Gecko

- Experts

- Profalgo Limited

- 버전: 1.2

- 업데이트됨: 6 7월 2020

- 활성화: 10

NEW PROMO:

- Only a few copies copies available at 349$

- Next price: 449$

Gecko runs a simple, yet very effective, proven strategy. It looks for important recent high and lows and will trade the breakouts.

The actual execution of this strategy however, is what makes this EA truly shine. Entry calculations and exit algorithms are not only unique but also very advanced.

LIVE RESULTS:

The EA uses many trade management techniques, including but not limited to:

- a Trailing SL, using multipe parameters to control its function

- "Move to Break-even" at certain point, with the possibility to add extra pips to the point of breakeven

- Trailing SL based on recent highs/lows, including an option to run this only until breakeven level (to provide more room for full TP to be reached)

- Trailing SL based on trade duration, to limit exposure after the move has run out of momentum

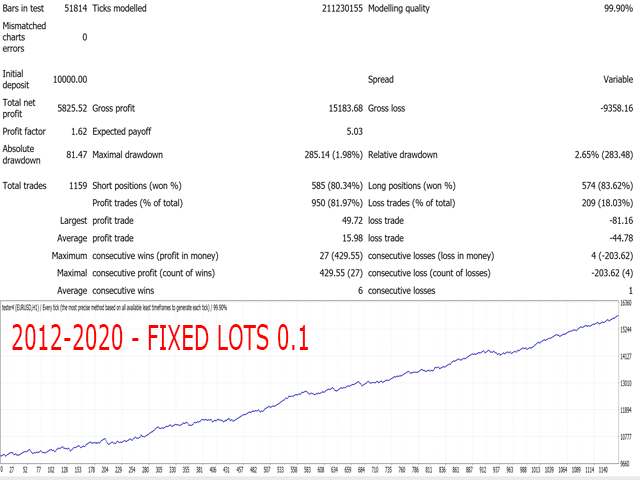

This is NOT a scalper EA, and it does not use any grid/martingale or other risky techniques. It uses very strict Stoploss, at safe distance.

There are many risk management option, including setting a certain risk per trade.

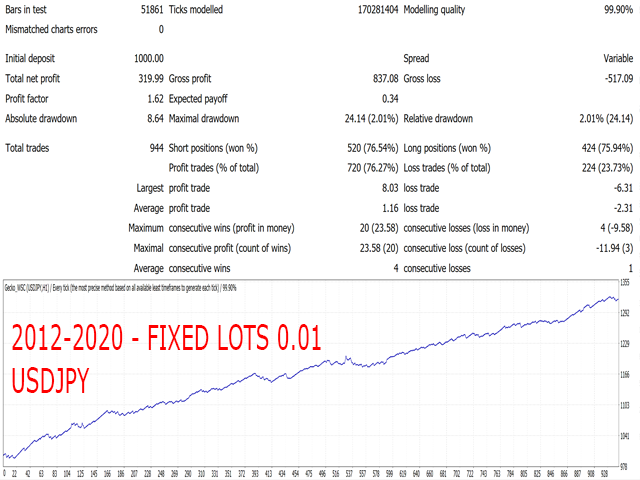

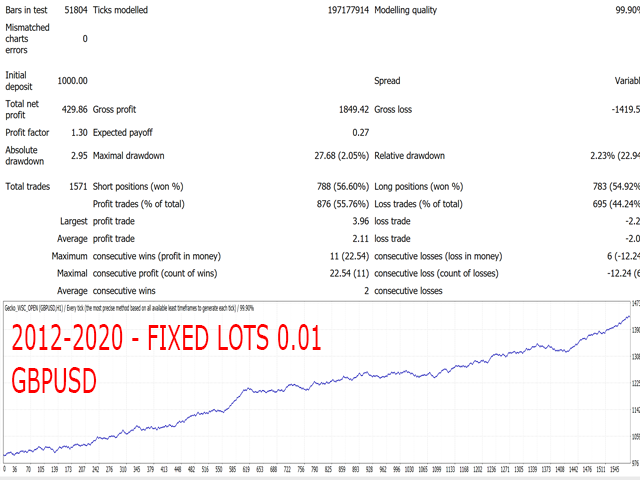

The EA is developed mainly for EURUSD, since it is the most succesful pair for running breakout strategies. However, backtests shows promising results on multiple pairs already, without any optimization for those pairs.

Recommended VPS: 4xhosting.com

Recommended timeframe is H1.

Minimum accountbalance: 100$

Default parameters are for EURUSD H1. There are sets available also for GBPUSD,USDJPY and AUDUSD available. Download all presets here

Key features:

- Safe trading: every trade is protected by a Stoploss

- EA is not sensitive to spread or slippage

- No risk of over-optimization, since no optimization process has been done

- No dangerous money management techniques used like grid or martingale

- High correlation between live trades and backtest trades

- Very high hitrate (>80% of trades are profitable)

- Stress Tested with 99.90% tickdata using variable spread and slippage simulation

Parameters:

- EA's individual settings, like Magicnumber, Trade_comment, infopanel activation

- Lotsize settings: here you can determine how the EA will set the lotsize. Based on balance (Lots Per Balance), or based on risk per trade for example

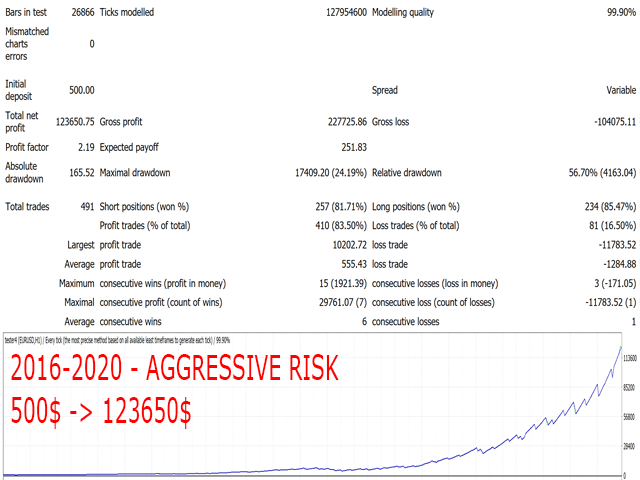

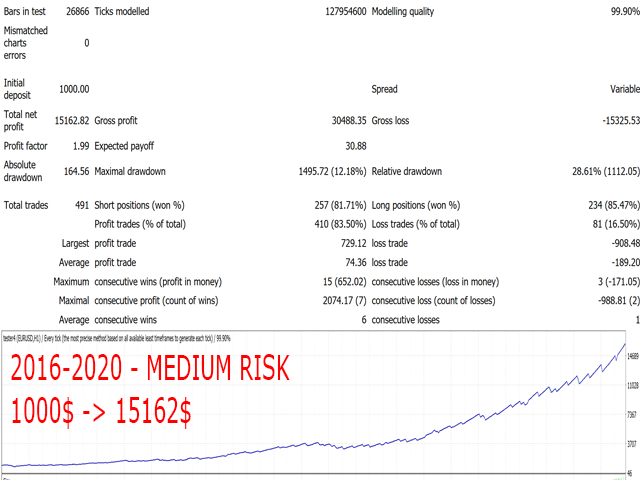

- For LOW RISK, use Lots Per Balance= 200 or bigger. For MEDIUM RISK, use Lots Per Balance=100. For AGGRESSIVE RISK, use Lots Per Balance = 50

- Maximum allowed spread can be set

- The option for Virtual SL is available for those who don't want the broker to know the SL location

- Entry parameters: these include (currencly) 3 entry models, entry timing, and various parameters to determine the entry's strictness

- Stoploss and Takeprofit can be set

- TrailingSL can be set, including where to start, stop, size of the TrailSL, and when modify

- Breakeven settings, with a start parameter, and a parameter for adding extra pips

- High/Low trailingSL can be activated, including option to stop at breakeven

- Time based TrailingSL, which will be activated after X minutes

Reminder: As with every trading system, always remember that forex trading can be risky. Don't trade with money that you can not afford to lose. It is always best to test EA's first on demo accounts, or live accounts running low lotsize. You can always increase risk later!

support from Wim is outstanding - every question answered fast, very fast... I received free EA as promised with as many demo accounts linked as I wanted.... after one week Gecko is on the plus side but it's a small one - I will write / review more in two months time - that is a promise... whether it will be positive or negative we will see :) update - 29.09.2020 - 2 months - demo - more profit than loss after 2 months I decided to try live Gecko together with Wim's Advanced Scalper (on one account) effect: total return - 4,9% peak drawdown -4,2% trade win - 74,3% trades per day - 2.5 most trades were made on EURUSD (52,9%), then GPBUSD (28,6%) and least on USDJPY 18,6% (it was worst pair - but even this was on plus side (profit) - even with only 69% win rate, while EURUSD was 86% win rate So - personally I'm pleased...