sathish kumar / Profile

HAI, I AM TRADER. I HOPE YOU ALL DOING WELL.

I USE FIBONACCI RETRACEMENT, SUPPORT AND RESISTANCE

I USE FIBONACCI RETRACEMENT, SUPPORT AND RESISTANCE

Friends

549

Requests

Outgoing

sathish kumar

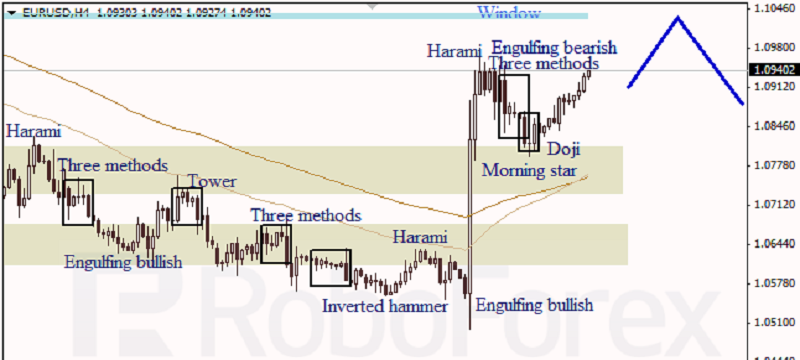

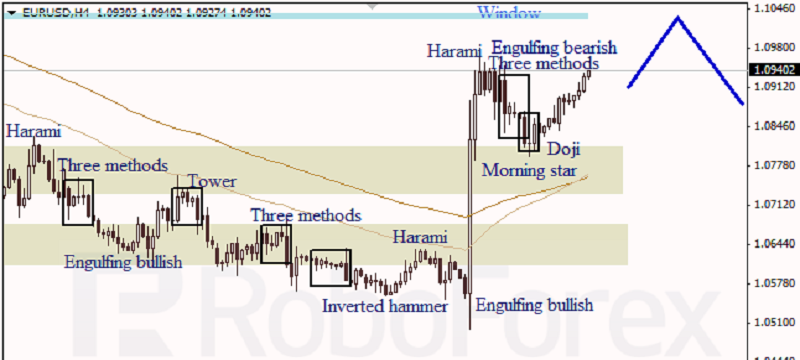

EURUSD 1 HOUR Japanese Candlesticks Analysis 09.12.2015

9 December 2015, 14:51

EUR USD, “Euro vs. US Dollar” The H1 chart of EUR USD shows a sideways correction. Three Methods pattern, Three Line Break chart, and Heiken Ashi candlesticks confirm an ascending movement...

Share on social networks · 1

67

sathish kumar

EURUSD 4 HOUR Japanese Candlesticks Analysis 09.12.2015

9 December 2015, 14:49

EUR USD, “Euro vs. US Dollar” At the H4 chart of EUR USD, Morning Star pattern near the support level indicated an ascending movement. The closest Window provides resistance. Three Line Break chart and Heiken Ashi candlesticks confirm a bullish direction...

Share on social networks · 1

63

sathish kumar

Published post Gold: gains capped by 5-DMA

The two-day rally seen in gold appears to lose steam near 5-DMA placed at 1079 levels and the price drifted lower amid positive sentiment on the European stocks. Gold: Higher lows on daily charts, breakout in sight? Currently, gold trades marginally higher at 1076...

Share on social networks · 1

68

sathish kumar

Published post USDCNY on a new high, will the USDJPY follow the same path? - BNPP

Research Team at BNP Paribas, notes that the USDCNY reached a new high this morning at 6.4250 as Chinese authorities allowed further RMB depreciation. Key Quotes “This trend is consistent with our expetctations that the pair will trend towards 6.60 during 2016 as the USD rebounds...

Share on social networks · 1

88

sathish kumar

Published post USD/JPY attempts recovery along with European stocks

The bid tone on the JPY is seen easing post-European open, sending USD/JPY back towards 123 handle as risk-on returns to markets. USD/JPY: Risk-on seeps back Currently, the USD/JPY pair trades -0.09% lower at 122.81, recovering from session lows reached at 122.64 levels...

Share on social networks · 2

43

sathish kumar

Published post BoE will likely hold rates steady tomorrow; McCafferty can be the lone hawk yet again

The Bank of England has held interest rates at record low of 0.5 per cent since March 2009. There is a lot of speculation in the market with respect to the timing of the rate hike. Bank Governor Mark Carney told lawmakers on that interest rates were likely to stay low for "some time...

Share on social networks · 2

62

sathish kumar

Published post GBP/JPY rebounds from Fib support

The GBP/JPY pair ran into fresh bids near 184.02 (23.6% of 195.88-180.36) and recovered losses to trade largely unchanged around 184.45 levels. Stuck between key Fib levels The cross has been stuck between key fib levels – 184.02 (23.6% of 195.88-180.36) and 186.29 (38.2% of 195.88-180.36...

Share on social networks · 2

48

sathish kumar

Published post European equities rise in early trading, FTSE up 0.4%

The stock markets across Europe opened on a positive note, tracking the relief rally in oil. The mining-heavy London’s FTSE index advanced 0.4%. The pan-European Euro Stoxx 50 index was largely unchanged. France’s CAC was up 0.20%, while Germany’s DAX was trading dead flat...

Share on social networks · 2

66

sathish kumar

Published post GBP/USD struggles to extend beyond hourly 50-MA

The GBP/USD pair stages a solid comeback this session, bringing an end to three consecutive days of declines, mirroring the recovery in oil prices. GBP/USD finding support above daily pivot at 1.5008 The GBP/USD pair trades 0.18% higher at 1.5037, having posted fresh session highs at 1.5043...

Share on social networks · 1

58

sathish kumar

Published post JPY: Rising current account surplus for Japan – Deutsche Bank

Taisuke Tanaka, Research Analyst at Deutsche Bank, suggests that the rising current account surplus of Japan can contribute to capping USD/JPY upcycle in 2016. Key Quotes “Japan’s C/A surplus has been expanding...

Share on social networks · 1

58

sathish kumar

Published post JPY: Rising current account surplus for Japan – Deutsche Bank

Taisuke Tanaka, Research Analyst at Deutsche Bank, suggests that the rising current account surplus of Japan can contribute to capping USD/JPY upcycle in 2016. Key Quotes “Japan’s C/A surplus has been expanding...

Share on social networks · 1

49

sathish kumar

Published post EUR/GBP looks overbought – Danske Bank

Senior Analyst at Danske Bank Pernille Henneberg sees the cross entering in the overbought territory following the recent rally...

Share on social networks · 1

56

sathish kumar

Published post World Bank sees no recovery in commodity prices over next 5 years

World Bank, in its latest review, mentioned the commodity prices are unlikely to see a recovery over the next 5 years. The review also says African currencies have depreciated due to anticipated US interest rate hike...

Share on social networks · 1

93

sathish kumar

Published post EUR/CHF advances to 1.0840

The single currency keeps appreciating vs. its Swiss peer on Wednesday, pushing EUR/CHF to test highs around 1.0840. EUR/CHF within range ahead of SNB The cross seems now to be stabilizing around the mid-1.0800s after being rejected from the 1...

Share on social networks · 1

60

sathish kumar

Published post Oil sees relief rally as US inventories dip

Oil prices at both the sides of the Atlantic rose today as oil stocks in the US dipped. At the time of writing, the WTI oil Jan futures were up 1.77% or 66 cents at USD 38.17/barrel. Brent futures were up 1.2% or 50 cents at USD 40.77/barrel...

Share on social networks · 1

93

sathish kumar

Published post USD usually weakens after the first hike – Danske Bank

Research Team at Danske Bank, suggests that when looking at the previous hiking cycles there is a tendency for the USD (DXY index) to weaken after the first Fed hike...

Share on social networks · 1

62

sathish kumar

Published post BoE: Expect no fireworks - RBS

Research Team at RBS, suggests that the Bank of England holds its December monetary policy decision, and we do not expect a change in interest rates by the Bank of England...

Share on social networks · 1

58

sathish kumar

Published post USD RUB Technical Analysis

USD RUB, “US Dollar vs Russian Ruble” Russian Ruble continues moving upwards as the oil prices hit new lows. The market has reached the target of the extension. We think, today, the price may form a consolidation channel and a reversal pattern...

Share on social networks · 1

185

sathish kumar

USD RUB, “US Dollar vs Russian Ruble” Russian Ruble continues moving upwards as the oil prices hit new lows. The market has reached the target of the extension. We think, today, the price may form a consolidation channel and a reversal pattern...

Share on social networks · 2

45

sathish kumar

USD JPY, “US Dollar vs Japanese Yen” Yen is forming the ascending structure with the target at 123.50. After that, the instrument may return to 123.00. Later, the price may break its consolidation channel upwards to reach 124.50...

Share on social networks · 1

64

: