Valeriy Brusilovskyy / Profile

- Information

|

7+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

I have more than 18 years of trading experience. Except of forex trading also I worked with vanil options.

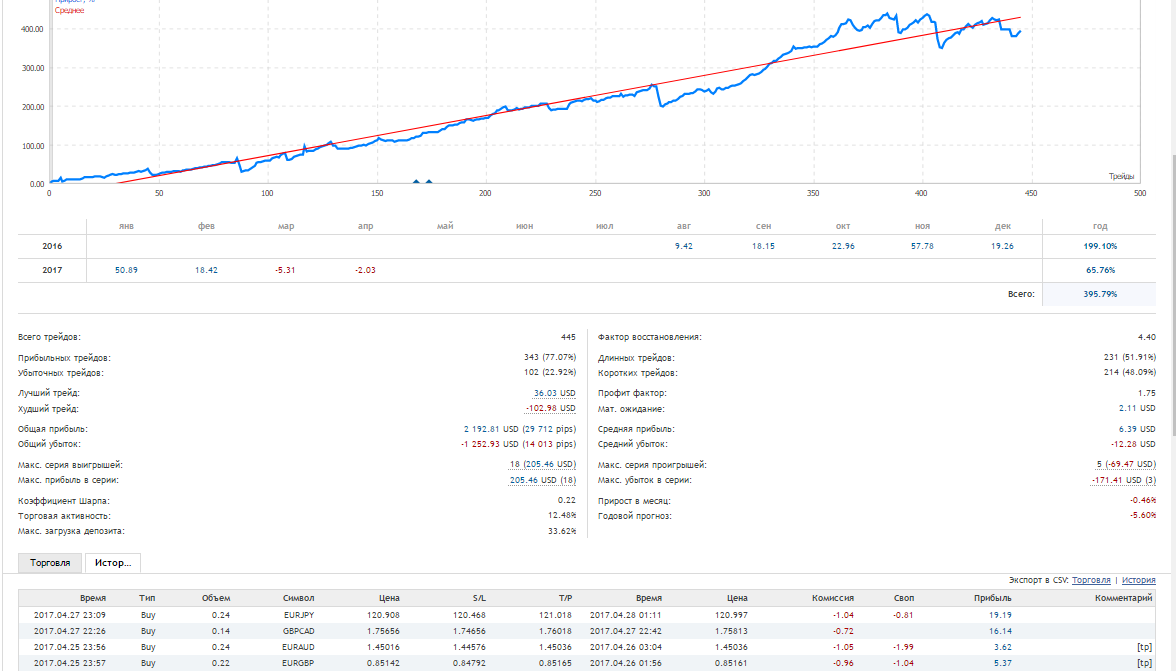

When I traded in divergences I had got 60-80% profit each year. Constantly I'm searching a new currency pairs that will be useful for my method of trading. I put currency pairs to demo-account only after their showing of good results (4-6 pips of expected value) in tester. I started to use pair in real account only after, at least, three months of successful trading (at least 3-4 pips of expected value). In the same time I don't stop to monitor the price movement of well-recommended currency pairs. Based on the results I change algorithm, time of trading and if it's necessary I change position size or even I can take of the pair from active trade.

In that moment I successfully drive a trade in six accounts.

If you are still not sure about me, please take a look on the indicators of all of my signals - https://www.mql5.com/en/signals/author/valera309

I can't wait to start working with you.

Please don't hesitate to address to me I always answer for all questions!

Sincerely yours, Valery!

When I traded in divergences I had got 60-80% profit each year. Constantly I'm searching a new currency pairs that will be useful for my method of trading. I put currency pairs to demo-account only after their showing of good results (4-6 pips of expected value) in tester. I started to use pair in real account only after, at least, three months of successful trading (at least 3-4 pips of expected value). In the same time I don't stop to monitor the price movement of well-recommended currency pairs. Based on the results I change algorithm, time of trading and if it's necessary I change position size or even I can take of the pair from active trade.

In that moment I successfully drive a trade in six accounts.

If you are still not sure about me, please take a look on the indicators of all of my signals - https://www.mql5.com/en/signals/author/valera309

I can't wait to start working with you.

Please don't hesitate to address to me I always answer for all questions!

Sincerely yours, Valery!

Friends

979

Requests

Outgoing

Valeriy Brusilovskyy

Нефтяные котировки по обе стороны Атлантики консолидируются после агрессивного вчерашнего падения, спровоцированного разочарованием, которое было вызвано итогами вчерашнего заседания ОПЕК, и обусловившего обвал цен на 5...

Share on social networks · 1

73

Valeriy Brusilovskyy

Trump Risk and Geopolitics Weighs on Pound, Stocks, Supports Yen

Trump risk and geopolitical concerns triggered by the U.K news overnight has investors prone to risk-aversion moves.

The yen has rallied and the pound has dropped along with stocks, as the market turns cautious after a suspect terrorist bomb attack in the U.K and the latest reports on the Trump administration.

In the U.S, political wrangling returns to the fore, taking the focus away from global economic growth. It’s being reported that President Trump asked intelligence chiefs to publicly deny any collusion between his campaign and Russia.

Also, the White House is set to deliver Trump’s first full budget to lawmakers later today. The plan is to cut -$3.6T in government spending over 10 years – Investors should expect fallout.

1. Stocks mixed results

Risk aversion mood has kept many investors on the sidelines overnight.

In Japan, the Nikkei stock average fell -0.1%. Its broader Topix dropped -0.2%.

In South Korea, the Kospi rallied +0.3%, while in Hong Kong, the Hang Seng fell -0.1%.

In China, the Shanghai Composite Index lost -0.5%.

The selloff of Brazilian assets has resumed, the Ibovespa index has slumped another -3.9% in overnight trading as a political crisis has returned to the country after last year’s impeachment process.

In Europe, regional indices are trading modestly higher buoyed by stronger PMI and IFO data out of Europe (see below). Some positive earnings results are also adding to the sentiment.

U.S stocks are set to open in the black (+0.1%).

Indices: Stoxx50 +0.6% at 3598, FTSE +0.2% at 7509, DAX +0.3% at 12660. CAC-40 +0.7% at 5359, IBEX-35 +0.9% at 10885, FTSE MIB +0.6% at 21449, SMI -0.4% at 9049, S&P 500 Futures +0.1%.

Brent Crude Oil

2. Oil prices fall on White House proposal to sell U.S oil reserves, gold unchanged

Ahead of the U.S open, oil prices are under pressure, weighed down by Trump’s plan to sell off half of the U.S’s stockpile, threatening a future and further “glut” despite OPEC trying to tighten the market.

Brent crude has ended a run of four consecutive session gains to trade -36c lower at +$53.51 per barrel. U.S. light crude (WTI) is down -33c at +$50.80.

Note: The White House plans to sell -50% of its oil stockpile from 2018 to 2027 to raise +$16.5B to help balance the budget. The budget is to be delivered to Congress today.

OPEC meet on Thursday, May 25 and are expected to extend the period of their pledge to cut output by -1.8m bpd from just the first half of this year to all of 2017 and the first quarter of 2018.

Note: Yesterday, Kuwait’s oil minister said ‘not’ all OPEC countries and allies were on board for a nine-month extension and producers would discuss this week whether to extend output cuts by six or nine months.

Gold prices are little changed (+$1,259.49 per ounce) despite the geopolitical events overnight. President Trump controversies and a weaker USD have been providing the yellow metal support over the past week.

Note: Spot gold advanced +2.2% last week over Trump’s alleged links to Russia and his firing of former FBI chief James Comey raised concerns about his ability to push through promised fiscal stimulus.

Gold

3. U.S debt supply to back up yields

This week’s U.S Treasury debt supply is expected to back up U.S yields a tad. Today, there is +$26B sale of two-year notes is due, followed by +$34B five-year notes tomorrow and +$28B sale of seven-year notes Thursday.

Ahead of the U.S open, 10’s are trading at +2.24%. U.S yield have been under pressure by political worries out of D.C. that is deflating investors’ optimism towards a rollout of large fiscal stimulus this year.

Note: The Fed’s minutes for May are due tomorrow afternoon. The market will focus on clues about the pace of interest-rate increases as well as discussions about how to wind down the Fed’s balance sheet.

Currently, fed funds show a +79% chance that the Fed would raise short-term interest rates at its June 13-14 meeting – the odds was at +74% on Friday and +51% a month ago.

Elsewhere, yields on Aussie debt lost -4 bps to +2.45%, while German bunds slipped -1 bps, France and the U.K fell -2 bps.

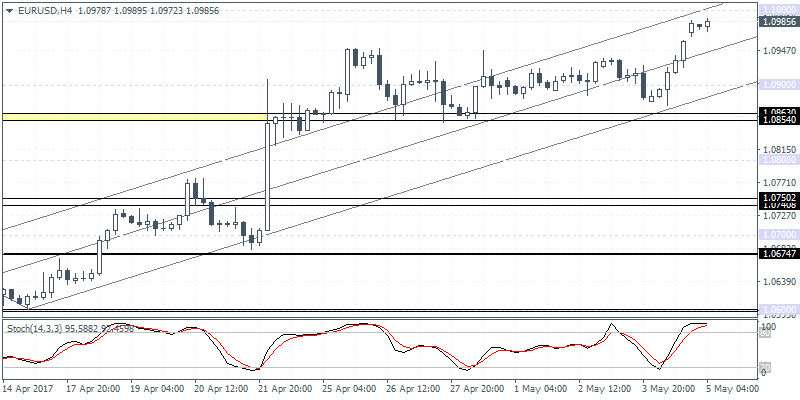

EURUSD

4. U.S dollar losing its luster

The EUR/USD (€1.1258) trades atop of its six-month high aided by yesterday’s comments from German Chancellor Merkel reiterating that the large German surpluses are being “aided by a weak EUR currency.” Other regional data (see below) this morning is also providing the single unit support.

The pound (£1.2988) is off its overnight highs on the terror incident in Manchester, but still within reach of the psychological £1.3000 handle. However, to many, £1.3000 is considered the key pivot and with any momentum through theses levels expect the structural shorts out there post-Brexit will be looking to wind back. Short-term sterling bulls are now targeting £1.3350/1.3400.

JPY (¥111.14) has befitted from safe-haven flows following the U.K terror incident.

EURGBP

5. Eurozone composite PMI stronger than expected

Data this morning showed that the composite PMI for the eurozone was slightly stronger than expected in May, with an unchanged reading of 56.8 comparing to a consensus forecast for a slight drop to 56.6.

Digging deeper, it’s a six-year high and points to robust growth in Q2. Most of the support comes from France and Germany, both of which recorded significant increases, while other economies slowed.

The surveys also pointed to a possible weakening of activity in coming months, with new orders at their lowest for four-months. Inflationary pressures have also eased slightly.

Trump risk and geopolitical concerns triggered by the U.K news overnight has investors prone to risk-aversion moves.

The yen has rallied and the pound has dropped along with stocks, as the market turns cautious after a suspect terrorist bomb attack in the U.K and the latest reports on the Trump administration.

In the U.S, political wrangling returns to the fore, taking the focus away from global economic growth. It’s being reported that President Trump asked intelligence chiefs to publicly deny any collusion between his campaign and Russia.

Also, the White House is set to deliver Trump’s first full budget to lawmakers later today. The plan is to cut -$3.6T in government spending over 10 years – Investors should expect fallout.

1. Stocks mixed results

Risk aversion mood has kept many investors on the sidelines overnight.

In Japan, the Nikkei stock average fell -0.1%. Its broader Topix dropped -0.2%.

In South Korea, the Kospi rallied +0.3%, while in Hong Kong, the Hang Seng fell -0.1%.

In China, the Shanghai Composite Index lost -0.5%.

The selloff of Brazilian assets has resumed, the Ibovespa index has slumped another -3.9% in overnight trading as a political crisis has returned to the country after last year’s impeachment process.

In Europe, regional indices are trading modestly higher buoyed by stronger PMI and IFO data out of Europe (see below). Some positive earnings results are also adding to the sentiment.

U.S stocks are set to open in the black (+0.1%).

Indices: Stoxx50 +0.6% at 3598, FTSE +0.2% at 7509, DAX +0.3% at 12660. CAC-40 +0.7% at 5359, IBEX-35 +0.9% at 10885, FTSE MIB +0.6% at 21449, SMI -0.4% at 9049, S&P 500 Futures +0.1%.

Brent Crude Oil

2. Oil prices fall on White House proposal to sell U.S oil reserves, gold unchanged

Ahead of the U.S open, oil prices are under pressure, weighed down by Trump’s plan to sell off half of the U.S’s stockpile, threatening a future and further “glut” despite OPEC trying to tighten the market.

Brent crude has ended a run of four consecutive session gains to trade -36c lower at +$53.51 per barrel. U.S. light crude (WTI) is down -33c at +$50.80.

Note: The White House plans to sell -50% of its oil stockpile from 2018 to 2027 to raise +$16.5B to help balance the budget. The budget is to be delivered to Congress today.

OPEC meet on Thursday, May 25 and are expected to extend the period of their pledge to cut output by -1.8m bpd from just the first half of this year to all of 2017 and the first quarter of 2018.

Note: Yesterday, Kuwait’s oil minister said ‘not’ all OPEC countries and allies were on board for a nine-month extension and producers would discuss this week whether to extend output cuts by six or nine months.

Gold prices are little changed (+$1,259.49 per ounce) despite the geopolitical events overnight. President Trump controversies and a weaker USD have been providing the yellow metal support over the past week.

Note: Spot gold advanced +2.2% last week over Trump’s alleged links to Russia and his firing of former FBI chief James Comey raised concerns about his ability to push through promised fiscal stimulus.

Gold

3. U.S debt supply to back up yields

This week’s U.S Treasury debt supply is expected to back up U.S yields a tad. Today, there is +$26B sale of two-year notes is due, followed by +$34B five-year notes tomorrow and +$28B sale of seven-year notes Thursday.

Ahead of the U.S open, 10’s are trading at +2.24%. U.S yield have been under pressure by political worries out of D.C. that is deflating investors’ optimism towards a rollout of large fiscal stimulus this year.

Note: The Fed’s minutes for May are due tomorrow afternoon. The market will focus on clues about the pace of interest-rate increases as well as discussions about how to wind down the Fed’s balance sheet.

Currently, fed funds show a +79% chance that the Fed would raise short-term interest rates at its June 13-14 meeting – the odds was at +74% on Friday and +51% a month ago.

Elsewhere, yields on Aussie debt lost -4 bps to +2.45%, while German bunds slipped -1 bps, France and the U.K fell -2 bps.

EURUSD

4. U.S dollar losing its luster

The EUR/USD (€1.1258) trades atop of its six-month high aided by yesterday’s comments from German Chancellor Merkel reiterating that the large German surpluses are being “aided by a weak EUR currency.” Other regional data (see below) this morning is also providing the single unit support.

The pound (£1.2988) is off its overnight highs on the terror incident in Manchester, but still within reach of the psychological £1.3000 handle. However, to many, £1.3000 is considered the key pivot and with any momentum through theses levels expect the structural shorts out there post-Brexit will be looking to wind back. Short-term sterling bulls are now targeting £1.3350/1.3400.

JPY (¥111.14) has befitted from safe-haven flows following the U.K terror incident.

EURGBP

5. Eurozone composite PMI stronger than expected

Data this morning showed that the composite PMI for the eurozone was slightly stronger than expected in May, with an unchanged reading of 56.8 comparing to a consensus forecast for a slight drop to 56.6.

Digging deeper, it’s a six-year high and points to robust growth in Q2. Most of the support comes from France and Germany, both of which recorded significant increases, while other economies slowed.

The surveys also pointed to a possible weakening of activity in coming months, with new orders at their lowest for four-months. Inflationary pressures have also eased slightly.

Valeriy Brusilovskyy

Доброго времени суток, товарищи трейдеры! Тема процентных ставок нередко возникает на повестке различных СМИ и многие уже в курсе, что это тесно связано с глобальной экономикой и финансами и каким-то образом влияет на процессы, происходящие на валютных рынках...

Share on social networks · 1

1132

Valeriy Brusilovskyy

Published post The Post-Truth Trade

Maybe the dollar rally late Thursday had nothing to do with politics, maybe it was an obscure fundamental headline, or flows or a fat finger in cable that morphed into a broad USD bid. 5 straight daily declines in the currency of the world's strongest economy may have a been excessive...

Share on social networks · 1

94

Valeriy Brusilovskyy

Опрос Gfk: В Британии лидируют консерваторы

Согласно данным опроса Международного института Маркетинговых и Социальных Исследований (Gfk) по выборам в Великобритании, на данный момент лидируют консерваторы.

Консервативная партия: 48%

Прогрессивный альянс социалистов и демократов: 28%

Либеральные демократы: 7%

Партия независимости Соединённого Королевства: 5%

"Зелёные": 3%

Согласно данным опроса Международного института Маркетинговых и Социальных Исследований (Gfk) по выборам в Великобритании, на данный момент лидируют консерваторы.

Консервативная партия: 48%

Прогрессивный альянс социалистов и демократов: 28%

Либеральные демократы: 7%

Партия независимости Соединённого Королевства: 5%

"Зелёные": 3%

Valeriy Brusilovskyy

Germany’s Schauble: “It is very clear: Macron is our ally”

Germany’s Finance Minister Wolfgang Schauble told Der Spiegel in an interview published Saturday, French president Macron should take care of its domestic affairs before attempting to reform the bloc, Politico reports.

Key Quotes:

“Macron wants a stronger Europe, just like the chancellor and I do”

“It is very clear: Macron is our ally”

Every European country — including Italy, France and Germany — should ensure “that it becomes stronger itself,” before turning to discuss how the European community can be improved

“That is the correct order”

“New French president will hold to his pledge to reduce new borrowing,” given that France is “not far off the 3-percent mark”

Germany’s Finance Minister Wolfgang Schauble told Der Spiegel in an interview published Saturday, French president Macron should take care of its domestic affairs before attempting to reform the bloc, Politico reports.

Key Quotes:

“Macron wants a stronger Europe, just like the chancellor and I do”

“It is very clear: Macron is our ally”

Every European country — including Italy, France and Germany — should ensure “that it becomes stronger itself,” before turning to discuss how the European community can be improved

“That is the correct order”

“New French president will hold to his pledge to reduce new borrowing,” given that France is “not far off the 3-percent mark”

Valeriy Brusilovskyy

Published post ATR: индикатор, без которого никуда

Технический индикатор Средний Истинный Диапазон (Average True Range, ATR) — это показатель волатильности рынка. Его ввел Уэллс Уайлдер в книге «Новые концепции технических торговых систем» и с тех пор индикатор применяется как составляющая многих других индикаторов и торговых систем...

Share on social networks · 5

2122

Valeriy Brusilovskyy

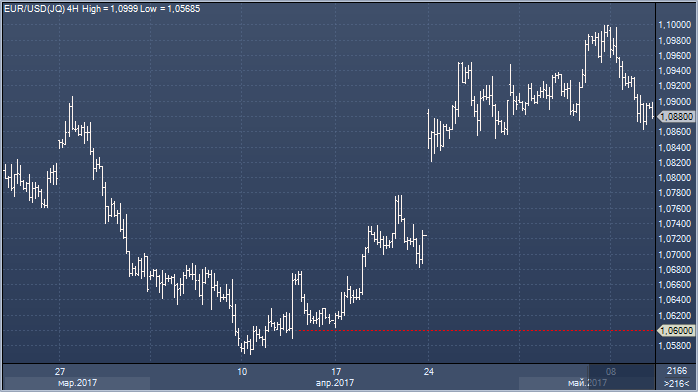

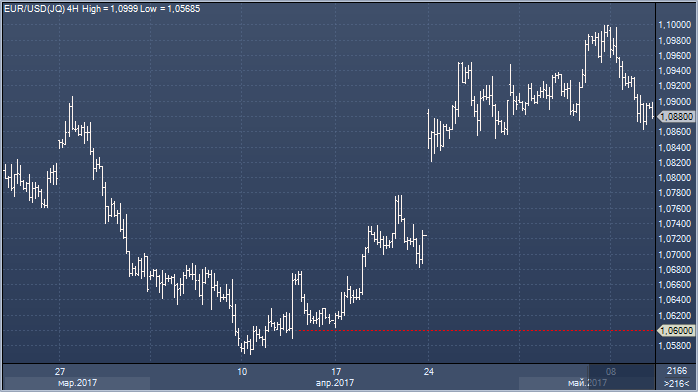

Morgan Stanley: евро/доллар идет на $1.06

Евро/доллар: текущий курс неоправданно высок, исходя из дифференциала реальной доходности европейских и американских бондов. Мы ждем его дальнейшего увеличения в пользу доллара, а прорыв единой валюты ниже $1.09 открывает дорогу для дальнейшего снижения к $1.06.

Евро/доллар: текущий курс неоправданно высок, исходя из дифференциала реальной доходности европейских и американских бондов. Мы ждем его дальнейшего увеличения в пользу доллара, а прорыв единой валюты ниже $1.09 открывает дорогу для дальнейшего снижения к $1.06.

Valeriy Brusilovskyy

Вектор движения доллара – ценный индикатор потенциальной динамики цен на сырьевые товары, которые, как правило, идут в противоположном «американцу» направлении...

Share on social networks · 1

65

Valeriy Brusilovskyy

EUR/USD продолжает торговаться над 1.0970, тестируя сейчас область 1.0990. Пара поглотила предыдущий многомесячный максимум, передвинув его на 1 пкт. выше до 1.0992. В целом быки продолжают присматриваться к уровню 1.1000. После релиза данных NFP по рынку труда США пара быстро нырнула к 1...

Share on social networks · 1

60

1

Valeriy Brusilovskyy

EURUSD at 6-month high, payrolls, and Yellen speech awaited

EURUSD rallied to a fresh 6-month high yesterday closing the day at 1.0983. The gains came about as later in the day, ECB officials were seen making hawkish comments on monetary policy.

Governing council member, Peter Praet was quoted as saying the central bank might not wait until the asset purchase program expires in December before raising interest rates. His hawkish views came after a recent string of economic reports from the Eurozone suggested a broad pickup in both inflation as well as economic growth.

On the economic front, data from the U.S. was lackluster with the quarterly nonfarm productivity numbers showing a decline in the first quarter of the year. Unit labor costs grew just 3.0% in the first quarter, while productivity declined 0.6% at an annual rate.

Looking ahead, the markets will be focusing on today's upcoming nonfarm payrolls report from the U.S. Expectations are for the unemployment rate to rise to 4.6% from 4.5% previously while the monthly jobs are expected to show 198k print. Fed members, Yellen and Fischer, are also due to speak later in the day.

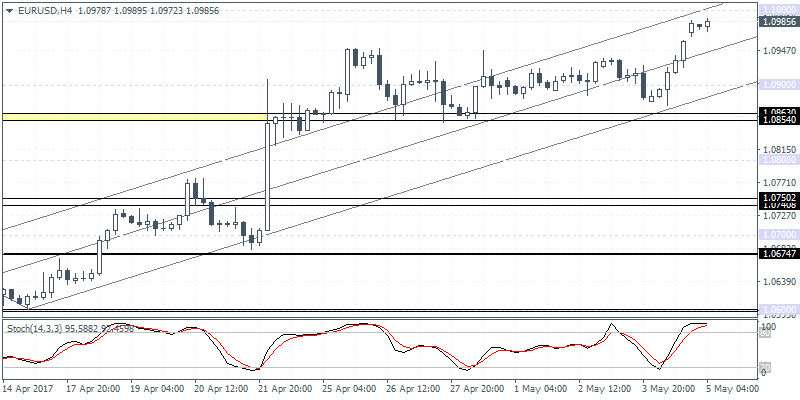

EURUSD (1.0985): EURUSD is now within reach of 1.1000 resistance level in the near term. The upside momentum is likely to keep the currency pair well supported to the upside, but further gains can be expected only on a strong break out above 1.1000.

With the key U.S. economic releases due today, there is a chance of pull back in prices. Expect to see some short-term consolidation in the markets with EURUSD likely to close the week within 1.1000 and 1.0900. A breakout from either of these levels will signal further continuation, but it is unlikely to expect that today.

EURUSD rallied to a fresh 6-month high yesterday closing the day at 1.0983. The gains came about as later in the day, ECB officials were seen making hawkish comments on monetary policy.

Governing council member, Peter Praet was quoted as saying the central bank might not wait until the asset purchase program expires in December before raising interest rates. His hawkish views came after a recent string of economic reports from the Eurozone suggested a broad pickup in both inflation as well as economic growth.

On the economic front, data from the U.S. was lackluster with the quarterly nonfarm productivity numbers showing a decline in the first quarter of the year. Unit labor costs grew just 3.0% in the first quarter, while productivity declined 0.6% at an annual rate.

Looking ahead, the markets will be focusing on today's upcoming nonfarm payrolls report from the U.S. Expectations are for the unemployment rate to rise to 4.6% from 4.5% previously while the monthly jobs are expected to show 198k print. Fed members, Yellen and Fischer, are also due to speak later in the day.

EURUSD (1.0985): EURUSD is now within reach of 1.1000 resistance level in the near term. The upside momentum is likely to keep the currency pair well supported to the upside, but further gains can be expected only on a strong break out above 1.1000.

With the key U.S. economic releases due today, there is a chance of pull back in prices. Expect to see some short-term consolidation in the markets with EURUSD likely to close the week within 1.1000 and 1.0900. A breakout from either of these levels will signal further continuation, but it is unlikely to expect that today.

Valeriy Brusilovskyy

Сегодня в 22.00 мск. состоятся последние теледебаты между кандидатами в президенты Франции Макроном и Ле Пен, которые продлятся более 2 часов...

Share on social networks · 2

66

Valeriy Brusilovskyy

Аналитики Natixis отмечают, что дневной стохастик EUR/USD перекуплен, что позволяет предполагать откат пары в район 1.08-1.0820 (9-дневная MA) и даже в район 1.0707 (дневная скользящая Боллинджера...

Share on social networks · 1

70

Valeriy Brusilovskyy

Аналитики HSBC пишут, что последние показатели инфляции в еврозоне оказались выше прогнозов рынка – в апреле CPI вырос к 1,9% (консенсус: 1,8%) от мартовского результата 1,5% г/г. Базовая инфляция также выросла до 1,2%, а инфляция с сфере услуг достигла максимального с марта 2013 г. уровня 1,8...

Share on social networks · 2

66

Valeriy Brusilovskyy

EUR/USD Forecast: Dollar in trouble ahead of Fed's meeting

29 April 2017, 09:44

What a way for the EUR/USD pair to close April! The common currency surged to fresh 2017, gapping around 200 pips on Sunday, amid the result of the first round of the French presidential election...

Share on social networks · 3

71

Valeriy Brusilovskyy

Евро ждет турбулентный понедельник

Единая валюта завершает ростом вторую неделю кряду, причем за последнюю, еще не завершившуюся пятидневку EURUSD набрала без малого 1%. В рамках сегодняшних внутридневных торгов пара ощущает на себе небольшое давление, но в целом сохраняет выдержку, осциллируя вокруг отметки 1.07.

В воскресенье пройдет первый тур президентских выборов во Франции. Вчерашний теракт в центре Парижа немного ослабил позиции евро, но в целом не оказал существенного влияния на поведение рынков. Судя по минимальному разрыву голосов у всех четырех основных кандидатов в президенты, можно с уверенностью сказать, что второй тур обязательно будет.

Но игроков на данный момент, конечно, больше волнует, кто вырвется вперед по итогам воскресного голосования. Большинство участников рынка прогнозируют, что в мае сразятся Макрон и Ле Пен. В рамках этого сценария для укрепления евро потребуется ощутимый отрыв первого от лидера «Национального фронта».

При любом раскладе волатильность в паре на открытии торгов в понедельник обещает быть высокой. Причем если французы сделают выбор в пользу евроскептиков, под мощным давлением рискую оказаться все рисковые активы на новой волне опасений за целостность Европы. В случае такого сценария больше остальных пострадает, безусловно, единая валюта.

Единая валюта завершает ростом вторую неделю кряду, причем за последнюю, еще не завершившуюся пятидневку EURUSD набрала без малого 1%. В рамках сегодняшних внутридневных торгов пара ощущает на себе небольшое давление, но в целом сохраняет выдержку, осциллируя вокруг отметки 1.07.

В воскресенье пройдет первый тур президентских выборов во Франции. Вчерашний теракт в центре Парижа немного ослабил позиции евро, но в целом не оказал существенного влияния на поведение рынков. Судя по минимальному разрыву голосов у всех четырех основных кандидатов в президенты, можно с уверенностью сказать, что второй тур обязательно будет.

Но игроков на данный момент, конечно, больше волнует, кто вырвется вперед по итогам воскресного голосования. Большинство участников рынка прогнозируют, что в мае сразятся Макрон и Ле Пен. В рамках этого сценария для укрепления евро потребуется ощутимый отрыв первого от лидера «Национального фронта».

При любом раскладе волатильность в паре на открытии торгов в понедельник обещает быть высокой. Причем если французы сделают выбор в пользу евроскептиков, под мощным давлением рискую оказаться все рисковые активы на новой волне опасений за целостность Европы. В случае такого сценария больше остальных пострадает, безусловно, единая валюта.

Valeriy Brusilovskyy

If you are trading the euro, you need to be watching the election in France this weekend. While it is the first of two rounds with a final vote scheduled for May 7th, the winner's lead could set the tone for how European assets trade for the next few weeks...

Share on social networks · 2

129

: