Seyedmajid Masharian / Profile

forex trader

at

home

Seyedmajid Masharian

MOST OF TIMES PRICE IS A LIAR AND JUST A FEW TIMES PRICE WILL TELL YOU THE TRUTH

DISTINGUISHING FAKE PRICE FROM REAL ONE IS THE ART OF SUCCESSFUL TRADERS $$$

23 Investing Lessons from George Soros

Price Is a Liar

When John Burbank of Passport Capital spoke at our iCIO event, the title of his speech was “Price is a Liar,” a concept that Soros expounds upon when he says, “the generally accepted view is that markets are always right, that is, market prices tend to discount future developments accurately even when it is unclear what those developments are. I start with the opposite view. I believe the market prices are always wrong in the sense that they present a biased view of the future.” The construct here is that in a Reflexive world, where markets tend not toward equilibrium but toward disequilibrium, the current price of a security is not a reflection of “fair value” as the Efficient Markets Hypothesis would have us believe, but rather a temporary “unfair value” driven by the virtuous, or vicious, cycles created by market participants’ misperceptions and the resulting collective inappropriate actions that come from participants acting on those misperceptions.

continue reading ...

https://www.caseyresearch.com/23-investing-lessons-from-george-soros/

DISTINGUISHING FAKE PRICE FROM REAL ONE IS THE ART OF SUCCESSFUL TRADERS $$$

23 Investing Lessons from George Soros

Price Is a Liar

When John Burbank of Passport Capital spoke at our iCIO event, the title of his speech was “Price is a Liar,” a concept that Soros expounds upon when he says, “the generally accepted view is that markets are always right, that is, market prices tend to discount future developments accurately even when it is unclear what those developments are. I start with the opposite view. I believe the market prices are always wrong in the sense that they present a biased view of the future.” The construct here is that in a Reflexive world, where markets tend not toward equilibrium but toward disequilibrium, the current price of a security is not a reflection of “fair value” as the Efficient Markets Hypothesis would have us believe, but rather a temporary “unfair value” driven by the virtuous, or vicious, cycles created by market participants’ misperceptions and the resulting collective inappropriate actions that come from participants acting on those misperceptions.

continue reading ...

https://www.caseyresearch.com/23-investing-lessons-from-george-soros/

Seyedmajid Masharian

NO OTHER PERSON CAN HELP YOU ACHIEVE SUCCESS

THIS IS A PATH YOU SHOULD WALK LONELY...

THIS IS A PATH YOU SHOULD WALK LONELY...

Seyedmajid Masharian

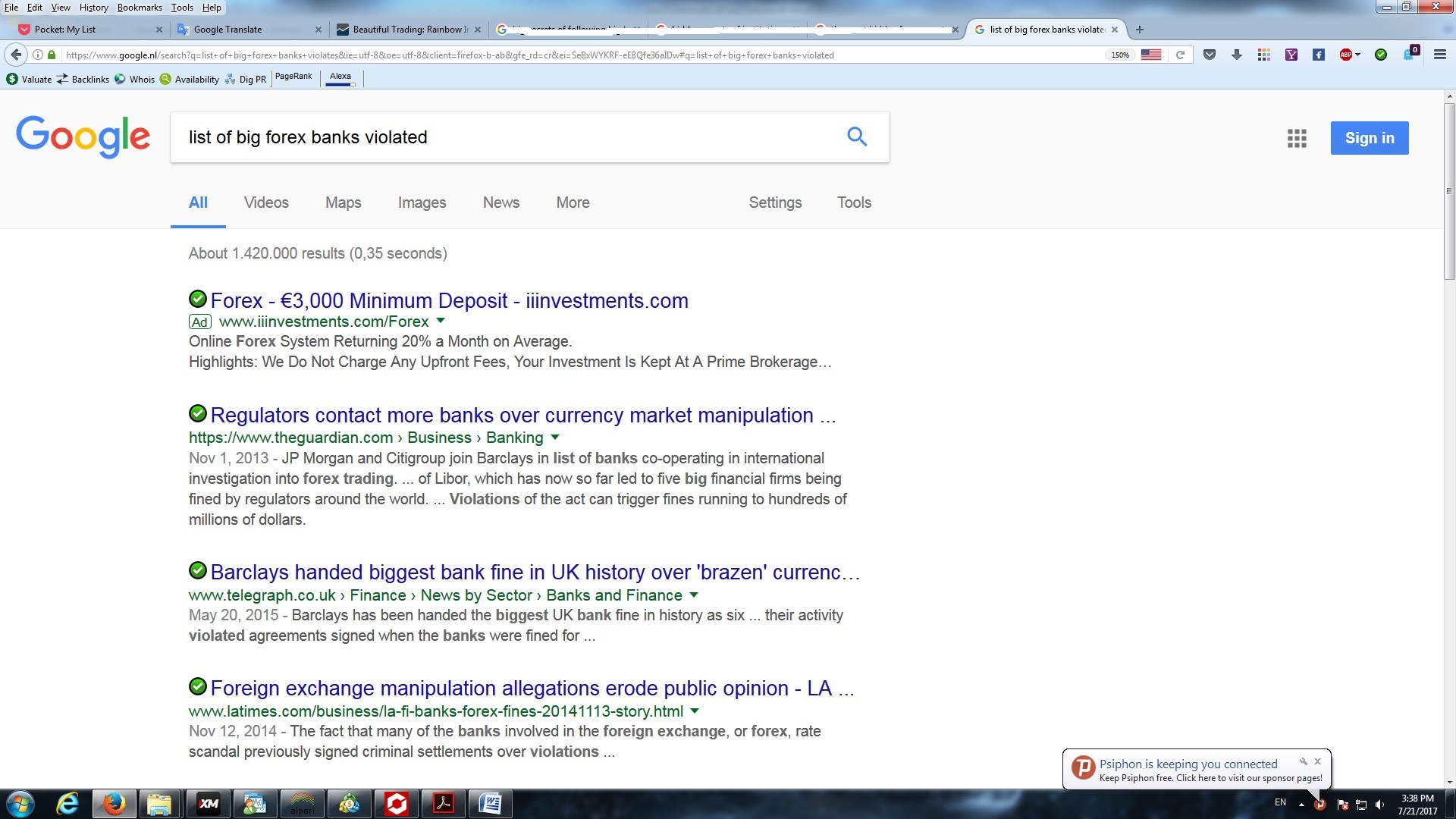

DO YOU WANT TO WIN IN ALL FINANCIAL MARKETS AND MAKE A FORTUNE ?

JUST KNOW BIG PLAYERS GAME RULES AND PLAY WITH THEIR OWN METHOD WITH THEM....

THIS IS THE ONLY PROVEN METHOD TO BEAT BIG BANKS AND HEDGE FUNDS REGULARLY AND CONSISTENTLY...

SEYED MAJID MASHARIAN

JUST KNOW BIG PLAYERS GAME RULES AND PLAY WITH THEIR OWN METHOD WITH THEM....

THIS IS THE ONLY PROVEN METHOD TO BEAT BIG BANKS AND HEDGE FUNDS REGULARLY AND CONSISTENTLY...

SEYED MAJID MASHARIAN

Seyedmajid Masharian

Why Trading ‘End-of-Day’ Strategies Will Improve Your Results

What is ‘End-of-Day’ Trading, what will it do for you and how exactly do you trade ‘End-of-Day’ strategies? Continue reading to find out…

When I talk about ‘End-of-Day’ trading strategies, what I am basically talking about is trading based on the daily chart time frame. We are focusing on daily chart candles that are closed out, not candles that are still open. The actual daily close of the Forex market occurs at 5pm New York time, however, not all brokers provide charts that show the 5pm New York close. To make sure you are seeing the true daily close of the market, you need a broker that offers 5 daily bars per week that close at 5pm New York time. Here’s a link to get the right charting platform – New York close charts.

http://www.learntotradethemarket.com/forex-trading-strategies/trading-end-of-day-strategies

What is ‘End-of-Day’ Trading, what will it do for you and how exactly do you trade ‘End-of-Day’ strategies? Continue reading to find out…

When I talk about ‘End-of-Day’ trading strategies, what I am basically talking about is trading based on the daily chart time frame. We are focusing on daily chart candles that are closed out, not candles that are still open. The actual daily close of the Forex market occurs at 5pm New York time, however, not all brokers provide charts that show the 5pm New York close. To make sure you are seeing the true daily close of the market, you need a broker that offers 5 daily bars per week that close at 5pm New York time. Here’s a link to get the right charting platform – New York close charts.

http://www.learntotradethemarket.com/forex-trading-strategies/trading-end-of-day-strategies

Seyedmajid Masharian

IF YOU WANT TO MAKE MONEY TRADING CONSISTENTLY YOU HAVE TO MOVE FROM INTRADAY TRADING TO SWING

TRADING... AS SOON AS POSSIBLE

FORGET EVERYTHING ABOUT LOWER TIME FRAMES OF DAILY

TRADING... AS SOON AS POSSIBLE

FORGET EVERYTHING ABOUT LOWER TIME FRAMES OF DAILY

Seyedmajid Masharian

HOW MANY PERCENT OF RETAIL TRADERS HAVE COMPLETE CONTROL ON THEIR OWN POWERFUL EMOTIONS IN THEIR BRAINS DURING LOSING AND WINING PERIODS ... ?

I THINK MAYBE %1 EVEN LESS THAN %1 $$$

AND REMAINING %99 WILL WIPE OUT THEIR ACCOUNTS SOON OR LATE , BECAUSE THEY WILL DEFEATED TO THEIR OWN FEAR , GREED AND REVENGE EMOTIONS.

THAT'S WHY BROKERAGES ARE GROWING JUST LIKE MUSHROOMS...

THEY KNOW SOON OR LATE YOU WILL GIVE THEM YOUR HARD EARNED MONEY.

I THINK MAYBE %1 EVEN LESS THAN %1 $$$

AND REMAINING %99 WILL WIPE OUT THEIR ACCOUNTS SOON OR LATE , BECAUSE THEY WILL DEFEATED TO THEIR OWN FEAR , GREED AND REVENGE EMOTIONS.

THAT'S WHY BROKERAGES ARE GROWING JUST LIKE MUSHROOMS...

THEY KNOW SOON OR LATE YOU WILL GIVE THEM YOUR HARD EARNED MONEY.

Seyedmajid Masharian

Beautiful Trading: Rainbow Indicator

Source: http://dewinforex.com/forex-indicators/beautiful-trading-rainbow-indicator.html

Source: http://dewinforex.com/forex-indicators/beautiful-trading-rainbow-indicator.html

Seyedmajid Masharian

Morgan Stanley: Trading with the Bank!

Changes compared to the previous publication!

CADJPY . A limit order was placed: long from 87.90, target 93.20, stop 87.10.

Currently opened trades:

USDJPY - 14 th of July - long from 112.50, target 118.00, stop 110.90. Current result +13 pips.

Pending orders:

CADJPY - July 17th - long from 87.90, target 93.20, stop 87.10.

EURUSD - May 19 - long from 1.1200, target 1.1800, stop 1.0900.

Changes compared to the previous publication!

CADJPY . A limit order was placed: long from 87.90, target 93.20, stop 87.10.

Currently opened trades:

USDJPY - 14 th of July - long from 112.50, target 118.00, stop 110.90. Current result +13 pips.

Pending orders:

CADJPY - July 17th - long from 87.90, target 93.20, stop 87.10.

EURUSD - May 19 - long from 1.1200, target 1.1800, stop 1.0900.

Seyedmajid Masharian

Currency investors should consider buying GBP/JPY this week, advises CitiFX Research in its weekly FX pick.

Citi recommends buying GBP/JPY around 147.41 targeting 150 with a stop at 145.67.

You can get this trade at a discount right now, the pair was last at 146.91.

For bank trade ideas,

http://www.forexlive.com/news/!/citi-says-gbpjpy-is-its-trade-of-the-week-20170717

Citi recommends buying GBP/JPY around 147.41 targeting 150 with a stop at 145.67.

You can get this trade at a discount right now, the pair was last at 146.91.

For bank trade ideas,

http://www.forexlive.com/news/!/citi-says-gbpjpy-is-its-trade-of-the-week-20170717

Seyedmajid Masharian

Credit Suisse FX Technical Strategy Research notes that NZD/USD recent rally is likely due for a short-term correction against the strong resistance of the core bull trend at the .7376/.7404 area.

If a cap is found into this area, CS expects the pair to form a small top below .7253 to target .7198 initially, then the measured objective from the top and 38.2% retracement of the recent rally at .7160/45.

"We would expect the latter to try and hold at first. Removal of .7145 can see a deeper fall to test the 55- and 200-day averages at .7100/.7096, and potentially lower to the 50% retracement at .7082, where we see a firmer floor," CS adds.

https://www.efxnews.com/story/36532/nzdusd-rally-may-come-end-levels-targets-credit-suisse

If a cap is found into this area, CS expects the pair to form a small top below .7253 to target .7198 initially, then the measured objective from the top and 38.2% retracement of the recent rally at .7160/45.

"We would expect the latter to try and hold at first. Removal of .7145 can see a deeper fall to test the 55- and 200-day averages at .7100/.7096, and potentially lower to the 50% retracement at .7082, where we see a firmer floor," CS adds.

https://www.efxnews.com/story/36532/nzdusd-rally-may-come-end-levels-targets-credit-suisse

Seyedmajid Masharian

Footprints of the Big Boys

Brandon Wendell

Instructor, CMT

When we are trying to learn a new skill, we usually try to copy the actions of someone who is already successful in that field. When it comes to making money in the markets, we can easily see that the institutional traders are the big winners on a consistent basis. Online Trading Academy teaches their students how to identify where those institutional traders make their money and how to follow them for their own trading success.

One of the things that we will look for is the area where institutions have pushed prices higher or lower with high velocity due to a large order. When placing these orders, these institutions know that they may not get all of their orders filled at once. They are looking to receive an average price in a zone that is acceptable for their goals with that investment. This is known as working the order.

Imagine that I am working an order for several hundred thousand shares for a mutual fund. They decided they wanted to invest in XYZ stock due to its potential to rise on their good management, good product, past track record, new products, etc. I identify that a good price for this stock is in the $40 to $41 range. I will start to place orders when price gets into that range.

There is a problem though. I cannot place the order for the entire amount all at once. If I were to show that much demand in the market, most astute traders would jump in front of me and buy knowing I will support price with my demand. This would drive prices higher and prevent me from getting my stock in the desired price range. So I have to be smart and buy in pieces with smaller orders that seem innocuous.

What happens if the price zone I selected happens to be a great buying price? This would mean that I am buying in an area where there is a lack of sellers since prices dropped so fast that they either dumped their supply or they are holding on, hoping that prices will return to lessen their losses.

When I step in with my demand, I find a lack of supply to fill my buy orders. This is going to cause me to have to raise my bid for shares quickly and dramatically so that I can get those shares. This is going to cause a large green candle at an area where I was trying to buy. As a retail trader, this is a signal of a demand zone for me.

Going back to the institutional trader, they were unlikely to fill all of their orders to buy shares when prices moved up as quickly as they did. So there are still latent (unfilled) orders sitting in the demand zone they created. Since they likely programmed a computer to do the buying for them in that zone, there is no emotion involved. The computer will not chase price or become impatient. The computer waits for prices to return to the demand (specified entry) zone to buy again.

This is where traders should pounce. Once the institutions have shown their hand on the charts by forming the origin of the demand zone, we have an opportunity to buy in the same zone as prices return to it. We can see from past behavior that the supply is lacking in the zone and someone is supporting the price. Those latent orders are likely to cause another bounce in price that we can benefit from.

Trading is simply a game of identifying the order placement locations of the institutional traders.

http://www.tradingacademy.com/lessons/article/footprints-big-boys/

Brandon Wendell

Instructor, CMT

When we are trying to learn a new skill, we usually try to copy the actions of someone who is already successful in that field. When it comes to making money in the markets, we can easily see that the institutional traders are the big winners on a consistent basis. Online Trading Academy teaches their students how to identify where those institutional traders make their money and how to follow them for their own trading success.

One of the things that we will look for is the area where institutions have pushed prices higher or lower with high velocity due to a large order. When placing these orders, these institutions know that they may not get all of their orders filled at once. They are looking to receive an average price in a zone that is acceptable for their goals with that investment. This is known as working the order.

Imagine that I am working an order for several hundred thousand shares for a mutual fund. They decided they wanted to invest in XYZ stock due to its potential to rise on their good management, good product, past track record, new products, etc. I identify that a good price for this stock is in the $40 to $41 range. I will start to place orders when price gets into that range.

There is a problem though. I cannot place the order for the entire amount all at once. If I were to show that much demand in the market, most astute traders would jump in front of me and buy knowing I will support price with my demand. This would drive prices higher and prevent me from getting my stock in the desired price range. So I have to be smart and buy in pieces with smaller orders that seem innocuous.

What happens if the price zone I selected happens to be a great buying price? This would mean that I am buying in an area where there is a lack of sellers since prices dropped so fast that they either dumped their supply or they are holding on, hoping that prices will return to lessen their losses.

When I step in with my demand, I find a lack of supply to fill my buy orders. This is going to cause me to have to raise my bid for shares quickly and dramatically so that I can get those shares. This is going to cause a large green candle at an area where I was trying to buy. As a retail trader, this is a signal of a demand zone for me.

Going back to the institutional trader, they were unlikely to fill all of their orders to buy shares when prices moved up as quickly as they did. So there are still latent (unfilled) orders sitting in the demand zone they created. Since they likely programmed a computer to do the buying for them in that zone, there is no emotion involved. The computer will not chase price or become impatient. The computer waits for prices to return to the demand (specified entry) zone to buy again.

This is where traders should pounce. Once the institutions have shown their hand on the charts by forming the origin of the demand zone, we have an opportunity to buy in the same zone as prices return to it. We can see from past behavior that the supply is lacking in the zone and someone is supporting the price. Those latent orders are likely to cause another bounce in price that we can benefit from.

Trading is simply a game of identifying the order placement locations of the institutional traders.

http://www.tradingacademy.com/lessons/article/footprints-big-boys/

Seyedmajid Masharian

DID YOU KNOW YOU SHOULD FOLLOW MAJOR CENTRAL BANKS POLICIES AND THEIR MAIN MONETARY GOAL AT CURRENT TIME TO MAKE CONSISTENT MONEY IN FOREX?

TO KNOW MORE GO HERE:

https://www.jarrattdavis.com/

TO KNOW MORE GO HERE:

https://www.jarrattdavis.com/

Seyedmajid Masharian

Barclays Capital Research expects an additional BoC hike in Q1 2018 to undo the past “insurance cuts”, but acknowledging that the probability that the BoC moves earlier (in Q4 17) has increased given its upbeat assessment.

On the CAD front, Barclays sees limited downside risk to USD/CAD and continues to expect CAD weakness over the coming months as a subdued inflationary outlook does not imply a more aggressive rate hiking cycle relative to current market pricing.

In line with this view, Barclays is looking for USD/CAD to recover toward 1.33 by year-end and remains long USD/CAD through a 3m 1x2 call spread structure.

Source: Barclays Research

https://www.efxnews.com/story/36528/usdcad-limited-downside-risk-where-target-barclays

On the CAD front, Barclays sees limited downside risk to USD/CAD and continues to expect CAD weakness over the coming months as a subdued inflationary outlook does not imply a more aggressive rate hiking cycle relative to current market pricing.

In line with this view, Barclays is looking for USD/CAD to recover toward 1.33 by year-end and remains long USD/CAD through a 3m 1x2 call spread structure.

Source: Barclays Research

https://www.efxnews.com/story/36528/usdcad-limited-downside-risk-where-target-barclays

: