Mohammed Abdulwadud Soubra / Perfil

- Informações

|

8+ anos

experiência

|

7

produtos

|

1086

versão demo

|

|

134

trabalhos

|

1

sinais

|

1

assinantes

|

Estou no mercado forex desde 2005.

Veja este produto:

https://www.mql5.com/en/users/soubra2003/seller

Sinais de negociação promissores no US30 e em ações americanas:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para suporte imediato, por favor, junte-se a este grupo no WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Veja este produto:

https://www.mql5.com/en/users/soubra2003/seller

Sinais de negociação promissores no US30 e em ações americanas:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para suporte imediato, por favor, junte-se a este grupo no WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Amigos

8599

Pedidos

Enviados

Mohammed Abdulwadud Soubra

Pre US Open, Daily Technical Analysis Friday, April 01, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: further upside. Pivot: 1.1365 Most Likely Scenario: long positions above 1...

Mohammed Abdulwadud Soubra

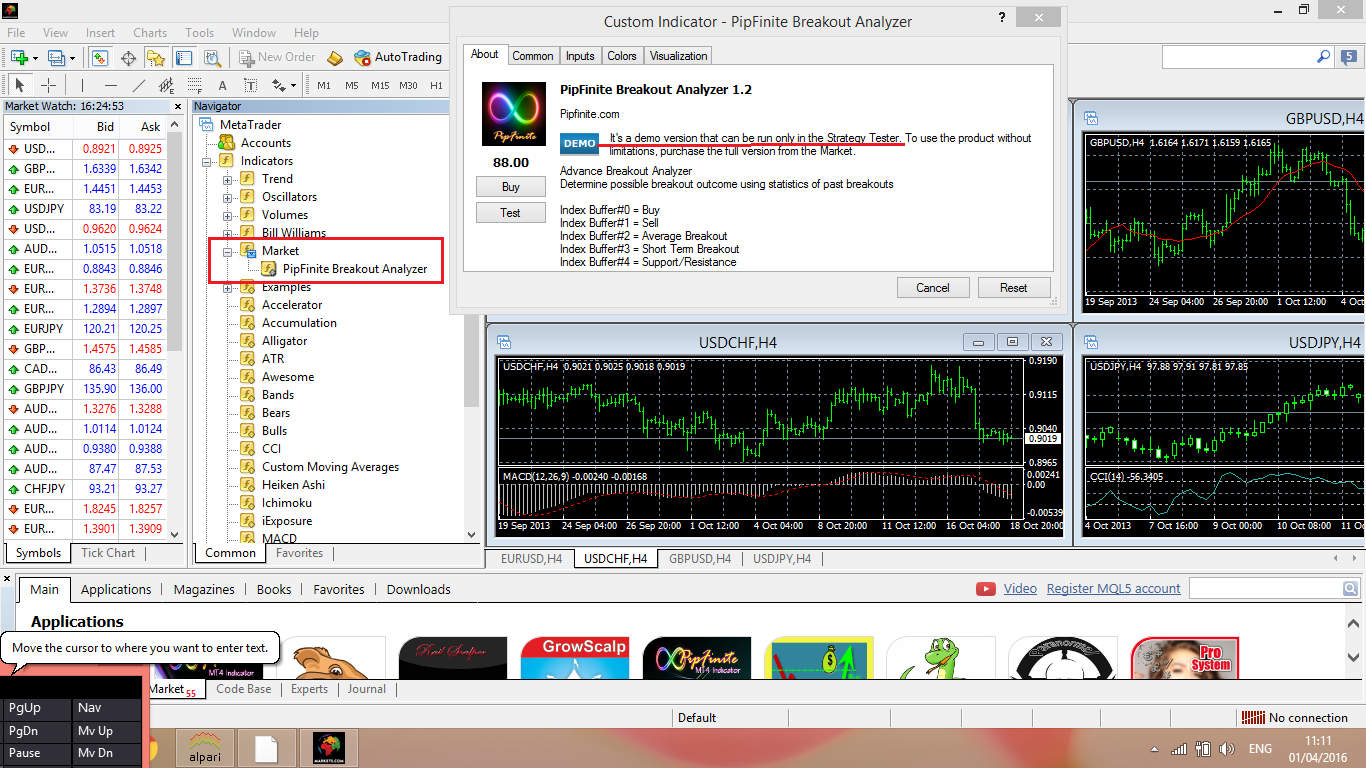

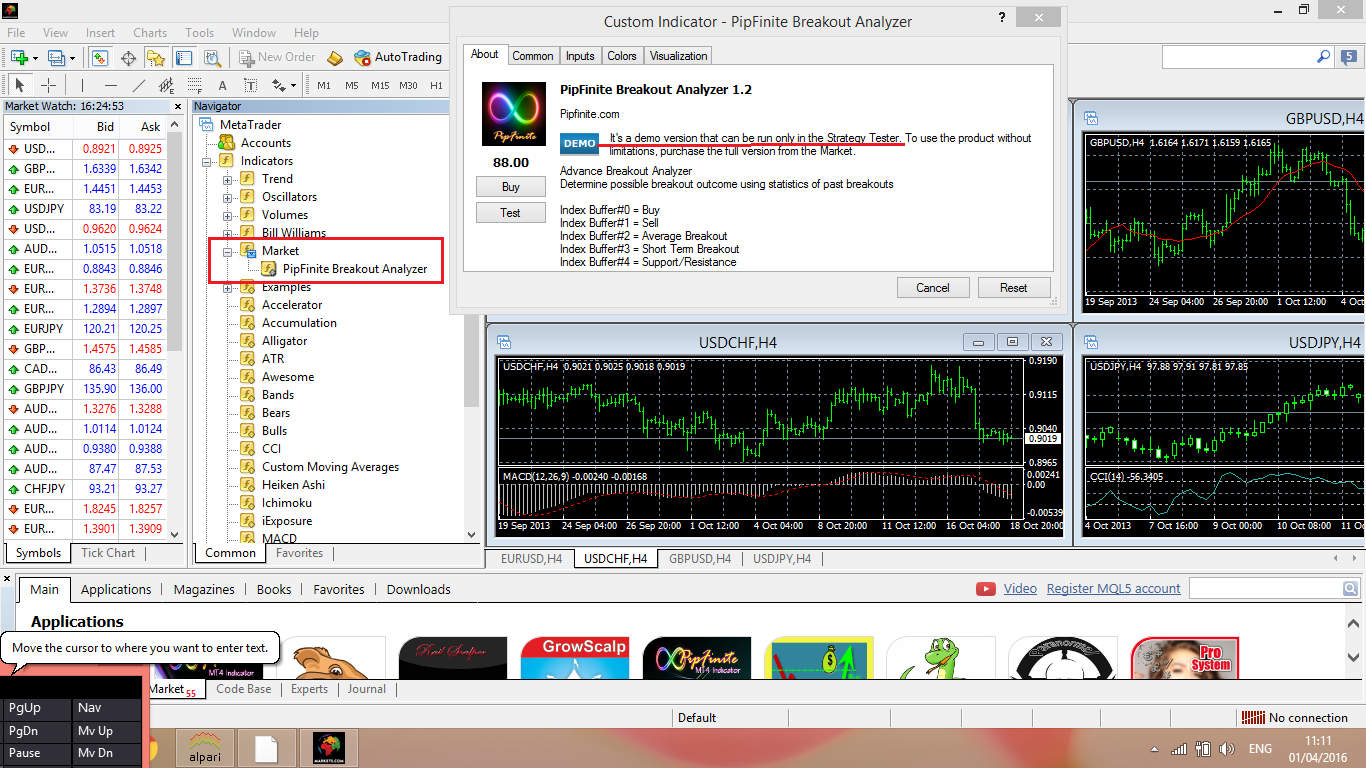

Hi

Is it possible to call a market indicator which is not payed yet (demo version) in mql4(mt4) in iCustom(....) function???

Is it possible to call a market indicator which is not payed yet (demo version) in mql4(mt4) in iCustom(....) function???

Mohammed Abdulwadud Soubra

Latest News

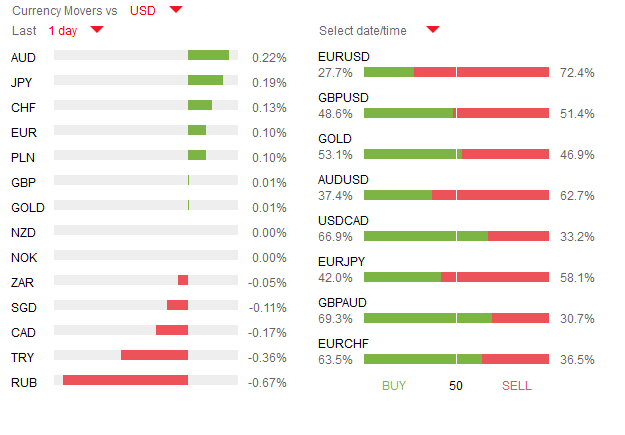

Yesterday’s price action once saw the USD selling off, which at the time of writing means that the Dollar is experiencing its fifth consecutive down day, as analysts continue to push back their expectations for the next rate hike from the FED. EURUSD is currently at a 5.5 month high, while USDJPY and GBPUSD are more range bound. During the Asian session we saw Chinese manufacturing figures, which unexpectedly showed the sector expanding for the first time in eight months. Price action in AUDUSD however was somewhat muted, with the pair initially rising before paring its gains to trade almost unchanged on the day.

Today’s economic highlight will come from the North American session in the form of the US’ Non-Farm Employment Change report. With jobless claims remaining near decade lows, and the ADP report which was strong on Wednesday, sentiment remains high for this afternoon’s release. Perhaps more importantly however will be the average earnings, which are forecasted to come in at 0.2% month-on-month. Before the NFP report however, we will see manufacturing data out of the UK and employment data out of the Eurozone. Also of note is the manufacturing data out of the US, which will come in after the NFP’s release.

Yesterday’s price action once saw the USD selling off, which at the time of writing means that the Dollar is experiencing its fifth consecutive down day, as analysts continue to push back their expectations for the next rate hike from the FED. EURUSD is currently at a 5.5 month high, while USDJPY and GBPUSD are more range bound. During the Asian session we saw Chinese manufacturing figures, which unexpectedly showed the sector expanding for the first time in eight months. Price action in AUDUSD however was somewhat muted, with the pair initially rising before paring its gains to trade almost unchanged on the day.

Today’s economic highlight will come from the North American session in the form of the US’ Non-Farm Employment Change report. With jobless claims remaining near decade lows, and the ADP report which was strong on Wednesday, sentiment remains high for this afternoon’s release. Perhaps more importantly however will be the average earnings, which are forecasted to come in at 0.2% month-on-month. Before the NFP report however, we will see manufacturing data out of the UK and employment data out of the Eurozone. Also of note is the manufacturing data out of the US, which will come in after the NFP’s release.

Mohammed Abdulwadud Soubra

Pre US Open, Daily Technical Analysis Thursday, March 31, 2016

Info Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out.

EUR/USD Intraday: further upside.

Prev Prev arrow

Next Next arrow

Pivot: 1.1300

Most Likely Scenario: long positions above 1.1300 with targets @ 1.1400 & 1.1450 in extension.

Alternative scenario: below 1.1300 look for further downside with 1.1280 & 1.1255 as targets.

Comment: the RSI is well directed.

GBP/USD Intraday: rebound.

Prev Prev arrow

Next Next arrow

Pivot: 1.4305

Most Likely Scenario: long positions above 1.4305 with targets @ 1.4455 & 1.4515 in extension.

Alternative scenario: below 1.4305 look for further downside with 1.4260 & 1.4225 as targets.

Comment: the RSI is well directed.

USD/JPY Intraday: the downside prevails.

Prev Prev arrow

Next Next arrow

Pivot: 112.85

Most Likely Scenario: short positions below 112.85 with targets @ 112.05 & 111.60 in extension.

Alternative scenario: above 112.85 look for further upside with 113.20 & 113.45 as targets.

Comment: as long as 112.85 is resistance, look for choppy price action with a bearish bias.

AUD/USD Intraday: the upside prevails.

Prev Prev arrow

Next Next arrow

Pivot: 0.7610

Most Likely Scenario: long positions above 0.7610 with targets @ 0.7700 & 0.7745 in extension.

Alternative scenario: below 0.7610 look for further downside with 0.7565 & 0.7515 as targets.

Comment: the RSI is well directed.

Gold spot Intraday: key resistance at 1237.00.

Prev Prev arrow

Next Next arrow

Pivot: 1237.00

Most Likely Scenario: short positions below 1237.00 with targets @ 1223.00 & 1216.00 in extension.

Alternative scenario: above 1237.00 look for further upside with 1243.00 & 1249.00 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Crude Oil (WTI) (K6) Intraday: under pressure.

Prev Prev arrow

Top Top arrow

Pivot: 38.71

Most Likely Scenario: short positions below 38.71 with targets @ 37.38 & 36.94 in extension.

Alternative scenario: above 38.71 look for further upside with 39.07 & 39.45 as targets.

Comment: technically the RSI is below its neutrality area at 50.

Info Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out.

EUR/USD Intraday: further upside.

Prev Prev arrow

Next Next arrow

Pivot: 1.1300

Most Likely Scenario: long positions above 1.1300 with targets @ 1.1400 & 1.1450 in extension.

Alternative scenario: below 1.1300 look for further downside with 1.1280 & 1.1255 as targets.

Comment: the RSI is well directed.

GBP/USD Intraday: rebound.

Prev Prev arrow

Next Next arrow

Pivot: 1.4305

Most Likely Scenario: long positions above 1.4305 with targets @ 1.4455 & 1.4515 in extension.

Alternative scenario: below 1.4305 look for further downside with 1.4260 & 1.4225 as targets.

Comment: the RSI is well directed.

USD/JPY Intraday: the downside prevails.

Prev Prev arrow

Next Next arrow

Pivot: 112.85

Most Likely Scenario: short positions below 112.85 with targets @ 112.05 & 111.60 in extension.

Alternative scenario: above 112.85 look for further upside with 113.20 & 113.45 as targets.

Comment: as long as 112.85 is resistance, look for choppy price action with a bearish bias.

AUD/USD Intraday: the upside prevails.

Prev Prev arrow

Next Next arrow

Pivot: 0.7610

Most Likely Scenario: long positions above 0.7610 with targets @ 0.7700 & 0.7745 in extension.

Alternative scenario: below 0.7610 look for further downside with 0.7565 & 0.7515 as targets.

Comment: the RSI is well directed.

Gold spot Intraday: key resistance at 1237.00.

Prev Prev arrow

Next Next arrow

Pivot: 1237.00

Most Likely Scenario: short positions below 1237.00 with targets @ 1223.00 & 1216.00 in extension.

Alternative scenario: above 1237.00 look for further upside with 1243.00 & 1249.00 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Crude Oil (WTI) (K6) Intraday: under pressure.

Prev Prev arrow

Top Top arrow

Pivot: 38.71

Most Likely Scenario: short positions below 38.71 with targets @ 37.38 & 36.94 in extension.

Alternative scenario: above 38.71 look for further upside with 39.07 & 39.45 as targets.

Comment: technically the RSI is below its neutrality area at 50.

Mohammed Abdulwadud Soubra

Latest News

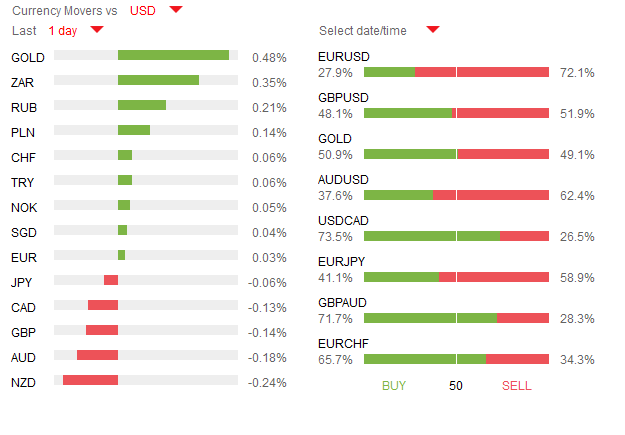

Risk-on sentiment carried over into financial markets yesterday, following Janet Yellen’s dovish speech on Tuesday, which pushed stocks and crude oil higher while the USD-Index fell for a second consecutive day -reaching a 5-month low. Losses in USD were somewhat capped however, as the ADP Non-farm employment report showed that the US economy added 200K private sector jobs, beating estimates of 195K. This morning has seen the USD recover some of the losses against the Euro, Aussie, Loonie & Pound, with USDJPY being one of the lone exceptions as investors turn cautious ahead of important manufacturing data out of China overnight and the all-important NFP report from the US tomorrow.

The economic calendar picks up steam today, as BOE’s Governor Carney will be speaking in Tokyo shortly regarding financial stability. Elsewhere, the Eurozone is scheduled to release inflation data, while the US will publish challenger job cuts figures and unemployment claims. Meanwhile, Canada’s economy is forecasted to have grown 0.3% month-over month as it gets set to publish GDP figures. Additionally, the FED’s Dudley is scheduled to deliver a speech named the role of the Federal Reserve. Lastly, both the official Chinese and Caixin manufacturing reports will be released during the overnight session.

Risk-on sentiment carried over into financial markets yesterday, following Janet Yellen’s dovish speech on Tuesday, which pushed stocks and crude oil higher while the USD-Index fell for a second consecutive day -reaching a 5-month low. Losses in USD were somewhat capped however, as the ADP Non-farm employment report showed that the US economy added 200K private sector jobs, beating estimates of 195K. This morning has seen the USD recover some of the losses against the Euro, Aussie, Loonie & Pound, with USDJPY being one of the lone exceptions as investors turn cautious ahead of important manufacturing data out of China overnight and the all-important NFP report from the US tomorrow.

The economic calendar picks up steam today, as BOE’s Governor Carney will be speaking in Tokyo shortly regarding financial stability. Elsewhere, the Eurozone is scheduled to release inflation data, while the US will publish challenger job cuts figures and unemployment claims. Meanwhile, Canada’s economy is forecasted to have grown 0.3% month-over month as it gets set to publish GDP figures. Additionally, the FED’s Dudley is scheduled to deliver a speech named the role of the Federal Reserve. Lastly, both the official Chinese and Caixin manufacturing reports will be released during the overnight session.

Mohammed Abdulwadud Soubra

EUR/USD Intraday: rebound.

Pivot: 1.1300

Most Likely Scenario: long positions above 1.1300 with targets @ 1.1365 & 1.1400 in extension.

Alternative scenario: below 1.1300 look for further downside with 1.1280 & 1.1255 as targets.

Comment: the RSI lacks downward momentum.

GBP/USD Intraday: under pressure.

Pivot: 1.4395

Most Likely Scenario: short positions below 1.4395 with targets @ 1.4305 & 1.4260 in extension.

Alternative scenario: above 1.4395 look for further upside with 1.4455 & 1.4515 as targets.

Comment: the RSI is bearish and calls for further downside.

USD/JPY Intraday: under pressure.

Pivot: 112.85

Most Likely Scenario: short positions below 112.85 with targets @ 112.05 & 111.60 in extension.

Alternative scenario: above 112.85 look for further upside with 113.20 & 113.45 as targets.

Comment: as long as 112.85 is resistance, look for choppy price action with a bearish bias.

AUD/USD Intraday: the upside prevails.

Pivot: 0.7610

Most Likely Scenario: long positions above 0.7610 with targets @ 0.7700 & 0.7745 in extension.

Alternative scenario: below 0.7610 look for further downside with 0.7565 & 0.7515 as targets.

Comment: the RSI is mixed to bullish.

Gold spot Intraday: under pressure.

Pivot: 1237.00

Most Likely Scenario: short positions below 1237.00 with targets @ 1223.00 & 1216.00 in extension.

Alternative scenario: above 1237.00 look for further upside with 1243.00 & 1249.00 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Crude Oil (WTI) (K6) Intraday: break of a ST rising trendline support.

Pivot: 38.71

Most Likely Scenario: short positions below 38.71 with targets @ 37.38 & 36.94 in extension.

Alternative scenario: above 38.71 look for further upside with 39.07 & 39.45 as targets.

Comment: technically the RSI is below its neutrality area at 50.

Pivot: 1.1300

Most Likely Scenario: long positions above 1.1300 with targets @ 1.1365 & 1.1400 in extension.

Alternative scenario: below 1.1300 look for further downside with 1.1280 & 1.1255 as targets.

Comment: the RSI lacks downward momentum.

GBP/USD Intraday: under pressure.

Pivot: 1.4395

Most Likely Scenario: short positions below 1.4395 with targets @ 1.4305 & 1.4260 in extension.

Alternative scenario: above 1.4395 look for further upside with 1.4455 & 1.4515 as targets.

Comment: the RSI is bearish and calls for further downside.

USD/JPY Intraday: under pressure.

Pivot: 112.85

Most Likely Scenario: short positions below 112.85 with targets @ 112.05 & 111.60 in extension.

Alternative scenario: above 112.85 look for further upside with 113.20 & 113.45 as targets.

Comment: as long as 112.85 is resistance, look for choppy price action with a bearish bias.

AUD/USD Intraday: the upside prevails.

Pivot: 0.7610

Most Likely Scenario: long positions above 0.7610 with targets @ 0.7700 & 0.7745 in extension.

Alternative scenario: below 0.7610 look for further downside with 0.7565 & 0.7515 as targets.

Comment: the RSI is mixed to bullish.

Gold spot Intraday: under pressure.

Pivot: 1237.00

Most Likely Scenario: short positions below 1237.00 with targets @ 1223.00 & 1216.00 in extension.

Alternative scenario: above 1237.00 look for further upside with 1243.00 & 1249.00 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Crude Oil (WTI) (K6) Intraday: break of a ST rising trendline support.

Pivot: 38.71

Most Likely Scenario: short positions below 38.71 with targets @ 37.38 & 36.94 in extension.

Alternative scenario: above 38.71 look for further upside with 39.07 & 39.45 as targets.

Comment: technically the RSI is below its neutrality area at 50.

Mohammed Abdulwadud Soubra

Publicado o postagem Pre European Open, Daily Technical Analysis Thursday, March 31, 2016

Pre European Open, Daily Technical Analysis Thursday, March 31, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: rebound. Pivot: 1.1300 Most Likely Scenario: long positions above 1...

Mohammed Abdulwadud Soubra

Publicado o código Example of Commodity Channel Index Automated

Expert Advisor based on Commodity Channel Index (CCI) indicator.

Compartilhar nas redes sociais · 1

1769

Mohammed Abdulwadud Soubra

Latest News

Monday’s economic reports out of the US, which included personal spending and goods trade balance, resulted in economists lowering their forecasts for Q1 GDP. The Atlanta FED’s GDP tracker, which is one of the most trusted source, has lowered its estimates for Q1 GDP from 1.4% to a paltry 0.6%. Core PCE data out of the US also disappointed, coming in at 0.1% versus estimates of 0.2% month-on-month, though it shows that inflation grew by 1.7% year-over-year which is close to the FED’s 2% target. The ending result was a broad based USD-selloff, which saw GBPUSD rise by nearly 1% and USDCAD drop 0.7%, as thin volumes due to the Eastern holidays added to the volatility.

Today’s highlights will come from the North American session, with the US scheduled to report fresh consumer confidence numbers – anticipated to have gained from 92.2 to 93.9. Elsewhere, the FED’s Chair Janet Yellen is slated to deliver a speech before the economic club of New York, which will be her first public appearance since the March 16 FOMC meeting.

Monday’s economic reports out of the US, which included personal spending and goods trade balance, resulted in economists lowering their forecasts for Q1 GDP. The Atlanta FED’s GDP tracker, which is one of the most trusted source, has lowered its estimates for Q1 GDP from 1.4% to a paltry 0.6%. Core PCE data out of the US also disappointed, coming in at 0.1% versus estimates of 0.2% month-on-month, though it shows that inflation grew by 1.7% year-over-year which is close to the FED’s 2% target. The ending result was a broad based USD-selloff, which saw GBPUSD rise by nearly 1% and USDCAD drop 0.7%, as thin volumes due to the Eastern holidays added to the volatility.

Today’s highlights will come from the North American session, with the US scheduled to report fresh consumer confidence numbers – anticipated to have gained from 92.2 to 93.9. Elsewhere, the FED’s Chair Janet Yellen is slated to deliver a speech before the economic club of New York, which will be her first public appearance since the March 16 FOMC meeting.

Mohammed Abdulwadud Soubra

28 March 2016, Time of Writing: 09:00 am

Trader Daily Market Update

Major Calendar News

Time (GMT) Name Country Vol. Prev. Cons. Sentiment

12:30 Core PCE Price Index m/m USD Med. 0.3% 0.2% Neutral

12:30 Personal Spending m/m USD Med. 0.5% 0.2% Neutral

14:00 Pending Home Sales m/m USD Med. -2.5% 1.2% Negative

23:30 Household Spending y/y JPY Med. -3.1% -1.8% Negative

23:50 Retail Sales y/y JPY Med. -0.2% 1.6% Negative

Vol.: Volatility; Prev.: Previous; Cons.: Consensus

Key Support/Resistance Levels

H4 R2 R1 Pivot S1 S2

EURUSD 1.1188 1.1179 1.1166 1.1157 1.1144

GBPUSD 1.4182 1.4159 1.4134 1.4111 1.4085

USDJPY 113.54 113.33 113.11 112.89 112.67

AUDUSD 0.7541 0.7534 0.7521 0.7513 0.7500

USDCAD 1.3319 1.3297 1.3260 1.3238 1.3202

Latest News

Terrorist attacks in Pakistan over the weekend had little impact on the FX markets this morning, with USDJPY trading higher by 0.35% - currently around 113.50 which is a 12-day high for the pair. Elsewhere, oil prices are gaining traction this morning, which in turn is pushing USDCAD slightly lower towards 1.3240 at the time of writing. Lastly, a positive revision for the final reading of the US’ fourth quarter GDP reading from 1% to 1.4% on Friday has pushed up the probability of the FED raising interest rates in April to 11.5% - according to the options markets.

With several markets still offline today due to the Eastern holidays, trading volumes should once again be thin which heightens the risk for unpredictable and sudden spikes in FX trading. Australia and New Zealand markets were closed this morning, with European and the UK also closed. Data wise, the US will publish the all-important PCE Price Index, which is the FED’s favourite inflation reading. Besides the inflation data, the US will release pending home sales as well.

Trader Daily Market Update

Major Calendar News

Time (GMT) Name Country Vol. Prev. Cons. Sentiment

12:30 Core PCE Price Index m/m USD Med. 0.3% 0.2% Neutral

12:30 Personal Spending m/m USD Med. 0.5% 0.2% Neutral

14:00 Pending Home Sales m/m USD Med. -2.5% 1.2% Negative

23:30 Household Spending y/y JPY Med. -3.1% -1.8% Negative

23:50 Retail Sales y/y JPY Med. -0.2% 1.6% Negative

Vol.: Volatility; Prev.: Previous; Cons.: Consensus

Key Support/Resistance Levels

H4 R2 R1 Pivot S1 S2

EURUSD 1.1188 1.1179 1.1166 1.1157 1.1144

GBPUSD 1.4182 1.4159 1.4134 1.4111 1.4085

USDJPY 113.54 113.33 113.11 112.89 112.67

AUDUSD 0.7541 0.7534 0.7521 0.7513 0.7500

USDCAD 1.3319 1.3297 1.3260 1.3238 1.3202

Latest News

Terrorist attacks in Pakistan over the weekend had little impact on the FX markets this morning, with USDJPY trading higher by 0.35% - currently around 113.50 which is a 12-day high for the pair. Elsewhere, oil prices are gaining traction this morning, which in turn is pushing USDCAD slightly lower towards 1.3240 at the time of writing. Lastly, a positive revision for the final reading of the US’ fourth quarter GDP reading from 1% to 1.4% on Friday has pushed up the probability of the FED raising interest rates in April to 11.5% - according to the options markets.

With several markets still offline today due to the Eastern holidays, trading volumes should once again be thin which heightens the risk for unpredictable and sudden spikes in FX trading. Australia and New Zealand markets were closed this morning, with European and the UK also closed. Data wise, the US will publish the all-important PCE Price Index, which is the FED’s favourite inflation reading. Besides the inflation data, the US will release pending home sales as well.

Mohammed Abdulwadud Soubra

US Dollar Forecast – US Dollar Tempers Pace, But Bull Trend Still Endures

The US Dollar took a dangerous tumble through the first quarter, throwing into doubt the currency’s ambitions after more than four years of advance. The extreme contrast between the Greenback and its global counterparts has notably moderated over the past months and that in turn has cooled the bullish fervor for the currency.

Euro Forecast - EUR/USD Stuck in No-Man’s Land Headed into Q2’16; Don’t Discount ‘Brexit’

Coming into Q1’16, our main theme for EUR/USD was that, because market participants would be wholly fixated on seeing what the European Central Bank and the Federal Reserve would do in their March meetings, neutrality would prevail.

Japanese Yen Forecast - Bullish USD/JPY Outlook Mired by Dovish Fed, Wait-and-See BoJ

The diverging paths for monetary policy fosters a long-term bullish outlook forUSD/JPY, but the Federal Reserve’s and the Bank of Japan’s (BoJ) wait-and-see approach may continue to drag on the exchange rate especially as Janet Yellen and Co. look to further delay their normalization cycle.

Gold Forecast – Will Gold’s Multi-Year Down Trend Resume in Q2?

Gold embarked on an aggressive recovery in the first quarter of 2016, buoyed by a slump in Federal Reserve rate hike expectations. A dovish shift in investors’ policy bets reduces the opportunity cost to owning gold versus interest-bearing assets while boosting demand for alternative stores of value to hedge against increased inflation risk.

Crude Oil Forecast –Oil Price Optimism May Be Short-Lived

Oil has stayed resilient during the past few weeks, despite occasional risk-off sentiment. Crude prices rose to their highest in three months in early March, at $42.49/barrel for WTI and $42.54/barrel for Brent. This was triggered by a combination of tightening supply, a proposed production freeze and a weakerUS dollar.

Stock Forecasts - Markets Roared, Central Banks Offer a Jostled Response

As we entered the New Year, it became obvious that the lack of further Central Bank support in December threatened the fragile recoveries that have been seen around the globe in the post-Financial Collapse environment. The European Central Bank had talked up more QE leading into their December meeting, and that fell flat on December 3rd when the bank failed to increase their QE program, and instead merely cut the deposit rate into deeper negative territory.

The US Dollar took a dangerous tumble through the first quarter, throwing into doubt the currency’s ambitions after more than four years of advance. The extreme contrast between the Greenback and its global counterparts has notably moderated over the past months and that in turn has cooled the bullish fervor for the currency.

Euro Forecast - EUR/USD Stuck in No-Man’s Land Headed into Q2’16; Don’t Discount ‘Brexit’

Coming into Q1’16, our main theme for EUR/USD was that, because market participants would be wholly fixated on seeing what the European Central Bank and the Federal Reserve would do in their March meetings, neutrality would prevail.

Japanese Yen Forecast - Bullish USD/JPY Outlook Mired by Dovish Fed, Wait-and-See BoJ

The diverging paths for monetary policy fosters a long-term bullish outlook forUSD/JPY, but the Federal Reserve’s and the Bank of Japan’s (BoJ) wait-and-see approach may continue to drag on the exchange rate especially as Janet Yellen and Co. look to further delay their normalization cycle.

Gold Forecast – Will Gold’s Multi-Year Down Trend Resume in Q2?

Gold embarked on an aggressive recovery in the first quarter of 2016, buoyed by a slump in Federal Reserve rate hike expectations. A dovish shift in investors’ policy bets reduces the opportunity cost to owning gold versus interest-bearing assets while boosting demand for alternative stores of value to hedge against increased inflation risk.

Crude Oil Forecast –Oil Price Optimism May Be Short-Lived

Oil has stayed resilient during the past few weeks, despite occasional risk-off sentiment. Crude prices rose to their highest in three months in early March, at $42.49/barrel for WTI and $42.54/barrel for Brent. This was triggered by a combination of tightening supply, a proposed production freeze and a weakerUS dollar.

Stock Forecasts - Markets Roared, Central Banks Offer a Jostled Response

As we entered the New Year, it became obvious that the lack of further Central Bank support in December threatened the fragile recoveries that have been seen around the globe in the post-Financial Collapse environment. The European Central Bank had talked up more QE leading into their December meeting, and that fell flat on December 3rd when the bank failed to increase their QE program, and instead merely cut the deposit rate into deeper negative territory.

Mohammed Abdulwadud Soubra

Hello

can anyone help me regarding one minute chart to get more data for back test

in most brokers it is not more than two monthes!!

can anyone help me regarding one minute chart to get more data for back test

in most brokers it is not more than two monthes!!

Dr. Trader

2016.03.25

There is a new beta build for MetaTrader5, which has good tick and history quality. Install new MT5 copy to have old one as backup, then connect to MetaQuotes-Demo server and create an account there and login to trigger an update to new MT5 beta version. Then use this MetaQuotes-Demo account for backtest.

Mohammed Abdulwadud Soubra

2016.03.26

Thanks for your opinion share

but I need it in MT4

.... I will try your idea of MT5 ... but which broker you prefer ???

but I need it in MT4

.... I will try your idea of MT5 ... but which broker you prefer ???

Mohammed Abdulwadud Soubra

Latest News

Disappointing durable goods orders out of the US yesterday resulted in Atlanta’s FED GDP tracker to lower their forecasts for Q1 growth from 1.9% to 1.4%. This pessimistic forecast however had little effect on the USD, as EURUSD closed the day slightly lower while GBPUSD gained marginally. USDJPY meanwhile continued its 5-day winning streak, ending the day just shy of the 113 handle, despite equity markets in the US closing mixed. Lastly, bullish comments by the FED’s Bullard and Kaplan have pushed the probability of a rate-hike at the FOMC meeting in April to 11.5%, according to the options markets.

With a large number of banks across the world closed for Eastern holidays, along with certain markets, today’s economic calendar is thin along with liquidity which may in turn boost volatility without any real explanation. The lone tier-one economic news release this afternoon will come from the US in the form of its final GDP reading for the fourth quarter, which is expected to show a growth of 1% quarter-on-quarter.

Disappointing durable goods orders out of the US yesterday resulted in Atlanta’s FED GDP tracker to lower their forecasts for Q1 growth from 1.9% to 1.4%. This pessimistic forecast however had little effect on the USD, as EURUSD closed the day slightly lower while GBPUSD gained marginally. USDJPY meanwhile continued its 5-day winning streak, ending the day just shy of the 113 handle, despite equity markets in the US closing mixed. Lastly, bullish comments by the FED’s Bullard and Kaplan have pushed the probability of a rate-hike at the FOMC meeting in April to 11.5%, according to the options markets.

With a large number of banks across the world closed for Eastern holidays, along with certain markets, today’s economic calendar is thin along with liquidity which may in turn boost volatility without any real explanation. The lone tier-one economic news release this afternoon will come from the US in the form of its final GDP reading for the fourth quarter, which is expected to show a growth of 1% quarter-on-quarter.

Mohammed Abdulwadud Soubra

Feedback deixado para o cliente no serviço One technical specification

no comments !

Mohammed Abdulwadud Soubra

Daily Technical Outlook - March 23-

23rd March 2016 at 04:25 PM

The Euro fell from the upper side of the consolidation triangle seen in the daily chart and prices dropped towards the hourly support zone.

Actually, our view is flat in the near-term with a light preference to the upside, as per the daily trend. Technically, as far as 1.1060 low is intact, the single currency may stay well supported in the next days. Otherwise, the bullish cycle from 1.0820 support is likely to come to end.

Consequently, we will look for a bullish reaction in the Euro around 1.1200/1.1160 levels, as the recent drop is considered as corrective only.

Support: 1.1200-1.1160-1.1060

Resistance: 1.1340-1.1375-1.1495

23rd March 2016 at 04:25 PM

The Euro fell from the upper side of the consolidation triangle seen in the daily chart and prices dropped towards the hourly support zone.

Actually, our view is flat in the near-term with a light preference to the upside, as per the daily trend. Technically, as far as 1.1060 low is intact, the single currency may stay well supported in the next days. Otherwise, the bullish cycle from 1.0820 support is likely to come to end.

Consequently, we will look for a bullish reaction in the Euro around 1.1200/1.1160 levels, as the recent drop is considered as corrective only.

Support: 1.1200-1.1160-1.1060

Resistance: 1.1340-1.1375-1.1495

: