Claws and Horns / Profile

Claws and Horns

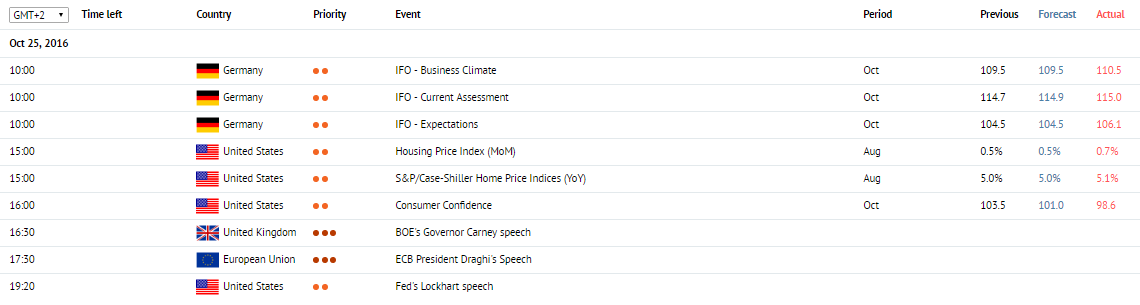

News of the day. 25.10.2016

IFO – Expectations. Germany, 10:00 am

Data on the IFO – Expectations is due at 10:00 am (GMT+2). In October, the index is expected to decline from 104.5 to 104.0 points. The index is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses and their forecasts for the next 6 months. The forecast can assume that things will improve, stay the same or get worse. Positive forecasts from the majority of participants are perceived as a positive signal and strengthen the EUR. Negative forecasts weaken the EUR.

Consumer Confidence. US, 4:00 pm

Data on the Consumer Confidence is due at 4:00 pm (GMT+2). In October, the index is expected to fall from 104.1 to 102.0 points. The index represent consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

BOE's Governor Carney speech. UK, 4:30 pm

BOE's Governor Carney speech is due at 4:30 pm (GMT+2). Mark Carney is the Governor of the Bank of England and chairs the Monetary Policy Committee. Giving commentaries regarding current economic conditions in the country.

ECB President Draghi's Speech. EU, 5:30 pm

ECB President Draghi's Speech is due at 5:30 pm (GMT+2). Mario Draghi gives commentaries on current economic conditions in the eurozone. Positive commentaries strengthen the EUR, while negative commentaries weaken the EUR.

IFO – Expectations. Germany, 10:00 am

Data on the IFO – Expectations is due at 10:00 am (GMT+2). In October, the index is expected to decline from 104.5 to 104.0 points. The index is based on surveys of executives of more than 7000 companies regarding their opinion on current economic conditions for businesses and their forecasts for the next 6 months. The forecast can assume that things will improve, stay the same or get worse. Positive forecasts from the majority of participants are perceived as a positive signal and strengthen the EUR. Negative forecasts weaken the EUR.

Consumer Confidence. US, 4:00 pm

Data on the Consumer Confidence is due at 4:00 pm (GMT+2). In October, the index is expected to fall from 104.1 to 102.0 points. The index represent consumer confidence in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

BOE's Governor Carney speech. UK, 4:30 pm

BOE's Governor Carney speech is due at 4:30 pm (GMT+2). Mark Carney is the Governor of the Bank of England and chairs the Monetary Policy Committee. Giving commentaries regarding current economic conditions in the country.

ECB President Draghi's Speech. EU, 5:30 pm

ECB President Draghi's Speech is due at 5:30 pm (GMT+2). Mario Draghi gives commentaries on current economic conditions in the eurozone. Positive commentaries strengthen the EUR, while negative commentaries weaken the EUR.

Claws and Horns

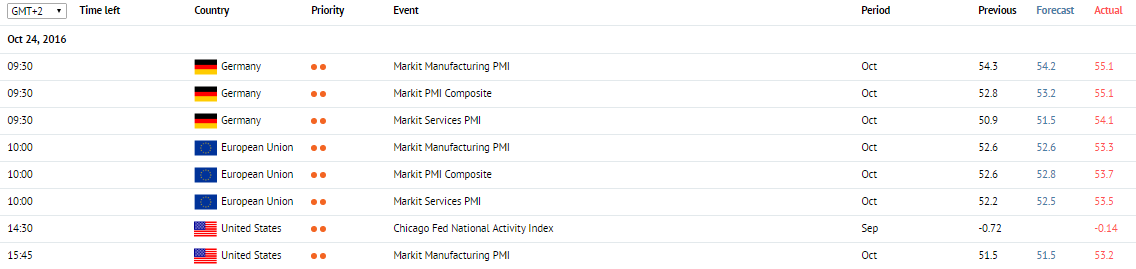

News of the day. 24.10.2016

Markit Services PMI. Germany, 9:30 am

The Markit Services PMI for October is due in Germany at 9:30 am (GMT+2). The indicator is expected to grow from 50.9 to 51.5 points. The index is based on surveys of executives of German companies operating in the service sector regarding their opinion on current economic conditions in the sector. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50 is perceived as negative and pressures the EUR.

Markit Services PMI. EU, 10:00 am

The Markit Eurozone Services PMI for October is due 10:00 am (GMT+2). The indicator is expected to grow from 52.2 to 52.5 points. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50, on the contrary, is perceived as negative and pressures the EUR.

Markit Manufacturing PMI. US, 3:45 pm

Markit Manufacturing PMI for October is due in the US at 3:45 pm (GMT+2). The index represents current economic conditions in the manufacturing sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and pressures the USD.

Markit Services PMI. Germany, 9:30 am

The Markit Services PMI for October is due in Germany at 9:30 am (GMT+2). The indicator is expected to grow from 50.9 to 51.5 points. The index is based on surveys of executives of German companies operating in the service sector regarding their opinion on current economic conditions in the sector. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50 is perceived as negative and pressures the EUR.

Markit Services PMI. EU, 10:00 am

The Markit Eurozone Services PMI for October is due 10:00 am (GMT+2). The indicator is expected to grow from 52.2 to 52.5 points. The index represents current economic conditions in the sector and its future prospects. A reading above 50 is perceived as positive and strengthens the EUR. A reading below 50, on the contrary, is perceived as negative and pressures the EUR.

Markit Manufacturing PMI. US, 3:45 pm

Markit Manufacturing PMI for October is due in the US at 3:45 pm (GMT+2). The index represents current economic conditions in the manufacturing sector and its future prospects. A reading above 50 is perceived as positive and strengthens the USD. A reading below 50 is perceived as negative and pressures the USD.

Claws and Horns

News of the day. 21.10.2016

Public Sector Net Borrowing. UK, 10:30 am

Data on the Public Sector Net Borrowing for September is due in the UK at 10:30 am (GMT+2). The indicator is expected to fall from 10.051 to 8.200 billion pounds. The index represents the government debt. Positive values indicate a budget deficit and weaken the GBP. Negative values denote a budget surplus and strengthen the GBP.

Public Sector Net Borrowing. UK, 10:30 am

Data on the Public Sector Net Borrowing for September is due in the UK at 10:30 am (GMT+2). The indicator is expected to fall from 10.051 to 8.200 billion pounds. The index represents the government debt. Positive values indicate a budget deficit and weaken the GBP. Negative values denote a budget surplus and strengthen the GBP.

Claws and Horns

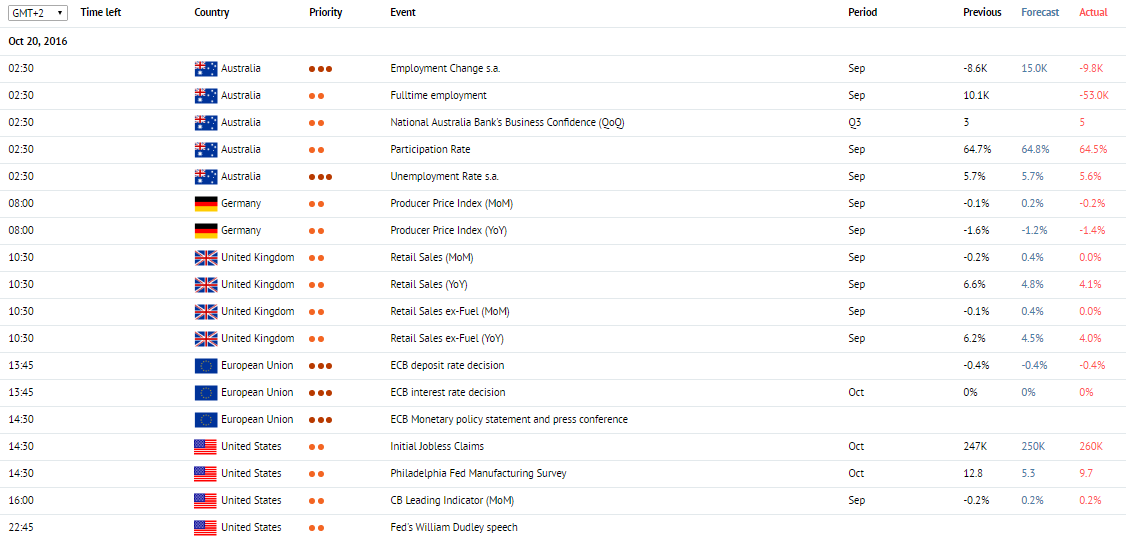

News of the day. 20.10.2016

Unemployment Rate. Australia, 2:30

Data on the Unemployment Rate for September is due in Australia at 2:30 (GMT+2). The indicator is expected to grow from 5.6% to 5.7%. The Unemployment Rate represents a percentage of the total labour force that is currently unemployed. A growth in the indicator is considered a negative factor for the country’s economy and weakens the AUD. A fall in the indicator suggests economic growth and strengthens the AUD.

Participation Rate. Australia, 2:30

Data on the Participation Rate for September is due in Australia at 2:30 (GMT+2). The indicator is expected to grow from 64.7% to 64.8%. The Participation Rate measures the working age population as a percentage of the total population. People who are employed or actively seeking for work are included in measurement.

Producer Price Index. Germany, 8:00 am

Data on the Producer Price Index for September is due in Germany at 8:00 am (GMT+2). The indicator is expected to grow from -0.1% to 0.2% in monthly terms. The index represents the change in wholesale prices from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Retail Sales. UK, 10:30 am

Data on the Retail Sales for September is due in the UK at 10:30 am (GMT+2). The indicator is expected to fall from 6.2% to 4.8% in annual terms and to growth from -0.3% to 0.4% in monthly terms. The data is based on the total value of all receipts from retail shops in the country and characterizes the level of consumer expenditure and demand. A growth in retail sales is an important factor for the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

ECB interest rate decision. EU, 1:45 pm

The European Central Bank announces its decision on the interest rate at 1:45 pm (GMT+2). The indicator is expected to remain unchanged at 0%. The interest rate influences commercial banks’ interest rates and the EUR exchange rate. A rate increase strengthens the EUR. ECB’s decision to cut the rate or keep in unchanged pressures the EUR.

ECB deposit rate decision. EU, 1:45 pm

The European Central Bank announces its decision on the deposit rate at 1:45 pm (GMT+2). The indicator is expected to remain unchanged at -0.4%. The deposit rate is the interest rate paid on the surplus liquidity, which credit institutions deposit on an account with their national central bank.

Initial Jobless Claims. US, 2:30 pm

Data on the Initial Jobless Claims is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from 246 000 to 250 000. The indicator represents the number of new unemployment claims. The data is published every Thursday and allows approximating what the Nonfarm Payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

ECB Monetary policy statement and press conference. EU, 2:30 pm

After the interest rate decision is announced, ECB President Mario Draghi gives commentaries on this decision and answers questions about economic conditions in the eurozone.

Unemployment Rate. Australia, 2:30

Data on the Unemployment Rate for September is due in Australia at 2:30 (GMT+2). The indicator is expected to grow from 5.6% to 5.7%. The Unemployment Rate represents a percentage of the total labour force that is currently unemployed. A growth in the indicator is considered a negative factor for the country’s economy and weakens the AUD. A fall in the indicator suggests economic growth and strengthens the AUD.

Participation Rate. Australia, 2:30

Data on the Participation Rate for September is due in Australia at 2:30 (GMT+2). The indicator is expected to grow from 64.7% to 64.8%. The Participation Rate measures the working age population as a percentage of the total population. People who are employed or actively seeking for work are included in measurement.

Producer Price Index. Germany, 8:00 am

Data on the Producer Price Index for September is due in Germany at 8:00 am (GMT+2). The indicator is expected to grow from -0.1% to 0.2% in monthly terms. The index represents the change in wholesale prices from producers. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Retail Sales. UK, 10:30 am

Data on the Retail Sales for September is due in the UK at 10:30 am (GMT+2). The indicator is expected to fall from 6.2% to 4.8% in annual terms and to growth from -0.3% to 0.4% in monthly terms. The data is based on the total value of all receipts from retail shops in the country and characterizes the level of consumer expenditure and demand. A growth in retail sales is an important factor for the economy. A high reading strengthens the GBP. A low reading weakens the GBP.

ECB interest rate decision. EU, 1:45 pm

The European Central Bank announces its decision on the interest rate at 1:45 pm (GMT+2). The indicator is expected to remain unchanged at 0%. The interest rate influences commercial banks’ interest rates and the EUR exchange rate. A rate increase strengthens the EUR. ECB’s decision to cut the rate or keep in unchanged pressures the EUR.

ECB deposit rate decision. EU, 1:45 pm

The European Central Bank announces its decision on the deposit rate at 1:45 pm (GMT+2). The indicator is expected to remain unchanged at -0.4%. The deposit rate is the interest rate paid on the surplus liquidity, which credit institutions deposit on an account with their national central bank.

Initial Jobless Claims. US, 2:30 pm

Data on the Initial Jobless Claims is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from 246 000 to 250 000. The indicator represents the number of new unemployment claims. The data is published every Thursday and allows approximating what the Nonfarm Payrolls will be. A fall in the index strengthens the USD. A growth in the index weakens the USD.

ECB Monetary policy statement and press conference. EU, 2:30 pm

After the interest rate decision is announced, ECB President Mario Draghi gives commentaries on this decision and answers questions about economic conditions in the eurozone.

Claws and Horns

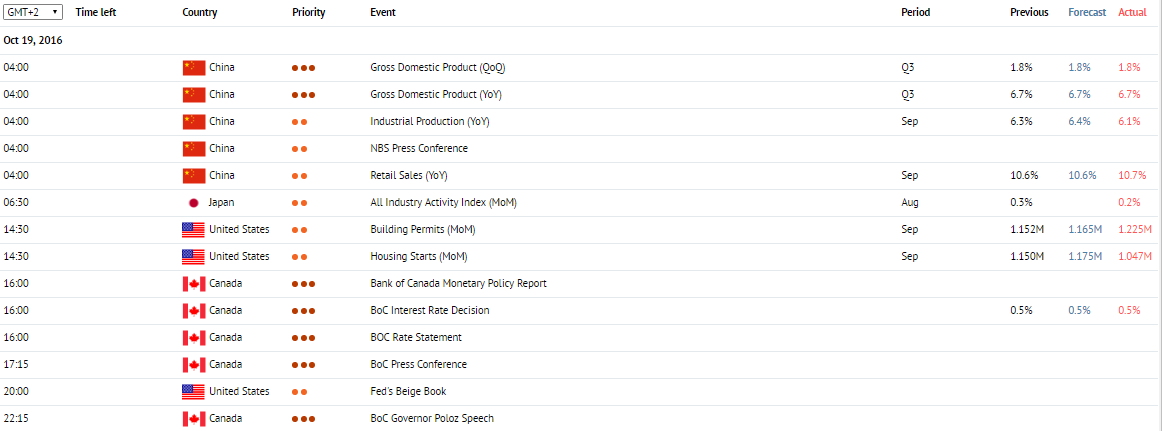

News of the day. 19.10.2016

Gross Domestic Product. China, 4:00 am

Data on the Gross Domestic Product for the third quarter is due in China at 4:00 (GMT+2). The indicator represents the value of all goods and services created in the country during a period. A growth in the index strengthens the CNY. A fall in the index weakens the CNY.

All Industry Activity Index. Japan, 6:30 am

Data on the All Industry Activity Index is due in Japan at 6:30 am (GMT+2). The index represents expenditures of large manufacturers in all sectors excluding the financial one. It is the leading indicator of productivity growth. Generally, an increase in the index strengthens the JPY. A fall in the index weakens the JPY.

Housing Starts. US, 2:30 pm

Data on the Housing Starts for September is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from 1.142 million to 1.170 million in monthly terms. The indicator represents the number of new building starts. A high reading strengthens the USD. A low reading weakens the USD.

BoC Interest Rate Decision. Canada, 4:00 pm

The Bank of Canada announces its decision on the interest rate at 4:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. It is an important economic indicator, which Influences interest rates of commercial banks and the CAD exchange rate. An increase in the interest rate strengthens the CAD. The regulator’s decision to cut the interest rate or keep it unchanged pressures the CAD.

BOC Rate Statement. Canada, 4:00 pm

The Bank of Canada releases its Rate Statement at 4:00 pm (GMT+2). In the statement, the regulator gives commentaries regarding its decision on the interest rate.

Gross Domestic Product. China, 4:00 am

Data on the Gross Domestic Product for the third quarter is due in China at 4:00 (GMT+2). The indicator represents the value of all goods and services created in the country during a period. A growth in the index strengthens the CNY. A fall in the index weakens the CNY.

All Industry Activity Index. Japan, 6:30 am

Data on the All Industry Activity Index is due in Japan at 6:30 am (GMT+2). The index represents expenditures of large manufacturers in all sectors excluding the financial one. It is the leading indicator of productivity growth. Generally, an increase in the index strengthens the JPY. A fall in the index weakens the JPY.

Housing Starts. US, 2:30 pm

Data on the Housing Starts for September is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from 1.142 million to 1.170 million in monthly terms. The indicator represents the number of new building starts. A high reading strengthens the USD. A low reading weakens the USD.

BoC Interest Rate Decision. Canada, 4:00 pm

The Bank of Canada announces its decision on the interest rate at 4:00 pm (GMT+2). The indicator is expected to remain unchanged at 0.5%. It is an important economic indicator, which Influences interest rates of commercial banks and the CAD exchange rate. An increase in the interest rate strengthens the CAD. The regulator’s decision to cut the interest rate or keep it unchanged pressures the CAD.

BOC Rate Statement. Canada, 4:00 pm

The Bank of Canada releases its Rate Statement at 4:00 pm (GMT+2). In the statement, the regulator gives commentaries regarding its decision on the interest rate.

Claws and Horns

News of the day. 18.10.2016

RBA Meeting's Minutes. Australia, 2:30 am

The RBA Meeting's Minutes are due at 2:30 am (GMT+2). The Minutes are released two weeks after each meeting. The publication contains commentaries regarding the most recent decisions as well as information about the votes of each individual member of the Board.

Consumer Price Index. UK, 10:30 am

Data on the Consumer Price Index for September is due at 10:30 am (GMT+2). On a year-to-year basis, the index is expected to grow from 0.6% to 0.8%. On a month-to-month basis, the index is forecasted to fall from 0.3% to 0.1%. One of the key indicators of inflation in the country. Represents the change in prices for goods and services. A high reading strengthens the GBP. A low reading weakens the GBP.

Consumer Price Index. US, 2:30 pm

Data on the Consumer Price Index for September is due at 2:30 pm (GMT+2). On a year-to-year basis, the index is expected to grow from 1.1% to 1.5%. The key indicator of inflation in the country. Represents the change in the value of the basket of goods and services. A positive reading strengthens the USD. A negative reading weakens the USD.

NAHB Housing Price Index. US, 4:00 pm

The NAHB Housing Price Index is due at 4:00 pm (GMT+2). In October, the index is expected to fall from 65 to 63 points. The index is based on a survey of randomly sampled homeowners aiming at estimating a current market value of their property and its further dynamics for the next 6 months. A value above 50 represents favourable situation on the property market as participants find house prices acceptable.

RBA Meeting's Minutes. Australia, 2:30 am

The RBA Meeting's Minutes are due at 2:30 am (GMT+2). The Minutes are released two weeks after each meeting. The publication contains commentaries regarding the most recent decisions as well as information about the votes of each individual member of the Board.

Consumer Price Index. UK, 10:30 am

Data on the Consumer Price Index for September is due at 10:30 am (GMT+2). On a year-to-year basis, the index is expected to grow from 0.6% to 0.8%. On a month-to-month basis, the index is forecasted to fall from 0.3% to 0.1%. One of the key indicators of inflation in the country. Represents the change in prices for goods and services. A high reading strengthens the GBP. A low reading weakens the GBP.

Consumer Price Index. US, 2:30 pm

Data on the Consumer Price Index for September is due at 2:30 pm (GMT+2). On a year-to-year basis, the index is expected to grow from 1.1% to 1.5%. The key indicator of inflation in the country. Represents the change in the value of the basket of goods and services. A positive reading strengthens the USD. A negative reading weakens the USD.

NAHB Housing Price Index. US, 4:00 pm

The NAHB Housing Price Index is due at 4:00 pm (GMT+2). In October, the index is expected to fall from 65 to 63 points. The index is based on a survey of randomly sampled homeowners aiming at estimating a current market value of their property and its further dynamics for the next 6 months. A value above 50 represents favourable situation on the property market as participants find house prices acceptable.

Claws and Horns

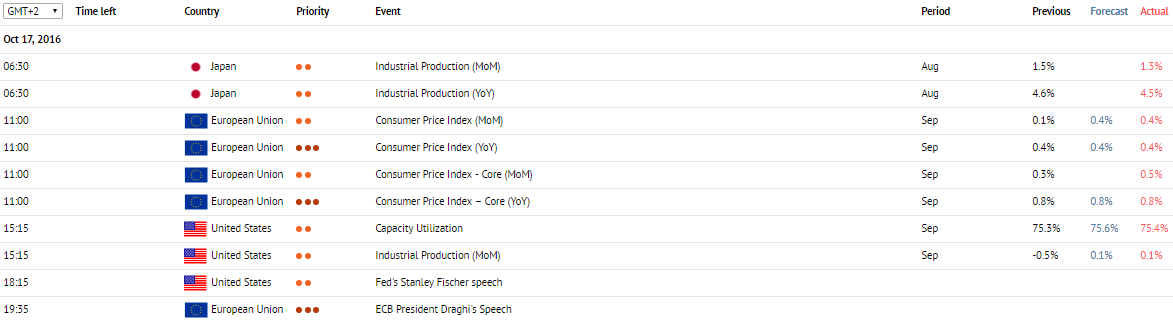

News of the day. 17.10.2016

Industrial Production. Japan, 6:30 am

Data on Industrial Production for August is due at 6:30 am (GMT+2) in Japan. The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

Consumer Price Index. EU, 11:00 am

The Consumer Price Index for September is due at 11:00 am (GMT+2). On a year-to-year basis, the index is expected to remain unchanged at 0.4%. On a month-over-month basis, it is expected to increase from 0.1% to 0.4%. The key indicator of inflation in the eurozone. Represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Industrial Production. US, 3:15 pm

Data on Industrial Production for September is due at 3:15 pm (GMT+2). On a month-to-month basis, the index is expected to grow from -0.4% to 0.1%. Represents industrial output in the US. It is one of the major indicators of the state of the national economy. Has a high impact on the market. A growth in the index supports the USD. A fall in the index pressures the USD.

Capacity Utilization. US, 3:15 pm

Data on the Capacity Utilization is due at 3:15 pm (GMT+2). In September, the index is expected to grow from 75.5% to 75.6%. The percentage expression of the production capacity utilisation in the economy of the country. Represents economic growth and the level of demand. The value of 85% is considered optimal and represents a good balance between economic growth and inflation. A value above 85% leads to an acceleration in inflation. A growth in the index generally strengthens the USD.

Industrial Production. Japan, 6:30 am

Data on Industrial Production for August is due at 6:30 am (GMT+2) in Japan. The indicator represents changes in industrial output in Japan. Data on industrial production is one of the major indicators of the state of the national economy. A growth in the indicator supports the JPY. A fall in the indicator pressures the JPY.

Consumer Price Index. EU, 11:00 am

The Consumer Price Index for September is due at 11:00 am (GMT+2). On a year-to-year basis, the index is expected to remain unchanged at 0.4%. On a month-over-month basis, it is expected to increase from 0.1% to 0.4%. The key indicator of inflation in the eurozone. Represents the change in the value of the basket of goods and services. A growth in the indicator strengthens the EUR. A fall in the indicator weakens the EUR.

Industrial Production. US, 3:15 pm

Data on Industrial Production for September is due at 3:15 pm (GMT+2). On a month-to-month basis, the index is expected to grow from -0.4% to 0.1%. Represents industrial output in the US. It is one of the major indicators of the state of the national economy. Has a high impact on the market. A growth in the index supports the USD. A fall in the index pressures the USD.

Capacity Utilization. US, 3:15 pm

Data on the Capacity Utilization is due at 3:15 pm (GMT+2). In September, the index is expected to grow from 75.5% to 75.6%. The percentage expression of the production capacity utilisation in the economy of the country. Represents economic growth and the level of demand. The value of 85% is considered optimal and represents a good balance between economic growth and inflation. A value above 85% leads to an acceleration in inflation. A growth in the index generally strengthens the USD.

Claws and Horns

News of the day. 14.10.2016

Consumer Price Index. China, 3:30 am

Data on the Consumer Price Index for September is due in China at 3:30 am (GMT+2). The indicator is expected to grow from 1.3% to 1.6% in annual terms. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A moderate growth in the index strengthens the CNY. A fall in the index weakens the CNY.

Producer Price Index. China, 3:30 am

Data on the Producer Price Index for September is due in China at 3:30 am (GMT+2). The indicator is expected to grow from -0.8% to -0.3% in annual terms. The index represents the change in wholesale prices from producers. It is an inflation indicator for the commodity sector. A moderate growth in the index strengthens the CNY. A fall in the index weakens the CNY.

Trade Balance. EU, 11:00 am

Data on the Trade Balance for August is due in the EU at 11:00 am (GMT+2). The indicator is expected to grow from €20.0 billion to €20.5 billion. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values indicate the balance deficit and weaken the EUR.

Retail Sales. US, 2:30 pm

Data on the Retail Sales for September is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from -0.3% to 0.6% in monthly terms. It is an indicator of consumer spending, which represents the change in the volume of retail sales. A growth in the index is a positive factor for the economy and strengthens the USD. A fall in the index weakens the USD.

Reuters/Michigan Consumer Sentiment Index. US, 4:00 pm

Data on the Reuters/Michigan Consumer Sentiment Index is due in the US at 4:00 pm (GMT+2). The indicator is expected to grow from 91.2 to 91.9 points. The index is calculated by experts from Reuters and Michigan University and represents readiness of consumers to spend money in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Fed's Yellen Speech. US, 6:00 pm

Fed’s Chair Janet Yellen is scheduled to deliver a speech at 6:00 pm (GMT+2). She is expected to give commentaries regarding economic situation in the US.

Consumer Price Index. China, 3:30 am

Data on the Consumer Price Index for September is due in China at 3:30 am (GMT+2). The indicator is expected to grow from 1.3% to 1.6% in annual terms. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A moderate growth in the index strengthens the CNY. A fall in the index weakens the CNY.

Producer Price Index. China, 3:30 am

Data on the Producer Price Index for September is due in China at 3:30 am (GMT+2). The indicator is expected to grow from -0.8% to -0.3% in annual terms. The index represents the change in wholesale prices from producers. It is an inflation indicator for the commodity sector. A moderate growth in the index strengthens the CNY. A fall in the index weakens the CNY.

Trade Balance. EU, 11:00 am

Data on the Trade Balance for August is due in the EU at 11:00 am (GMT+2). The indicator is expected to grow from €20.0 billion to €20.5 billion. The indicator represents the difference between the value of exports and imports. Positive values imply the balance is in surplus and strengthen the EUR. Negative values indicate the balance deficit and weaken the EUR.

Retail Sales. US, 2:30 pm

Data on the Retail Sales for September is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from -0.3% to 0.6% in monthly terms. It is an indicator of consumer spending, which represents the change in the volume of retail sales. A growth in the index is a positive factor for the economy and strengthens the USD. A fall in the index weakens the USD.

Reuters/Michigan Consumer Sentiment Index. US, 4:00 pm

Data on the Reuters/Michigan Consumer Sentiment Index is due in the US at 4:00 pm (GMT+2). The indicator is expected to grow from 91.2 to 91.9 points. The index is calculated by experts from Reuters and Michigan University and represents readiness of consumers to spend money in current economic conditions. A high reading strengthens the USD. A low reading weakens the USD.

Fed's Yellen Speech. US, 6:00 pm

Fed’s Chair Janet Yellen is scheduled to deliver a speech at 6:00 pm (GMT+2). She is expected to give commentaries regarding economic situation in the US.

Claws and Horns

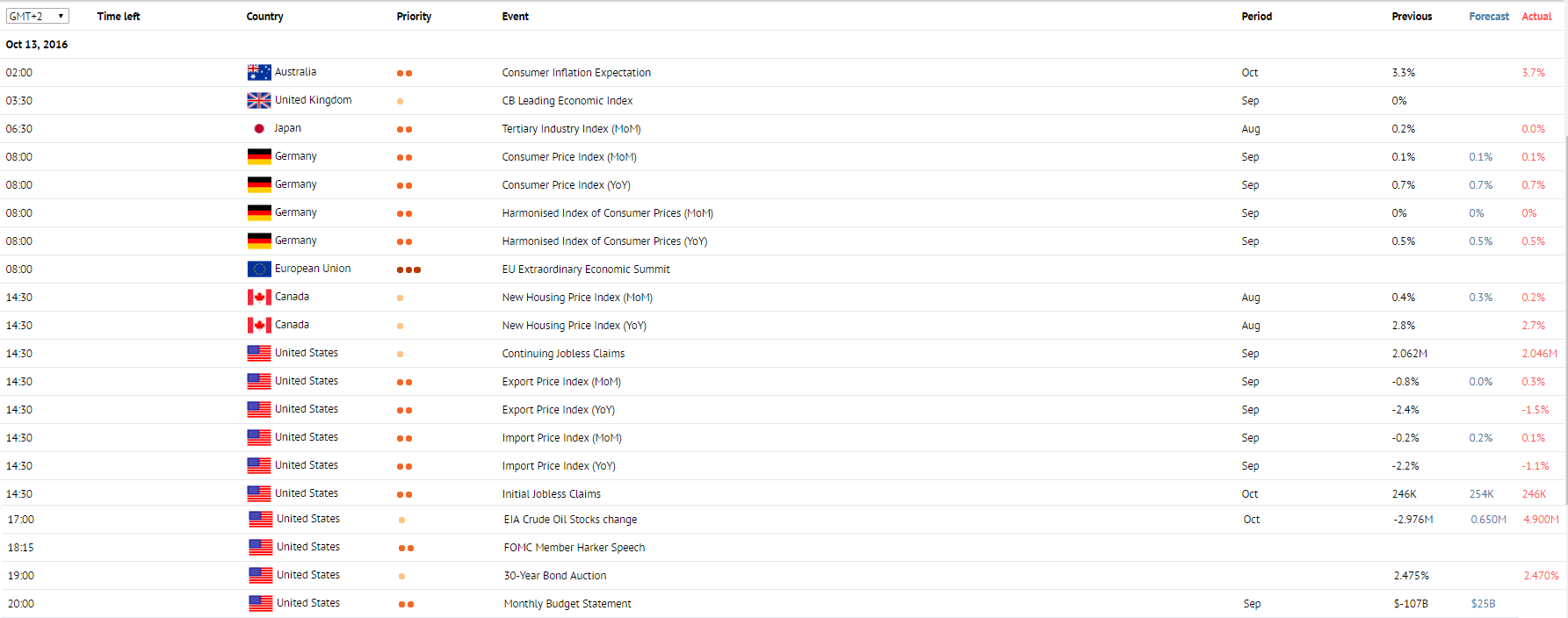

News of the day. 13.10.2016

Trade Balance. China, 4:30 am

Data on the Trade Balance for September is due in China at 4:30 am (GMT+2). The indicator is expected to grow from $52.05 billion to $53 billion. It is the difference between the value of exports and imports. Positive values imply the balance is in surplus, i.e., exports exceed imports. A growth in exports has a positive impact on the country’s economy. Negative values represent the balance deficit, i.e., imports exceed exports. A high reading strengthens the CNY. A low reading weakens the CNY.

Consumer Price Index. Germany, 8:00 am

Data on the Consumer Price Index for September is due in Germany at 8:00 am (GMT+2). The indicator is expected to remain unchanged at 0.7%. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Import Price Index. US, 2:30 pm

Data on the Import Price Index for September is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from -0.2% to 0.2% in monthly terms. The index represents the price change for goods and services imported in the US. A high reading strengthens the USD. A low reading weakens the USD.

Export Price Index. US, 2:30 pm

Data on the Export Price Index for September is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from -0.8% to 0.0% in monthly terms. The index represents the price change for goods and services exported from the US. The US share in the world trade is about 20%. The publication has a high impact on the market. A permanent growth in the index pressures the USD as high prices reduce demand.

FOMC Member Harker Speech. US, 6:15 pm

At 6:15 pm (GMT+2), Patrick Harker, President of the Federal Reserve Bank of Philadelphia, speaks on the economic outlook for the country.

Trade Balance. China, 4:30 am

Data on the Trade Balance for September is due in China at 4:30 am (GMT+2). The indicator is expected to grow from $52.05 billion to $53 billion. It is the difference between the value of exports and imports. Positive values imply the balance is in surplus, i.e., exports exceed imports. A growth in exports has a positive impact on the country’s economy. Negative values represent the balance deficit, i.e., imports exceed exports. A high reading strengthens the CNY. A low reading weakens the CNY.

Consumer Price Index. Germany, 8:00 am

Data on the Consumer Price Index for September is due in Germany at 8:00 am (GMT+2). The indicator is expected to remain unchanged at 0.7%. The index represents the change in prices for goods and services for households. It is the key indicator of inflation. A growth in the index strengthens the EUR. A fall in the index weakens the EUR.

Import Price Index. US, 2:30 pm

Data on the Import Price Index for September is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from -0.2% to 0.2% in monthly terms. The index represents the price change for goods and services imported in the US. A high reading strengthens the USD. A low reading weakens the USD.

Export Price Index. US, 2:30 pm

Data on the Export Price Index for September is due in the US at 2:30 pm (GMT+2). The indicator is expected to grow from -0.8% to 0.0% in monthly terms. The index represents the price change for goods and services exported from the US. The US share in the world trade is about 20%. The publication has a high impact on the market. A permanent growth in the index pressures the USD as high prices reduce demand.

FOMC Member Harker Speech. US, 6:15 pm

At 6:15 pm (GMT+2), Patrick Harker, President of the Federal Reserve Bank of Philadelphia, speaks on the economic outlook for the country.

Claws and Horns

News of the day. 12.10.2016.

Westpac Consumer Confidence. Australia, 1:30 am

Data on the Westpac Consumer Confidence for October is due in Australia at 1:30 am (GMT+2). The index is based on survey responses from consumers regarding how confident they feel about economic conditions and whether they are ready to make large purchases. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Industrial Production. EU, 11:00 am

Data on the Industrial Production in the EU for August is due at 11:00 am (GMT+2). The indicator is expected to grow from -0.5% to 1.4% in annual terms. It is one of the major indicators of the state of the economy which represents the change in industrial output. A high reading strengthens the EUR. A low reading weakens the EUR.

FOMC Minutes. US, 8:00 pm

FOMC Minutes are released at 8:00 pm (GMT+2). The committee gives their opinion on economic conditions in the US and decides on the direction of monetary policy. The publication has a high impact on the market.

Westpac Consumer Confidence. Australia, 1:30 am

Data on the Westpac Consumer Confidence for October is due in Australia at 1:30 am (GMT+2). The index is based on survey responses from consumers regarding how confident they feel about economic conditions and whether they are ready to make large purchases. A growth in the indicator strengthens the AUD. A fall in the indicator weakens the AUD.

Industrial Production. EU, 11:00 am

Data on the Industrial Production in the EU for August is due at 11:00 am (GMT+2). The indicator is expected to grow from -0.5% to 1.4% in annual terms. It is one of the major indicators of the state of the economy which represents the change in industrial output. A high reading strengthens the EUR. A low reading weakens the EUR.

FOMC Minutes. US, 8:00 pm

FOMC Minutes are released at 8:00 pm (GMT+2). The committee gives their opinion on economic conditions in the US and decides on the direction of monetary policy. The publication has a high impact on the market.

: