Mohammed Abdulwadud Soubra / Perfil

- Informações

|

8+ anos

experiência

|

7

produtos

|

1086

versão demo

|

|

134

trabalhos

|

1

sinais

|

1

assinantes

|

Estou no mercado forex desde 2005.

Veja este produto:

https://www.mql5.com/en/users/soubra2003/seller

Sinais de negociação promissores no US30 e em ações americanas:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para suporte imediato, por favor, junte-se a este grupo no WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Veja este produto:

https://www.mql5.com/en/users/soubra2003/seller

Sinais de negociação promissores no US30 e em ações americanas:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para suporte imediato, por favor, junte-se a este grupo no WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Amigos

8602

Pedidos

Enviados

Mohammed Abdulwadud Soubra

Publicado o postagem Oil prices fell after the resumption of Canadian producers production processes and the approach of the OPEC delegates m

Oil prices fell after the resumption of Canadian producers production processes and the approach of the OPEC delegates meeting Oil prices tumbled for the third straight day, with the support of the Canadian producers resume production after a break over the previous two weeks on the one hand and...

Compartilhar nas redes sociais · 3

119

Mohammed Abdulwadud Soubra

Latest News

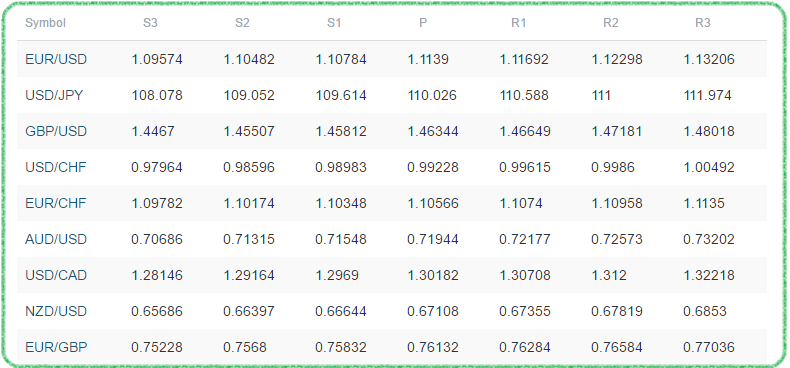

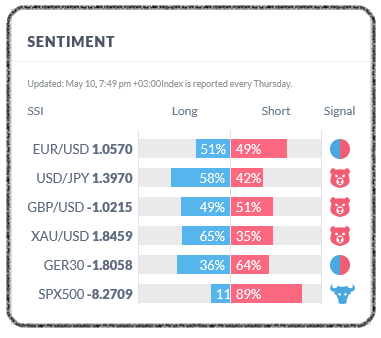

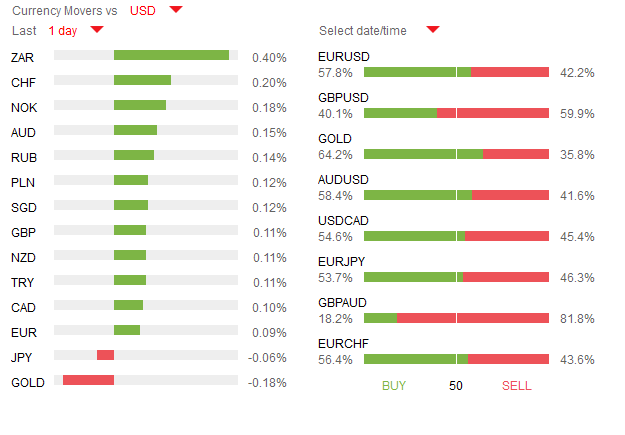

Preliminary GDP in the US climbed to 0.8% for the first quarter, as opposed to last month’s advanced reading of 0.5%, mostly attributed to a surge in home building projects. In addition, Janet Yellen’s speech in which she stated that a rate hike would be appropriate in the coming months, helped boost the USD-Index 0.4% on Friday. Meanwhile, USDJPY has surged 0.8% in early trading thus far, as positive sentiment from Friday’s rally for the USD has spilled over into today’s trading, as well as rumours regarding a possible sales tax delay from the Japanese government. Lastly, oil prices are down roughly 1% this morning, boosting USDCAD 0.55% from this morning's opening.

Volumes in today’s trading should be lower than normal, as both the UK and the US are off for their respective public holidays. Other than that, the spotlight during the European session will be on Germany as it will publish individual province’s inflation figures throughout the morning – with Germany’s inflation forecasted to grow to 0.4% month-on-month. Spain meanwhile is expected to remain in deflationary territory for the fifth consecutive month when it publishes its inflation data – anticipated at -1% year-on-year. Lastly, during the overnight Asian session, the volatile building approvals report out of Australia is forecasted to show a 2.8% decline month-on-month.

Preliminary GDP in the US climbed to 0.8% for the first quarter, as opposed to last month’s advanced reading of 0.5%, mostly attributed to a surge in home building projects. In addition, Janet Yellen’s speech in which she stated that a rate hike would be appropriate in the coming months, helped boost the USD-Index 0.4% on Friday. Meanwhile, USDJPY has surged 0.8% in early trading thus far, as positive sentiment from Friday’s rally for the USD has spilled over into today’s trading, as well as rumours regarding a possible sales tax delay from the Japanese government. Lastly, oil prices are down roughly 1% this morning, boosting USDCAD 0.55% from this morning's opening.

Volumes in today’s trading should be lower than normal, as both the UK and the US are off for their respective public holidays. Other than that, the spotlight during the European session will be on Germany as it will publish individual province’s inflation figures throughout the morning – with Germany’s inflation forecasted to grow to 0.4% month-on-month. Spain meanwhile is expected to remain in deflationary territory for the fifth consecutive month when it publishes its inflation data – anticipated at -1% year-on-year. Lastly, during the overnight Asian session, the volatile building approvals report out of Australia is forecasted to show a 2.8% decline month-on-month.

Mohammed Abdulwadud Soubra

European Central Bank Policy, the OPEC Meeting and NFP Lead FX Agenda

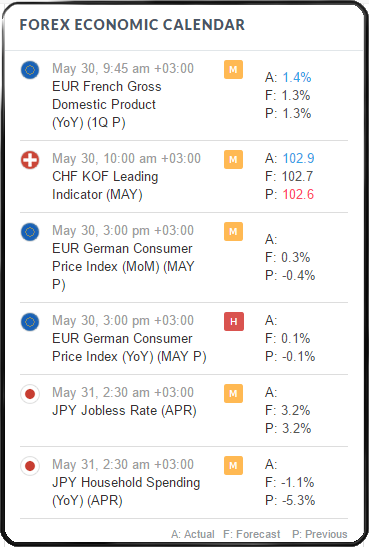

The U.S. Memorial Day weekend will shorten the trading week and compress employment releases in a week that is already filled with major events. The Organization of the Petroleum Exporting Countries (OPEC) will meet in Vienna on Thursday and that day the European Central Bank (ECB) will publish its rate statement and forecasts. The U.S. will release its employment indicators as well as manufacturing and non-manufacturing PMIs in a week that could make or break the possibility of a June Federal Open Market Committee (FOMC) meeting interest rate hike.

The European Central Bank (ECB) is not expected to change monetary policy when it releases its statement on Thursday, June 2 at 7:45 am EDT. The market will be following ECB President Mario Draghi speech for details about the implementation of corporate bond purchases that will kick off in June but the only surprise on the agenda could be the ECB’s forecasts. March’s forecasts were put together using the horrible beginning of the year data, which has improved and before the quantitative easing additional stimulus announced in the same time the forecasts were published. The inflation forecast could rise to 1.6 percent next year, putting less pressure on the ECB to ease monetary policy.

The USD economic calendar kicks off on Tuesday, May 31 with the release of the Consumer Confidence data at 10:00 am EDT. The ISM manufacturing PMI will be released on Wednesday, June 1 at 10:00 am EDT. The ADP private payrolls will be published on Thursday, June 2 at 8:15 am EDT to kick off the employment data a day later than usual due to the U.S. holiday on Monday. U.S. unemployment claims will be released that same day at 8:30 am EDT. The biggest indicator in forex, the U.S. non farm payrolls (NFP) will be published on Friday, June 3 at 8:30 am and followed by the ISM non-manufacturing PMI at 10:00 am EDT. The last NFP before June gains extra importance after the minutes from the April FOMC hinted that the Fed could hike rates if the U.S. economy showed signs of a rebound.

The U.S. Memorial Day weekend will shorten the trading week and compress employment releases in a week that is already filled with major events. The Organization of the Petroleum Exporting Countries (OPEC) will meet in Vienna on Thursday and that day the European Central Bank (ECB) will publish its rate statement and forecasts. The U.S. will release its employment indicators as well as manufacturing and non-manufacturing PMIs in a week that could make or break the possibility of a June Federal Open Market Committee (FOMC) meeting interest rate hike.

The European Central Bank (ECB) is not expected to change monetary policy when it releases its statement on Thursday, June 2 at 7:45 am EDT. The market will be following ECB President Mario Draghi speech for details about the implementation of corporate bond purchases that will kick off in June but the only surprise on the agenda could be the ECB’s forecasts. March’s forecasts were put together using the horrible beginning of the year data, which has improved and before the quantitative easing additional stimulus announced in the same time the forecasts were published. The inflation forecast could rise to 1.6 percent next year, putting less pressure on the ECB to ease monetary policy.

The USD economic calendar kicks off on Tuesday, May 31 with the release of the Consumer Confidence data at 10:00 am EDT. The ISM manufacturing PMI will be released on Wednesday, June 1 at 10:00 am EDT. The ADP private payrolls will be published on Thursday, June 2 at 8:15 am EDT to kick off the employment data a day later than usual due to the U.S. holiday on Monday. U.S. unemployment claims will be released that same day at 8:30 am EDT. The biggest indicator in forex, the U.S. non farm payrolls (NFP) will be published on Friday, June 3 at 8:30 am and followed by the ISM non-manufacturing PMI at 10:00 am EDT. The last NFP before June gains extra importance after the minutes from the April FOMC hinted that the Fed could hike rates if the U.S. economy showed signs of a rebound.

Mohammed Abdulwadud Soubra

Technical Analysis

Saturday, May 28, 2016 4:24 am +03:00

A Late Push for the Dollar from Yellen Puts Bulls on Notice

We will open the new trading week with the USDollar at a two months high but liquidity curtailed by Monday’s Memorial Day holiday.

Continue Reading

Saturday, May 28, 2016 2:36 am +03:00

Aussie Dollar Selling May Continue as RBA vs. Fed Outlooks Diverge

Saturday, May 28, 2016 2:16 am +03:00

Sterling Continues to Strengthen With Brexit Vote a Month Away

Saturday, May 28, 2016 1:04 am +03:00

Yellen Gives First Public Appearance Following April FOMC Minutes

Friday, May 27, 2016 10:52 am +03:00

Nikkei 225 Technical Analysis: Short Term Levels Prevail

Thursday, May 26, 2016 8:10 pm +03:00

WTI Crude Oil Price Forecast: Hello, $50!

Saturday, May 28, 2016 4:24 am +03:00

A Late Push for the Dollar from Yellen Puts Bulls on Notice

We will open the new trading week with the USDollar at a two months high but liquidity curtailed by Monday’s Memorial Day holiday.

Continue Reading

Saturday, May 28, 2016 2:36 am +03:00

Aussie Dollar Selling May Continue as RBA vs. Fed Outlooks Diverge

Saturday, May 28, 2016 2:16 am +03:00

Sterling Continues to Strengthen With Brexit Vote a Month Away

Saturday, May 28, 2016 1:04 am +03:00

Yellen Gives First Public Appearance Following April FOMC Minutes

Friday, May 27, 2016 10:52 am +03:00

Nikkei 225 Technical Analysis: Short Term Levels Prevail

Thursday, May 26, 2016 8:10 pm +03:00

WTI Crude Oil Price Forecast: Hello, $50!

Mohammed Abdulwadud Soubra

News

Saturday, May 28, 2016 3:02 am +03:00

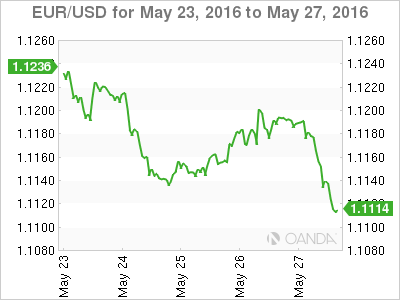

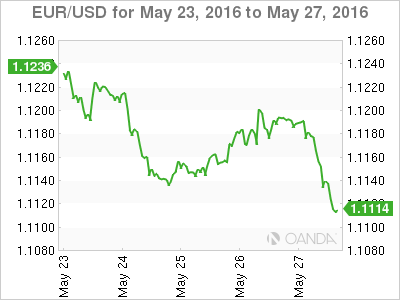

Dollar Pushes EUR/USD to Verge of Breakdown Ahead of ECB, NFPs

Rather than drift off into the weekend with little potential to draw traders' interests; the Dollar roped our attention with a final move th...Continue Reading

Saturday, May 28, 2016 2:41 am +03:00

Video: A Fed Hike, Brexit Vote and Oil May Not Allow a Quiet June

Friday, May 27, 2016 7:35 pm +03:00

EUR/USD to Mount Near-Term Recover on Sticky CPI, Wait-and-See ECB

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

Saturday, May 28, 2016 3:02 am +03:00

Dollar Pushes EUR/USD to Verge of Breakdown Ahead of ECB, NFPs

Rather than drift off into the weekend with little potential to draw traders' interests; the Dollar roped our attention with a final move th...Continue Reading

Saturday, May 28, 2016 2:41 am +03:00

Video: A Fed Hike, Brexit Vote and Oil May Not Allow a Quiet June

Friday, May 27, 2016 7:35 pm +03:00

EUR/USD to Mount Near-Term Recover on Sticky CPI, Wait-and-See ECB

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

Mohammed Abdulwadud Soubra

Technical Analysis

Saturday, May 28, 2016 4:24 am +03:00

A Late Push for the Dollar from Yellen Puts Bulls on Notice

We will open the new trading week with the USDollar at a two months high but liquidity curtailed by Monday’s Memorial Day holiday.

Continue Reading

Saturday, May 28, 2016 2:36 am +03:00

Aussie Dollar Selling May Continue as RBA vs. Fed Outlooks Diverge

Saturday, May 28, 2016 2:16 am +03:00

Sterling Continues to Strengthen With Brexit Vote a Month Away

Saturday, May 28, 2016 1:04 am +03:00

Yellen Gives First Public Appearance Following April FOMC Minutes

Friday, May 27, 2016 10:52 am +03:00

Nikkei 225 Technical Analysis: Short Term Levels Prevail

Thursday, May 26, 2016 8:10 pm +03:00

WTI Crude Oil Price Forecast: Hello, $50!

Saturday, May 28, 2016 4:24 am +03:00

A Late Push for the Dollar from Yellen Puts Bulls on Notice

We will open the new trading week with the USDollar at a two months high but liquidity curtailed by Monday’s Memorial Day holiday.

Continue Reading

Saturday, May 28, 2016 2:36 am +03:00

Aussie Dollar Selling May Continue as RBA vs. Fed Outlooks Diverge

Saturday, May 28, 2016 2:16 am +03:00

Sterling Continues to Strengthen With Brexit Vote a Month Away

Saturday, May 28, 2016 1:04 am +03:00

Yellen Gives First Public Appearance Following April FOMC Minutes

Friday, May 27, 2016 10:52 am +03:00

Nikkei 225 Technical Analysis: Short Term Levels Prevail

Thursday, May 26, 2016 8:10 pm +03:00

WTI Crude Oil Price Forecast: Hello, $50!

Mohammed Abdulwadud Soubra

News

Saturday, May 28, 2016 3:02 am +03:00

Dollar Pushes EUR/USD to Verge of Breakdown Ahead of ECB, NFPs

Rather than drift off into the weekend with little potential to draw traders' interests; the Dollar roped our attention with a final move th...Continue Reading

Saturday, May 28, 2016 2:41 am +03:00

Video: A Fed Hike, Brexit Vote and Oil May Not Allow a Quiet June

Friday, May 27, 2016 7:35 pm +03:00

EUR/USD to Mount Near-Term Recover on Sticky CPI, Wait-and-See ECB

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

Saturday, May 28, 2016 3:02 am +03:00

Dollar Pushes EUR/USD to Verge of Breakdown Ahead of ECB, NFPs

Rather than drift off into the weekend with little potential to draw traders' interests; the Dollar roped our attention with a final move th...Continue Reading

Saturday, May 28, 2016 2:41 am +03:00

Video: A Fed Hike, Brexit Vote and Oil May Not Allow a Quiet June

Friday, May 27, 2016 7:35 pm +03:00

EUR/USD to Mount Near-Term Recover on Sticky CPI, Wait-and-See ECB

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

Mohammed Abdulwadud Soubra

Publicado o postagem Weekly Trading Forecast: NFPs, ECB and Aussie GDP to Combat Expected Slow Start

Weekly Trading Forecast: NFPs, ECB and Aussie GDP to Combat Expected Slow Start The Dollar has advanced four 3 straight weeks as the freeze from rate skeptics finally thawed. Can the BoJ also regain influence or does it need to take it by force...

Mohammed Abdulwadud Soubra

Latest News

The first quarter GDP estimate out of the UK was confirmed at 0.4% following the release of the second estimate, marking the country’s weakest quarter since Q1 of 2015 – as a result, GBPUSD dropped a meagre 0.3% on the day. Meanwhile, the US’ core durable goods orders came in as expected, at 0.4%, while the headline figure smashed estimates mostly due to aircraft and automobile orders. Additionally, unemployment claims dropped 10K on the week, at 268K vs expectations of 275K. Despite the mostly positive US macro data, the USD-Index fell 0.3% yesterday.

Janet Yellen’s speech will be the main event for today’s markets, though that is scheduled for later in the afternoon - it’s highly unlikely that she will detach from her general “FED is data dependent” pitch. Sticking with the US, preliminary GDP figures (their second estimate) for Q1 are expected to get rise to 0.8% from the initial 0.5%. Also of note, the Atlanta’s FED GDP forecasting model for Q2 rose to 2.9% from 2.5% yesterday, following the stellar durable goods report. Lastly, consumer sentiment out of the US is forecasted to remain relatively unchanged when the UoM publishes its report this afternoon

The first quarter GDP estimate out of the UK was confirmed at 0.4% following the release of the second estimate, marking the country’s weakest quarter since Q1 of 2015 – as a result, GBPUSD dropped a meagre 0.3% on the day. Meanwhile, the US’ core durable goods orders came in as expected, at 0.4%, while the headline figure smashed estimates mostly due to aircraft and automobile orders. Additionally, unemployment claims dropped 10K on the week, at 268K vs expectations of 275K. Despite the mostly positive US macro data, the USD-Index fell 0.3% yesterday.

Janet Yellen’s speech will be the main event for today’s markets, though that is scheduled for later in the afternoon - it’s highly unlikely that she will detach from her general “FED is data dependent” pitch. Sticking with the US, preliminary GDP figures (their second estimate) for Q1 are expected to get rise to 0.8% from the initial 0.5%. Also of note, the Atlanta’s FED GDP forecasting model for Q2 rose to 2.9% from 2.5% yesterday, following the stellar durable goods report. Lastly, consumer sentiment out of the US is forecasted to remain relatively unchanged when the UoM publishes its report this afternoon

Mohammed Abdulwadud Soubra

Greece’s creditors reached a deal to avoid a summer car crash in a way that only they know how, involving extension of maturities, adjustment of interest rate payments with a good dose of things still to be decided, some of them after the German federal elections next year. The often used headline in recent years was “kicking the can down the road” and for the most part, this amounts to another example of that. The IMF remains involved, but retains its demand for meaningful debt restructuring. Still, for the single currency, this has removed one of the potential risks for the summer, with the deal unusually being reached comfortably ahead of the loan disbursement next month.

Yesterday saw a sharp move lower on EURGBP, pushing 3.5 month lows as the single currency was favoured vs. the dollar by yen bulls. On the other side, sterling is gaining more confidence that the EU referendum will see a win for the ‘remain’ side next month. The Bank of England Governor had a charged appearance in front of the Treasury Select Committee yesterday largely focusing on the issue. Sterling is again, so far, the strongest performing major currency this week. For today, there may be a stronger focus than usual on the German IFO data at 08:00 GMT, with yesterday’s GDP data showing a better than expected balance of growth for Germany. The market expects a modest rise in the headline index. The yen remains cautiously optimistic going into the G7 meeting this coming weekend, USDJPY struggling for a sustained push above the 110 level.

Yesterday saw a sharp move lower on EURGBP, pushing 3.5 month lows as the single currency was favoured vs. the dollar by yen bulls. On the other side, sterling is gaining more confidence that the EU referendum will see a win for the ‘remain’ side next month. The Bank of England Governor had a charged appearance in front of the Treasury Select Committee yesterday largely focusing on the issue. Sterling is again, so far, the strongest performing major currency this week. For today, there may be a stronger focus than usual on the German IFO data at 08:00 GMT, with yesterday’s GDP data showing a better than expected balance of growth for Germany. The market expects a modest rise in the headline index. The yen remains cautiously optimistic going into the G7 meeting this coming weekend, USDJPY struggling for a sustained push above the 110 level.

Mohammed Abdulwadud Soubra

Latest News

Figures out of Germany showed that economic sentiment in the country fell in May, mostly due to uncertainties regarding the economic outlook and the upcoming “Brexit” referendum. Meanwhile, yesterday's new home sales in the US smashed estimates, coming in at 619K vs forecasts of 521K, causing EURUSD to fall 0.8% on the day. GBPUSD in the meantime gained 0.9% yesterday, as the stay camp continues to gain momentum ahead of the June 23 referendum vote. Eurogroup ministers agreed on a formal deal with Greece to release 10.3B Euros after Greek officials agreed on further austerity measures. Lastly, the FED’s James Bullard stated that “there’s no reason to prejudge June”, however that labour data suggested it was time to hike interest rates in the summer.

Today’s economic calendar begins with German IFO business climate, expected to have risen to 106.9 from 106.6. This report comes after yesterday’s disappointing economic sentiment figures from the region which showed that the population was uncertain regarding Germany’s economic outlook. The spotlight for today will turn to Canada’s central bank and their announcement regarding the country’s latest monetary policy stance. The majority of analysts believe that the BOC will leave interest rates unchanged, yet highlight the damaging effects on the economy from the fall in the price of oil.

Figures out of Germany showed that economic sentiment in the country fell in May, mostly due to uncertainties regarding the economic outlook and the upcoming “Brexit” referendum. Meanwhile, yesterday's new home sales in the US smashed estimates, coming in at 619K vs forecasts of 521K, causing EURUSD to fall 0.8% on the day. GBPUSD in the meantime gained 0.9% yesterday, as the stay camp continues to gain momentum ahead of the June 23 referendum vote. Eurogroup ministers agreed on a formal deal with Greece to release 10.3B Euros after Greek officials agreed on further austerity measures. Lastly, the FED’s James Bullard stated that “there’s no reason to prejudge June”, however that labour data suggested it was time to hike interest rates in the summer.

Today’s economic calendar begins with German IFO business climate, expected to have risen to 106.9 from 106.6. This report comes after yesterday’s disappointing economic sentiment figures from the region which showed that the population was uncertain regarding Germany’s economic outlook. The spotlight for today will turn to Canada’s central bank and their announcement regarding the country’s latest monetary policy stance. The majority of analysts believe that the BOC will leave interest rates unchanged, yet highlight the damaging effects on the economy from the fall in the price of oil.

: