Mohammed Abdulwadud Soubra / Perfil

- Informações

|

8+ anos

experiência

|

7

produtos

|

1086

versão demo

|

|

134

trabalhos

|

1

sinais

|

1

assinantes

|

Estou no mercado forex desde 2005.

Veja este produto:

https://www.mql5.com/en/users/soubra2003/seller

Sinais de negociação promissores no US30 e em ações americanas:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para suporte imediato, por favor, junte-se a este grupo no WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Veja este produto:

https://www.mql5.com/en/users/soubra2003/seller

Sinais de negociação promissores no US30 e em ações americanas:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para suporte imediato, por favor, junte-se a este grupo no WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Amigos

8602

Pedidos

Enviados

Mohammed Abdulwadud Soubra

Pivot: 37.25

Most Likely Scenario: short positions below 37.25 with targets @ 34.50 & 34.00 in extension.

Alternative scenario: above 37.25 look for further upside with 38.39 & 39.07 as targets.

Comment: technically the RSI is below its neutrality area at 50.

Most Likely Scenario: short positions below 37.25 with targets @ 34.50 & 34.00 in extension.

Alternative scenario: above 37.25 look for further upside with 38.39 & 39.07 as targets.

Comment: technically the RSI is below its neutrality area at 50.

Mohammed Abdulwadud Soubra

Pivot: 1222.50

Most Likely Scenario: long positions above 1222.50 with targets @ 1238.50 & 1243.00 in extension.

Alternative scenario: below 1222.50 look for further downside with 1214.50 & 1208.50 as targets.

Comment: the RSI is well directed.

Most Likely Scenario: long positions above 1222.50 with targets @ 1238.50 & 1243.00 in extension.

Alternative scenario: below 1222.50 look for further downside with 1214.50 & 1208.50 as targets.

Comment: the RSI is well directed.

Mohammed Abdulwadud Soubra

Pivot: 0.7645

Most Likely Scenario: short positions below 0.7645 with targets @ 0.7540 & 0.7510 in extension.

Alternative scenario: above 0.7645 look for further upside with 0.7680 & 0.7705 as targets.

Comment: the RSI is badly directed.

Most Likely Scenario: short positions below 0.7645 with targets @ 0.7540 & 0.7510 in extension.

Alternative scenario: above 0.7645 look for further upside with 0.7680 & 0.7705 as targets.

Comment: the RSI is badly directed.

Mohammed Abdulwadud Soubra

Pivot: 111.05

Most Likely Scenario: short positions below 111.05 with targets @ 110.25 & 109.50 in extension.

Alternative scenario: above 111.05 look for further upside with 111.40 & 111.75 as targets.

Comment: the RSI is badly directed.

Most Likely Scenario: short positions below 111.05 with targets @ 110.25 & 109.50 in extension.

Alternative scenario: above 111.05 look for further upside with 111.40 & 111.75 as targets.

Comment: the RSI is badly directed.

Mohammed Abdulwadud Soubra

Pivot: 1.4280

Most Likely Scenario: short positions below 1.4280 with targets @ 1.4185 & 1.4140 in extension.

Alternative scenario: above 1.4280 look for further upside with 1.4325 & 1.4375 as targets.

Comment: the RSI is badly directed.

Most Likely Scenario: short positions below 1.4280 with targets @ 1.4185 & 1.4140 in extension.

Alternative scenario: above 1.4280 look for further upside with 1.4325 & 1.4375 as targets.

Comment: the RSI is badly directed.

Mohammed Abdulwadud Soubra

Pivot: 1.1415

Most Likely Scenario: short positions below 1.1415 with targets @ 1.1340 & 1.1310 in extension.

Alternative scenario: above 1.1415 look for further upside with 1.1435 & 1.1465 as targets.

Comment: the upward potential is likely to be limited by the resistance at 1.1415.

Most Likely Scenario: short positions below 1.1415 with targets @ 1.1340 & 1.1310 in extension.

Alternative scenario: above 1.1415 look for further upside with 1.1435 & 1.1465 as targets.

Comment: the upward potential is likely to be limited by the resistance at 1.1415.

Mohammed Abdulwadud Soubra

Pre US Open, Daily Technical Analysis Tuesday, April 05, 2016

5 abril 2016, 13:23

Pre US Open, Daily Technical Analysis Tuesday, April 05, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: under pressure. Pivot: 1.1415 Most Likely Scenario: short positions below 1...

Mohammed Abdulwadud Soubra

Global stocks descended into Q2 lacking inspiration, following the heavy declines in oil prices that arrested risk appetite and dampened confidence towards the global economy. Asia markets were left under pressure in the early trading sessions of Tuesday with most Asian stocks venturing into the red territory as risk aversion empowered the safe-haven Japanese Yen. Although Europe displayed some resilience during trading on Monday, a decline may be pending as risk aversion and anxiety ahead of the release of the FOMC minutes encourages investors to scatter from riskier assets. Wall Street had previous gains relinquished as investor anxiety, complimented with growing caution ahead of the heavily anticipated minutes, spurred a selloff that left most stocks at the mercy of the bears. With Q2 commencing in such a tepid fashion and ongoing concerns over the health of the global economy lingering in the background, stock markets could be poised for further declines.

Mohammed Abdulwadud Soubra

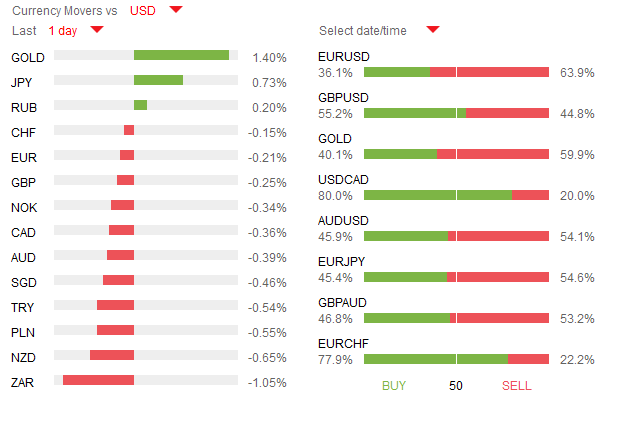

Latest News

USDJPY has formed a new 1.5-year low this morning, currently trading around 110.5, as risk-off sentiment has caused the majority of global stock markets and commodities to retreat, while traders are seeking shelter in safe haven investments. The Aussie meanwhile is mainly unchanged on the day, after the Reserve Bank of Australia kept interest rates unchanged while expressing concern regarding the recent appreciation in AUDUSD. The FED’s Charles Evans, who is a non-voter this year and a major dove, stated yesterday his desire for the US to raise interest rates twice this year. Lastly, oil prices are once again falling this morning, as expectations for an agreement in Qatar at the April 17th meeting are fading, causing USDCAD to jump above 1.31 temporarily.

The UK will publish its all-important services PMI figure, forecasted to have jumped to 53.9 versus last month’s 52.7. Elsewhere, both Canada and the US will release trade balance figures, while the US will also publish services PMI data and its JOLTS job openings report. Lastly, NZD traders should be on the lookout for the bi-weekly dairy auction.

USDJPY has formed a new 1.5-year low this morning, currently trading around 110.5, as risk-off sentiment has caused the majority of global stock markets and commodities to retreat, while traders are seeking shelter in safe haven investments. The Aussie meanwhile is mainly unchanged on the day, after the Reserve Bank of Australia kept interest rates unchanged while expressing concern regarding the recent appreciation in AUDUSD. The FED’s Charles Evans, who is a non-voter this year and a major dove, stated yesterday his desire for the US to raise interest rates twice this year. Lastly, oil prices are once again falling this morning, as expectations for an agreement in Qatar at the April 17th meeting are fading, causing USDCAD to jump above 1.31 temporarily.

The UK will publish its all-important services PMI figure, forecasted to have jumped to 53.9 versus last month’s 52.7. Elsewhere, both Canada and the US will release trade balance figures, while the US will also publish services PMI data and its JOLTS job openings report. Lastly, NZD traders should be on the lookout for the bi-weekly dairy auction.

Mohammed Abdulwadud Soubra

Crude Oil (WTI) (K6) Intraday: under pressure.

Pivot: 37.25

Most Likely Scenario: short positions below 37.25 with targets @ 34.50 & 34.00 in extension.

Alternative scenario: above 37.25 look for further upside with 38.39 & 39.07 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Pivot: 37.25

Most Likely Scenario: short positions below 37.25 with targets @ 34.50 & 34.00 in extension.

Alternative scenario: above 37.25 look for further upside with 38.39 & 39.07 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Mohammed Abdulwadud Soubra

Pivot: 1209.00

Gold

Most Likely Scenario: long positions above 1209.00 with targets @ 1229.00 & 1235.00 in extension.

Alternative scenario: below 1209.00 look for further downside with 1202.00 & 1195.00 as targets.

Comment: the RSI is bullish and calls for further upside

Gold

Most Likely Scenario: long positions above 1209.00 with targets @ 1229.00 & 1235.00 in extension.

Alternative scenario: below 1209.00 look for further downside with 1202.00 & 1195.00 as targets.

Comment: the RSI is bullish and calls for further upside

Mohammed Abdulwadud Soubra

Pivot: 0.7645

AUDUSD

Most Likely Scenario: short positions below 0.7645 with targets @ 0.7565 & 0.7540 in extension.

Alternative scenario: above 0.7645 look for further upside with 0.7680 & 0.7705 as targets.

Comment: the RSI lacks upward momentum

AUDUSD

Most Likely Scenario: short positions below 0.7645 with targets @ 0.7565 & 0.7540 in extension.

Alternative scenario: above 0.7645 look for further upside with 0.7680 & 0.7705 as targets.

Comment: the RSI lacks upward momentum

Mohammed Abdulwadud Soubra

Pivot: 111.40

USDJPY

Most Likely Scenario: short positions below 111.40 with targets @ 110.65 & 110.25 in extension.

Alternative scenario: above 111.40 look for further upside with 111.75 & 112.00 as targets.

Comment: the RSI is badly directed.

USDJPY

Most Likely Scenario: short positions below 111.40 with targets @ 110.65 & 110.25 in extension.

Alternative scenario: above 111.40 look for further upside with 111.75 & 112.00 as targets.

Comment: the RSI is badly directed.

Mohammed Abdulwadud Soubra

Pivot: 1.4235

GBPUSD

Most Likely Scenario: long positions above 1.4235 with targets @ 1.4325 & 1.4375 in extension.

Alternative scenario: below 1.4235 look for further downside with 1.4185 & 1.4140 as targets.

Comment: the RSI is mixed and calls for caution.

GBPUSD

Most Likely Scenario: long positions above 1.4235 with targets @ 1.4325 & 1.4375 in extension.

Alternative scenario: below 1.4235 look for further downside with 1.4185 & 1.4140 as targets.

Comment: the RSI is mixed and calls for caution.

Mohammed Abdulwadud Soubra

Pivot: 1.1415

EURUSD

Most Likely Scenario: short positions below 1.1415 with targets @ 1.1355 & 1.1340 in extension.

Alternative scenario: above 1.1415 look for further upside with 1.1435 & 1.1465 as targets.

Comment: the upward potential is likely to be limited by the resistance at 1.1415.

EURUSD

Most Likely Scenario: short positions below 1.1415 with targets @ 1.1355 & 1.1340 in extension.

Alternative scenario: above 1.1415 look for further upside with 1.1435 & 1.1465 as targets.

Comment: the upward potential is likely to be limited by the resistance at 1.1415.

Mohammed Abdulwadud Soubra

EUR/USD

During last week, the Euro succeeded to break above the symmetrical triangle that comes from 1.1497 peak, which brought to the table a strong bullish signal.

In addition, the weekly close was above 1.1375 daily resistance, reinforcing the upside pressure. As of the week ahead, the single currency is likely to continue trading higher towards 1.1500 psychological barrier as far as 1.1145 low is in place.

Meanwhile, a short-term correction to the downside cannot be ruled out and the pair may re-test 1.1290-1.1250 support zone before to begin another leg higher in the coming days.

To summarize, the outlook is bullish in this pair by now, and as far as prices keep trading above 1.1145, the upside pressure will remain strong.

Support: 1.1290-1.1250-1.1145

Resistance: 1.1440-1.1500-1.1710

During last week, the Euro succeeded to break above the symmetrical triangle that comes from 1.1497 peak, which brought to the table a strong bullish signal.

In addition, the weekly close was above 1.1375 daily resistance, reinforcing the upside pressure. As of the week ahead, the single currency is likely to continue trading higher towards 1.1500 psychological barrier as far as 1.1145 low is in place.

Meanwhile, a short-term correction to the downside cannot be ruled out and the pair may re-test 1.1290-1.1250 support zone before to begin another leg higher in the coming days.

To summarize, the outlook is bullish in this pair by now, and as far as prices keep trading above 1.1145, the upside pressure will remain strong.

Support: 1.1290-1.1250-1.1145

Resistance: 1.1440-1.1500-1.1710

Mohammed Abdulwadud Soubra

GBPJPY

The lingering impact of last week’s Sterling selloff has rolled over into this trading week with the GBPJPY facing extreme pressures just above the 158.50 support. This pair is bearish and the elevated fears over the impacts of a Brexit should provide bearish investors with a foundation to break below the 158.50 support. If the Brexit woes are not enough, then Yen strength caused by risk aversion may act as the catalyst needed for a heavy decline towards 156.00. From a technical standpoint, prices are trading below the daily 20 SMA while the MACD has crossed to the downside. Previous support at 158.50 could transform into a dynamic resistance which should encourage a further decline to 156.00.

The lingering impact of last week’s Sterling selloff has rolled over into this trading week with the GBPJPY facing extreme pressures just above the 158.50 support. This pair is bearish and the elevated fears over the impacts of a Brexit should provide bearish investors with a foundation to break below the 158.50 support. If the Brexit woes are not enough, then Yen strength caused by risk aversion may act as the catalyst needed for a heavy decline towards 156.00. From a technical standpoint, prices are trading below the daily 20 SMA while the MACD has crossed to the downside. Previous support at 158.50 could transform into a dynamic resistance which should encourage a further decline to 156.00.

Mohammed Abdulwadud Soubra

Weekly Trading Forecast: Dollar Slide and Euro, Equity Rallies Temper Yellen cut the legs from under the Dollar, but the currency hasn't simply collapsed. Market conditions may be tempering fundamental drive heading into the new quarter...

Compartilhar nas redes sociais · 1

116

: