Trade Direction

- インディケータ

- Gevorg Hakobyan

- バージョン: 1.1

- アップデート済み: 8 4月 2020

- アクティベーション: 10

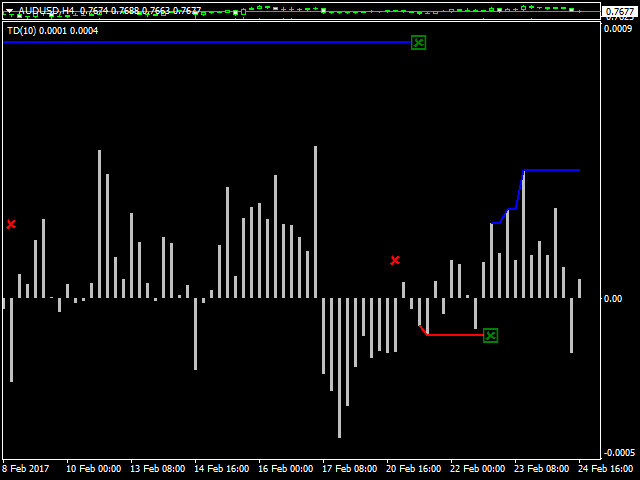

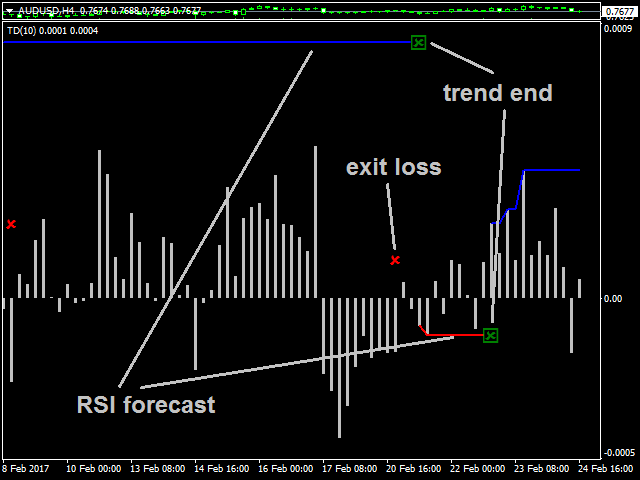

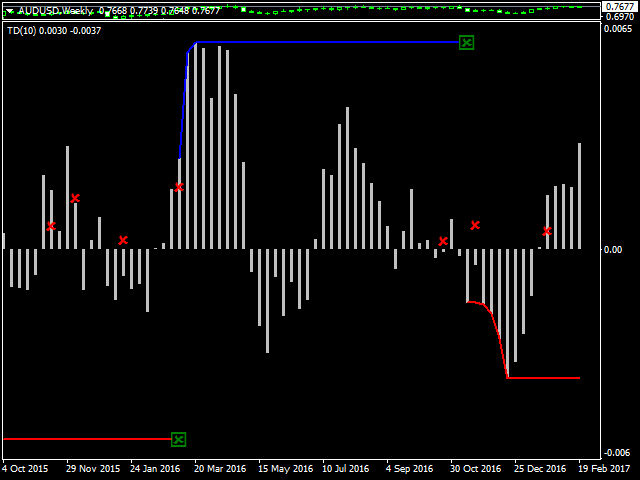

The oscillator shows trend direction using its own algorithm, which is based on calculating price values by analyzing prices of separate currencies (original valuation of currencies). The histogram shows the average value of physical price change over the selected period. When the histogram has a positive value, the trend is rising, if negative - the trend id falling. The indicator uses standard RSI to determine the current market direction on a selected period as follows: the default value of the parameter is 25, which means that if RSI will be greater than 75 on the selected period, a rising trend will be displayed, i.e. by signals will persist as long as RSI is above 75, and the falling trend will be displayed if RSI is below 25. The end of trend according to RSI will be marked by a green cross. Possible reverse movement is determined using a Moving Average. If the reverse trend movement according to MA is greater than the specified value of points, the indicator will add a red cross. The average price of a currency in the market is calculated based on 7 different currency pairs, the list of which may vary (if a pair is not available in your, it will be removed from the list and thus the list is reduced).

Input Parameters

- period - the number of bars used for calculation (minimum value is 2).

- TrendLevel - level to determine trend using RSI (a value from 0 to 50). Recommended value from 10.0 to 35.0.

- LossPoint - allowable fluctuation in points according to moving average values (minimum value is 0).*

- Suffix - set when a suffix is used in the currency pair name (e.g. if you have EURUSDx, you should input x here).

- Prefix - set when a prefix is used in the currency pair name (e.g. if you have xEURUSD, you should input x here).

Indicator Features

The main feature of the indicator is its original calculation of currency value and its changes. The idea is based on the theory about close correlation of all currency pairs, i.e. change of one currency pair naturally influences prices of other pairs. Therefore, when calculating a currency value, the algorithm takes into account recent changes in the prices of all related pairs.

An initial list of currency pairs used in the indicator.

| EURUSD | GBPUSD | USDCHF | USDCAD | AUDUSD | NZDUSD | USDJPY | EURGBP | EURCHF | EURCAD | EURAUD | EURNZD | EURJPY | GBPCHF |

| GBPCAD | GBPAUD | GBPNZD | GBPJPY | CADCHF | AUDCHF | NZDCHF | CHFJPY | NZDCAD | CADJPY | AUDCAD | AUDNZD | AUDJPY | NZDJPY |

* - this parameter is not taken into account in order to give signals to close positions in cases of correlation and when the moving average (by MACD method) indicates a possible reversal of more than specified number of points. The indicator does not analyze position opening on a pair and does not calculate potential losses, no meed to specify a large value in order to reduce false signals.

Important!

Before purchasing the full version, be sure to test the product and ensure that it works in your terminal with a set of currency pairs provided by your broker! I would appreciate if you let me know about any errors.

5 star the indicator work very well and the developer is very amazing person who will help with in personal to make this awesome indicator work with broker setting, he will me for everything and even make me a new indicator to make everything run very well. 10 star from happy customer