Young Ho Seo / Профиль

- Информация

|

10+ лет

опыт работы

|

62

продуктов

|

1170

демо-версий

|

|

4

работ

|

0

сигналов

|

0

подписчиков

|

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

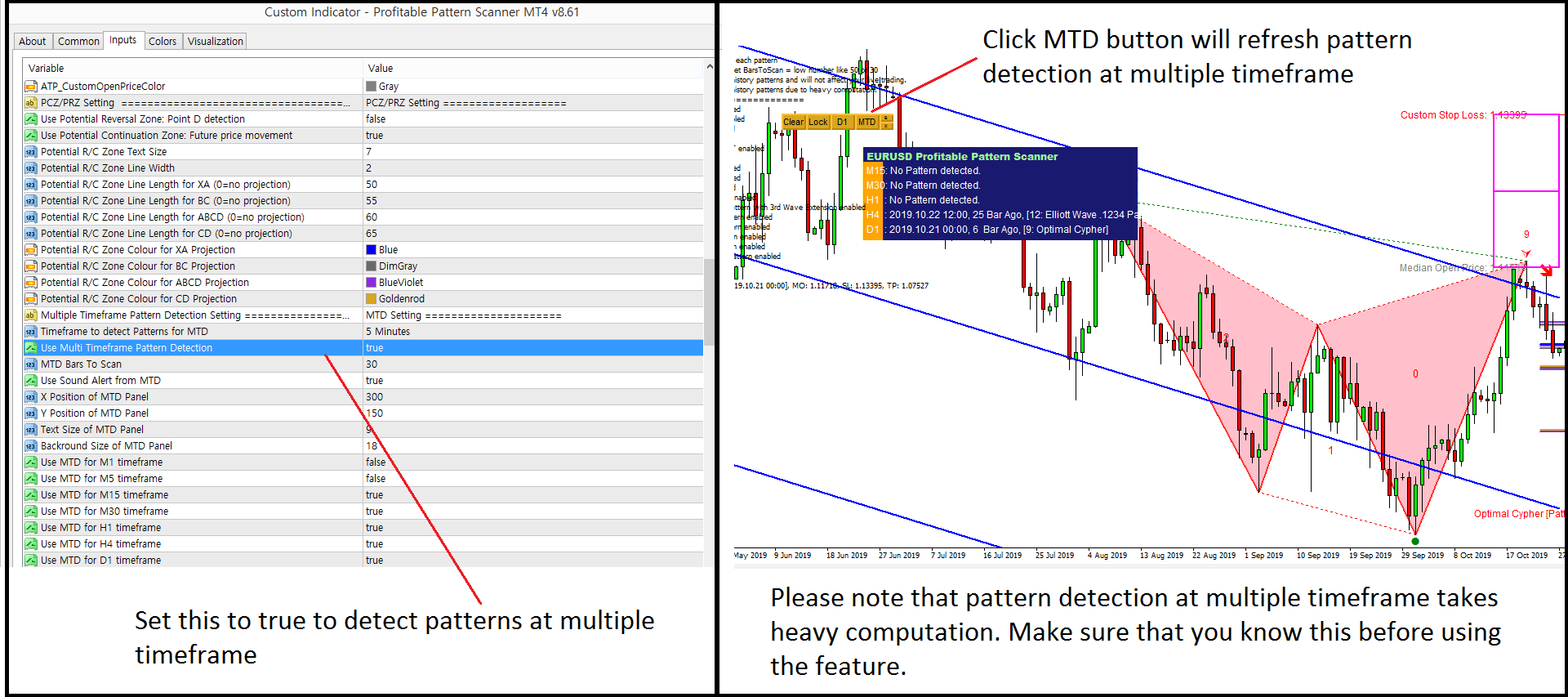

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

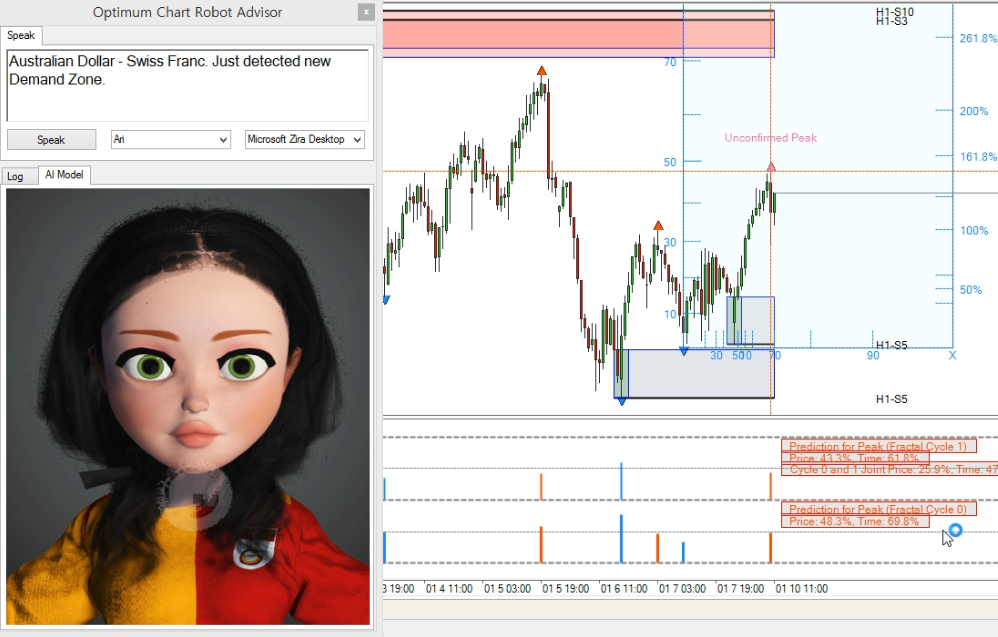

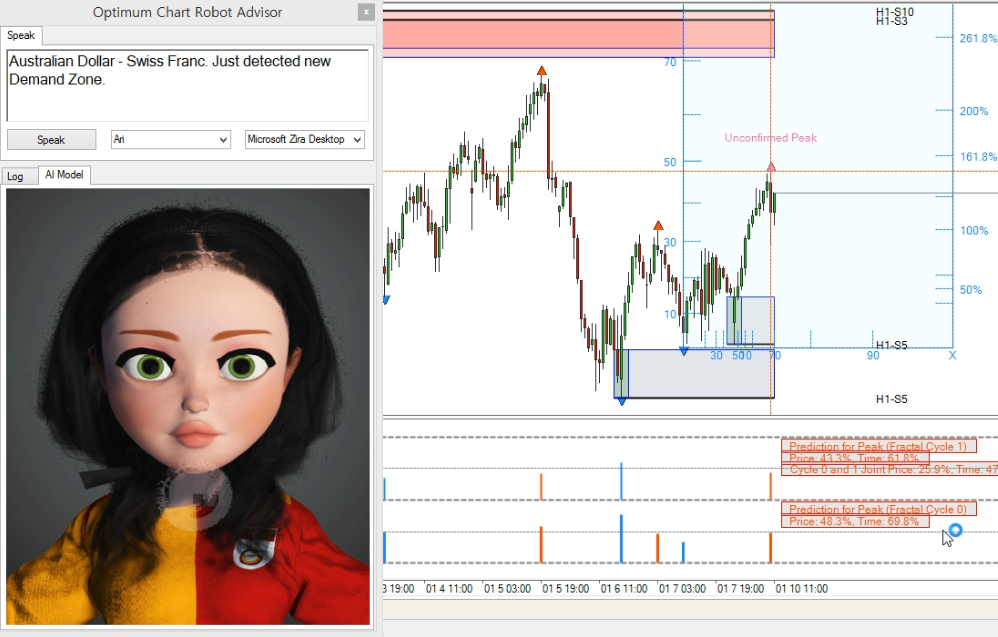

Turning Point Prediction for Forex Trading

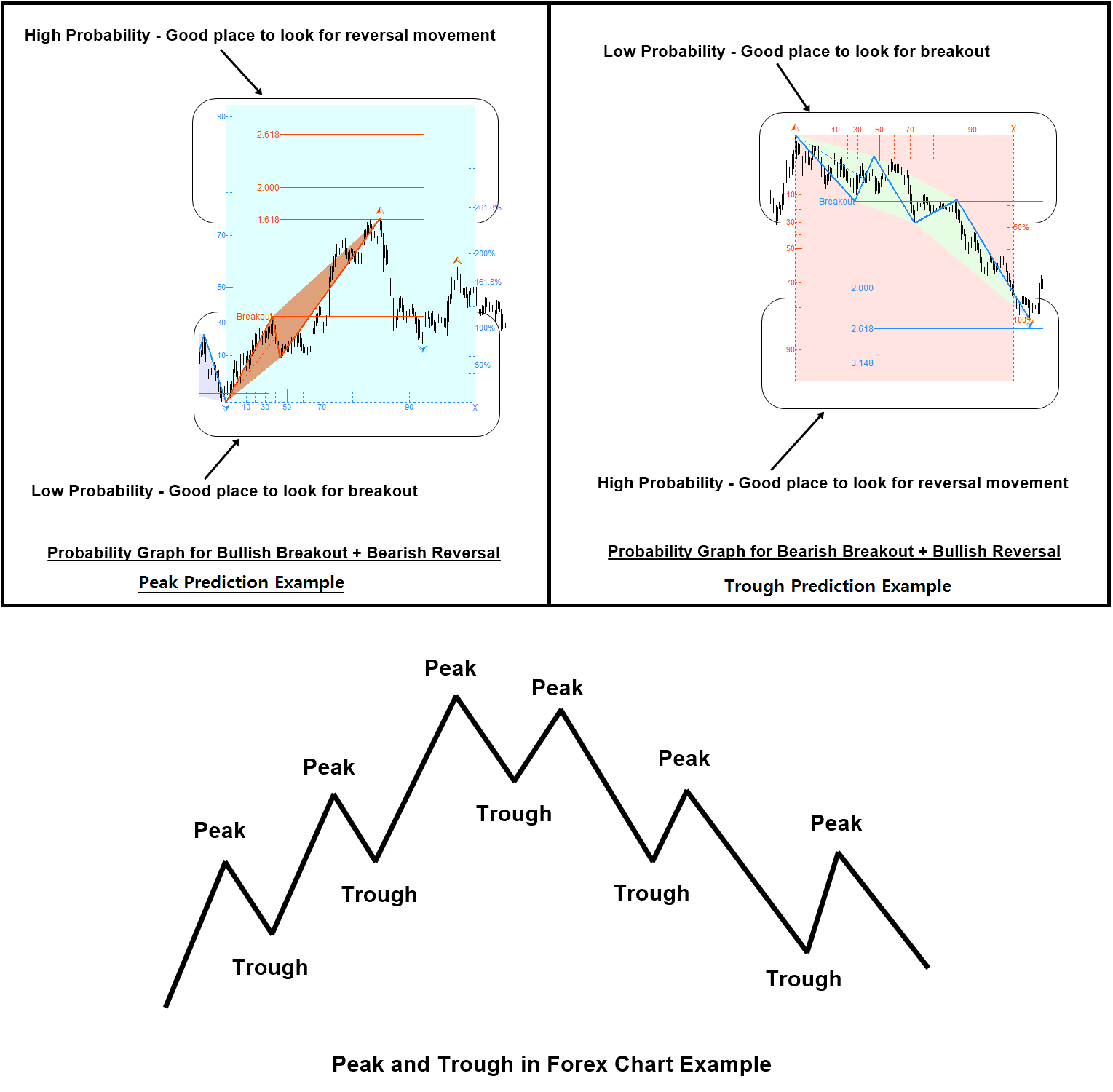

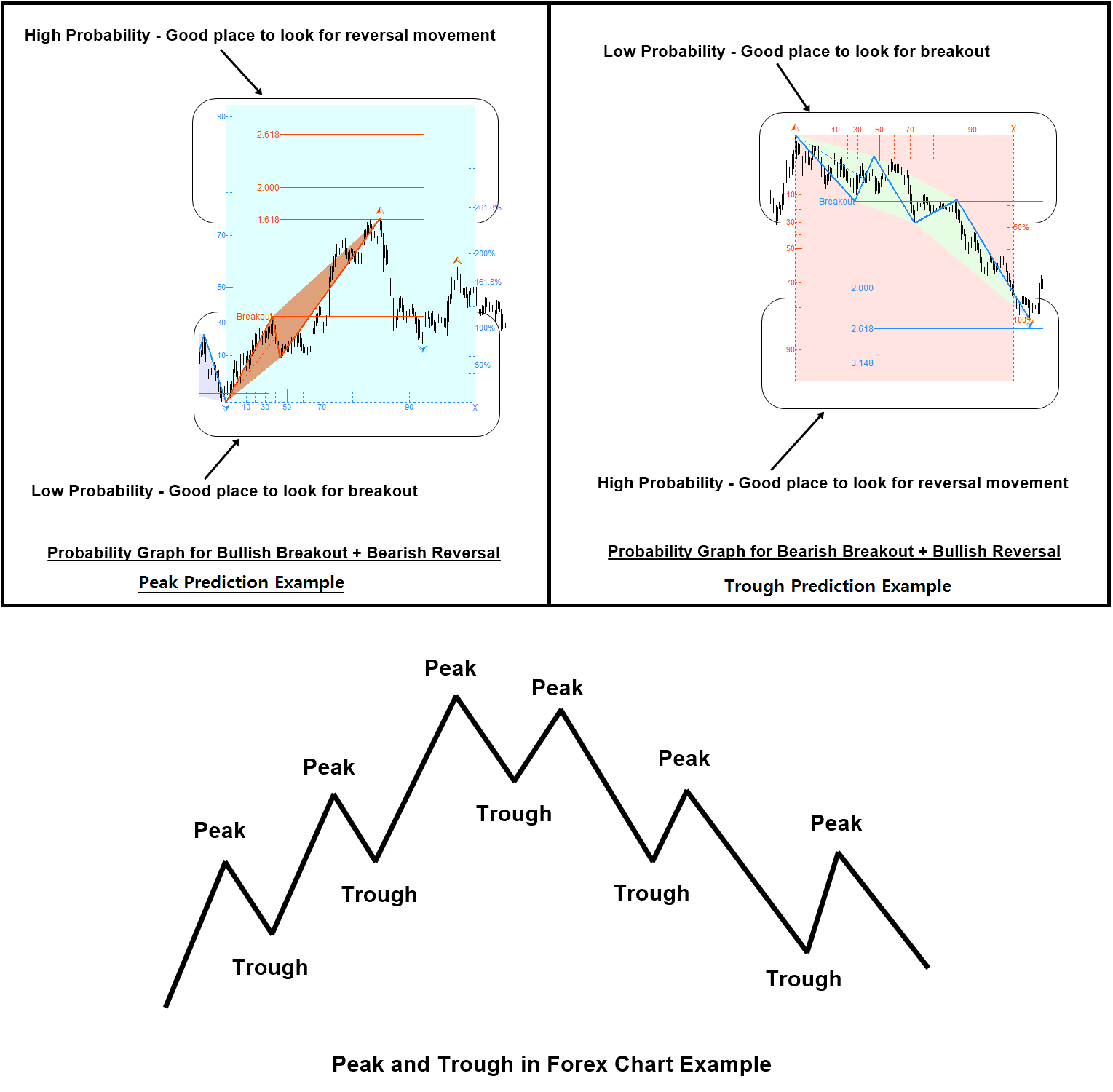

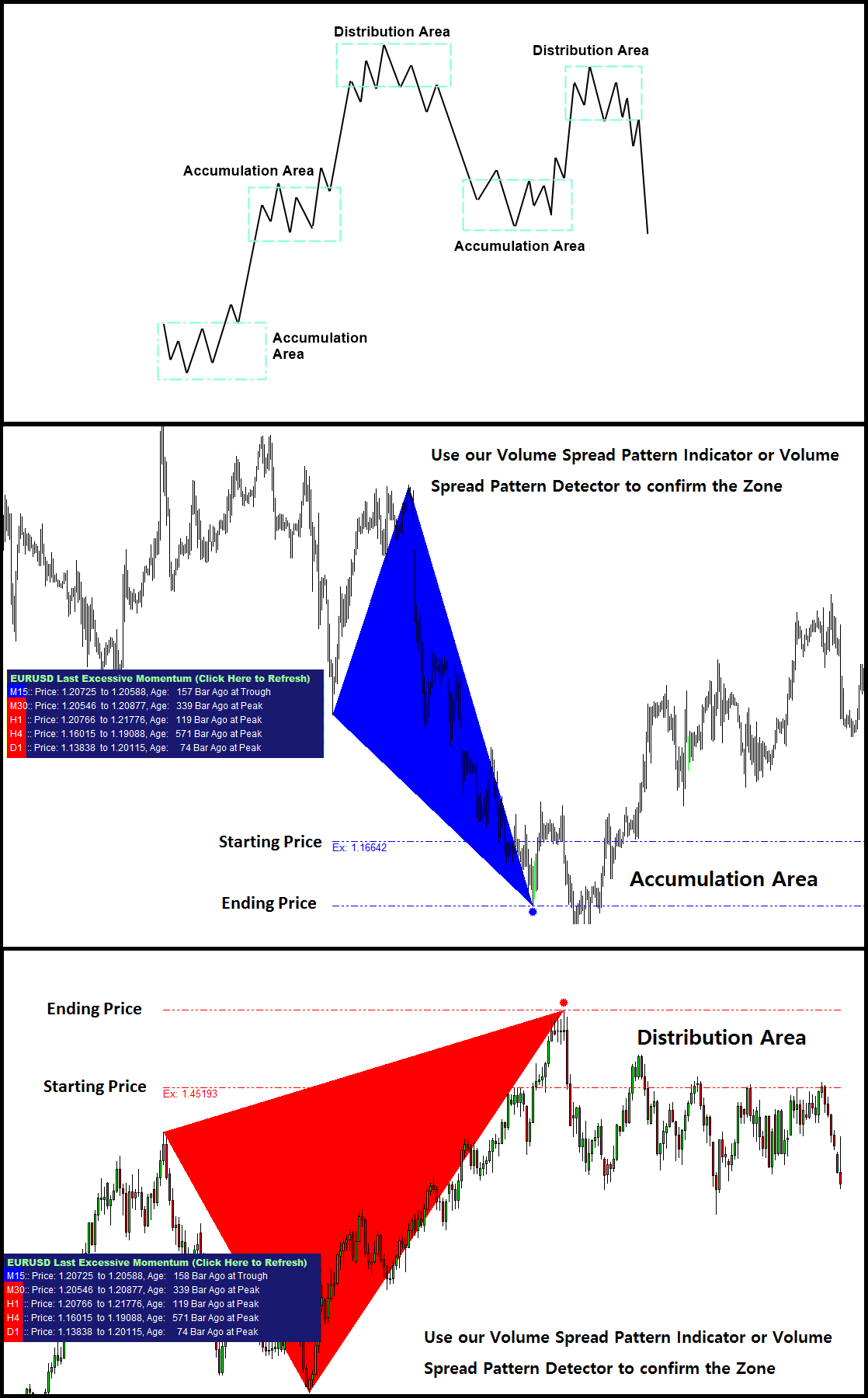

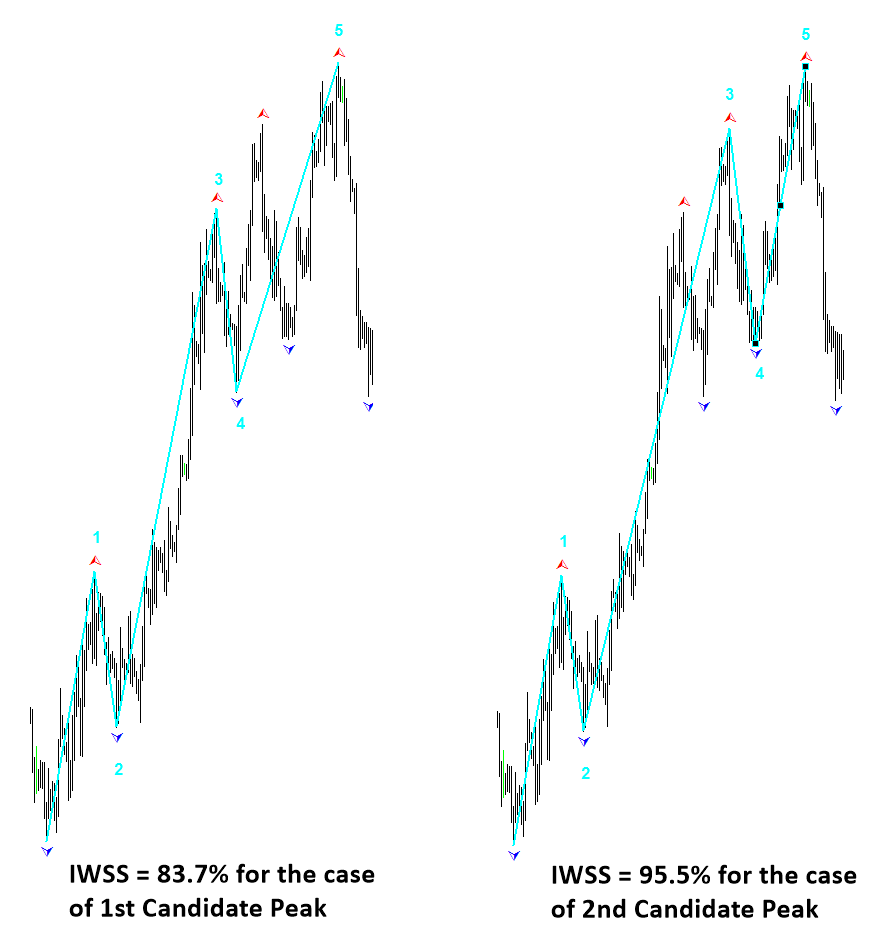

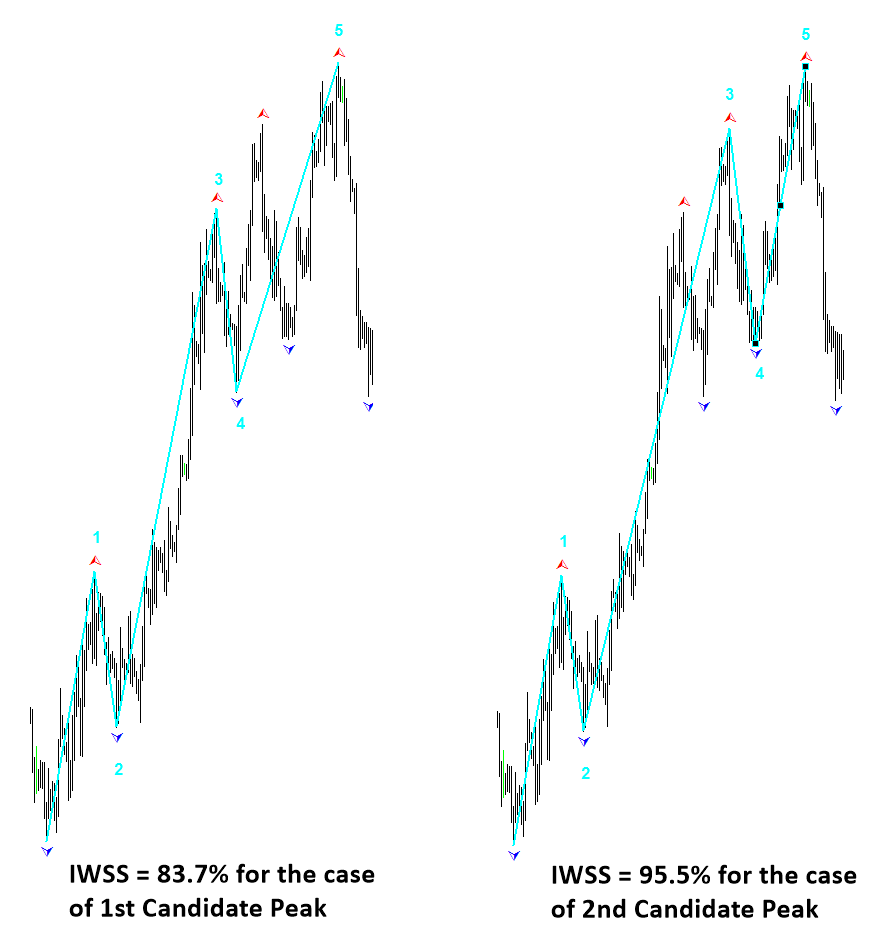

Fractal Pattern Scanner provides the ability to predict the turning point in the financial market. In this article, we provide the practical guide line on how to use the provided turning point prediction for your day trading. The turning point prediction consists of two prediction types. The first one is the prediction of trough. In the trough prediction, we are trying to predict the possible bullish turning point while the price is falling. The second one is the prediction of Peak. In peak prediction, we are trying to predict the possible bearish turning point while the price is rising. The turning point prediction is useful because it tells us the complete story of the price series. For example, it will provide you the visual guidance of price movement + it will also provides the probability information. It is a true hybrid of statistical prediction and technical analysis. As a trader, we can manage the entry and exit with the turning point prediction. Another advantage is that the probability provides us the opportunity for the second level of decision making. This is in fact the important part because many other technical indicator miss to provide the probability information, which we can use for the more advanced level of decision making. With ability to read these probability, practically we can use these turning point prediction to decide the price action in the financial market. They are the good predictor of the price movement assuming you are not misusing the probability information.

Here are the breakdown of the price action with the turning point prediction. We also provide the screenshot to explain each peak and trough cases with some visual aid. As you can see from the screenshot, we can respectively draw two price action for each peak and trough prediction.

When We Predict the Peak:

1. Possible bullish breakout trading opportunity at low probability area

2. Possible bearish reversal trading opportunity at high probability area

When We Predict the Trough:

1. Possible bearish breakout trading opportunity at low probability area

2. Possible bullish reversal trading opportunity at high probability area.

Probably, guessing of these price actions is so natural during the turning point prediction. The screenshot below is for you to confirm your understanding. If the term of peak and trough is not familiar to you, then google some physics articles explaining Peak and Trough in wave cycle. We are using the identical term here as we do not want to reinvent the wheel again. Once, you understand the cycle with peak and trough in those articles, it would be much easier to project the action items for your trading with this article too. In my opinion, the turning point prediction is in its unique position between the statistical prediction and technical analysis. Probably we can consider it as the hybrid of both world. We will recommend you enjoying this scientific advancement for your trading.

For example, you can watch this video titled as “Breakout Trading vs Reversal Trading – Turn Support & Resistance to Killer Strategy” to understand how to control the market timing with this probability tool.

YouTube: https://www.youtube.com/watch?v=UbORmOacKIQ

Below is the landing page for Fractal Pattern Scanner in MetaTrader version.

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Fractal Pattern Scanner provides the ability to predict the turning point in the financial market. In this article, we provide the practical guide line on how to use the provided turning point prediction for your day trading. The turning point prediction consists of two prediction types. The first one is the prediction of trough. In the trough prediction, we are trying to predict the possible bullish turning point while the price is falling. The second one is the prediction of Peak. In peak prediction, we are trying to predict the possible bearish turning point while the price is rising. The turning point prediction is useful because it tells us the complete story of the price series. For example, it will provide you the visual guidance of price movement + it will also provides the probability information. It is a true hybrid of statistical prediction and technical analysis. As a trader, we can manage the entry and exit with the turning point prediction. Another advantage is that the probability provides us the opportunity for the second level of decision making. This is in fact the important part because many other technical indicator miss to provide the probability information, which we can use for the more advanced level of decision making. With ability to read these probability, practically we can use these turning point prediction to decide the price action in the financial market. They are the good predictor of the price movement assuming you are not misusing the probability information.

Here are the breakdown of the price action with the turning point prediction. We also provide the screenshot to explain each peak and trough cases with some visual aid. As you can see from the screenshot, we can respectively draw two price action for each peak and trough prediction.

When We Predict the Peak:

1. Possible bullish breakout trading opportunity at low probability area

2. Possible bearish reversal trading opportunity at high probability area

When We Predict the Trough:

1. Possible bearish breakout trading opportunity at low probability area

2. Possible bullish reversal trading opportunity at high probability area.

Probably, guessing of these price actions is so natural during the turning point prediction. The screenshot below is for you to confirm your understanding. If the term of peak and trough is not familiar to you, then google some physics articles explaining Peak and Trough in wave cycle. We are using the identical term here as we do not want to reinvent the wheel again. Once, you understand the cycle with peak and trough in those articles, it would be much easier to project the action items for your trading with this article too. In my opinion, the turning point prediction is in its unique position between the statistical prediction and technical analysis. Probably we can consider it as the hybrid of both world. We will recommend you enjoying this scientific advancement for your trading.

For example, you can watch this video titled as “Breakout Trading vs Reversal Trading – Turn Support & Resistance to Killer Strategy” to understand how to control the market timing with this probability tool.

YouTube: https://www.youtube.com/watch?v=UbORmOacKIQ

Below is the landing page for Fractal Pattern Scanner in MetaTrader version.

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Young Ho Seo

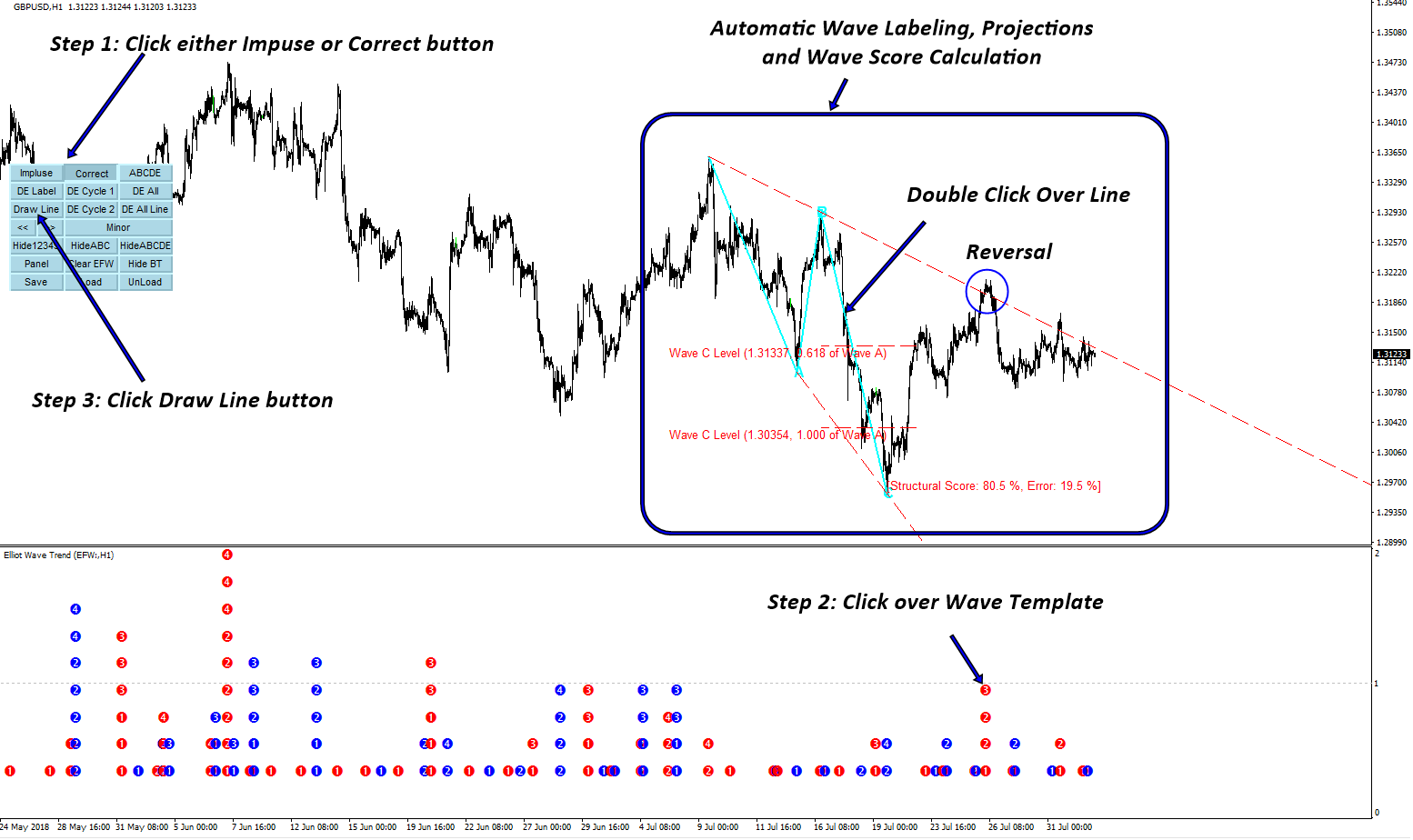

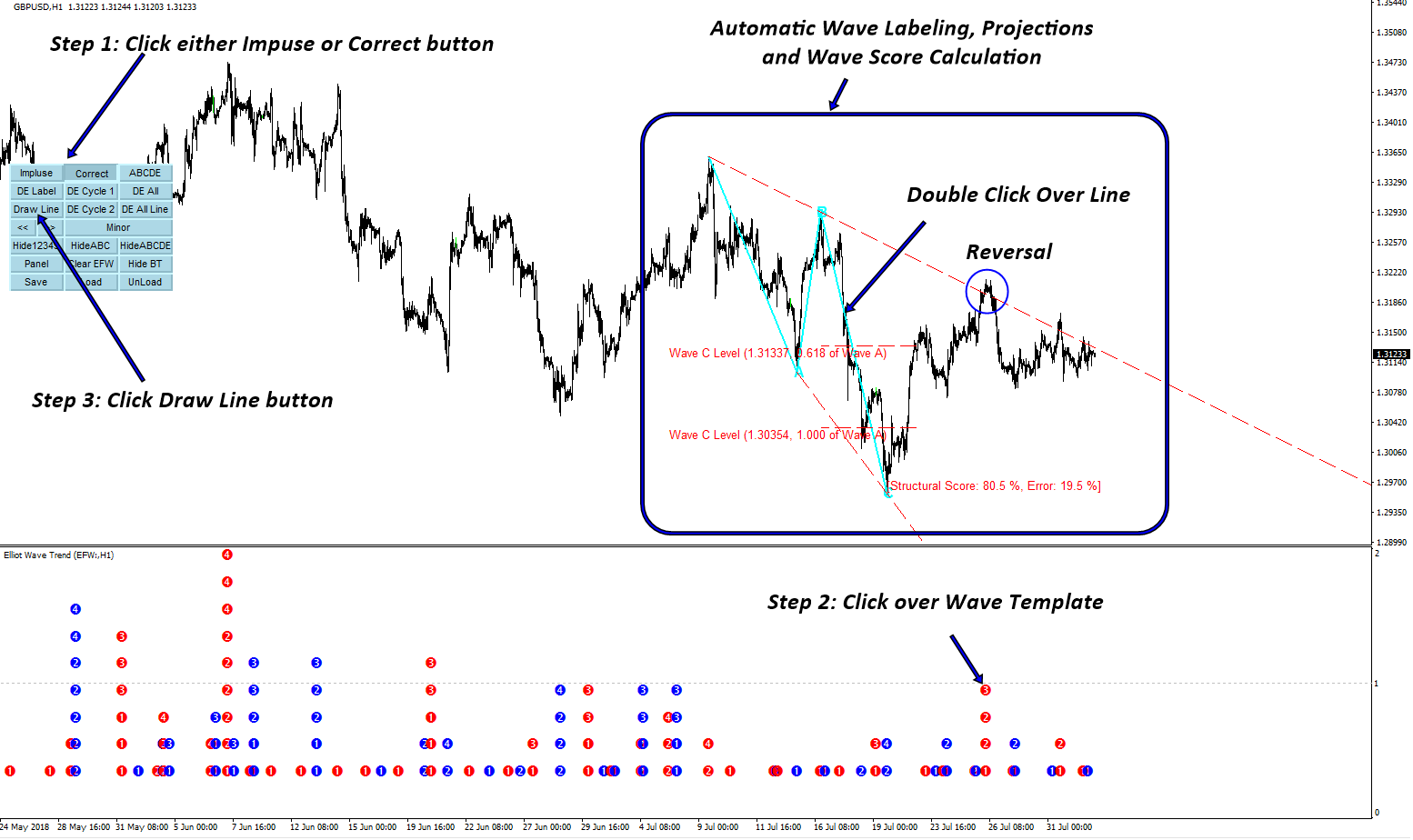

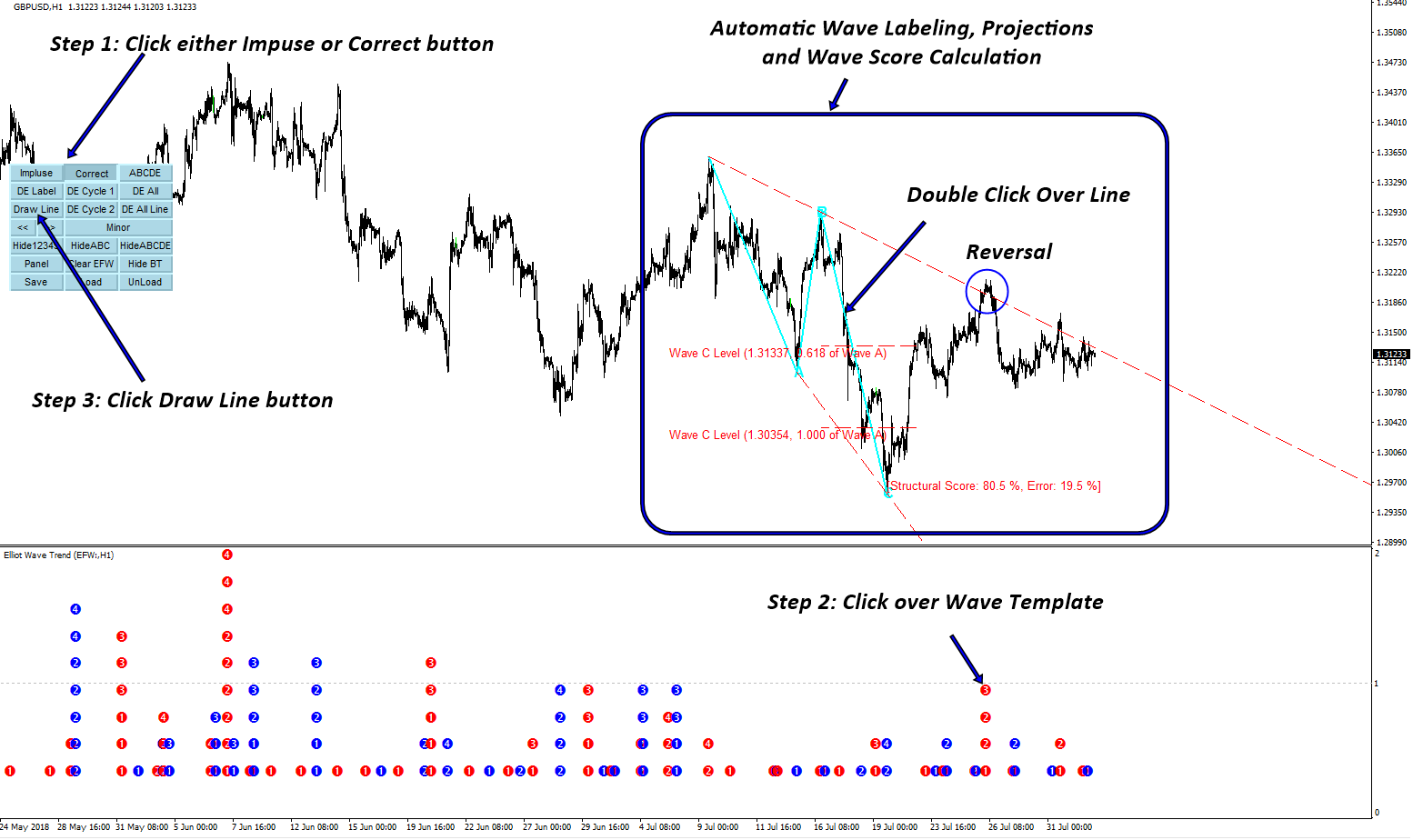

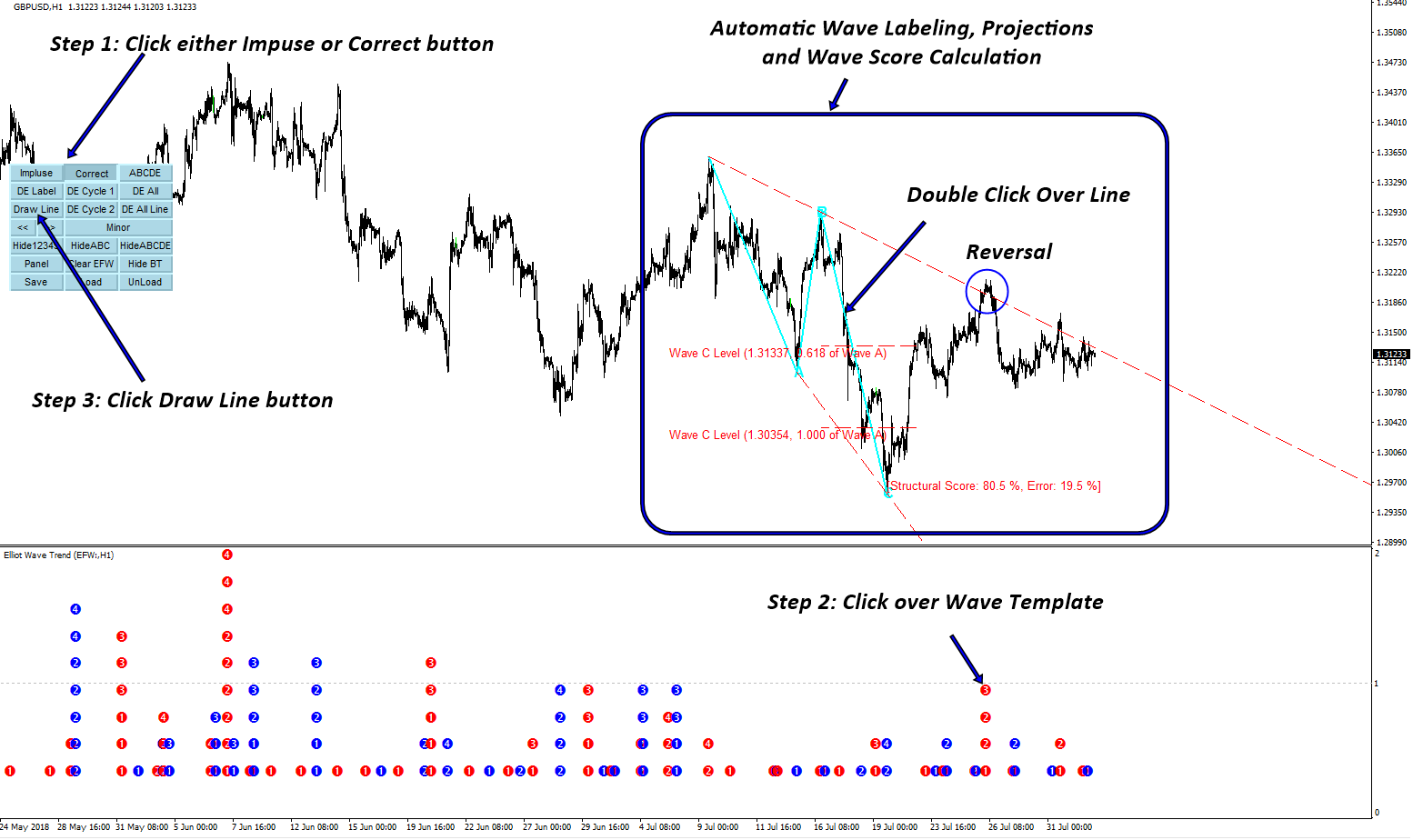

Elliott Wave Trading

Below articles will provide a guide to count Elliott Wave using scientific approach. Applying the scientific approach helps to reduce the subjectivity involved in Elliott Wave counting. Hence, you can reproduce your trading outcome over and over.

● Introduction to the Wave Principle

https://algotrading-investment.com/2020/06/04/introduction-to-the-wave-principle/

● Scientific Wave Counting with the Template and Pattern Approach

https://algotrading-investment.com/2020/06/04/scientific-wave-counting-with-the-template-and-pattern-approach/

● Impulse Wave Structural Score and Corrective Wave Structural Score

https://algotrading-investment.com/2020/06/04/impulse-wave-structural-score-and-corrective-wave-structural-score/

● Channelling Techniques

https://algotrading-investment.com/2020/06/04/channelling-technique-elliott-wave/

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

Elliott Wave Trend is extremely powerful indicator. Allow you to perform Elliott wave counting as well as Elliott wave pattern detection. On top of them, it provides built in accurate support and resistance system to improve your trading performance. You can watch this YouTube Video to feel how the Elliott Wave Indicator look like:

https://www.youtube.com/watch?v=Oftml-JKyKM

Here is the landing page for Elliott Wave Trend.

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Below articles will provide a guide to count Elliott Wave using scientific approach. Applying the scientific approach helps to reduce the subjectivity involved in Elliott Wave counting. Hence, you can reproduce your trading outcome over and over.

● Introduction to the Wave Principle

https://algotrading-investment.com/2020/06/04/introduction-to-the-wave-principle/

● Scientific Wave Counting with the Template and Pattern Approach

https://algotrading-investment.com/2020/06/04/scientific-wave-counting-with-the-template-and-pattern-approach/

● Impulse Wave Structural Score and Corrective Wave Structural Score

https://algotrading-investment.com/2020/06/04/impulse-wave-structural-score-and-corrective-wave-structural-score/

● Channelling Techniques

https://algotrading-investment.com/2020/06/04/channelling-technique-elliott-wave/

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

Elliott Wave Trend is extremely powerful indicator. Allow you to perform Elliott wave counting as well as Elliott wave pattern detection. On top of them, it provides built in accurate support and resistance system to improve your trading performance. You can watch this YouTube Video to feel how the Elliott Wave Indicator look like:

https://www.youtube.com/watch?v=Oftml-JKyKM

Here is the landing page for Elliott Wave Trend.

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Young Ho Seo

Repainting and Non Repainting Harmonic Pattern Indicator

Here is some quick guide on repainting and non repainting Harmonic Pattern indicators. Pattern Scanner based on Fractal Wave detection algorithm can be either repainting or non repainting one. In our products, we provide two choices between repainting and non repainting. Their capability and their price is different.

For Harmonic Pattern Scanner,

Harmonic Pattern Plus (and also Harmonic Pattern Scenario Planner) is the powerful but they are the repainting Harmonic Pattern Scanner. At the same time, they are cheaper. Below is links for them.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern and X3 pattern Scanner. Below is links for them.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Typically it is easier to trade with non repainting and non lagging Harmonic Pattern indicator. Of course, the signal will be reserved once they are detected. Hence, if you do not mind the cost, we recommend to use X3 Chart Pattern Scanner since it is non repainting Harmonic Pattern and X3 pattern indicator.

However, if you do not mind repainting Harmonic Pattern Indicator and you want to have something cheaper, then use Harmonic Pattern Plus (or Harmonic Pattern Scenario Planner). Many traders are still do not mind to use the repainting Harmonic Pattern Indicator. They are cheaper too.

If you are starter, we do recommend using non repainting Harmonic Pattern Scanner like X3 Chart Pattern Scanner. It is easier to trade with non repainting indicator. At the same time, there are a lot of bonus features inside X3 Chart Pattern Scanner too.

For your information, we are the only one who supply non repainting and non lagging Harmonic Pattern Indicator in the world. Of course, the first one in the world too.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator (Repainting but non lagging)”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Here is some quick guide on repainting and non repainting Harmonic Pattern indicators. Pattern Scanner based on Fractal Wave detection algorithm can be either repainting or non repainting one. In our products, we provide two choices between repainting and non repainting. Their capability and their price is different.

For Harmonic Pattern Scanner,

Harmonic Pattern Plus (and also Harmonic Pattern Scenario Planner) is the powerful but they are the repainting Harmonic Pattern Scanner. At the same time, they are cheaper. Below is links for them.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern and X3 pattern Scanner. Below is links for them.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Typically it is easier to trade with non repainting and non lagging Harmonic Pattern indicator. Of course, the signal will be reserved once they are detected. Hence, if you do not mind the cost, we recommend to use X3 Chart Pattern Scanner since it is non repainting Harmonic Pattern and X3 pattern indicator.

However, if you do not mind repainting Harmonic Pattern Indicator and you want to have something cheaper, then use Harmonic Pattern Plus (or Harmonic Pattern Scenario Planner). Many traders are still do not mind to use the repainting Harmonic Pattern Indicator. They are cheaper too.

If you are starter, we do recommend using non repainting Harmonic Pattern Scanner like X3 Chart Pattern Scanner. It is easier to trade with non repainting indicator. At the same time, there are a lot of bonus features inside X3 Chart Pattern Scanner too.

For your information, we are the only one who supply non repainting and non lagging Harmonic Pattern Indicator in the world. Of course, the first one in the world too.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator (Repainting but non lagging)”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Young Ho Seo

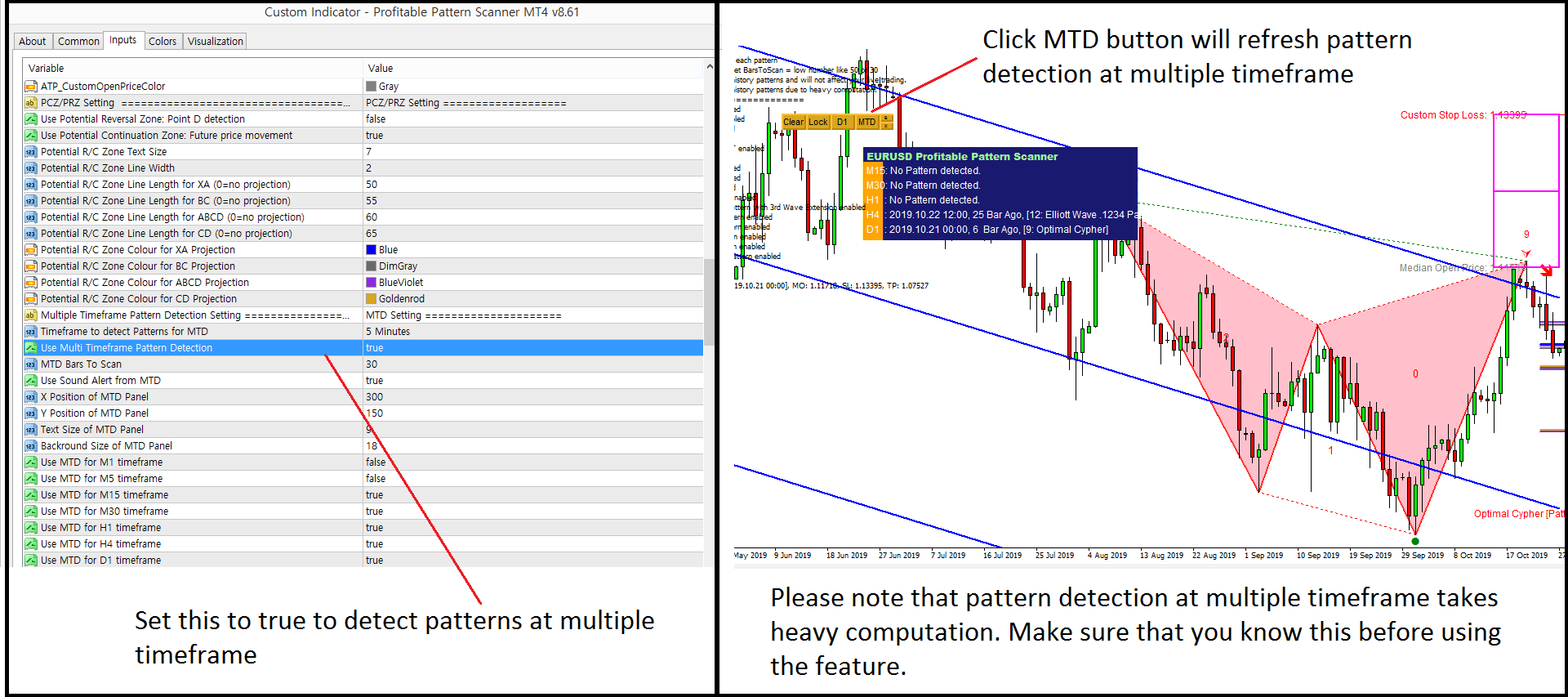

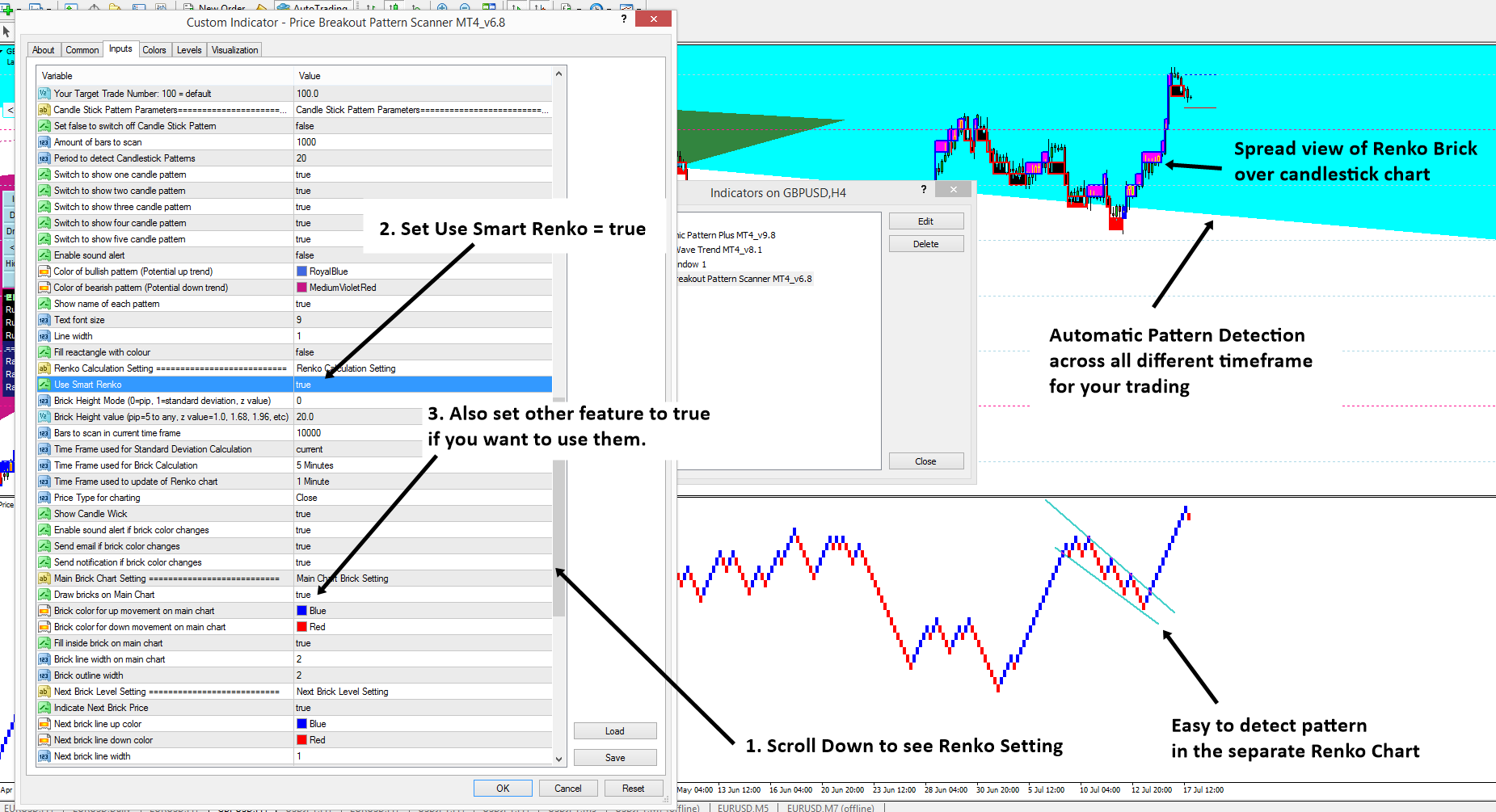

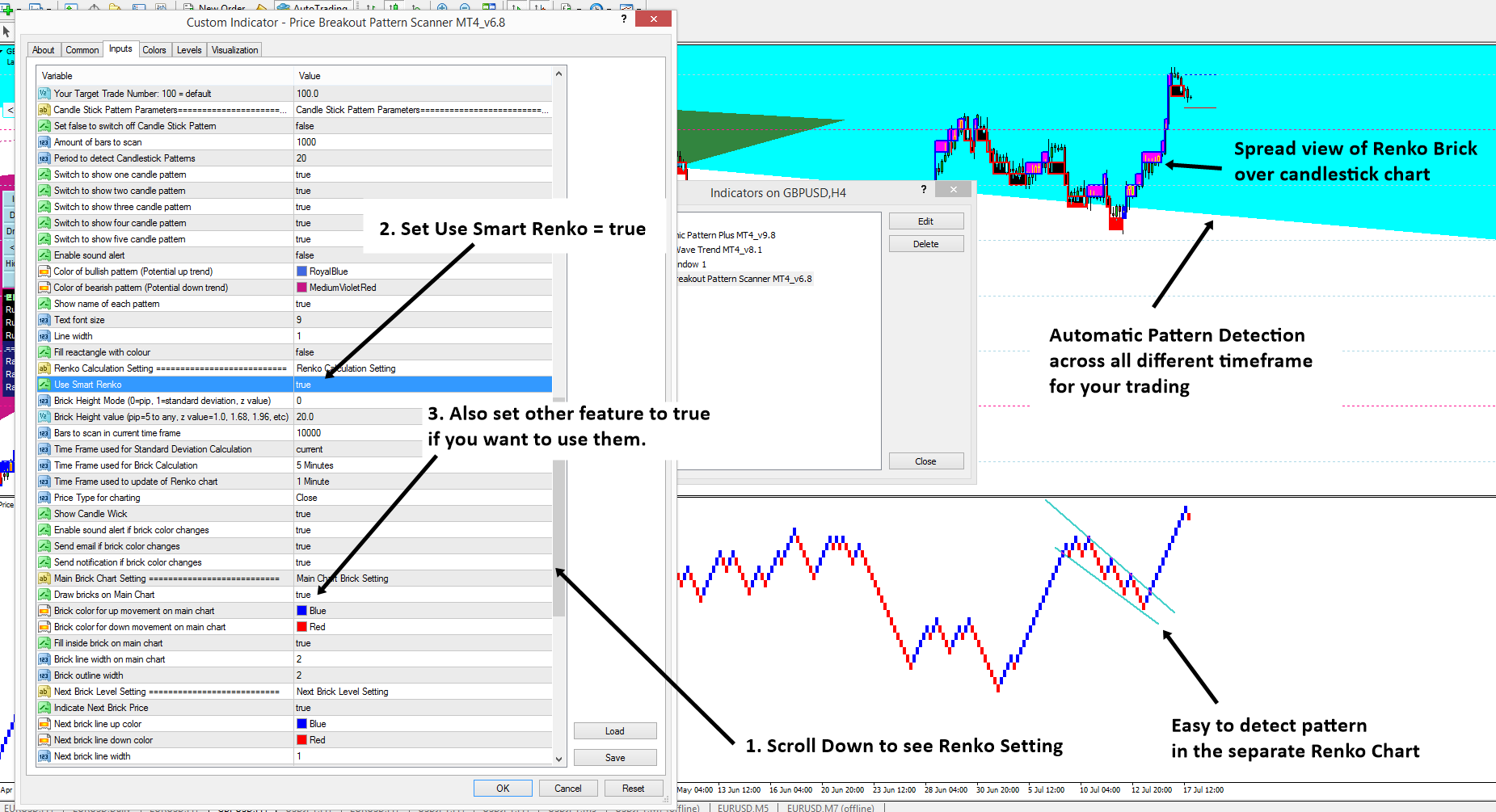

Price Breakout Pattern Scanner and Smart Renko

In the last post, we have shown you how to switch on and off many features in our Smart Renko.

https://algotradinginvestment.wordpress.com/2017/07/15/simple-instruction-on-smart-renko/

Our Price breakout pattern scanner is very unique tool in the market because it have built in feature for Smart Renko inside. There is reason for that. Smart Renko is really helpful for any pattern detection in the separate window. So they will rainforce your trading decision. Imagine that in the candlestick chart, Price Breakout Pattern Scanner is automatically detecting the patterns for you. In the indicator window, you can also detect any other important patterns readily. If you can collect evidence for your trading from both candlestick chart and renko chart, you can make very powerful trading decision.

In this post, let us show how to switch on and off the smart Renko chart from your price breakout pattern Scanner. Before you are using Smart Renko feature enabled, you might download sufficient history in your chart first. Once you have done it, set Use “Smart Renko = true” from your indicator setting. See the screenshots for your better understanding. Some of our customer know that there is great way of trading with Price breakout pattern scanner and our Harmonic Pattern Plus (or Harmonic Pattern Scenario Planner) If you are curious, you migh check our ebook. We have described the trading principle in details in this book: Price Action and Pattern Trading Course.

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Here are the links for the Price Breakout Pattern Scanner

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

In the last post, we have shown you how to switch on and off many features in our Smart Renko.

https://algotradinginvestment.wordpress.com/2017/07/15/simple-instruction-on-smart-renko/

Our Price breakout pattern scanner is very unique tool in the market because it have built in feature for Smart Renko inside. There is reason for that. Smart Renko is really helpful for any pattern detection in the separate window. So they will rainforce your trading decision. Imagine that in the candlestick chart, Price Breakout Pattern Scanner is automatically detecting the patterns for you. In the indicator window, you can also detect any other important patterns readily. If you can collect evidence for your trading from both candlestick chart and renko chart, you can make very powerful trading decision.

In this post, let us show how to switch on and off the smart Renko chart from your price breakout pattern Scanner. Before you are using Smart Renko feature enabled, you might download sufficient history in your chart first. Once you have done it, set Use “Smart Renko = true” from your indicator setting. See the screenshots for your better understanding. Some of our customer know that there is great way of trading with Price breakout pattern scanner and our Harmonic Pattern Plus (or Harmonic Pattern Scenario Planner) If you are curious, you migh check our ebook. We have described the trading principle in details in this book: Price Action and Pattern Trading Course.

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Here are the links for the Price Breakout Pattern Scanner

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Young Ho Seo

Live Forex Technical Analysis Presentation by Forex Robot Advisor ARI. Sit back and enjoy the entire technical analysis for winning trading.

https://www.youtube.com/watch?v=uTnwKnX9r8E

https://www.youtube.com/watch?v=uTnwKnX9r8E

Young Ho Seo

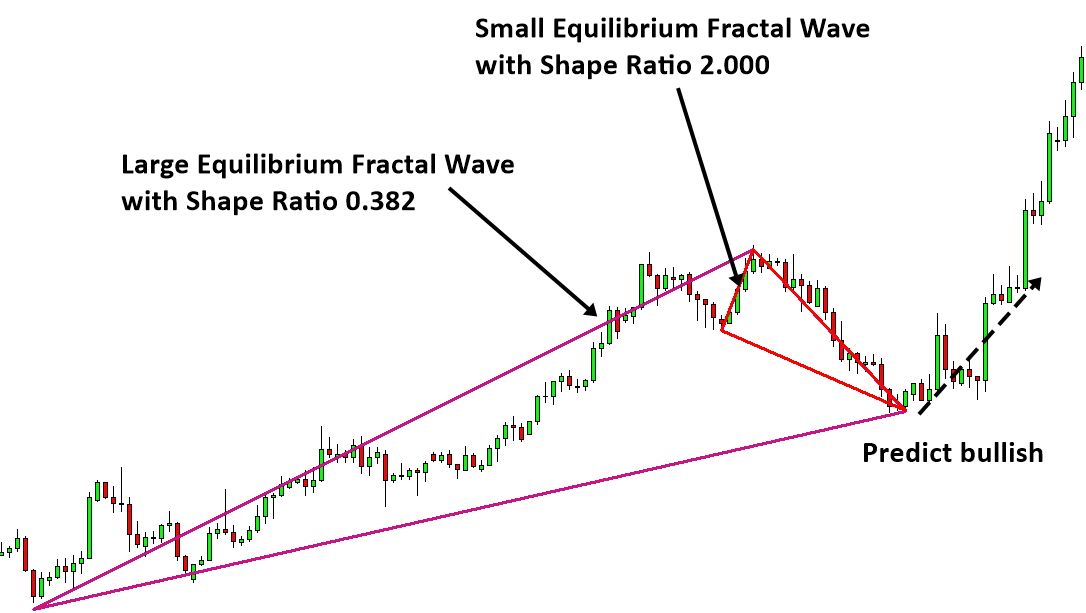

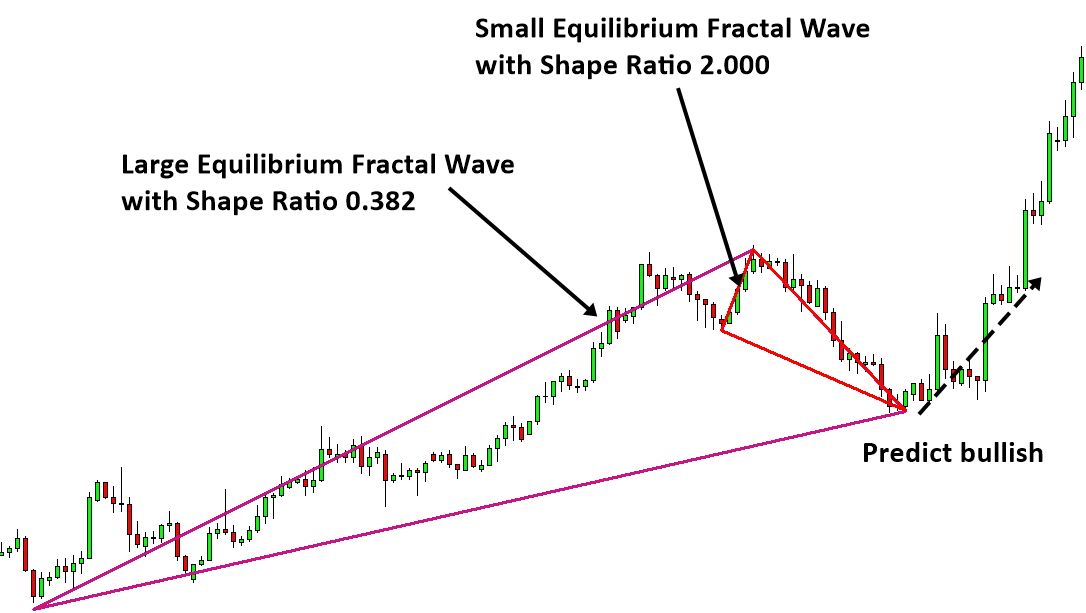

Superimposed Equilibrium Fractal Waves

Third characteristic of equilibrium fractal wave is that smaller equilibrium fractal waves can combine to form a bigger equilibrium fractal wave (superimposed). This third characteristic is often used by a professional trader to improve the predictability of the financial market. For example, instead of puzzling with a set of small equilibrium fractal waves, it is much more accurate to puzzle with both small and big equilibrium fractal waves together to predict the market direction. Now we show some examples of our reversal prediction using this superimposed equilibrium fractal waves. In Figure 3-23 and Figure 3-24, a large Equilibrium fractal wave is overlapping with a small equilibrium fractal wave. We can make the bullish reversal prediction after the last candle is completed. Making the prediction based on the two Equilibrium fractal waves can increase the probability of winning marginally over just using one equilibrium fractal wave.

Figure 3-23: Superimposed Equilibrium fractal wave for bullish reversal trading setup (EURUSD D1).

Figure 3-24: Superimposed Equilibrium fractal wave for bullish reversal trading setup (EURUSD H1).

Likewise, we can use these superimposed equilibrium fractal waves to make the bearish reversal prediction too as shown in Figure 3-25 and Figure 3-26. You can even use three or four equilibrium fractal waves for your prediction. However, the superimposed patterns with three or four equilibrium fractal waves are rare. If they do appears then they can provide a good trading opportunity.

Figure 3-25: Superimposed Equilibrium fractal wave for bearish reversal trading setup (EURUSD H1).

Figure 3-26: Superimposed Equilibrium fractal wave for bearish reversal trading setup (EURUSD M15).

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

Third characteristic of equilibrium fractal wave is that smaller equilibrium fractal waves can combine to form a bigger equilibrium fractal wave (superimposed). This third characteristic is often used by a professional trader to improve the predictability of the financial market. For example, instead of puzzling with a set of small equilibrium fractal waves, it is much more accurate to puzzle with both small and big equilibrium fractal waves together to predict the market direction. Now we show some examples of our reversal prediction using this superimposed equilibrium fractal waves. In Figure 3-23 and Figure 3-24, a large Equilibrium fractal wave is overlapping with a small equilibrium fractal wave. We can make the bullish reversal prediction after the last candle is completed. Making the prediction based on the two Equilibrium fractal waves can increase the probability of winning marginally over just using one equilibrium fractal wave.

Figure 3-23: Superimposed Equilibrium fractal wave for bullish reversal trading setup (EURUSD D1).

Figure 3-24: Superimposed Equilibrium fractal wave for bullish reversal trading setup (EURUSD H1).

Likewise, we can use these superimposed equilibrium fractal waves to make the bearish reversal prediction too as shown in Figure 3-25 and Figure 3-26. You can even use three or four equilibrium fractal waves for your prediction. However, the superimposed patterns with three or four equilibrium fractal waves are rare. If they do appears then they can provide a good trading opportunity.

Figure 3-25: Superimposed Equilibrium fractal wave for bearish reversal trading setup (EURUSD H1).

Figure 3-26: Superimposed Equilibrium fractal wave for bearish reversal trading setup (EURUSD M15).

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

Young Ho Seo

Supply Demand Zone Indicator on MetaTrader 5

MetaTrader 5 is the next generation trading platform developed by Meta Quote who developed MetaTrader 4. MetaTrader 5 is accessible for free of charge for any trader from all over the world. More and more brokers are now offering MetaTrader 5 trading options even including US based firms.

Here is the list of Advanced Supply Demand Zone Indicator. These supply and demand zone indicators are rich in features with many powerful features to help you to trade the right supply and demand zone to trading. Also note that supply demand zone indicator can be used as a great support and resistance indicator too. So if you are looking for good support resistance indicator, then these tools are good too. Please check it out.

Mean Reversion Supply Demand MT5

Mean Reversion Supply Demand indicator is our earliest supply demand zone indicator and loved by many trader all over the world. It is great to trade with reversal and breakout. You can also fully setup your trading with stop loss and take profit target.

Below are the links to MT5 version of the Mean Reversion Supply Demand indicator.

https://www.mql5.com/en/market/product/16823

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand

Ace Supply Demand Zone Indicator MT5

Ace Supply Demand Zone indicator is our next generation supply demand zone indicator. It was built in non repainting and non lagging algorithm. On top of many powerful features, you can also make use of archived supply and demand zone in your trading to find more accurate trading opportunity.

Below are the links to MT5 version of the Ace Supply Demand Zone indicator.

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to accomplish the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

For your information, both indicators provides many powerful features to complete for your trading. You can also use this indicators together with Harmonic pattern and Elliott wave pattern indicators.

MetaTrader 5 is the next generation trading platform developed by Meta Quote who developed MetaTrader 4. MetaTrader 5 is accessible for free of charge for any trader from all over the world. More and more brokers are now offering MetaTrader 5 trading options even including US based firms.

Here is the list of Advanced Supply Demand Zone Indicator. These supply and demand zone indicators are rich in features with many powerful features to help you to trade the right supply and demand zone to trading. Also note that supply demand zone indicator can be used as a great support and resistance indicator too. So if you are looking for good support resistance indicator, then these tools are good too. Please check it out.

Mean Reversion Supply Demand MT5

Mean Reversion Supply Demand indicator is our earliest supply demand zone indicator and loved by many trader all over the world. It is great to trade with reversal and breakout. You can also fully setup your trading with stop loss and take profit target.

Below are the links to MT5 version of the Mean Reversion Supply Demand indicator.

https://www.mql5.com/en/market/product/16823

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand

Ace Supply Demand Zone Indicator MT5

Ace Supply Demand Zone indicator is our next generation supply demand zone indicator. It was built in non repainting and non lagging algorithm. On top of many powerful features, you can also make use of archived supply and demand zone in your trading to find more accurate trading opportunity.

Below are the links to MT5 version of the Ace Supply Demand Zone indicator.

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to accomplish the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

For your information, both indicators provides many powerful features to complete for your trading. You can also use this indicators together with Harmonic pattern and Elliott wave pattern indicators.

Young Ho Seo

Scan and search future harmonic patterns with Harmonic Pattern Scenario Planner

Harmonic Pattern Scenario Planner is a tool you can scan and search future harmonic patterns in just one button click. It would detect any potential future harmonic patterns in your search range using the algorithm like Monte Carlo simulation. You can even get the potential take profit and stop loss of the future patterns even before they form. What is even more, you can use all the features and functionality of harmonic pattern plus from your harmonic pattern scenario planner too.

Have watched this interesting movie called “Next” ? Check out the guy can see the few minutes into the futures. How powerful the 2 minutes vision for future is. Predicting future is very tactical game but it is hard because future keep changing based on the presents. However, it is definitely an interesting game. As a trader, you can gain a lot of advantage over other traders by predicting futures.

http://www.imdb.com/title/tt0435705/

This movie like predicting concept was equipped in our Harmonic Pattern Scenario Planner. check the power of predictive harmonic pattern for your trading. We are only one selling this future predictive harmonic pattern scanner in the universe.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Harmonic Pattern Scenario Planner is a tool you can scan and search future harmonic patterns in just one button click. It would detect any potential future harmonic patterns in your search range using the algorithm like Monte Carlo simulation. You can even get the potential take profit and stop loss of the future patterns even before they form. What is even more, you can use all the features and functionality of harmonic pattern plus from your harmonic pattern scenario planner too.

Have watched this interesting movie called “Next” ? Check out the guy can see the few minutes into the futures. How powerful the 2 minutes vision for future is. Predicting future is very tactical game but it is hard because future keep changing based on the presents. However, it is definitely an interesting game. As a trader, you can gain a lot of advantage over other traders by predicting futures.

http://www.imdb.com/title/tt0435705/

This movie like predicting concept was equipped in our Harmonic Pattern Scenario Planner. check the power of predictive harmonic pattern for your trading. We are only one selling this future predictive harmonic pattern scanner in the universe.

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

Young Ho Seo

Fractal-Wave Process

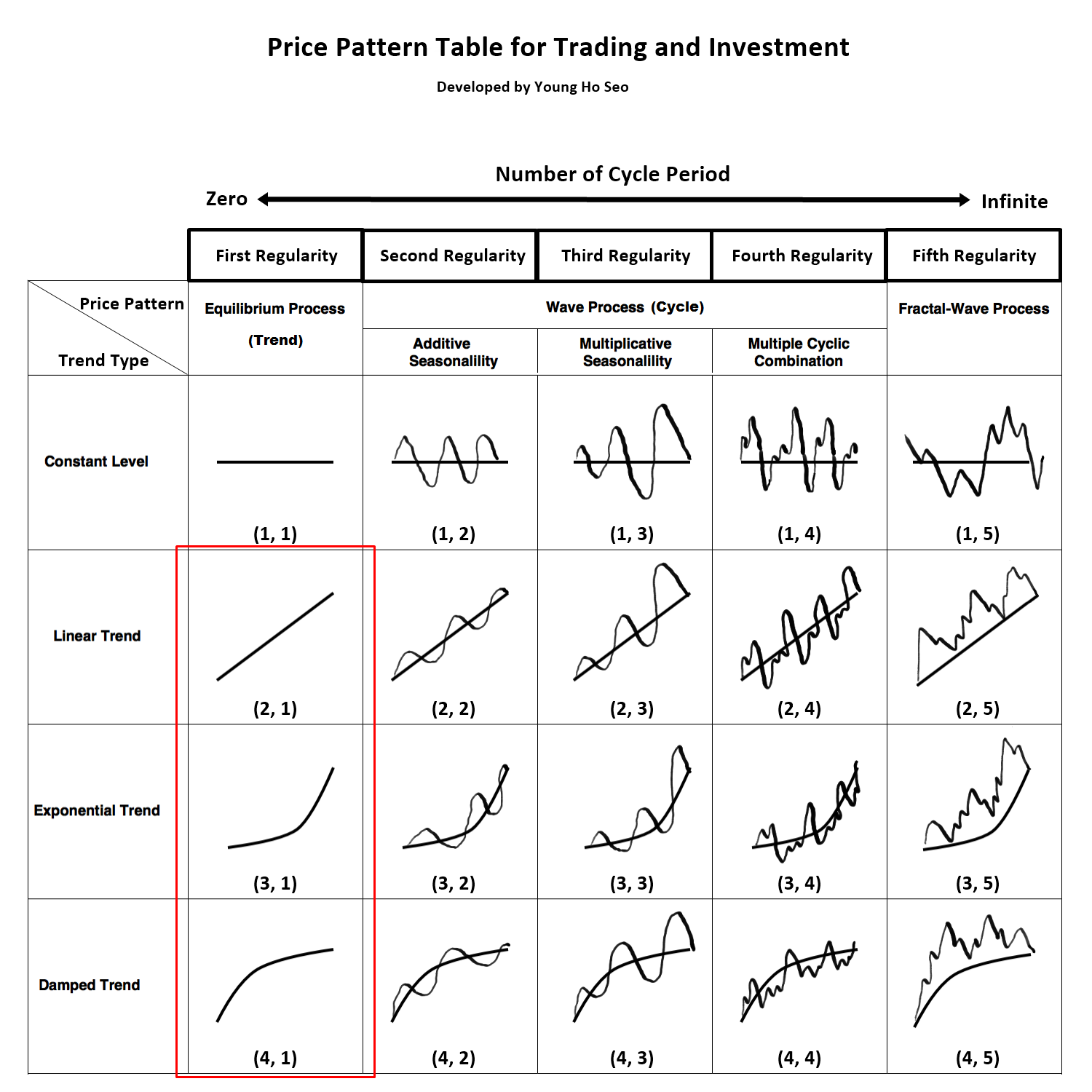

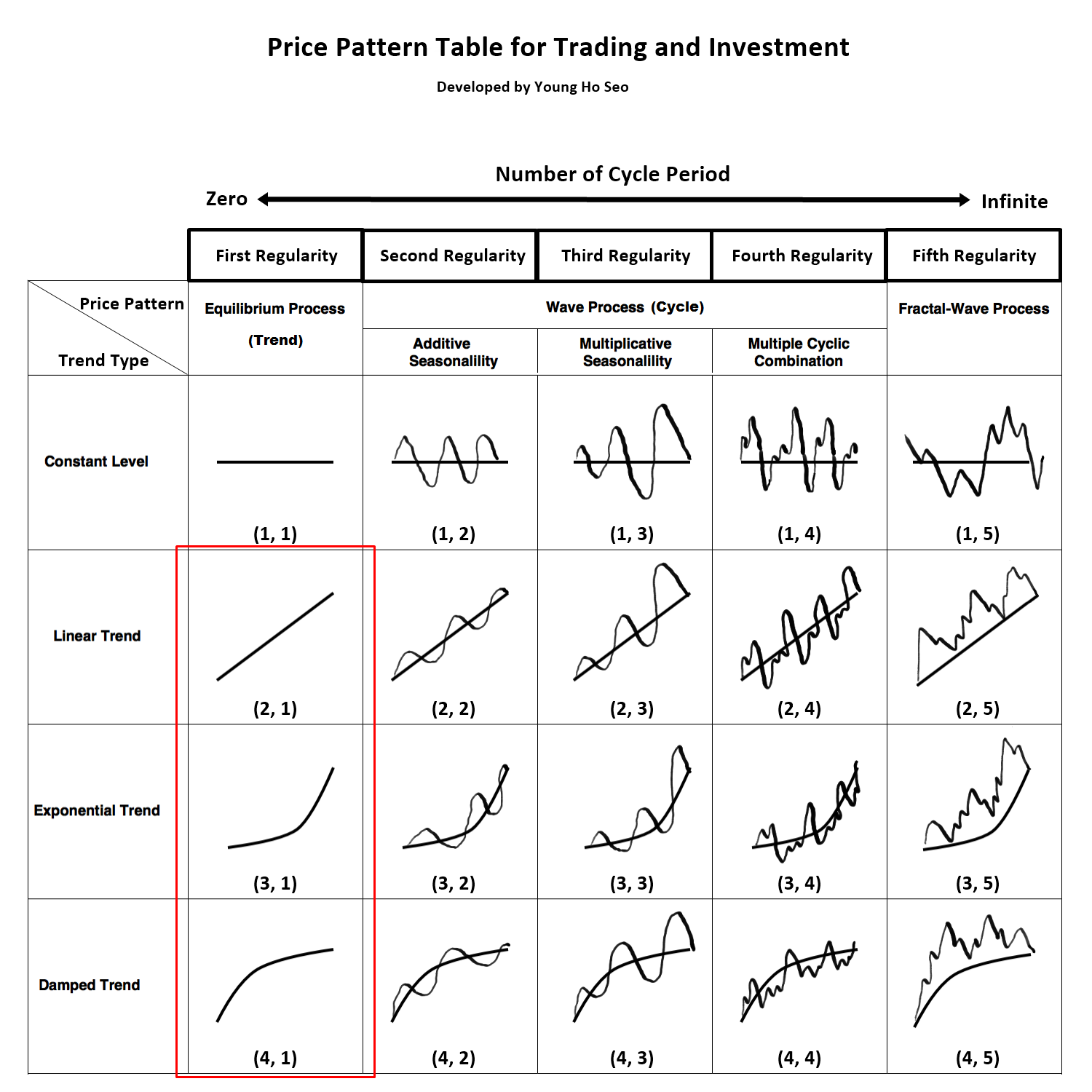

Figure 8-1: Fractal-Wave process is corresponding to price pattern (1, 5) in the table.

Fractal-Wave process is the representation of the Fractal geometry in the time dimension. Fractal geometry is made from a repeating pattern at many different scales. Simply speaking it is repeating patterns with varying size. Fractal geometry can be a self-similar pattern with the strictly same patterns across at every scale. Or if the pattern loosely matches to the past one, this can be still considered as fractal geometry. We call this as near self-similarity against the strict self-similarity. Many examples of Fractal geometry can be found in nature. Snowflakes, coastlines, Trees are the typical example of the Fractals geometry in space. Fractal-Wave is the fractal geometry generated in time dimension. Just like Fractal Geometry can be described by self-similar patterns. Fractal-Wave can be described by self-similar patterns repeating in time. The concept of Fractal-Wave can be illustrated well by Weierstrass function.

Loosely speaking, Weierstrass function is the cyclic function generated from infinite number of Cosine functions with different amplitude and wavelength. By combining infinite number of Cosine functions, it can generate a complex structure repeating self-similar patterns in different scales. This is a typical synthetic example of Fractal-Wave patterns with strict self-similar patterns. We present this function to help you to understand the properties of the self-similar process. The real world financial market shows the loose fractal geometry. They do not repeat in the identical patterns in shape and in size. The repeating patterns are similar to each other up to certain degree. Since Weierstrss function is the synthetic example for the strict fractal geometry, reader should note that Weierstrss function does not represent the real world financial market.

Figure 8-2: Weierstrass function to give you a feel for the Fractal-Wave process. Note that this is synthetic Fractal-Wave process only and this function does not represent many of real world cases.

In the real world application, Fractal-Wave process appears with the near self-similar patterns most of time. Therefore, detecting them is not easy. The Heart Beat Rate signal is one typical example of the Fractal-Wave process in nature (Figure 8-3 and Figure 8-4). If we zoom in on a subset of time series, we can see the apparent self-similar patterns. In Financial Market, Fractal-Wave process occurs frequently but the market typically shows the near self-similarity too. In terms of pattern shape, the financial market and Heart beat rate signal are different because their underlying pattern generating dynamics inside human organ and crowd behaviour are substantially different.

Figure 8-3: Self-similar process in Heart Beat rate (Goldberger et al, 2000).

Figure 8-4: Continuous Heart Beat time series.

Figure 8-5: Self-similar geometry in EURUSD daily series.

Fractal-Wave process is the basis for many popular trading strategies like Elliott Wave, Harmonic patterns, triangle and wedge patterns. However, these trading strategies were not well connected to existing science in the past. This was one of the important motivation for myself to step up to write and to connect these trading strategies into existing science. Most of time, day traders were referencing that these strategies will work because market repeats themselves. For me, this explanation would be not enough before I make the full time commitment on them.

Therefore, I had to do a lot of research to find the origin of these trading strategies and to see real value behind them. From my research, most likely, the repeating patterns in these strategies come from Fractal-Wave. I was very happy initially until I found that there is big difference between the underlying concepts of these trading strategies and Fractal-wave itself.

To see the difference, you might compare the heart beat signal and EURUSD price series in Figure 8-4 and Figure 8-5. You could also compare the heartbeat signal and S&P 500 series in Figure 8-6. With heart beat signal in Figure 8-4, you might think that it would look similar to Stock or Forex market data but different in some ways. If you felt this way, you are very correct. Here is the main difference.

Heartbeat signal seems to have fixed mean or horizontal patterns as we described in Stationary process in Chapter 5. However, EURUSD price series or S&P 500 series do not show any noticeable horizontal patterns. With human, the heartbeat increases dramatically to get more blood out during intensive activity like sprinting, but they must come back to normal range to maintain our life. Naturally, this makes up the horizontal patterns as we described in Stationary process. On the other hands, the operational range of the financial market does not have to create the horizontal patterns as if heartbeat does. Firstly, financial market is designed to grow or decline with time (Figure 8-6). Secondly, the underlying fundamental drives the rise and fall of the financial market (Figure 8-6) towards unknown destination.

With human, we know that our heartbeat rate must be kept between 60 and 100 times per minute. While you are a living man, this normal range is the destination of your heartbeat rate most of time. It is very predictable that your heartbeat will come back to 80 times per minute once it hits 130 times per minute. In the financial market, the final destination is not known and open. Even if S&P500 hits 3000 points tomorrow, we are not sure if it would even come back to 1000 points next year or ever. Hence, we are talking about similar but very different type of Fractal-Wave. Fractal wave alone can not explain the difference between these two. In the past, many day traders were having misleading picture between fractal wave and these trading strategies because no one or no literature attempted to give clear or easy explanation on them. This was another motivation for me to write this book too.

The open and unknown destination of the financial market is there because the underlying fundamental drives the market towards the price level, at which majority of people think it is most reasonable. In another words, market will move towards the equilibrium price. We have covered this in Equilibrium process in Chapter 8. Financial market is not only made up from Fractal-Wave but with Equilibrium process too. Hence, this is why financial market is different from heartbeat series although both have fractal wave in them. We have just pinned down the important concept of Equilibrium Fractal Wave process. In next two chapters, we will take you to the details of Equilibrium Wave process and Equilibrium Fractal Wave process to give you the complete and systematic view of the trading strategy and financial market.

Figure 8-6: S&P 500 growth last 70 years.

Analytical Note

In the Fractal Geometry, two important quantifiable properties are fractal dimension and self-similarity. Fractal dimension is a measure of how much an N dimensional space is occupied by an object. For example, a straight line have dimension of 1 but a wiggly line has a dimension between 1 and 2. More precisely, their Fractal Dimension can be expressed as Log (N)/Log (r) where N = number of self-similar pieces and r = linear scale factor. Now to illustrate the concept, we will present the four cases from dimension 1 to 2. If we reduce size of straight line by linear scale factor r = 2, then then we get two self-similar piece, N = 2. Therefore, the dimension of the straight line is 1.

Figure 8-7: Iteration of self-similar process for straight line (Dimension = 1).

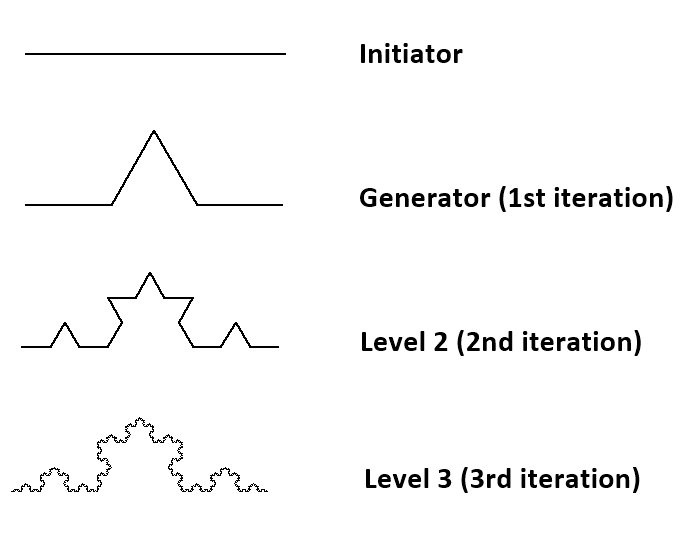

Likewise, if we remove the middle third of the straight line and replace it with two lines with the same length, then we get the first iteration of the Koch Curve. In this example, for the linear scale factor r = 3, we get the four self-similar pieces. Therefore, the dimension of Koch Curve is 1.26816 = Log (4) / Log (3).

Figure 8-8: Iteration of self-similar process for Koch Curve (Dimension = 1.26816).

Sierpinski Triangle is another good example of Fractal Geometry. If we connect the mid points of the three side inside an equilateral triangle, then we get 3 equilateral triangles inside the first equilateral triangle. Note that we do not count the resulting upside down triangle as a self-similar piece. In this case, the linear scale factor r is 2 since generated triangle have the half of the width and height. The Fractal dimension D = 1.585 = Log (3)/ Log (2).

Figure 8-9: Iteration of self-similar process for Sierpinski Triangle (Dimension = 1.585).

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

Advanced Price Pattern Scanner uses highly sophisticated pattern detection algorithm. However, we have designed it in the easy to use and intuitive manner. Advanced Price Pattern Scanner will show all the patterns in your chart in the most efficient format for your trading. It is non repainting pattern detector. Below are the links to Advanced Price Pattern Scanner.

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

https://www.mql5.com/en/market/product/24679

https://www.mql5.com/en/market/product/24678

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Figure 8-1: Fractal-Wave process is corresponding to price pattern (1, 5) in the table.

Fractal-Wave process is the representation of the Fractal geometry in the time dimension. Fractal geometry is made from a repeating pattern at many different scales. Simply speaking it is repeating patterns with varying size. Fractal geometry can be a self-similar pattern with the strictly same patterns across at every scale. Or if the pattern loosely matches to the past one, this can be still considered as fractal geometry. We call this as near self-similarity against the strict self-similarity. Many examples of Fractal geometry can be found in nature. Snowflakes, coastlines, Trees are the typical example of the Fractals geometry in space. Fractal-Wave is the fractal geometry generated in time dimension. Just like Fractal Geometry can be described by self-similar patterns. Fractal-Wave can be described by self-similar patterns repeating in time. The concept of Fractal-Wave can be illustrated well by Weierstrass function.

Loosely speaking, Weierstrass function is the cyclic function generated from infinite number of Cosine functions with different amplitude and wavelength. By combining infinite number of Cosine functions, it can generate a complex structure repeating self-similar patterns in different scales. This is a typical synthetic example of Fractal-Wave patterns with strict self-similar patterns. We present this function to help you to understand the properties of the self-similar process. The real world financial market shows the loose fractal geometry. They do not repeat in the identical patterns in shape and in size. The repeating patterns are similar to each other up to certain degree. Since Weierstrss function is the synthetic example for the strict fractal geometry, reader should note that Weierstrss function does not represent the real world financial market.

Figure 8-2: Weierstrass function to give you a feel for the Fractal-Wave process. Note that this is synthetic Fractal-Wave process only and this function does not represent many of real world cases.

In the real world application, Fractal-Wave process appears with the near self-similar patterns most of time. Therefore, detecting them is not easy. The Heart Beat Rate signal is one typical example of the Fractal-Wave process in nature (Figure 8-3 and Figure 8-4). If we zoom in on a subset of time series, we can see the apparent self-similar patterns. In Financial Market, Fractal-Wave process occurs frequently but the market typically shows the near self-similarity too. In terms of pattern shape, the financial market and Heart beat rate signal are different because their underlying pattern generating dynamics inside human organ and crowd behaviour are substantially different.

Figure 8-3: Self-similar process in Heart Beat rate (Goldberger et al, 2000).

Figure 8-4: Continuous Heart Beat time series.

Figure 8-5: Self-similar geometry in EURUSD daily series.

Fractal-Wave process is the basis for many popular trading strategies like Elliott Wave, Harmonic patterns, triangle and wedge patterns. However, these trading strategies were not well connected to existing science in the past. This was one of the important motivation for myself to step up to write and to connect these trading strategies into existing science. Most of time, day traders were referencing that these strategies will work because market repeats themselves. For me, this explanation would be not enough before I make the full time commitment on them.

Therefore, I had to do a lot of research to find the origin of these trading strategies and to see real value behind them. From my research, most likely, the repeating patterns in these strategies come from Fractal-Wave. I was very happy initially until I found that there is big difference between the underlying concepts of these trading strategies and Fractal-wave itself.

To see the difference, you might compare the heart beat signal and EURUSD price series in Figure 8-4 and Figure 8-5. You could also compare the heartbeat signal and S&P 500 series in Figure 8-6. With heart beat signal in Figure 8-4, you might think that it would look similar to Stock or Forex market data but different in some ways. If you felt this way, you are very correct. Here is the main difference.

Heartbeat signal seems to have fixed mean or horizontal patterns as we described in Stationary process in Chapter 5. However, EURUSD price series or S&P 500 series do not show any noticeable horizontal patterns. With human, the heartbeat increases dramatically to get more blood out during intensive activity like sprinting, but they must come back to normal range to maintain our life. Naturally, this makes up the horizontal patterns as we described in Stationary process. On the other hands, the operational range of the financial market does not have to create the horizontal patterns as if heartbeat does. Firstly, financial market is designed to grow or decline with time (Figure 8-6). Secondly, the underlying fundamental drives the rise and fall of the financial market (Figure 8-6) towards unknown destination.

With human, we know that our heartbeat rate must be kept between 60 and 100 times per minute. While you are a living man, this normal range is the destination of your heartbeat rate most of time. It is very predictable that your heartbeat will come back to 80 times per minute once it hits 130 times per minute. In the financial market, the final destination is not known and open. Even if S&P500 hits 3000 points tomorrow, we are not sure if it would even come back to 1000 points next year or ever. Hence, we are talking about similar but very different type of Fractal-Wave. Fractal wave alone can not explain the difference between these two. In the past, many day traders were having misleading picture between fractal wave and these trading strategies because no one or no literature attempted to give clear or easy explanation on them. This was another motivation for me to write this book too.

The open and unknown destination of the financial market is there because the underlying fundamental drives the market towards the price level, at which majority of people think it is most reasonable. In another words, market will move towards the equilibrium price. We have covered this in Equilibrium process in Chapter 8. Financial market is not only made up from Fractal-Wave but with Equilibrium process too. Hence, this is why financial market is different from heartbeat series although both have fractal wave in them. We have just pinned down the important concept of Equilibrium Fractal Wave process. In next two chapters, we will take you to the details of Equilibrium Wave process and Equilibrium Fractal Wave process to give you the complete and systematic view of the trading strategy and financial market.

Figure 8-6: S&P 500 growth last 70 years.

Analytical Note

In the Fractal Geometry, two important quantifiable properties are fractal dimension and self-similarity. Fractal dimension is a measure of how much an N dimensional space is occupied by an object. For example, a straight line have dimension of 1 but a wiggly line has a dimension between 1 and 2. More precisely, their Fractal Dimension can be expressed as Log (N)/Log (r) where N = number of self-similar pieces and r = linear scale factor. Now to illustrate the concept, we will present the four cases from dimension 1 to 2. If we reduce size of straight line by linear scale factor r = 2, then then we get two self-similar piece, N = 2. Therefore, the dimension of the straight line is 1.

Figure 8-7: Iteration of self-similar process for straight line (Dimension = 1).

Likewise, if we remove the middle third of the straight line and replace it with two lines with the same length, then we get the first iteration of the Koch Curve. In this example, for the linear scale factor r = 3, we get the four self-similar pieces. Therefore, the dimension of Koch Curve is 1.26816 = Log (4) / Log (3).

Figure 8-8: Iteration of self-similar process for Koch Curve (Dimension = 1.26816).

Sierpinski Triangle is another good example of Fractal Geometry. If we connect the mid points of the three side inside an equilateral triangle, then we get 3 equilateral triangles inside the first equilateral triangle. Note that we do not count the resulting upside down triangle as a self-similar piece. In this case, the linear scale factor r is 2 since generated triangle have the half of the width and height. The Fractal dimension D = 1.585 = Log (3)/ Log (2).

Figure 8-9: Iteration of self-similar process for Sierpinski Triangle (Dimension = 1.585).

About this Article

This article is the part taken from the draft version of the Book: Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave). Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

Advanced Price Pattern Scanner uses highly sophisticated pattern detection algorithm. However, we have designed it in the easy to use and intuitive manner. Advanced Price Pattern Scanner will show all the patterns in your chart in the most efficient format for your trading. It is non repainting pattern detector. Below are the links to Advanced Price Pattern Scanner.

https://algotrading-investment.com/portfolio-item/advanced-price-pattern-scanner/

https://www.mql5.com/en/market/product/24679

https://www.mql5.com/en/market/product/24678

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

Using Harmonic Pattern Plus and X3 Chart Pattern Scanner Together

Harmonic Pattern Plus and X3 Chart Pattern Scanner are the great harmonic pattern detection indicator. Some trader asked me if they can use Harmonic Pattern Plus and X3 Chart Pattern Scanner together.

The short answer is yes. It is possible to combine them. Even though both indicators detect harmonic patterns, they are using completely different pattern detection algorithm. Harmonic pattern Plus uses the classic pattern detection algorithm whereas X3 Chart Pattern Scanner uses non repainting pattern detection algorithm (i.e. latest pattern detection technology).

There can be some overlapping in the detected patterns. However, many patterns can be detected in different timing. If both indicator detect the same patterns, then the patterns are often more accurate. At the same time, with non overlapping patterns, you have less chance to miss out the good signals.

When you want to use the channel function together with Harmonic Pattern, then use the channel function in X3 Chart Pattern Scanner because it is more advanced version. Of course, the same logic applies to Harmonic Pattern Scenario planner.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator (Repainting but non lagging)”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Link to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Harmonic Pattern Plus and X3 Chart Pattern Scanner are the great harmonic pattern detection indicator. Some trader asked me if they can use Harmonic Pattern Plus and X3 Chart Pattern Scanner together.

The short answer is yes. It is possible to combine them. Even though both indicators detect harmonic patterns, they are using completely different pattern detection algorithm. Harmonic pattern Plus uses the classic pattern detection algorithm whereas X3 Chart Pattern Scanner uses non repainting pattern detection algorithm (i.e. latest pattern detection technology).

There can be some overlapping in the detected patterns. However, many patterns can be detected in different timing. If both indicator detect the same patterns, then the patterns are often more accurate. At the same time, with non overlapping patterns, you have less chance to miss out the good signals.

When you want to use the channel function together with Harmonic Pattern, then use the channel function in X3 Chart Pattern Scanner because it is more advanced version. Of course, the same logic applies to Harmonic Pattern Scenario planner.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator (Repainting but non lagging)”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Link to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Volume Spread Analysis Indicator List

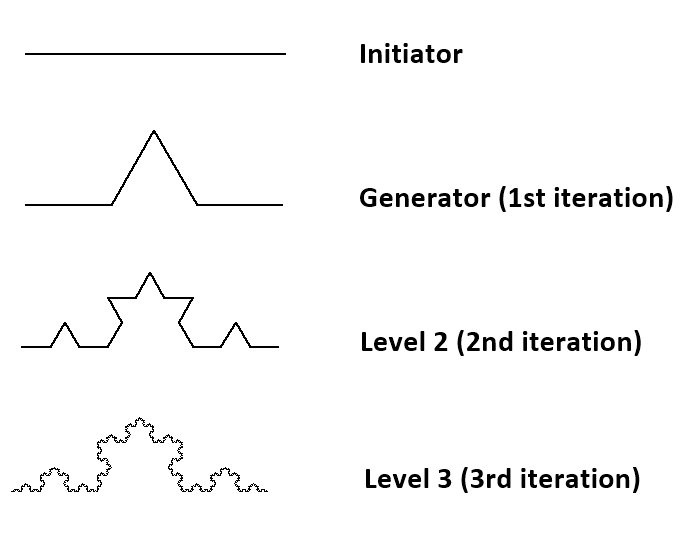

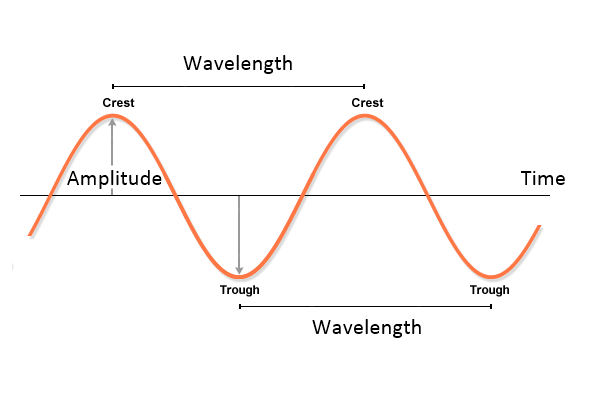

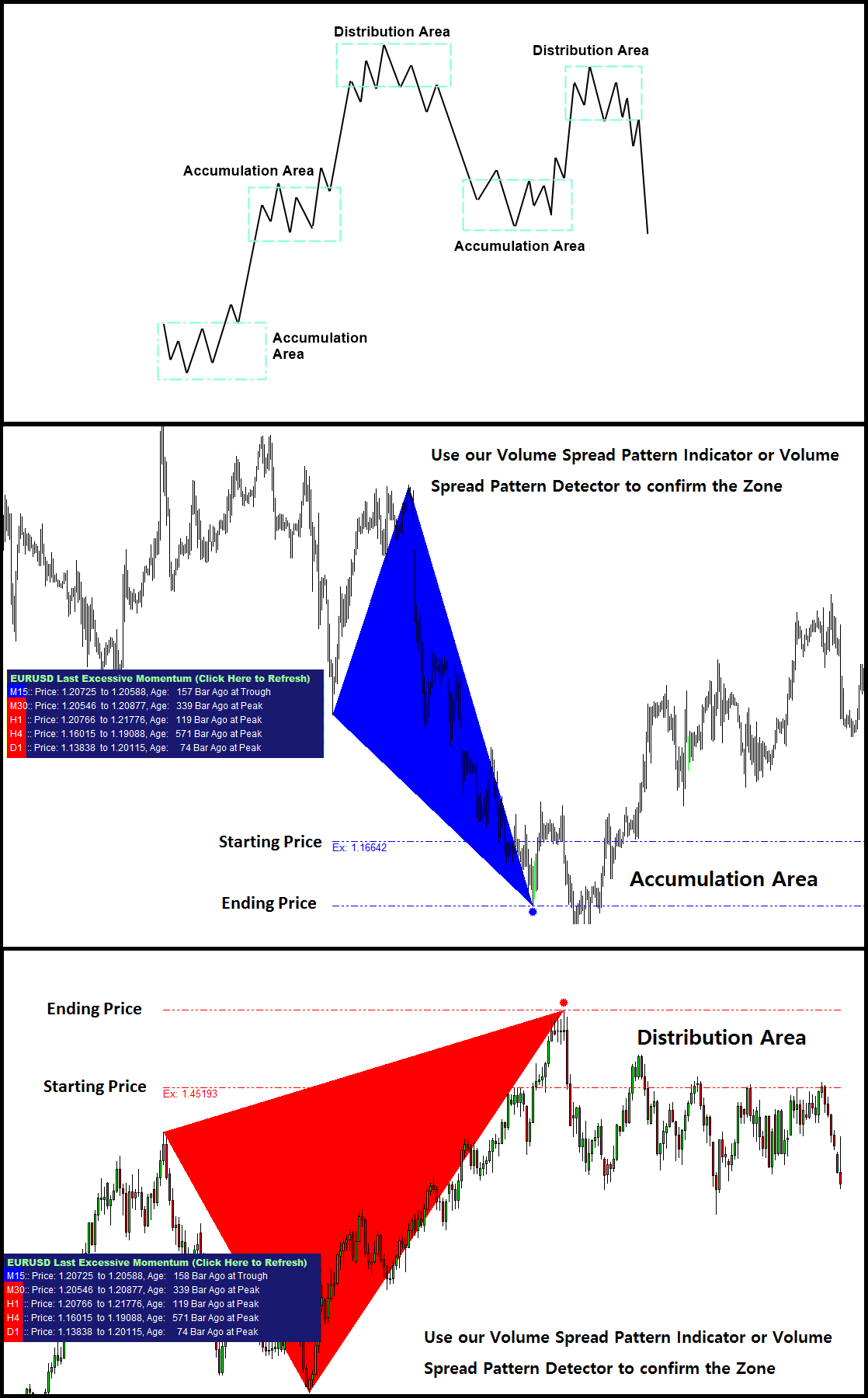

We provide three different Volume Spread Analysis indicators and volume based tools. Our volume spread analysis tools are the hybrid of volume spread analysis and signal processing theory.

These tools will help you to complete your trading decision with high precision. As long as you understand the concept of the Accumulation and Distribution area in the volume spread analysis, these tools will help you to predict the presence of Accumulation and Distribution area. Hence, you can predict the best trading opportunity.

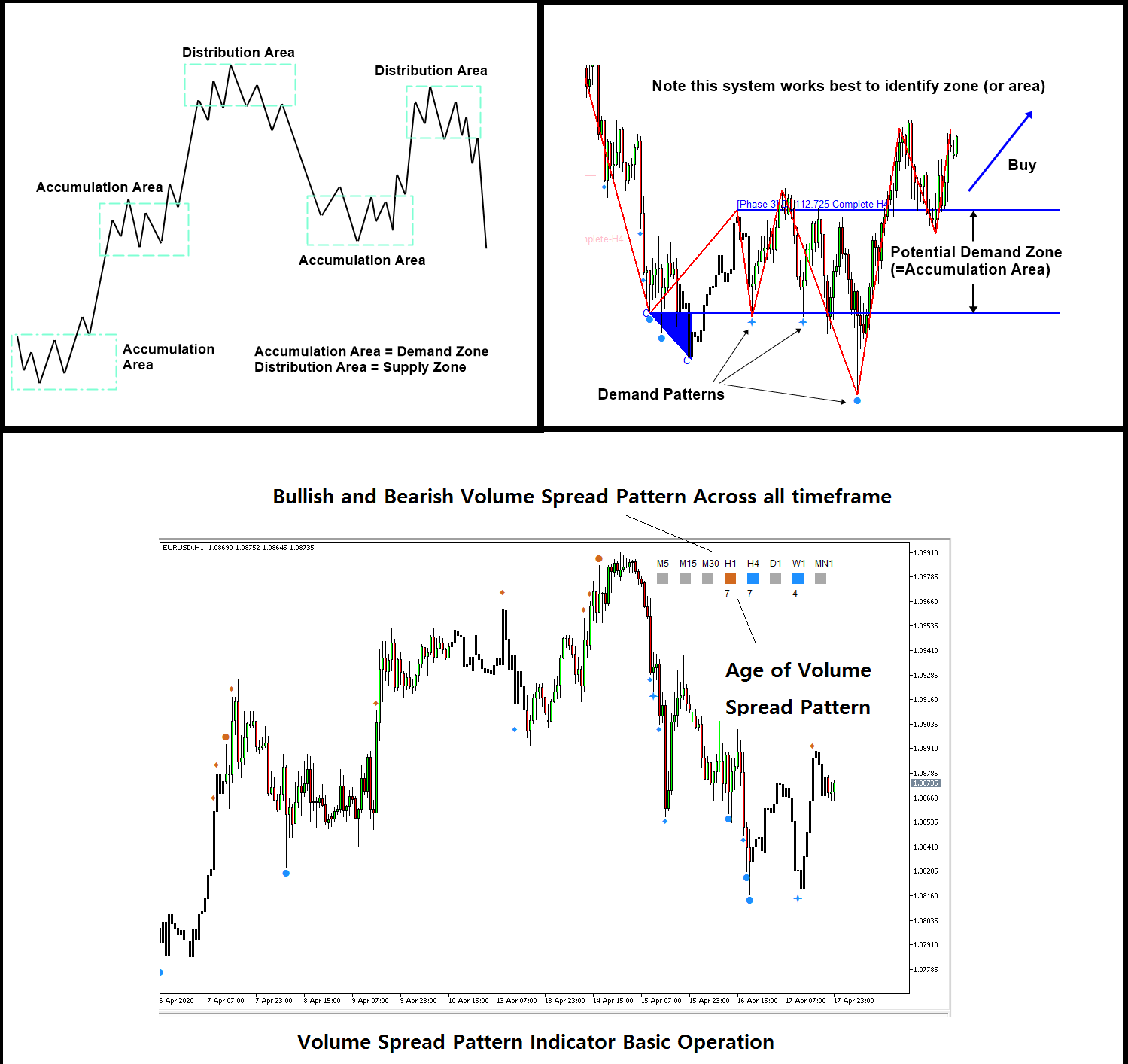

Firstly, Volume Spread Pattern Indicator is the powerful volume spread analysis indicator that operated across multiple timeframe. Volume Spread Pattern Indicator will not only provide the bearish and bullish volume spread pattern in the current time frame but also it will detect the same patterns across all timeframe. You just need to open one chart and you will be notified bullish and bearish patterns in all timeframe in real time.

Here is the link to Volume Spread Pattern Indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Secondly, Volume Spread Pattern Detector is the light version of Volume Spread Pattern Indicator above. This is free tool with some limited features. However, Volume Spread Pattern Detector is used by thousands of traders. Especially, it works great with the support and resistance to confirm the turning point. This is free tool. Just grab one.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Both Volume Spread Pattern Indicator and Volume Spread Pattern Detector works well with Excessive Momentum indicator as Excessive Momentum indicator helps to detect the potential Accumulation and Distribution area automatically. Hence, if you are using Excessive Momentum Indicator, then you can use one between Volume Spread Pattern Indicator or Volume Spread Pattern Detector. In addition, we provide the YouTube video to accomplish the basic operations of Excessive Momentum Indicator.

YouTube Video (Excessive Momentum Indicator): https://youtu.be/oztARcXsAVA

YouTube Video (Excessive Momentum Indicator Explained): https://youtu.be/A4JcTcakOKw

Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Thirdly, we provide the volume Zone Oscillator. This is another useful free tool that utilizes the volume information for your trading. You can use these tools for volume spread analysis, Harmonic Pattern, Elliott Wave Pattern, X3 Price Pattern further. This is free tool. Just grab one.

https://algotrading-investment.com/portfolio-item/volume-zone-oscillator/

We provide three different Volume Spread Analysis indicators and volume based tools. Our volume spread analysis tools are the hybrid of volume spread analysis and signal processing theory.

These tools will help you to complete your trading decision with high precision. As long as you understand the concept of the Accumulation and Distribution area in the volume spread analysis, these tools will help you to predict the presence of Accumulation and Distribution area. Hence, you can predict the best trading opportunity.

Firstly, Volume Spread Pattern Indicator is the powerful volume spread analysis indicator that operated across multiple timeframe. Volume Spread Pattern Indicator will not only provide the bearish and bullish volume spread pattern in the current time frame but also it will detect the same patterns across all timeframe. You just need to open one chart and you will be notified bullish and bearish patterns in all timeframe in real time.

Here is the link to Volume Spread Pattern Indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Secondly, Volume Spread Pattern Detector is the light version of Volume Spread Pattern Indicator above. This is free tool with some limited features. However, Volume Spread Pattern Detector is used by thousands of traders. Especially, it works great with the support and resistance to confirm the turning point. This is free tool. Just grab one.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Both Volume Spread Pattern Indicator and Volume Spread Pattern Detector works well with Excessive Momentum indicator as Excessive Momentum indicator helps to detect the potential Accumulation and Distribution area automatically. Hence, if you are using Excessive Momentum Indicator, then you can use one between Volume Spread Pattern Indicator or Volume Spread Pattern Detector. In addition, we provide the YouTube video to accomplish the basic operations of Excessive Momentum Indicator.

YouTube Video (Excessive Momentum Indicator): https://youtu.be/oztARcXsAVA

YouTube Video (Excessive Momentum Indicator Explained): https://youtu.be/A4JcTcakOKw

Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Thirdly, we provide the volume Zone Oscillator. This is another useful free tool that utilizes the volume information for your trading. You can use these tools for volume spread analysis, Harmonic Pattern, Elliott Wave Pattern, X3 Price Pattern further. This is free tool. Just grab one.

https://algotrading-investment.com/portfolio-item/volume-zone-oscillator/

Young Ho Seo

Wave Process (Cycle)

Figure 7-1: Wave process is corresponding to price pattern (1, 2), (1, 3) and (1, 4) in the table.

Wave process is any cyclic patterns repeating in the fixed time interval. Two main references for Wave process can be found from Physics and Time series Analysis. Both references deal exclusively with periodic cycle of an object or a signal. However, they use different methodology to describe the periodic cycle. In physics, wave is the main term describing the periodic cycle of an object or a signal. In time series analysis, the term “Seasonality” is used to deal with seasonal fluctuations in the price series. In the Price Pattern Table (Figure 7-1), Wave Process covers both wave in Physics and seasonality in time series analysis. To better illustrate the Wave process, we provide simple description for Wave and Seasonality in this section.

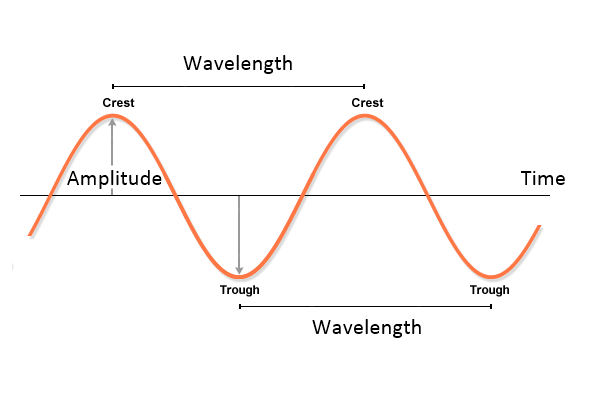

In Physics, Wave can be described by three independent variables, which are frequency, wavelength and amplitude. Frequency is the number of waves passing a point in certain time interval. Scientists and engineers normally use a time of one second. Therefore, number of waves passing a point in 1 second is described by the unit called Hertz. 1 Hertz equals to one Wave per second. Wavelength is the distance from any point on one wave to the same point on the next wave along. Amplitude is the height of wave from the top of a crest to the centre line of the wave.

Figure 7-2: Description of Wave in Physics.

Normally textbook will show you a clean sine or cosine wave function to describe the property of wave. In the real world, the wave often consists of multiple cyclic components. For example, Figure 7-3 shows the synthetic multiple cycles built by adding three Sine Wave Functions: Sine (2x) + Sine (13x) + Sine (30x). Many real world signals can have more complex cyclic structure than this example. In addition, many real world signal will exhibit decreasing or increasing amplitude to make your analysis more difficult as shown in Figure 7-4.