Mohammed Abdulwadud Soubra / Profile

- Information

|

8+ years

experience

|

7

products

|

1086

demo versions

|

|

134

jobs

|

1

signals

|

1

subscribers

|

"Я в форексе с 2005 года.

Ознакомьтесь с этим продуктом:

https://www.mql5.com/en/users/soubra2003/seller

Многообещающие торговые сигналы по US30 и американским акциям:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Для мгновенной поддержки, присоединяйтесь к этой группе в WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W "

Ознакомьтесь с этим продуктом:

https://www.mql5.com/en/users/soubra2003/seller

Многообещающие торговые сигналы по US30 и американским акциям:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Для мгновенной поддержки, присоединяйтесь к этой группе в WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W "

Friends

8602

Requests

Outgoing

Mohammed Abdulwadud Soubra

EUR/USD Intraday: under pressure.

Pivot: 1.1385

Most Likely Scenario: short positions below 1.1385 with targets @ 1.1340 & 1.1310 in extension.

Alternative scenario: above 1.1385 look for further upside with 1.1415 & 1.1435 as targets.

Comment: the RSI is badly directed.

Pivot: 1.1385

Most Likely Scenario: short positions below 1.1385 with targets @ 1.1340 & 1.1310 in extension.

Alternative scenario: above 1.1385 look for further upside with 1.1415 & 1.1435 as targets.

Comment: the RSI is badly directed.

Mohammed Abdulwadud Soubra

Pre US Open, Daily Technical Analysis Wednesday, April 06, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: under pressure. Pivot: 1.1385 Most Likely Scenario: short positions below 1...

Share on social networks · 1

61

Mohammed Abdulwadud Soubra

Sentiment towards the global economy was dealt a numbing blow during trading on Tuesday following the International Monetary Fund’s (IMF) gloomy outlook on global growth which consequently dented risk appetite. These meek outlooks come at a time when the violent combination of stubbornly low commodity price and ongoing China woes has persistently exposed other nations to major downside risks. With the horrible cocktail of ongoing global instabilities potentially sabotaging any real recovery in global growth and blurring economic outlooks, it seems likely that the IMF will slash growth forecasts once again at the next meeting in Washington.

The logical steps to mitigating the headwinds of slowing global growth in a normal market environment may be to unleash further accommodative monetary policy, but recent market reactions from central bank intervention have almost exacerbated the situation. We live in a period of negative rate policies where unorthodox central bank

The logical steps to mitigating the headwinds of slowing global growth in a normal market environment may be to unleash further accommodative monetary policy, but recent market reactions from central bank intervention have almost exacerbated the situation. We live in a period of negative rate policies where unorthodox central bank

Mohammed Abdulwadud Soubra

Latest News

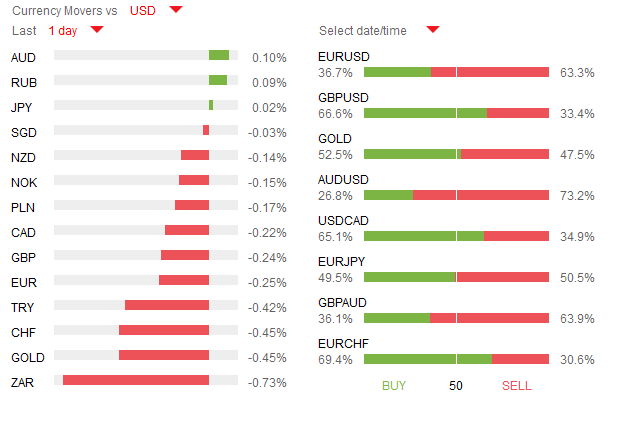

The USD got a late bid yesterday, following non-manufacturing PMI figures which came in above estimates, and resulted in GBPUSD falling 0.7% on the day. USDJPY meanwhile is little changed this morning, following three consecutive days of losses which saw the pair fall a cumulative 2%, as risk-off sentiment continues to grapple global financial markets ahead of the US’ earnings season. Lastly, NZDUSD got a boost yesterday after the results of the bi-weekly GDT auction saw dairy prices rising by 2.1%, though the pair still managed to close slightly negative on the day.

Today’s attention will be on the FOMC meeting minutes from their March meeting, in which we saw the forecasts for future interest rate hikes for 2016 fall from four to only two. Expectations are for FED members to turn their attention back to downside risks, as a slowdown in global economies threaten the US’ recovery. Besides that, there are also two FOMC members speaking, Mester (hawk) & Bullard (hawk) shortly before and after the FOMC minutes are released. Lastly, crude oil inventories which are forecasted to have grown by 3.1M barrels, will put the CAD in the spotlight later this afternoon.

The USD got a late bid yesterday, following non-manufacturing PMI figures which came in above estimates, and resulted in GBPUSD falling 0.7% on the day. USDJPY meanwhile is little changed this morning, following three consecutive days of losses which saw the pair fall a cumulative 2%, as risk-off sentiment continues to grapple global financial markets ahead of the US’ earnings season. Lastly, NZDUSD got a boost yesterday after the results of the bi-weekly GDT auction saw dairy prices rising by 2.1%, though the pair still managed to close slightly negative on the day.

Today’s attention will be on the FOMC meeting minutes from their March meeting, in which we saw the forecasts for future interest rate hikes for 2016 fall from four to only two. Expectations are for FED members to turn their attention back to downside risks, as a slowdown in global economies threaten the US’ recovery. Besides that, there are also two FOMC members speaking, Mester (hawk) & Bullard (hawk) shortly before and after the FOMC minutes are released. Lastly, crude oil inventories which are forecasted to have grown by 3.1M barrels, will put the CAD in the spotlight later this afternoon.

Mohammed Abdulwadud Soubra

Added topic re-activating personal signals!

Hello I have created 4 personal signals in real mode, they are perfectly working. but suddenly 3 of them are disconnected!!! why? how to re-activate them???

Share on social networks · 1

2

Mohammed Abdulwadud Soubra

Added topic RefreshRates()

Hello community I have always one problem the error 130 MT4 error description: invalid stops in the function below, if I call it then the error continuously will appear also if I place it inside the OnTick() same error

Mohammed Abdulwadud Soubra

Pivot: 37.25

Most Likely Scenario: short positions below 37.25 with targets @ 34.50 & 34.00 in extension.

Alternative scenario: above 37.25 look for further upside with 38.39 & 39.07 as targets.

Comment: technically the RSI is below its neutrality area at 50.

Most Likely Scenario: short positions below 37.25 with targets @ 34.50 & 34.00 in extension.

Alternative scenario: above 37.25 look for further upside with 38.39 & 39.07 as targets.

Comment: technically the RSI is below its neutrality area at 50.

Mohammed Abdulwadud Soubra

Pivot: 1222.50

Most Likely Scenario: long positions above 1222.50 with targets @ 1238.50 & 1243.00 in extension.

Alternative scenario: below 1222.50 look for further downside with 1214.50 & 1208.50 as targets.

Comment: the RSI is well directed.

Most Likely Scenario: long positions above 1222.50 with targets @ 1238.50 & 1243.00 in extension.

Alternative scenario: below 1222.50 look for further downside with 1214.50 & 1208.50 as targets.

Comment: the RSI is well directed.

Mohammed Abdulwadud Soubra

Pivot: 0.7645

Most Likely Scenario: short positions below 0.7645 with targets @ 0.7540 & 0.7510 in extension.

Alternative scenario: above 0.7645 look for further upside with 0.7680 & 0.7705 as targets.

Comment: the RSI is badly directed.

Most Likely Scenario: short positions below 0.7645 with targets @ 0.7540 & 0.7510 in extension.

Alternative scenario: above 0.7645 look for further upside with 0.7680 & 0.7705 as targets.

Comment: the RSI is badly directed.

Mohammed Abdulwadud Soubra

Pivot: 111.05

Most Likely Scenario: short positions below 111.05 with targets @ 110.25 & 109.50 in extension.

Alternative scenario: above 111.05 look for further upside with 111.40 & 111.75 as targets.

Comment: the RSI is badly directed.

Most Likely Scenario: short positions below 111.05 with targets @ 110.25 & 109.50 in extension.

Alternative scenario: above 111.05 look for further upside with 111.40 & 111.75 as targets.

Comment: the RSI is badly directed.

Mohammed Abdulwadud Soubra

Pivot: 1.4280

Most Likely Scenario: short positions below 1.4280 with targets @ 1.4185 & 1.4140 in extension.

Alternative scenario: above 1.4280 look for further upside with 1.4325 & 1.4375 as targets.

Comment: the RSI is badly directed.

Most Likely Scenario: short positions below 1.4280 with targets @ 1.4185 & 1.4140 in extension.

Alternative scenario: above 1.4280 look for further upside with 1.4325 & 1.4375 as targets.

Comment: the RSI is badly directed.

Mohammed Abdulwadud Soubra

Pivot: 1.1415

Most Likely Scenario: short positions below 1.1415 with targets @ 1.1340 & 1.1310 in extension.

Alternative scenario: above 1.1415 look for further upside with 1.1435 & 1.1465 as targets.

Comment: the upward potential is likely to be limited by the resistance at 1.1415.

Most Likely Scenario: short positions below 1.1415 with targets @ 1.1340 & 1.1310 in extension.

Alternative scenario: above 1.1415 look for further upside with 1.1435 & 1.1465 as targets.

Comment: the upward potential is likely to be limited by the resistance at 1.1415.

Mohammed Abdulwadud Soubra

Pre US Open, Daily Technical Analysis Tuesday, April 05, 2016

5 April 2016, 13:23

Pre US Open, Daily Technical Analysis Tuesday, April 05, 2016 Please note that due to market volatility, some of the below sight prices may have already been reached and scenarios played out. EUR/USD Intraday: under pressure. Pivot: 1.1415 Most Likely Scenario: short positions below 1...

Share on social networks · 1

52

Mohammed Abdulwadud Soubra

Global stocks descended into Q2 lacking inspiration, following the heavy declines in oil prices that arrested risk appetite and dampened confidence towards the global economy. Asia markets were left under pressure in the early trading sessions of Tuesday with most Asian stocks venturing into the red territory as risk aversion empowered the safe-haven Japanese Yen. Although Europe displayed some resilience during trading on Monday, a decline may be pending as risk aversion and anxiety ahead of the release of the FOMC minutes encourages investors to scatter from riskier assets. Wall Street had previous gains relinquished as investor anxiety, complimented with growing caution ahead of the heavily anticipated minutes, spurred a selloff that left most stocks at the mercy of the bears. With Q2 commencing in such a tepid fashion and ongoing concerns over the health of the global economy lingering in the background, stock markets could be poised for further declines.

Mohammed Abdulwadud Soubra

Latest News

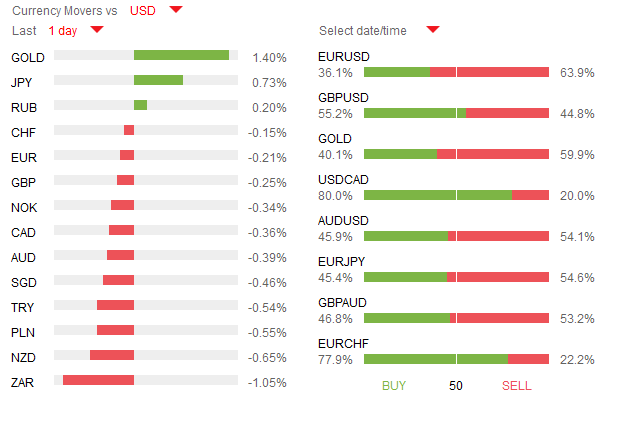

USDJPY has formed a new 1.5-year low this morning, currently trading around 110.5, as risk-off sentiment has caused the majority of global stock markets and commodities to retreat, while traders are seeking shelter in safe haven investments. The Aussie meanwhile is mainly unchanged on the day, after the Reserve Bank of Australia kept interest rates unchanged while expressing concern regarding the recent appreciation in AUDUSD. The FED’s Charles Evans, who is a non-voter this year and a major dove, stated yesterday his desire for the US to raise interest rates twice this year. Lastly, oil prices are once again falling this morning, as expectations for an agreement in Qatar at the April 17th meeting are fading, causing USDCAD to jump above 1.31 temporarily.

The UK will publish its all-important services PMI figure, forecasted to have jumped to 53.9 versus last month’s 52.7. Elsewhere, both Canada and the US will release trade balance figures, while the US will also publish services PMI data and its JOLTS job openings report. Lastly, NZD traders should be on the lookout for the bi-weekly dairy auction.

USDJPY has formed a new 1.5-year low this morning, currently trading around 110.5, as risk-off sentiment has caused the majority of global stock markets and commodities to retreat, while traders are seeking shelter in safe haven investments. The Aussie meanwhile is mainly unchanged on the day, after the Reserve Bank of Australia kept interest rates unchanged while expressing concern regarding the recent appreciation in AUDUSD. The FED’s Charles Evans, who is a non-voter this year and a major dove, stated yesterday his desire for the US to raise interest rates twice this year. Lastly, oil prices are once again falling this morning, as expectations for an agreement in Qatar at the April 17th meeting are fading, causing USDCAD to jump above 1.31 temporarily.

The UK will publish its all-important services PMI figure, forecasted to have jumped to 53.9 versus last month’s 52.7. Elsewhere, both Canada and the US will release trade balance figures, while the US will also publish services PMI data and its JOLTS job openings report. Lastly, NZD traders should be on the lookout for the bi-weekly dairy auction.

Mohammed Abdulwadud Soubra

Crude Oil (WTI) (K6) Intraday: under pressure.

Pivot: 37.25

Most Likely Scenario: short positions below 37.25 with targets @ 34.50 & 34.00 in extension.

Alternative scenario: above 37.25 look for further upside with 38.39 & 39.07 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Pivot: 37.25

Most Likely Scenario: short positions below 37.25 with targets @ 34.50 & 34.00 in extension.

Alternative scenario: above 37.25 look for further upside with 38.39 & 39.07 as targets.

Comment: even though a continuation of the technical rebound cannot be ruled out, its extent should be limited.

Mohammed Abdulwadud Soubra

Pivot: 1209.00

Gold

Most Likely Scenario: long positions above 1209.00 with targets @ 1229.00 & 1235.00 in extension.

Alternative scenario: below 1209.00 look for further downside with 1202.00 & 1195.00 as targets.

Comment: the RSI is bullish and calls for further upside

Gold

Most Likely Scenario: long positions above 1209.00 with targets @ 1229.00 & 1235.00 in extension.

Alternative scenario: below 1209.00 look for further downside with 1202.00 & 1195.00 as targets.

Comment: the RSI is bullish and calls for further upside

Mohammed Abdulwadud Soubra

Pivot: 0.7645

AUDUSD

Most Likely Scenario: short positions below 0.7645 with targets @ 0.7565 & 0.7540 in extension.

Alternative scenario: above 0.7645 look for further upside with 0.7680 & 0.7705 as targets.

Comment: the RSI lacks upward momentum

AUDUSD

Most Likely Scenario: short positions below 0.7645 with targets @ 0.7565 & 0.7540 in extension.

Alternative scenario: above 0.7645 look for further upside with 0.7680 & 0.7705 as targets.

Comment: the RSI lacks upward momentum

: