Mohammed Abdulwadud Soubra / Perfil

- Informações

|

8+ anos

experiência

|

7

produtos

|

1086

versão demo

|

|

134

trabalhos

|

1

sinais

|

1

assinantes

|

Estou no mercado forex desde 2005.

Veja este produto:

https://www.mql5.com/en/users/soubra2003/seller

Sinais de negociação promissores no US30 e em ações americanas:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para suporte imediato, por favor, junte-se a este grupo no WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Veja este produto:

https://www.mql5.com/en/users/soubra2003/seller

Sinais de negociação promissores no US30 e em ações americanas:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para suporte imediato, por favor, junte-se a este grupo no WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Amigos

8601

Pedidos

Enviados

Mohammed Abdulwadud Soubra

Pivot Points Daily Last Updated: Apr 22, 12:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.11278 1.12256 1.12598 1.13234 1.13576 1.14212 1.1519 USD/JPY 107.246 108.364 109.095 109.482 110.213 110.6 111.718 GBP/USD 1.41892 1.42718 1.42995 1.43544 1.43821 1.4437 1.45196 USD/CHF 0.9423 0.95533 0...

Mohammed Abdulwadud Soubra

Feedback deixado para o cliente no serviço I want to have a reliable Scalping Expert Advisor

Great customer, I will help him always with all my experience, hope you a great forex future

Mohammed Abdulwadud Soubra

NZD/USD

The New Zealand Dollar managed to break above 0.6965 peak and cleared the way for a rally above 0.7000 barrier.

The kiwi soared yesterday and reached the daily resistance mentioned in our previous report, which stands at 0.7055 level. As of now, we expect some downside correction to begin and if prices manage to re-test 0.6980-0.6965 zone then we expect a bounce to occur.

In extension, a break below this hourly support zone will expose 0.6910 level before another leg higher towards 0.7100 zone to begin.

Support: 0.6980-0.6965-0.6910

Resistance: 0.7050-0.7100-0.7130

The New Zealand Dollar managed to break above 0.6965 peak and cleared the way for a rally above 0.7000 barrier.

The kiwi soared yesterday and reached the daily resistance mentioned in our previous report, which stands at 0.7055 level. As of now, we expect some downside correction to begin and if prices manage to re-test 0.6980-0.6965 zone then we expect a bounce to occur.

In extension, a break below this hourly support zone will expose 0.6910 level before another leg higher towards 0.7100 zone to begin.

Support: 0.6980-0.6965-0.6910

Resistance: 0.7050-0.7100-0.7130

Mohammed Abdulwadud Soubra

GOLD

Gold remain bullish in the daily chart as prices keep printing higher lows from 1210 support. As of now, 1242-1244 represents the hourly support zone and the yellow should remain steady above this area.

Technically, the daily trend remains bullish but we still need a daily close above 1258-1262 zone to confirm another attempt to break the yearly highs around 1285$ per ounce.

In sum, we maintain the bullish outlook unless we see a daily close below 1230 level.

Support: 1244-1242-1231

Resistance: 1258-1262-1271

Gold remain bullish in the daily chart as prices keep printing higher lows from 1210 support. As of now, 1242-1244 represents the hourly support zone and the yellow should remain steady above this area.

Technically, the daily trend remains bullish but we still need a daily close above 1258-1262 zone to confirm another attempt to break the yearly highs around 1285$ per ounce.

In sum, we maintain the bullish outlook unless we see a daily close below 1230 level.

Support: 1244-1242-1231

Resistance: 1258-1262-1271

Mohammed Abdulwadud Soubra

USD/JPY

The pair continue to trade sideways in the near-term as 109.70 peak continue to play as a strong resistance, while in the downside 1.0760/80 zone keep supporting prices.

From a technical standpoint, as far as last week high at 109.73 is intact, downside pressure may resume. Consequently, we are looking at the recent upside as a short-term correction only that can take the form of a flat correction. In the meantime, if the pair breaks above 109.73 peak we expect the pair to find a strong barrier around 110.15/50 zone from where the bearish trend is likely to resume.

Support: 108.70-107.80-107.60

Resistance: 109.50-109.70-110.15

The pair continue to trade sideways in the near-term as 109.70 peak continue to play as a strong resistance, while in the downside 1.0760/80 zone keep supporting prices.

From a technical standpoint, as far as last week high at 109.73 is intact, downside pressure may resume. Consequently, we are looking at the recent upside as a short-term correction only that can take the form of a flat correction. In the meantime, if the pair breaks above 109.73 peak we expect the pair to find a strong barrier around 110.15/50 zone from where the bearish trend is likely to resume.

Support: 108.70-107.80-107.60

Resistance: 109.50-109.70-110.15

Mohammed Abdulwadud Soubra

AUD/USD

The Australian Dollar continue to gain some ground, as bullish momentum remain steady.

Technically, the trend is strongly bullish in all the periods, and the pair broke above its daily resistance at 0.7720, which cleared the way for another extension towards 0.7850 area.

In the near-term, we believe that the pair is likely to remain positive, as momentum indicators continue to show strength in the Aussie. Moreover, the Aussie keeps trading above 0.7620 hourly support which keeps the upside pressure intact.

Therefore, the view remains bullish in the daily chart and only a break below 0.7700 psychological level will send prices into a deeper correction.

Support: 0.7750-0.7720-0.7620

Resistance: 0.7830-0.7850-0.7920

The Australian Dollar continue to gain some ground, as bullish momentum remain steady.

Technically, the trend is strongly bullish in all the periods, and the pair broke above its daily resistance at 0.7720, which cleared the way for another extension towards 0.7850 area.

In the near-term, we believe that the pair is likely to remain positive, as momentum indicators continue to show strength in the Aussie. Moreover, the Aussie keeps trading above 0.7620 hourly support which keeps the upside pressure intact.

Therefore, the view remains bullish in the daily chart and only a break below 0.7700 psychological level will send prices into a deeper correction.

Support: 0.7750-0.7720-0.7620

Resistance: 0.7830-0.7850-0.7920

Mohammed Abdulwadud Soubra

USD/CAD

The pair fell sharply yesterday after breaking below 1.2750 daily support. As expected, the pair extended its losses and reached the weekly support of 1.2650 level from where we expect to see some recovery in the near-term.

However, as far as 1.2820 peak is in place, USD/CAD will remain under pressure and only a break above this level will call for a larger correction.

From a technical view, the pair remains bearish in the daily chart and a move back to 1.2750 broken support may see sellers coming around, which should cap any recovery attempt in the hourly chart.

Finally, our view remain heavily bearish in this pair as far as 1.2820 resistance is intact.

Support 1.2660-1.2630-1.2600

Resistance: 1.2750-1.2780-1.2820

The pair fell sharply yesterday after breaking below 1.2750 daily support. As expected, the pair extended its losses and reached the weekly support of 1.2650 level from where we expect to see some recovery in the near-term.

However, as far as 1.2820 peak is in place, USD/CAD will remain under pressure and only a break above this level will call for a larger correction.

From a technical view, the pair remains bearish in the daily chart and a move back to 1.2750 broken support may see sellers coming around, which should cap any recovery attempt in the hourly chart.

Finally, our view remain heavily bearish in this pair as far as 1.2820 resistance is intact.

Support 1.2660-1.2630-1.2600

Resistance: 1.2750-1.2780-1.2820

Mohammed Abdulwadud Soubra

GBP/USD

The British pound rallied after bulls managed to overtake 1.4350 hourly resistance. As of now, the chances of a bullish reversal has increased significantly but we still need a break above 1.4500 barrier to confirm the end of a med-term bearish cycle.

Looking at the hourly chart, the trend remains bearish in the daily chart as far as 1.4460 high is in place and we expect a short-term drop in the direction of 1.4325-1.4350 area before to see a bounce in the pair. Traders should focus on 1.4285 in the downside and 1.4420/60 zone in the upside for the next directional move in the Sterling. However, and looking at momentum indicators, we believe that another extension higher towards 1.4500 area is likely as far as the pair keep trading above 1.4260 low.

In the opposite, a break below this support will weaken this positive outlook.

Resistance: 1.4420-1.4460-1.4510

Support: 1.4350-1.4325-1.4285

The British pound rallied after bulls managed to overtake 1.4350 hourly resistance. As of now, the chances of a bullish reversal has increased significantly but we still need a break above 1.4500 barrier to confirm the end of a med-term bearish cycle.

Looking at the hourly chart, the trend remains bearish in the daily chart as far as 1.4460 high is in place and we expect a short-term drop in the direction of 1.4325-1.4350 area before to see a bounce in the pair. Traders should focus on 1.4285 in the downside and 1.4420/60 zone in the upside for the next directional move in the Sterling. However, and looking at momentum indicators, we believe that another extension higher towards 1.4500 area is likely as far as the pair keep trading above 1.4260 low.

In the opposite, a break below this support will weaken this positive outlook.

Resistance: 1.4420-1.4460-1.4510

Support: 1.4350-1.4325-1.4285

Mohammed Abdulwadud Soubra

EUR/USD

The Euro traded higher yesterday after we saw strong demand from the hourly support zone located between 1.1230 and 1.1180 levels. Actually, the single currency has reached a critical resistance area, which stands between 1.1350 and 1.1380 levels. Therefore, we expect the pair to stabilize today and traders should watch carefully the future price action ahead of the ECB press conference tomorrow.

Technically, the Euro remains bullish in the daily chart after breaking above the symmetrical triangle formation. In addition, traders should be aware that the recent decline is corrective only and as far as 1.1140 low is in place, the upside pressure will remain intact.

In the near-term, we will wait for an hourly close above 1.1380 level to confirm another leg higher in the direction of 1.1460 peak, while a close below 1.1300 psychological barrier will warn about a deeper correction.

Support: 1.1327-1.1313-1.1300

Resistance: 1.1355-1.1380-1.1460

The Euro traded higher yesterday after we saw strong demand from the hourly support zone located between 1.1230 and 1.1180 levels. Actually, the single currency has reached a critical resistance area, which stands between 1.1350 and 1.1380 levels. Therefore, we expect the pair to stabilize today and traders should watch carefully the future price action ahead of the ECB press conference tomorrow.

Technically, the Euro remains bullish in the daily chart after breaking above the symmetrical triangle formation. In addition, traders should be aware that the recent decline is corrective only and as far as 1.1140 low is in place, the upside pressure will remain intact.

In the near-term, we will wait for an hourly close above 1.1380 level to confirm another leg higher in the direction of 1.1460 peak, while a close below 1.1300 psychological barrier will warn about a deeper correction.

Support: 1.1327-1.1313-1.1300

Resistance: 1.1355-1.1380-1.1460

Mohammed Abdulwadud Soubra

Markets aren't expecting out of the European Central Bank this morning, with a 0% chance of a rate cut being priced in by EONIA forward rates as well as overnight index swaps. Accordingly, that means that all focus for the Euro will be on President Mario Draghi's press conference, where the tone and tenor could easily dictate rate expectations shifting - especially if he brings focus back to the FX channel. It goes without saying that, as one of the world's most important central banks, the ECB today could push along the rally in higher yielding currencies and risk-correlated assets just as easily as it could derail it.

Mohammed Abdulwadud Soubra

Preview for ECB Meeting and Implications for EUR, Metals, Equities Talking Points: - EUR/USD lingering below key resistance near $1.1460/1.1500. - Equity markets, precious metals remain in a bullish posture. - Crowd's disdain for EUR/USD shows in positioning changes...

Mohammed Abdulwadud Soubra

Pivot Points Daily Last Updated: Apr 21, 3:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.11278 1.12256 1.12598 1.13234 1.13576 1.14212 1.1519 USD/JPY 107.246 108.364 109.095 109.482 110.213 110.6 111.718 GBP/USD 1.41892 1.42718 1.42995 1.43544 1.43821 1.4437 1.45196 USD/CHF 0.9423 0.95533 0...

Mohammed Abdulwadud Soubra

Stock markets staged a miraculous rebound during trading on Tuesday following the abrupt appreciation in oil prices that renewed risk appetite and boosted some confidence towards the global economy. Asian equities were injected with vigour, with major stocks in Asia venturing into the green territory as the resurgence of risk appetite somewhat weakened demand for the safe-haven Japanese Yen. In Europe, losses were clawed back as investors pondered on the likelihood of a potential OPEC freeze deal in the June meeting, and with America also concluding positive in Monday’s session, stock market rallies may be the short term theme. While these gains are impressive, investors should keep in mind that oil prices have dictated the movements in global stocks, and with the commodity poised to decline as expectations deteriorate over a solution to the supply glut, stocks could be exposed to further punishment.

Mohammed Abdulwadud Soubra

NEWS

Wednesday, Apr 20, 2016 10:50 pm +03:00

US DOLLAR Technical Analysis: Who’s Happier? Bears or Central Bankers

The US Dollar has found Year-Long Support. If It Doesn’t Bounce Now, It May Not for a While.

Continue Reading

Wednesday, Apr 20, 2016 8:04 pm +03:00

China’s Market News: Liquidity Shortage May Trigger PBOC Rate Cuts

Wednesday, Apr 20, 2016 4:30 pm +03:00

EUR/USD, EUR/JPY Strategy Ahead of the ECB

Wednesday, Apr 20, 2016 3:00 pm +03:00

EUR-crosses Telling Their Own Stories Ahead of ECB Tomorrow

Wednesday, Apr 20, 2016 10:50 pm +03:00

US DOLLAR Technical Analysis: Who’s Happier? Bears or Central Bankers

The US Dollar has found Year-Long Support. If It Doesn’t Bounce Now, It May Not for a While.

Continue Reading

Wednesday, Apr 20, 2016 8:04 pm +03:00

China’s Market News: Liquidity Shortage May Trigger PBOC Rate Cuts

Wednesday, Apr 20, 2016 4:30 pm +03:00

EUR/USD, EUR/JPY Strategy Ahead of the ECB

Wednesday, Apr 20, 2016 3:00 pm +03:00

EUR-crosses Telling Their Own Stories Ahead of ECB Tomorrow

Mohammed Abdulwadud Soubra

EUR/USD may largely consolidate going into the European Central Bank (ECB) interest rate decision as market participants gauge the outlook for monetary policy; despite speculation for more easing, the single-currency may largely preserve the gains from earlier this year as the euro-area returns to its historic current account surplus following the ‘Great Recession.’

Even though ECB President Mario Draghi keeps the door open to further support the monetary union, a batch of dovish rhetoric may not be enough to weaken the single-currency after the central bank head unintentionally put a floor on interest rates following the March 10 meeting.

Will continue to watch the topside targets for EUR/USD as the pair appears to be in a long-term bottoming process, with a break/close above 1.1420 (23.6% retracement) to 1.1460 (78.6% retracement) raising the risk for a run at 1.1713 (August high).

Even though ECB President Mario Draghi keeps the door open to further support the monetary union, a batch of dovish rhetoric may not be enough to weaken the single-currency after the central bank head unintentionally put a floor on interest rates following the March 10 meeting.

Will continue to watch the topside targets for EUR/USD as the pair appears to be in a long-term bottoming process, with a break/close above 1.1420 (23.6% retracement) to 1.1460 (78.6% retracement) raising the risk for a run at 1.1713 (August high).

Mohammed Abdulwadud Soubra

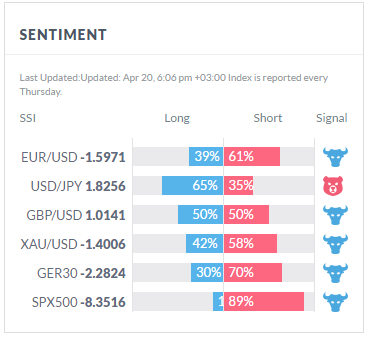

EUR/USD Retail FX Cling to Net-Short Positions Ahead of ECB Meeting

20 abril 2016, 19:20

EUR/USD Retail FX Cling to Net-Short Positions Ahead of ECB Meeting EUR/USD EUR/USD may largely consolidate going into the European Central Bank (ECB) interest rate decision as market participants gauge the outlook for monetary policy; despite speculation for more easing, the single-currency may...

Mohammed Abdulwadud Soubra

Pre US Open, Daily Technical Analysis Wednesday, April 20, 2016

EUR/USD Intraday: the upside prevails. Prev Next

Pivot: 1.1325

Most Likely Scenario: long positions above 1.1325 with targets @ 1.1400 & 1.1430 in extension.

Alternative scenario: below 1.1325 look for further downside with 1.1290 & 1.1270 as targets.

Comment: the RSI is mixed to bullish.

GBP/USD Intraday: rebound. Prev Next

Pivot: 1.4340

Most Likely Scenario: long positions above 1.4340 with targets @ 1.4425 & 1.4460 in extension.

Alternative scenario: below 1.4340 look for further downside with 1.4285 & 1.4240 as targets.

Comment: the RSI is well directed.

USD/JPY Intraday: rebound. Prev Next

Pivot: 108.70

Most Likely Scenario: long positions above 108.70 with targets @ 109.45 & 109.75 in extension.

Alternative scenario: below 108.70 look for further downside with 108.50 & 108.10 as targets.

Comment: the RSI is mixed to bullish.

AUD/USD Intraday: the upside prevails. Prev Next

Pivot: 0.7760

Most Likely Scenario: long positions above 0.7760 with targets @ 0.7825 & 0.7860 in extension.

Alternative scenario: below 0.7760 look for further downside with 0.7730 & 0.7675 as targets.

Comment: the RSI is well directed.

Gold spot Intraday: the bias remains bullish. Prev Next

Pivot: 1244.00

Most Likely Scenario: long positions above 1244.00 with targets @ 1259.50 & 1265.00 in extension.

Alternative scenario: below 1244.00 look for further downside with 1235.50 & 1227.00 as targets.

Comment: a support base at 1244.00 has formed and has allowed for a temporary stabilisation.

EUR/USD Intraday: the upside prevails. Prev Next

Pivot: 1.1325

Most Likely Scenario: long positions above 1.1325 with targets @ 1.1400 & 1.1430 in extension.

Alternative scenario: below 1.1325 look for further downside with 1.1290 & 1.1270 as targets.

Comment: the RSI is mixed to bullish.

GBP/USD Intraday: rebound. Prev Next

Pivot: 1.4340

Most Likely Scenario: long positions above 1.4340 with targets @ 1.4425 & 1.4460 in extension.

Alternative scenario: below 1.4340 look for further downside with 1.4285 & 1.4240 as targets.

Comment: the RSI is well directed.

USD/JPY Intraday: rebound. Prev Next

Pivot: 108.70

Most Likely Scenario: long positions above 108.70 with targets @ 109.45 & 109.75 in extension.

Alternative scenario: below 108.70 look for further downside with 108.50 & 108.10 as targets.

Comment: the RSI is mixed to bullish.

AUD/USD Intraday: the upside prevails. Prev Next

Pivot: 0.7760

Most Likely Scenario: long positions above 0.7760 with targets @ 0.7825 & 0.7860 in extension.

Alternative scenario: below 0.7760 look for further downside with 0.7730 & 0.7675 as targets.

Comment: the RSI is well directed.

Gold spot Intraday: the bias remains bullish. Prev Next

Pivot: 1244.00

Most Likely Scenario: long positions above 1244.00 with targets @ 1259.50 & 1265.00 in extension.

Alternative scenario: below 1244.00 look for further downside with 1235.50 & 1227.00 as targets.

Comment: a support base at 1244.00 has formed and has allowed for a temporary stabilisation.

: