche Bank AG are seen in Tokyo© Reuters. Logos of Deutsche Bank AG are seen in Tokyo

EU state aid regulators are investigating Amazon's tax deals with Luxembourg, saying the arrangements could have underestimated the U.S. online retailer's profits and given it an unfair advantage, Reuters reported in October.

Evgeniy Piskachev

Опубликовал пост Торговый план на 6 ноября

Спрос на доллар США остается высоким после того, как республиканцы взяли контроль над Конгрессом. Кроме того, сильные данные по занятости от ADP (230 тыс. против прогноза 214 тыс.) прибавили трейдерам оптимизма в ожидании основных данных по NFP в пятницу. Пара EUR/USD вернулась ниже фигуры 1...

Поделитесь в соцсетях · 6

190

Evgeniy Piskachev

U.S. stocks rose on Wednesday, with both the S&P 500 and Dow advancing to records, after Republicans took control of the Senate, allaying fears of drawn-out runoffs and raising investor hopes for more business- and energy-friendly policies.

A stronger-than-expected report on the labor market also helped lift stocks, but some weak tech sector earnings weighed on the Nasdaq.

The beaten-down energy sector rallied on hopes that a Republican majority could pass legislation that includes approval of oil and gas pipelines and reforms of crude and natural gas export laws. The S&P energy index was up 1.8 percent.

"For now, the market generally likes the results. If we had uncertainty around the result, that would have been a cause for concern," said John Canally, chief economic strategist at LPL Financial.

"A little bit less business unfriendliness coming out of Washington is a clear plus," he added, noting that 88 percent of the time, stocks rise in the fourth quarter of midterm election years, regardless of the outcome.

U.S. private employers added 230,000 jobs in October, the most since June, according to the ADP National Employment report. The data could raise hopes for Friday's closely-watched payroll report. On the downside, the pace of growth in the U.S. services sector slowed more than expected in October.

Time Warner Inc (N:TWX) rose 4 percent to $77.99 after it reported revenue growth of 3 percent. Activision Blizzard Inc (O:ATVI) late Tuesday raised its full-year forecast, sending shares up 4.4 percent to $20.83.

The Dow Jones industrial average (DJI) rose 100.69 points, or 0.58 percent, to 17,484.53, the S&P 500 (SPX) gained 11.47 points, or 0.57 percent, to 2,023.57 and the Nasdaq Composite (IXIC) dipped 2.92 points, or 0.06 percent, to 4,620.72.

Weighing on the Nasdaq, TripAdvisor Inc (O:TRIP) dropped 14.1 percent to $71.95, a day after weaker-than-expected earnings. FireEye Inc (O:FEYE) fell 15 percent to $29.12 a day after the cybersecurity company's revenue outlook was largely below expectations.

After the market closed, Tesla Motors shares (O:TSLA) gained 5.2 percent following results.

About 6.4 billion shares changed hands on U.S. exchanges, below the 7.3 billion average for the last five sessions.

NYSE advancing issues outnumbered decliners 1,799 to 1,258, for a 1.43-to-1 ratio on the upside; on the Nasdaq, 1,408 issues rose and 1,278 fell for a 1.10-to-1 ratio.

The S&P 500 posted 92 new 52-week highs and 5 new lows; the Nasdaq Composite showed 113 new highs and 55 new lows.

A stronger-than-expected report on the labor market also helped lift stocks, but some weak tech sector earnings weighed on the Nasdaq.

The beaten-down energy sector rallied on hopes that a Republican majority could pass legislation that includes approval of oil and gas pipelines and reforms of crude and natural gas export laws. The S&P energy index was up 1.8 percent.

"For now, the market generally likes the results. If we had uncertainty around the result, that would have been a cause for concern," said John Canally, chief economic strategist at LPL Financial.

"A little bit less business unfriendliness coming out of Washington is a clear plus," he added, noting that 88 percent of the time, stocks rise in the fourth quarter of midterm election years, regardless of the outcome.

U.S. private employers added 230,000 jobs in October, the most since June, according to the ADP National Employment report. The data could raise hopes for Friday's closely-watched payroll report. On the downside, the pace of growth in the U.S. services sector slowed more than expected in October.

Time Warner Inc (N:TWX) rose 4 percent to $77.99 after it reported revenue growth of 3 percent. Activision Blizzard Inc (O:ATVI) late Tuesday raised its full-year forecast, sending shares up 4.4 percent to $20.83.

The Dow Jones industrial average (DJI) rose 100.69 points, or 0.58 percent, to 17,484.53, the S&P 500 (SPX) gained 11.47 points, or 0.57 percent, to 2,023.57 and the Nasdaq Composite (IXIC) dipped 2.92 points, or 0.06 percent, to 4,620.72.

Weighing on the Nasdaq, TripAdvisor Inc (O:TRIP) dropped 14.1 percent to $71.95, a day after weaker-than-expected earnings. FireEye Inc (O:FEYE) fell 15 percent to $29.12 a day after the cybersecurity company's revenue outlook was largely below expectations.

After the market closed, Tesla Motors shares (O:TSLA) gained 5.2 percent following results.

About 6.4 billion shares changed hands on U.S. exchanges, below the 7.3 billion average for the last five sessions.

NYSE advancing issues outnumbered decliners 1,799 to 1,258, for a 1.43-to-1 ratio on the upside; on the Nasdaq, 1,408 issues rose and 1,278 fell for a 1.10-to-1 ratio.

The S&P 500 posted 92 new 52-week highs and 5 new lows; the Nasdaq Composite showed 113 new highs and 55 new lows.

Evgeniy Piskachev

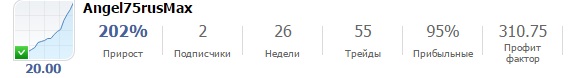

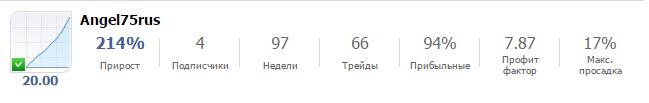

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

Опубликовал пост Новые правила ЦБ РФ

На открытии торгов рубль подешевел к доллару, достигнув новых минимумов – 44,98 долл./руб. Стоимость бивалютной корзины превысила отметку 50 рублей...

Поделитесь в соцсетях · 7

129

1

Evgeniy Piskachev

Опубликовал пост Повышение ставки не оправдало ожиданий

Прогнозы на текущий день: Цены корпоративных рублёвых облигаций понизятся; Ставки денежно-кредитного рынка сохранятся на повышенных уровнях; Доходности ОФЗ вырастут ввиду внутреннего негатива. Прошлая пятница, мягко говоря, у валютного рынка, да и Центробанка не задалась...

Поделитесь в соцсетях · 7

128

Evgeniy Piskachev

Опубликовал пост Долларовое ралли продолжается

На утренних торгах перед открытием европейской торговой сессии американских доллар подрастает против всех без исключения основных валют на фоне ожиданий положительных данных от ADP, которые будут опубликованы позднее днем...

Поделитесь в соцсетях · 6

110

Evgeniy Piskachev

Опубликовал пост Новозеландец нашел силы для борьбы

Воспользовавшись слабостью американского доллара, обусловленной ростом дефицита внешней торговли США до $43 млрд...

Поделитесь в соцсетях · 6

116

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

Опубликовал пост Активность на валютном рынке заметно снижается

Перед публикацией важных данных по занятости в США на валютном рынке наблюдается явное снижение активности. Участники рынка не спешат предпринимать активные действия, но вся динамика рынка указывает на то, что игроки по-прежнему ожидают продолжения роста американского доллара...

Поделитесь в соцсетях · 4

165

Evgeniy Piskachev

Опубликовал пост Обзор рынка

В пятницу на мировых фондовых рынках продолжился рост котировок. От своего локального минимума 15 октября, S&P 500вырос на 8,4%, что стало максимальным повышением с декабря 2011 года. Как и ожидалось, американские макроэкономические данные в пятницу оказались неоднозначными...

Поделитесь в соцсетях · 3

198

Evgeniy Piskachev

Korean carmakers Hyundai Motor Co and affiliate Kia Motors Corp will pay $350 million in penalties to the U.S. government for overstating fuel economy ratings in what officials said on Monday was the biggest settlement of its kind.

Hyundai, Kia in record settlement with U.S. for overstating mileageHyundai, Kia in record settlement with U.S. for overstating mileage

The deal comes on top of $395 million the automakers agreed to pay last December to resolve claims from the owners of the vehicles, bringing the companies' total cost for the mileage overstatements to more than $700 million.

Monday's settlement with the U.S. Environmental Protection Agency, the U.S. Department of Justice and the California Air Resources Board resolves an investigation of the South Korean carmakers' 2012 fuel economy ratings.

The penalties were the largest ever under the Clean Air Act.

"This will send an important message to automakers around the world that they must comply with the law," said Attorney General Eric Holder.

Under the accord, which involved the sale of 1.2 million cars and SUVs, the South Korean car firms will pay a $100 million penalty, spend around $50 million to prevent future violations and forfeit emissions credits estimated to be worth more than $200 million.

The greenhouse gas emissions that the forfeited credits would have allowed are equal to the emissions from powering more than 433,000 homes for a year, the EPA said.

"Businesses that play by the rules shouldn't have to compete with those breaking the law," said EPA Administrator Gina McCarthy.

McCarthy said Hyundai and Kia had committed the most egregious violation of the reporting standards. She declined to say whether other violators may also be fined.

Hyundai, Kia in record settlement with U.S. for overstating mileageHyundai, Kia in record settlement with U.S. for overstating mileage

The deal comes on top of $395 million the automakers agreed to pay last December to resolve claims from the owners of the vehicles, bringing the companies' total cost for the mileage overstatements to more than $700 million.

Monday's settlement with the U.S. Environmental Protection Agency, the U.S. Department of Justice and the California Air Resources Board resolves an investigation of the South Korean carmakers' 2012 fuel economy ratings.

The penalties were the largest ever under the Clean Air Act.

"This will send an important message to automakers around the world that they must comply with the law," said Attorney General Eric Holder.

Under the accord, which involved the sale of 1.2 million cars and SUVs, the South Korean car firms will pay a $100 million penalty, spend around $50 million to prevent future violations and forfeit emissions credits estimated to be worth more than $200 million.

The greenhouse gas emissions that the forfeited credits would have allowed are equal to the emissions from powering more than 433,000 homes for a year, the EPA said.

"Businesses that play by the rules shouldn't have to compete with those breaking the law," said EPA Administrator Gina McCarthy.

McCarthy said Hyundai and Kia had committed the most egregious violation of the reporting standards. She declined to say whether other violators may also be fined.

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

The major news overnight has been the upward explosion of the Japanese stock market. There are some sound macro reasons why Japanese stocks must trade higher, but for now I will focus on the charts.

First, the monthly chart of the Topix. As shown below, the Japanese market remains depressed relative to other global stock markets. For nearly two years The Factor has been forecasting a move by the Topix to 1750 — a retest of the highs in 1993, 1994, 1996, 2006, and 2007. This price target represents a 26% advance from present levels.

The weekly chart displays a possible completion (as of today) of a 17-month ascending triangle. Major continuation patterns often develop at the half-way mark of a trend. Thus, I am fully expecting that the current advance (#2) will duplicate the advance from the Nov 2012 low to the May 2013 high.

The daily Topix chart is a close-up of the present breakout. Support would be found at 1320 to 1350. However, if the present advance resembles the Nov 2012 to May 2013 advance, price breaks should be brief and well supported.

Note: This post represents the type of chart analysis produced on at least a weekly basis for members of the Factor subscription service. For more information, see the menu bar at the top of this blog site, or click here. In the near future, a limit may be placed on Factor membership.

First, the monthly chart of the Topix. As shown below, the Japanese market remains depressed relative to other global stock markets. For nearly two years The Factor has been forecasting a move by the Topix to 1750 — a retest of the highs in 1993, 1994, 1996, 2006, and 2007. This price target represents a 26% advance from present levels.

The weekly chart displays a possible completion (as of today) of a 17-month ascending triangle. Major continuation patterns often develop at the half-way mark of a trend. Thus, I am fully expecting that the current advance (#2) will duplicate the advance from the Nov 2012 low to the May 2013 high.

The daily Topix chart is a close-up of the present breakout. Support would be found at 1320 to 1350. However, if the present advance resembles the Nov 2012 to May 2013 advance, price breaks should be brief and well supported.

Note: This post represents the type of chart analysis produced on at least a weekly basis for members of the Factor subscription service. For more information, see the menu bar at the top of this blog site, or click here. In the near future, a limit may be placed on Factor membership.

Evgeniy Piskachev

By Francisco Alvarado, Zachary Fagenson and Joshua Franklin

Trial of former UBS executive dredges up Swiss banks' shady pastTrial of former UBS executive dredges up Swiss banks' shady past

FORT LAUDERDALE Fla./ZURICH (Reuters) - From bundles of cash inside scraps of newspaper to setting up shell companies, the trial in Florida of a former UBS executive is a reminder of the extreme methods some Swiss bankers used to hide clients' cash.

Raoul Weil, 54, is the highest ranking Swiss banker to be arrested in the United States and prosecutors are seeking to paint him as a facilitator of efforts that helped conceal up to $20 billion in taxpayers' assets in secret offshore accounts.

Weil's main defense has been that these efforts were done by people below him and that the U.S. cross border business was a tiny fraction of his overall responsibilities. If convicted, Weil faces up to five years in prison for conspiracy to commit tax fraud. Weil and his attorneys declined comment on the trial.

At the trial, which pits Weil against several former UBS colleagues who have chosen to cooperate with U.S. authorities in exchange for favorable sentencing, Swiss bankers have testified about using an arsenal of James Bond-like tactics to avoid detection while in the United States, and to help U.S. clients keep their accounts hidden from tax authorities.

Bankers were given laptops with two hard drives, Hansruedi Schumacher, who formerly ran UBS' cross-border business, told the trial, which began on Oct. 14 and is expected to run for about four weeks.

One hard drive was filled with anything from family photos and personal emails while another contained a password-protected database with the U.S. citizens' code-named bank records. Another witness said the drive with the bank details could be wiped simply by typing in a short password.

"It was known all those account holders were not paying their taxes, and for the Swiss bank it was a very profitable business," Schumacher said during testimony at the trial.

Eskander Ensafi, who banked with UBS, told the court about a clandestine meeting in 2005 at a Los Angeles hotel with bank adviser Claude Ullman. The adviser handed him roughly $50,000 in U.S. bills wrapped in newspaper, Ensafi testified, tax-free interest from a Swiss bank account in the name of Ensafi's father, who had just suffered a debilitating stroke.

Ullman was sued by a number of U.S. individuals -- who were jailed for not paying U.S. taxes by hiding their money in Swiss bank accounts -- for alleged racketeering, along with UBS and a number of high ranking bankers, including Weil, in a 2009 lawsuit in the Eastern District of California. The case was dismissed with prejudice in September 2014. An attorney for Ullman did not respond to a request for an update on the case.

German businessman Juergen Homann, 72, who pleaded guilty to a U.S. charge of failing to report a foreign account to the Internal Revenue Service (IRS) in 2009, told the court one UBS client adviser, Hans Thomann, helped him set up a Hong Kong-based shell company. The company, the Prodon Foundation, was then used to funnel income Homann made from his raw minerals business venture in China.

Attempts to reach Thomann for comment were unsuccessful.

In 2012, he was charged in the Southern District of New York with conspiracy to defraud the United States and conducting an unlicensed money transmitting business.

Trial of former UBS executive dredges up Swiss banks' shady pastTrial of former UBS executive dredges up Swiss banks' shady past

FORT LAUDERDALE Fla./ZURICH (Reuters) - From bundles of cash inside scraps of newspaper to setting up shell companies, the trial in Florida of a former UBS executive is a reminder of the extreme methods some Swiss bankers used to hide clients' cash.

Raoul Weil, 54, is the highest ranking Swiss banker to be arrested in the United States and prosecutors are seeking to paint him as a facilitator of efforts that helped conceal up to $20 billion in taxpayers' assets in secret offshore accounts.

Weil's main defense has been that these efforts were done by people below him and that the U.S. cross border business was a tiny fraction of his overall responsibilities. If convicted, Weil faces up to five years in prison for conspiracy to commit tax fraud. Weil and his attorneys declined comment on the trial.

At the trial, which pits Weil against several former UBS colleagues who have chosen to cooperate with U.S. authorities in exchange for favorable sentencing, Swiss bankers have testified about using an arsenal of James Bond-like tactics to avoid detection while in the United States, and to help U.S. clients keep their accounts hidden from tax authorities.

Bankers were given laptops with two hard drives, Hansruedi Schumacher, who formerly ran UBS' cross-border business, told the trial, which began on Oct. 14 and is expected to run for about four weeks.

One hard drive was filled with anything from family photos and personal emails while another contained a password-protected database with the U.S. citizens' code-named bank records. Another witness said the drive with the bank details could be wiped simply by typing in a short password.

"It was known all those account holders were not paying their taxes, and for the Swiss bank it was a very profitable business," Schumacher said during testimony at the trial.

Eskander Ensafi, who banked with UBS, told the court about a clandestine meeting in 2005 at a Los Angeles hotel with bank adviser Claude Ullman. The adviser handed him roughly $50,000 in U.S. bills wrapped in newspaper, Ensafi testified, tax-free interest from a Swiss bank account in the name of Ensafi's father, who had just suffered a debilitating stroke.

Ullman was sued by a number of U.S. individuals -- who were jailed for not paying U.S. taxes by hiding their money in Swiss bank accounts -- for alleged racketeering, along with UBS and a number of high ranking bankers, including Weil, in a 2009 lawsuit in the Eastern District of California. The case was dismissed with prejudice in September 2014. An attorney for Ullman did not respond to a request for an update on the case.

German businessman Juergen Homann, 72, who pleaded guilty to a U.S. charge of failing to report a foreign account to the Internal Revenue Service (IRS) in 2009, told the court one UBS client adviser, Hans Thomann, helped him set up a Hong Kong-based shell company. The company, the Prodon Foundation, was then used to funnel income Homann made from his raw minerals business venture in China.

Attempts to reach Thomann for comment were unsuccessful.

In 2012, he was charged in the Southern District of New York with conspiracy to defraud the United States and conducting an unlicensed money transmitting business.

Evgeniy Piskachev

Опубликовал пост ТОЧКА ЗРЕНИЯ-ЦБР резко повысил ключевую ставку на 150 б.п.

Банк России повысил ключевую ставку на 150 базисных пунктов до 9,50 процента годовых, что стало неожиданностью для большинства аналитиков. ТОЧКА ЗРЕНИЯ-ЦБР резко повысил ключевую ставку на 150 б.п...

Поделитесь в соцсетях · 6

164

1

Evgeniy Piskachev

Опубликовал пост Нефть опускается на сильном долларе

В пятницу фьючерсы на нефть WTI опускаются в цене, поскольку оптимистичные американские отчеты, вышедшие в четверг, и недавнее политическое заявление ФРС оказывают поддержку доллару...

Поделитесь в соцсетях · 5

102

: