Claws and Horns / プロファイル

Claws and Horns

News of the day. Wednesday 25.11.2015

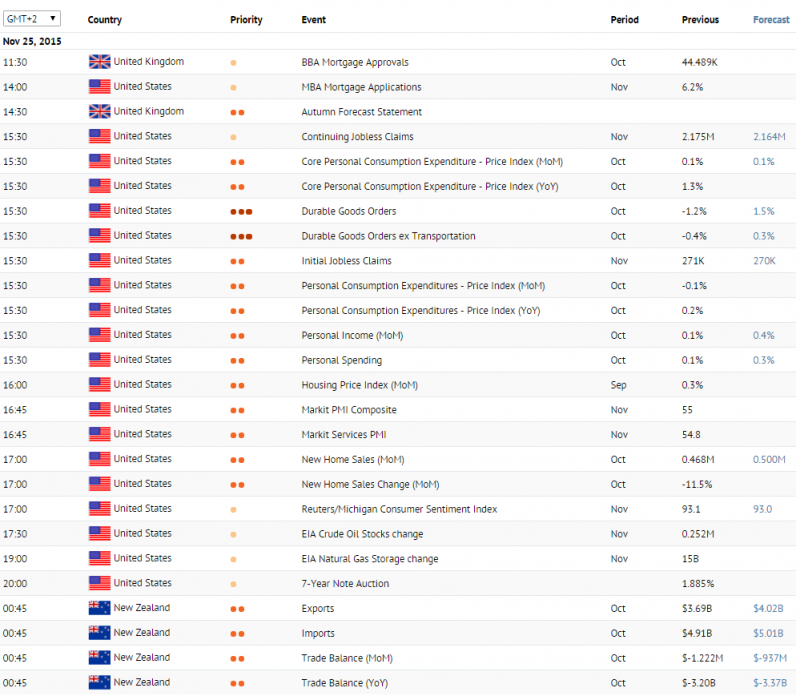

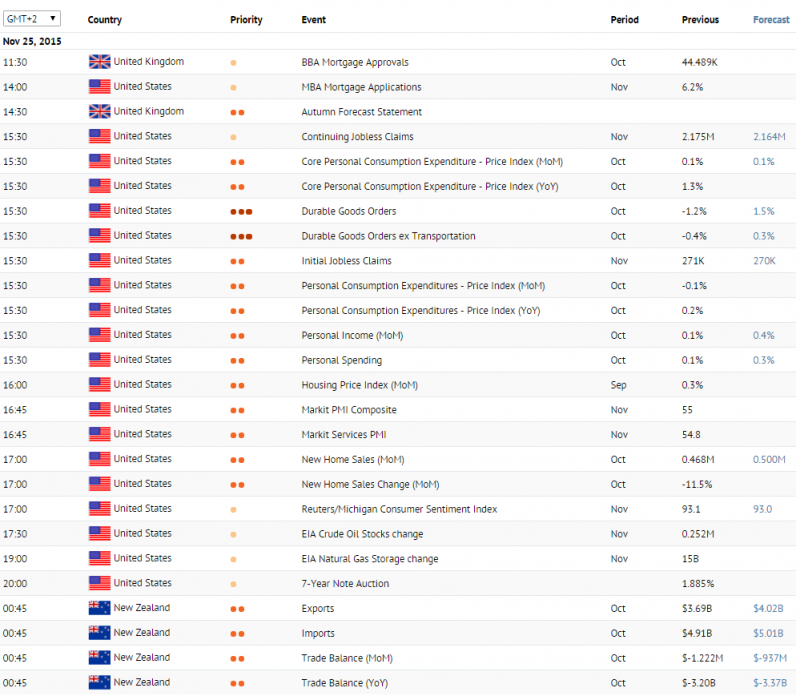

Out of macroeconomic statistics that can affect dynamics in currencies today, it is worth paying attention to publications from the UK, the US and New Zealand. The Autumn Forecast Statement is due at 2:30 pm (all times stated in GMT+2) in the UK. The report includes a review of current state of the economy and its future prospects, and preliminary budget forecast for the next year. October Durable Goods Orders data is due at 3:30 pm in the US. The index is expected to grow by 1.5% against a 1.2% contraction in the previous month. Durable Goods Orders excluding Transportation is forecasted to grow by 0.3%, against -0.4% in September. Also at 3:30 pm, Initial Jobless Claims data for October is out. The figure is expected to fall from 271 thousands to 270 thousands. At the same time, data on Personal Income and Personal Spending will come out. Both figures are expected to be positive. Income will increase by 0.4%, while spending will grow by 0.3%, which might strengthen the Dollar. On Wednesday night at 0:45 am trade balance data is due in New Zealand. Imports for October are expected to grow from 4.91 to 5.01 billion NZD, while Exports will rise from 3.69 to 4.02 billion and Trade Balance deficit will fall from 1.222 billion to 937 million NZD. Forecasts confirmation might provide short-term support to the NZD.

Out of macroeconomic statistics that can affect dynamics in currencies today, it is worth paying attention to publications from the UK, the US and New Zealand. The Autumn Forecast Statement is due at 2:30 pm (all times stated in GMT+2) in the UK. The report includes a review of current state of the economy and its future prospects, and preliminary budget forecast for the next year. October Durable Goods Orders data is due at 3:30 pm in the US. The index is expected to grow by 1.5% against a 1.2% contraction in the previous month. Durable Goods Orders excluding Transportation is forecasted to grow by 0.3%, against -0.4% in September. Also at 3:30 pm, Initial Jobless Claims data for October is out. The figure is expected to fall from 271 thousands to 270 thousands. At the same time, data on Personal Income and Personal Spending will come out. Both figures are expected to be positive. Income will increase by 0.4%, while spending will grow by 0.3%, which might strengthen the Dollar. On Wednesday night at 0:45 am trade balance data is due in New Zealand. Imports for October are expected to grow from 4.91 to 5.01 billion NZD, while Exports will rise from 3.69 to 4.02 billion and Trade Balance deficit will fall from 1.222 billion to 937 million NZD. Forecasts confirmation might provide short-term support to the NZD.

Claws and Horns

News of the day. Tuesday 24.11.2015

Today the trading session will start with publications from Germany where the Gross Domestic Product data for the third quarter is due at 9 am (all times stated in GMT +2). The figure is expected to remain unchanged at 0.3% against the previous quarter. Data from the German Institute for Economic Research is due at 11 am. According to forecasts, the IFO – Expectations will fall from 103.8 to 103.5 points against the previous month. The IFO – Business Climate will remain unchanged at 108.8 points, while the IFO – Current Assessment will fall from 112.6 to 112.3 points. Confirmation of negative forecasts can pressure the Euro. RBA Governor Glenn Stevens Speech is due at 11:05 am. His commentaries regarding the current state of the Australian economy might cause volatility on the market. In the second half of the day, publications will be coming out in the US. At 3:30 pm, attention should be paid to the GDP Annualised for the third quarter, which is expected to grow from 1.5% to 2.0%. The S&P/Case-Shiller Home Prices Indices is due at 4 pm. On a year-to-year basis, the index is expected to increase from 5.1% to 5.2%. Data on the Consumer Confidence is due at 5 pm. The index should grow from 97.6 to 99.5 points. Positive figures will strengthen the US Dollar. On Tuesday night, attention needs to be paid to data from Japan where the Coincidence Index and Leading Economic Index are due at 7 am.

Today the trading session will start with publications from Germany where the Gross Domestic Product data for the third quarter is due at 9 am (all times stated in GMT +2). The figure is expected to remain unchanged at 0.3% against the previous quarter. Data from the German Institute for Economic Research is due at 11 am. According to forecasts, the IFO – Expectations will fall from 103.8 to 103.5 points against the previous month. The IFO – Business Climate will remain unchanged at 108.8 points, while the IFO – Current Assessment will fall from 112.6 to 112.3 points. Confirmation of negative forecasts can pressure the Euro. RBA Governor Glenn Stevens Speech is due at 11:05 am. His commentaries regarding the current state of the Australian economy might cause volatility on the market. In the second half of the day, publications will be coming out in the US. At 3:30 pm, attention should be paid to the GDP Annualised for the third quarter, which is expected to grow from 1.5% to 2.0%. The S&P/Case-Shiller Home Prices Indices is due at 4 pm. On a year-to-year basis, the index is expected to increase from 5.1% to 5.2%. Data on the Consumer Confidence is due at 5 pm. The index should grow from 97.6 to 99.5 points. Positive figures will strengthen the US Dollar. On Tuesday night, attention needs to be paid to data from Japan where the Coincidence Index and Leading Economic Index are due at 7 am.

Claws and Horns

News of the day. Monday 23.11.2015

On Monday, there are no many important publications, which could significantly affect dynamics in currencies. Nevertheless, attention needs to be paid to publications in Germany, the eurozone and the US. Preliminary data on Markit Manufacturing and Services PMI’s for November is due in Germany at 10:30 am (all times stated in GMT +2). The indices are calculated based on surveys of purchasing managers from the leading companies in the country regarding the current state of the economy and its future prospects. The Manufacturing PMI is expected to remain unchanged at 52.1 points, while the Services PMI can fall slightly from 54.5 to 54.3 points. Preliminary data on the same indices for the eurozone is due at 11 am. According to forecasts, the Manufacturing PMI will remain unchanged at 52.3 points, while the Services PMI will fall from 54.1 to 54.0 points. A reading above the 50-points mark indicates a positive tendency in the industry. Preliminary November data on the Markit Manufacturing PMI in the US is due at 3:30 pm, which is a leading indicator for the federal index. The figure has been growing for the last two months and reached 54.1 points in October. On Monday night at 2:05 am, RBA Governor Glenn Stevens’s speech is due in Australia that is traditionally attracting investors’ attention.

On Monday, there are no many important publications, which could significantly affect dynamics in currencies. Nevertheless, attention needs to be paid to publications in Germany, the eurozone and the US. Preliminary data on Markit Manufacturing and Services PMI’s for November is due in Germany at 10:30 am (all times stated in GMT +2). The indices are calculated based on surveys of purchasing managers from the leading companies in the country regarding the current state of the economy and its future prospects. The Manufacturing PMI is expected to remain unchanged at 52.1 points, while the Services PMI can fall slightly from 54.5 to 54.3 points. Preliminary data on the same indices for the eurozone is due at 11 am. According to forecasts, the Manufacturing PMI will remain unchanged at 52.3 points, while the Services PMI will fall from 54.1 to 54.0 points. A reading above the 50-points mark indicates a positive tendency in the industry. Preliminary November data on the Markit Manufacturing PMI in the US is due at 3:30 pm, which is a leading indicator for the federal index. The figure has been growing for the last two months and reached 54.1 points in October. On Monday night at 2:05 am, RBA Governor Glenn Stevens’s speech is due in Australia that is traditionally attracting investors’ attention.

Claws and Horns

News of the day. Friday 20.11.2015

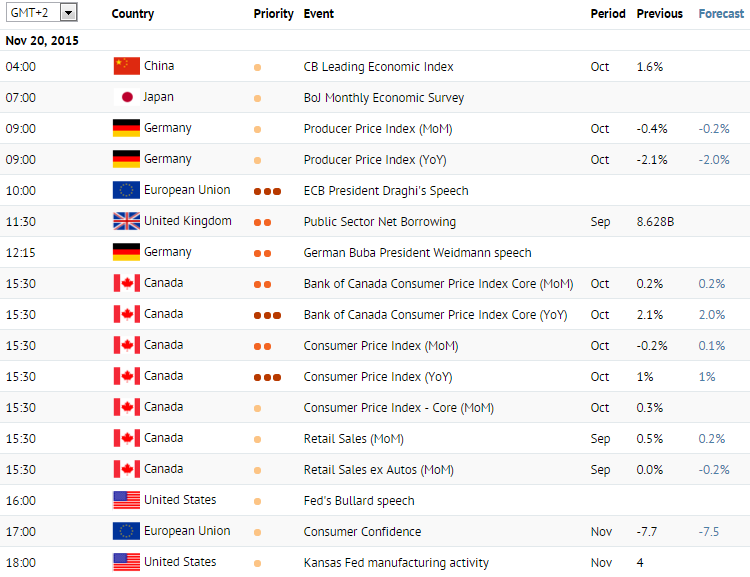

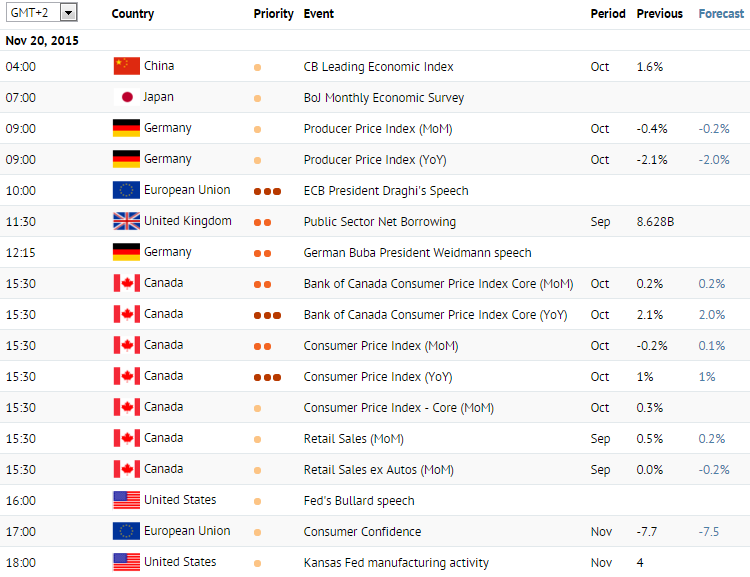

Today markets are going to be waiting for news from the eurozone, Germany and Canada. ECB President Draghi’s speech is due at 10 am (all times stated in GMT +2) as he appears at the 25th Frankfurt European Banking Congress in Germany. During the speech, he might comment on the current state of the European economy. At 12:15 pm German Buba President Weidmann speech is due that could attract investors’ attention as well. In the second half of the day news will be released in Canada. October Consumer Price Index data is due at 3:30 pm. On a year-to-year basis the index is expected to remain unchanged from the previous month at 1%. On a month-to-month basis the index can grow from -0.2% to 0.1%. Generally, inflation in Canada is higher than in the US or the eurozone, but it won’t be able to achieve it optimum level of 2% before the end of the year. September data on Retail Sales in Canada is due at the same time. The figure is expected to fall from 0% to -0.2% that could pressure the Canadian Dollar.

Today markets are going to be waiting for news from the eurozone, Germany and Canada. ECB President Draghi’s speech is due at 10 am (all times stated in GMT +2) as he appears at the 25th Frankfurt European Banking Congress in Germany. During the speech, he might comment on the current state of the European economy. At 12:15 pm German Buba President Weidmann speech is due that could attract investors’ attention as well. In the second half of the day news will be released in Canada. October Consumer Price Index data is due at 3:30 pm. On a year-to-year basis the index is expected to remain unchanged from the previous month at 1%. On a month-to-month basis the index can grow from -0.2% to 0.1%. Generally, inflation in Canada is higher than in the US or the eurozone, but it won’t be able to achieve it optimum level of 2% before the end of the year. September data on Retail Sales in Canada is due at the same time. The figure is expected to fall from 0% to -0.2% that could pressure the Canadian Dollar.

Claws and Horns

News of the day. Thursday 19.11.2015

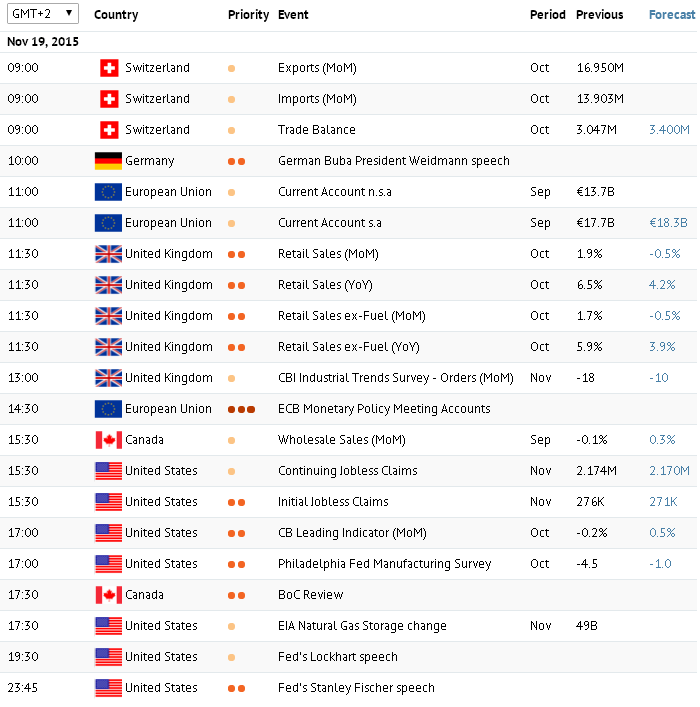

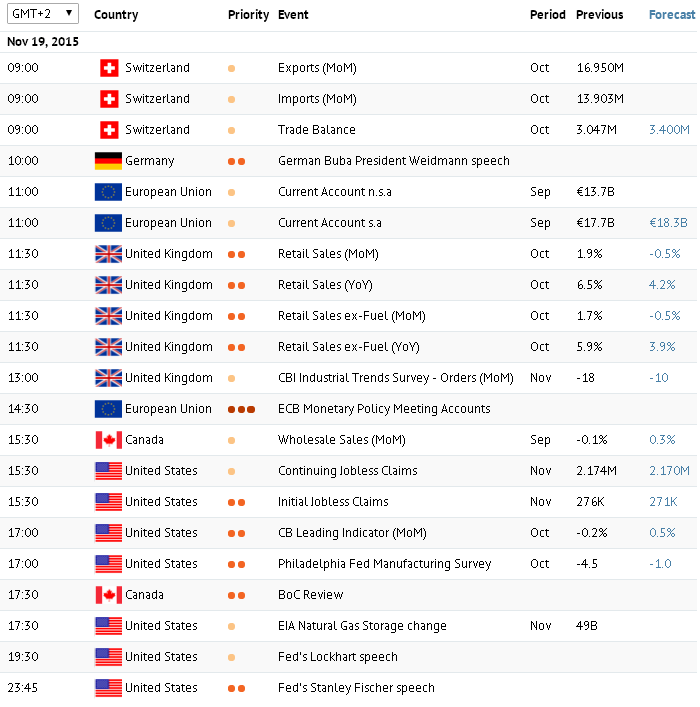

Today, investos will be following news for the UK, the eurozone and the US.

At 11:30 am (all times stated in GMT+2) Retail Sales statistics for October are due in the UK. According to the forecast, Retail Sales will decline from 6.2% to 4.2% in annual terms. In monthly terms, the indicator will be down by 0.5% that will affect the GBP. ECB Monetary Policy Meeting Accounts, due at 2:30 pm, may shed light on the future EU monetary policy.

In the afternoon, attention needs to be paid to news for the USA. Initial Jobless Claims statistics for November are due at 3:30 pm. The indicator is expected to decline from 276K to 271K. The conference Board releases the Leading Indicator for October at 5:00 pm. Analysts forecast a growth from 0.2% to 0.5%. Philadelphia Fed Manufacturing Survey is released at 5:00 pm as well. Though the indicator still keeps its general negative dynamics, a growth from -4.5 to -1.0 points is expected. If the forecasts are confirmed, the USD may get support in the short term.

Today, investos will be following news for the UK, the eurozone and the US.

At 11:30 am (all times stated in GMT+2) Retail Sales statistics for October are due in the UK. According to the forecast, Retail Sales will decline from 6.2% to 4.2% in annual terms. In monthly terms, the indicator will be down by 0.5% that will affect the GBP. ECB Monetary Policy Meeting Accounts, due at 2:30 pm, may shed light on the future EU monetary policy.

In the afternoon, attention needs to be paid to news for the USA. Initial Jobless Claims statistics for November are due at 3:30 pm. The indicator is expected to decline from 276K to 271K. The conference Board releases the Leading Indicator for October at 5:00 pm. Analysts forecast a growth from 0.2% to 0.5%. Philadelphia Fed Manufacturing Survey is released at 5:00 pm as well. Though the indicator still keeps its general negative dynamics, a growth from -4.5 to -1.0 points is expected. If the forecasts are confirmed, the USD may get support in the short term.

Claws and Horns

News of the day. Wednesday 18.11.2015

Today, the main suppliers of macroeconomic data are going to be Switzerland, Canada and the US. At 12:00 pm (GMT+2), November’s ZEW Survey Expectations is due in Switzerland that serves as an indicator of economic optimism and measures the ratio of optimists and pessimists in business community. The indicator has been growing or three months already and its further increase will strengthen the CHF against major counterparts.

The US releases its construction sector statistics for October at 3:30 pm. According to the forecasts, the number of Housing Starts will decline from 1.206M to 1.160M. At the same time, the number of Building Permits will grow from 1.105M to 1.150M that suggests improvements in the US construction sector in the next month as it takes time to start any construction work after a building permit has been issued. In general, the indicators are likely to counterbalance each other, thus, the USD will not be under significant pressure.

The most important news of the trading day is due at 8:00 pm, when FOMC Minutes are published. They will give account of the discussion process and shed light on the future US monetary policy, therefore, the volatility in the USD may be raised.

Japan releases its Trade Balance, Exports and Imports statistics on Thursday night, at 01:50 am. Analysts expect that, in annual terms, Exports will decline by 2.1% after a 0.6% growth in September. Imports will be down by 8.6%, while the indicator fell by 11.1% in the previous month. Thus, trade deficit will deepen and reach ¥292.0B. Negative statistics will strongly affect the Japanese currency.

The Bank of Japan publishes its interest rate decision at 05:00 am. The BoJ is unlikely to change its interest rate which has been kept at the level of 0.1% for several years.

Today, the main suppliers of macroeconomic data are going to be Switzerland, Canada and the US. At 12:00 pm (GMT+2), November’s ZEW Survey Expectations is due in Switzerland that serves as an indicator of economic optimism and measures the ratio of optimists and pessimists in business community. The indicator has been growing or three months already and its further increase will strengthen the CHF against major counterparts.

The US releases its construction sector statistics for October at 3:30 pm. According to the forecasts, the number of Housing Starts will decline from 1.206M to 1.160M. At the same time, the number of Building Permits will grow from 1.105M to 1.150M that suggests improvements in the US construction sector in the next month as it takes time to start any construction work after a building permit has been issued. In general, the indicators are likely to counterbalance each other, thus, the USD will not be under significant pressure.

The most important news of the trading day is due at 8:00 pm, when FOMC Minutes are published. They will give account of the discussion process and shed light on the future US monetary policy, therefore, the volatility in the USD may be raised.

Japan releases its Trade Balance, Exports and Imports statistics on Thursday night, at 01:50 am. Analysts expect that, in annual terms, Exports will decline by 2.1% after a 0.6% growth in September. Imports will be down by 8.6%, while the indicator fell by 11.1% in the previous month. Thus, trade deficit will deepen and reach ¥292.0B. Negative statistics will strongly affect the Japanese currency.

The Bank of Japan publishes its interest rate decision at 05:00 am. The BoJ is unlikely to change its interest rate which has been kept at the level of 0.1% for several years.

Claws and Horns

News of the day. Tuesday 17.11.2015

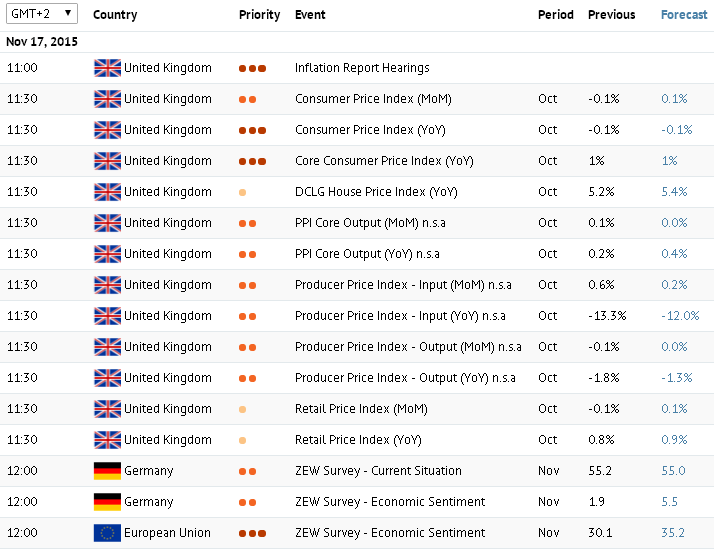

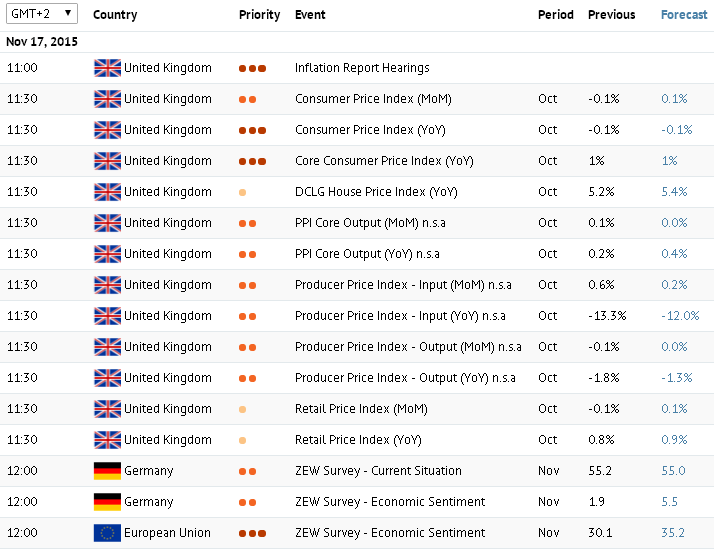

Today, market participants are waiting for news for the UK, Germany, the eurozone, the US and Canada.

Inflation Report Hearings are 11:00 am (all times stated in GMT+2) in the UK. Members of the Monetary policy Committee and the Governor of the Bank of England will comment on the UK inflation and economic situation.

Then, at 11:30 am, Consumer Price Index and Core Consumer Price Index statistics for October are released. According to the forecast, on the annual basis, the CPI will grow slightly from -0.1% to 0.0%, while the Core CPI will remain unchanged at 1.0%. UK inflation has been very low for quite a long time due to a decline in oil, commodity and food prices. If the forecasts are confirmed, the GBP may get short-term support.

ZEW Economic Sentiments for Germany and the eurozone are released at 12:00 pm. Both indicators are expected to grow in November: from 1.9 to 5.5 points for Germany and from 30.1 to 35.2 points for the eurozone that may strengthen the EUR.

The US, in its turn, publishes Consumer Price Index for October at 3:30 pm. On the annual basis, a rise from 0.0% to 0.1% is expected. In this case, the USD will get support. October’s Industrial Production is due at 4:15 in the US. Analysts forecast a growth from 0.2% to 0.1% that will strengthen the USD as well. At 5:30 pm, the Bank of Canada publishes its review of economic situation and monetary policy.

Today, market participants are waiting for news for the UK, Germany, the eurozone, the US and Canada.

Inflation Report Hearings are 11:00 am (all times stated in GMT+2) in the UK. Members of the Monetary policy Committee and the Governor of the Bank of England will comment on the UK inflation and economic situation.

Then, at 11:30 am, Consumer Price Index and Core Consumer Price Index statistics for October are released. According to the forecast, on the annual basis, the CPI will grow slightly from -0.1% to 0.0%, while the Core CPI will remain unchanged at 1.0%. UK inflation has been very low for quite a long time due to a decline in oil, commodity and food prices. If the forecasts are confirmed, the GBP may get short-term support.

ZEW Economic Sentiments for Germany and the eurozone are released at 12:00 pm. Both indicators are expected to grow in November: from 1.9 to 5.5 points for Germany and from 30.1 to 35.2 points for the eurozone that may strengthen the EUR.

The US, in its turn, publishes Consumer Price Index for October at 3:30 pm. On the annual basis, a rise from 0.0% to 0.1% is expected. In this case, the USD will get support. October’s Industrial Production is due at 4:15 in the US. Analysts forecast a growth from 0.2% to 0.1% that will strengthen the USD as well. At 5:30 pm, the Bank of Canada publishes its review of economic situation and monetary policy.

Claws and Horns

News of the day. Monday 16.11 2015

On Monday, market participants will be following news for the eurozone. Consumer Price Index is due at 12 pm (GMT+2). For almost a year, the eurozone has been teetering on the verge of deflation, and all the ECB's attempts to tackle this issue have failed. Thus, in October, Consumer Price Index is expected to decline from 0.2% to 0.1% on a monthly basis, while in annual terms, the indicator is likely to remain unchanged at 0.0%.

The ECB President Draghi's Speech is due at 12:15 pm in Madrid. Mario Draghi may comment on the current state and prospects of the European economy. At 1:00 pm Deutsche Bundesbank releases its monthly report on current and future economic conditions of Germany. Moreover, RBA Meeting's Minutes are due on Tuesday night and may shed light on the future of Australia's monetary policy.

On Monday, market participants will be following news for the eurozone. Consumer Price Index is due at 12 pm (GMT+2). For almost a year, the eurozone has been teetering on the verge of deflation, and all the ECB's attempts to tackle this issue have failed. Thus, in October, Consumer Price Index is expected to decline from 0.2% to 0.1% on a monthly basis, while in annual terms, the indicator is likely to remain unchanged at 0.0%.

The ECB President Draghi's Speech is due at 12:15 pm in Madrid. Mario Draghi may comment on the current state and prospects of the European economy. At 1:00 pm Deutsche Bundesbank releases its monthly report on current and future economic conditions of Germany. Moreover, RBA Meeting's Minutes are due on Tuesday night and may shed light on the future of Australia's monetary policy.

Claws and Horns

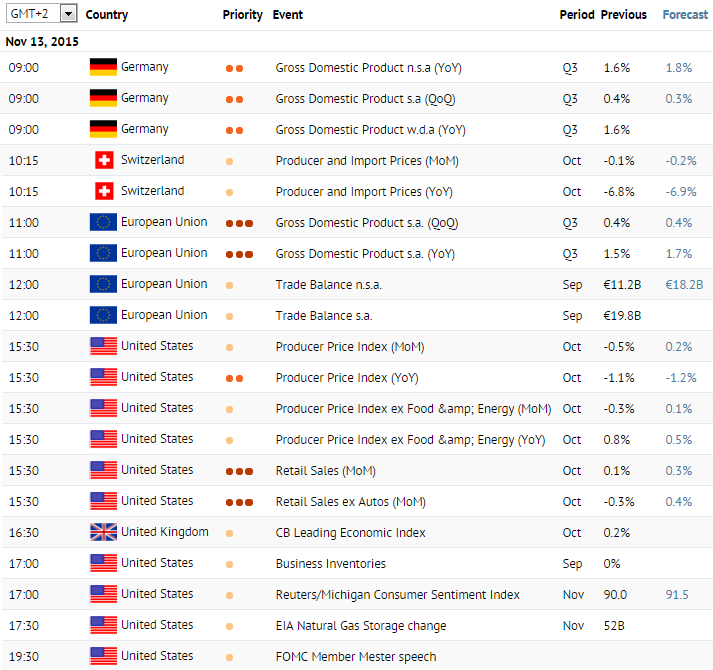

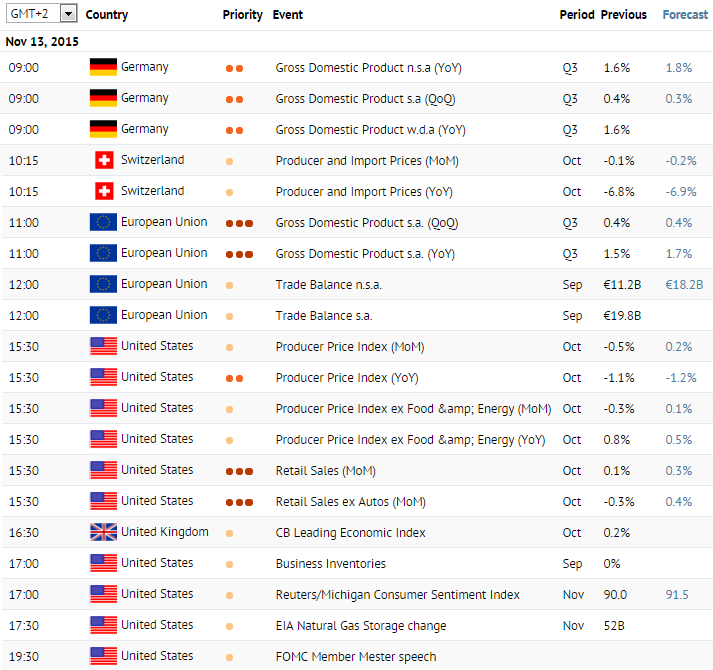

News of the day. Friday 13.11.2015

For market participants the day will start with the news from Germany where at 9 am (all times stated in GMT +2) preliminary GDP data for the third quarter is due. According to forecasts, the GDP growth can slow from 0.4% to 0.3%. Preliminary data on the GDP for the eurozone is due at 11 am. Against the previous quarter, the index is expected to remain unchanged at 0.4%, and to grow from 1.5% to 1.7% against the previous year. Thus, the Euro can be substantially supported. In the second half of the day, investors will be waiting for publications from the US. At 3:30 pm, October data on Retail Sales and Retail Sales excluding Autos is due. Both indices are expected to rise. Retail Sales will grow by 0.3% against September figure of 0.1%, while Retail Sales excluding Autos will grow from -0.3% to 0.4%. With forecasts confirmation the USD could strengthen. On Sunday night at 1:50 am, attention needs to be paid to preliminary data on the Japanese GDP for the third quarter, which is forecasted to decline from -0.2% to -1.2%. That would represent a contraction of the economy in Japan and can significantly weaken the Yen.

For market participants the day will start with the news from Germany where at 9 am (all times stated in GMT +2) preliminary GDP data for the third quarter is due. According to forecasts, the GDP growth can slow from 0.4% to 0.3%. Preliminary data on the GDP for the eurozone is due at 11 am. Against the previous quarter, the index is expected to remain unchanged at 0.4%, and to grow from 1.5% to 1.7% against the previous year. Thus, the Euro can be substantially supported. In the second half of the day, investors will be waiting for publications from the US. At 3:30 pm, October data on Retail Sales and Retail Sales excluding Autos is due. Both indices are expected to rise. Retail Sales will grow by 0.3% against September figure of 0.1%, while Retail Sales excluding Autos will grow from -0.3% to 0.4%. With forecasts confirmation the USD could strengthen. On Sunday night at 1:50 am, attention needs to be paid to preliminary data on the Japanese GDP for the third quarter, which is forecasted to decline from -0.2% to -1.2%. That would represent a contraction of the economy in Japan and can significantly weaken the Yen.

Claws and Horns

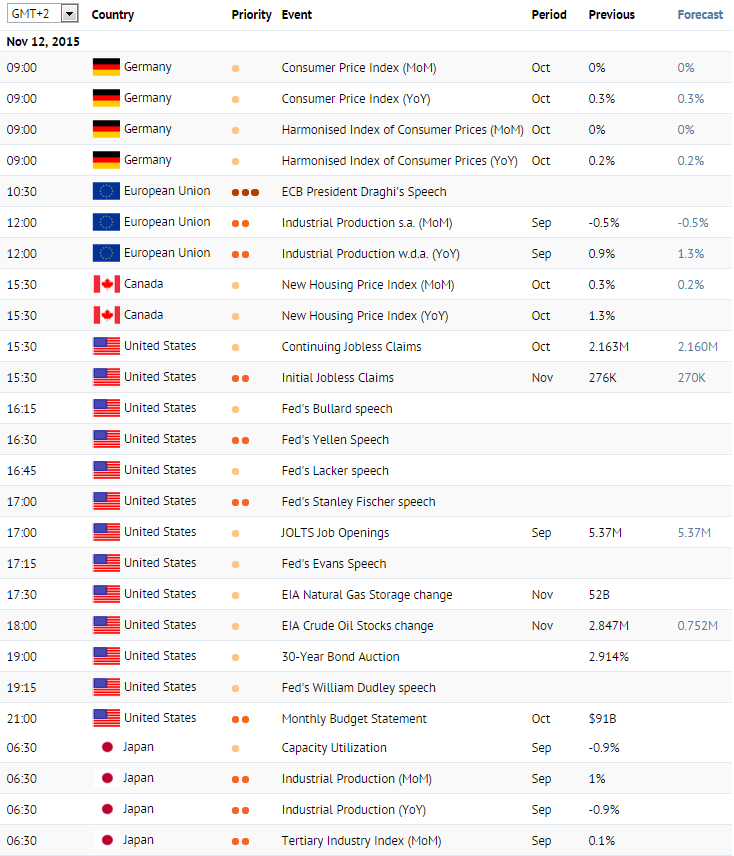

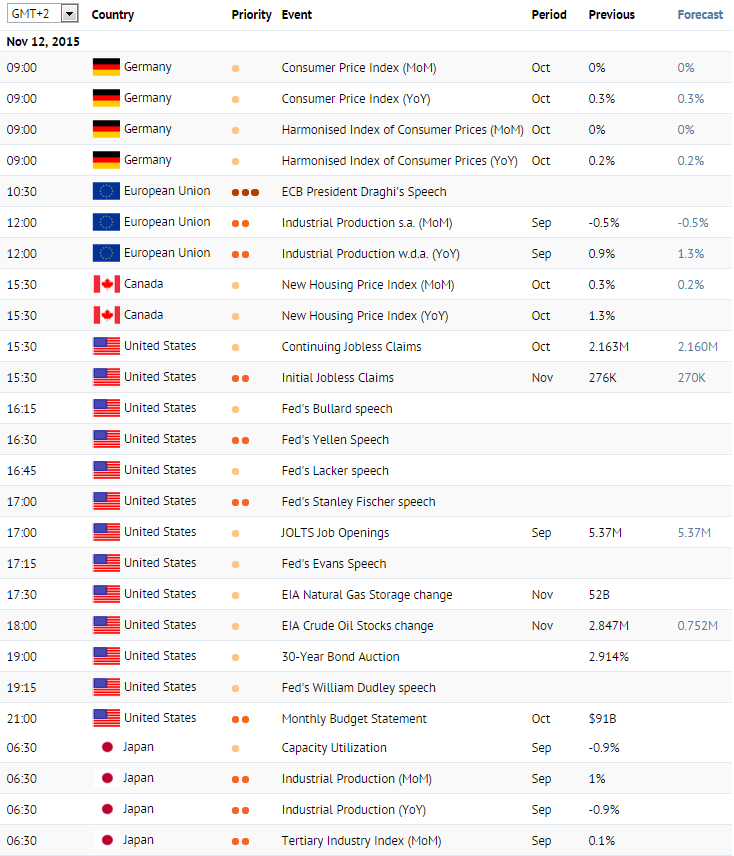

News of the day. Thursday 12.11.2015

On Thursday, attention needs to be paid to the final data on the Consumer Price Index for October in Germany, due at 9 am (all times stated in GMT +2). The index is expected to remain unchanged at 0.3% against the previous month and 0% on the last year. ECB President Draghi speech is due at 10:30 am, as he appears at a Hearing before the Committee on Economic and Monetary Affairs of the European Parliament in Brussels. In his speech, he could touch upon the current state of the European economy and future prospects in monetary policy. September data on Industrial Production in the eurozone is due at 12 pm. According to forecasts, the index will fall by 0.5% against the previous month but will grow by 1.3% on the last year that could support the Euro. There is a number of important appearances of responsible for the economy officials in the US on Thursday. At 4:30 pm, Fed’s Yellen speech is due, as she appears at the Conference on Monetary Policy Implementation and Transmission in the Post-Crisis Period in Washington D.C., and at 5 pm Fed’s Stanley Fischer will present his speech on the Transmission of Exchange Rate Changes to Output and Inflation at the same venue. Furthermore, at 7:15 pm Fed’s William Dudley speech is expected. Speeches by Fed officials traditionally attract investors’ attention as they can contain commentaries and hints on future monetary policy plans. Finally, on Thursday night at 6:30 am markets will be waiting for September data on Industrial Production in Japan. The index is expected to remain unchanged at -0.9% against the previous year and 1% against the previous month.

On Thursday, attention needs to be paid to the final data on the Consumer Price Index for October in Germany, due at 9 am (all times stated in GMT +2). The index is expected to remain unchanged at 0.3% against the previous month and 0% on the last year. ECB President Draghi speech is due at 10:30 am, as he appears at a Hearing before the Committee on Economic and Monetary Affairs of the European Parliament in Brussels. In his speech, he could touch upon the current state of the European economy and future prospects in monetary policy. September data on Industrial Production in the eurozone is due at 12 pm. According to forecasts, the index will fall by 0.5% against the previous month but will grow by 1.3% on the last year that could support the Euro. There is a number of important appearances of responsible for the economy officials in the US on Thursday. At 4:30 pm, Fed’s Yellen speech is due, as she appears at the Conference on Monetary Policy Implementation and Transmission in the Post-Crisis Period in Washington D.C., and at 5 pm Fed’s Stanley Fischer will present his speech on the Transmission of Exchange Rate Changes to Output and Inflation at the same venue. Furthermore, at 7:15 pm Fed’s William Dudley speech is expected. Speeches by Fed officials traditionally attract investors’ attention as they can contain commentaries and hints on future monetary policy plans. Finally, on Thursday night at 6:30 am markets will be waiting for September data on Industrial Production in Japan. The index is expected to remain unchanged at -0.9% against the previous year and 1% against the previous month.

Claws and Horns

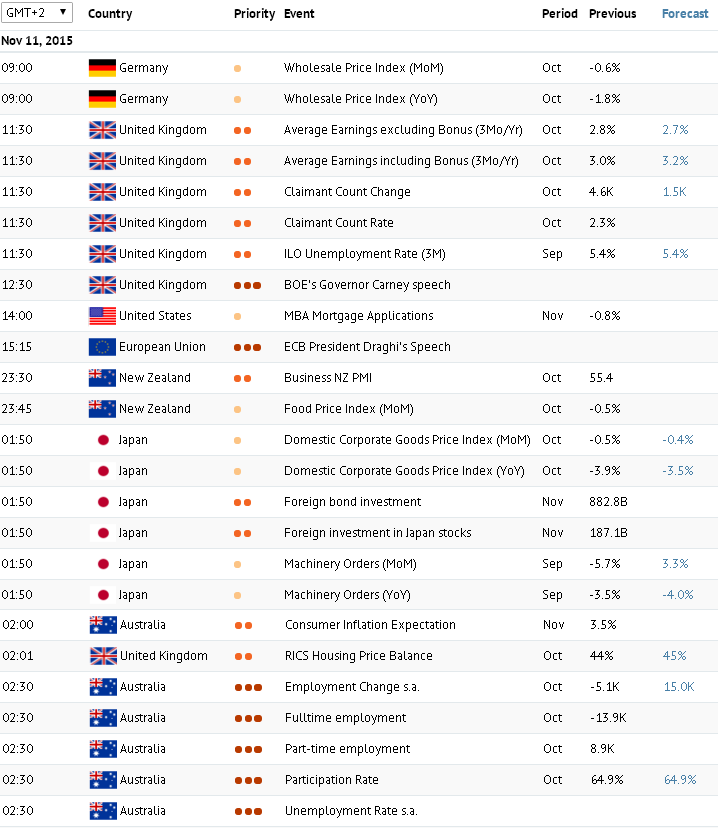

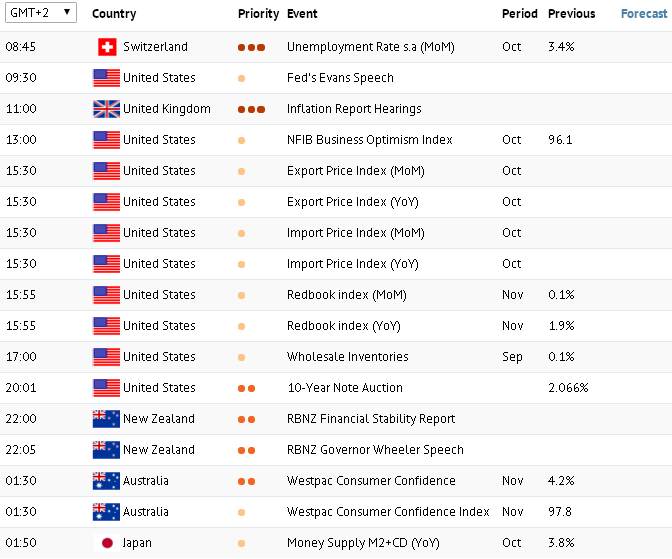

News of the day. Wednesday 11.11.2015

Today the main suppliers of macroeconomic data are going to be the UK, the eurozone and Australia. The UK’s labour market data is due at 11:30 am (all times stated in GMT +2) that includes the ILO Unemployment Rate and Claimant Count Change for October. According to forecasts, the unemployment will stay unchanged at 5.4%, while the number of claimants will fall to 1.5 thousands, against 4.6 thousands a month earlier. If forecasts are confirmed it could support the Pound for a short while. In addition, the BOE’s Governor Carney speech is due at 12:30 pm in which he could comment on the current economic state and monetary policy in the country. His speech may lead to an increased volatility in pairs with the Pound. At 3:15 pm, ECB President Draghi will appear on the Open Forum in London with his speech on “Building real markets for the good of the people”, in which he might touch on economic conditions in the eurozone. On Wednesday night at 2:30 am, October labour market data is due in Australia. According to forecasts, the Unemployment Rate will remain unchanged at 6.2%, while the Employment Change is expected to increase to 15 thousands, against a contraction of more than 5 thousands in the previous month. If forecasts match the real figures, the Australian Dollar could receive a substantial support.

Today the main suppliers of macroeconomic data are going to be the UK, the eurozone and Australia. The UK’s labour market data is due at 11:30 am (all times stated in GMT +2) that includes the ILO Unemployment Rate and Claimant Count Change for October. According to forecasts, the unemployment will stay unchanged at 5.4%, while the number of claimants will fall to 1.5 thousands, against 4.6 thousands a month earlier. If forecasts are confirmed it could support the Pound for a short while. In addition, the BOE’s Governor Carney speech is due at 12:30 pm in which he could comment on the current economic state and monetary policy in the country. His speech may lead to an increased volatility in pairs with the Pound. At 3:15 pm, ECB President Draghi will appear on the Open Forum in London with his speech on “Building real markets for the good of the people”, in which he might touch on economic conditions in the eurozone. On Wednesday night at 2:30 am, October labour market data is due in Australia. According to forecasts, the Unemployment Rate will remain unchanged at 6.2%, while the Employment Change is expected to increase to 15 thousands, against a contraction of more than 5 thousands in the previous month. If forecasts match the real figures, the Australian Dollar could receive a substantial support.

Claws and Horns

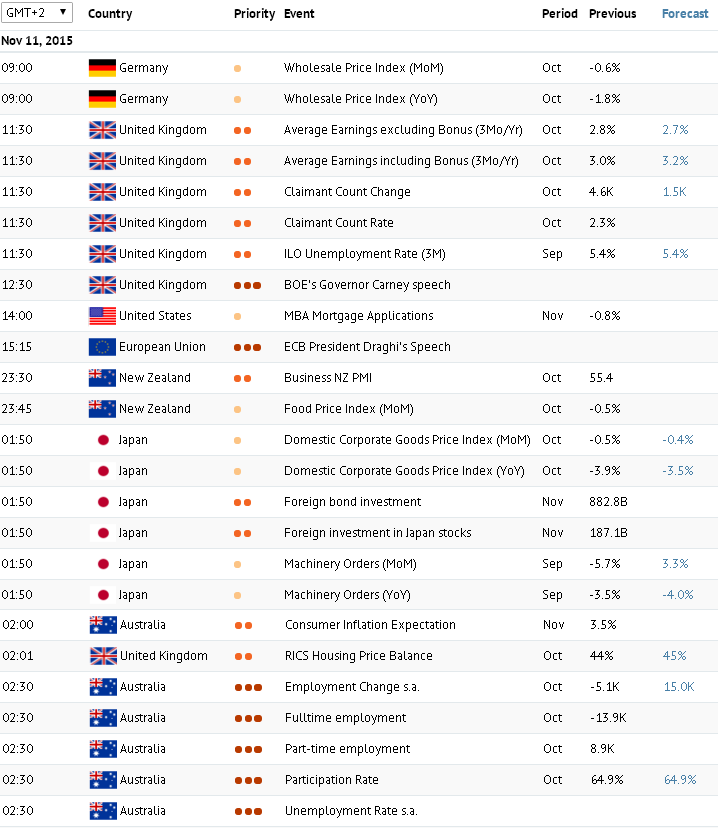

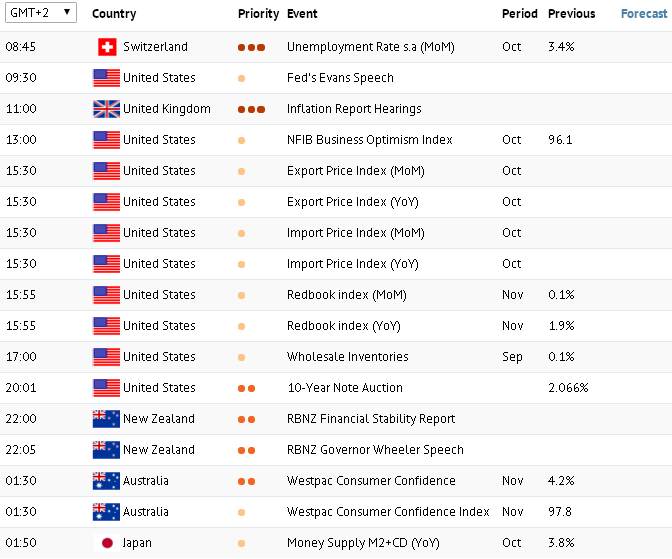

News of the day. Tuesday 10.11.2015

Today there will not be many important publications, which could significantly affect movements in currencies. Investors will pay attention to data from Switzerland, Australia and the UK. The Unemployment Rate data for October is due at 8:45 am (all times stated in GMT +2) in Switzerland. The unemployment in Switzerland remains at 3.2-3.4% for a while now, but even a small change in the index in either direction could affect the dynamics in the Swiss Franc. At 11 am, Inflation Report Hearings are due in the UK. During the hearings, Governor of the Bank of England and members of the Monetary Policy Committee will give speeches regarding inflation in the country and future prospects of the economy. Their commentaries could affect the dynamics in the Pound. On Tuesday night at 1:30 am, the Westpac Consumer Confidence data for November is due in Australia.

Today there will not be many important publications, which could significantly affect movements in currencies. Investors will pay attention to data from Switzerland, Australia and the UK. The Unemployment Rate data for October is due at 8:45 am (all times stated in GMT +2) in Switzerland. The unemployment in Switzerland remains at 3.2-3.4% for a while now, but even a small change in the index in either direction could affect the dynamics in the Swiss Franc. At 11 am, Inflation Report Hearings are due in the UK. During the hearings, Governor of the Bank of England and members of the Monetary Policy Committee will give speeches regarding inflation in the country and future prospects of the economy. Their commentaries could affect the dynamics in the Pound. On Tuesday night at 1:30 am, the Westpac Consumer Confidence data for November is due in Australia.

Claws and Horns

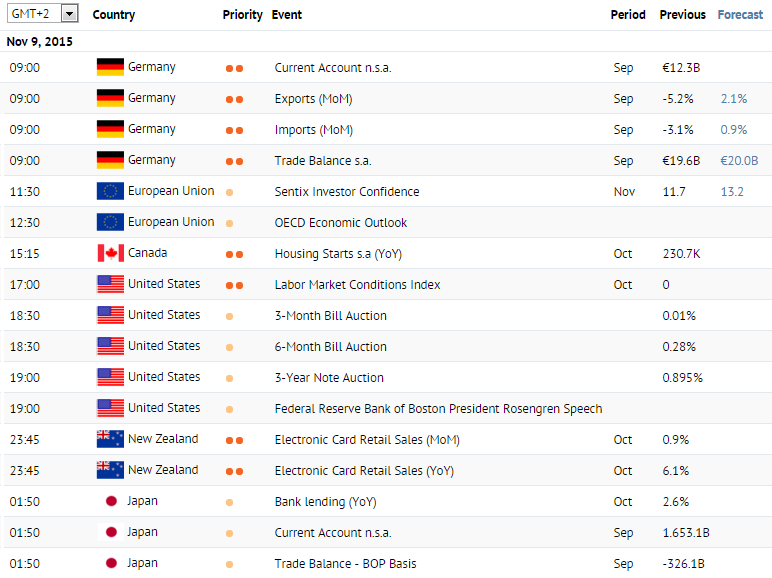

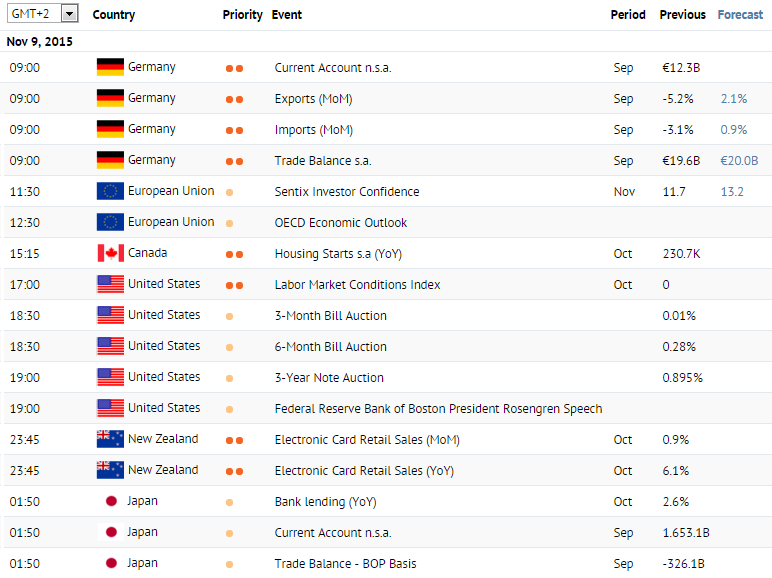

News of the day. Monday 09.11.2015

Today markets are going to be following news from Germany, Canada, New Zealand and China. A number of releases is due in Germany, the biggest economy in the eurozone, at 9 am (all times stated in GMT +2). Amongst them are data on Imports, Exports and Trade Balance. Last month all three indicators fell. If Imports and Exports come out worse than their forecasts that would be their worst figures since October and November 2014 accordingly. Germany’s Current Account was declining for the last two months, and if it falls this month again that could pressure the Euro. October Housing Starts data is due at 3:15 pm in Canada, which, if comes out above forecasts could strengthen the CAD against its major opponents. Electronic Card Retail Sales data for October is due at 11:45 pm in New Zealand. Year-on-year figures for the index tend to be growing that shows optimistic mood prevailing within New Zealand consumers. On Monday night at 03:30 am, the Consumer Price Index for October is due in China. According to forecasts, the index will fall to -0.2% against the previous month and by 0.1% to 1.5% against the previous year.

Today markets are going to be following news from Germany, Canada, New Zealand and China. A number of releases is due in Germany, the biggest economy in the eurozone, at 9 am (all times stated in GMT +2). Amongst them are data on Imports, Exports and Trade Balance. Last month all three indicators fell. If Imports and Exports come out worse than their forecasts that would be their worst figures since October and November 2014 accordingly. Germany’s Current Account was declining for the last two months, and if it falls this month again that could pressure the Euro. October Housing Starts data is due at 3:15 pm in Canada, which, if comes out above forecasts could strengthen the CAD against its major opponents. Electronic Card Retail Sales data for October is due at 11:45 pm in New Zealand. Year-on-year figures for the index tend to be growing that shows optimistic mood prevailing within New Zealand consumers. On Monday night at 03:30 am, the Consumer Price Index for October is due in China. According to forecasts, the index will fall to -0.2% against the previous month and by 0.1% to 1.5% against the previous year.

Claws and Horns

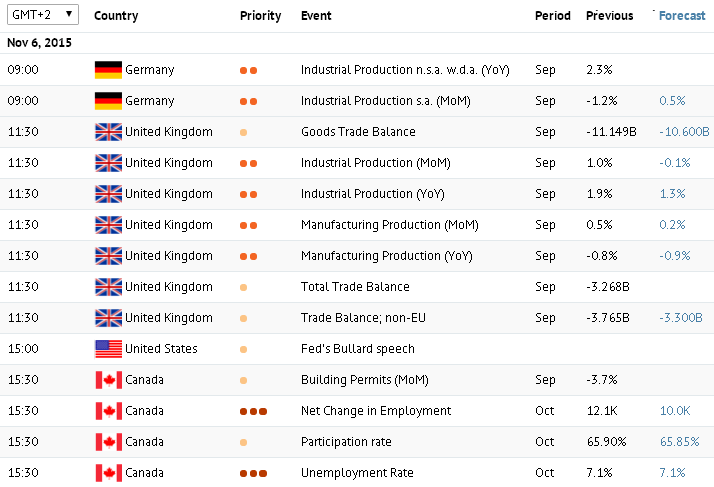

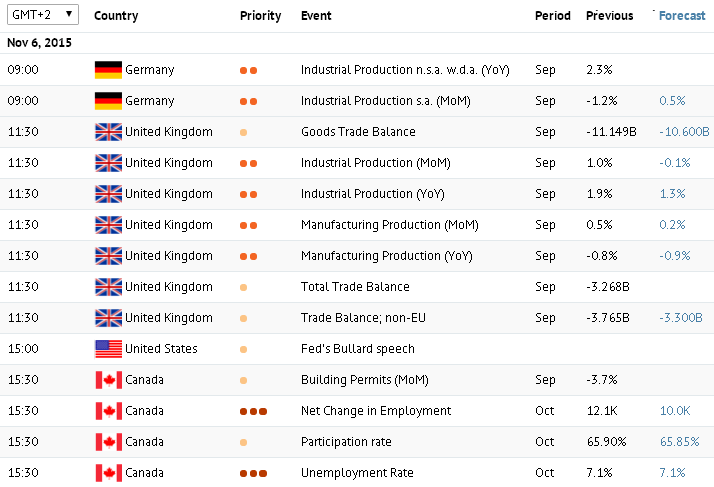

News of the day. Friday 06.11.2015

The most important publication of Friday is going to be the data on the US labour market. Prior to that, however, data on Industrial Production for September is due in Germany at 9 am (all times stated in GMT +2). On a month-to-month basis, the index is expected to grow from -1.2% to 0.5%. On a year-to-year basis, the index will probably rise as well, just not as strong as in September when it came out at 2.3%. September Industrial Production data is due at 11:30 am in the UK. According to forecasts, the index will fall against the previous month and the year, from 1.0% to -0.1% and from 1.9% to 1.3% respectively, which could pressure the Pound. October labour market data from the US is due at 3:30 pm, of which the most important are going to be the Unemployment Rate and Nonfarm Payrolls. The unemployment Rate is expected to remain unchanged at 5.1%, while the number of new jobs will come out at 180 thousands that is significantly higher than the previous figure. The leading indicators, however, give contradicting information. On one hand, the ADP Employment Change fell against its September data. On the other hand, Challenger Job Cuts, as well as averaged Initial and Continuing Jobless Claims also fell against their September data. Generally, forecasts confirmation is more than possible and can significantly support the US Dollar. Also at 3:30 pm, the labour market data is due from Canada. According to forecasts, the Unemployment Rate that has been gradually growing since October last year will remain unchanged at 7.1% in October. The Net Change in Employment, however, can fall from 12.1 to 9.7 thousands that would pressure the CAD.

The most important publication of Friday is going to be the data on the US labour market. Prior to that, however, data on Industrial Production for September is due in Germany at 9 am (all times stated in GMT +2). On a month-to-month basis, the index is expected to grow from -1.2% to 0.5%. On a year-to-year basis, the index will probably rise as well, just not as strong as in September when it came out at 2.3%. September Industrial Production data is due at 11:30 am in the UK. According to forecasts, the index will fall against the previous month and the year, from 1.0% to -0.1% and from 1.9% to 1.3% respectively, which could pressure the Pound. October labour market data from the US is due at 3:30 pm, of which the most important are going to be the Unemployment Rate and Nonfarm Payrolls. The unemployment Rate is expected to remain unchanged at 5.1%, while the number of new jobs will come out at 180 thousands that is significantly higher than the previous figure. The leading indicators, however, give contradicting information. On one hand, the ADP Employment Change fell against its September data. On the other hand, Challenger Job Cuts, as well as averaged Initial and Continuing Jobless Claims also fell against their September data. Generally, forecasts confirmation is more than possible and can significantly support the US Dollar. Also at 3:30 pm, the labour market data is due from Canada. According to forecasts, the Unemployment Rate that has been gradually growing since October last year will remain unchanged at 7.1% in October. The Net Change in Employment, however, can fall from 12.1 to 9.7 thousands that would pressure the CAD.

Claws and Horns

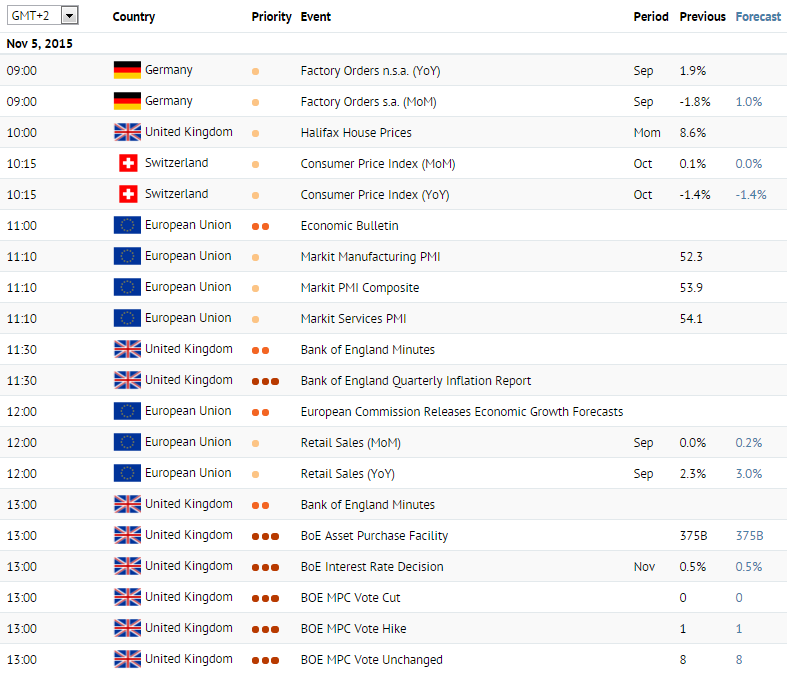

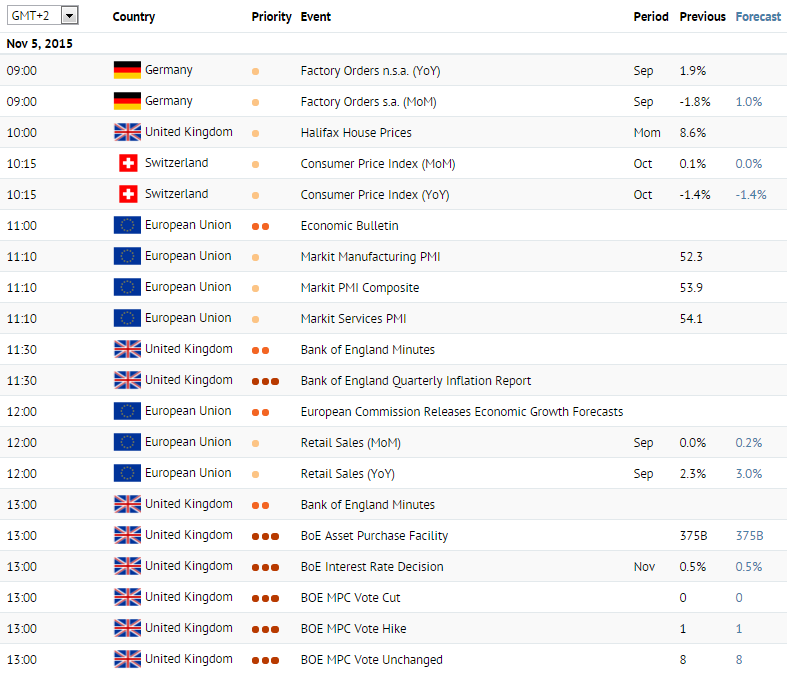

News of the day. Thursday 05.11.2015

The most important event on Thursday is going to happen in the UK, where the Bank of England will hold its meeting and at 1 pm (all times stated in GMT +2) will make its Interest Rate Decision. Markets do not expect the regulator to change the rate in current economic conditions, which would remain at 0.5%. The BOE Asset Purchase Facility is also expected to remain unchanged at 375 billion Pounds. The closest attention will be paid to BOE’s Governor Mark Carney speech at 2:45 pm. Investors are going to be looking for hints on future plans in regulator’s monetary policy.

In addition, on Thursday attention needs to be paid to October data on the Consumer Price Index in Switzerland, due at 10:15 am. Here, just as in other European countries inflation remains in negative territory. According to forecasts, on a year-to-year basis the index will remain at -1.4% and will fall from 0.1% to 0% against the previous month. The Bank of England Quarterly Inflation Report is due at 11:30 am. Data on Initial and Continuing Jobless Claims are due in the US at 3:30 pm. These indices are not as important by themselves but their averaged figures can act as leading indicators to the most important Non-farm Payrolls. Data on Ivey Purchasing Managers’ Index is due at 5 pm in Canada. The index is forecasted to grow from 53.7 to 54.0 points that would support the Canadian dollar. On Thursday night at 01:30 am, the RBA Monetary Policy Statement is due that traditionally attracts investors’ attention who are looking to find out regulator’s opinion on the current state of the Australian economy.

The most important event on Thursday is going to happen in the UK, where the Bank of England will hold its meeting and at 1 pm (all times stated in GMT +2) will make its Interest Rate Decision. Markets do not expect the regulator to change the rate in current economic conditions, which would remain at 0.5%. The BOE Asset Purchase Facility is also expected to remain unchanged at 375 billion Pounds. The closest attention will be paid to BOE’s Governor Mark Carney speech at 2:45 pm. Investors are going to be looking for hints on future plans in regulator’s monetary policy.

In addition, on Thursday attention needs to be paid to October data on the Consumer Price Index in Switzerland, due at 10:15 am. Here, just as in other European countries inflation remains in negative territory. According to forecasts, on a year-to-year basis the index will remain at -1.4% and will fall from 0.1% to 0% against the previous month. The Bank of England Quarterly Inflation Report is due at 11:30 am. Data on Initial and Continuing Jobless Claims are due in the US at 3:30 pm. These indices are not as important by themselves but their averaged figures can act as leading indicators to the most important Non-farm Payrolls. Data on Ivey Purchasing Managers’ Index is due at 5 pm in Canada. The index is forecasted to grow from 53.7 to 54.0 points that would support the Canadian dollar. On Thursday night at 01:30 am, the RBA Monetary Policy Statement is due that traditionally attracts investors’ attention who are looking to find out regulator’s opinion on the current state of the Australian economy.

Claws and Horns

News of the day. Wednesday 04.11.2015

There will not be many important publications on Wednesday. Markets are going to wait for the results of the ECB Non-monetary policy meeting, due at 10 am (all times stated in GMT +2). At the meeting, the ECB officials are going to discuss non-monetary measures used to influence the eurozone economy that could lead to moderate volatility in the Euro. After that, October data on the Markit Services PMI’s is due from Germany (at 10:55 am), the eurozone (at 11 am) and the UK (at 11:30 am) though the index is expected to change only for the UK. In Germany, it will remain at 55.2 points, in the eurozone at 54.2 points, while in the UK it will grow from 53.3 to 54.2 points that might support the Pound. The ADP Employment Change for October is due at 3:15 pm in the US. According to forecasts, the figure will fall from 200 to 181 thousands. The index is thought to be the leading to Non-farm Payrolls data. If forecasts are confirmed that would pressure the USD. The ISM Non-Manufacturing PMI data for October is due at 5 pm in the US and the index is expected to grow from 56.9 points to 57.1 points. In the same hour, Fed Chair Janet Yellen is due to give a speech in Congress, in which she might touch on the future direction in regulator’s monetary policy. RBA’s Governor Glen Stevens Speech is due at 11:45 pm in Melbourne, in which he might express his opinion on the current state of the Australian economy that could have a short-term effect on the AUD.

There will not be many important publications on Wednesday. Markets are going to wait for the results of the ECB Non-monetary policy meeting, due at 10 am (all times stated in GMT +2). At the meeting, the ECB officials are going to discuss non-monetary measures used to influence the eurozone economy that could lead to moderate volatility in the Euro. After that, October data on the Markit Services PMI’s is due from Germany (at 10:55 am), the eurozone (at 11 am) and the UK (at 11:30 am) though the index is expected to change only for the UK. In Germany, it will remain at 55.2 points, in the eurozone at 54.2 points, while in the UK it will grow from 53.3 to 54.2 points that might support the Pound. The ADP Employment Change for October is due at 3:15 pm in the US. According to forecasts, the figure will fall from 200 to 181 thousands. The index is thought to be the leading to Non-farm Payrolls data. If forecasts are confirmed that would pressure the USD. The ISM Non-Manufacturing PMI data for October is due at 5 pm in the US and the index is expected to grow from 56.9 points to 57.1 points. In the same hour, Fed Chair Janet Yellen is due to give a speech in Congress, in which she might touch on the future direction in regulator’s monetary policy. RBA’s Governor Glen Stevens Speech is due at 11:45 pm in Melbourne, in which he might express his opinion on the current state of the Australian economy that could have a short-term effect on the AUD.

Claws and Horns

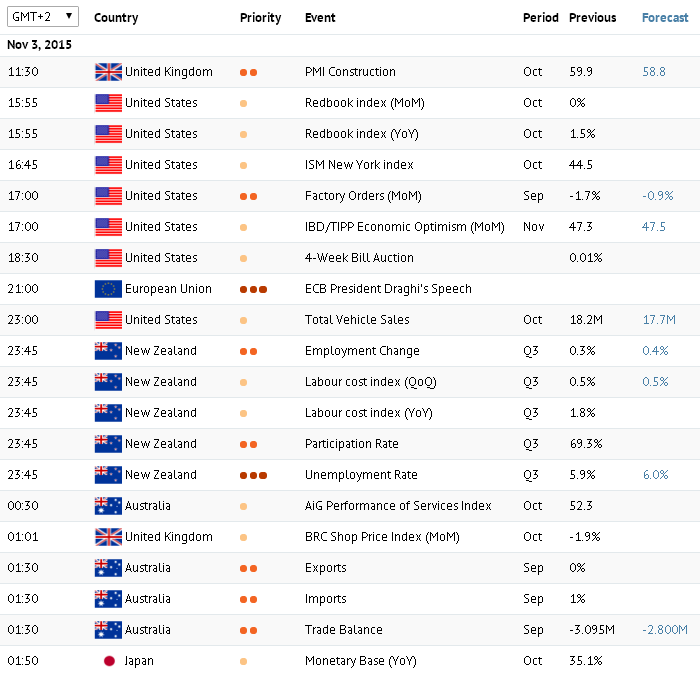

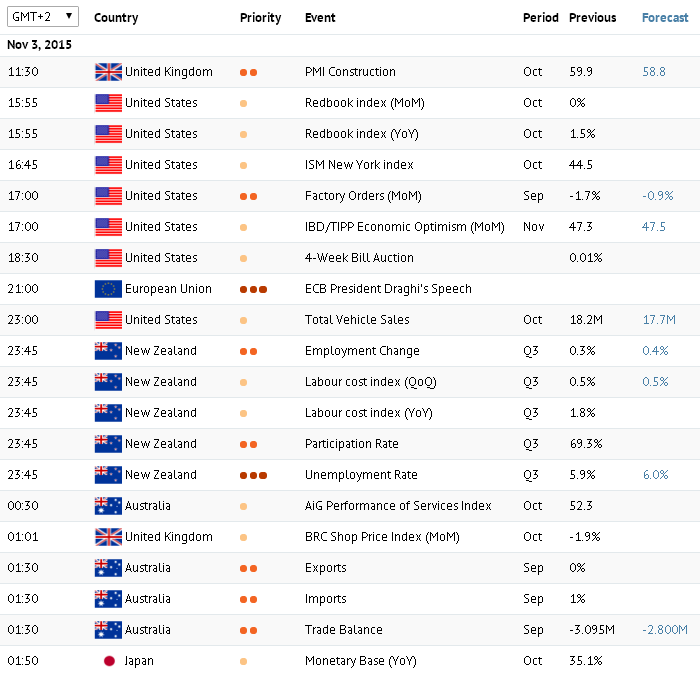

News of the day. Tuesday 03.11.2015

On Tuesday, important macroeconomic statistics are going to be published in the UK, the US, New Zealand and the eurozone. The PMI Construction for October is due at 11:30 am (all times stated in GMT +2) in the UK. The index is expected to remain unchanged at 59.1 points that would show positive dynamics in the construction sector, one of the keys sectors representing the state of the economy, as it stands above the 50-point threshold. Factory Orders for September are due at 5 pm in the US. The index is forecasted to grow from -1.7% to -0.8%. Thus, contraction in the volume of orders will slow but remain that could pressure the US Dollar. At 9 pm, economists expect the Speech by ECB President Mario Draghi at the Opening of the European Cultural Days 2015 in Frankfurt, Germany. In the speech, he could touch upon the current state of the European economy and future monetary policy plans. The Unemployment Rate for the third quarter of the year is due at 11:45 pm in New Zealand. According to forecasts, the figure will grow from 5.9% to 6% that would weaken the NZD. On Tuesday night at 2:30 am, September Retail Sales data is due in Australia that expected to remain unchanged at 0.4%.

On Tuesday, important macroeconomic statistics are going to be published in the UK, the US, New Zealand and the eurozone. The PMI Construction for October is due at 11:30 am (all times stated in GMT +2) in the UK. The index is expected to remain unchanged at 59.1 points that would show positive dynamics in the construction sector, one of the keys sectors representing the state of the economy, as it stands above the 50-point threshold. Factory Orders for September are due at 5 pm in the US. The index is forecasted to grow from -1.7% to -0.8%. Thus, contraction in the volume of orders will slow but remain that could pressure the US Dollar. At 9 pm, economists expect the Speech by ECB President Mario Draghi at the Opening of the European Cultural Days 2015 in Frankfurt, Germany. In the speech, he could touch upon the current state of the European economy and future monetary policy plans. The Unemployment Rate for the third quarter of the year is due at 11:45 pm in New Zealand. According to forecasts, the figure will grow from 5.9% to 6% that would weaken the NZD. On Tuesday night at 2:30 am, September Retail Sales data is due in Australia that expected to remain unchanged at 0.4%.

Claws and Horns

News of the day. Monday 02.11.2015

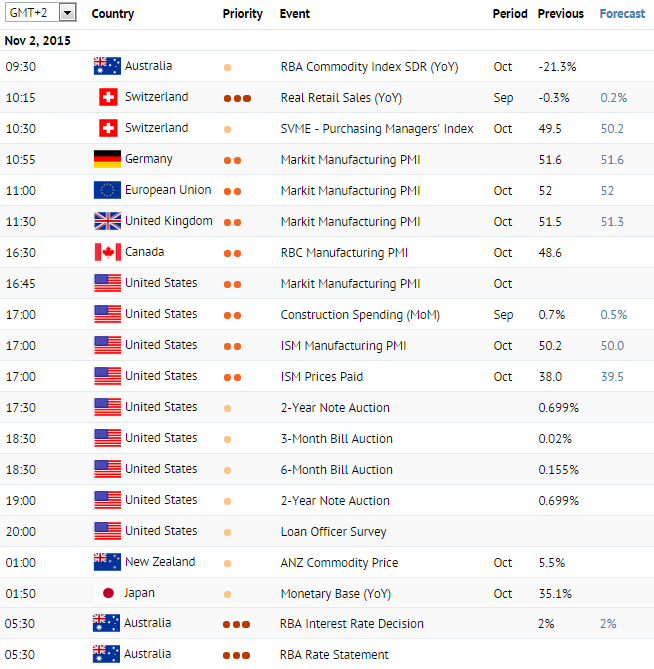

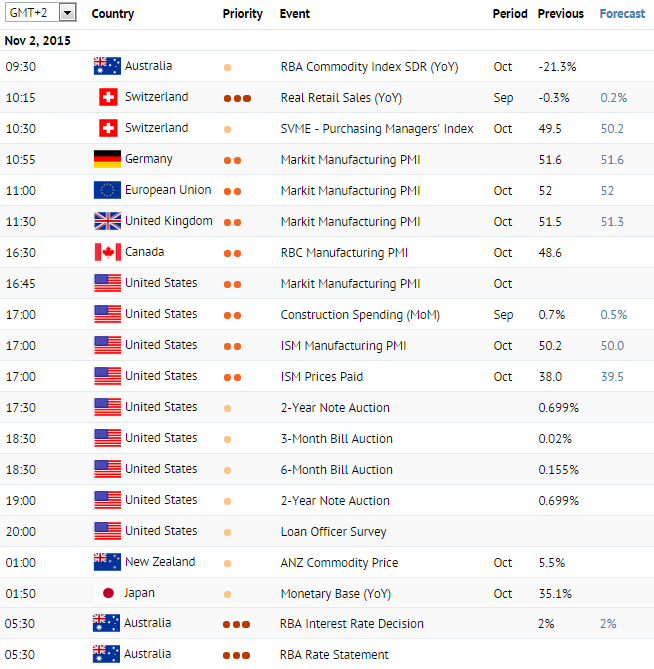

Monday can be called the day of Manufacturing PMI. Today, October data on the index is going to be published in the eurozone, Germany, Canada, the UK and the US. The index is based on surveys of purchasing managers of the biggest national companies and represents their view on the current state of the economy and its future prospects. The threshold in the index is the 50-point mark, figures below which represent manufacturing sector contraction. Data on Markit Manufacturing PMI’s for Germany and the eurozone are due at 10:55 and 11 am (all times stated in GMT +2). Both indexes are expected to stay unchanged at 51.6 and 52 points respectively, therefore remaining above the threshold but dangerously close to it. Similar picture is in the UK, where the index remains near the 52 mark since April this year and is going to be published at 11:30 am. The RBC Manufacturing PMI is due at 4:30 pm. Here, the index stays below the 50 mark for few months now (last figure was 48.6 points) and tends to decline. The ISM Manufacturing PMI is due at 5 pm. However, a number of leading indicators in the US, including the Chicago PMI, have grown thus increasing chances for the general index to grow as well. It is worth noting that the index has been falling for the last four months and in September reached its critical level of 50.2 points.

In addition, on Monday attention needs to be paid to September data on Real Retail Sales from Switzerland that are due at 10:15 am. The index has been falling during this year and there does not seem to be a reason for it to stop its fall. If the index declines again, that would pressure the Franc. On Monday night at 5:30 am, the RBA Interest Rate Decision is due though majority of experts expect the rate to stay unchanged at its current 2%.

Monday can be called the day of Manufacturing PMI. Today, October data on the index is going to be published in the eurozone, Germany, Canada, the UK and the US. The index is based on surveys of purchasing managers of the biggest national companies and represents their view on the current state of the economy and its future prospects. The threshold in the index is the 50-point mark, figures below which represent manufacturing sector contraction. Data on Markit Manufacturing PMI’s for Germany and the eurozone are due at 10:55 and 11 am (all times stated in GMT +2). Both indexes are expected to stay unchanged at 51.6 and 52 points respectively, therefore remaining above the threshold but dangerously close to it. Similar picture is in the UK, where the index remains near the 52 mark since April this year and is going to be published at 11:30 am. The RBC Manufacturing PMI is due at 4:30 pm. Here, the index stays below the 50 mark for few months now (last figure was 48.6 points) and tends to decline. The ISM Manufacturing PMI is due at 5 pm. However, a number of leading indicators in the US, including the Chicago PMI, have grown thus increasing chances for the general index to grow as well. It is worth noting that the index has been falling for the last four months and in September reached its critical level of 50.2 points.

In addition, on Monday attention needs to be paid to September data on Real Retail Sales from Switzerland that are due at 10:15 am. The index has been falling during this year and there does not seem to be a reason for it to stop its fall. If the index declines again, that would pressure the Franc. On Monday night at 5:30 am, the RBA Interest Rate Decision is due though majority of experts expect the rate to stay unchanged at its current 2%.

Claws and Horns

News of the day. Friday 30.10.2015

The most important publication on Friday is going to be data on the Consumer Price Index for October from the eurozone at 12 pm (all times stated in GMT +2). The figure is expected to grow from -0.1% to 0% against the previous year, which, however, will give little support to the Euro. Inflation in the eurozone remains near its negative numbers, while the QE program has little positive effect on the economy yet. Data on Personal Income and Personal Spending for September is due at 2:30 pm in the US. Both figures are expected to decline, from 0.3% to 0.2% and from 0.4% to 0.2% accordingly that might pressure the USD. Chicago Purchasing Managers’ Index for October is due at 4:45 pm. According to forecasts, the index will grow from 48.7 to 49 points, which is still a negative sign as positive sentiment in business activity indicates only a figure above 50 points. On Saturday night at 4 am, attention needs to be paid to the NBS Manufacturing PMI from China. The index is expected to grow from 49.8 to 50 points that could affect movements in currencies at the opening of the next trading session.

The most important publication on Friday is going to be data on the Consumer Price Index for October from the eurozone at 12 pm (all times stated in GMT +2). The figure is expected to grow from -0.1% to 0% against the previous year, which, however, will give little support to the Euro. Inflation in the eurozone remains near its negative numbers, while the QE program has little positive effect on the economy yet. Data on Personal Income and Personal Spending for September is due at 2:30 pm in the US. Both figures are expected to decline, from 0.3% to 0.2% and from 0.4% to 0.2% accordingly that might pressure the USD. Chicago Purchasing Managers’ Index for October is due at 4:45 pm. According to forecasts, the index will grow from 48.7 to 49 points, which is still a negative sign as positive sentiment in business activity indicates only a figure above 50 points. On Saturday night at 4 am, attention needs to be paid to the NBS Manufacturing PMI from China. The index is expected to grow from 49.8 to 50 points that could affect movements in currencies at the opening of the next trading session.

Claws and Horns

News of the day. Thursday 29.10.2015

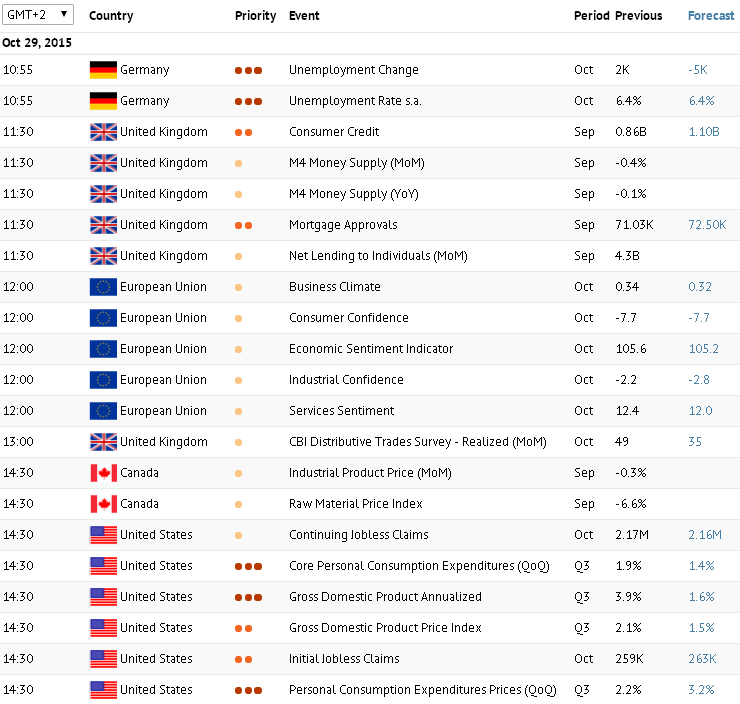

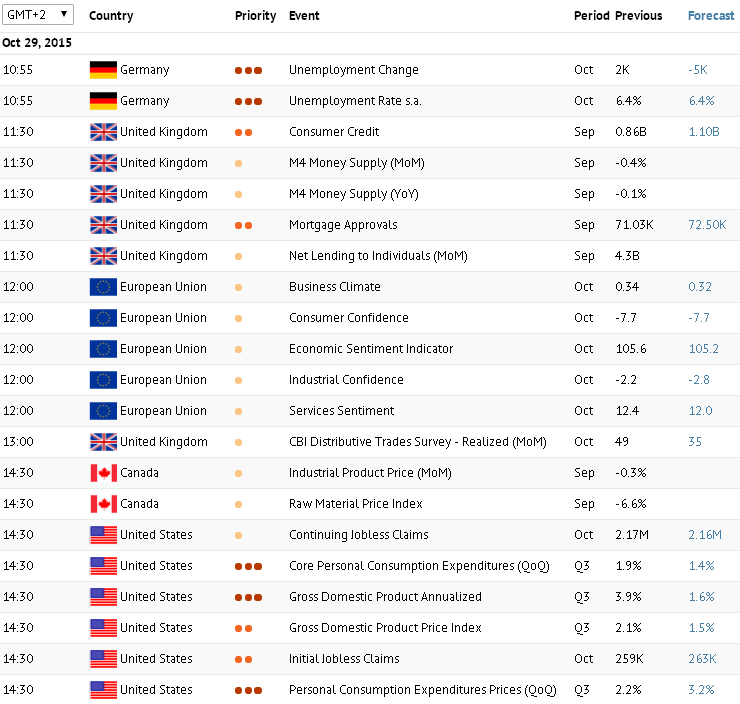

On Thursday, important macroeconomic statistics are going to come out in the US and in Germany. The Unemployment Rate for September is due at 11:55 am (all times stated in GMT +2) in Germany. The index is expected to remain at the same level of 6.4%. The unemployment in Germany is slowly falling for the last few years that shows a gradual recovery of the German economy. It is worth noting, however, that it remained at 6.4% since March this year. The Gross Domestic Product Annualized is due at 3:30 pm from the US, which is forecasted to show a decline from 3.9% to 1.6%. If forecasts are confirmed that would be another sign that the growth is slowing in the world’s leading economy. Slowing GDP growth rates could also lead to delays in interest rate increases in the US. Forecasts confirmation might also result in serious weakening in the USD against its major competitors. Data on the Consumer Price Index, the main inflation indicator, for October is due at 4 pm in Germany. On a year-to-year basis, the index is expected to grow from 0% to 0.2%, which is the positive news for Germany as well as for the eurozone as the whole. Against the previous month, the index will also increase to -0.1% that would still represent deflation.

On Thursday night at 00:30 am, attention needs to be paid to the publication of the National Consumer Price Index for September from Japan. Presently, inflation in the country remains at 0.2% but tends to decrease over the time that pressures the Yen.

On Thursday, important macroeconomic statistics are going to come out in the US and in Germany. The Unemployment Rate for September is due at 11:55 am (all times stated in GMT +2) in Germany. The index is expected to remain at the same level of 6.4%. The unemployment in Germany is slowly falling for the last few years that shows a gradual recovery of the German economy. It is worth noting, however, that it remained at 6.4% since March this year. The Gross Domestic Product Annualized is due at 3:30 pm from the US, which is forecasted to show a decline from 3.9% to 1.6%. If forecasts are confirmed that would be another sign that the growth is slowing in the world’s leading economy. Slowing GDP growth rates could also lead to delays in interest rate increases in the US. Forecasts confirmation might also result in serious weakening in the USD against its major competitors. Data on the Consumer Price Index, the main inflation indicator, for October is due at 4 pm in Germany. On a year-to-year basis, the index is expected to grow from 0% to 0.2%, which is the positive news for Germany as well as for the eurozone as the whole. Against the previous month, the index will also increase to -0.1% that would still represent deflation.

On Thursday night at 00:30 am, attention needs to be paid to the publication of the National Consumer Price Index for September from Japan. Presently, inflation in the country remains at 0.2% but tends to decrease over the time that pressures the Yen.

: