Daniel Stein / プロファイル

- 情報

|

10+ 年

経験

|

20

製品

|

2977

デモバージョン

|

|

9

ジョブ

|

4

シグナル

|

2

購読者

|

Founder

において

Stein Investments

新しくなったスタイン・インベストメンツのウェルカム・ページをご覧ください。

をご覧ください。

https://www.mql5.com/en/blogs/post/755375 をクリックしてください。

ご不明な点がございましたら、お気軽にお問い合わせください。

それではよい取引を

ダニエル

をご覧ください。

https://www.mql5.com/en/blogs/post/755375 をクリックしてください。

ご不明な点がございましたら、お気軽にお問い合わせください。

それではよい取引を

ダニエル

Daniel Stein

Most of us use a VPS to run our trading EA's 24/7, but how to monitor if these terminals are up and running? What if they crash, or shut-down due to an update? How do I get notified about that? That's where our Heartbeat Monitoring comes into play...

ソーシャルネットワーク上でシェアする · 2

425

Daniel Stein

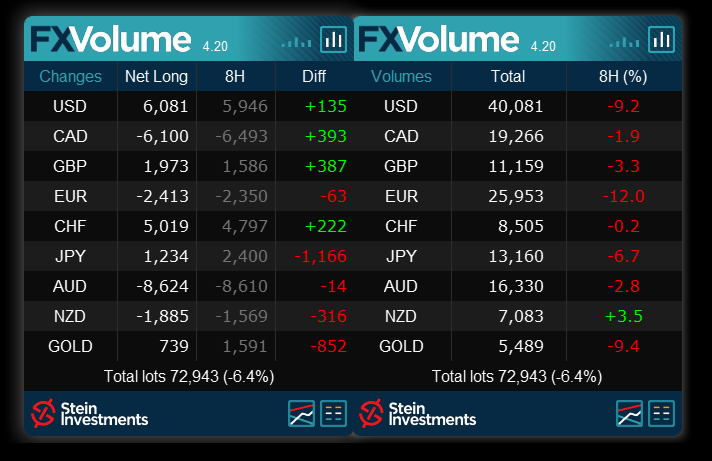

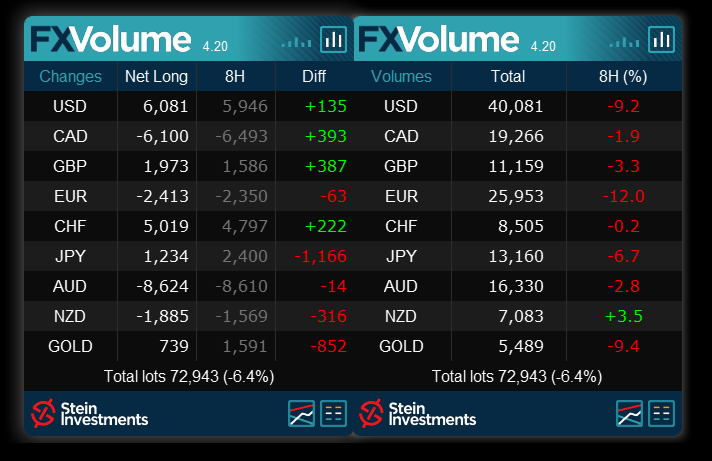

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

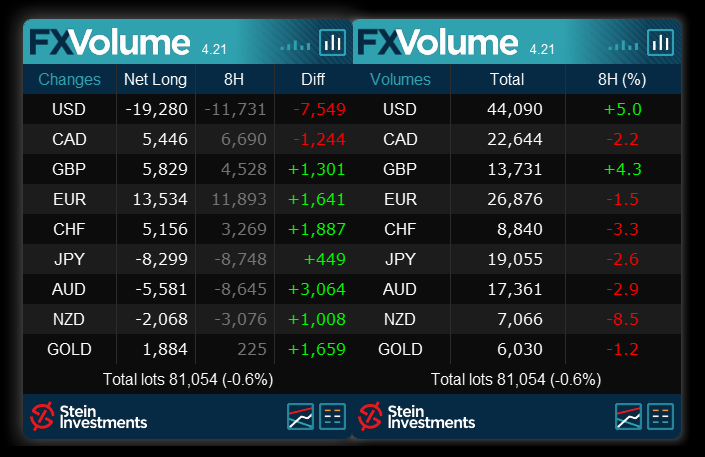

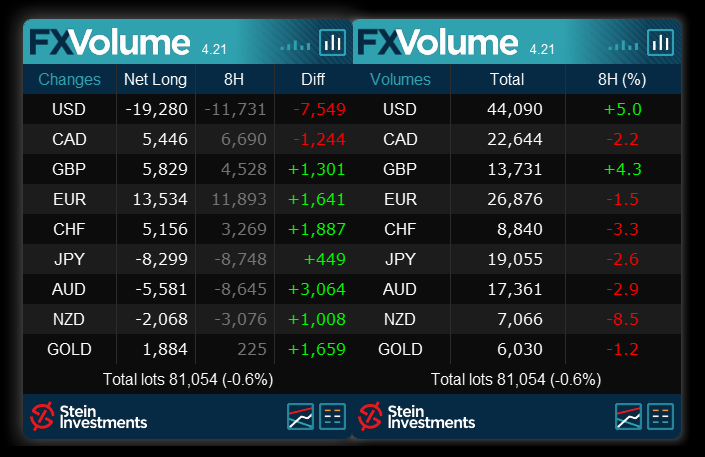

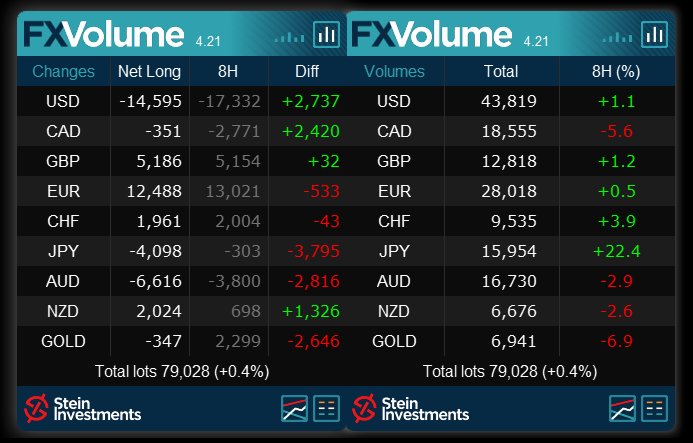

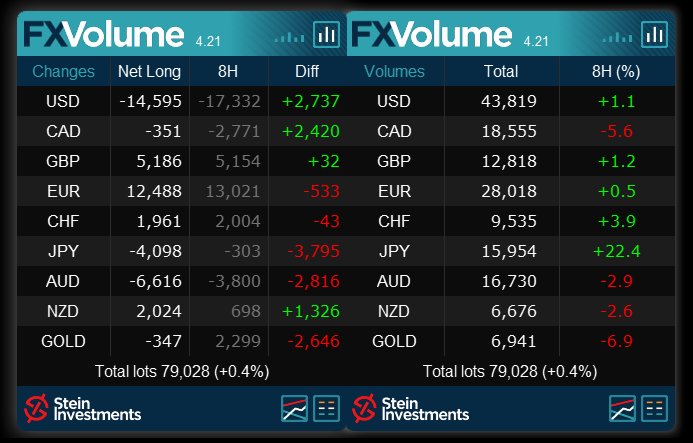

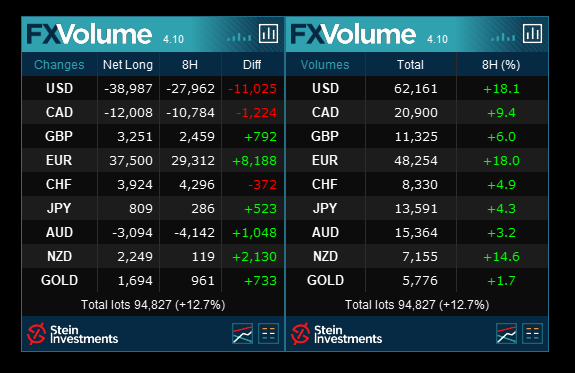

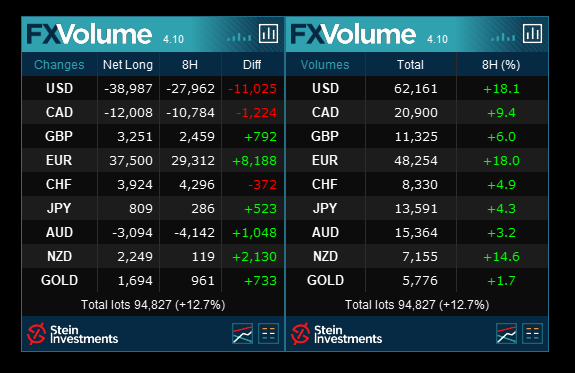

at the beginning of this new trading week, we see (again) a mixed picture in terms of retail trading volume. The USD shows the most significant change in its Net Long Volume, with almost 30% changing to the Long side, and covered by a rising interest in USD positions.

However, the total volume in USD positions and the total market volume, which is dominated by the USD pairs, already dropped since the London pre-market opened. And we also see that most of the USD pairs reversed since then.

So, I highly recommend waiting until the market stabilizes, and have another look at it as soon as we see this total volume history line rise again.

Best regards

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

at the beginning of this new trading week, we see (again) a mixed picture in terms of retail trading volume. The USD shows the most significant change in its Net Long Volume, with almost 30% changing to the Long side, and covered by a rising interest in USD positions.

However, the total volume in USD positions and the total market volume, which is dominated by the USD pairs, already dropped since the London pre-market opened. And we also see that most of the USD pairs reversed since then.

So, I highly recommend waiting until the market stabilizes, and have another look at it as soon as we see this total volume history line rise again.

Best regards

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

販売者Alain Verleyenによって共有されたプロダクト

If you have never used FX Power on your MT4 before, this is the ideal tool to download all the necessary market data at once, and fully automated.

このユーティリティEAは、ブローカーからすべてのヒストリカルデータを一度にダウンロードすることを目的としています。チャート(どのチャートでも可)にドロップしたら、入力で処理するシンボルとタイムフレームを選択します。そうすると、すべてが自動化されます。時間はかかりますが、処理された内容はExpertsログに表示されます。 もちろん、ダウンロードできるのはブローカーサーバーにあるデータのみです。このプロセスは、MT4の「チャート」設定の「ヒストリーの最大バー」と「チャートの最大バー」によって異なりますので、最大データを確実に取得したい場合は、これらの値をデフォルトよりも大きく設定することができます。しかし、すべてのブローカーが多くの履歴データを提供するわけではなく、これらの設定に非常に大きな値を使用すると、あなたのプラットフォームのパフォーマンスに深刻な影響を与える可能性があります、それを使用して注意してください。 このツールは主に、複数のシンボルと複数のタイムフレームで動作する指標やEAに必要なすべてのデータをダウンロードするために非常に便利です。 私のパートナーである

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

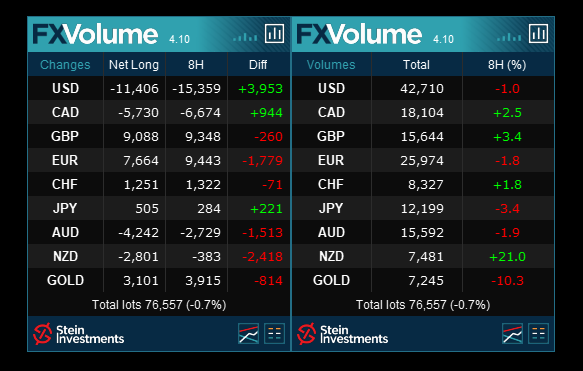

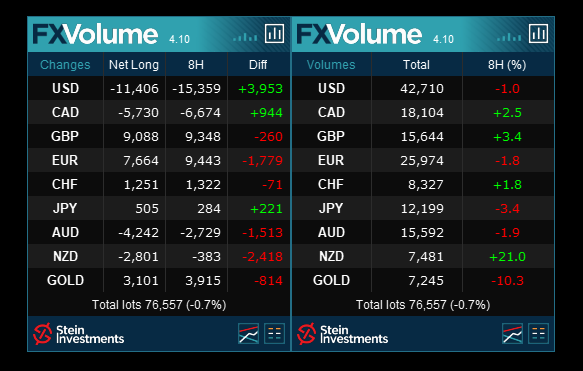

today we see a mixed picture in terms of retail trading volume. The NZD provides us with a seductive setup ticking all boxes, but the total market volume has dropped slightly since it’s peak around 4 hours ago as illustrated by the history line below the panel. When checking the NZD pairs, you’ll also see that this uptrend is already over.

So, this will be another Friday where I don’t think it’s worth risking anything. Of course, there will be some movement in the market, mostly during the NY session, but we ignore it because it doesn’t suit our trading approach.

So, we’re happy with the profits achieved and look forward to the next week, and it’s upcoming trading opportunities.

All the best, and happy weekend

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

today we see a mixed picture in terms of retail trading volume. The NZD provides us with a seductive setup ticking all boxes, but the total market volume has dropped slightly since it’s peak around 4 hours ago as illustrated by the history line below the panel. When checking the NZD pairs, you’ll also see that this uptrend is already over.

So, this will be another Friday where I don’t think it’s worth risking anything. Of course, there will be some movement in the market, mostly during the NY session, but we ignore it because it doesn’t suit our trading approach.

So, we’re happy with the profits achieved and look forward to the next week, and it’s upcoming trading opportunities.

All the best, and happy weekend

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Update on todays Morning Briefing

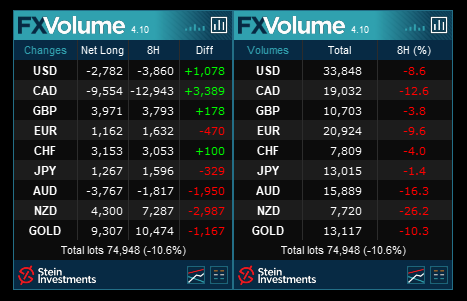

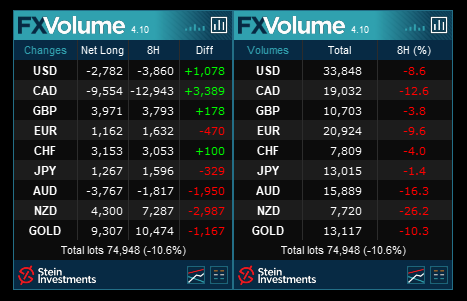

The London session was, as expected, pretty boring due to the constantly dropping volume across all currencies, but right upfront the NY session a new opportunity appeared on the USD. The FXV screenshot was taken at 13:02 London Time.

Why did we take the USD, and not GBP?

Because the USD showed the much bigger change in the Net Long Volume related to it’s total volume than the GBP did.

I hope you guys had a great trading day too.

All the best

Daniel

The London session was, as expected, pretty boring due to the constantly dropping volume across all currencies, but right upfront the NY session a new opportunity appeared on the USD. The FXV screenshot was taken at 13:02 London Time.

Why did we take the USD, and not GBP?

Because the USD showed the much bigger change in the Net Long Volume related to it’s total volume than the GBP did.

I hope you guys had a great trading day too.

All the best

Daniel

Daniel Stein

Back to our daily volume analysis:

The FX Volume panels provide us with a pretty strong NZD downtrend during the last 8 hours, which is unfortunately already over, as we can see in the NZD total volume history line and NZDUSD as the main force in this currency. We’ll see if there is something better coming up during the London session.

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

The FX Volume panels provide us with a pretty strong NZD downtrend during the last 8 hours, which is unfortunately already over, as we can see in the NZD total volume history line and NZDUSD as the main force in this currency. We’ll see if there is something better coming up during the London session.

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

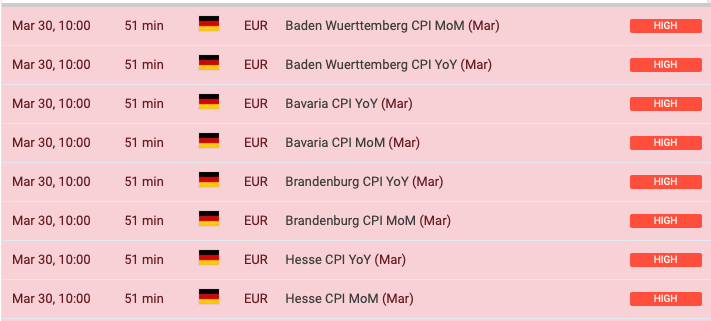

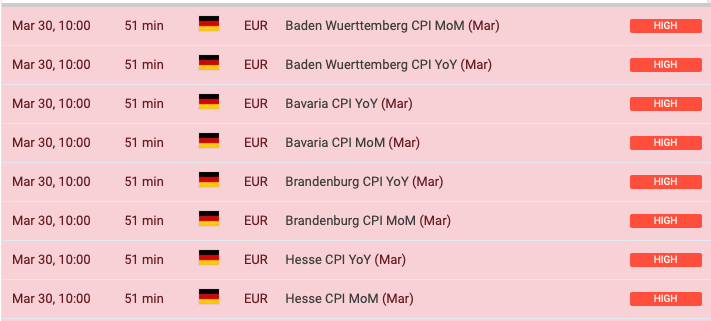

Today, I’d like to explain why the Myfxbook calendar is becoming more and more ridiculous. This screenshot displays high-impact news for the EUR and lists inflation rates for German federal states, states that are smaller than US cities. This is nuts, or do we really care about the inflation rate of Las Vegas or Miami or the Provence (France) or Tuscany (Italy) when trading? Due to this misleading classification of news events, I clearly prefer using the ForexFactory calendar.

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today, I’d like to explain why the Myfxbook calendar is becoming more and more ridiculous. This screenshot displays high-impact news for the EUR and lists inflation rates for German federal states, states that are smaller than US cities. This is nuts, or do we really care about the inflation rate of Las Vegas or Miami or the Provence (France) or Tuscany (Italy) when trading? Due to this misleading classification of news events, I clearly prefer using the ForexFactory calendar.

Daniel Stein

Update on today’s Morning Briefing

Due to an appointment this morning, I had to take the JPY trades very early, and way before the London Opening. In hindsight, it would have been better to wait for a FXV/FXP Divergence, but the result is positive anyway.

AJ and NJ hit their SL, which cost us 2R in total. The 4 other JPY pairs hit their TP, which brought us 8R of profit. So, ultimately, we closed the day with a 6R profit, which also covers our yesterday's loss of 3R.

I hope you guys have been successful, too, and I’m excited to provide you the next volume analysis tomorrow morning.

All the best,

Daniel

Due to an appointment this morning, I had to take the JPY trades very early, and way before the London Opening. In hindsight, it would have been better to wait for a FXV/FXP Divergence, but the result is positive anyway.

AJ and NJ hit their SL, which cost us 2R in total. The 4 other JPY pairs hit their TP, which brought us 8R of profit. So, ultimately, we closed the day with a 6R profit, which also covers our yesterday's loss of 3R.

I hope you guys have been successful, too, and I’m excited to provide you the next volume analysis tomorrow morning.

All the best,

Daniel

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

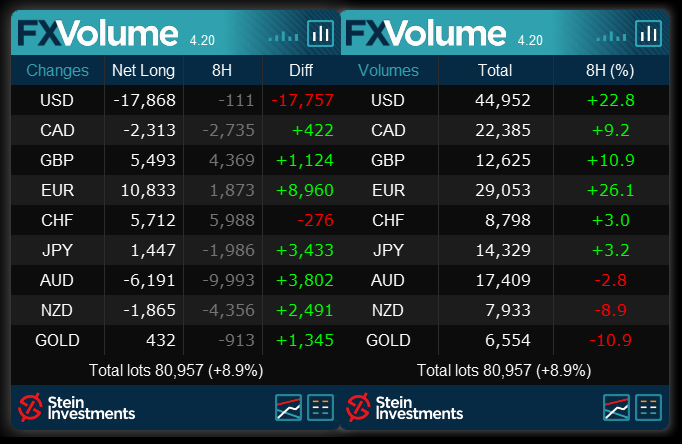

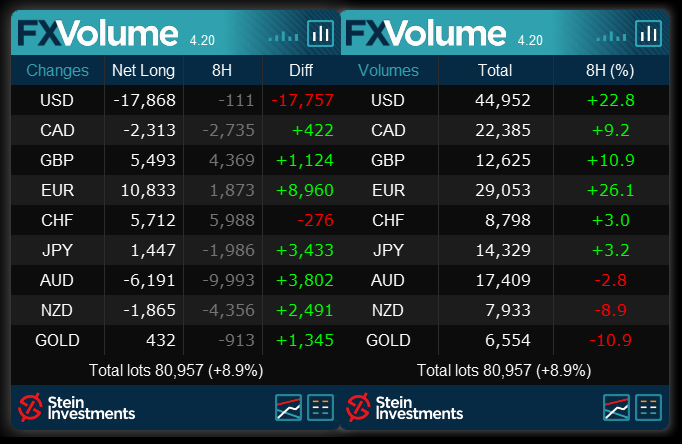

Today we see a clear downtrend for the JPY. More than one quarter of all JPY positions turned sell, covered by a massively rising interest in JPY positions. However, it seems the JPY pairs struggle at their today's highs, and the London session lacks of dynamic in supporting this trend so far.

However, the JPY is, volume-wise, the only interesting currency so far, and we have some high-impact USD news coming up which needs to be considered in today's trading, too.

So, if you’re unsure, better stay out until you feel comfortable with a new opportunity.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today we see a clear downtrend for the JPY. More than one quarter of all JPY positions turned sell, covered by a massively rising interest in JPY positions. However, it seems the JPY pairs struggle at their today's highs, and the London session lacks of dynamic in supporting this trend so far.

However, the JPY is, volume-wise, the only interesting currency so far, and we have some high-impact USD news coming up which needs to be considered in today's trading, too.

So, if you’re unsure, better stay out until you feel comfortable with a new opportunity.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today we see a clear downtrend for the USD, and more or less strong uptrends in most other currencies. We assume this situation remains stable until the NY session, and the upcoming news later today.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today we see a clear downtrend for the USD, and more or less strong uptrends in most other currencies. We assume this situation remains stable until the NY session, and the upcoming news later today.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Update on today’s Morning Briefing

Less than an hour ago, we mentioned the JPY weakness, with the chance to gain some pips if (!) we ignore the volume information.

In the screenshot above, you can see that it’s not even worth thinking about a trade if there is no support by a rising total volume.

The JPY weakness collapsed quickly and the JPY rose quickly against all other currencies, and all involved trading pairs.

⚠️ Conclusion: If there is no rising volume, there is no reason to trade at all. ⚠️

Less than an hour ago, we mentioned the JPY weakness, with the chance to gain some pips if (!) we ignore the volume information.

In the screenshot above, you can see that it’s not even worth thinking about a trade if there is no support by a rising total volume.

The JPY weakness collapsed quickly and the JPY rose quickly against all other currencies, and all involved trading pairs.

⚠️ Conclusion: If there is no rising volume, there is no reason to trade at all. ⚠️

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today we see only minor changes in the Net Long Volume, and, apart from the NZD, no rising interest in new trading positions.

The JPY lost the most during the Asian session, and started weak into today's London session. So, independent of the trading volume, the JPY offers currently the highest chance to gain some pips on a short-term basis.

All the best and have a great start everyone

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today we see only minor changes in the Net Long Volume, and, apart from the NZD, no rising interest in new trading positions.

The JPY lost the most during the Asian session, and started weak into today's London session. So, independent of the trading volume, the JPY offers currently the highest chance to gain some pips on a short-term basis.

All the best and have a great start everyone

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

today's trading sessions didn’t provide us with any clear trends, and I don’t expect any on a Friday, due to the reasons I explained last Friday.

If you trade, nevertheless, please be aware of few high-impact news published throughout the day because they are, most probably, responsible for the spikes and (false) breakouts you might see.

That’s it from us for this week. We’re happy with the achieved profits, and hope you enjoyed it too.

All the best, and happy weekend

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

today's trading sessions didn’t provide us with any clear trends, and I don’t expect any on a Friday, due to the reasons I explained last Friday.

If you trade, nevertheless, please be aware of few high-impact news published throughout the day because they are, most probably, responsible for the spikes and (false) breakouts you might see.

That’s it from us for this week. We’re happy with the achieved profits, and hope you enjoyed it too.

All the best, and happy weekend

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today is indeed a bit hard to judge. The USD pairs already reached their yesterday's highs and lows, but have been rejected. After yesterdays high-volatile FED event, it's questionable if there is enough power in the market to push the USD pairs beyond these limits.

The USD and EUR currently stagnate in terms of Net Long Volume and Total Trading Volume. So, it's possible we'll see an end of today's trend moves with these currencies involved.

Remains the NZD as the last currency with some potential from a volume perspective, and it's currently strong in all aspects. So, we'll monitor this closely and see if there is some potential to gain some pips.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today is indeed a bit hard to judge. The USD pairs already reached their yesterday's highs and lows, but have been rejected. After yesterdays high-volatile FED event, it's questionable if there is enough power in the market to push the USD pairs beyond these limits.

The USD and EUR currently stagnate in terms of Net Long Volume and Total Trading Volume. So, it's possible we'll see an end of today's trend moves with these currencies involved.

Remains the NZD as the last currency with some potential from a volume perspective, and it's currently strong in all aspects. So, we'll monitor this closely and see if there is some potential to gain some pips.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

As expected, the retail market takes off the risks upfront tonight's FED event. Besides the interest rate decision, their press conference will be very interesting because they surely provide a statement about the current bank crisis in the US, which will affect their future money policy.

The currently seen move on the GBP was triggered by higher than expected inflation of 10.4% which will force the BOE to care about. However, this is no trading trigger for us.

We’ll enjoy a sunny day off and return to the market once the dust after the FED event has settled.

All the best and see you tomorrow

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

As expected, the retail market takes off the risks upfront tonight's FED event. Besides the interest rate decision, their press conference will be very interesting because they surely provide a statement about the current bank crisis in the US, which will affect their future money policy.

The currently seen move on the GBP was triggered by higher than expected inflation of 10.4% which will force the BOE to care about. However, this is no trading trigger for us.

We’ll enjoy a sunny day off and return to the market once the dust after the FED event has settled.

All the best and see you tomorrow

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Update on today's Morning briefing

Our NZD analysis worked perfectly, and we’ve been able to catch some pips on 5 out of 6 pairs. So, we lost 1R on NZDJPY, and gained 10R on the other pairs.

We could have achieved more on NZDCAD and EURNZD, but we stick to our risk:reward ratio and are happy with today's trading result.

All the best and see you tomorrow

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Our NZD analysis worked perfectly, and we’ve been able to catch some pips on 5 out of 6 pairs. So, we lost 1R on NZDJPY, and gained 10R on the other pairs.

We could have achieved more on NZDCAD and EURNZD, but we stick to our risk:reward ratio and are happy with today's trading result.

All the best and see you tomorrow

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

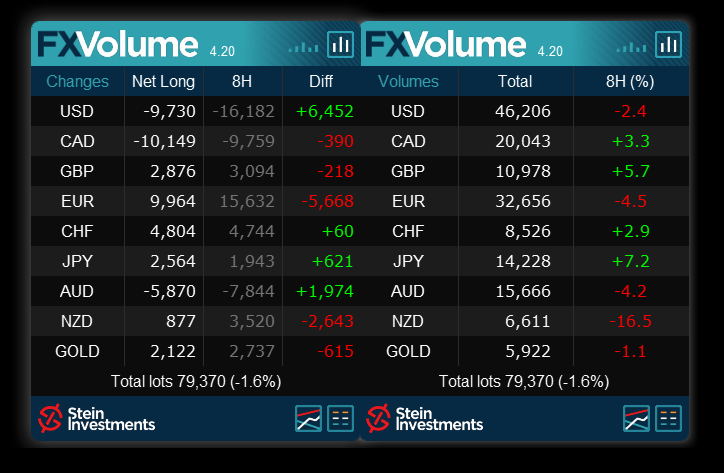

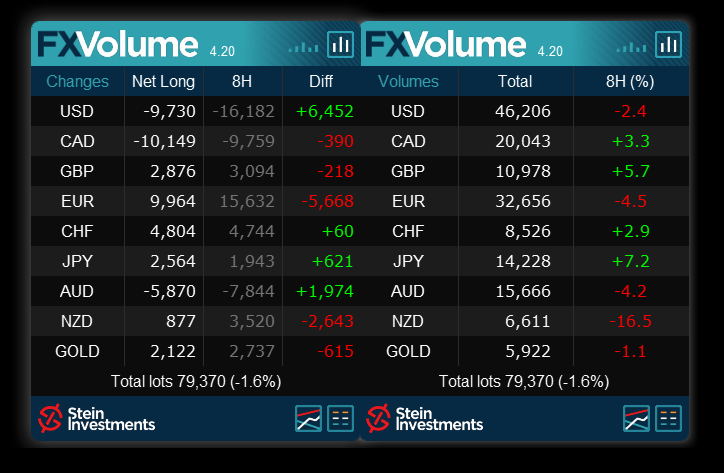

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today we recommend having a closer look at the NZD. It gained more than 20% in total trading positions, and the utmost of them are SELL positions, as we can clearly see in its Net Long Volume Change during the last 8 hours.

The NZD pairs didn’t move that much so far, which means there is still some potential to the downside as long as the Volume trend conditions remain stable.

All the best, and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today we recommend having a closer look at the NZD. It gained more than 20% in total trading positions, and the utmost of them are SELL positions, as we can clearly see in its Net Long Volume Change during the last 8 hours.

The NZD pairs didn’t move that much so far, which means there is still some potential to the downside as long as the Volume trend conditions remain stable.

All the best, and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

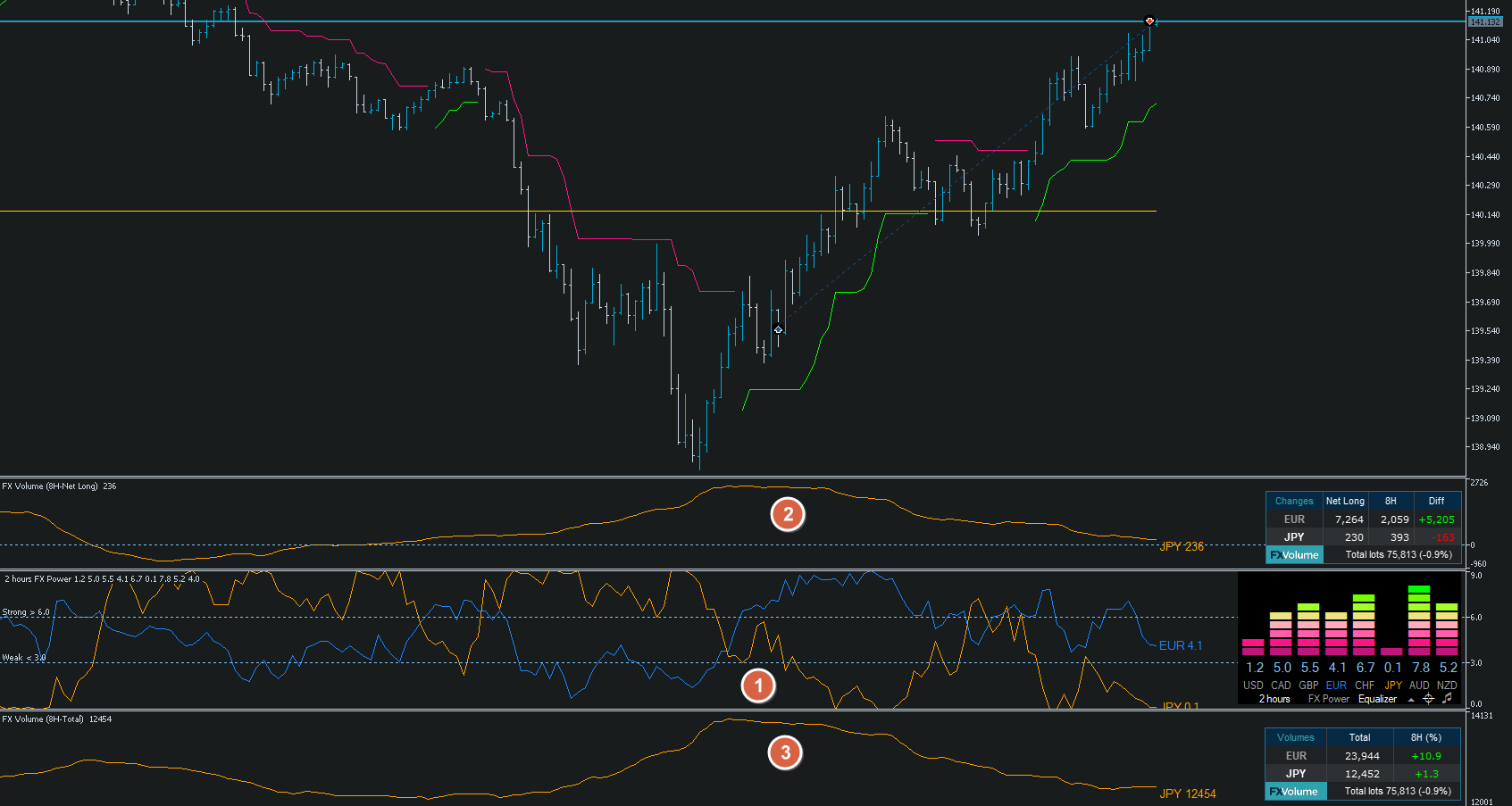

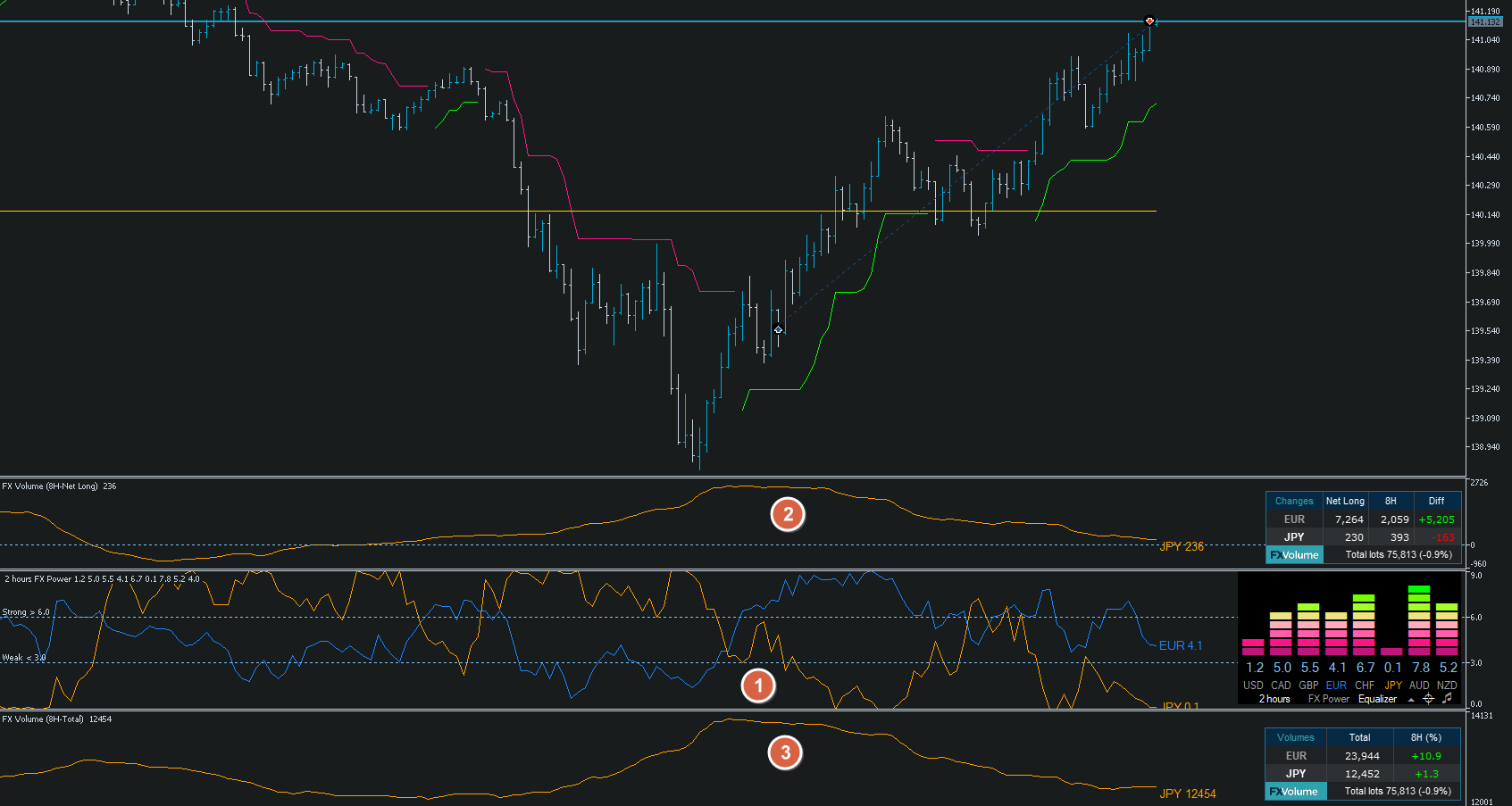

Update on today's Morning briefing

The JPY reversal we mentioned this morning started around 30 minutes after the London opening, which was around 40 minutes after our Morning Briefing post.

1. At first, FX Power indicated a massive drop in JPY strength

2. Then we saw the Net Long Volume stagnate at a high level

3. And the dropping JPY total volume indicated that the JPY strength is most probably over

See yourself what happened afterward…

Happy Trading and see you tomorrow

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

The JPY reversal we mentioned this morning started around 30 minutes after the London opening, which was around 40 minutes after our Morning Briefing post.

1. At first, FX Power indicated a massive drop in JPY strength

2. Then we saw the Net Long Volume stagnate at a high level

3. And the dropping JPY total volume indicated that the JPY strength is most probably over

See yourself what happened afterward…

Happy Trading and see you tomorrow

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

The retail traders lost trust again and closed 10% of their positions during the Asian session.

The market environment remains uncertain after the UBS had to overtake the Credit Suisse in a concentrated 48-hour action to calm down the market investors.

I’m in doubt this will work because the Credit Suisse is the third collapsed bank in less than two weeks, and the first system-critical or system-relevant.

Movement-wise, the JPY benefited so far, but already reached more than 120% ADR across all JPY pairs, so it’s more likely to see a reversal.

We’ll remain at the side-line, and wait until trust comes back in the market.

Best regards

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

The retail traders lost trust again and closed 10% of their positions during the Asian session.

The market environment remains uncertain after the UBS had to overtake the Credit Suisse in a concentrated 48-hour action to calm down the market investors.

I’m in doubt this will work because the Credit Suisse is the third collapsed bank in less than two weeks, and the first system-critical or system-relevant.

Movement-wise, the JPY benefited so far, but already reached more than 120% ADR across all JPY pairs, so it’s more likely to see a reversal.

We’ll remain at the side-line, and wait until trust comes back in the market.

Best regards

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

: