Evgeniy Piskachev / プロファイル

- 情報

|

11+ 年

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

In the forex market for over 5 years . In trade used technical analysis indicators , as well as economic and political news. If you are interested in more conservative and lucrative trade might trust.

Evgeniy Piskachev

ソーシャルネットワーク上でシェアする · 22

すべてのコメントを示す (8)

Matthew Todorovski

2014.09.30

Haha!

Stefania Conti

2014.09.30

:-D :-D

Imtiaz Ahmed

2014.10.01

is this mr. draghi??

Evgeniy Piskachev

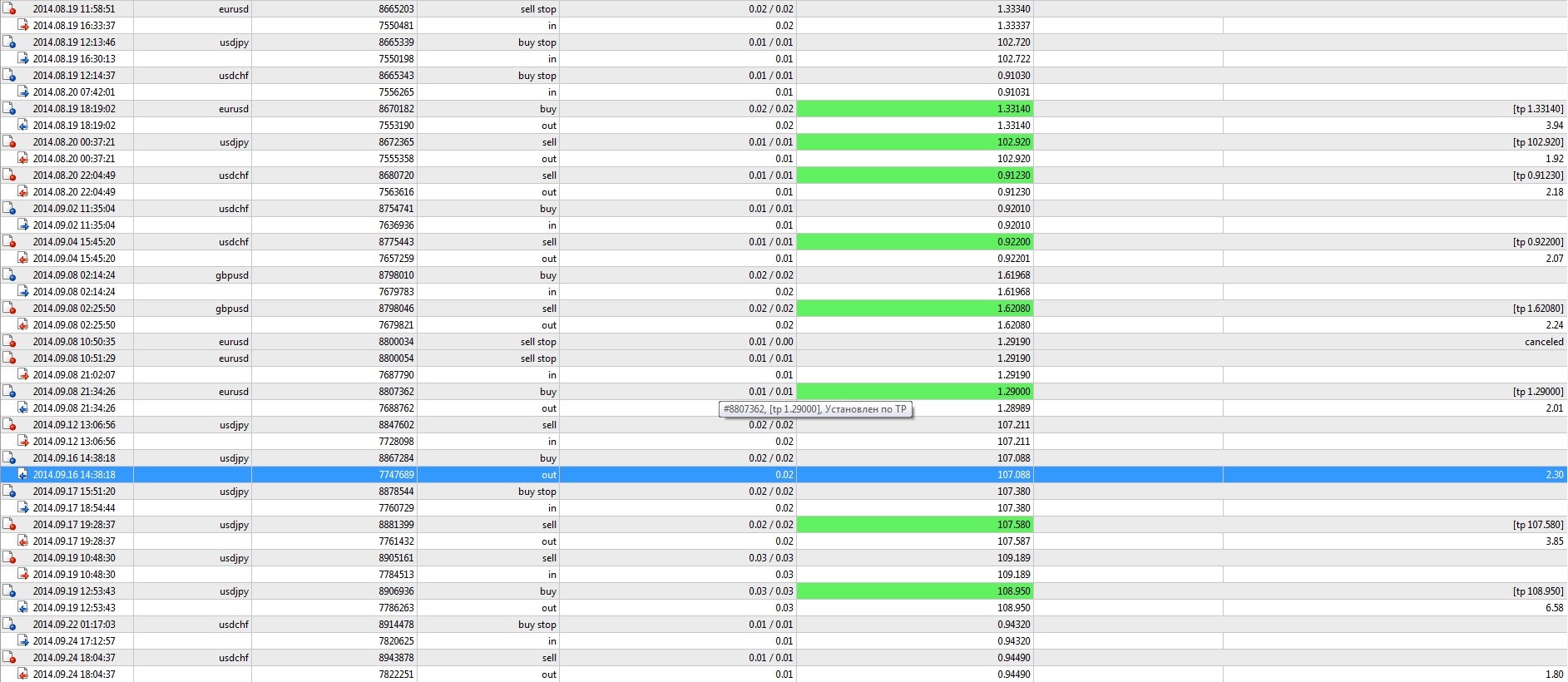

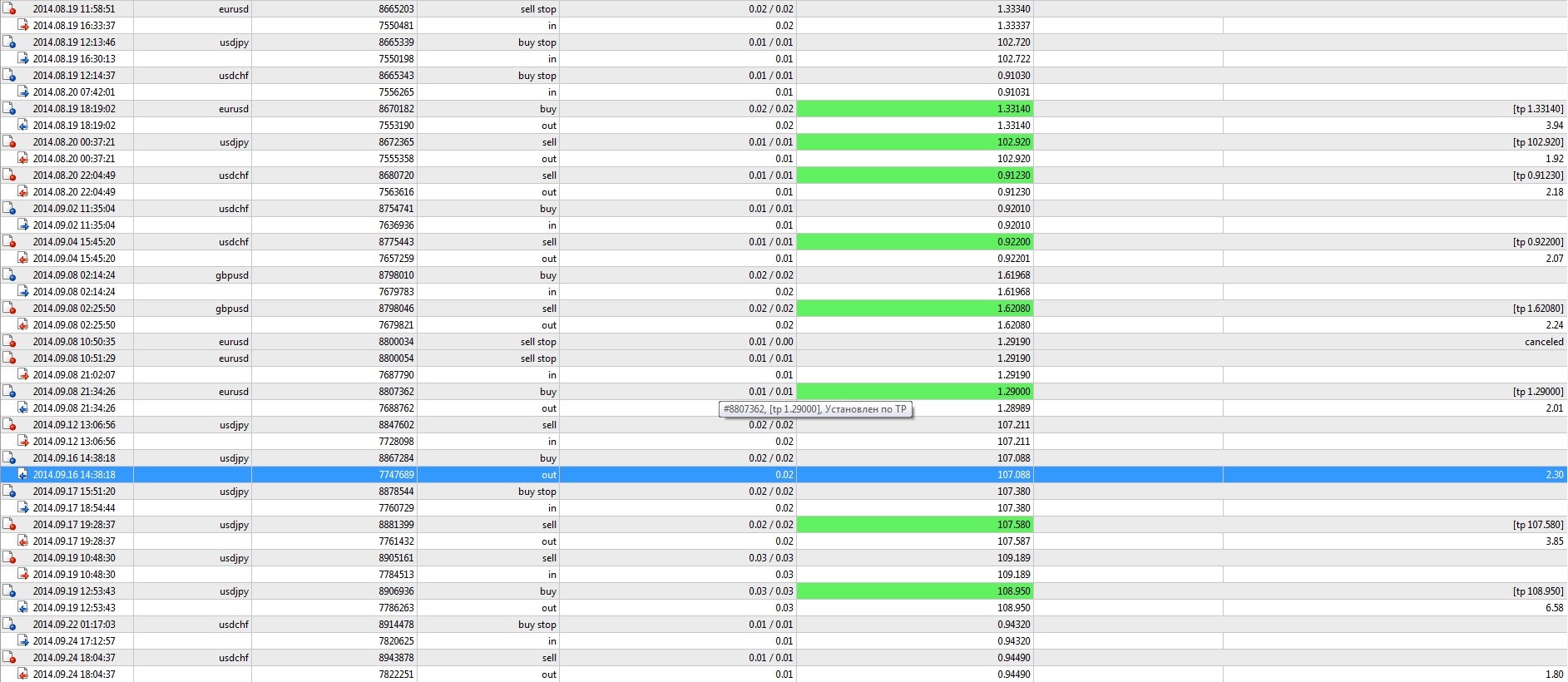

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Evgeniy Piskachev

The S&P/Case-Shiller home price index rose at the slowest pace in 20 months in July, dampening optimism over the housing sector, industry data showed on Tuesday.

S&P/Case-Shiller home price index rises 6.7% in JulyS&P/Case-Shiller home price index rises less than expected in July

In a report, Standard & Poor’s with Case-Shiller said its house price index rose at an annualized rate of 6.7% in July from a year earlier, below forecasts for a gain of 7.5% and following a rise of 8.1% in June.

Month-on-month, U.S. home prices climbed by a non-seasonally adjusted 0.6%, below forecasts for a 1.1% gain and following an increase of 1% in June.

“The pace of home price appreciation is consistent with most of the other housing data on housing starts and home sales,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices.

EUR/USD was trading at 1.2598 following the release of the data, from 1.2595 ahead of the report, while GBP/USD was at 1.6213, compared to 1.6210 earlier.

Meanwhile, U.S. equity markets pointed to a higher open. The Dow 30 indicated a gain of 0.2%, the S&P 500 pointed to a rise of 0.2%, wh

S&P/Case-Shiller home price index rises 6.7% in JulyS&P/Case-Shiller home price index rises less than expected in July

In a report, Standard & Poor’s with Case-Shiller said its house price index rose at an annualized rate of 6.7% in July from a year earlier, below forecasts for a gain of 7.5% and following a rise of 8.1% in June.

Month-on-month, U.S. home prices climbed by a non-seasonally adjusted 0.6%, below forecasts for a 1.1% gain and following an increase of 1% in June.

“The pace of home price appreciation is consistent with most of the other housing data on housing starts and home sales,” says David M. Blitzer, Chairman of the Index Committee at S&P Dow Jones Indices.

EUR/USD was trading at 1.2598 following the release of the data, from 1.2595 ahead of the report, while GBP/USD was at 1.6213, compared to 1.6210 earlier.

Meanwhile, U.S. equity markets pointed to a higher open. The Dow 30 indicated a gain of 0.2%, the S&P 500 pointed to a rise of 0.2%, wh

Evgeniy Piskachev

U.S. stocks came off earlier lows on Monday after expectations that data due for release later this week will be positive offset bearish pressures from Hong Kong unrest and a soft housing report.

U.S. stocks move off earlier lows on Hong Kong unrest; Dow falls 0.25% Hong Kong unrest pushes stock prices lower, though shares move off earlier lows

At the close of U.S. trading, the Dow 30 fell 0.25%, the S&P 500 index fell 0.25%, while the NASDAQ Composite index fell 0.14%.

The Volatility S&P 500 index, which measures the outlook for market volatility, was up 7.61% at 15.98.

Events in Hong Kong sent stock prices falling earlier.

Pro-democracy protestors in Hong Kong are angry at China's move to vet all candidates running in the city's elections for chief executive in 2017.

Fears the protests will exacerbate existing geopolitical tensions in Ukraine and in the Middle East punished stock prices earlier, though expectations began to arise that the protests will have only short-term effects on markets, which brought share prices off earlier lows.

Elsewhere, the National Association of Realtors reported earlier that its pending home sales index fell 1.0% to 104.7 in August from 105.8 in July. Economists had expected the index to tick down 0.1% last month.

U.S. stocks move off earlier lows on Hong Kong unrest; Dow falls 0.25% Hong Kong unrest pushes stock prices lower, though shares move off earlier lows

At the close of U.S. trading, the Dow 30 fell 0.25%, the S&P 500 index fell 0.25%, while the NASDAQ Composite index fell 0.14%.

The Volatility S&P 500 index, which measures the outlook for market volatility, was up 7.61% at 15.98.

Events in Hong Kong sent stock prices falling earlier.

Pro-democracy protestors in Hong Kong are angry at China's move to vet all candidates running in the city's elections for chief executive in 2017.

Fears the protests will exacerbate existing geopolitical tensions in Ukraine and in the Middle East punished stock prices earlier, though expectations began to arise that the protests will have only short-term effects on markets, which brought share prices off earlier lows.

Elsewhere, the National Association of Realtors reported earlier that its pending home sales index fell 1.0% to 104.7 in August from 105.8 in July. Economists had expected the index to tick down 0.1% last month.

Evgeniy Piskachev

The dollar hit its highest in almost two years against the euro with German inflation data expected to keep pressure on the ECB to ease monetary policy further, while unrest in Hong Kong hurt Asian-exposed European shares.

Dollar broadly stronger as Hong Kong unrest caps stocksDollar broadly stronger as Hong Kong unrest caps stocks

The dollar was broadly stronger, hitting a four-year high against a basket of currencies, a six-year peak against the yen and a 13-month high against the New Zealand dollar. Reserve Bank of New Zealand data showed the central bank intervened last month to speed its currency's descent.

Data on Friday showing higher U.S. growth in the second quarter fueled speculation that a Federal Reserve interest rate hike may come sooner than expected, in striking contrast with the outlook for the European Central Bank.

"The strength of the dollar is forcing investors to move away from a lot of the stock market assets and put it into the greenback," said James Hughes, chief market analyst at Alpari.

"With a potential rate hike becoming more likely and the data showing constant improvement, it's no surprise we are seeing the positive move."

Dollar broadly stronger as Hong Kong unrest caps stocksDollar broadly stronger as Hong Kong unrest caps stocks

The dollar was broadly stronger, hitting a four-year high against a basket of currencies, a six-year peak against the yen and a 13-month high against the New Zealand dollar. Reserve Bank of New Zealand data showed the central bank intervened last month to speed its currency's descent.

Data on Friday showing higher U.S. growth in the second quarter fueled speculation that a Federal Reserve interest rate hike may come sooner than expected, in striking contrast with the outlook for the European Central Bank.

"The strength of the dollar is forcing investors to move away from a lot of the stock market assets and put it into the greenback," said James Hughes, chief market analyst at Alpari.

"With a potential rate hike becoming more likely and the data showing constant improvement, it's no surprise we are seeing the positive move."

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Evgeniy Piskachev

U.S. cleaning products maker Clorox Co (N:CLX) said the Venezuelan government's takeover of two of its plants after the company pulled out of the country raised "grave concerns" about the safety of workers and surrounding communities.

Clorox warns of safety concerns after Venezuelan takeover of plants Clorox warns of safety concerns after Venezuelan takeover of plants

Venezuela announced on Friday the "temporary" takeover of the two plants owned by Clorox, which said it left the country because of difficult economic conditions.

After Clorox management's departure, many of the firm's 400 workers occupied two plants in the Valles del Tuy district south of Caracas and in central Carabobo district.

Clorox said the production of cleaning products, in particular bleach, was "a highly specialized and technical process." The company said it had safely secured the plants before its exit, including removing all the chlorine.

"The Venezuelan government's actions raise grave concerns, and Clorox and its affiliates cannot be responsible for the safety of workers and the surrounding communities or any liability or damages resulting from this occupation," Clorox said in a statement on Friday.

Clorox warns of safety concerns after Venezuelan takeover of plants Clorox warns of safety concerns after Venezuelan takeover of plants

Venezuela announced on Friday the "temporary" takeover of the two plants owned by Clorox, which said it left the country because of difficult economic conditions.

After Clorox management's departure, many of the firm's 400 workers occupied two plants in the Valles del Tuy district south of Caracas and in central Carabobo district.

Clorox said the production of cleaning products, in particular bleach, was "a highly specialized and technical process." The company said it had safely secured the plants before its exit, including removing all the chlorine.

"The Venezuelan government's actions raise grave concerns, and Clorox and its affiliates cannot be responsible for the safety of workers and the surrounding communities or any liability or damages resulting from this occupation," Clorox said in a statement on Friday.

Evgeniy Piskachev

Перспектива отчуждения дочерней Башнефти обрушила в пятницу котировки АФК Система еще боле чем на 20 процентов, но рублевые цены российских акций в целом демонстрируют устойчивость к неблагоприятной для инвестиционного климата РФ информации.

Перспектива отчуждения Башнефти обрушила акции Системы, индексы снизилисьПерспектива отчуждения Башнефти обрушила акции Системы, индексы снизились

Индекс ММВБ опустился на 0,13 процента от закрытия четверга до 1.434 пунктов. Индекс РТС на фоне роста доллара до 39 рублей потерял 1,65 процента, откатившись до 1.156 пунктов.

"Активность торгов сегодня крайне низкая, практически никто из клиентов не торгует, многие с грустью смотрят на пару рубль/доллар. Людям сложно понять, на что сейчас ориентироваться в торговле", - сказал трейдер Универ Капитала Павел Корышев.

"Удивительно, что рынок неплохо держится на фоне таких плачевных новостей, которые откровенно свидетельствуют о перспективе национализации активов Системы. Конечно, сегодняшнее решение перечеркивает всю инвестиционную идею в Башнефти, да и в Системе", - сказала управляющая активами одной из российских УК.

Перспектива отчуждения Башнефти обрушила акции Системы, индексы снизилисьПерспектива отчуждения Башнефти обрушила акции Системы, индексы снизились

Индекс ММВБ опустился на 0,13 процента от закрытия четверга до 1.434 пунктов. Индекс РТС на фоне роста доллара до 39 рублей потерял 1,65 процента, откатившись до 1.156 пунктов.

"Активность торгов сегодня крайне низкая, практически никто из клиентов не торгует, многие с грустью смотрят на пару рубль/доллар. Людям сложно понять, на что сейчас ориентироваться в торговле", - сказал трейдер Универ Капитала Павел Корышев.

"Удивительно, что рынок неплохо держится на фоне таких плачевных новостей, которые откровенно свидетельствуют о перспективе национализации активов Системы. Конечно, сегодняшнее решение перечеркивает всю инвестиционную идею в Башнефти, да и в Системе", - сказала управляющая активами одной из российских УК.

Evgeniy Piskachev

China's industrial profits fell 0.6 percent in August from a year earlier, reversing from July's 13.5 percent annual rise, the government said on Saturday, the latest in a series of weak data from the world's second-largest economy.

China industrial profits fall in August in latest weak dataChina industrial profits fall in August in latest weak data

Industrial companies made profits of 3.83 trillion yuan between January and August, 10 percent higher than the same period last year. China's National Bureau of Statistics did not give a reason for the August decline.

The monthly decline adds to recent weak figures that have fueled fears that China is at risk of a sharp slowdown if it does not make fresh stimulus measures.

China's factory output grew at its weakest pace in nearly six years in August while growth in other key sectors such as retail sales and imports also cooled.

China industrial profits fall in August in latest weak dataChina industrial profits fall in August in latest weak data

Industrial companies made profits of 3.83 trillion yuan between January and August, 10 percent higher than the same period last year. China's National Bureau of Statistics did not give a reason for the August decline.

The monthly decline adds to recent weak figures that have fueled fears that China is at risk of a sharp slowdown if it does not make fresh stimulus measures.

China's factory output grew at its weakest pace in nearly six years in August while growth in other key sectors such as retail sales and imports also cooled.

Evgeniy Piskachev

U.S. stocks ended higher on Friday, with the S&P 500 rallying back above a key technical level, but the advance was not enough to offset recent declines and major indexes closed out their worst week of the past eight.

The day's gains were broad. While all ten primary S&P 500 sectors ended higher on the day, energy was the top advancer, up 1.3 percent alongside a 1 percent rise in the price of crude oil .

Much of the advance came after a read on second-quarter GDP showed that the economy grew at its fastest pace in 2-1/2 years.

Equity markets have seen bigger moves of late, including a selloff on Thursday that was the S&P's biggest one-day decline since July. In four of the past five sessions, the S&P posted a point move that was larger than its 14.6 point average over the past 250 sessions.

"It's interesting to see this kind of rebound so quickly, but it shows you how skittish the market is, with volatility higher in both directions," said Michael Mullaney, chief investment officer at Fiduciary Trust Co in Boston.

The day's gains were broad. While all ten primary S&P 500 sectors ended higher on the day, energy was the top advancer, up 1.3 percent alongside a 1 percent rise in the price of crude oil .

Much of the advance came after a read on second-quarter GDP showed that the economy grew at its fastest pace in 2-1/2 years.

Equity markets have seen bigger moves of late, including a selloff on Thursday that was the S&P's biggest one-day decline since July. In four of the past five sessions, the S&P posted a point move that was larger than its 14.6 point average over the past 250 sessions.

"It's interesting to see this kind of rebound so quickly, but it shows you how skittish the market is, with volatility higher in both directions," said Michael Mullaney, chief investment officer at Fiduciary Trust Co in Boston.

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Evgeniy Piskachev

U.S. stocks rose modestly at the open on Friday after major indexes suffered their biggest drop since July, as data showed the economy grew at its fastest pace in more than two years.

Wall St. gains after selloff, helped by GDP dataWall St. gains after selloff, helped by GDP data

© Reuters. Traders work on the floor of the New York Stock Exchange© Reuters. Traders work on the floor of the New York Stock Exchange

The Dow Jones industrial average (DJI) rose 69.22 points, or 0.41 percent, to 17,015.02, the S&P 500 (SPX) gained 4.31 points, or 0.22 percent, to 1,970.3 and the Nasdaq Composite (IXIC) added 14.11 points, or 0.32 percent, to 4,480.86.

(Reporting by Chuck Mikolajczak; Editing by Bernadette Baum)

Wall St. gains after selloff, helped by GDP dataWall St. gains after selloff, helped by GDP data

© Reuters. Traders work on the floor of the New York Stock Exchange© Reuters. Traders work on the floor of the New York Stock Exchange

The Dow Jones industrial average (DJI) rose 69.22 points, or 0.41 percent, to 17,015.02, the S&P 500 (SPX) gained 4.31 points, or 0.22 percent, to 1,970.3 and the Nasdaq Composite (IXIC) added 14.11 points, or 0.32 percent, to 4,480.86.

(Reporting by Chuck Mikolajczak; Editing by Bernadette Baum)

Evgeniy Piskachev

Join! ! ! Stablly 15-20% a month! ! !

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Присоединяйтесь!!! Стабильно 15-20% в месяц!!!

https://www.mql5.com/ru/signals/6922

https://www.mql5.com/ru/signals/52212

https://www.mql5.com/ru/signals/58648

Evgeniy Piskachev

GBP/USD hit 1.6286 during European morning trade, the session low; the pair subsequently consolidated at 1.6315, easing 0.01%.

Cable was likely to find support at 1.6244, the low of September 18 and resistance at 1.6416, the high of September 24.

Demand for the dollar remained supported by mounting expectations for an early U.S. rate hike.

Dallas Federal Reserve President Richard Fisher signalled on Thursday that the U.S. central bank may start raising interest rates around the spring of 2015.

The pound had strengthened earlier in the week as investor focus returned to the outlook for U.K. monetary policy in the wake of last week's Scottish independence referendum.

Cable was likely to find support at 1.6244, the low of September 18 and resistance at 1.6416, the high of September 24.

Demand for the dollar remained supported by mounting expectations for an early U.S. rate hike.

Dallas Federal Reserve President Richard Fisher signalled on Thursday that the U.S. central bank may start raising interest rates around the spring of 2015.

The pound had strengthened earlier in the week as investor focus returned to the outlook for U.K. monetary policy in the wake of last week's Scottish independence referendum.

Evgeniy Piskachev

U.S. stocks rallied on Wednesday on news that new homes in the U.S. far surpassed expectations, giving investors hope the economy will improve and boost corporate top lines down the road.

U.S. stocks gain on surging U.S. home sales; Dow rises 0.91% Stocks rise on solidy U.S. housing data

At the close of U.S. trading, the Dow 30 rose 0.91%, the S&P 500 index rose 0.78%, while the Nasdaq Composite index rose 1.03%.

The Volatility S&P 500 index, which measures the outlook for market volatility, was down 11.25% at 13.25.

The Census Bureau reported earlier that U.S. new home sales rose 18.0% last month to 504,000 units, far surpassing expectations for a 4.4% gain to 430,000 units. New home sales for July were revised to a 1.9% increase from a previously estimated 2.4% drop.

The numbers sent stock prices gaining by keeping sentiments strong that U.S. recovery is gaining steam despite hiccups here and there.

Separately, the Department of Energy reported earlier that crude stockpiles plunged by 4.3 million barrels last week, confounding market calls for a build of 386,000, which further stoked expectations that the U.S. economy is improving as evidenced by its demand for fuel and energy.

U.S. stocks gain on surging U.S. home sales; Dow rises 0.91% Stocks rise on solidy U.S. housing data

At the close of U.S. trading, the Dow 30 rose 0.91%, the S&P 500 index rose 0.78%, while the Nasdaq Composite index rose 1.03%.

The Volatility S&P 500 index, which measures the outlook for market volatility, was down 11.25% at 13.25.

The Census Bureau reported earlier that U.S. new home sales rose 18.0% last month to 504,000 units, far surpassing expectations for a 4.4% gain to 430,000 units. New home sales for July were revised to a 1.9% increase from a previously estimated 2.4% drop.

The numbers sent stock prices gaining by keeping sentiments strong that U.S. recovery is gaining steam despite hiccups here and there.

Separately, the Department of Energy reported earlier that crude stockpiles plunged by 4.3 million barrels last week, confounding market calls for a build of 386,000, which further stoked expectations that the U.S. economy is improving as evidenced by its demand for fuel and energy.

Evgeniy Piskachev

U.S. stock index futures were trading modestly higher on Wednesday, putting the S&P 500 on track to snap a three-session losing skid, ahead of data on the housing market.

* Providing support was a renewed pledge by European Central Bank President Mario Draghi to keep monetary policy loose for an extended period to push inflation in the euro zone closer to the two percent level.

* New home sales data for August is due at 10:00 a.m. Expectations call for sales of single-family homes to increase to 430,000 from the 412,000 seasonally adjusted annual rate in July.

* Bed, Bath & Beyond shares were trading up 6.9 percent to $67 in premarket trading after the home furnishings retailer reported better-than-expected quarterly revenue as increased discounting and promotions helped attract more shoppers to its stores.

* Accenture shares were off 1.4 percent to $78.51 in premarket trading after posting fourth-quarter results and providing an outlook for the first-quarter and 2015.

* Providing support was a renewed pledge by European Central Bank President Mario Draghi to keep monetary policy loose for an extended period to push inflation in the euro zone closer to the two percent level.

* New home sales data for August is due at 10:00 a.m. Expectations call for sales of single-family homes to increase to 430,000 from the 412,000 seasonally adjusted annual rate in July.

* Bed, Bath & Beyond shares were trading up 6.9 percent to $67 in premarket trading after the home furnishings retailer reported better-than-expected quarterly revenue as increased discounting and promotions helped attract more shoppers to its stores.

* Accenture shares were off 1.4 percent to $78.51 in premarket trading after posting fourth-quarter results and providing an outlook for the first-quarter and 2015.

Evgeniy Piskachev

Stocks and safe-haven government bonds in Europe edged higher on Wednesday, with the prospect of more monetary stimulus from the European Central Bank offsetting a drop in German business sentiment.

A recovery in Russian and Chinese shares also helped emerging markets halt a near-unbroken three-week run of falls.

Investors, however, have been rattled by this week's worse-than-expected economic data from euro zone countries, leaving Europe's equity markets pretty much where they began this month.

There was more bad news on Wednesday, with German business sentiment dropping for a fifth straight month in September to its lowest level since April 2013 and the Bank of Spain warning that Spanish private consumption growth and new job creation were likely to have slowed in the third quarter.

But a renewed pledge from ECB President Mario Draghi to keep monetary policy accommodative - for as long as it takes to push ultra-low inflation in the euro zone back up closer to 2 percent - gave support to financial markets and dulled the sting of economic weakness without entirely neutralizing it.

A recovery in Russian and Chinese shares also helped emerging markets halt a near-unbroken three-week run of falls.

Investors, however, have been rattled by this week's worse-than-expected economic data from euro zone countries, leaving Europe's equity markets pretty much where they began this month.

There was more bad news on Wednesday, with German business sentiment dropping for a fifth straight month in September to its lowest level since April 2013 and the Bank of Spain warning that Spanish private consumption growth and new job creation were likely to have slowed in the third quarter.

But a renewed pledge from ECB President Mario Draghi to keep monetary policy accommodative - for as long as it takes to push ultra-low inflation in the euro zone back up closer to 2 percent - gave support to financial markets and dulled the sting of economic weakness without entirely neutralizing it.

Evgeniy Piskachev

В среду евро стабилен по отношению к доллару, торгуется над 14-месячными минимумами после выхода данных, которые показали, что деловая уверенность в Германии продолжила ухудшаться в этом месяце, а также после того, как Европейский центральный банк вновь подтвердил свою приверженность к адаптивной денежно-кредитной политике.

Евро стабилен против доллара после данных IFO, комментариев ДрагиЕвро держится стабильно против доллара после слабых данных IFO, комментариев Драги

Пара EUR/USD торгуется на 1,2850, выше 14-месячного минимума понедельника 1,2815.

Пара, вероятно, найдет поддержку на 1,2815 и сопротивление на отметке 1,29.

Евро почти не изменился после того, как отчет показал, что в сентябре индикатор условий деловой среды Германии от IFO ухудшился пятый месяц подряд.

Индекс условий деловой среды упал до 104,7 с 106,3 в августе. Экономисты ожидали снижения до 105,7.

Это самый низкий уровень с апреля 2013 года, а также намного ниже прогнозировавшихся 105,7.

Евро стабилен против доллара после данных IFO, комментариев ДрагиЕвро держится стабильно против доллара после слабых данных IFO, комментариев Драги

Пара EUR/USD торгуется на 1,2850, выше 14-месячного минимума понедельника 1,2815.

Пара, вероятно, найдет поддержку на 1,2815 и сопротивление на отметке 1,29.

Евро почти не изменился после того, как отчет показал, что в сентябре индикатор условий деловой среды Германии от IFO ухудшился пятый месяц подряд.

Индекс условий деловой среды упал до 104,7 с 106,3 в августе. Экономисты ожидали снижения до 105,7.

Это самый низкий уровень с апреля 2013 года, а также намного ниже прогнозировавшихся 105,7.

Evgeniy Piskachev

Crude oil futures edged higher on Wednesday, but gains were expected to remain limited as ample supplies and weak economic data from the euro zone overshadowed geopolitical tensions in the Middle East.

Crude oil futures edge up but gains limited by supply riseCrude oil rises but upside seen limited by ample supplies

On the New York Mercantile Exchange, crude oil for delivery in November traded at $91.66 a barrel during European morning trade, up 0.10%.

Prices gained 0.76% on Tuesday to settle at $91.56.

Futures were likely to find support at $90.58 a barrel, Tuesday's low and resistance at $93.60, the high from September 18.

Oil prices remained under pressure after the U.S. Energy Information Administration said that total U.S. crude oil inventories stood at 362.3 million barrels as of last week, the highest level for this time of year since 2012.

In addition, Iraq and Nigeria were said to be stepping up exports, adding more oil to the market, while output at Libya has rebounded.

Crude oil futures edge up but gains limited by supply riseCrude oil rises but upside seen limited by ample supplies

On the New York Mercantile Exchange, crude oil for delivery in November traded at $91.66 a barrel during European morning trade, up 0.10%.

Prices gained 0.76% on Tuesday to settle at $91.56.

Futures were likely to find support at $90.58 a barrel, Tuesday's low and resistance at $93.60, the high from September 18.

Oil prices remained under pressure after the U.S. Energy Information Administration said that total U.S. crude oil inventories stood at 362.3 million barrels as of last week, the highest level for this time of year since 2012.

In addition, Iraq and Nigeria were said to be stepping up exports, adding more oil to the market, while output at Libya has rebounded.

: