Young Ho Seo / Perfil

- Informações

|

10+ anos

experiência

|

62

produtos

|

1171

versão demo

|

|

4

trabalhos

|

0

sinais

|

0

assinantes

|

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

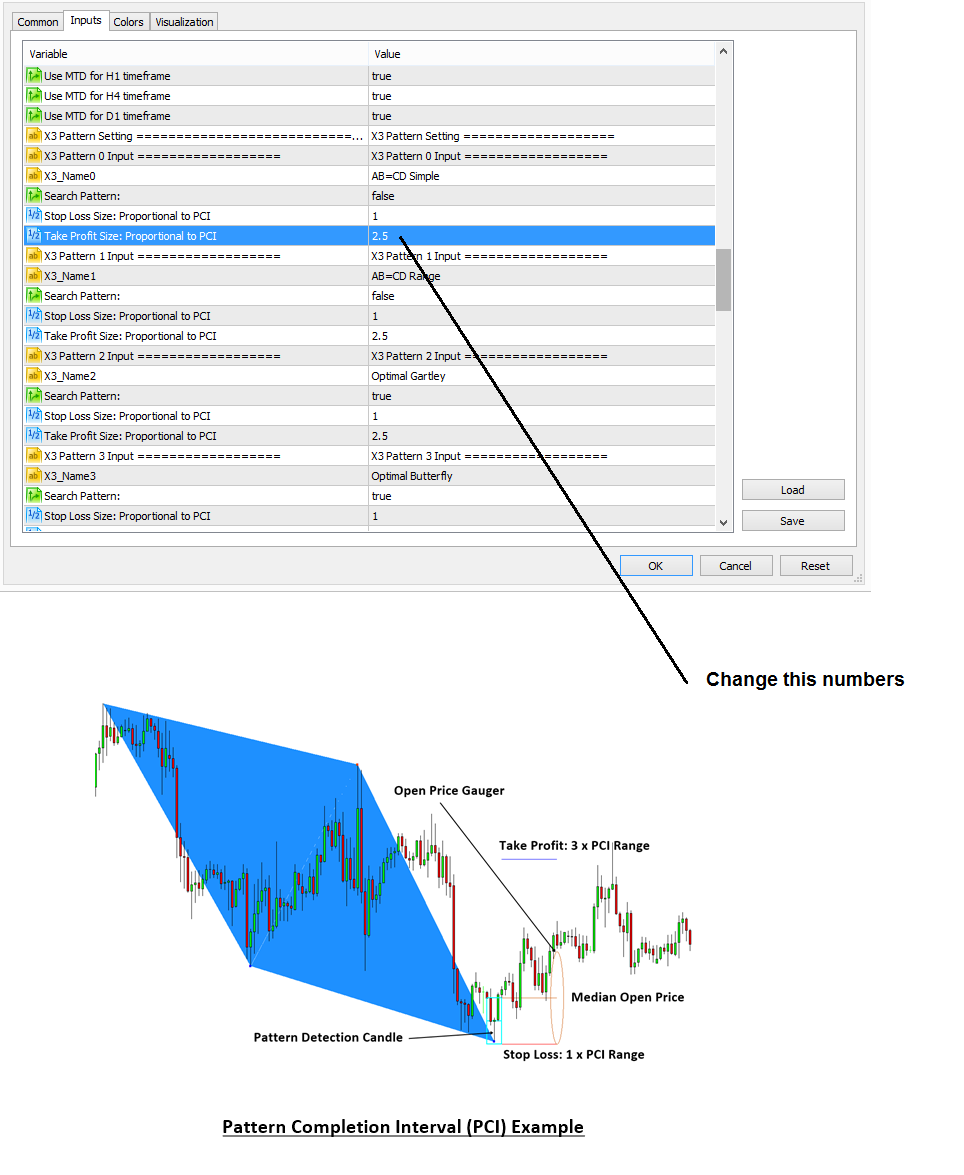

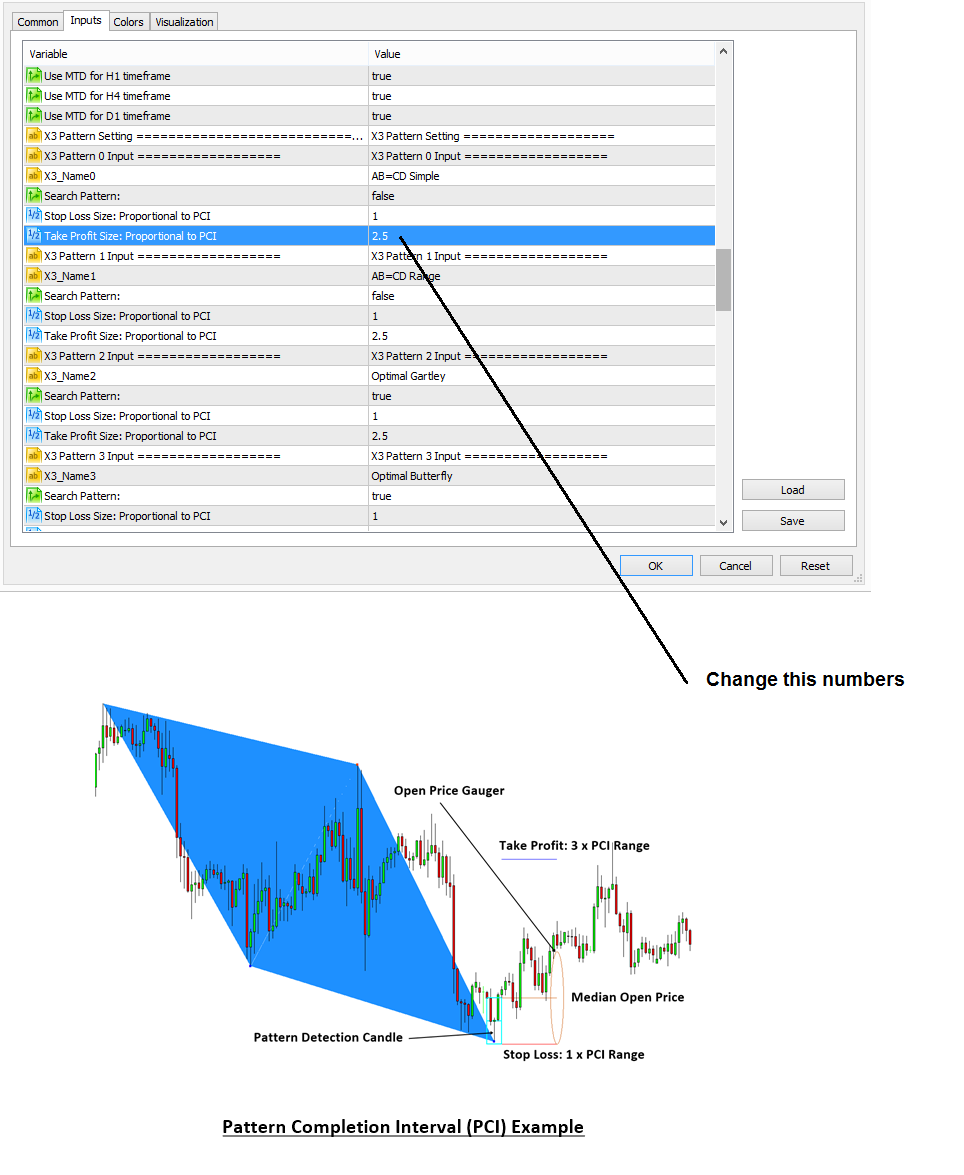

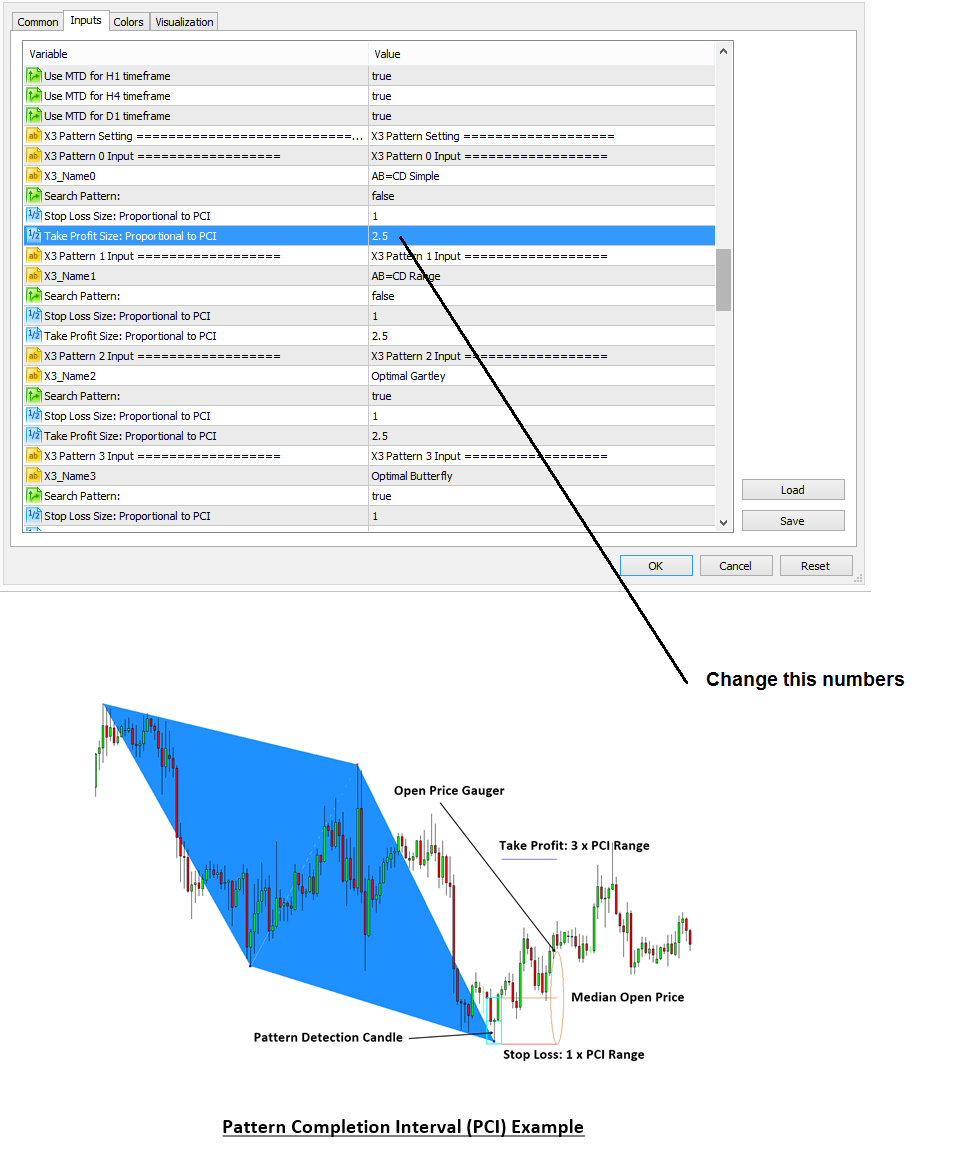

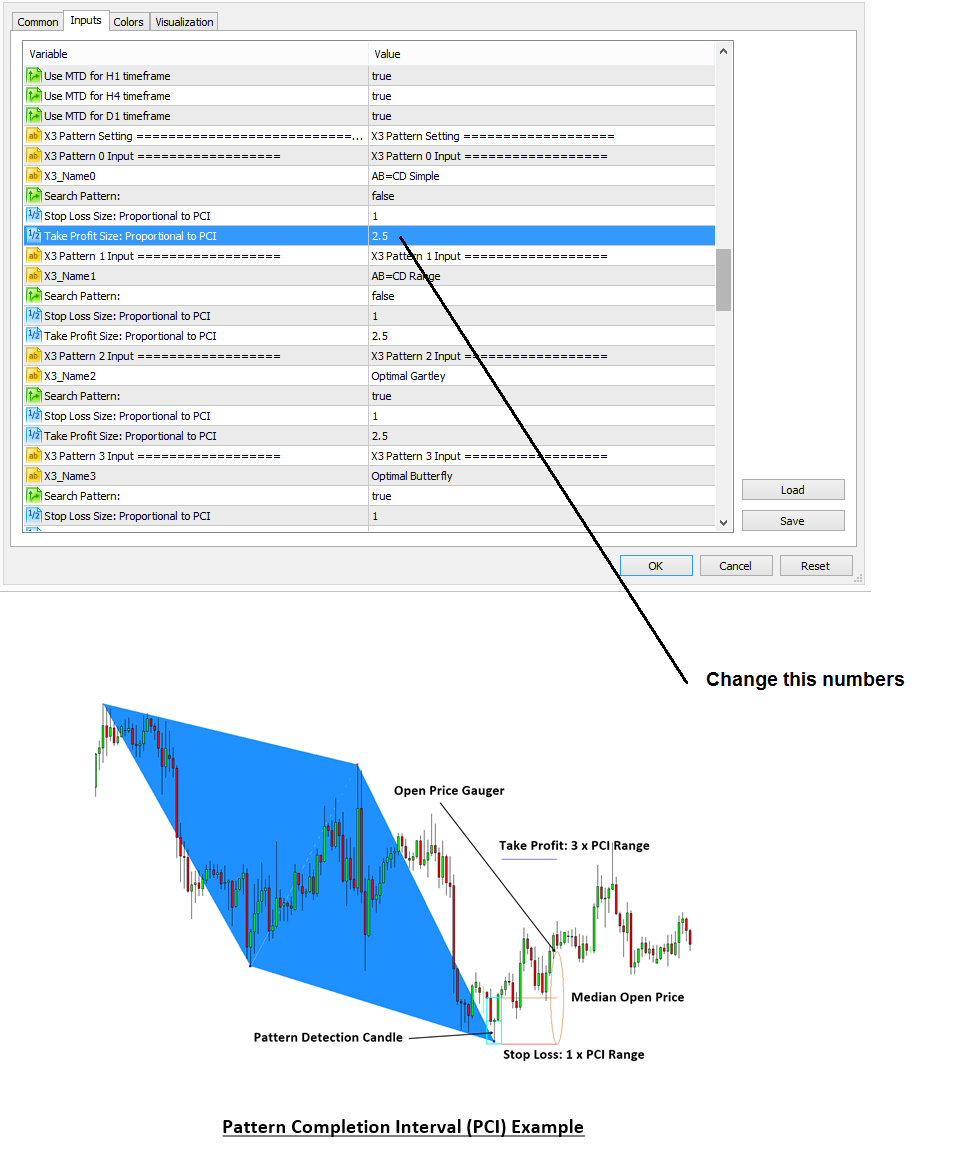

Take Profit and Stop Loss in X3 Chart Pattern Scanner

X3 Chart Pattern Scanner is also using the risk management concept with Pattern Completion Interval for your trading. Must remember that trading without having good reward/Risk ratio is useless. They can blow your account pretty quickly. Please make sure that you understand the role of Pattern Completion Interval and how it can help for your trading.

In X3 Chart Pattern Scanner, your stop loss and take profit is controlled for individual patterns. This is the main difference from Harmonic Pattern Plus and Harmonic Pattern Scenario Planner. Since X3 Chart Pattern Scanner have different categories of patterns like Elliott Wave patterns, Harmonic patterns and X3 patterns, you can apply different money management scheme if you wish.

To change your stop loss and take profit, scroll down in your input. Stop Loss = 1 means that it is size of 1 x Pattern Completion Interval Box. Take Profit = 2.5 means that it is size of 2.5 x Pattern Completion Interval.

X3 Chart Pattern Scanner provide all the historical patterns, helping you to tune your strategy. Hence, please test your strategy and change your stop loss and take profit according to your observation from your chart. We have already shown you how to test your strategy with X3 Chart Pattern Scanner in another article here.

https://algotrading-investment.com/2019/09/18/showing-historical-patterns-in-profitable-pattern-scanner/

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like.

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Also check the screenshot for better understanding of this basic risk management concept.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

X3 Chart Pattern Scanner is also using the risk management concept with Pattern Completion Interval for your trading. Must remember that trading without having good reward/Risk ratio is useless. They can blow your account pretty quickly. Please make sure that you understand the role of Pattern Completion Interval and how it can help for your trading.

In X3 Chart Pattern Scanner, your stop loss and take profit is controlled for individual patterns. This is the main difference from Harmonic Pattern Plus and Harmonic Pattern Scenario Planner. Since X3 Chart Pattern Scanner have different categories of patterns like Elliott Wave patterns, Harmonic patterns and X3 patterns, you can apply different money management scheme if you wish.

To change your stop loss and take profit, scroll down in your input. Stop Loss = 1 means that it is size of 1 x Pattern Completion Interval Box. Take Profit = 2.5 means that it is size of 2.5 x Pattern Completion Interval.

X3 Chart Pattern Scanner provide all the historical patterns, helping you to tune your strategy. Hence, please test your strategy and change your stop loss and take profit according to your observation from your chart. We have already shown you how to test your strategy with X3 Chart Pattern Scanner in another article here.

https://algotrading-investment.com/2019/09/18/showing-historical-patterns-in-profitable-pattern-scanner/

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like.

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Also check the screenshot for better understanding of this basic risk management concept.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

Young Ho Seo

Black Friday Special Discount 2021

During this Thanksgiving and Black Friday Period, we hope everyone is safe and well from this Corona Virus. We are sure that we can overcome this COVID-19 pandemic together. Hence, we provide more than 50 dollar discounts on the MetaTrader 4 and MetaTrader 5 products.

Please note that the discounted price can go back to the original price when this campaign ends. Please take the discounted price now while it last only.

For your information, we are planning to add some powerful features to our Ace Supply Demand Indicator. Hence, if you do not have Ace Supply Demand Zone indicator yet, then it is the great time to get the Ace Supply Demand Indicator at the discounted price. Get it now. In addition, other MetaTrader products are also powerful tool for your trading.

Here is the Discounted price. The price reduction is applicable to both MetaTrader 4 and MetaTrader 5 version of the indicators.

Ace Supply Demand Zone indicator (150 to 100 dollar, Save 50 dollar)

Advanced Price Pattern Scanner (230 to 180 dollar, Save 50 dollar)

Elliott Wave Trend (250 to 200 dollar, Save 50 dollar)

Price Breakout Pattern Scanner (150 to 100 dollar, Save 50 dollar)

Harmonic Pattern Scenario Planner (150 to 100 dollar, Save 50 dollar)

X3 Chart Pattern Scanner (358 to 280 dollar, Save 78 dollar)

Excessive Momentum Indicator (250 to 200 dollar, Save 50 dollar)

This discounted price is only available when you buy these products from mql5.com

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

During this Thanksgiving and Black Friday Period, we hope everyone is safe and well from this Corona Virus. We are sure that we can overcome this COVID-19 pandemic together. Hence, we provide more than 50 dollar discounts on the MetaTrader 4 and MetaTrader 5 products.

Please note that the discounted price can go back to the original price when this campaign ends. Please take the discounted price now while it last only.

For your information, we are planning to add some powerful features to our Ace Supply Demand Indicator. Hence, if you do not have Ace Supply Demand Zone indicator yet, then it is the great time to get the Ace Supply Demand Indicator at the discounted price. Get it now. In addition, other MetaTrader products are also powerful tool for your trading.

Here is the Discounted price. The price reduction is applicable to both MetaTrader 4 and MetaTrader 5 version of the indicators.

Ace Supply Demand Zone indicator (150 to 100 dollar, Save 50 dollar)

Advanced Price Pattern Scanner (230 to 180 dollar, Save 50 dollar)

Elliott Wave Trend (250 to 200 dollar, Save 50 dollar)

Price Breakout Pattern Scanner (150 to 100 dollar, Save 50 dollar)

Harmonic Pattern Scenario Planner (150 to 100 dollar, Save 50 dollar)

X3 Chart Pattern Scanner (358 to 280 dollar, Save 78 dollar)

Excessive Momentum Indicator (250 to 200 dollar, Save 50 dollar)

This discounted price is only available when you buy these products from mql5.com

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Young Ho Seo

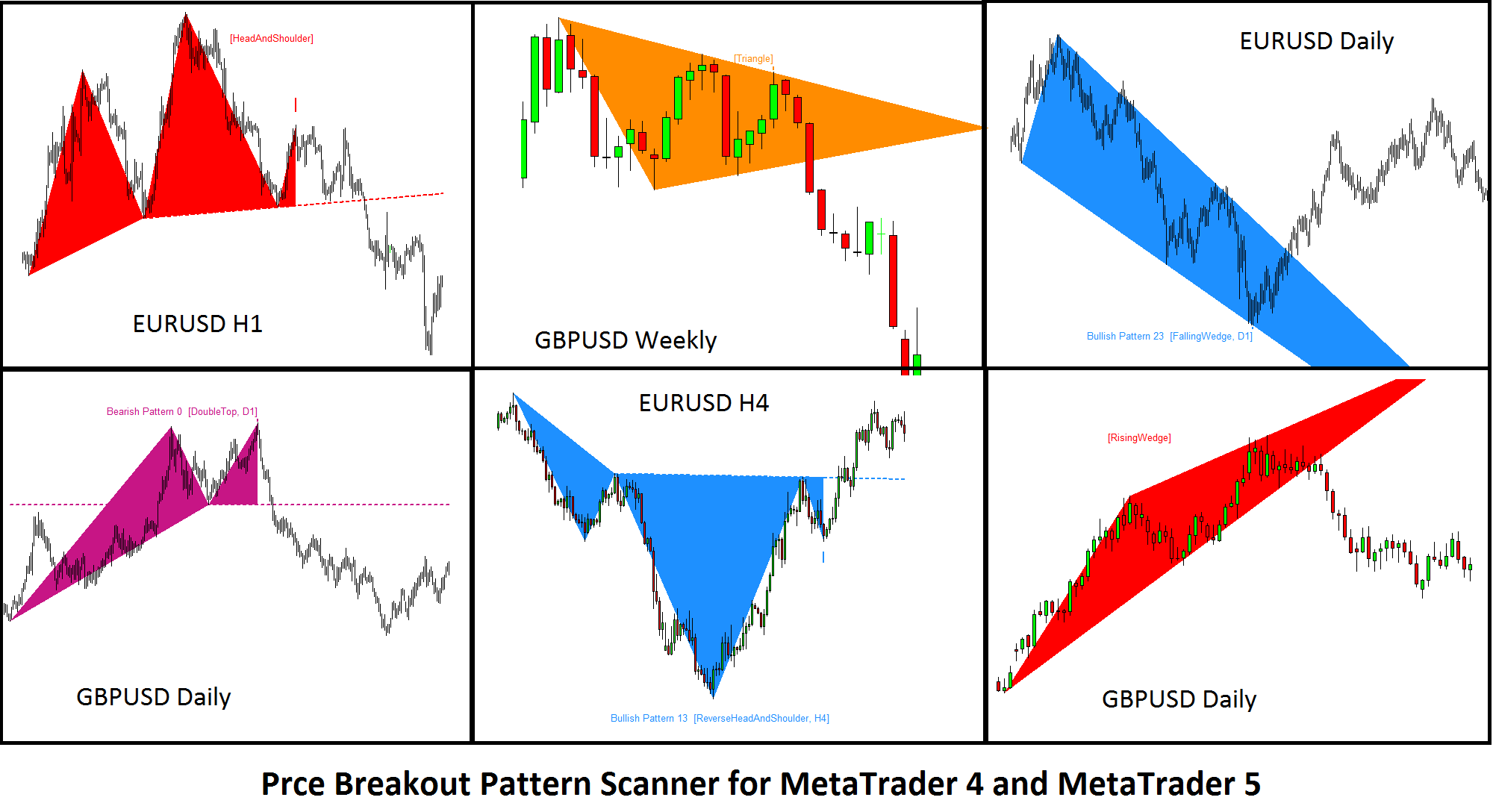

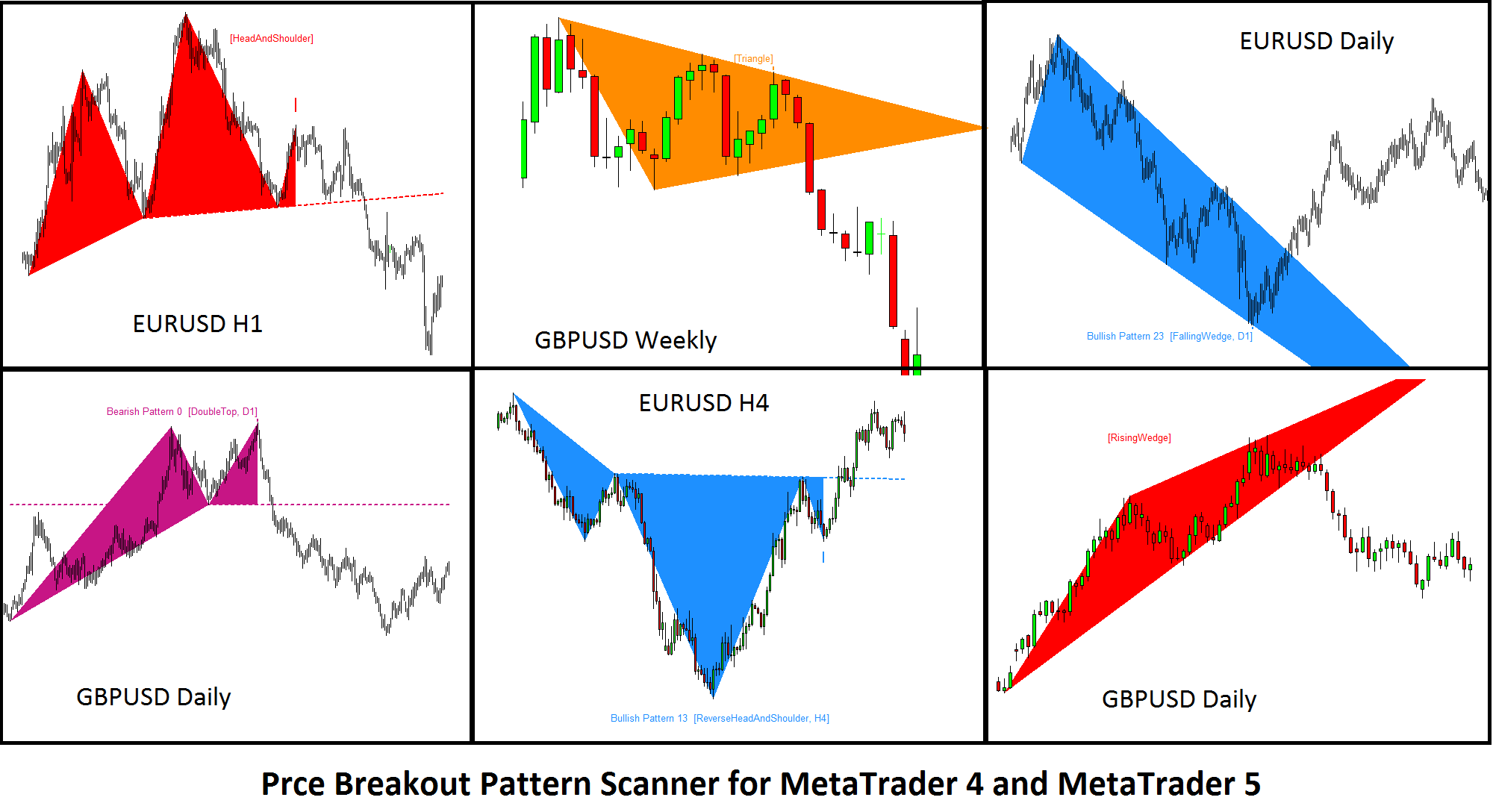

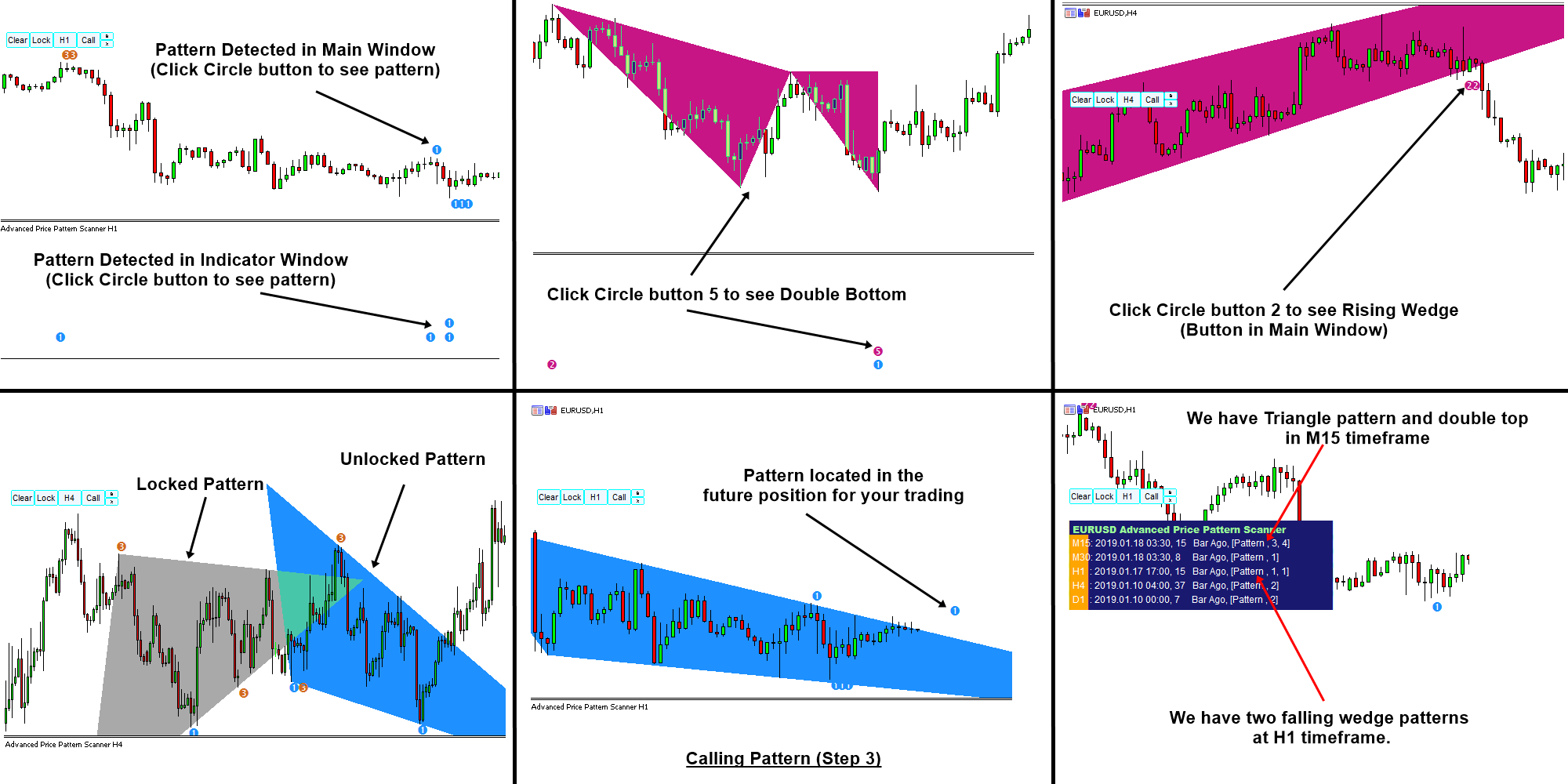

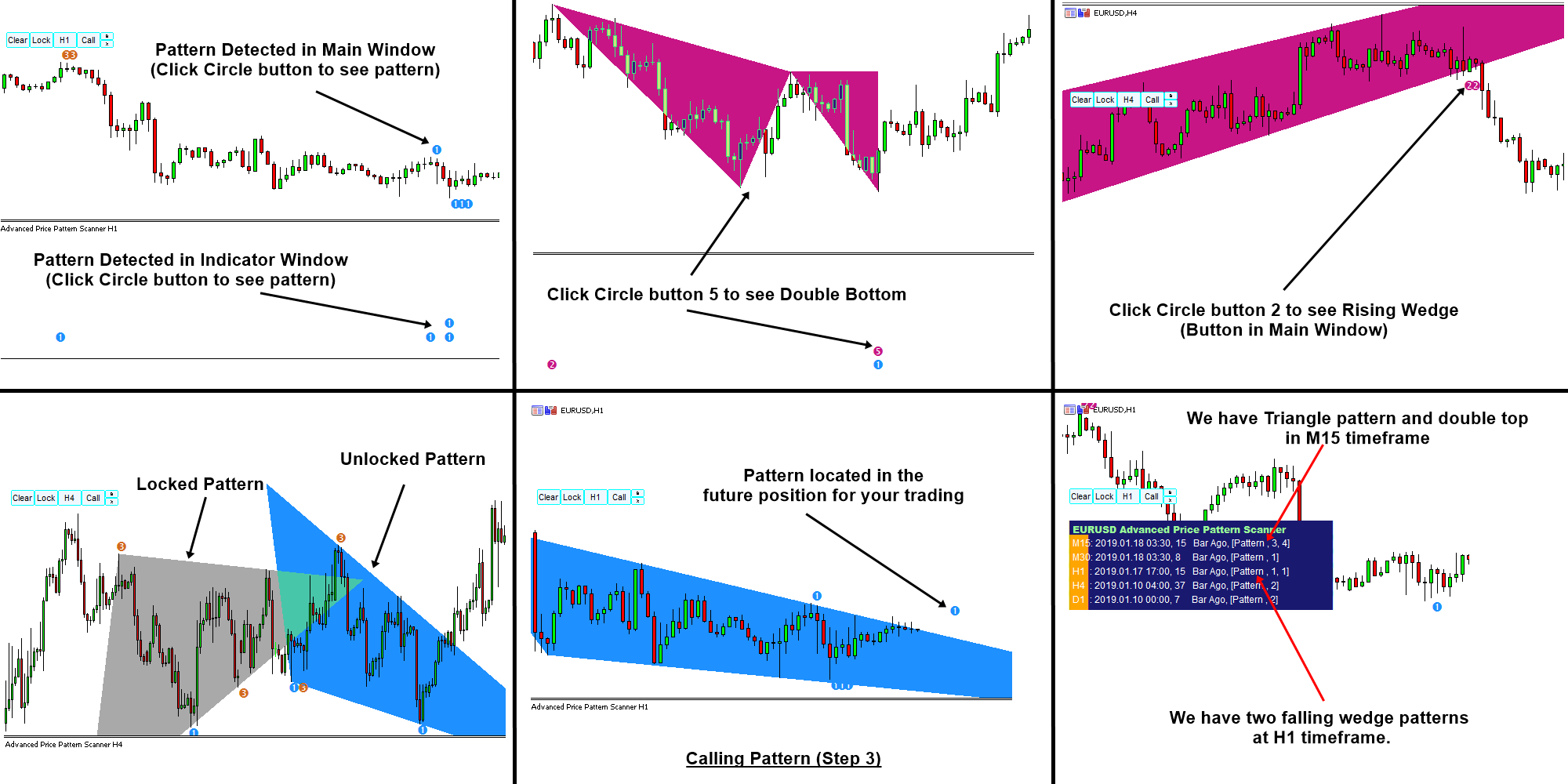

Price Breakout Pattern Scanner for Metatrader

Price Breakout Pattern Scanner is the powerful pattern scanner designed to solve the puzzle of the market geometry beyond the technical indicators. With built in Japanese candlestick patterns + Smart Renko features together, Price Breakout pattern scanner can help you to define the accurate market entry for your breakout trading. Here is some screenshots from Price Breakout Pattern Scanner.

Below are the links to Price breakout Pattern Scanner

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

In addition, we provide the YouTube Video for Price Breakout Pattern Scanner. With the video, you can see some basic operation of the price breakout pattern scanner. This video is applicable to both MetaTrader 4 and MetaTrader 5 platforms.

YouTube Video “How To Use Price Breakout Pattern Scanner”: https://www.youtube.com/watch?v=aKeSmi_Di2s

Price Breakout Pattern Scanner is the powerful pattern scanner designed to solve the puzzle of the market geometry beyond the technical indicators. With built in Japanese candlestick patterns + Smart Renko features together, Price Breakout pattern scanner can help you to define the accurate market entry for your breakout trading. Here is some screenshots from Price Breakout Pattern Scanner.

Below are the links to Price breakout Pattern Scanner

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

In addition, we provide the YouTube Video for Price Breakout Pattern Scanner. With the video, you can see some basic operation of the price breakout pattern scanner. This video is applicable to both MetaTrader 4 and MetaTrader 5 platforms.

YouTube Video “How To Use Price Breakout Pattern Scanner”: https://www.youtube.com/watch?v=aKeSmi_Di2s

Young Ho Seo

Harmonic Pattern Signal – Free

Harmonic Pattern Trading Signal provides a mean of detecting the turning point in the market. It is one way to solve the puzzle of market geometry, which is often not solvable with other technical indicators. Especially, we provide the Harmonic Pattern Signal for your trading. It is absolutely free of charge. The Harmonic Pattern Signal can be accessible from the link below.

https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

We present the trading signal in the simple table form. To use this trading signal, you need to mark up the location of the Harmonic Pattern in your chart. You can do this in any trading platform including MetaTrader, Trading View, Ninja Trader and so on. Follow the two steps below:

Open the Chart with the same timeframe shown in the table

Mark up the pattern location using Price at Point D and Date at Point D

That is all. Check the attached screenshot and more detailed Instruction can be found from the above link. Our Harmonic Pattern Trading signal is absolutely free. It is a good staring point for anyone who are interested in trading Forex market. At the same time, we provide the MetaTrader 4 and MetaTrader 5 version of Harmonic Pattern Scanner. If you prefer the indicator version of Harmonic Pattern Signal, then you can visit the product page for Harmonic Pattern Plus or X3 Chart Pattern Scanner.

=================================================

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Below are the Links to X3 Chart Pattern Scanner.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Harmonic Pattern Trading Signal provides a mean of detecting the turning point in the market. It is one way to solve the puzzle of market geometry, which is often not solvable with other technical indicators. Especially, we provide the Harmonic Pattern Signal for your trading. It is absolutely free of charge. The Harmonic Pattern Signal can be accessible from the link below.

https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

We present the trading signal in the simple table form. To use this trading signal, you need to mark up the location of the Harmonic Pattern in your chart. You can do this in any trading platform including MetaTrader, Trading View, Ninja Trader and so on. Follow the two steps below:

Open the Chart with the same timeframe shown in the table

Mark up the pattern location using Price at Point D and Date at Point D

That is all. Check the attached screenshot and more detailed Instruction can be found from the above link. Our Harmonic Pattern Trading signal is absolutely free. It is a good staring point for anyone who are interested in trading Forex market. At the same time, we provide the MetaTrader 4 and MetaTrader 5 version of Harmonic Pattern Scanner. If you prefer the indicator version of Harmonic Pattern Signal, then you can visit the product page for Harmonic Pattern Plus or X3 Chart Pattern Scanner.

=================================================

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Below are the Links to X3 Chart Pattern Scanner.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

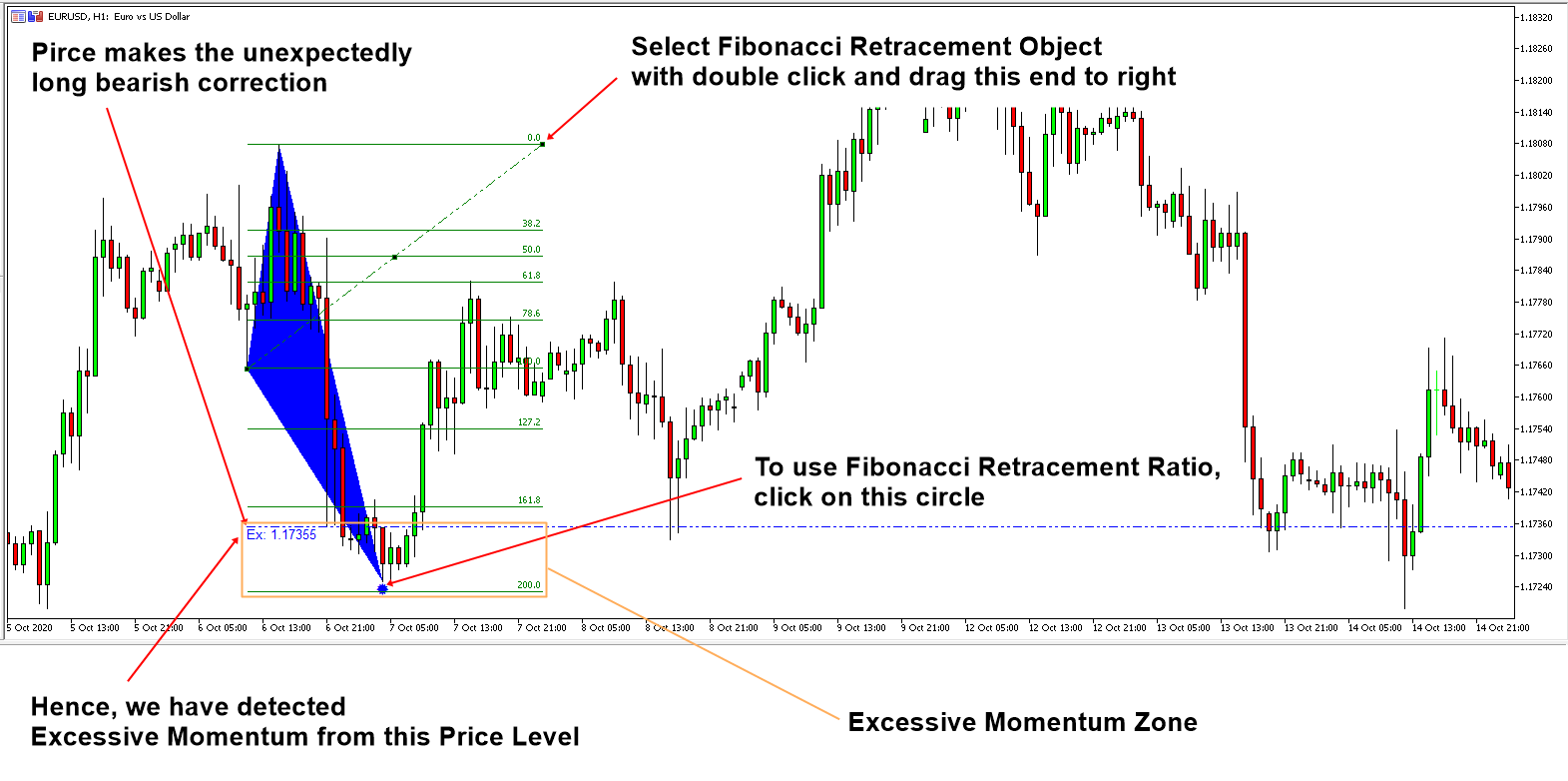

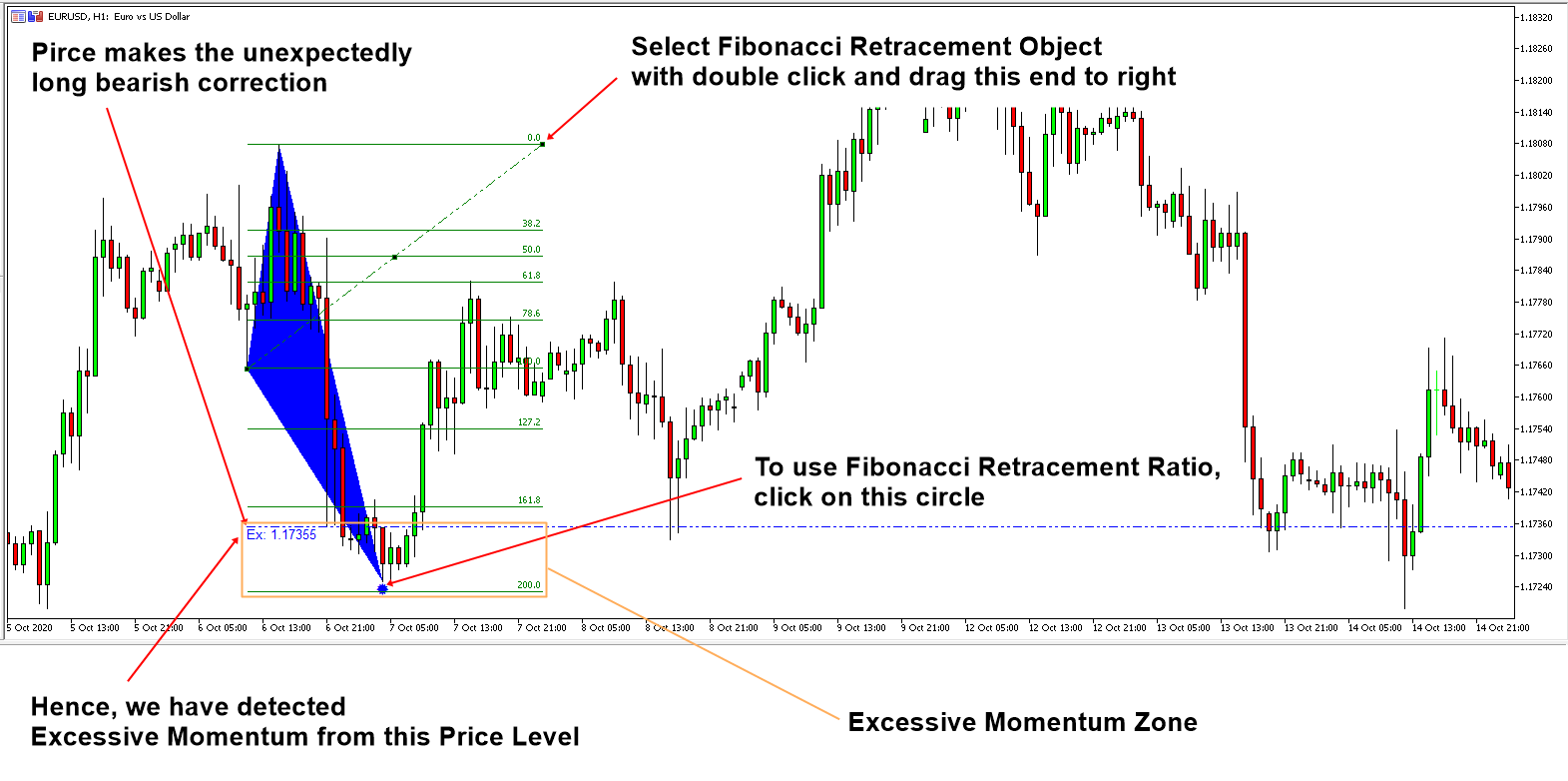

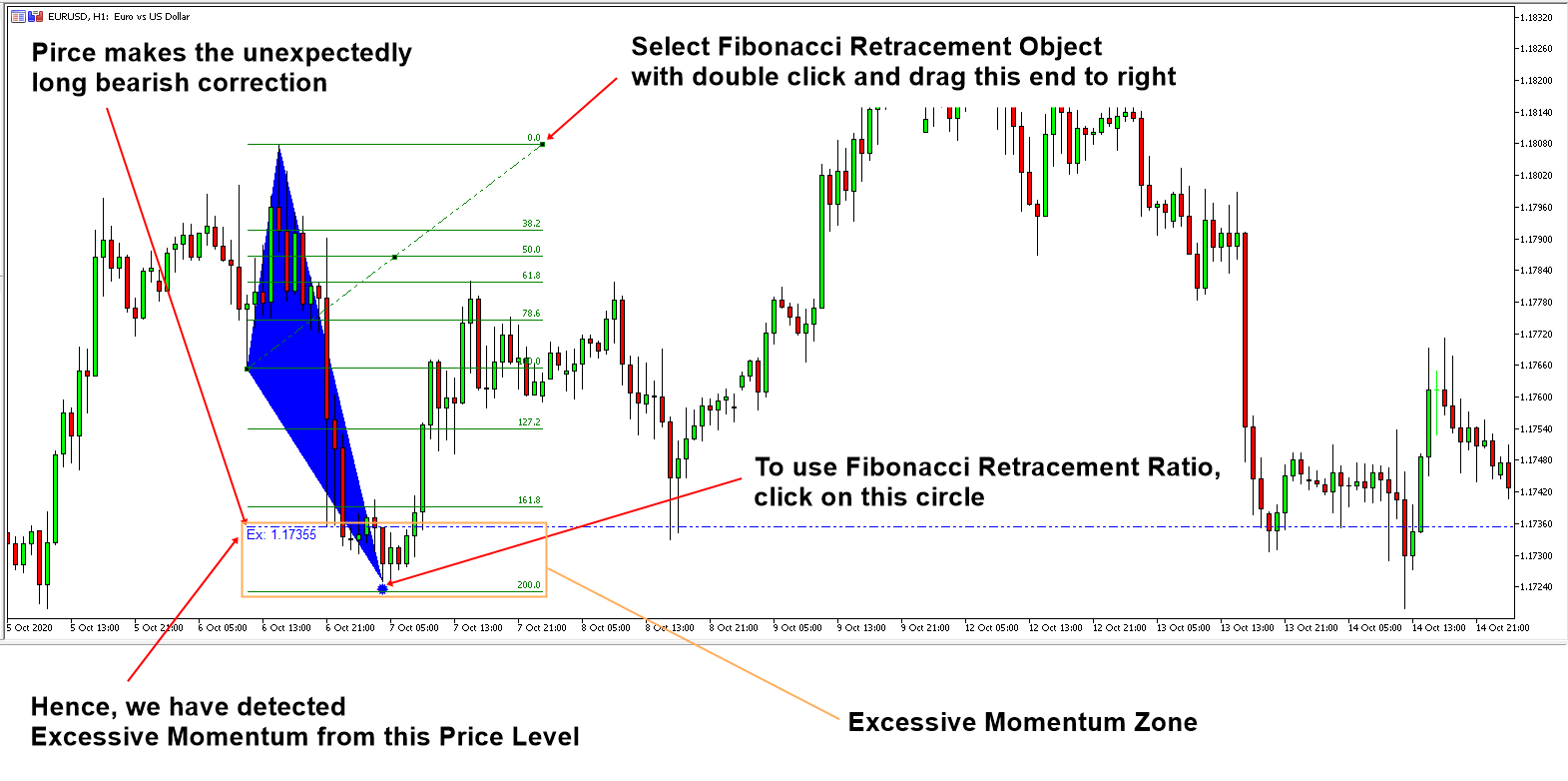

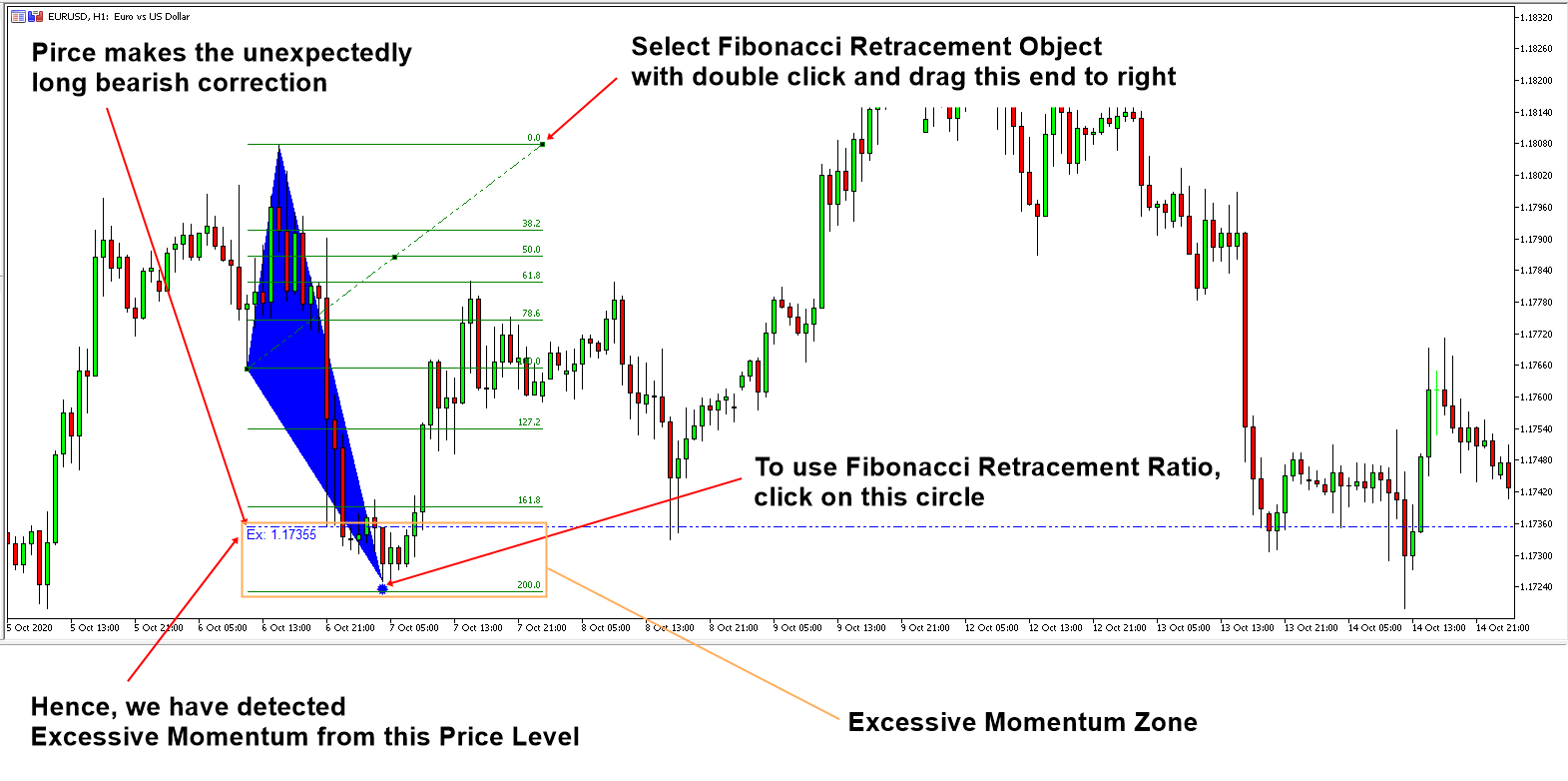

Tutorial Using Excessive Momentum and Fibonacci Ratio Analysis

With Excessive Momentum Indicator, you can access to the automatic Fibonacci Ratio Analysis. Combining these two powerful trading system are the excellent ways to trade in Forex market. In this article, we will show you how to combine both with step by step guide.

When there is an unexpectedly long bearish and bullish price movement, the indicator will detect these excessive momentum area for your trading. This excessive momentum zone are often the true accumulation and distribution area in the Volume Spread Analysis. What does this mean for your trading ?This means that entry around this excessive momentum area can provide you the great advantage that favors your Reward and Risk for your trading whether they are breakout trading or reversal trading. The indicator provides such a great opportunity automatically.

In addition, Fibonacci retracement level can provide further idea about when the price can move according to our expectation. To call the Fibonacci retracement level automatically, simply click on the circle at the Excessive Momentum Zone. Then it will place the Fibonacci retracement level automatically in your chart. The thing is that the placed Fibonacci Retracement level might be too short in its width. Sometime, you want to project the Fibonacci Retracement level far right to see the price action around the retracement level. It is doable too.

To do so, double click on the Fibonacci retracement object in your chart. Then you will see the three anchor points in the retracement object. Drag the right anchor point to the right. You can drag them as far as you want to cover the chart area at your interest. Please check the screenshot attached to complete this tutorial.

This Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version). You can watch the YouTube videos to find more about the Excessive Momentum Indicator.

YouTube Video 1: https://youtu.be/oztARcXsAVA

YouTube Video 2: https://youtu.be/A4JcTcakOKw

===========================================================================

Here is link to Excessive Momentum Indicator.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

With Excessive Momentum indicator, you can use our Free Volume Spread Pattern Detector. Volume Spread Pattern Detector is a great free tool to complete your Volume Spread Analysis to detect Accumulation and Distribution. Or even you can use them to detect important support and resistance for your trading too. Here is the link to the free Volume Spread Pattern Detector.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

In addition, Volume Spread Pattern Indicator is the more advanced version of Volume Spread Pattern Detector. If you want to improve your trading performance even more, then we recommend using Volume Spread Pattern Indicator. This is not free indicator but it is affordable. Here is the link to the Advanced Volume Spread Analysis indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

With Excessive Momentum Indicator, you can access to the automatic Fibonacci Ratio Analysis. Combining these two powerful trading system are the excellent ways to trade in Forex market. In this article, we will show you how to combine both with step by step guide.

When there is an unexpectedly long bearish and bullish price movement, the indicator will detect these excessive momentum area for your trading. This excessive momentum zone are often the true accumulation and distribution area in the Volume Spread Analysis. What does this mean for your trading ?This means that entry around this excessive momentum area can provide you the great advantage that favors your Reward and Risk for your trading whether they are breakout trading or reversal trading. The indicator provides such a great opportunity automatically.

In addition, Fibonacci retracement level can provide further idea about when the price can move according to our expectation. To call the Fibonacci retracement level automatically, simply click on the circle at the Excessive Momentum Zone. Then it will place the Fibonacci retracement level automatically in your chart. The thing is that the placed Fibonacci Retracement level might be too short in its width. Sometime, you want to project the Fibonacci Retracement level far right to see the price action around the retracement level. It is doable too.

To do so, double click on the Fibonacci retracement object in your chart. Then you will see the three anchor points in the retracement object. Drag the right anchor point to the right. You can drag them as far as you want to cover the chart area at your interest. Please check the screenshot attached to complete this tutorial.

This Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version). You can watch the YouTube videos to find more about the Excessive Momentum Indicator.

YouTube Video 1: https://youtu.be/oztARcXsAVA

YouTube Video 2: https://youtu.be/A4JcTcakOKw

===========================================================================

Here is link to Excessive Momentum Indicator.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

With Excessive Momentum indicator, you can use our Free Volume Spread Pattern Detector. Volume Spread Pattern Detector is a great free tool to complete your Volume Spread Analysis to detect Accumulation and Distribution. Or even you can use them to detect important support and resistance for your trading too. Here is the link to the free Volume Spread Pattern Detector.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

In addition, Volume Spread Pattern Indicator is the more advanced version of Volume Spread Pattern Detector. If you want to improve your trading performance even more, then we recommend using Volume Spread Pattern Indicator. This is not free indicator but it is affordable. Here is the link to the Advanced Volume Spread Analysis indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Young Ho Seo

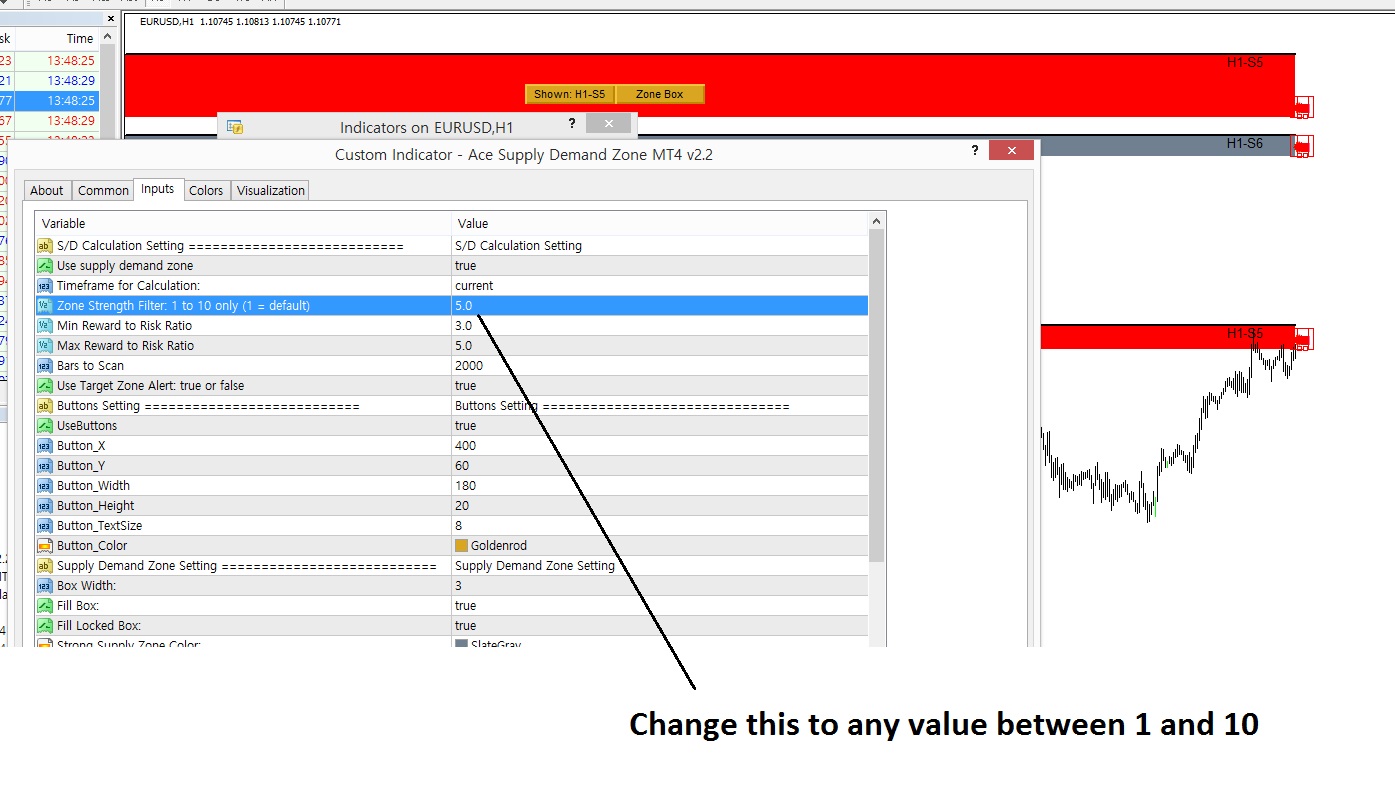

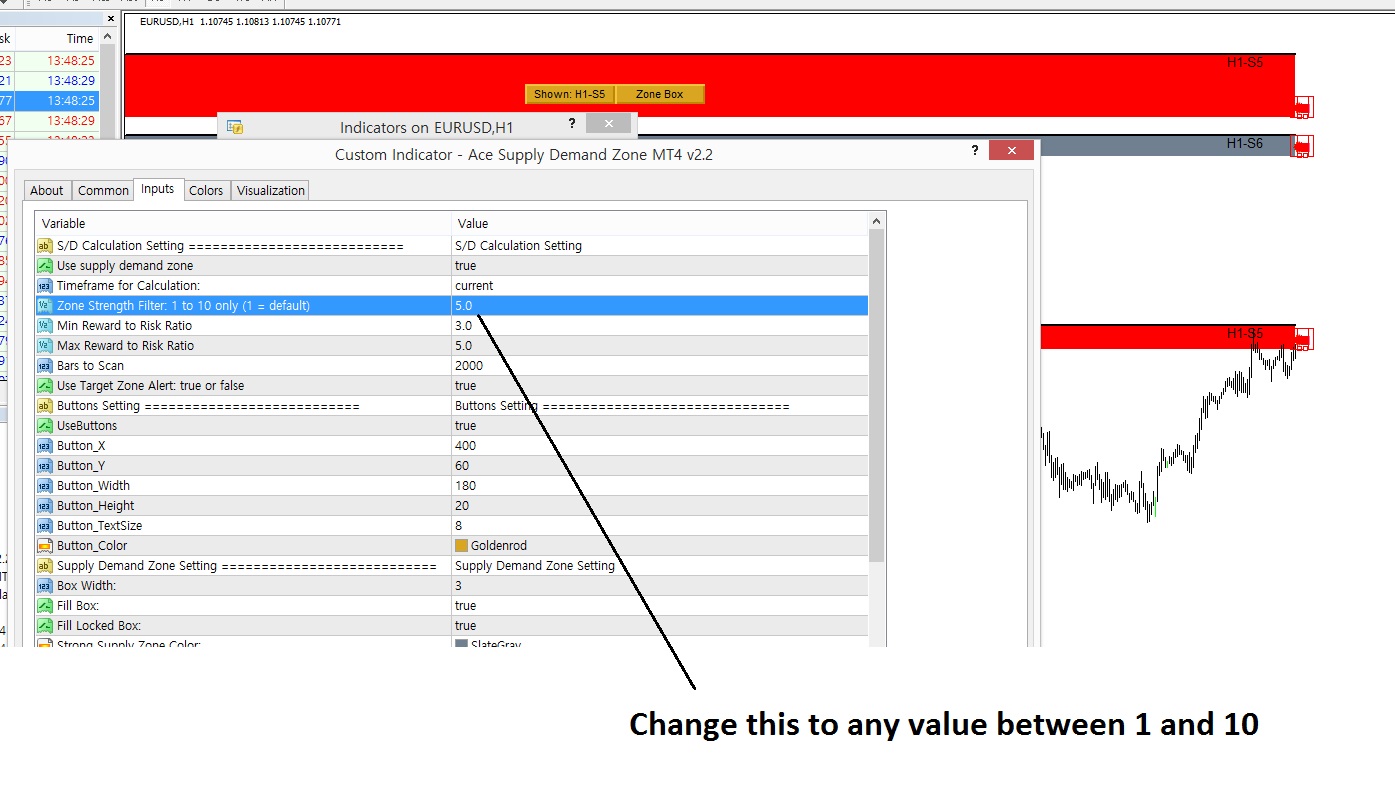

Choosing Strength at Origin in your Supply Demand Zone indicator

Ace Supply Demand Zone indicator is non repainting Supply Demand zone indicator. You can consider it as the advanced support and resistance indicator too. Strength at Origin input is an important input for supply and demand zone. This input can be selected between 1 and 10. Strength at Origin 1 is less significant and 10 is more significant in relative term. But this is only rough guide line about Strength at Origin input for supply and demand zone trading. We also provide the screenshot of how to do it in your chart. We hope this article is useful.

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Below is link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Ace Supply Demand Zone indicator is non repainting Supply Demand zone indicator. You can consider it as the advanced support and resistance indicator too. Strength at Origin input is an important input for supply and demand zone. This input can be selected between 1 and 10. Strength at Origin 1 is less significant and 10 is more significant in relative term. But this is only rough guide line about Strength at Origin input for supply and demand zone trading. We also provide the screenshot of how to do it in your chart. We hope this article is useful.

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Below is link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

New Article – Trading Setup with Pattern Completion Interval for Harmonic Pattern Trading

Here is another article explaining some useful concept for your harmonic pattern trading. Of course, this is free article to improve your harmonic pattern trading.

https://algotrading-investment.com/2020/06/01/trading-setup-with-pattern-completion-interval/

In addition, you can also have an access to important free articles for your trading here.

https://algotrading-investment.com/2019/07/23/trading-education/

You can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Harmonic Pattern Plus (and also Harmonic Pattern Scenario Planner) is the repainting but non lagging Harmonic Pattern Scanner. You can get them for the affordable price. Below is links for them.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern and X3 pattern Scanner. Below is links for them.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Here is another article explaining some useful concept for your harmonic pattern trading. Of course, this is free article to improve your harmonic pattern trading.

https://algotrading-investment.com/2020/06/01/trading-setup-with-pattern-completion-interval/

In addition, you can also have an access to important free articles for your trading here.

https://algotrading-investment.com/2019/07/23/trading-education/

You can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Harmonic Pattern Plus (and also Harmonic Pattern Scenario Planner) is the repainting but non lagging Harmonic Pattern Scanner. You can get them for the affordable price. Below is links for them.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern and X3 pattern Scanner. Below is links for them.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

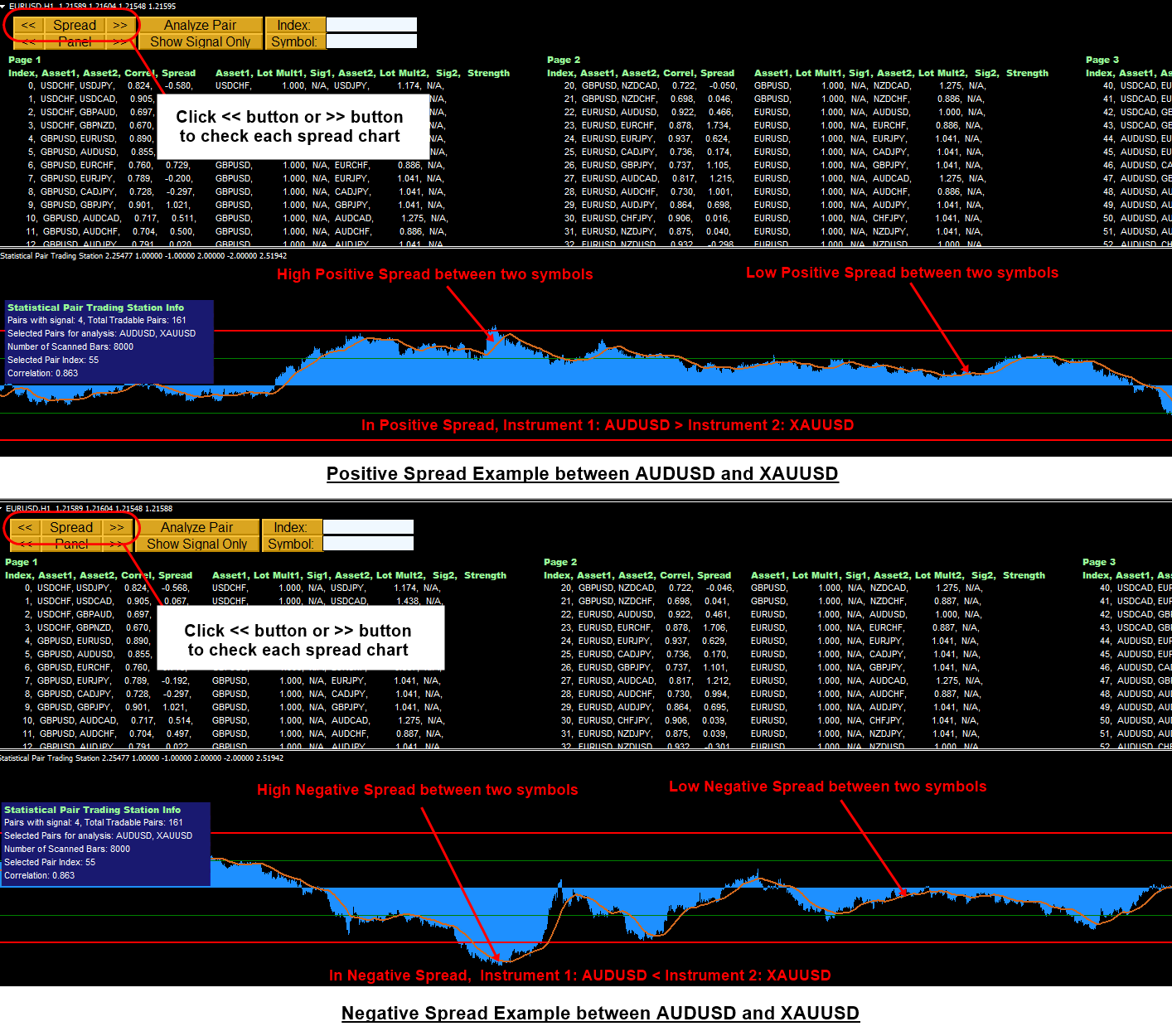

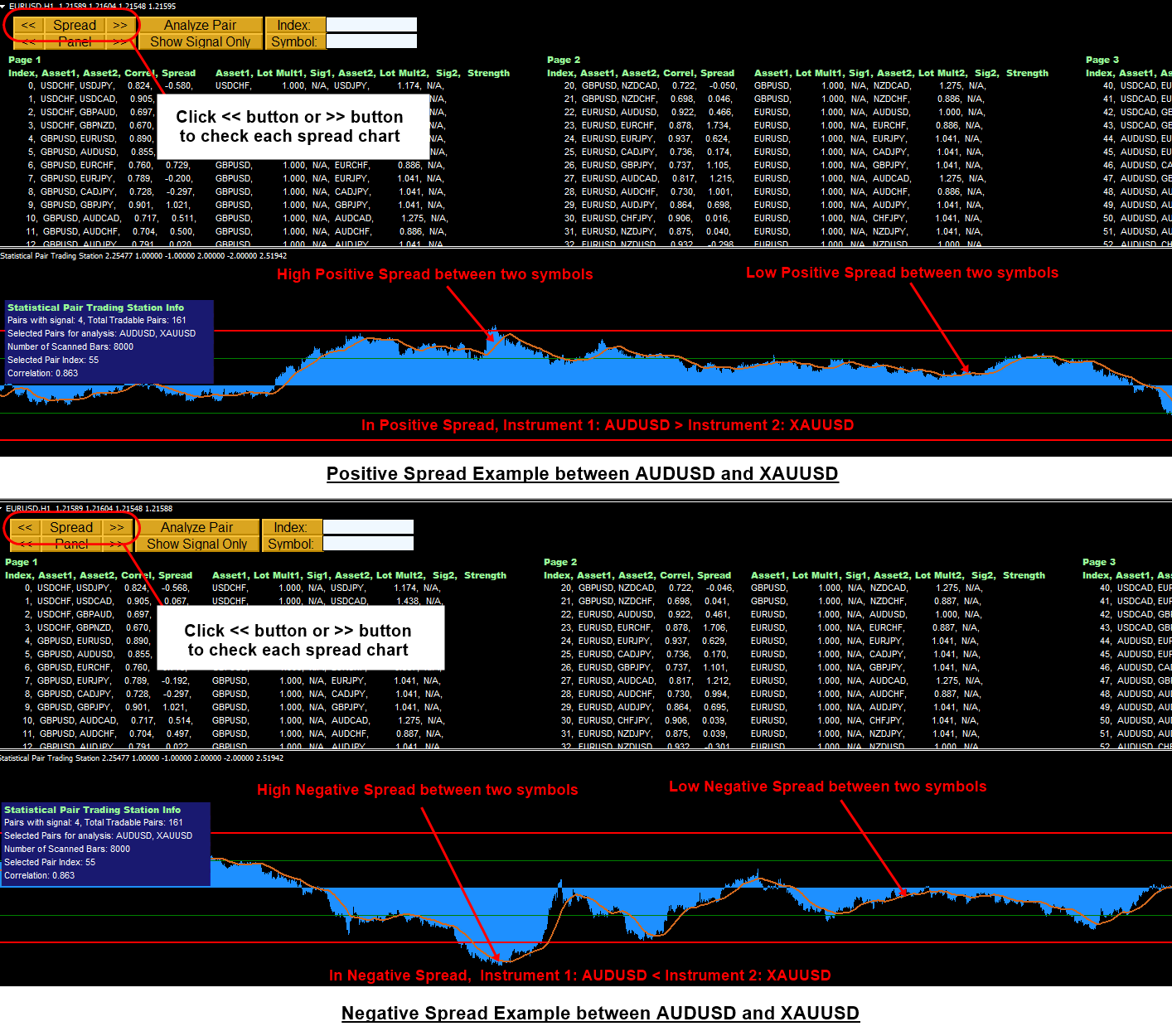

Manual For Pair Trading Station

Pair Trading Station is a powerful MetaTrader Indicator. Its decision making algorithm is based on Pairs trading (a.k.a Statistical arbitrage or spread analysis). This manual was written already few years ago for our Pair Trading Station. I think this is still very useful if your trading is based on correlation and spread. This is pdf manual, so please download it into your hard drive and read them. Below is the link to the pdf manual:

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

In addition, you can watch this YouTube Video titled as How to use Pairs Trading Station

https://youtu.be/fAE9pByxZDA

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

Pair Trading Station is a powerful MetaTrader Indicator. Its decision making algorithm is based on Pairs trading (a.k.a Statistical arbitrage or spread analysis). This manual was written already few years ago for our Pair Trading Station. I think this is still very useful if your trading is based on correlation and spread. This is pdf manual, so please download it into your hard drive and read them. Below is the link to the pdf manual:

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

In addition, you can watch this YouTube Video titled as How to use Pairs Trading Station

https://youtu.be/fAE9pByxZDA

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

Young Ho Seo

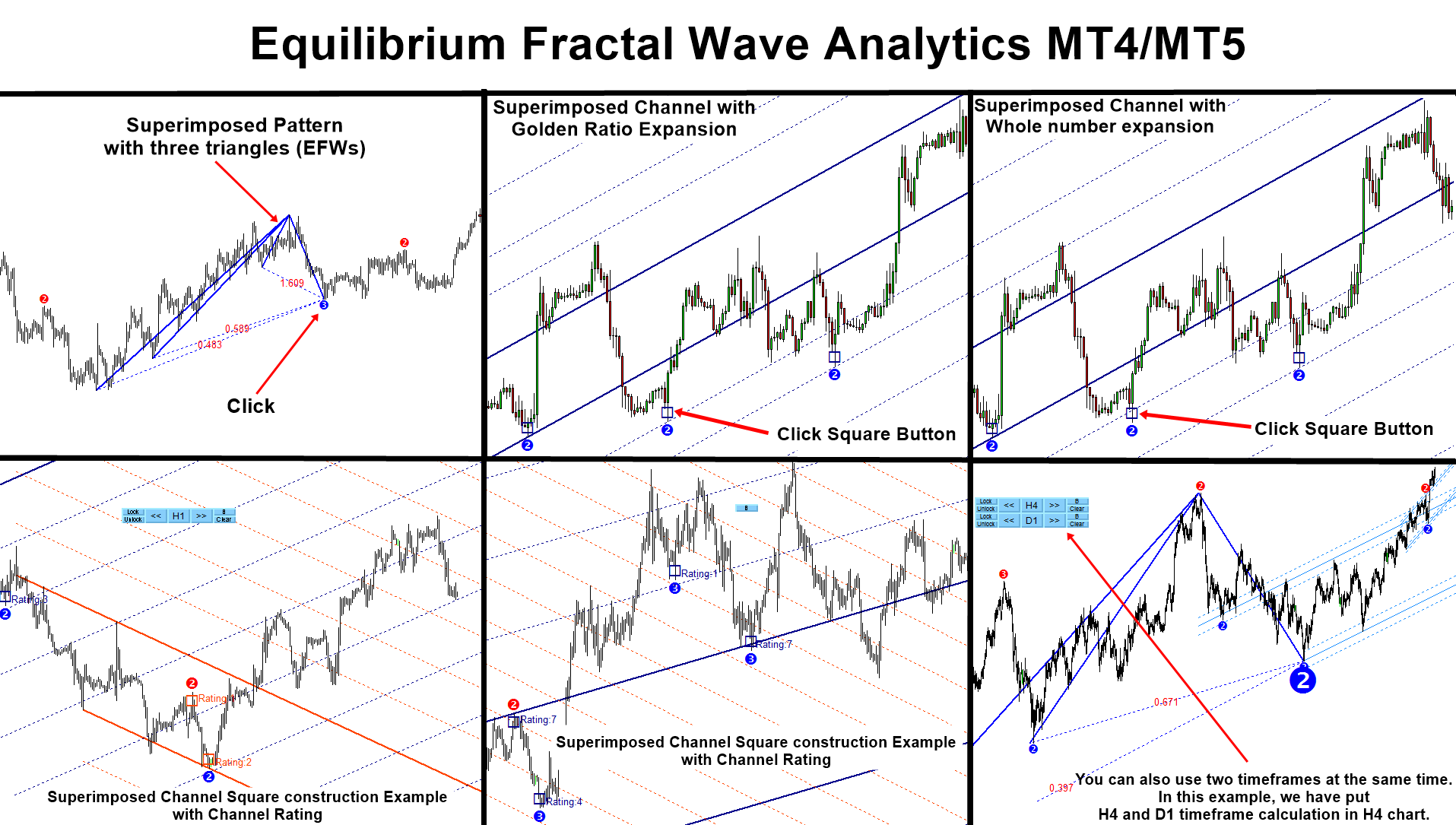

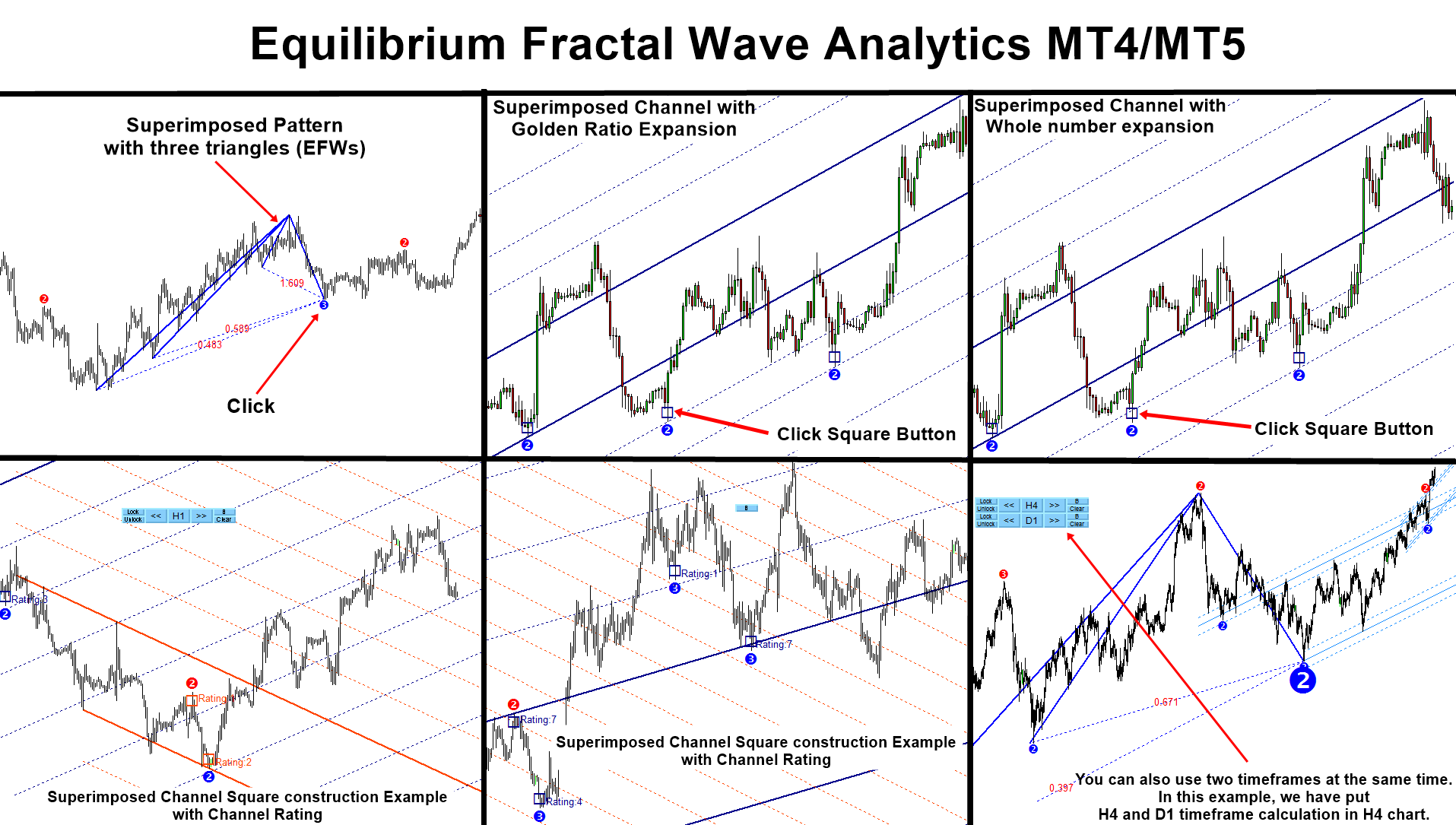

Introduction to Equilibrium Fractal Wave Analytics

EFW Analytics was designed to accomplish the statement “We trade because there are regularities in the financial market”. EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts including:

1. Equilibrium Fractal Wave Index: exploratory tool to support your trading logic to choose which ratio to trade

2. Superimposed Pattern Detection as turning point analysis

3. Superimposed Channel for market prediction with Golden ratio expansion

4. Superimposed Channel for market prediction with whole number expansion

5. Equilibrium Fractal Wave (EFW) Channel detection

6. Superimposed Channel Rating (Higher rating = higher predictive power)

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

EFW Analytics was designed to accomplish the statement “We trade because there are regularities in the financial market”. EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts including:

1. Equilibrium Fractal Wave Index: exploratory tool to support your trading logic to choose which ratio to trade

2. Superimposed Pattern Detection as turning point analysis

3. Superimposed Channel for market prediction with Golden ratio expansion

4. Superimposed Channel for market prediction with whole number expansion

5. Equilibrium Fractal Wave (EFW) Channel detection

6. Superimposed Channel Rating (Higher rating = higher predictive power)

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

Young Ho Seo

Repainting Harmonic Pattern and Non Repainting Harmonic Pattern

Here is a brief article covering on Repainting Harmonic Pattern and Non Repainting Harmonic Pattern. In Harmonic Pattern Plus and Harmonic Pattern Scenario Planner, they can indicate if the harmonic pattern is completely formed or if the Harmonic Pattern is still in the forming stage. When the pattern is formed completely, the completely formed pattern is no longer subject to the repainting. Forming pattern might repaint or might no repaint depending on the future price action. The attached screenshot will be helpful to confirm your understanding on this.

Depending on your strategy, this piece of information can be important. You can use this piece of information to reinforce your current trading position or exit strategy with Harmonic Pattern. Here is a further thought. If the harmonic pattern is big in terms of its size, then it also takes long time to confirm the pattern formation. In turn, repainting or non repainting confirmation is typically fast with small harmonic pattern. In addition, repainting happens in any technical indicator. But the repainting only affect the last candle bar most of technical indicators. For example, as new price arrives, the moving average indicator will keep changing its value for the last candle bar. As the repainting of ZigZag indicator can affect the last swing point to the previous swing point, ZigZag indicator is affected by repainting over many candle bars from last swing point to previous swing point. Hence, you might feel the repainting more in the ZigZag indicator.

For your information, you do not have to worry about repainting for X3 Chart Pattern Scanner because X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern Scanner. Hence, this article is only applicable to Harmonic Pattern Plus and Harmonic Pattern Scenario Planner. At the same time , you can use X3 Chart Pattern Scanner with Harmonic Pattern Plus in the same chart.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

.

Harmonic Pattern Plus Landing Page

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

.

Harmonic Pattern Scenario Planner Page

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

.

X3 Chart Pattern Scanner Landing Page

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Here is a brief article covering on Repainting Harmonic Pattern and Non Repainting Harmonic Pattern. In Harmonic Pattern Plus and Harmonic Pattern Scenario Planner, they can indicate if the harmonic pattern is completely formed or if the Harmonic Pattern is still in the forming stage. When the pattern is formed completely, the completely formed pattern is no longer subject to the repainting. Forming pattern might repaint or might no repaint depending on the future price action. The attached screenshot will be helpful to confirm your understanding on this.

Depending on your strategy, this piece of information can be important. You can use this piece of information to reinforce your current trading position or exit strategy with Harmonic Pattern. Here is a further thought. If the harmonic pattern is big in terms of its size, then it also takes long time to confirm the pattern formation. In turn, repainting or non repainting confirmation is typically fast with small harmonic pattern. In addition, repainting happens in any technical indicator. But the repainting only affect the last candle bar most of technical indicators. For example, as new price arrives, the moving average indicator will keep changing its value for the last candle bar. As the repainting of ZigZag indicator can affect the last swing point to the previous swing point, ZigZag indicator is affected by repainting over many candle bars from last swing point to previous swing point. Hence, you might feel the repainting more in the ZigZag indicator.

For your information, you do not have to worry about repainting for X3 Chart Pattern Scanner because X3 Chart Pattern Scanner is non repainting and non lagging Harmonic Pattern Scanner. Hence, this article is only applicable to Harmonic Pattern Plus and Harmonic Pattern Scenario Planner. At the same time , you can use X3 Chart Pattern Scanner with Harmonic Pattern Plus in the same chart.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

.

Harmonic Pattern Plus Landing Page

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

.

Harmonic Pattern Scenario Planner Page

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

.

X3 Chart Pattern Scanner Landing Page

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

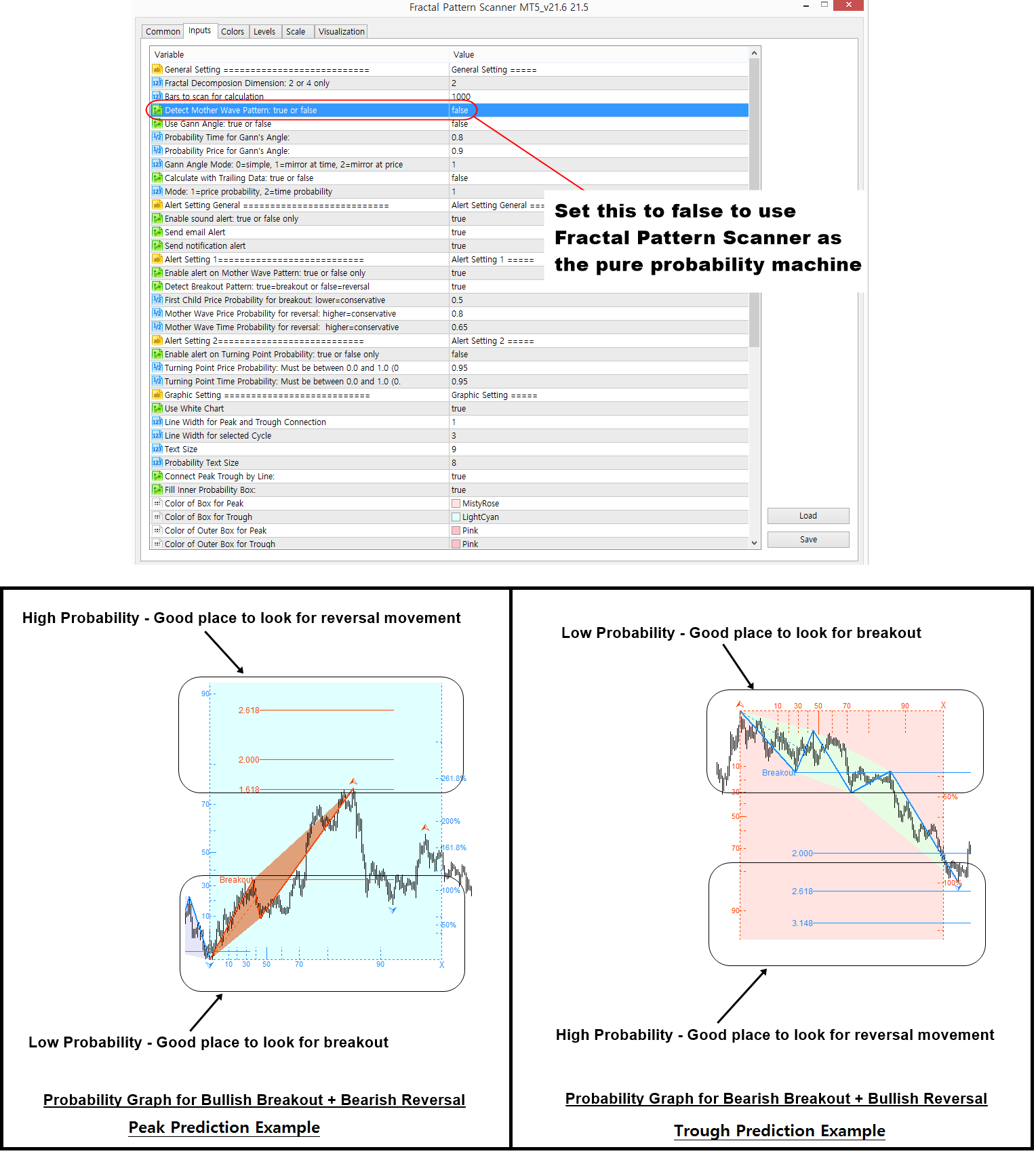

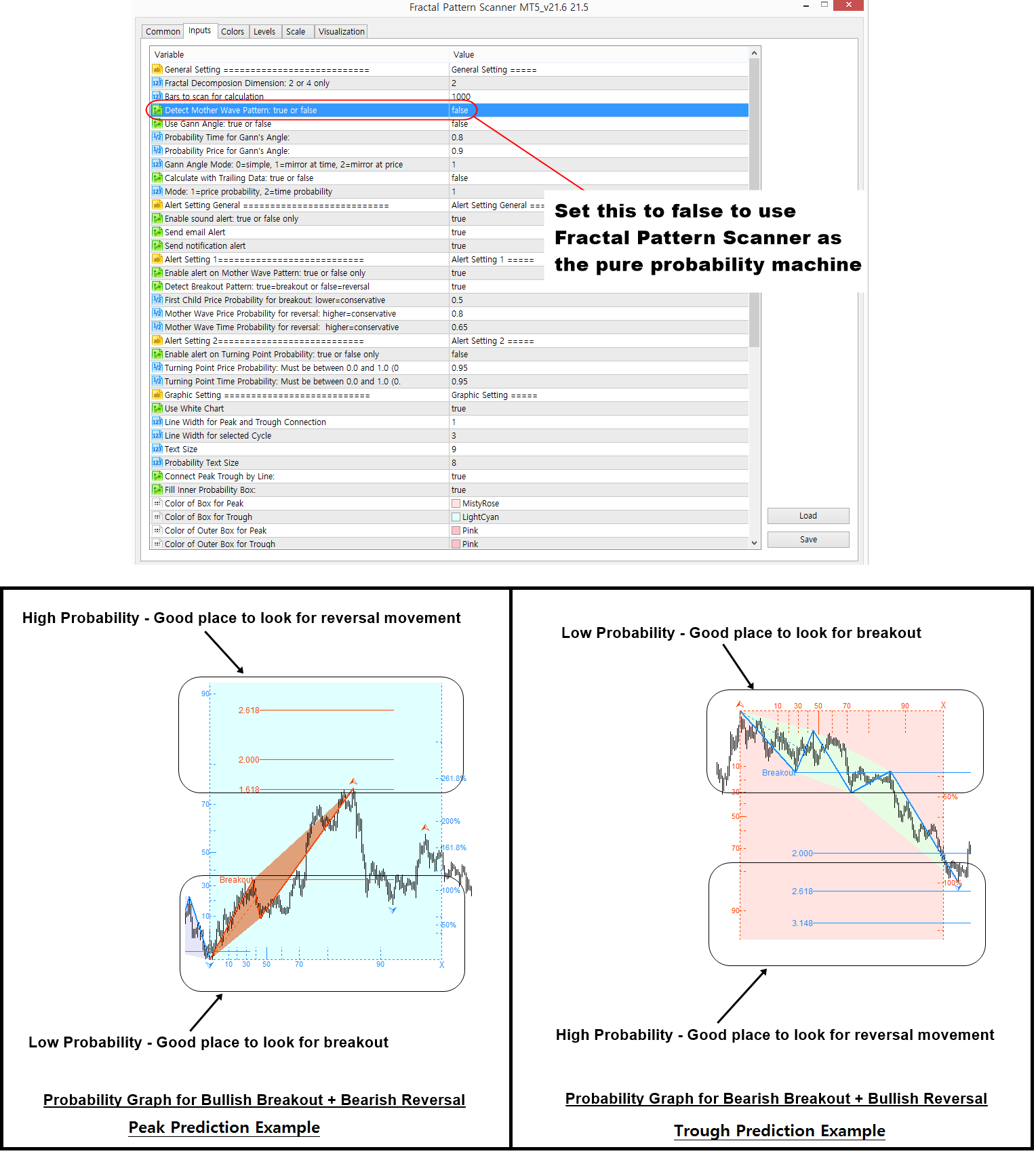

Fractal Pattern Scanner – Trading Operation

In this short article, we will explain the trading operation with turning point probability for Fractal Pattern Scanner in MetaTrader and in Optimum Chart. Fractal Pattern Scanner is the powerful tool to predict the Forex and Stock market. It is the highly predictive tool that quantifies the price action at every wave in your chart. Fractal Pattern Scanner provides three main features. The three features include:

1. Turning Point Probability Measurement (Essential feature that you can use everyday)

2. Breakout and Reversal Trading Signal Detection with Mother Wave detection

3. Automatic Gann Angles (Bonus feature and optional use only)

The turning point probability measurement is the essential to your daily trading. The turning point probability basically quantifies the price action in your chart. Quantifying the price action will provide you the another level of trading experience. Capability to access the turning point probability in one button click is really handy feature for every day trader on the earth. In addition, Fractal Pattern Scanner provides the probability scanning capability across all timeframe. You can also switch on and off the multiple timeframe pattern detection. When you set Detect Mother Wave = false, you can run the Fractal Pattern Scanner as the pure probability machine.

The turning point probability is a powerful tool that you can use it as both reversal trading or breakout trading within your technical analysis. You can watch this YouTube video titled as “Breakout Trading vs Reversal Trading (Turn Support & Resistance to Killer Strategy)” in this link below to get some hands on practice with breakout and reversal trading opportunity with Support and Resistance Technical Analysis.

YouTube Video Link: https://youtu.be/UbORmOacKIQ

Mother wave pattern detection can be considered as the statistical representation of the Elliott Wave Theory. For example, Mother wave pattern detect the pattern inside pattern structure, where small patterns are jagged inside big pattern, like the Elliott Wave pattern. We can use this pattern inside pattern to trade both reversal and breakout trading. Fractal Pattern Scanner does the excellent job in detecting these signals automatically. When you set Detect Mother Wave = true, then Fractal Pattern Scanner will detect trading signal using Mother wave pattern detection. Even in that, you can also perform both breakout and reversal trading automatically.

If you want to use Breakout Trading Mode, then set Detect Breakout Opportunity = true.

If you want to use Reversal Trading Mode, then set Detect Breakout Opportunity = false.

You can also watch the YouTube Video titled as “Breakout Trading Signal Explained” to understand the breakout trading with mother wave detection.

YouTube video link: https://youtu.be/4XGuMIMaV6w

====================================================================================

Mother Wave Pattern Explained further

The idea behind the Breakout trading with Mother wave is to detect mother wave relatively young and fresh. Those young and fresh mother wave will be typically found in the low turning point probability area. Then what does “First Child Price Probability” input do ? It is the criteria for how small first child wave could be when the mother wave pattern is detected. If this is even hard to understand, then you can think it is the size of mother wave.

If you set the First Child Price Probability = 30%, then Fractal Pattern Scanner will detect first child wave with its size less than 30% amplitude. Likewise, if you set the First Child Price Probability = 50%, then Fractal Pattern Scanner will detect first child wave with its size less than 50%. For your information, the detected mother wave patterns does not provide any sort of geometric regularity detection in the case of breakout trading. We have taught you several geometric regularity detection like support, resistance and triangle and wedge patterns. You will need similar sort of operation here.

In the reversal trading mode with Mother Wave, the size of first child wave is no longer required to be controlled. However, we can control the size of Mother wave. The idea behind the reversal trading mode is to detect mature mother wave pattern that are likely to make reversal movement. Hence, it is better to find these mother wave patterns in high probability area in the probability graph.

For this reason, we have set the mother wave price probability = 80%. You can set even higher number if you wish. When you are using reversal trading mode, we provide automatic Fibonacci expansion to help you to decide the final turning point. This is sort of geometric regularity you can use. But you can use any other geometric regularity we have taught you in our articles and books too like Harmonic Pattern or Elliott Wave patterns, etc if you are good with them.

Here is some important tips. From our experience, some Forex symbols are better with breakout trading mode. Some Forex symbols are better with reversal trading mode. To find out the best trading approach, just set Bars to Scan = 6000 or higher. Just find how each trading mode is profitable in the chart.

You can also use strategy tester for this purpose too. When you are using the strategy tester, then set Calculating with Trailing Data = true. This will tell the Fractal Pattern Scanner to calculate the probability with trailing data (i.e. technical analysis approach) rather than the statistical approach. When you are using technical analysis approach, the probability will be calculated like other technical indicators like Moving average indicator or RSI indicator using trailing data. In statistical approach, the entire data will be used to calculate probability.

Statistical approach and technical analysis approach does not matter for the latest pattern to trade. It is only matter for historical patterns for your information. I personally prefer to calculate the probability using Statistical approach because it provides the identical probability across all price series.

I guess it is too much mathematical talk. I will cut it out. If you do not want to think, then just remember these two cases.

A. If you want to see the historical patterns in your chart, then set “Calculating with Trailing Data” = false.

B. When you are using the strategy tester, then set “Calculating with Trailing Data” = true.

Landing Page to Fractal Pattern Scanner

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Landing Page to Optimum Chart

https://algotrading-investment.com/2019/07/23/optimum-chart/

In this short article, we will explain the trading operation with turning point probability for Fractal Pattern Scanner in MetaTrader and in Optimum Chart. Fractal Pattern Scanner is the powerful tool to predict the Forex and Stock market. It is the highly predictive tool that quantifies the price action at every wave in your chart. Fractal Pattern Scanner provides three main features. The three features include:

1. Turning Point Probability Measurement (Essential feature that you can use everyday)

2. Breakout and Reversal Trading Signal Detection with Mother Wave detection

3. Automatic Gann Angles (Bonus feature and optional use only)

The turning point probability measurement is the essential to your daily trading. The turning point probability basically quantifies the price action in your chart. Quantifying the price action will provide you the another level of trading experience. Capability to access the turning point probability in one button click is really handy feature for every day trader on the earth. In addition, Fractal Pattern Scanner provides the probability scanning capability across all timeframe. You can also switch on and off the multiple timeframe pattern detection. When you set Detect Mother Wave = false, you can run the Fractal Pattern Scanner as the pure probability machine.

The turning point probability is a powerful tool that you can use it as both reversal trading or breakout trading within your technical analysis. You can watch this YouTube video titled as “Breakout Trading vs Reversal Trading (Turn Support & Resistance to Killer Strategy)” in this link below to get some hands on practice with breakout and reversal trading opportunity with Support and Resistance Technical Analysis.

YouTube Video Link: https://youtu.be/UbORmOacKIQ

Mother wave pattern detection can be considered as the statistical representation of the Elliott Wave Theory. For example, Mother wave pattern detect the pattern inside pattern structure, where small patterns are jagged inside big pattern, like the Elliott Wave pattern. We can use this pattern inside pattern to trade both reversal and breakout trading. Fractal Pattern Scanner does the excellent job in detecting these signals automatically. When you set Detect Mother Wave = true, then Fractal Pattern Scanner will detect trading signal using Mother wave pattern detection. Even in that, you can also perform both breakout and reversal trading automatically.

If you want to use Breakout Trading Mode, then set Detect Breakout Opportunity = true.

If you want to use Reversal Trading Mode, then set Detect Breakout Opportunity = false.

You can also watch the YouTube Video titled as “Breakout Trading Signal Explained” to understand the breakout trading with mother wave detection.

YouTube video link: https://youtu.be/4XGuMIMaV6w

====================================================================================

Mother Wave Pattern Explained further

The idea behind the Breakout trading with Mother wave is to detect mother wave relatively young and fresh. Those young and fresh mother wave will be typically found in the low turning point probability area. Then what does “First Child Price Probability” input do ? It is the criteria for how small first child wave could be when the mother wave pattern is detected. If this is even hard to understand, then you can think it is the size of mother wave.

If you set the First Child Price Probability = 30%, then Fractal Pattern Scanner will detect first child wave with its size less than 30% amplitude. Likewise, if you set the First Child Price Probability = 50%, then Fractal Pattern Scanner will detect first child wave with its size less than 50%. For your information, the detected mother wave patterns does not provide any sort of geometric regularity detection in the case of breakout trading. We have taught you several geometric regularity detection like support, resistance and triangle and wedge patterns. You will need similar sort of operation here.

In the reversal trading mode with Mother Wave, the size of first child wave is no longer required to be controlled. However, we can control the size of Mother wave. The idea behind the reversal trading mode is to detect mature mother wave pattern that are likely to make reversal movement. Hence, it is better to find these mother wave patterns in high probability area in the probability graph.

For this reason, we have set the mother wave price probability = 80%. You can set even higher number if you wish. When you are using reversal trading mode, we provide automatic Fibonacci expansion to help you to decide the final turning point. This is sort of geometric regularity you can use. But you can use any other geometric regularity we have taught you in our articles and books too like Harmonic Pattern or Elliott Wave patterns, etc if you are good with them.

Here is some important tips. From our experience, some Forex symbols are better with breakout trading mode. Some Forex symbols are better with reversal trading mode. To find out the best trading approach, just set Bars to Scan = 6000 or higher. Just find how each trading mode is profitable in the chart.

You can also use strategy tester for this purpose too. When you are using the strategy tester, then set Calculating with Trailing Data = true. This will tell the Fractal Pattern Scanner to calculate the probability with trailing data (i.e. technical analysis approach) rather than the statistical approach. When you are using technical analysis approach, the probability will be calculated like other technical indicators like Moving average indicator or RSI indicator using trailing data. In statistical approach, the entire data will be used to calculate probability.

Statistical approach and technical analysis approach does not matter for the latest pattern to trade. It is only matter for historical patterns for your information. I personally prefer to calculate the probability using Statistical approach because it provides the identical probability across all price series.

I guess it is too much mathematical talk. I will cut it out. If you do not want to think, then just remember these two cases.

A. If you want to see the historical patterns in your chart, then set “Calculating with Trailing Data” = false.

B. When you are using the strategy tester, then set “Calculating with Trailing Data” = true.

Landing Page to Fractal Pattern Scanner

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

Landing Page to Optimum Chart

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

Supply and Demand Zone with Harmonic Pattern Indicator

Supply and Demand Zone are the most important concept for your trading. Supply and Demand zone can be effectively combined with Harmonic Pattern Indicator to improve your trading performance. This is not about the number but about geometry. Your ability to combine these geometry together with Harmonic Pattern Indicator can typically form the secret trading recipes for your successful career. Here is the list of Supply and Demand Zone Indicator that can go together with your harmonic pattern indicator.

Mean Reversion Supply Demand

Classic supply and demand zone indicator. This tools is the great to produce highly accurate supply and demand zone.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Ace Supply Demand Zone

This is also great supply and demand zone tool extending the ability of Mean Reversion Supply Demand. What is even better? This is non repainting one. This is the great tool for different level of trader.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Supply and Demand Zone are the most important concept for your trading. Supply and Demand zone can be effectively combined with Harmonic Pattern Indicator to improve your trading performance. This is not about the number but about geometry. Your ability to combine these geometry together with Harmonic Pattern Indicator can typically form the secret trading recipes for your successful career. Here is the list of Supply and Demand Zone Indicator that can go together with your harmonic pattern indicator.

Mean Reversion Supply Demand

Classic supply and demand zone indicator. This tools is the great to produce highly accurate supply and demand zone.

https://www.mql5.com/en/market/product/16823

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

Ace Supply Demand Zone

This is also great supply and demand zone tool extending the ability of Mean Reversion Supply Demand. What is even better? This is non repainting one. This is the great tool for different level of trader.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

Using Japanese Candlestick Patterns in X3 Chart Pattern Scanner

X3 Chart Pattern Scanner is the powerful pattern trading system with many powerful features. Properly used, this tool can yield excellent trading results. One of the trading system built inside X3 Chart Pattern Scanner is the Japanese candlestick patterns. X3 Chart Pattern Scanner can detect around 52 different Japanese candlestick patterns. They are categorized under five categories including one, two, three, four and five candlestick patterns.

To use Japanese candlestick patterns, you have to enable the candlestick pattern from X3 Chart Pattern Scanner. See the attached screenshot for the purpose. Then you can switch on and off the individual category of patterns according to your preferences. For example, you can only use two and three candlestick patterns if you wish.

In addition, you can also receive sound alert, email and push notification when new Japanese candlestick patterns are detected. Note that Japanese candlestick patterns are only one of the pattern category. It can also detect other powerful patterns like Harmonic Patterns, Elliott Wave Patterns and X3 patterns.

You can watch the YouTube Video to feel what is the automated harmonic pattern indicator like.

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Below we provide the link to X3 Chart Pattern Scanner available in MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

X3 Chart Pattern Scanner is the powerful pattern trading system with many powerful features. Properly used, this tool can yield excellent trading results. One of the trading system built inside X3 Chart Pattern Scanner is the Japanese candlestick patterns. X3 Chart Pattern Scanner can detect around 52 different Japanese candlestick patterns. They are categorized under five categories including one, two, three, four and five candlestick patterns.

To use Japanese candlestick patterns, you have to enable the candlestick pattern from X3 Chart Pattern Scanner. See the attached screenshot for the purpose. Then you can switch on and off the individual category of patterns according to your preferences. For example, you can only use two and three candlestick patterns if you wish.

In addition, you can also receive sound alert, email and push notification when new Japanese candlestick patterns are detected. Note that Japanese candlestick patterns are only one of the pattern category. It can also detect other powerful patterns like Harmonic Patterns, Elliott Wave Patterns and X3 patterns.

You can watch the YouTube Video to feel what is the automated harmonic pattern indicator like.

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Below we provide the link to X3 Chart Pattern Scanner available in MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

Young Ho Seo

Excessive Momentum Trading

Excessive momentum is an important clue in our trading as well as the sideways market. You can consider Excessive momentum as the opposite concept to sideways market. So why Excessive momentum is important signal in our trading? Imagine that you are pouring some milk in your cup. It is fine until it is overflow. When milk is starting to get split from our cup, we realized that we need to take some correction.

This analogical concept can be applied to our trading too. Simply speaking, Excessive momentum can signal us that market can go through some brand new action from the existing trend. It might be turning point opportunity or reversal opportunity. Around this Excessive momentum area, market is more predictable. In addition, you have an opportunity to become early enterer with good profitable range.

Before, trader did not have a good tool to catch an excessive momentum but now we have the Excessive Momentum Indicator designed to catch Excessive momentum automatically in your chart. Good news is that this entry is more accurate with Excessive momentum than without Excessive momentum presents. Hence, Excessive momentum is ideal location to place your trading. Excessive momentum area is marked up as triangle in Excessive Momentum indicator.

At the same time, this Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version). You can also watch the YouTube video to find out more about Excessive Momentum Indicator.

YouTube Video “Excessive Momentum Indicator”: https://youtu.be/oztARcXsAVA

YouTube Video “Excessive Momentum Indicator Explained”: https://youtu.be/A4JcTcakOKw

======================================

Here is the landing page for Excessive Momentum Indicator available in MetaTrader 4 and MetaTrader 5.

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Excessive momentum is an important clue in our trading as well as the sideways market. You can consider Excessive momentum as the opposite concept to sideways market. So why Excessive momentum is important signal in our trading? Imagine that you are pouring some milk in your cup. It is fine until it is overflow. When milk is starting to get split from our cup, we realized that we need to take some correction.

This analogical concept can be applied to our trading too. Simply speaking, Excessive momentum can signal us that market can go through some brand new action from the existing trend. It might be turning point opportunity or reversal opportunity. Around this Excessive momentum area, market is more predictable. In addition, you have an opportunity to become early enterer with good profitable range.

Before, trader did not have a good tool to catch an excessive momentum but now we have the Excessive Momentum Indicator designed to catch Excessive momentum automatically in your chart. Good news is that this entry is more accurate with Excessive momentum than without Excessive momentum presents. Hence, Excessive momentum is ideal location to place your trading. Excessive momentum area is marked up as triangle in Excessive Momentum indicator.

At the same time, this Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version). You can also watch the YouTube video to find out more about Excessive Momentum Indicator.

YouTube Video “Excessive Momentum Indicator”: https://youtu.be/oztARcXsAVA

YouTube Video “Excessive Momentum Indicator Explained”: https://youtu.be/A4JcTcakOKw

======================================

Here is the landing page for Excessive Momentum Indicator available in MetaTrader 4 and MetaTrader 5.

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Young Ho Seo

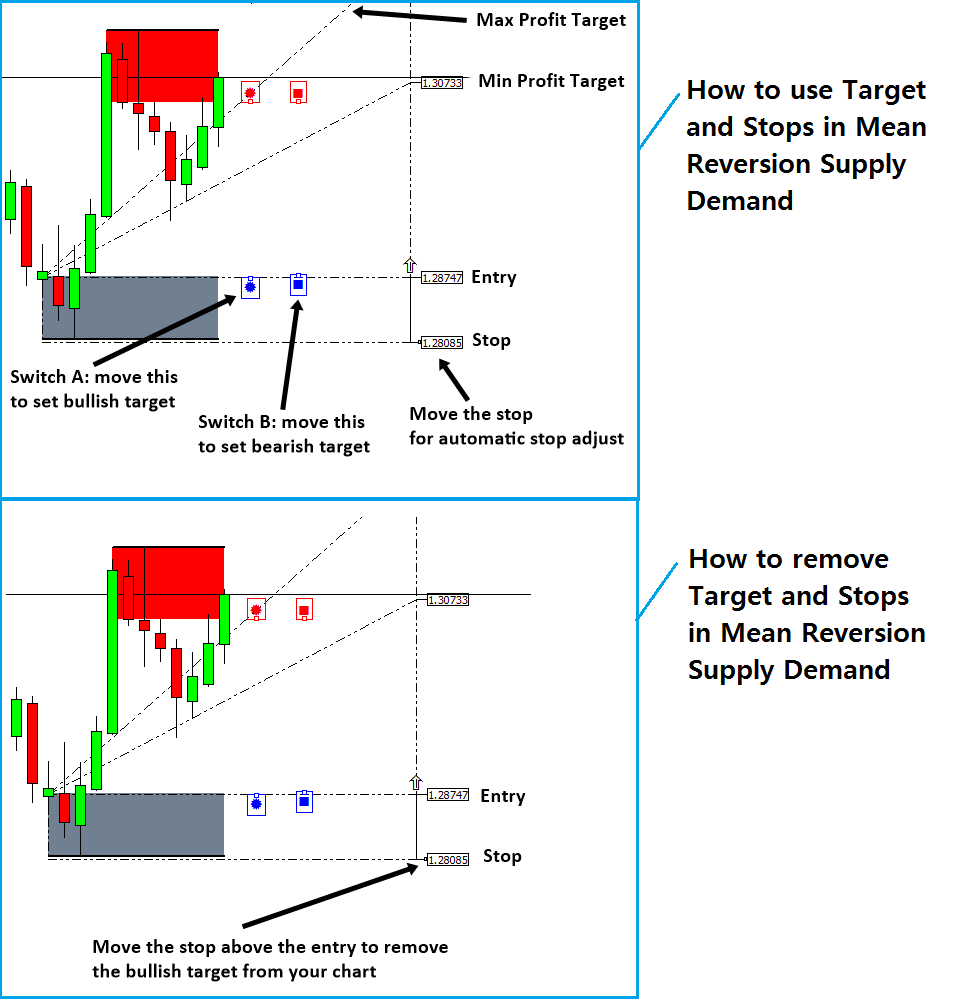

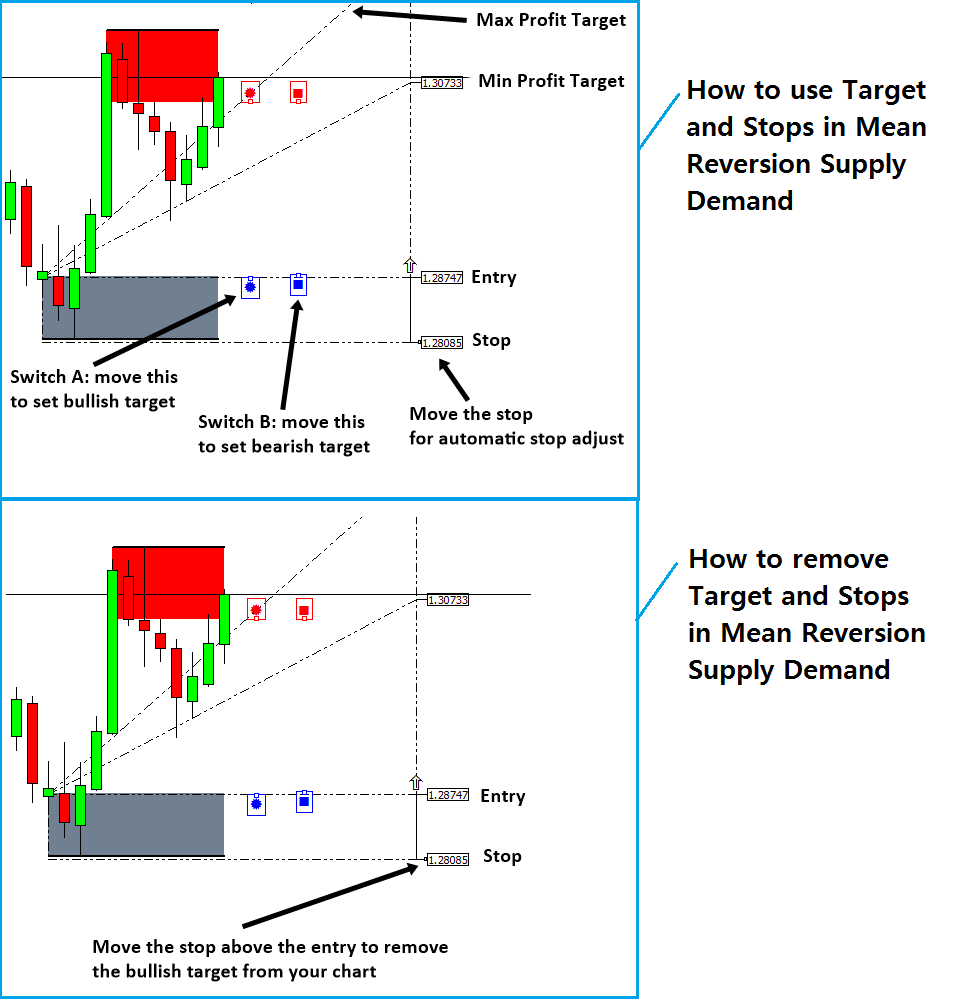

Ace Supply Demand Zone Indicator – How to Remove Take Profit and Stop Loss Levels

One of the greatest advantage of Ace Supply Demand Zone indicator is that it provide a flexible Profit and stop target for your trading. After you have learnt how to use this profit targets, now you want to learn how to remove them. Of course, there is a way to remove them. The trick is simply moving the stop text above the Entry text (for the case of buy). You will do the opposite for the case of sell. In the screenshot, the bottom image describe how to remove the targets from your chart.

There is another approach to remove take profit and stop loss targets. We provide the shortcut in keyboard for doing the same task. Simply hit “z” button in your keyboard. This will also remove the stop loss and take profit targets if you do not need them any longer.

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Below is link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

One of the greatest advantage of Ace Supply Demand Zone indicator is that it provide a flexible Profit and stop target for your trading. After you have learnt how to use this profit targets, now you want to learn how to remove them. Of course, there is a way to remove them. The trick is simply moving the stop text above the Entry text (for the case of buy). You will do the opposite for the case of sell. In the screenshot, the bottom image describe how to remove the targets from your chart.

There is another approach to remove take profit and stop loss targets. We provide the shortcut in keyboard for doing the same task. Simply hit “z” button in your keyboard. This will also remove the stop loss and take profit targets if you do not need them any longer.

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Below is link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

Automatic Resizing your Stop Loss and Take Profit Level with Harmonic Pattern Plus (Harmonic Pattern Scenario Planner)