Zaimi Yazid / プロファイル

- 情報

|

10+ 年

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

Zaimi Yazid

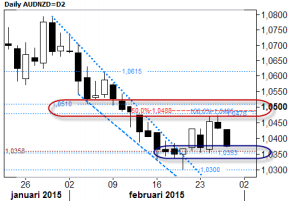

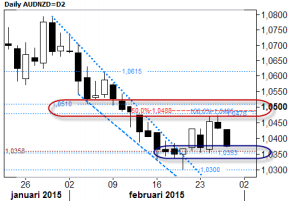

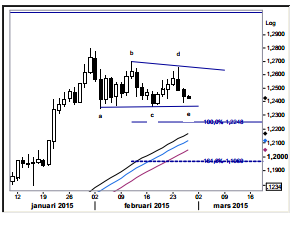

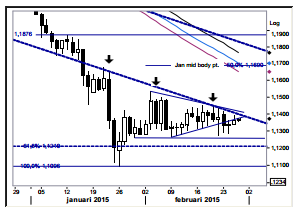

AUDNZD: Correctional peak likely in place. The favored 1.0490\10 correctional objective was missed with a tiny margin before selling resumed and knocked the cross back lower. So a correctional high is most likely in place, a sub-1.0350 drop is all that is needed to confirm this – and then with a fresh low (<1.0300) at hand. Current intraday stretches are located at 1.0365 & 1.0470 (but this cross has a nasty habit of hugging one or the other and only post minor rejections on the way down (or up)).

Zaimi Yazid

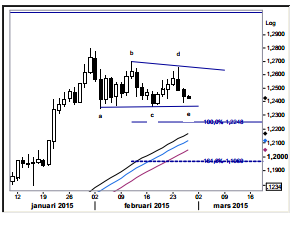

USDCAD: Triangle - make or break? If the past month’s consolidation is a bullish triangle, which has been and still is our working assumption, then the market should/must step up to the plate and start buying the pair ahead of the c-wave low, 1.2360, or an alternate wave count must be implemented (opening up for 1.2248). The best fitted pattern will be a drop below 1.2395 and then turning higher (without having violated 1.2360).

Zaimi Yazid

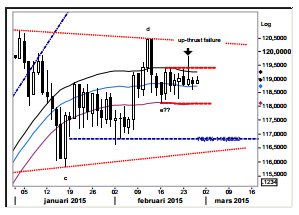

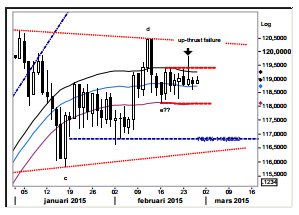

USDJPY: Still looking for lower prices. The false upside break, the up-thrust top still calls for the market to try lower levels. The very slow recovery from yesterday’s low point, 118.62, also indicates that the market should be vulnerable to renewed selling. So if our assumption is right selling should resume basically here and now calling for next a move down to 118.30 and/or 118.10.

Zaimi Yazid

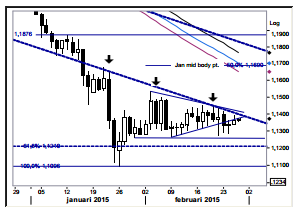

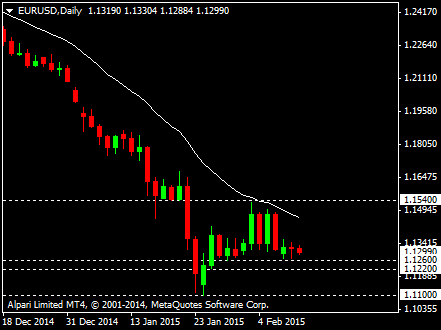

EURUSD: Quo vadis? Since a few days the market is established below the lower boundary of the triangle but annoyingly without downside follow through. So far bids below 1.13 have repeatedly (see the downside spikes) been preventing the market from breaking below the 1.1262 key support (and barrier to a new trend low). To get any directional input the market must at least move above 1.1450 or fall below 1.1262.

Zaimi Yazid

The following are latest short-term (mostly intraday) trading strategies for EURUSD, GBPUSD, and USDCAD.

EURUSD: The buying interest below 1.1300 seems powerful and with sellers lined up around 1.1500, the recent range should remain intact. Stay flexible and fade 50-60pip moves in either direction with stops at 1.1240-1.1460.

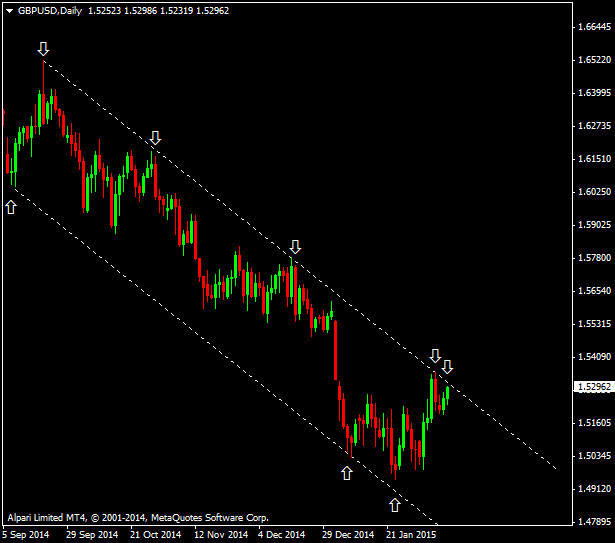

GBPUSD: Cable just traded through 1.5500 for the first time this year. Expect the pair to trade in a 1.56-1.58 range soon. Buy cable on dips to yesterday's high, with a stop below 1.5450.

USDCAD: sharply retraced on combination of a dovish Yellen and BoC's Poloz stressing on the downside risk insurance provided by last meeting's surprise rate cut. Go long towards the lower end of the current range, buying on dips to 1.24-1.2310 with stops below 1.2250.

EURUSD: The buying interest below 1.1300 seems powerful and with sellers lined up around 1.1500, the recent range should remain intact. Stay flexible and fade 50-60pip moves in either direction with stops at 1.1240-1.1460.

GBPUSD: Cable just traded through 1.5500 for the first time this year. Expect the pair to trade in a 1.56-1.58 range soon. Buy cable on dips to yesterday's high, with a stop below 1.5450.

USDCAD: sharply retraced on combination of a dovish Yellen and BoC's Poloz stressing on the downside risk insurance provided by last meeting's surprise rate cut. Go long towards the lower end of the current range, buying on dips to 1.24-1.2310 with stops below 1.2250.

Zaimi Yazid

1.Trading is not a get rich quick scheme; it is a normal investment that gets you return on capital.

Did you ever hear of a trader making 100% percent return per month on a consistent basis? If you did, did you see a proof of that?

Trading professionally with proper money management would likely get you a return of few percents a month, from my personal experience a 3-5% return on capital per month is a very realistic number, and could be the ultimate target for any successful trader...

So if you’re that kind of person who wants to “make a killing” trading please reconsider your expectations.

2. You should be well-capitalized. Small accounts will probably burn you.

This point is really correlated to the first one, let me illustrate by an example:

Suppose that you have a 30k trading account, according to the 3-5 percent return per month rule; that would give you 1000-$1500 return per month, which is relatively a very good number.

Now let’s assume that you have a 5k account, according to the 3-5 percent return per month rule, which would return 150-$250 per month.

In the 5k case, the return would likely be not-satisfying for someone looking to trade for living and for a consistent income. Would it be for you?

Wouldn't you take more risk to increase that return, and break your money management rules to make better return? I think you would.. It's a complete psychological game...

3.Technical Analysis doesn’t work all the time, assumption we make will always have a percentage of failure. The main goal is to keep you risk limited, and your targets bigger than your risk to make consistent profit on the long run.

4.Trading is not about forecasting the market, do not try to be smart and always forecast where markets are headed. What a trader does is, wait for the market to GIVE him certain conditions that validates a trade. (Don’t trade under the market rules, trade under your rules). Do you feel sometimes that your lost and don’t know what to do ? its probably because of this, This is very important, and the avoids you from getting lost in the process..

5. If you did use stop loss on your trades within the past year, but you didn't and took excessive risk only on one trade, this single trade might wipe out all of the profits you gained through the year.

How many times, did you ignore your stop loss convincing your self that you will close at better price, and guess what it may have worked sometimes, but what if the price goes against you more and more, would you mentally strong and able to close at a bigger loss? Or you probably won’t, and end up with a margin call.

6. Don’t over analyze, over analysis and complicating your tools will lead to confusion and not necessarily efficient.

7. Ignore your bias, trades require technical evidence 3,4 or 5 conditions that occur at the same time making you enter a trade.

8. Always use a top to down analysis approach, from the higher time frame to the lower time frame, because the higher the time frame the more strong and invulnerable the trend is, and the more strong and invulnerable the support and resistance levels are.

9. Trading setups that occur within the context of the trend usually turn more profitable than those against the trend.

10. Don’t give up when you encounter a losing streak, yeah it can go up to 10 losing trades… don’t worry it’s normal in trading.

Hope you found it useful and enjoyable... If you have points that you would add to this, I would be happy to hear them, please comment and discuss..

Did you ever hear of a trader making 100% percent return per month on a consistent basis? If you did, did you see a proof of that?

Trading professionally with proper money management would likely get you a return of few percents a month, from my personal experience a 3-5% return on capital per month is a very realistic number, and could be the ultimate target for any successful trader...

So if you’re that kind of person who wants to “make a killing” trading please reconsider your expectations.

2. You should be well-capitalized. Small accounts will probably burn you.

This point is really correlated to the first one, let me illustrate by an example:

Suppose that you have a 30k trading account, according to the 3-5 percent return per month rule; that would give you 1000-$1500 return per month, which is relatively a very good number.

Now let’s assume that you have a 5k account, according to the 3-5 percent return per month rule, which would return 150-$250 per month.

In the 5k case, the return would likely be not-satisfying for someone looking to trade for living and for a consistent income. Would it be for you?

Wouldn't you take more risk to increase that return, and break your money management rules to make better return? I think you would.. It's a complete psychological game...

3.Technical Analysis doesn’t work all the time, assumption we make will always have a percentage of failure. The main goal is to keep you risk limited, and your targets bigger than your risk to make consistent profit on the long run.

4.Trading is not about forecasting the market, do not try to be smart and always forecast where markets are headed. What a trader does is, wait for the market to GIVE him certain conditions that validates a trade. (Don’t trade under the market rules, trade under your rules). Do you feel sometimes that your lost and don’t know what to do ? its probably because of this, This is very important, and the avoids you from getting lost in the process..

5. If you did use stop loss on your trades within the past year, but you didn't and took excessive risk only on one trade, this single trade might wipe out all of the profits you gained through the year.

How many times, did you ignore your stop loss convincing your self that you will close at better price, and guess what it may have worked sometimes, but what if the price goes against you more and more, would you mentally strong and able to close at a bigger loss? Or you probably won’t, and end up with a margin call.

6. Don’t over analyze, over analysis and complicating your tools will lead to confusion and not necessarily efficient.

7. Ignore your bias, trades require technical evidence 3,4 or 5 conditions that occur at the same time making you enter a trade.

8. Always use a top to down analysis approach, from the higher time frame to the lower time frame, because the higher the time frame the more strong and invulnerable the trend is, and the more strong and invulnerable the support and resistance levels are.

9. Trading setups that occur within the context of the trend usually turn more profitable than those against the trend.

10. Don’t give up when you encounter a losing streak, yeah it can go up to 10 losing trades… don’t worry it’s normal in trading.

Hope you found it useful and enjoyable... If you have points that you would add to this, I would be happy to hear them, please comment and discuss..

Zaimi Yazid

How to minimize a risk which we cannot avoid at all?

-must have a stop loss.

-move a stop loss/break even once trade going in our direction.

-entering a trade in support/resistance & supply/demand zone.

-entering a trade if have many confluences.

any else?

-must have a stop loss.

-move a stop loss/break even once trade going in our direction.

-entering a trade in support/resistance & supply/demand zone.

-entering a trade if have many confluences.

any else?

Zaimi Yazid

EURUSD - From an Elliott wave perspective its plausible (not certain however) that a low could already be in place. A break below 1.1237-1.10 is necessary to suggest that the market still has one more leg to the downside. -Bloomberg

Zaimi Yazid

GBPUSD - a break below 1.5376 looks imminent and ultimately should open downside risks to ~1.50-1.4952 (lows from late-Jan./early Feb.) -Bloomberg

Zaimi Yazid

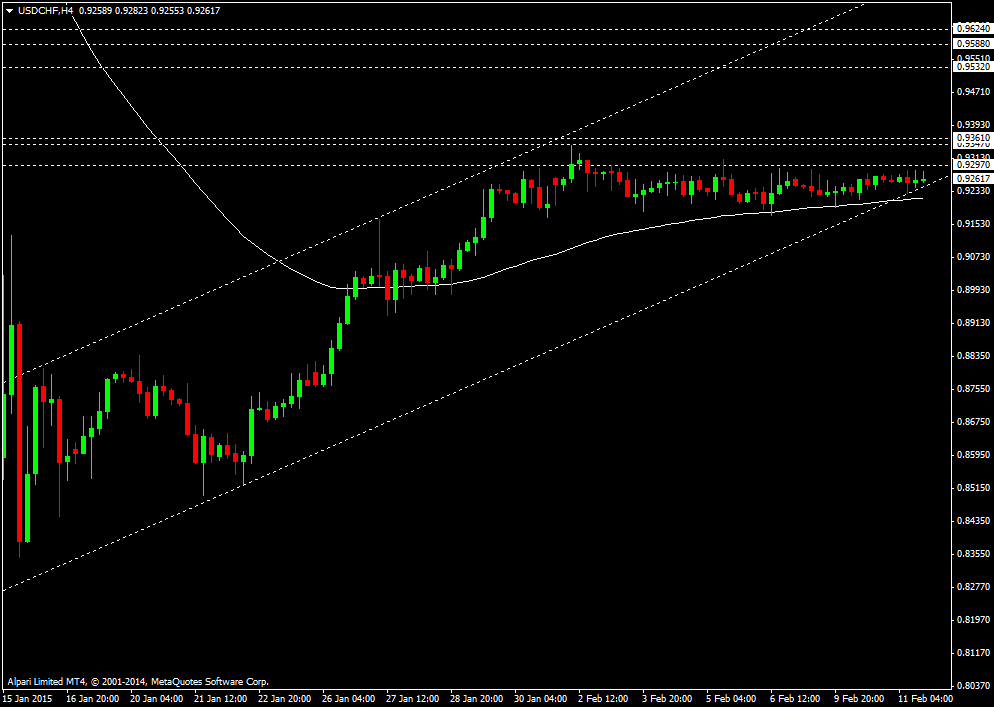

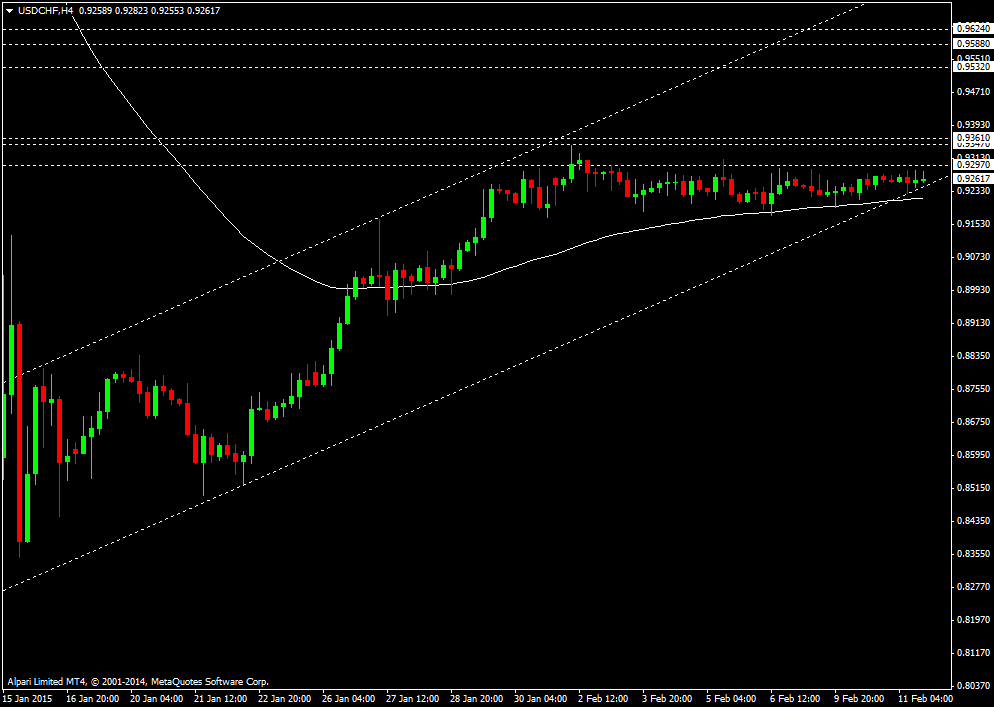

usdchf consolidates its gains as it continues to hold in a high level range.

resistance shows at 0.9297 initially, with a break higher needed to see scope for 0.9347/0.9361 and then 0.9532. above can then see scope for the 55-day average and 78.6% retracement resistance at 0.9588/0.9624 which would expected to find a cap.

resistance shows at 0.9297 initially, with a break higher needed to see scope for 0.9347/0.9361 and then 0.9532. above can then see scope for the 55-day average and 78.6% retracement resistance at 0.9588/0.9624 which would expected to find a cap.

Zaimi Yazid

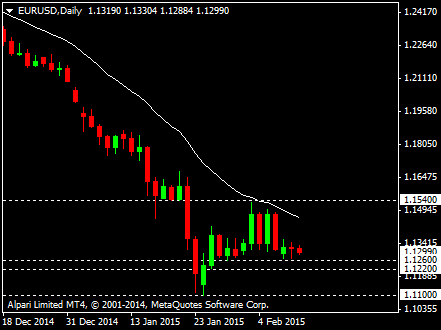

eurusd was unable to extend its rally above the falling 21- day average at 1.154 and has staged a turn lower.

support shows at 1.126 at first, followed by 1.122 and then the cycle low at 1.11. below here is needed to signal a resumption of the core bear trend towards our medium-term bear target at 1.0836/1.0765 – price and 50% retracement of the 1985/2008 bull trend.

support shows at 1.126 at first, followed by 1.122 and then the cycle low at 1.11. below here is needed to signal a resumption of the core bear trend towards our medium-term bear target at 1.0836/1.0765 – price and 50% retracement of the 1985/2008 bull trend.

: