Pg Md Radzuan Pg Hashim / Perfil

- Información

|

5+ años

experiencia

|

0

productos

|

0

versiones demo

|

|

0

trabajos

|

0

señales

|

0

suscriptores

|

Pg Md Radzuan Pg Hashim

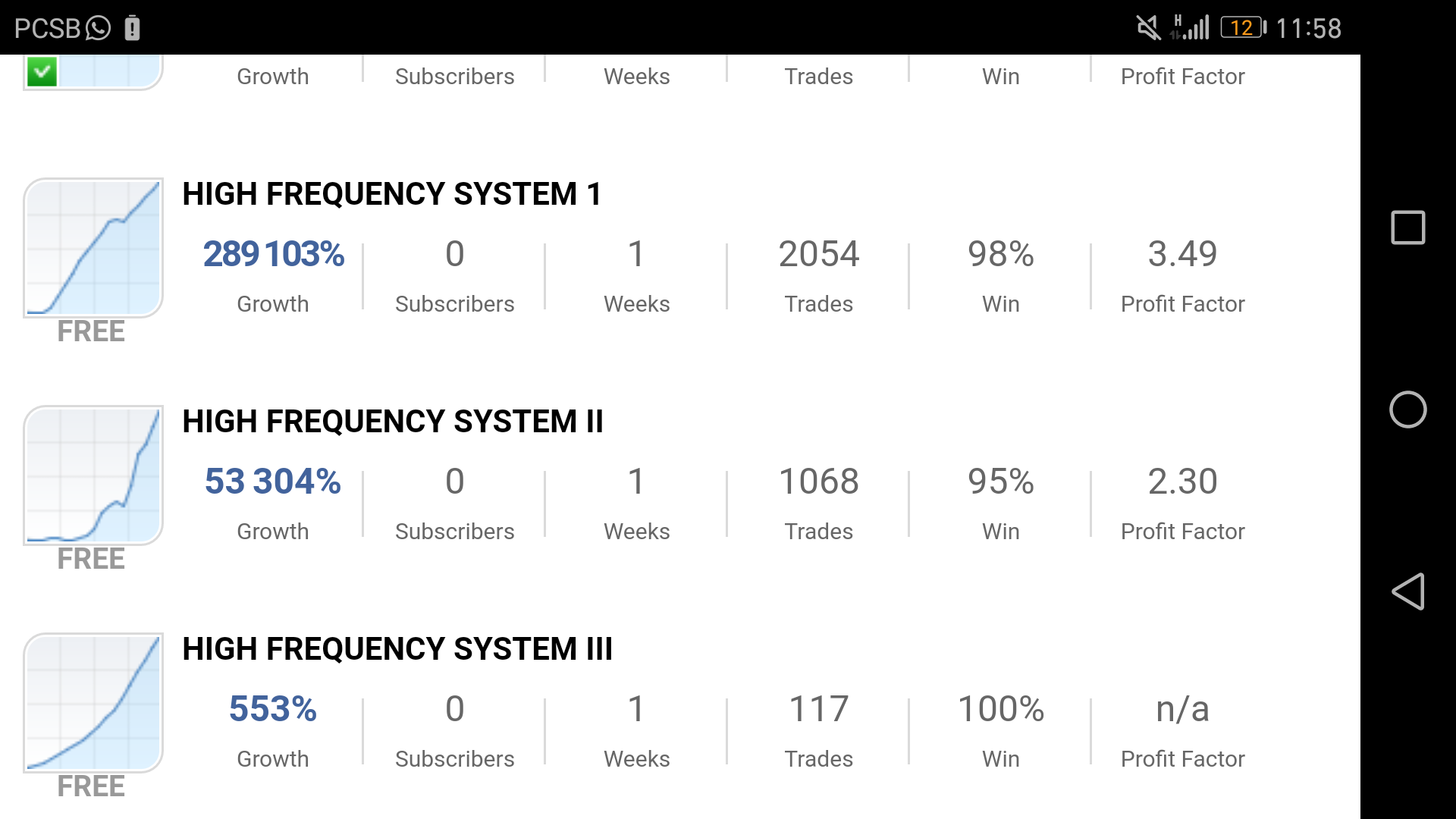

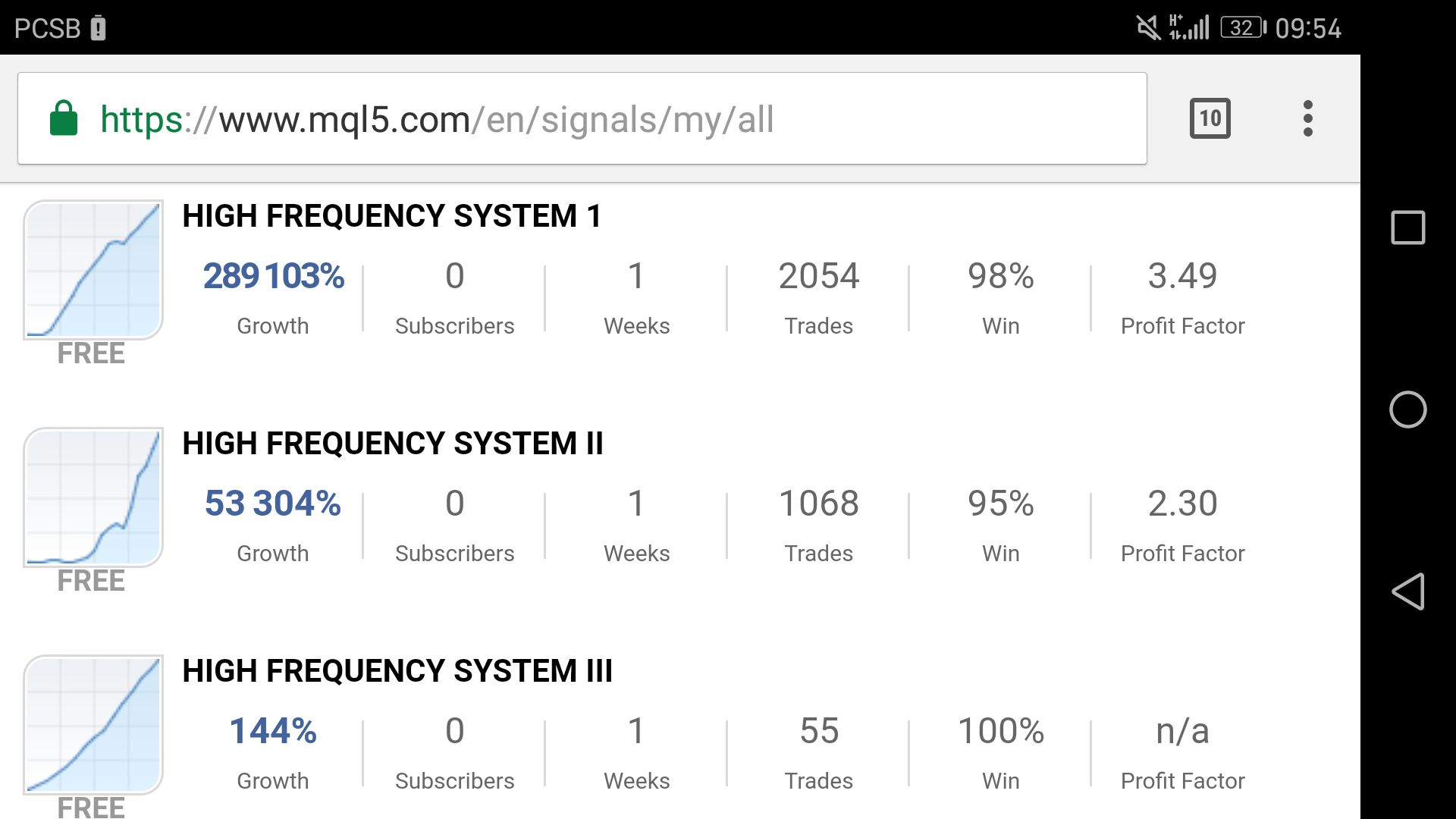

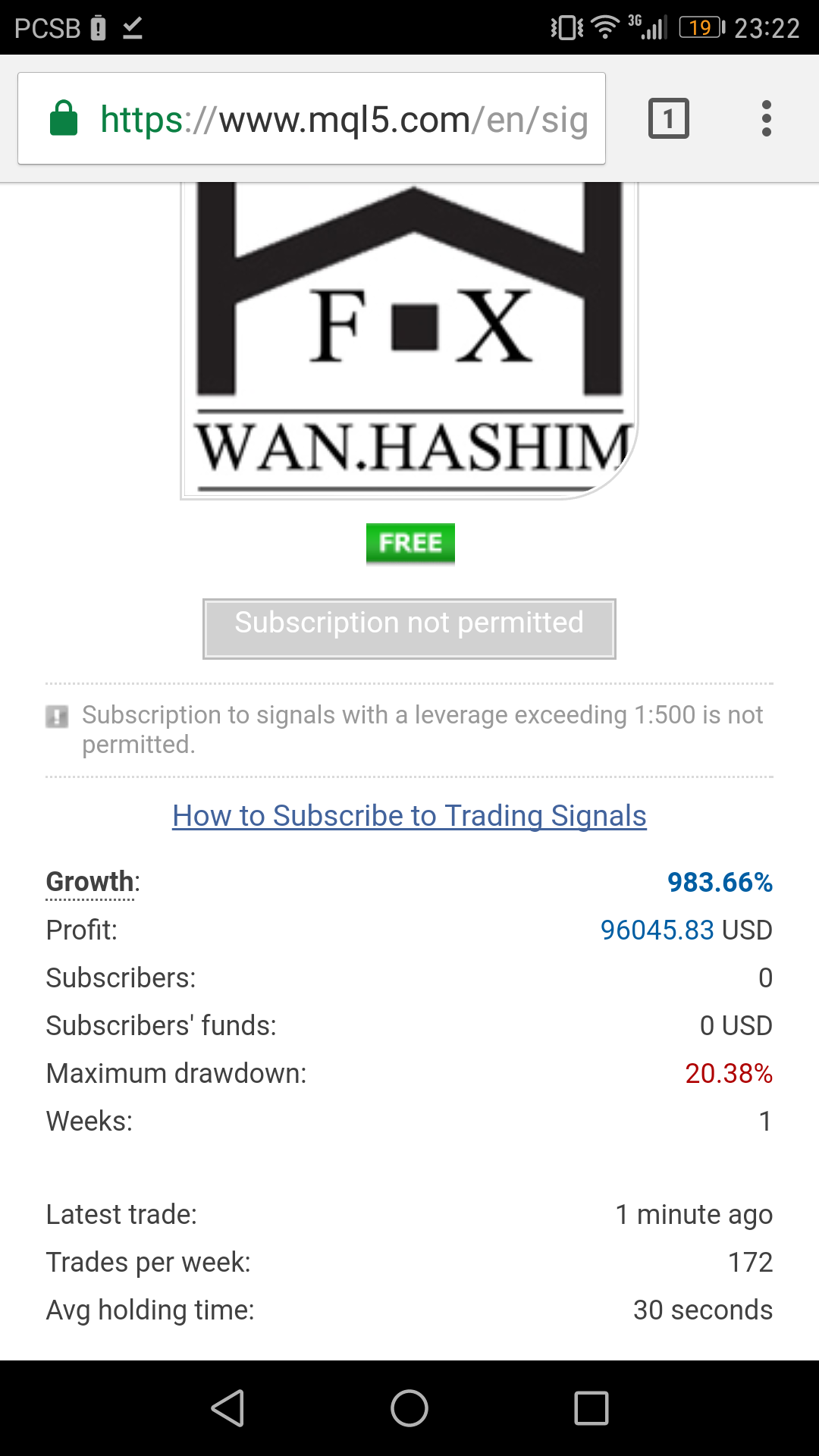

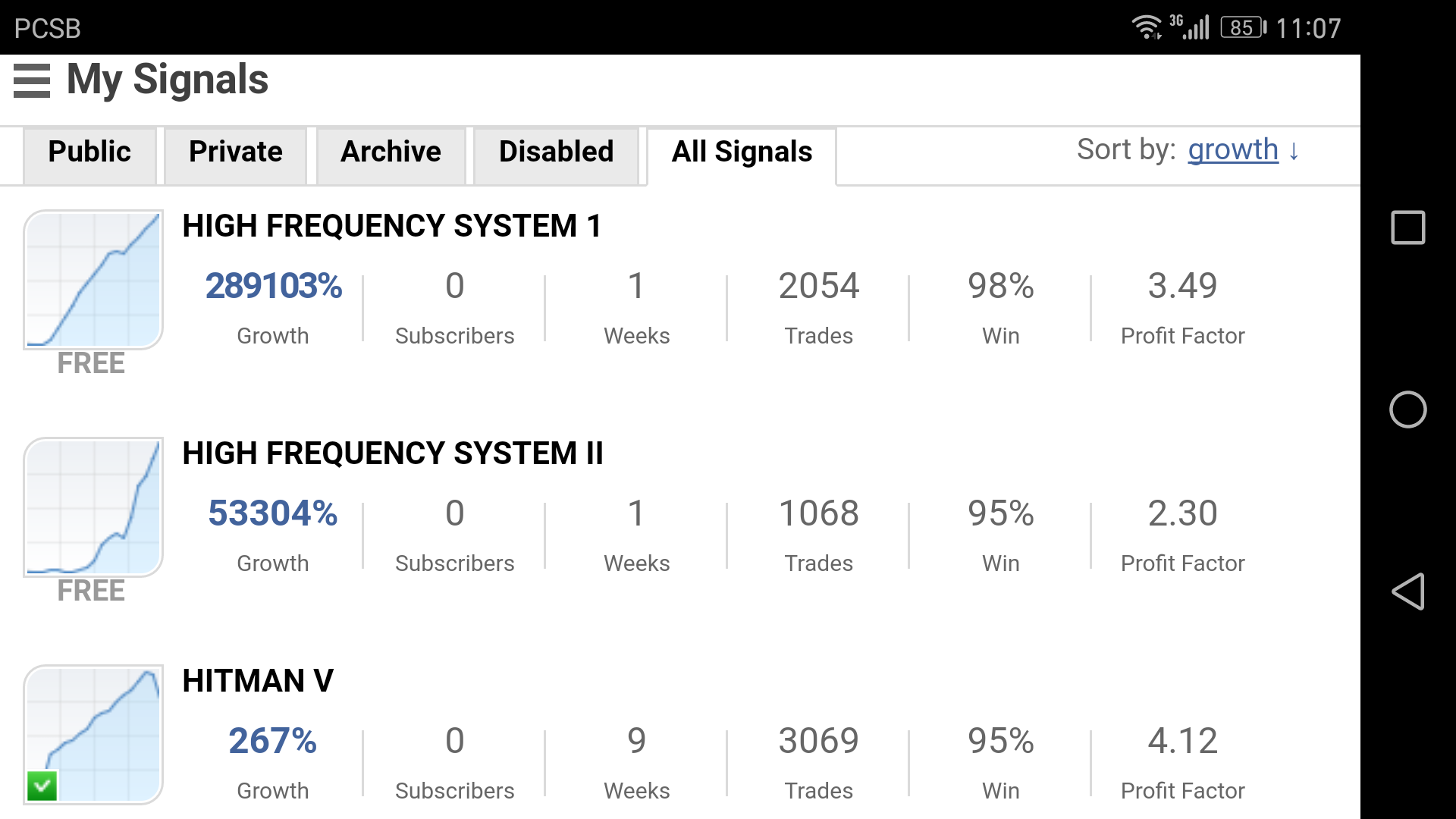

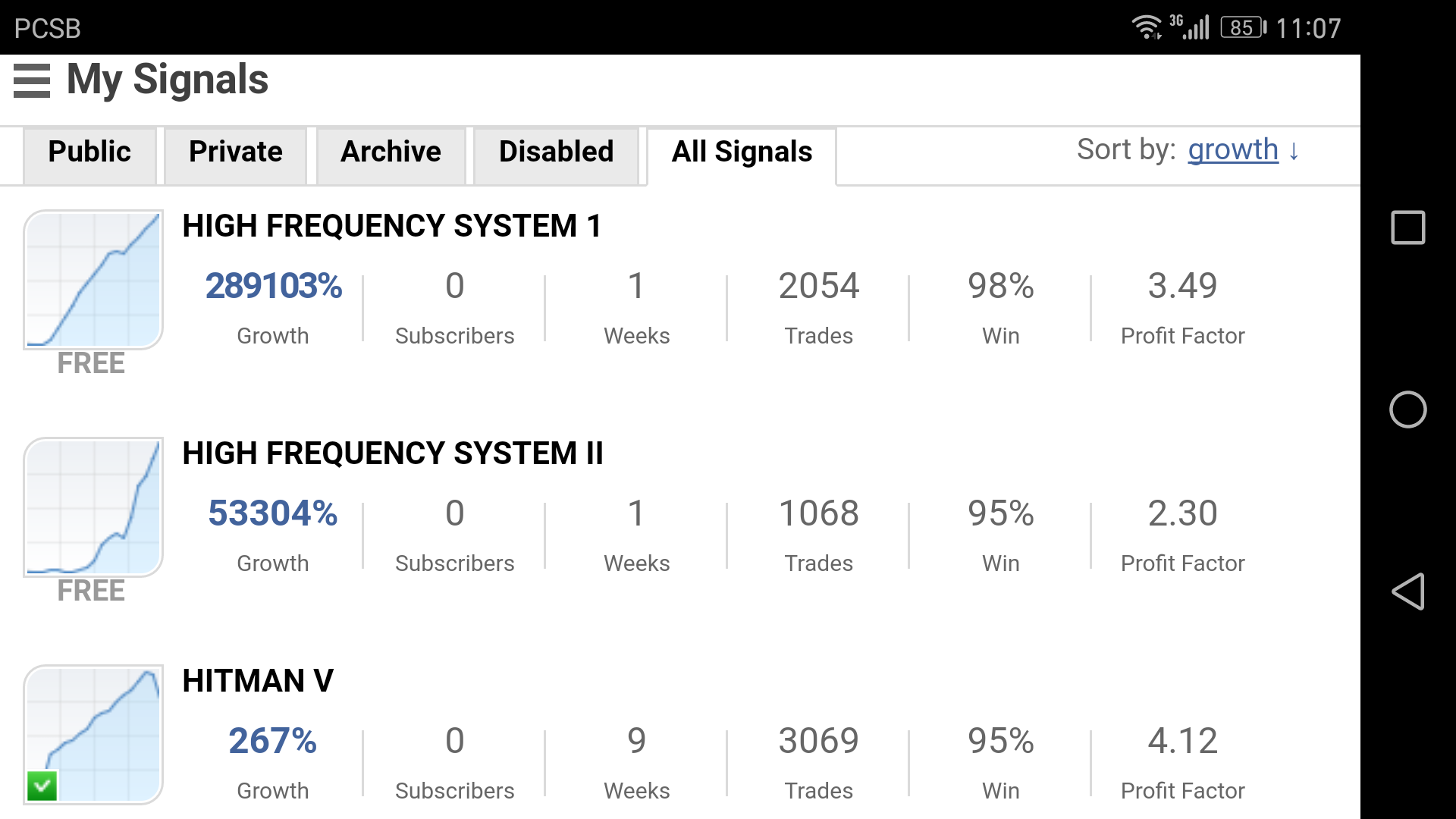

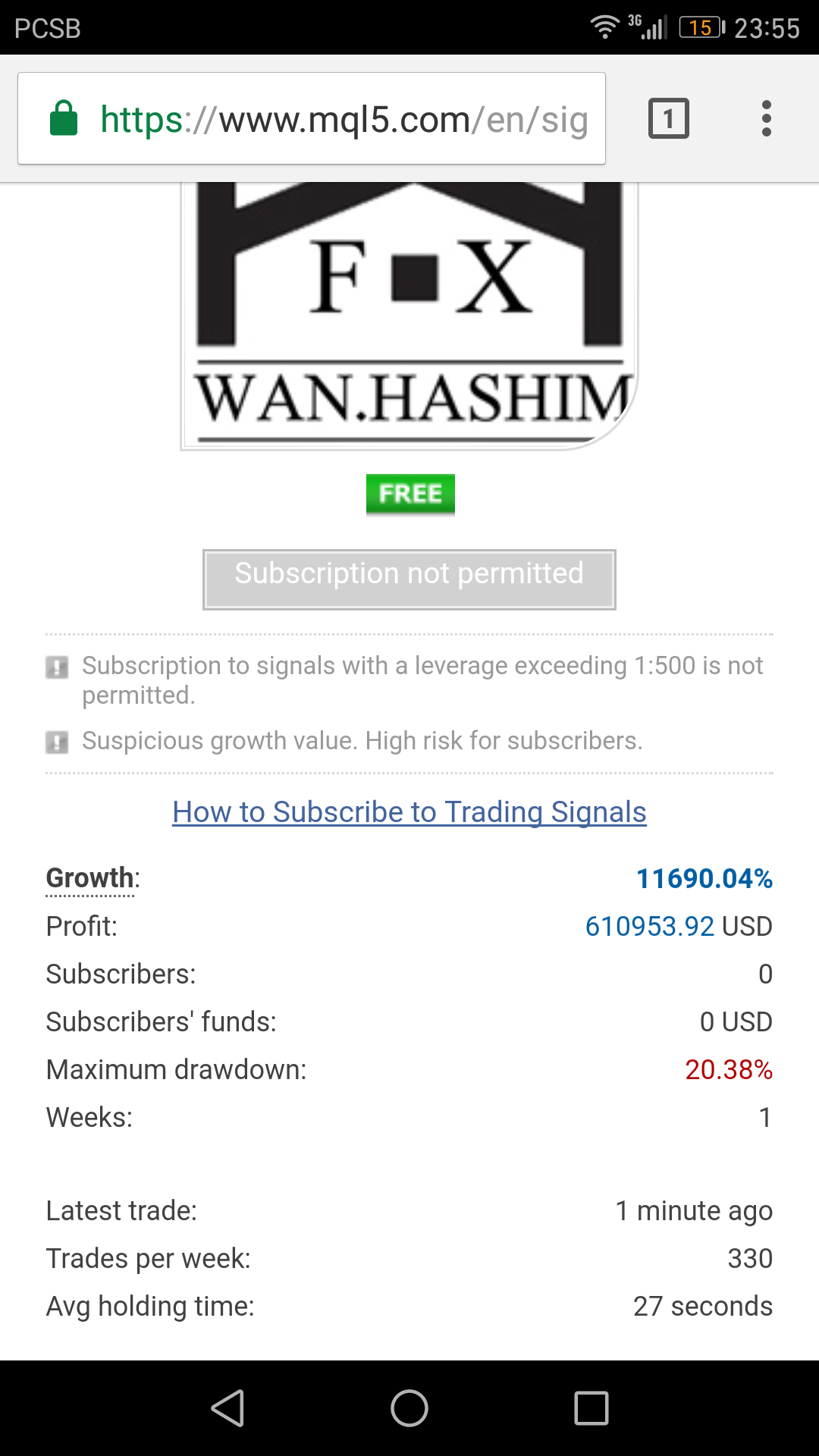

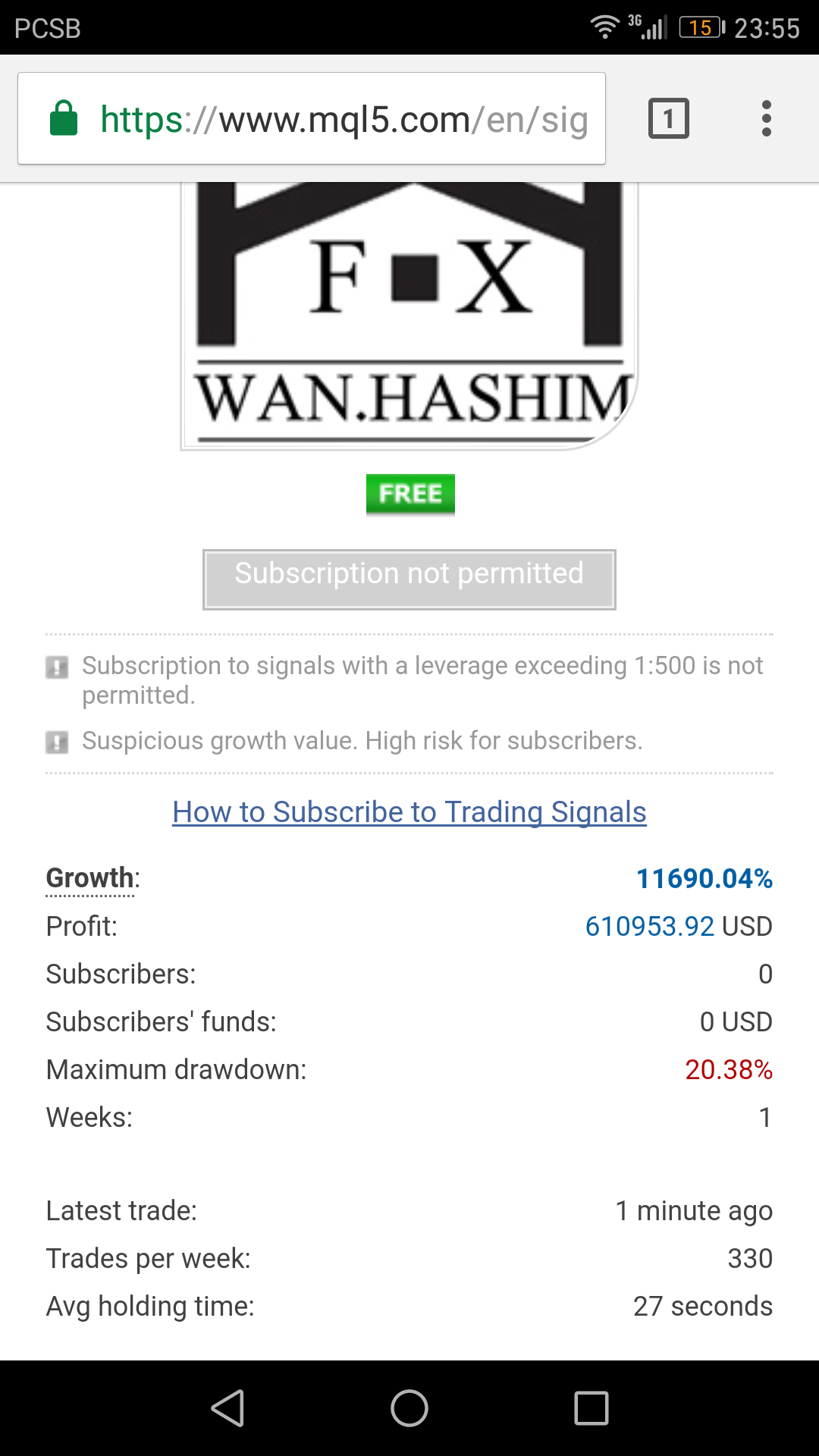

2nd account. New high Frequency System II on action, 5k to 2million in less 24hours(trade and lot and money managment set automatically by the system).

Pg Md Radzuan Pg Hashim

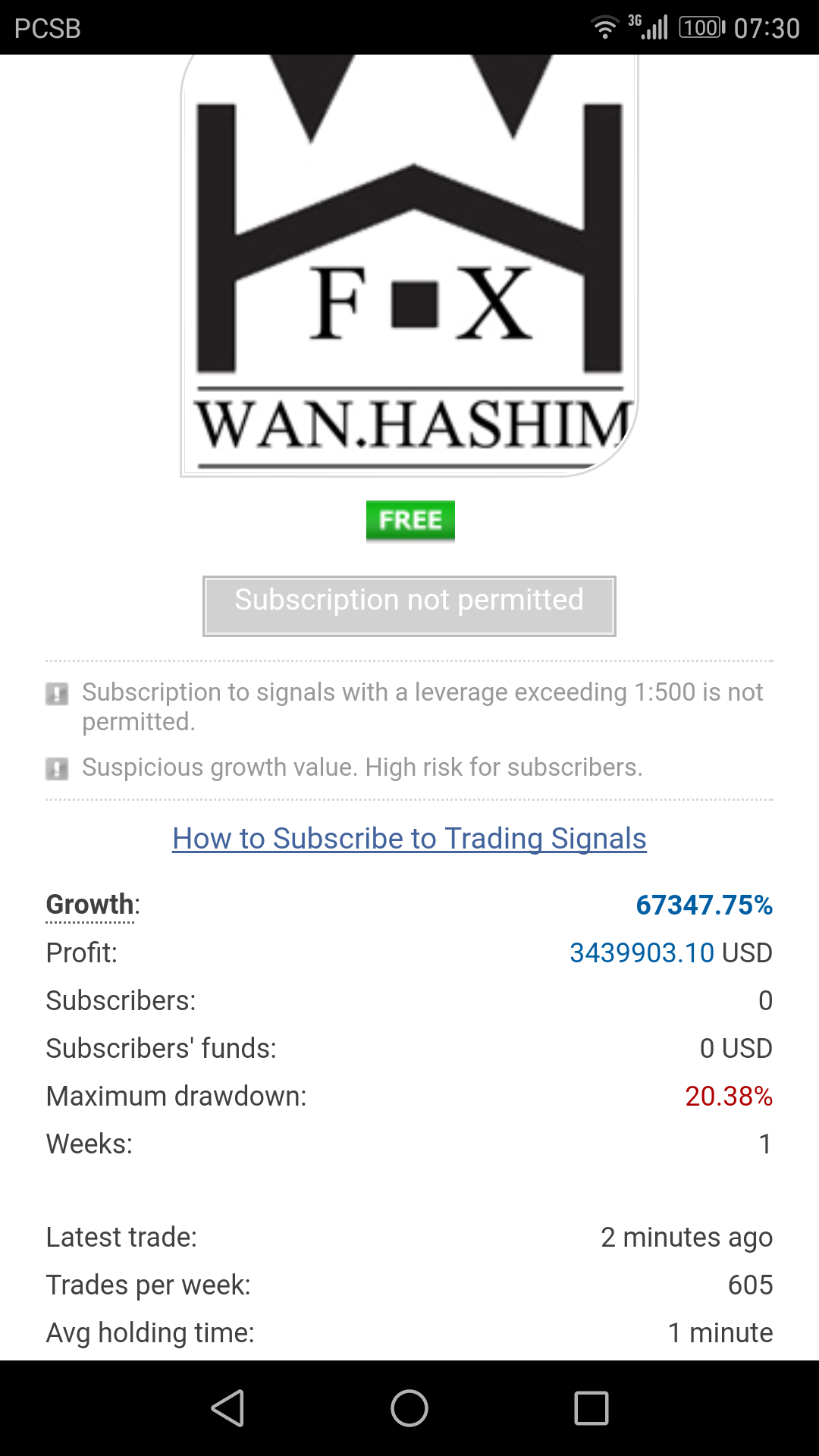

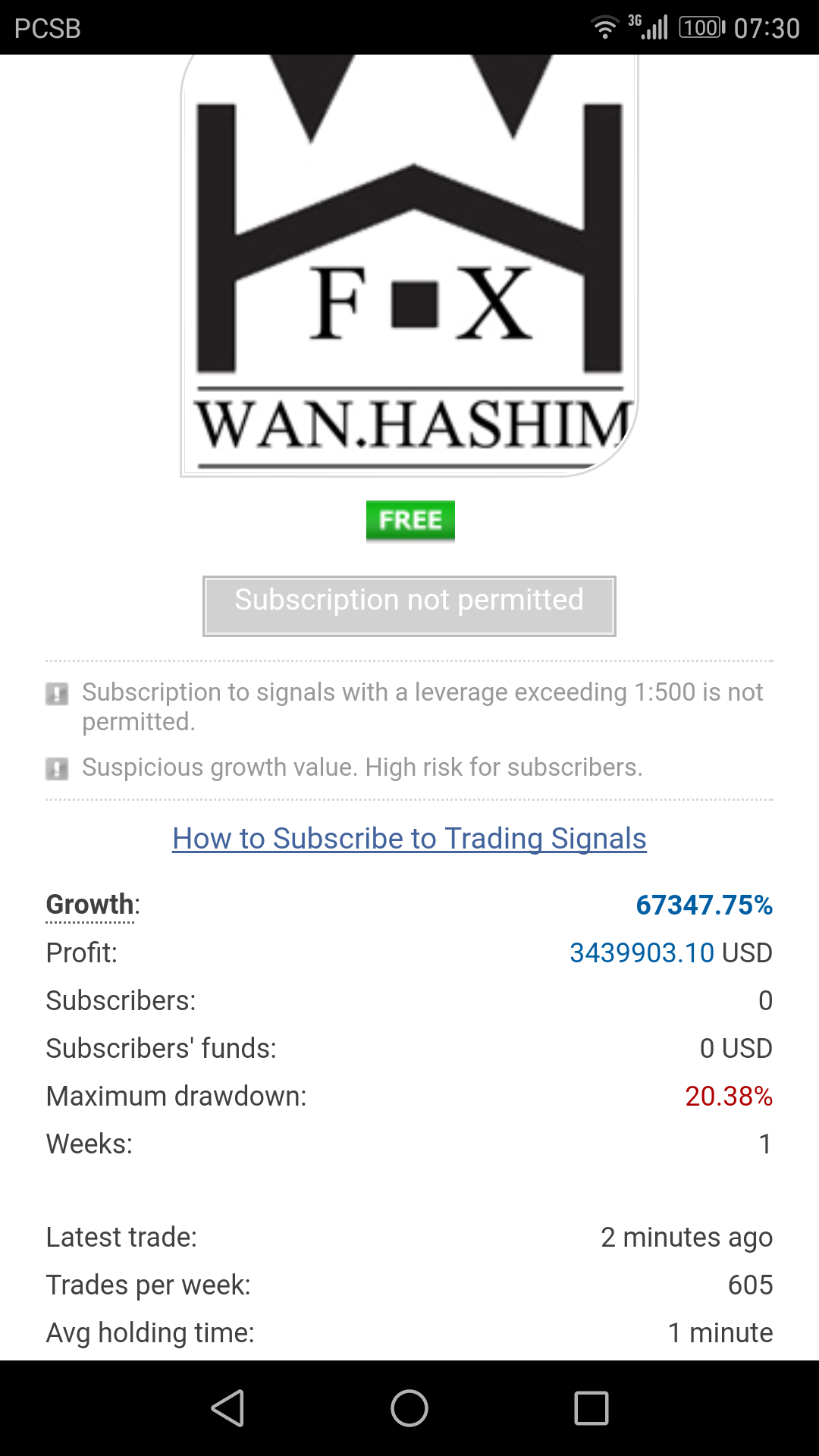

Update: 5k to 3.4Million profit in less than 24hours!! 64,000℅ gain. Holding time a minute. Its superb system with money managment.

[Eliminado]

2017.03.12

Try with Real Account please.

Pg Md Radzuan Pg Hashim

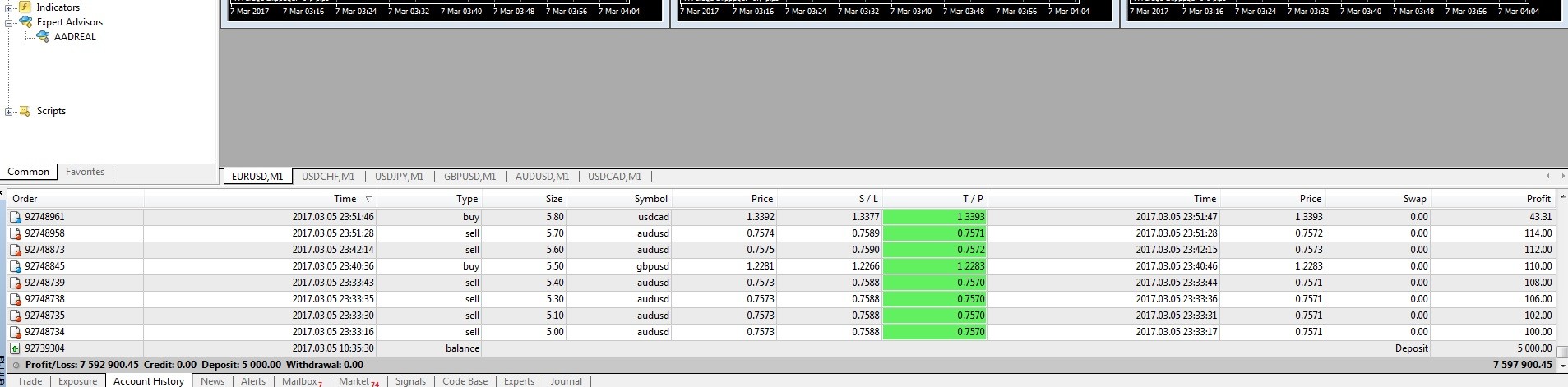

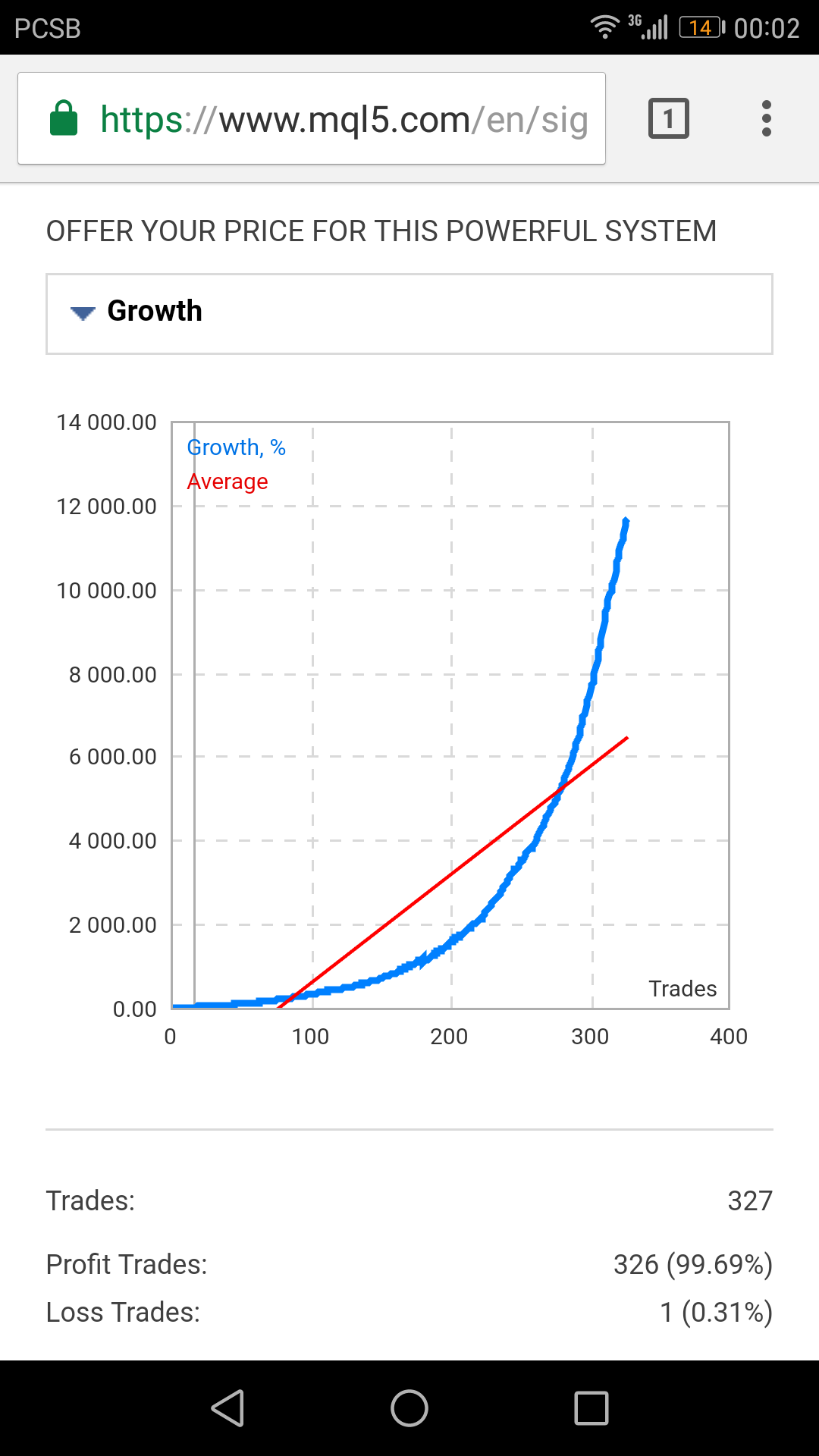

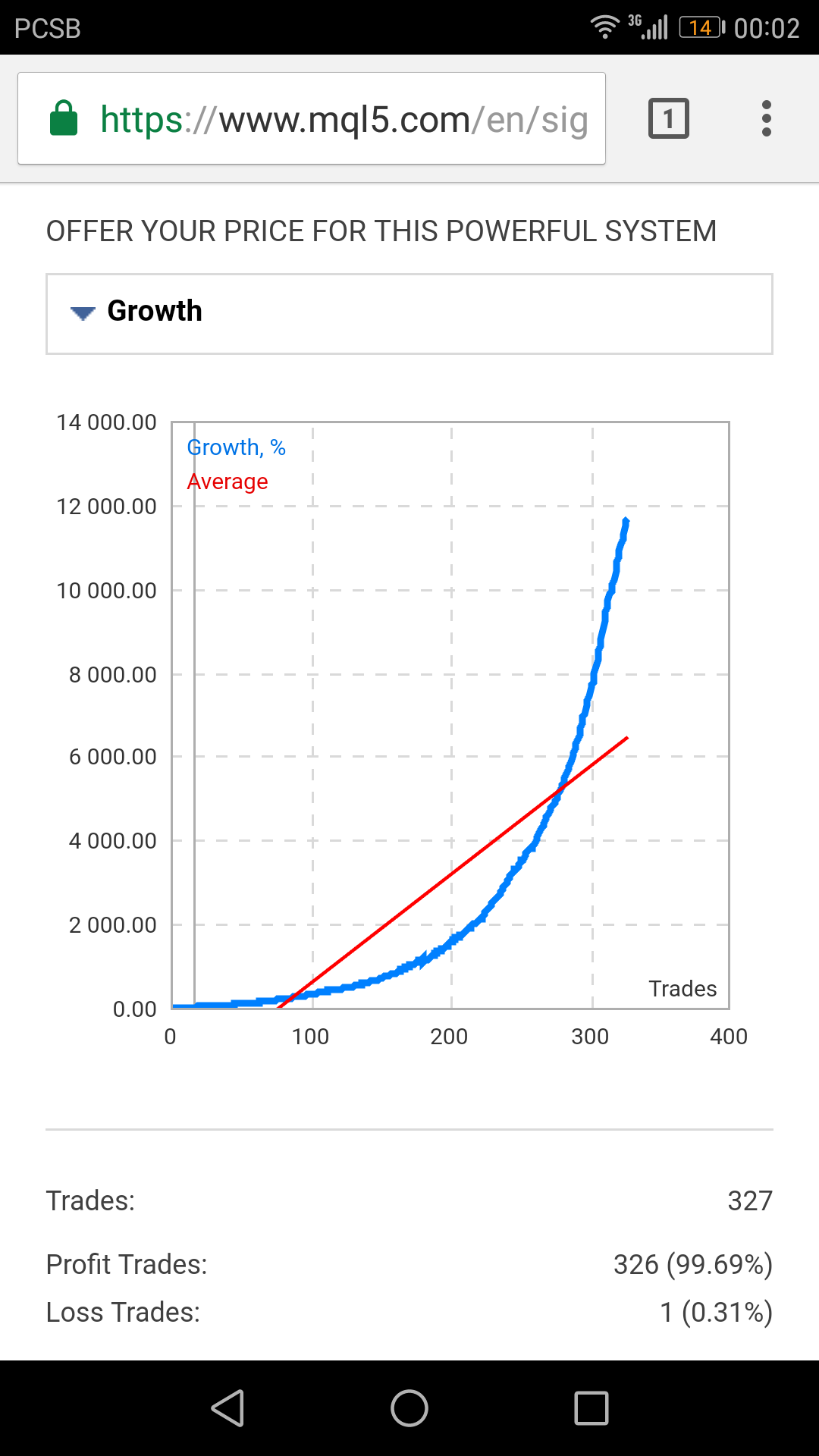

In less 4 hours our system make 326 automatic trade with 1 loss only. Everage holding not more than a minute. Its super perfect system

Pg Md Radzuan Pg Hashim

Update:everage holding position is only 27second

5k deposit to 600k profit in less 4hours. 11,000% gain

5k deposit to 600k profit in less 4hours. 11,000% gain

Pg Md Radzuan Pg Hashim

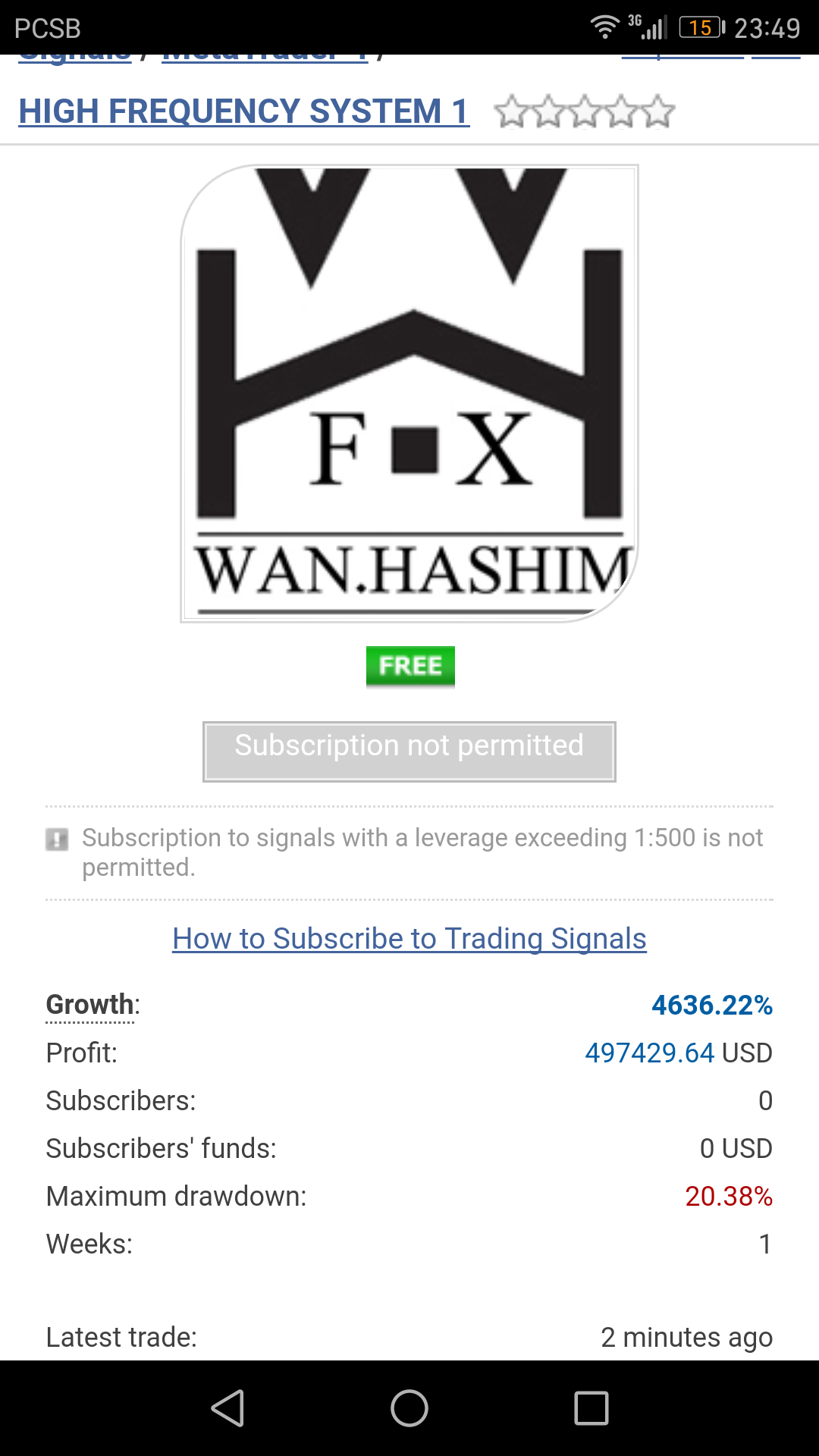

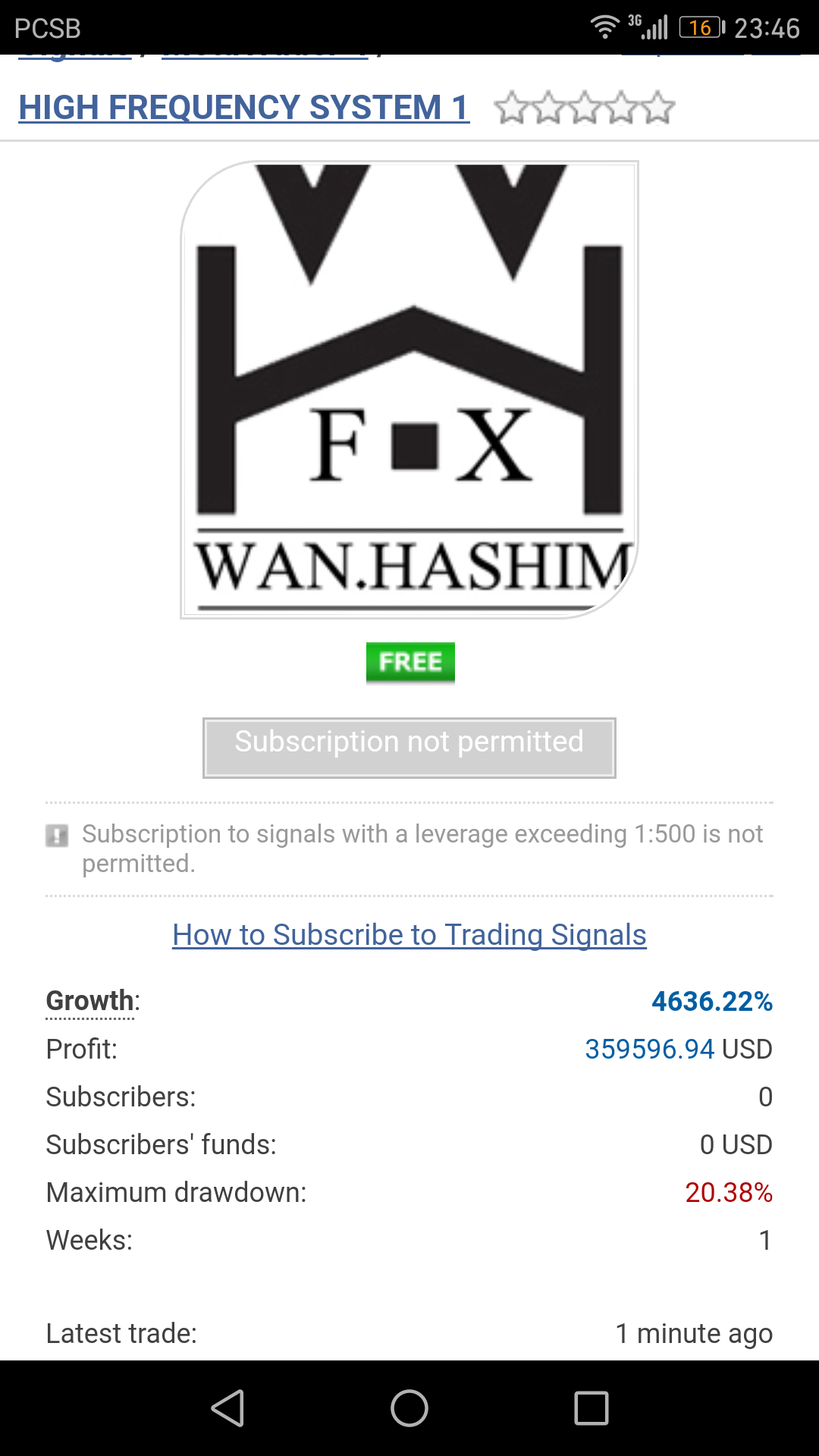

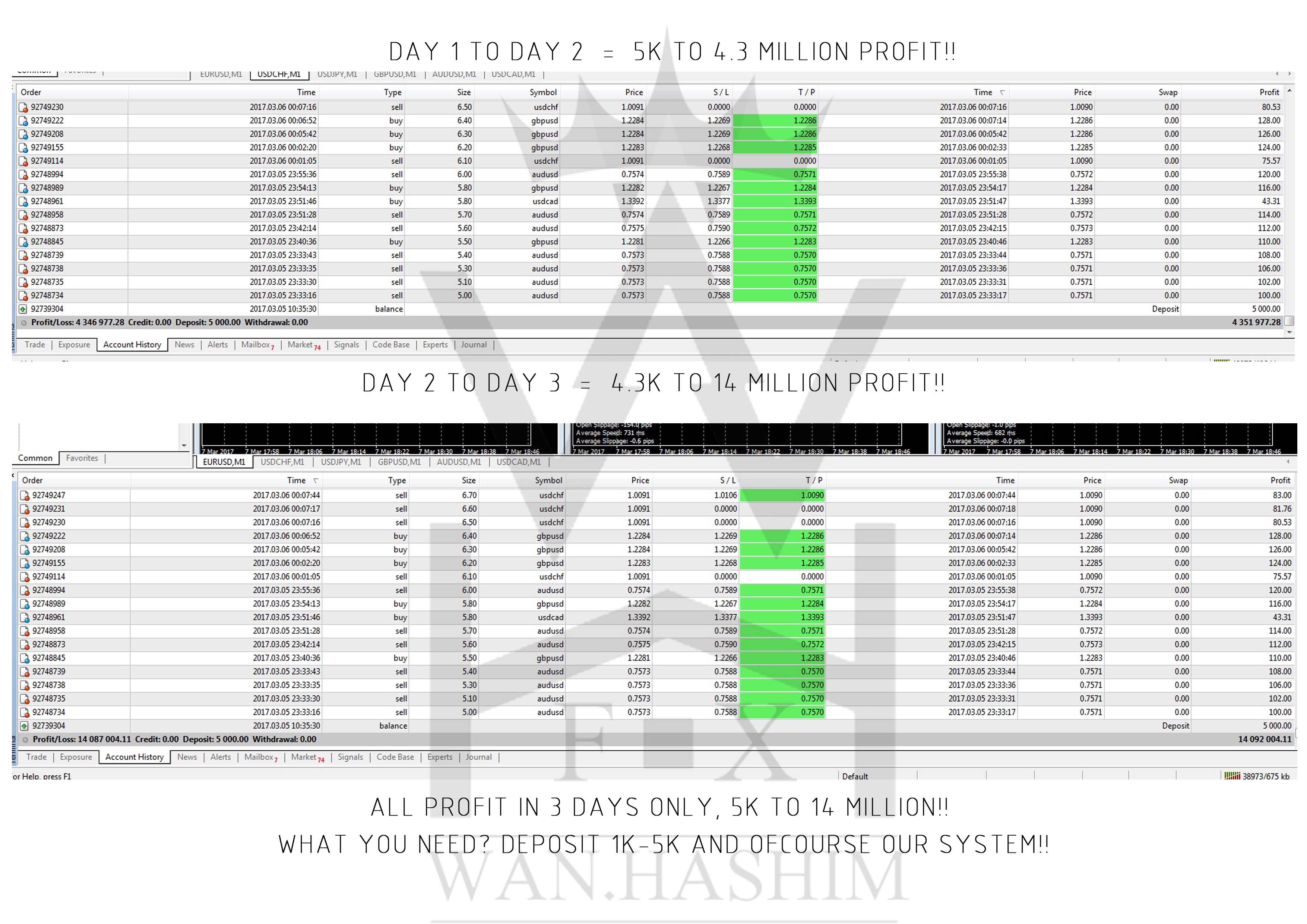

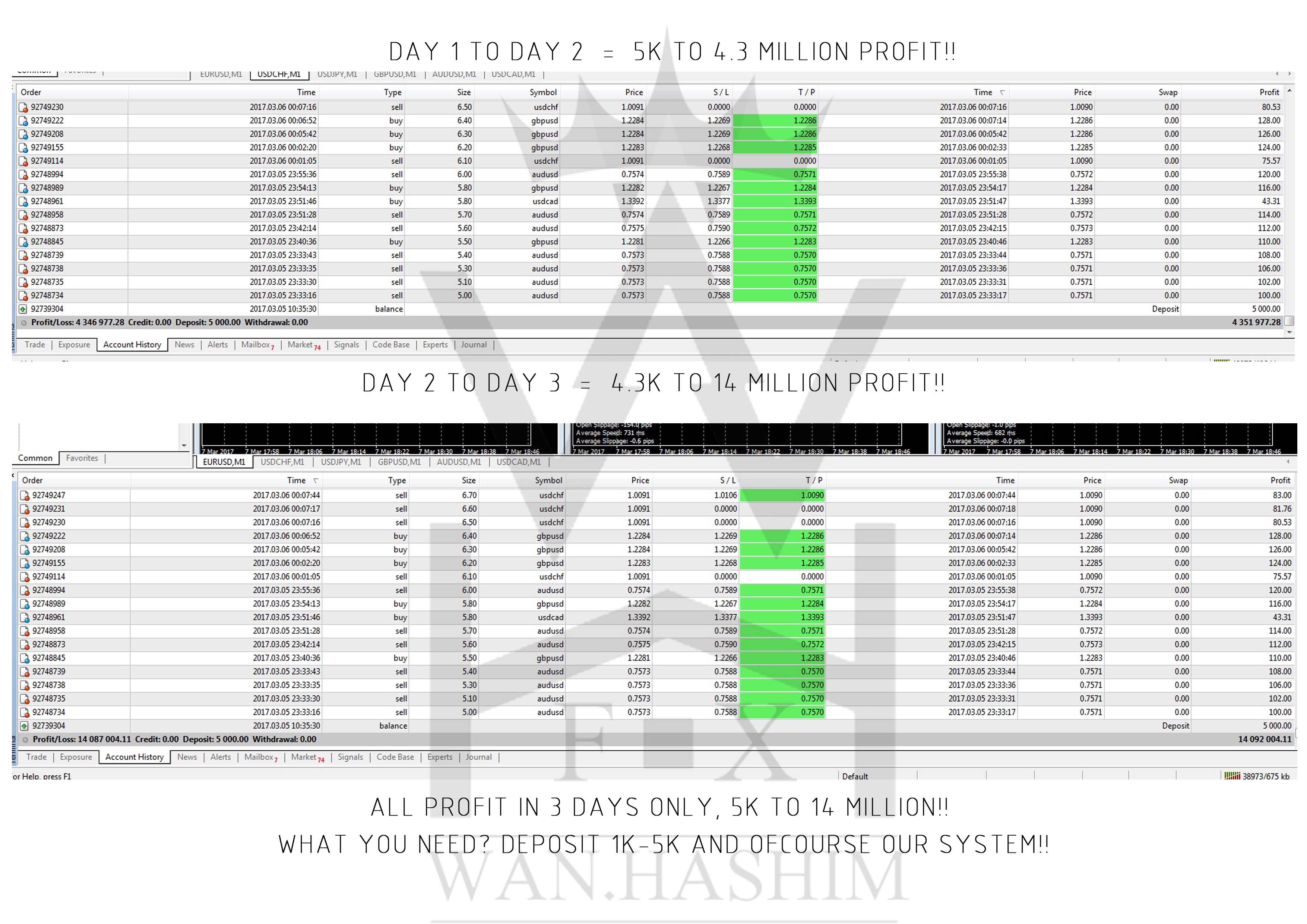

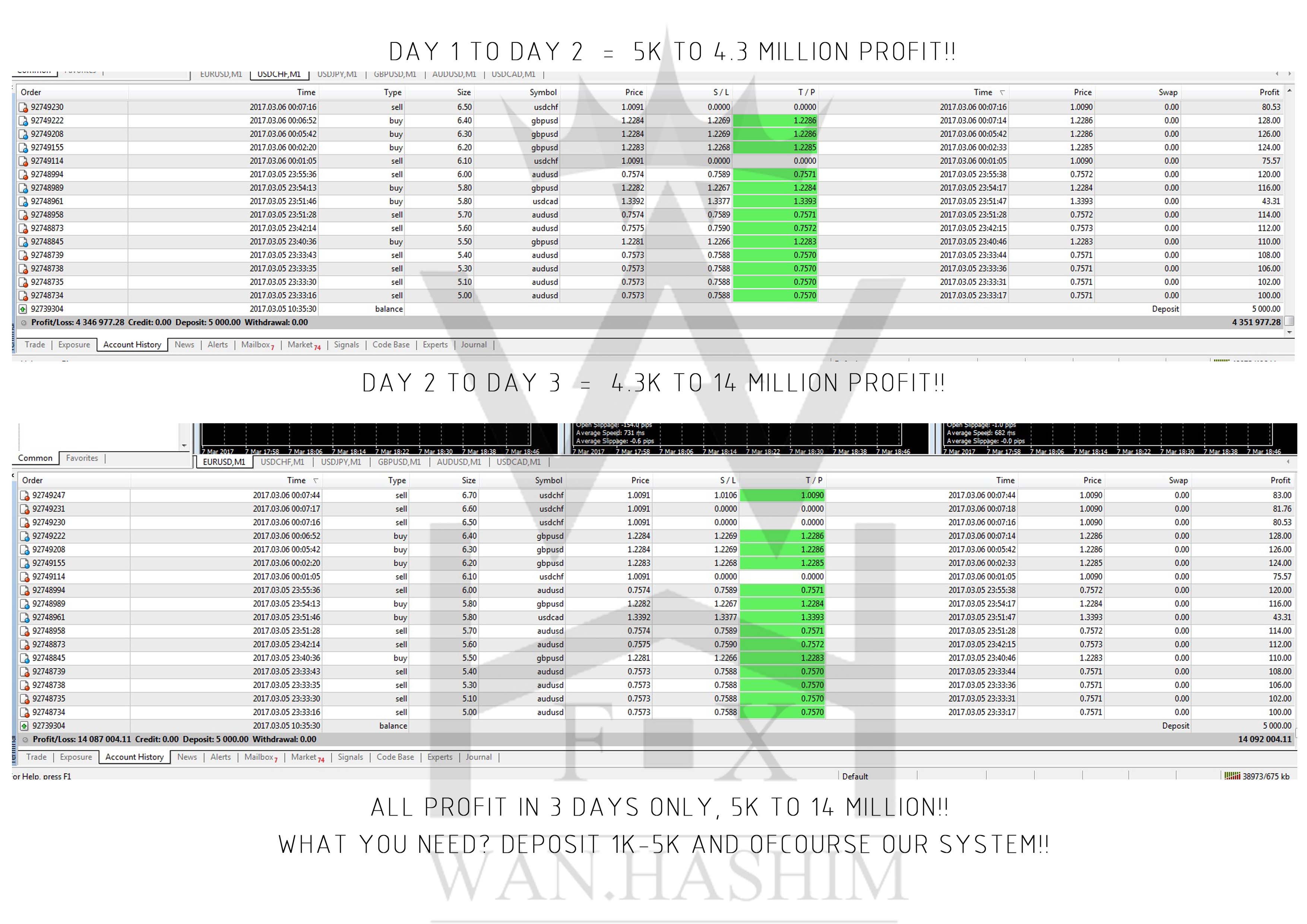

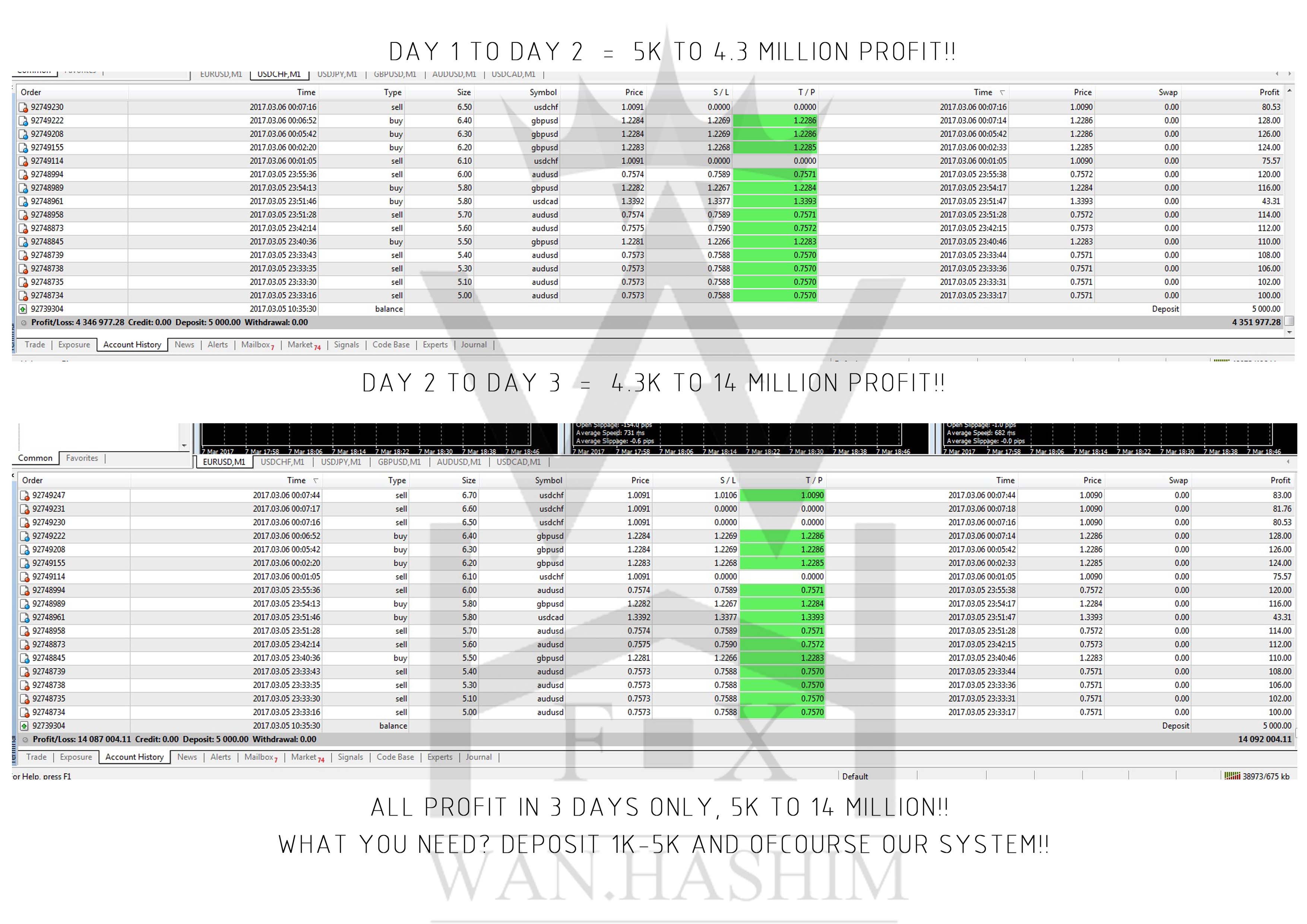

Dear Traders and Client, Below attached is a performance of our system. Deposit of 5K Turns to 14.1Million Profit!!

JUST IN 3 DAYS!!

JUST IN 3 DAYS!!

[Eliminado]

2017.03.12

This is Demo Account, please try it with Real Account. Thank you.

Pg Md Radzuan Pg Hashim

Dear Traders and Client, Below attached is a performance of our system. Deposit of 5K Turns to 14.1Million Profit!!

JUST IN 3 DAYS!!

JUST IN 3 DAYS!!

Pg Md Radzuan Pg Hashim

High-frequency trading (HFT) is a type of algorithmic trading, specifically the use of sophisticated technological tools and computer algorithms to rapidly trade securities. HFT uses proprietary trading strategies carried out by computers to move in and out of positions in seconds or fractions of a second. Firms focused on HFT rely on advanced computer systems, the processing speed of their trades and their access to the market.

As of 2009, studies suggested HFT firms accounted for 60-73% of all US equity trading volume, with that number falling to approximately 50% in 2012.

High-frequency traders move in and out of short-term positions aiming to capture sometimes just a fraction of a cent in profit on every trade. HFT firms do not employ significant leverage, accumulate positions or hold their portfolios overnight; they typically compete against other HFTs, rather than long-term investors. As a result, HFT has a potential Sharpe ratio (a measure of risk and reward) thousands of times higher than traditional buy-and-hold strategies.

HFT may cause new types of serious risks to the financial system. Algorithmic and HFT were both found to have contributed to volatility in the May 6, 2010 Flash Crash, when high-frequency liquidity providers rapidly withdrew from the market. Several European countries have proposed curtailing or banning HFT due to concerns about volatility. Other complaints against HFT include the argument that some HFT firms scrape profits from investors when index funds rebalance their portfolios.

History

Profiting from speed advantages in the market is as old as trading itself. In the 17th century, the Rothschilds were able to arbitrage prices of the same security across country borders by using carrier pigeons to relay information before their competitors. HFT modernises this concept using the latest communications technology.

High-frequency trading has taken place at least since 1999, after the U.S. Securities and Exchange Commission (SEC) authorized electronic exchanges in 1998. At the turn of the 21st century, HFT trades had an execution time of several seconds, whereas by 2010 this had decreased to milli- and even microseconds. Until recently, high-frequency trading was a little-known topic outside the financial sector, with an article published by the New York Times in July 2009 being one of the first to bring the subject to the public's attention. On September 2, 2013, Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0.002% on equity transactions lasting less than 0.5 seconds.

Market growth

In the early 2000s, high-frequency trading still accounted for fewer than 10% of equity orders, but this proportion was soon to begin rapid growth. According to data from the NYSE, trading volume grew by about 164% between 2005 and 2009 for which high-frequency trading might be accounted. As of the first quarter in 2009, total assets under management for hedge funds with high-frequency trading strategies were $141 billion, down about 21% from their peak before the worst of the crises. The high-frequency strategy was first made successful by Renaissance Technologies. Many high-frequency firms are market makers and provide liquidity to the market which has lowered volatility and helped narrow Bid-offer spreads, making trading and investing cheaper for other market participants. In the United States, high-frequency trading firms represent 2% of the approximately 20,000 firms operating today, but account for 73% of all equity orders volume. The largest high-frequency trading firms in the US include names like Getco LLC, Knight Capital Group, Jump Trading, and Citadel LLC. The Bank of England estimates similar percentages for the 2010 US market share, also suggesting that in Europe HFT accounts for about 40% of equity orders volume and for Asia about 5-10%, with potential for rapid growth. By value, HFT was estimated in 2010 by consultancy Tabb Group to make up 56% of equity trades in the US and 38% in Europe.

As HFT strategies become more widely used, it can be more difficult to deploy them profitably. According to an estimate from Frederi Viens of Purdue University, profits from HFT in the U.S. has been declining from an estimated peak of $5bn in 2009, to about $1.25bn in 2012.

High Frequency Trading Strategies

High-frequency trading is quantitative trading that is characterized by short portfolio holding periods (see Wilmott (2008)). All portfolio-allocation decisions are made by computerized quantitative models. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. Specific algorithms are closely guarded by their owners and are known as "algos". Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur though who can execute them the fastest rather than who can create new breakthrough algorithms. Some examples of standard arbitrages used in HFT are listed below.

Trading ahead of index fund rebalancing

Most retirement savings, such as private pension funds or 401(k) and individual retirement accounts in the US, are invested in mutual funds, the most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. This allows algorithmic traders (80% of the trades of whom involve the top 20% most popular securities) to anticipate and trade ahead of stock price movements caused by mutual fund rebalancing, making a profit on advance knowledge of the large institutional block orders. This results in profits transferred from investors to algorithmic traders, estimated to be at least 21 to 28 basis points annually for S&P 500 index funds, and at least 38 to 77 basis points per year for Russell 2000 funds. John Montgomery of Bridgeway Capital Management says that the resulting "poor investor returns" from trading ahead of mutual funds is "the elephant in the room" that "shockingly, people are not talking about."

Market making

Market making is a set of high-frequency trading strategies that involve placing a limit order to sell (or offer) or a buy limit order (or bid) in order to earn the bid-ask spread. By doing so, market makers provide counterpart to incoming market orders. Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access. As pointed out by empirical studies. this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors.

Some high-frequency trading firms use market making as their primary trading strategy. Automated Trading Desk, which was bought by Citigroup in July 2007, has been an active market maker, accounting for about 6% of total volume on both the NASDAQ and the New York Stock Exchange. Building up market making strategies typically involves precise modeling of the target market microstructure together with stochastic control techniques.

These strategies appear intimately related to the entry of new electronic venues. Academic study of Chi-X's entry into the European equity market reveals that its launch coincided with a large HFT that made markets using both the incumbent market, NYSE-Euronext, and the new market, Chi-X. The study shows that the new market provided ideal conditions for HFT market-making, low fees (i.e., rebates for quotes that led to execution) and a fast system, yet the HFT was equally active in the incumbent market to offload nonzero positions. New market entry and HFT arrival are further shown to coincide with a significant improvement in liquidity supply.

Ticker tape trading

Much information happens to be unwittingly embedded in market data, such as quotes and volumes. By observing a flow of quotes, high-frequency trading machines are capable of extracting information that has not yet crossed the news screens. Since all quote and volume information is public, such strategies are fully compliant with all the applicable laws.

Filter trading is one of the more primitive high-frequency trading strategies that involves monitoring large amounts of stocks for significant or unusual price changes or volume activity. This includes trading on announcements, news, or other event criteria. Software would then generate a buy or sell order depending on the nature of the event being looked for.

Tick trading often aims to recognize the beginnings of large orders being placed in the market. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. An arbitreur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. This strategy has become more difficult since the introduction of dedicated trade execution companies in the 2000s which provide optimal trading for pension and other funds, specifically designed to remove the arbitrage opportunity.

Event arbitrage

Certain recurring events generate predictable short-term responses in a selected set of securities. High-frequency traders take advantage of such predictability to generate short-term profits.

Statistical arbitrage

Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange, etc. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange market, which gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. High-frequency trading allows similar arbitrages using models of greater complexity involving many more than four securities. The TABB Group estimates that annual aggregate profits of high-frequency arbitrage strategies currently exceed US$21 billion which conflicts with the findings in the Perdue study which estimates the profits for all high frequency trading to be $1.25bn in 2012.

News-based trading

Company news in electronic text format is available from many sources including commercial providers like Bloomberg, public news websites, and Twitter feeds. Automated systems can identify company names, keywords and sometimes semantics to trade news before human traders can process it.

Low-latency strategies

A separate, "naïve" class of high-frequency trading strategies relies exclusively on ultra-low latency direct market access technology. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets.

Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking. Especially since 2011, there has been a trend to use microwaves to transmit data across key connections such as the one between New York and Chicago. This is because microwaves travelling in air suffer a less than 1% speed reduction compared to light travelling in a vacuum, whereas with conventional fiber optics light travels over 30% slower.

In 2010, Alex Wissner-Gross at Harvard University proposed an optimally low-latency solution for statistical arbitrage of geographically separated financial instruments.

Effects

The effects of algorithmic and high-frequency trading are the subject of ongoing research. Regulators claim these practices contributed to volatility in the May 6, 2010 Flash Crash and find that risk controls are much less stringent for faster trades.

Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, narrows bid-offer spread, lowers volatility and makes trading and investing cheaper for other market participants.

An academic study found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; however, it found "no significant effects for smaller-cap stocks", and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets...algorithmic liquidity suppliers may simply turn off their machines when markets spike downward."

In September 2011, Nanex, LLC (a high-frequency trading software company) published a report stating the contrary. They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a 10-fold decrease in efficiency.[52] Many discussions about HFT focus solely on the frequency aspect of the algorithms and not on their decision-making logic (which is typically kept secret by the companies that develop them). This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. The growing quote traffic compared to trade value could indicate that more firms are trying to profit from cross-market arbitrage techniques that do not add significant value through increased liquidity when measured globally.

More fully automated markets such as NASDAQ, Direct Edge, and BATS, in the US, have gained market share from less automated markets such as the NYSE. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges.

The speeds of computer connections, measured in milliseconds or microseconds, have become important. Competition is developing among exchanges for the fastest processing times for completing trades. For example, in 2009 the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform[55] which they claim has an average latency of 126 microseconds. Since then, competitive exchanges have continued to reduce latency, and today, with turnaround times of three milliseconds available, are useful to traders to pinpoint the consistent and probable performance ranges of financial instruments. These professionals are often dealing in versions of stock index funds like the E-mini S&Ps because they seek consistency and risk-mitigation along with top performance. They must filter market data to work into their software programming so that there is the lowest latency and highest liquidity at the time for placing stop-losses and/or taking profits. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, in which a small mistake can lead to a large loss. Absolute frequency data play into the development of the trader's pre-programmed instructions.

Spending on computers and software in the financial industry increased to $26.4 billion in 2005.

May 6, 2010 Flash Crash

The brief but dramatic stock market crash of May 6, 2010 was initially thought to have been caused by high-frequency trading. The Dow Jones Industrial Average plunged to its largest intraday point loss, but not percentage loss, in history, only to recover much of those losses within minutes.

In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. CME Group, a large futures exchange, stated that, insofar as stock index futures traded on CME Group were concerned, its investigation had found no support for the notion that high-frequency trading was related to the crash, and actually stated it had a market stabilizing effect.

However, after almost five months of investigations, the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission issued a joint report identifying the cause that set off the sequence of events leading to the Flash Crash and concluding that the actions of high-frequency trading firms contributed to volatility during the crash.

The report found that the cause was a single sale of $4.1 billion in futures contracts by a mutual fund, identified as Waddell & Reed Financial, in an aggressive attempt to hedge its investment position. The joint report also found that "high-frequency traders quickly magnified the impact of the mutual fund's selling."The joint report "portrayed a market so fragmented and fragile that a single large trade could send stocks into a sudden spiral," that a large mutual fund firm "chose to sell a big number of futures contracts using a computer program that essentially ended up wiping out available buyers in the market," that as a result high-frequency firms "were also aggressively selling the E-mini contracts," contributing to rapid price declines. The joint report also noted "'HFTs began to quickly buy and then resell contracts to each other — generating a 'hot-potato' volume effect as the same positions were passed rapidly back and forth.'" The combined sales by Waddell and high-frequency firms quickly drove "the E-mini price down 3% in just four minutes."As prices in the futures market fell, there was a spillover into the equities markets where "the liquidity in the market evaporated because the automated systems used by most firms to keep pace with the market paused" and scaled back their trading or withdrew from the markets altogether. The joint report then noted that "Automatic computerized traders on the stock market shut down as they detected the sharp rise in buying and selling." As computerized high-frequency traders exited the stock market, the resulting lack of liquidity "...caused shares of some prominent companies like Procter & Gamble and Accenture to trade down as low as a penny or as high as $100,000." While some firms exited the market, high-frequency firms that remained in the market exacerbated price declines because they "'escalated their aggressive selling' during the downdraft."

Risks and controversy

Various studies have reported that high-frequency reduces volatility and does not pose a systemic risk, and lowers transaction costs for retail investors, without impacting long term investors, However, high-frequency trading has been the subject of intense public focus and debate since the May 6, 2010 Flash Crash. At least one Nobel Prize winning economist, Michael Spence, believes that HFT should be banned.

In their joint report on the 2010 Flash Crash, the Securities Exchange Commission and the Commodity Futures Trading Commission stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets"[64] during the Flash Crash.

Politicians, regulators, journalists and market participants have all raised concerns on both sides of the Atlantic. and this has led to discussion of whether high-frequency market makers should be subject to various kinds of regulations.

In September 22, 2010 speech, SEC chairperson Mary Schapiro signaled that US authorities were considering the introduction of regulations targeted at HFT. She said, "...high frequency trading firms have a tremendous capacity to affect the stability and integrity of the equity markets. Currently, however, high frequency trading firms are subject to very little in the way of obligations either to protect that stability by promoting reasonable price continuity in tough times, or to refrain from exacerbating price volatility." She proposed regulation that would require high-frequency traders to stay active in volatile markets.

The Chicago Federal Reserve letter of October 2012, titled "How to keep markets safe in an era of high-speed trading," reports on the results of a survey of several dozen financial industry professionals including traders, brokers, and exchanges. It found that

risk controls were poorer in high-frequency trading, because of competitive time pressure to execute trades without the more extensive safety checks normally used in slower trades.

"some firms do not have stringent processes for the development, testing, and deployment of code used in their trading algorithms."

"out-of control algorithms were more common than anticipated prior to the study and that there were no clear patterns as to their cause. Two of the four clearing BDs/FCMs, two-thirds of proprietary trading firms, and every exchange interviewed had experienced one or more errant algorithms."

The letter recommended new controls on high-frequency trading, including:

Limits on the number of orders that can be sent to an exchange within a specified period of time

A “kill switch” that could stop trading at one or more levels

Intraday position limits that set the maximum position a firm can take during one day

Profit-and-loss limits that restrict the dollar value that can be lost.

Flash Trading

Another area of concern relates to flash trading. Flash trading is a form of trading in which certain market participants are allowed to see incoming orders to buy or sell securities very slightly earlier than the general market participants, typically 30 milliseconds, in exchange for a fee. This feature was introduced to allow participants like market makers the opportunity to meet or improve on the National best bid and offer price to ensure incoming orders were matched at the most advantageous prices according to Regulation NMS.

According to some sources, the programs can inspect major orders as they come in and use that information to profit. Currently, the majority of exchanges either do not offer flash trading, or have discontinued it. In March 2011, Direct Edge ceased offering its Competition for Price Improvement functionality (widely referred to as "flash technology/trading").

Inside Trading

On September 24, 2013 it was revealed that some traders are under investigation for possible news leak and inside trading. Right after Federal Reserve announced its newest decision trades were registered in Chicago future market within 2 milliseconds. The information of such decision, calibrated to release at exactly 2 pm using atomic clock, takes seven millisecond to reach Chicago at the speed of light. Anything faster is not physically possible. (See Superluminal communication).

Advanced trading platforms

Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of Risk Filters before hitting the execution venue(s). Ultra Low Latency Direct Market Access (ULLDMA) is a hot topic amongst Brokers and Technology vendors such as Goldman Sachs, Credit Suisse, and UBS.[citation needed] Typically, ULLDMA systems can currently handle high amounts of volume and boast round-trip order execution speeds (from hitting "transmit order" to receiving an acknowledgment) of 10 milliseconds or less.

Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market data, in association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing.

As of 2009, studies suggested HFT firms accounted for 60-73% of all US equity trading volume, with that number falling to approximately 50% in 2012.

High-frequency traders move in and out of short-term positions aiming to capture sometimes just a fraction of a cent in profit on every trade. HFT firms do not employ significant leverage, accumulate positions or hold their portfolios overnight; they typically compete against other HFTs, rather than long-term investors. As a result, HFT has a potential Sharpe ratio (a measure of risk and reward) thousands of times higher than traditional buy-and-hold strategies.

HFT may cause new types of serious risks to the financial system. Algorithmic and HFT were both found to have contributed to volatility in the May 6, 2010 Flash Crash, when high-frequency liquidity providers rapidly withdrew from the market. Several European countries have proposed curtailing or banning HFT due to concerns about volatility. Other complaints against HFT include the argument that some HFT firms scrape profits from investors when index funds rebalance their portfolios.

History

Profiting from speed advantages in the market is as old as trading itself. In the 17th century, the Rothschilds were able to arbitrage prices of the same security across country borders by using carrier pigeons to relay information before their competitors. HFT modernises this concept using the latest communications technology.

High-frequency trading has taken place at least since 1999, after the U.S. Securities and Exchange Commission (SEC) authorized electronic exchanges in 1998. At the turn of the 21st century, HFT trades had an execution time of several seconds, whereas by 2010 this had decreased to milli- and even microseconds. Until recently, high-frequency trading was a little-known topic outside the financial sector, with an article published by the New York Times in July 2009 being one of the first to bring the subject to the public's attention. On September 2, 2013, Italy became the world's first country to introduce a tax specifically targeted at HFT, charging a levy of 0.002% on equity transactions lasting less than 0.5 seconds.

Market growth

In the early 2000s, high-frequency trading still accounted for fewer than 10% of equity orders, but this proportion was soon to begin rapid growth. According to data from the NYSE, trading volume grew by about 164% between 2005 and 2009 for which high-frequency trading might be accounted. As of the first quarter in 2009, total assets under management for hedge funds with high-frequency trading strategies were $141 billion, down about 21% from their peak before the worst of the crises. The high-frequency strategy was first made successful by Renaissance Technologies. Many high-frequency firms are market makers and provide liquidity to the market which has lowered volatility and helped narrow Bid-offer spreads, making trading and investing cheaper for other market participants. In the United States, high-frequency trading firms represent 2% of the approximately 20,000 firms operating today, but account for 73% of all equity orders volume. The largest high-frequency trading firms in the US include names like Getco LLC, Knight Capital Group, Jump Trading, and Citadel LLC. The Bank of England estimates similar percentages for the 2010 US market share, also suggesting that in Europe HFT accounts for about 40% of equity orders volume and for Asia about 5-10%, with potential for rapid growth. By value, HFT was estimated in 2010 by consultancy Tabb Group to make up 56% of equity trades in the US and 38% in Europe.

As HFT strategies become more widely used, it can be more difficult to deploy them profitably. According to an estimate from Frederi Viens of Purdue University, profits from HFT in the U.S. has been declining from an estimated peak of $5bn in 2009, to about $1.25bn in 2012.

High Frequency Trading Strategies

High-frequency trading is quantitative trading that is characterized by short portfolio holding periods (see Wilmott (2008)). All portfolio-allocation decisions are made by computerized quantitative models. The success of high-frequency trading strategies is largely driven by their ability to simultaneously process volumes of information, something ordinary human traders cannot do. Specific algorithms are closely guarded by their owners and are known as "algos". Many practical algorithms are in fact quite simple arbitrages which could previously have been performed at lower frequency—competition tends to occur though who can execute them the fastest rather than who can create new breakthrough algorithms. Some examples of standard arbitrages used in HFT are listed below.

Trading ahead of index fund rebalancing

Most retirement savings, such as private pension funds or 401(k) and individual retirement accounts in the US, are invested in mutual funds, the most popular of which are index funds which must periodically "rebalance" or adjust their portfolio to match the new prices and market capitalization of the underlying securities in the stock or other index that they track. This allows algorithmic traders (80% of the trades of whom involve the top 20% most popular securities) to anticipate and trade ahead of stock price movements caused by mutual fund rebalancing, making a profit on advance knowledge of the large institutional block orders. This results in profits transferred from investors to algorithmic traders, estimated to be at least 21 to 28 basis points annually for S&P 500 index funds, and at least 38 to 77 basis points per year for Russell 2000 funds. John Montgomery of Bridgeway Capital Management says that the resulting "poor investor returns" from trading ahead of mutual funds is "the elephant in the room" that "shockingly, people are not talking about."

Market making

Market making is a set of high-frequency trading strategies that involve placing a limit order to sell (or offer) or a buy limit order (or bid) in order to earn the bid-ask spread. By doing so, market makers provide counterpart to incoming market orders. Although the role of market maker was traditionally fulfilled by specialist firms, this class of strategy is now implemented by a large range of investors, thanks to wide adoption of direct market access. As pointed out by empirical studies. this renewed competition among liquidity providers causes reduced effective market spreads, and therefore reduced indirect costs for final investors.

Some high-frequency trading firms use market making as their primary trading strategy. Automated Trading Desk, which was bought by Citigroup in July 2007, has been an active market maker, accounting for about 6% of total volume on both the NASDAQ and the New York Stock Exchange. Building up market making strategies typically involves precise modeling of the target market microstructure together with stochastic control techniques.

These strategies appear intimately related to the entry of new electronic venues. Academic study of Chi-X's entry into the European equity market reveals that its launch coincided with a large HFT that made markets using both the incumbent market, NYSE-Euronext, and the new market, Chi-X. The study shows that the new market provided ideal conditions for HFT market-making, low fees (i.e., rebates for quotes that led to execution) and a fast system, yet the HFT was equally active in the incumbent market to offload nonzero positions. New market entry and HFT arrival are further shown to coincide with a significant improvement in liquidity supply.

Ticker tape trading

Much information happens to be unwittingly embedded in market data, such as quotes and volumes. By observing a flow of quotes, high-frequency trading machines are capable of extracting information that has not yet crossed the news screens. Since all quote and volume information is public, such strategies are fully compliant with all the applicable laws.

Filter trading is one of the more primitive high-frequency trading strategies that involves monitoring large amounts of stocks for significant or unusual price changes or volume activity. This includes trading on announcements, news, or other event criteria. Software would then generate a buy or sell order depending on the nature of the event being looked for.

Tick trading often aims to recognize the beginnings of large orders being placed in the market. For example, a large order from a pension fund to buy will take place over several hours or even days, and will cause a rise in price due to increased demand. An arbitreur can try to spot this happening then buy up the security, then profit from selling back to the pension fund. This strategy has become more difficult since the introduction of dedicated trade execution companies in the 2000s which provide optimal trading for pension and other funds, specifically designed to remove the arbitrage opportunity.

Event arbitrage

Certain recurring events generate predictable short-term responses in a selected set of securities. High-frequency traders take advantage of such predictability to generate short-term profits.

Statistical arbitrage

Another set of high-frequency trading strategies are strategies that exploit predictable temporary deviations from stable statistical relationships among securities. Statistical arbitrage at high frequencies is actively used in all liquid securities, including equities, bonds, futures, foreign exchange, etc. Such strategies may also involve classical arbitrage strategies, such as covered interest rate parity in the foreign exchange market, which gives a relationship between the prices of a domestic bond, a bond denominated in a foreign currency, the spot price of the currency, and the price of a forward contract on the currency. High-frequency trading allows similar arbitrages using models of greater complexity involving many more than four securities. The TABB Group estimates that annual aggregate profits of high-frequency arbitrage strategies currently exceed US$21 billion which conflicts with the findings in the Perdue study which estimates the profits for all high frequency trading to be $1.25bn in 2012.

News-based trading

Company news in electronic text format is available from many sources including commercial providers like Bloomberg, public news websites, and Twitter feeds. Automated systems can identify company names, keywords and sometimes semantics to trade news before human traders can process it.

Low-latency strategies

A separate, "naïve" class of high-frequency trading strategies relies exclusively on ultra-low latency direct market access technology. In these strategies, computer scientists rely on speed to gain minuscule advantages in arbitraging price discrepancies in some particular security trading simultaneously on disparate markets.

Another aspect of low latency strategy has been the switch from fiber optic to microwave technology for long distance networking. Especially since 2011, there has been a trend to use microwaves to transmit data across key connections such as the one between New York and Chicago. This is because microwaves travelling in air suffer a less than 1% speed reduction compared to light travelling in a vacuum, whereas with conventional fiber optics light travels over 30% slower.

In 2010, Alex Wissner-Gross at Harvard University proposed an optimally low-latency solution for statistical arbitrage of geographically separated financial instruments.

Effects

The effects of algorithmic and high-frequency trading are the subject of ongoing research. Regulators claim these practices contributed to volatility in the May 6, 2010 Flash Crash and find that risk controls are much less stringent for faster trades.

Members of the financial industry generally claim high-frequency trading substantially improves market liquidity, narrows bid-offer spread, lowers volatility and makes trading and investing cheaper for other market participants.

An academic study found that, for large-cap stocks and in quiescent markets during periods of "generally rising stock prices", high-frequency trading lowers the cost of trading and increases the informativeness of quotes; however, it found "no significant effects for smaller-cap stocks", and "it remains an open question whether algorithmic trading and algorithmic liquidity supply are equally beneficial in more turbulent or declining markets...algorithmic liquidity suppliers may simply turn off their machines when markets spike downward."

In September 2011, Nanex, LLC (a high-frequency trading software company) published a report stating the contrary. They looked at the amount of quote traffic compared to the value of trade transactions over 4 and half years and saw a 10-fold decrease in efficiency.[52] Many discussions about HFT focus solely on the frequency aspect of the algorithms and not on their decision-making logic (which is typically kept secret by the companies that develop them). This makes it difficult for observers to pre-identify market scenarios where HFT will dampen or amplify price fluctuations. The growing quote traffic compared to trade value could indicate that more firms are trying to profit from cross-market arbitrage techniques that do not add significant value through increased liquidity when measured globally.

More fully automated markets such as NASDAQ, Direct Edge, and BATS, in the US, have gained market share from less automated markets such as the NYSE. Economies of scale in electronic trading have contributed to lowering commissions and trade processing fees, and contributed to international mergers and consolidation of financial exchanges.

The speeds of computer connections, measured in milliseconds or microseconds, have become important. Competition is developing among exchanges for the fastest processing times for completing trades. For example, in 2009 the London Stock Exchange bought a technology firm called MillenniumIT and announced plans to implement its Millennium Exchange platform[55] which they claim has an average latency of 126 microseconds. Since then, competitive exchanges have continued to reduce latency, and today, with turnaround times of three milliseconds available, are useful to traders to pinpoint the consistent and probable performance ranges of financial instruments. These professionals are often dealing in versions of stock index funds like the E-mini S&Ps because they seek consistency and risk-mitigation along with top performance. They must filter market data to work into their software programming so that there is the lowest latency and highest liquidity at the time for placing stop-losses and/or taking profits. With high volatility in these markets, this becomes a complex and potentially nerve-wracking endeavor, in which a small mistake can lead to a large loss. Absolute frequency data play into the development of the trader's pre-programmed instructions.

Spending on computers and software in the financial industry increased to $26.4 billion in 2005.

May 6, 2010 Flash Crash

The brief but dramatic stock market crash of May 6, 2010 was initially thought to have been caused by high-frequency trading. The Dow Jones Industrial Average plunged to its largest intraday point loss, but not percentage loss, in history, only to recover much of those losses within minutes.

In the aftermath of the crash, several organizations argued that high-frequency trading was not to blame, and may even have been a major factor in minimizing and partially reversing the Flash Crash. CME Group, a large futures exchange, stated that, insofar as stock index futures traded on CME Group were concerned, its investigation had found no support for the notion that high-frequency trading was related to the crash, and actually stated it had a market stabilizing effect.

However, after almost five months of investigations, the U.S. Securities and Exchange Commission and the Commodity Futures Trading Commission issued a joint report identifying the cause that set off the sequence of events leading to the Flash Crash and concluding that the actions of high-frequency trading firms contributed to volatility during the crash.

The report found that the cause was a single sale of $4.1 billion in futures contracts by a mutual fund, identified as Waddell & Reed Financial, in an aggressive attempt to hedge its investment position. The joint report also found that "high-frequency traders quickly magnified the impact of the mutual fund's selling."The joint report "portrayed a market so fragmented and fragile that a single large trade could send stocks into a sudden spiral," that a large mutual fund firm "chose to sell a big number of futures contracts using a computer program that essentially ended up wiping out available buyers in the market," that as a result high-frequency firms "were also aggressively selling the E-mini contracts," contributing to rapid price declines. The joint report also noted "'HFTs began to quickly buy and then resell contracts to each other — generating a 'hot-potato' volume effect as the same positions were passed rapidly back and forth.'" The combined sales by Waddell and high-frequency firms quickly drove "the E-mini price down 3% in just four minutes."As prices in the futures market fell, there was a spillover into the equities markets where "the liquidity in the market evaporated because the automated systems used by most firms to keep pace with the market paused" and scaled back their trading or withdrew from the markets altogether. The joint report then noted that "Automatic computerized traders on the stock market shut down as they detected the sharp rise in buying and selling." As computerized high-frequency traders exited the stock market, the resulting lack of liquidity "...caused shares of some prominent companies like Procter & Gamble and Accenture to trade down as low as a penny or as high as $100,000." While some firms exited the market, high-frequency firms that remained in the market exacerbated price declines because they "'escalated their aggressive selling' during the downdraft."

Risks and controversy

Various studies have reported that high-frequency reduces volatility and does not pose a systemic risk, and lowers transaction costs for retail investors, without impacting long term investors, However, high-frequency trading has been the subject of intense public focus and debate since the May 6, 2010 Flash Crash. At least one Nobel Prize winning economist, Michael Spence, believes that HFT should be banned.

In their joint report on the 2010 Flash Crash, the Securities Exchange Commission and the Commodity Futures Trading Commission stated that "market makers and other liquidity providers widened their quote spreads, others reduced offered liquidity, and a significant number withdrew completely from the markets"[64] during the Flash Crash.

Politicians, regulators, journalists and market participants have all raised concerns on both sides of the Atlantic. and this has led to discussion of whether high-frequency market makers should be subject to various kinds of regulations.

In September 22, 2010 speech, SEC chairperson Mary Schapiro signaled that US authorities were considering the introduction of regulations targeted at HFT. She said, "...high frequency trading firms have a tremendous capacity to affect the stability and integrity of the equity markets. Currently, however, high frequency trading firms are subject to very little in the way of obligations either to protect that stability by promoting reasonable price continuity in tough times, or to refrain from exacerbating price volatility." She proposed regulation that would require high-frequency traders to stay active in volatile markets.

The Chicago Federal Reserve letter of October 2012, titled "How to keep markets safe in an era of high-speed trading," reports on the results of a survey of several dozen financial industry professionals including traders, brokers, and exchanges. It found that

risk controls were poorer in high-frequency trading, because of competitive time pressure to execute trades without the more extensive safety checks normally used in slower trades.

"some firms do not have stringent processes for the development, testing, and deployment of code used in their trading algorithms."

"out-of control algorithms were more common than anticipated prior to the study and that there were no clear patterns as to their cause. Two of the four clearing BDs/FCMs, two-thirds of proprietary trading firms, and every exchange interviewed had experienced one or more errant algorithms."

The letter recommended new controls on high-frequency trading, including:

Limits on the number of orders that can be sent to an exchange within a specified period of time

A “kill switch” that could stop trading at one or more levels

Intraday position limits that set the maximum position a firm can take during one day

Profit-and-loss limits that restrict the dollar value that can be lost.

Flash Trading

Another area of concern relates to flash trading. Flash trading is a form of trading in which certain market participants are allowed to see incoming orders to buy or sell securities very slightly earlier than the general market participants, typically 30 milliseconds, in exchange for a fee. This feature was introduced to allow participants like market makers the opportunity to meet or improve on the National best bid and offer price to ensure incoming orders were matched at the most advantageous prices according to Regulation NMS.

According to some sources, the programs can inspect major orders as they come in and use that information to profit. Currently, the majority of exchanges either do not offer flash trading, or have discontinued it. In March 2011, Direct Edge ceased offering its Competition for Price Improvement functionality (widely referred to as "flash technology/trading").

Inside Trading

On September 24, 2013 it was revealed that some traders are under investigation for possible news leak and inside trading. Right after Federal Reserve announced its newest decision trades were registered in Chicago future market within 2 milliseconds. The information of such decision, calibrated to release at exactly 2 pm using atomic clock, takes seven millisecond to reach Chicago at the speed of light. Anything faster is not physically possible. (See Superluminal communication).

Advanced trading platforms

Advanced computerized trading platforms and market gateways are becoming standard tools of most types of traders, including high-frequency traders. Broker-dealers now compete on routing order flow directly, in the fastest and most efficient manner, to the line handler where it undergoes a strict set of Risk Filters before hitting the execution venue(s). Ultra Low Latency Direct Market Access (ULLDMA) is a hot topic amongst Brokers and Technology vendors such as Goldman Sachs, Credit Suisse, and UBS.[citation needed] Typically, ULLDMA systems can currently handle high amounts of volume and boast round-trip order execution speeds (from hitting "transmit order" to receiving an acknowledgment) of 10 milliseconds or less.

Such performance is achieved with the use of hardware acceleration or even full-hardware processing of incoming market data, in association with high-speed communication protocols, such as 10 Gigabit Ethernet or PCI Express. More specifically, some companies provide full-hardware appliances based on FPGA technology to obtain sub-microsecond end-to-end market data processing.

Pg Md Radzuan Pg Hashim

SOON WE WILL BE BACK WITH OUR NEW HIGH FREQUENCY TRADING SYSTEM, NOW ALL ACCOUNT WILL START AT 5$.

Pg Md Radzuan Pg Hashim

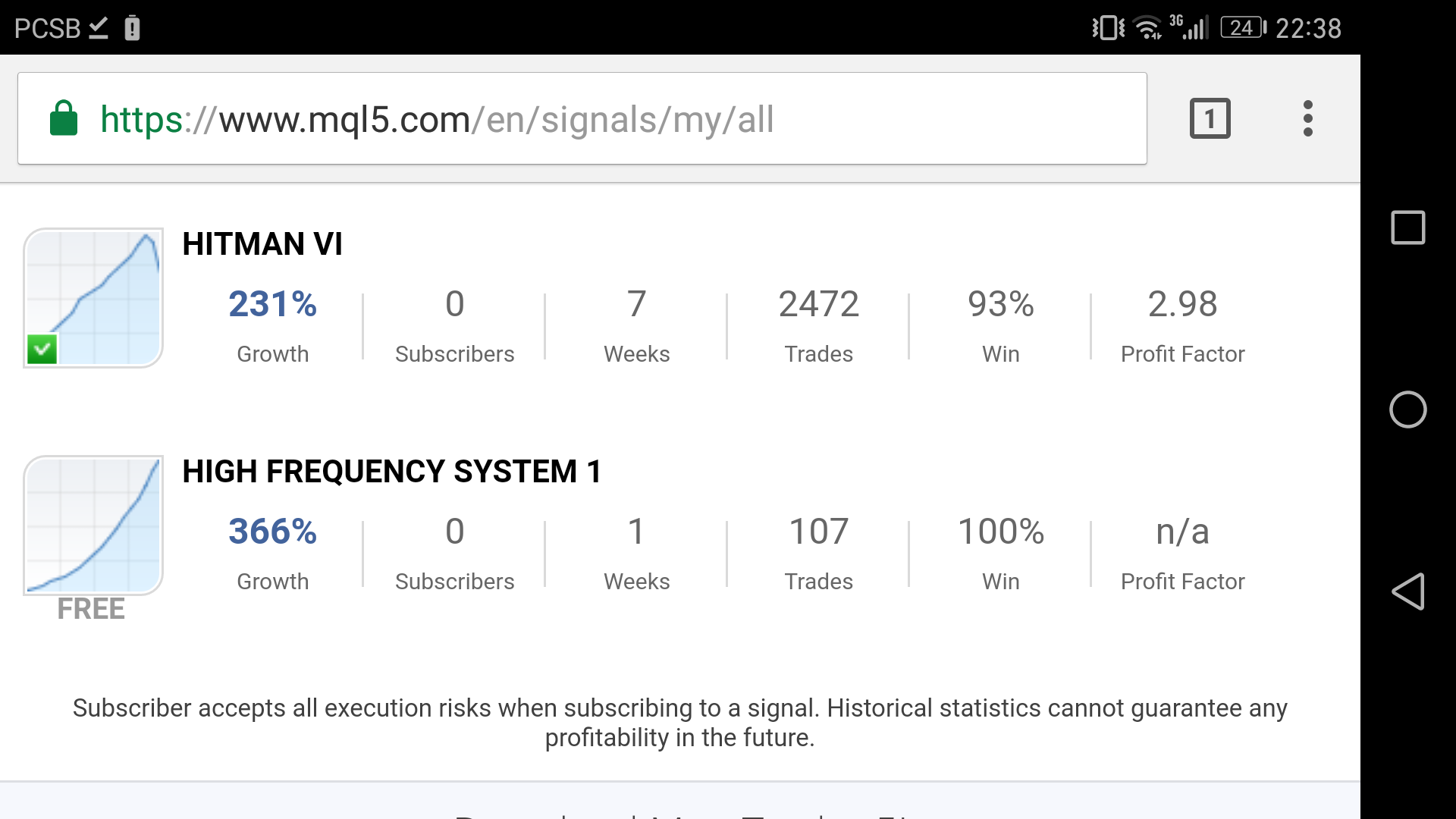

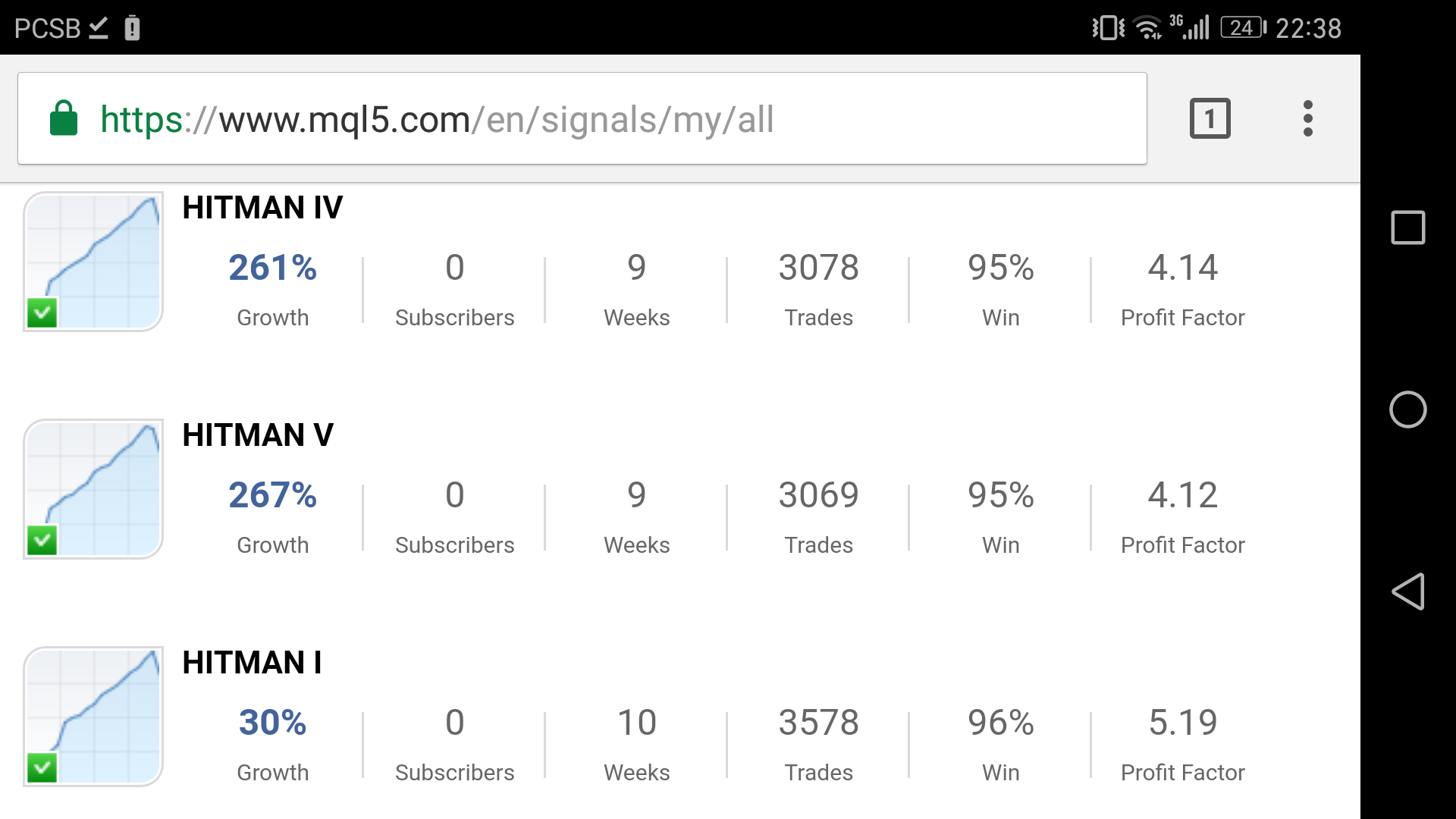

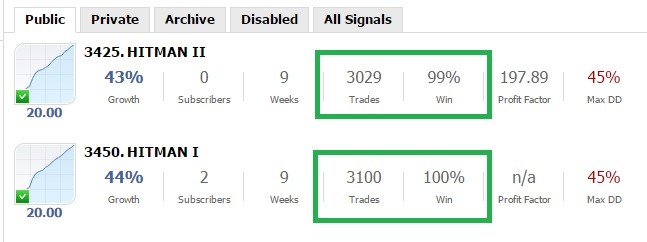

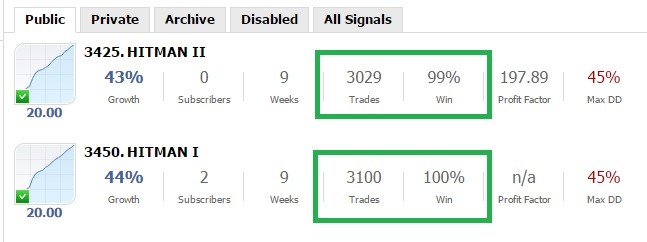

We have High Frequency Trading System(HFT) its powerful than any other system, 100% For sure,

Why? 3000 over trades, taking high trades with ACCURACY!! reaching 100% winning with no loss or less.

Please do offer Us your price for this system.(Only serious buyer)

Why? 3000 over trades, taking high trades with ACCURACY!! reaching 100% winning with no loss or less.

Please do offer Us your price for this system.(Only serious buyer)

Pg Md Radzuan Pg Hashim

HITMAN II has reached 3000 TRADES!! Other HITMAN will be joining soon!! Good Investment for the Powerful System!!

Pg Md Radzuan Pg Hashim

Pg Md Radzuan Pg Hashim

2017.01.25

No more looking for other system, This system consider Holy Grails!!!

: