Daniel Stein / プロファイル

- 情報

|

10+ 年

経験

|

20

製品

|

2978

デモバージョン

|

|

9

ジョブ

|

4

シグナル

|

2

購読者

|

Founder

において

Stein Investments

新しくなったスタイン・インベストメンツのウェルカム・ページをご覧ください。

をご覧ください。

https://www.mql5.com/en/blogs/post/755375 をクリックしてください。

ご不明な点がございましたら、お気軽にお問い合わせください。

それではよい取引を

ダニエル

をご覧ください。

https://www.mql5.com/en/blogs/post/755375 をクリックしてください。

ご不明な点がございましたら、お気軽にお問い合わせください。

それではよい取引を

ダニエル

Daniel Stein

Update on today's Morning Briefing

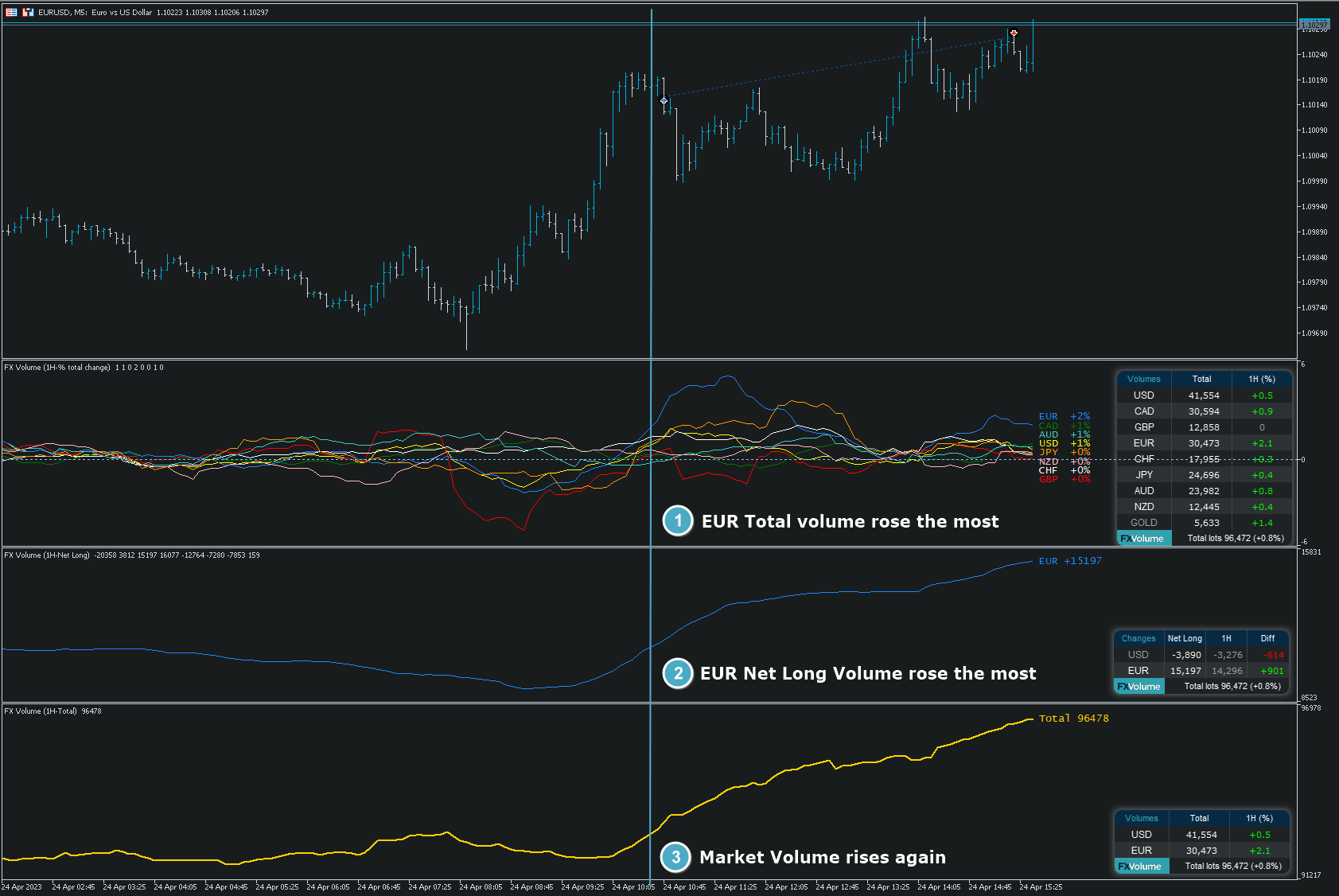

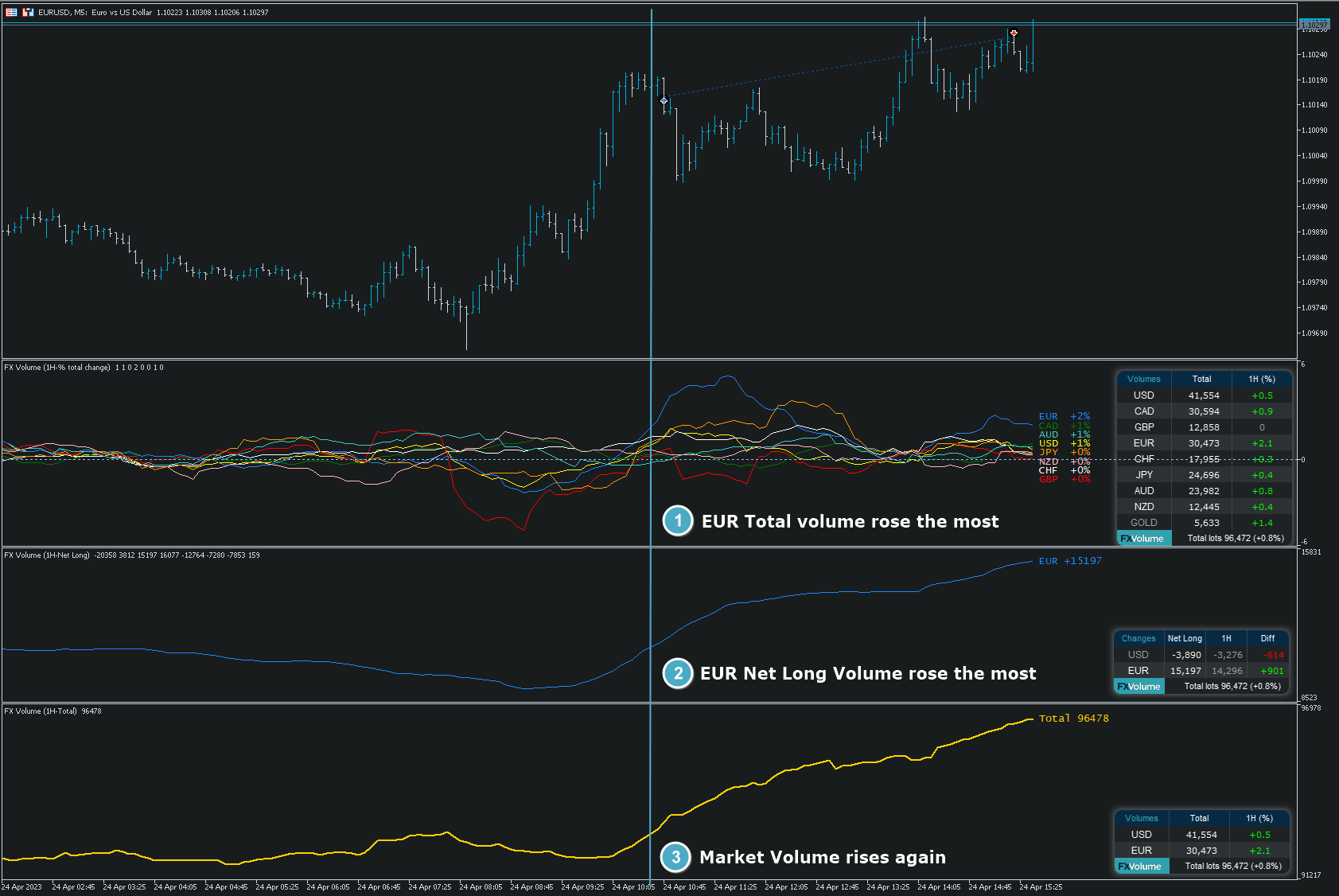

During all those boring days last week, I noticed a possible option to detect trend moves early. So, I used a 1-Hour comparison setup on FX Volume to determine any relevant and significant volume change as soon as possible.

And that’s what I like to share with you today.

Get the details and screenshots via our Morning Briefing

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

All the best,

Daniel

During all those boring days last week, I noticed a possible option to detect trend moves early. So, I used a 1-Hour comparison setup on FX Volume to determine any relevant and significant volume change as soon as possible.

And that’s what I like to share with you today.

Get the details and screenshots via our Morning Briefing

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

All the best,

Daniel

Daniel Stein

Get your daily update, details and screenshots via our Morning Briefing

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Get your daily update, details and screenshots via our Morning Briefing

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Get your daily update, details and screenshots via our Morning Briefing

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

here on mql5 at https://www.mql5.com/en/channels/morningbriefing

and on Telegram at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

シェアされた作者Fernando Carreiroの記事

Valuable content for every serious trader

プロップファームから少し教訓を得よう(第1回)-導入編

今回は、プロップファーム(自己勘定取引会社)が実施するチャレンジルールから得られる教訓のいくつかを取り上げます。これは特に、初心者の方や、この取引の世界で足元を固めるのに苦労している方には重要です。次の記事では、コードの実装について説明します。

Daniel Stein

Stein Investments Morning Briefing

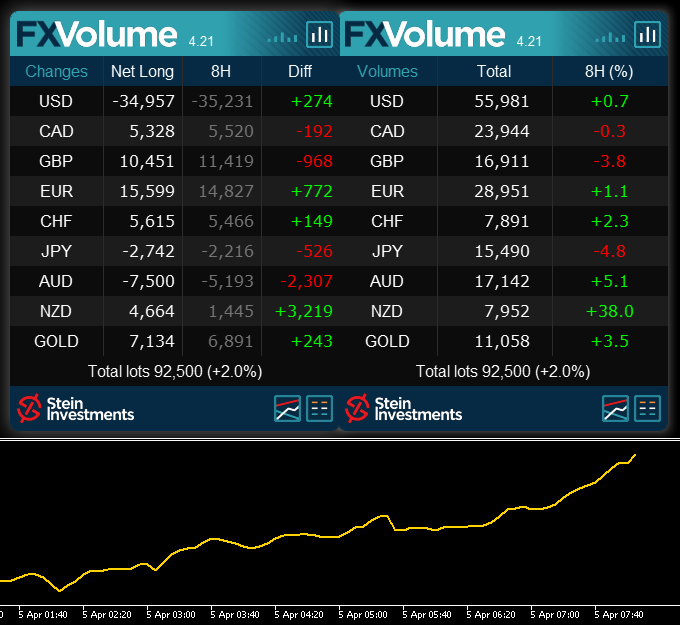

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today we start a bit unusual, with the trade results first 😊, and the analysis that led to them.

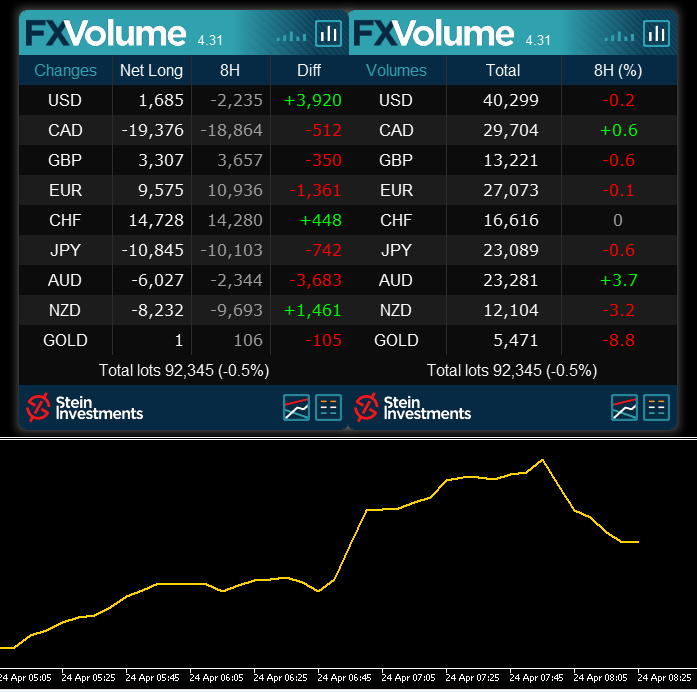

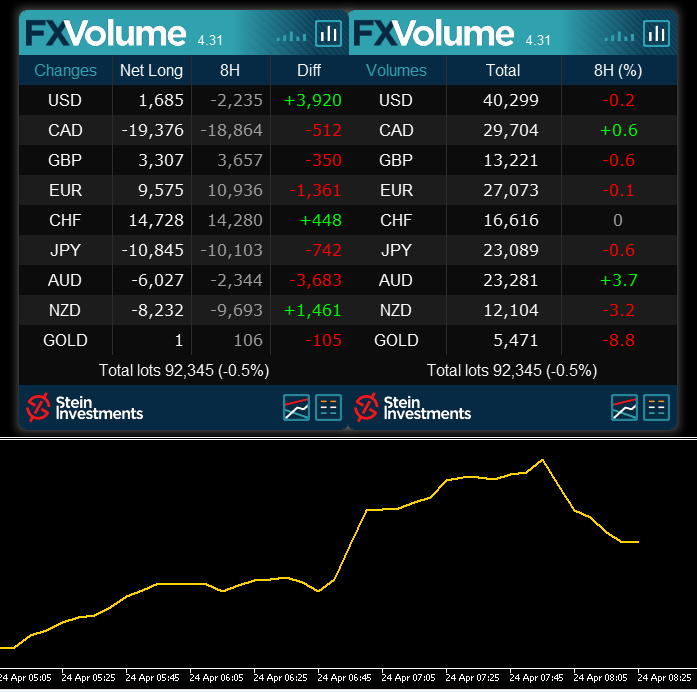

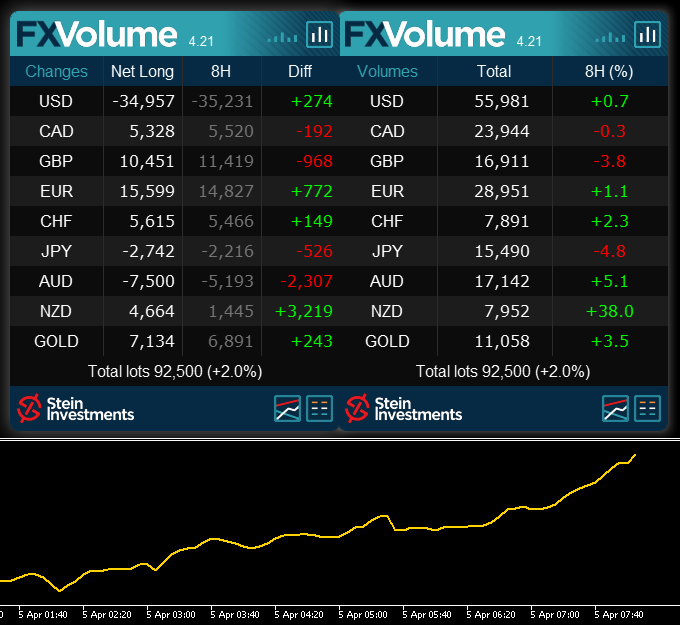

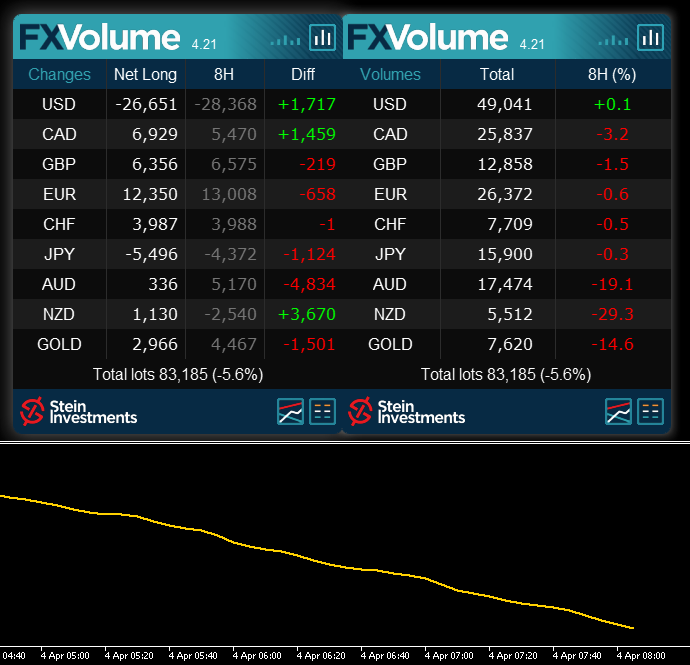

Before the London pre-market opened we noticed that the JPY provided the best setup because its Net Long Volume changed the most, and, unlike the CAD or NZD, this was covered by a rising interest in JPY positions.

The entire setup was also supported by a smoothly rising market trading volume.

So, we took the chance and placed some JPY trades. In hindsight, we could have achieved even more, but that’s how it is, and we hope you’ve seen the opportunity on the JPY pairs as well.

All the best and happy trading

Daniel

P.S: The FXV screenshot is from the time we placed our trades to provide an insight of why we took them.

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today we start a bit unusual, with the trade results first 😊, and the analysis that led to them.

Before the London pre-market opened we noticed that the JPY provided the best setup because its Net Long Volume changed the most, and, unlike the CAD or NZD, this was covered by a rising interest in JPY positions.

The entire setup was also supported by a smoothly rising market trading volume.

So, we took the chance and placed some JPY trades. In hindsight, we could have achieved even more, but that’s how it is, and we hope you’ve seen the opportunity on the JPY pairs as well.

All the best and happy trading

Daniel

P.S: The FXV screenshot is from the time we placed our trades to provide an insight of why we took them.

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

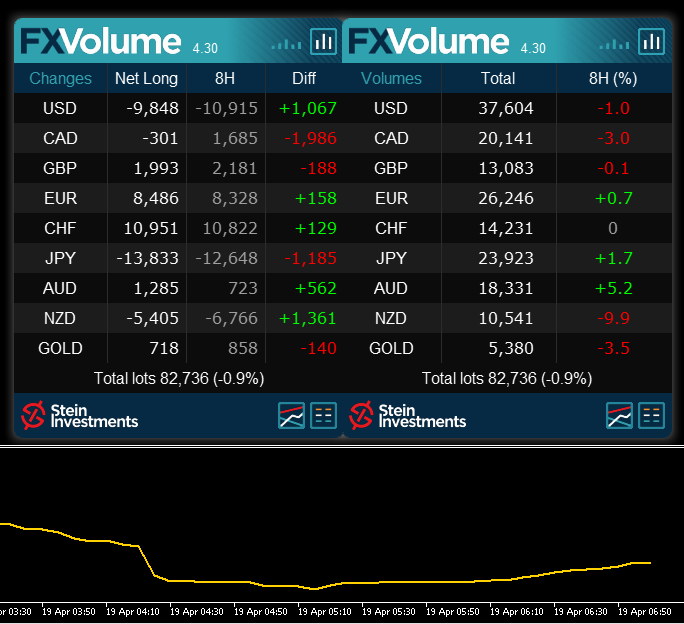

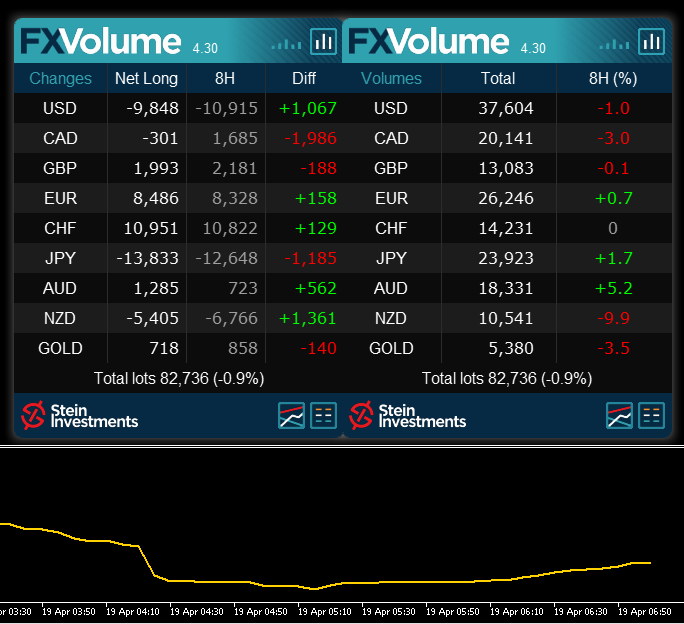

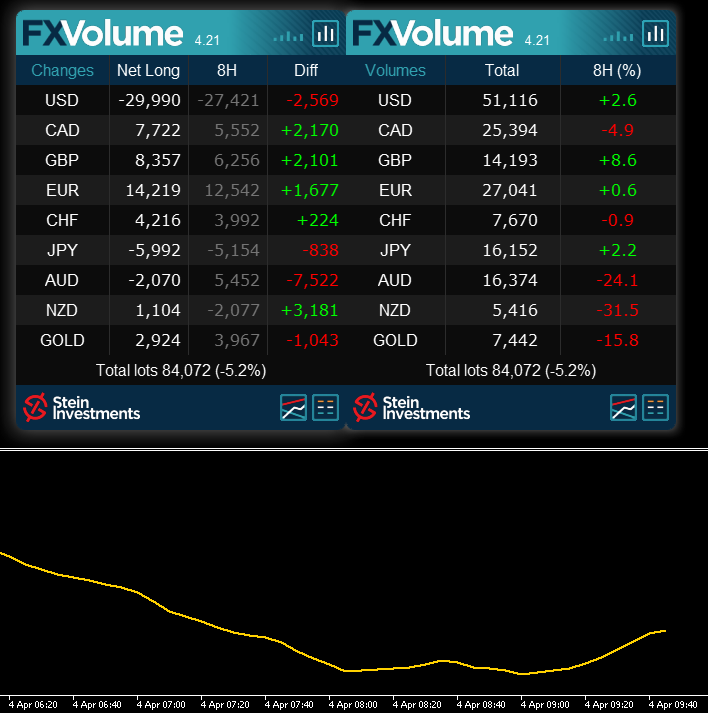

Today’s currency with the most significant change in the Net Long Volume is the AUD, and this change is also covered by a rising interest in AUD positions.

The NZD rose the most in terms of total trading volume, but provides a less significant Net Volume Change.

We also need to consider the total trading volume, which starts to drop currently, as we see at the golden line at the bottom of our screenshot.

Once this stabilizes, we’ll focus on the AUD, and see if it provides some pips for us.

Best regards,

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today’s currency with the most significant change in the Net Long Volume is the AUD, and this change is also covered by a rising interest in AUD positions.

The NZD rose the most in terms of total trading volume, but provides a less significant Net Volume Change.

We also need to consider the total trading volume, which starts to drop currently, as we see at the golden line at the bottom of our screenshot.

Once this stabilizes, we’ll focus on the AUD, and see if it provides some pips for us.

Best regards,

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

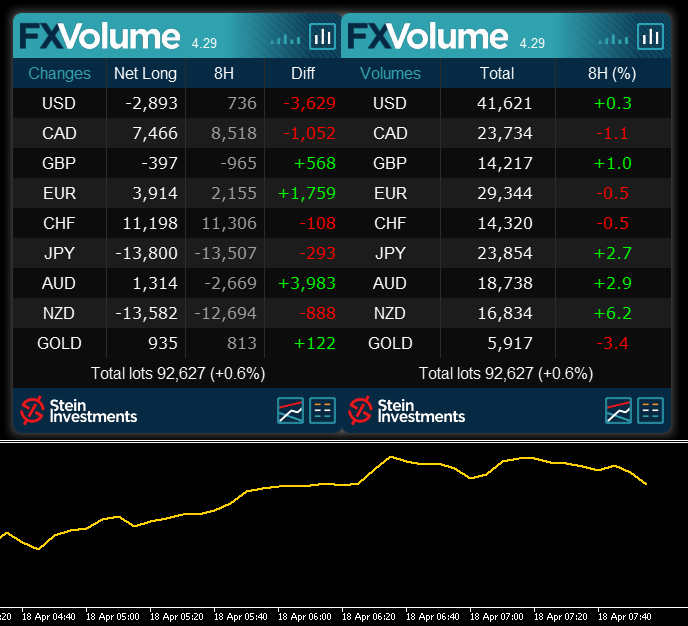

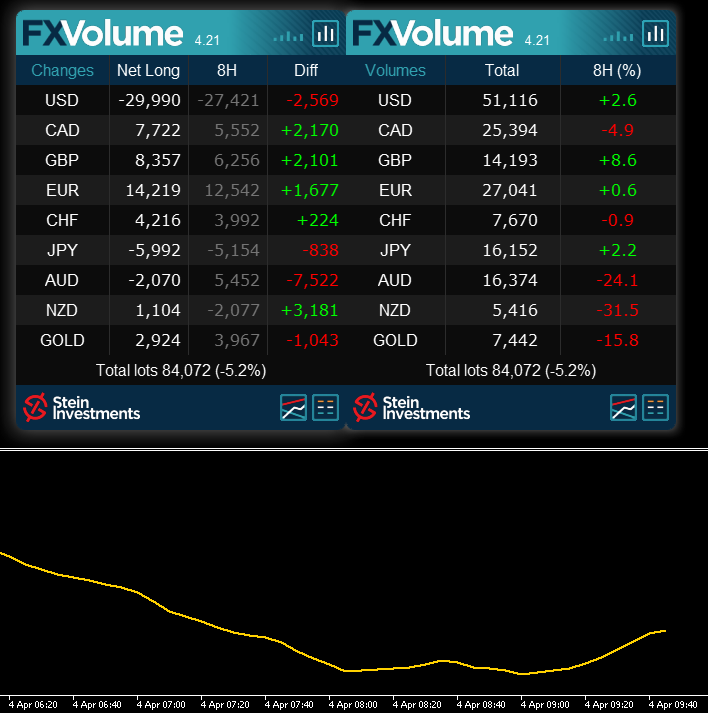

Today’s market is tricky and it took some time to understand it. Hence, this Morning Briefing comes a bit later than usual.

1. The USD pairs had a massive move on Friday. Today they tested their last highs and lows where they got rejected so far. Not surprising because these retests went along with a dropping volume in USD positions.

2. The CAD and NZD moved the most in terms of their Net Long Volume, but there is currently not much action in the corresponding pairs. Both need their corresponding major pair, USDCAD or NZDUSD, to force a continuation of their indicated volume trend.

Considering this, I suggest waiting until the situation becomes more clear.

Maybe the NY session provides more clarity and volatility.

Best regards,

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today’s market is tricky and it took some time to understand it. Hence, this Morning Briefing comes a bit later than usual.

1. The USD pairs had a massive move on Friday. Today they tested their last highs and lows where they got rejected so far. Not surprising because these retests went along with a dropping volume in USD positions.

2. The CAD and NZD moved the most in terms of their Net Long Volume, but there is currently not much action in the corresponding pairs. Both need their corresponding major pair, USDCAD or NZDUSD, to force a continuation of their indicated volume trend.

Considering this, I suggest waiting until the situation becomes more clear.

Maybe the NY session provides more clarity and volatility.

Best regards,

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today's retail volume analysis seems to provide a stable trend trading environment, but there has been almost no movement so far.

The USD weakness is misleading because we've already seen two days of USD weakness after the published CPI and PPI news.

Taking this into account, and considering it's already Friday, I highly doubt this trend will continue.

However, Fridays are no trading days for me, so we'll close this week with this final volume analysis.

All the best and a happy weekend

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today's retail volume analysis seems to provide a stable trend trading environment, but there has been almost no movement so far.

The USD weakness is misleading because we've already seen two days of USD weakness after the published CPI and PPI news.

Taking this into account, and considering it's already Friday, I highly doubt this trend will continue.

However, Fridays are no trading days for me, so we'll close this week with this final volume analysis.

All the best and a happy weekend

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

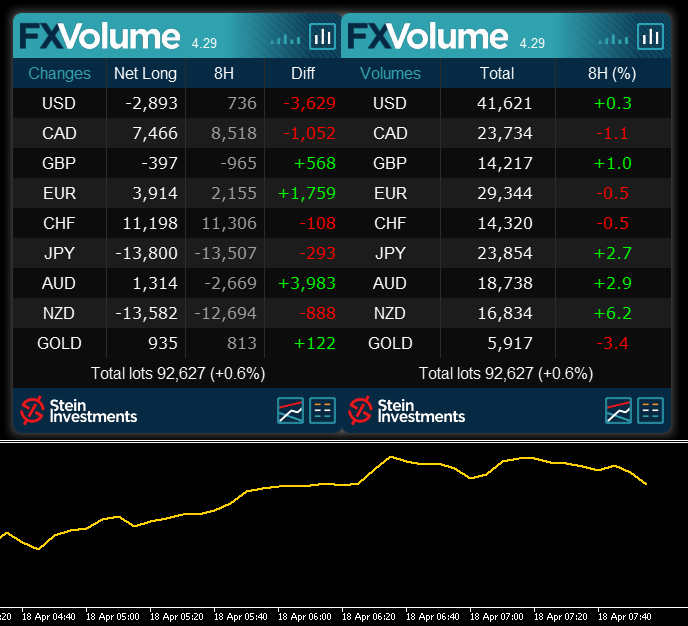

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

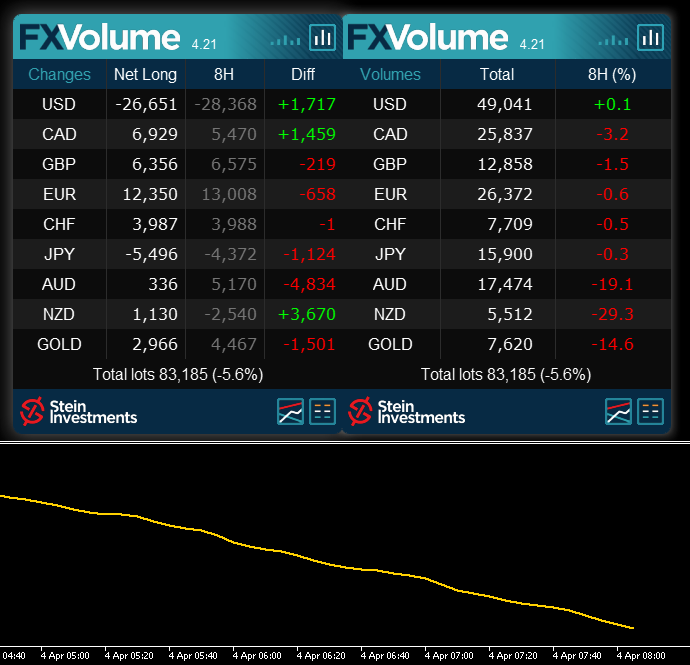

During today's Asian session, there have been only two currencies with relevant changes in their trading volume, AUD and NZD.

However, both moves are already over, and the total market volume weakens clearly as we can see in its history line.

We recommend to wait for more market stability, indicated by a rising total market volume, before going into a more in-depth analysis for future trades.

There is also some high-impact USD news that has to be taken care of.

All the best

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

During today's Asian session, there have been only two currencies with relevant changes in their trading volume, AUD and NZD.

However, both moves are already over, and the total market volume weakens clearly as we can see in its history line.

We recommend to wait for more market stability, indicated by a rising total market volume, before going into a more in-depth analysis for future trades.

There is also some high-impact USD news that has to be taken care of.

All the best

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today's market is very balanced. All currencies rise in terms of their Total Trading Volume, while some win and some lose regarding their Net Long Volume. The volatility is very low and most pairs are moving sideways.

I guess one reason is the upcoming US Core Inflation publication later today, which is able to flip the market upside down, if the inflation is far from its expected numbers.

Another interesting event is the BOC interest rate decision.

All this combined makes it unlikely seeing any consistent trend moves during the London session.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

Today's market is very balanced. All currencies rise in terms of their Total Trading Volume, while some win and some lose regarding their Net Long Volume. The volatility is very low and most pairs are moving sideways.

I guess one reason is the upcoming US Core Inflation publication later today, which is able to flip the market upside down, if the inflation is far from its expected numbers.

Another interesting event is the BOC interest rate decision.

All this combined makes it unlikely seeing any consistent trend moves during the London session.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

We hope all of you had a great and relaxing long weekend.

After such a long trading break with 2 bank holidays, I prefer to await the London Opening before judging the situation.

Volume-wise we see the following after the Asian session: The USD lost the most while EUR, AUD, and NZD rose on the Net Long side. All this is also covered by a rising market interest, but the total market volume currently stagnates at a high level.

We’ll see if the USD continues its downtrend, or if one of the other currencies tries a breakout.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

We hope all of you had a great and relaxing long weekend.

After such a long trading break with 2 bank holidays, I prefer to await the London Opening before judging the situation.

Volume-wise we see the following after the Asian session: The USD lost the most while EUR, AUD, and NZD rose on the Net Long side. All this is also covered by a rising market interest, but the total market volume currently stagnates at a high level.

We’ll see if the USD continues its downtrend, or if one of the other currencies tries a breakout.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

You like to know if all your VPS terminals are up and running? ⚠️

Use our Heartbeat Monitoring, and get immediate alerts if your terminal is offline.

This allows you to react and fix it as quickly as possible. ✅

The setup is easy 👉 https://www.mql5.com/en/blogs/post/752322 and the benefit is priceless

Use our Heartbeat Monitoring, and get immediate alerts if your terminal is offline.

This allows you to react and fix it as quickly as possible. ✅

The setup is easy 👉 https://www.mql5.com/en/blogs/post/752322 and the benefit is priceless

Daniel Stein

I'd like to explain to you how we gather the real trading volume and how we provide it to our customers.

I'll number every sentence so that you can refer to a specific number/sentence in case of questions.

1. If you open an EURUSD BUY Trade with 0.2 lot, your broker has to take the counter position of 0.2 lot EURUSD SELL

2. If your broker just routes your order to the liquidity pool, there is an institution playing the counterpart that takes this 0.2 lot EURUSD SELL

3. Via our data provider, we get the information that there is a 0.2 lot EURUSD BUY Trade running. It's anonymous, but we know it's an open live trading position.

4. We get and summarize all this trading information from many users, many brokers, and tons of trades - all centralized and anonymous from our data provider

5. Now we see how the crowd of retail traders is positioned for EURUSD. Do they buy, sell, or is it balanced?

6. This allows us to analyze if their judgement is right. Does the EU price go up when most retail traders, like you, have EURUSD BUY positions running.

7. Unfortunately, they are seldom right. In the utmost cases, the prices move in the exact opposite direction.

8. Maybe because the big boys of the counterpart side (point 1 and 2) know exactly where the retailers stand. So, it's easy for them to squeeze the retailers out.

9. Because of point 7, we analyze where the retailers stand and display it from the opposite side, the big boys' perspective.

10. If the retail crowd is 80% bullish (BUY) for the EUR, we display the EUR 80% bearish (SELL) in FX Volume because that's how the big boys see it because they hold the counter bet. And that's why FX Volume is so outstanding precise.

I hope this helps to get a better understanding, and please ask if there are questions left.

I'll number every sentence so that you can refer to a specific number/sentence in case of questions.

1. If you open an EURUSD BUY Trade with 0.2 lot, your broker has to take the counter position of 0.2 lot EURUSD SELL

2. If your broker just routes your order to the liquidity pool, there is an institution playing the counterpart that takes this 0.2 lot EURUSD SELL

3. Via our data provider, we get the information that there is a 0.2 lot EURUSD BUY Trade running. It's anonymous, but we know it's an open live trading position.

4. We get and summarize all this trading information from many users, many brokers, and tons of trades - all centralized and anonymous from our data provider

5. Now we see how the crowd of retail traders is positioned for EURUSD. Do they buy, sell, or is it balanced?

6. This allows us to analyze if their judgement is right. Does the EU price go up when most retail traders, like you, have EURUSD BUY positions running.

7. Unfortunately, they are seldom right. In the utmost cases, the prices move in the exact opposite direction.

8. Maybe because the big boys of the counterpart side (point 1 and 2) know exactly where the retailers stand. So, it's easy for them to squeeze the retailers out.

9. Because of point 7, we analyze where the retailers stand and display it from the opposite side, the big boys' perspective.

10. If the retail crowd is 80% bullish (BUY) for the EUR, we display the EUR 80% bearish (SELL) in FX Volume because that's how the big boys see it because they hold the counter bet. And that's why FX Volume is so outstanding precise.

I hope this helps to get a better understanding, and please ask if there are questions left.

Daniel Stein

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

today is the last trading day of this week due to the upcoming Easter holidays in Europe and overseas. So, we see a very instable market environment with dropping total market volume, as we usually see on a Friday before the weekend.

That said, I don’t expect any serious trading opportunities today, and so I’ll enjoy a sunny day off and the profits we achieved this week.

Due to Monday being another Easter holiday too, the next Morning Briefing will be published on Tuesday next week.

Enjoy the days off with family and friends.

All the best

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

today is the last trading day of this week due to the upcoming Easter holidays in Europe and overseas. So, we see a very instable market environment with dropping total market volume, as we usually see on a Friday before the weekend.

That said, I don’t expect any serious trading opportunities today, and so I’ll enjoy a sunny day off and the profits we achieved this week.

Due to Monday being another Easter holiday too, the next Morning Briefing will be published on Tuesday next week.

Enjoy the days off with family and friends.

All the best

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Update on today’s Morning Briefing

The AUD did exactly what we expected this morning and continued its downtrend. So, most of our trades hit their profit target.

The AUDNZD trade was pointless because there was no more power in the NZD, as also expected and bespoken this morning.

Anyway, it’s well documented and we learned something of it.

However, we're very happy with the overall result, the precision of our morning analysis and the profits achieved. 😎

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

The AUD did exactly what we expected this morning and continued its downtrend. So, most of our trades hit their profit target.

The AUDNZD trade was pointless because there was no more power in the NZD, as also expected and bespoken this morning.

Anyway, it’s well documented and we learned something of it.

However, we're very happy with the overall result, the precision of our morning analysis and the profits achieved. 😎

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

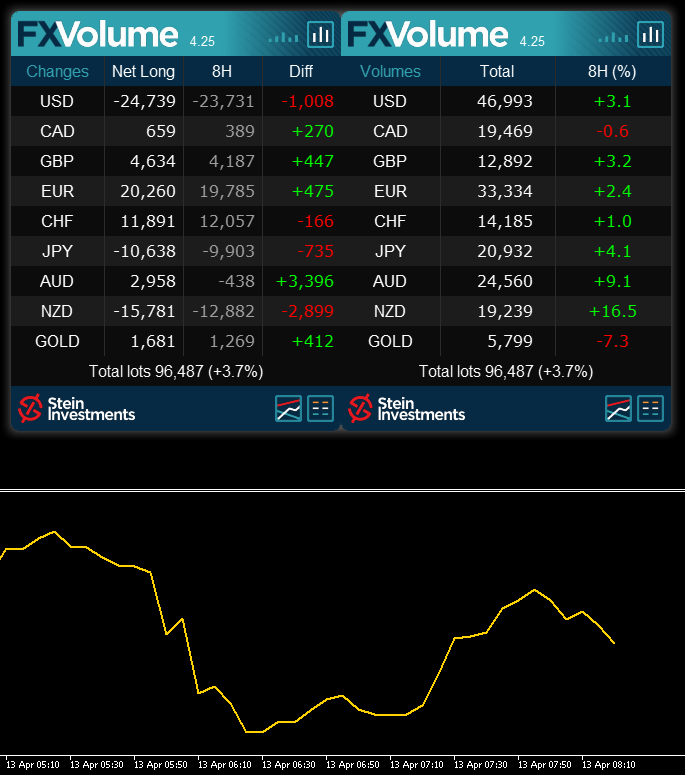

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

today we’re starting with a healthy and stable market, as you can see at the rising total volume history line below the panels. The NZD BUY trend is a result of today’s RBNZ rate decision, who decided to rise the interest rates for the NZD with 0.5% more than expected. However, this explosive move happened directly afterward, and so we can ignore NZD for today.

We focus on AUD, which provides the second most significant change in terms of Net Long and Total Volume. So, we expect the AUD to continue it’s indicated SELL trend as long as these conditions remain stable.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

today we’re starting with a healthy and stable market, as you can see at the rising total volume history line below the panels. The NZD BUY trend is a result of today’s RBNZ rate decision, who decided to rise the interest rates for the NZD with 0.5% more than expected. However, this explosive move happened directly afterward, and so we can ignore NZD for today.

We focus on AUD, which provides the second most significant change in terms of Net Long and Total Volume. So, we expect the AUD to continue it’s indicated SELL trend as long as these conditions remain stable.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

Update on todays Morning Briefing

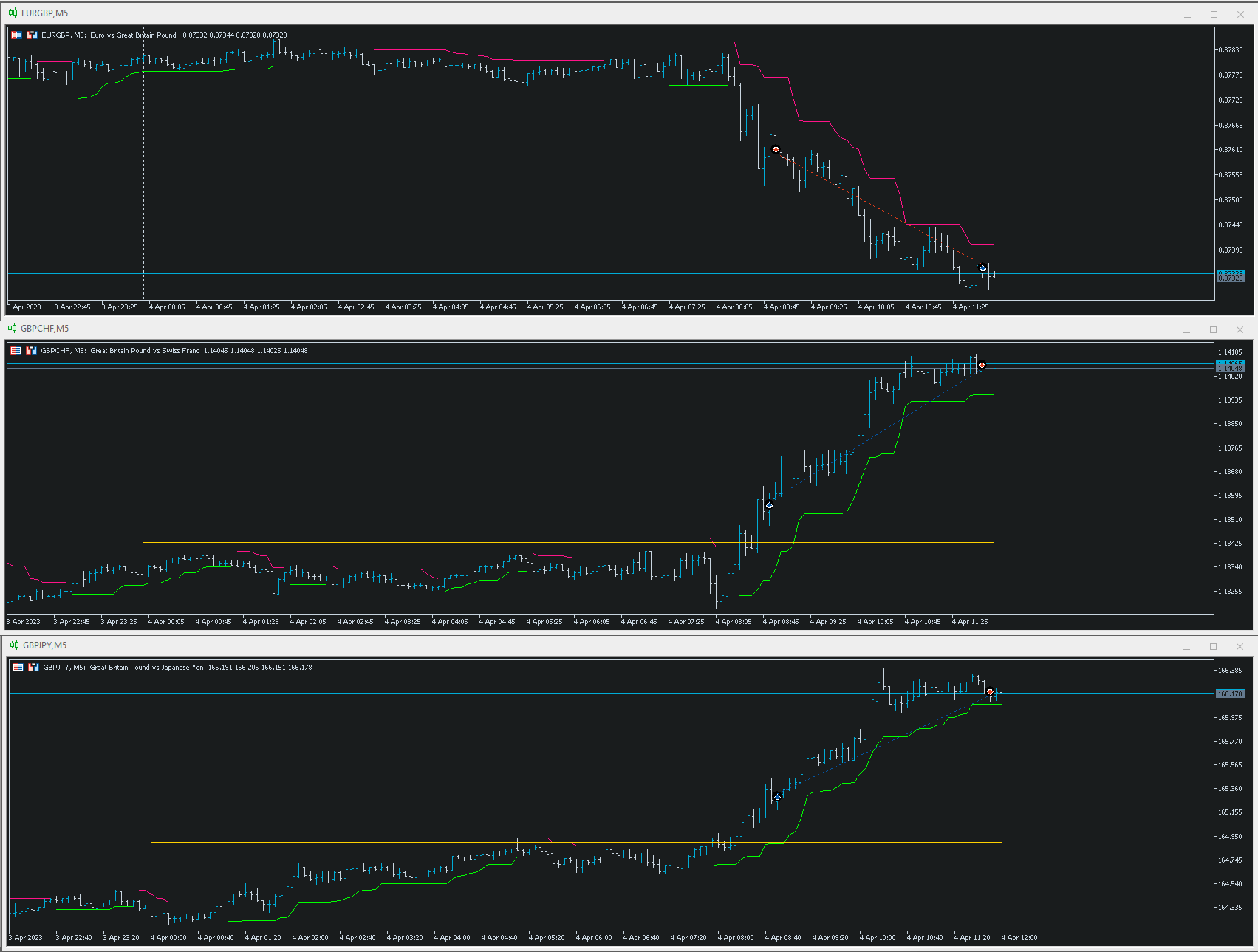

Around an hour after the London opening, we noticed the GBP started to rise in terms of its Net Long Volume, and it’s Total Volume. So, we took the chance and traded the GBP against all other currencies.

Another 45 minutes later, it’s been 100% clear that the GBP is the currency in the focus at the London session, with a rise of almost 10% in total in a stable market environment with rising interest.

So even with a late entry, one would have achieved great profits with zero drawdown.

We closed the trades now, and are happy with our profits before the NY session starts.

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Around an hour after the London opening, we noticed the GBP started to rise in terms of its Net Long Volume, and it’s Total Volume. So, we took the chance and traded the GBP against all other currencies.

Another 45 minutes later, it’s been 100% clear that the GBP is the currency in the focus at the London session, with a rise of almost 10% in total in a stable market environment with rising interest.

So even with a late entry, one would have achieved great profits with zero drawdown.

We closed the trades now, and are happy with our profits before the NY session starts.

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

Daniel Stein

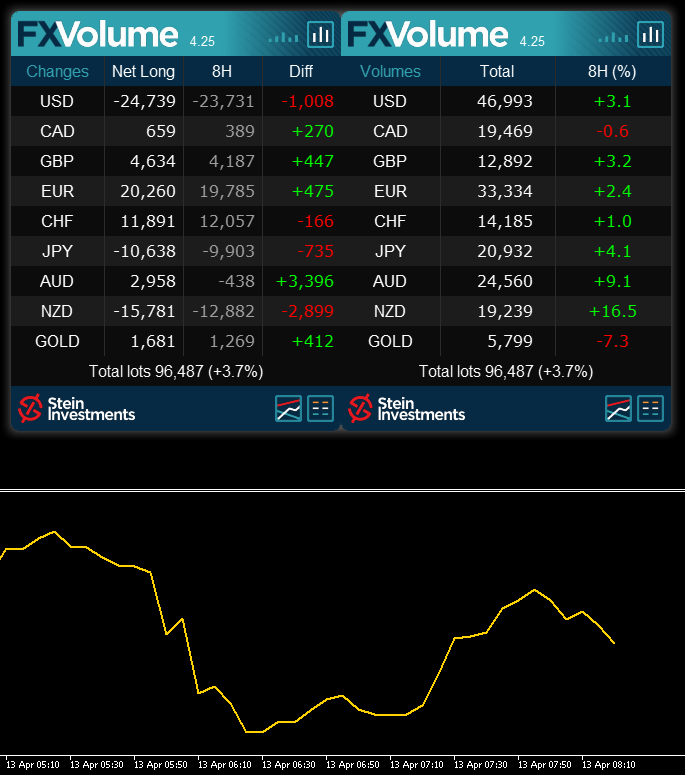

Stein Investments Morning Briefing

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

as you can see, there is not much to expect from the market so far. The total volume drops constantly, and besides the AUD weakness as consequence of the RBA interest rate decision, there is nothing promising visible. But because this AUD down move is NOT covered by a rising volume, we’ll let it go without trading, and just monitor.

We’ll see which currency comes up next as soon with a rising market interest in form of new trading positions.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

⚠️ This informal service is currently in a beta stadium and no trading advice. Please do your own research before trading. ⚠️

Good morning everyone,

as you can see, there is not much to expect from the market so far. The total volume drops constantly, and besides the AUD weakness as consequence of the RBA interest rate decision, there is nothing promising visible. But because this AUD down move is NOT covered by a rising volume, we’ll let it go without trading, and just monitor.

We’ll see which currency comes up next as soon with a rising market interest in form of new trading positions.

All the best and happy trading

Daniel

Get your daily update with details and screenshots at our Telegram News channel at https://t.me/STEIN_INVESTMENTS_NEWS

: