Aleksey Ivanov / Perfil

- Informações

|

6+ anos

experiência

|

32

produtos

|

134

versão demo

|

|

0

trabalhos

|

0

sinais

|

0

assinantes

|

👑 Físico teórico, programador, comerciante com 15 anos de experiência.

--------------------------------------------------------------------------------------

💰 Produtos apresentados:

1) 🏆 Indicadores com ótima filtragem de ruídos de mercado (para escolha de pontos de abertura e fechamento de posições).

2) 🏆 Indicadores estatísticos (para determinar a tendência global).

3) 🏆 Indicadores de pesquisa de mercado (para esclarecer a microestrutura de preços, construir canais, identificar diferenças entre reversões e retrações de tendências).

--------------------------------------------------------------------------------------

☛ Mais informações no blog https://www.mql5.com/en/blogs/post/741637

--------------------------------------------------------------------------------------

💰 Produtos apresentados:

1) 🏆 Indicadores com ótima filtragem de ruídos de mercado (para escolha de pontos de abertura e fechamento de posições).

2) 🏆 Indicadores estatísticos (para determinar a tendência global).

3) 🏆 Indicadores de pesquisa de mercado (para esclarecer a microestrutura de preços, construir canais, identificar diferenças entre reversões e retrações de tendências).

--------------------------------------------------------------------------------------

☛ Mais informações no blog https://www.mql5.com/en/blogs/post/741637

Aleksey Ivanov

Friends, I am a theoretical physicist and a trader, mathematically rigorously studying market processes, aspects of which I have already begun to present in my articles. https://www.mql5.com/en/articles/10955

https://www.mql5.com/en/articles/11158

https://www.mql5.com/en/articles/12891

Based on a rigorous theory, I have developed indicators with optimal market noise filtering for trading. https://www.mql5.com/en/blogs/post/741637

However, it should be emphasized that a trader (investor) should choose the direction of his positions on the basis of fundamental analysis, and correctly applied indicators of optimal filtering of market noise should be only its auxiliary tool. These indicators are used to determine:

(4) market entry points are determined,

(5) the positions of stop-loss and profit and their order (time and number of points) of movement are determined,

(6) determine the size of the opened lots (calculated through money management built into the work of many indicators presented here).

I emphasize that for today's highly volatile market, these (1-3) statistically calculated parameters of the game are also (like fundamental analysis) key, in the sense that without them it will be generally impossible to get a stable profit.

Subscribe to my channel and you will be aware of my latest developments in the field of trading

https://www.mql5.com/en/channels/statlab

https://www.mql5.com/en/articles/11158

https://www.mql5.com/en/articles/12891

Based on a rigorous theory, I have developed indicators with optimal market noise filtering for trading. https://www.mql5.com/en/blogs/post/741637

However, it should be emphasized that a trader (investor) should choose the direction of his positions on the basis of fundamental analysis, and correctly applied indicators of optimal filtering of market noise should be only its auxiliary tool. These indicators are used to determine:

(4) market entry points are determined,

(5) the positions of stop-loss and profit and their order (time and number of points) of movement are determined,

(6) determine the size of the opened lots (calculated through money management built into the work of many indicators presented here).

I emphasize that for today's highly volatile market, these (1-3) statistically calculated parameters of the game are also (like fundamental analysis) key, in the sense that without them it will be generally impossible to get a stable profit.

Subscribe to my channel and you will be aware of my latest developments in the field of trading

https://www.mql5.com/en/channels/statlab

Aleksey Ivanov

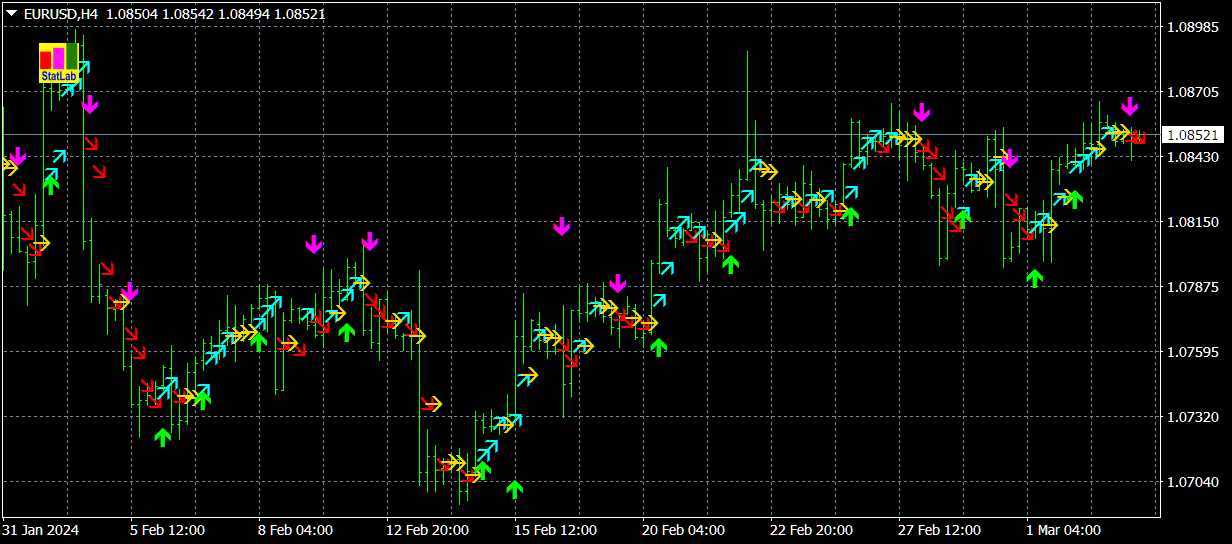

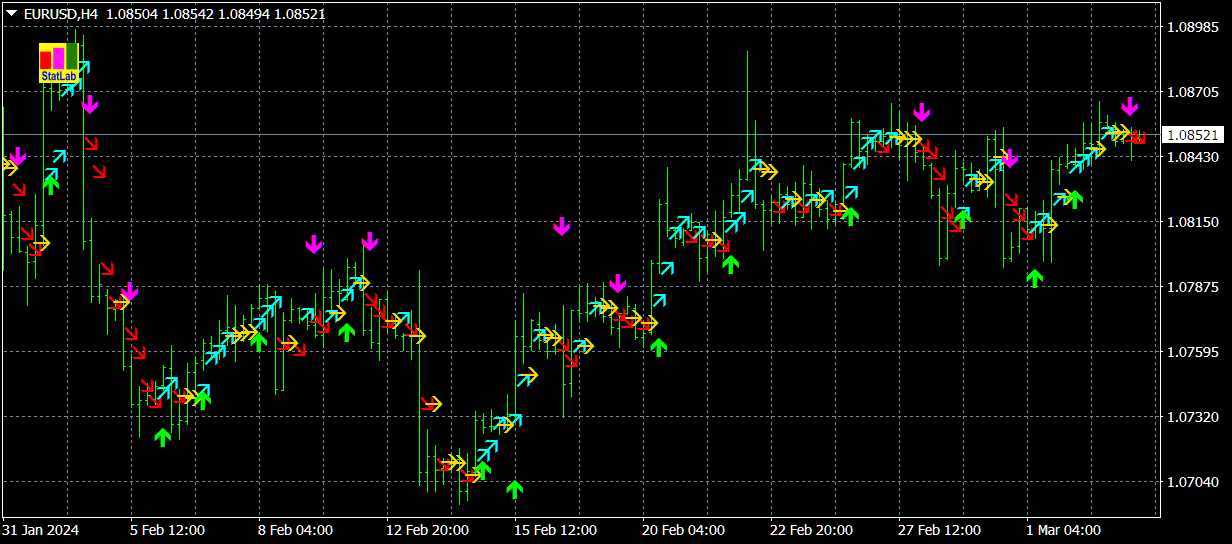

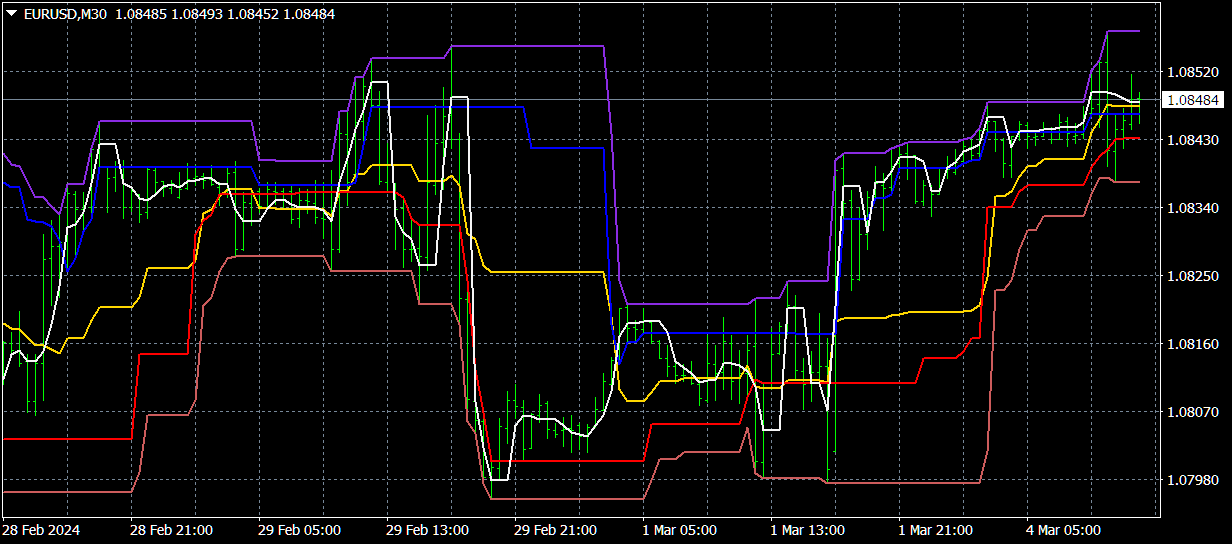

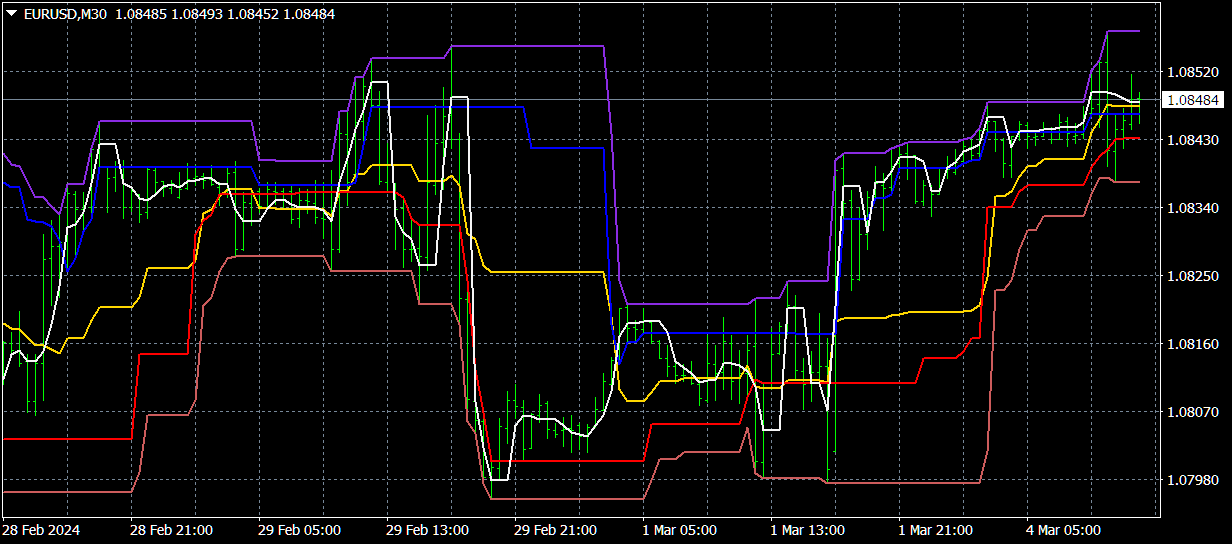

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Identify Trend FREE https://www.mql5.com/en/market/product/36336

Identify Trend well-known popular indicator with optimal market noise filtering.

✔️The indicator has all kinds of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Identify Trend FREE https://www.mql5.com/en/market/product/36336

Identify Trend well-known popular indicator with optimal market noise filtering.

✔️The indicator has all kinds of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Casual Channel https://www.mql5.com/en/accounting/buy/market/71806?period=0 - One of the most accurate non-redrawing indicators that filters out random market noise. Buy this indicator and you are guaranteed success in the financial and stock markets.

The trends that you see on the charts are not always trends or, more precisely, trends on which you can make money. The point is that there are two kinds of trends: 1) true trends that are caused by fundamental economic reasons that are stable and, therefore, can provide a reliable profit for the trader; 2) and there are false trend sections that only look like a trend and arise due to chains of random events - moving the price (mainly) in one direction. These false trend sections are short and can reverse their direction at any time (and, as a rule, reverse immediately after their identification); therefore, making money on them (not by chance) is impossible. Visually true and false trends are indistinguishable at the beginning. Moreover, random price movements or the false trends they generate are always superimposed on true trends, which, in particular, can create pullbacks in true trends that need to be identified and distinguished from reversals caused by new fundamental economic causes.

The Casual Channel indicator distinguishes between these two types of trends by plotting a random walk channel of the price. If you attach this indicator to the charts of currency pairs, then these charts, as a rule, will be entirely inside the channel of random walks, within which many trend sections (but not all) are false. At the same time, the price will move from one channel border to another only touching the channel borders. If you attach the Casual Channel to the charts of indices, CFDs, or stocks on large timeframes, then in some cases you may find that their quotes in sufficiently long periods fall outside the random walk channel, namely at the top of the channel in an uptrend and below in a downtrend. In these cases, we have true trends and the higher the chart is above the upper line or below the lower line of the Casual Channel indicator, the stronger the true trend, which can be considered identified if the chart follows approximately one of the indicator lines.

When opening a buy position on a true uptrend, StopLoss should be placed on the lower line of the indicator, and when opening a sell position on a downtrend, StopLoss should be placed on the upper line of the indicator. In this case, the imposition of false trend sections or random price movements on the true trend, which manifest themselves as rollbacks, will not trigger StopLos, which will only work when the trend reversals. However, CFD trends grow very slowly, and pullbacks during this growth, as a rule, greatly exceed the growth itself, which makes a purely trending strategy low-profit and high-risk.

If there is a trend on a shorter timeframe (on which you open a position), then the price moving away from the channel border on a larger timeframe towards this trend will most likely reach the moving average line in this channel, where then you need to set a take profit. If the price on a larger timeframe following a trend set on a smaller timeframe has moved away from the moving average along the trend, then it will reach the opposite border of the large channel, on which a take-profit must be set, since the boundaries of the random walk channel are calculated very accurately.

Guaranteed success https://www.mql5.com/en/accounting/buy/market/71806?period=0

The trends that you see on the charts are not always trends or, more precisely, trends on which you can make money. The point is that there are two kinds of trends: 1) true trends that are caused by fundamental economic reasons that are stable and, therefore, can provide a reliable profit for the trader; 2) and there are false trend sections that only look like a trend and arise due to chains of random events - moving the price (mainly) in one direction. These false trend sections are short and can reverse their direction at any time (and, as a rule, reverse immediately after their identification); therefore, making money on them (not by chance) is impossible. Visually true and false trends are indistinguishable at the beginning. Moreover, random price movements or the false trends they generate are always superimposed on true trends, which, in particular, can create pullbacks in true trends that need to be identified and distinguished from reversals caused by new fundamental economic causes.

The Casual Channel indicator distinguishes between these two types of trends by plotting a random walk channel of the price. If you attach this indicator to the charts of currency pairs, then these charts, as a rule, will be entirely inside the channel of random walks, within which many trend sections (but not all) are false. At the same time, the price will move from one channel border to another only touching the channel borders. If you attach the Casual Channel to the charts of indices, CFDs, or stocks on large timeframes, then in some cases you may find that their quotes in sufficiently long periods fall outside the random walk channel, namely at the top of the channel in an uptrend and below in a downtrend. In these cases, we have true trends and the higher the chart is above the upper line or below the lower line of the Casual Channel indicator, the stronger the true trend, which can be considered identified if the chart follows approximately one of the indicator lines.

When opening a buy position on a true uptrend, StopLoss should be placed on the lower line of the indicator, and when opening a sell position on a downtrend, StopLoss should be placed on the upper line of the indicator. In this case, the imposition of false trend sections or random price movements on the true trend, which manifest themselves as rollbacks, will not trigger StopLos, which will only work when the trend reversals. However, CFD trends grow very slowly, and pullbacks during this growth, as a rule, greatly exceed the growth itself, which makes a purely trending strategy low-profit and high-risk.

If there is a trend on a shorter timeframe (on which you open a position), then the price moving away from the channel border on a larger timeframe towards this trend will most likely reach the moving average line in this channel, where then you need to set a take profit. If the price on a larger timeframe following a trend set on a smaller timeframe has moved away from the moving average along the trend, then it will reach the opposite border of the large channel, on which a take-profit must be set, since the boundaries of the random walk channel are calculated very accurately.

Guaranteed success https://www.mql5.com/en/accounting/buy/market/71806?period=0

Aleksey Ivanov

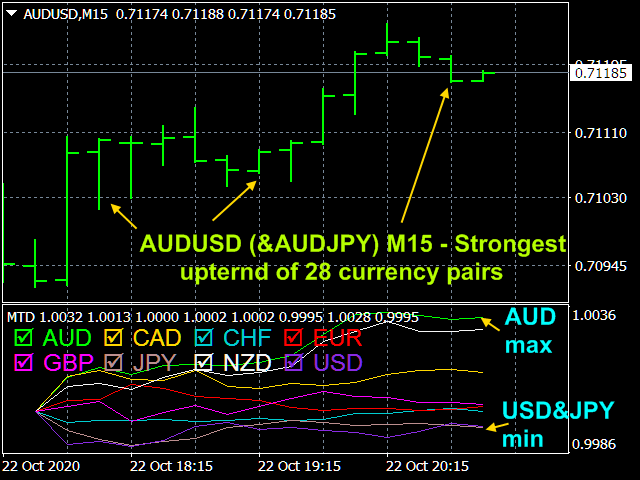

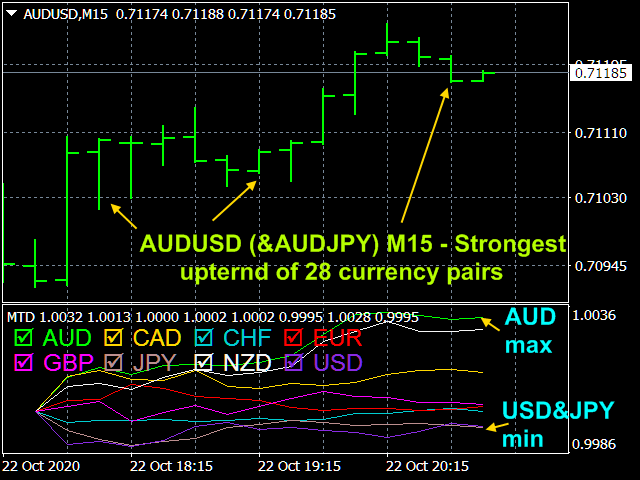

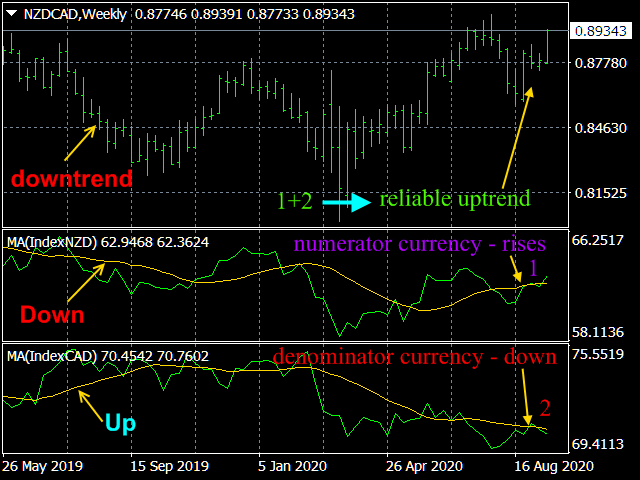

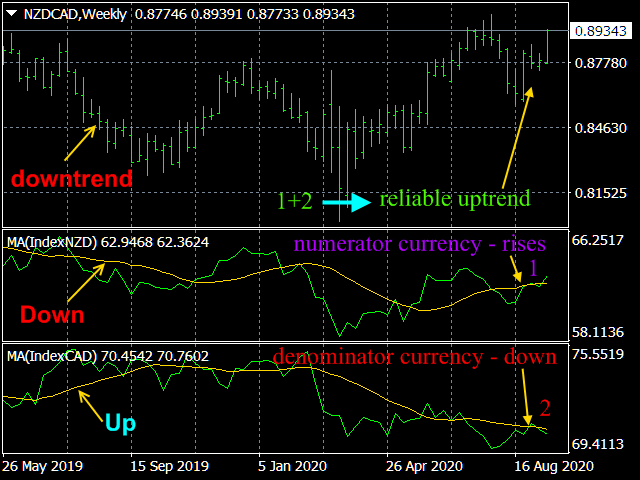

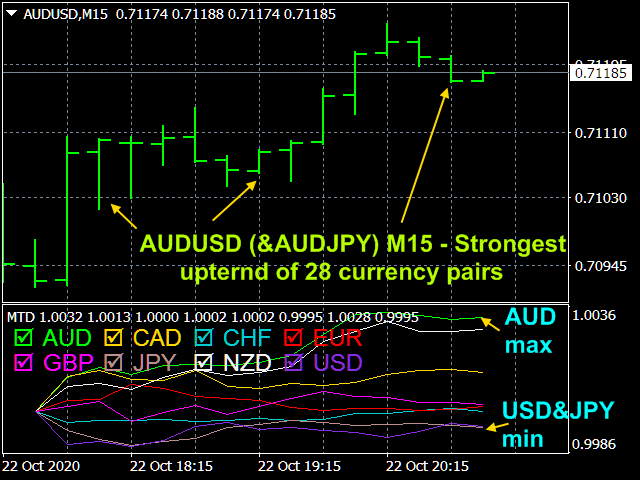

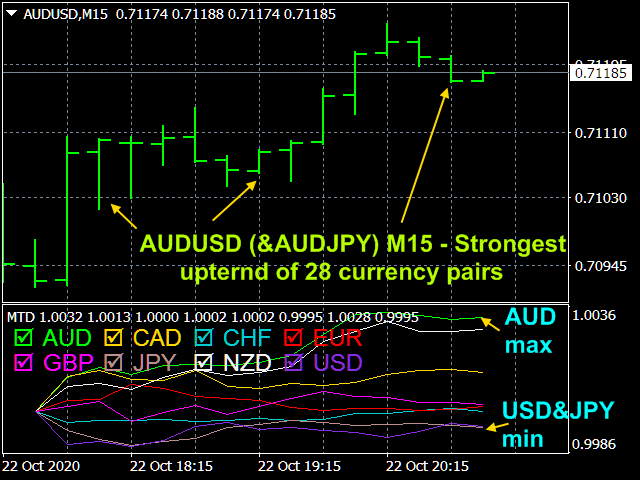

The Multicurrency Trend Detector https://www.mql5.com/en/accounting/buy/market/56194?period=0 - One of the most accurate non-redrawing indicators that filters out random market noise. Buy this indicator and you are guaranteed success in the financial and stock markets.

The Multicurrency Trend Detector( MTD) indicator allows you to immediately and on one chart on a selected time interval (extending from a zero bar to a bar set in the settings by the value horizon) determine the presence, direction and strength of trends in all major currencies, as well as assess the reliability of these trends.

This is achieved by calculating indices (non-relative purchasing power) of eight major currencies, namely: AUD, CAD, CHF, EUR, GBP, JPY, NZD and USD, of which 28 currency pairs are composed, the states of which are easily estimated by such indices. At the same time, the Index (X) indices of these currencies X are reduced to one at the horizon point, i.e. the graph displays the values of the reduced index Index (X, t)/Index (X, horizon), which allows one graph to easily correlate with each other the evolution of indices of all currencies that originate there from a single point on the horizon.

If, for example, such an index of currency X on this chart rises the most, and the index of currency Y, on the contrary, falls the most, then the currency pair X/Y will grow the fastest in a given time interval. Moreover, the trends of currency pairs in which the index of one of the currencies falls, and the index of another currency is growing, are the most stable.

The indices of these major currencies are calculated based on the USDX dollar index, which is determined by the standards adopted by the Intercontinental Exchange( ICE), where this index is calculated as a geometric weighted average of these currencies using the formula:

USDX= 50.14348112 * USDEUR^(0.576) * USDJPY^(0.136) * USDGBP^(0.119) * USDCAD^(0.091) * USDSEK^(0.042) * USDCHF^(0.036),

showing the value of the US dollar against a basket of six major currencies: the euro (EUR), the yen (JPY), the pound sterling (GBP), the Canadian dollar (CAD), the Swedish krona (SEK), and the Swiss franc (CHF).

For the indicator to work, you need to load the history (Tools / History Center) of quotes EURUSD, USDJPY, GBPUSD, USDCAD, USDSEK and USDCHF.

The information display chart for each currency has its own "check-box", which, for the convenience of analysis, can both hide the corresponding currency and display it.

In addition, the indices can be averaged with a moving average.

Using the indicator in trading.

Since the indexes of currencies reflect the true economic conditions of the respective states, the growth of the index indicates the growth of the economy, and the fall - of the fall, which expresses true or reliable trends. Therefore, if the Index (X) of currency X in a currency pair X/Y rises, and Index (Y) of currency Y falls, then this is the most reliable signal to buy X/Y. The indicator allows you to immediately visually identify the fastest growing currency and the fastest falling currency, which allows you to instantly see (at a given time interval) the pair with the strongest trend out of many (28 pieces) currency pairs. The trends of currency pairs arising from the joint growth of their constituent currencies or their joint fall are extremely unstable and subject to large and unpredictable random fluctuations.

In addition, the indicator on a given time interval easily identifies similarly changing currencies X, Z, etc., which allows you to compose such portfolios of currency pairs X/Y, Z/X, etc. in which separate multidirectional price fluctuations will compensate each other, reducing drawdowns.

Guaranteed success https://www.mql5.com/en/accounting/buy/market/56194?period=0

The Multicurrency Trend Detector( MTD) indicator allows you to immediately and on one chart on a selected time interval (extending from a zero bar to a bar set in the settings by the value horizon) determine the presence, direction and strength of trends in all major currencies, as well as assess the reliability of these trends.

This is achieved by calculating indices (non-relative purchasing power) of eight major currencies, namely: AUD, CAD, CHF, EUR, GBP, JPY, NZD and USD, of which 28 currency pairs are composed, the states of which are easily estimated by such indices. At the same time, the Index (X) indices of these currencies X are reduced to one at the horizon point, i.e. the graph displays the values of the reduced index Index (X, t)/Index (X, horizon), which allows one graph to easily correlate with each other the evolution of indices of all currencies that originate there from a single point on the horizon.

If, for example, such an index of currency X on this chart rises the most, and the index of currency Y, on the contrary, falls the most, then the currency pair X/Y will grow the fastest in a given time interval. Moreover, the trends of currency pairs in which the index of one of the currencies falls, and the index of another currency is growing, are the most stable.

The indices of these major currencies are calculated based on the USDX dollar index, which is determined by the standards adopted by the Intercontinental Exchange( ICE), where this index is calculated as a geometric weighted average of these currencies using the formula:

USDX= 50.14348112 * USDEUR^(0.576) * USDJPY^(0.136) * USDGBP^(0.119) * USDCAD^(0.091) * USDSEK^(0.042) * USDCHF^(0.036),

showing the value of the US dollar against a basket of six major currencies: the euro (EUR), the yen (JPY), the pound sterling (GBP), the Canadian dollar (CAD), the Swedish krona (SEK), and the Swiss franc (CHF).

For the indicator to work, you need to load the history (Tools / History Center) of quotes EURUSD, USDJPY, GBPUSD, USDCAD, USDSEK and USDCHF.

The information display chart for each currency has its own "check-box", which, for the convenience of analysis, can both hide the corresponding currency and display it.

In addition, the indices can be averaged with a moving average.

Using the indicator in trading.

Since the indexes of currencies reflect the true economic conditions of the respective states, the growth of the index indicates the growth of the economy, and the fall - of the fall, which expresses true or reliable trends. Therefore, if the Index (X) of currency X in a currency pair X/Y rises, and Index (Y) of currency Y falls, then this is the most reliable signal to buy X/Y. The indicator allows you to immediately visually identify the fastest growing currency and the fastest falling currency, which allows you to instantly see (at a given time interval) the pair with the strongest trend out of many (28 pieces) currency pairs. The trends of currency pairs arising from the joint growth of their constituent currencies or their joint fall are extremely unstable and subject to large and unpredictable random fluctuations.

In addition, the indicator on a given time interval easily identifies similarly changing currencies X, Z, etc., which allows you to compose such portfolios of currency pairs X/Y, Z/X, etc. in which separate multidirectional price fluctuations will compensate each other, reducing drawdowns.

Guaranteed success https://www.mql5.com/en/accounting/buy/market/56194?period=0

Aleksey Ivanov

Friends! The foreign exchange market in our time is an absolute chaos. If you play on the foreign exchange market, then you should treat it exactly like a game, i.e. it is the same as playing in a casino. Don't expect this game to be your main source of income. These are false hopes. Therefore, play for extra money. In no case do not play with borrowed money from someone (banks, friends, etc.). This will lead to disaster.

There is a little more order in the stock market than in the foreign exchange market. Here you can rely on fundamental data on the economic condition (financial statements, etc.) of the companies that issue the respective shares. But here, in our time, when the global crisis is approaching, the data provided by even reputable experts can be unreliable. However, the indicators I provide are better applied to the stock market, which is more orderly.

Modern profitable indicators https://www.mql5.com/en/blogs/post/741637

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

There is a little more order in the stock market than in the foreign exchange market. Here you can rely on fundamental data on the economic condition (financial statements, etc.) of the companies that issue the respective shares. But here, in our time, when the global crisis is approaching, the data provided by even reputable experts can be unreliable. However, the indicators I provide are better applied to the stock market, which is more orderly.

Modern profitable indicators https://www.mql5.com/en/blogs/post/741637

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Profit Trade https://www.mql5.com/en/accounting/buy/market/49806?period=0 - One of the most accurate non-redrawing indicators that filters out random market noise. Buy this indicator and you are guaranteed success in the financial and stock markets.

The benefits of the indicator.

The indicator demonstrates the current state of the market in a clear and covering all characteristic price scales. The filtration used in Profit Trade is extremely robust; and this indicator does not redraw. The indicator settings are extremely simple.

Trading with the Profit Trade Indicator.

The upper Dup and lower Ddn lines cover all the current price fluctuations for the period n1 and outline a large-scale channel. Price breaks through this large-scale channel as market conditions change. If an uptrend occurs, then the price will almost always fit into the narrow channel formed by the Dup and Pup lines. When a downtrend occurs, the price is clamped into a narrow channel by the lines Ddn and Pdn. With the continuation of trends arising from breakdowns of a large-scale channel, the signal line Ps will always go through the middle of such ascending or descending channels. If the signal line Ps crosses the Pup line in the ascending channel from top to bottom or crosses the Pdn line in the descending channel from bottom to top, this indicates a change in direction of the corresponding trend. Further intersection by the signal line Ps of the midline Dm confirms the emerging trend. An earlier signal for a change in the direction of the trend is a sharp bend in the signal line Ps, when it from the direction parallel to the horizontal becomes directed against the established trend. If the signal line, being horizontal at first, bends in the direction of the trend, then this trend will continue. If the trend is upward and starts when you exit the lower channel limited by the Ddn and Pdn lines, then StopLoss of a buy position must be placed on the Ddn line. For a downtrend starting from the channel Dup and Pup, StopLoss of the sell position must be placed on the Dup line.

When the signal line Ps crosses the Pup line in the upstream channel from the top down or crosses the Pdn line in the downward channel from the bottom up, this may also indicate a rollback on the corresponding trend. Profitable positions in this case must be closed; and wait until Ps crosses the Pup line in the upstream channel from the bottom up or crosses the Pdn line in the down channel from the top down, which will indicate the completion of the rollback. Then again we open positions according to the trend. StopLoss in this case is also defined as previously described, but on a smaller timeframe.

The flat is identified by long, horizontal indicator lines that are comparable in length with trend areas. Opening positions on the flat is undesirable.

An analysis of the state of the market should begin with a consideration of a large time frame, which determines the direction of the current trend. If flat, it is better not to open positions. We open positions according to the trend on a smaller timeframe. If there is a pullback, then the corresponding position against the trend is also undesirable to open, because at the time of the rollback, we do not know its duration, which may turn out to be small.

Indicator Settings.

§ The main averaging period - Any positive integer (20 default).

§ The signal line averaging period - Any positive integer (3 default).

§ Line thickness - Any positive integer (1 default).

Guaranteed success https://www.mql5.com/en/accounting/buy/market/49806?period=0

The benefits of the indicator.

The indicator demonstrates the current state of the market in a clear and covering all characteristic price scales. The filtration used in Profit Trade is extremely robust; and this indicator does not redraw. The indicator settings are extremely simple.

Trading with the Profit Trade Indicator.

The upper Dup and lower Ddn lines cover all the current price fluctuations for the period n1 and outline a large-scale channel. Price breaks through this large-scale channel as market conditions change. If an uptrend occurs, then the price will almost always fit into the narrow channel formed by the Dup and Pup lines. When a downtrend occurs, the price is clamped into a narrow channel by the lines Ddn and Pdn. With the continuation of trends arising from breakdowns of a large-scale channel, the signal line Ps will always go through the middle of such ascending or descending channels. If the signal line Ps crosses the Pup line in the ascending channel from top to bottom or crosses the Pdn line in the descending channel from bottom to top, this indicates a change in direction of the corresponding trend. Further intersection by the signal line Ps of the midline Dm confirms the emerging trend. An earlier signal for a change in the direction of the trend is a sharp bend in the signal line Ps, when it from the direction parallel to the horizontal becomes directed against the established trend. If the signal line, being horizontal at first, bends in the direction of the trend, then this trend will continue. If the trend is upward and starts when you exit the lower channel limited by the Ddn and Pdn lines, then StopLoss of a buy position must be placed on the Ddn line. For a downtrend starting from the channel Dup and Pup, StopLoss of the sell position must be placed on the Dup line.

When the signal line Ps crosses the Pup line in the upstream channel from the top down or crosses the Pdn line in the downward channel from the bottom up, this may also indicate a rollback on the corresponding trend. Profitable positions in this case must be closed; and wait until Ps crosses the Pup line in the upstream channel from the bottom up or crosses the Pdn line in the down channel from the top down, which will indicate the completion of the rollback. Then again we open positions according to the trend. StopLoss in this case is also defined as previously described, but on a smaller timeframe.

The flat is identified by long, horizontal indicator lines that are comparable in length with trend areas. Opening positions on the flat is undesirable.

An analysis of the state of the market should begin with a consideration of a large time frame, which determines the direction of the current trend. If flat, it is better not to open positions. We open positions according to the trend on a smaller timeframe. If there is a pullback, then the corresponding position against the trend is also undesirable to open, because at the time of the rollback, we do not know its duration, which may turn out to be small.

Indicator Settings.

§ The main averaging period - Any positive integer (20 default).

§ The signal line averaging period - Any positive integer (3 default).

§ Line thickness - Any positive integer (1 default).

Guaranteed success https://www.mql5.com/en/accounting/buy/market/49806?period=0

Aleksey Ivanov

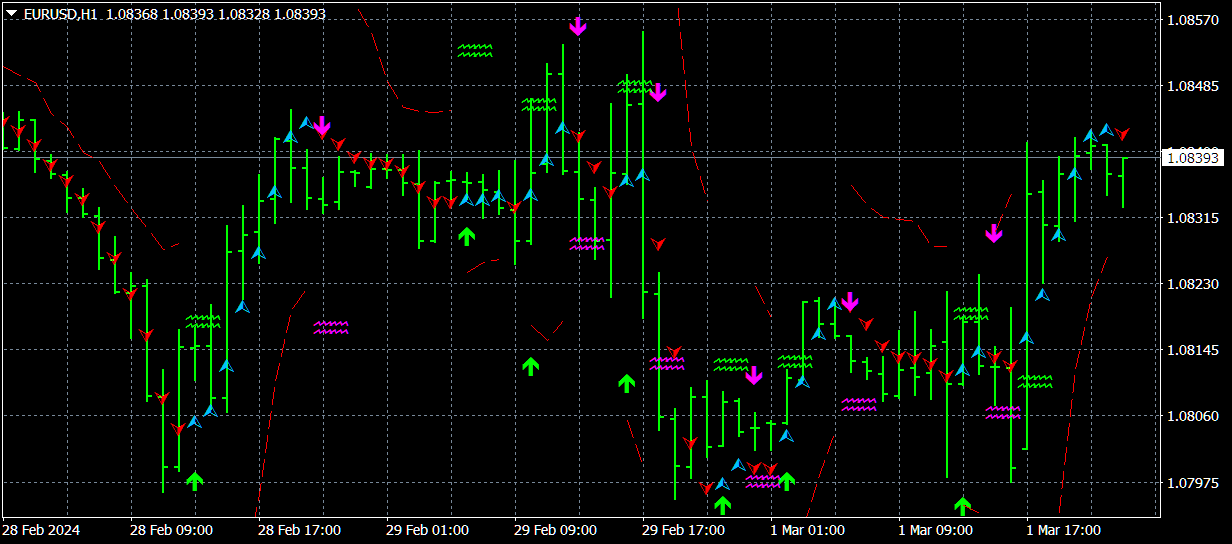

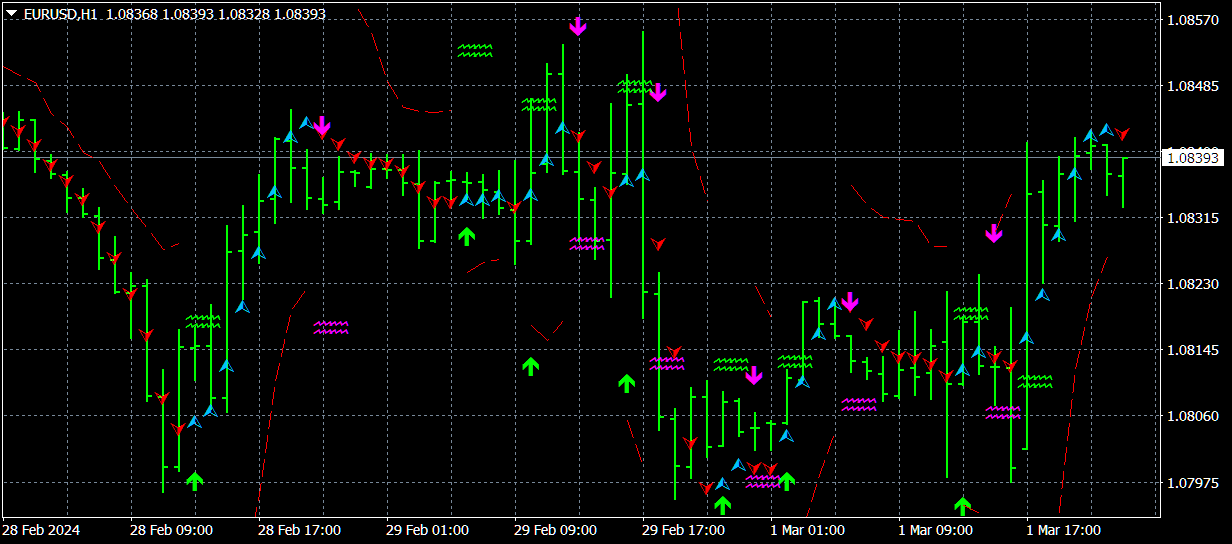

Identify Market State https://www.mql5.com/en/accounting/buy/market/46028?period=0 - One of the most accurate non-redrawing indicators that filters out random market noise. Buy this indicator and you are guaranteed success in the financial and stock markets.

The Identify Market State indicator allows you to set the beginning of a new trends and pullbacks on an existing trend. This indicator can be used both for trading on scalper strategies and for long-term trading strategies.

The indicator is based on the 14 periodic DeMarker indicator and the 8 periodic simple moving average from this indicator. Statistical studies have shown that the sharp peaks of the DeMarker indicator curve when they drop below its minimum line (oversold zone) or when they exceed its maximum line (overbought zone), indicate possible rollback points (which do not exclude the continuation of the same trend movement). Going beyond the same extreme lines of intersection of the DeMarker indicator line with the average from this indicator determine the beginning of new trends.

Possible moments of a change in trend direction and pullbacks are indicated by different arrows. The option to display these signals on the main chart by vertical lines is provided.

The indicator does not redraw. The indicator has all types of alerts.

Indicator settings.

§ DeMarker Period. – The averaging period of DeMarker indicator. Values: any positive integer (14 default).

§ Max level. – Maximum level of DeMarker (0.7 default).

§ Min level. – Minimum level of DeMarker (0.3 default).

§ DeMarker color. - Line color of DeMarker. (Magenta default).

§ DeMarker width. - Line thickness of DeMarker. (1 default).

§ MA Period. - Moving Average Period by DeMarker. Values: any positive integer (8 default).

§ The averaging method - DeMarker indicator curve averaging method. Values: Simple (default), Exponential, Smoothed, Linear weighted.

§ MA Color. – Moving average color from DeMarker. (Gold default).

§ MA Width. - Moving average line thickness from DeMarker. (1 default).

§ Arrows Buy Color – Arrow color for buy. (YellowGreen default).

§ Arrows Sell Color - Arrow color for sale. (Red default).

§ Arrows Width. - Arrow thickness. (1 default).

§ Show rollback signals. Values: true (default), false.

§ Show trending sell and buy signals. Values: true (default), false.

§ Show vertical lines. – Show vertical lines of signals on the main chart. Values: true, false(default).

§ The Signal method - Type of trading signal alert. Values: No (default), Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound, Push + Comment, Push, Mail + Comment, Mail.

Guaranteed success https://www.mql5.com/en/accounting/buy/market/46028?period=0

The Identify Market State indicator allows you to set the beginning of a new trends and pullbacks on an existing trend. This indicator can be used both for trading on scalper strategies and for long-term trading strategies.

The indicator is based on the 14 periodic DeMarker indicator and the 8 periodic simple moving average from this indicator. Statistical studies have shown that the sharp peaks of the DeMarker indicator curve when they drop below its minimum line (oversold zone) or when they exceed its maximum line (overbought zone), indicate possible rollback points (which do not exclude the continuation of the same trend movement). Going beyond the same extreme lines of intersection of the DeMarker indicator line with the average from this indicator determine the beginning of new trends.

Possible moments of a change in trend direction and pullbacks are indicated by different arrows. The option to display these signals on the main chart by vertical lines is provided.

The indicator does not redraw. The indicator has all types of alerts.

Indicator settings.

§ DeMarker Period. – The averaging period of DeMarker indicator. Values: any positive integer (14 default).

§ Max level. – Maximum level of DeMarker (0.7 default).

§ Min level. – Minimum level of DeMarker (0.3 default).

§ DeMarker color. - Line color of DeMarker. (Magenta default).

§ DeMarker width. - Line thickness of DeMarker. (1 default).

§ MA Period. - Moving Average Period by DeMarker. Values: any positive integer (8 default).

§ The averaging method - DeMarker indicator curve averaging method. Values: Simple (default), Exponential, Smoothed, Linear weighted.

§ MA Color. – Moving average color from DeMarker. (Gold default).

§ MA Width. - Moving average line thickness from DeMarker. (1 default).

§ Arrows Buy Color – Arrow color for buy. (YellowGreen default).

§ Arrows Sell Color - Arrow color for sale. (Red default).

§ Arrows Width. - Arrow thickness. (1 default).

§ Show rollback signals. Values: true (default), false.

§ Show trending sell and buy signals. Values: true (default), false.

§ Show vertical lines. – Show vertical lines of signals on the main chart. Values: true, false(default).

§ The Signal method - Type of trading signal alert. Values: No (default), Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound, Push + Comment, Push, Mail + Comment, Mail.

Guaranteed success https://www.mql5.com/en/accounting/buy/market/46028?period=0

Aleksey Ivanov

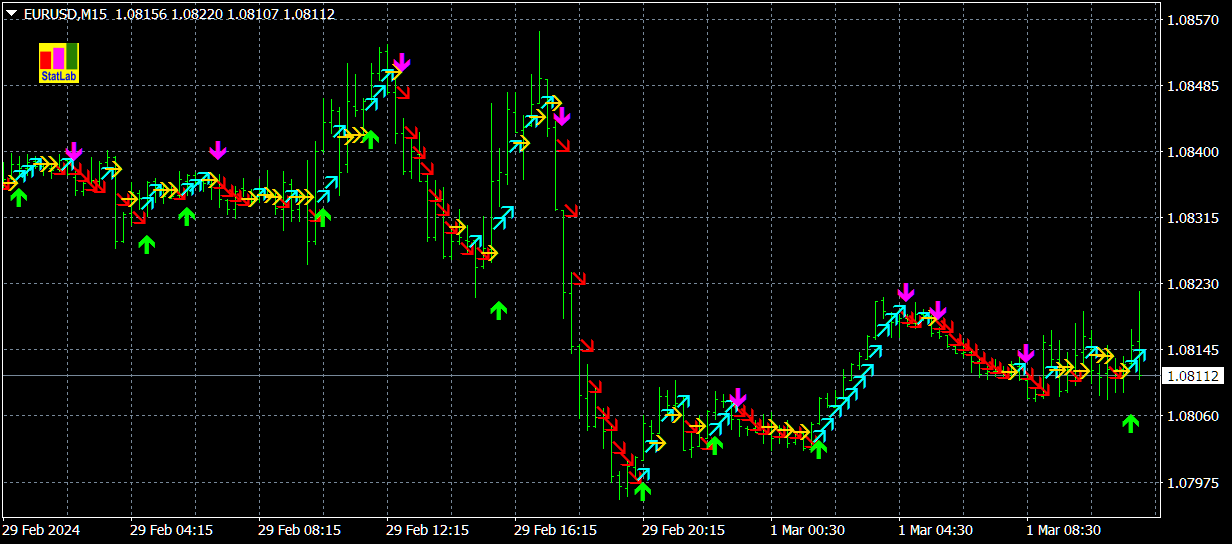

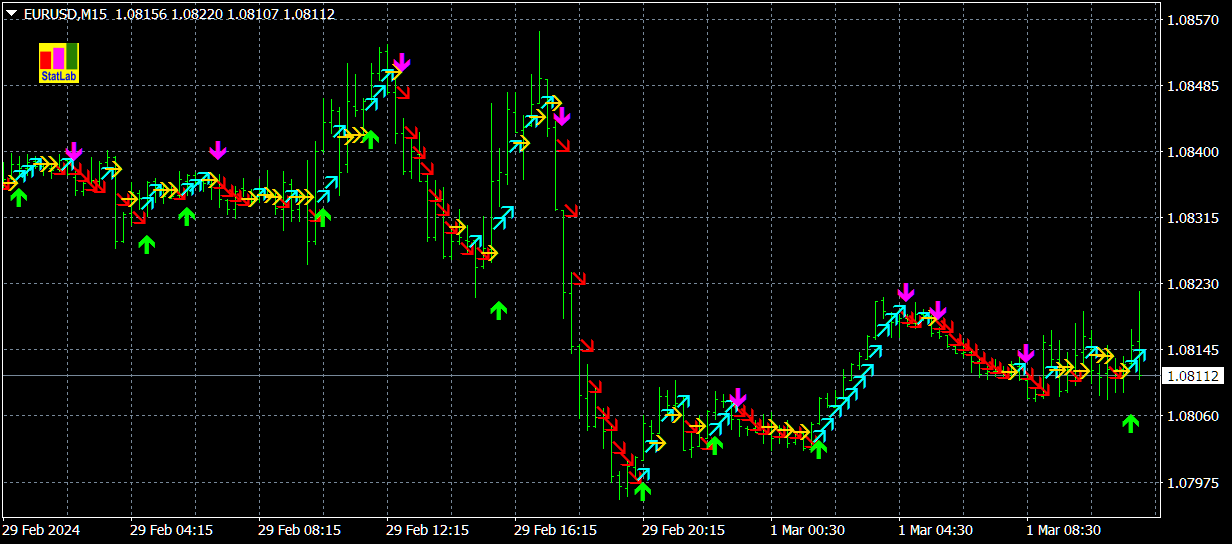

Sensitive Signal https://www.mql5.com/en/accounting/buy/market/34171?period=0 - one of the most sensitive indicators that filters out random market noise. Buy this indicator and you are guaranteed success in the financial and stock markets.

The Sensitive Signal ( SS) indicator, using the filtering methods (which includes cluster multicurrency analysis) developed by the author, allows, with a high degree of probability, to establish the beginning of the true (filtered from interference - random price walks) trend movement. It is clear that such an indicator is very effective for trading on the currency exchange, where signals are highly distorted by random noise. The filtration developed by the author is carried out in several iterations and reveals the true trajectory of the regular price movement (more precisely, the most likely curve of such movement) and draws it.

Indicator readings are visual, extremely simple and do not require comments. Blue triangles are located on the uptrend of the regular component of the price movement, red triangles - on the downward. Accordingly, entry points for Buy are where the blue triangles appear immediately behind the red triangles, and for Sell, the opposite. The level of sensitivity of the indicator is adjusted by setting « Select sensitivity level». At the same time, you need to understand that increasing the sensitivity level not only reduces the signal delay (which, in fact, is small for all levels), but increases the probability of issuing a false signal.

Possible moments of a change in the direction of price movement are also marked by arrows, which are never redrawn under any circumstances.

The indicator calculates and displays the StopLoss position lines, calculated based on the current distributions of the price probability and the selected level of probability of closing an order by StopLossas far as the trend reversal. The indicator also considers TakeProfit as the most probable value reached by the price after the signal.

The indicator also has a built-in money management function, in which you can calculate the lot size based on the accepted risk level, the size of the deposit and the StopLoss position.

The indicator has all kinds of alerts. Alert may be turned on: 1) if the indications of the indicator coincide (regarding the direction of the trend) on the last two bars; 2) on a closed candle; 3) on the closed candle and the bar preceding it.

Indicator settings.

§ Price type - applied price. Values: Close price, Open price, High price, Low price, Median price ((high + low)/2 - default), Typical price ((high + low + close)/3), Weighted price ((high + low + 2*close)/4).

§ The averaging method - averaging method. Values: Simple, Exponential (default), Smoothed, Linear weighted.

§ The averaging period - averaging period. Values: any integer (14 default).

§ Select sensitivity level - sensitivity level of the Indicator. Values: Low, Middle (default) and High.

§ Dimensions of markers – Dimensions of the markers. Values: any integer (2 default).

§ The display method - Values: Show trend arrows and show change trend arrows (default), Show only trend arrows, Show only change trend arrows.

§ Show StopLoss and TakeProfit lines? Values : true (default)? false.

§ Trend UP arrow color= DeepSkyBlue

§ Trend DOWN arrow color=Red

§ Down arrow color=Magenta

§ Up arrow color=Lime

§ Signal Identification Method - Values: By the last two bars (default), By closed candle, By closed candle and by the previous for it bar.

§ The Signal method - Type of trading signal alert. Values: No, Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound, Push + Comment, Push, Mail + Comment, Mail.

§ The probability of triggering StopLoss P_sl - The probability of closing an order by StopLoss before the trend reversal. Any real number between 0 and 1 (0.05 default).

§ Calculate the lot size from the risk, deposit and P_sl ? – Calculate lot size based on risk, deposit and probability of order closing by StopLoss? Values: true, false (default).

§ Allowable losses in % from Free Margin - (2% default).

Guaranteed success https://www.mql5.com/en/accounting/buy/market/34171?period=0

The Sensitive Signal ( SS) indicator, using the filtering methods (which includes cluster multicurrency analysis) developed by the author, allows, with a high degree of probability, to establish the beginning of the true (filtered from interference - random price walks) trend movement. It is clear that such an indicator is very effective for trading on the currency exchange, where signals are highly distorted by random noise. The filtration developed by the author is carried out in several iterations and reveals the true trajectory of the regular price movement (more precisely, the most likely curve of such movement) and draws it.

Indicator readings are visual, extremely simple and do not require comments. Blue triangles are located on the uptrend of the regular component of the price movement, red triangles - on the downward. Accordingly, entry points for Buy are where the blue triangles appear immediately behind the red triangles, and for Sell, the opposite. The level of sensitivity of the indicator is adjusted by setting « Select sensitivity level». At the same time, you need to understand that increasing the sensitivity level not only reduces the signal delay (which, in fact, is small for all levels), but increases the probability of issuing a false signal.

Possible moments of a change in the direction of price movement are also marked by arrows, which are never redrawn under any circumstances.

The indicator calculates and displays the StopLoss position lines, calculated based on the current distributions of the price probability and the selected level of probability of closing an order by StopLossas far as the trend reversal. The indicator also considers TakeProfit as the most probable value reached by the price after the signal.

The indicator also has a built-in money management function, in which you can calculate the lot size based on the accepted risk level, the size of the deposit and the StopLoss position.

The indicator has all kinds of alerts. Alert may be turned on: 1) if the indications of the indicator coincide (regarding the direction of the trend) on the last two bars; 2) on a closed candle; 3) on the closed candle and the bar preceding it.

Indicator settings.

§ Price type - applied price. Values: Close price, Open price, High price, Low price, Median price ((high + low)/2 - default), Typical price ((high + low + close)/3), Weighted price ((high + low + 2*close)/4).

§ The averaging method - averaging method. Values: Simple, Exponential (default), Smoothed, Linear weighted.

§ The averaging period - averaging period. Values: any integer (14 default).

§ Select sensitivity level - sensitivity level of the Indicator. Values: Low, Middle (default) and High.

§ Dimensions of markers – Dimensions of the markers. Values: any integer (2 default).

§ The display method - Values: Show trend arrows and show change trend arrows (default), Show only trend arrows, Show only change trend arrows.

§ Show StopLoss and TakeProfit lines? Values : true (default)? false.

§ Trend UP arrow color= DeepSkyBlue

§ Trend DOWN arrow color=Red

§ Down arrow color=Magenta

§ Up arrow color=Lime

§ Signal Identification Method - Values: By the last two bars (default), By closed candle, By closed candle and by the previous for it bar.

§ The Signal method - Type of trading signal alert. Values: No, Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound, Push + Comment, Push, Mail + Comment, Mail.

§ The probability of triggering StopLoss P_sl - The probability of closing an order by StopLoss before the trend reversal. Any real number between 0 and 1 (0.05 default).

§ Calculate the lot size from the risk, deposit and P_sl ? – Calculate lot size based on risk, deposit and probability of order closing by StopLoss? Values: true, false (default).

§ Allowable losses in % from Free Margin - (2% default).

Guaranteed success https://www.mql5.com/en/accounting/buy/market/34171?period=0

Aleksey Ivanov

Profit MACD https://www.mql5.com/en/accounting/buy/market/35659?period=0 - One of the most accurate non-redrawing indicators that filters out random market noise. Buy this indicator and you are guaranteed success in the financial and stock markets.

I present an indicator for professionals. ProfitMACD is very similar to classic MACD in appearance and its functions. However, ProfitMACD is based on completely new algorithms (for example, it has only one averaging period) and is more robust, especially on small timeframes, since it filters random price walks. The classic MACD indicator (Moving Average Convergence / Divergence) is a very good indicator following the trend, based on the ratio between two moving averages, namely the EMA with periods of 12 and 26, i.e.

MACD = EMA(CLOSE, 12) - EMA(CLOSE, 26),

and the signal line - 9-period moving average from the indicator itself

SIGNAL = SMA(MACD, 9).

The algorithm of the indicator ProfitMACD is much more complicated and is shown in the last screenshot. ProfitMACD, like the classic MACD, is most effective when the market fluctuates with a large amplitude in the trading corridor.

The indicator has all kinds of alerts.

Benefits of ProfitMACD.

1. Classic MACD gives a lot of false signals on small timeframes, providing good results on weekly and daily charts. ProfitMACD works on hour timeframes and can be quite accurate even on M5, which allows it to be used for scalping.

2. In addition, the ProfitMACD indicator has less lag.

3. According to the value of the main line ProfitMACD, presented in points, you can, if there is a signal, set the position of Take Profit when playing on the oscillations inside the channel. And when playing by the trend at this value, you can set the value of Stop Loss.

ProfitMACD signals.

The signals for these indicators are: (1) intersections, (2) overbought / oversold conditions, and (3) divergences.

1. Intersections .

If the main line of the indicator falls below the signal line, then you should sell; if it rises above the signal line, buy. As signals to buy / sell, the intersection of the main line of the zero mark up / down is also used.

2. Overbought / Oversold conditions.

If the indicator is very high, the price is too high and will soon return to a more realistic level.

3. Divergences .

If a higher price high is not confirmed by a higher high on the indicator (bearish divergence) or vice versa, a lower minimum is not confirmed by a minimum on the indicator (bullish divergence), this means the end of the trend and the possible reversal of the trend. Discrepancies are most significant if they form in overbought / oversold areas.

Indicator settings.

§ Price type - applied price. Values: Close price (default), Open price, High price, Low price, Median price ((high + low)/2), Typical price ((high + low + close)/3), Weighted price ((high + low + 2*close)/4).

§ The averaging period - averaging period. Values: any integer (9 default).

§ Main line thickness - Values: any integer (1 default).

§ Signal line thickness - Values: any integer (1 default).

§ Data in points of possible profit? - Show data in points of possible profit? Values: true (default), false.

§ The Signal method - Type of trading signal alert. Values: No, Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound, Push + Comment, Push, Mail + Comment, Mail.

Guaranteed success https://www.mql5.com/en/accounting/buy/market/35659?period=0

I present an indicator for professionals. ProfitMACD is very similar to classic MACD in appearance and its functions. However, ProfitMACD is based on completely new algorithms (for example, it has only one averaging period) and is more robust, especially on small timeframes, since it filters random price walks. The classic MACD indicator (Moving Average Convergence / Divergence) is a very good indicator following the trend, based on the ratio between two moving averages, namely the EMA with periods of 12 and 26, i.e.

MACD = EMA(CLOSE, 12) - EMA(CLOSE, 26),

and the signal line - 9-period moving average from the indicator itself

SIGNAL = SMA(MACD, 9).

The algorithm of the indicator ProfitMACD is much more complicated and is shown in the last screenshot. ProfitMACD, like the classic MACD, is most effective when the market fluctuates with a large amplitude in the trading corridor.

The indicator has all kinds of alerts.

Benefits of ProfitMACD.

1. Classic MACD gives a lot of false signals on small timeframes, providing good results on weekly and daily charts. ProfitMACD works on hour timeframes and can be quite accurate even on M5, which allows it to be used for scalping.

2. In addition, the ProfitMACD indicator has less lag.

3. According to the value of the main line ProfitMACD, presented in points, you can, if there is a signal, set the position of Take Profit when playing on the oscillations inside the channel. And when playing by the trend at this value, you can set the value of Stop Loss.

ProfitMACD signals.

The signals for these indicators are: (1) intersections, (2) overbought / oversold conditions, and (3) divergences.

1. Intersections .

If the main line of the indicator falls below the signal line, then you should sell; if it rises above the signal line, buy. As signals to buy / sell, the intersection of the main line of the zero mark up / down is also used.

2. Overbought / Oversold conditions.

If the indicator is very high, the price is too high and will soon return to a more realistic level.

3. Divergences .

If a higher price high is not confirmed by a higher high on the indicator (bearish divergence) or vice versa, a lower minimum is not confirmed by a minimum on the indicator (bullish divergence), this means the end of the trend and the possible reversal of the trend. Discrepancies are most significant if they form in overbought / oversold areas.

Indicator settings.

§ Price type - applied price. Values: Close price (default), Open price, High price, Low price, Median price ((high + low)/2), Typical price ((high + low + close)/3), Weighted price ((high + low + 2*close)/4).

§ The averaging period - averaging period. Values: any integer (9 default).

§ Main line thickness - Values: any integer (1 default).

§ Signal line thickness - Values: any integer (1 default).

§ Data in points of possible profit? - Show data in points of possible profit? Values: true (default), false.

§ The Signal method - Type of trading signal alert. Values: No, Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound, Push + Comment, Push, Mail + Comment, Mail.

Guaranteed success https://www.mql5.com/en/accounting/buy/market/35659?period=0

Aleksey Ivanov

One of the most accurate non-redrawing indicators that filters out random market noise. Buy https://www.mql5.com/ru/accounting/buy/market/32028?period=0&source=Site+Profile+Seller&cartId=06f22a00000000007152e365

Structure of the indicator.

The Cunning crocodile indicator consists of three moving averages (applied to the price Median price = (high + low)/2): 1) the usual SMA or the mean of the process X and her two generalizations 2) = > * and 3) = > / with the same averaging period. All three curves intersect at common points that (such an intersection in which the cunning crocodile, unlike the usual one, "never bites his tongue") indicates a change in the trend in the price movement. The formulas for these generalized averages, one of which is faster, and the other slower than the usual SMA, are presented in the following figure.

Algorithms of the indicator.

Using the Cunning crocodile indicator and its advantages.

The trade of the Cunning crocodile indicator is similar to that of the trade of the usual Alligator indicator, but it has the following advantages. First, averaging over the algorithm is less delay than behind the fast SMMA used in the classical Alligator. Secondly, the small slope of the slow is also faster achieved than the small slope of the slow SMMA of the normal Alligator. Therefore, the indicator Cunning crocodile more quickly indicates the transition to both trend and flat market conditions than the classic Alligator. Thirdly, the filtering (from random noise) algorithms developed by the author, which are used in the Cunning crocodile indicator, provide greater signal reliability (i.e., they reduce the probability of a false signal) given by this indicator.

Trade with the Cunning crocodile indicator.

If after reaching a single point of intersection of all three curves "the mouth of the crocodile" is widely opened and the slow average acquires a significant slope, then there is a trend. In this case, the position on Buy (Sell) opens when the price is higher (lower) than the fast average and closes when it is below (above) (those. in the "mouth" Cunning crocodile).

If the slow mean is practically horizontal and (that occupies a significant section of the history) all three lines intersect repeatedly (3 to 6 times) at single points, then the price consolidation takes place. At the same time, the length of the subsequent trend is usually proportional to the length of the previous consolidation area, in which the market spends most of the time (70% -80%), which provides additional information for assessing the state of the market, i.e. it allows to judge whether the trend reversal starts or the trend ends. A rough estimate is as follows: if the trend lasted for 25% -40% of the time of the previous consolidation, then, most likely, there will be a trend end; If the trend lasted less than 20% of the time of the previous consolidation, then a rollback.

In the latest (2.0) version of the indicator, all kinds of alerts have been added.

Indicator parameters.

· Price type - Values: Close price, Open price, High price, Low price, Median price ((high + low)/2 – default), Typical price ((high + low + close)/3), Weighted price ((high + low + 2*close)/4).

· The averaging period - Values: Integer. Default is 5.

· The Signal method - Type of trading signal alert. Values: No, Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound.

Buy https://www.mql5.com/ru/accounting/buy/market/32028?period=0&source=Site+Profile+Seller&cartId=06f22a00000000007152e365

Structure of the indicator.

The Cunning crocodile indicator consists of three moving averages (applied to the price Median price = (high + low)/2): 1) the usual SMA or the mean of the process X and her two generalizations 2) = > * and 3) = > / with the same averaging period. All three curves intersect at common points that (such an intersection in which the cunning crocodile, unlike the usual one, "never bites his tongue") indicates a change in the trend in the price movement. The formulas for these generalized averages, one of which is faster, and the other slower than the usual SMA, are presented in the following figure.

Algorithms of the indicator.

Using the Cunning crocodile indicator and its advantages.

The trade of the Cunning crocodile indicator is similar to that of the trade of the usual Alligator indicator, but it has the following advantages. First, averaging over the algorithm is less delay than behind the fast SMMA used in the classical Alligator. Secondly, the small slope of the slow is also faster achieved than the small slope of the slow SMMA of the normal Alligator. Therefore, the indicator Cunning crocodile more quickly indicates the transition to both trend and flat market conditions than the classic Alligator. Thirdly, the filtering (from random noise) algorithms developed by the author, which are used in the Cunning crocodile indicator, provide greater signal reliability (i.e., they reduce the probability of a false signal) given by this indicator.

Trade with the Cunning crocodile indicator.

If after reaching a single point of intersection of all three curves "the mouth of the crocodile" is widely opened and the slow average acquires a significant slope, then there is a trend. In this case, the position on Buy (Sell) opens when the price is higher (lower) than the fast average and closes when it is below (above) (those. in the "mouth" Cunning crocodile).

If the slow mean is practically horizontal and (that occupies a significant section of the history) all three lines intersect repeatedly (3 to 6 times) at single points, then the price consolidation takes place. At the same time, the length of the subsequent trend is usually proportional to the length of the previous consolidation area, in which the market spends most of the time (70% -80%), which provides additional information for assessing the state of the market, i.e. it allows to judge whether the trend reversal starts or the trend ends. A rough estimate is as follows: if the trend lasted for 25% -40% of the time of the previous consolidation, then, most likely, there will be a trend end; If the trend lasted less than 20% of the time of the previous consolidation, then a rollback.

In the latest (2.0) version of the indicator, all kinds of alerts have been added.

Indicator parameters.

· Price type - Values: Close price, Open price, High price, Low price, Median price ((high + low)/2 – default), Typical price ((high + low + close)/3), Weighted price ((high + low + 2*close)/4).

· The averaging period - Values: Integer. Default is 5.

· The Signal method - Type of trading signal alert. Values: No, Send alert, Print (in expert), Comment (in chart), Sound + Print, Sound + Comment, Sound.

Buy https://www.mql5.com/ru/accounting/buy/market/32028?period=0&source=Site+Profile+Seller&cartId=06f22a00000000007152e365

Aleksey Ivanov

Absolute price https://www.mql5.com/en/market/product/54630

✔️ This indicator is intended for professionals assessing fundamental market trends. This indicator calculates the index of any instrument and analyzes it.

✔️ The indicator has modes for analyzing the indices themselves, namely: Moving Average; Relative Strength Index; Momentum; Commodity Channel Index; Bollinger Bands; Envelopes.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

✔️ This indicator is intended for professionals assessing fundamental market trends. This indicator calculates the index of any instrument and analyzes it.

✔️ The indicator has modes for analyzing the indices themselves, namely: Moving Average; Relative Strength Index; Momentum; Commodity Channel Index; Bollinger Bands; Envelopes.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

TrueChannel FREE https://www.mql5.com/en/market/product/61769

The TrueChannel indicator shows us the true price movement channels. This indicator resembles Donchian Channel in its appearance, but is built on the basis of completely different principles and gives (in comparison with Donchian Channel, which is better just to use to assess volatility) more adequate trading signals.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

TrueChannel FREE https://www.mql5.com/en/market/product/61769

The TrueChannel indicator shows us the true price movement channels. This indicator resembles Donchian Channel in its appearance, but is built on the basis of completely different principles and gives (in comparison with Donchian Channel, which is better just to use to assess volatility) more adequate trading signals.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

StatZigZag https://www.mql5.com/en/market/product/61091

Its indicator that allows you to get real sustainable profits in long-term trading.

✔️The algorithms of this indicator are unique and developed by their author

✔️ The StatZigZag indicator also builds a channel of maximum price fluctuations around the broken regression line, on the lower (red) line of which you can set StopLoss for buy orders, and on the upper (blue) line - StopLoss for sell orders.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

StatZigZag https://www.mql5.com/en/market/product/61091

Its indicator that allows you to get real sustainable profits in long-term trading.

✔️The algorithms of this indicator are unique and developed by their author

✔️ The StatZigZag indicator also builds a channel of maximum price fluctuations around the broken regression line, on the lower (red) line of which you can set StopLoss for buy orders, and on the upper (blue) line - StopLoss for sell orders.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Friends, I am a theoretical physicist and a trader, mathematically rigorously studying market processes, aspects of which I have already begun to present in my articles. https://www.mql5.com/en/articles/10955

https://www.mql5.com/en/articles/11158

https://www.mql5.com/en/articles/12891

Based on a rigorous theory, I have developed indicators with optimal market noise filtering for trading. https://www.mql5.com/en/blogs/post/741637

However, it should be emphasized that a trader (investor) should choose the direction of his positions on the basis of fundamental analysis, and correctly applied indicators of optimal filtering of market noise should be only its auxiliary tool. These indicators are used to determine:

(1) market entry points are determined,

(2) the positions of stop-loss and profit and their order (time and number of points) of movement are determined,

(3) determine the size of the opened lots (calculated through money management built into the work of many indicators presented here).

I emphasize that for today's highly volatile market, these (1-3) statistically calculated parameters of the game are also (like fundamental analysis) key, in the sense that without them it will be generally impossible to get a stable profit.

Subscribe to my channel and you will be aware of my latest developments in the field of trading

https://www.mql5.com/en/channels/statlab

https://www.mql5.com/en/articles/11158

https://www.mql5.com/en/articles/12891

Based on a rigorous theory, I have developed indicators with optimal market noise filtering for trading. https://www.mql5.com/en/blogs/post/741637

However, it should be emphasized that a trader (investor) should choose the direction of his positions on the basis of fundamental analysis, and correctly applied indicators of optimal filtering of market noise should be only its auxiliary tool. These indicators are used to determine:

(1) market entry points are determined,

(2) the positions of stop-loss and profit and their order (time and number of points) of movement are determined,

(3) determine the size of the opened lots (calculated through money management built into the work of many indicators presented here).

I emphasize that for today's highly volatile market, these (1-3) statistically calculated parameters of the game are also (like fundamental analysis) key, in the sense that without them it will be generally impossible to get a stable profit.

Subscribe to my channel and you will be aware of my latest developments in the field of trading

https://www.mql5.com/en/channels/statlab

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Identify Trend FREE https://www.mql5.com/en/market/product/36336

Identify Trend well-known popular indicator with optimal market noise filtering.

✔️The indicator has all kinds of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Identify Trend FREE https://www.mql5.com/en/market/product/36336

Identify Trend well-known popular indicator with optimal market noise filtering.

✔️The indicator has all kinds of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Casual Channel https://www.mql5.com/en/market/product/71806

The trends that you see on the charts are not always trends or, more precisely, trends on which you can make money. The point is that there are two kinds of trends: 1) true trends that are caused by fundamental economic reasons that are stable and, therefore, can provide a reliable profit for the trader; 2) and there are false trend sections that only look like a trend and arise due to chains of random events - moving the price (mainly) in one direction. It is impossible to make money on false trends. («True and illusory currency market trends» https://www.mql5.com/en/blogs/post/740838 )

✔️Casual Channel indicator allows you to distinguish a true trend from a false one.

✔️The indicator has a built-in money management function.

✔️The algorithms of this indicator are unique and developed by their author

The algorithm of this indicator is presented in the article. https://www.mql5.com/en/articles/12891

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Casual Channel https://www.mql5.com/en/market/product/71806

The trends that you see on the charts are not always trends or, more precisely, trends on which you can make money. The point is that there are two kinds of trends: 1) true trends that are caused by fundamental economic reasons that are stable and, therefore, can provide a reliable profit for the trader; 2) and there are false trend sections that only look like a trend and arise due to chains of random events - moving the price (mainly) in one direction. It is impossible to make money on false trends. («True and illusory currency market trends» https://www.mql5.com/en/blogs/post/740838 )

✔️Casual Channel indicator allows you to distinguish a true trend from a false one.

✔️The indicator has a built-in money management function.

✔️The algorithms of this indicator are unique and developed by their author

The algorithm of this indicator is presented in the article. https://www.mql5.com/en/articles/12891

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

The Multicurrency Trend Detector https://www.mql5.com/en/market/product/56194

Multicurrency Trend Detector indicator allows you to immediately and on one chart on a selected time interval (extending from a zero bar to a bar set in the settings by the value horizon) determine the presence, direction and strength of trends in all major currencies, as well as assess the reliability of these trends.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Multicurrency Trend Detector indicator allows you to immediately and on one chart on a selected time interval (extending from a zero bar to a bar set in the settings by the value horizon) determine the presence, direction and strength of trends in all major currencies, as well as assess the reliability of these trends.

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Friends! The foreign exchange market in our time is an absolute chaos. If you play on the foreign exchange market, then you should treat it exactly like a game, i.e. it is the same as playing in a casino. Don't expect this game to be your main source of income. These are false hopes. Therefore, play for extra money. In no case do not play with borrowed money from someone (banks, friends, etc.). This will lead to disaster.

There is a little more order in the stock market than in the foreign exchange market. Here you can rely on fundamental data on the economic condition (financial statements, etc.) of the companies that issue the respective shares. But here, in our time, when the global crisis is approaching, the data provided by even reputable experts can be unreliable. However, the indicators I provide are better applied to the stock market, which is more orderly.

Modern profitable indicators https://www.mql5.com/en/blogs/post/741637

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

There is a little more order in the stock market than in the foreign exchange market. Here you can rely on fundamental data on the economic condition (financial statements, etc.) of the companies that issue the respective shares. But here, in our time, when the global crisis is approaching, the data provided by even reputable experts can be unreliable. However, the indicators I provide are better applied to the stock market, which is more orderly.

Modern profitable indicators https://www.mql5.com/en/blogs/post/741637

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Profit Trade https://www.mql5.com/en/market/product/49806

Profit Trade is a deep development of the well-known Donchian channel indicator.

✔️ The indicator demonstrates the current state of the market in a clear and covering all characteristic price scales.

✔️The filtration used in Profit Trade is extremely robust; and this indicator does not redraw.

✔️The indicator settings are extremely simple.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Profit Trade https://www.mql5.com/en/market/product/49806

Profit Trade is a deep development of the well-known Donchian channel indicator.

✔️ The indicator demonstrates the current state of the market in a clear and covering all characteristic price scales.

✔️The filtration used in Profit Trade is extremely robust; and this indicator does not redraw.

✔️The indicator settings are extremely simple.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Aleksey Ivanov

Dear friends! The indicator's performance is presented on the latest data. Evaluate his work.

Identify Market State https://www.mql5.com/en/market/product/46028

The Identify Market State indicator allows you to set the beginning of a new trends and pullbacks on an existing trend. This indicator can be used both for trading on scalper strategies and for long-term trading strategies.

✔️ The indicator does not redraw.

✔️The indicator has all types of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

Identify Market State https://www.mql5.com/en/market/product/46028

The Identify Market State indicator allows you to set the beginning of a new trends and pullbacks on an existing trend. This indicator can be used both for trading on scalper strategies and for long-term trading strategies.

✔️ The indicator does not redraw.

✔️The indicator has all types of alerts.

✔️The algorithms of this indicator are unique and developed by their author

Author Aleksey Ivanov https://www.mql5.com/en/users/60000382

: