Mohammed Abdulwadud Soubra / Perfil

- Informações

|

8+ anos

experiência

|

7

produtos

|

1086

versão demo

|

|

134

trabalhos

|

1

sinais

|

1

assinantes

|

Estou no mercado forex desde 2005.

Veja este produto:

https://www.mql5.com/en/users/soubra2003/seller

Sinais de negociação promissores no US30 e em ações americanas:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para suporte imediato, por favor, junte-se a este grupo no WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Veja este produto:

https://www.mql5.com/en/users/soubra2003/seller

Sinais de negociação promissores no US30 e em ações americanas:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para suporte imediato, por favor, junte-se a este grupo no WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Amigos

8602

Pedidos

Enviados

Mohammed Abdulwadud Soubra

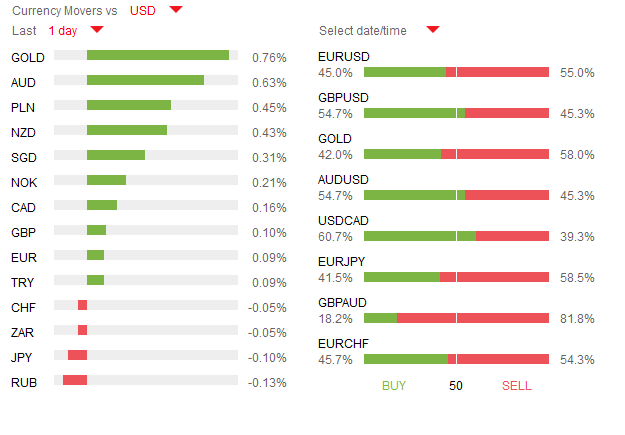

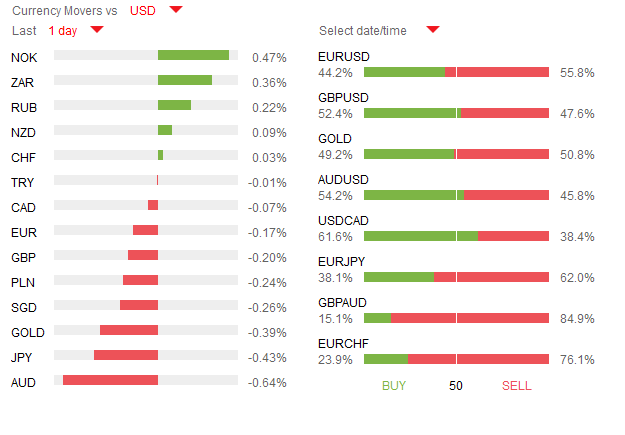

No major central bank decisions this week, but plenty of indications of their thinking with minutes from the FOMC, ECB and the RBA overnight from Australia. The rate cut earlier this month was not fully expected by the market, so it should not be a surprise that the minutes were suggesting that the RBA is taking a cautious approach to the outlook. Perhaps it is not surprising was that it was the “broad based softness in prices and costs” was the main factor behind the decision to cut rates to 1.75%. They also noted the impact of “supervisory measures” on the housing market, which had tightening lending standards and taken some of the heat from the housing market, reducing the risks of lowering rates. The Aussie jumped around 1% on the back of the release, brining it above the 2.5 month lows recorded yesterday on AUDUSD at 0.7237. The focus remains with New Zealand and Canada, the other commodity bloc currencies, as the next major central banks to cut rates, with New Zealand likely to cut rates early June. AUDNZD was also marking 2.5 month lows yesterday, but the policy backdrop does argue for a more sustained correction into June.

Sterling has been on a firmer footing for the past couple of sessions, something which could be challenged by today’s inflation data. The headline rate is seen steady at 0.5%, with core prices falling from 1.5% to 1.4%. PPI data is also seen at the same time, so volatility risks are increased. Sterling has 5 weeks to go to the ‘Brexit’ referendum in June, which still has the potential to weakness the currency should the polls continue to show only a slight margin for the ‘remain’ camp. US CPI data is also seen this afternoon. The dollar has settled into a range (dollar index) after the recent recovery from the early May lows. Meanwhile, ahead of the G7 meeting at the end of the week, the pressure is reduced on the Bank of Japan in terms of the strength of the yen vs. the USD, the yen 2.6% weaker vs. the dollar from the USDJPY lows.

Sterling has been on a firmer footing for the past couple of sessions, something which could be challenged by today’s inflation data. The headline rate is seen steady at 0.5%, with core prices falling from 1.5% to 1.4%. PPI data is also seen at the same time, so volatility risks are increased. Sterling has 5 weeks to go to the ‘Brexit’ referendum in June, which still has the potential to weakness the currency should the polls continue to show only a slight margin for the ‘remain’ camp. US CPI data is also seen this afternoon. The dollar has settled into a range (dollar index) after the recent recovery from the early May lows. Meanwhile, ahead of the G7 meeting at the end of the week, the pressure is reduced on the Bank of Japan in terms of the strength of the yen vs. the USD, the yen 2.6% weaker vs. the dollar from the USDJPY lows.

Giorgio Monteleone

2016.05.17

:)

Mohammed Abdulwadud Soubra

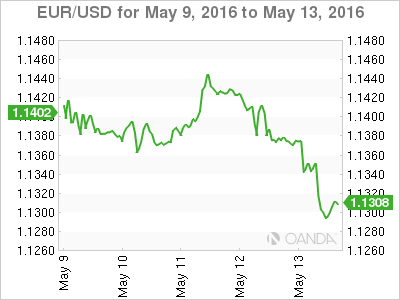

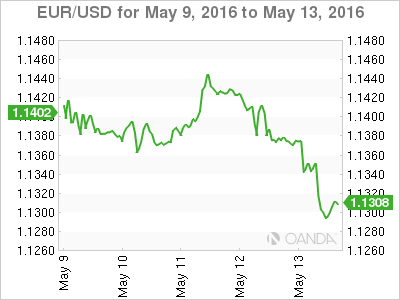

AFTER LUCKY FRIDAY 13 THE USD EXPECTED TO COOL WITH DOVISH FOMC MINUTES AND LOW INFLATION

Friday the 13 is usually considered an unlucky day but the USD rally was given a boost by the retail sales data coming in above expectations. Core retail sales (minus auto) was 0.8 percent in April and the headline retail sales number expected at a loss of 0.3 percent came in at a gain of 1.3 percent. The American consumer appears to be coming back with purchases marking yearly highs. The University of Michigan consumer sentiment survey came in at 95.8 a 12 month high. The previous gap between sentiment and spending is shrinking to the benefit of the greenback.

Inflation data will guide the forex market on the week of May 16 to 20. The United Kingdom will release its inflation report on Tuesday, May 17 at 4:30 am EDT. The United States will release on the same day at 8:30 am EDT. Canada will publish its consumer price index on Friday, May 20 at 8:30 am EDT. Inflation data in the U.S. is the most widely anticipated as it could provide insight into the path of future rate hikes.

The minutes of the Federal Open Market Committee (FOMC) meeting in April will be published on Wednesday, May 18 at 2:00 pm EDT. In their meeting on April 27 the Fed released a statement that downgraded some overseas risks, but admitted to a slowdown in the U.S. economy. The strong U.S. employment and retail sales data is showing the first quarter slowdown could be temporary. Putting the June FOMC back on the table is still premature but positive inflation growth would make the case for a summer U.S. interest rate hike more compelling.

Friday the 13 is usually considered an unlucky day but the USD rally was given a boost by the retail sales data coming in above expectations. Core retail sales (minus auto) was 0.8 percent in April and the headline retail sales number expected at a loss of 0.3 percent came in at a gain of 1.3 percent. The American consumer appears to be coming back with purchases marking yearly highs. The University of Michigan consumer sentiment survey came in at 95.8 a 12 month high. The previous gap between sentiment and spending is shrinking to the benefit of the greenback.

Inflation data will guide the forex market on the week of May 16 to 20. The United Kingdom will release its inflation report on Tuesday, May 17 at 4:30 am EDT. The United States will release on the same day at 8:30 am EDT. Canada will publish its consumer price index on Friday, May 20 at 8:30 am EDT. Inflation data in the U.S. is the most widely anticipated as it could provide insight into the path of future rate hikes.

The minutes of the Federal Open Market Committee (FOMC) meeting in April will be published on Wednesday, May 18 at 2:00 pm EDT. In their meeting on April 27 the Fed released a statement that downgraded some overseas risks, but admitted to a slowdown in the U.S. economy. The strong U.S. employment and retail sales data is showing the first quarter slowdown could be temporary. Putting the June FOMC back on the table is still premature but positive inflation growth would make the case for a summer U.S. interest rate hike more compelling.

Mohammed Abdulwadud Soubra

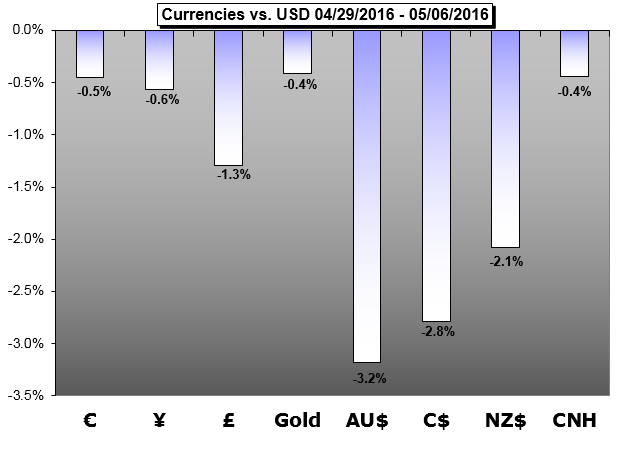

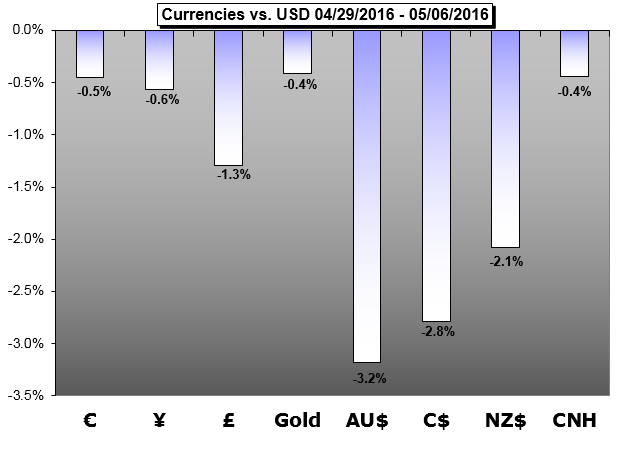

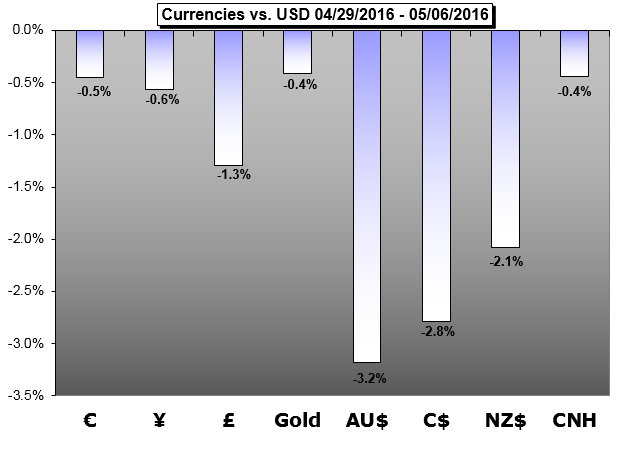

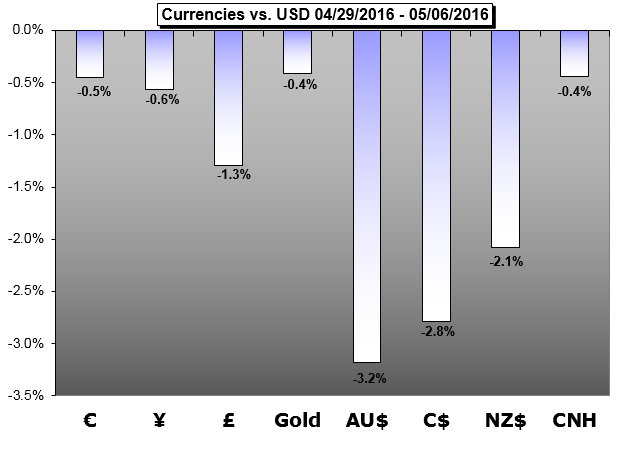

The Dollar has mounted a recover and risk trends have lost traction this past week. Will these themes carry through to the week ahead, and what will the G-7 meeting elicit from speculators?

US Dollar Forecast – Dollar Forges Bullish Reversal but May Struggle to Maintain Lift

The Greenback advanced against all of its major counterparts this past week, and the USDollar secured its strongest two-week rally since the May 2015 climb forestalled a bearish reversal.

British Pound Forecast - Mixed U.K./U.S. Data to Foster Range-Bound Conditions for GBP/USD

Mixed data prints coming out of the U.S. & U.K. may foster range-bound prices in GBP/USD especially as the Federal Reserve and the Bank of England (BoE) retain a wait-and-see approach for monetary policy.

Chinese Yuan (CNH) Forecast – Eco Policies, Commodity Volatility Add Mixed Moves to the Yuan

The onshore Yuan (CNY) extended losses against the US Dollar on Friday after PBOC fixed the daily reference rate to the weakest level in two months, to 6.5246.

Australian Dollar Forecast - Australian Dollar Torn Between RBA Bets, Sentiment TrendsTitle

The Australian Dollar may find itself torn between the influence of RBA monetary policy expectations and market-wide risk sentiment trends in the week ahead.

Gold Forecast – Gold Bulls Look to CPI, Fed Minutes for Solace

Gold prices are lower for a second consecutive week with the previous metal off 1.26% to trade at 1272 ahead of the New York close on Friday.

US Dollar Forecast – Dollar Forges Bullish Reversal but May Struggle to Maintain Lift

The Greenback advanced against all of its major counterparts this past week, and the USDollar secured its strongest two-week rally since the May 2015 climb forestalled a bearish reversal.

British Pound Forecast - Mixed U.K./U.S. Data to Foster Range-Bound Conditions for GBP/USD

Mixed data prints coming out of the U.S. & U.K. may foster range-bound prices in GBP/USD especially as the Federal Reserve and the Bank of England (BoE) retain a wait-and-see approach for monetary policy.

Chinese Yuan (CNH) Forecast – Eco Policies, Commodity Volatility Add Mixed Moves to the Yuan

The onshore Yuan (CNY) extended losses against the US Dollar on Friday after PBOC fixed the daily reference rate to the weakest level in two months, to 6.5246.

Australian Dollar Forecast - Australian Dollar Torn Between RBA Bets, Sentiment TrendsTitle

The Australian Dollar may find itself torn between the influence of RBA monetary policy expectations and market-wide risk sentiment trends in the week ahead.

Gold Forecast – Gold Bulls Look to CPI, Fed Minutes for Solace

Gold prices are lower for a second consecutive week with the previous metal off 1.26% to trade at 1272 ahead of the New York close on Friday.

Mohammed Abdulwadud Soubra

Weekly Trading Forecast: Will FX Policy and Global Risk Come Up at G-7 The Dollar has mounted a recover and risk trends have lost traction this past week. Will these themes carry through to the week ahead, and what will the G-7 meeting elicit from speculators...

Mohammed Abdulwadud Soubra

The Dollar has mounted a recover and risk trends have lost traction this past week. Will these themes carry through to the week ahead, and what will the G-7 meeting elicit from speculators?

US Dollar Forecast – Dollar Forges Bullish Reversal but May Struggle to Maintain Lift

The Greenback advanced against all of its major counterparts this past week, and the USDollar secured its strongest two-week rally since the May 2015 climb forestalled a bearish reversal.

British Pound Forecast - Mixed U.K./U.S. Data to Foster Range-Bound Conditions for GBP/USD

Mixed data prints coming out of the U.S. & U.K. may foster range-bound prices in GBP/USD especially as the Federal Reserve and the Bank of England (BoE) retain a wait-and-see approach for monetary policy.

Chinese Yuan (CNH) Forecast – Eco Policies, Commodity Volatility Add Mixed Moves to the Yuan

The onshore Yuan (CNY) extended losses against the US Dollar on Friday after PBOC fixed the daily reference rate to the weakest level in two months, to 6.5246.

Australian Dollar Forecast - Australian Dollar Torn Between RBA Bets, Sentiment TrendsTitle

The Australian Dollar may find itself torn between the influence of RBA monetary policy expectations and market-wide risk sentiment trends in the week ahead.

Gold Forecast – Gold Bulls Look to CPI, Fed Minutes for Solace

Gold prices are lower for a second consecutive week with the previous metal off 1.26% to trade at 1272 ahead of the New York close on Friday.

US Dollar Forecast – Dollar Forges Bullish Reversal but May Struggle to Maintain Lift

The Greenback advanced against all of its major counterparts this past week, and the USDollar secured its strongest two-week rally since the May 2015 climb forestalled a bearish reversal.

British Pound Forecast - Mixed U.K./U.S. Data to Foster Range-Bound Conditions for GBP/USD

Mixed data prints coming out of the U.S. & U.K. may foster range-bound prices in GBP/USD especially as the Federal Reserve and the Bank of England (BoE) retain a wait-and-see approach for monetary policy.

Chinese Yuan (CNH) Forecast – Eco Policies, Commodity Volatility Add Mixed Moves to the Yuan

The onshore Yuan (CNY) extended losses against the US Dollar on Friday after PBOC fixed the daily reference rate to the weakest level in two months, to 6.5246.

Australian Dollar Forecast - Australian Dollar Torn Between RBA Bets, Sentiment TrendsTitle

The Australian Dollar may find itself torn between the influence of RBA monetary policy expectations and market-wide risk sentiment trends in the week ahead.

Gold Forecast – Gold Bulls Look to CPI, Fed Minutes for Solace

Gold prices are lower for a second consecutive week with the previous metal off 1.26% to trade at 1272 ahead of the New York close on Friday.

Mohammed Abdulwadud Soubra

Publicado o código Example of SAR Automated - with Advanced Money Management

This example has been built using SAR (Stop And Reverse) indicator with Advanced Money Management function.

Compartilhar nas redes sociais · 4

2217

Mohammed Abdulwadud Soubra

Volatility risks lie squarely with sterling today, with both the monetary policy decision (together with meeting minutes) falling at 11:00 GMT, with the BoE Inflation Report published soon after. The real interest is going to be with the Inflation Report, where we are going to see a lot of questions regarding the impact of Brexit on the Inflation Outlook. We’re unlikely to see major changes to the inflation outlook over the forecast horizon. On one side, if we look at market based measures of expectations, these have risen modestly since the last Report published in February. Furthermore, interest rate expectations (on Bank of England’s method) will have likely softened on over the past 3 months. On the other side of the equation, we’ve seen some weaker activity data over past few months, which could offset. Morgan Stanley’s measure for the length of time for the first hike currently stands at 40 months, which remains far longer than most economist and other pundits are looking at. With the first hike priced so far head, it’s hard to see sterling getting that excited about the Inflation Report. The risks lie mainly with any indication or talk of easier policy, given the backdrop that we see of easier elsewhere (Japan, ECB, RBA and potentially the RBNZ and BoC).

Elsewhere, the Brazilian Real continues to pin hopes on the imminent impeachment of President Rousseff, with this seen paving the way for an improved outlook for the economy and finances. Most EM currencies have fallen so far this month and the Real’s performance has stood for most of the year. The question is whether this can continue once the euphoria settles from the current political theatre. From many angles, this looks unlikely.

Elsewhere, the Brazilian Real continues to pin hopes on the imminent impeachment of President Rousseff, with this seen paving the way for an improved outlook for the economy and finances. Most EM currencies have fallen so far this month and the Real’s performance has stood for most of the year. The question is whether this can continue once the euphoria settles from the current political theatre. From many angles, this looks unlikely.

Mohammed Abdulwadud Soubra

UK CENTRAL BANK TRYING TO APPEAR UNBIASED TO AVOID INFLUENCING OUTCOME

12 maio 2016, 04:17

UK CENTRAL BANK TRYING TO APPEAR UNBIASED TO AVOID INFLUENCING OUTCOME The Bank of England (BoE) has to appear unbiased on the very political topic of Britain exiting the European Union...

Mohammed Abdulwadud Soubra

Pivot Points Daily Last Updated: May 12, 2:15 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.12555 1.13339 1.13793 1.14123 1.14577 1.14907 1.15691 USD/JPY 106.696 107.697 108.035 108.698 109.036 109.699 110.7 GBP/USD 1.42552 1.43486 1.4397 1.4442 1.44904 1.45354 1.46288 USD/CHF 0.95967 0.96592 0...

Mohammed Abdulwadud Soubra

Pivot Points Hourly Last Updated: May 12, 2:15 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.14155 1.14193 1.1421 1.14231 1.14248 1.14269 1.14307 USD/JPY 108.289 108.369 108.401 108.449 108.481 108.529 108.609 GBP/USD 1.44197 1.44293 1.44332 1.44389 1.44428 1.44485 1.44581 USD/CHF 0.96995 0...

Mohammed Abdulwadud Soubra

EUR/JPY Technical Analysis: Stuck in the Middle with Yen Talking Points: EUR/JPY Technical Strategy: Previously short, limit hit, remainder taken out at breakeven stop. EUR/JPY price action is in the middle of near-term highs and lows, offering little clarity on trend direction...

Mohammed Abdulwadud Soubra

DXY (Dollar index)

The Dollar index added further gains today and continue to trade higher in the direction of 94.50/80 resistance zone highlighted yesterday.

Therefore, our view remains bullish in the U.S Dollar in the near-term, and traders should expect another acceleration to the upside as far as 93.20 low is in place.

Support: 93.80-92.85-92.65

Resistance: 94.20-94.50-94.80

The Dollar index added further gains today and continue to trade higher in the direction of 94.50/80 resistance zone highlighted yesterday.

Therefore, our view remains bullish in the U.S Dollar in the near-term, and traders should expect another acceleration to the upside as far as 93.20 low is in place.

Support: 93.80-92.85-92.65

Resistance: 94.20-94.50-94.80

Mohammed Abdulwadud Soubra

JAPAN

After being the biggest loser on Monday, the Japanese currency continued to slip against its major peers today, losing 3% versus the US Dollar from its 18-month peak on May-3 at 105.52. Loses occurred after Finance Minister Taro Aso warned of stepping-in to weaken the currency if moves will hurt the economy, ignoring recent US treasury warnings which added Japan and four other countries into its currency watchlist for FX practices. However, in the past couple of weeks we heard similar speeches from Prime Minister Shinzo Abe and BoJ Governor Haruhiko Kuroda but traders did not respond back then. So why traders are now responding to verbal interventions now? Or did Finance Minister Taro Aso find the magical words?

In fact, there are two reasons why traders responded now. CFTC report in week ending May 3 showed that speculators were cutting gross long Japanese Yen positions for second consecutive week, indicating that traders were seeking opportunities to book profits on short covering their long positions, and comments from Finance Minister helped this trade to continue. On the other side, comments this time were more straight forward as Mr. Aso mentioned the word “Intervene” rather than the usual diplomatic language to act appropriately against excessive moves. Although BoJ cannot put a floor to USDJPY as SNB did 2011 introducing the exchange-rate peg to the EUR, it’s becoming clearer that USDJPY at 105 is being considered a danger zone for Japans central bank.

Commodity currencies were under pressure yesterday as Chinese trade numbers impacted both the Aussie and Kiwi, however inflation numbers out of Beijing today helped to ease concerns on the health of the second biggest economy. The Australian dollar which dropped by more than 6% from its peak in April against the U.S. currency seems to have priced in another rate cut by RBA, and going forward the high yielding currency will take its que from a combination of commodity prices, specifically iron ore and Chinese data. Meanwhile the Canadian dollar which was hit hard by the wildfire in Alberta seems to have reached a turning point as cool temperatures and light rain are likely to bring production back in the next couple of days. Focus will turn now to oil prices to determine whether USDCAD will break above 1.3.

Mixed economic data from Europe’s largest economy did little to move the Euro. German industrial output which declined by strongest pace since Aug 2014 was offset by exports rising 1.9% in March. With no tier one economic data on the calendar today expect EURUSD to continue trading range bound for the rest of the day.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

After being the biggest loser on Monday, the Japanese currency continued to slip against its major peers today, losing 3% versus the US Dollar from its 18-month peak on May-3 at 105.52. Loses occurred after Finance Minister Taro Aso warned of stepping-in to weaken the currency if moves will hurt the economy, ignoring recent US treasury warnings which added Japan and four other countries into its currency watchlist for FX practices. However, in the past couple of weeks we heard similar speeches from Prime Minister Shinzo Abe and BoJ Governor Haruhiko Kuroda but traders did not respond back then. So why traders are now responding to verbal interventions now? Or did Finance Minister Taro Aso find the magical words?

In fact, there are two reasons why traders responded now. CFTC report in week ending May 3 showed that speculators were cutting gross long Japanese Yen positions for second consecutive week, indicating that traders were seeking opportunities to book profits on short covering their long positions, and comments from Finance Minister helped this trade to continue. On the other side, comments this time were more straight forward as Mr. Aso mentioned the word “Intervene” rather than the usual diplomatic language to act appropriately against excessive moves. Although BoJ cannot put a floor to USDJPY as SNB did 2011 introducing the exchange-rate peg to the EUR, it’s becoming clearer that USDJPY at 105 is being considered a danger zone for Japans central bank.

Commodity currencies were under pressure yesterday as Chinese trade numbers impacted both the Aussie and Kiwi, however inflation numbers out of Beijing today helped to ease concerns on the health of the second biggest economy. The Australian dollar which dropped by more than 6% from its peak in April against the U.S. currency seems to have priced in another rate cut by RBA, and going forward the high yielding currency will take its que from a combination of commodity prices, specifically iron ore and Chinese data. Meanwhile the Canadian dollar which was hit hard by the wildfire in Alberta seems to have reached a turning point as cool temperatures and light rain are likely to bring production back in the next couple of days. Focus will turn now to oil prices to determine whether USDCAD will break above 1.3.

Mixed economic data from Europe’s largest economy did little to move the Euro. German industrial output which declined by strongest pace since Aug 2014 was offset by exports rising 1.9% in March. With no tier one economic data on the calendar today expect EURUSD to continue trading range bound for the rest of the day.

Disclaimer: The content in this article comprises personal opinions and should not be construed as containing personal and/or other investment advice and/or an offer of and/or solicitation for any transactions in financial instruments and/or a guarantee and/or prediction of future performance. ForexTime (FXTM), its affiliates, agents, directors, officers or employees do not guarantee the accuracy, validity, timeliness or completeness, of any information or data made available and assume no liability as to any loss arising from any investment based on the same.

Mohammed Abdulwadud Soubra

The EURUSD ventured towards the 1.135 support during trading on Tuesday as a combination of Dollar resurgence and profit taking provided an opportunity for sellers to attack. Regardless of these short-term losses, this pair looks firmly bullish on the daily timeframe and the potential higher low at 1.135 may grant an opportunity for bulls to install another round of buying. From a technical standpoint, prices are trading above the daily 20 SMA while the MACD trades firmly to the upside. A decisive breakout above 1.140 could trigger a rally towards 1.150 and potentially higher. If bears manage to conquer the 1.135 support then this daily bullish outlook becomes invalidated.

Mohammed Abdulwadud Soubra

Talking Points: - The US Dollar continues to see bullish price action, and over the past two days we’ve seen the Yen begin to stage a turn-around. But is this a lasting move? - Perhaps more interesting in the bigger picture is the potential for a turn in equity markets...

: