Infleizmente, "RobotInNasdaq2" está indisponível

Você pode conferir outros produtos de Omega J Msigwa:

Linear regression AI powered Indicator: Linear regression is a simple yet effective AI technique that is the foundation of complex neural networks, This indicator is built based on linear regression analysis and tries to make predictions on the upcoming event in the market Inputs : train_bars: This controls the number of bars that the price information will be collected and used to train the AI inside it, The greater this value the better also the slower the indicator becomes during initializati

Optimus PrimeX: Elevando Sua Experiência de Trading na NASDAQ! Desperte o poder do Optimus PrimeX, um sofisticado robô de trading para a NASDAQ meticulosamente projetado para navegar pelo dinâmico mundo dos mercados financeiros. Construído com base em uma estratégia de seguimento de tendências e impregnado de Inteligência Artificial, este consultor especializado foi desenvolvido para aproveitar a natureza de alta a longo prazo do índice NASDAQ. Análise Estratégica em Vários Prazos O Optimus Prim

Matrix is the foundation of complex trading algorithms as it helps you perform complex calculations effortlessly and without the need for too much computation power, It's no doubt that matrix has made possible many of the calculations in modern computers as we all know that bits of information are stored in array forms in our computer memory RAM, Using some of the functions in this library I was able to create machine learning robots that could take on a large number of inputs To use this libra

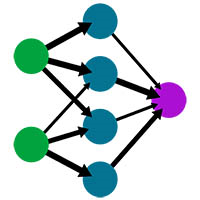

This is standard library built for flexible neural Networks with performance in mind. Calling this Library is so simple and takes few lines of code:

matrix Matrix = matrix_utils.ReadCsv( "Nasdaq analysis.csv" ); matrix x_train, x_test; vector y_train, y_test; matrix_utils.TrainTestSplitMatrices(Matrix,x_train,y_train,x_test,y_test, 0.7 , 42 ); reg_nets = new CRegressorNets(x_train,y_train,AF_RELU_,HL, NORM_MIN_MAX_SCALER); //INitializing network reg_nets.RegressorN

Probability-Based Indicator This indicator analyses price movements of a given period to obtain crucial information for probability distribution analysis such as their mean and standard deviation, Once it has such piece of information it does all the necessary calculations and finally calculates the probability that the current market value will go above or below the given period bars. Since this indicator effectively leverages the power of probability which doesn't lie, It is a powerful indicat