Andrew Turner / プロファイル

- 情報

|

9+ 年

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

Andrew Turner

Investment Research experience in Funds Management and Stockbroking. Also Financial Advisor / Portfolio Management and Professional Investment / Trading

Trading Experience: 5 Years +

Trader Type: Economist

Markets Traded: Forex, Crypto, Commodities, FI, Stocks, Indices, Options

Currency Pairs Traded: EURUSD, GBPUSD, USDJPY, AUDUSD, NZDUSD, AUDNZD, EURGBP, EURJPY, GBPJPY

Skill Level: Intermediate

Favorite Trading Platform: MetaTrader 4 By Meta Quotes

Preferred Approach: Fundamental

Software/Technical

Indicators Used: Advance-Decline, Bollinger Bands, MACD, Moving Averages (1, 2, 3, Lines), RSI, Stochastic (Slow, Fast)

Preferred Trading Time Frame: weekly, monthly

Twitter : @adt_fx @adt_crypto

LinkedIn : au.linkedin.com/in/andrewdouglasturner/

Investment Research experience in Funds Management and Stockbroking. Also Financial Advisor / Portfolio Management and Professional Investment / Trading

Trading Experience: 5 Years +

Trader Type: Economist

Markets Traded: Forex, Crypto, Commodities, FI, Stocks, Indices, Options

Currency Pairs Traded: EURUSD, GBPUSD, USDJPY, AUDUSD, NZDUSD, AUDNZD, EURGBP, EURJPY, GBPJPY

Skill Level: Intermediate

Favorite Trading Platform: MetaTrader 4 By Meta Quotes

Preferred Approach: Fundamental

Software/Technical

Indicators Used: Advance-Decline, Bollinger Bands, MACD, Moving Averages (1, 2, 3, Lines), RSI, Stochastic (Slow, Fast)

Preferred Trading Time Frame: weekly, monthly

Twitter : @adt_fx @adt_crypto

LinkedIn : au.linkedin.com/in/andrewdouglasturner/

Andrew Turner

$USD. $USDJPY double top at 118? The $USD was up 9% in around 2 months - $DXY 95 to 103.8. It corrected 2%. Fundamentals remain the same. The US economy is relatively healthy and there is some intent to ease long standing fiscal restraint and constraints. Interest rate rises are logical from zero base. The Bond market was probably overbought due to extensive and prolonged QE and yields should rise further in the medium term. To my mind $USD medium term trend remains firmly up.

Andrew Turner

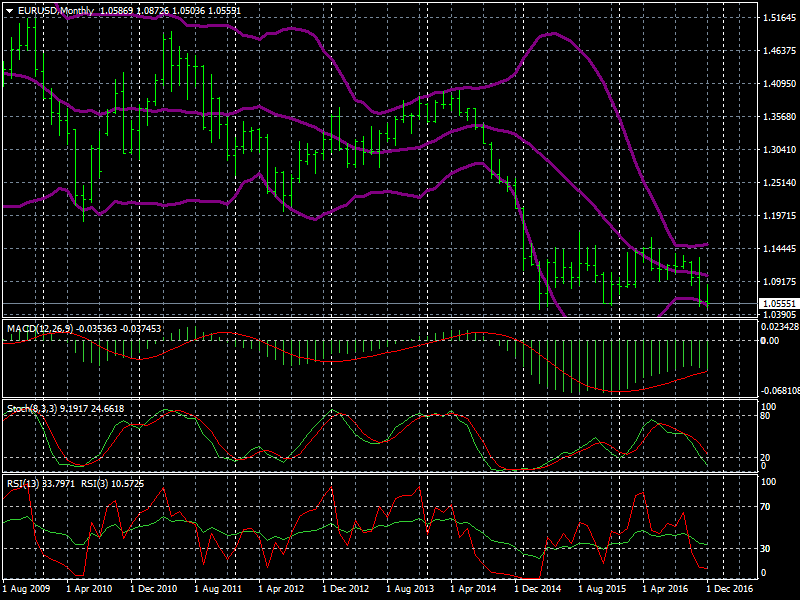

EURUSD - Fundamental or Technical.

Fundamentally EURUSD is going lower. EU Monetary Policy has been given a new leg of QE and is completely divergent from US into a week where a second US rate rise is highly likely and justifiable. Politics and economics both provide a firm downward direction for the rate into the end of 2016 and start of 2017.

However the pair has failed to break lower from 1.046 - 1.053 for a little under two years. The monthly chart indicates a potential triple bottom at 1.05.

While in conflict with the Fundamental view, the rate will be worth watching in the next week from a Technical perspective. Greatest probability is for a 25bp US Fed Funds rate increase and a re-test of the 1.046 March 2015 low in the next two weeks, but given the Technical’s and the potential buy-on-rumour, sell-on-fact market behaviour, that is a deferral or ambiguity to further US rate rise, the pair could bounce. I’m thinking maybe dead cat though if anything.

Fundamentally EURUSD is going lower. EU Monetary Policy has been given a new leg of QE and is completely divergent from US into a week where a second US rate rise is highly likely and justifiable. Politics and economics both provide a firm downward direction for the rate into the end of 2016 and start of 2017.

However the pair has failed to break lower from 1.046 - 1.053 for a little under two years. The monthly chart indicates a potential triple bottom at 1.05.

While in conflict with the Fundamental view, the rate will be worth watching in the next week from a Technical perspective. Greatest probability is for a 25bp US Fed Funds rate increase and a re-test of the 1.046 March 2015 low in the next two weeks, but given the Technical’s and the potential buy-on-rumour, sell-on-fact market behaviour, that is a deferral or ambiguity to further US rate rise, the pair could bounce. I’m thinking maybe dead cat though if anything.

Andrew Turner

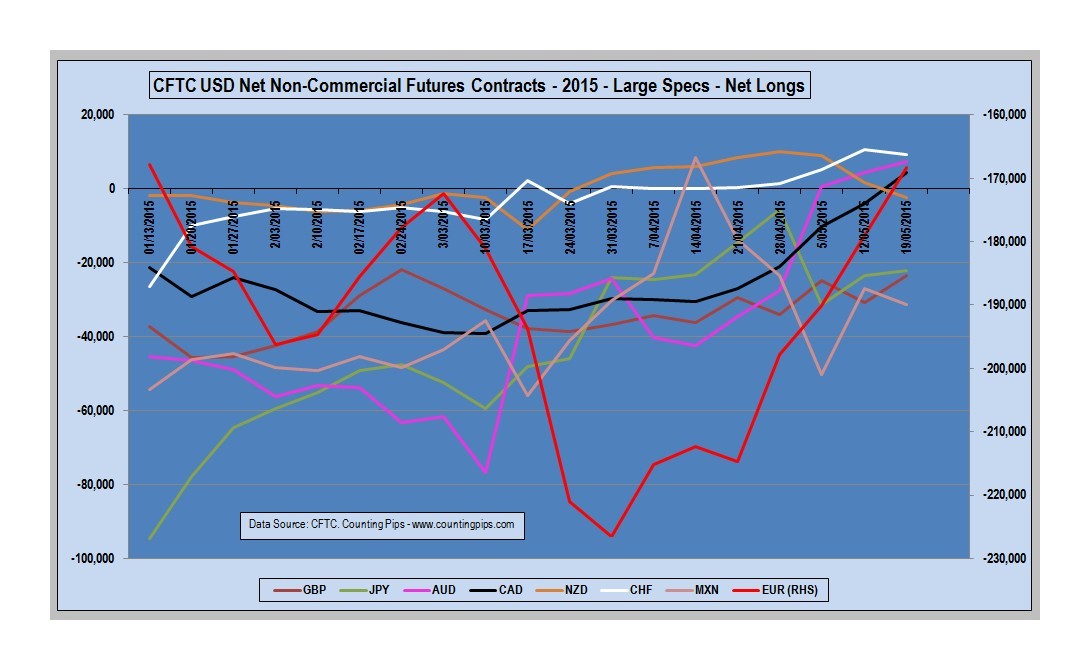

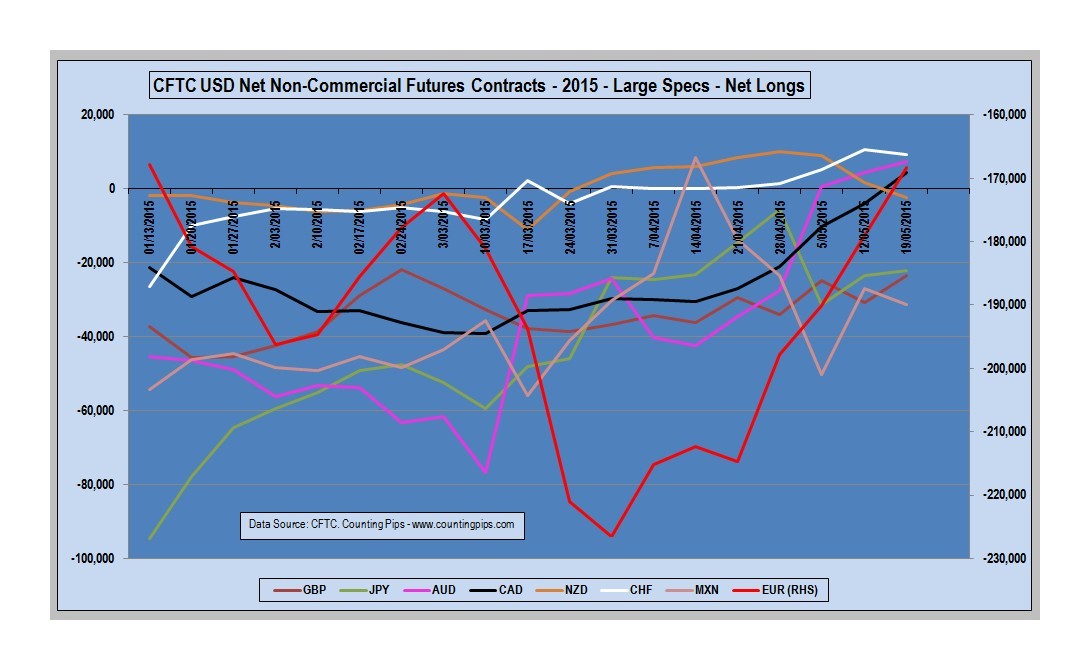

adt_fx #CFTC - #COT v $USD

Last week saw $EUR slight ↓ net short, $CHF ↑ net long, and all other Major currencies turning or ↑ net short.

$EUR -165.5K (-171.7K), $JPY -85.7K (-62.2K), $GBP -25.7K (-25.5K), $CHF +8.4K (+8.3K), $CAD -1.0K (+7.3K), $AUD -13.3K (+6.4K), $NZD -10.5K (-5.1K), $MXN -45.1K (-32.5K)

Last week saw $EUR slight ↓ net short, $CHF ↑ net long, and all other Major currencies turning or ↑ net short.

$EUR -165.5K (-171.7K), $JPY -85.7K (-62.2K), $GBP -25.7K (-25.5K), $CHF +8.4K (+8.3K), $CAD -1.0K (+7.3K), $AUD -13.3K (+6.4K), $NZD -10.5K (-5.1K), $MXN -45.1K (-32.5K)

Andrew Turner

adt_fx Disclosure:

Positions – Short $EURUSD →2015. Intending – June ↑Short $EURUSD, Short $AUDUSD, Long $USDJPY. Looking - Short $AUDCAD, Long USDSEK, USDNOK on relative economic performance and divergent monetary stance, Long DAX

Positions – Short $EURUSD →2015. Intending – June ↑Short $EURUSD, Short $AUDUSD, Long $USDJPY. Looking - Short $AUDCAD, Long USDSEK, USDNOK on relative economic performance and divergent monetary stance, Long DAX

Andrew Turner

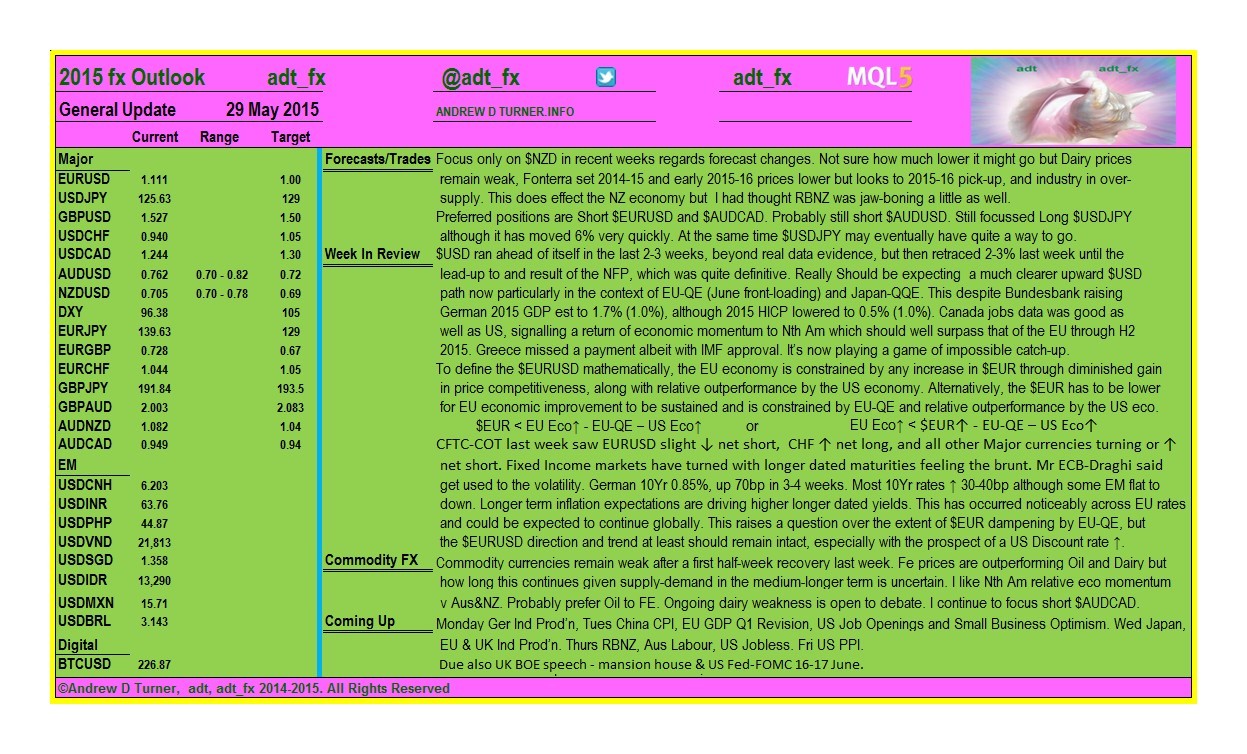

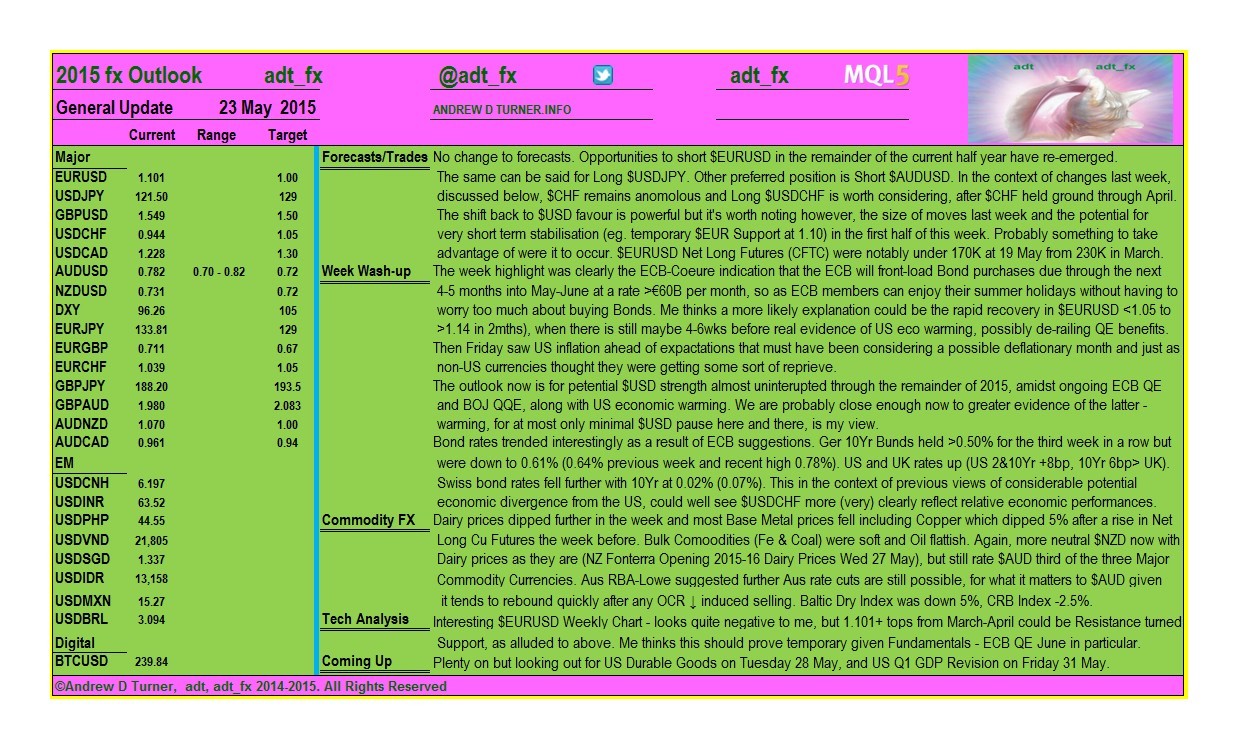

パブリッシュされた投稿FX Outlook 2015 – General Update – 23 May 2015

adt_fx FX Outlook 2015 – General Update – 23 May 2015 No change to forecasts. Opportunities to short $EURUSD in the remainder of the current half year have re-emerged. The same can be said for Long $USDJPY. Other preferred position is Short $AUDUSD...

ソーシャルネットワーク上でシェアする · 1

158

Andrew Turner

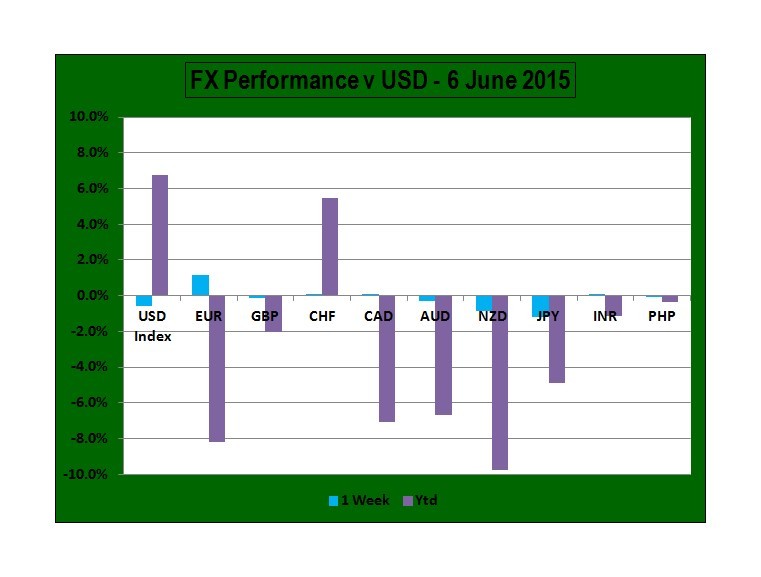

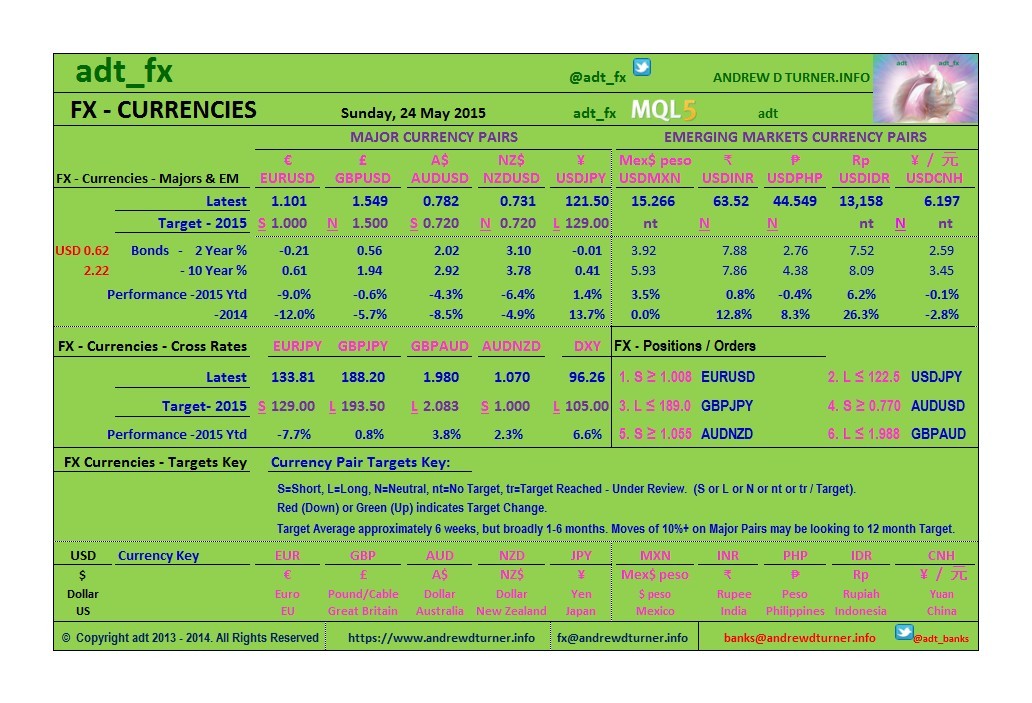

adt_fx Weekly and YTD FX Performance.

Week To 22 May 2015 v $USD – $JPY -1.9%, $CHF -3.0%, $EUR -3.8%, $GBP -1.5%, $NZD -2.2%, $AUD -2.6%, $CAD -2.2%, $INR +0%, $PHP -0.2%. $USD Index -3.4%

2015 YTD v $USD – $JPY -1.4%, $CHF +5.1%, $EUR -9.0%, $GBP -0.6%, $NZD -6.4%, $AUD -4.3%, $CAD -5.7%, $INR -0.8%, $PHP +0.4%. DXY - USD Index +6.6%

Week To 22 May 2015 v $USD – $JPY -1.9%, $CHF -3.0%, $EUR -3.8%, $GBP -1.5%, $NZD -2.2%, $AUD -2.6%, $CAD -2.2%, $INR +0%, $PHP -0.2%. $USD Index -3.4%

2015 YTD v $USD – $JPY -1.4%, $CHF +5.1%, $EUR -9.0%, $GBP -0.6%, $NZD -6.4%, $AUD -4.3%, $CAD -5.7%, $INR -0.8%, $PHP +0.4%. DXY - USD Index +6.6%

Andrew Turner

adt_fx #CFTC - #COT $USD Net Long $USD Futures Contracts wk to 19 May. Further ↓ $USD net Longs except v $NZD & $MXN ↑net Long. $AUD ↑net Long, $CAD net Long from previous net Short, $CHF ↓net Long

$EUR -168.3K (-179.0K), $JPY -22.0K (-23.6K), $GBP -23.4K (-30.8K), $CHF +9.4K (+10.6), $CAD +4.3K (-4.0K), $AUD +4.5K (+4.5K), $NZD +1.8K (+1.8K), $MXN -27.0K (-27.0K)

$EUR -168.3K (-179.0K), $JPY -22.0K (-23.6K), $GBP -23.4K (-30.8K), $CHF +9.4K (+10.6), $CAD +4.3K (-4.0K), $AUD +4.5K (+4.5K), $NZD +1.8K (+1.8K), $MXN -27.0K (-27.0K)

Andrew Turner

adt_fx Disclosure:

Positions – Short $EURUSD →2015.

Intending – May ↑Short $EURUSD, Short $AUDUSD, Long $USDJPY.

Looking - Short $AUDCAD, Long DAX (Short $EUR) may have / may yet emerge into May-June.

Positions – Short $EURUSD →2015.

Intending – May ↑Short $EURUSD, Short $AUDUSD, Long $USDJPY.

Looking - Short $AUDCAD, Long DAX (Short $EUR) may have / may yet emerge into May-June.

Andrew Turner

adt_fx Weekly and YTD Performance.

Week To 15 May 2015 v $USD – $JPY +0.4%, $CHF +1.5%, $EUR +2.3%, $GBP +1.8%, $NZD -0.2%, $AUD +1.4%, $CAD +0.5%, $INR +0.7%, $PHP +0.4%. $USD Index -1.8%

2015 YTD v $USD – $JPY +0.4%, $CHF +7.9%, $EUR -5.4%, $GBP +0.9%, $NZD -4.3%, $AUD -1.7%, $CAD -3.4%, $INR -0.7%, $PHP +0.6%. USD Index +3.2%

Week To 15 May 2015 v $USD – $JPY +0.4%, $CHF +1.5%, $EUR +2.3%, $GBP +1.8%, $NZD -0.2%, $AUD +1.4%, $CAD +0.5%, $INR +0.7%, $PHP +0.4%. $USD Index -1.8%

2015 YTD v $USD – $JPY +0.4%, $CHF +7.9%, $EUR -5.4%, $GBP +0.9%, $NZD -4.3%, $AUD -1.7%, $CAD -3.4%, $INR -0.7%, $PHP +0.6%. USD Index +3.2%

Andrew Turner

adt_fx Disclosure:

Positions – Short $EURUSD →2015.

Intending – May - ↑Short $EURUSD, Short $AUDUSD, Long $USDJPY.

Looking - Short $AUDCAD, Long DAX (Short $EUR) may have / may yet emerge into May.

Positions – Short $EURUSD →2015.

Intending – May - ↑Short $EURUSD, Short $AUDUSD, Long $USDJPY.

Looking - Short $AUDCAD, Long DAX (Short $EUR) may have / may yet emerge into May.

Andrew Turner

adt_fx

#CFTC - #COT $USD Net Long $USD Futures Contracts wk to 12 May. Further ↓ $USD Longs except $JPY & $GBP ↑net short. $AUD & $CHF ↑net Long, $NZDUSD ↓Net Long

$EUR --179.0K (-190.1K), $JPY -23.6K (-31.2K), $GBP -30.8K (-24.8K), $CHF +10.6K (+5.3), $CAD -4.0K (-10.1K), $AUD +4.5K (+0.6K), $NZD +1.8K (+9.1K), $MXN -27.0K (-50.1K)

#CFTC - #COT $USD Net Long $USD Futures Contracts wk to 12 May. Further ↓ $USD Longs except $JPY & $GBP ↑net short. $AUD & $CHF ↑net Long, $NZDUSD ↓Net Long

$EUR --179.0K (-190.1K), $JPY -23.6K (-31.2K), $GBP -30.8K (-24.8K), $CHF +10.6K (+5.3), $CAD -4.0K (-10.1K), $AUD +4.5K (+0.6K), $NZD +1.8K (+9.1K), $MXN -27.0K (-50.1K)

Andrew Turner

Some signs of a bottom in NZDUSD. Looking for evidence of a Reversal to the two week decline. Maybe look to crosses. Either way there is an RBNZ News Conference a...

Andrew Turner

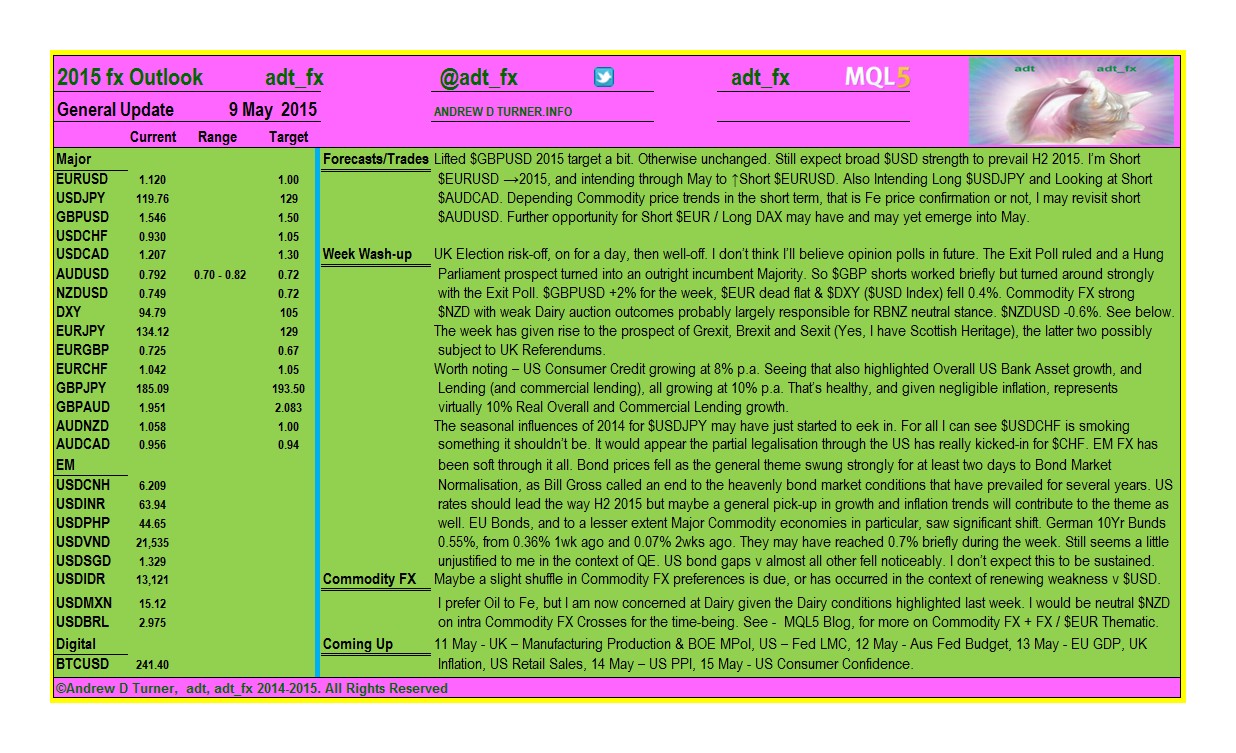

adt_fx FX Outlook 2015 – General (Weekly) Update – 9 May 2015 Forecasts & Trades Lifted $GBPUSD 2015 target a bit. Otherwise unchanged. Still expect broad $USD strength to prevail H2 2015. I’m Short $EURUSD →2015, and intending through May to ↑Short $EURUSD...

Andrew Turner

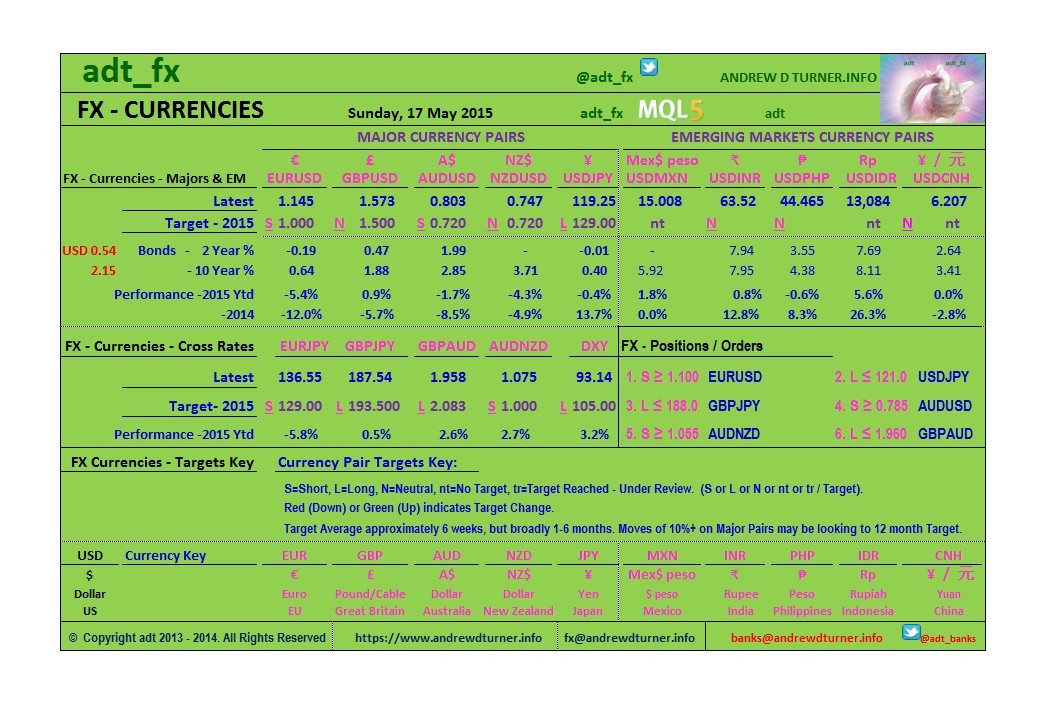

adt_fx FX Outlook 2015 – General Update

See below for table and separately (blog) for expanded adt_fx FX Outlook Commentary

See below for table and separately (blog) for expanded adt_fx FX Outlook Commentary

: