Evgeniy Piskachev / Профиль

- Информация

|

11+ лет

опыт работы

|

0

продуктов

|

0

демо-версий

|

|

0

работ

|

0

сигналов

|

0

подписчиков

|

На рынке Форекс уже более 5 лет. В торговле используются индикаторы технического анализа, а также экономические и политические новости. Если интересует более консервативная и прибыльная торговля, возможно доверительное управление.

Друзья

3566

Заявки

Исходящие

Evgeniy Piskachev

Francis Dogbe

2014.09.21

Batlleship Movie

Imtiaz Ahmed

2014.09.22

Dangerous weapon

Evgeniy Piskachev

USD/JPY was last up 0.34% to 109.06 after rising as high as 109.46 earlier in the day, the most since August 2008. For the week, the pair added 1.61%.

EUR/USD was down 0.71% to 1.2830 in late trade, the lowest level since July 2013.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, ended Friday’s session up 0.63% to 84.93, the highest level since July 2013, capping its tenth consecutive week of gains.

The dollar has rallied in the past two months as economic data indicated that the U.S. recovery is progressing strongly, while growth in Japan and the euro zone appears to be faltering.

On Wednesday the Federal Reserve offered fresh guidance on its plans to raise interest rates, underlining the diverging policy stance between it and central banks in Japan and Europe, which look likely to continue with looser monetary policy.

The Fed statement reiterated that it expects rates to remain on hold for a "considerable time", after its bond purchasing program ends, but it outlined in more detail how it will start to raise short term interest rates when the time comes.

The Fed also cut its monthly asset purchase program by another $10 billion, keeping the program on track to finish next month.

EUR/USD was down 0.71% to 1.2830 in late trade, the lowest level since July 2013.

The US Dollar Index, which tracks the performance of the greenback versus a basket of six other major currencies, ended Friday’s session up 0.63% to 84.93, the highest level since July 2013, capping its tenth consecutive week of gains.

The dollar has rallied in the past two months as economic data indicated that the U.S. recovery is progressing strongly, while growth in Japan and the euro zone appears to be faltering.

On Wednesday the Federal Reserve offered fresh guidance on its plans to raise interest rates, underlining the diverging policy stance between it and central banks in Japan and Europe, which look likely to continue with looser monetary policy.

The Fed statement reiterated that it expects rates to remain on hold for a "considerable time", after its bond purchasing program ends, but it outlined in more detail how it will start to raise short term interest rates when the time comes.

The Fed also cut its monthly asset purchase program by another $10 billion, keeping the program on track to finish next month.

Evgeniy Piskachev

New Zealand is to release private sector data on consumer sentiment.

European Central Bank President Mario Draghi is to appear before the European Parliament's Economic and Monetary Committee, in Brussels.

The U.S. is to release private sector data on existing home sales.

European Central Bank President Mario Draghi is to appear before the European Parliament's Economic and Monetary Committee, in Brussels.

The U.S. is to release private sector data on existing home sales.

Evgeniy Piskachev

China's Cyperspace Administration has closed nearly 1.8 million accounts on social networking and instant messaging services since it launched its anti-pornography campaign in April, state news agency Xinhua reported on Saturday.

China shuts almost 1.8 million accounts in pornography crackdown: XinhuaChina shuts almost 1.8 million accounts in pornography crackdown: Xinhua

The campaign has been focused on shutting down websites showing pornography and services used to solicit prostitution.

Most of the accounts closed were associated with microblogs, smart phone app WeChat and the instant messaging service QQ, Xinhua quoted the Cyberspace Administration as saying.

Many of the accounts were shut down by the companies owning the apps themselves after public complaints, Xinhua said. There was no immediate comment from any of the companies involved.

The Chinese government regularly launches anti-pornography campaigns because the ruling Communist Party considers it deeply offensive to public morale.

Mobile messaging apps are hugely popular in China. Tencent Holding Ltd's WeChat is among the biggest with more than 300 million users.

China shuts almost 1.8 million accounts in pornography crackdown: XinhuaChina shuts almost 1.8 million accounts in pornography crackdown: Xinhua

The campaign has been focused on shutting down websites showing pornography and services used to solicit prostitution.

Most of the accounts closed were associated with microblogs, smart phone app WeChat and the instant messaging service QQ, Xinhua quoted the Cyberspace Administration as saying.

Many of the accounts were shut down by the companies owning the apps themselves after public complaints, Xinhua said. There was no immediate comment from any of the companies involved.

The Chinese government regularly launches anti-pornography campaigns because the ruling Communist Party considers it deeply offensive to public morale.

Mobile messaging apps are hugely popular in China. Tencent Holding Ltd's WeChat is among the biggest with more than 300 million users.

Evgeniy Piskachev

Hyundai Motor (KS:005380) and two listed affiliates did not seek board clearance for the size of their record $10 billion bid for a plot of land in Seoul, more than triple its appraised value, four board members of the companies told Reuters.

Thursday's winning bid for the land sent shares in Hyundai Motor, Kia Motors (KS:000270) and Hyundai Mobis (KS:012330) plunging, wiping out $8 billion in shareholder value, and sparked howls of protest from investors, rekindling worries about corporate governance at South Korea's conglomerates, or chaebol.

While boards of the three firms discussed and approved bidding for the plot in the capital's high-end Gangnam district to house a headquarters complex, hotel and automotive theme park, the bid price was not shared with directors as it was deemed to be confidential, three of the directors said.

The Hyundai Motor and Kia Motors boards unanimously approved making a bid for the KEPCO land, two directors said.

Thursday's winning bid for the land sent shares in Hyundai Motor, Kia Motors (KS:000270) and Hyundai Mobis (KS:012330) plunging, wiping out $8 billion in shareholder value, and sparked howls of protest from investors, rekindling worries about corporate governance at South Korea's conglomerates, or chaebol.

While boards of the three firms discussed and approved bidding for the plot in the capital's high-end Gangnam district to house a headquarters complex, hotel and automotive theme park, the bid price was not shared with directors as it was deemed to be confidential, three of the directors said.

The Hyundai Motor and Kia Motors boards unanimously approved making a bid for the KEPCO land, two directors said.

Evgeniy Piskachev

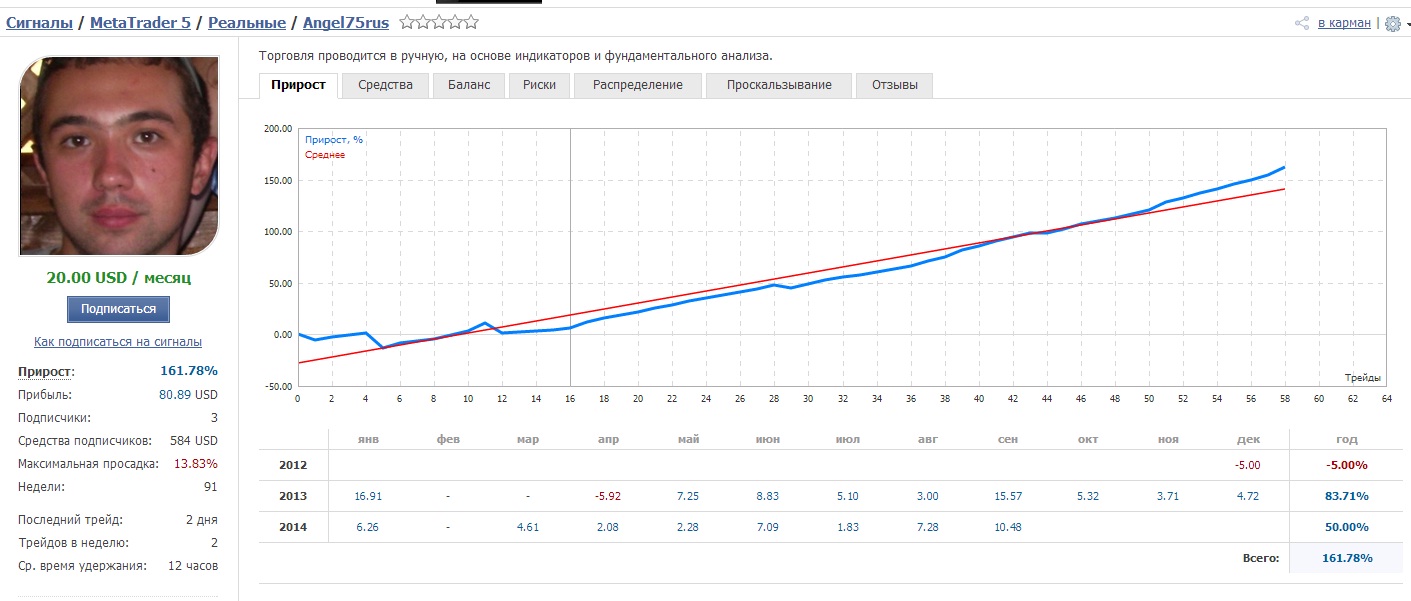

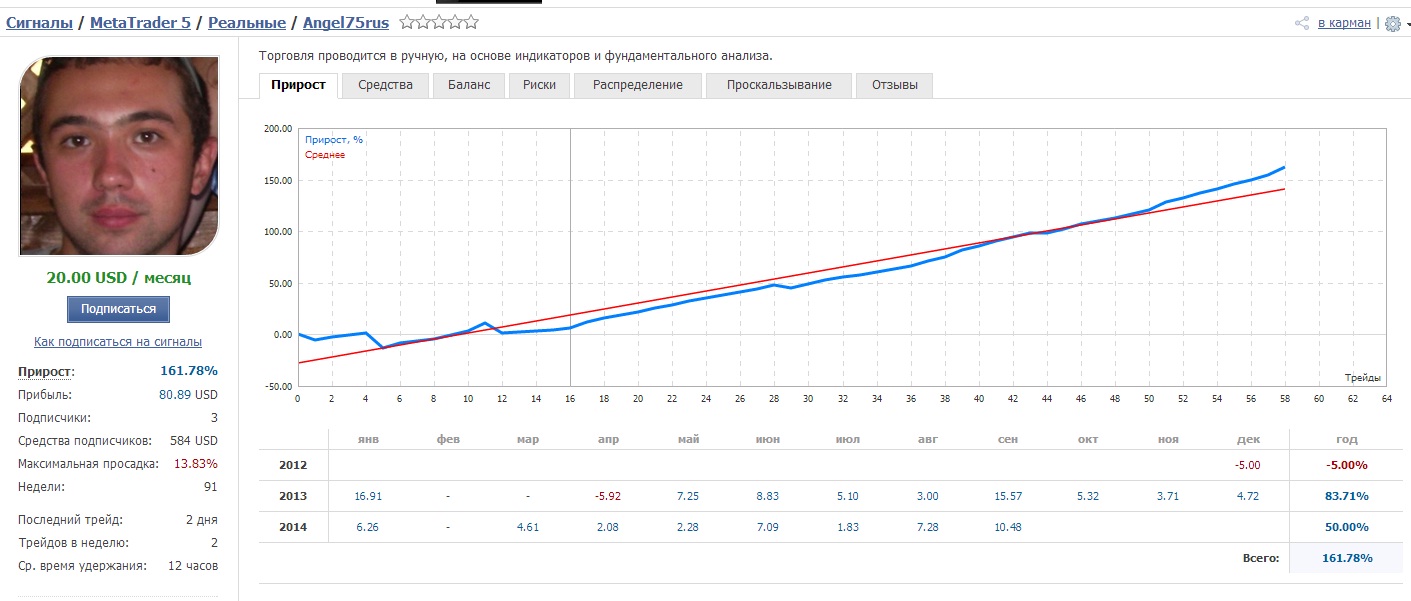

Steadily to trade and receive 15-20% a month! ! !

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

Steadily to trade and receive 15-20% a month! ! !

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

Matthew Todorovski

2014.09.20

"No rest for the wicked" "Love of money is the root of all evil"

I love money > therefore I am very wicked > ergo I get no rest - ever!

I love money > therefore I am very wicked > ergo I get no rest - ever!

Evgeniy Piskachev

LONDON/FRANKFURT (Reuters) - French low-cost telecom operator Iliad has set a mid-October deadline to decide whether to improve its bid for T-Mobile US or walk away as it faces resistance from seller Deutsche Telekom, several people familiar with the situation said.

Deutsche Telekom, which owns 66 percent of the fourth-largest U.S. carrier, has doubts that Iliad will be able to improve the U.S. business since the French startup has no track record in the country, a source close to the German company's management said.

Under the deal structure proposed by Iliad, Deutsche Telekom would have to keep a stake in the combined company.

Iliad is currently in talks with several U.S. banks to help it finance a possible improved bid for T-Mobile US alongside existing lenders HSBC and BNP Paribas, the people familiar with the situation said, after a $33 per share offer for 56.6 percent of T-Mobile US was rejected by Deutsche Telekom.

Deutsche Telekom, which owns 66 percent of the fourth-largest U.S. carrier, has doubts that Iliad will be able to improve the U.S. business since the French startup has no track record in the country, a source close to the German company's management said.

Under the deal structure proposed by Iliad, Deutsche Telekom would have to keep a stake in the combined company.

Iliad is currently in talks with several U.S. banks to help it finance a possible improved bid for T-Mobile US alongside existing lenders HSBC and BNP Paribas, the people familiar with the situation said, after a $33 per share offer for 56.6 percent of T-Mobile US was rejected by Deutsche Telekom.

Evgeniy Piskachev

Рынок акций РФ снизился на фоне негативных внутренних факторов, отыгрывая информацию об аресте главы АФК "Система" Владимира Евтушенкова, а также на новостях о возможных новых санкциях со стороны США, Канады и Европейского Союза.

Рынок акций РФ закрылся в минусеРынок акций РФ закрылся в минусе

Вечером рынок стал подниматься на новостях об освобождении из-под домашнего ареста Евтушенкова, в лидерах повышения оказались акции "Системы" и "Башнефти".

Вместе с тем спустя несколько минут на лентах информагентств вышла новость со ссылкой на Мосгорсуд о том, что московские суды не принимали решение об освобождении В.Евтушенкова из-под домашнего ареста, что вызвало обратное движение рынка вниз. В результате, акции "Башнефти" оказались в минусе, а рост бумаг "Системы" сократился.

Рынок акций РФ закрылся в минусеРынок акций РФ закрылся в минусе

Вечером рынок стал подниматься на новостях об освобождении из-под домашнего ареста Евтушенкова, в лидерах повышения оказались акции "Системы" и "Башнефти".

Вместе с тем спустя несколько минут на лентах информагентств вышла новость со ссылкой на Мосгорсуд о том, что московские суды не принимали решение об освобождении В.Евтушенкова из-под домашнего ареста, что вызвало обратное движение рынка вниз. В результате, акции "Башнефти" оказались в минусе, а рост бумаг "Системы" сократился.

Evgeniy Piskachev

EUR/USD торгуется 1,2831, теряя к моменту написания данного комментария 0,71%.

Похоже, что пара нашла поддержку на уровне 1,2829, что соответствует лоу сегодняшнего дня. Сопротивлением пока является уровень 1,2994 - хай вторника.

Между тем, Евро упал против Британского Фунта и Японской Йены. EUR/GBP потеряв 0,04%, достиг 0,7879 и EUR/JPY падая на 0,37%, достиг 139,95.

Похоже, что пара нашла поддержку на уровне 1,2829, что соответствует лоу сегодняшнего дня. Сопротивлением пока является уровень 1,2994 - хай вторника.

Между тем, Евро упал против Британского Фунта и Японской Йены. EUR/GBP потеряв 0,04%, достиг 0,7879 и EUR/JPY падая на 0,37%, достиг 139,95.

Evgeniy Piskachev

U.S. stocks closed little changed on Friday after Alibaba's strong debut was offset by falling technology shares as Oracle and Yahoo stumbled, but the Dow managed to edge higher to set a record for a second straight session.

Alibaba (N:BABA) took the spotlight after its initial public offering priced at $68 a share and rose as high as $99.70 before ending the session up 38 percent to $93.89. Shares of Yahoo (O:YHOO), which is selling part of its Alibaba stake but will remain a top shareholder, were volatile in heavy volume and closed down 2.7 percent at $40.93.

"Alibaba was awesome. The Alibaba deal was done correctly, which is, you leave something on the table for investors to enjoy," said Phil Orlando, chief equity market strategist at Federated Investors in New York.

"So the market got to focus on Alibaba, which was a positive."

But technology shares weighed on the S&P 500 with Oracle (N:ORCL) down after Larry Ellison, co-founder and leader for 37 years, stepped aside as chief executive. He will be replaced by co-CEOs Safra Catz and Mark Hurd, raising questions about a job-sharing arrangement that has had a mixed record elsewhere.

Alibaba (N:BABA) took the spotlight after its initial public offering priced at $68 a share and rose as high as $99.70 before ending the session up 38 percent to $93.89. Shares of Yahoo (O:YHOO), which is selling part of its Alibaba stake but will remain a top shareholder, were volatile in heavy volume and closed down 2.7 percent at $40.93.

"Alibaba was awesome. The Alibaba deal was done correctly, which is, you leave something on the table for investors to enjoy," said Phil Orlando, chief equity market strategist at Federated Investors in New York.

"So the market got to focus on Alibaba, which was a positive."

But technology shares weighed on the S&P 500 with Oracle (N:ORCL) down after Larry Ellison, co-founder and leader for 37 years, stepped aside as chief executive. He will be replaced by co-CEOs Safra Catz and Mark Hurd, raising questions about a job-sharing arrangement that has had a mixed record elsewhere.

Evgeniy Piskachev

German business software maker SAP (DE:SAPG) said on Thursday it has agreed to acquire U.S.-based expense management software maker Concur Technologies Inc (O:CNQR) in a cash deal valued at $7.3 billion.

SAP agrees to buy expense software maker Concur for $7.3 billionSAP agrees to buy expense software maker Concur for $7.3 billion

SAP said in a statement it would offer $129 per share, a 20 percent premium over the Sept. 17 closing price.

Based on 57 million outstanding shares, the offer for Bellevue, Washington-based Concur is valued at $7.3 billion. Including debt, the offer represents an enterprise value of about $8.3 billion, SAP said.

The Concur board of directors has unanimously approved the transaction, which is expected to close in the fourth quarter of 2014 or the first quarter 2015, subject to shareholder and regulatory approvals, SAP said.

SAP agrees to buy expense software maker Concur for $7.3 billionSAP agrees to buy expense software maker Concur for $7.3 billion

SAP said in a statement it would offer $129 per share, a 20 percent premium over the Sept. 17 closing price.

Based on 57 million outstanding shares, the offer for Bellevue, Washington-based Concur is valued at $7.3 billion. Including debt, the offer represents an enterprise value of about $8.3 billion, SAP said.

The Concur board of directors has unanimously approved the transaction, which is expected to close in the fourth quarter of 2014 or the first quarter 2015, subject to shareholder and regulatory approvals, SAP said.

Evgeniy Piskachev

Steadily to trade and receive 15-20% a month! ! !

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

Пара USD/JPY поднялась до максимума 109,46, самого высокого уровня с августа 2008 года, затем закрепилась на 108,93, поднявшись на 0,23%.

Доллар получил поддержку после того, как в среду ФРС сократил свою программу ежемесячной покупки активов еще на $10 млрд на пути к полному ее завершению уже в следующем месяце.

Рынки интерпретировали заявление ФРС как «ястребиное», хотя некоторые члены комитета предполагают, что повышение процентных ставок не будет происходить в течение «долгого времени».

Инвесторы проигнорировали данные, показывающие, что производственный индекс ФРБ Филадельфии обрушился до трехмесячного минимума в этом месяце, а также отчет, показывающий, что число разрешений на строительство снизилось на 5,6% в прошлом месяце, а объемы строительства нового жилья упали на 14,4%.

Доллар получил поддержку после того, как в среду ФРС сократил свою программу ежемесячной покупки активов еще на $10 млрд на пути к полному ее завершению уже в следующем месяце.

Рынки интерпретировали заявление ФРС как «ястребиное», хотя некоторые члены комитета предполагают, что повышение процентных ставок не будет происходить в течение «долгого времени».

Инвесторы проигнорировали данные, показывающие, что производственный индекс ФРБ Филадельфии обрушился до трехмесячного минимума в этом месяце, а также отчет, показывающий, что число разрешений на строительство снизилось на 5,6% в прошлом месяце, а объемы строительства нового жилья упали на 14,4%.

Evgeniy Piskachev

USD/JPY climbed to highs of 109.46, the strongest level since August 2008 and was last up 0.23% to 108.93.

The dollar remained supported after the Fed on Wednesday cut its monthly bond-buying program by another $10 billion following its two-day policy meeting on Wednesday, keeping the program on track to finish next month.

Markets interpreted the Fed's statement as hawkish, despite policymakers maintaining language suggesting that rate hikes would not happen for a "considerable time."

Investors shrugged off data on Thursday showing that the Philadelphia Fed's manufacturing index deteriorated to a three-month low this month, as well as a report showing that U.S. building permits dropped by 5.6% last month and that housing starts tumbled by 14.4%.

The dollar remained supported after the Fed on Wednesday cut its monthly bond-buying program by another $10 billion following its two-day policy meeting on Wednesday, keeping the program on track to finish next month.

Markets interpreted the Fed's statement as hawkish, despite policymakers maintaining language suggesting that rate hikes would not happen for a "considerable time."

Investors shrugged off data on Thursday showing that the Philadelphia Fed's manufacturing index deteriorated to a three-month low this month, as well as a report showing that U.S. building permits dropped by 5.6% last month and that housing starts tumbled by 14.4%.

Evgeniy Piskachev

Steadily to trade and receive 15-20% a month! ! !

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

Evgeniy Piskachev

The British pound rose sharply after the Scottish independence vote indicated Scotland would remain in the United Kingdom, while Wall Street's overnight gains and Alibaba Group's red-hot initial public offering underpinned Asian shares.

Sterling was last up 0.6 percent at $1.6489 after rising as high as $1.6525, a marked turnaround from a 10-month low of $1.6051 touched just last week. Investors awaited final results, with figures so far indicating a solid win for the "No" camp.

"The results appear to be leaning toward 'No,' and this indirectly lifted the dollar against the yen," said Masashi Murata, currency strategist for Brown Brothers Harriman in Tokyo.

Sterling was last up 0.6 percent at $1.6489 after rising as high as $1.6525, a marked turnaround from a 10-month low of $1.6051 touched just last week. Investors awaited final results, with figures so far indicating a solid win for the "No" camp.

"The results appear to be leaning toward 'No,' and this indirectly lifted the dollar against the yen," said Masashi Murata, currency strategist for Brown Brothers Harriman in Tokyo.

Evgeniy Piskachev

The dollar hit its highest levels in more than six years against the yen and four years against other major currencies on Thursday as markets eyed the widening policy split between the United States and other rich nations.

The U.S. Federal Reserve's outlook for rising interest rates had already illustrated the diverging path from other advanced economies but it was underscored even more firmly in Europe as the ECB opened its liquidity taps again.

Lackluster demand for the ECB's new ultra-cheap loans boosted bets the bank will have to overcome reservations about sovereign bond buying and sent the euro lower and lifted European shares.

Wall Street was expected to see the S&P 500 test its recent record highs when trading resumes too, hot on the heels of data showing a bigger-than-expected dip in U.S. unemployment claims.

Two-and-a-half years on from the ECB's last injection of long-term funding that pushed a trillion euros into Europe's markets, banks this time took a much more restrained 83 billion that was well below the 133 billion traders had been expecting.

The launch of the scheme is the central plank of the ECB's efforts to coax reluctant banks to lend more and fire up the bloc's flagging economy. Alongside a yet-to-be-detailed asset purchase program, it hopes to hit the 1 trillion mark again.

The U.S. Federal Reserve's outlook for rising interest rates had already illustrated the diverging path from other advanced economies but it was underscored even more firmly in Europe as the ECB opened its liquidity taps again.

Lackluster demand for the ECB's new ultra-cheap loans boosted bets the bank will have to overcome reservations about sovereign bond buying and sent the euro lower and lifted European shares.

Wall Street was expected to see the S&P 500 test its recent record highs when trading resumes too, hot on the heels of data showing a bigger-than-expected dip in U.S. unemployment claims.

Two-and-a-half years on from the ECB's last injection of long-term funding that pushed a trillion euros into Europe's markets, banks this time took a much more restrained 83 billion that was well below the 133 billion traders had been expecting.

The launch of the scheme is the central plank of the ECB's efforts to coax reluctant banks to lend more and fire up the bloc's flagging economy. Alongside a yet-to-be-detailed asset purchase program, it hopes to hit the 1 trillion mark again.

Evgeniy Piskachev

Steadily to trade and receive 15-20% a month! ! !

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

: