Claws and Horns / Profile

Claws and Horns

News of the day. Wednesday 30.09.2015

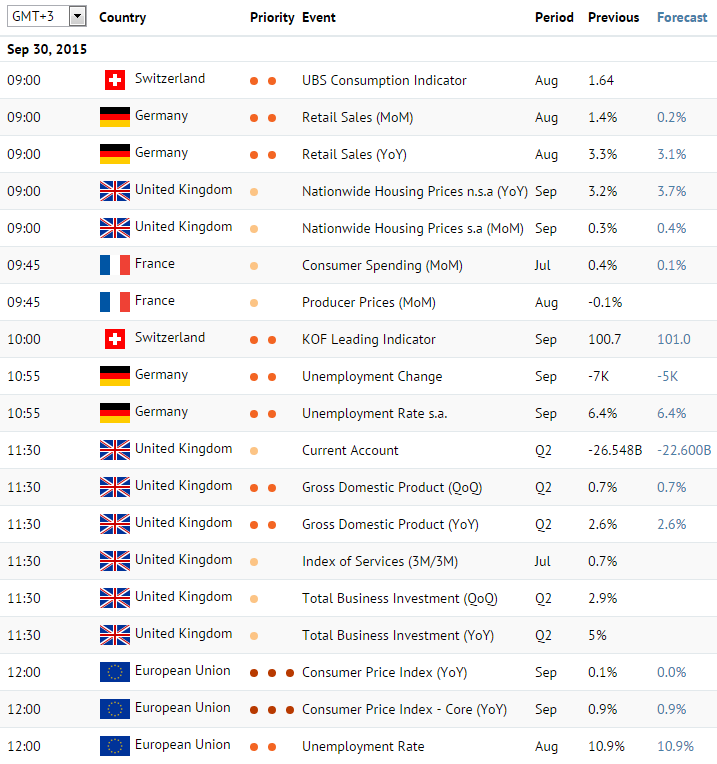

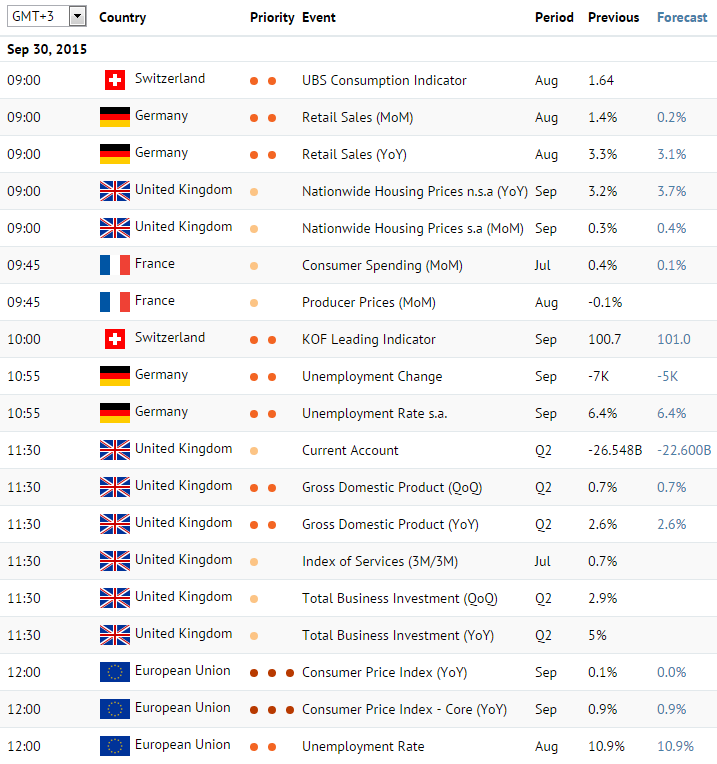

Wednesday is going to be full of important publications. The final Gross Domestic Product (QoQ) data for the second quarter of the year is due from the UK at 11:30 am (all times stated in GMT +3). After the first quarter reduction to 2.9%, the figure is expected to fall again to 2.6% in yearly terms. The market reaction is going to be moderate, as the data would match preliminary figure. Preliminary data on the Consumer Price Index for September is due at 12 pm in the eurozone. The index was expected to keep gradually falling and in September would have reached 0%, thus pressuring the Euro. July GDP (MoM) data is due at 3:30 pm in Canada. According to forecasts, the figure was going to fall to 0.2% after a growth by 0.5% in June, which would pressure the CAD. Fed’s Yellen Speech is due at the Third Annual Community Banking Research and Policy Conference in St. Louis, Missouri at 10 pm. The speech traditionally attracts market attention as it may have hints on the future direction of US monetary policy.

On Wednesday night at 2:50 am, the key Japanese indices Tankan are due. Amongst those, the most important one is the Tankan Large Manufacturing Index for the third quarter of the year, which is calculated based on surveys of the largest Japanese companies and represents business conditions in the manufacturing sector. According to forecasts, the index is going to fall from 15 to 13 points thus showing a slowdown of the Japanese economy. Finally, at 4 am September NBS Manufacturing PMI is due in China. The index is expected to continue its fall that started in July. In August, it already fell below the level of 50, which indicates a contraction of the manufacturing sector, and could decline further in September from 49.7 to 49.6 points. If forecasts are confirmed it could pressure all major currency pairs and commodity markets.

Wednesday is going to be full of important publications. The final Gross Domestic Product (QoQ) data for the second quarter of the year is due from the UK at 11:30 am (all times stated in GMT +3). After the first quarter reduction to 2.9%, the figure is expected to fall again to 2.6% in yearly terms. The market reaction is going to be moderate, as the data would match preliminary figure. Preliminary data on the Consumer Price Index for September is due at 12 pm in the eurozone. The index was expected to keep gradually falling and in September would have reached 0%, thus pressuring the Euro. July GDP (MoM) data is due at 3:30 pm in Canada. According to forecasts, the figure was going to fall to 0.2% after a growth by 0.5% in June, which would pressure the CAD. Fed’s Yellen Speech is due at the Third Annual Community Banking Research and Policy Conference in St. Louis, Missouri at 10 pm. The speech traditionally attracts market attention as it may have hints on the future direction of US monetary policy.

On Wednesday night at 2:50 am, the key Japanese indices Tankan are due. Amongst those, the most important one is the Tankan Large Manufacturing Index for the third quarter of the year, which is calculated based on surveys of the largest Japanese companies and represents business conditions in the manufacturing sector. According to forecasts, the index is going to fall from 15 to 13 points thus showing a slowdown of the Japanese economy. Finally, at 4 am September NBS Manufacturing PMI is due in China. The index is expected to continue its fall that started in July. In August, it already fell below the level of 50, which indicates a contraction of the manufacturing sector, and could decline further in September from 49.7 to 49.6 points. If forecasts are confirmed it could pressure all major currency pairs and commodity markets.

Claws and Horns

Published post NZD/USD: trading flat

Current trend On Tuesday, the NZD/USD pair was trading flat. The demand for the USD is not high, as market participants have relatively calmed down on US rate hike speculations...

Claws and Horns

News of the day. Tuesday 29.09.2015

On Tuesday, attention needs to be paid to the data on the Consumer Credit and Mortgage Approvals from the UK, due at 11:30 am (GMT +3). The growth of consumer indebtedness in the national economy indicates their confidence, while mortgage numberstell about demand on the property market. Both indicators are expected to grow for August, from 1.173 million to 1.200 million Pounds and from 68764 thousands to 70000 thousand accordingly, which would support the British Pound. At 3 pm (GMT +3) preliminary data on the Consumer Price Index for September is due in Germany. Low inflation remains one of the main problems for all countries within the eurozone, with Germany being no exception. The index is expected to fall form 0.2% to 0.1% on a year-to-year basis, while in monthly terms it is going to show deflation being at -0.1%. The data would pressure the Euro is forecasts are confirmed. The BOE’s Governor Carney Speech is due at 10:40 pm (GMT +3) in London, in which he could shed the light on regulator’s future monetary policy. On Tuesday night at 2:50 am (GMT +3), Retail Trade data for August is due in Japan. The figure is expected to decline in yearly terms from 1.6% to 1.1%, which could lead to the Yen weakening.

On Tuesday, attention needs to be paid to the data on the Consumer Credit and Mortgage Approvals from the UK, due at 11:30 am (GMT +3). The growth of consumer indebtedness in the national economy indicates their confidence, while mortgage numberstell about demand on the property market. Both indicators are expected to grow for August, from 1.173 million to 1.200 million Pounds and from 68764 thousands to 70000 thousand accordingly, which would support the British Pound. At 3 pm (GMT +3) preliminary data on the Consumer Price Index for September is due in Germany. Low inflation remains one of the main problems for all countries within the eurozone, with Germany being no exception. The index is expected to fall form 0.2% to 0.1% on a year-to-year basis, while in monthly terms it is going to show deflation being at -0.1%. The data would pressure the Euro is forecasts are confirmed. The BOE’s Governor Carney Speech is due at 10:40 pm (GMT +3) in London, in which he could shed the light on regulator’s future monetary policy. On Tuesday night at 2:50 am (GMT +3), Retail Trade data for August is due in Japan. The figure is expected to decline in yearly terms from 1.6% to 1.1%, which could lead to the Yen weakening.

Claws and Horns

News of the day. Monday 28.09.2015

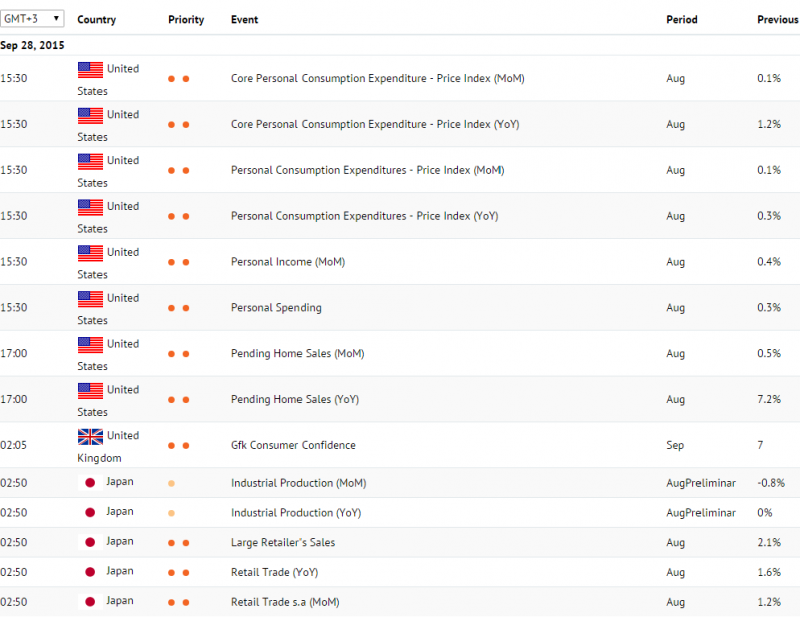

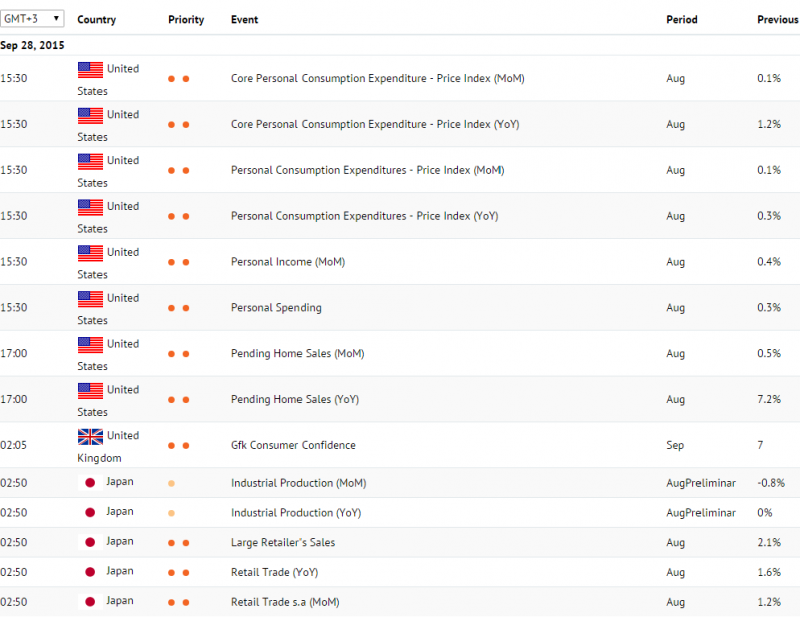

On Monday, major fundamental announcements and events are due in the US.

At 3:30 p.m. (GMT+3) Personal Income and Personal Spending statistics are released. Personal Income provides insight on the labor market situation, as labor earnings account for major part of personal income. Personal Spending may serve as an indicator for GDP and inflation assessment. Both Personal Income and Personal Spending are expected to remain unchanged at 0.4% and 0.3%, respectively.

Pending Home Sales statistics for August is due at 5:00 p.m. (GMT+3). The indicator is based on signed real estate contracts and is one of the most important for assessment of the US housing market situation. The forecast is rather negative: a decline from 0.5% to 0.2% is expected, thus, the USD will be under pressure.

At the end of the day, at 8:30 p.m. (GMT+3) and 00:00 a.m. (GMT+3), market participants will turn their attention to the speeches given by two members of the Federal Reserve: Charles Evans, president and chief executive officer of the Federal Reserve Bank of Chicago, and John Williams, president and chief executive officer of the Federal Reserve Bank of San Francisco. They may share their views on the possibility and the timing of an interest rate increase.

On Monday, major fundamental announcements and events are due in the US.

At 3:30 p.m. (GMT+3) Personal Income and Personal Spending statistics are released. Personal Income provides insight on the labor market situation, as labor earnings account for major part of personal income. Personal Spending may serve as an indicator for GDP and inflation assessment. Both Personal Income and Personal Spending are expected to remain unchanged at 0.4% and 0.3%, respectively.

Pending Home Sales statistics for August is due at 5:00 p.m. (GMT+3). The indicator is based on signed real estate contracts and is one of the most important for assessment of the US housing market situation. The forecast is rather negative: a decline from 0.5% to 0.2% is expected, thus, the USD will be under pressure.

At the end of the day, at 8:30 p.m. (GMT+3) and 00:00 a.m. (GMT+3), market participants will turn their attention to the speeches given by two members of the Federal Reserve: Charles Evans, president and chief executive officer of the Federal Reserve Bank of Chicago, and John Williams, president and chief executive officer of the Federal Reserve Bank of San Francisco. They may share their views on the possibility and the timing of an interest rate increase.

Claws and Horns

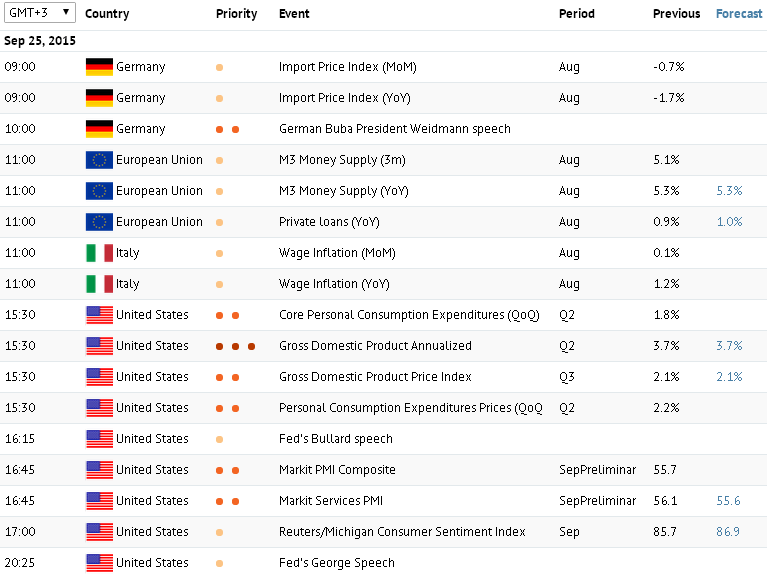

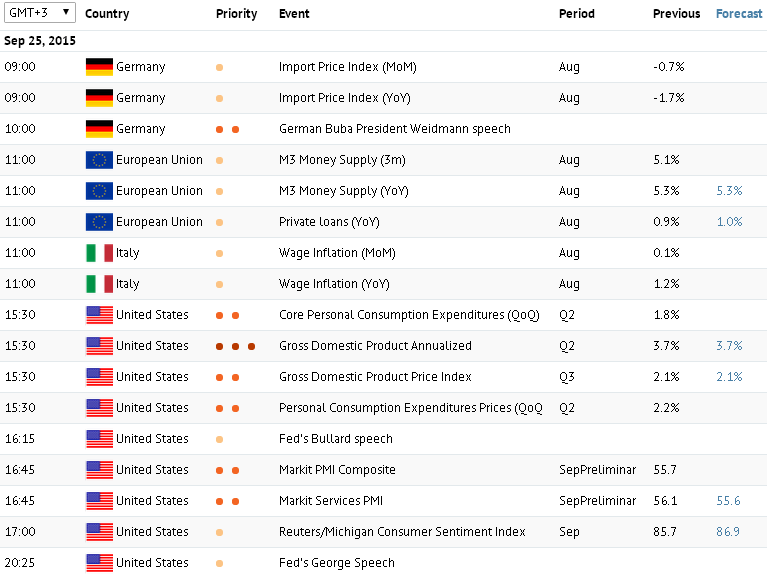

News of the Day. Friday 25.09.2015

On Friday, the key macroeconomic release is Gross Domestic Product Annualized, due at 3:30 p.m. (GMT+3) in the US. The indicator is expected to remain at the same level of 3.7% which agrees with preliminary data. It should be noted that Personal Spending and Retail Sales grew in the second quarter, thus, the GDP forecast is likely to pan out, and, as a result, the USD will strengthen.

Attention should also be paid to Markit Services PMI for September, due at 4:45 p.m. (GMT+3) in the US. The indicator is similar to Markit Manufacturing PMI, but these are purchasing managers of the largest enterprises in the services sector who assess current economic situation. According to preliminary data, Manufacturing PMI remained unchanged at 53.0 points, while Services PMI, on the contrary, may decline from 56.1 to 55.6 points that is still highly above the key level of 50.0 points, a reading below which indicates a starting slowdown in the sector.

Moreover, German Buba President Weidmann speech is due at 10:00 a.m. (GMT+3) in Florence, but it is unlikely to shed light on prospects of the EU monetary policy. At 5:00 p.m. (GMT+3) the US releases Reuters/Michigan Consumer Sentiment Index, which is expected to grow from 85.7 to 86.9 points.

On Friday, the key macroeconomic release is Gross Domestic Product Annualized, due at 3:30 p.m. (GMT+3) in the US. The indicator is expected to remain at the same level of 3.7% which agrees with preliminary data. It should be noted that Personal Spending and Retail Sales grew in the second quarter, thus, the GDP forecast is likely to pan out, and, as a result, the USD will strengthen.

Attention should also be paid to Markit Services PMI for September, due at 4:45 p.m. (GMT+3) in the US. The indicator is similar to Markit Manufacturing PMI, but these are purchasing managers of the largest enterprises in the services sector who assess current economic situation. According to preliminary data, Manufacturing PMI remained unchanged at 53.0 points, while Services PMI, on the contrary, may decline from 56.1 to 55.6 points that is still highly above the key level of 50.0 points, a reading below which indicates a starting slowdown in the sector.

Moreover, German Buba President Weidmann speech is due at 10:00 a.m. (GMT+3) in Florence, but it is unlikely to shed light on prospects of the EU monetary policy. At 5:00 p.m. (GMT+3) the US releases Reuters/Michigan Consumer Sentiment Index, which is expected to grow from 85.7 to 86.9 points.

Claws and Horns

News of the day. Thursday 24.09.2015

On Thursday, the majority of important macroeconomic publicationsis going to come out from the US though a few are released from other countries. At 12:15 pm (all times stated in GMT +3) Targeted LTRO (Long Term Refinancing Operations) are due in the eurozone. The program was created to support the European banking sector with liquidity during the crisis and to increase inflationary pressures, and was shrinking during this year.

Durable Goods Orders are due at 3:30 pm form the US. The indicator represents consumer confidence in the economy outlook and is the leading indicator for manufacturing activity. Orders are expected to shrink by 2% in August, while Durable Goods Orders excluding Transportation to grow by 0.1%. If actual figures match their forecasts, it could put the Dollar under pressure. At 5 pm, New Home Sales for August are due in the US. According to forecasts, sales are going to increase by 1.6%, from 507 to 516 thousands, and such insignificant growth is unlikely to support the USD. Fed’s Yellen Speech is due at midnight, and investors are traditionally waiting for hints on the interest rates increase timing. Experts, however, are starting doubting that the regulator is going to start with its tightening cycle in the near future.

At 2:30 am on Thursday night, the National Consumer Price Index for August is due in Japan. The index is expected to come out below its previous figure of 0.2%, while the Nation CPI ex-Fresh Food to fall to -0.1% which would indicate deflation. The data can significantly pressure the Yen if confirmed by actual figures.

On Thursday, the majority of important macroeconomic publicationsis going to come out from the US though a few are released from other countries. At 12:15 pm (all times stated in GMT +3) Targeted LTRO (Long Term Refinancing Operations) are due in the eurozone. The program was created to support the European banking sector with liquidity during the crisis and to increase inflationary pressures, and was shrinking during this year.

Durable Goods Orders are due at 3:30 pm form the US. The indicator represents consumer confidence in the economy outlook and is the leading indicator for manufacturing activity. Orders are expected to shrink by 2% in August, while Durable Goods Orders excluding Transportation to grow by 0.1%. If actual figures match their forecasts, it could put the Dollar under pressure. At 5 pm, New Home Sales for August are due in the US. According to forecasts, sales are going to increase by 1.6%, from 507 to 516 thousands, and such insignificant growth is unlikely to support the USD. Fed’s Yellen Speech is due at midnight, and investors are traditionally waiting for hints on the interest rates increase timing. Experts, however, are starting doubting that the regulator is going to start with its tightening cycle in the near future.

At 2:30 am on Thursday night, the National Consumer Price Index for August is due in Japan. The index is expected to come out below its previous figure of 0.2%, while the Nation CPI ex-Fresh Food to fall to -0.1% which would indicate deflation. The data can significantly pressure the Yen if confirmed by actual figures.

Claws and Horns

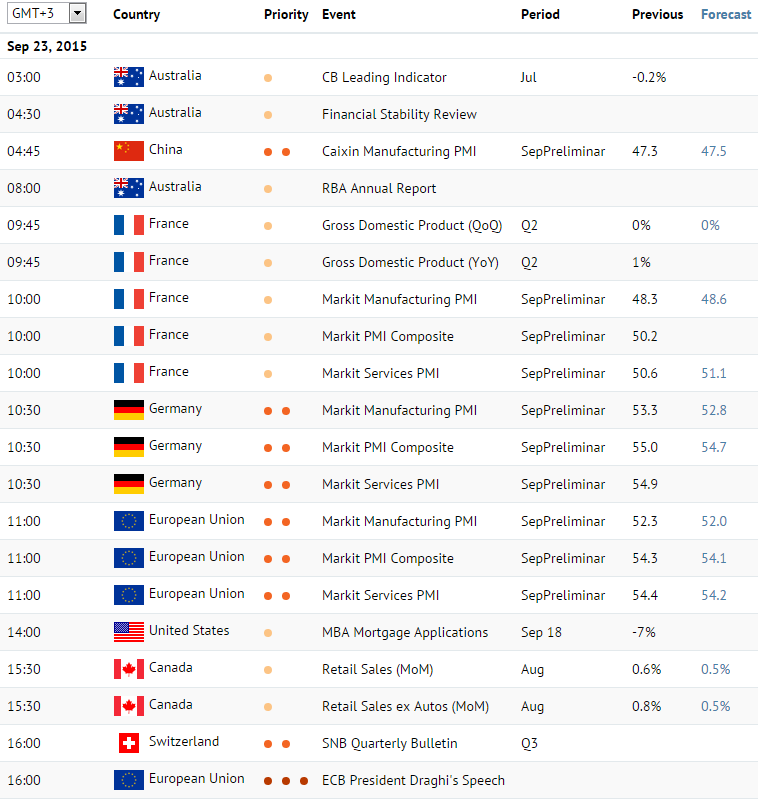

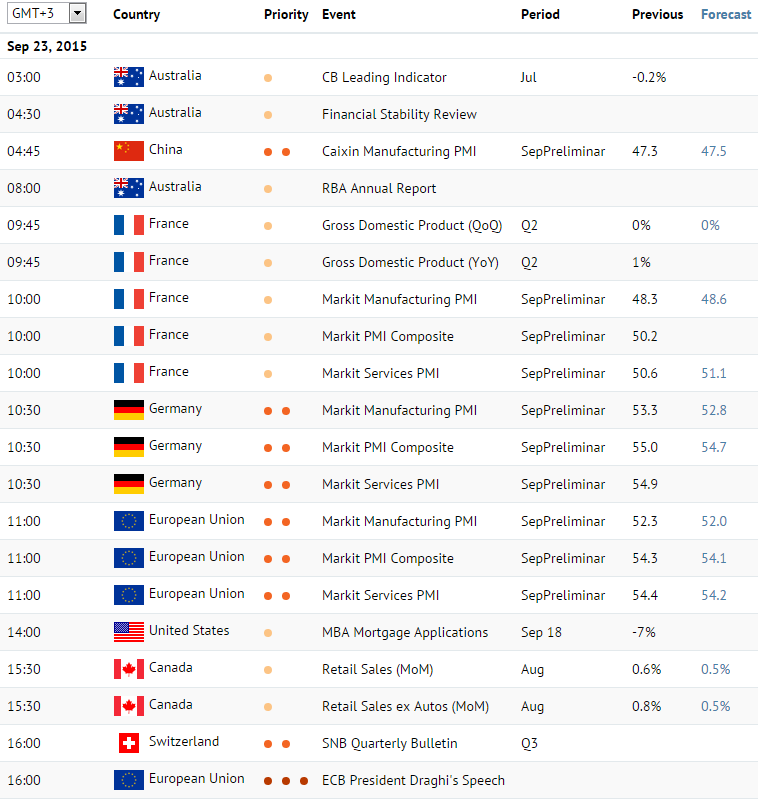

News of the day. Wednesday 23.09.2015

On Wednesday, market participants will be turning their attention to the publication of key indices for the EU countries, the US and Japan as well as to the ECB President Mario Draghi's Speech. Markit Manufacturing PMI for September is due at 10:30 a.m. (GMT+3) in Germany. The same index for the eurozone as a whole is released at 11:00 a.m. (GMT+3). Manufacturing PMI reflects how purchasing managers assess current economic situation and its prospects. Both indicators are expected to decline in September: from 53.3 to 52.8 points in Germany and from 52.3 to 52.0 points in the eurozone. Thus, the pessimism may worsen, but, nevertheless, the index is likely to remain above the key level of 50 points. Retail Sales statistics for July are due at 3:30 p.m. in Canada. This important indicator, used to forecast GDP, is likely to decline from 0.6% to 0.5%, and Retail Sales ex Auto are expected to shrink from 0.8% to 0.5%. These factors may affect the Canadian currency.

At 4:00 p.m., the ECB President Mario Draghi delivers his speech at the hearing by the Committee on Economic and Monetary Affairs of the European Parliament in Brussels. This speech is worth noting as Mario Draghi may comment on the EU monetary policy. At 4.45 p.m. (GMT+3) the US releases Markit Manufacturing PMI for September, which is the leading indicator of the national Manufacturing PMI, due next week. The US index, unlike the EU one, is expected to grow from 53.0 to 53.3 points.

On Thursday night, attention should be paid to Trade Balance statistics for August in New Zealand, due at 01:45 a.m. (GMT+3), and Nomura/JMMA Manufacturing PMI for September in Japan, due at 04:35 a.m. (GMT+3). Analysts forecast a slight decline, but the indicator is likely to remain above the level of 50 points.

On Wednesday, market participants will be turning their attention to the publication of key indices for the EU countries, the US and Japan as well as to the ECB President Mario Draghi's Speech. Markit Manufacturing PMI for September is due at 10:30 a.m. (GMT+3) in Germany. The same index for the eurozone as a whole is released at 11:00 a.m. (GMT+3). Manufacturing PMI reflects how purchasing managers assess current economic situation and its prospects. Both indicators are expected to decline in September: from 53.3 to 52.8 points in Germany and from 52.3 to 52.0 points in the eurozone. Thus, the pessimism may worsen, but, nevertheless, the index is likely to remain above the key level of 50 points. Retail Sales statistics for July are due at 3:30 p.m. in Canada. This important indicator, used to forecast GDP, is likely to decline from 0.6% to 0.5%, and Retail Sales ex Auto are expected to shrink from 0.8% to 0.5%. These factors may affect the Canadian currency.

At 4:00 p.m., the ECB President Mario Draghi delivers his speech at the hearing by the Committee on Economic and Monetary Affairs of the European Parliament in Brussels. This speech is worth noting as Mario Draghi may comment on the EU monetary policy. At 4.45 p.m. (GMT+3) the US releases Markit Manufacturing PMI for September, which is the leading indicator of the national Manufacturing PMI, due next week. The US index, unlike the EU one, is expected to grow from 53.0 to 53.3 points.

On Thursday night, attention should be paid to Trade Balance statistics for August in New Zealand, due at 01:45 a.m. (GMT+3), and Nomura/JMMA Manufacturing PMI for September in Japan, due at 04:35 a.m. (GMT+3). Analysts forecast a slight decline, but the indicator is likely to remain above the level of 50 points.

Claws and Horns

Published post AUD/USD: pair falling

Current trend The markets are hit by a new wave of uncertainty. Since the beginning of the week, prices of copper are rapidly falling. Copper widely perceived as the general indicator of world economic outlook, and therefore markets now assume the world economy outlook is getting worse...

Claws and Horns

News of the day. Tuesday 22.09.2015

There are no many important macroeconomic releases on Tuesday, but it is worth noting the publication of Trade Balance statistics, due at 09:00 a.m. (GMT+3) in Switzerland. The trade balance is expected to decline but, nevertheless, still indicate a trade surplus. In addition, attention needs to be paid to Exports data, which is a part of the national GDP. Public Sector Net Borrowing statistics is due at 11:30 a.m. (GMT+3) in Great Britain. The indicator is expected to grow significantly that may negatively affect the budget and the national currency. Preliminary Consumer Confidence data for September is released at 5: 00 p.m. (GMT+3) in the eurozone. And on Wednesday night, at 04:45 a.m. (GMT+3), market participants may turn their attention to preliminary data on Caixin Manufacturing PMI, which is the leading indicator of China’s official Manufacturing PMI. The index is expected to grow from 47.3 to 47.5 points but remain below the key level of 50 points, a reading above which indicates that the manufacturing sector has started developing.

There are no many important macroeconomic releases on Tuesday, but it is worth noting the publication of Trade Balance statistics, due at 09:00 a.m. (GMT+3) in Switzerland. The trade balance is expected to decline but, nevertheless, still indicate a trade surplus. In addition, attention needs to be paid to Exports data, which is a part of the national GDP. Public Sector Net Borrowing statistics is due at 11:30 a.m. (GMT+3) in Great Britain. The indicator is expected to grow significantly that may negatively affect the budget and the national currency. Preliminary Consumer Confidence data for September is released at 5: 00 p.m. (GMT+3) in the eurozone. And on Wednesday night, at 04:45 a.m. (GMT+3), market participants may turn their attention to preliminary data on Caixin Manufacturing PMI, which is the leading indicator of China’s official Manufacturing PMI. The index is expected to grow from 47.3 to 47.5 points but remain below the key level of 50 points, a reading above which indicates that the manufacturing sector has started developing.

Claws and Horns

News of the day. Monday 21.09.2015

There are no many important macroeconomic publications on Monday, but attention needs to be paid to few that are coming out. The Producer Price Index for August is due at 9 am (all times stated in GMT +3) in Germany, which is often used as an indication of future inflation. Existing Home Sales data for August is due at 5 pm in the US. Property market is one of the leading sectors in the US and traditionally attract attention of investors. A growth of house sales can strengthen the Dollar.

In addition, attention needs to be paid to the Fed’s Lockhart Speech that is due at 8 pm. It is worth mentioning that this member of the Fed voted for the soonest interest rate increase, which, however, did not happen at the Fed meeting last Thursday. The BoC Governor Poloz Speech is due at 9:45 pm, in which the head of the Bank of Canada gives a lecture on‘Riding the Commodity Cycle: Resources and the Canadian Economy’ and may touch on future monetary policy direction in Canada.

There are no many important macroeconomic publications on Monday, but attention needs to be paid to few that are coming out. The Producer Price Index for August is due at 9 am (all times stated in GMT +3) in Germany, which is often used as an indication of future inflation. Existing Home Sales data for August is due at 5 pm in the US. Property market is one of the leading sectors in the US and traditionally attract attention of investors. A growth of house sales can strengthen the Dollar.

In addition, attention needs to be paid to the Fed’s Lockhart Speech that is due at 8 pm. It is worth mentioning that this member of the Fed voted for the soonest interest rate increase, which, however, did not happen at the Fed meeting last Thursday. The BoC Governor Poloz Speech is due at 9:45 pm, in which the head of the Bank of Canada gives a lecture on‘Riding the Commodity Cycle: Resources and the Canadian Economy’ and may touch on future monetary policy direction in Canada.

Claws and Horns

Published post GBP/USD: decline expected

Current trend Last week, the GBP strengthened significantly against the USD amid a decline in investor demand for the American currency and favorable labor market and retail sales statistics, released in the UK. On the contrary, the US published weak construction and key indices data...

Share on social networks · 1

66

Claws and Horns

News of the day. Friday 18.09.2015

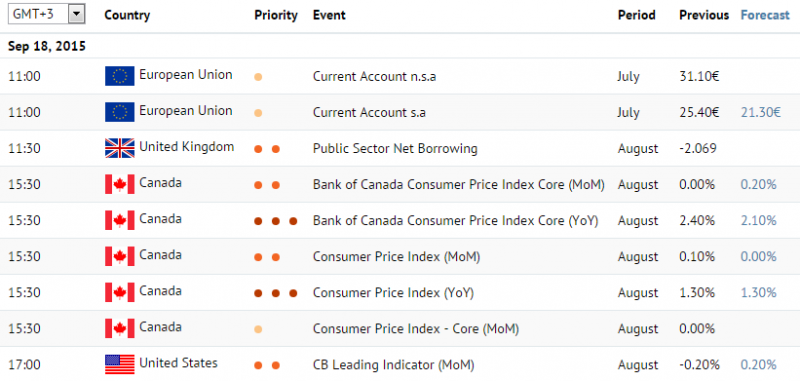

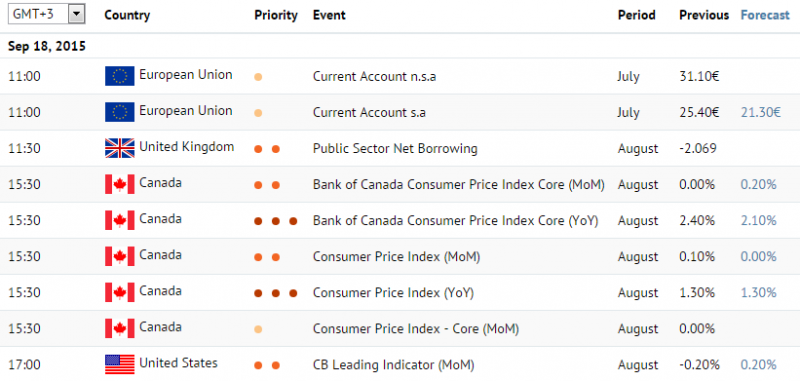

After eventful Thursday, there are very few macroeconomic publications due on Friday. The most important is going to be the data on the Consumer Price Index (YoY) for August, which is due at 3:30 pm (GMT +3). It is worth noting that inflation in Canada is higher than in the US or the eurozone. For example, in July the figure grew to 1.3% after the Bank of Canada cut its interest rates to 0.5%. The Consumer Price Index for August is expected to remain the same at 1.3%. However, the Bank of Canada Consumer Price Index Core (YoY) that does not include food and energy prices can fall from 2.4% to 2.1% on a year-to-year basis.

Other macroeconomic publications that attention needs to be paid to include the Seasonal Adjusted Current Account for the eurozone at 11:00 am (GMT +3), which represents a difference between the amount of payments coming into the eurozone and the amount of payments coming out of it. In July, the Current Account s.a.is expected to show a surplus of 21.3 million euro. In addition, the CB Leading Indicator (MoM) for August is going to come out in the US at 5 pm (GMT +3). The indicator is calculated based on the 10 most important macroeconomic indices and allows estimating the state of the American economy for the next 3-6 months. The indicator is expected to increase from -0.2% to 0.2%.

After eventful Thursday, there are very few macroeconomic publications due on Friday. The most important is going to be the data on the Consumer Price Index (YoY) for August, which is due at 3:30 pm (GMT +3). It is worth noting that inflation in Canada is higher than in the US or the eurozone. For example, in July the figure grew to 1.3% after the Bank of Canada cut its interest rates to 0.5%. The Consumer Price Index for August is expected to remain the same at 1.3%. However, the Bank of Canada Consumer Price Index Core (YoY) that does not include food and energy prices can fall from 2.4% to 2.1% on a year-to-year basis.

Other macroeconomic publications that attention needs to be paid to include the Seasonal Adjusted Current Account for the eurozone at 11:00 am (GMT +3), which represents a difference between the amount of payments coming into the eurozone and the amount of payments coming out of it. In July, the Current Account s.a.is expected to show a surplus of 21.3 million euro. In addition, the CB Leading Indicator (MoM) for August is going to come out in the US at 5 pm (GMT +3). The indicator is calculated based on the 10 most important macroeconomic indices and allows estimating the state of the American economy for the next 3-6 months. The indicator is expected to increase from -0.2% to 0.2%.

Claws and Horns

News of the day. Thursday 17.09.2015

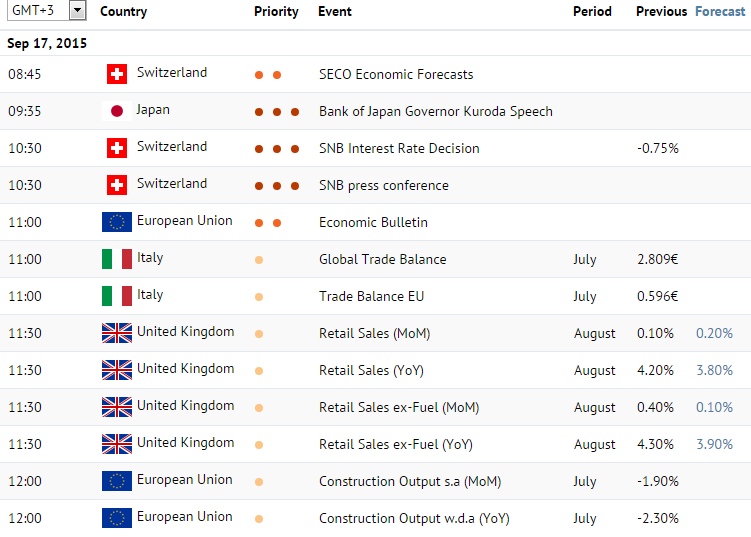

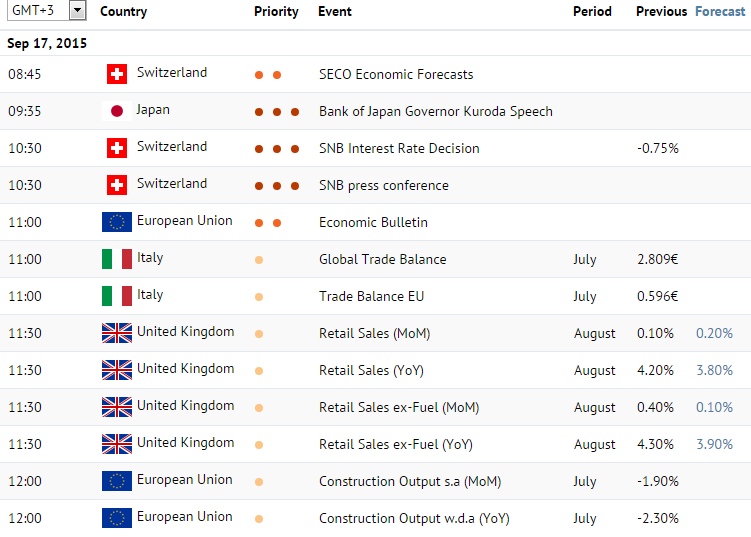

On Thursday, attention of the markets is going to be fully paid to the 2-day Federal Open Market Committee meeting. The question is whether the Fed will increase its interest rates, the move markets have been long waiting for, which would cause a serious growth in the USD, or a correction if rates stay unchanged. Many experts suggest that despite a fall in unemployment and an increase in participation rates, the rate hike is going to be delayed. There are two main reasons for doing so – financial market instability caused by a decline in the Chinese stock market, and low inflation in the US. Increasing rates in current conditions may cause an excessive strengthening in the USD, which would harm the American economy. There is a possibility that the Fed will delay the rate increase but announce the dates of its future hike at press conference. So markets will find out of the Fed Interest Rate Decision today at 9 pm (all times stated in GMT +3), at 9:30 pm the Fed’s Monetary Policy Statement and Press Conference will start, and at 10 pm FOMC Economic Projections is due.

There are few more important events on Thursdaythat attention needs to be paid to. The Bank of Japan Governor Kuroda Speech is planned for 9:35 am, at which he could tip about the future bank’s actions. The SNB Interest Rate Decision is due at 10:30 am, and the regulator is likely to leave the interest rate unchanged at its current -0.75%. August data on retail sales is coming out in the UK at 11:30 am, an important indicator for the GDP growth estimate. Both figures, Retail Sales (year-on-year) and Retail Sales ex-Fuel (YoY) are expected to fall, from 4.2% to 3.8% and from 4.3% to 3.9% respectively, which would pressure the GBP. Construction sector data for August is due in the US at 3:30 pm. Building Permits (MoM) are forecasted to grow from 1.119 to 1.160 million, while Housing Starts (MoM) are expected to fall from 1.206 to 1.170 million. The RBA’s Governor Glenn Stevens Speech is due at 2:30 on Thursday night, during which he will share his view of the prospects of the Australian economy.

On Thursday, attention of the markets is going to be fully paid to the 2-day Federal Open Market Committee meeting. The question is whether the Fed will increase its interest rates, the move markets have been long waiting for, which would cause a serious growth in the USD, or a correction if rates stay unchanged. Many experts suggest that despite a fall in unemployment and an increase in participation rates, the rate hike is going to be delayed. There are two main reasons for doing so – financial market instability caused by a decline in the Chinese stock market, and low inflation in the US. Increasing rates in current conditions may cause an excessive strengthening in the USD, which would harm the American economy. There is a possibility that the Fed will delay the rate increase but announce the dates of its future hike at press conference. So markets will find out of the Fed Interest Rate Decision today at 9 pm (all times stated in GMT +3), at 9:30 pm the Fed’s Monetary Policy Statement and Press Conference will start, and at 10 pm FOMC Economic Projections is due.

There are few more important events on Thursdaythat attention needs to be paid to. The Bank of Japan Governor Kuroda Speech is planned for 9:35 am, at which he could tip about the future bank’s actions. The SNB Interest Rate Decision is due at 10:30 am, and the regulator is likely to leave the interest rate unchanged at its current -0.75%. August data on retail sales is coming out in the UK at 11:30 am, an important indicator for the GDP growth estimate. Both figures, Retail Sales (year-on-year) and Retail Sales ex-Fuel (YoY) are expected to fall, from 4.2% to 3.8% and from 4.3% to 3.9% respectively, which would pressure the GBP. Construction sector data for August is due in the US at 3:30 pm. Building Permits (MoM) are forecasted to grow from 1.119 to 1.160 million, while Housing Starts (MoM) are expected to fall from 1.206 to 1.170 million. The RBA’s Governor Glenn Stevens Speech is due at 2:30 on Thursday night, during which he will share his view of the prospects of the Australian economy.

Claws and Horns

Published post GBP/USD: growth resumed

Current trend The GBP/USD strengthened significantly, supported by strong labor market statistics, released in the UK on Wednesday. From May to July, Average Earnings including Bonus grew by 2.9%, compared to the same period last year. It is the highest growth for the last 6-1/2-years...

Share on social networks · 1

29

Claws and Horns

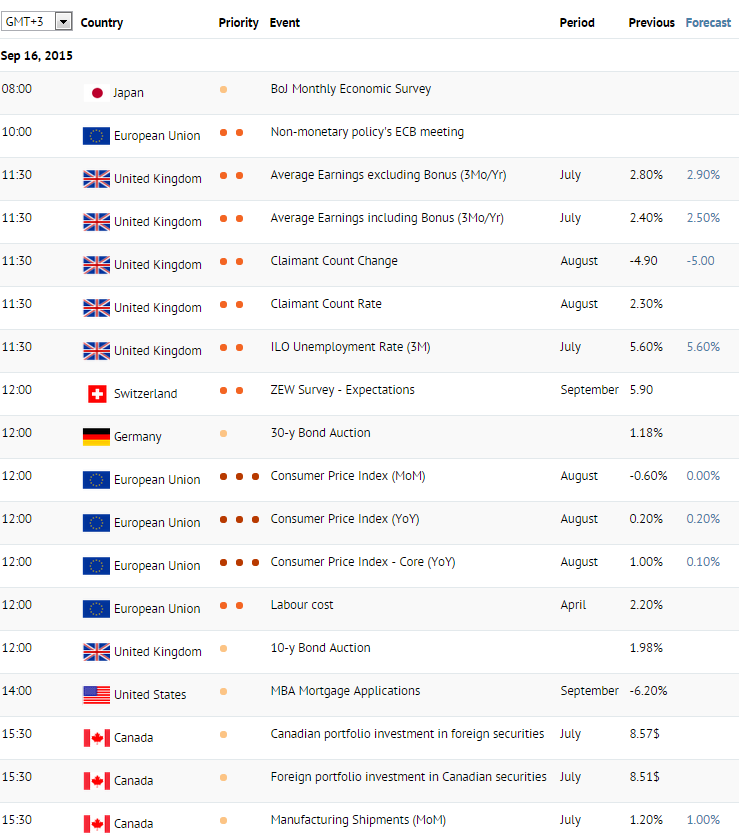

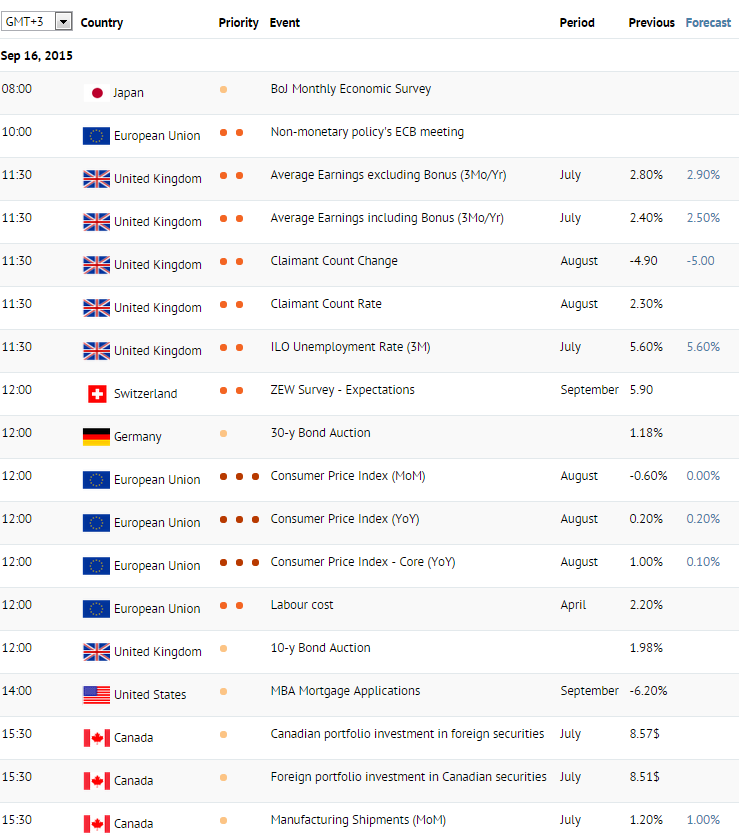

News of the day. Wednesday 16.09.2015

The most important macroeconomic publications that are due on Wednesday are Consumer Price Indexes for the eurozone and the US.

However, other important publications should not be overlooked. At 11:30 am (all times stated in GMT +3) labour market data comes out in the UK. Since the beginning of the year, the ILO Unemployment Rate in the country remains between 5.6% and 5.7%, and again it is forecasted to stay unchanged at 5.6%. Meanwhile, the Claimant Count Change is going to fall by 5 thousand, which positively charachtarises the state of the labour market in the UK. The less important publications include Average Earnings including Bonus and Average Earnings excluding Bonus. The indices are forecasted to increase for the last 3 months from 2.4% to 2.5%, and from 2.8% to 2.9% accordingly.

At 12 pm, the Consumer Price Index for August is due in the eurozone, and at 4:30 pm – in the US. The Consumer Price Index is the major inflation indicator that is used by monetary authorities in most of the countries in their decision-making. On a month-to-month basis, the index for the eurozone is expected to grow from -0.6% to 0%, and remain unchanged at 0.2% on early basis. This low increase also shows that the QE program for the eurozone is not bringing a result the ECB expected and inflation is far from its 2% target. On the other hand, the monthly CPI in the US can fall from 0.1% to 0%, though remain unchanged at 0.2% in early terms. That represents a near-deflation state of the American economy and can force the Fed to delay its interest rate increase. The less important publications include the weekly EIA Crude Oil Stocks Change report that has big influence on commodities markets, due at 5:30 pm.

On Wednesday night, investors are going to follow the news from the Asian and the Pacific Ocean region markets. At 1:45 am, the New Zealand GDP for the second quarter is due. This is one of the most important indices representing the state of the economy. The quarterly Gross Domestic Product (QoQ) is expected to grow from 0.2% to 0.5%, but the more important yearly GDP (YoY) figure is going to decrease from 2.6% to 2.5%, which would happen for the second quarter in a row and may weaken the NZD.

The Trade Balance data for August is due in Japan at 2:50 am. Merchandise Trade Balance Total is expected to show a deficit increase by 541.3 million, Imports (YoY) decrease by 2.2%, and Exports (YoY) grow by 4%, which is significantly worse than the previous figures and may weaken the Yen.

The most important macroeconomic publications that are due on Wednesday are Consumer Price Indexes for the eurozone and the US.

However, other important publications should not be overlooked. At 11:30 am (all times stated in GMT +3) labour market data comes out in the UK. Since the beginning of the year, the ILO Unemployment Rate in the country remains between 5.6% and 5.7%, and again it is forecasted to stay unchanged at 5.6%. Meanwhile, the Claimant Count Change is going to fall by 5 thousand, which positively charachtarises the state of the labour market in the UK. The less important publications include Average Earnings including Bonus and Average Earnings excluding Bonus. The indices are forecasted to increase for the last 3 months from 2.4% to 2.5%, and from 2.8% to 2.9% accordingly.

At 12 pm, the Consumer Price Index for August is due in the eurozone, and at 4:30 pm – in the US. The Consumer Price Index is the major inflation indicator that is used by monetary authorities in most of the countries in their decision-making. On a month-to-month basis, the index for the eurozone is expected to grow from -0.6% to 0%, and remain unchanged at 0.2% on early basis. This low increase also shows that the QE program for the eurozone is not bringing a result the ECB expected and inflation is far from its 2% target. On the other hand, the monthly CPI in the US can fall from 0.1% to 0%, though remain unchanged at 0.2% in early terms. That represents a near-deflation state of the American economy and can force the Fed to delay its interest rate increase. The less important publications include the weekly EIA Crude Oil Stocks Change report that has big influence on commodities markets, due at 5:30 pm.

On Wednesday night, investors are going to follow the news from the Asian and the Pacific Ocean region markets. At 1:45 am, the New Zealand GDP for the second quarter is due. This is one of the most important indices representing the state of the economy. The quarterly Gross Domestic Product (QoQ) is expected to grow from 0.2% to 0.5%, but the more important yearly GDP (YoY) figure is going to decrease from 2.6% to 2.5%, which would happen for the second quarter in a row and may weaken the NZD.

The Trade Balance data for August is due in Japan at 2:50 am. Merchandise Trade Balance Total is expected to show a deficit increase by 541.3 million, Imports (YoY) decrease by 2.2%, and Exports (YoY) grow by 4%, which is significantly worse than the previous figures and may weaken the Yen.

Claws and Horns

Published post AUD/USD: Fibonacci analysis

A growth can continue. On the 4-hour chart, the price is trying to consolidate above the level of 0.7150 (50.0% correction). In case of success, a growth to 0.7205 (50.0% correction) and 0.7240 is possible. Otherwise, the price may decline during a correction along the 50.0% arc towards 0...

Share on social networks · 2

70

Claws and Horns

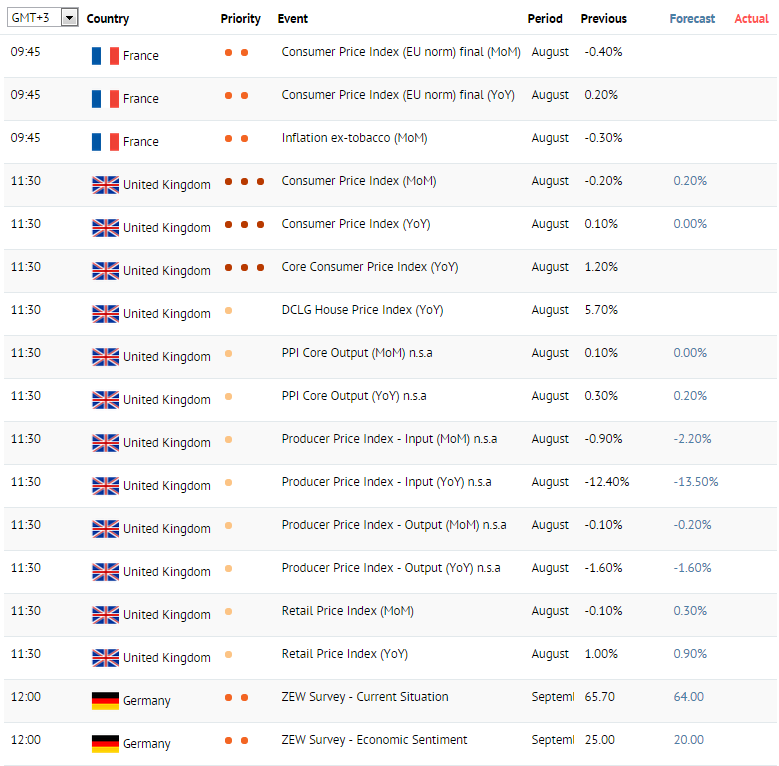

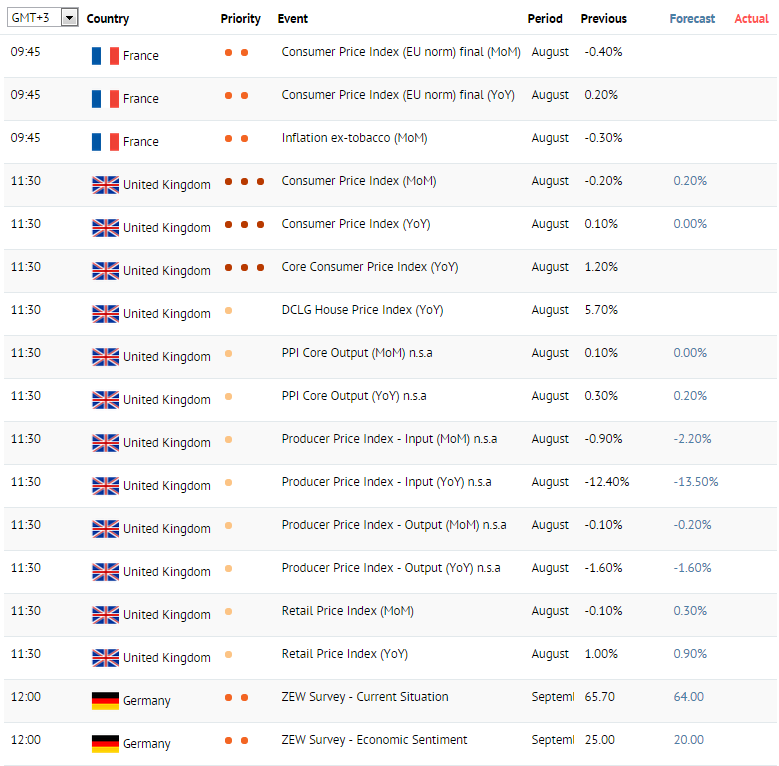

News of day. Tuesday 15.09.2015

On Tuesday, a large number of important macroeconomic releases are published in the United Kingdom, eurozone countries and the US. A block of UK statistics is due at 11:30 a.m. (GMT+3), the most important of which is Consumer Price Index (CPI) for August, a key indicator to measure inflation. From the start of the year, CPI has been ranging between -0.1%-0.1% which is far below the target level of 2.0%. In August, the indicator is expected to decline from 0.1% to 0.0% which will not add attractiveness to the GBP. On a monthly basis, CPI may rise from -0.2% to 0.2%, however, the indicator has been at this level since May and fails to grow higher. Moreover, the UK Core Consumer Price Index for August is worth noting.

The EU ZEW Economic Sentiment, due at 12:00 p.m. (GMT+3), reflects the difference between the share optimists and the share of pessimists among investors. The indicator is expected to continue declining in September, so the number of investors who are pessimistic about the prospects of the European economy will increase. Out of less significant releases, it is worth noting Trade Balance and Employment Change statistics on a monthly and a year-over-year basis for the second quarter of the year.

At 3:30 (GMT+3), the US releases Retail Sales statistics for August which are important for preliminary assessment of the national GDP. Retail Sales and Retail Sales ex Autos are expected to decline from 0.6% to 0.4% and from 0.4% to 0.3%, respectively. According to negative forecasts, the US Industrial Production, due at 4:15 p.m. (GMT+3), is to decline by 0.2% in August after a 0.6% gain in July. In general, if negative predictions pan out, the USD may be affected. Out of less important releases, it is worth noting the US Business Inventories and Capacity Utilization statistics for August.

On Tuesday, a large number of important macroeconomic releases are published in the United Kingdom, eurozone countries and the US. A block of UK statistics is due at 11:30 a.m. (GMT+3), the most important of which is Consumer Price Index (CPI) for August, a key indicator to measure inflation. From the start of the year, CPI has been ranging between -0.1%-0.1% which is far below the target level of 2.0%. In August, the indicator is expected to decline from 0.1% to 0.0% which will not add attractiveness to the GBP. On a monthly basis, CPI may rise from -0.2% to 0.2%, however, the indicator has been at this level since May and fails to grow higher. Moreover, the UK Core Consumer Price Index for August is worth noting.

The EU ZEW Economic Sentiment, due at 12:00 p.m. (GMT+3), reflects the difference between the share optimists and the share of pessimists among investors. The indicator is expected to continue declining in September, so the number of investors who are pessimistic about the prospects of the European economy will increase. Out of less significant releases, it is worth noting Trade Balance and Employment Change statistics on a monthly and a year-over-year basis for the second quarter of the year.

At 3:30 (GMT+3), the US releases Retail Sales statistics for August which are important for preliminary assessment of the national GDP. Retail Sales and Retail Sales ex Autos are expected to decline from 0.6% to 0.4% and from 0.4% to 0.3%, respectively. According to negative forecasts, the US Industrial Production, due at 4:15 p.m. (GMT+3), is to decline by 0.2% in August after a 0.6% gain in July. In general, if negative predictions pan out, the USD may be affected. Out of less important releases, it is worth noting the US Business Inventories and Capacity Utilization statistics for August.

Claws and Horns

News of the day. Monday 14.09.2015

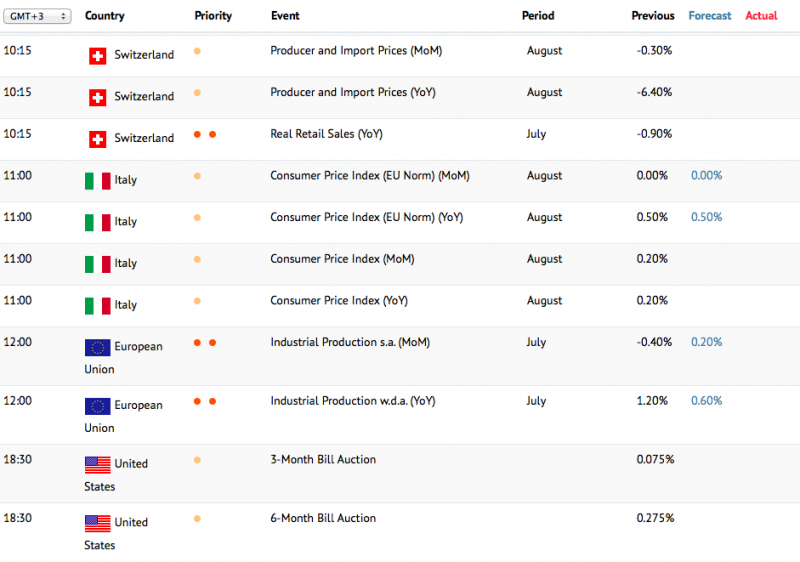

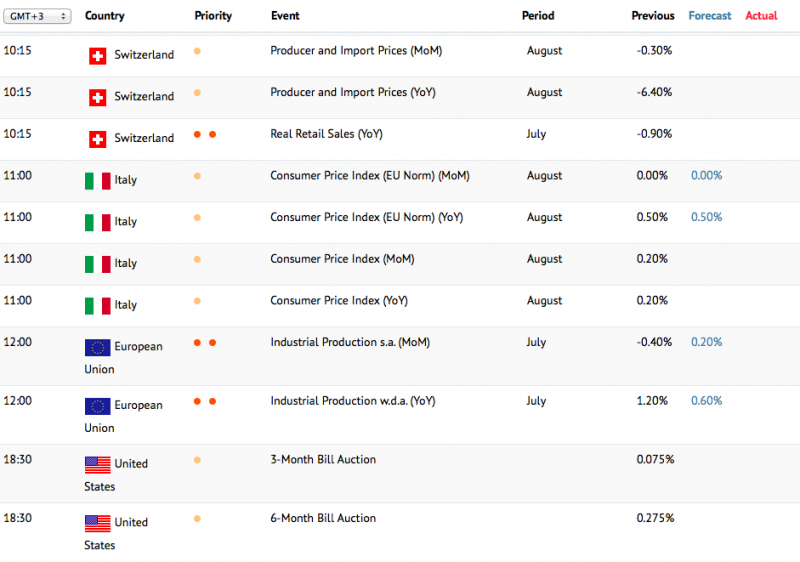

On Monday, major macroeconomic releases are due in Switzerland, eurozone and Australia. The EU Industrial Production statistics for July are seen as the most important and are published at 12:00 p.m. (GMT+3). The indicator has been growing, however, the growth cannot be considered as a significant one. So, in July, Industrial Production is forecasted to increase from -0.4% to 0.2% on a monthly basis. On a year-over-year basis, a 0.6% gain is expected, which is lower than the previous 1.2%, however, is still considered as a positive reading, able to support the EUR.

Switzerland's Retail Sales statistics, released at 10:15 a.m. (GMT+3), are also worth noting due to the fact that Retail Sales account for a significant part of the national GDP in most countries. This year, the indicator has been declining steadily, and the tendency is still unlikely to change. Switzerland's Producer and Import Prices for August will be published at 10:15 a.m. (GMT+3) as well.

On Tuesday night, the Reserve Bank of Australia Meeting's Minutes, due at 4:30 a.m. (GMT+3), are expected to shed light on future of country's monetary policy. The Bank of Japan, in its turn, decides on its interest rate, which is likely to remain unchanged at 0.1%. Moreover, BoJ Monetary Policy Statement, released at 6:00 a.m. (GMT+3), should clarify how the Regulator is going to further stimulate Japan's economy.

On Monday, major macroeconomic releases are due in Switzerland, eurozone and Australia. The EU Industrial Production statistics for July are seen as the most important and are published at 12:00 p.m. (GMT+3). The indicator has been growing, however, the growth cannot be considered as a significant one. So, in July, Industrial Production is forecasted to increase from -0.4% to 0.2% on a monthly basis. On a year-over-year basis, a 0.6% gain is expected, which is lower than the previous 1.2%, however, is still considered as a positive reading, able to support the EUR.

Switzerland's Retail Sales statistics, released at 10:15 a.m. (GMT+3), are also worth noting due to the fact that Retail Sales account for a significant part of the national GDP in most countries. This year, the indicator has been declining steadily, and the tendency is still unlikely to change. Switzerland's Producer and Import Prices for August will be published at 10:15 a.m. (GMT+3) as well.

On Tuesday night, the Reserve Bank of Australia Meeting's Minutes, due at 4:30 a.m. (GMT+3), are expected to shed light on future of country's monetary policy. The Bank of Japan, in its turn, decides on its interest rate, which is likely to remain unchanged at 0.1%. Moreover, BoJ Monetary Policy Statement, released at 6:00 a.m. (GMT+3), should clarify how the Regulator is going to further stimulate Japan's economy.

Claws and Horns

Published post XAU/USD: gold under pressure

Current trend At the beginning of the week, the price of gold is not changing significantly as market participants are waiting for the publication of key macroeconomic statistics from the US, where the Federal Reserve holds its meeting this Thursday...

Share on social networks · 2

109

1

Claws and Horns

Published post GBP/USD: Pound is trying to develop correction

Current trend In the end of last week, the Pound strengthened against the USD and gained back most of the losses of early September. However, macroeconomic statistics remain ambiguous. In particular, the GBP was pressured by poor data on Industrial Production that in June shrank by 0...

Share on social networks · 1

91

: