sathish kumar / Profile

HAI, I AM TRADER. I HOPE YOU ALL DOING WELL.

I USE FIBONACCI RETRACEMENT, SUPPORT AND RESISTANCE

I USE FIBONACCI RETRACEMENT, SUPPORT AND RESISTANCE

Friends

549

Requests

Outgoing

sathish kumar

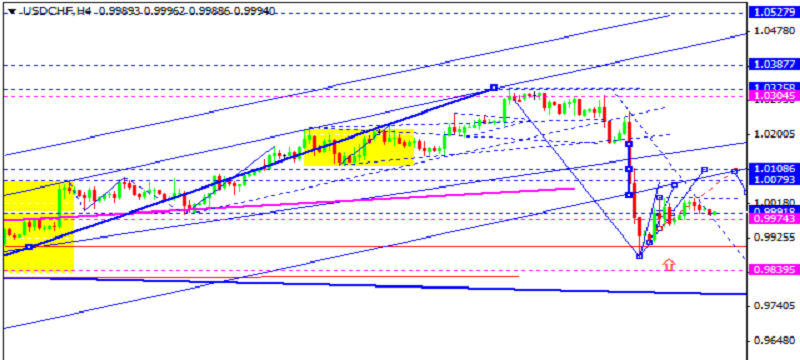

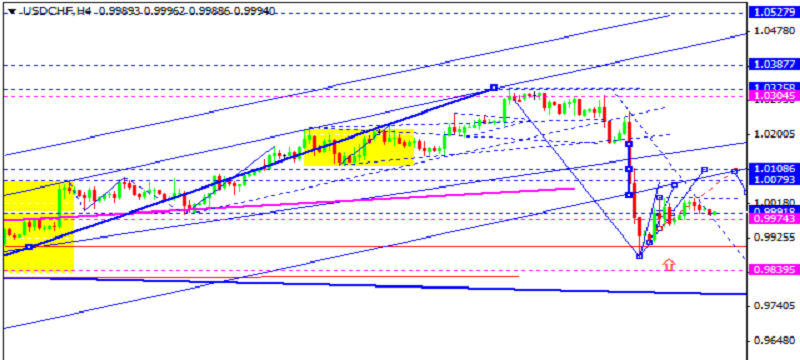

USD CHF, “US Dollar vs Swiss Franc” Franc is moving upwards to reach 1.0108. Later, in our opinion, the market may test 0.9990 from above , thus forming a new consolidation channel. If this channel is broken upwards, the pair may growing inside the uptrend to reach 1...

Share on social networks · 1

53

sathish kumar

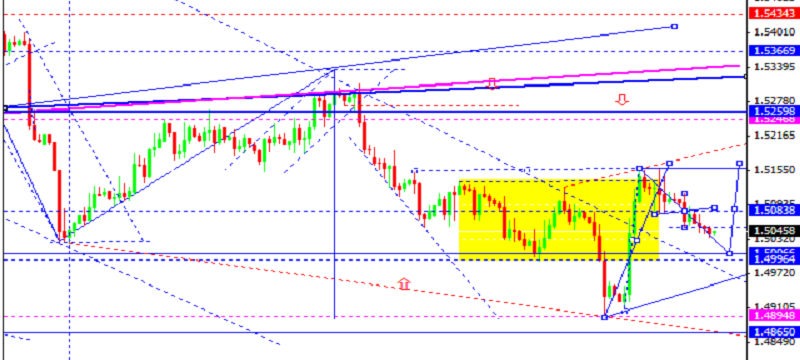

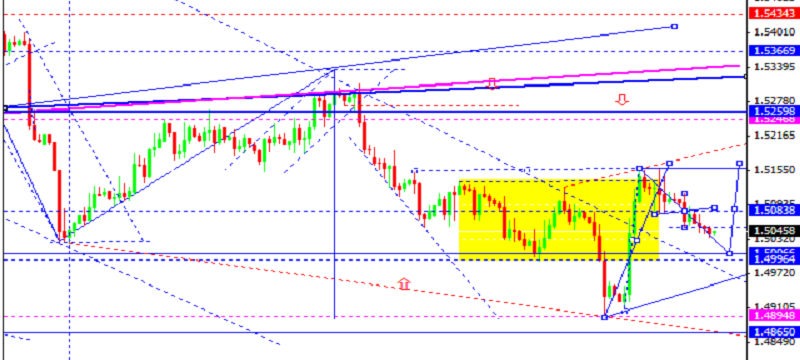

GBP USD, “Great Britain Pound vs US Dollar” Pound is being corrected towards 1.5000. After that, the instrument may grow to reach 1.5084 and then form another consolidation structure. If this structure is broken upwards, the market may grow to reach 1...

Share on social networks · 1

47

sathish kumar

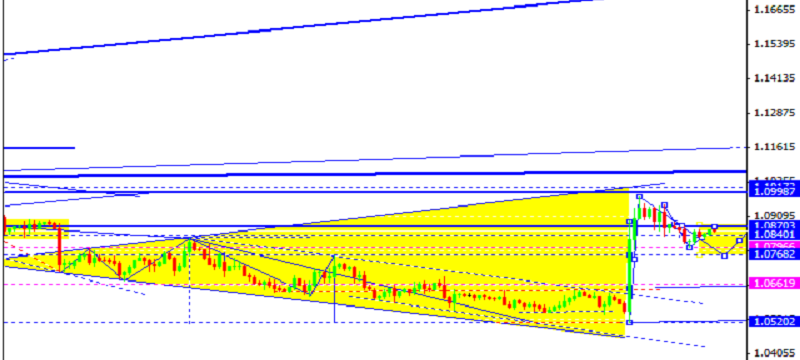

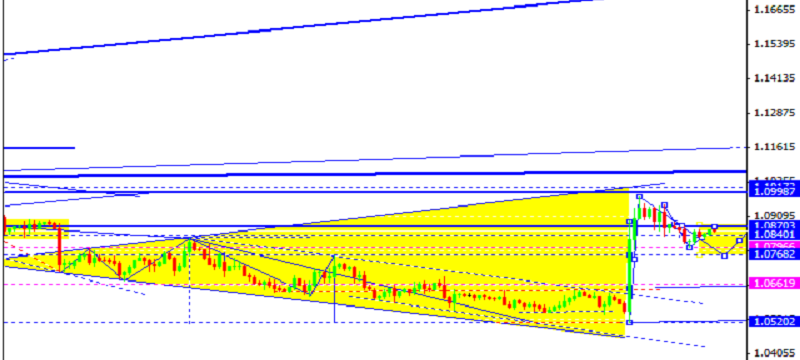

EUR USD, “Euro vs US Dollar” In case of Eurodollar, the correction continues. We think, today, the price may return to 1.0875 (at least) and then form another descending structure towards 1.0770. Later, in our opinion, the market may return to 1.0870 once again...

Share on social networks · 1

41

sathish kumar

Published post US: Lift-off, here we come – Danske Bank

Research Team at Danske Bank, suggests that in line with most other analysts and market participants we expect the Fed to hike 25bp at its meeting next week...

Share on social networks · 1

66

sathish kumar

Published post US employment report paves the way for Fed action – RBS

Research Team at RBS, suggests that all the economic boxes have been checked as the US November employment release paves the way for Fed action in December...

Share on social networks · 1

63

sathish kumar

USD CAD, “US Dollar vs Canadian Dollar” At the H1 chart, the market is trying to break the 7/8 level. If later the price is able to stay above this level in the nearest future, the pair may start a new descending correction towards the 4/8 level...

Share on social networks · 1

65

sathish kumar

Published post EUR/USD off highs, supported above 1.0900

The EUR/USD pair prolongs its recovery mode from post-ECB lows below 1.08 handle and now trades firmer above 1.09 handle, with 1.0983/ 1.10 back on sight. EUR/USD tested daily R1 at 1.0921 Currently, the EUR/USD pair rises 0.17% to 1.0911, easing-off fresh three-day highs posted at 1...

Share on social networks · 1

47

sathish kumar

USD CAD, “US Dollar vs Canadian Dollar” Canadian Dollar continues growing inside “overbought zone”. Earlier, the price was supported by the 6/8 level and rebounded from it several times. It’s highly likely that in the nearest future the market may break +2/8 level...

Share on social networks · 1

106

sathish kumar

EUR USD, “Euro vs US Dollar” At the H1 chart, Eurodollar is moving towards the 4/8 level. If the price rebounds from it, the ascending correction may continue. However, if the pair breaks the 4/8 level and stays below it, the market will continue falling...

Share on social networks · 1

74

sathish kumar

EUR USD, “Euro vs US Dollar” After rebounding from the 2/8, Eurodollar has started a new correction. If later the price is supported by the 0/8 level and rebounds from it, it may resume moving upwards. In case the market stays above the 2/8 level, it may continue growing much higher...

Share on social networks · 1

79

sathish kumar

Published post Russia: L-shaped recovery as economy set to grow marginally in 2016 – Danske Bank

Vladimir Miklashevsky, Economist at Danske Bank, suggests that the bank has raised their 2015 Russian GDP forecast to -3.9% y/y on 20 November 2015, from a 6...

Share on social networks · 1

60

sathish kumar

Published post CNY: Weaker Yuan under new Chinese regime - RBS

Mansoor Mohi-Uddin, Senior Market Strategist at RBS, notes that the Chinese authorities have fixed the rate almost lower each day since the start of November when it was set at 6.3154...

Share on social networks · 1

85

sathish kumar

Published post Emerging Markets: Brazil, Mexico and South Africa’s inflation in focus - TDS

Research Team at TDS, lists down the key inflation releases from the emerging markets. Key Quotes “BRL: IPCA inflation for Nov is expected to be 10.4% Y/Y, up from 9.93% Y/Y in Oct. This data point will both be meaningful and old news as we look to 2016...

Share on social networks · 1

40

sathish kumar

Published post Carry trade is back as the primary market driver – Deutsche Bank

Research Team at Deutsche Bank, suggests that over the past month, carry has turned into the primary market driver, attributable largely to the outperformance of the Antipodean high-yielders. Key Quotes “Trendiness remains at moderate levels in G10 across all dollar crosses...

Share on social networks · 1

56

sathish kumar

Published post Additional bearish EUR/USD bets added ahead of ECB – Danske Bank

Kristoffer Kjær Lomholt, Analyst at Danske Bank, notes that according to the latest IMM data covering the week from 24 November to 1 December 2015, revealed that it was the sixth consecutive week of bearish EUR/USD builds...

Share on social networks · 1

47

sathish kumar

Published post EUR/GBP to continue to grind lower - Rabobank

Jane Foley, Research Analyst at Rabobank, notes that since the start of the month EUR/GBP has recovered around 3.3% and the move is likely to have been greeted with some relief to BoE policy setters who have been viewing sterling strength as a headwind to UK economic activity...

Share on social networks · 1

68

sathish kumar

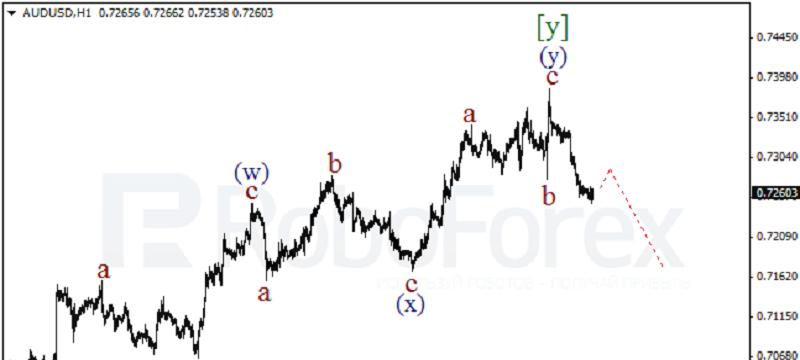

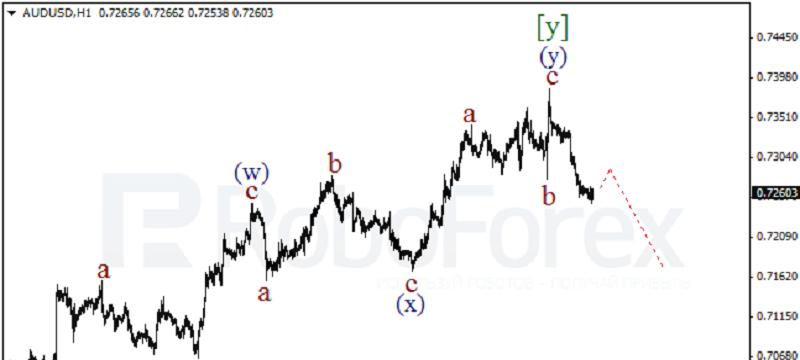

AUD USD, “Australian Dollar vs US Dollar” As we can see at the H1 chart, the market has formed the zigzag in the wave (y) and started a new descending impulse. On Tuesday, the pair may be corrected for a while and then continue falling...

Share on social networks · 1

46

sathish kumar

AUD USD, “Australian Dollar vs US Dollar” It's highly likely that Australian Dollar has finished the correctional wave 4. On the minor wave level, the pair has formed the double zigzag in the wave [y]. Possibly, in the future the market may fall in the wave (i...

Share on social networks · 1

44

sathish kumar

Published post Asia unimpressed by upbeat China CPI, German trade data eyed

Risk-off sentiment extends into Asia on Wednesday, mainly due to the ongoing weakness in oil prices. As a result, the demand for safe-havens was on the rise while the risk-currencies traded in the red...

Share on social networks · 1

64

sathish kumar

Published post Global economic outlook remain lacklustre - NAB

Research Team at NAB, suggests that although some of the risks hanging over global markets have abated, recent global economic growth and the outlook remains lacklustre...

Share on social networks · 1

57

: