LazyBoy AI Trader Prob Firms Ready

- Эксперты

- Hesham Ahmed Kamal Barakat

- Версия: 1.5

- Обновлено: 6 июля 2023

- Активации: 5

NEW!

Jan 8th 2024 Flash sale - 90% discount!

SEP 29 2023 - Get the source code and redistribute the EA as you wish, contact us for details.

SEP 11 2023 - Now you can pay only $1000 a monthly installment and get full access to the EA.

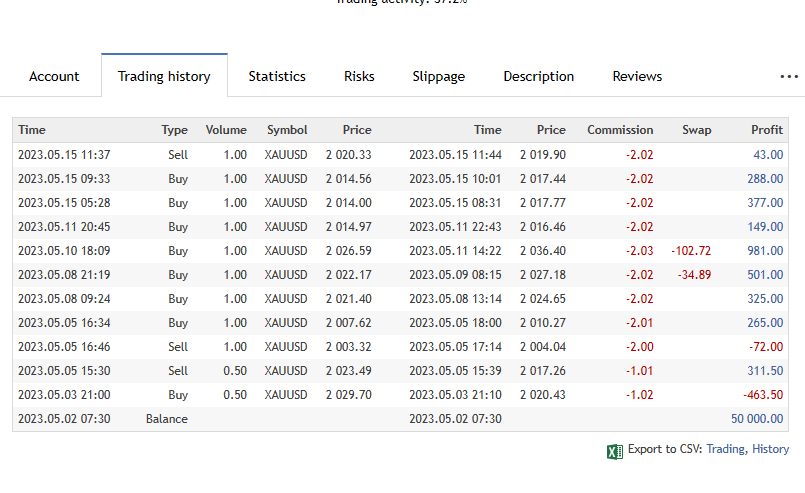

Trades;

Currency pairs - Metals and more!

The Strategy;

| Our Advanced Support/Resistance Trading Strategy is a powerful tool designed to help traders achieve consistent gains while effectively managing risk and avoiding losses. Here are the key strengths of this code: | ||||||

| 1. Robust Support/Resistance Zone Identification: | ||||||

| - The strategy uses AI to identify market patterns. | ||||||

| - The strategy uses fractal patterns to identify support and resistance zones accurately. | ||||||

| - Fractals are calculated based on customizable factors, allowing traders to adapt the strategy to different market conditions. | ||||||

| - The zones are categorized by strength (proven, verified, untested, turncoat, weak), providing valuable insights into market dynamics. | ||||||

| 2. Adaptive Position Management: | ||||||

| - The strategy offers flexible position management techniques, including scaling, adjusting take profit and stop loss levels, and implementing hedging. | ||||||

| - Traders can control position sizing and choose different methods for opening counter-hedging positions. | ||||||

| - The strategy can be configured to automatically close positions or pending orders upon reaching a specified gain, minimizing exposure and securing profits. | ||||||

| 3. Customizable Risk Management: | ||||||

| - Traders can define their preferred stop loss and take profit percentages, tailoring the risk-reward ratio to their individual trading style. | ||||||

| - Options such as stop loss trailing and adjusting take profit levels dynamically provide additional risk management capabilities. | ||||||

| 4. Market Direction Awareness: | ||||||

| - The strategy allows traders to consider market direction when opening positions, with options to trade only in specific directions or adjust position management based on market movements. | ||||||

| - By aligning trades with the prevailing market trend, the strategy increases the probability of success and reduces the risk of trading against the trend. | ||||||

| 5. Scalability and Gain Multipliers: | ||||||

| - Traders can leverage scaling techniques, enabling the strategy to add or reduce positions based on predefined rules and conditions. | ||||||

| - Gain multipliers provide flexibility to adjust profit levels for different scaling stages, allowing for targeted profitability during different market phases. | ||||||

| 6. Loss Mitigation Strategies: | ||||||

| - The strategy incorporates various methods for handling losing positions, including closing positions, opening counter-hedging positions, or employing loss vibration techniques. | ||||||

| - Traders can choose the approach that aligns with their risk tolerance and trading objectives. | ||||||

| 7. User-Friendly Customization: | ||||||

| - The code is equipped with a comprehensive set of input variables, allowing traders to easily customize the strategy's behavior according to their preferences and market conditions. | ||||||

| - Users can fine-tune parameters such as timeframe, training period, buffer sizes, safety measures, drawdown limits, and more. | ||||||

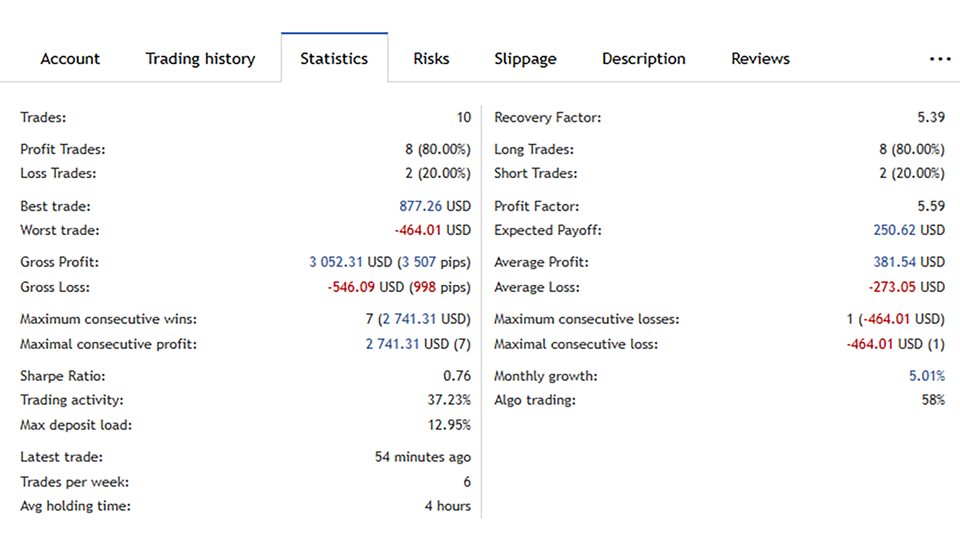

| By combining the strength of accurate support/resistance zone identification, adaptive position management, and effective risk management techniques, our Advanced Support/Resistance Trading Strategy provides traders with a robust framework to capitalize on market opportunities while minimizing potential losses. It is a versatile tool suitable for both novice and experienced traders seeking consistent gains and risk control in their trading endeavors. | ||||||

This is a no gamic ChatGPT nor OpenAi EA!

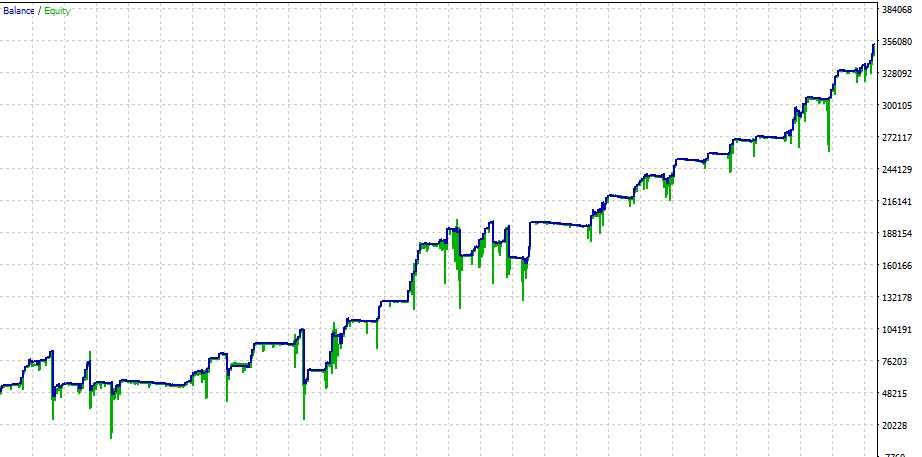

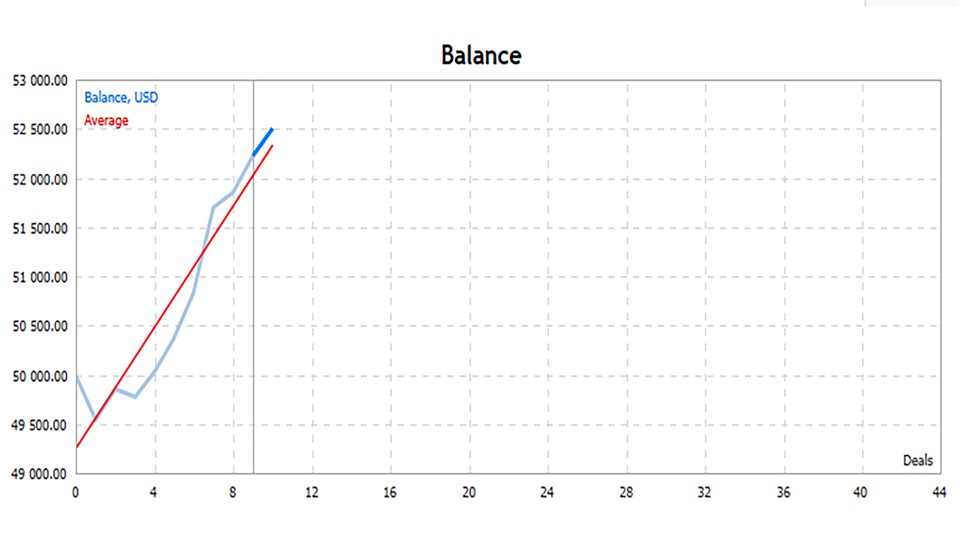

This is a real Ai history trainer/trader.

It starts by training the EA with the backward history of any currency pairs under the one hour time frame.

Then it will start trading based on support and resistance zones and matching them with the trained data. Which trains the EA with so many indicators data, Volume Profiling, and more.

To create the optimal win ratio to get the best winning rate possible.

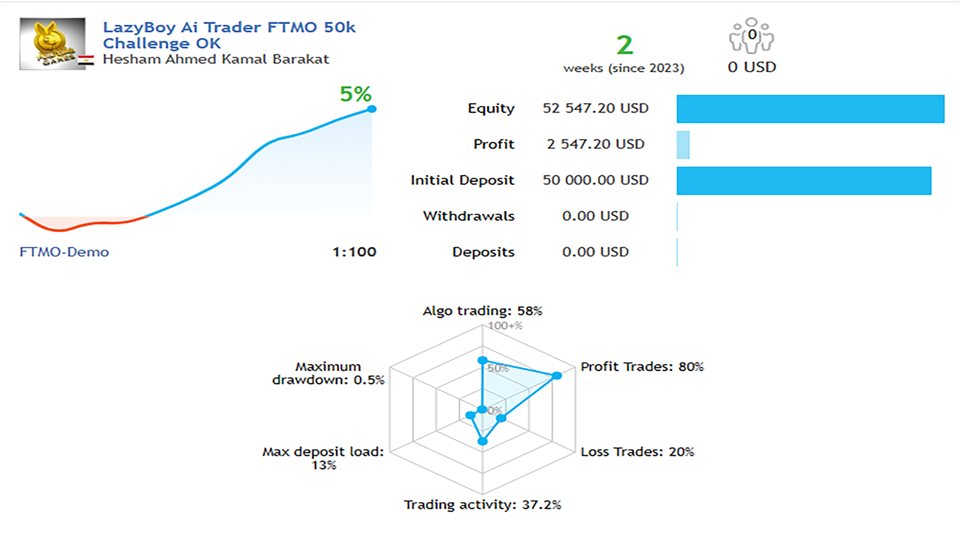

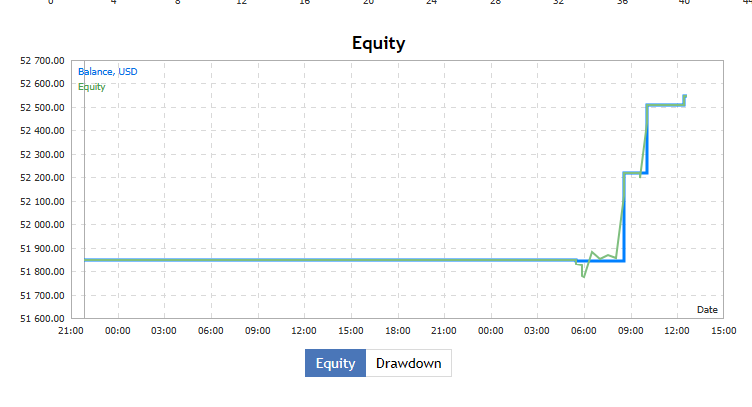

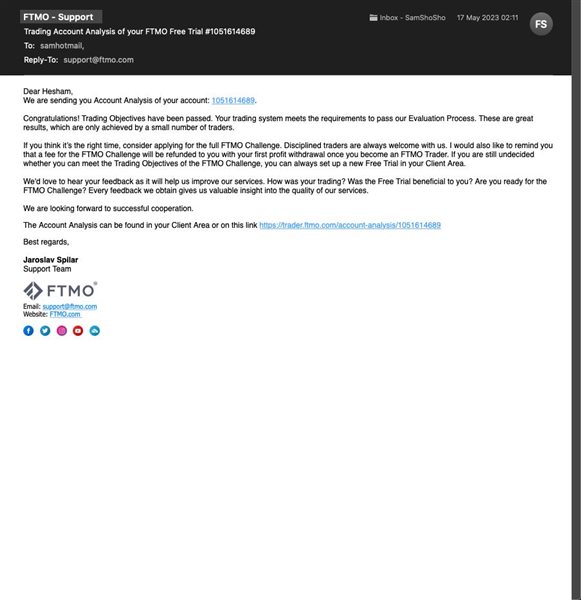

As we also target proprietary firms accounts which has very tight trading conditions.

Please make sure to watch the video which explains the best practice when using this EA.

Recommendations;

Out of the box, we recommend using the EA with following pairs;

DHSUSD

HK50

USOIL

UK100

SP500

NAS100

ESP35

XAUUSD

EURGBP

USDCHF

BTCUSD

EURUSD

EURMXN

EURPLN

EURNZD

EURHUF

EURCAD

US30

NZDUSD

AUDJPY

AUDCHF

AUDNZD

AUDUSD

USDCAD

GBPUSD

with 0.1 Max Lot Size.

For other currency pairs, metals or more. Please follow the instructions at the end of the video.

Key inputs for optimization

- SRTakeProfitPercentage(take profit as a percentage of the AI learned zones)

- SRStopLossPercentage (stop loss as a percentage of the AI learned zones only if using SROpenHedgingwithSL or SROpenPositionsWithSL)

- CloseAllPendingHedgingOnGain / CloseAllPositionsOnGain(As a gain happens, close pending order and order other positions)

- SRUseMarketDirectionGoingUp / SRUseMarketDirectionGoingDown (Trade when market is trending up or down)

- SROpenCounterHedging(If hedging position goes in loss, then open opposite position)

- SROpenHedging(When opening positions at the AI learned zones, should the EA also give a hedging order in case market goes against the position)

- SRAdjustTakeProfit(Take profit price will be adjusted based on few factors which might prevent losing a chance in gaining some profit before market goes other way)

- AllowScalling / CloseAsWeScale / ScaleLotSize(Scaling is use to multiply the positions if market is going in the correct position direction)

- SRRemoveLosingPositionsChoice(if position is in loss, which method should be followed)

Partner Program

------------------------

First pay for the EA. Then join our Partner Program. Then purchase any account from any Prob Firm, pay small setup fee and we will take it from there.

We will setup everything and get the EA attached to your newly created account.

Once the EA starts trading and start making profit.

If you pay $500 setup fees upfront, you will get 50% out of your profit share from the Prob Firm and we will keep 50% as long as you keep this partnership program going on.

You can stop the program anytime.

If you pay $1000 upfront then the share will be split 70% for you and 30% for us.