Hans Hoedemakers / Perfil

- Informações

|

6+ anos

experiência

|

0

produtos

|

0

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

Amigos

106

Pedidos

Enviados

Hans Hoedemakers

I bought EUR/CHF's current dip on the ground that from current levels, CHF upside risks appear limited against the Euro.

This is especially true as further safe-haven driven CHF upside is likely to trigger renewed risk of currency intervention by the SNB. After all, the SNB seems to be pursuing a gradual currency depreciation trend. Hence, a policy mix consisting of negative rates and currency intervention if needed remains in place.

In the longer run, I see no further scope for ECB-SNB monetary policy expectations to diverge, and such a prospect suggests any downside in the cross would be a correction rather than a change in trend.

This is especially true as further safe-haven driven CHF upside is likely to trigger renewed risk of currency intervention by the SNB. After all, the SNB seems to be pursuing a gradual currency depreciation trend. Hence, a policy mix consisting of negative rates and currency intervention if needed remains in place.

In the longer run, I see no further scope for ECB-SNB monetary policy expectations to diverge, and such a prospect suggests any downside in the cross would be a correction rather than a change in trend.

Hans Hoedemakers

I believe the USD/JPY will remain within its recent range of around ¥110 for now. One factor is the ongoing steadiness of the US economy, as seen in US payroll data last Friday. In addition, Japanese institutional investors continue to

buy quietly on weakness whenever the USD/JPY dips to ¥110 or below. The trend is supported as well by bearish yen sentiment from the strength of the euro and other non-USD currencies. Polls by the Nikkei and other major media find

that support for the Abe administration has risen several percentage points since the recent Cabinet reshuffle, indicating a retreat in concern over political risk-off factors.

At the same time, I see no evident catalyst sufficient to spark a renewed rally in the USD/JPY anytime soon. US inflation remains low despite the buoyant economy, and expectations of a rate hike next month are virtually nil. Congress will again face the government debt cap problem when it resumes deliberations on 29 September soon after the summer holidays, which could be a source of market frustration. Overseas speculators still hold significant long positions in USD/JPY markets. Domestically, hedged USD/JPY sales by exporters and institutional investors may put pressure on the markets amid thin trading ahead of the summer Obon holidays.

Buying USD/JPY will need to wait a bit longer because a new opportunity will present itself. I recommend tactical dip buying of USD/JPY at around the recent range.

buy quietly on weakness whenever the USD/JPY dips to ¥110 or below. The trend is supported as well by bearish yen sentiment from the strength of the euro and other non-USD currencies. Polls by the Nikkei and other major media find

that support for the Abe administration has risen several percentage points since the recent Cabinet reshuffle, indicating a retreat in concern over political risk-off factors.

At the same time, I see no evident catalyst sufficient to spark a renewed rally in the USD/JPY anytime soon. US inflation remains low despite the buoyant economy, and expectations of a rate hike next month are virtually nil. Congress will again face the government debt cap problem when it resumes deliberations on 29 September soon after the summer holidays, which could be a source of market frustration. Overseas speculators still hold significant long positions in USD/JPY markets. Domestically, hedged USD/JPY sales by exporters and institutional investors may put pressure on the markets amid thin trading ahead of the summer Obon holidays.

Buying USD/JPY will need to wait a bit longer because a new opportunity will present itself. I recommend tactical dip buying of USD/JPY at around the recent range.

Hans Hoedemakers

I placed a short limit for NZDCAD ahead of the BNZ August policy meeting on the 10th of August.

Hans Hoedemakers

Someone asked me if USD/JPY will go up. In overall, I don't think so. USD/JPY closed at 110.65 in New York last on the 25th of July, just a few pips above the key 110.60 support and this is enough to indicate that this pair has moved into a bearish phase again.

Also, I noted that USD/JPY removed the 55- and 200-day averages to test basing support at 110.81. I expect this to hold initially, but look for a break below to target the 78.6% retracement of the June/July rally at 110.04, then the potential uptrend from April at 109.29/28. Beneath here, I can see a deeper fall to the June low at 108.83, with the potential to extend to the April low at 108.13.

Lastly, falling US treasury yields are likely to push USD/JPY through the current support level and open up technical scope for further downside. The correlation with the ten-year nominal rate spread remains exceptionally strong at close to 100% over the past year, and the risk to US yields remains skewed to the downside with the FOMC likely to delay an announcement regarding the balance sheet and to emphasize concerns that inflation has disappointed for more than temporary reasons.

I hope this makes it clear why I am shorting USD/JPY.

Also, I noted that USD/JPY removed the 55- and 200-day averages to test basing support at 110.81. I expect this to hold initially, but look for a break below to target the 78.6% retracement of the June/July rally at 110.04, then the potential uptrend from April at 109.29/28. Beneath here, I can see a deeper fall to the June low at 108.83, with the potential to extend to the April low at 108.13.

Lastly, falling US treasury yields are likely to push USD/JPY through the current support level and open up technical scope for further downside. The correlation with the ten-year nominal rate spread remains exceptionally strong at close to 100% over the past year, and the risk to US yields remains skewed to the downside with the FOMC likely to delay an announcement regarding the balance sheet and to emphasize concerns that inflation has disappointed for more than temporary reasons.

I hope this makes it clear why I am shorting USD/JPY.

Hans Hoedemakers

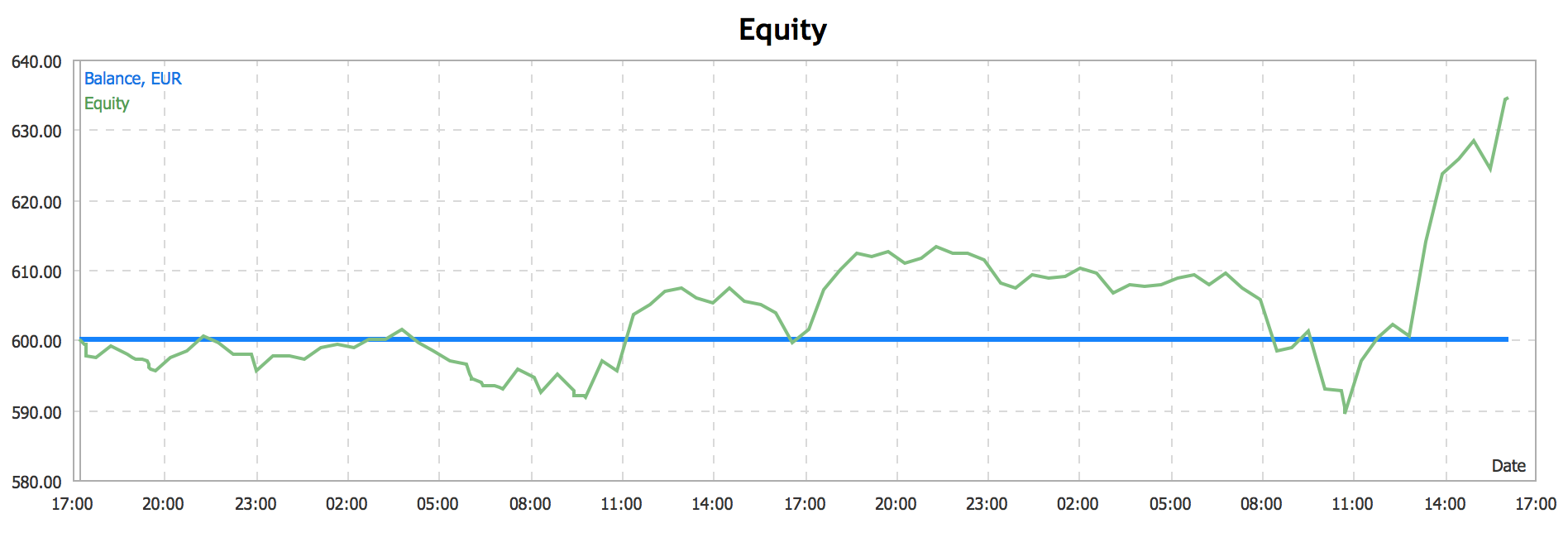

I closed the long EURJPY position because even though the euro is the strongest of the JPY pair positions that I have open at this moment, I had my doubts if EURJPY would go up higher anytime soon. Thus, I closed it in a loss, but in overall there is still growth in front of us for this month because my equity is still higher than my balance. Thank you for keeping your trust in me.

Hans Hoedemakers

I added a new short next to the current short of CHF/JPY around NY close on the ground that the trade will likely turn into a momentum play driven mainly by Swiss real money accounts who will start to decrease their hedges by liquidating CHF positions and reallocating to foreign investments. I placed the same target and stop as the other CHF/JPY position from earlier.

Leveraged accounts lost interest in trading CHF when the SNB removed its EURCHF floor, allowing it to drop below 1.20. Investors who hoped the SNB would defend it at all costs exposed themselves to leveraged carry trades and paid a high price for this misjudgment, in my opinion.

With hedge funds mostly on the sidelines, I anticipated further CHF weakness might turn into a momentum trade driven entirely by Swiss real money accounts increasing investment abroad and reducing their FX hedges.

Leveraged accounts lost interest in trading CHF when the SNB removed its EURCHF floor, allowing it to drop below 1.20. Investors who hoped the SNB would defend it at all costs exposed themselves to leveraged carry trades and paid a high price for this misjudgment, in my opinion.

With hedge funds mostly on the sidelines, I anticipated further CHF weakness might turn into a momentum trade driven entirely by Swiss real money accounts increasing investment abroad and reducing their FX hedges.

Hans Hoedemakers

Going slowly to 5% in profit with floating P/L. So far so good. https://www.mql5.com/en/signals/329380

: