Supply Demand Brake Out

- Experts

- Domantas Juodenis

- Versão: 2.7

- Ativações: 10

Automated Supply & Demand Zone Trading System with Advanced Risk Management and False Breakout Protection

WHAT IS THIS EA?

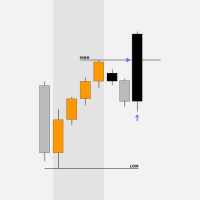

The Supply Demand Breakout EA is a fully automated trading robot that identifies and trades high-probability supply and demand zones using institutional trading concepts. It combines CHoCH (Change of Character) and BOS (Break of Structure) detection with intelligent risk management and a professional real-time dashboard.

Perfect for traders who want to automate supply/demand trading without spending hours watching charts!

KEY FEATURES

Professional Dashboard

- Real-time statistics - Win rate, profit/loss, total trades

- Live account metrics - Balance, equity, free margin

- Zone status indicators - Active supply/demand zones highlighted

- Signal alerts - BUY READY, SELL READY, IN POSITION status

- Fully customizable - Colors, position, compact mode

4 Advanced Risk Management Modes

- Risk % of Balance - Risk fixed percentage per trade (recommended)

- Risk % of Equity - Dynamic risk based on current equity

- Fixed Lot Size - Trade constant volume

- Fixed Money Amount - Risk specific dollar amount

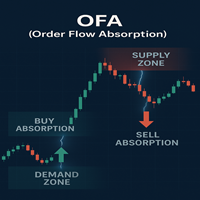

False Breakout Protection

- Auto-close on reversal - Exits losing trades early

- Configurable distance - Set your comfort level (default: 10 pips)

- Saves your capital - Prevents getting stuck in fake breakouts

Smart Trading Logic

- Automatic zone identification - Finds supply/demand zones

- CHoCH detection - Identifies trend reversals

- Liquidity sweep confirmation - Catches institutional moves

- Momentum filters - Only takes high-probability setups

- Dynamic SL/TP - Adapts to market conditions

Volume Protection System

- Maximum lot size limiter - Prevents broker rejections

- Volume validation - Checks all broker requirements

- Margin calculator - Ensures sufficient funds

- Smart position sizing - Never exceeds safe limits

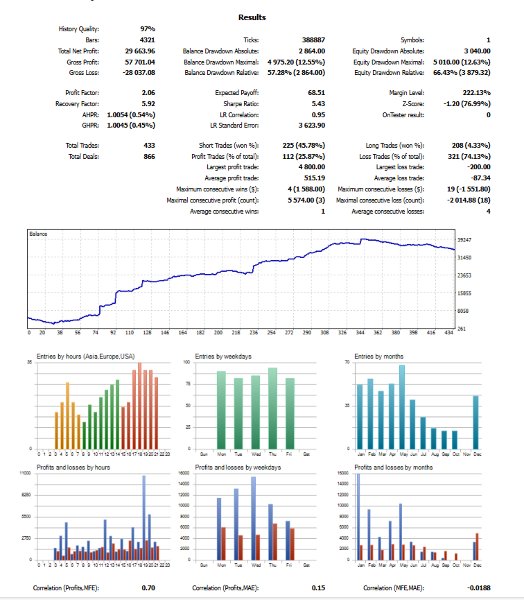

TESTED & PROVEN

Forex Majors - EUR/USD, GBP/USD, USD/JPY, AUD/USD Forex Crosses - EUR/GBP, GBP/JPY, AUD/NZD Precious Metals - XAU/USD (Gold), XAG/USD (Silver) Indices - US30, NAS100, SPX500 Stocks - Major stocks with sufficient liquidity

Optimal Timeframes: M5, M15, M30, H1 Strategy Tester Verified: 400+ trades tested across multiple instruments

QUICK START (3 STEPS)

Step 1: Install

Drag EA onto your chart → Allow AutoTrading → Done!

Step 2: Configure

- Set Risk Management Type to "Balance %"

- Set Risk Percent to 0.5-1.0%

- Set Max Lot Size to 1.0-2.0 lots

- Enable Auto Close on False Breakout

Step 3: Trade

The EA automatically:

- Identifies supply/demand zones

- Waits for confirmation signals

- Opens trades with proper risk

- Manages positions to profit/stop loss

- Closes early on false breakouts

INPUT PARAMETERS

Strategy Settings

CHoCH Detection Period: 20 bars BOS Detection Period: 20 bars Supply/Demand Bars: 50 bars (lookback period)

Risk Management

Risk Management Type: Balance % / Equity % / Fixed Lot / Fixed Money Risk Percent: 1.0% (adjustable 0.1-5.0%) Fixed Lot Size: 0.01 (if using fixed mode) Fixed Money Amount: 100 (if using fixed money) Maximum Lot Size: 0 (0=broker max, or set custom limit) Auto Close on False Breakout: true/false Auto Close Distance: 10 pips

Entry Filters

Use Bearish Confirmation: true (requires confirmation candle) Use Momentum: true (confirms directional strength) Check Liquidity: true (detects stop hunts)

Trade Management

Use Fixed SL: false (dynamic SL recommended) Fixed Stop Loss: 500 points Use Fixed TP: false (uses risk-reward ratio) Fixed Take Profit: 1000 points Risk:Reward Ratio: 2.0 (default 1:2)

Dashboard Settings

Show Dashboard: true/false Dashboard Position: X/Y coordinates Colors: Fully customizable Zone Transparency: 0-100% Compact Mode: true/false

RECOMMENDED SETTINGS BY INSTRUMENT

Forex Majors (EUR/USD, GBP/USD)

- Timeframe: M15, M30, H1

- Risk: 0.5-1.0% per trade

- Max Lot: 2.0 lots

- Auto Close: 10-15 pips

Gold (XAU/USD)

- Timeframe: M5, M15, M30

- Risk: 0.5-0.75% per trade

- Max Lot: 1.0 lot

- Auto Close: 20-30 pips

Indices (US30, NAS100)

- Timeframe: M15, M30, H1

- Risk: 0.5-1.0% per trade

- Max Lot: Per broker specifications

- Auto Close: 10-50 points (index-specific)

Stocks

- Timeframe: M15, M30, H1

- Risk: 0.5-1.0% per trade

- Max Lot: As per broker

- Auto Close: Based on stock volatility

HOW IT WORKS

1. Zone Identification

The EA scans the last 50 bars to identify:

- Supply Zones - Areas where price reversed downward

- Demand Zones - Areas where price reversed upward

- Uses swing highs/lows and CHoCH patterns

2. Entry Confirmation

When price enters a zone, the EA checks:

- Confirmation candle (bearish for sell, bullish for buy)

- Momentum in correct direction

- Liquidity build-up (stop hunt detection)

- All filters must pass for entry

3. Trade Execution

- Calculates position size based on risk settings

- Validates lot size against broker limits

- Checks available margin

- Places market order with SL/TP

- Monitors for false breakout

4. Trade Management

- Normal Exit: Hit stop loss or take profit

- Early Exit: Auto-close if price reverses (false breakout)

- Statistics: All trades tracked in dashboard

- Zone Reset: Zones update after each candle

WHO IS THIS EA FOR?

Traders who understand supply/demand concepts Busy professionals wanting automation Day traders on 5M-1H timeframes Multi-instrument traders (forex, gold, stocks) Risk-conscious traders needing position sizing Anyone wanting professional trade tracking

IMPORTANT INFORMATION

Requirements

- Platform: MetaTrader 5 (build 3800 or higher)

- Account Type: Netting accounts (standard MT5)

- Broker: Low spread, fast execution, no restrictions

- VPS: Recommended for 24/7 operation

- Capital: Minimum $500 for proper risk management

Best Practices

Start with 0.5% risk per trade Test on demo for 1-2 weeks first Use on tested timeframes (M5-H1) Set reasonable max lot size Enable false breakout protection Monitor first few trades manually Keep EA running 24/7 for best results

Not Suitable For

Scalping (too short timeframe) Long-term investing (too long timeframe) Ranging markets (needs trending conditions) High spread brokers (reduces profitability) Accounts under $100 (insufficient capital)

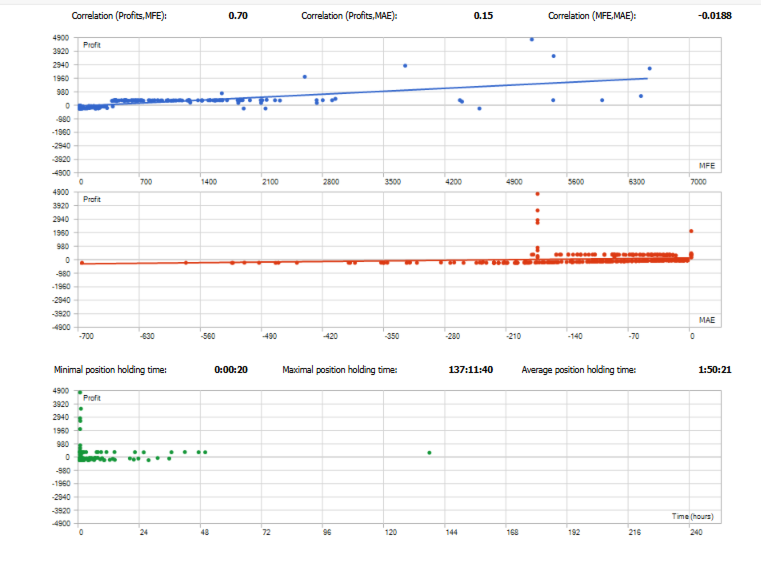

PERFORMANCE EXPECTATIONS

Realistic Metrics

- Win Rate: 45-55% (quality over quantity)

- Risk:Reward: 1:2 default (adjustable)

- Trades per Day: 1-5 depending on timeframe

- Max Drawdown: 10-20% with 1% risk

- Recovery Speed: Fast due to high R:R ratio

What Makes This EA Different?

False breakout protection - Most EAs don't have this 4 risk management modes - Flexibility for all traders Professional dashboard - Know exactly what's happening Volume limit protection - Never get "rejected" errors Multi-instrument tested - Forex, gold, stocks verified Clean professional code - No random entry logic

RISK WARNING

Trading involves substantial risk and may not be suitable for all investors.

Past performance is not indicative of future results. This EA is a trading tool, not a guaranteed profit system. Always:

- Use proper risk management (max 2% per trade)

- Test thoroughly on demo first

- Never risk money you cannot afford to lose

- Monitor EA performance regularly

- Understand the trading strategy before using

- Use reputable brokers with good conditions

The seller provides the EA "as is" without guarantees of profitability.

FREQUENTLY ASKED QUESTIONS

Q: Does this work on MT4? A: No, this is MT5 only. MT4 version not available.

Q: What's the minimum deposit? A: $500 minimum recommended for proper risk management with 0.5-1% risk.

Q: Does it work on all brokers? A: Yes, but works best with low-spread brokers offering fast execution.

Q: Can I use it on multiple pairs simultaneously? A: Yes! Run separate instances on different charts. Ensure sufficient margin.

Q: Will it work on H4 or Daily timeframes? A: Not recommended. Tested and optimized for M5-H1 timeframes only.

Q: What happens during news events? A: EA trades normally. Consider disabling during major news if desired.

Q: Does it use martingale or grid strategies? A: No! It uses proper risk management with dynamic position sizing.

Q: Can I modify the source code? A: Depends on license type. Contact seller for details.

Q: What if I get "Volume limit reached" error? A: Set the "Max Lot Size" parameter to limit position size (e.g., 1.0-2.0 lots).

Q: Is there a money-back guarantee? A: Follow MQL5 Market refund policy. Test thoroughly on demo first.

WHAT'S INCLUDED

Supply_Demand_Breakout.ex5 - Compiled EA file Complete user manual - Setup and configuration guide Recommended settings - For different instruments Strategy explanation - Understand the logic Risk management guide - Protect your capital Video tutorial (if available) - Visual walkthrough

SUPPORT & UPDATES

- Free lifetime updates - Bug fixes and improvements

- Email support - Questions answered within 24-48 hours

- Active development - Regular enhancements

- User feedback - Considered for future versions

Current Version: 2.07 (Latest) Last Updated: 2024 Language: English (interface and documentation)

WHY CHOOSE THIS EA?

Compared to Other EAs:

Transparent strategy - Clear supply/demand logic, no black box Risk protection - Multiple safeguards against losses Visual feedback - Professional dashboard shows everything Tested thoroughly - 400+ strategy tester trades verified Clean execution - No hedging, martingale, or dangerous tactics Educational - Learn supply/demand while it trad

Our Commitment:

- Quality code - Professional MQL5 programming

- Honest marketing - Realistic expectations, no hype

- Customer support - We're here to help you succeed

- Continuous improvement - Regular updates based on feedback

SPECIAL OFFER

Limited Time: Get started today and receive:

- Exclusive setup guide for your broker

- Recommended settings PDF

- Priority email support for 30 days

- Free updates for life

CONTACT & SUPPORT

For questions, support, or custom modifications:

- Message through MQL5 Market

- Response time: 24-48 hours

- Languages: English

FINAL THOUGHTS

The Supply Demand Breakout EA is designed for serious traders who want to automate a proven strategy with professional risk management. It's not a "get rich quick" system – it's a sophisticated tool for disciplined trading.

Best suited for:

- Traders who understand technical analysis

- Those wanting to automate their manual strategy

- Professionals needing consistent execution

- Multi-instrument traders seeking efficiency

Start your automated supply/demand trading journey today!

Trading forex, gold, stocks, and indices carries a high level of risk. Only trade with money you can afford to lose. Past performance is not indicative of future results.