Seyedmajid Masharian / Profile

forex trader

at

home

Seyedmajid Masharian

UK Police Arrest Ex-HSBC Banker for Rigging $3.4 Billion Deal

Johnson and Scott are the first executives to be charged in connection with the US' long-running investigation.

http://www.financemagnates.com/forex/regulation/uk-police-arrests-ex-hsbc-banker-rigging-3-4-billion-deal/?utm_content=bufferd82c9&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer

Johnson and Scott are the first executives to be charged in connection with the US' long-running investigation.

http://www.financemagnates.com/forex/regulation/uk-police-arrests-ex-hsbc-banker-rigging-3-4-billion-deal/?utm_content=bufferd82c9&utm_medium=social&utm_source=facebook.com&utm_campaign=buffer

Seyedmajid Masharian

NEW YORK (HedgeWorld.com)—Jim Simons, the legendary mathematician and hedge fund manager who runs Renaissance Technologies Corp., may use black boxes on his trading floors, but as a person he is open and forthcoming: a mixture of humility, common sense and pragmatism.

At the International Association of Financial Engineers annual conference, this year titled "From Quant to Riches," and held in New York on Monday [May 21], Mr. Simons gave a speech in which he offered self-effacing insights about himself and his investment style.

Mr. Simons is probably the most successful hedge fund manager of all time. His $26 billion hedge fund has yielded returns exceeding 30% for more than a decade. He also brought home $1.5 billion last year, according to Trader Magazine, tops among his peers in compensation. And yet, he remains modest and attributes a lot of his successful career to luck.

"There is no real substitute for common sense except for good luck, which is a perfect substitute for everything," Mr. Simons said at the conference. "I had luck as a mathematician. I became very famous but I had very little to do with it."

Mr. Simons' success may be the result of several factors. One is certainly the rare ability to be at the same time a top trader and a high-end mathematician. In some instances, Mr. Simons the mathematician almost appears to be a different person than Mr. Simons the trader. And yet, the man is all of that. Who would have thought, for instance that Mr. Simons viewed himself as a speculator? But he does. "Speculation comes in and destroys trends. I am a speculator. It accelerates the trend. It gets you closer to the truth faster," he said.

One interesting revelation was that the champion of statistical arbitrage and computer-generated trading started as a directional trader. The master of quantitative finance started with his business partner as a commodity trader. Both made wild bets and in 1974 the two launched their fund with $600,000. In seven months, they had grown in size by a factor of 10. Mr. Simons' partner "never made any money as a commodity trader after that for the rest of his life," said Mr. Simons.

In the 1970s, Mr. Simons made a lot of his fortune with sugar. In his speech, he said he bought sugar at 20 cents per pound. The commodity went up to 60 cents per pound in a short time.

Then came a time when the directional trader slowly moved toward models. But the evolution did not happen overnight. During that transition time, Mr. Simons hired a partner, Lenny Baum, to write models for him. Mr. Baum concentrated on writing currency models, and it worked out well. But after some time, Mr. Baum grew tired and bored of it, said Mr. Simons. At some point, Mr. Baum decided to buy the British pound. "The pound went through the roof. Lenny never looked at a model again," said Mr. Simons.

During the first two years after the two partners gave up modeling altogether, they multiplied their capital by a factor of 12.

Mr. Simons credited both luck and common sense in explaining his success. In an anecdote, he explained how he came to sell his gold during a gold rally. "My broker said his wife had sold his [gold] cuff. I told my broker to sell my gold position. He didn't want to but I told him: ‘I'm the boss.' Gold was up the next day, but the following day, it was the end of the gold rally. I was lucky. But that was also common sense."

Two of Mr. Simons' other interesting personality traits, ones that are necessary to be a master trader, are his adaptability and flexibility.

Mr. Simons took his currency model and applied it to commodities. At the end of the 1980s, he switched styles. "We decided that systematic trading was best. Fundamental trading gave me ulcers."

Mr. Simons also needed traders. But he felt that he did not know how to pick a good trader. "Science, I understood. I decided to just focus on making models."

That's when the Medallion Fund started in 1988 with $25 million. It's worth noting that during these early years Mr. Simons did not completely settle for quantitative finance.

Mr. Simons, who does not suffer from an inflated ego, said that even at that time, he had a lot to learn. "It took us six years to learn how to trade stocks," he said. But the learning paid off. Five years after Medallion launched, the fund was closed to new investors. And by the end of 2002, Medallion had almost $7 billion under management. Judging that it was too much, Mr. Simons in 2005 returned all the money to investors.

This marked another milestone, at which point Mr. Simons again reinvented himself. "We understood the limitations of very high-speed trading techniques. We looked at other factors besides intraday fluctuations," he said. From high-frequency trading, Mr. Simons evolved to a system that focused on the long end of the frequency spectrum. In addition, his new systems integrated elements of fundamental analysis, such as balance sheets or income statements.

His new research began at the start of 2004 and in July of 2005, Renaissance launched its Renaissance Institutional Equities Fund (RIEF).

The launch was newsworthy due to its phenomenal size. "We targeted $100 billion. It attracted a great deal of attention, which I intended to do," Mr. Simons said. "The $100 billion was a template for research. This fund can only charge low fees. In order to make it worthwhile, you have to make it very big, otherwise, it doesn't make sense."

Renaissance has charged incentive fees of up to 44% for some of its products in the past. RIEF charges a 1% management fee and 10% for performance with high water mark, according to a marketing document obtained by HedgeWorld.

So far, the fund is growing at a steady pace and has reached $26 billion.

Mr. Simons said that "trend-following is not such a good model. It's simply eroded." Things change and being able to adjust is what made Mr. Simons so successful. "Statistic predictor signals erode over the next several years; it can be five years or 10 years. You have to keep coming up with new things because the market is against us. If you don't keep getting better, you're going to do worse." Mr. Simons said that his models change weekly.

Mr. Simons talked about Renaissance's little-known fund of funds, arguing as a good contrarian that "past performance is to some degree indicative of what it's going to be in the future." He then rephrased his statement to make it acceptable to the Securities and Exchange Commission: "Past performance is certainly not a guarantee, but somewhat, it's likely correlated," he said.

Mr. Simons said that Renaissance comprises 300 people. Here again, the myth of secrecy collapsed. "Our atmosphere is 100% open," he said. "It's the best way to do science. There's a weekly meeting with everybody."

As is widely known, Mr. Simons works with scientists, not traders. "We use a lot of mathematicians, physicists, astronomers, computer scientists. We haven't hired out of Wall Street at all."

In 2004, Mr. Simons, along with a group of mathematicians and business people, founded Math for America to improve math education in U.S. public schools. The organization is behind a new bill called America Competes—a bill to expand basic research and development and promote math and science education—which Mr. Simons said he hopes will get passed.

So what's in Mr. Simons' black box? He won't say of course. But if there is a secret, it's a pretty simple one "It's 100% automated. It's as automated as it can be. The computer does its thing. It generates its trade, and the trade gets executed. No one sticks its head to the door, and says: ‘Jeez! You should buy IBM!' We couldn't model that."

At the International Association of Financial Engineers annual conference, this year titled "From Quant to Riches," and held in New York on Monday [May 21], Mr. Simons gave a speech in which he offered self-effacing insights about himself and his investment style.

Mr. Simons is probably the most successful hedge fund manager of all time. His $26 billion hedge fund has yielded returns exceeding 30% for more than a decade. He also brought home $1.5 billion last year, according to Trader Magazine, tops among his peers in compensation. And yet, he remains modest and attributes a lot of his successful career to luck.

"There is no real substitute for common sense except for good luck, which is a perfect substitute for everything," Mr. Simons said at the conference. "I had luck as a mathematician. I became very famous but I had very little to do with it."

Mr. Simons' success may be the result of several factors. One is certainly the rare ability to be at the same time a top trader and a high-end mathematician. In some instances, Mr. Simons the mathematician almost appears to be a different person than Mr. Simons the trader. And yet, the man is all of that. Who would have thought, for instance that Mr. Simons viewed himself as a speculator? But he does. "Speculation comes in and destroys trends. I am a speculator. It accelerates the trend. It gets you closer to the truth faster," he said.

One interesting revelation was that the champion of statistical arbitrage and computer-generated trading started as a directional trader. The master of quantitative finance started with his business partner as a commodity trader. Both made wild bets and in 1974 the two launched their fund with $600,000. In seven months, they had grown in size by a factor of 10. Mr. Simons' partner "never made any money as a commodity trader after that for the rest of his life," said Mr. Simons.

In the 1970s, Mr. Simons made a lot of his fortune with sugar. In his speech, he said he bought sugar at 20 cents per pound. The commodity went up to 60 cents per pound in a short time.

Then came a time when the directional trader slowly moved toward models. But the evolution did not happen overnight. During that transition time, Mr. Simons hired a partner, Lenny Baum, to write models for him. Mr. Baum concentrated on writing currency models, and it worked out well. But after some time, Mr. Baum grew tired and bored of it, said Mr. Simons. At some point, Mr. Baum decided to buy the British pound. "The pound went through the roof. Lenny never looked at a model again," said Mr. Simons.

During the first two years after the two partners gave up modeling altogether, they multiplied their capital by a factor of 12.

Mr. Simons credited both luck and common sense in explaining his success. In an anecdote, he explained how he came to sell his gold during a gold rally. "My broker said his wife had sold his [gold] cuff. I told my broker to sell my gold position. He didn't want to but I told him: ‘I'm the boss.' Gold was up the next day, but the following day, it was the end of the gold rally. I was lucky. But that was also common sense."

Two of Mr. Simons' other interesting personality traits, ones that are necessary to be a master trader, are his adaptability and flexibility.

Mr. Simons took his currency model and applied it to commodities. At the end of the 1980s, he switched styles. "We decided that systematic trading was best. Fundamental trading gave me ulcers."

Mr. Simons also needed traders. But he felt that he did not know how to pick a good trader. "Science, I understood. I decided to just focus on making models."

That's when the Medallion Fund started in 1988 with $25 million. It's worth noting that during these early years Mr. Simons did not completely settle for quantitative finance.

Mr. Simons, who does not suffer from an inflated ego, said that even at that time, he had a lot to learn. "It took us six years to learn how to trade stocks," he said. But the learning paid off. Five years after Medallion launched, the fund was closed to new investors. And by the end of 2002, Medallion had almost $7 billion under management. Judging that it was too much, Mr. Simons in 2005 returned all the money to investors.

This marked another milestone, at which point Mr. Simons again reinvented himself. "We understood the limitations of very high-speed trading techniques. We looked at other factors besides intraday fluctuations," he said. From high-frequency trading, Mr. Simons evolved to a system that focused on the long end of the frequency spectrum. In addition, his new systems integrated elements of fundamental analysis, such as balance sheets or income statements.

His new research began at the start of 2004 and in July of 2005, Renaissance launched its Renaissance Institutional Equities Fund (RIEF).

The launch was newsworthy due to its phenomenal size. "We targeted $100 billion. It attracted a great deal of attention, which I intended to do," Mr. Simons said. "The $100 billion was a template for research. This fund can only charge low fees. In order to make it worthwhile, you have to make it very big, otherwise, it doesn't make sense."

Renaissance has charged incentive fees of up to 44% for some of its products in the past. RIEF charges a 1% management fee and 10% for performance with high water mark, according to a marketing document obtained by HedgeWorld.

So far, the fund is growing at a steady pace and has reached $26 billion.

Mr. Simons said that "trend-following is not such a good model. It's simply eroded." Things change and being able to adjust is what made Mr. Simons so successful. "Statistic predictor signals erode over the next several years; it can be five years or 10 years. You have to keep coming up with new things because the market is against us. If you don't keep getting better, you're going to do worse." Mr. Simons said that his models change weekly.

Mr. Simons talked about Renaissance's little-known fund of funds, arguing as a good contrarian that "past performance is to some degree indicative of what it's going to be in the future." He then rephrased his statement to make it acceptable to the Securities and Exchange Commission: "Past performance is certainly not a guarantee, but somewhat, it's likely correlated," he said.

Mr. Simons said that Renaissance comprises 300 people. Here again, the myth of secrecy collapsed. "Our atmosphere is 100% open," he said. "It's the best way to do science. There's a weekly meeting with everybody."

As is widely known, Mr. Simons works with scientists, not traders. "We use a lot of mathematicians, physicists, astronomers, computer scientists. We haven't hired out of Wall Street at all."

In 2004, Mr. Simons, along with a group of mathematicians and business people, founded Math for America to improve math education in U.S. public schools. The organization is behind a new bill called America Competes—a bill to expand basic research and development and promote math and science education—which Mr. Simons said he hopes will get passed.

So what's in Mr. Simons' black box? He won't say of course. But if there is a secret, it's a pretty simple one "It's 100% automated. It's as automated as it can be. The computer does its thing. It generates its trade, and the trade gets executed. No one sticks its head to the door, and says: ‘Jeez! You should buy IBM!' We couldn't model that."

Seyedmajid Masharian

23 Investing Lessons from George Soros

Dear Reader,

The folks at Morgan Creek Capital Management were kind enough to allow me to share with you an excerpt of their quarterly review and outlook, authored by prolific CEO Mark Yusko. Some of you will recognize Mark from our last Casey Research Summit; attendees loved his insightful and passionate presentation on where in the world the best investment opportunities are today. If you’re not familiar with Mark, he was the head of the University of North Carolina’s endowment before founding Morgan Creek.

In what follows, Mark discusses the most important lessons he’s learned from legendary investor George Soros. Its a tour de force in investment theory. At the end of the excerpt, you’ll find a link to the full Q4 report. I encourage you to read the whole thing, especially Mark’s “Ten Surprises” for 2015.

Enjoy.

https://www.caseyresearch.com/articles/23-investing-lessons-from-george-soros

Dear Reader,

The folks at Morgan Creek Capital Management were kind enough to allow me to share with you an excerpt of their quarterly review and outlook, authored by prolific CEO Mark Yusko. Some of you will recognize Mark from our last Casey Research Summit; attendees loved his insightful and passionate presentation on where in the world the best investment opportunities are today. If you’re not familiar with Mark, he was the head of the University of North Carolina’s endowment before founding Morgan Creek.

In what follows, Mark discusses the most important lessons he’s learned from legendary investor George Soros. Its a tour de force in investment theory. At the end of the excerpt, you’ll find a link to the full Q4 report. I encourage you to read the whole thing, especially Mark’s “Ten Surprises” for 2015.

Enjoy.

https://www.caseyresearch.com/articles/23-investing-lessons-from-george-soros

Seyedmajid Masharian

From $6,000 to $73 billion: Warren Buffett’s wealth through the ages

‘I just feel very, very lucky,’ the billionaire says in an upcoming documentary

“For over 60 years, I’ve been able to tap dance to work, doing what I love doing,” Warren Buffett says in an HBO documentary slated to premiere at the end of the month. “I just feel very, very lucky.” In fact, he says he “won the ovarian lottery.”

Sure, luck certainly played a part in the octogenarian’s journey to incredible wealth, but there’s a whole lot more to the story than just serendipity.

After all, what were you doing as a preteen?

http://www.marketwatch.com/story/from-6000-to-67-billion-warren-buffetts-wealth-through-the-ages-2015-08-17

‘I just feel very, very lucky,’ the billionaire says in an upcoming documentary

“For over 60 years, I’ve been able to tap dance to work, doing what I love doing,” Warren Buffett says in an HBO documentary slated to premiere at the end of the month. “I just feel very, very lucky.” In fact, he says he “won the ovarian lottery.”

Sure, luck certainly played a part in the octogenarian’s journey to incredible wealth, but there’s a whole lot more to the story than just serendipity.

After all, what were you doing as a preteen?

http://www.marketwatch.com/story/from-6000-to-67-billion-warren-buffetts-wealth-through-the-ages-2015-08-17

Seyedmajid Masharian

We have some important risk events coming up this week.

First of all, tomorrow is the UK General Election. I expect Prime Minister Theresa May to win a majority, despite the recent squeeze in national polls. This will act to support the pound.

Secondly, we also have the Fed's two-day meeting. It's widely expected that the Fed will go ahead with another interest rate hike of 0.25%. I agree with this view - although recent economic data from the US makes me believe that the Fed will be more cautious in their approach for the remainder of 2017.

Have you positioned yourself in the market for these two events? Share your trades below and I'll do my best to come back to you.

https://www.facebook.com/JarrattD?hc_ref=NEWSFEED&fref=nf

First of all, tomorrow is the UK General Election. I expect Prime Minister Theresa May to win a majority, despite the recent squeeze in national polls. This will act to support the pound.

Secondly, we also have the Fed's two-day meeting. It's widely expected that the Fed will go ahead with another interest rate hike of 0.25%. I agree with this view - although recent economic data from the US makes me believe that the Fed will be more cautious in their approach for the remainder of 2017.

Have you positioned yourself in the market for these two events? Share your trades below and I'll do my best to come back to you.

https://www.facebook.com/JarrattD?hc_ref=NEWSFEED&fref=nf

Seyedmajid Masharian

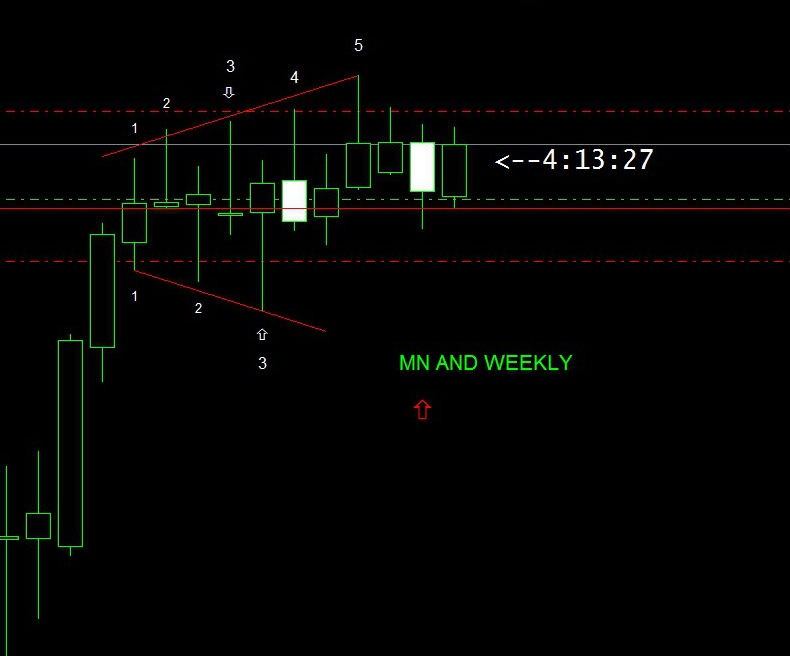

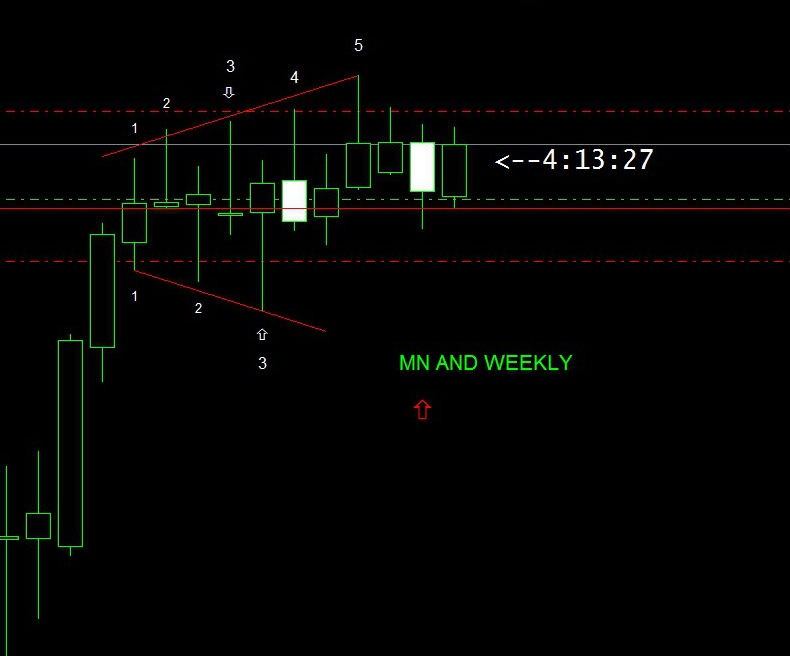

HOW DO YOU TRADE THIS WORST MEGAPHONE PATTERN

PLEASE GIVE YOUR KIND COMMENTS

http://www.sidewaysmarkets.com/2014/04/day-trading-with-inverted-triangles-and.html

PLEASE GIVE YOUR KIND COMMENTS

http://www.sidewaysmarkets.com/2014/04/day-trading-with-inverted-triangles-and.html

Seyedmajid Masharian

Exclusive: Retail traders can now design, backtest and work together to develop algos historically available only to banks and hedge funds

Hedge funds and interbank dealers no longer have an advantage over retail traders with more capital to design algos and trading systems to beat the market

https://financefeeds.com/exclusive-retail-traders-can-now-design-backtest-and-work-together-to-develop-algos-historically-available-only-to-banks-and-hedge-funds/

Hedge funds and interbank dealers no longer have an advantage over retail traders with more capital to design algos and trading systems to beat the market

https://financefeeds.com/exclusive-retail-traders-can-now-design-backtest-and-work-together-to-develop-algos-historically-available-only-to-banks-and-hedge-funds/

Seyedmajid Masharian

Building A Better Brain – A Holiday Message From Chris Capre & The 2ndSkiesForex Team

https://2ndskiesforex.com/trading-strategies/building-a-better-brain-a-holiday-message-from-chris-capre-the-2ndskiesforex-team/

https://2ndskiesforex.com/trading-strategies/building-a-better-brain-a-holiday-message-from-chris-capre-the-2ndskiesforex-team/

Seyedmajid Masharian

Why Trading Against the Trend Will Destroy Your Account

In light of the current market conditions which consist of some very strong ‘one-way’ trends in the U.S. dollar pairs, I wanted to write a lesson not just about the advantages of trend-trading, but also about how trading against the trend can and will destroy your trading account, if you let it.

Simply put, the easiest way to make money as a trader or investor, is trading with the dominant daily chart trend. However, during my time teaching people how to trade, I have found that it almost seems to be human nature to want to trade against the trend, at least in the early-stages of one’s trading journey. So, I hope today’s lesson will help you avoid making this gigantic mistake that so many beginning traders make, by showing you tangible proof of why the trend is definitely your friend and why you should not trade against it most of the time.

Don’t fight the path of least resistance…

http://www.learntotradethemarket.com/forex-trading-strategies/why-trading-against-the-trend-will-destroy-your-account

In light of the current market conditions which consist of some very strong ‘one-way’ trends in the U.S. dollar pairs, I wanted to write a lesson not just about the advantages of trend-trading, but also about how trading against the trend can and will destroy your trading account, if you let it.

Simply put, the easiest way to make money as a trader or investor, is trading with the dominant daily chart trend. However, during my time teaching people how to trade, I have found that it almost seems to be human nature to want to trade against the trend, at least in the early-stages of one’s trading journey. So, I hope today’s lesson will help you avoid making this gigantic mistake that so many beginning traders make, by showing you tangible proof of why the trend is definitely your friend and why you should not trade against it most of the time.

Don’t fight the path of least resistance…

http://www.learntotradethemarket.com/forex-trading-strategies/why-trading-against-the-trend-will-destroy-your-account

Seyedmajid Masharian

Trading Psychology - Greed & Fear

Besides all of the fundamental and technical factors a trader must keep track of in order to be successful, there is another area which is often overlooked – themselves.

No matter how good your strategy is, the other factor which will always influence your outcomes are your own emotions. After all, it is emotions that move the markets. Emotions are what most of our indicators are designed to give us a measurement of. And in order to be able to profit on market movements created by the emotions of others, you must first learn how to read the mood behind the move, and also how recognize and control your own.

Greed

As prices rise, they naturally attract more attention. As more and more people jump onboard the rally, its climb accelerates. But in all the excitement, there is a tendency to confuse account balance (the amount actually on your account) with account equity (the total value including the sum of your open positions). People begin to treat their potential profits as if they were already realized. This expectation can sometimes cause basic reversal signals to be overlooked.

Additionally, those who missed out on the opportunity early on, when the trend was still young, are becoming hypnotized by the length and size of the rally. Jumping onboard late is a risky game, however, as those who got in early will eventually need to take their profits. There is also a bit of the “greater fool” factor, as anyone who is still buying is now buying at a higher price, and from a seller who has reason to believe the move may soon be over. The idea then is that hopefully someone will keep on buying after you, at an even higher price, when you eventually decide to become a seller yourself.

Fear

https://www.fxstreet.com/education/10-basisc-forex-lessons-201007050000

Besides all of the fundamental and technical factors a trader must keep track of in order to be successful, there is another area which is often overlooked – themselves.

No matter how good your strategy is, the other factor which will always influence your outcomes are your own emotions. After all, it is emotions that move the markets. Emotions are what most of our indicators are designed to give us a measurement of. And in order to be able to profit on market movements created by the emotions of others, you must first learn how to read the mood behind the move, and also how recognize and control your own.

Greed

As prices rise, they naturally attract more attention. As more and more people jump onboard the rally, its climb accelerates. But in all the excitement, there is a tendency to confuse account balance (the amount actually on your account) with account equity (the total value including the sum of your open positions). People begin to treat their potential profits as if they were already realized. This expectation can sometimes cause basic reversal signals to be overlooked.

Additionally, those who missed out on the opportunity early on, when the trend was still young, are becoming hypnotized by the length and size of the rally. Jumping onboard late is a risky game, however, as those who got in early will eventually need to take their profits. There is also a bit of the “greater fool” factor, as anyone who is still buying is now buying at a higher price, and from a seller who has reason to believe the move may soon be over. The idea then is that hopefully someone will keep on buying after you, at an even higher price, when you eventually decide to become a seller yourself.

Fear

https://www.fxstreet.com/education/10-basisc-forex-lessons-201007050000

Seyedmajid Masharian

Left feedback to developer for job I need an expert advisor

HE IS VERY PATIENT AND A REAL PROFESSIONAL PROGRAMMER...

I AM VERY SATISFIED AND WILL CONTINUE WITH HIM NEXT MY PROJECTS.

I RECOMMEND HIM TO EVERY ONE WHO SEEK FOR AN EXCELLENT PROGRAMMER...

: