Mirza Baig / Profile

- Information

|

10+ years

experience

|

0

products

|

0

demo versions

|

|

0

jobs

|

0

signals

|

0

subscribers

|

::: You must expect to be stung by bees when in search of honey :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

::: He who is not courageous enough to take risks will accomplish nothing in life :::

Friends

301

Requests

Outgoing

Mirza Baig

shared author's Roberto Jacobs code

NineTFMovement

NineTFMovement indicator gives an overview of the price movement on 9 timeframes (M1 to Monthly).

Mirza Baig

Sergey Golubev

WEEKLY DIGEST 2014, November 23 - 30 for Scalping Trading: High Frequency Scalping System and Indicators To Download. Markets are fast moving and subject to large intraday swings...

1

Mirza Baig

Sergey Golubev

ISM Index (Institute of Supply Management's index, former NAPM — National Association of Purchasing Managers) is the index of business activity. ISM figures above 50 are usually considered as an indicator of expansion, while values below 50 indicate contraction...

1

Mirza Baig

Sergey Golubev

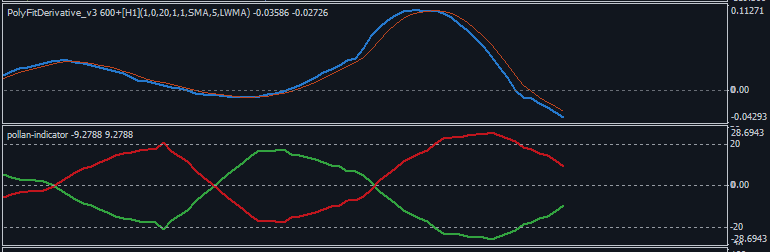

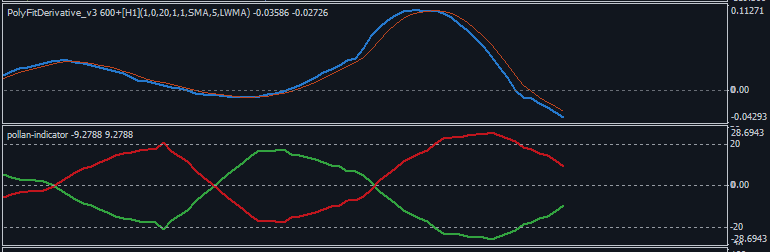

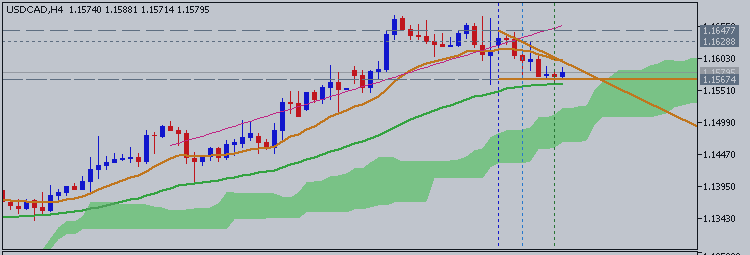

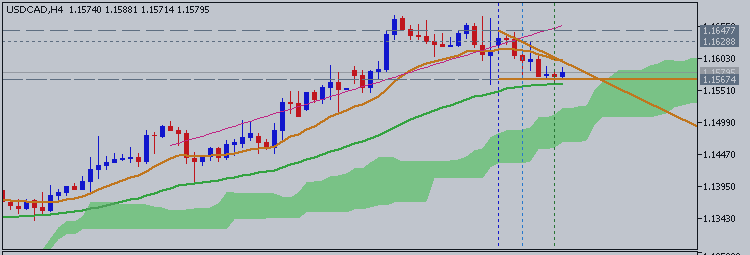

A slowdown in Canada’s Consumer Price Index (CPI) may spur fresh monthly highs in USD/CAD especially as the Bank of Canada (BoC) remains reluctant to further normalize monetary policy...

1

Mirza Baig

Sergey Golubev

What is an Inside bar? Inside bars are easily identified pricing patterns that can be found on virtually any chart. The pattern itself requires some simple technical analysis, which includes identifying a series of highs and lows on a daily chart...

1

Mirza Baig

Sergey Golubev

George Osborne announced on Monday that the Government would extend legislation covering Libor to seven other major benchmarks, including the WM/Reuters 4pm London Fix - the dominant global benchmark in the $5.3 trillion-a-day currency market - and the ISDAFix for swap rates...

1

Mirza Baig

Sergey Golubev

The Successful Investor: What 80 Million People Need to Know to Invest Profitably and Avoid Big Losses by William J. O'Neil More than 80 million investors lost 50 to 80 percent of their savings in the recent stock market crash. Investor's Business Daily publisher William J...

1

Mirza Baig

Sergey Golubev

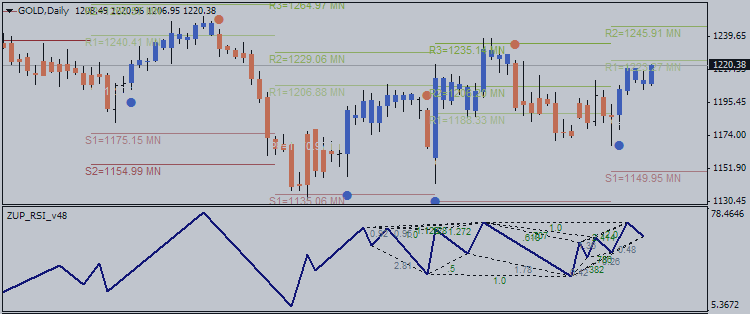

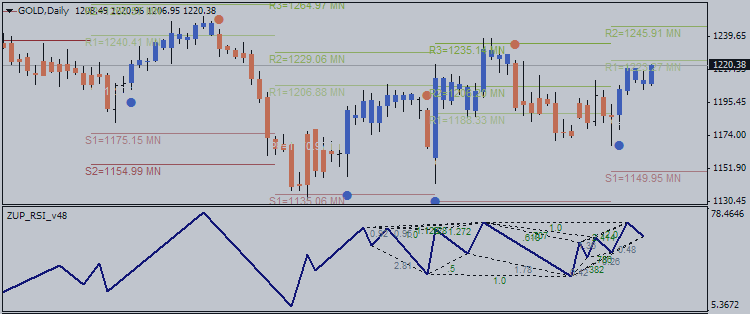

US DOLLAR TECHNICAL ANALYSIS Prices flat-lined after hitting a five-year high, with negative RSI divergence warning a downturn may be ahead. Near-term resistance is at 11577, the 38.2% Fibonacci expansion, with a break above that on a daily closing basis exposing the 50% level at 11648...

1

Mirza Baig

Sergey Golubev

Comment to topic Something Interesting to Read January 2015

How To Day Trade Stocks For Profit by Harvey Walsh Would you like the freedom to make money from anywhere in the world? Trade in an office, or from a beach hotel, you choose when and where you work

Mirza Baig

Sergey Golubev

US Dollar Forecast - NFPs and FOMC minutes last week offered measures of balance, but net they draw the first Fed hike closer Conditions are generally improving to the point where rate hikes will become likely...

1

Mirza Baig

shared author's Sergey Golubev post

WEEKLY DIGEST 2014, October 19 - 26 for Quantitative Analysis, Trading and Development

WEEKLY DIGEST 2014, October 12 - 19 for Quantitative Analysis, Trading and Development - mql5 digest An Overview of Fundamental-Quantitative Analysis - Financial Statements - Part 2 The Fundamental

Mirza Baig

shared author's Leonardo Barata post

What happened before the FOMC announcement today

There is inside trading and this is what happens many times before major announcements. They were taking shorts right before EURUSD collapsed. Analytical Trader

Mirza Baig

Sergey Golubev

Something Interesting to Read November 2014

This is the thread about books related for stocks, forex, financial market and economics. Please make a post about books with possible cover image, short description and official link to buy (amazon for example). Posts without books' presentation

Mirza Baig

Evgeniy Piskachev

The yen remained weaker against the dollar after consumer prices and unemployment met expectations, thought it recoered from early Friday lows as investors looked ahead to a central bank statement on monetary policy.

Forex - Yen retains weakness after CPI, unemployment, market awaits BoJYen weaker in AsiaSeptember national core CPI rose 3.0%, in-line with forecast for a 16th straight year-on-year rise, but the slowest pace since April sales tax hike

The unemployment rate came in at 3.6%, a tick up from August, but meeting expectations.

USD/JPY traded at 109.31, up 0.09%, while AUD/USD fell 0.06% to 0.8826. EUR/USD traded at 1.2605, down 0.06%.

Ahead is a key Bank of Japan decision on monetary policy at 1230 Tokyo (0330 GMT). The BoJ board is likely to stand pat on monetary policy at its one-day policy meeting.

BoJ Governor Haruhiko Kuroda's regular news conference is then due to start about half an hour later at 1530 (0630 GMT).

In afternoon, Japan's September housing starts are due at 1400 (0500 GMT).

In Australia, there's Q3 PPI final demand and the RBA's private sector credit data for September, all due at 1130 in Sydney (0030 GMT).

PPI is expected to show a rise of 0.72 quarter-on-quarter. Private sector credit is expected to rise 0.4% month-on-month.

Overnight, the dollar firmed against most major currencies after a better-than-expected U.S. growth report and a Federal Reserve decision to close its bond-buying program fueled expectations for rate hikes some time in 2015.

The Commerce Department reported earlier that the U.S. gross domestic product grew at an annual rate of 3.5% in the three months to September, beating forecast for 3% growth, which fueled demand for the greenback on expectations that the Federal Reserve remains set to hike interest rates in 2015.

On Wednesday, the Federal Reserve said it was ending its monthly bond-buying program due to improvements taking place in the labor market, which continued to firm the dollar on Thursday.

Still, the dollar didn't soar on Thursday, as the GDP report revealed that consumer spending slowed to 1.8% from 2.5% in the second quarter, and fixed investment spending also declined from the previous quarter, pointing to slackening domestic demand.

Elsewhere, the Labor Department reported earlier that the number of individuals filing new claims for jobless benefits rose by 3,000 to 287,000, confounding market forecasts for a decline to 283,000.

Meanwhile in the euro zone, preliminary data on Thursday revealed that German inflation was unchanged at 0.7% in October from a month earlier, the lowest level since May.

Separately, the number of people unemployed in Germany fell by 22,000 this month, compared to expectations for a gain of 5,000. The country’s unemployment rate was unchanged at 6.7%.

The US dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, fell 0.03% at 86.22.

On Friday, the U.S. is to round up the week with data on personal income and expenditure as well as revised data on consumer sentiment and a report on business activity in the Chicago region.

Forex - Yen retains weakness after CPI, unemployment, market awaits BoJYen weaker in AsiaSeptember national core CPI rose 3.0%, in-line with forecast for a 16th straight year-on-year rise, but the slowest pace since April sales tax hike

The unemployment rate came in at 3.6%, a tick up from August, but meeting expectations.

USD/JPY traded at 109.31, up 0.09%, while AUD/USD fell 0.06% to 0.8826. EUR/USD traded at 1.2605, down 0.06%.

Ahead is a key Bank of Japan decision on monetary policy at 1230 Tokyo (0330 GMT). The BoJ board is likely to stand pat on monetary policy at its one-day policy meeting.

BoJ Governor Haruhiko Kuroda's regular news conference is then due to start about half an hour later at 1530 (0630 GMT).

In afternoon, Japan's September housing starts are due at 1400 (0500 GMT).

In Australia, there's Q3 PPI final demand and the RBA's private sector credit data for September, all due at 1130 in Sydney (0030 GMT).

PPI is expected to show a rise of 0.72 quarter-on-quarter. Private sector credit is expected to rise 0.4% month-on-month.

Overnight, the dollar firmed against most major currencies after a better-than-expected U.S. growth report and a Federal Reserve decision to close its bond-buying program fueled expectations for rate hikes some time in 2015.

The Commerce Department reported earlier that the U.S. gross domestic product grew at an annual rate of 3.5% in the three months to September, beating forecast for 3% growth, which fueled demand for the greenback on expectations that the Federal Reserve remains set to hike interest rates in 2015.

On Wednesday, the Federal Reserve said it was ending its monthly bond-buying program due to improvements taking place in the labor market, which continued to firm the dollar on Thursday.

Still, the dollar didn't soar on Thursday, as the GDP report revealed that consumer spending slowed to 1.8% from 2.5% in the second quarter, and fixed investment spending also declined from the previous quarter, pointing to slackening domestic demand.

Elsewhere, the Labor Department reported earlier that the number of individuals filing new claims for jobless benefits rose by 3,000 to 287,000, confounding market forecasts for a decline to 283,000.

Meanwhile in the euro zone, preliminary data on Thursday revealed that German inflation was unchanged at 0.7% in October from a month earlier, the lowest level since May.

Separately, the number of people unemployed in Germany fell by 22,000 this month, compared to expectations for a gain of 5,000. The country’s unemployment rate was unchanged at 6.7%.

The US dollar index, which tracks the performance of the greenback versus a basket of six other major currencies, fell 0.03% at 86.22.

On Friday, the U.S. is to round up the week with data on personal income and expenditure as well as revised data on consumer sentiment and a report on business activity in the Chicago region.

1

Mirza Baig

Sergey Golubev

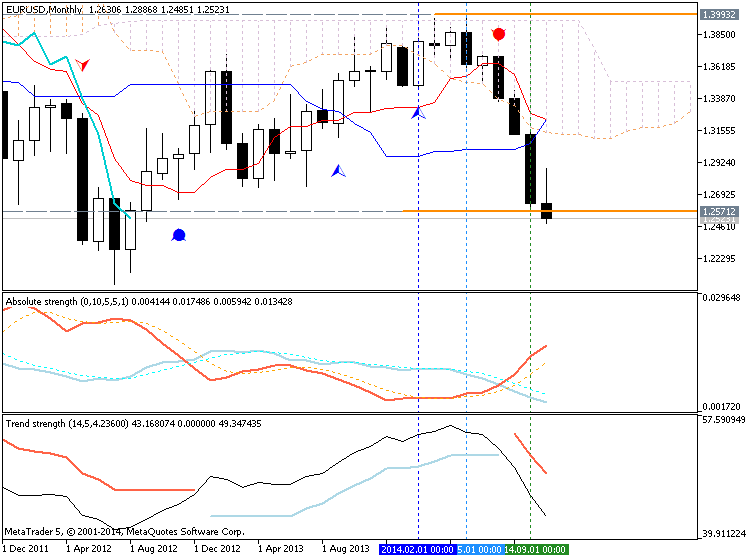

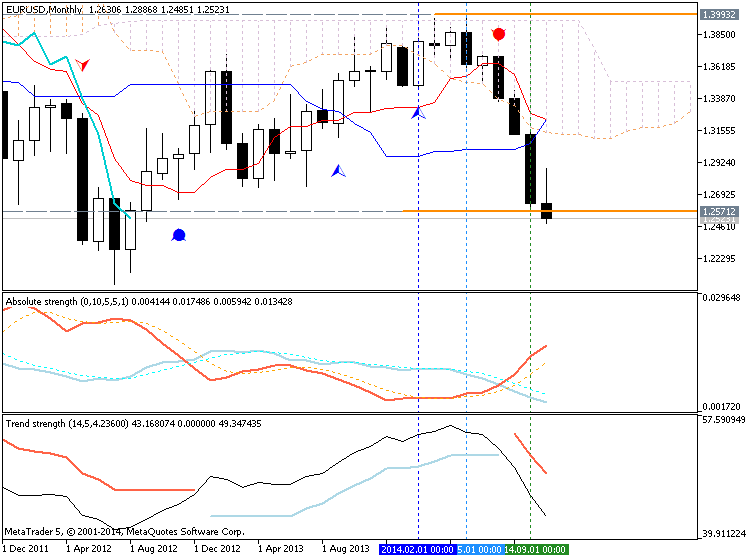

EURUSD Technical Analysis 2014, 02.11 - 09.11: Bearish With W1 Psy Level Crossing

D1 price is on primary bearish for crossing 1.2546 support level on open bar for now. H4 price is on bearish ranging between 1.2485 support and 1.2631 resistance. W1 price is on bearish with market rally finishing, the price is trying to break 1.2500

Mirza Baig

Sergey Golubev

A look at how to trade the AB=CD Pattern. This is educational video about how to trade this pattern. There are a few key steps: Identify the start of the trend (point A to point B) Once the market begins to retrace at Point B, use Fibonacci lines to measure a retracement...

1

Mirza Baig

shared author's Sergey Golubev post

SOMETHING TO READ - Market Wizards by Jack Schwager - a collection of interviews of a group of successful traders in the 1970s/80s.

This is a classic to read and enjoy. How do the world's most successful traders amass tens, hundreds of millions of dollars a year? Are they masters of an occult knowledge, lucky winners in a random

Mirza Baig

shared author's Roberto Jacobs code

AutoTStop EA

AutoTStop EA does not work to open the orders, but only helps trader to use Trailing Stop.

Mirza Baig

shared author's Roberto Jacobs code

The SmartAssTrade-V2 Forex Expert Advisor

The SmartAssTrade-V2 Forex Expert Advisor is a new update for SmartAssTrade EA Version 1.

: