Mohammed Abdulwadud Soubra / Perfil

- Información

|

8+ años

experiencia

|

7

productos

|

1086

versiones demo

|

|

134

trabajos

|

1

señales

|

1

suscriptores

|

Llevo en el mercado de divisas desde 2005.

Consulta este producto:

https://www.mql5.com/en/users/soubra2003/seller

Prometedores señales de trading en US30 y acciones estadounidenses:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para obtener soporte instantáneo, únete a este grupo de WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Consulta este producto:

https://www.mql5.com/en/users/soubra2003/seller

Prometedores señales de trading en US30 y acciones estadounidenses:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Para obtener soporte instantáneo, únete a este grupo de WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W

Amigos

8602

Solicitudes

Enviadas

Mohammed Abdulwadud Soubra

The fundamental focus will shift temporarily from the Dollar over the coming week - just as trend pressure comes into view - with China's NPC meeting and the ECB rate decision drawing traders' anxiety.

US Dollar Forecast – Dollar Tumble Threatens Long-Term Trend Again, FOMC Too Far Away

The Dollar tumbled this past week as a tempered view for Fed rate hikes rendered the currency incapable of taking advantage of the improved sentiment across global markets.

Euro Forecast - Euro Unlikely to Stay Lower Unless ECB Meeting Yields Big Bazooka

Another swell in volatility is a near-certainty across the EUR-crosses with the European Central Bank’s meeting this Thursday. Without a surprise, the ECB seems destined to send the Euro on an early-December 2015 replay.

British Pound Forecast – GBP/USD Rebound at Risk as BoE Speaks on U.K. Referendum

After posting the first five-consecutive days of advances since June, GBP/USD stands at risk facing near-term headwinds should Bank of England (BoE) officials endorse a wait-and-see approach ahead of their next interest rate decision on March 17.

Japanese Yen Forecast - Japanese Yen Poised to Gain this week if Big Event Disappoints

A great week for the US S&P 500, Japanese Nikkei 225, and other global financial bellwethers pushed the inversely-correlated Japanese Yen lower against almost all G10 counterparts.

Australian Dollar Forecast – Australian Dollar Outlook Hinges on ECB Meeting, China News-Flow

The Australian Dollar will look to the impact of the ECB rate decision on risk appetite trends and news-flow from China’s NPC for fuel to extend the largest rally in four years.

New Zealand Dollar Forecast - RBNZ Will Provide Guidance on NZ Dollar’s Recent Flight

The New Zealand Dollar has out-performed every currency aside from its rival Australian Dollar over the last week.

Chinese Yuan Forecast - Yuan To Remain in Focus at the NPC Conference

The offshore Yuan rate (CNH) climbed over 260 pips against the US Dollar on Thursday and extended gains going into the Friday close.

Gold Forecast – All That Glitters is Gold

This title is a line taken from Shakespeare. He actually said ‘all that glisters is not gold,’ but ‘glisters’ was the word for ‘glitters’ in the 17th century, so the saying has held while the English language has evolved.

US Dollar Forecast – Dollar Tumble Threatens Long-Term Trend Again, FOMC Too Far Away

The Dollar tumbled this past week as a tempered view for Fed rate hikes rendered the currency incapable of taking advantage of the improved sentiment across global markets.

Euro Forecast - Euro Unlikely to Stay Lower Unless ECB Meeting Yields Big Bazooka

Another swell in volatility is a near-certainty across the EUR-crosses with the European Central Bank’s meeting this Thursday. Without a surprise, the ECB seems destined to send the Euro on an early-December 2015 replay.

British Pound Forecast – GBP/USD Rebound at Risk as BoE Speaks on U.K. Referendum

After posting the first five-consecutive days of advances since June, GBP/USD stands at risk facing near-term headwinds should Bank of England (BoE) officials endorse a wait-and-see approach ahead of their next interest rate decision on March 17.

Japanese Yen Forecast - Japanese Yen Poised to Gain this week if Big Event Disappoints

A great week for the US S&P 500, Japanese Nikkei 225, and other global financial bellwethers pushed the inversely-correlated Japanese Yen lower against almost all G10 counterparts.

Australian Dollar Forecast – Australian Dollar Outlook Hinges on ECB Meeting, China News-Flow

The Australian Dollar will look to the impact of the ECB rate decision on risk appetite trends and news-flow from China’s NPC for fuel to extend the largest rally in four years.

New Zealand Dollar Forecast - RBNZ Will Provide Guidance on NZ Dollar’s Recent Flight

The New Zealand Dollar has out-performed every currency aside from its rival Australian Dollar over the last week.

Chinese Yuan Forecast - Yuan To Remain in Focus at the NPC Conference

The offshore Yuan rate (CNH) climbed over 260 pips against the US Dollar on Thursday and extended gains going into the Friday close.

Gold Forecast – All That Glitters is Gold

This title is a line taken from Shakespeare. He actually said ‘all that glisters is not gold,’ but ‘glisters’ was the word for ‘glitters’ in the 17th century, so the saying has held while the English language has evolved.

Mohammed Abdulwadud Soubra

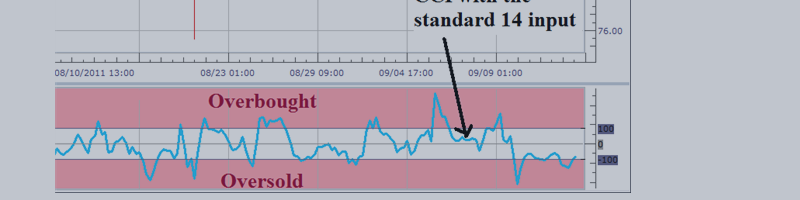

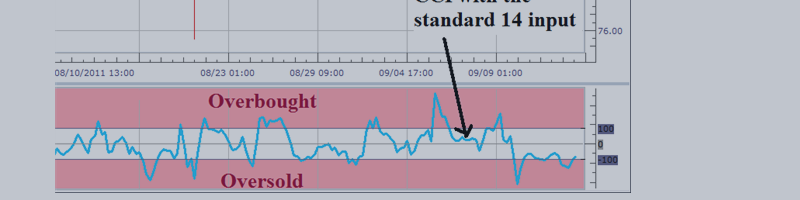

How to Trade Commodity Channel Index (CCI) in Forex Commodity Channel Index (CCI) is an oscillator introduced by Donald Lambert in 1980. Though its name refers to commodities, it can also be useful in equities and currency trading as well. CCI measures the statistical variation from the average...

Compartir en las redes sociales · 7

385

Mohammed Abdulwadud Soubra

WTI Crude Oil Price Forecast: Payrolls Push Oil & Risk Higher

4 marzo 2016, 23:40

WTI Crude Oil Price Forecast: Payrolls Push Oil & Risk Higher Talking Points: Crude Oil Technical Strategy: Oil Too Strong To Fight Intermarket Analysis Turns Focus of Price Support Of a Weak US Dollar Crude Oil Rises for Third Week After Report Shows Jobs Gain...

Compartir en las redes sociales · 5

260

Mohammed Abdulwadud Soubra

USD/CAD Selloff to Persist on Upbeat Bank of Canada (BoC) Talking Points: - USD/CAD Slips to Fresh Monthly Low; Retail FX Remains Net-Long Ahead of BoC Meeting. - USDOLLAR Extends Decline Amid Slowing U.S. Wage Growth; Fed’s Fischer & Brainard in Focus. USD/CAD...

Mohammed Abdulwadud Soubra

Post publicado Pivot Points-Hourly

Pivot Points-Hourly Last Updated: Mar 4, 10:00 pm +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.09712 1.09827 1.0988 1.09942 1.09995 1.10057 1.10172 USD/JPY 113.438 113.77 113.977 114.102 114.309 114.434 114.766 GBP/USD 1.41679 1.41901 1.42026 1.42123 1.42248 1.42345 1.42567 USD/CHF 0.99173 0...

Mohammed Abdulwadud Soubra

Due to it being a state holiday in Russia on 8th March, 2016, - International Women’s Day - trading of USDRUB and EURRUB currency pairs will be closed.

Trading of these pairs will resume as normal on 9 th

March, 2016.

Trading of these pairs will resume as normal on 9 th

March, 2016.

Mohammed Abdulwadud Soubra

Talking Points: February’s US employment report in the spotlight across financial markets Data’s non-impact on March rate hike bets may restrict trend development Upside surprise may translate into US Dollar strength in the weeks ahead All eyes are on February’s US Employment report in the final...

Mohammed Abdulwadud Soubra

04 March 2016, Time of Writing: 09:00 am Trader Daily Market Update Major Calendar News Time (GMT) Name Country Vol. Prev. Cons. Sentiment 13:30 Non-Farm Employment Change USD High 195K 151K Positive 13:30 Average Hourly Earnings m/m USD High 0.5% 0.2% Neutral 13:30 Unemployment Rate USD High 4...

Mohammed Abdulwadud Soubra

THE NFP REPORT IS EXPECTED TO BREAK ABOVE 200,000 NEW JOBS IN FEBRUARY U.S. employment data has been mixed ahead of the U.S. non-farm payrolls (NFP) report...

Mohammed Abdulwadud Soubra

Pivot Points-Hourly Last Updated: Mar 4, 11:30 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.09297 1.09393 1.09446 1.09489 1.09542 1.09585 1.09681 USD/JPY 113.547 113.707 113.784 113.867 113.944 114.027 114.187 GBP/USD 1.41024 1.41285 1.41383 1.41546 1.41644 1.41807 1.42068 USD/CHF 0.98868 0...

Mohammed Abdulwadud Soubra

Pivot Points_Daily Last Updated: Mar 4, 11:30 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.06875 1.08068 1.08806 1.09261 1.09999 1.10454 1.11647 USD/JPY 111.794 112.765 113.213 113.736 114.184 114.707 115.678 GBP/USD 1.38081 1.397 1.40706 1.41319 1.42325 1.42938 1.44557 USD/CHF 0.97492 0...

Mohammed Abdulwadud Soubra

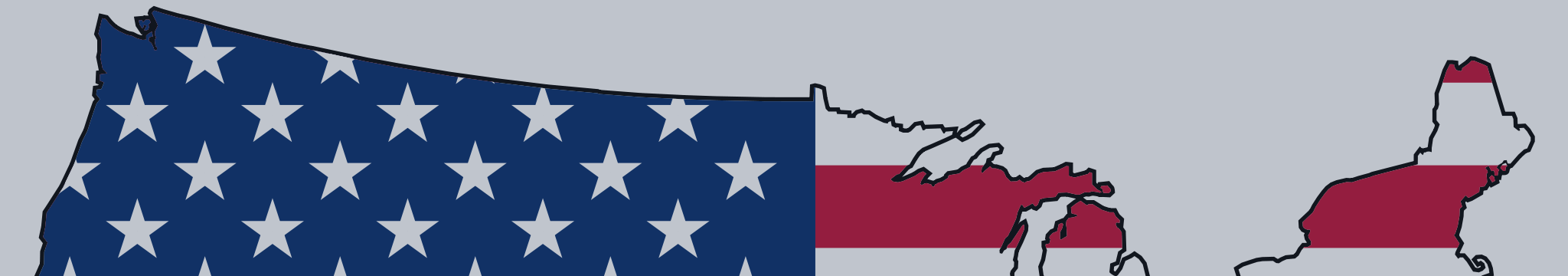

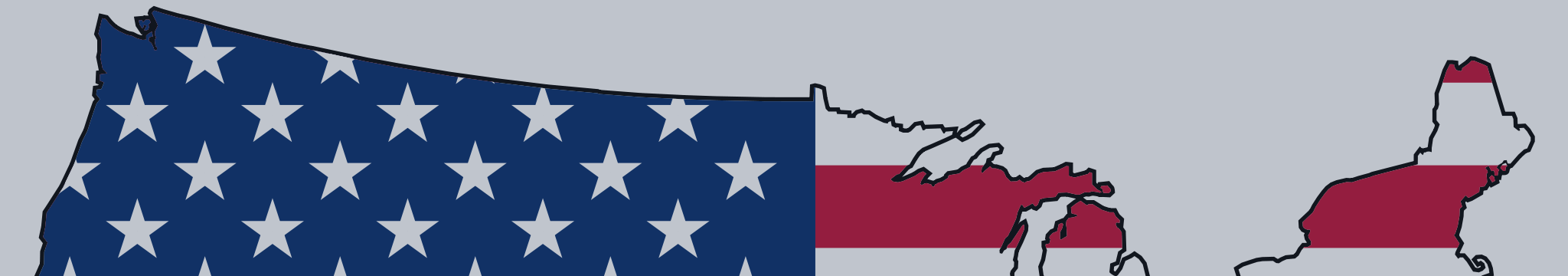

THE NFP REPORT IS EXPECTED TO BREAK ABOVE 200,000 NEW JOBS IN FEBRUARY

U.S. employment data has been mixed ahead of the U.S. non-farm payrolls (NFP) report. A weak Institute for Supply Management (ISM) Employment Index showing a contraction on Thursday is being balanced against a strong ADP Private payrolls report that beat expectations on Wednesday. The ADP Research Institute reported that US private payrolls grew by 214,000 in February beating the forecast of 185,000. Usually there is a low correlation between the ADP and the NFP due Friday, but aside from the employment change disappointment in January they have consistently beaten expectations in the past four months. The private payrolls report shows manufacturing is still weak with a loss of 9,000 jobs, but the optimism comes from the expansion of the services sector that added 59,000 new jobs.

The USD declined against the EUR after the release of the ISM Employment Index that posted a contraction at 49.7 in February. Overall the U.S. service sector continues to expand albeit at a slower pace, but given the focus on employment data this week investors sold U.S. dollars ahead of what could be a disappointing Non-farm payrolls number. Last month even though the NFP headline number was less than anticipated the fact that wages grew and the unemployment rate was lower was enough to boost the USD.

The NFP will be published by the U.S. Bureau of Labor Statistics on Friday, March 4 at 8:30 am EST. Employment is the strongest pillar of the U.S. economic recovery since the credit crisis and the influence on the Fed's interest rate decision is significant. Economist's forecasts range around 185,000 to 200,000 new jobs added. Anything outside of that range for the biggest forex indicator will set a direction for the USD.

U.S. employment data has been mixed ahead of the U.S. non-farm payrolls (NFP) report. A weak Institute for Supply Management (ISM) Employment Index showing a contraction on Thursday is being balanced against a strong ADP Private payrolls report that beat expectations on Wednesday. The ADP Research Institute reported that US private payrolls grew by 214,000 in February beating the forecast of 185,000. Usually there is a low correlation between the ADP and the NFP due Friday, but aside from the employment change disappointment in January they have consistently beaten expectations in the past four months. The private payrolls report shows manufacturing is still weak with a loss of 9,000 jobs, but the optimism comes from the expansion of the services sector that added 59,000 new jobs.

The USD declined against the EUR after the release of the ISM Employment Index that posted a contraction at 49.7 in February. Overall the U.S. service sector continues to expand albeit at a slower pace, but given the focus on employment data this week investors sold U.S. dollars ahead of what could be a disappointing Non-farm payrolls number. Last month even though the NFP headline number was less than anticipated the fact that wages grew and the unemployment rate was lower was enough to boost the USD.

The NFP will be published by the U.S. Bureau of Labor Statistics on Friday, March 4 at 8:30 am EST. Employment is the strongest pillar of the U.S. economic recovery since the credit crisis and the influence on the Fed's interest rate decision is significant. Economist's forecasts range around 185,000 to 200,000 new jobs added. Anything outside of that range for the biggest forex indicator will set a direction for the USD.

Mohammed Abdulwadud Soubra

Pre European Open, Daily Technical Analysis Friday, March 04, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: the upside prevails. Pivot: 1.0890 Most Likely Scenario: long positions above 1...

Mohammed Abdulwadud Soubra

Crude Oil (WTI) (J6) Intraday: supported by a rising trend line.

Prev Top

Pivot: 34.30

Most Likely Scenario: long positions above 34.30 with targets @ 35.60 & 36.30 in extension.

Alternative scenario: below 34.30 look for further downside with 33.55 & 33.00 as targets.

Comment: the RSI is bullish and calls for further upside.

Prev Top

Pivot: 34.30

Most Likely Scenario: long positions above 34.30 with targets @ 35.60 & 36.30 in extension.

Alternative scenario: below 34.30 look for further downside with 33.55 & 33.00 as targets.

Comment: the RSI is bullish and calls for further upside.

Mohammed Abdulwadud Soubra

Gold spot Intraday: further upside.

Pivot: 1248.50

Most Likely Scenario: long positions above 1248.50 with targets @ 1268.50 & 1276.00 in extension.

Alternative scenario: below 1248.50 look for further downside with 1240.00 & 1235.00 as targets.

Comment: the RSI is mixed with a bullish bias

Pivot: 1248.50

Most Likely Scenario: long positions above 1248.50 with targets @ 1268.50 & 1276.00 in extension.

Alternative scenario: below 1248.50 look for further downside with 1240.00 & 1235.00 as targets.

Comment: the RSI is mixed with a bullish bias

Mohammed Abdulwadud Soubra

AUD/USD Intraday: the upside prevails. Prev Next

Pivot: 0.7295

Most Likely Scenario: long positions above 0.7295 with targets @ 0.7385 & 0.7420 in extension.

Alternative scenario: below 0.7295 look for further downside with 0.7250 & 0.7200 as targets.

Comment: the RSI is mixed to bullish.

Pivot: 0.7295

Most Likely Scenario: long positions above 0.7295 with targets @ 0.7385 & 0.7420 in extension.

Alternative scenario: below 0.7295 look for further downside with 0.7250 & 0.7200 as targets.

Comment: the RSI is mixed to bullish.

Mohammed Abdulwadud Soubra

USD/JPY Intraday: the bias remains bullish. Prev Next

Pivot: 113.20

Most Likely Scenario: long positions above 113.20 with targets @ 114.25 & 114.55 in extension.

Alternative scenario: below 113.20 look for further downside with 112.85 & 112.50 as targets.

Comment: the RSI advocates for further upside.

Pivot: 113.20

Most Likely Scenario: long positions above 113.20 with targets @ 114.25 & 114.55 in extension.

Alternative scenario: below 113.20 look for further downside with 112.85 & 112.50 as targets.

Comment: the RSI advocates for further upside.

Mohammed Abdulwadud Soubra

GBP/USD Intraday: the upside prevails. Prev Next

Pivot: 1.4095

Most Likely Scenario: long positions above 1.4095 with targets @ 1.4215 & 1.4255 in extension.

Alternative scenario: below 1.4095 look for further downside with 1.4020 & 1.3980 as targets.

Comment: the RSI is mixed to bullish.

Pivot: 1.4095

Most Likely Scenario: long positions above 1.4095 with targets @ 1.4215 & 1.4255 in extension.

Alternative scenario: below 1.4095 look for further downside with 1.4020 & 1.3980 as targets.

Comment: the RSI is mixed to bullish.

Mohammed Abdulwadud Soubra

EUR/USD Intraday: the upside prevails. Prev Next

Pivot: 1.0890

Most Likely Scenario: long positions above 1.0890 with targets @ 1.1000 & 1.1030 in extension.

Alternative scenario: below 1.0890 look for further downside with 1.0850 & 1.0820 as targets.

Comment: the RSI is well directed.

Pivot: 1.0890

Most Likely Scenario: long positions above 1.0890 with targets @ 1.1000 & 1.1030 in extension.

Alternative scenario: below 1.0890 look for further downside with 1.0850 & 1.0820 as targets.

Comment: the RSI is well directed.

Mohammed Abdulwadud Soubra

With Stocks Showing Strength, Will the Feedback Loop of the Fed Continue?

3 marzo 2016, 17:23

With Stocks Showing Strength, Will the Feedback Loop of the Fed Continue? Talking Points: - Many global indices have continued higher into resistance points. Heavy data is on the docket for the next two weeks, and this will likely determine whether stocks rip or dip...

: