Seyedmajid Masharian / Profile

forex trader

at

home

Seyedmajid Masharian

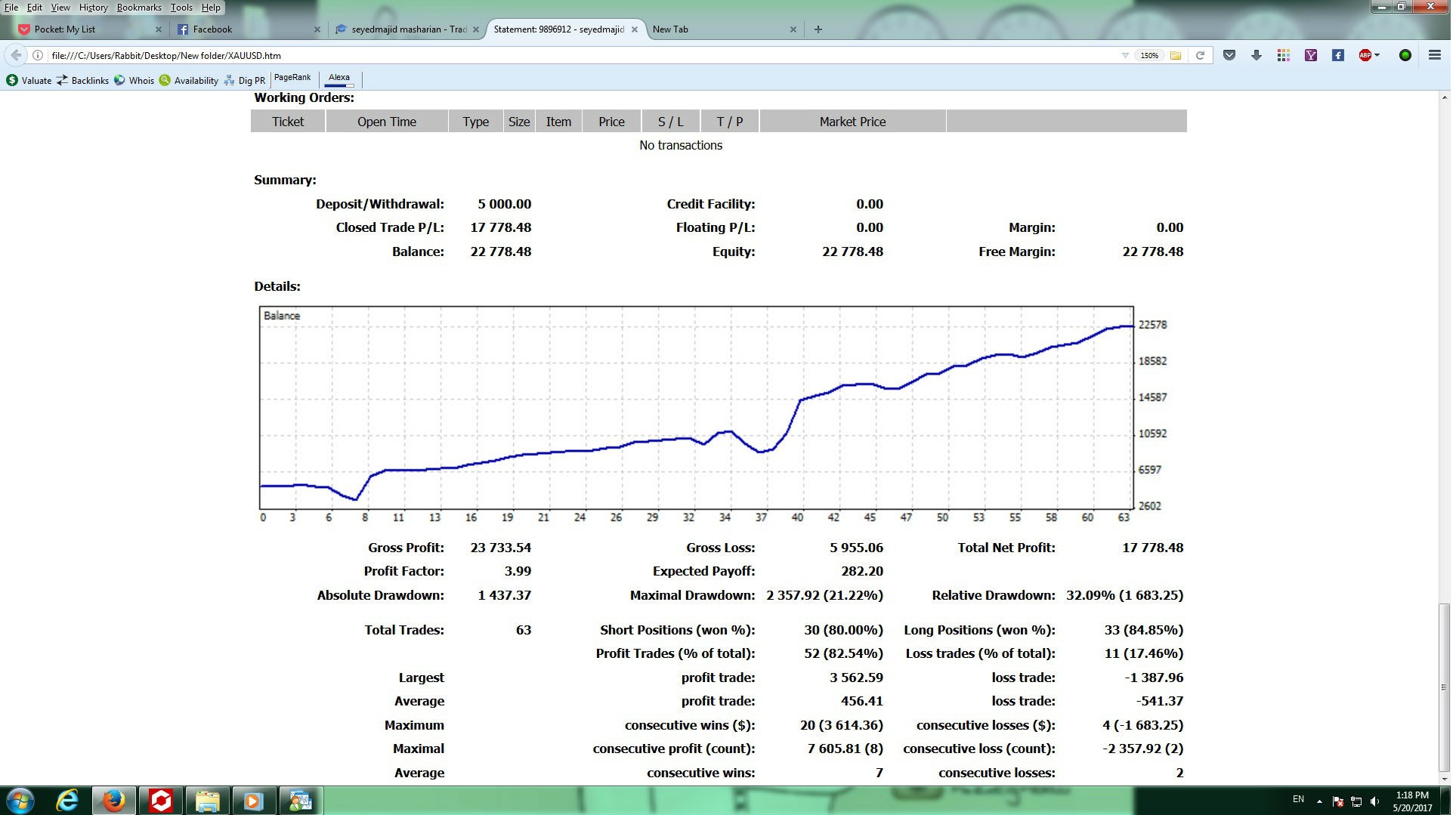

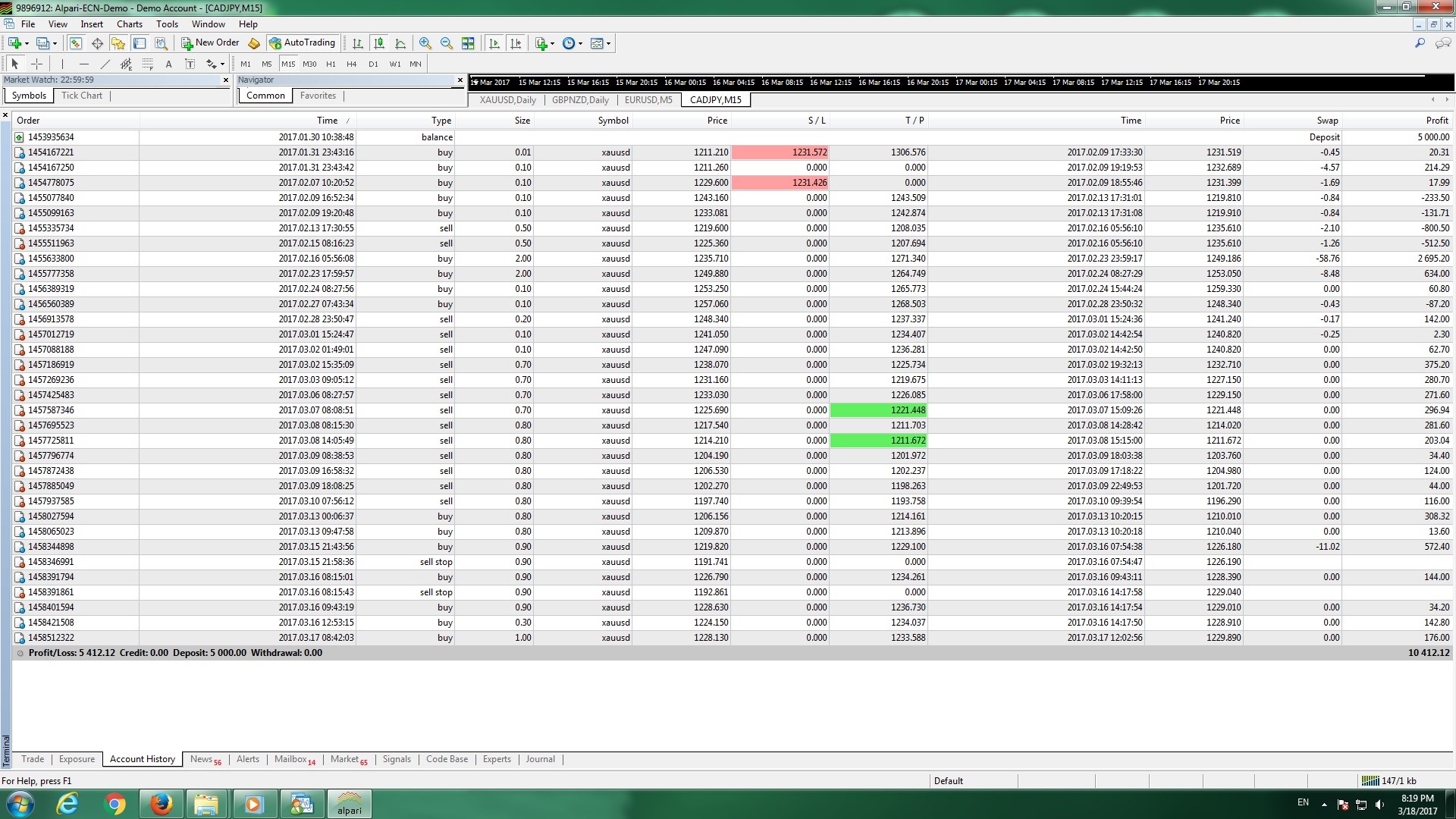

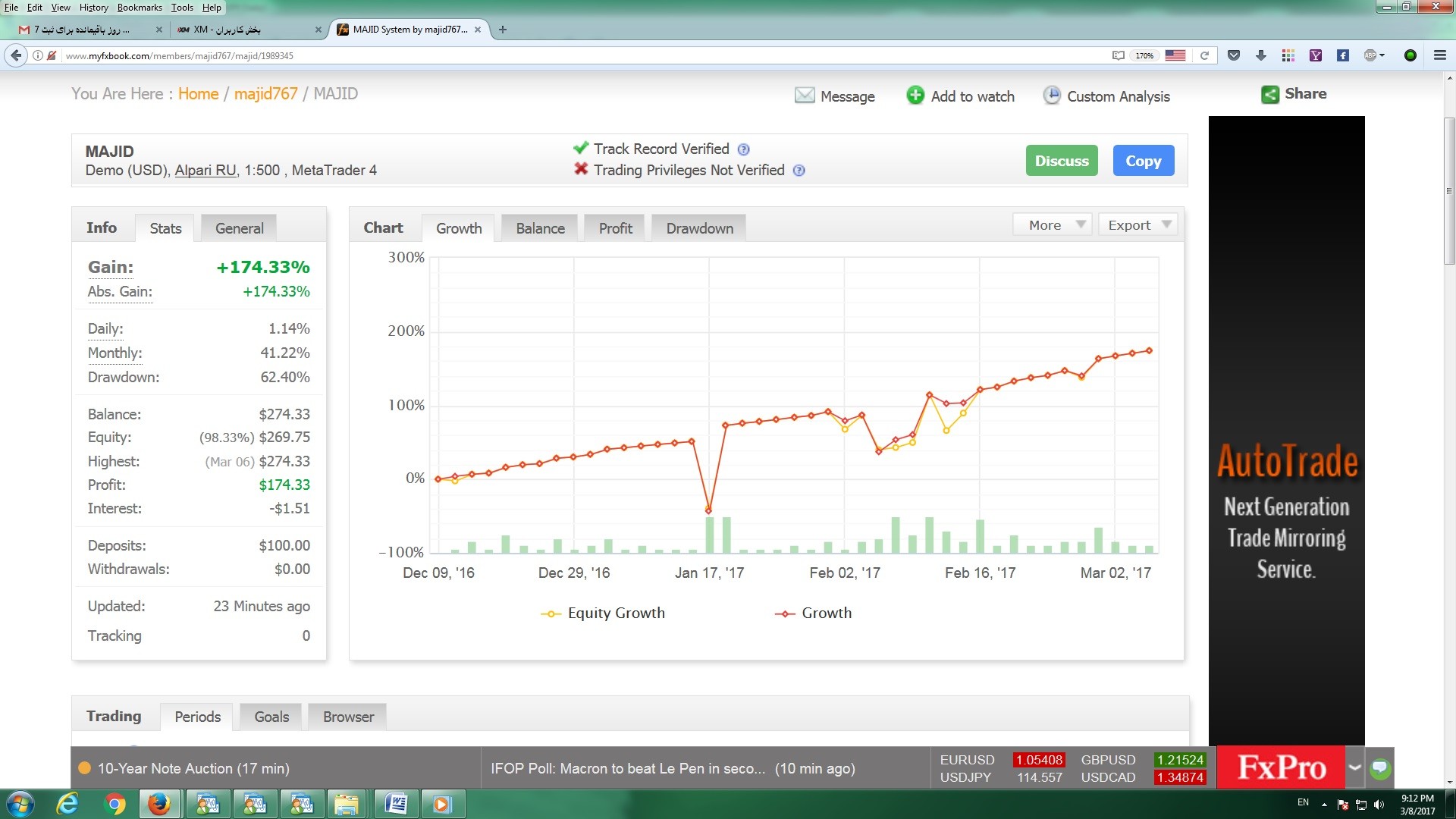

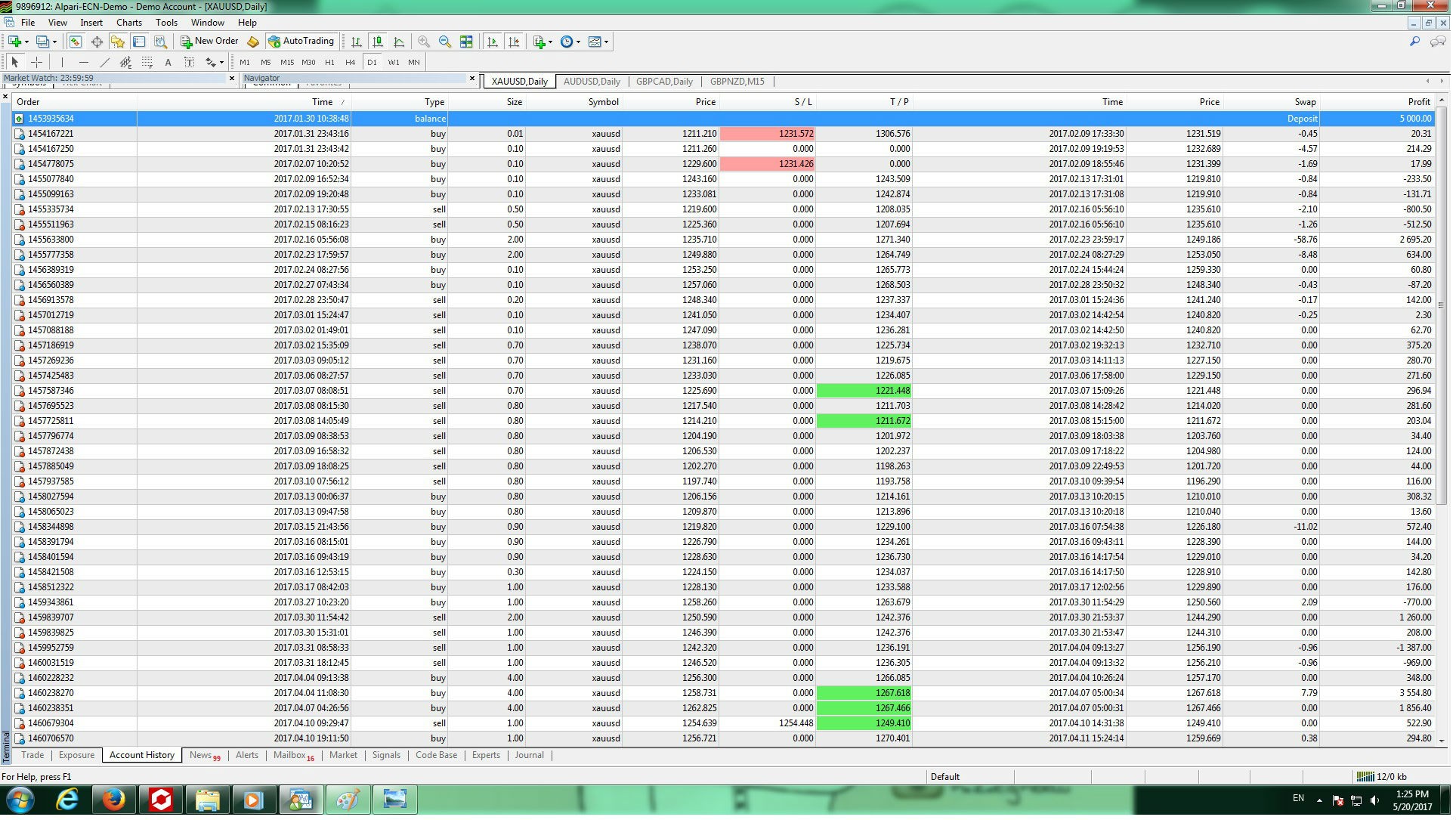

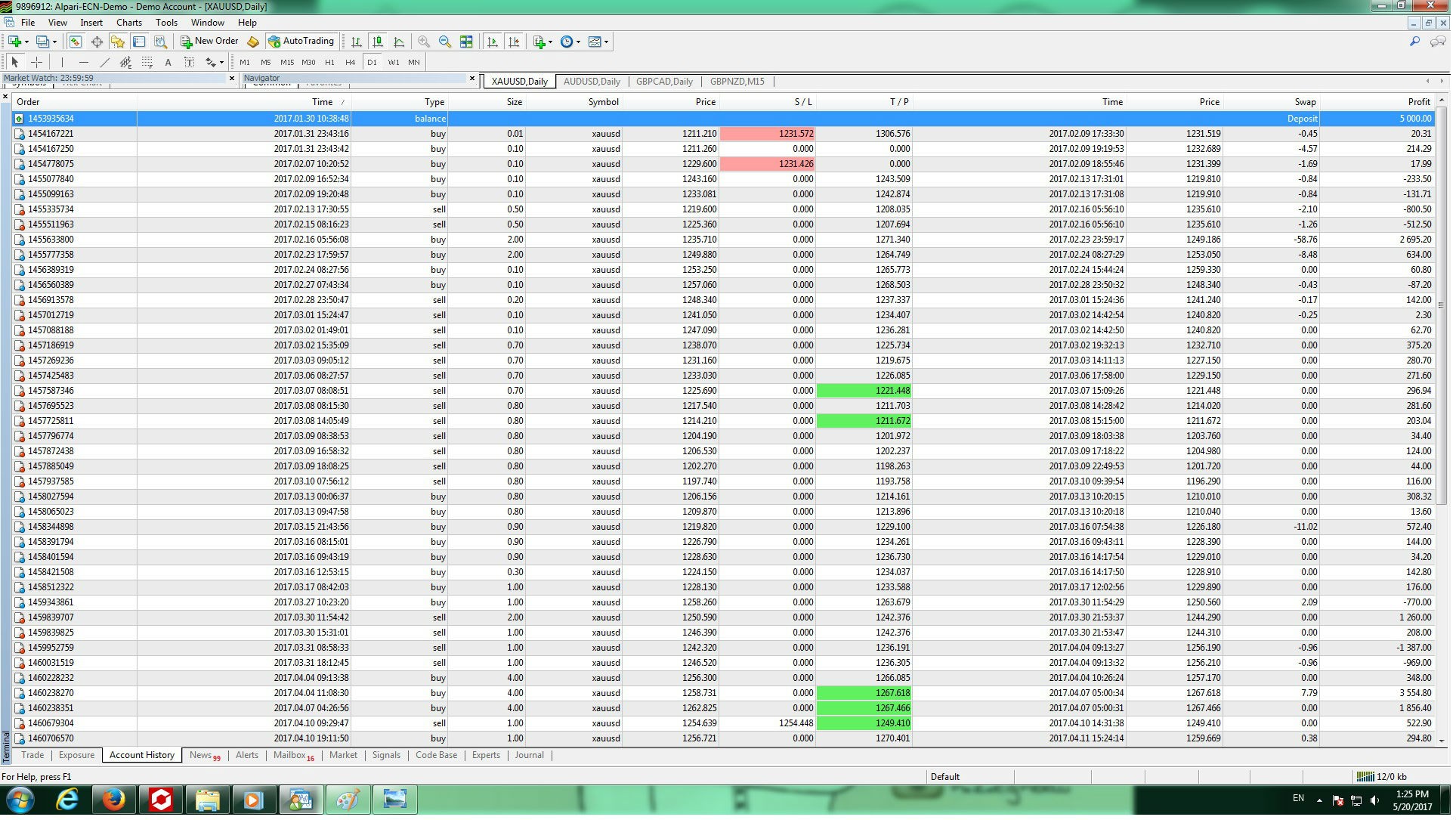

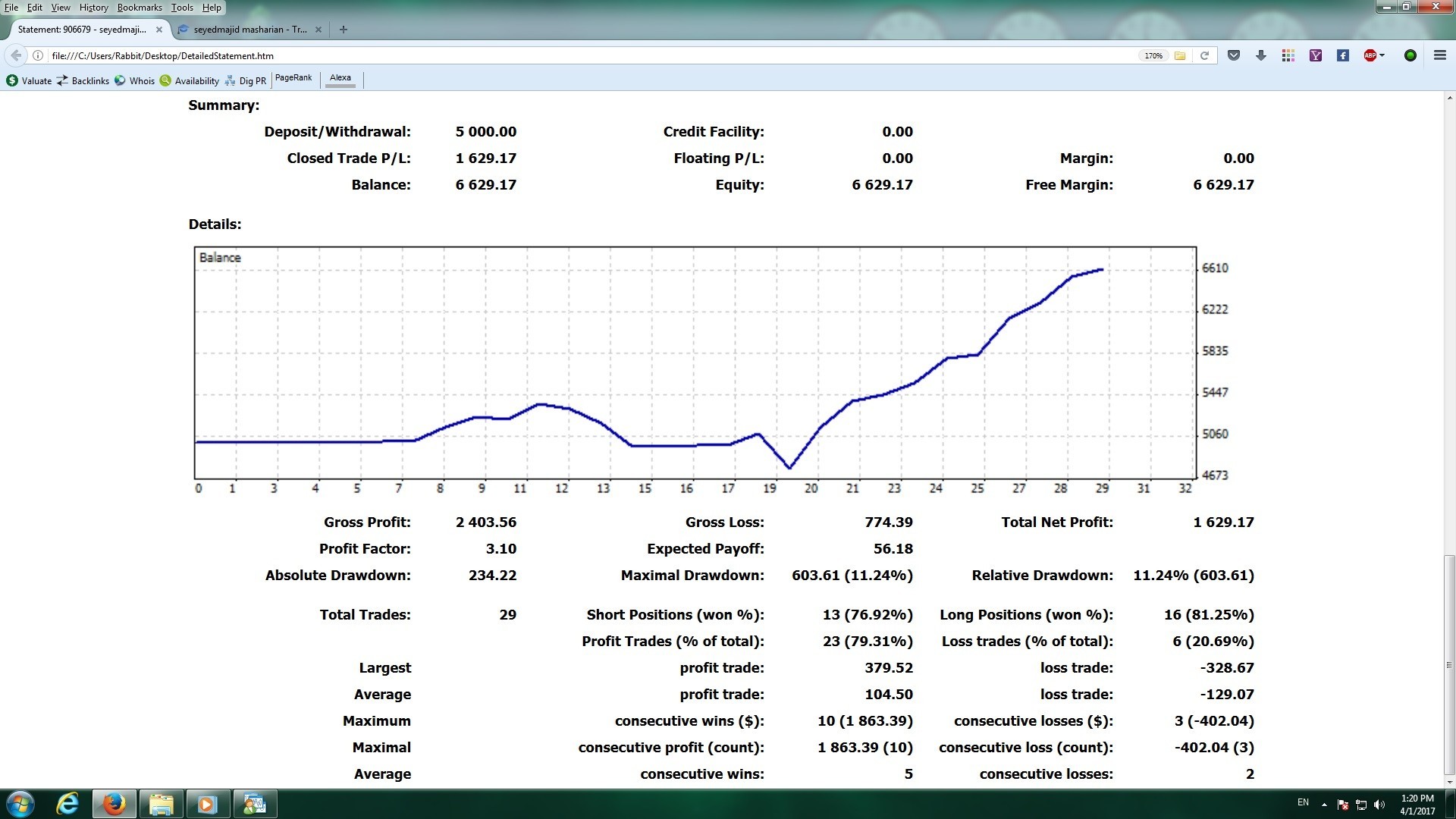

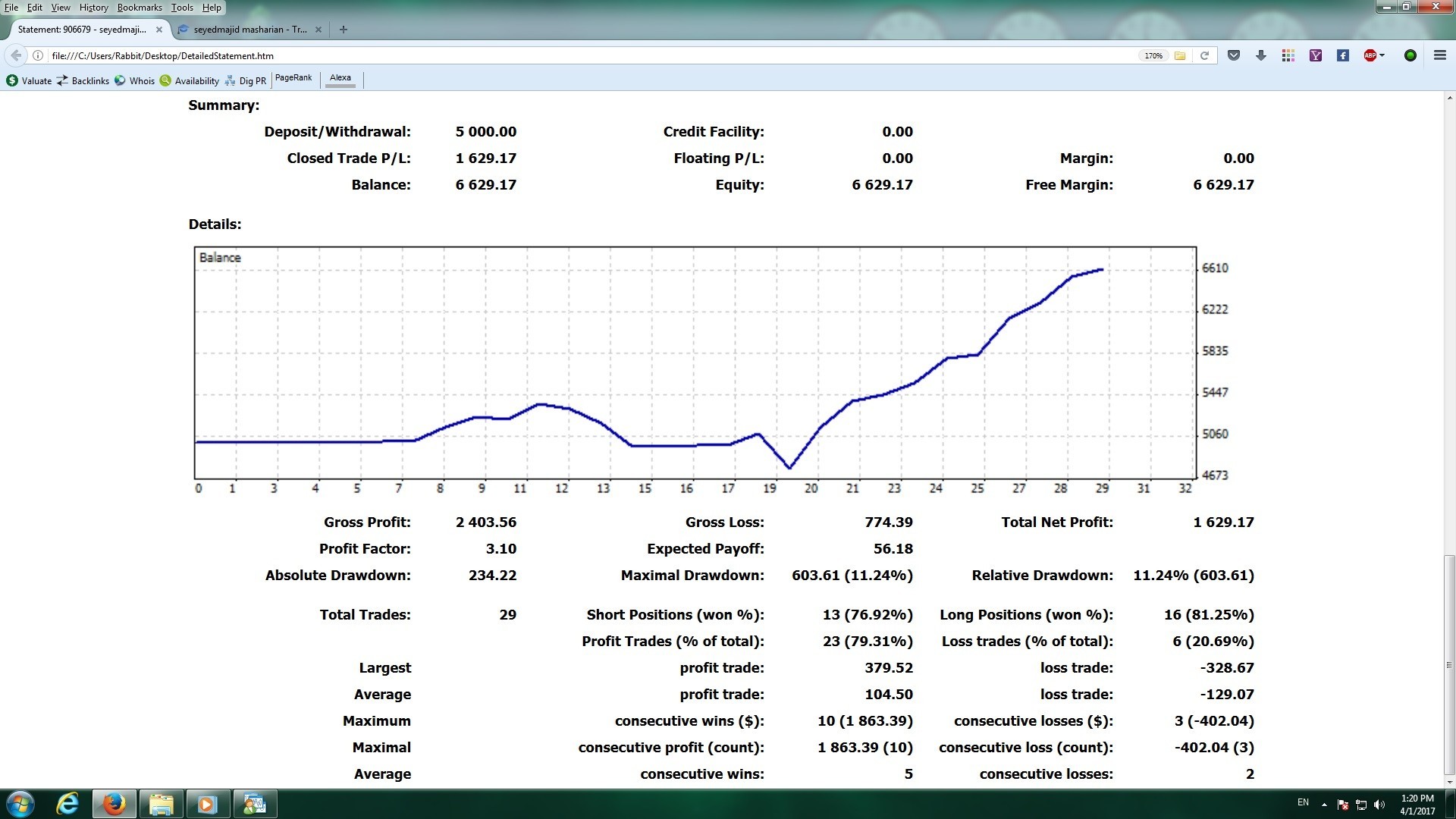

DEAR SUCCESSFUL REAL TRADERS

LETS FIGHT BACK TEST SCAMMERS HERE

BY SHOWING YOUR FORWARD TEST RESULTS

THEY ONLY SHOW THEIR BACK TEST AND IN FORWARD TEST NOTHING ....

LETS FIGHT BACK TEST SCAMMERS HERE

BY SHOWING YOUR FORWARD TEST RESULTS

THEY ONLY SHOW THEIR BACK TEST AND IN FORWARD TEST NOTHING ....

Seyedmajid Masharian

What is the Number One Mistake Forex Traders Make?

Summary: Traders are right more than 50% of the time, but lose more money on losing trades than they win on winning trades. Traders should use stops and limits to enforce a risk/reward ratio of 1:1 or higher.

Big US Dollar moves against the Euro and other currencies have made forex trading more popular than ever, but the influx of new traders has been matched by an outflow of existing traders.

Why do major currency moves bring increased trader losses? To find out, the FXCM research team has looked through amalgamated trading data on thousands of live accounts from a major FX broker. In this article, we look at the biggest mistake that forex traders make, and a way to trade appropriately.

What Does the Average Forex Trader Do Wrong?

Many forex traders have significant experience trading in other markets, and their technical and fundamental analysis is often quite good. In fact, in almost all of the most popular currency pairs that clients traded at this major FX broker, traders are correct more than 50% of the time:

https://www.fxcm.news/uk/learn/senior-uk/risk-management/traits-successful-forex-traders/number-one-mistake-forex-traders-make/?CMP=SFS-70160000000MusHAAS&utm_source=facebook&utm_medium=post&utm_campaign=SM-Global-FB_genericFXCM

Summary: Traders are right more than 50% of the time, but lose more money on losing trades than they win on winning trades. Traders should use stops and limits to enforce a risk/reward ratio of 1:1 or higher.

Big US Dollar moves against the Euro and other currencies have made forex trading more popular than ever, but the influx of new traders has been matched by an outflow of existing traders.

Why do major currency moves bring increased trader losses? To find out, the FXCM research team has looked through amalgamated trading data on thousands of live accounts from a major FX broker. In this article, we look at the biggest mistake that forex traders make, and a way to trade appropriately.

What Does the Average Forex Trader Do Wrong?

Many forex traders have significant experience trading in other markets, and their technical and fundamental analysis is often quite good. In fact, in almost all of the most popular currency pairs that clients traded at this major FX broker, traders are correct more than 50% of the time:

https://www.fxcm.news/uk/learn/senior-uk/risk-management/traits-successful-forex-traders/number-one-mistake-forex-traders-make/?CMP=SFS-70160000000MusHAAS&utm_source=facebook&utm_medium=post&utm_campaign=SM-Global-FB_genericFXCM

Seyedmajid Masharian

A Logical Method Of Stop Placement

By Jamie Saettele

Trading is a game of probability. This means that every trader will be wrong sometimes. When a trade does go wrong, there are only two options: to accept the loss and liquidate your position, or go down with the ship.

This is why using stop orders is so important. Many traders take profits quickly but also hold on to losing trades - it's simply human nature. We take profits because it feels good and we try to hide from the discomfort of defeat. A properly placed stop order takes care of this problem by acting as insurance against losing too much. In order to work properly, a stop must answer one question: At what price is your opinion wrong? In this article, we'll explore several approaches to determining stop placement that will help you to swallow your pride and keep your portfolio afloat. (For more insight, read Limiting Losses and Trailing-Stop Techniques.)

Read more: A Logical Method Of Stop Placement http://www.investopedia.com/articles/trading/06/stopplacement.asp#ixzz4ePbIrKjA

Follow us: Investopedia on Facebook

...

http://www.investopedia.com/articles/trading/06/stopplacement.asp

By Jamie Saettele

Trading is a game of probability. This means that every trader will be wrong sometimes. When a trade does go wrong, there are only two options: to accept the loss and liquidate your position, or go down with the ship.

This is why using stop orders is so important. Many traders take profits quickly but also hold on to losing trades - it's simply human nature. We take profits because it feels good and we try to hide from the discomfort of defeat. A properly placed stop order takes care of this problem by acting as insurance against losing too much. In order to work properly, a stop must answer one question: At what price is your opinion wrong? In this article, we'll explore several approaches to determining stop placement that will help you to swallow your pride and keep your portfolio afloat. (For more insight, read Limiting Losses and Trailing-Stop Techniques.)

Read more: A Logical Method Of Stop Placement http://www.investopedia.com/articles/trading/06/stopplacement.asp#ixzz4ePbIrKjA

Follow us: Investopedia on Facebook

...

http://www.investopedia.com/articles/trading/06/stopplacement.asp

Seyedmajid Masharian

Can Regular Investors Beat The Market?

We all invest with the hopes that one day we will have enough money to live off our investments. The question remains, can a regular investor like us really beat the market? Do we have what it takes to win over the middlemen and institutions that have millions or even billions invested in the market? According to Terrance Odean, a finance professor at the University of California, Berkley's Haas School of Business, "Many of the mistakes investors make come from a lack of any understanding of the innate disadvantages they face."

David and Goliath

The answer to this question is not an easy one, and the answers will vary depending on who you ask. By "beating the market" we're talking about everyday working Americans who try to obtain greater capital gains and income return than the S&P 500.

David E. Y. Sarna author of "History Of Greed," explains it this way, "We all have some larceny in us. We buy securities because we think we know someone or something others don't. I don't think anyone can consistently outperform the S&P 500 without assuming greater than market risk."

Some of us might have the tools (and connections) required to make knowledgeable decisions that will lead us to a portfolio with higher returns, but others like stockbrokers, bankers and big corporations most likely have an advantage, right? While many people in the financial industry have insider information which they cannot legally trade on, they also possess the necessary financial statement analysis skills to develop a greater insight about a given company. Robert Laura, author of "Naked Retirement: A Stimulating Guide To A More Meaningful Retirement" and President of SYNERGOS Financial Group says, "The reality is there will always be a lure to try and beat the market, especially since those who have beat it consistently are revered so highly (Bill Miller, Peter Lynch) and/or are compensated well (hedge fund managers). I think the market can be beaten, but even a broken clock is right twice a day. Best way to describe it: It's possible but not probable."

According to Laura, the sad reality is, the average individual investor has little chance of beating the market. He says the common investor uses mutual funds, are stuck in 401(k) plans which essentially track the broader index, and pay higher fees as compared to stock, index funds or ETFs. Also many mutual fund type investments don't use stop loss order to protect gains and thus do not always provide the type of protection individualized portfolios can perform. As he puts it, "investors are set-up to fail from the get-go."

Investing in 401(k)s is no better. "Most 401(k)s aren't benchmarked and most companies don't have a good investment policy for selecting funds within the program. You can't even get some asset classes in many and most advisors are sales people, not fiduciaries and just taught how to sell funds," he adds.

The good thing is many more investors are taking responsibility and interest in their investments. They are taking the initiative to learn how their investments work and are less intimidated. Laura says investors are learning that individual stocks aren't as scary as everyone suggests and there is valuable information available to everyone if they know where to find it and how to apply it.

He adds, "The advent of ETFs and Index investing allow people to mimic the market, instead of trying to beat it, which is a better, less expensive perspective to have."

A Lost Cause?

Founder of FinancialMentor.com, Todd R. Tresidder, said in 2010 "All the evidence supports the disappointing fact that regular investors as a whole underperform the market. As long as they try to 'beat the market' they actually underperform."

The best way for regular investors to achieve better risk-adjusted returns is by focusing not on out performance, says Tresidder, but instead by losing less. In other words, regular investors have one competitive advantage - liquidity.

"Big investors are the market but the little guy is nimble and can buy or sell without affecting the market - something the big guy can't do. Systematic risk management can work to provide regular investors with similar or slightly improved investment performance relative to the market at substantially less risk," he says.

Helping the Odds

What can an investor do to increase their chances of "beating" the market? Laura says there are several things:

Use low cost funds and/or a low cost platform for trades. The best way to make money is to save money.

Establish and follow a discipline which translates into just doing what you said you are going to do.

Give every investment in your portfolio a buy price, hold price and sell price along with one or two reasons to buy, hold or sell at that value. This gives you specific criteria to act and provides your portfolio with purpose and specific direction.

Watch for headline risk. Set up email alerts for your investments so as new information comes out about them, you are aware of it in the early stages to consider changes. Mark your calendar for things to watch like earning dates, intellectual property timelines and industry reports like Federal Reserve meetings, unemployment numbers, new housing starts and other information that will affect the specific sector or security.

Sarna suggests investing in what you know and understand, such as solid, profitable small-caps and even microcaps in niches you can monitor and understand. These can appreciate much more rapidly than equivalently-priced large-caps.

The only way to get above market returns is to develop a competitive advantage says Tresidder. "It is either developed through knowledge and information flow, or it is developed through extensive research resulting in an investment strategy that exploits irregular market behavior."

According to Tresidder, the only way to outperform the markets is to develop a competitive advantage that exceeds transaction costs and passive market return.

The Bottom Line

The debate of whether an individual investor can beat the market is as old as the stock market itself. Those who have found fortune investing will often preach that they possess superior analytical skills which allowed them to predict the market. Those investors who suffer losses will tell a much different tale.

Read more: Can Regular Investors Beat The Market? | Investopedia http://www.investopedia.com/articles/trading/10/beat-the-market.asp#ixzz4d4sHxiW9

Follow us: Investopedia on Facebook

We all invest with the hopes that one day we will have enough money to live off our investments. The question remains, can a regular investor like us really beat the market? Do we have what it takes to win over the middlemen and institutions that have millions or even billions invested in the market? According to Terrance Odean, a finance professor at the University of California, Berkley's Haas School of Business, "Many of the mistakes investors make come from a lack of any understanding of the innate disadvantages they face."

David and Goliath

The answer to this question is not an easy one, and the answers will vary depending on who you ask. By "beating the market" we're talking about everyday working Americans who try to obtain greater capital gains and income return than the S&P 500.

David E. Y. Sarna author of "History Of Greed," explains it this way, "We all have some larceny in us. We buy securities because we think we know someone or something others don't. I don't think anyone can consistently outperform the S&P 500 without assuming greater than market risk."

Some of us might have the tools (and connections) required to make knowledgeable decisions that will lead us to a portfolio with higher returns, but others like stockbrokers, bankers and big corporations most likely have an advantage, right? While many people in the financial industry have insider information which they cannot legally trade on, they also possess the necessary financial statement analysis skills to develop a greater insight about a given company. Robert Laura, author of "Naked Retirement: A Stimulating Guide To A More Meaningful Retirement" and President of SYNERGOS Financial Group says, "The reality is there will always be a lure to try and beat the market, especially since those who have beat it consistently are revered so highly (Bill Miller, Peter Lynch) and/or are compensated well (hedge fund managers). I think the market can be beaten, but even a broken clock is right twice a day. Best way to describe it: It's possible but not probable."

According to Laura, the sad reality is, the average individual investor has little chance of beating the market. He says the common investor uses mutual funds, are stuck in 401(k) plans which essentially track the broader index, and pay higher fees as compared to stock, index funds or ETFs. Also many mutual fund type investments don't use stop loss order to protect gains and thus do not always provide the type of protection individualized portfolios can perform. As he puts it, "investors are set-up to fail from the get-go."

Investing in 401(k)s is no better. "Most 401(k)s aren't benchmarked and most companies don't have a good investment policy for selecting funds within the program. You can't even get some asset classes in many and most advisors are sales people, not fiduciaries and just taught how to sell funds," he adds.

The good thing is many more investors are taking responsibility and interest in their investments. They are taking the initiative to learn how their investments work and are less intimidated. Laura says investors are learning that individual stocks aren't as scary as everyone suggests and there is valuable information available to everyone if they know where to find it and how to apply it.

He adds, "The advent of ETFs and Index investing allow people to mimic the market, instead of trying to beat it, which is a better, less expensive perspective to have."

A Lost Cause?

Founder of FinancialMentor.com, Todd R. Tresidder, said in 2010 "All the evidence supports the disappointing fact that regular investors as a whole underperform the market. As long as they try to 'beat the market' they actually underperform."

The best way for regular investors to achieve better risk-adjusted returns is by focusing not on out performance, says Tresidder, but instead by losing less. In other words, regular investors have one competitive advantage - liquidity.

"Big investors are the market but the little guy is nimble and can buy or sell without affecting the market - something the big guy can't do. Systematic risk management can work to provide regular investors with similar or slightly improved investment performance relative to the market at substantially less risk," he says.

Helping the Odds

What can an investor do to increase their chances of "beating" the market? Laura says there are several things:

Use low cost funds and/or a low cost platform for trades. The best way to make money is to save money.

Establish and follow a discipline which translates into just doing what you said you are going to do.

Give every investment in your portfolio a buy price, hold price and sell price along with one or two reasons to buy, hold or sell at that value. This gives you specific criteria to act and provides your portfolio with purpose and specific direction.

Watch for headline risk. Set up email alerts for your investments so as new information comes out about them, you are aware of it in the early stages to consider changes. Mark your calendar for things to watch like earning dates, intellectual property timelines and industry reports like Federal Reserve meetings, unemployment numbers, new housing starts and other information that will affect the specific sector or security.

Sarna suggests investing in what you know and understand, such as solid, profitable small-caps and even microcaps in niches you can monitor and understand. These can appreciate much more rapidly than equivalently-priced large-caps.

The only way to get above market returns is to develop a competitive advantage says Tresidder. "It is either developed through knowledge and information flow, or it is developed through extensive research resulting in an investment strategy that exploits irregular market behavior."

According to Tresidder, the only way to outperform the markets is to develop a competitive advantage that exceeds transaction costs and passive market return.

The Bottom Line

The debate of whether an individual investor can beat the market is as old as the stock market itself. Those who have found fortune investing will often preach that they possess superior analytical skills which allowed them to predict the market. Those investors who suffer losses will tell a much different tale.

Read more: Can Regular Investors Beat The Market? | Investopedia http://www.investopedia.com/articles/trading/10/beat-the-market.asp#ixzz4d4sHxiW9

Follow us: Investopedia on Facebook

Seyedmajid Masharian

5 Forex Day Trading Mistakes To Avoid

In the high leverage game of retail forex day trading, there are certain practices that, if used regularly, are likely to lose a trader all he has. There are five common mistakes that day traders often make in an attempt to ramp up returns, but that end up resulting in lower returns. These five potentially devastating mistakes can be avoided with knowledge, discipline and an alternative approach. (For more strategies that you can use, check out Strategies For Part-Time Forex Traders.)

TUTORIAL: Forex

Averaging Down

Traders often stumble across averaging down. It is not something they intended to do when they began trading, but most traders have ended up doing it. There are several problems with averaging down.

The main problem is that a losing position is being held - not only potentially sacrificing money, but also time. This time and money could be placed in something else that is proving itself to be a better position.

Also, for capital that is lost, a larger return is needed on remaining capital to get it back. If a trader loses 50% of her capital, it will take a 100% return to bring her back to the original capital level. Losing large chunks of money on single trades or on single days of trading can cripple capital growth for long periods of time.

While it may work a few times, averaging down will inevitably lead to a large loss or margin call, as a trend can sustain itself longer than a trader can stay liquid - especially if more capital is being added as the position moves further out of the money.

Day traders are especially sensitive to these issues. The short time frame for trades means opportunities must be capitalized on when they occur and bad trades must be exited quickly. (To learn more on averaging down, check out Buying Stocks When The Price Goes Down: Big Mistake?)

Pre-Positioning for News

Traders know the news events that will move the market, yet the direction is not known in advance. A trader may even be fairly confident what a news announcement may be - for instance that the Federal Reserve will or will not raise interest rates - but even so cannot predict how the market will react to this expected news. Often there are additional statements, figures or forward looking indications provided by news announcements that can make movements extremely illogical.

There is also the simple fact that as volatility surges and all sorts of orders hit the market, stops are triggered on both sides of the market. This often results in whip-saw like action before a trend emerges (if one emerges in the near term at all).

For all these reasons, taking a position before a news announcement can seriously jeopardize a trader's chances of success. There is no easy money here; those who believe there is may face larger than usual losses.

Trading Right after News

A news headline hits the markets and then the market starts to move aggressively. It seems like easy money to hop on board and grab some pips. If this is done in a non-regimented and untested way without a solid trading plan behind it, it can be just as devastating as placing a gamble before the news comes out.

News announcements often cause whipsaw-like action because of a lack of liquidity and hair-pin turns in the market assessment of the report. Even a trade that is in the money can turn quickly, bringing large losses as large swings occur back and forth. Stops during these times are dependent on liquidity that may not be there, which means losses could potentially be much more than calculated.

Day traders should wait for volatility to subside and for a definitive trend to develop after news announcements. By doing so there is likely to be fewer liquidity concerns, risk can be managed more effectively and a more stable price direction is likely. (For more on trading with news releases, read How To Trade Forex On News Releases.)

Risking More Than 1% of Capital

Excessive risk does not equal excessive returns. Almost all traders who risk large amounts of capital on single trades will eventually lose in the long run. A common rule is that a trader should risk (in terms of the difference between entry and stop price) no more than 1% of capital on any single trade. Professional traders will often risk far less than 1% of capital.

Day trading also deserves some extra attention in this area. A daily risk maximum should also be implemented. This daily risk maximum can be 1% (or less) of capital, or equivalent to the average daily profit over a 30 day period. For example, a trader with a $50,000 account (leverage not included) could lose a maximum of $500 per day. Alternatively, this number could be altered so it is more in line with the average daily gain - if a trader makes $100 on positive days, she keeps losing days close to $100 or less.

The purpose of this method is to make sure no single trade or single day of trading hurts the traders account significantly. By adopting a risk maximum that is equivalent to the average daily gain over a 30 day period, the trader knows that he will not lose more in a single trade/day than he can make back on another. (To understand the risks involved in the forex market, see Forex Leverage: A Double-Edged Sword.)

Unrealistic Expectations

Unrealistic expectations come from many sources, but often result in all of the above problems. Our own trading expectations are often imposed on the market, leaving us expecting it to act according our desires and trade direction. The market doesn't care what you want. Traders must accept that the market can be illogical. It can be choppy, volatile and trending all in short, medium and long-term cycles. Isolating each move and profiting from it is not possible, and believing so will result in frustration and errors in judgment.

The best way to avoid unrealistic expectations is formulate a trading plan and then trade it. If it yields steady results, then don't change it - with forex leverage, even a small gain can become large. Accept this as what the market gives you. As capital grows over time, the position size can be increased to bring in higher dollar returns. Also, new strategies can be implemented and tested with minimal capital at first. Then, if positive results are seen, more capital can be put into the strategy.

Intra-day, a trader must also accept what the market provides at different parts of the day. Near the open, the markets are more volatile. Specific strategies can be used during the market open that may not work later in the day. As the day progresses, it may become quieter and a different strategy can be used. Towards the close, there may be a pickup in action and yet another strategy can be used. Accept what is given at each point in the day and don't expect more from a system than what it is providing.

Bottom Line

Traders get trapped in five common forex day trading mistakes. These must be avoided at all costs by developing an alternative approach. For averaging down, traders must not add to positions but rather exit losers quickly with a pre-planned exit strategy. Traders should sit back and watch news announcements until the volatility has subsided. Risk must be kept in check, with no single trade or day losing more than what can be easily made back on another. Expectations must be managed, and what the market gives must be accepted. By understanding the pitfalls and how to avoid to them, traders are more likely to find success in trading. (To help you become successful in the forex market, check out 10 Ways To Avoid Losing Money In Forex.)

Read more: 5 Forex Day Trading Mistakes To Avoid | Investopedia http://www.investopedia.com/articles/forex/11/5-forex-day-trading-mistakes.asp#ixzz4d4nbOvvm

Follow us: Investopedia on Facebook

In the high leverage game of retail forex day trading, there are certain practices that, if used regularly, are likely to lose a trader all he has. There are five common mistakes that day traders often make in an attempt to ramp up returns, but that end up resulting in lower returns. These five potentially devastating mistakes can be avoided with knowledge, discipline and an alternative approach. (For more strategies that you can use, check out Strategies For Part-Time Forex Traders.)

TUTORIAL: Forex

Averaging Down

Traders often stumble across averaging down. It is not something they intended to do when they began trading, but most traders have ended up doing it. There are several problems with averaging down.

The main problem is that a losing position is being held - not only potentially sacrificing money, but also time. This time and money could be placed in something else that is proving itself to be a better position.

Also, for capital that is lost, a larger return is needed on remaining capital to get it back. If a trader loses 50% of her capital, it will take a 100% return to bring her back to the original capital level. Losing large chunks of money on single trades or on single days of trading can cripple capital growth for long periods of time.

While it may work a few times, averaging down will inevitably lead to a large loss or margin call, as a trend can sustain itself longer than a trader can stay liquid - especially if more capital is being added as the position moves further out of the money.

Day traders are especially sensitive to these issues. The short time frame for trades means opportunities must be capitalized on when they occur and bad trades must be exited quickly. (To learn more on averaging down, check out Buying Stocks When The Price Goes Down: Big Mistake?)

Pre-Positioning for News

Traders know the news events that will move the market, yet the direction is not known in advance. A trader may even be fairly confident what a news announcement may be - for instance that the Federal Reserve will or will not raise interest rates - but even so cannot predict how the market will react to this expected news. Often there are additional statements, figures or forward looking indications provided by news announcements that can make movements extremely illogical.

There is also the simple fact that as volatility surges and all sorts of orders hit the market, stops are triggered on both sides of the market. This often results in whip-saw like action before a trend emerges (if one emerges in the near term at all).

For all these reasons, taking a position before a news announcement can seriously jeopardize a trader's chances of success. There is no easy money here; those who believe there is may face larger than usual losses.

Trading Right after News

A news headline hits the markets and then the market starts to move aggressively. It seems like easy money to hop on board and grab some pips. If this is done in a non-regimented and untested way without a solid trading plan behind it, it can be just as devastating as placing a gamble before the news comes out.

News announcements often cause whipsaw-like action because of a lack of liquidity and hair-pin turns in the market assessment of the report. Even a trade that is in the money can turn quickly, bringing large losses as large swings occur back and forth. Stops during these times are dependent on liquidity that may not be there, which means losses could potentially be much more than calculated.

Day traders should wait for volatility to subside and for a definitive trend to develop after news announcements. By doing so there is likely to be fewer liquidity concerns, risk can be managed more effectively and a more stable price direction is likely. (For more on trading with news releases, read How To Trade Forex On News Releases.)

Risking More Than 1% of Capital

Excessive risk does not equal excessive returns. Almost all traders who risk large amounts of capital on single trades will eventually lose in the long run. A common rule is that a trader should risk (in terms of the difference between entry and stop price) no more than 1% of capital on any single trade. Professional traders will often risk far less than 1% of capital.

Day trading also deserves some extra attention in this area. A daily risk maximum should also be implemented. This daily risk maximum can be 1% (or less) of capital, or equivalent to the average daily profit over a 30 day period. For example, a trader with a $50,000 account (leverage not included) could lose a maximum of $500 per day. Alternatively, this number could be altered so it is more in line with the average daily gain - if a trader makes $100 on positive days, she keeps losing days close to $100 or less.

The purpose of this method is to make sure no single trade or single day of trading hurts the traders account significantly. By adopting a risk maximum that is equivalent to the average daily gain over a 30 day period, the trader knows that he will not lose more in a single trade/day than he can make back on another. (To understand the risks involved in the forex market, see Forex Leverage: A Double-Edged Sword.)

Unrealistic Expectations

Unrealistic expectations come from many sources, but often result in all of the above problems. Our own trading expectations are often imposed on the market, leaving us expecting it to act according our desires and trade direction. The market doesn't care what you want. Traders must accept that the market can be illogical. It can be choppy, volatile and trending all in short, medium and long-term cycles. Isolating each move and profiting from it is not possible, and believing so will result in frustration and errors in judgment.

The best way to avoid unrealistic expectations is formulate a trading plan and then trade it. If it yields steady results, then don't change it - with forex leverage, even a small gain can become large. Accept this as what the market gives you. As capital grows over time, the position size can be increased to bring in higher dollar returns. Also, new strategies can be implemented and tested with minimal capital at first. Then, if positive results are seen, more capital can be put into the strategy.

Intra-day, a trader must also accept what the market provides at different parts of the day. Near the open, the markets are more volatile. Specific strategies can be used during the market open that may not work later in the day. As the day progresses, it may become quieter and a different strategy can be used. Towards the close, there may be a pickup in action and yet another strategy can be used. Accept what is given at each point in the day and don't expect more from a system than what it is providing.

Bottom Line

Traders get trapped in five common forex day trading mistakes. These must be avoided at all costs by developing an alternative approach. For averaging down, traders must not add to positions but rather exit losers quickly with a pre-planned exit strategy. Traders should sit back and watch news announcements until the volatility has subsided. Risk must be kept in check, with no single trade or day losing more than what can be easily made back on another. Expectations must be managed, and what the market gives must be accepted. By understanding the pitfalls and how to avoid to them, traders are more likely to find success in trading. (To help you become successful in the forex market, check out 10 Ways To Avoid Losing Money In Forex.)

Read more: 5 Forex Day Trading Mistakes To Avoid | Investopedia http://www.investopedia.com/articles/forex/11/5-forex-day-trading-mistakes.asp#ixzz4d4nbOvvm

Follow us: Investopedia on Facebook

Seyedmajid Masharian

A Simple Plan To Exit Your Trades Successfully

What is the hardest decision you have to make on any given trade? If you said the trade exit, you are correct and if you’ve traded for any length of time, you already knew that was the answer.

Over my years of trading the market and helping traders, I’ve gained a lot of experience and insight into how best to manage and exit trades, and today I’m going to share some of that with you.

To be clear, ‘trade exits’ means managing your stop loss and profit target as the trade unfolds. This can be a very tricky topic to tackle, because it is ‘tricky’ in reality, to put it nicely, as you probably already know. So, let’s dive into what I consider to be the best way to exit your trades after they are live in order to maximize profits and minimize losses…

Why are trade exits so difficult?!

http://www.learntotradethemarket.com/forex-trading-strategies/a-simple-plan-to-exit-your-trades-successfully

What is the hardest decision you have to make on any given trade? If you said the trade exit, you are correct and if you’ve traded for any length of time, you already knew that was the answer.

Over my years of trading the market and helping traders, I’ve gained a lot of experience and insight into how best to manage and exit trades, and today I’m going to share some of that with you.

To be clear, ‘trade exits’ means managing your stop loss and profit target as the trade unfolds. This can be a very tricky topic to tackle, because it is ‘tricky’ in reality, to put it nicely, as you probably already know. So, let’s dive into what I consider to be the best way to exit your trades after they are live in order to maximize profits and minimize losses…

Why are trade exits so difficult?!

http://www.learntotradethemarket.com/forex-trading-strategies/a-simple-plan-to-exit-your-trades-successfully

Seyedmajid Masharian

Australian Insider Trading Duo Gets Jail Time After Trading Margin FX

Former Australian Bureau of Statistics employee Christopher Hill got 3 years and 3 months while the holder of margin forex

Australian Insider Trading Duo Gets Jail Time After Trading Margin FX

Former Australian Bureau of Statistics employee Christopher Hill got 3 years and 3 months while the holder of margin forex

Former Australian Bureau of Statistics employee Christopher Hill got 3 years and 3 months while the holder of margin forex

Australian Insider Trading Duo Gets Jail Time After Trading Margin FX

Former Australian Bureau of Statistics employee Christopher Hill got 3 years and 3 months while the holder of margin forex

Seyedmajid Masharian

Insider Trading

What is 'Insider Trading'

Insider trading is the buying or selling of a security by someone who has access to material nonpublic information about the security. Insider trading can be illegal or legal depending on when the insider makes the trade. It is illegal when the material information is still nonpublic; trading while having special knowledge is unfair to other investors who don't have access to such knowledge.

BREAKING DOWN 'Insider Trading'

Illegal insider trading includes tipping others when you have any sort of nonpublic information. Legal insider trading happens when directors of the company purchase or sell shares, but they disclose their transactions legally. The Securities and Exchange Commission (SEC) has rules to protect investments from the effects of insider trading.

Martha Stewart and Insider Trading

Directors of companies are not the only ones who have the potential to be convicted of insider trading. Brokers and clients can be found guilty of insider trading. For example, Martha Stewart was found guilty of insider trading in 2003.

Stewart sold her shares of biopharmaceutical company ImClone Systems based on a tip from Peter Bacanovic, a broker at Merrill Lynch. Bacanovic's tip came after ImClone Systems' chief executive officer (CEO), Samuel Waksal, sold all his shares of the company. This came around the time ImClone was waiting on the Food and Drug Administration (FDA) for a decision on its cancer treatment, Erbitux.

Shortly after these sales, the FDA rejected ImClone's drug, causing shares to fall 16% in one day. The early sale by Stewart saved her a loss of $45,673. However, the sale was done based on a tip she received about Waksal selling his shares, which was not public information. Stewart served five months in prison and also months of house arrest and probation. Waksal was convicted and sentenced to a seven-year prison term.

Legal Insider Trading

The term "insider trading" is generally negative. Legal insider trading happens in the stock market on a weekly basis. The SEC requires transactions to be submitted electronically in a timely manner. Transactions are submitted electronically to the SEC and also must be disclosed on the company’s website.

The Securities Exchange Act of 1934 was the first step to legal disclosing transactions of company stock. Directors and major owners of stock must disclose their stakes, transactions and ownership changed. Form 3 is used as an initial filing to show a stake in the company. Form 4 is used to disclose a transaction of company stock within two days of the purchase or sale. Form 5 is used earlier transactions or those that have been deferred.

Read more: Insider Trading Definition | Investopedia http://www.investopedia.com/terms/i/insidertrading.asp#ixzz4czDwL2Yk

Follow us: Investopedia on Facebook

http://www.investopedia.com/terms/i/insidertrading.asp

What is 'Insider Trading'

Insider trading is the buying or selling of a security by someone who has access to material nonpublic information about the security. Insider trading can be illegal or legal depending on when the insider makes the trade. It is illegal when the material information is still nonpublic; trading while having special knowledge is unfair to other investors who don't have access to such knowledge.

BREAKING DOWN 'Insider Trading'

Illegal insider trading includes tipping others when you have any sort of nonpublic information. Legal insider trading happens when directors of the company purchase or sell shares, but they disclose their transactions legally. The Securities and Exchange Commission (SEC) has rules to protect investments from the effects of insider trading.

Martha Stewart and Insider Trading

Directors of companies are not the only ones who have the potential to be convicted of insider trading. Brokers and clients can be found guilty of insider trading. For example, Martha Stewart was found guilty of insider trading in 2003.

Stewart sold her shares of biopharmaceutical company ImClone Systems based on a tip from Peter Bacanovic, a broker at Merrill Lynch. Bacanovic's tip came after ImClone Systems' chief executive officer (CEO), Samuel Waksal, sold all his shares of the company. This came around the time ImClone was waiting on the Food and Drug Administration (FDA) for a decision on its cancer treatment, Erbitux.

Shortly after these sales, the FDA rejected ImClone's drug, causing shares to fall 16% in one day. The early sale by Stewart saved her a loss of $45,673. However, the sale was done based on a tip she received about Waksal selling his shares, which was not public information. Stewart served five months in prison and also months of house arrest and probation. Waksal was convicted and sentenced to a seven-year prison term.

Legal Insider Trading

The term "insider trading" is generally negative. Legal insider trading happens in the stock market on a weekly basis. The SEC requires transactions to be submitted electronically in a timely manner. Transactions are submitted electronically to the SEC and also must be disclosed on the company’s website.

The Securities Exchange Act of 1934 was the first step to legal disclosing transactions of company stock. Directors and major owners of stock must disclose their stakes, transactions and ownership changed. Form 3 is used as an initial filing to show a stake in the company. Form 4 is used to disclose a transaction of company stock within two days of the purchase or sale. Form 5 is used earlier transactions or those that have been deferred.

Read more: Insider Trading Definition | Investopedia http://www.investopedia.com/terms/i/insidertrading.asp#ixzz4czDwL2Yk

Follow us: Investopedia on Facebook

http://www.investopedia.com/terms/i/insidertrading.asp

Seyedmajid Masharian

THE ONLY PERSON THAT CAN HELP YOU IN BUSINESS AND LIFE IS JUST YOURSELF...

ONLY TRUST TO YOUR ABILITIES TO MAKE BIG FORTUNES

ONLY TRUST TO YOUR ABILITIES TO MAKE BIG FORTUNES

Seyedmajid Masharian

Top Ten US Economic Indicators

http://www.investopedia.com/articles/personal-finance/020215/top-ten-us-economic-indicators.asp

http://www.investopedia.com/articles/personal-finance/020215/top-ten-us-economic-indicators.asp

Seyedmajid Masharian

The Smart Money Trade – Is That You?

Smart money index (SMI) of smart money flow index is a technical analysis indicator demonstrating investors’ sentiment. The index was invented and popularized by money manager Don Hays. The indicator is based on intra-day price patterns.

The main idea is that the majority of traders (emotional, news-driven) overreact at the beginning of the trading day because of the overnight news and economic data. There is also a lot of buying on market orders and short covering at the opening.

Smart, experienced investors start trading closer to the end of the day having the opportunity to evaluate market performance. Therefore, the basic strategy is to bet against the morning price trend and bet with the evening price trend.

Sounds simple enough. The “dumb money” active in the morning, while the “smart money” work’s its magic near the close.

Check it out – The SP 500 is the top chart, and the “smart money” on the bottom.

The smart money has been “selling into this rally” since June of 2012!

It’s not rocket science, as emotions tend to drive new traders / investors right into the hands of the more experienced.

If you’re “up and attem” in the mornings and can’t figure out why your trading isn’t going so well, perhaps it’s time to really question…….

Are you dumb?

https://forexkong.com/2013/11/21/the-smart-money-trade-is-that-you/

Smart money index (SMI) of smart money flow index is a technical analysis indicator demonstrating investors’ sentiment. The index was invented and popularized by money manager Don Hays. The indicator is based on intra-day price patterns.

The main idea is that the majority of traders (emotional, news-driven) overreact at the beginning of the trading day because of the overnight news and economic data. There is also a lot of buying on market orders and short covering at the opening.

Smart, experienced investors start trading closer to the end of the day having the opportunity to evaluate market performance. Therefore, the basic strategy is to bet against the morning price trend and bet with the evening price trend.

Sounds simple enough. The “dumb money” active in the morning, while the “smart money” work’s its magic near the close.

Check it out – The SP 500 is the top chart, and the “smart money” on the bottom.

The smart money has been “selling into this rally” since June of 2012!

It’s not rocket science, as emotions tend to drive new traders / investors right into the hands of the more experienced.

If you’re “up and attem” in the mornings and can’t figure out why your trading isn’t going so well, perhaps it’s time to really question…….

Are you dumb?

https://forexkong.com/2013/11/21/the-smart-money-trade-is-that-you/

Seyedmajid Masharian

Daily retail FX volumes dip to $317 bln in Q2 -industry site

Online retail brokers traded $317 billion worth of currencies a day in the second quarter, down around 13 percent on the quarter but still up substantially compared to the same period last year, according to industry website Finance Magnates.

Previously viewed as a sideshow to the wholesale trading between banks and big investment and pension funds that forms the core of the $5 trillion a day global currency market, the retail sector has grown steadily in size and importance.

In a year which has seen currency trading jump as a percentage of the activity of banks and other financial market players, volumes across the retail sector are up by anything between 20 and 40 percent on the same period of last year.

Data and estimates collated by industry news and analysis website Finance Magnates (www.financemagnates.com) showed U.S.-based Gain Capital, Interactive Brokers and Oanda all made gains on the quarter against their competitors.

The numbers, which Reuters has seen but not verified with each of the companies, also showed volumes at another smaller European player, CMC, rose 23 percent in a quarter that saw it announce plans for a public share flotation.

"CMC Markets outperformed other major brokers by posting 23% growth of forex trading volumes during Q2," Finance Magnates senior analyst Ron Finberg said.

"With CMC Markets publicly stating its goals of an IPO, their forex performance and higher account sizes reveal that the broker is successfully being able to achieve growth as a prelude to going public."

Trade on Japanese platforms, the single biggest market for ordinary consumers making small leveraged bets on currency movements, fell by a quarter to $144 billion, pulling overall global volumes down from $368 billion on the first quarter.

But for brokers outside of Japan business grew by just over a billion dollars a day to a total of $173.5 billion a day in the second quarter, helping U.S. and European firms to increase market share.

http://www.reuters.com/article/markets-forex-volumes-idUSL5N10A3ZC20150730

Online retail brokers traded $317 billion worth of currencies a day in the second quarter, down around 13 percent on the quarter but still up substantially compared to the same period last year, according to industry website Finance Magnates.

Previously viewed as a sideshow to the wholesale trading between banks and big investment and pension funds that forms the core of the $5 trillion a day global currency market, the retail sector has grown steadily in size and importance.

In a year which has seen currency trading jump as a percentage of the activity of banks and other financial market players, volumes across the retail sector are up by anything between 20 and 40 percent on the same period of last year.

Data and estimates collated by industry news and analysis website Finance Magnates (www.financemagnates.com) showed U.S.-based Gain Capital, Interactive Brokers and Oanda all made gains on the quarter against their competitors.

The numbers, which Reuters has seen but not verified with each of the companies, also showed volumes at another smaller European player, CMC, rose 23 percent in a quarter that saw it announce plans for a public share flotation.

"CMC Markets outperformed other major brokers by posting 23% growth of forex trading volumes during Q2," Finance Magnates senior analyst Ron Finberg said.

"With CMC Markets publicly stating its goals of an IPO, their forex performance and higher account sizes reveal that the broker is successfully being able to achieve growth as a prelude to going public."

Trade on Japanese platforms, the single biggest market for ordinary consumers making small leveraged bets on currency movements, fell by a quarter to $144 billion, pulling overall global volumes down from $368 billion on the first quarter.

But for brokers outside of Japan business grew by just over a billion dollars a day to a total of $173.5 billion a day in the second quarter, helping U.S. and European firms to increase market share.

http://www.reuters.com/article/markets-forex-volumes-idUSL5N10A3ZC20150730

: