Mohammed Abdulwadud Soubra / Profile

- Information

|

8+ years

experience

|

7

products

|

1086

demo versions

|

|

134

jobs

|

1

signals

|

1

subscribers

|

"Я в форексе с 2005 года.

Ознакомьтесь с этим продуктом:

https://www.mql5.com/en/users/soubra2003/seller

Многообещающие торговые сигналы по US30 и американским акциям:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Для мгновенной поддержки, присоединяйтесь к этой группе в WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W "

Ознакомьтесь с этим продуктом:

https://www.mql5.com/en/users/soubra2003/seller

Многообещающие торговые сигналы по US30 и американским акциям:

https://www.mql5.com/en/signals/1770631

https://www.mql5.com/en/signals/2091904

Для мгновенной поддержки, присоединяйтесь к этой группе в WhatsApp:

https://chat.whatsapp.com/LItGOMZbpvN730NDA3fJ9W "

Friends

8602

Requests

Outgoing

Mohammed Abdulwadud Soubra

Latest News

Chinese shares are soaring this morning, with the Shanghai composite currently up over 2%, on rumoured intervention, helping to boost risk-on sentiment. The Yen initially strengthened to 110.80 vs the USD, though has pared gains since then and is currently trading around 111.20, following better than expected macro data which included industrial production and household spending figures. Though year-on-year household spending continues to contract, its seventh decline in the last eight months, the 0.4% decline was better than the market’s expectation of -1.3%. The Aussie meanwhile rose during the Asian session by 0.85% against the USD, after data showed that net exports grew to 0.8% during the last quarter which in turn is raising analysts’ expectations of Q1 GDP which is due to be released on Wednesday. Lastly, oil is trading relatively unchanged this morning, with WTI barely under $50 while Brent is just above the $50 handle, as investors await the OPEC meeting on Thursday. Expectations are currently low for any sort of agreement on a production cut or even production freeze.

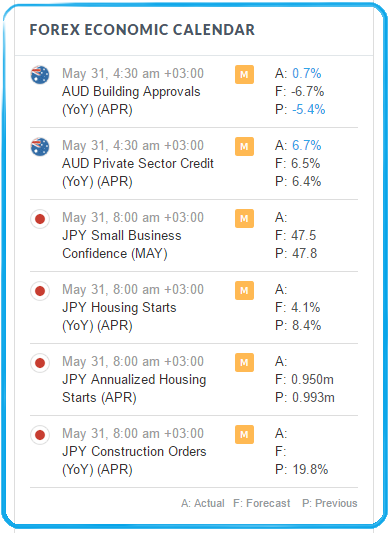

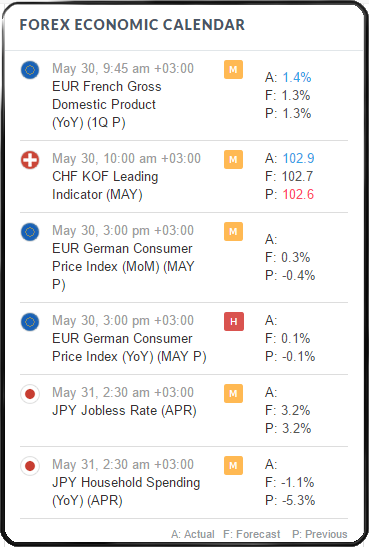

The economic calendar begins to pick up today after both the UK and the US come back online from their bank holidays. Germany is scheduled to publish retail sales and employment figures this morning. The Eurozone will post inflation data which is expected to show the headline figure continue to sit in deflation territory on a year-on-year basis – marking its fourth consecutive month of contracting prices. Core inflation is meanwhile expected to have risen to 0.8% versus 0.7%. The spotlight during the North American session will be when the US releases its PCE Price Index, the FED’s favorite measure of inflation. The core index is forecasted to have risen to 0.2% from 0.1%, while personal spending is anticipated to have jumped to 0.7% from 0.1%. GDP figures out of Canada is projected to have shrunk 0.1% month-on-month, marking their second consecutive decline. Lastly, consumer confidence in the US are estimated to have risen to 96.1 from 94.2 according to the CB’s latest data. Also of note, during the Asian session we will see China publish both its official and Caixin manufacturing/services reports. Both figures are expected to show that activity in the manufacturing sector continues to shrink for the world's second largest economy.

Chinese shares are soaring this morning, with the Shanghai composite currently up over 2%, on rumoured intervention, helping to boost risk-on sentiment. The Yen initially strengthened to 110.80 vs the USD, though has pared gains since then and is currently trading around 111.20, following better than expected macro data which included industrial production and household spending figures. Though year-on-year household spending continues to contract, its seventh decline in the last eight months, the 0.4% decline was better than the market’s expectation of -1.3%. The Aussie meanwhile rose during the Asian session by 0.85% against the USD, after data showed that net exports grew to 0.8% during the last quarter which in turn is raising analysts’ expectations of Q1 GDP which is due to be released on Wednesday. Lastly, oil is trading relatively unchanged this morning, with WTI barely under $50 while Brent is just above the $50 handle, as investors await the OPEC meeting on Thursday. Expectations are currently low for any sort of agreement on a production cut or even production freeze.

The economic calendar begins to pick up today after both the UK and the US come back online from their bank holidays. Germany is scheduled to publish retail sales and employment figures this morning. The Eurozone will post inflation data which is expected to show the headline figure continue to sit in deflation territory on a year-on-year basis – marking its fourth consecutive month of contracting prices. Core inflation is meanwhile expected to have risen to 0.8% versus 0.7%. The spotlight during the North American session will be when the US releases its PCE Price Index, the FED’s favorite measure of inflation. The core index is forecasted to have risen to 0.2% from 0.1%, while personal spending is anticipated to have jumped to 0.7% from 0.1%. GDP figures out of Canada is projected to have shrunk 0.1% month-on-month, marking their second consecutive decline. Lastly, consumer confidence in the US are estimated to have risen to 96.1 from 94.2 according to the CB’s latest data. Also of note, during the Asian session we will see China publish both its official and Caixin manufacturing/services reports. Both figures are expected to show that activity in the manufacturing sector continues to shrink for the world's second largest economy.

Mohammed Abdulwadud Soubra

NEWS

Tuesday, May 31, 2016 3:41 am +03:00

USD/JPY Tempts Break, Liquidity Returns with EUR/USD at 200DMA

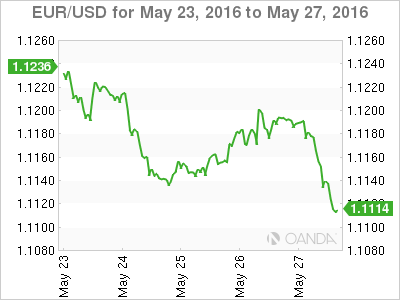

Holiday trading conditions kept most of the key technical boundaries - like the EUR/USD 200-day moving average as support - in place.

Tuesday, May 31, 2016 2:35 am +03:00

Video: Keeping Track of Deeper Fundamental Currents for the Euro

Monday, May 30, 2016 5:11 pm +03:00

Elliott Wave Patterns: What is a Zigzag?

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

Tuesday, May 31, 2016 3:41 am +03:00

USD/JPY Tempts Break, Liquidity Returns with EUR/USD at 200DMA

Holiday trading conditions kept most of the key technical boundaries - like the EUR/USD 200-day moving average as support - in place.

Tuesday, May 31, 2016 2:35 am +03:00

Video: Keeping Track of Deeper Fundamental Currents for the Euro

Monday, May 30, 2016 5:11 pm +03:00

Elliott Wave Patterns: What is a Zigzag?

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

Mohammed Abdulwadud Soubra

Published post Oil prices fell after the resumption of Canadian producers production processes and the approach of the OPEC delegates m

Oil prices fell after the resumption of Canadian producers production processes and the approach of the OPEC delegates meeting Oil prices tumbled for the third straight day, with the support of the Canadian producers resume production after a break over the previous two weeks on the one hand and...

Share on social networks · 3

118

Mohammed Abdulwadud Soubra

Latest News

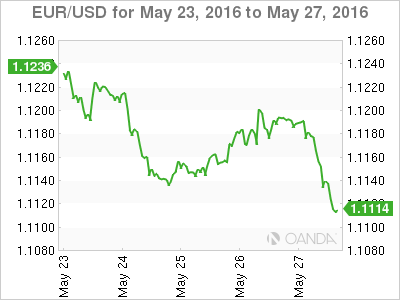

Preliminary GDP in the US climbed to 0.8% for the first quarter, as opposed to last month’s advanced reading of 0.5%, mostly attributed to a surge in home building projects. In addition, Janet Yellen’s speech in which she stated that a rate hike would be appropriate in the coming months, helped boost the USD-Index 0.4% on Friday. Meanwhile, USDJPY has surged 0.8% in early trading thus far, as positive sentiment from Friday’s rally for the USD has spilled over into today’s trading, as well as rumours regarding a possible sales tax delay from the Japanese government. Lastly, oil prices are down roughly 1% this morning, boosting USDCAD 0.55% from this morning's opening.

Volumes in today’s trading should be lower than normal, as both the UK and the US are off for their respective public holidays. Other than that, the spotlight during the European session will be on Germany as it will publish individual province’s inflation figures throughout the morning – with Germany’s inflation forecasted to grow to 0.4% month-on-month. Spain meanwhile is expected to remain in deflationary territory for the fifth consecutive month when it publishes its inflation data – anticipated at -1% year-on-year. Lastly, during the overnight Asian session, the volatile building approvals report out of Australia is forecasted to show a 2.8% decline month-on-month.

Preliminary GDP in the US climbed to 0.8% for the first quarter, as opposed to last month’s advanced reading of 0.5%, mostly attributed to a surge in home building projects. In addition, Janet Yellen’s speech in which she stated that a rate hike would be appropriate in the coming months, helped boost the USD-Index 0.4% on Friday. Meanwhile, USDJPY has surged 0.8% in early trading thus far, as positive sentiment from Friday’s rally for the USD has spilled over into today’s trading, as well as rumours regarding a possible sales tax delay from the Japanese government. Lastly, oil prices are down roughly 1% this morning, boosting USDCAD 0.55% from this morning's opening.

Volumes in today’s trading should be lower than normal, as both the UK and the US are off for their respective public holidays. Other than that, the spotlight during the European session will be on Germany as it will publish individual province’s inflation figures throughout the morning – with Germany’s inflation forecasted to grow to 0.4% month-on-month. Spain meanwhile is expected to remain in deflationary territory for the fifth consecutive month when it publishes its inflation data – anticipated at -1% year-on-year. Lastly, during the overnight Asian session, the volatile building approvals report out of Australia is forecasted to show a 2.8% decline month-on-month.

Mohammed Abdulwadud Soubra

European Central Bank Policy, the OPEC Meeting and NFP Lead FX Agenda

The U.S. Memorial Day weekend will shorten the trading week and compress employment releases in a week that is already filled with major events. The Organization of the Petroleum Exporting Countries (OPEC) will meet in Vienna on Thursday and that day the European Central Bank (ECB) will publish its rate statement and forecasts. The U.S. will release its employment indicators as well as manufacturing and non-manufacturing PMIs in a week that could make or break the possibility of a June Federal Open Market Committee (FOMC) meeting interest rate hike.

The European Central Bank (ECB) is not expected to change monetary policy when it releases its statement on Thursday, June 2 at 7:45 am EDT. The market will be following ECB President Mario Draghi speech for details about the implementation of corporate bond purchases that will kick off in June but the only surprise on the agenda could be the ECB’s forecasts. March’s forecasts were put together using the horrible beginning of the year data, which has improved and before the quantitative easing additional stimulus announced in the same time the forecasts were published. The inflation forecast could rise to 1.6 percent next year, putting less pressure on the ECB to ease monetary policy.

The USD economic calendar kicks off on Tuesday, May 31 with the release of the Consumer Confidence data at 10:00 am EDT. The ISM manufacturing PMI will be released on Wednesday, June 1 at 10:00 am EDT. The ADP private payrolls will be published on Thursday, June 2 at 8:15 am EDT to kick off the employment data a day later than usual due to the U.S. holiday on Monday. U.S. unemployment claims will be released that same day at 8:30 am EDT. The biggest indicator in forex, the U.S. non farm payrolls (NFP) will be published on Friday, June 3 at 8:30 am and followed by the ISM non-manufacturing PMI at 10:00 am EDT. The last NFP before June gains extra importance after the minutes from the April FOMC hinted that the Fed could hike rates if the U.S. economy showed signs of a rebound.

The U.S. Memorial Day weekend will shorten the trading week and compress employment releases in a week that is already filled with major events. The Organization of the Petroleum Exporting Countries (OPEC) will meet in Vienna on Thursday and that day the European Central Bank (ECB) will publish its rate statement and forecasts. The U.S. will release its employment indicators as well as manufacturing and non-manufacturing PMIs in a week that could make or break the possibility of a June Federal Open Market Committee (FOMC) meeting interest rate hike.

The European Central Bank (ECB) is not expected to change monetary policy when it releases its statement on Thursday, June 2 at 7:45 am EDT. The market will be following ECB President Mario Draghi speech for details about the implementation of corporate bond purchases that will kick off in June but the only surprise on the agenda could be the ECB’s forecasts. March’s forecasts were put together using the horrible beginning of the year data, which has improved and before the quantitative easing additional stimulus announced in the same time the forecasts were published. The inflation forecast could rise to 1.6 percent next year, putting less pressure on the ECB to ease monetary policy.

The USD economic calendar kicks off on Tuesday, May 31 with the release of the Consumer Confidence data at 10:00 am EDT. The ISM manufacturing PMI will be released on Wednesday, June 1 at 10:00 am EDT. The ADP private payrolls will be published on Thursday, June 2 at 8:15 am EDT to kick off the employment data a day later than usual due to the U.S. holiday on Monday. U.S. unemployment claims will be released that same day at 8:30 am EDT. The biggest indicator in forex, the U.S. non farm payrolls (NFP) will be published on Friday, June 3 at 8:30 am and followed by the ISM non-manufacturing PMI at 10:00 am EDT. The last NFP before June gains extra importance after the minutes from the April FOMC hinted that the Fed could hike rates if the U.S. economy showed signs of a rebound.

Mohammed Abdulwadud Soubra

Technical Analysis

Saturday, May 28, 2016 4:24 am +03:00

A Late Push for the Dollar from Yellen Puts Bulls on Notice

We will open the new trading week with the USDollar at a two months high but liquidity curtailed by Monday’s Memorial Day holiday.

Continue Reading

Saturday, May 28, 2016 2:36 am +03:00

Aussie Dollar Selling May Continue as RBA vs. Fed Outlooks Diverge

Saturday, May 28, 2016 2:16 am +03:00

Sterling Continues to Strengthen With Brexit Vote a Month Away

Saturday, May 28, 2016 1:04 am +03:00

Yellen Gives First Public Appearance Following April FOMC Minutes

Friday, May 27, 2016 10:52 am +03:00

Nikkei 225 Technical Analysis: Short Term Levels Prevail

Thursday, May 26, 2016 8:10 pm +03:00

WTI Crude Oil Price Forecast: Hello, $50!

Saturday, May 28, 2016 4:24 am +03:00

A Late Push for the Dollar from Yellen Puts Bulls on Notice

We will open the new trading week with the USDollar at a two months high but liquidity curtailed by Monday’s Memorial Day holiday.

Continue Reading

Saturday, May 28, 2016 2:36 am +03:00

Aussie Dollar Selling May Continue as RBA vs. Fed Outlooks Diverge

Saturday, May 28, 2016 2:16 am +03:00

Sterling Continues to Strengthen With Brexit Vote a Month Away

Saturday, May 28, 2016 1:04 am +03:00

Yellen Gives First Public Appearance Following April FOMC Minutes

Friday, May 27, 2016 10:52 am +03:00

Nikkei 225 Technical Analysis: Short Term Levels Prevail

Thursday, May 26, 2016 8:10 pm +03:00

WTI Crude Oil Price Forecast: Hello, $50!

Mohammed Abdulwadud Soubra

News

Saturday, May 28, 2016 3:02 am +03:00

Dollar Pushes EUR/USD to Verge of Breakdown Ahead of ECB, NFPs

Rather than drift off into the weekend with little potential to draw traders' interests; the Dollar roped our attention with a final move th...Continue Reading

Saturday, May 28, 2016 2:41 am +03:00

Video: A Fed Hike, Brexit Vote and Oil May Not Allow a Quiet June

Friday, May 27, 2016 7:35 pm +03:00

EUR/USD to Mount Near-Term Recover on Sticky CPI, Wait-and-See ECB

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

Saturday, May 28, 2016 3:02 am +03:00

Dollar Pushes EUR/USD to Verge of Breakdown Ahead of ECB, NFPs

Rather than drift off into the weekend with little potential to draw traders' interests; the Dollar roped our attention with a final move th...Continue Reading

Saturday, May 28, 2016 2:41 am +03:00

Video: A Fed Hike, Brexit Vote and Oil May Not Allow a Quiet June

Friday, May 27, 2016 7:35 pm +03:00

EUR/USD to Mount Near-Term Recover on Sticky CPI, Wait-and-See ECB

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

Mohammed Abdulwadud Soubra

Technical Analysis

Saturday, May 28, 2016 4:24 am +03:00

A Late Push for the Dollar from Yellen Puts Bulls on Notice

We will open the new trading week with the USDollar at a two months high but liquidity curtailed by Monday’s Memorial Day holiday.

Continue Reading

Saturday, May 28, 2016 2:36 am +03:00

Aussie Dollar Selling May Continue as RBA vs. Fed Outlooks Diverge

Saturday, May 28, 2016 2:16 am +03:00

Sterling Continues to Strengthen With Brexit Vote a Month Away

Saturday, May 28, 2016 1:04 am +03:00

Yellen Gives First Public Appearance Following April FOMC Minutes

Friday, May 27, 2016 10:52 am +03:00

Nikkei 225 Technical Analysis: Short Term Levels Prevail

Thursday, May 26, 2016 8:10 pm +03:00

WTI Crude Oil Price Forecast: Hello, $50!

Saturday, May 28, 2016 4:24 am +03:00

A Late Push for the Dollar from Yellen Puts Bulls on Notice

We will open the new trading week with the USDollar at a two months high but liquidity curtailed by Monday’s Memorial Day holiday.

Continue Reading

Saturday, May 28, 2016 2:36 am +03:00

Aussie Dollar Selling May Continue as RBA vs. Fed Outlooks Diverge

Saturday, May 28, 2016 2:16 am +03:00

Sterling Continues to Strengthen With Brexit Vote a Month Away

Saturday, May 28, 2016 1:04 am +03:00

Yellen Gives First Public Appearance Following April FOMC Minutes

Friday, May 27, 2016 10:52 am +03:00

Nikkei 225 Technical Analysis: Short Term Levels Prevail

Thursday, May 26, 2016 8:10 pm +03:00

WTI Crude Oil Price Forecast: Hello, $50!

Mohammed Abdulwadud Soubra

News

Saturday, May 28, 2016 3:02 am +03:00

Dollar Pushes EUR/USD to Verge of Breakdown Ahead of ECB, NFPs

Rather than drift off into the weekend with little potential to draw traders' interests; the Dollar roped our attention with a final move th...Continue Reading

Saturday, May 28, 2016 2:41 am +03:00

Video: A Fed Hike, Brexit Vote and Oil May Not Allow a Quiet June

Friday, May 27, 2016 7:35 pm +03:00

EUR/USD to Mount Near-Term Recover on Sticky CPI, Wait-and-See ECB

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

Saturday, May 28, 2016 3:02 am +03:00

Dollar Pushes EUR/USD to Verge of Breakdown Ahead of ECB, NFPs

Rather than drift off into the weekend with little potential to draw traders' interests; the Dollar roped our attention with a final move th...Continue Reading

Saturday, May 28, 2016 2:41 am +03:00

Video: A Fed Hike, Brexit Vote and Oil May Not Allow a Quiet June

Friday, May 27, 2016 7:35 pm +03:00

EUR/USD to Mount Near-Term Recover on Sticky CPI, Wait-and-See ECB

Friday, May 27, 2016 3:37 pm +03:00

CAC 40 Approaches Resistance Ahead of Yellen Speech

: