Edson Antonelli / プロファイル

- 情報

|

9+ 年

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

Edson Antonelli

Leonardo Barata

2015.03.02

As a Portuguese myself, I can confirm that! It means that when doing business with someone, it doesn't matter if he's your friend or not.

Olivian Calancea

2015.03.02

All time was like this proverb

Imtiaz Ahmed

2015.03.02

mixing these two end up loosing one or another in some cases...

Edson Antonelli

News

O mercado de ouro operou em alta durante a sessão de sexta-feira, indo para o nível de 1.220 dólares. No entanto, houve resistência suficiente para fazer o mercado recuar e formar um shooting star...

1

Edson Antonelli

News

Petróleo Bruto O mercado de petróleo bruto teve um alcance muito pequeno na sessão na sexta-feira, à medida que continuamos próximos do nível de $ 50. Em última análise, o nível inferior a 48 $ oferece suporte, uma vez que esta na parte inferior da zona de consolidação recente...

1

Edson Antonelli

News

EUR/USD Análisis Técnico Por Día El EUR/USD subió ligeramente en el ecuador de la sesión, pero está en posición para formar un fondo de inversión de precio de cierre potencialmente alcista si puede mantener sus ganancias. Esto podría desencadenar un rally de cobertura de cortos de 2 a 3 días...

3

Edson Antonelli

シェアされた作者---の記事

SQL と MQL5:SQLite データベースとの連携

本稿はご自身のプロジェクトで SQL を利用することに興味のある開発者を対象としています。ここではSQLite の機能性とメリットについて説明します。SQLite の特別な知識は必要ありませんが、SQL の最小限の知識があれば役に立つと思います。

Edson Antonelli

シェアされた作者Serhii Shevchukの記事

リキッドチャート

時間の秒、5分から開くバーを持つ毎時チャートを見たいですか?バーのオープン時間が毎分変わるようであれば再作成されたチャートはどのように見えるのでしょうか?そのようなチャートでトレードすることにどんなメリットがあるのでしょうか?本稿ではこういった疑問に対する答えを見つけていきます。

Edson Antonelli

News

On Monday the greenback was almost unchanged against its Canadian counterpart, as disappointing U.S. personal spending data weighed, though a weak report on Canada's current account dented demand for the loonie...

2

Edson Antonelli

News

Gold held near a two-week high on Monday, as traders continued to monitor the direction of the dollar while digesting the latest spate of U.S. economic data in their quest to gauge the metal’s appeal...

3

Edson Antonelli

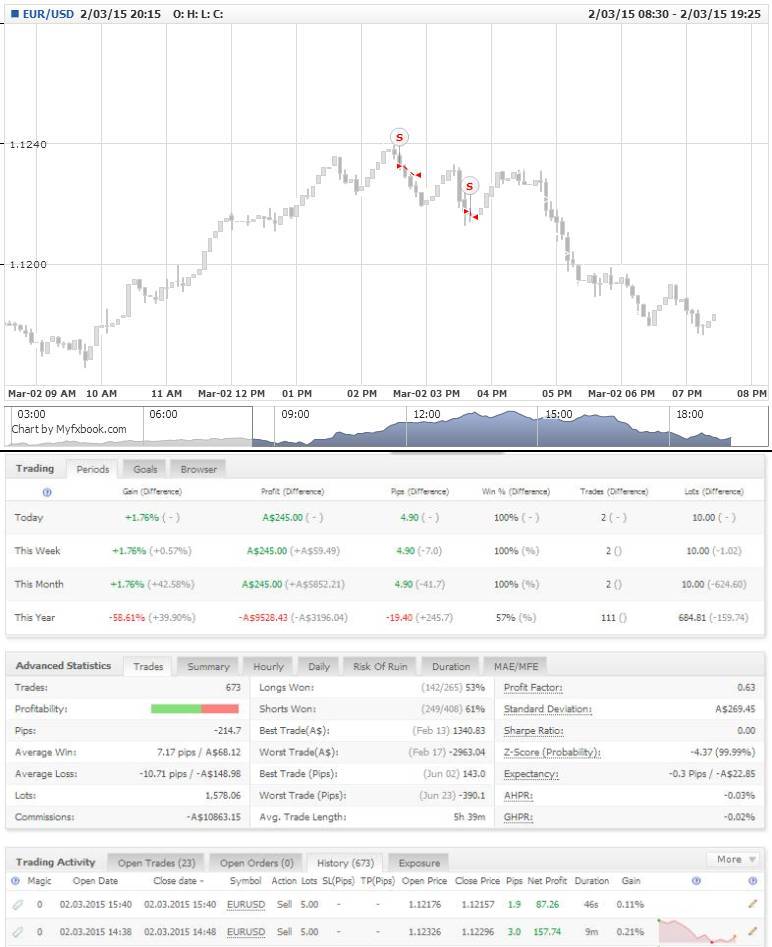

パブリッシュされた投稿EUR/USD Forecast March 2, 2015, Technical Analysis

EUR/USD pair tried to rally during the course of the session on Friday, but as you can see gave back all of the gains to close just below the 1.12 handle. The resulting candle is a shooting star of sorts, and it looks like we are ready to continue going lower...

ソーシャルネットワーク上でシェアする · 3

98

Edson Antonelli

EUR/USD Forecast March 2, 2015, Technical Analysis

EUR/USD pair tried to rally during the course of the session on Friday, but as you can see gave back all of the gains to close just below the 1.12 handle. The resulting candle is a shooting star of sorts, and it looks like we are ready to continue going lower. With that, we are sellers on a break below the bottom of the candle, as we believe that the market will then target the 1.10 handle given enough time. If we get below there, this market could continue all the way down to the parity level. A break of the top of the shooting star suggests that we could get a little bit of a bounce, but we continue to sell resistive candles above.

With the increased liquidity out of the European Central Bank, it makes sense that the Euro continues to fall against the US dollar as the Federal Reserve at least is stepping away from the quantitative easing game, if not tightening rate sometime the next year or so. This is a market that should continue to favor the US dollar as it is one of the favored currencies around the world anyway, and of course there are far too many moving parts in the European Union for people to be comfortable owning the currency. We have problems in Greece, we have deflationary concerns around the continent, and then of course there’s also a lot of uncertainty in various bond markets.

Rallies will run into a significant barrier at the 1.15 level, as it is a large, round, psychologically significant number and the beginning of massive resistance all the way to the 1.1650 level. Even if we got there, the biggest problem is that the 1.18 level begins another 200 pips resistance barrier. In other words, it’s just not worth being bothered with trying to go long. This is a trend that’s not going to easily break, so at this point time we look at rallies as value in the US dollar and will continue to as the Euro simply is not trusted.

EUR/USD pair tried to rally during the course of the session on Friday, but as you can see gave back all of the gains to close just below the 1.12 handle. The resulting candle is a shooting star of sorts, and it looks like we are ready to continue going lower. With that, we are sellers on a break below the bottom of the candle, as we believe that the market will then target the 1.10 handle given enough time. If we get below there, this market could continue all the way down to the parity level. A break of the top of the shooting star suggests that we could get a little bit of a bounce, but we continue to sell resistive candles above.

With the increased liquidity out of the European Central Bank, it makes sense that the Euro continues to fall against the US dollar as the Federal Reserve at least is stepping away from the quantitative easing game, if not tightening rate sometime the next year or so. This is a market that should continue to favor the US dollar as it is one of the favored currencies around the world anyway, and of course there are far too many moving parts in the European Union for people to be comfortable owning the currency. We have problems in Greece, we have deflationary concerns around the continent, and then of course there’s also a lot of uncertainty in various bond markets.

Rallies will run into a significant barrier at the 1.15 level, as it is a large, round, psychologically significant number and the beginning of massive resistance all the way to the 1.1650 level. Even if we got there, the biggest problem is that the 1.18 level begins another 200 pips resistance barrier. In other words, it’s just not worth being bothered with trying to go long. This is a trend that’s not going to easily break, so at this point time we look at rallies as value in the US dollar and will continue to as the Euro simply is not trusted.

Edson Antonelli

The Australian dollar eased on Monday in early Asia after data at the weekend showed China's official manufacturing index just in contraction.

On Saturday, the People's Bank of China cut its benchmark interest rate by a quarter percentage point to 5.35%. Later Monday, China is to publish the final February reading of the HSBC manufacturing index, or PMI with 50.1 expected, placing it just in the expansion zone.

At the weekend, the February China Federation of Logistics and Purchasing (CFLP) manufacturing PMI improved for the first time in seven months, despite the Chinese New Year holiday, but remained just below the 50 mark, indicating that the sector contracted for a second straight month. The index rose to 49.9 in February from 49.8 in January.

Australia's AI Group PMI fell 3.6 points to 45.4 in February, data released Monday showed.

Also on Monday, Australia publishes the MI inflation gauge and HIA new home sales for January. In Japan comes the February PMI as well.

AUD/USD traded at 0.7806, down 0.02%, while USD/JPY changed hands at 119.68, up 0.08%.

Last week, the dollar pushed higher against the yen and the euro on Friday after data showed that the U.S. economy expanded modestly in the last quarter of 2014, supporting expectations for interest rate increases.

The Commerce Department reported that U.S. gross domestic product grew at an annual rate of 2.2% in the last three months of 2014, down from an initial estimate of 2.6% but ahead of expectations for a downward revision to 2.1% growth.

Other reports showed that U.S. pending home sales rose to a one-and-a-half year high in January and consumer sentiment also remained strong.

The February reading of the University of Michigan's consumer sentiment index was revised up to 95.4 from the preliminary reading of 93.6. While this was down from the previous months final reading of 98.1, it was still the second highest level since January 2007.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, ended the day almost unchanged at 95.29, not far from Thursday’s one-month highs of 95.43.

Last week, Federal Reserve Chair Janet Yellen said that if the economy keeps improving as the bank expects it will modify its forward guidance, but emphasized that a modification of its language should not be read as indicating that a rate hike would automatically happen within a number of meetings.

In the week ahead, Friday’s U.S. employment report will be closely watched, while central banks in Australia, Canada, the U.K. and the euro zone are all to hold monetary policy meetings.

On Monday, the U.K. is to publish private sector data on house price inflation, as well as what will be a closely watched report on manufacturing activity.

The euro zone is to produce preliminary data on consumer prices and a report on unemployment.

In the U.S., the Institute of Supply Management is to report on manufacturing activity.

On Saturday, the People's Bank of China cut its benchmark interest rate by a quarter percentage point to 5.35%. Later Monday, China is to publish the final February reading of the HSBC manufacturing index, or PMI with 50.1 expected, placing it just in the expansion zone.

At the weekend, the February China Federation of Logistics and Purchasing (CFLP) manufacturing PMI improved for the first time in seven months, despite the Chinese New Year holiday, but remained just below the 50 mark, indicating that the sector contracted for a second straight month. The index rose to 49.9 in February from 49.8 in January.

Australia's AI Group PMI fell 3.6 points to 45.4 in February, data released Monday showed.

Also on Monday, Australia publishes the MI inflation gauge and HIA new home sales for January. In Japan comes the February PMI as well.

AUD/USD traded at 0.7806, down 0.02%, while USD/JPY changed hands at 119.68, up 0.08%.

Last week, the dollar pushed higher against the yen and the euro on Friday after data showed that the U.S. economy expanded modestly in the last quarter of 2014, supporting expectations for interest rate increases.

The Commerce Department reported that U.S. gross domestic product grew at an annual rate of 2.2% in the last three months of 2014, down from an initial estimate of 2.6% but ahead of expectations for a downward revision to 2.1% growth.

Other reports showed that U.S. pending home sales rose to a one-and-a-half year high in January and consumer sentiment also remained strong.

The February reading of the University of Michigan's consumer sentiment index was revised up to 95.4 from the preliminary reading of 93.6. While this was down from the previous months final reading of 98.1, it was still the second highest level since January 2007.

The U.S. dollar index, which measures the greenback’s strength against a trade-weighted basket of six major currencies, ended the day almost unchanged at 95.29, not far from Thursday’s one-month highs of 95.43.

Last week, Federal Reserve Chair Janet Yellen said that if the economy keeps improving as the bank expects it will modify its forward guidance, but emphasized that a modification of its language should not be read as indicating that a rate hike would automatically happen within a number of meetings.

In the week ahead, Friday’s U.S. employment report will be closely watched, while central banks in Australia, Canada, the U.K. and the euro zone are all to hold monetary policy meetings.

On Monday, the U.K. is to publish private sector data on house price inflation, as well as what will be a closely watched report on manufacturing activity.

The euro zone is to produce preliminary data on consumer prices and a report on unemployment.

In the U.S., the Institute of Supply Management is to report on manufacturing activity.

Edson Antonelli

Japanese capital spending 2.8% vs. 4.1% forecast

Investing.com – Capital spending by Japanese companies fell more-than-expected in the last quarter, official data showed on Sunday.

In a report, Ministry of Finance said that Japanese capital spending fell to an annual rate of 2.8%, from 5.5% in the preceding quarter.

Analysts had expected Japanese capital spending to fall to 4.1% in the last quarter

Investing.com – Capital spending by Japanese companies fell more-than-expected in the last quarter, official data showed on Sunday.

In a report, Ministry of Finance said that Japanese capital spending fell to an annual rate of 2.8%, from 5.5% in the preceding quarter.

Analysts had expected Japanese capital spending to fall to 4.1% in the last quarter

Edson Antonelli

News

O mercado de ouro operou em alta durante a sessão de sexta-feira, indo para o nível de 1.220 dólares. No entanto, houve resistência suficiente para fazer o mercado recuar e formar um shooting star...

4

: