Abdalla Mohamed Mahmoud Taha / プロファイル

- 情報

|

6+ 年

経験

|

0

製品

|

0

デモバージョン

|

|

0

ジョブ

|

0

シグナル

|

0

購読者

|

my name Abdalla Mohamed, I have more than 11 years experience in forex market .

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

I am very professional scalping trader and I own research and studies on the pairs of the British pound

, i have signals providers at MT4 / MT5 , available through the MQL5.com Market.

Abdalla Mohamed Mahmoud Taha

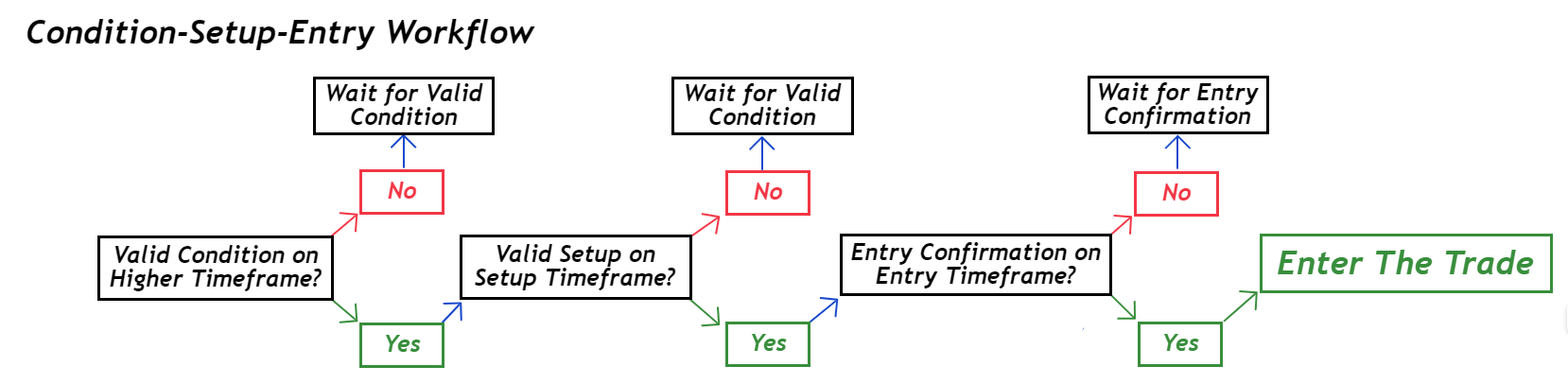

The “Condition-Setup-Entry” Trade Model

Condition-Setup-Entry Box

The condition is the container for the setup and the setup is the container for the entry, thus an entry cannot be valid if it is not within a valid setup, and a setup cannot be valid if it is not within a valid condition.

It may seem obvious that a sell setup should occur within bearish conditions in order to have a higher probability of success but sometimes confirmation bias clouds our vision causing us to consider buy setups in a seller’s market. This is a technique for framing entry confirmation within a setup and framing a setup within the appropriate market conditions.

Condition-Setup-Entry Workflow

Identify the current market direction on the Higher Time Frame (HTF) (ex. Daily or H4) to identify if a Buying or Selling Condition is present. Identify areas of imbalance and supply & demand points of interest (POIs) within the most recent impulsive wave that created a BOS. I reference supply & demand because I use that in my trading, but this applies to any rules based method of trading.

Look for a valid setup on the Setup Time Frame (STF) (ex. H4 or H1) within the context of a HTF buy or sell condition as long as the HTF buy or sell condition is valid. If there is a valid STF setup within a valid HTF condition, proceed to step 3. If not, wait for a valid STF setup to form within a valid HTF condition.

Wait for an Entry Confirmation on the Entry Timeframe (ETF) (ex. M15 or M5) and execute the trade when you have entry confirmation within a valid setup.

Condition-Setup-Entry Box

The condition is the container for the setup and the setup is the container for the entry, thus an entry cannot be valid if it is not within a valid setup, and a setup cannot be valid if it is not within a valid condition.

It may seem obvious that a sell setup should occur within bearish conditions in order to have a higher probability of success but sometimes confirmation bias clouds our vision causing us to consider buy setups in a seller’s market. This is a technique for framing entry confirmation within a setup and framing a setup within the appropriate market conditions.

Condition-Setup-Entry Workflow

Identify the current market direction on the Higher Time Frame (HTF) (ex. Daily or H4) to identify if a Buying or Selling Condition is present. Identify areas of imbalance and supply & demand points of interest (POIs) within the most recent impulsive wave that created a BOS. I reference supply & demand because I use that in my trading, but this applies to any rules based method of trading.

Look for a valid setup on the Setup Time Frame (STF) (ex. H4 or H1) within the context of a HTF buy or sell condition as long as the HTF buy or sell condition is valid. If there is a valid STF setup within a valid HTF condition, proceed to step 3. If not, wait for a valid STF setup to form within a valid HTF condition.

Wait for an Entry Confirmation on the Entry Timeframe (ETF) (ex. M15 or M5) and execute the trade when you have entry confirmation within a valid setup.

Abdalla Mohamed Mahmoud Taha

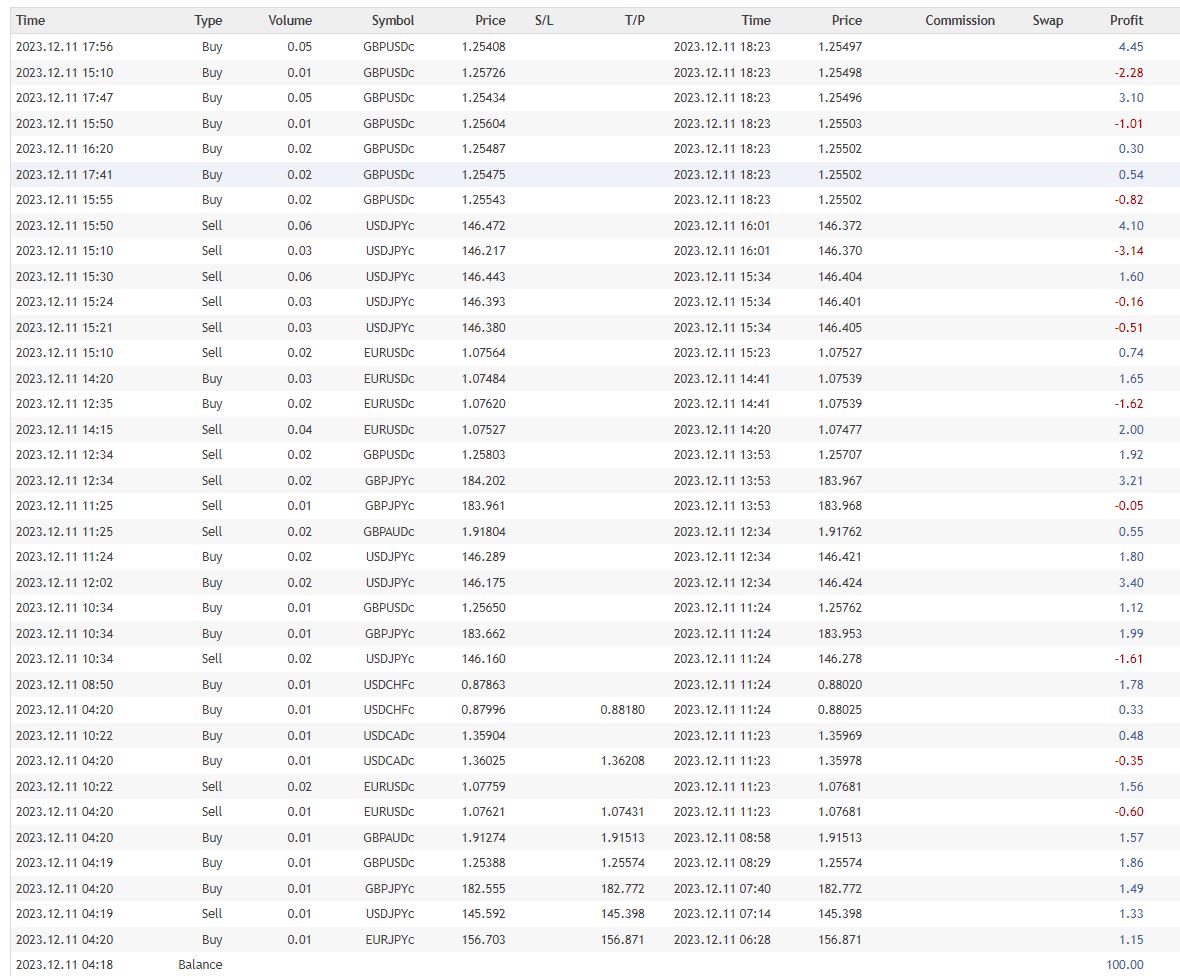

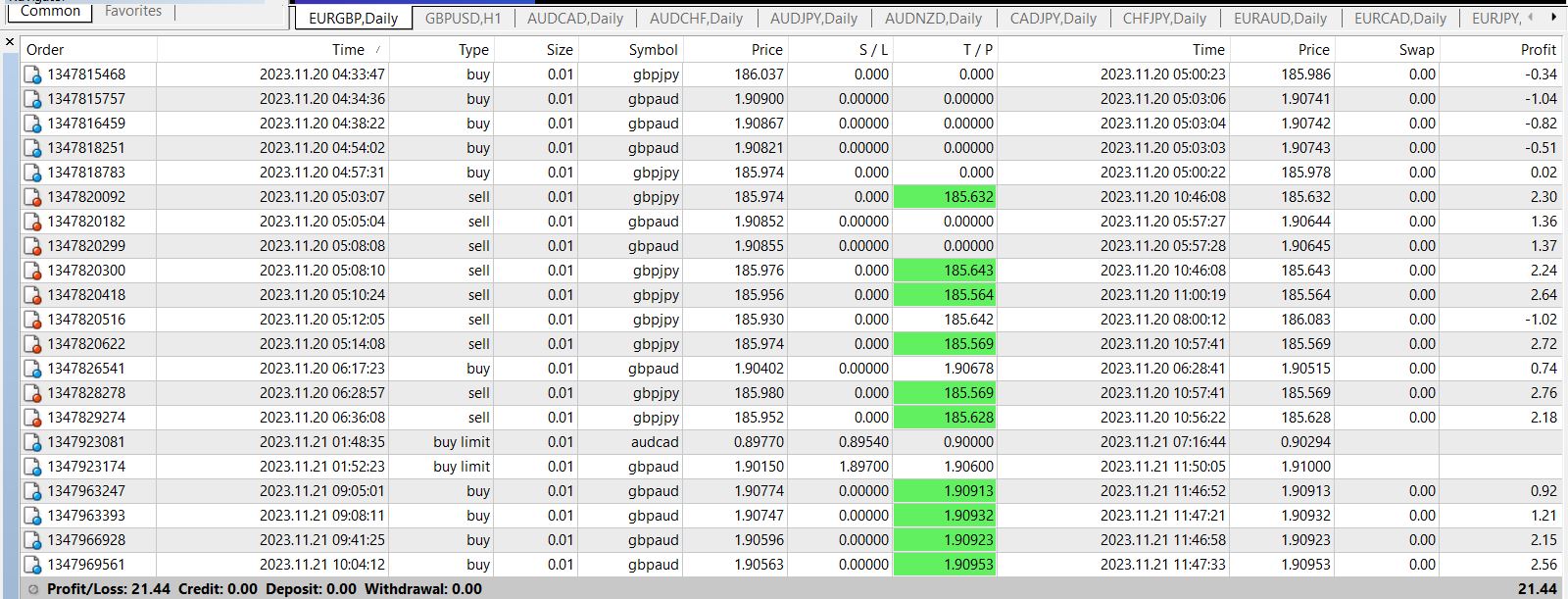

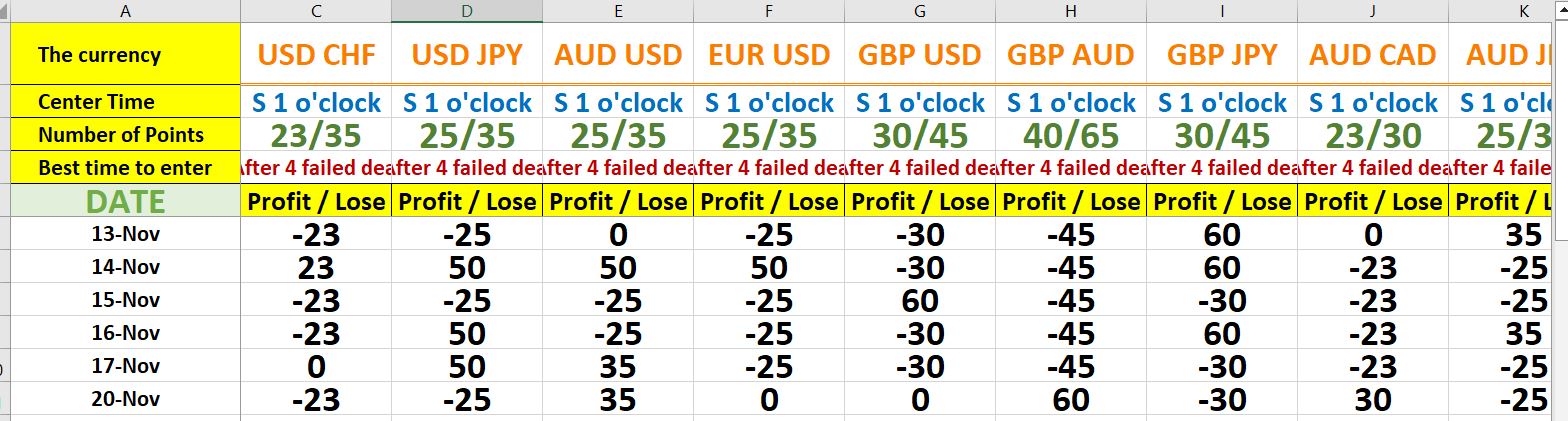

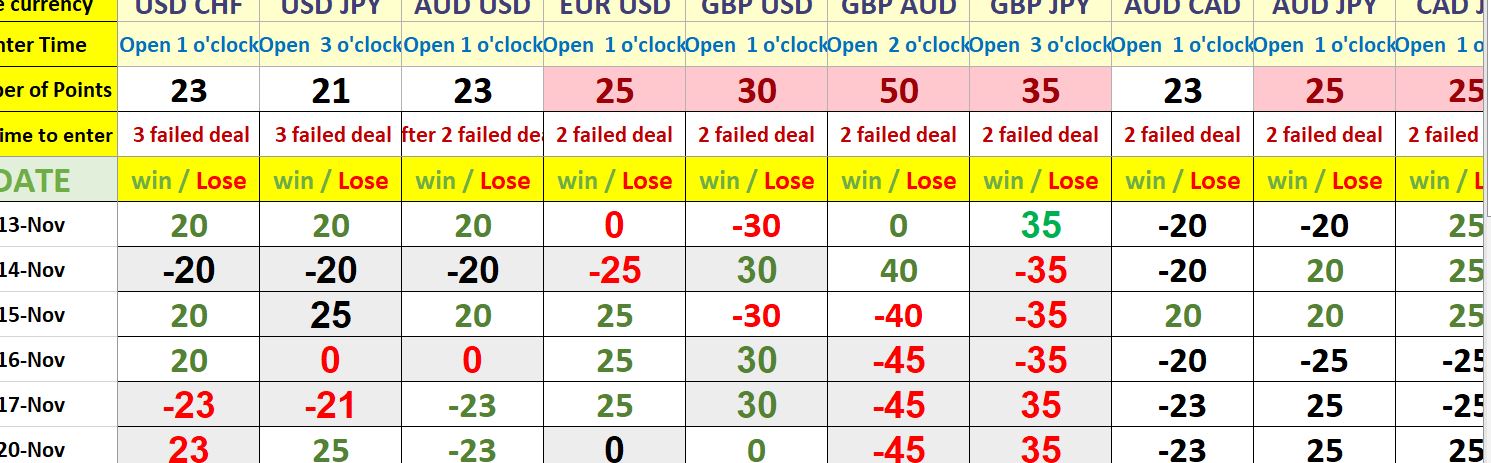

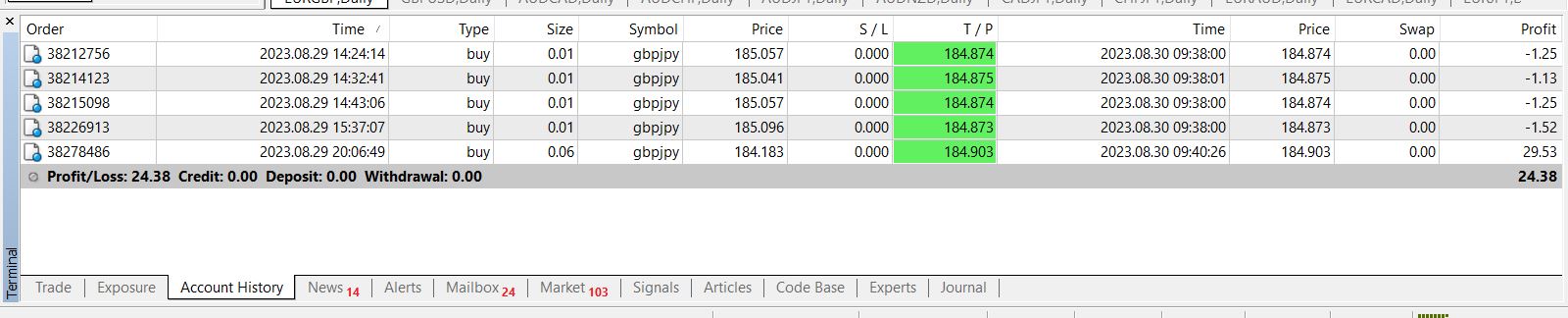

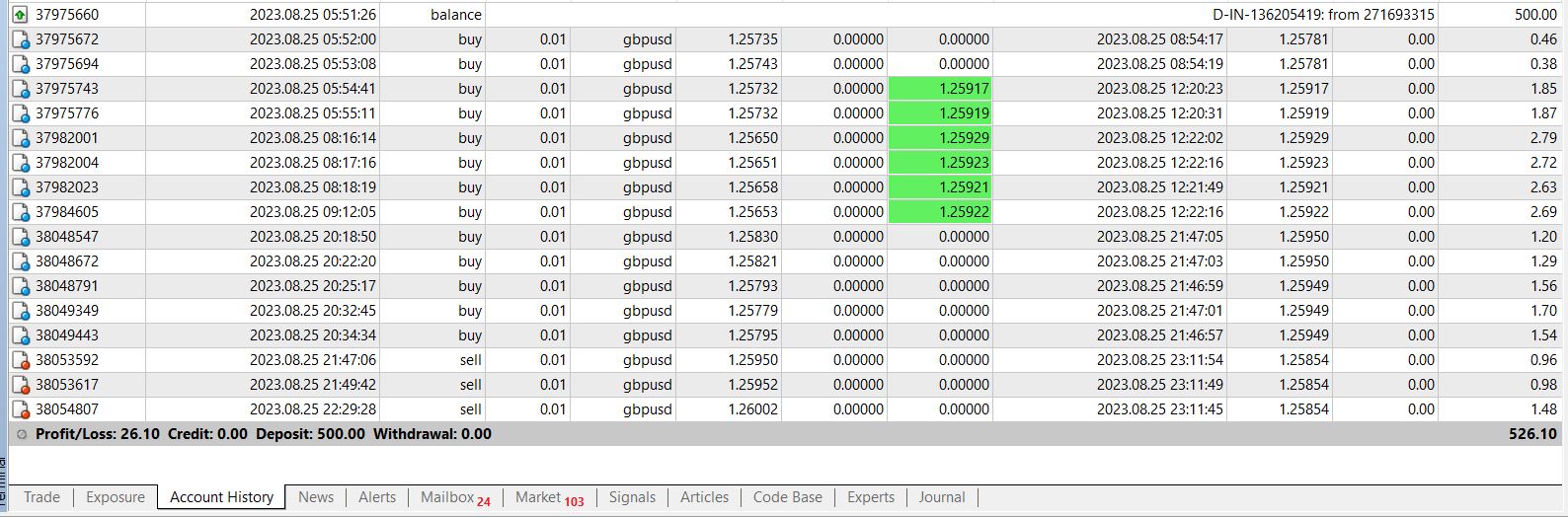

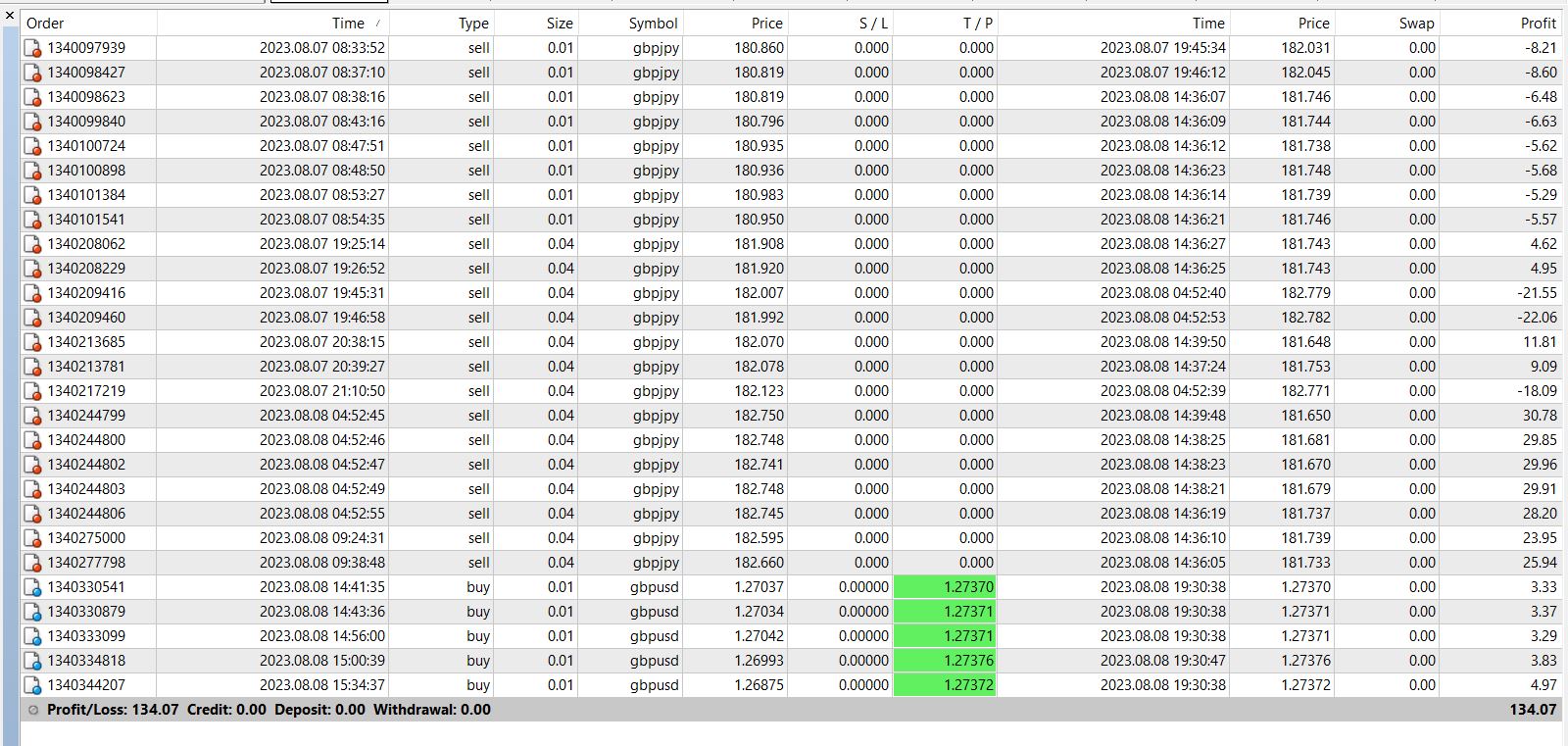

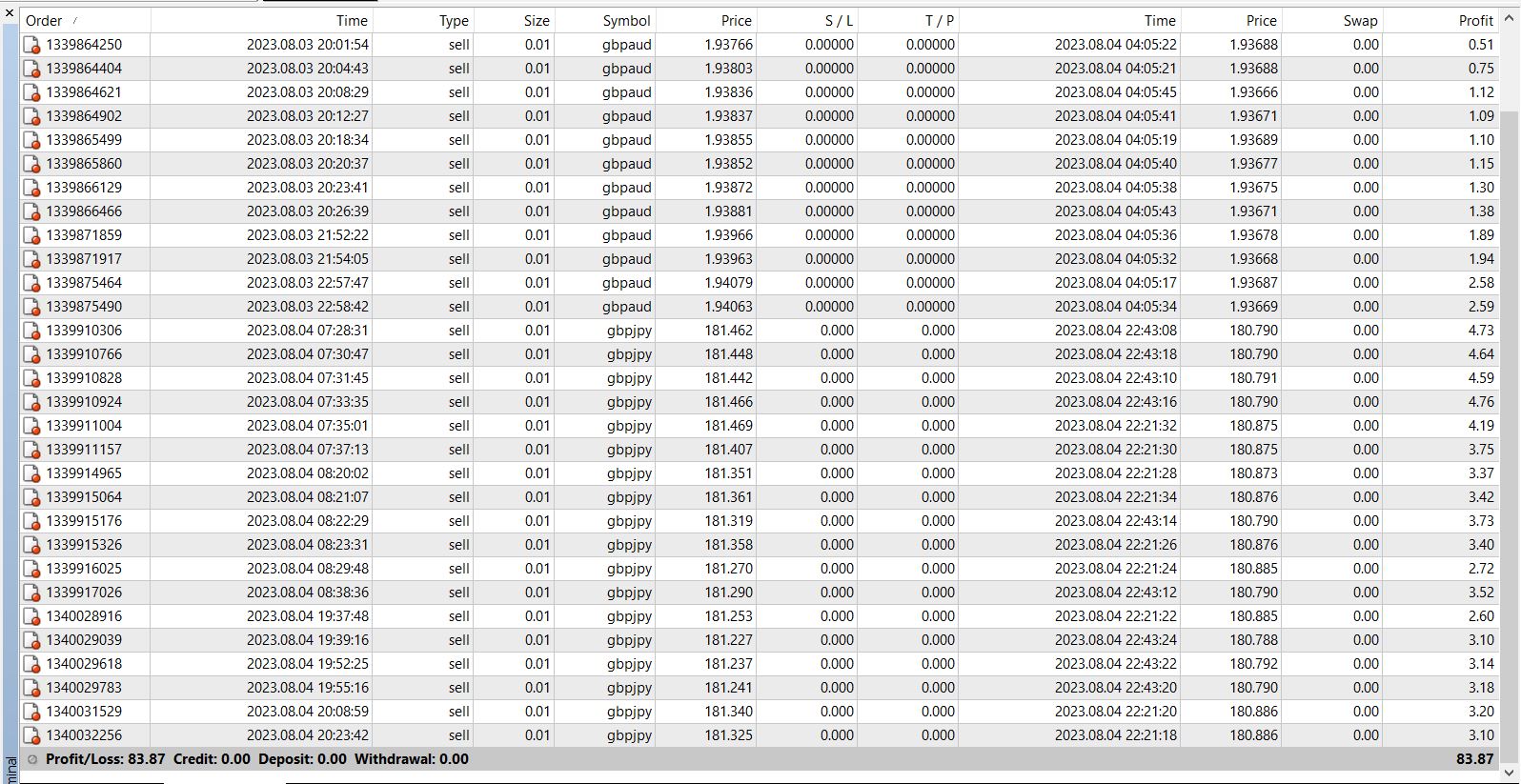

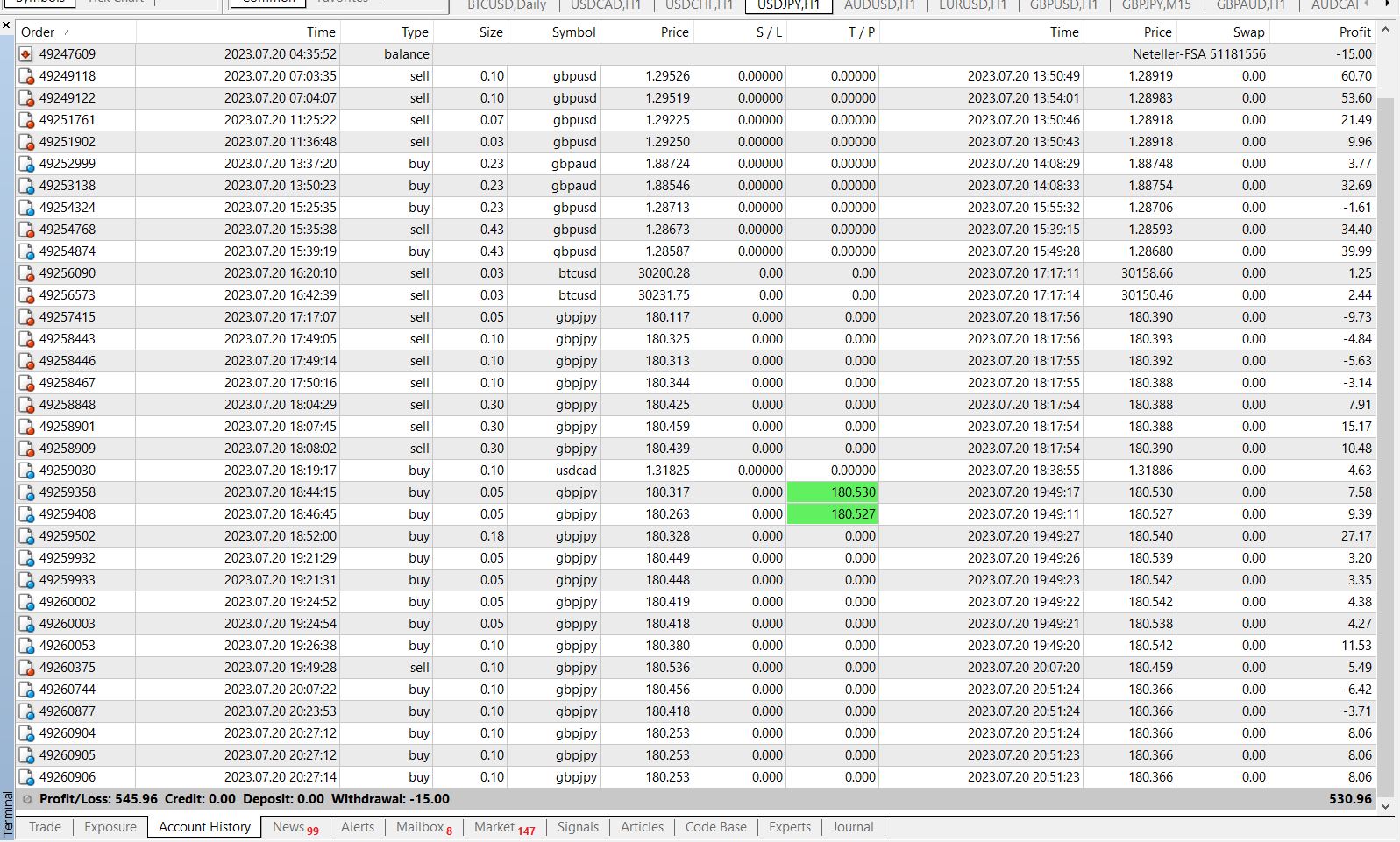

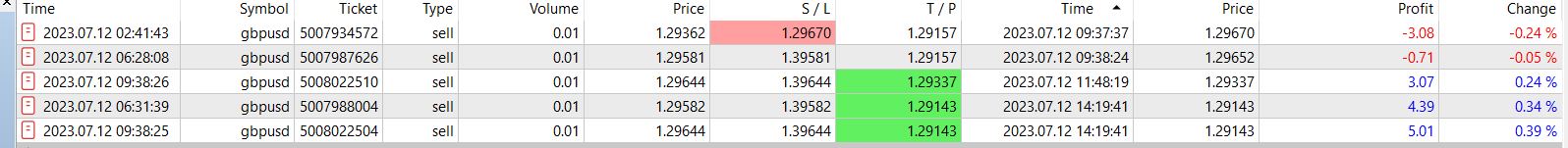

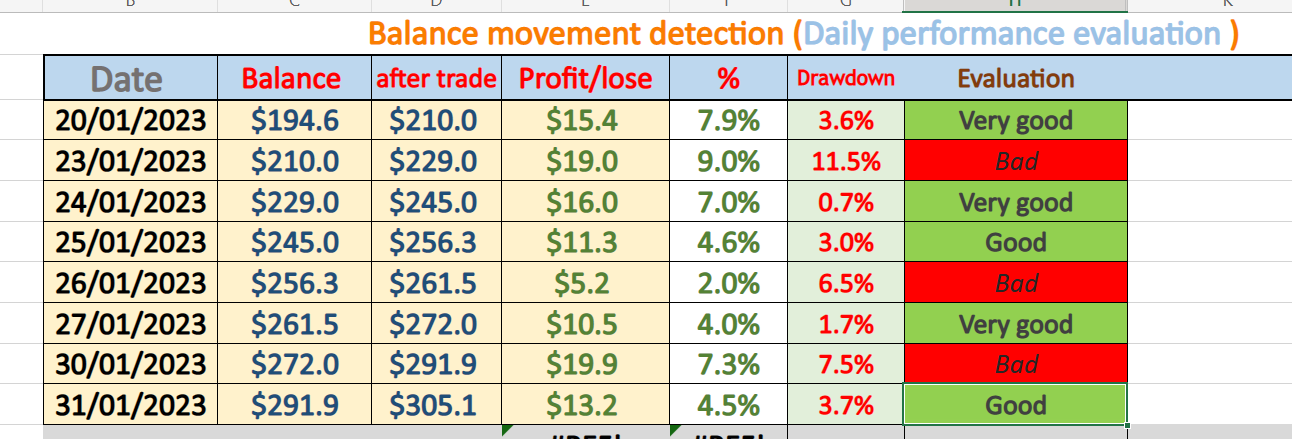

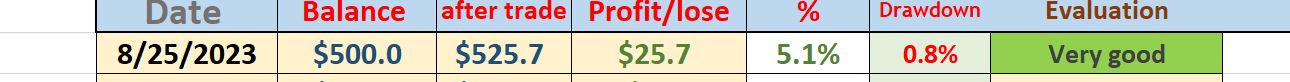

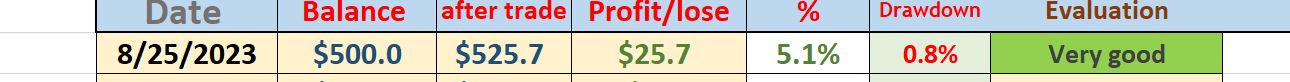

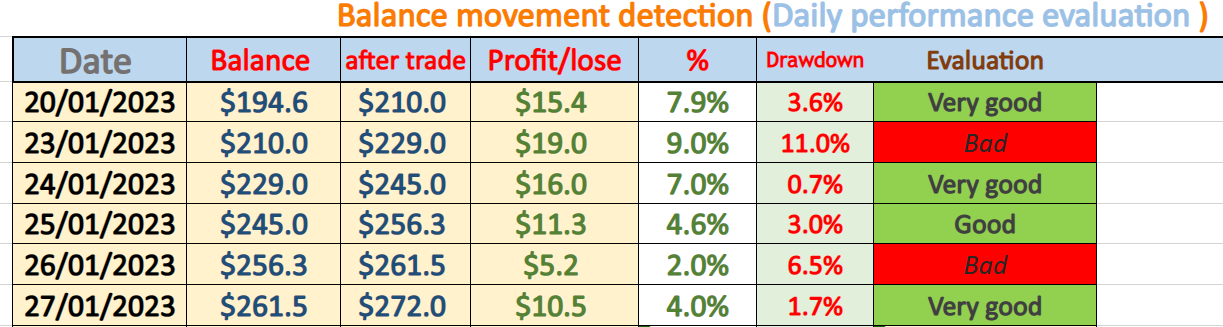

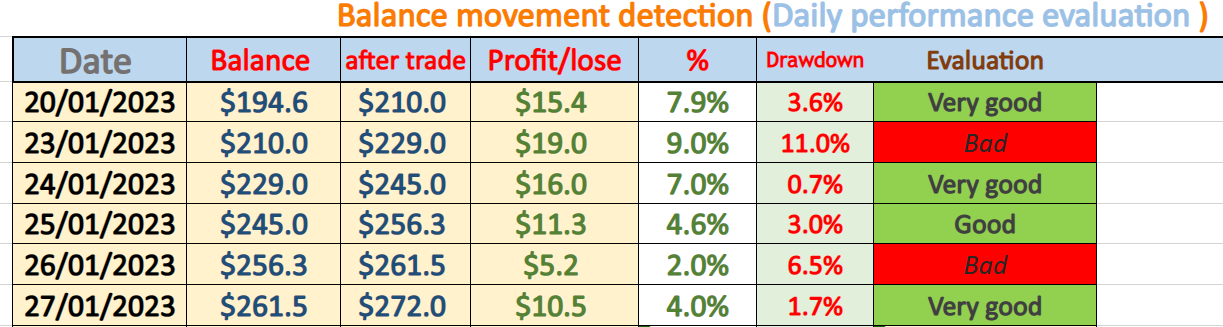

MQL5 EA PERFORMANCE UNTIL NOW

DAILY TRADING

IF PROFIT LESS THAN DRAWDOWN ( BAD )

IF PROFIT MORE THAN DRAWDOWN ( GOOD )

IF PROFIT MORE THAN DOUBLE DRAWDOWN ( VERY GOOD )

DAILY TRADING

IF PROFIT LESS THAN DRAWDOWN ( BAD )

IF PROFIT MORE THAN DRAWDOWN ( GOOD )

IF PROFIT MORE THAN DOUBLE DRAWDOWN ( VERY GOOD )

Abdalla Mohamed Mahmoud Taha

7 Tips To Overcome a Trading Burnout

Online trading may seem like an easy job to outsiders.

To them, all traders do is sit in front of a computer, read a bunch of news articles, put up some lines on a chart, and then money will magically appear.

forex burnout

But every trader will tell you that this is not the case.

Every single time a trader opens his platform, he knows that he will be exposed to a variety of stressful situations.

This makes us very susceptible to “mental burnout” or the collapse of the mind due to overwork or stress.

Mental burnout can be triggered many factors like overtrading, extreme market conditions, unrealistic expectations, and of course, losses.

The first thing you must understand about mental burnout is that, typically, there is not one single event that can trigger it. It is a gradual process that happens over a long period of time.

Burnout is also very broad as it doesn’t only affect one part of your life. It can manifest itself in school, at work, in your relationships, and sometimes even affect the burnout victim physically.

Here are some ways you can avoid getting burned out:

1. Pay attention to early warning signs

Burnout can sneak up on you without notice, so it’s very important to pay attention to the early warning signs.

Below are a few questions for you to ask to see if you’re about to burn out or are already burning out.

The more times you answer “yes,” the more likely you are about to experience a burnout:

Are you beginning to question why you should care about your trading plan?

Even with proper diet and fitness habits, are you having frequent migraines, muscle aches, and sickness?

Do you feel self-doubt?

Do you feel helpless, trapped, and unmotivated?

Do you hold off in closing a losing trade even though you know it’s already doomed anyway?

Have you started to eat more, take drugs, or consume more alcohol than usual?

Do you feel angry towards others for the smallest reasons?

2. Recall the feeling when you first started trading

Do you remember that light bulb moment when you first understood how fundamental and technical analysis made sense?

Did you feel giddy when you placed your very first trade?

Use that excitement you felt when you first started trading to renew your enthusiasm for the craft.

This way, you’d be able to focus more on the positive aspects and less on the stressful ones.

3. Find a trading buddy

They say that “misery loves company” and oftentimes it’s great to blow out steam with someone who understands exactly what you’re going through.

But instead of holding hands and cursing at the market when trades don’t go your way, share your trading thoughts with your buddy instead.

He might be able to help you determine your common mistakes and correct them, allowing you to avoid stress from these problems down the line.

4. Pamper yourself

We all have our own ways of unwinding – be it through a beach vacation, a yoga class or a few rounds of paintball. It’s important to know what does the trick for you… and then do it!

As much as you love trading, make sure that you also do something else that you enjoy regularly to avoid the dreaded burnout.

Taking measures to avoid burnout is well and good, but if you’re already experiencing it, then here are some tips that might help you recover:

5. Take it easy

When you’re feeling more stressed about your trading than usual, you run the risk of making things worse if you force yourself to trade more and work harder.

Taking a moment to unwind could help you clear your mind and make it easier for you to focus later on.

6. Ask for help

More often than not, trying to overcome a burnout on your own can result in twice the pressure you already feel.

In this case, there’s nothing wrong with consulting a friend or even a psychological counselor.

After all, it’s possible that burnout might be a product of a different concern other than trading and it’d be best to isolate which problem you really need to work on.

7. Take control

One of the major causes of burnout is the perceived loss of control over a situation, which is something that traders could be prone to given the market’s dynamic nature.

When you feel this kind of anxiety while trading, try to regain control by setting simpler goals.

These can be in the form of managing your time wisely, updating your trade journal regularly, or developing a trading plan and sticking to it.

How about you? Have you experienced trading burnout before? What have you done to overcome the condition?

Online trading may seem like an easy job to outsiders.

To them, all traders do is sit in front of a computer, read a bunch of news articles, put up some lines on a chart, and then money will magically appear.

forex burnout

But every trader will tell you that this is not the case.

Every single time a trader opens his platform, he knows that he will be exposed to a variety of stressful situations.

This makes us very susceptible to “mental burnout” or the collapse of the mind due to overwork or stress.

Mental burnout can be triggered many factors like overtrading, extreme market conditions, unrealistic expectations, and of course, losses.

The first thing you must understand about mental burnout is that, typically, there is not one single event that can trigger it. It is a gradual process that happens over a long period of time.

Burnout is also very broad as it doesn’t only affect one part of your life. It can manifest itself in school, at work, in your relationships, and sometimes even affect the burnout victim physically.

Here are some ways you can avoid getting burned out:

1. Pay attention to early warning signs

Burnout can sneak up on you without notice, so it’s very important to pay attention to the early warning signs.

Below are a few questions for you to ask to see if you’re about to burn out or are already burning out.

The more times you answer “yes,” the more likely you are about to experience a burnout:

Are you beginning to question why you should care about your trading plan?

Even with proper diet and fitness habits, are you having frequent migraines, muscle aches, and sickness?

Do you feel self-doubt?

Do you feel helpless, trapped, and unmotivated?

Do you hold off in closing a losing trade even though you know it’s already doomed anyway?

Have you started to eat more, take drugs, or consume more alcohol than usual?

Do you feel angry towards others for the smallest reasons?

2. Recall the feeling when you first started trading

Do you remember that light bulb moment when you first understood how fundamental and technical analysis made sense?

Did you feel giddy when you placed your very first trade?

Use that excitement you felt when you first started trading to renew your enthusiasm for the craft.

This way, you’d be able to focus more on the positive aspects and less on the stressful ones.

3. Find a trading buddy

They say that “misery loves company” and oftentimes it’s great to blow out steam with someone who understands exactly what you’re going through.

But instead of holding hands and cursing at the market when trades don’t go your way, share your trading thoughts with your buddy instead.

He might be able to help you determine your common mistakes and correct them, allowing you to avoid stress from these problems down the line.

4. Pamper yourself

We all have our own ways of unwinding – be it through a beach vacation, a yoga class or a few rounds of paintball. It’s important to know what does the trick for you… and then do it!

As much as you love trading, make sure that you also do something else that you enjoy regularly to avoid the dreaded burnout.

Taking measures to avoid burnout is well and good, but if you’re already experiencing it, then here are some tips that might help you recover:

5. Take it easy

When you’re feeling more stressed about your trading than usual, you run the risk of making things worse if you force yourself to trade more and work harder.

Taking a moment to unwind could help you clear your mind and make it easier for you to focus later on.

6. Ask for help

More often than not, trying to overcome a burnout on your own can result in twice the pressure you already feel.

In this case, there’s nothing wrong with consulting a friend or even a psychological counselor.

After all, it’s possible that burnout might be a product of a different concern other than trading and it’d be best to isolate which problem you really need to work on.

7. Take control

One of the major causes of burnout is the perceived loss of control over a situation, which is something that traders could be prone to given the market’s dynamic nature.

When you feel this kind of anxiety while trading, try to regain control by setting simpler goals.

These can be in the form of managing your time wisely, updating your trade journal regularly, or developing a trading plan and sticking to it.

How about you? Have you experienced trading burnout before? What have you done to overcome the condition?

Abdalla Mohamed Mahmoud Taha

MQL5 EA PERFORMANCE UNTIL NOW

DAILY TRADING

IF PROFIT LESS THAN DRAWDOWN ( BAD )

IF PROFIT MORE THAN DRAWDOWN ( GOOD )

IF PROFIT MORE THAN DOUBLE DRAWDOWN ( VERY GOOD )

DAILY TRADING

IF PROFIT LESS THAN DRAWDOWN ( BAD )

IF PROFIT MORE THAN DRAWDOWN ( GOOD )

IF PROFIT MORE THAN DOUBLE DRAWDOWN ( VERY GOOD )

: