Claws and Horns / Profilo

Claws and Horns

Post pubblicati EUR/USD: euro remains under pressure

Current trend This week the EUR/USD pair continued moving down amid the recovering demand for the US currency after the Yuan devaluation...

Claws and Horns

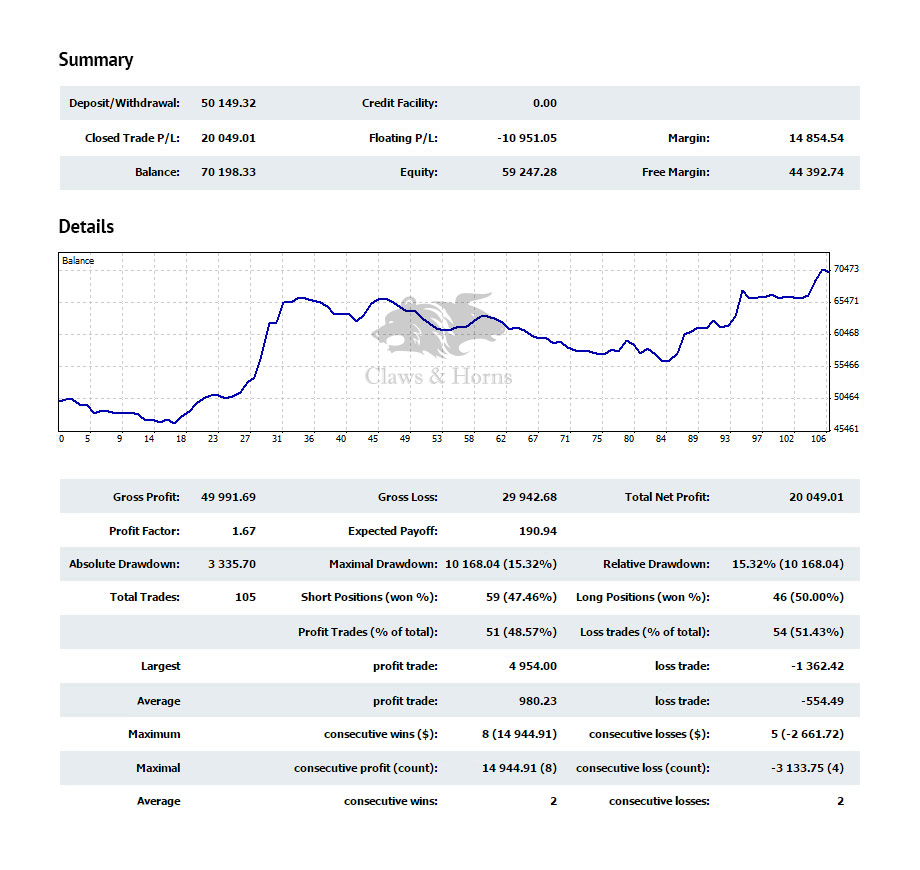

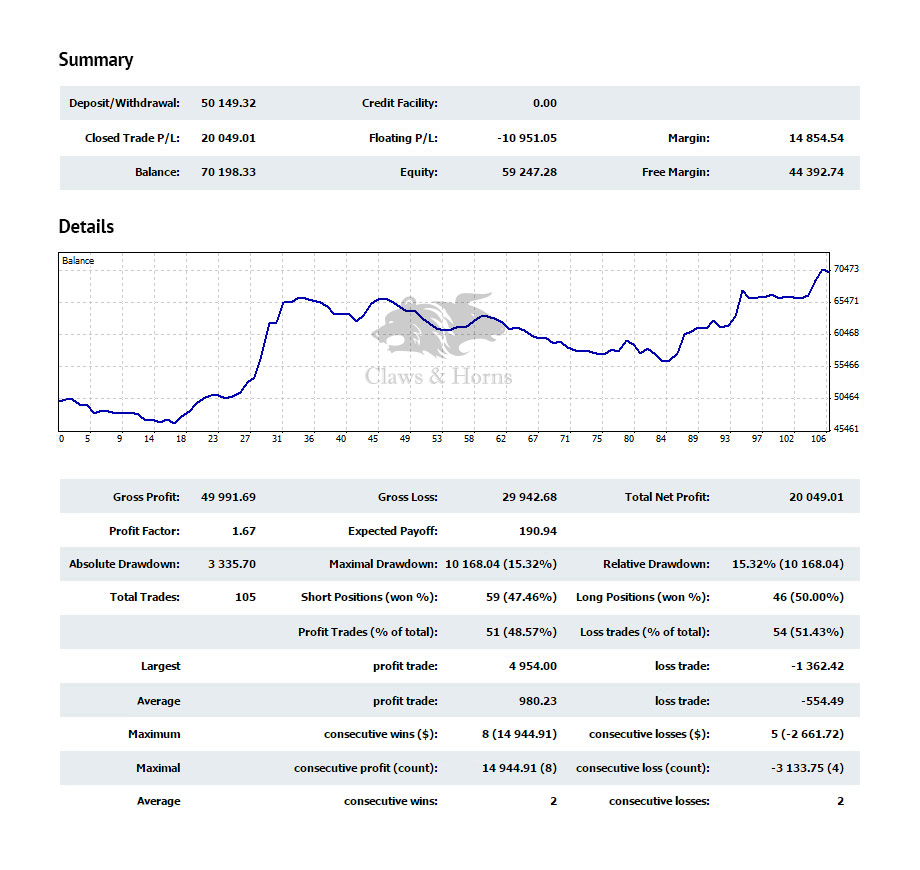

Claws&Horns Signals Statistics for last week:

All signals for the AUD/USD trading instrument – trading result: -60 points, floating P/L: -6 points;

All signals for the EUR/GBP trading instrument – trading result: +22 points, floating P/L: 0 points;

All signals for the AUD/JPY trading instrument - trading result: 0 points, floating P/L: -31 points;

All signals for the EUR/USD trading instrument - trading result: +10 points, floating P/L: 0 points;

All signals for the GBP/USD trading instrument - trading result: -145 points, floating P/L: -92 points;

All signals for the BRENT trading instrument - trading result: +106 points, floating P/L: -53 points;

All signals for the USD/CAD trading instrument - trading result: +101 points, floating P/L: +391 points;

All signals for the USD/CHF trading instrument - trading result: +52 points, floating P/L: -16 points;

All signals for the USD/JPY trading instrument - trading result: -74 points, floating P/L: +9 points;

All signals for the XAG/USD trading instrument - trading result: -30 points, floating P/L: -10 points;

All signals for the XAU/USD trading instrument - trading result: +1600 points, floating P/L: 0 points;

All signals for the NZD/USD trading instrument - trading result: +93 points, floating P/L: -60 points;

All signals for the EUR/JPY trading instrument - trading result: -90 points, floating P/L: -1 point;

All signals for the GBP/JPY trading instrument - trading result: 0 points, floating P/L: -9 points;

Total for all trading instruments - trading result: +1585 points, floating P/L: +122 points.

All signals for the AUD/USD trading instrument – trading result: -60 points, floating P/L: -6 points;

All signals for the EUR/GBP trading instrument – trading result: +22 points, floating P/L: 0 points;

All signals for the AUD/JPY trading instrument - trading result: 0 points, floating P/L: -31 points;

All signals for the EUR/USD trading instrument - trading result: +10 points, floating P/L: 0 points;

All signals for the GBP/USD trading instrument - trading result: -145 points, floating P/L: -92 points;

All signals for the BRENT trading instrument - trading result: +106 points, floating P/L: -53 points;

All signals for the USD/CAD trading instrument - trading result: +101 points, floating P/L: +391 points;

All signals for the USD/CHF trading instrument - trading result: +52 points, floating P/L: -16 points;

All signals for the USD/JPY trading instrument - trading result: -74 points, floating P/L: +9 points;

All signals for the XAG/USD trading instrument - trading result: -30 points, floating P/L: -10 points;

All signals for the XAU/USD trading instrument - trading result: +1600 points, floating P/L: 0 points;

All signals for the NZD/USD trading instrument - trading result: +93 points, floating P/L: -60 points;

All signals for the EUR/JPY trading instrument - trading result: -90 points, floating P/L: -1 point;

All signals for the GBP/JPY trading instrument - trading result: 0 points, floating P/L: -9 points;

Total for all trading instruments - trading result: +1585 points, floating P/L: +122 points.

Claws and Horns

Post pubblicati Brent: oil resumed fall

Current trend In the end of last week, the price of Brent crude oil resumed its fall amid the growing USD. Last week, the USD significantly declined due to the Yuan devaluation in China, which increased the concerns regarding an anticipated interest rate hike in the US in September...

Claws and Horns

Post pubblicati NZD/USD flat continues

Current trend The NZD remains volatile, trading not far from where it was at the start of the week. On Thursday, the USD gained back some of its losses Yesterday, New Zealand released Business PMI for July (54.5 points from 55.1 earlier). Food Price Index grew from 0.5% to 0...

Condividi sui social network · 1

51

Claws and Horns

Post pubblicati GBP/USD: Pound grew despite poor statistics

Current trend The Pound continues growing amid the weakening USD, which is under pressure after the market intervention by the People’s Bank of China aimed at the Yuan devaluation. The GBP/USD pair grows despite poor labor market statistics from the UK. Average Earnings in June grew by only 2...

Claws and Horns

Company’s pulse

Claws & Horns is glad to announce the introduction of a new analytical tool for various financial instruments – the 'Pivot Point Calculator'.

Our specialists, who continually improve our service and strive to provide the best and most innovative analysis on the market, decided to add a new tab to our service menu, "Tools", which includes a volatility calculator, and pivot point and support/resistance levels calculator.

To derive current support/resistance levels and pivot points, the trader needs to choose the currency pair he is interested in, select the range (a number of bars that will be shown on the chart to illustrate the levels) and click on the 'Calculate' button.

The chart will show bars with lines drawn on it:

- Green – pivot point

- Blue – support levels

- Red – resistance levels

Under the chart, the corresponding numeric data will be given.

These levels can be useful for a short-term trading strategy. When trading inside the range, they could indicate possible price turning points. And if the strategy is to follow the trend, these levels could indicate the beginning of the trend once they are broken.

Claws & Horns is glad to announce the introduction of a new analytical tool for various financial instruments – the 'Pivot Point Calculator'.

Our specialists, who continually improve our service and strive to provide the best and most innovative analysis on the market, decided to add a new tab to our service menu, "Tools", which includes a volatility calculator, and pivot point and support/resistance levels calculator.

To derive current support/resistance levels and pivot points, the trader needs to choose the currency pair he is interested in, select the range (a number of bars that will be shown on the chart to illustrate the levels) and click on the 'Calculate' button.

The chart will show bars with lines drawn on it:

- Green – pivot point

- Blue – support levels

- Red – resistance levels

Under the chart, the corresponding numeric data will be given.

These levels can be useful for a short-term trading strategy. When trading inside the range, they could indicate possible price turning points. And if the strategy is to follow the trend, these levels could indicate the beginning of the trend once they are broken.

Claws and Horns

Post pubblicati USD/CHF: USD resumed growth

Current trend On Tuesday, the USD/CHF pair resumed its growth after some correction in the US against its major competitors. As a result, the pair reached its highs since the end of March...

Claws and Horns

Post pubblicati EUR/JPY: at the upper border of the range

Current trend After the Chinese authorities devalued the Yuan, the US Dollar strengthened against most major currencies and against the Euro as well. The single currency also declined against the save-haven Yen...

Claws and Horns

Claws&Horns Signals Statistics for last week:

All signals for the AUD/JPY trading instrument – trading result: 0 points, floating P/L: +190 points;

All signals for the AUD/USD trading instrument – trading result: +73 points, floating P/L: -47 points;

All signals for the EUR/GBP trading instrument - trading result: -34 points, floating P/L: -193 points;

All signals for the EUR/USD trading instrument - trading result: -162 points, floating P/L: +49 points;

All signals for the GBP/USD trading instrument - trading result: -290 points, floating P/L: -57 points;

All signals for the NZD/USD trading instrument - trading result: +350 points, floating P/L: -102 points;

All signals for the BRENT trading instrument - trading result: -478 points, floating P/L: 0 points;

All signals for the USD/CAD trading instrument - trading result: -155 points, floating P/L: +73 points;

All signals for the USD/CHF trading instrument - trading result: +464 points, floating P/L: 0 points;

All signals for the USD/JPY trading instrument - trading result: +644 points, floating P/L: 0 points;

All signals for the XAG/USD trading instrument - trading result: +82 points, floating P/L: -78 points;

All signals for the XAU/USD trading instrument - trading result: +150 points, floating P/L: -704 points;

All signals for the EUR/JPY trading instrument - trading result: -0 points, floating P/L: +25 points;

All signals for the GBP/JPY trading instrument - trading result: -0 points, floating P/L: -142 points;

Total for all trading instruments - trading result: +644 points, floating P/L: -986 points.

All signals for the AUD/JPY trading instrument – trading result: 0 points, floating P/L: +190 points;

All signals for the AUD/USD trading instrument – trading result: +73 points, floating P/L: -47 points;

All signals for the EUR/GBP trading instrument - trading result: -34 points, floating P/L: -193 points;

All signals for the EUR/USD trading instrument - trading result: -162 points, floating P/L: +49 points;

All signals for the GBP/USD trading instrument - trading result: -290 points, floating P/L: -57 points;

All signals for the NZD/USD trading instrument - trading result: +350 points, floating P/L: -102 points;

All signals for the BRENT trading instrument - trading result: -478 points, floating P/L: 0 points;

All signals for the USD/CAD trading instrument - trading result: -155 points, floating P/L: +73 points;

All signals for the USD/CHF trading instrument - trading result: +464 points, floating P/L: 0 points;

All signals for the USD/JPY trading instrument - trading result: +644 points, floating P/L: 0 points;

All signals for the XAG/USD trading instrument - trading result: +82 points, floating P/L: -78 points;

All signals for the XAU/USD trading instrument - trading result: +150 points, floating P/L: -704 points;

All signals for the EUR/JPY trading instrument - trading result: -0 points, floating P/L: +25 points;

All signals for the GBP/JPY trading instrument - trading result: -0 points, floating P/L: -142 points;

Total for all trading instruments - trading result: +644 points, floating P/L: -986 points.

Claws and Horns

Post pubblicati AUD/USD: upward correction

Current trend On Friday, the AUD managed to strengthen against the USD and reached the local high near the level of 0.7428. The reason for a rising dynamics was poor data on the NFPR from the US and the RBA statement...

Claws and Horns

Post pubblicati USD/JPY: Dollar is waiting for new drivers for growth

Current trend The USD/JPY pair stabilised after the publication of the Bank of Japan Minutes and prior to the publication of the key US statistics. As expected, the Bank of Japan kept its key interest rate at 0%. The quantitative easing program also left unchanged at 80 trillion yen a year...

Claws and Horns

Post pubblicati AUD/JPY: rebound from 92.00

Current trend Despite a larger number of employed, the unemployment rate in Australia in July grew from 6.1% to 6.3%. The AUD/JPY pair is supported by the difference in interest rates in Japan (0.1%) and Australia (2%), and extra-soft monetary policy by the Bank of Japan...

Condividi sui social network · 1

98

Claws and Horns

Claws & Horns Company launches the updated website.

Now with a new modern design you can easily find all necessary information about our services and access the demo version of the Client’s area. Also, on the homepage you can get access to Claws & Horns news feeder for MT4/MT5 trading platforms. Moreover, we added news section, where various analytical and statistical reviews, company news and interviews with our clients are published. Visit our updated website at www.clawshorns.com

Now with a new modern design you can easily find all necessary information about our services and access the demo version of the Client’s area. Also, on the homepage you can get access to Claws & Horns news feeder for MT4/MT5 trading platforms. Moreover, we added news section, where various analytical and statistical reviews, company news and interviews with our clients are published. Visit our updated website at www.clawshorns.com

Claws and Horns

Post pubblicati EUR/JPY: pair remains flat

Current trend In the beginning of last week, the pair EUR/JPY grew but fell again soon after amid poor macroeconomic data from the eurozone...

Claws and Horns

Claws&Horns Signals Statistics for last week:

All signals for the AUD/USD trading instrument – trading result: -47 points, floating P/L: -37 points;

All signals for the EUR/GBP trading instrument – trading result: 0 points, floating P/L: -26 points;

All signals for the AUD/JPY trading instrument - trading result: 0 points, floating P/L: +24 points;

All signals for the EUR/USD trading instrument - trading result: -39 points, floating P/L: -50 points;

All signals for the GBP/USD trading instrument - trading result: -50 points, floating P/L: -50 points;

All signals for the BRENT trading instrument - trading result: -36 points, floating P/L: -104 points;

All signals for the USD/CAD trading instrument - trading result: -44 points, floating P/L: -127 points;

All signals for the USD/CHF trading instrument - trading result: +74 points, floating P/L: +84 points;

All signals for the USD/JPY trading instrument - trading result: 0 points, floating P/L: -2 points;

All signals for the XAG/USD trading instrument - trading result: 0 points, floating P/L: -26 points;

All signals for the XAU/USD trading instrument - trading result: 0 points, floating P/L: -84 points;

All signals for the NZD/USD trading instrument - trading result: -150 points, floating P/L: +66 points;

Total for all trading instruments - trading result: -292 points, floating P/L: -338 points.

All signals for the AUD/USD trading instrument – trading result: -47 points, floating P/L: -37 points;

All signals for the EUR/GBP trading instrument – trading result: 0 points, floating P/L: -26 points;

All signals for the AUD/JPY trading instrument - trading result: 0 points, floating P/L: +24 points;

All signals for the EUR/USD trading instrument - trading result: -39 points, floating P/L: -50 points;

All signals for the GBP/USD trading instrument - trading result: -50 points, floating P/L: -50 points;

All signals for the BRENT trading instrument - trading result: -36 points, floating P/L: -104 points;

All signals for the USD/CAD trading instrument - trading result: -44 points, floating P/L: -127 points;

All signals for the USD/CHF trading instrument - trading result: +74 points, floating P/L: +84 points;

All signals for the USD/JPY trading instrument - trading result: 0 points, floating P/L: -2 points;

All signals for the XAG/USD trading instrument - trading result: 0 points, floating P/L: -26 points;

All signals for the XAU/USD trading instrument - trading result: 0 points, floating P/L: -84 points;

All signals for the NZD/USD trading instrument - trading result: -150 points, floating P/L: +66 points;

Total for all trading instruments - trading result: -292 points, floating P/L: -338 points.

Claws and Horns

Post pubblicati USD/CHF: upward trend continues

Current trend The pair USD/CHF shows a moderate growth and reaches new local highs. A growth in the USD is a result of the promising statement by the Fed and strong macroeconomic data from the US...

Claws and Horns

Post pubblicati USD/JPY: yen is significantly weaker than US dollar

Current trend The pair growth, started this Tuesday, continued on Wednesday. Despite some interesting macroeconomic statistics, released in Japan, the yen fails to start a steady upward movement. On Wednesday Retail Sales rose by 0.9% at an annual rate in June which is 0.4% higher than expected...

Claws and Horns

Post pubblicati GBP/USD: GBP is strengthening

Current trend Yesterday, the Pound grew against the USD amid positive GDP data from the UK. According to the preliminary report, in the second quarter of the year the GDP grew by 0.7% (against 0.4% for the previous quarter) that amounts to a yearly growth of 2.6...

Claws and Horns

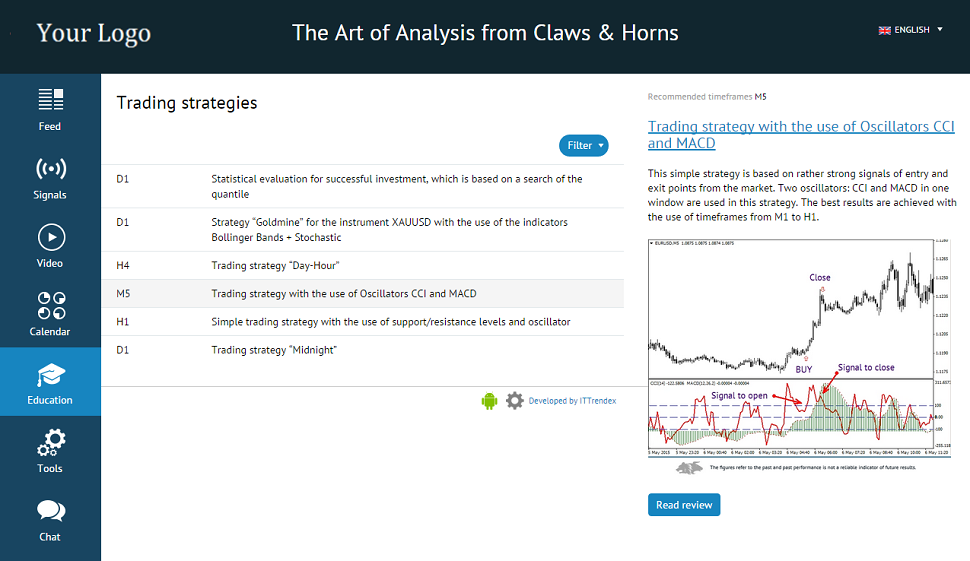

Dear Clients!

Claws & Horns is excited to announce the launch of a new section in the Client’s Area — Trading Strategies.

Clients who have only started trading Forex recently do not know where to start! There is so much information out there and limited advise on how to use it all. Additionally, they are uncertain how to achieve profit. Trading results are mainly chaotic and, generally, accidental. With Claws & Horns launching the ‘Trading Strategies’ section , you will be able to help your clients get an idea of different trading styles and help them to familiarize themselves with different trading instruments. The materials provided will be useful for experienced traders as well. The section will be updated every week. Your clients, no matter how experienced they are, will discover something new and start trading more intensively.

Claws & Horns is excited to announce the launch of a new section in the Client’s Area — Trading Strategies.

Clients who have only started trading Forex recently do not know where to start! There is so much information out there and limited advise on how to use it all. Additionally, they are uncertain how to achieve profit. Trading results are mainly chaotic and, generally, accidental. With Claws & Horns launching the ‘Trading Strategies’ section , you will be able to help your clients get an idea of different trading styles and help them to familiarize themselves with different trading instruments. The materials provided will be useful for experienced traders as well. The section will be updated every week. Your clients, no matter how experienced they are, will discover something new and start trading more intensively.

Claws and Horns

Ladies and gentlemen, we are delighted to share an interview with you from Yury Voloshin (Director at LiteForex) about his successful collaboration with Claws&Horns:

Q: Tell us about your first impressions of Claws&Horns.

A: First of all, I liked how the service was integrated; everything was so quick and of such a high quality. It did not take us long to sign the contract. We received the installation manual straightaway and launched the service in our client’s area within 15 minutes. It took the same amount of time to install the new feeder, used to deliver all materials directly to trading platforms. It is included in the standard MetaQuotes package. All we had to do was to enter the username and the password. It is the easiest integration we have ever dealt with.

Q: How do Claws&Horns services help you to attract new clients?

A: There are a lot of beginners among our clients who definitely need support in their trades. The company is really good at dealing with this issue, providing detailed analysis right on time, confirming their trading decisions and bettering their overall trading psychology.

Q: What is the increase in the trading volume of your clients?

A: It is hard to estimate the immediate change. But, our statistics show that in general, the volume of trades increased by around50% within 8 months of cooperating with Claws&Horns.

Q: How long did it take you to see the first positive changes in your company once you implemented Claws&Horns services? ?

A: We saw them almost instantly. As I previously stated, there were no immediate changes to the volume of trades. But our managers received yet another marketing tool; and now it is easier to work with new clients, and traders need less time to start trading on real accounts.

We included Claws&Horns service in our VIP club loyalty program. Depending on how active our traders are, they can access different services absolutely free of charge. Working in conjunction with Claws&Horns technical specialists, we launched the SMS-signals service for our VIP club Clients.

Q: What would you like to wish Claws&Horns?

A: To continue to move forward, and launch new analytical tools. All in all, to keep up with, and even exceed, the market requirements as they are demonstrating now, continually providing final customers with new, innovative services.

Q: Tell us about your first impressions of Claws&Horns.

A: First of all, I liked how the service was integrated; everything was so quick and of such a high quality. It did not take us long to sign the contract. We received the installation manual straightaway and launched the service in our client’s area within 15 minutes. It took the same amount of time to install the new feeder, used to deliver all materials directly to trading platforms. It is included in the standard MetaQuotes package. All we had to do was to enter the username and the password. It is the easiest integration we have ever dealt with.

Q: How do Claws&Horns services help you to attract new clients?

A: There are a lot of beginners among our clients who definitely need support in their trades. The company is really good at dealing with this issue, providing detailed analysis right on time, confirming their trading decisions and bettering their overall trading psychology.

Q: What is the increase in the trading volume of your clients?

A: It is hard to estimate the immediate change. But, our statistics show that in general, the volume of trades increased by around50% within 8 months of cooperating with Claws&Horns.

Q: How long did it take you to see the first positive changes in your company once you implemented Claws&Horns services? ?

A: We saw them almost instantly. As I previously stated, there were no immediate changes to the volume of trades. But our managers received yet another marketing tool; and now it is easier to work with new clients, and traders need less time to start trading on real accounts.

We included Claws&Horns service in our VIP club loyalty program. Depending on how active our traders are, they can access different services absolutely free of charge. Working in conjunction with Claws&Horns technical specialists, we launched the SMS-signals service for our VIP club Clients.

Q: What would you like to wish Claws&Horns?

A: To continue to move forward, and launch new analytical tools. All in all, to keep up with, and even exceed, the market requirements as they are demonstrating now, continually providing final customers with new, innovative services.

: