Young Ho Seo / Профиль

- Информация

|

10+ лет

опыт работы

|

62

продуктов

|

1170

демо-версий

|

|

4

работ

|

0

сигналов

|

0

подписчиков

|

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

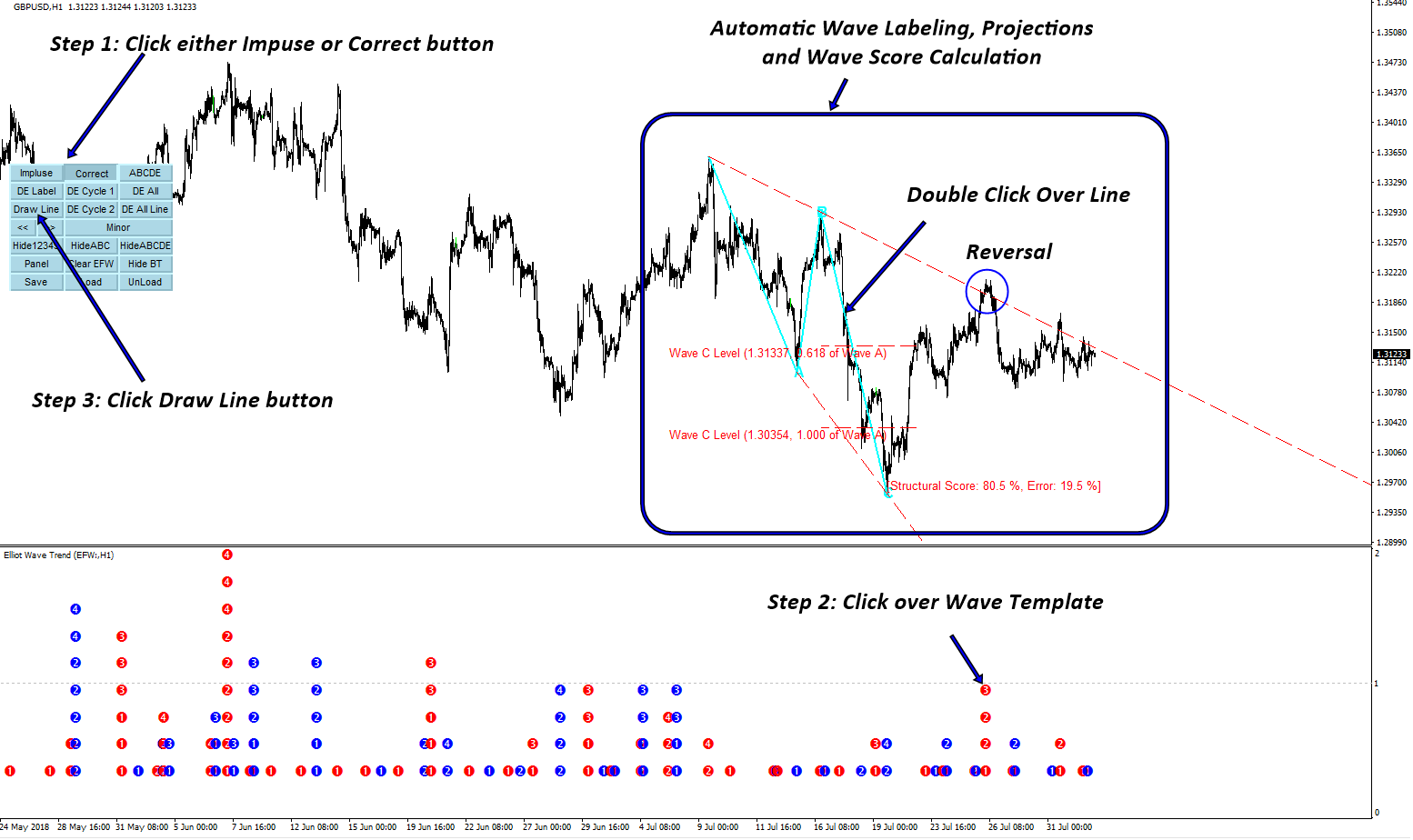

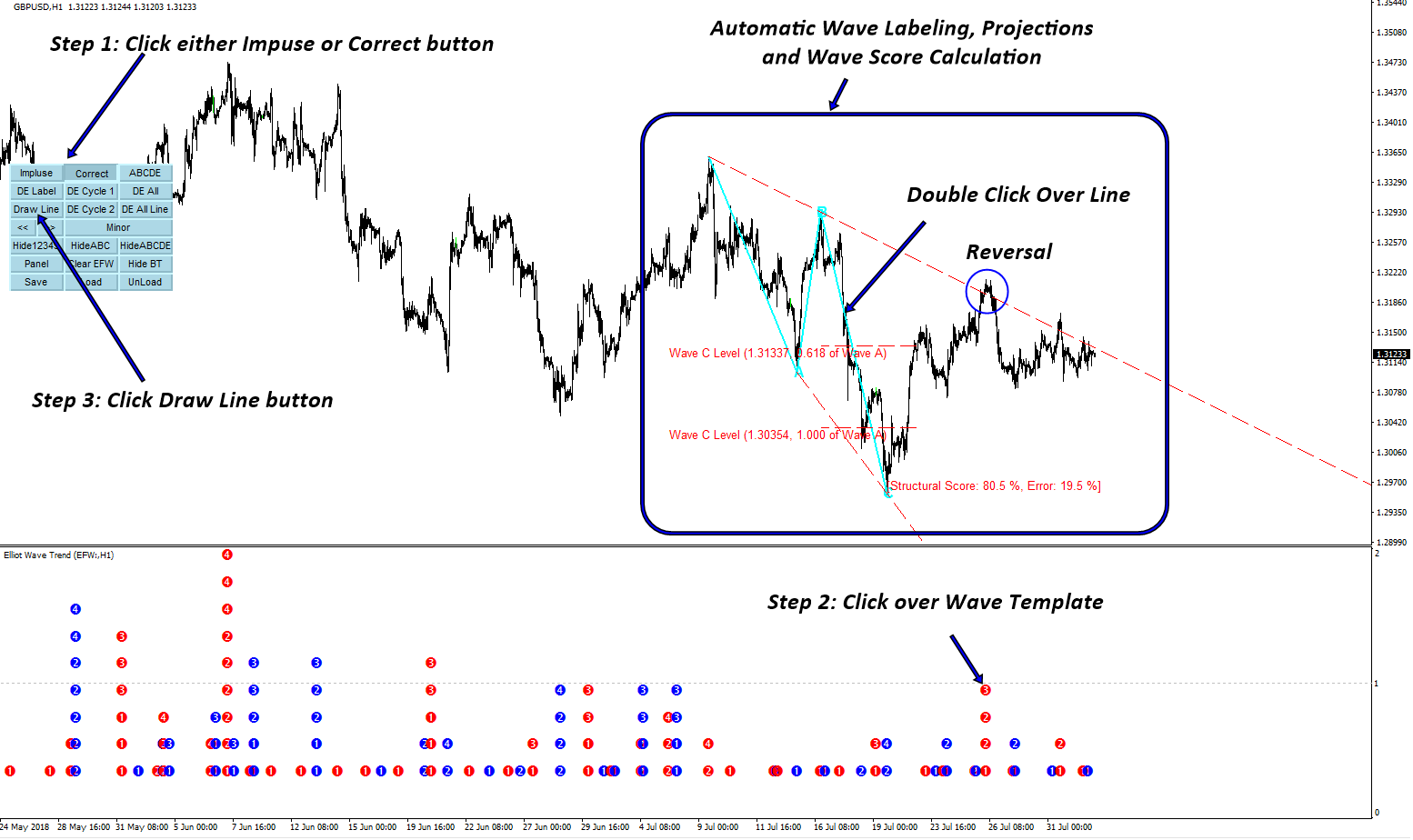

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

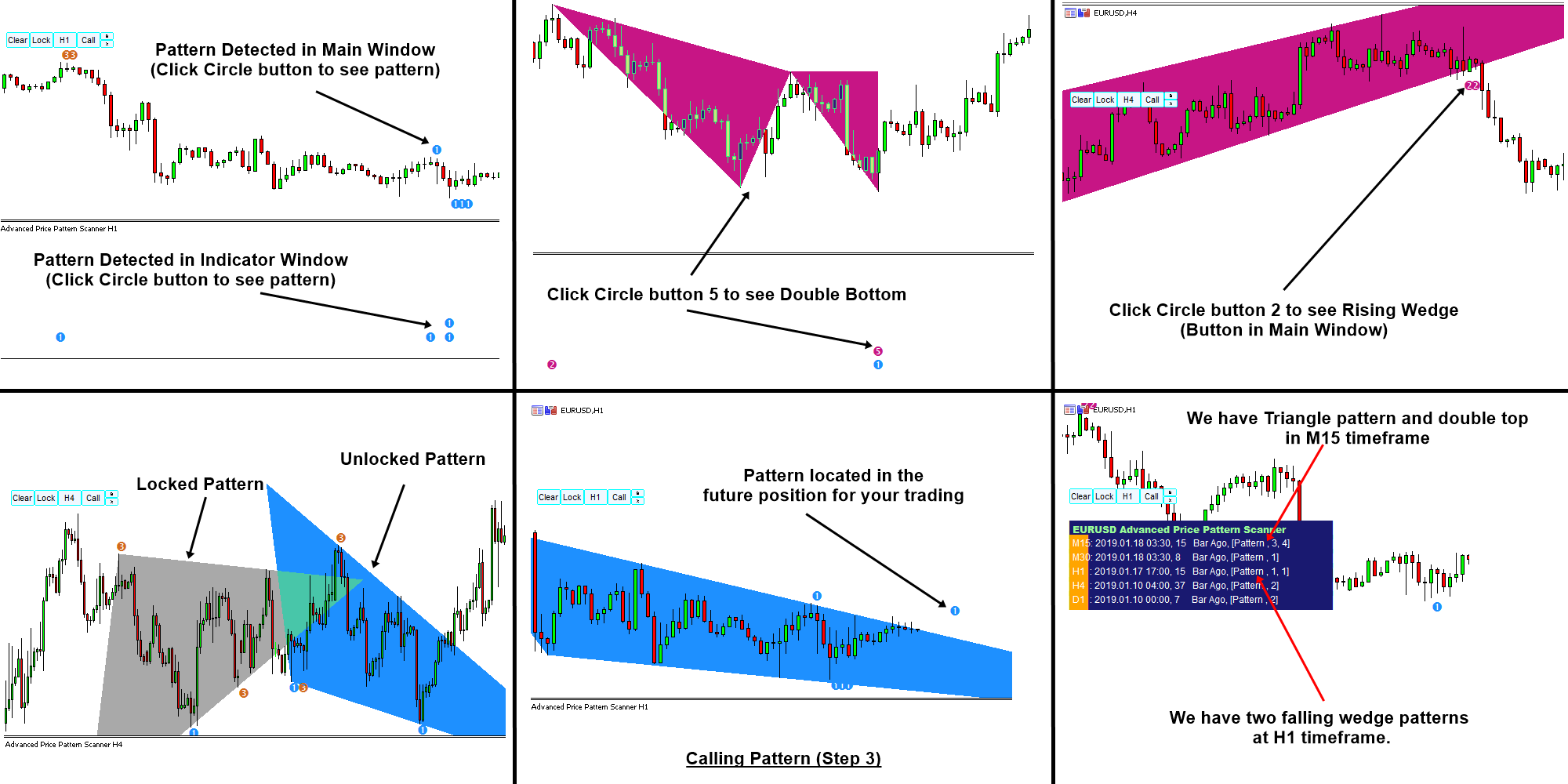

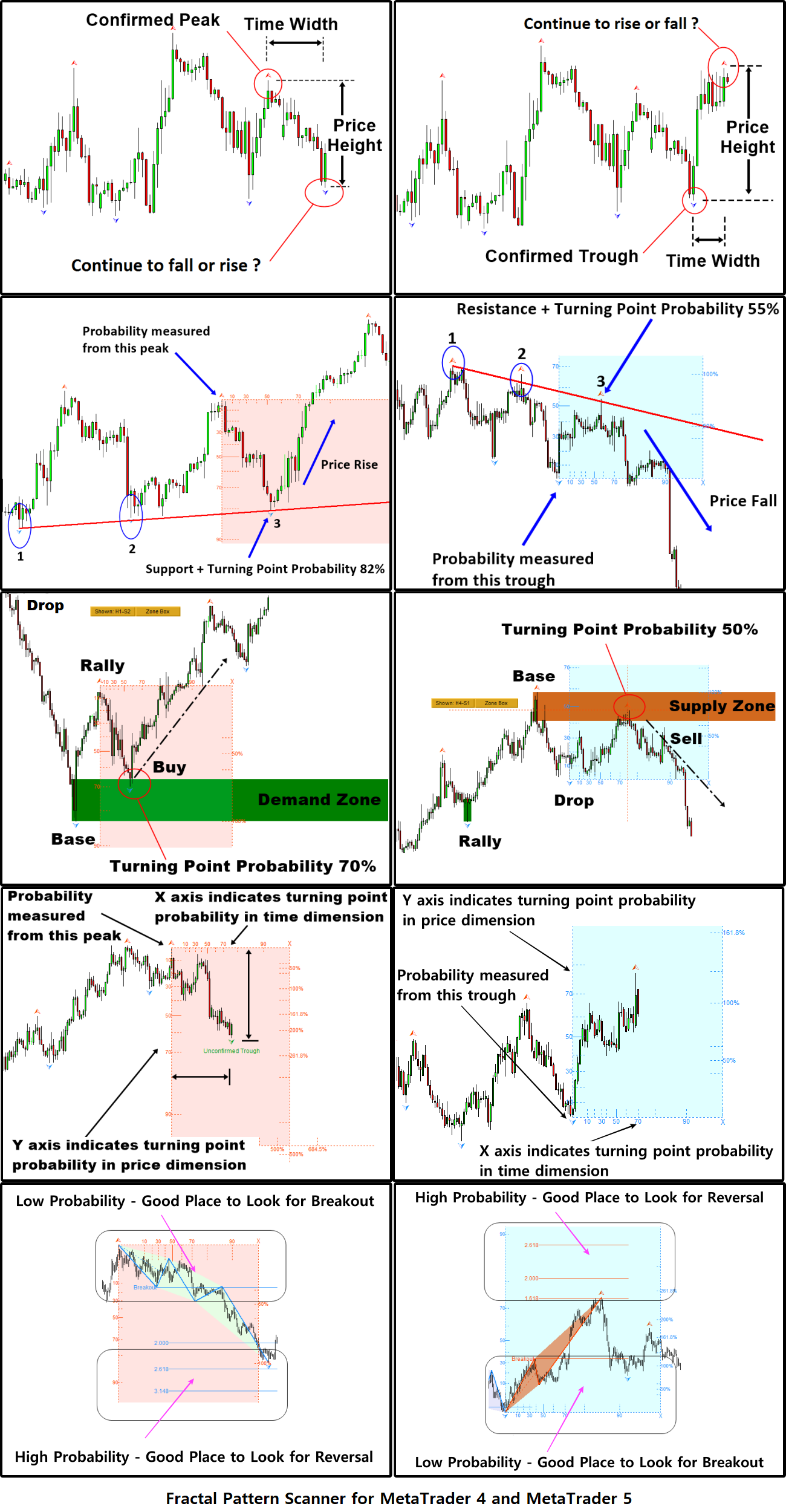

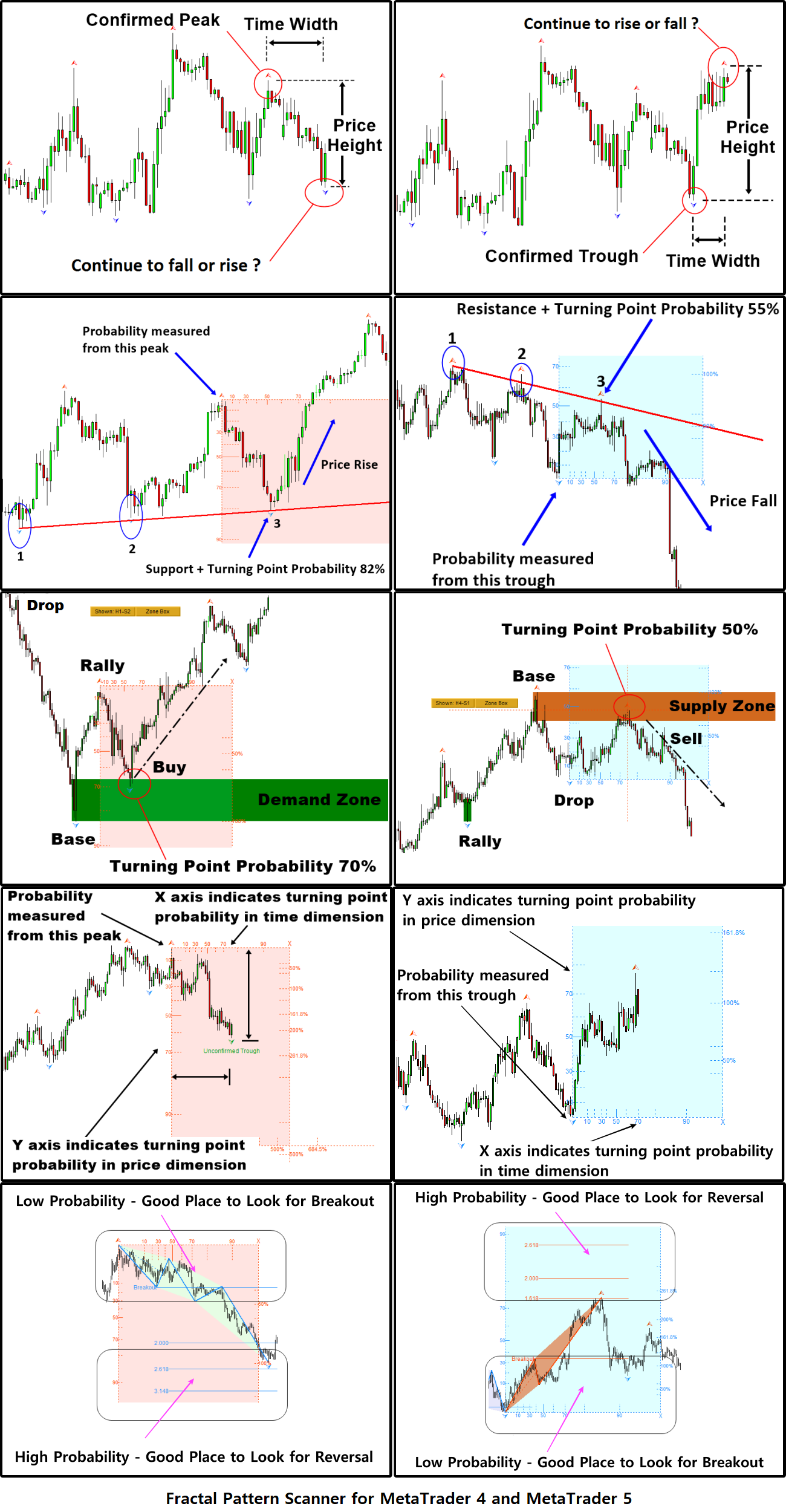

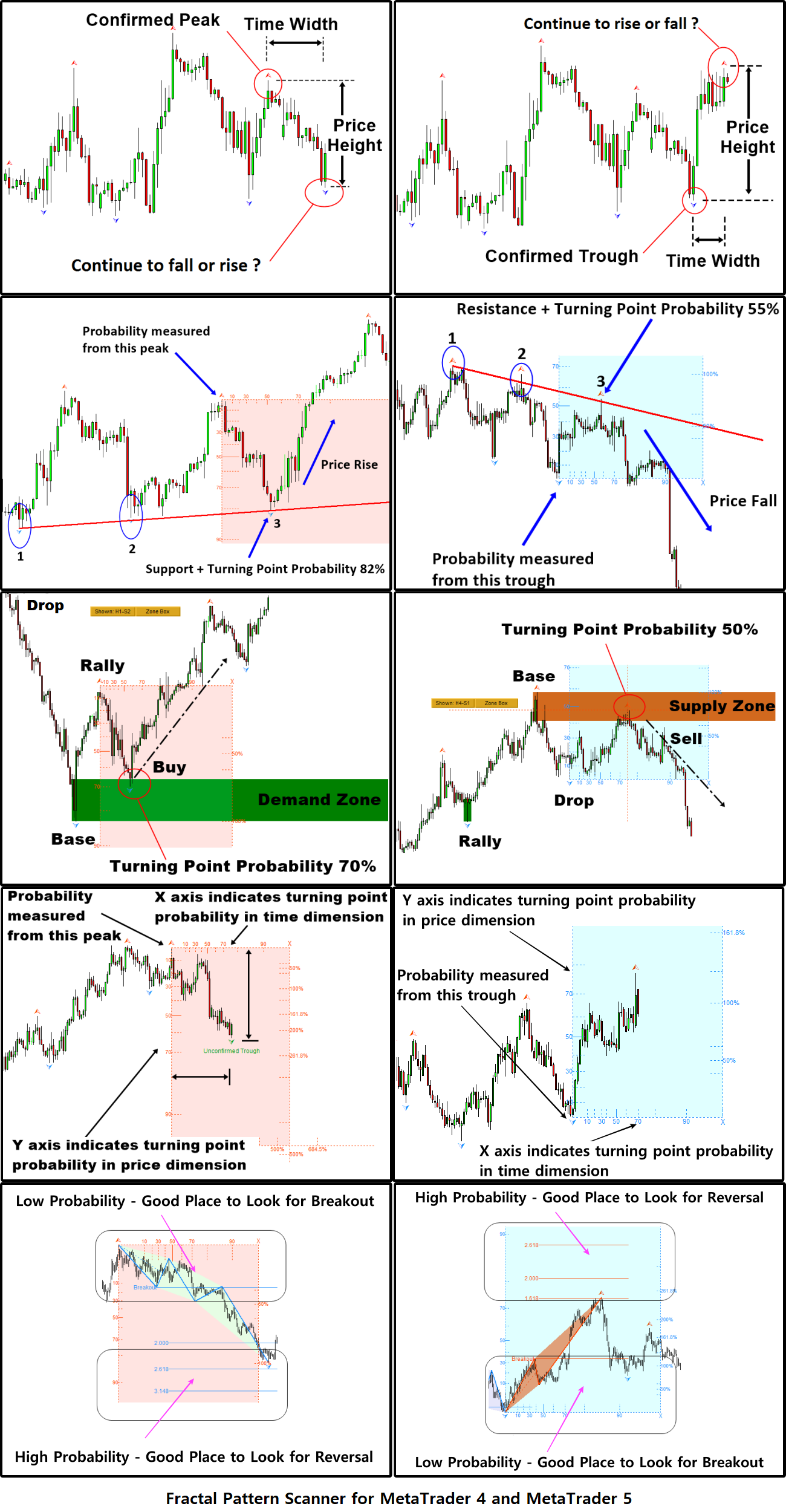

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

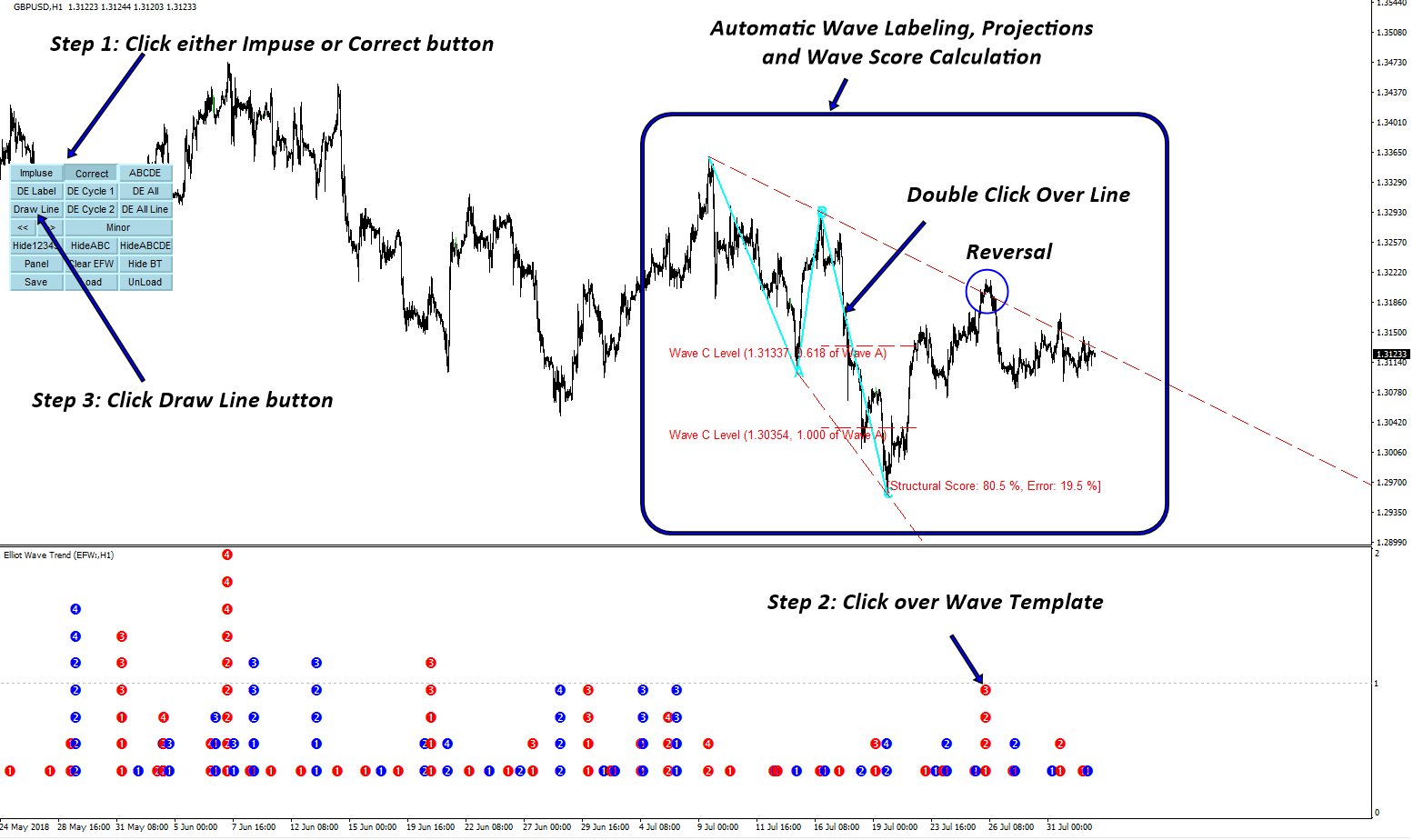

How Elliott Wave can Improve Your Trading Performance

In this article, we provide some guide to improve trading performance with Elliott Wave Analysis and Elliott Wave Counting. Elliott Wave is sophisticated. This sophistication makes it difficult to judge the trading performance of Elliott Wave in practice. Purely looking at the trading performance, Elliott Wave can introduce some subjectivity. It is true. However, many trader might agree that Elliott Wave can become a powerful tool when we can reduce or get rid of the subjectivity. The fact is that there are many seasoned traders using Elliott Wave successfully in practice. Some of them are high profile traders at the fund management level.

We have already suggested the way to reduce the subjectivity with Elliott Wave counting through the book and some other articles using the “template and pattern approach”.

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

Introduction on the Elliott Wave Trend with Wave Structural Score

The essence in the “Template and Pattern Approach” to count Elliott Wave is:

Building up wave counting using template (or patterns) first

Use the Wave score to get the scientific justification or when the wave score is not available, then you can check the correct location of each wave point to judge the valid trading point

These are the two main things about the “Template and Pattern Approach”. This is the only way to deal with the complex nature of Elliott Wave Trading. Now, in our Elliott Wave Trend, it shows all the available template (or pattern) to trader. This is good thing because you will not miss out any single possibility for your wave counting. At the same time, Elliott Wave Trend shows you both impulse wave structural score and corrective wave structural score.

Now here is important information for your trading. Elliott Wave can provide you trading entry at several different locations. These are not limited list but you can consider it at least. Some trader might prefer one entry over the other. You might create your own entry outside this list.

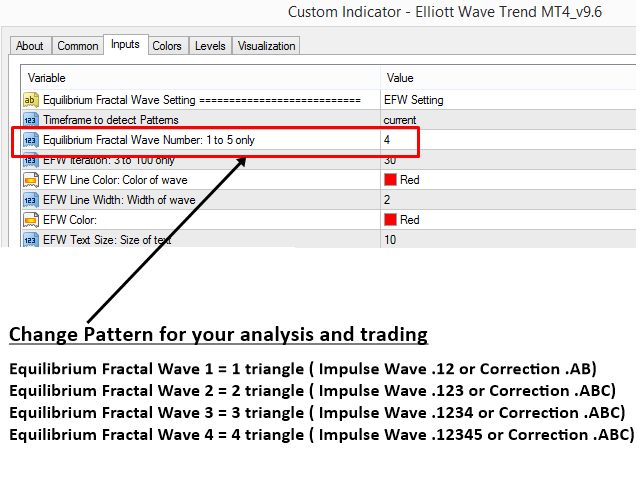

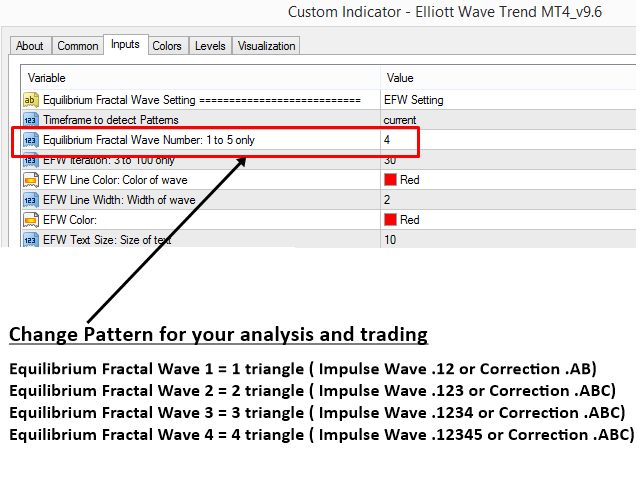

Entry Option 1) Impulse Wave .123 (= two triangles)

Entry Option 2) Impulse Wave .1234 (= three triangles)

Entry Option 3) Impulse Wave .12345 (= four triangles)

Entry Option 4) Corrective Wave .ABC (= two triangles)

Entry Option 5) Elliott Wave version of Triangle for breakout

You need to set the right template in the Elliott Wave Trend. Note that 1 Equilibrium Fractal Wave = 1 triangle. So if you wish to play with entry option 2, impulse wave .1234, then you will need to set for EFW number = 3. Then Elliott Wave Trend will bring the right template for impulse Wave .1234 (= three triangles).

You can read full article here. This article explains everything about to improve trading performance with Elliott Wave Analysis and Elliott Wave counting.

https://algotrading-investment.com/2018/10/25/how-elliott-wave-can-improve-your-trading-performance/

Elliott Wave Trend is a Elliott Wave indicator desinged to help Elliott Wave counting and Elliott Wave pattern detection. With Elliott Wave Trend, you have some additional tools to reduce the subjectivity with your wave counting and pattern detection. For example, Elliott Wave Trend provides the wave score and some template to start your wave counting. You can check the Elliott Wave Trend from the link below.

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

In this article, we provide some guide to improve trading performance with Elliott Wave Analysis and Elliott Wave Counting. Elliott Wave is sophisticated. This sophistication makes it difficult to judge the trading performance of Elliott Wave in practice. Purely looking at the trading performance, Elliott Wave can introduce some subjectivity. It is true. However, many trader might agree that Elliott Wave can become a powerful tool when we can reduce or get rid of the subjectivity. The fact is that there are many seasoned traders using Elliott Wave successfully in practice. Some of them are high profile traders at the fund management level.

We have already suggested the way to reduce the subjectivity with Elliott Wave counting through the book and some other articles using the “template and pattern approach”.

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

Introduction on the Elliott Wave Trend with Wave Structural Score

The essence in the “Template and Pattern Approach” to count Elliott Wave is:

Building up wave counting using template (or patterns) first

Use the Wave score to get the scientific justification or when the wave score is not available, then you can check the correct location of each wave point to judge the valid trading point

These are the two main things about the “Template and Pattern Approach”. This is the only way to deal with the complex nature of Elliott Wave Trading. Now, in our Elliott Wave Trend, it shows all the available template (or pattern) to trader. This is good thing because you will not miss out any single possibility for your wave counting. At the same time, Elliott Wave Trend shows you both impulse wave structural score and corrective wave structural score.

Now here is important information for your trading. Elliott Wave can provide you trading entry at several different locations. These are not limited list but you can consider it at least. Some trader might prefer one entry over the other. You might create your own entry outside this list.

Entry Option 1) Impulse Wave .123 (= two triangles)

Entry Option 2) Impulse Wave .1234 (= three triangles)

Entry Option 3) Impulse Wave .12345 (= four triangles)

Entry Option 4) Corrective Wave .ABC (= two triangles)

Entry Option 5) Elliott Wave version of Triangle for breakout

You need to set the right template in the Elliott Wave Trend. Note that 1 Equilibrium Fractal Wave = 1 triangle. So if you wish to play with entry option 2, impulse wave .1234, then you will need to set for EFW number = 3. Then Elliott Wave Trend will bring the right template for impulse Wave .1234 (= three triangles).

You can read full article here. This article explains everything about to improve trading performance with Elliott Wave Analysis and Elliott Wave counting.

https://algotrading-investment.com/2018/10/25/how-elliott-wave-can-improve-your-trading-performance/

Elliott Wave Trend is a Elliott Wave indicator desinged to help Elliott Wave counting and Elliott Wave pattern detection. With Elliott Wave Trend, you have some additional tools to reduce the subjectivity with your wave counting and pattern detection. For example, Elliott Wave Trend provides the wave score and some template to start your wave counting. You can check the Elliott Wave Trend from the link below.

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

Young Ho Seo

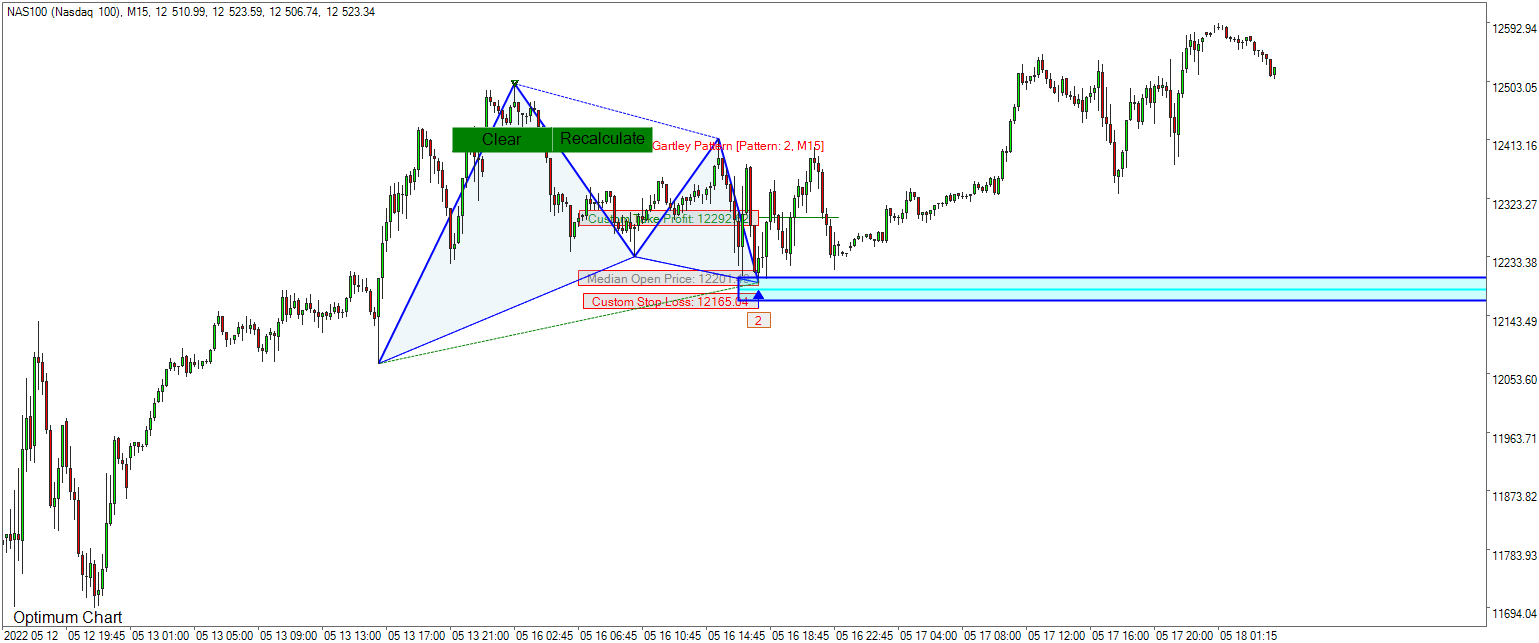

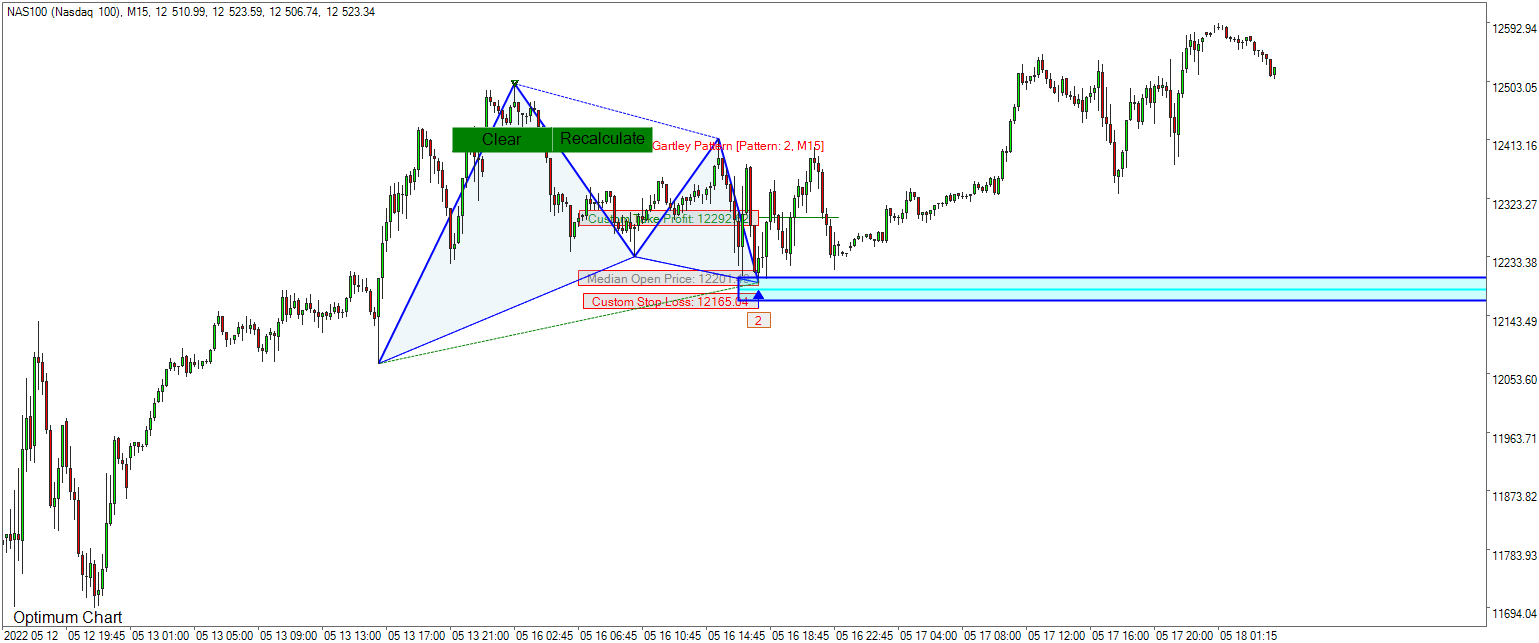

Pattern Completion Zone VS Potential Reversal Zone

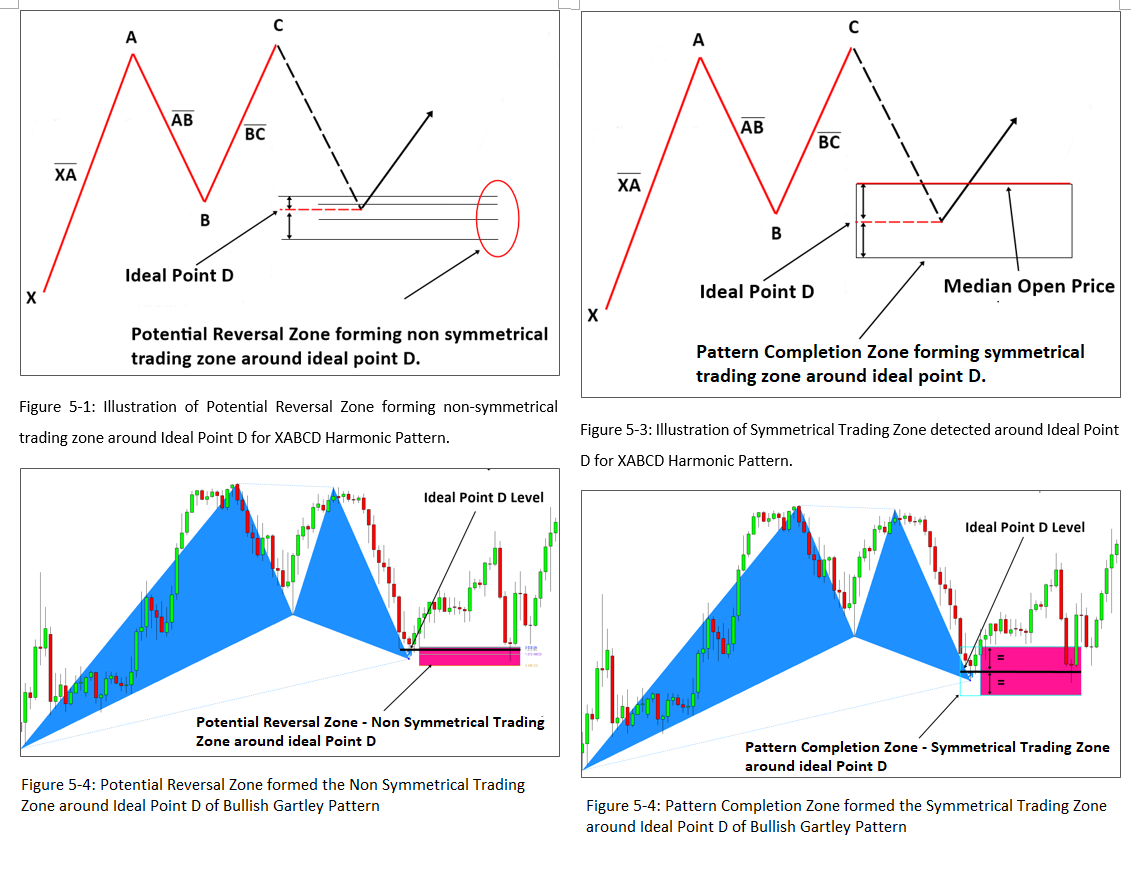

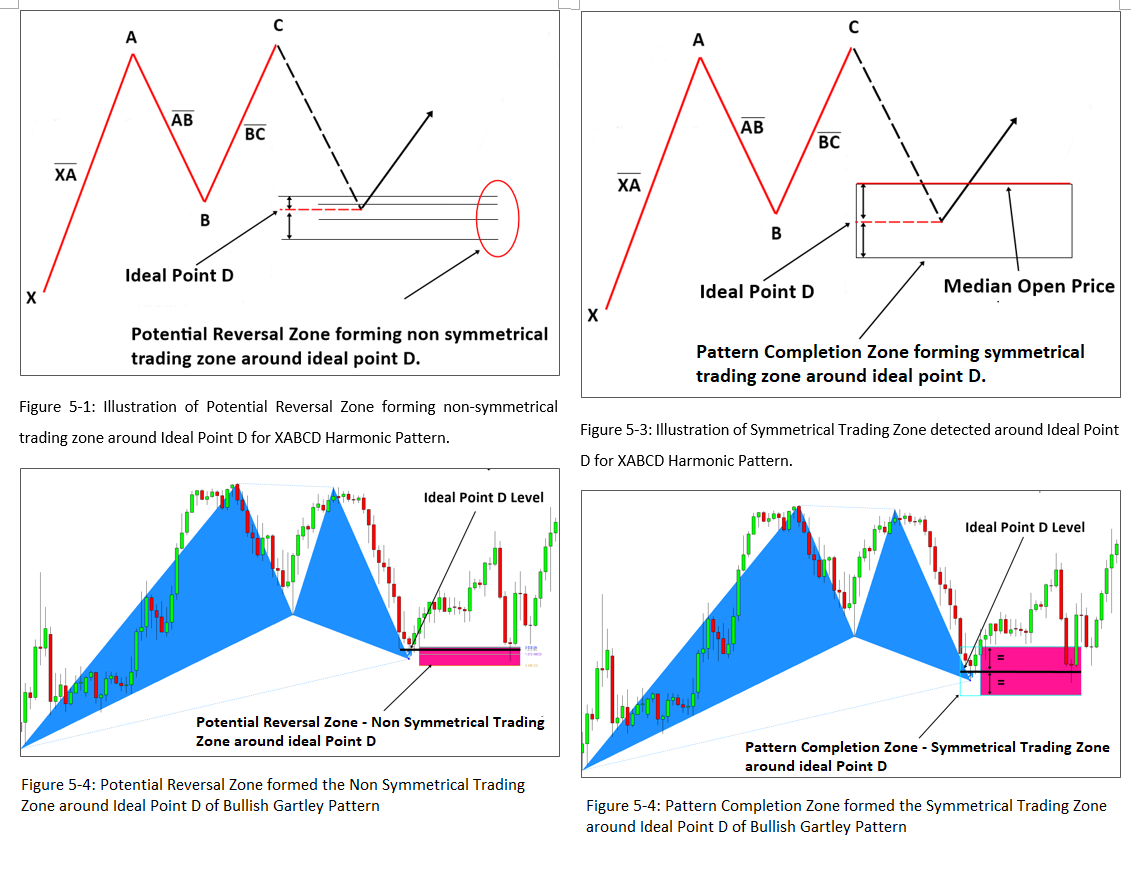

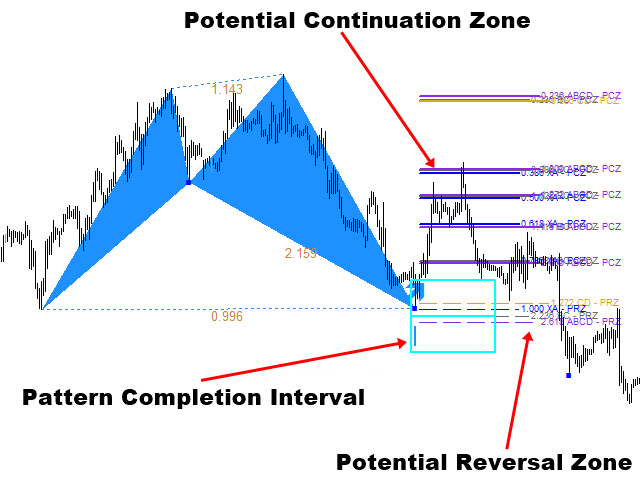

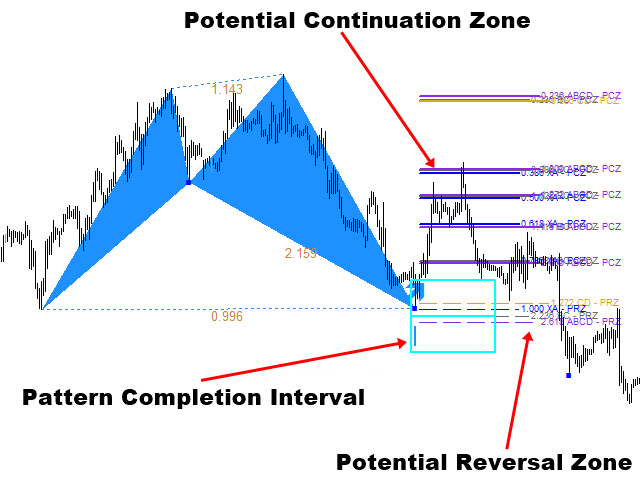

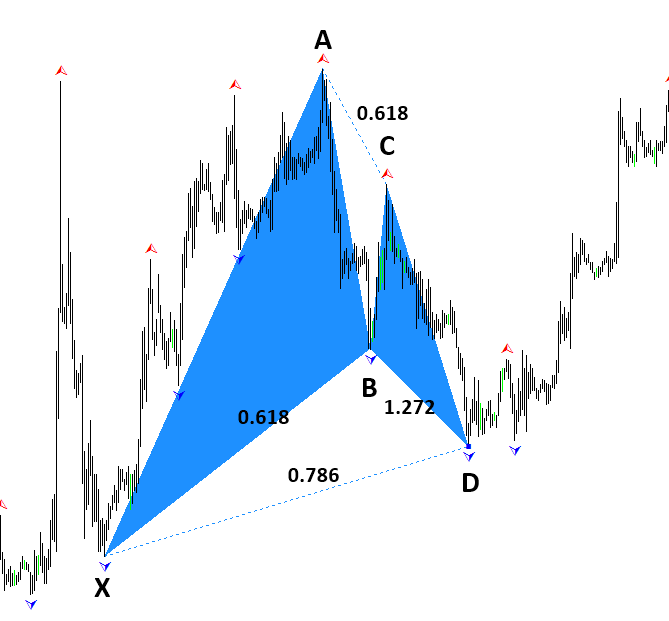

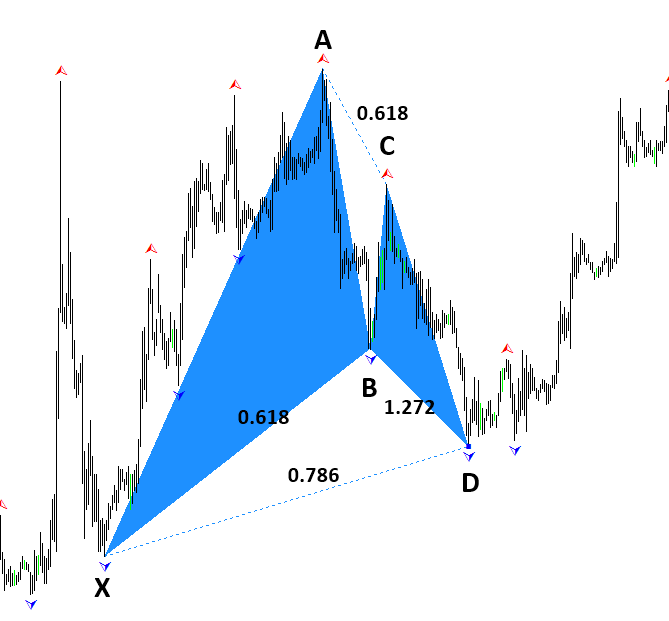

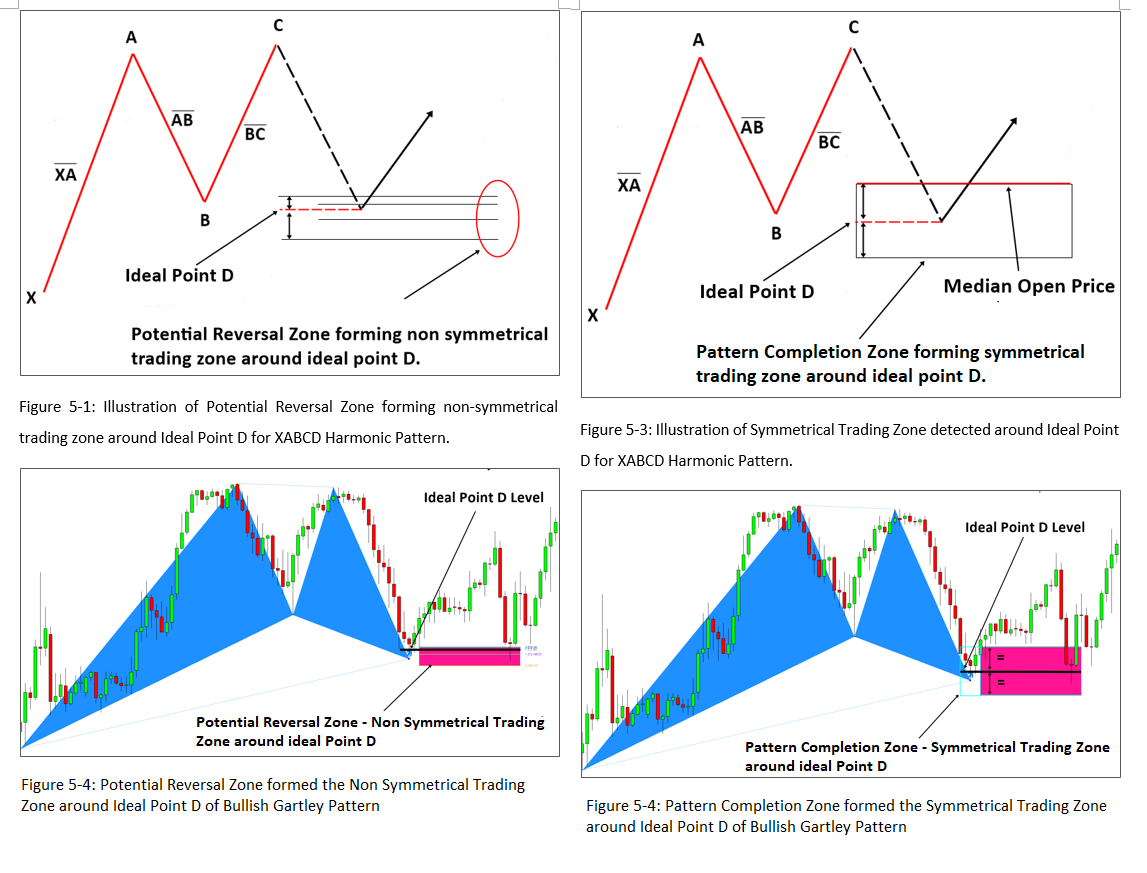

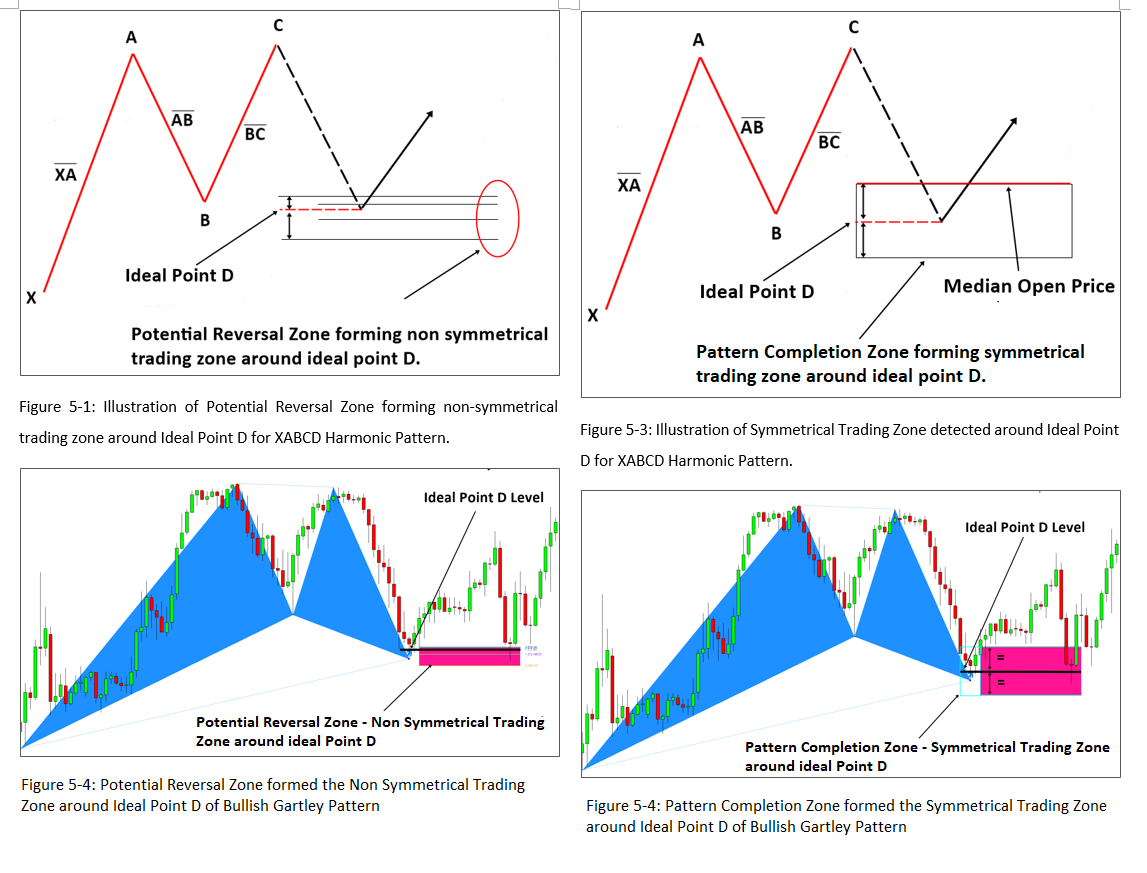

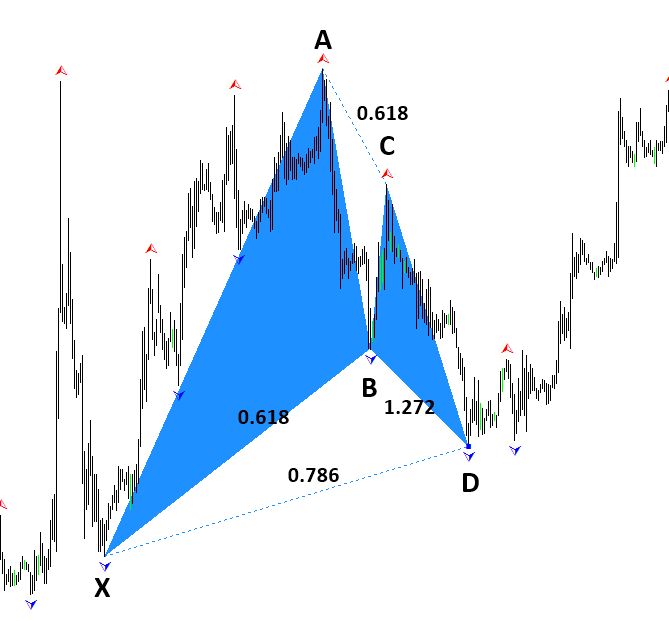

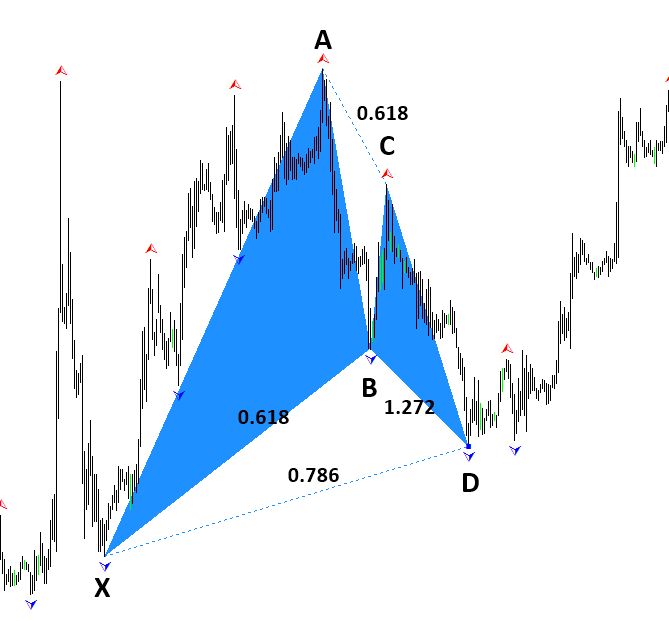

In previous chapter, we have described the Pattern Completion Zone, also known as Pattern Completion Interval, in details. Now many harmonic pattern trader can be curious how the Pattern Completion Zone (PCZ) is different from the Potential Reversal Zone (PRZ). In first place, as the PCZ and PRZ are derived from different process, they are different tool to trader. Having said that, the deriving process for PCZ and PRZ might be too complicated causing some traders to confuse the concept of each other. For this reason, we will clarify the difference by directly comparing PCZ and PRZ look. Let us look at the Potential Reversal Zone. So what is Potential Reversal Zone? Simply speaking potential Reversal zone is the area where three or four Fibonacci levels are converging together. Potential Reversal Zone can be used to detect the final Point D of the Harmonic Pattern by projecting several Fibonacci retracements respectively from the point X, A, B and C. The area of the Potential Reversal Zone can be defined by the top and the bottom projected levels in the all projected levels as shown in Figure 5-1.

The main difference between PCZ and PRZ is that Pattern Completion Zone forms the strict Symmetrical Trading Zone around the ideal Point D (Figure 5-3 and Figure 5-4). The Potential Reversal Zone (PRZ) does not form the symmetrical zone. However, the PRZ area formation is dependent on the location of each Fibonacci level projections as shown in Figure 5-1 and Figure 5-2. Sometime PRZ area can form the symmetrical trading zone but it is only by chance. Most of time, Potential Reversal Zone will not form the symmetrical trading zone. On the other hands, Pattern Completion Zone will strictly form symmetrical trading zone for every harmonic pattern. Due to this symmetrical property of the Pattern Completion Zone (= Pattern Completion Interval), trader can use many different trading strategies around the symmetrical trading zone beyond the classic harmonic pattern trading setup. With Pattern completion Zone, you can expand your classic trend reversal entry to hedging and breakout trading by setting identical but opposite trading. For example, for bullish Harmonic Pattern formation, you are able to setup the buy and sell hedging positions or straddle breakout setup around the Pattern Completion Zone. This is possible because the Pattern Completion Zone provides the median open price, which can be mirrored around the Ideal Point D.

In addition, Pattern Completion Zone provides you the direct numerical description corresponding to the size of the Harmonic Pattern. Therefore, the size of symmetrical trading zone around the Pattern Completion Zone is a sensible measurement for your stop loss and take profit for each Harmonic Pattern. Especially, once you have mastered the Pattern Completion Zone for your trading, you can gauge your Reward/Risk Ratio with real time market data without the need of any other additional tools. You can expand this with limit and stop order for better managing your order and risk. Overall, Pattern Completion Zone can provide you precise and fast decision-making process for your Harmonic Pattern Trading. In next chapter, we will continue to show you how the symmetrical trading zone works to manage your order and risk in details.

If you want to access automated Harmonic Pattern Detector, then you can also buy the Harmonic Pattern Plus or X3 Chart Pattern Scanner available in MetaTrader 4 and MetaTrader 5. In Harmonic Pattern Plus, you can access many additional features on top of the harmonic pattern trading signals. For example, you can also access Advanced Channel and around 52 Japanese candlestick pattern. It will also draw the Pattern Completion Interval automatically in your chart helping you to set your stop loss and take profit targets. It is a repainting indicator but it comes at the affordable price.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

If you need more advanced one than Harmonic Pattern Plus, then you can use our X3 Chart Pattern Scanner. X3 Chart Pattern Scanner is the non repainting and non lagging Harmonic Pattern and Elliott Wave Pattern Scanner with multiple of advanced features. You can even customize the patterns you want to detect by changing their pattern structure. At the same time, you can use both repainting and non repainting Harmonic Pattern Indicator together. This means that you can combine to use Harmonic Pattern Plus with X3 Chart Pattern Scanner if you wish.

Below are the Links to X3 Chart Pattern Scanner.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

You can read Guide to Precision Harmonic Pattern Trading to understand more about the Harmonic Pattern Strategy.

https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

In previous chapter, we have described the Pattern Completion Zone, also known as Pattern Completion Interval, in details. Now many harmonic pattern trader can be curious how the Pattern Completion Zone (PCZ) is different from the Potential Reversal Zone (PRZ). In first place, as the PCZ and PRZ are derived from different process, they are different tool to trader. Having said that, the deriving process for PCZ and PRZ might be too complicated causing some traders to confuse the concept of each other. For this reason, we will clarify the difference by directly comparing PCZ and PRZ look. Let us look at the Potential Reversal Zone. So what is Potential Reversal Zone? Simply speaking potential Reversal zone is the area where three or four Fibonacci levels are converging together. Potential Reversal Zone can be used to detect the final Point D of the Harmonic Pattern by projecting several Fibonacci retracements respectively from the point X, A, B and C. The area of the Potential Reversal Zone can be defined by the top and the bottom projected levels in the all projected levels as shown in Figure 5-1.

The main difference between PCZ and PRZ is that Pattern Completion Zone forms the strict Symmetrical Trading Zone around the ideal Point D (Figure 5-3 and Figure 5-4). The Potential Reversal Zone (PRZ) does not form the symmetrical zone. However, the PRZ area formation is dependent on the location of each Fibonacci level projections as shown in Figure 5-1 and Figure 5-2. Sometime PRZ area can form the symmetrical trading zone but it is only by chance. Most of time, Potential Reversal Zone will not form the symmetrical trading zone. On the other hands, Pattern Completion Zone will strictly form symmetrical trading zone for every harmonic pattern. Due to this symmetrical property of the Pattern Completion Zone (= Pattern Completion Interval), trader can use many different trading strategies around the symmetrical trading zone beyond the classic harmonic pattern trading setup. With Pattern completion Zone, you can expand your classic trend reversal entry to hedging and breakout trading by setting identical but opposite trading. For example, for bullish Harmonic Pattern formation, you are able to setup the buy and sell hedging positions or straddle breakout setup around the Pattern Completion Zone. This is possible because the Pattern Completion Zone provides the median open price, which can be mirrored around the Ideal Point D.

In addition, Pattern Completion Zone provides you the direct numerical description corresponding to the size of the Harmonic Pattern. Therefore, the size of symmetrical trading zone around the Pattern Completion Zone is a sensible measurement for your stop loss and take profit for each Harmonic Pattern. Especially, once you have mastered the Pattern Completion Zone for your trading, you can gauge your Reward/Risk Ratio with real time market data without the need of any other additional tools. You can expand this with limit and stop order for better managing your order and risk. Overall, Pattern Completion Zone can provide you precise and fast decision-making process for your Harmonic Pattern Trading. In next chapter, we will continue to show you how the symmetrical trading zone works to manage your order and risk in details.

If you want to access automated Harmonic Pattern Detector, then you can also buy the Harmonic Pattern Plus or X3 Chart Pattern Scanner available in MetaTrader 4 and MetaTrader 5. In Harmonic Pattern Plus, you can access many additional features on top of the harmonic pattern trading signals. For example, you can also access Advanced Channel and around 52 Japanese candlestick pattern. It will also draw the Pattern Completion Interval automatically in your chart helping you to set your stop loss and take profit targets. It is a repainting indicator but it comes at the affordable price.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

If you need more advanced one than Harmonic Pattern Plus, then you can use our X3 Chart Pattern Scanner. X3 Chart Pattern Scanner is the non repainting and non lagging Harmonic Pattern and Elliott Wave Pattern Scanner with multiple of advanced features. You can even customize the patterns you want to detect by changing their pattern structure. At the same time, you can use both repainting and non repainting Harmonic Pattern Indicator together. This means that you can combine to use Harmonic Pattern Plus with X3 Chart Pattern Scanner if you wish.

Below are the Links to X3 Chart Pattern Scanner.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

You can read Guide to Precision Harmonic Pattern Trading to understand more about the Harmonic Pattern Strategy.

https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

Young Ho Seo

Elliott Wave

This article discusses about Elliott Wave including Elliott Wave Theory, Elliott Wave Trading, Elliott Wave counting, Elliott Wave pattern and Elliott Wave education. Ralph Nelson Elliott was one of very first person who believed that he could predict the stock market by studying the repeating patterns in the price series. To prove this idea, he created the Wave Principle. Many years later, the Wave Principle was reintroduced in the Prechter’s Elliott Wave books to investors. The Wave Principle states that the wave patterns are repeating and superimposing on each other forming complex wave patterns. The advantage of Elliott Wave theory is that it is comprehensive as the theory can provide multiple trading entries on different market conditions. Elliott Wave theory can be used for both momentum trading and mean reversion trading. The disadvantage of Elliott Wave theory is that it is more complex comparing to other trading techniques. In addition, there are still some loose ends in detecting Elliott wave patterns. For this reason, many traders heavily criticize the lack of scientific methods of counting Elliott Waves.

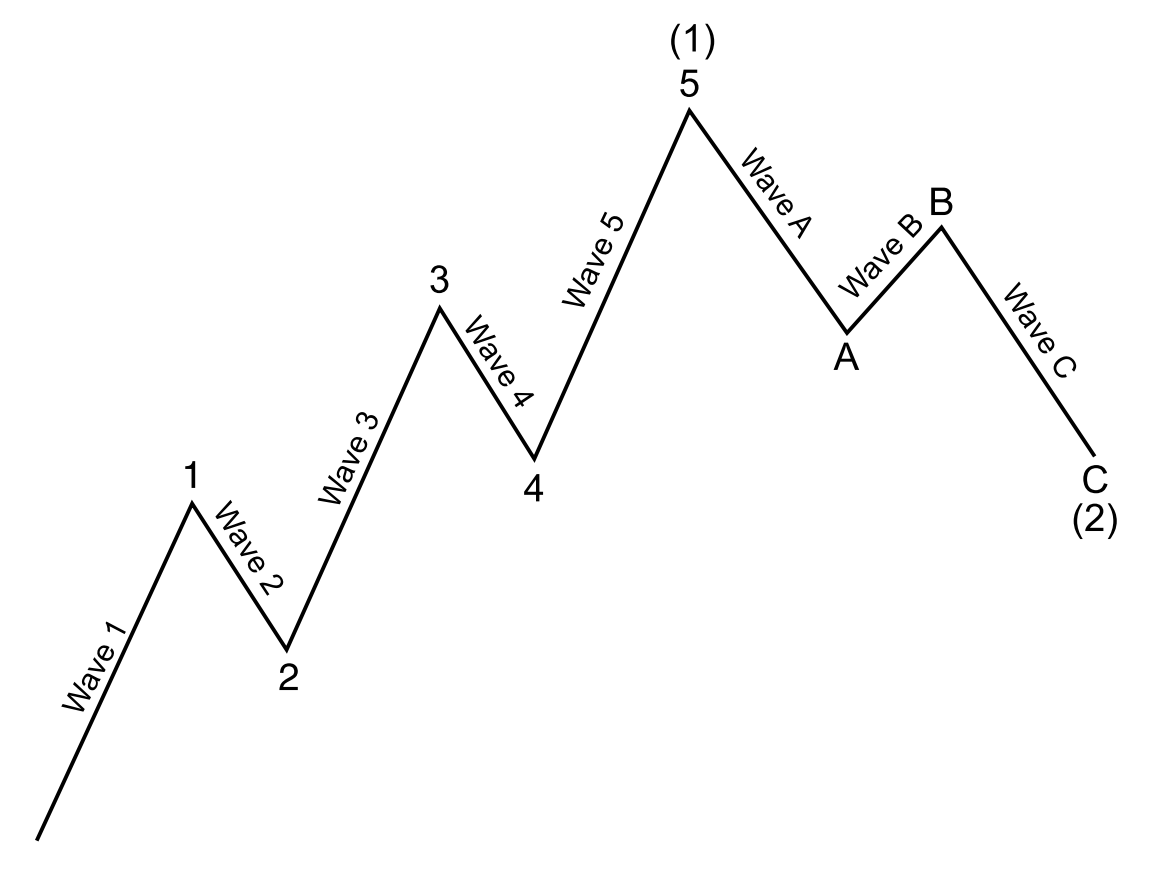

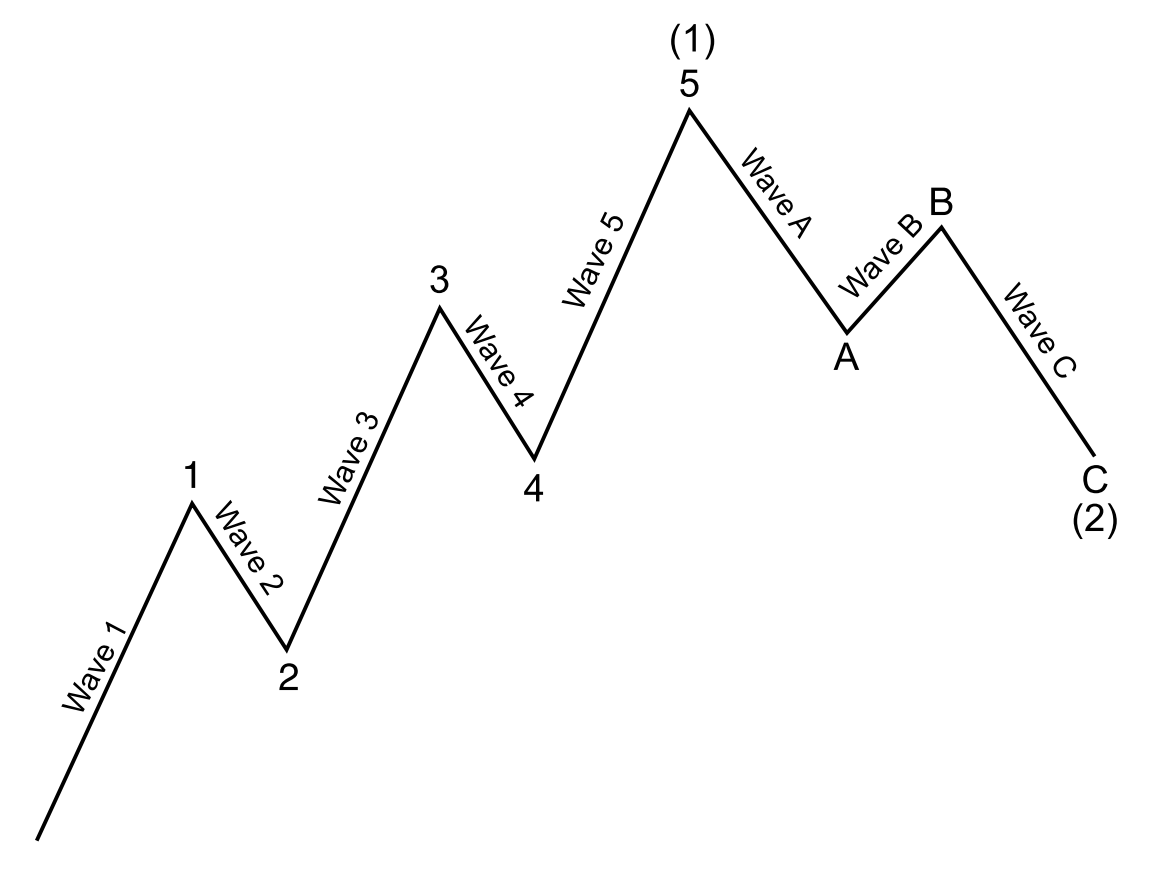

The Wave Principle states that the crowd or social behaviour follows a certain wave patterns repeating themselves. The Wave Principle identifies two wave patterns. They are impulse and corrective wave. Often, the term impulse wave is interchangeably used with the motive wave. Two terms are identical. Both motive and impulse wave progress during the main trend phase whereas the corrective wave progress during the corrective phase against the main trend. In general, the Impulse Wave has a five-wave structure, while the Corrective Wave has a three-wave structure (Figure 8-1). It is important to understand that these wave structures can override on smaller wave structure to form greater wave cycle (Figure 8-2). Elliott Wave theory is useful in identifying both trend market and correction market.

You can read full article here. This article explains everything about Elliott Wave and Elliott Wave Indicator.

https://algotrading-investment.com/2022/06/22/elliott-wave/

Elliott Wave Trading

Once you have some knowledge about Elliott Wave, there are two ways you can trade with Elliott Wave. First approach is to trade with Elliott Wave counting and second approach is to trade with Elliott Wave pattern. Both methods have pros and cons.

Elliott Wave Counting

Elliott Wave Pattern

If we have to say the point in short, trading with Elliott Wave counting is harder than trading with Elliott Wave pattern. One of the reason behind this is that Elliott wave counting has more chance to add some subjectivity in your trading. Subjectivity is bad because you can not measure the trading performance for your technique. Hence, if you want to tune or to improve your technique, then it is very hard to do so. Elliott wave theory is only general rule with potential to expand to too many possibility. For example, the wave counting done by one trader often does not agree with the wave counting done by other trader for the same chart and for the same subject. Before starting wave counting, you need to understand this. If you want to become successful with wave counting, reducing the subjectivity is the most important task. Hence, we created wave score to tell the integrity of the wave counting as well as to reduce some human error.

For example, before starting with wave counting, you can read these points.

Point 1: Always start your analysis with impulse wave (before corrective wave).

Point 2: Use Fibonacci anlaysis to check the correct position of impulse wave.

Point 3: Use wave score if possible to avoid any human error.

Point 4: Avoid complex wave counting and stick with simple and tradable one.

Point 5: When market does not fit with Elliott Wave theory, then do not trade.

Point 5 is particularly important as some people try too hard to fit Elliott Wave to all market situation. This can introduce overfitting for your wave counting. Overfitted wave counting is useless as they do not have any prediction power but they looks good on chart only. If you are trader, then making money is priority over fitting the wave to the chart. You need to know when to stop and when to start with your wave counting. This can be difficult if you are less experienced with Elliott Wave.

To stick with these important points, we have created Elliott Wave Trend. Elliott Wave Trend is the Elliott Wave indicator. With Elliott Wave Trend, you have some additional tools to reduce the subjectivity with your wave counting. For example, Elliott Wave Trend provides the wave score and some template to start your wave counting. You can check the Elliott Wave Trend from the link below.

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Now let us talk about the second approach, Elliott Wave pattern. Using Fibonacci relationship from Elliott Wave theory, we can create a set of tradable Elliott Wave pattern. Trading Elliott Wave pattern involves to use one of these Elliott Wave pattern to determine buy and sell entry for your trading. Hence, trading with Elliott Wave pattern is more mechanical approach than trading with wave counting. Mostly, the Elliott Wave pattern is constructed using the ratio guide from Elliott Wave theory. The good thing about this approach is that you can tune and improve your trading performance in objective way. For example, you can compare the performance of one Elliott Wave pattern to another Elliott Wave pattern in historical data. It is even possible to compare the Elliott Wave pattern to Harmonic Pattern. Using this approach, we can select the best performing Elliott Wave pattern to trade. This approach is purely driven by the performance. Hence, we can continuosuly improve Elliott Wave pattern for our trading.

For this purpose, we created X3 Chart Pattern Scanner. With X3 Chart Pattern Scanner, you can plug in any Elliott Wave pattern structure to test their trading performance in historical data. After that, you can use better Elliott Wave pattern to trade live. X3 Chart Pattern Scanner is a specialized tool in detecting chart patterns including Harmonic Pattern and Elliott Wave Patterns. Plus it can also detect Japanese Candlestick pattern and advanced channel.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

This article discusses about Elliott Wave including Elliott Wave Theory, Elliott Wave Trading, Elliott Wave counting, Elliott Wave pattern and Elliott Wave education. Ralph Nelson Elliott was one of very first person who believed that he could predict the stock market by studying the repeating patterns in the price series. To prove this idea, he created the Wave Principle. Many years later, the Wave Principle was reintroduced in the Prechter’s Elliott Wave books to investors. The Wave Principle states that the wave patterns are repeating and superimposing on each other forming complex wave patterns. The advantage of Elliott Wave theory is that it is comprehensive as the theory can provide multiple trading entries on different market conditions. Elliott Wave theory can be used for both momentum trading and mean reversion trading. The disadvantage of Elliott Wave theory is that it is more complex comparing to other trading techniques. In addition, there are still some loose ends in detecting Elliott wave patterns. For this reason, many traders heavily criticize the lack of scientific methods of counting Elliott Waves.

The Wave Principle states that the crowd or social behaviour follows a certain wave patterns repeating themselves. The Wave Principle identifies two wave patterns. They are impulse and corrective wave. Often, the term impulse wave is interchangeably used with the motive wave. Two terms are identical. Both motive and impulse wave progress during the main trend phase whereas the corrective wave progress during the corrective phase against the main trend. In general, the Impulse Wave has a five-wave structure, while the Corrective Wave has a three-wave structure (Figure 8-1). It is important to understand that these wave structures can override on smaller wave structure to form greater wave cycle (Figure 8-2). Elliott Wave theory is useful in identifying both trend market and correction market.

You can read full article here. This article explains everything about Elliott Wave and Elliott Wave Indicator.

https://algotrading-investment.com/2022/06/22/elliott-wave/

Elliott Wave Trading

Once you have some knowledge about Elliott Wave, there are two ways you can trade with Elliott Wave. First approach is to trade with Elliott Wave counting and second approach is to trade with Elliott Wave pattern. Both methods have pros and cons.

Elliott Wave Counting

Elliott Wave Pattern

If we have to say the point in short, trading with Elliott Wave counting is harder than trading with Elliott Wave pattern. One of the reason behind this is that Elliott wave counting has more chance to add some subjectivity in your trading. Subjectivity is bad because you can not measure the trading performance for your technique. Hence, if you want to tune or to improve your technique, then it is very hard to do so. Elliott wave theory is only general rule with potential to expand to too many possibility. For example, the wave counting done by one trader often does not agree with the wave counting done by other trader for the same chart and for the same subject. Before starting wave counting, you need to understand this. If you want to become successful with wave counting, reducing the subjectivity is the most important task. Hence, we created wave score to tell the integrity of the wave counting as well as to reduce some human error.

For example, before starting with wave counting, you can read these points.

Point 1: Always start your analysis with impulse wave (before corrective wave).

Point 2: Use Fibonacci anlaysis to check the correct position of impulse wave.

Point 3: Use wave score if possible to avoid any human error.

Point 4: Avoid complex wave counting and stick with simple and tradable one.

Point 5: When market does not fit with Elliott Wave theory, then do not trade.

Point 5 is particularly important as some people try too hard to fit Elliott Wave to all market situation. This can introduce overfitting for your wave counting. Overfitted wave counting is useless as they do not have any prediction power but they looks good on chart only. If you are trader, then making money is priority over fitting the wave to the chart. You need to know when to stop and when to start with your wave counting. This can be difficult if you are less experienced with Elliott Wave.

To stick with these important points, we have created Elliott Wave Trend. Elliott Wave Trend is the Elliott Wave indicator. With Elliott Wave Trend, you have some additional tools to reduce the subjectivity with your wave counting. For example, Elliott Wave Trend provides the wave score and some template to start your wave counting. You can check the Elliott Wave Trend from the link below.

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Now let us talk about the second approach, Elliott Wave pattern. Using Fibonacci relationship from Elliott Wave theory, we can create a set of tradable Elliott Wave pattern. Trading Elliott Wave pattern involves to use one of these Elliott Wave pattern to determine buy and sell entry for your trading. Hence, trading with Elliott Wave pattern is more mechanical approach than trading with wave counting. Mostly, the Elliott Wave pattern is constructed using the ratio guide from Elliott Wave theory. The good thing about this approach is that you can tune and improve your trading performance in objective way. For example, you can compare the performance of one Elliott Wave pattern to another Elliott Wave pattern in historical data. It is even possible to compare the Elliott Wave pattern to Harmonic Pattern. Using this approach, we can select the best performing Elliott Wave pattern to trade. This approach is purely driven by the performance. Hence, we can continuosuly improve Elliott Wave pattern for our trading.

For this purpose, we created X3 Chart Pattern Scanner. With X3 Chart Pattern Scanner, you can plug in any Elliott Wave pattern structure to test their trading performance in historical data. After that, you can use better Elliott Wave pattern to trade live. X3 Chart Pattern Scanner is a specialized tool in detecting chart patterns including Harmonic Pattern and Elliott Wave Patterns. Plus it can also detect Japanese Candlestick pattern and advanced channel.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Quick Guide for Harmonic Pattern

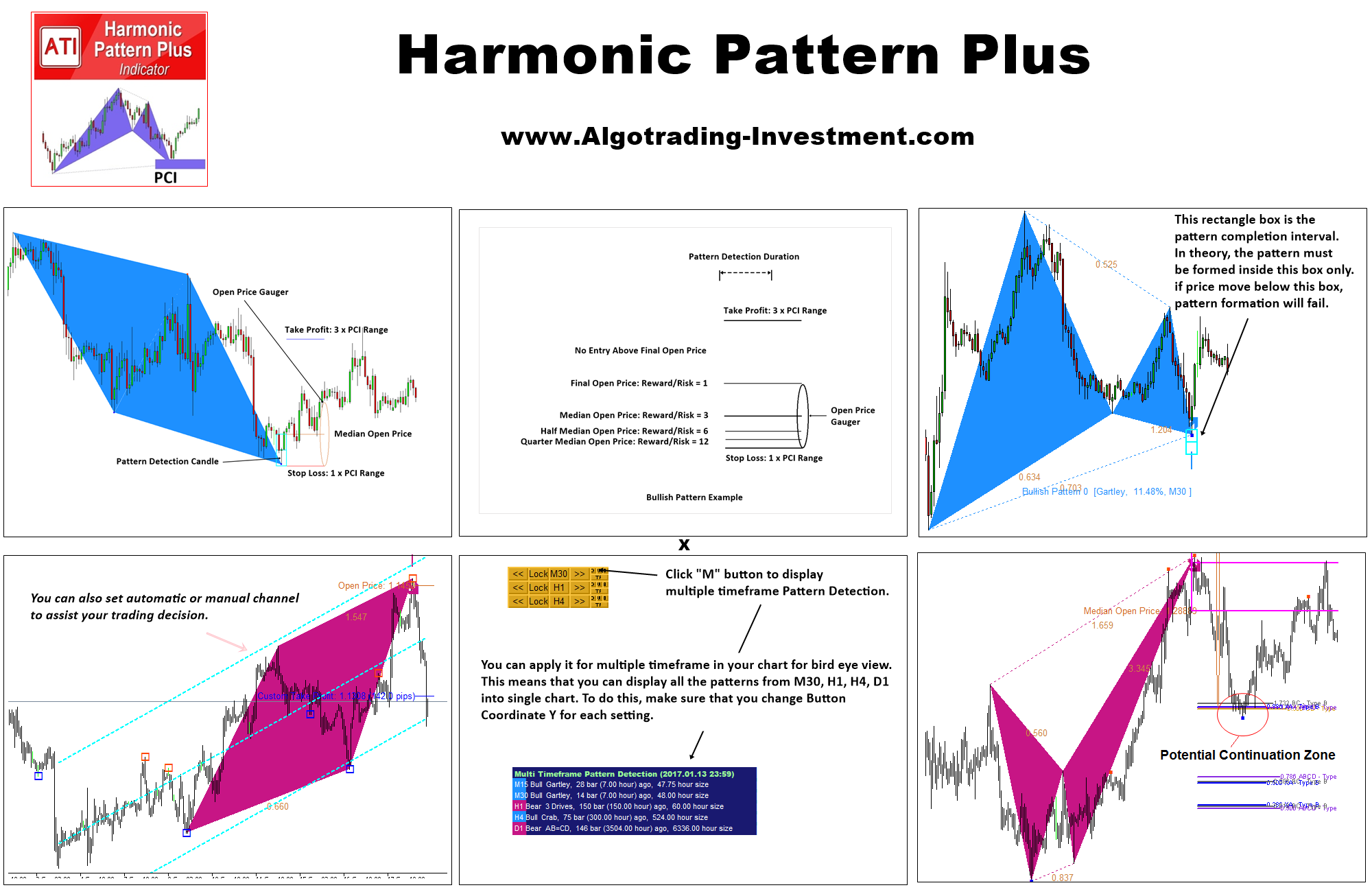

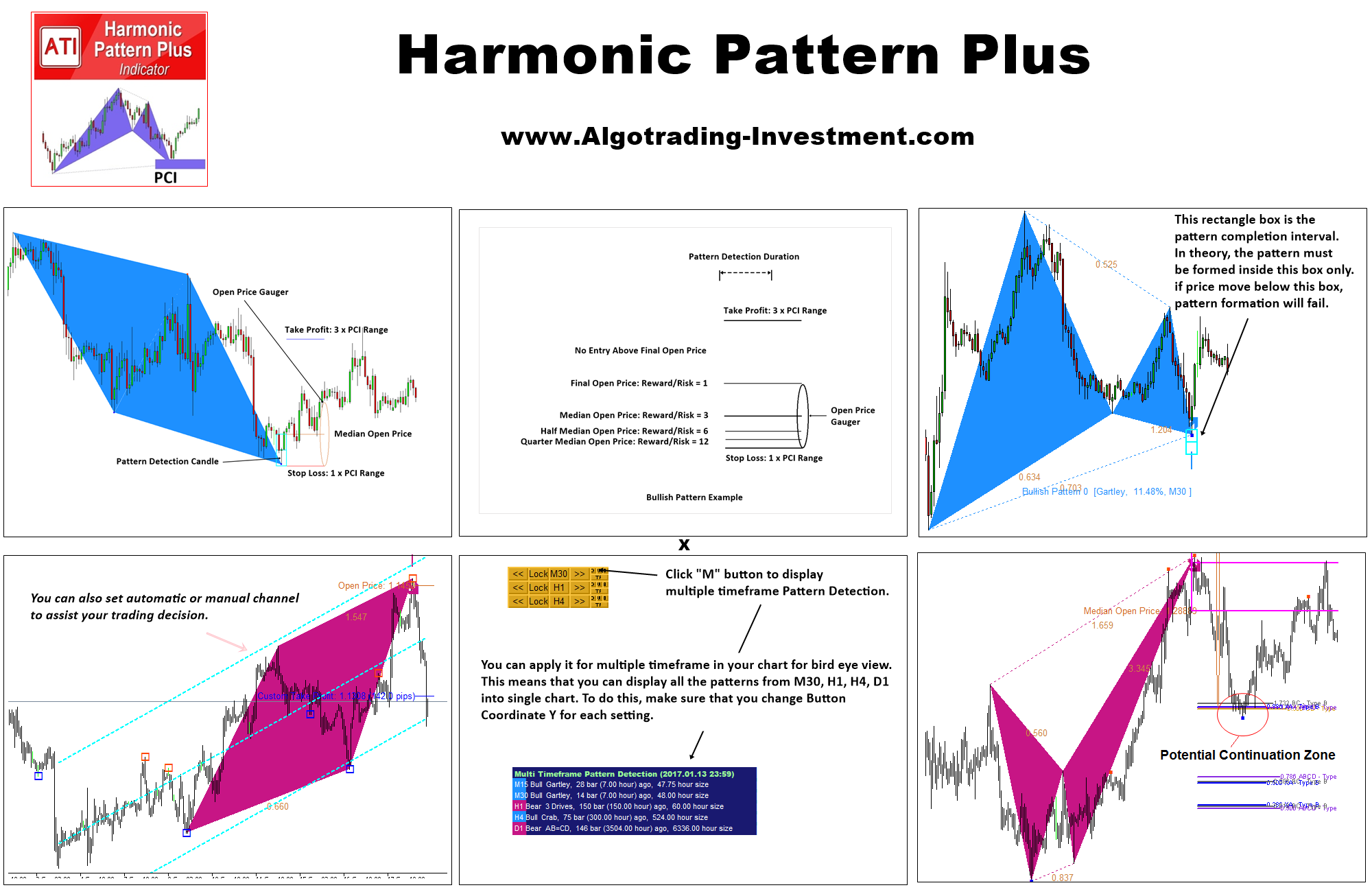

This article provides a guide for Harmonic Pattern and Harmonic Pattern Indicator used in Forex and Stock market. Harmonic Pattern Plus detects the reversal (turning point) patterns in your chart automatically. The software will recommend you to the potential entry and exit for your trading at turning point. With some discretionary thinking together, using Harmonic Pattern Plus is the profitable and convenient way for your trading. With a lot of automation, you have very little work to do for your trading. Harmonic Pattern Plus was evolved for many years to meet the needs for the professional traders. As a result, Harmonic Pattern Plus contains many different features and functionalities in one software. Because of this comprehensive feature, starters can get little frustrated at the beginning. However, it is important to remember that everyone evolve to different stage and different mind-set in his or her trading career. It is better not assume anything too quick. As your skills improve with your trading, you will be glad that Harmonic Pattern Plus offers those features and functionalities for your trading. Obviously, there are clear reasons that those feature and functionality are there. You may not see the benefit now but you can see the benefits in the future. Just avoid making too quick assumption or judgement on the software just after few days of using them. It is important to remember that you do not have to use all of features and functionalities at the same time. You will likely to use some features and functionalities depending on your experience and preferences. Please switch off rest of feature and functionality and only leave the features best suit for your needs. In this article, we provide brief description of features in Harmonic Pattern Plus.

Important Note: This document is applicable to Harmonic Pattern Scenario Planner too. So you can read it if you are Harmonic Pattern Scenario Planner User.

1. Automatic Reversal (turning point) Pattern Detection

It is the primary function of Harmonic Pattern Plus. Once the reversal (turning point) pattern is detected, you can anticipate the turning point in the market. It is not bulletproof strategy but many professional trader uses these patterns successfully in the financial market. Since each pattern show the direction of trading, it is not difficult to follow each pattern for your trading.

You can read full article here. This article explains everything about Harmonic Pattern and Harmonic Pattern Indicator.

https://algotrading-investment.com/2018/10/21/quick-guide-for-harmonic-pattern-plus/

Harmonic Pattern Plus is a repainting but powerful pattern scanner with tons of professional features. It also provides the pattern completion zone to manage your trading risk.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4475

https://www.mql5.com/en/market/product/4488

Harmonic Pattern Scenario Planner is a repainting but predictive pattern scanner. It is the most advanced Harmonic Pattern Scanner available in the market. Of course, it comes with tons of professional features too. It also provides the pattern completion zone to manage your trading risk.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

X3 Chart Pattern Scanner is the non repainting and non lagging Harmonic Pattern and Elliott Wave pattern. This pattern scanner provide you a lot of advantage for your trading from its non repainting and non lagging pattern detection algorithm. This is our next generation chart pattern scanner. At the same time, you can customize each pattern structure to find the most optimal trading entry and exit. It also provides the pattern completion zone to manage your trading risk.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

This article provides a guide for Harmonic Pattern and Harmonic Pattern Indicator used in Forex and Stock market. Harmonic Pattern Plus detects the reversal (turning point) patterns in your chart automatically. The software will recommend you to the potential entry and exit for your trading at turning point. With some discretionary thinking together, using Harmonic Pattern Plus is the profitable and convenient way for your trading. With a lot of automation, you have very little work to do for your trading. Harmonic Pattern Plus was evolved for many years to meet the needs for the professional traders. As a result, Harmonic Pattern Plus contains many different features and functionalities in one software. Because of this comprehensive feature, starters can get little frustrated at the beginning. However, it is important to remember that everyone evolve to different stage and different mind-set in his or her trading career. It is better not assume anything too quick. As your skills improve with your trading, you will be glad that Harmonic Pattern Plus offers those features and functionalities for your trading. Obviously, there are clear reasons that those feature and functionality are there. You may not see the benefit now but you can see the benefits in the future. Just avoid making too quick assumption or judgement on the software just after few days of using them. It is important to remember that you do not have to use all of features and functionalities at the same time. You will likely to use some features and functionalities depending on your experience and preferences. Please switch off rest of feature and functionality and only leave the features best suit for your needs. In this article, we provide brief description of features in Harmonic Pattern Plus.

Important Note: This document is applicable to Harmonic Pattern Scenario Planner too. So you can read it if you are Harmonic Pattern Scenario Planner User.

1. Automatic Reversal (turning point) Pattern Detection

It is the primary function of Harmonic Pattern Plus. Once the reversal (turning point) pattern is detected, you can anticipate the turning point in the market. It is not bulletproof strategy but many professional trader uses these patterns successfully in the financial market. Since each pattern show the direction of trading, it is not difficult to follow each pattern for your trading.

You can read full article here. This article explains everything about Harmonic Pattern and Harmonic Pattern Indicator.

https://algotrading-investment.com/2018/10/21/quick-guide-for-harmonic-pattern-plus/

Harmonic Pattern Plus is a repainting but powerful pattern scanner with tons of professional features. It also provides the pattern completion zone to manage your trading risk.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

https://www.mql5.com/en/market/product/4475

https://www.mql5.com/en/market/product/4488

Harmonic Pattern Scenario Planner is a repainting but predictive pattern scanner. It is the most advanced Harmonic Pattern Scanner available in the market. Of course, it comes with tons of professional features too. It also provides the pattern completion zone to manage your trading risk.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

X3 Chart Pattern Scanner is the non repainting and non lagging Harmonic Pattern and Elliott Wave pattern. This pattern scanner provide you a lot of advantage for your trading from its non repainting and non lagging pattern detection algorithm. This is our next generation chart pattern scanner. At the same time, you can customize each pattern structure to find the most optimal trading entry and exit. It also provides the pattern completion zone to manage your trading risk.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

Young Ho Seo

Fractal Wave Channel

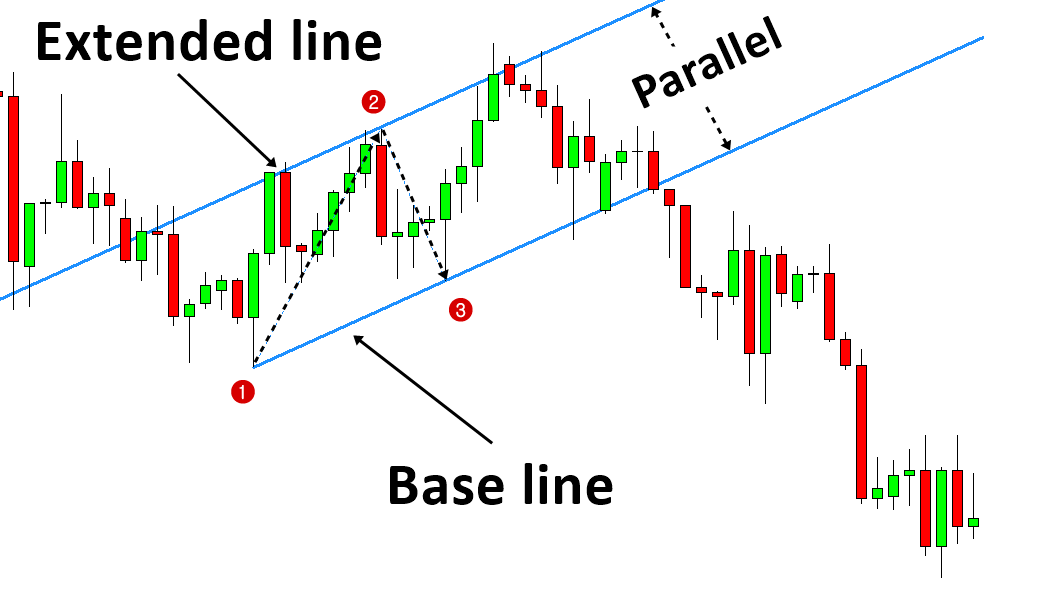

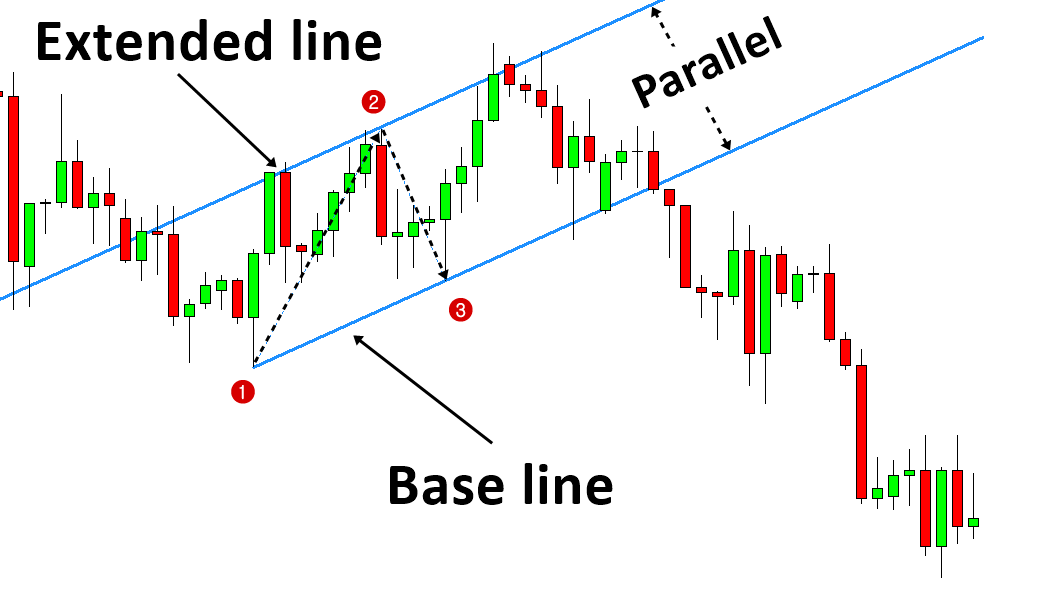

In previous chapter, we have introduced the Fractal Wave Channel. Probably it was not hard in term of how to construct Fractal Wave channels. Now the same idea can be extended using the superimposed patterns. Construction of Superimposed Channel can be done in two steps as before. Firstly, we will draw the base line by connecting point 1 and point 3. Secondly, by projecting the base line in parallel to point 2, we can create the channel over the superimposed pattern. It is typically good idea to aim to draw the channel on the 3 points of larger Equilibrium Fractal Wave. The channel on superimposed pattern has stronger prediction power comparing to the channel created from single EFW. If you are not convinced with this idea, then imagine simple two waves interfering. Two waves can interact together either constructive or destructive. To have the constructive interference, two waves must have the peak or trough overlapping in the same position. When the final points of two equilibrium fractal waves end up in the same position, two equilibrium fractal waves will have the constructive relationship. For example, traders recognized EFW 1 as the trading opportunity will join the force together with traders recognized EFW 2 as the trading opportunity. Hence, the superimposed patterns with two or three EFWs will bring much stronger reaction to the market. In general, more EFWs are superimposed together, its prediction power will grow too. Therefore, superimposed patterns are naturally the best location to place your channel.

You can read full article here. This article explains everything about Wave Channel.

https://algotrading-investment.com/2018/10/21/fractal-wave-channel/

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

In previous chapter, we have introduced the Fractal Wave Channel. Probably it was not hard in term of how to construct Fractal Wave channels. Now the same idea can be extended using the superimposed patterns. Construction of Superimposed Channel can be done in two steps as before. Firstly, we will draw the base line by connecting point 1 and point 3. Secondly, by projecting the base line in parallel to point 2, we can create the channel over the superimposed pattern. It is typically good idea to aim to draw the channel on the 3 points of larger Equilibrium Fractal Wave. The channel on superimposed pattern has stronger prediction power comparing to the channel created from single EFW. If you are not convinced with this idea, then imagine simple two waves interfering. Two waves can interact together either constructive or destructive. To have the constructive interference, two waves must have the peak or trough overlapping in the same position. When the final points of two equilibrium fractal waves end up in the same position, two equilibrium fractal waves will have the constructive relationship. For example, traders recognized EFW 1 as the trading opportunity will join the force together with traders recognized EFW 2 as the trading opportunity. Hence, the superimposed patterns with two or three EFWs will bring much stronger reaction to the market. In general, more EFWs are superimposed together, its prediction power will grow too. Therefore, superimposed patterns are naturally the best location to place your channel.

You can read full article here. This article explains everything about Wave Channel.

https://algotrading-investment.com/2018/10/21/fractal-wave-channel/

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

Young Ho Seo

Harmonic Pattern

Harmonic Pattern is a chart patterns used in Forex and Stock market including Butterfly, Gartley, Bat, Alternate Bat, AB=CD, Shark, Crab, Deep Crab, Cypher, 5-0 Patterns, 3 Drives Pattern and so on. Harmonic patterns are another fractal wave patterns that frequently used by many financial traders. Harmonic patterns are typically made up from two or three triangles (i.e. three price swings or four price swings). The structures of the harmonic pattern are based on the Fibonacci ratios. Hence, some people consider Harmonic pattern as an advanced Fibonacci price patterns.

The history of the harmonic pattern goes back to the Gartley’s book “Profits in the Stock Market” in 1935. At that time, Gartley described the trend reversal pattern on page 222 of his book. The pattern become popular in the late 1990s (Pesavento and Shapiro, 1997). Since then, many traders developed the common interest in looking for the repeating patterns in the financial markets. The harmonic patterns were refined many times in several decades. Harmonic trader emphasizes that the patterns are not only repeating in history but they also follow natural orders. Although few different references exist about the meaning of the natural orders, the natural orders mostly means the periods of the neighbouring waves in the Fibonacci relationship (Pesavento and Shapiro, 1997). Fibonacci ratio derived from Fibonacci numbers are the core relationship used in harmonic pattern identification.

Two main elements of Harmonic pattern trading are the pattern recognition and the market timing. Between those two elements, the pattern recognition is the prior task before the market timing. Mostly harmonic patterns consist of five points except few patterns. The five points are denoted as XABCD conventionally (Figure 1-2). Harmonic Pattern trading is the typical mean reversion trading strategy. It assumes that the market will change direction, for example, from buy to sell or from sell to buy. In fact, the harmonic pattern detection is equivalent to detecting the turning point. Although the accuracy of the turning point prediction is subject to the probabilistic nature, harmonic pattern trading is popular among traders.

You can read full article here. This article explains everything about Harmonic Pattern.

https://algotrading-investment.com/2022/06/22/harmonic-pattern/

Harmonic Pattern Detection

Manual detection of Harmonic Pattern is a tedious task. Most of traders use Harmonic Pattern Indicator or Harmonic Pattern Scanner, which uses automated algorithm to detect Harmonic Patterns. Each Harmonic Pattern Indicator and Harmonic Pattern Scanner have differnt attributes. The important point about Harmonic Pattern detection is that there is a trade off between fast signal and repainting. Here we list four types of Harmonic Pattern Detection for your information.

Type 1: Non lagging (fast signal) but repainting

option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint. This is almost considered as standard Harmonic Pattern Indicator. Even if they are repainting, harmonic pattern trader just accept it as it is. 99% of time, this is the harmonic pattern product you will get from the market whether they are free or paid one. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy.

Harmonic pattern plus is type 1 Harmonic Pattern Indicator. It is extremely good product for the price. With dozens of powerful features including Pattern Completion Interval, Potential Reversal Zone, Potential Continuation Zone, Automatic Stop loss and take profit sizing. This is type 1 harmonic pattern indicator.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Type 2: Lagging (slow signal) but non repainting

no option to enter at turning point (i.e. early signal). This type of indicator turns harmonic pattern indicator as slow as moving average cross over. It might be not overly attractive option for your trading. Indicator does not show the failed pattern. Hence, you can not use historical patterns to tune your strategy but last pattern does not repaint. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy. Probably about 1% of harmonic pattern indicator is this type.

Type 3: Detecting pattern at point C but repainting

option to enter at turning point. Indicator detect pattern too early and you have to wait quite bit of time until price move near the point D. In fact, price may not move near point D. You might just waste your time waiting for the pattern. Indicator does not show the failed pattern and last pattern can repaint. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy. Probably about 1% of harmonic pattern indicator is this type.

Harmonic Pattern Scenario Planner can be used like type 1 or type 3 Harmonic Pattern Detector. With additional features of predicting future harmonic patterns, this is very tactical harmonic pattern indicator with advanced simulation capability on top of the powerful features of harmonic pattern plus.

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

Type 4: Non lagging (fast signal) and non repainting

option to enter from turning point. At the same time, the pattern is not repainting. This is hybrid of all above three system and can be considered as the most powerful harmonic pattern indicator. You can trade live with this indicators and you can also use historical patterns to fine tune your strategy. With this indicator, you are complying perfectly with the statement “Trade What you See”.

X3 Chart Pattern Scanner is type 4 Harmonic Pattern Indicator, which can be considered as the hybrid of type 1, type 2 and type 3. With non repainting and non lagging algorithm, this tool can detect with Harmonic Pattern, Elliott Wave Pattern, X3 Pattern structure for your trading. As a bonus, it provides your Japanese candlestick patterns too. X3 Chart Pattern Scanner is type 4 harmonic pattern indicator, which means that you can fine tune your strategy using historical patterns while you are trading the same patterns on live trading.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Harmonic Pattern is a chart patterns used in Forex and Stock market including Butterfly, Gartley, Bat, Alternate Bat, AB=CD, Shark, Crab, Deep Crab, Cypher, 5-0 Patterns, 3 Drives Pattern and so on. Harmonic patterns are another fractal wave patterns that frequently used by many financial traders. Harmonic patterns are typically made up from two or three triangles (i.e. three price swings or four price swings). The structures of the harmonic pattern are based on the Fibonacci ratios. Hence, some people consider Harmonic pattern as an advanced Fibonacci price patterns.

The history of the harmonic pattern goes back to the Gartley’s book “Profits in the Stock Market” in 1935. At that time, Gartley described the trend reversal pattern on page 222 of his book. The pattern become popular in the late 1990s (Pesavento and Shapiro, 1997). Since then, many traders developed the common interest in looking for the repeating patterns in the financial markets. The harmonic patterns were refined many times in several decades. Harmonic trader emphasizes that the patterns are not only repeating in history but they also follow natural orders. Although few different references exist about the meaning of the natural orders, the natural orders mostly means the periods of the neighbouring waves in the Fibonacci relationship (Pesavento and Shapiro, 1997). Fibonacci ratio derived from Fibonacci numbers are the core relationship used in harmonic pattern identification.

Two main elements of Harmonic pattern trading are the pattern recognition and the market timing. Between those two elements, the pattern recognition is the prior task before the market timing. Mostly harmonic patterns consist of five points except few patterns. The five points are denoted as XABCD conventionally (Figure 1-2). Harmonic Pattern trading is the typical mean reversion trading strategy. It assumes that the market will change direction, for example, from buy to sell or from sell to buy. In fact, the harmonic pattern detection is equivalent to detecting the turning point. Although the accuracy of the turning point prediction is subject to the probabilistic nature, harmonic pattern trading is popular among traders.

You can read full article here. This article explains everything about Harmonic Pattern.

https://algotrading-investment.com/2022/06/22/harmonic-pattern/

Harmonic Pattern Detection

Manual detection of Harmonic Pattern is a tedious task. Most of traders use Harmonic Pattern Indicator or Harmonic Pattern Scanner, which uses automated algorithm to detect Harmonic Patterns. Each Harmonic Pattern Indicator and Harmonic Pattern Scanner have differnt attributes. The important point about Harmonic Pattern detection is that there is a trade off between fast signal and repainting. Here we list four types of Harmonic Pattern Detection for your information.

Type 1: Non lagging (fast signal) but repainting

option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint. This is almost considered as standard Harmonic Pattern Indicator. Even if they are repainting, harmonic pattern trader just accept it as it is. 99% of time, this is the harmonic pattern product you will get from the market whether they are free or paid one. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy.

Harmonic pattern plus is type 1 Harmonic Pattern Indicator. It is extremely good product for the price. With dozens of powerful features including Pattern Completion Interval, Potential Reversal Zone, Potential Continuation Zone, Automatic Stop loss and take profit sizing. This is type 1 harmonic pattern indicator.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Type 2: Lagging (slow signal) but non repainting

no option to enter at turning point (i.e. early signal). This type of indicator turns harmonic pattern indicator as slow as moving average cross over. It might be not overly attractive option for your trading. Indicator does not show the failed pattern. Hence, you can not use historical patterns to tune your strategy but last pattern does not repaint. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy. Probably about 1% of harmonic pattern indicator is this type.

Type 3: Detecting pattern at point C but repainting

option to enter at turning point. Indicator detect pattern too early and you have to wait quite bit of time until price move near the point D. In fact, price may not move near point D. You might just waste your time waiting for the pattern. Indicator does not show the failed pattern and last pattern can repaint. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy. Probably about 1% of harmonic pattern indicator is this type.

Harmonic Pattern Scenario Planner can be used like type 1 or type 3 Harmonic Pattern Detector. With additional features of predicting future harmonic patterns, this is very tactical harmonic pattern indicator with advanced simulation capability on top of the powerful features of harmonic pattern plus.

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

Type 4: Non lagging (fast signal) and non repainting

option to enter from turning point. At the same time, the pattern is not repainting. This is hybrid of all above three system and can be considered as the most powerful harmonic pattern indicator. You can trade live with this indicators and you can also use historical patterns to fine tune your strategy. With this indicator, you are complying perfectly with the statement “Trade What you See”.

X3 Chart Pattern Scanner is type 4 Harmonic Pattern Indicator, which can be considered as the hybrid of type 1, type 2 and type 3. With non repainting and non lagging algorithm, this tool can detect with Harmonic Pattern, Elliott Wave Pattern, X3 Pattern structure for your trading. As a bonus, it provides your Japanese candlestick patterns too. X3 Chart Pattern Scanner is type 4 harmonic pattern indicator, which means that you can fine tune your strategy using historical patterns while you are trading the same patterns on live trading.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Pattern Completion Zone VS Potential Reversal Zone

In previous chapter, we have described the Pattern Completion Zone, also known as Pattern Completion Interval, in details. Now many harmonic pattern trader can be curious how the Pattern Completion Zone (PCZ) is different from the Potential Reversal Zone (PRZ). In first place, as the PCZ and PRZ are derived from different process, they are different tool to trader. Having said that, the deriving process for PCZ and PRZ might be too complicated causing some traders to confuse the concept of each other. For this reason, we will clarify the difference by directly comparing PCZ and PRZ look. Let us look at the Potential Reversal Zone. So what is Potential Reversal Zone? Simply speaking potential Reversal zone is the area where three or four Fibonacci levels are converging together. Potential Reversal Zone can be used to detect the final Point D of the Harmonic Pattern by projecting several Fibonacci retracements respectively from the point X, A, B and C. The area of the Potential Reversal Zone can be defined by the top and the bottom projected levels in the all projected levels as shown in Figure 5-1.

The main difference between PCZ and PRZ is that Pattern Completion Zone forms the strict Symmetrical Trading Zone around the ideal Point D (Figure 5-3 and Figure 5-4). The Potential Reversal Zone (PRZ) does not form the symmetrical zone. However, the PRZ area formation is dependent on the location of each Fibonacci level projections as shown in Figure 5-1 and Figure 5-2. Sometime PRZ area can form the symmetrical trading zone but it is only by chance. Most of time, Potential Reversal Zone will not form the symmetrical trading zone. On the other hands, Pattern Completion Zone will strictly form symmetrical trading zone for every harmonic pattern. Due to this symmetrical property of the Pattern Completion Zone (= Pattern Completion Interval), trader can use many different trading strategies around the symmetrical trading zone beyond the classic harmonic pattern trading setup. With Pattern completion Zone, you can expand your classic trend reversal entry to hedging and breakout trading by setting identical but opposite trading. For example, for bullish Harmonic Pattern formation, you are able to setup the buy and sell hedging positions or straddle breakout setup around the Pattern Completion Zone. This is possible because the Pattern Completion Zone provides the median open price, which can be mirrored around the Ideal Point D.

In addition, Pattern Completion Zone provides you the direct numerical description corresponding to the size of the Harmonic Pattern. Therefore, the size of symmetrical trading zone around the Pattern Completion Zone is a sensible measurement for your stop loss and take profit for each Harmonic Pattern. Especially, once you have mastered the Pattern Completion Zone for your trading, you can gauge your Reward/Risk Ratio with real time market data without the need of any other additional tools. You can expand this with limit and stop order for better managing your order and risk. Overall, Pattern Completion Zone can provide you precise and fast decision-making process for your Harmonic Pattern Trading. In next chapter, we will continue to show you how the symmetrical trading zone works to manage your order and risk in details.

If you want to access automated Harmonic Pattern Detector, then you can also buy the Harmonic Pattern Plus or X3 Chart Pattern Scanner available in MetaTrader 4 and MetaTrader 5. In Harmonic Pattern Plus, you can access many additional features on top of the harmonic pattern trading signals. For example, you can also access Advanced Channel and around 52 Japanese candlestick pattern. It will also draw the Pattern Completion Interval automatically in your chart helping you to set your stop loss and take profit targets. It is a repainting indicator but it comes at the affordable price.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

If you need more advanced one than Harmonic Pattern Plus, then you can use our X3 Chart Pattern Scanner. X3 Chart Pattern Scanner is the non repainting and non lagging Harmonic Pattern and Elliott Wave Pattern Scanner with multiple of advanced features. You can even customize the patterns you want to detect by changing their pattern structure. At the same time, you can use both repainting and non repainting Harmonic Pattern Indicator together. This means that you can combine to use Harmonic Pattern Plus with X3 Chart Pattern Scanner if you wish.

Below are the Links to X3 Chart Pattern Scanner.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

You can read Guide to Precision Harmonic Pattern Trading to understand more about the Harmonic Pattern Strategy.

https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

In previous chapter, we have described the Pattern Completion Zone, also known as Pattern Completion Interval, in details. Now many harmonic pattern trader can be curious how the Pattern Completion Zone (PCZ) is different from the Potential Reversal Zone (PRZ). In first place, as the PCZ and PRZ are derived from different process, they are different tool to trader. Having said that, the deriving process for PCZ and PRZ might be too complicated causing some traders to confuse the concept of each other. For this reason, we will clarify the difference by directly comparing PCZ and PRZ look. Let us look at the Potential Reversal Zone. So what is Potential Reversal Zone? Simply speaking potential Reversal zone is the area where three or four Fibonacci levels are converging together. Potential Reversal Zone can be used to detect the final Point D of the Harmonic Pattern by projecting several Fibonacci retracements respectively from the point X, A, B and C. The area of the Potential Reversal Zone can be defined by the top and the bottom projected levels in the all projected levels as shown in Figure 5-1.

The main difference between PCZ and PRZ is that Pattern Completion Zone forms the strict Symmetrical Trading Zone around the ideal Point D (Figure 5-3 and Figure 5-4). The Potential Reversal Zone (PRZ) does not form the symmetrical zone. However, the PRZ area formation is dependent on the location of each Fibonacci level projections as shown in Figure 5-1 and Figure 5-2. Sometime PRZ area can form the symmetrical trading zone but it is only by chance. Most of time, Potential Reversal Zone will not form the symmetrical trading zone. On the other hands, Pattern Completion Zone will strictly form symmetrical trading zone for every harmonic pattern. Due to this symmetrical property of the Pattern Completion Zone (= Pattern Completion Interval), trader can use many different trading strategies around the symmetrical trading zone beyond the classic harmonic pattern trading setup. With Pattern completion Zone, you can expand your classic trend reversal entry to hedging and breakout trading by setting identical but opposite trading. For example, for bullish Harmonic Pattern formation, you are able to setup the buy and sell hedging positions or straddle breakout setup around the Pattern Completion Zone. This is possible because the Pattern Completion Zone provides the median open price, which can be mirrored around the Ideal Point D.