Ali Mohammadi / Profile

Friends

214

Requests

Outgoing

Ali Mohammadi

GBP/USD is currently trading with a bullish bias. Yesterday, the pair rebounded from the resistance level 1.47068, headed short and is still pretty much bearish. We expect the current upward rally to be a mere upward pullback and should not close above 1.4729, a close above this level will lead to an acceleration towards 1.4818, while a clear rebound from 1.4706-1.4729 will confirm the anticipated momentum to the lower side. This pair should be traded alongside GBP/CHF, and GBP/JPY. These pairs have a strong positive correlation of up to +0.85 and will have a similar price action during this intraday.

Ali Mohammadi

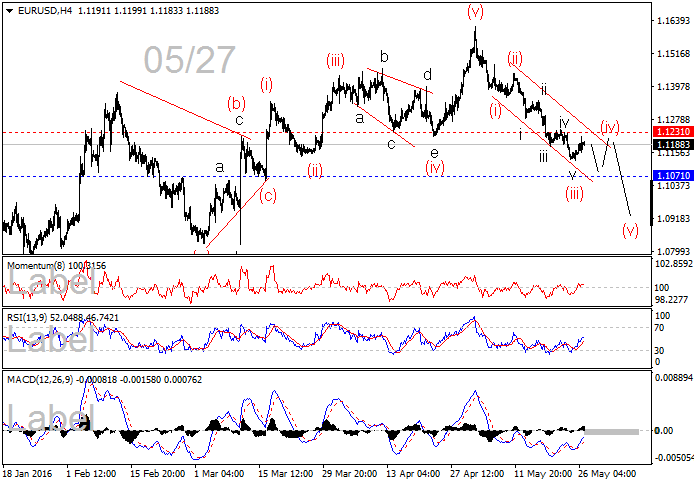

n acceleration to the lower side. This pair should be traded alongside NZD/USD, and AUD/USD. These pairs have a strong positive correlation of up to +0.89 and will likely have a similar price action during this intraday.

Trade Recommendations:

As long as the pair trades within the rising channel, remain long with you target at 1.12177. A break above this target will call for further long positions with the next target at 1.1283.

Trade Recommendations:

As long as the pair trades within the rising channel, remain long with you target at 1.12177. A break above this target will call for further long positions with the next target at 1.1283.

Ali Mohammadi

Ali Mohammadi

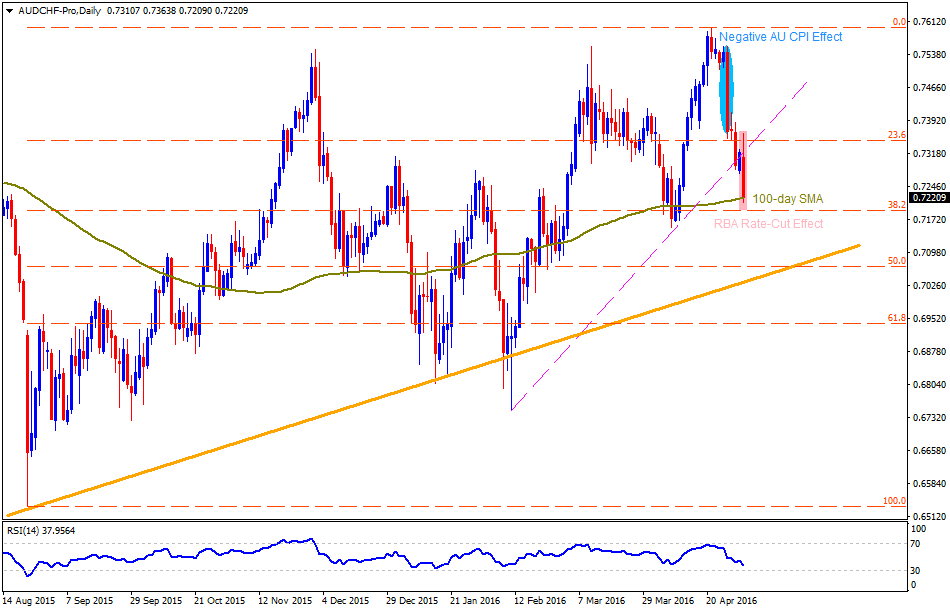

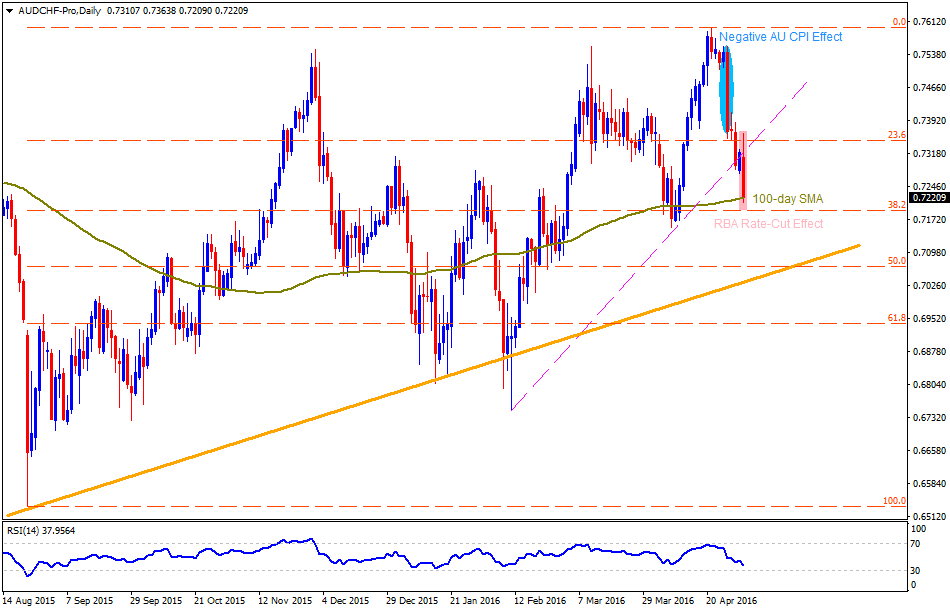

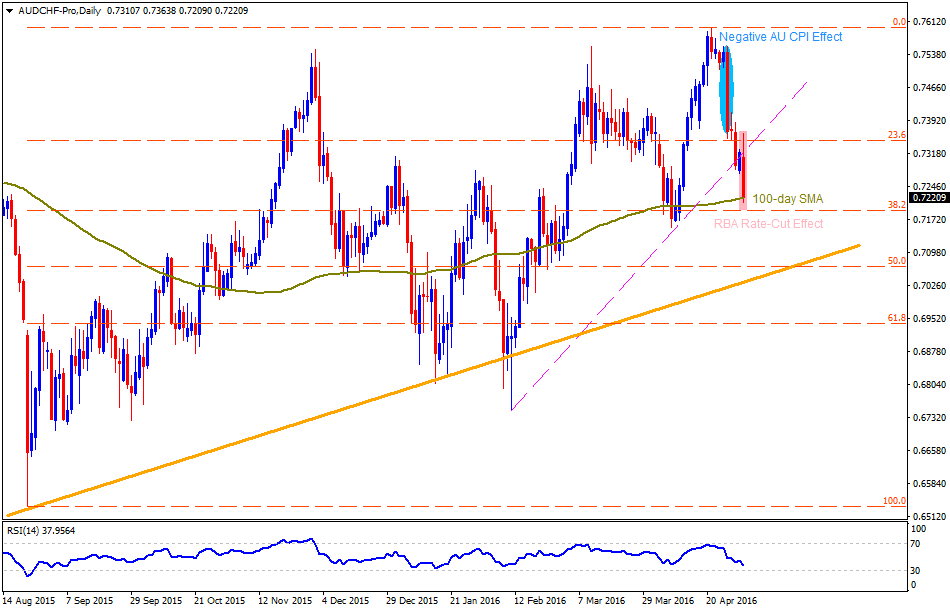

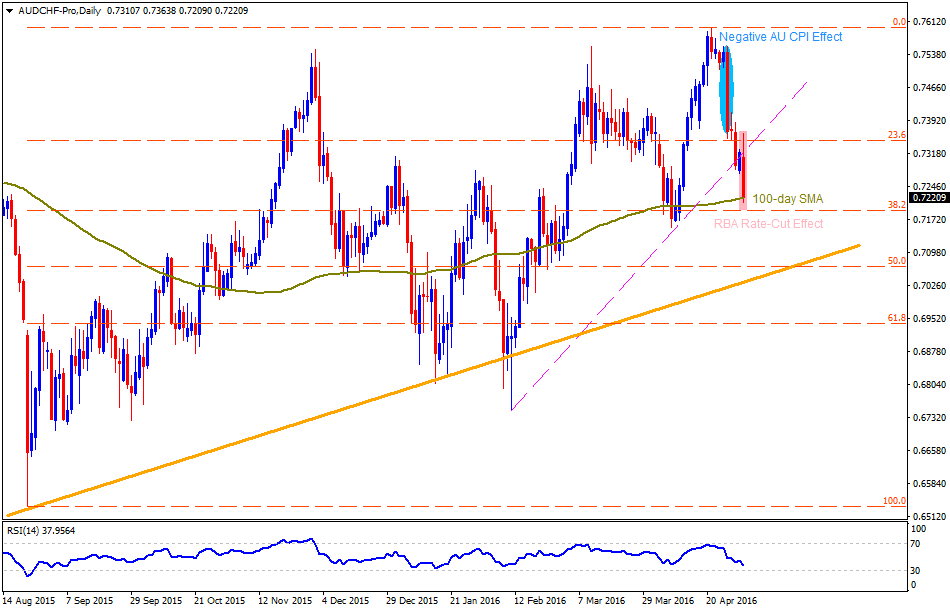

0.7240-50 can act as immediate resistance that the pair might target during its pullback from the SMA, breaking which 0.7300 and the 23.6% Fibo, near 0.7345-50, might offer intermediate resistance prior to fueling it towards 0.7420. If the successfully breaks above 0.7420, chances of its rally to 0.7470 and the 0.7550 can't be denied.

2

Ali Mohammadi

0.7240-50 can act as immediate resistance that the pair might target during its pullback from the SMA, breaking which 0.7300 and the 23.6% Fibo, near 0.7345-50, might offer intermediate resistance prior to fueling it towards 0.7420. If the successfully breaks above 0.7420, chances of its rally to 0.7470 and the 0.7550 can't be denied.

Ali Mohammadi

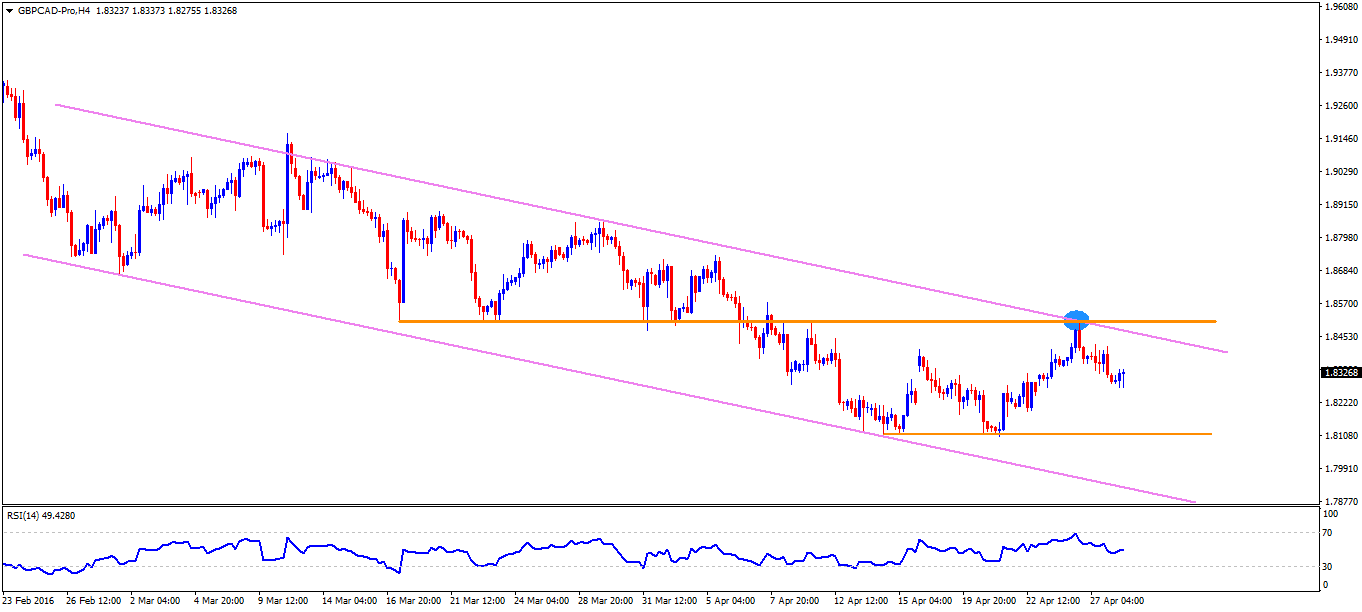

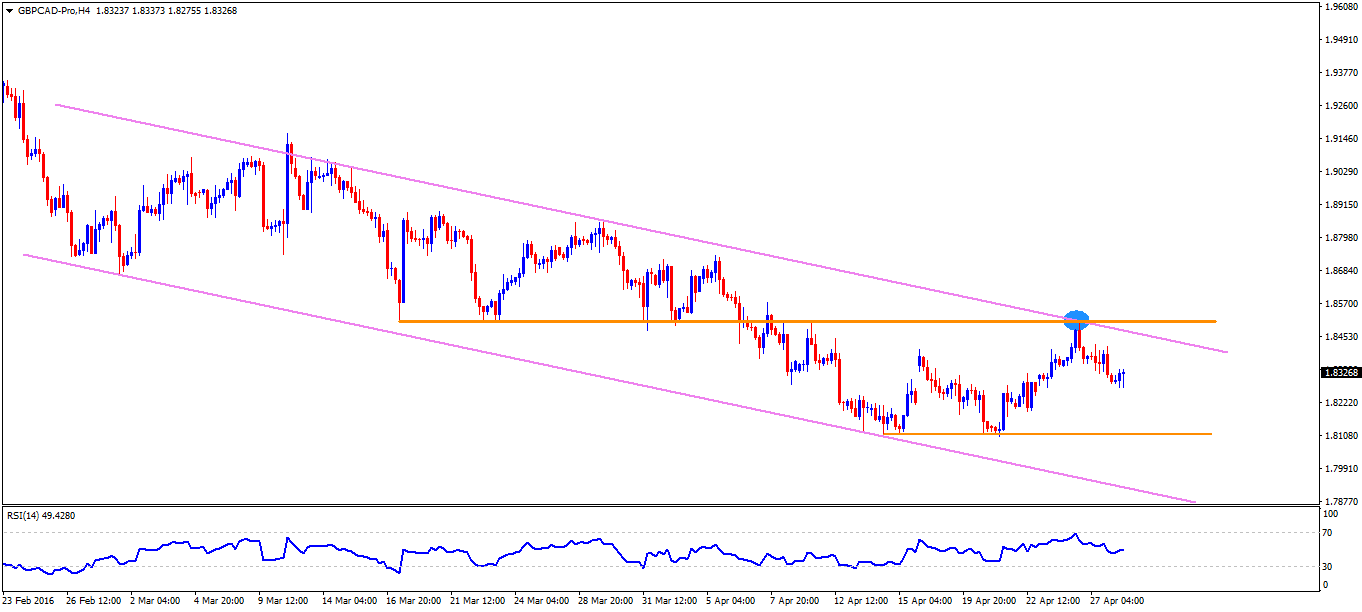

Having failed to clear the 1.8500 resistance confluence, comprising resistance-line of two-month old descending trend-channel and a horizontal resistance stretched since mid-March, the GBPCAD presently indicated its fresh downside to 1.8235-30 immediate support, breaking which 1.8185 and the 1.8150 are likely buffer levels that the pair can pass through prior to targeting the 1.8100 horizontal support re-test. If the pair continues dipping down below 1.8100, the 1.8000 psychological magnet and the channel support of 1.7930 may become reality to watch. Meanwhile, 1.8350, 1.8430 and the trend-line resistance of 1.8465 could entertain the pair's pullback before it could revisit the 1.8500 mark. Should it manage to break above 1.8500, chances of its rise to 1.8615 and the 1.8700 can't be denied.

Ali Mohammadi

Given the pair's sustained trading above 1.4560, the 1.4725-30 confluence, including three month old descending trend-line and the recently broke support-turned-resistance-line, can limit the pair's north-run.

Ali Mohammadi

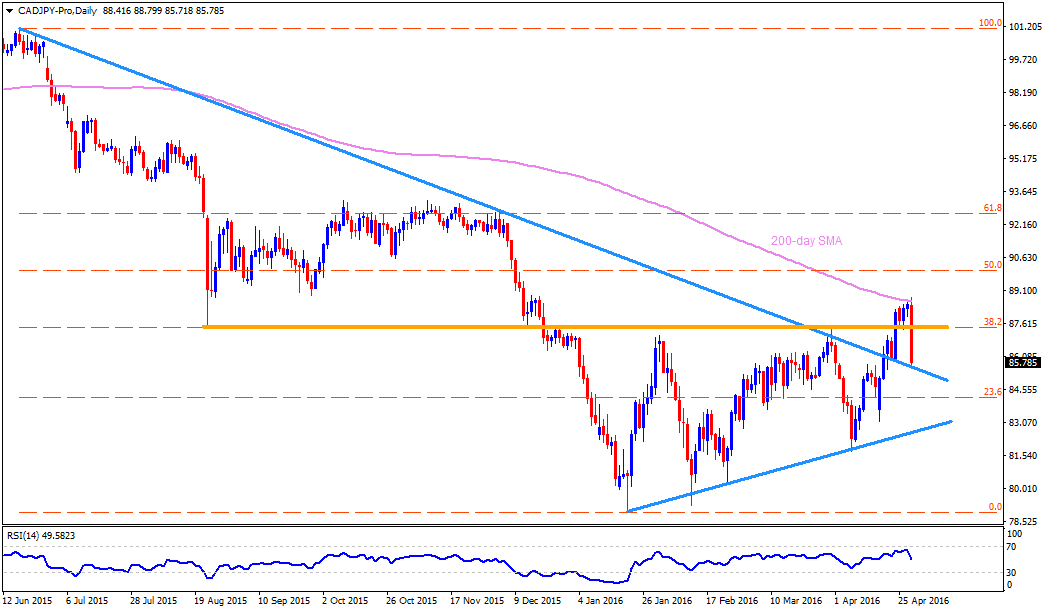

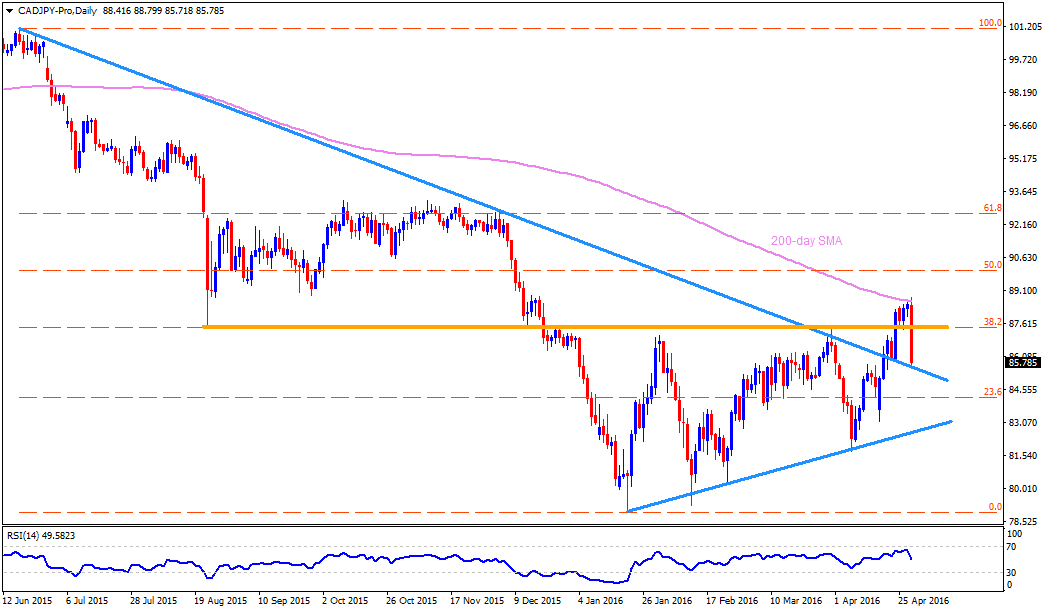

pair's further drop below 85.00 can fetch it to 23.6% Fibonacci Retracement of its June 2015 – January 2016 decline, near 84.10, and then towards three month old ascending trend-line support of 82.50.

Ali Mohammadi

Did Yen Traders Overreact or is USD/JPY 105 Next?

Daily FX Market Roundup 04.28.16

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management

It took no more than 3 minutes for USD/JPY to fall 300 pips with the sell-off spilling over to the yen crosses. The meltdown in USD/JPY was driven by the Bank of Japan's failure to add stimulus and indication to the market that they wanted to wait and see how negative interest rates affect the economy before easing again. Today's 3% decline took USD/JPY within pips of its 18-month low set in April and many contrarians are looking at today's move and wondering if investors are overreacting to last night's Bank of Japan announcement.

The last time the Yen rose this much was in late August when the Shanghai Composite Index plunged sharply, triggering concerns about regional growth and the Fed's ability to raise interest rates in September. The current backdrop is very different because the markets are stable and risk aversion is limited. Today's comments indicate that the BoJ is in no rush to increase stimulus, but having lowered their inflation and growth forecasts and pushed out the date by which they expect to reach their inflation target, the central bank still remains dovish. Kuroda expressed concerns about weakness in consumer spending, output and exports and warned that the BoJ could still ease in all 3 dimensions (quality, quantity and rates) if needed. In other words, the BoJ is still on track to increase stimulus this year especially after last night's weak inflation numbers.

However just because we expect the BoJ to ease again doesn't mean that we don't anticipate further losses in USD/JPY. The main takeaway from the BoJ meeting is the Japanese feel no immediate pressure to use monetary policy or currency intervention to turn around the economy. They feel like they've done enough for the time being and want to see how the economy reacts first. If the BoJ did not intervene in April and passed on cutting rates last night, they won't be intervening now unless USD/JPY drops to 105. They are clearly passing the baton to Prime Minister Abe and pressuring the government for more aggressive fiscal stimulus. If USD/JPY breaks below the April low of 107.63 (and we think it will), the next stop will be 106.65, the 38.2% Fibonacci retracement of the 2011 to 2015 rally.

The second best performing currency next to the Yen was the New Zealand dollar, which also benefitted from misaligned expectations. The RBNZ left monetary policy unchanged and like the BoJ, they maintained a dovish bias, saying that further policy easing may be required and that a lower New Zealand dollar is desirable. Nothing they said removes the possibility of additional easing and recent data only encourages the need for it but a subset of investors were positioned for a rate cut and when the RBNZ failed to deliver, they bailed out of their positions, sending NZD/USD sharply higher. Gains in the New Zealand dollar also helped to lift the Australian dollar but tonight's inflation report could sap some of those gains.

USD/CAD fell to a fresh 8 month low as oil prices climbed to its strongest level in 4 months. Oil is above $45 a barrel and that goes a long way in helping Canada's economy recover. February GDP numbers are scheduled for release tomorrow. While economists are looking for a decline in growth, the recent uptick in consumer spending leaves room for an upside surprise that could drive USD/CAD below 1.25.

The U.S. dollar ended the day lower against all of the major currencies despite mixed GDP data. Growth in the first quarter slowed to 0.5% from 1.4% and while this was weaker than expected, personal consumption and the GDP price index beat expectations. Jobless claims also continued to fall but the decline in Treasury yields tell us that investors are not convinced that these reports increase the chance of June tightening. Personal income, spending, Chicago PMI and revisions to the University of Michigan consumer sentiment report are scheduled for release on Friday but none of these numbers are significant enough to turn the dollar around.

The British pound resumed its rise against the U.S. dollar after a one-day pullback. The February high of 1.4670 remains the initial target for the pair. Unsurprisingly, sterling shrugged off slower house price growth and if tomorrow's mortgage approvals and net consumer credit numbers are weak, will ignore those as well. Gains in the currency were supported by optimistic comments from Bank of England Governor Carney. The central bank head acknowledged that the U.K. economy appears to be slowing in the very short term but he believes it is performing pretty well with wages expected to pick up. He warned about the risk of the E.U. referendum but it fell on deaf ears.

Finally, stronger economic data from the Eurozone provided a minor boost to the euro. German unemployment declined 16k in April, keeping the unemployment rate steady at 6.2%. Consumer prices in Germany declined but economic confidence in the Eurozone increased, led by gains in the industrial and service sectors. German retail sales are scheduled for release tomorrow but the main focus will be on first quarter Eurozone GDP and April CPI. Growth is expected to have accelerated in the first 3 months of the year but if that fails to be true, euro will give up its gains.

Daily FX Market Roundup 04.28.16

By Kathy Lien, Managing Director of FX Strategy for BK Asset Management

It took no more than 3 minutes for USD/JPY to fall 300 pips with the sell-off spilling over to the yen crosses. The meltdown in USD/JPY was driven by the Bank of Japan's failure to add stimulus and indication to the market that they wanted to wait and see how negative interest rates affect the economy before easing again. Today's 3% decline took USD/JPY within pips of its 18-month low set in April and many contrarians are looking at today's move and wondering if investors are overreacting to last night's Bank of Japan announcement.

The last time the Yen rose this much was in late August when the Shanghai Composite Index plunged sharply, triggering concerns about regional growth and the Fed's ability to raise interest rates in September. The current backdrop is very different because the markets are stable and risk aversion is limited. Today's comments indicate that the BoJ is in no rush to increase stimulus, but having lowered their inflation and growth forecasts and pushed out the date by which they expect to reach their inflation target, the central bank still remains dovish. Kuroda expressed concerns about weakness in consumer spending, output and exports and warned that the BoJ could still ease in all 3 dimensions (quality, quantity and rates) if needed. In other words, the BoJ is still on track to increase stimulus this year especially after last night's weak inflation numbers.

However just because we expect the BoJ to ease again doesn't mean that we don't anticipate further losses in USD/JPY. The main takeaway from the BoJ meeting is the Japanese feel no immediate pressure to use monetary policy or currency intervention to turn around the economy. They feel like they've done enough for the time being and want to see how the economy reacts first. If the BoJ did not intervene in April and passed on cutting rates last night, they won't be intervening now unless USD/JPY drops to 105. They are clearly passing the baton to Prime Minister Abe and pressuring the government for more aggressive fiscal stimulus. If USD/JPY breaks below the April low of 107.63 (and we think it will), the next stop will be 106.65, the 38.2% Fibonacci retracement of the 2011 to 2015 rally.

The second best performing currency next to the Yen was the New Zealand dollar, which also benefitted from misaligned expectations. The RBNZ left monetary policy unchanged and like the BoJ, they maintained a dovish bias, saying that further policy easing may be required and that a lower New Zealand dollar is desirable. Nothing they said removes the possibility of additional easing and recent data only encourages the need for it but a subset of investors were positioned for a rate cut and when the RBNZ failed to deliver, they bailed out of their positions, sending NZD/USD sharply higher. Gains in the New Zealand dollar also helped to lift the Australian dollar but tonight's inflation report could sap some of those gains.

USD/CAD fell to a fresh 8 month low as oil prices climbed to its strongest level in 4 months. Oil is above $45 a barrel and that goes a long way in helping Canada's economy recover. February GDP numbers are scheduled for release tomorrow. While economists are looking for a decline in growth, the recent uptick in consumer spending leaves room for an upside surprise that could drive USD/CAD below 1.25.

The U.S. dollar ended the day lower against all of the major currencies despite mixed GDP data. Growth in the first quarter slowed to 0.5% from 1.4% and while this was weaker than expected, personal consumption and the GDP price index beat expectations. Jobless claims also continued to fall but the decline in Treasury yields tell us that investors are not convinced that these reports increase the chance of June tightening. Personal income, spending, Chicago PMI and revisions to the University of Michigan consumer sentiment report are scheduled for release on Friday but none of these numbers are significant enough to turn the dollar around.

The British pound resumed its rise against the U.S. dollar after a one-day pullback. The February high of 1.4670 remains the initial target for the pair. Unsurprisingly, sterling shrugged off slower house price growth and if tomorrow's mortgage approvals and net consumer credit numbers are weak, will ignore those as well. Gains in the currency were supported by optimistic comments from Bank of England Governor Carney. The central bank head acknowledged that the U.K. economy appears to be slowing in the very short term but he believes it is performing pretty well with wages expected to pick up. He warned about the risk of the E.U. referendum but it fell on deaf ears.

Finally, stronger economic data from the Eurozone provided a minor boost to the euro. German unemployment declined 16k in April, keeping the unemployment rate steady at 6.2%. Consumer prices in Germany declined but economic confidence in the Eurozone increased, led by gains in the industrial and service sectors. German retail sales are scheduled for release tomorrow but the main focus will be on first quarter Eurozone GDP and April CPI. Growth is expected to have accelerated in the first 3 months of the year but if that fails to be true, euro will give up its gains.

Ali Mohammadi

Break of two-month old descending trend-line enabled GBPUSD to surpass 100-day SMA for the first time in nearly seven months, signaling further rise to 1.4580 and the 1.4670-80 adjacent resistances. If the pair manage to clear the 1.4670-80 horizontal resistance-region, including 50% Fibonacci Retracement of its October 2015 – February 2016 downside, it can accelerate the upward trajectory towards 1.4800 and the 1.4945-50 resistances. Should the pair reverses from current levels, 38.2% Fibo level of 1.4470, the 100-day SMA, at 1.4420 now, and the trend-line resistance-turned-support, around 1.4380, are consecutive levels to observe. Though, pair's sustained trading below 1.4380 can trigger its fresh south-run towards 1.4280 and the 1.4130 support levels.

Ali Mohammadi

برخی ها نمی خواهند ضرر را بپذیرند. آنها علیرغم داشتن معامله زیان ده همچنان می خواهند بازار در جهت موافق آنها حرکت کند. در این مسیر از تمام اهرم ها هم بهره می برند!!!

https://www.instagram.com/p/BEBvgPMo_28/?taken-by=dramohammadi

https://telegram.me/Mychart/1547

https://www.instagram.com/p/BEBvgPMo_28/?taken-by=dramohammadi

https://telegram.me/Mychart/1547

Ali Mohammadi

Added topic PIVBOLL STRATEGY

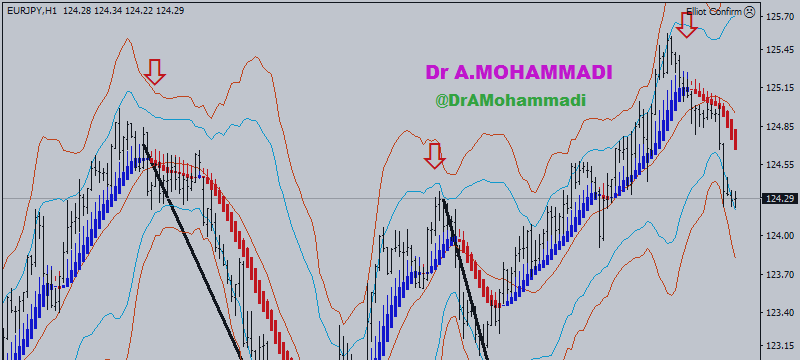

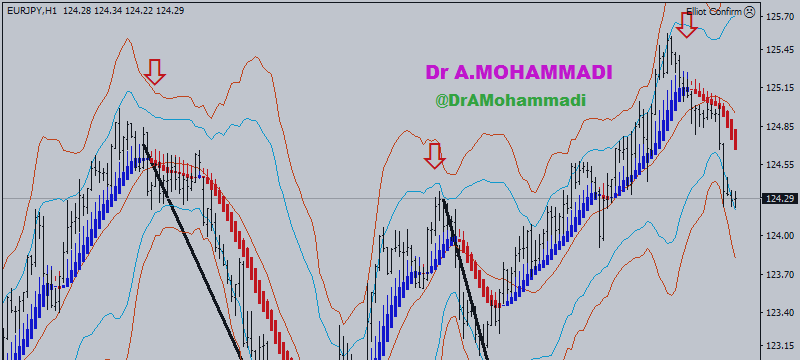

PIVBOLL is the specific Strategy. Most traders have an extremely hard time trading with the trend. This observation may seem counterintuitive since the majority of traders always claim that trend trading is their preferred approach

Ali Mohammadi

New Entry of PIVBOLL: Type: Sell Entry:125.30 TP1: 124:30 TP2:123:20...

Share on social networks · 1

82

: