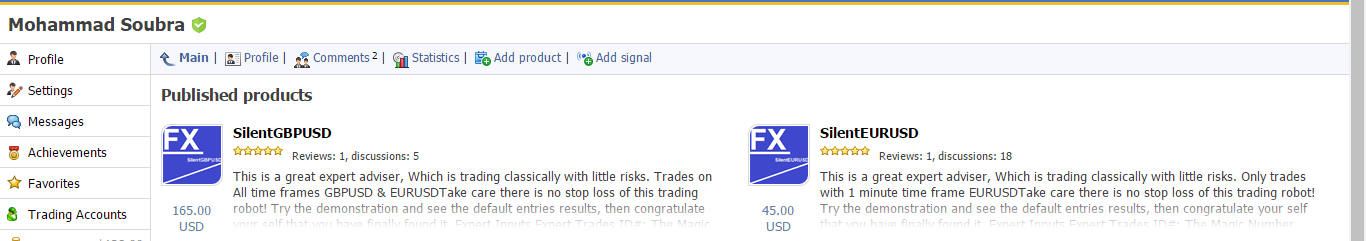

Mohammed Abdulwadud Soubra / Profile

- Information

|

8+ years

experience

|

7

products

|

1086

demo versions

|

|

134

jobs

|

1

signals

|

1

subscribers

|

"Я в форексе с 2005 года.

Ознакомьтесь с этим продуктом:

https://www.mql5.com/en/users/soubra2003/seller

Многообещающие торговые сигналы по US30 и американским акциям:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Для мгновенной поддержки, присоединяйтесь к этой группе в WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W "

Ознакомьтесь с этим продуктом:

https://www.mql5.com/en/users/soubra2003/seller

Многообещающие торговые сигналы по US30 и американским акциям:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Для мгновенной поддержки, присоединяйтесь к этой группе в WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W "

Friends

8602

Requests

Outgoing

Mohammed Abdulwadud Soubra

Latest News

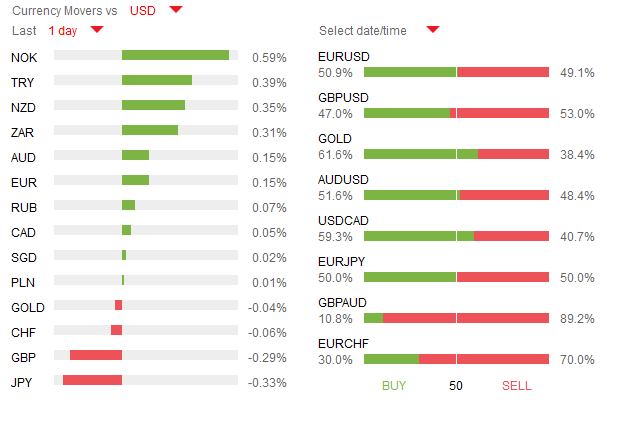

The USDJPY pair dipped below 110 this morning following the release of disappointing Japanese trade balance and manufacturing data which showed that exports fell 10.1% year-on-year in April. Boston’s FED president, Eric Rosengreen, stated that the US is on the edge of meeting most of the economic conditions set forth in order for FOMC members to be able to raise interest rates at the June meeting. Despite the latest chatter by hawkish FED members, the options markets has begun pricing in less of a chance for the US to raise interest rates in June – currently at 26% versus last week’s +30% probability.

Europe will publish services and manufacturing PMI figures this morning, both expected to have risen marginally in April. The FED’s James Bullard (Voter, Hawk) is scheduled to speak in Beijing this morning about US economic and monetary policy. The North American session will see volumes slightly lower as Canadian banks are off due to a public holiday. Meanwhile, the US is anticipated to show that the manufacturing sector slightly rebounded in April as it releases its latest flash manufacturing PMI figures.

The USDJPY pair dipped below 110 this morning following the release of disappointing Japanese trade balance and manufacturing data which showed that exports fell 10.1% year-on-year in April. Boston’s FED president, Eric Rosengreen, stated that the US is on the edge of meeting most of the economic conditions set forth in order for FOMC members to be able to raise interest rates at the June meeting. Despite the latest chatter by hawkish FED members, the options markets has begun pricing in less of a chance for the US to raise interest rates in June – currently at 26% versus last week’s +30% probability.

Europe will publish services and manufacturing PMI figures this morning, both expected to have risen marginally in April. The FED’s James Bullard (Voter, Hawk) is scheduled to speak in Beijing this morning about US economic and monetary policy. The North American session will see volumes slightly lower as Canadian banks are off due to a public holiday. Meanwhile, the US is anticipated to show that the manufacturing sector slightly rebounded in April as it releases its latest flash manufacturing PMI figures.

Mohammed Abdulwadud Soubra

Added topic #include <stdlib.mqh>

Hello I am confused why the here under library call is coming as an executed file: #include <stdlib.mqh> can any body help me please, I would be appreciated for the help. I want to i nclude

Mohammed Abdulwadud Soubra

Pivot Points WEEKLY Last Updated: May 23, 1:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.091 1.10787 1.11473 1.12474 1.1316 1.14161 1.15848 USD/JPY 105.456 107.581 108.835 109.706 110.96 111.831 113.956 GBP/USD 1.38334 1.41648 1.43297 1.44962 1.46611 1.48276 1.5159 USD/CHF 0.94788 0.96662 0...

Share on social networks · 1

83

Mohammed Abdulwadud Soubra

Pivot Points Daily Last Updated: May 23, 1:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.11339 1.11748 1.11953 1.12157 1.12362 1.12566 1.12975 USD/JPY 108.69 109.429 109.759 110.168 110.498 110.907 111.646 GBP/USD 1.42753 1.44028 1.44487 1.45303 1.45762 1.46578 1.47853 USD/CHF 0.98396 0...

Mohammed Abdulwadud Soubra

Published post Pivot Points Hourly

Pivot Points Hourly Last Updated: May 23, 1:00 am +03:00 Symbol S3 S2 S1 P R1 R2 R3 EUR/USD 1.12024 1.12101 1.1213 1.12178 1.12207 1.12255 1.12332 USD/JPY 109.84 109.983 110.036 110.126 110.179 110.269 110.412 GBP/USD 1.44705 1.44824 1.44885 1.44943 1.45004 1.45062 1.45181 USD/CHF 0.98669 0...

Mohammed Abdulwadud Soubra

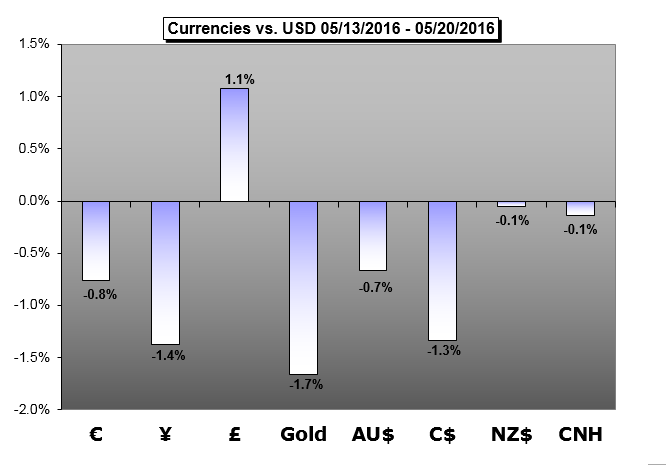

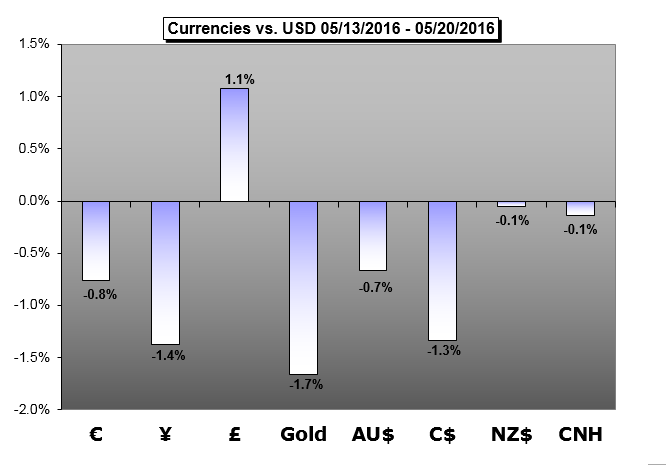

The Dollar has advanced for 3 straight weeks as the freeze from rate skeptics finally thawed. Can the BoJ also regain influence or does it need to take it by force?

US Dollar Forecast – Fed Provides Dollar Lift, FOMC Speak and SPX May Play Key Roles

The Dollar is finding some serious reprieve from a painful three months of selling pressure.

Euro Forecast – Don’t Be Surprised if You See More of the Same from the Euro

While there are no “high” rated events on the DailyFX Economic Calendar for the coming week for the Euro, there are almost twenty “medium” ranked events that bear enough significance to drive price action across the EUR-crosses.

British Pound Forecast – BoE Warns of Weakness, Even Without Brexit

The British Pound put in a strong week of gains through Thursday, snapping the two-week losing streak that the Sterling put in against the US Dollar after running up to a new nine-month high earlier in May.

Chinese Yuan (CNH) Forecast – Chinese Yuan Torn Between PBOC, Fed

Both the onshore Yuan (CNY) and offshore Yuan (CNH) traded lower against the US Dollar this week due to the increased expectations of a Fed rate hike in June after FOMC April minutes were released on Wednesday.

Australian Dollar Forecast – Aussie Dollar to Track Risk Trends on Fed Outlook, Brexit Bets

The Australian Dollar is likely to fall in with broad-based risk sentiment trends as markets size up the Fed policy outlook and Brexit probabilities in the week ahead.

Canadian Dollar Forecast – USD/CAD to Eye Fresh May Highs on Hawkish Fed Rhetoric, Dovish BoC

The near-term advance in USD/CAD may gather pace in the week ahead should the Bank of Canada (BoC) endorse a dovish outlook for monetary policy, while Federal Reserve officials show a greater willingness to implement higher borrowing-costs over the coming months.

New Zealand Dollar Forecast – New Zealand’s Migration Boom Could Keep RBNZ on Hold & Support NZD

The US Dollar surprised a lot of G10 currencies last week, but the New Zealand Dollar held firm.

Gold Forecast – Gold Decline Intensified as Fed Hints of Rate Hikes Ahead

Gold prices are down for a third consecutive week with the precious metal off 1.69% to trade at 1251 ahead of the New York close on Friday.

US Dollar Forecast – Fed Provides Dollar Lift, FOMC Speak and SPX May Play Key Roles

The Dollar is finding some serious reprieve from a painful three months of selling pressure.

Euro Forecast – Don’t Be Surprised if You See More of the Same from the Euro

While there are no “high” rated events on the DailyFX Economic Calendar for the coming week for the Euro, there are almost twenty “medium” ranked events that bear enough significance to drive price action across the EUR-crosses.

British Pound Forecast – BoE Warns of Weakness, Even Without Brexit

The British Pound put in a strong week of gains through Thursday, snapping the two-week losing streak that the Sterling put in against the US Dollar after running up to a new nine-month high earlier in May.

Chinese Yuan (CNH) Forecast – Chinese Yuan Torn Between PBOC, Fed

Both the onshore Yuan (CNY) and offshore Yuan (CNH) traded lower against the US Dollar this week due to the increased expectations of a Fed rate hike in June after FOMC April minutes were released on Wednesday.

Australian Dollar Forecast – Aussie Dollar to Track Risk Trends on Fed Outlook, Brexit Bets

The Australian Dollar is likely to fall in with broad-based risk sentiment trends as markets size up the Fed policy outlook and Brexit probabilities in the week ahead.

Canadian Dollar Forecast – USD/CAD to Eye Fresh May Highs on Hawkish Fed Rhetoric, Dovish BoC

The near-term advance in USD/CAD may gather pace in the week ahead should the Bank of Canada (BoC) endorse a dovish outlook for monetary policy, while Federal Reserve officials show a greater willingness to implement higher borrowing-costs over the coming months.

New Zealand Dollar Forecast – New Zealand’s Migration Boom Could Keep RBNZ on Hold & Support NZD

The US Dollar surprised a lot of G10 currencies last week, but the New Zealand Dollar held firm.

Gold Forecast – Gold Decline Intensified as Fed Hints of Rate Hikes Ahead

Gold prices are down for a third consecutive week with the precious metal off 1.69% to trade at 1251 ahead of the New York close on Friday.

Mohammed Abdulwadud Soubra

Added topic Repaint Indicator

Hello Can any one please let me know what is the "Repaint Indicator"? Thanks for all

Share on social networks · 1

5

Mohammed Abdulwadud Soubra

Explosive levels of volatility rattled the financial markets during trading on Wednesday following the shockingly hawkish FOMC meeting minutes which renewed expectations over the Federal Reserve raising US rates in Q2. It was even more surprising when the minutes displayed that most participants in the committee deemed that if domestic data from the States was consistent with a revival in economic growth, then the prerequisites of a June/July hike could be fulfilled. Although data in the States has picked up, with the resurgence in retails sales and rise in inflation providing additional ammunition for the Dollar bulls to attack, concerns over April’s dismal NFP report continue to linger on. While the Fed could be commended on their ability to boost speculations of another US rate hike in Q2, the bitter fundamentals and ongoing fears over the unstable economic landscape should sabotage any efforts taken by the central bank to act.

The Dollar Index surged with ferocity

The Dollar Index surged with ferocity

Mohammed Abdulwadud Soubra

EUR/USD Intraday: the downside prevails.

Pivot: 1.1255

Most Likely Scenario: short positions below 1.1255 with targets @ 1.1175 & 1.1140 in extension.

Alternative scenario: above 1.1255 look for further upside with 1.1290 & 1.1325 as targets.

Comment: as long as the resistance at 1.1255 is not surpassed, the risk of the break below 1.1175 remains high.

Pivot: 1.1255

Most Likely Scenario: short positions below 1.1255 with targets @ 1.1175 & 1.1140 in extension.

Alternative scenario: above 1.1255 look for further upside with 1.1290 & 1.1325 as targets.

Comment: as long as the resistance at 1.1255 is not surpassed, the risk of the break below 1.1175 remains high.

Mohammed Abdulwadud Soubra

Added poll IN YOUR OPINION, WHICH INDICATOR(S) IS/ARE VERY BAD

-

26% (15)

-

11% (6)

-

14% (8)

-

14% (8)

-

19% (11)

-

11% (6)

-

18% (10)

-

11% (6)

-

25% (14)

-

12% (7)

-

7% (4)

-

9% (5)

-

12% (7)

-

11% (6)

-

32% (18)

Total voters: 57

Share on social networks · 1

10

: