Young Ho Seo / Profile

- Information

|

10+ years

experience

|

62

products

|

1170

demo versions

|

|

4

jobs

|

0

signals

|

0

subscribers

|

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

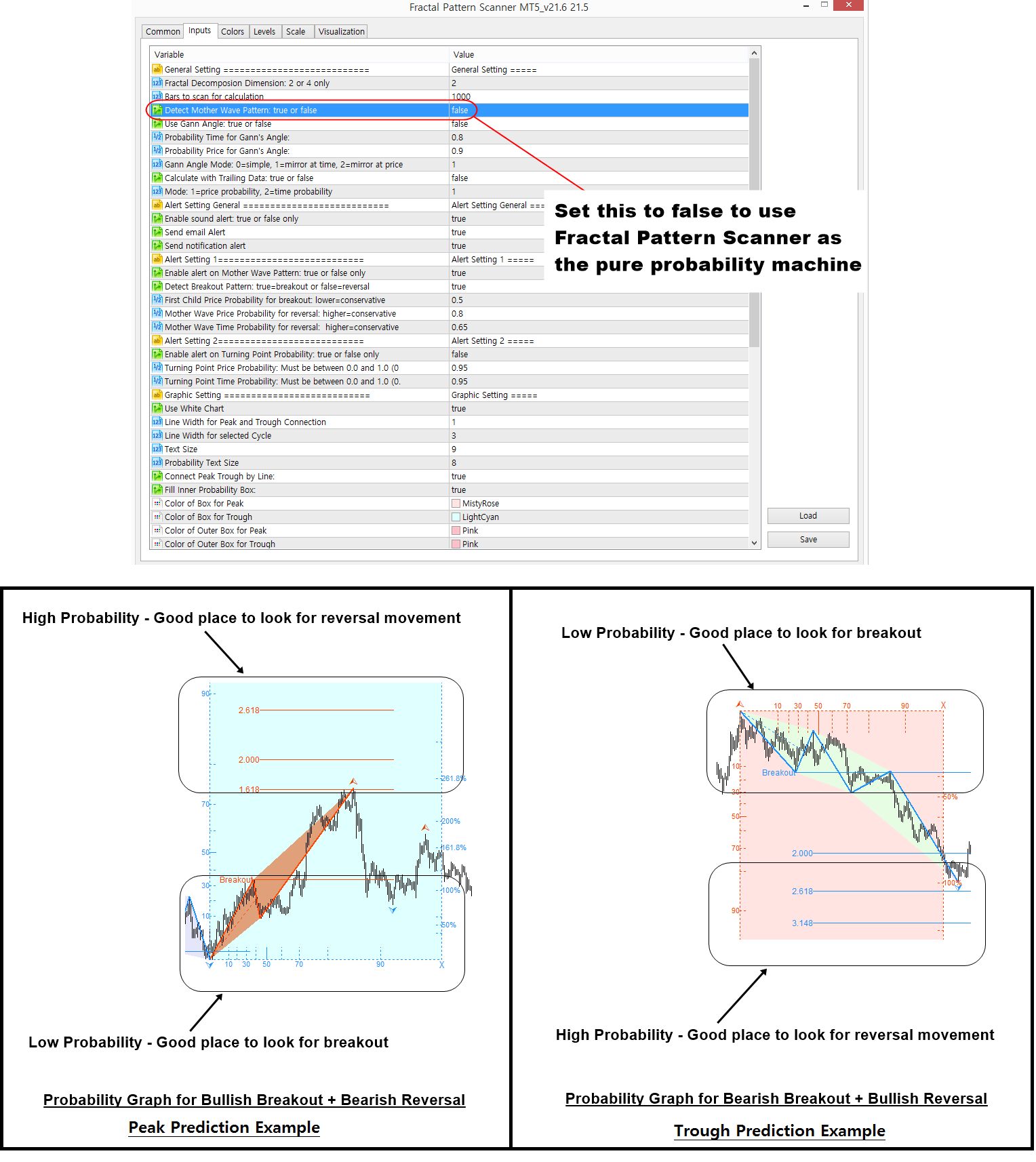

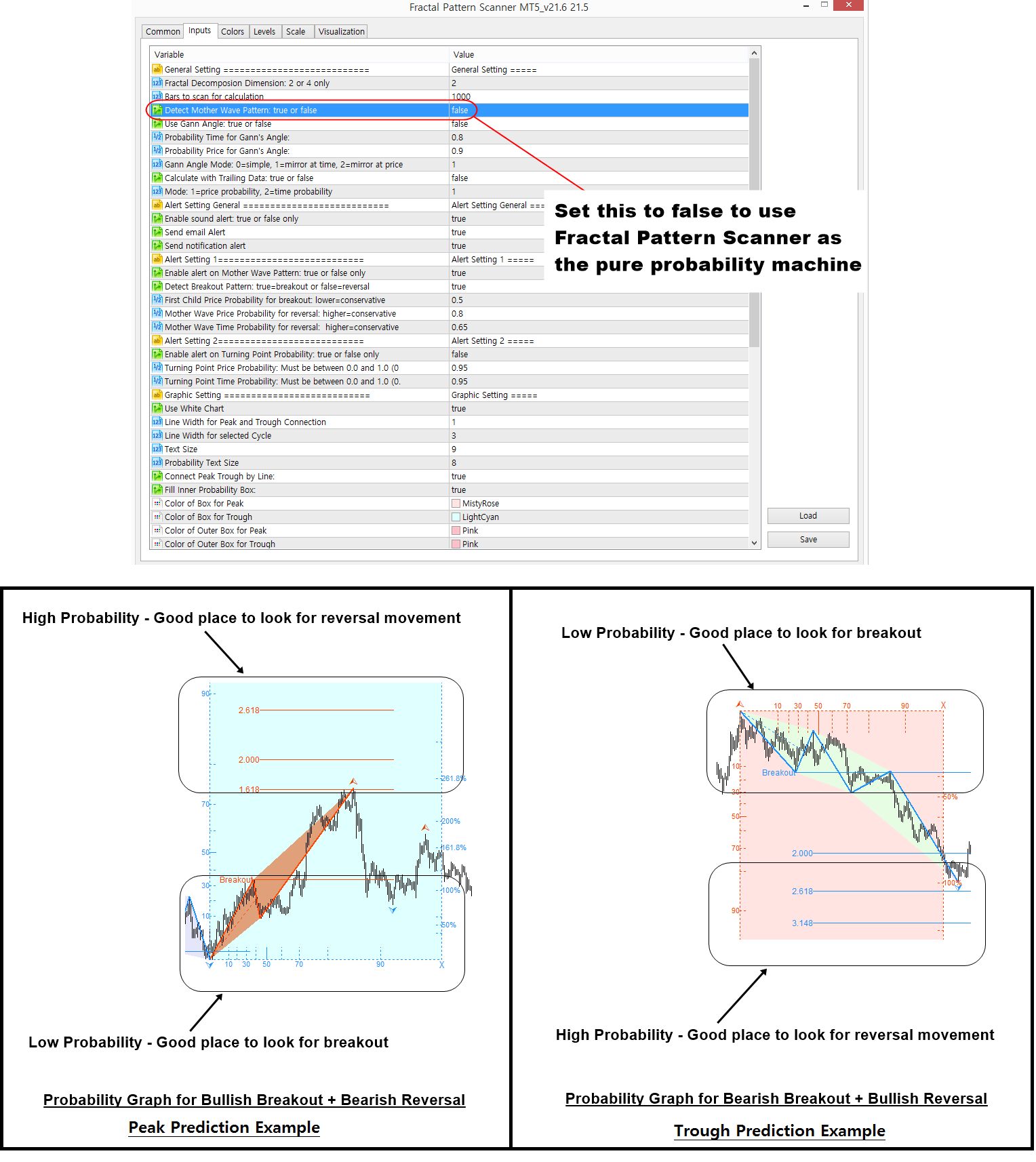

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

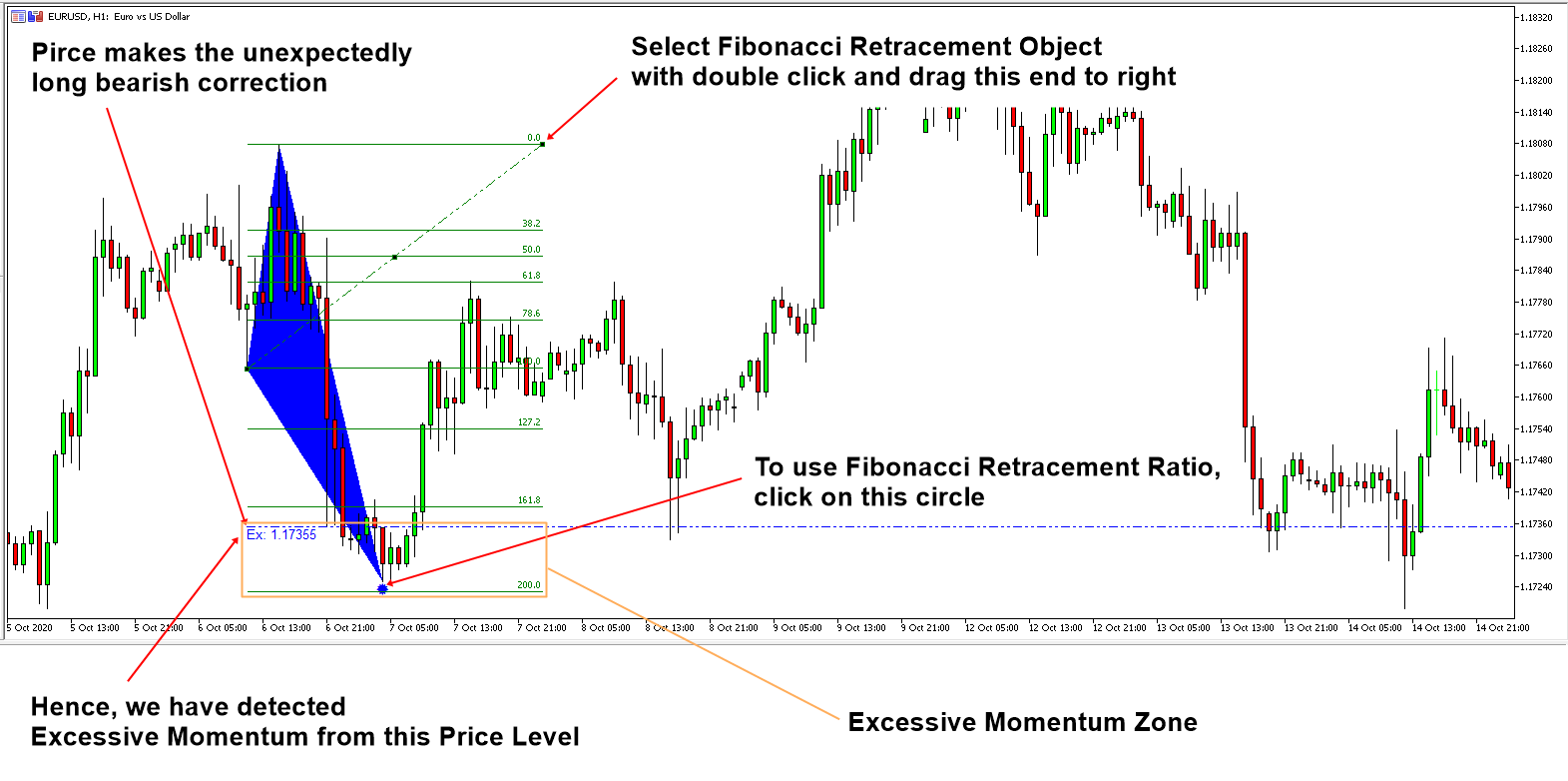

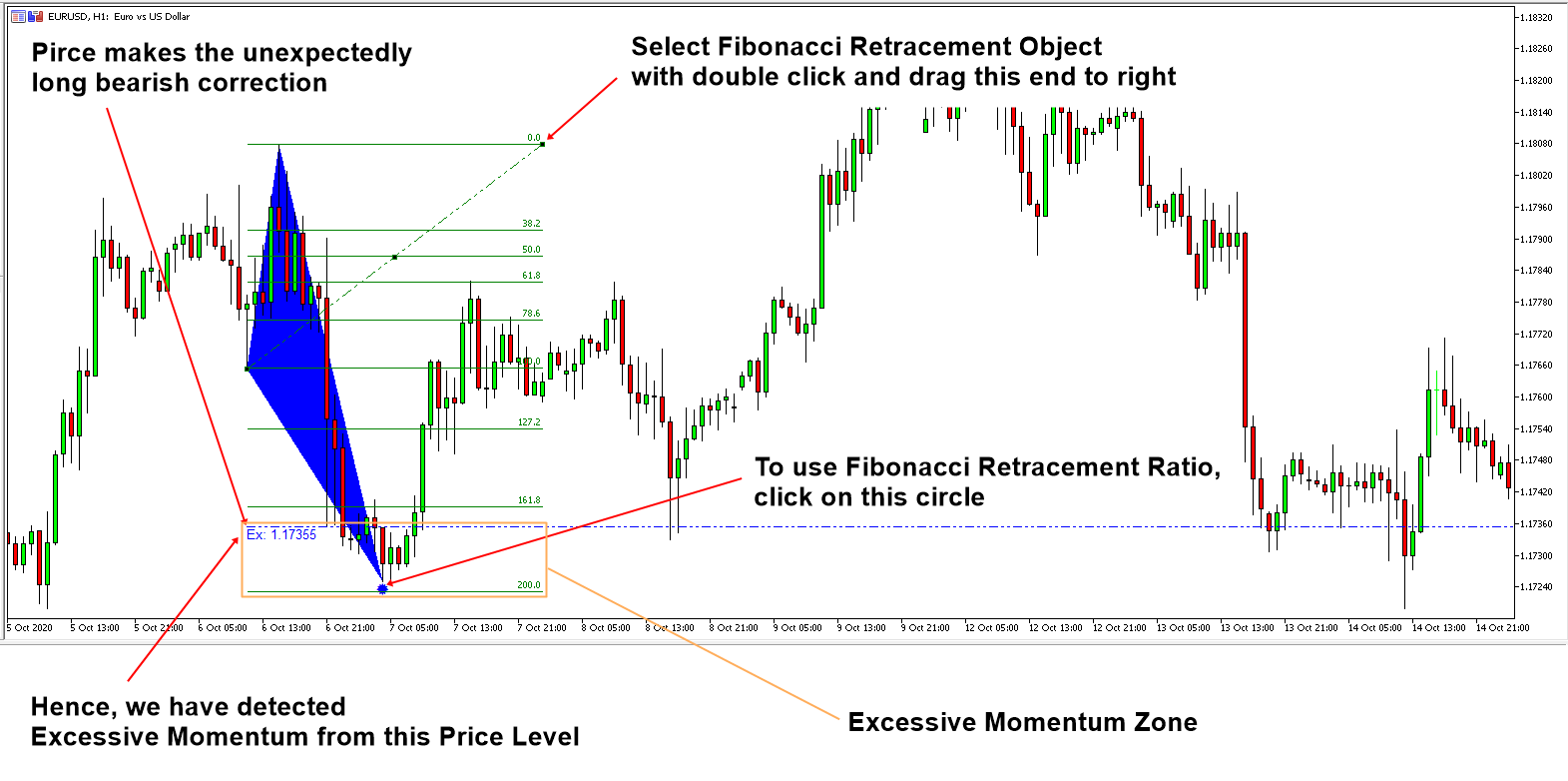

Excessive Momentum Indicator and Trading Operation

Excessive Momentum Indicator automatically detects the broken balance between supply and demand in the financial market. Detection of this broken balance provides the great market timing for the entry and exit for our trading. In this short article, we explain some of the controllable inputs in the Excessive Momentum Indicator.

There are the four main inputs, controlling the calculation process of Excessive Momentum Indicator. They are:

* Bars To Scan: amount of candle bars to calculate the indicator. Choose bigger numbers if you want to see the calculation over longer historical period.

* Momentum Strength Factor: Momentum Strength is the strength of Excessive Momentum to detect. It can stay between 0.1 and 0.5. In theory, it can go up to 1.0. However, you will not get many signals to trade. The default setting is 0.1. You can try various Momentum Strength Factor to optimize your trading performance if you wish.

* Equilibrium Fractal Wave Scale: This input controls the size of Fractal Wave when we detect the excessive momentum. If you put bigger number, then you get less signals to trade. The default setting is 0.5.

* Detrending Period: This input controls the statistical calculation in the algorithm. It should stay between 20 and 50.

Above four inputs are important because they can affect the number and quality of trading signals. You can use the default setting most of time. However, it is also possible that you can try different inputs and check how they perform in the historical data. Rest of inputs are probably self-explanatory from their name.

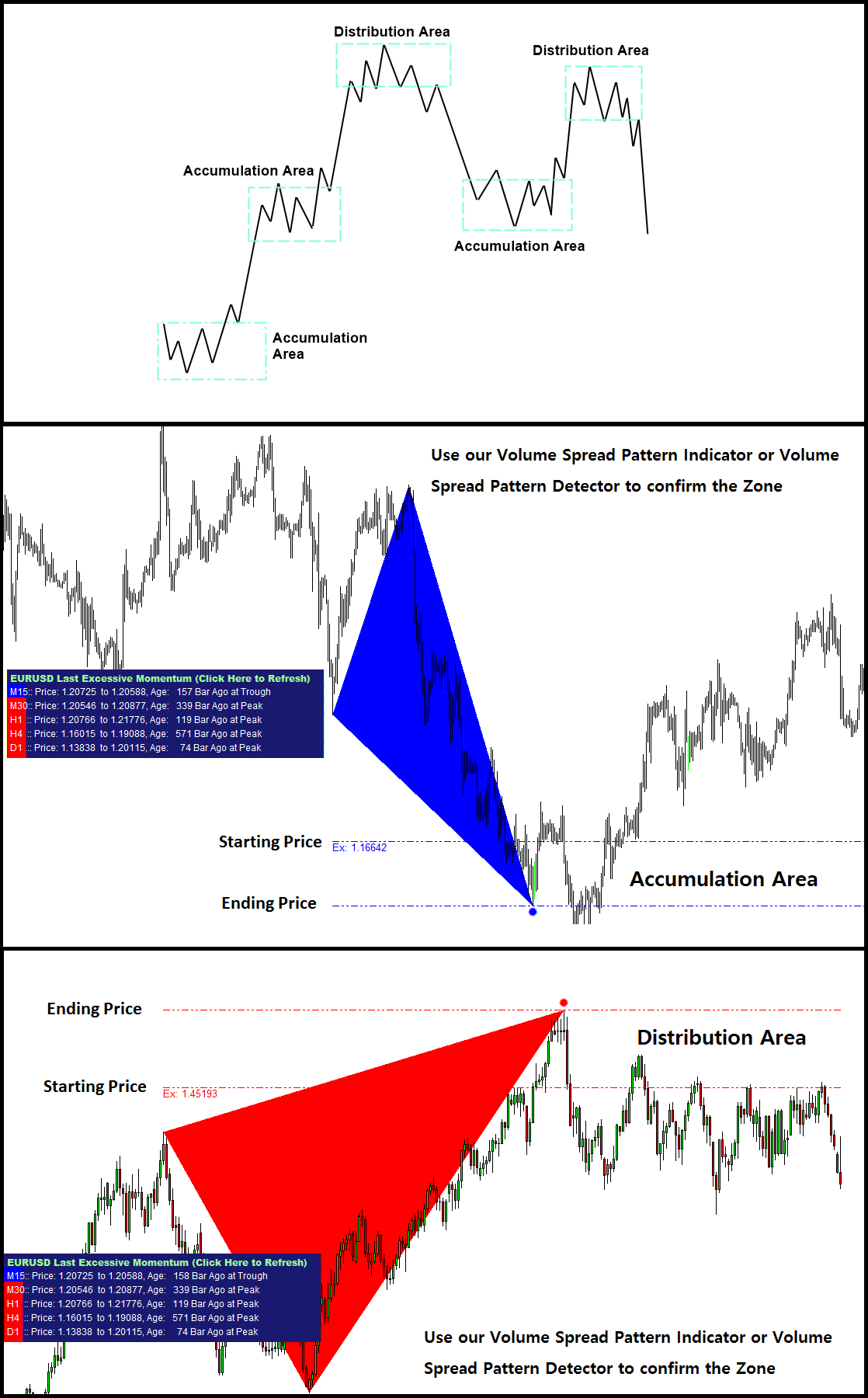

Now, let us cover the trading signals. In the Excessive Momentum indicator, you get two signal alerts. Firstly, you will get alert when the Excessive Momentum is starting in the market. In this case, it will notify you the starting price. At this stage, the excessive momentum is not completely expanded yet.

Secondly, you will get alert when the Excessive Momentum is completed in the market. At this stage, you will be notified both starting price and ending price of Excessive Momentum.

Both starting price and ending price of Excessive Momentum form the Excessive Momentum Zone. At which signal you want to trade is up to your choice. You can use the zone as the breakout trading when the zone is narrow. When the zone is sufficiently large, it might be possible to aim some reversal trading opportunity too.

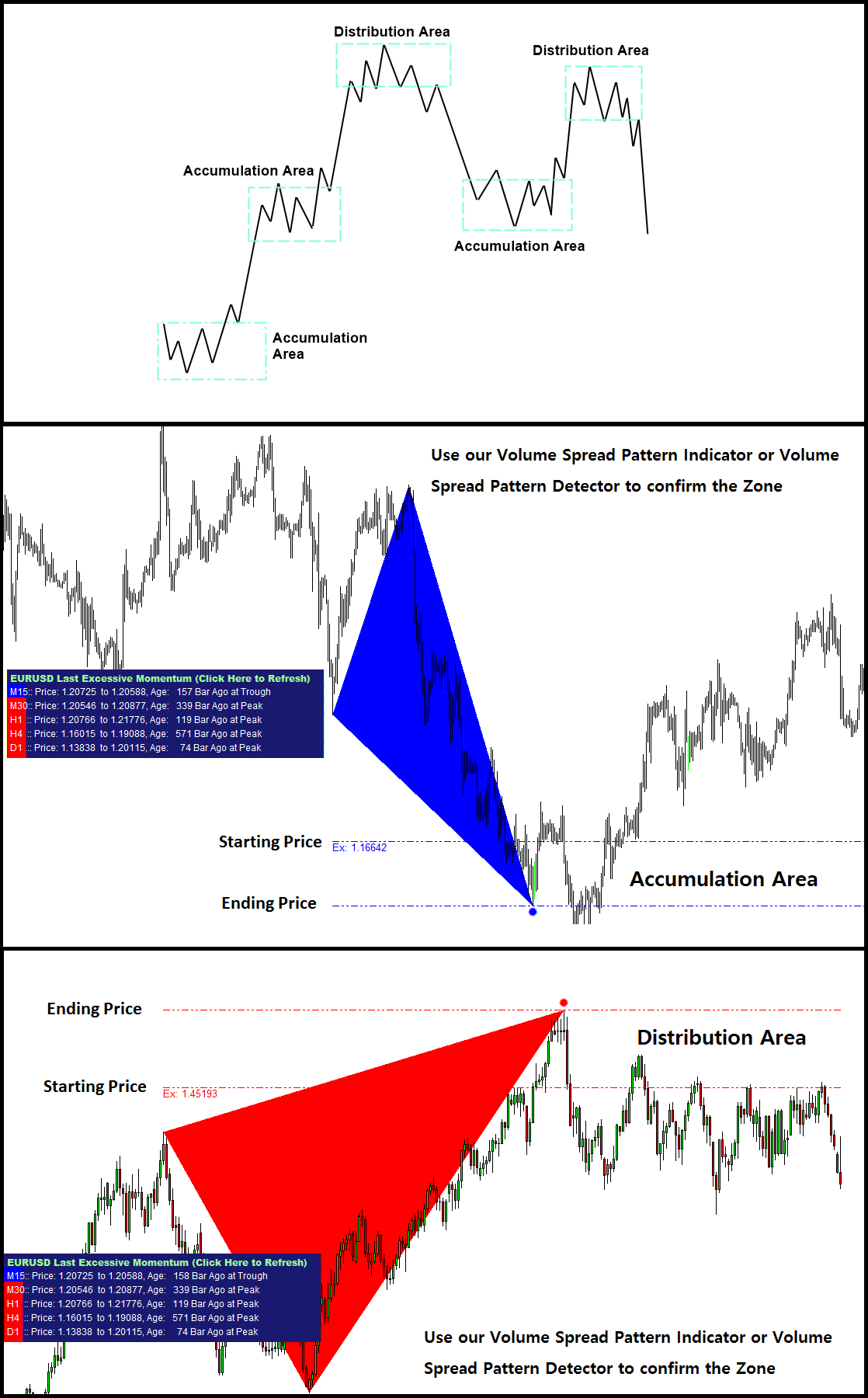

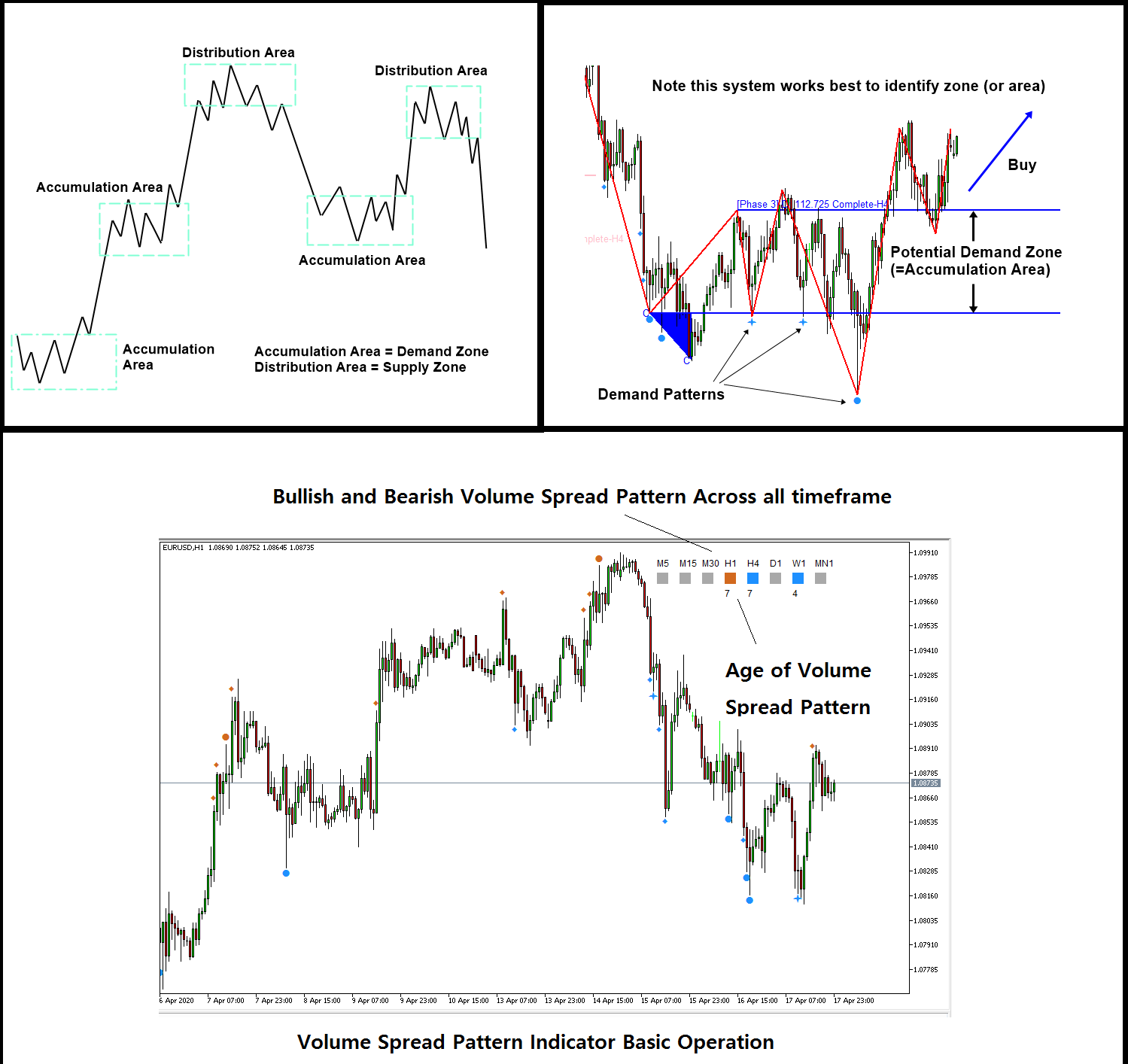

At the same time, this Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version).

YouTube Video 1: https://youtu.be/oztARcXsAVA

YouTube Video 2: https://youtu.be/A4JcTcakOKw

=============================================

Below is the landing page for Excessive Momentum Indicator.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Here is the link to Volume Spread Pattern Indicator (Paid and Advanced Version).

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Here is the link to Volume Spread Pattern Detector (Free and Light Version).

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Excessive Momentum Indicator automatically detects the broken balance between supply and demand in the financial market. Detection of this broken balance provides the great market timing for the entry and exit for our trading. In this short article, we explain some of the controllable inputs in the Excessive Momentum Indicator.

There are the four main inputs, controlling the calculation process of Excessive Momentum Indicator. They are:

* Bars To Scan: amount of candle bars to calculate the indicator. Choose bigger numbers if you want to see the calculation over longer historical period.

* Momentum Strength Factor: Momentum Strength is the strength of Excessive Momentum to detect. It can stay between 0.1 and 0.5. In theory, it can go up to 1.0. However, you will not get many signals to trade. The default setting is 0.1. You can try various Momentum Strength Factor to optimize your trading performance if you wish.

* Equilibrium Fractal Wave Scale: This input controls the size of Fractal Wave when we detect the excessive momentum. If you put bigger number, then you get less signals to trade. The default setting is 0.5.

* Detrending Period: This input controls the statistical calculation in the algorithm. It should stay between 20 and 50.

Above four inputs are important because they can affect the number and quality of trading signals. You can use the default setting most of time. However, it is also possible that you can try different inputs and check how they perform in the historical data. Rest of inputs are probably self-explanatory from their name.

Now, let us cover the trading signals. In the Excessive Momentum indicator, you get two signal alerts. Firstly, you will get alert when the Excessive Momentum is starting in the market. In this case, it will notify you the starting price. At this stage, the excessive momentum is not completely expanded yet.

Secondly, you will get alert when the Excessive Momentum is completed in the market. At this stage, you will be notified both starting price and ending price of Excessive Momentum.

Both starting price and ending price of Excessive Momentum form the Excessive Momentum Zone. At which signal you want to trade is up to your choice. You can use the zone as the breakout trading when the zone is narrow. When the zone is sufficiently large, it might be possible to aim some reversal trading opportunity too.

At the same time, this Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version).

YouTube Video 1: https://youtu.be/oztARcXsAVA

YouTube Video 2: https://youtu.be/A4JcTcakOKw

=============================================

Below is the landing page for Excessive Momentum Indicator.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Here is the link to Volume Spread Pattern Indicator (Paid and Advanced Version).

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Here is the link to Volume Spread Pattern Detector (Free and Light Version).

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Young Ho Seo

Ace Supply Demand Zone Indicator – How to Remove Take Profit and Stop Loss Levels

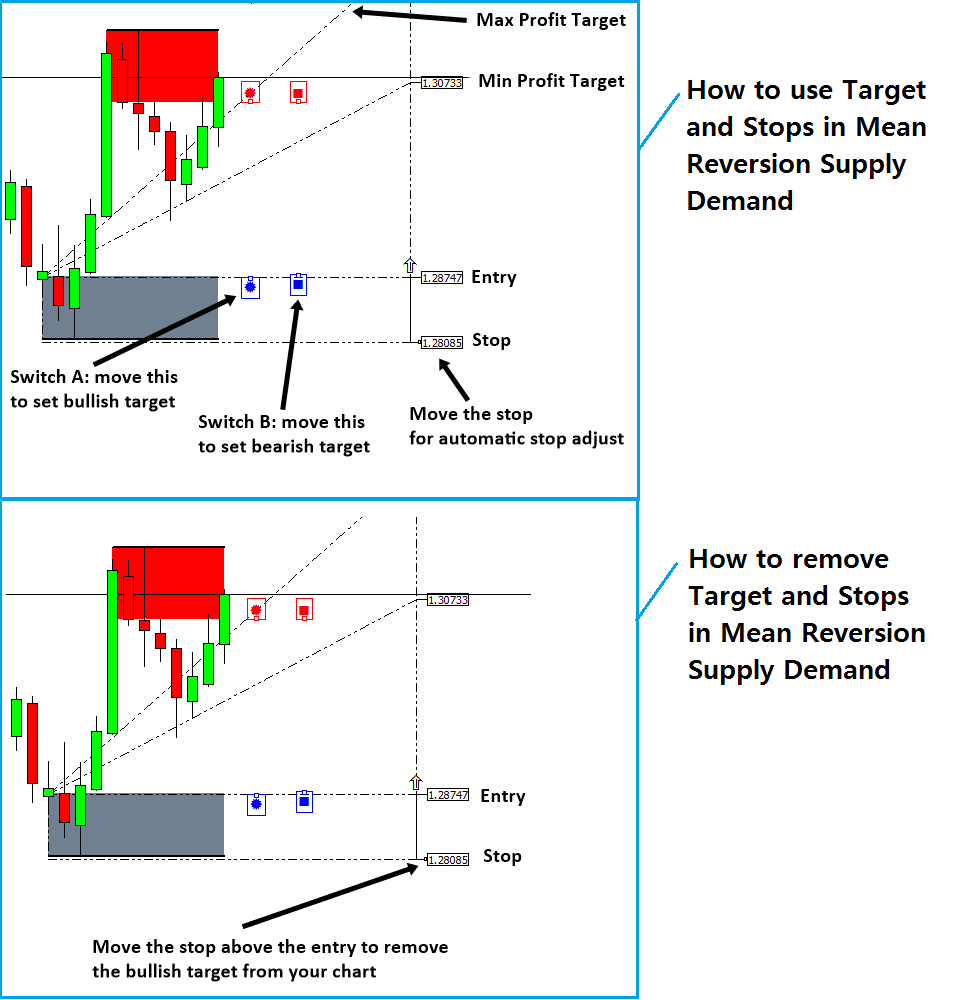

One of the greatest advantage of Ace Supply Demand Zone indicator is that it provide a flexible Profit and stop target for your trading. After you have learnt how to use this profit targets, now you want to learn how to remove them. Of course, there is a way to remove them. The trick is simply moving the stop text above the Entry text (for the case of buy). You will do the opposite for the case of sell. In the screenshot, the bottom image describe how to remove the targets from your chart.

There is another approach to remove take profit and stop loss targets. We provide the shortcut in keyboard for doing the same task. Simply hit “z” button in your keyboard. This will also remove the stop loss and take profit targets if you do not need them any longer.

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Below is link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

One of the greatest advantage of Ace Supply Demand Zone indicator is that it provide a flexible Profit and stop target for your trading. After you have learnt how to use this profit targets, now you want to learn how to remove them. Of course, there is a way to remove them. The trick is simply moving the stop text above the Entry text (for the case of buy). You will do the opposite for the case of sell. In the screenshot, the bottom image describe how to remove the targets from your chart.

There is another approach to remove take profit and stop loss targets. We provide the shortcut in keyboard for doing the same task. Simply hit “z” button in your keyboard. This will also remove the stop loss and take profit targets if you do not need them any longer.

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Below is link to Ace Supply Demand Zone Indicator.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

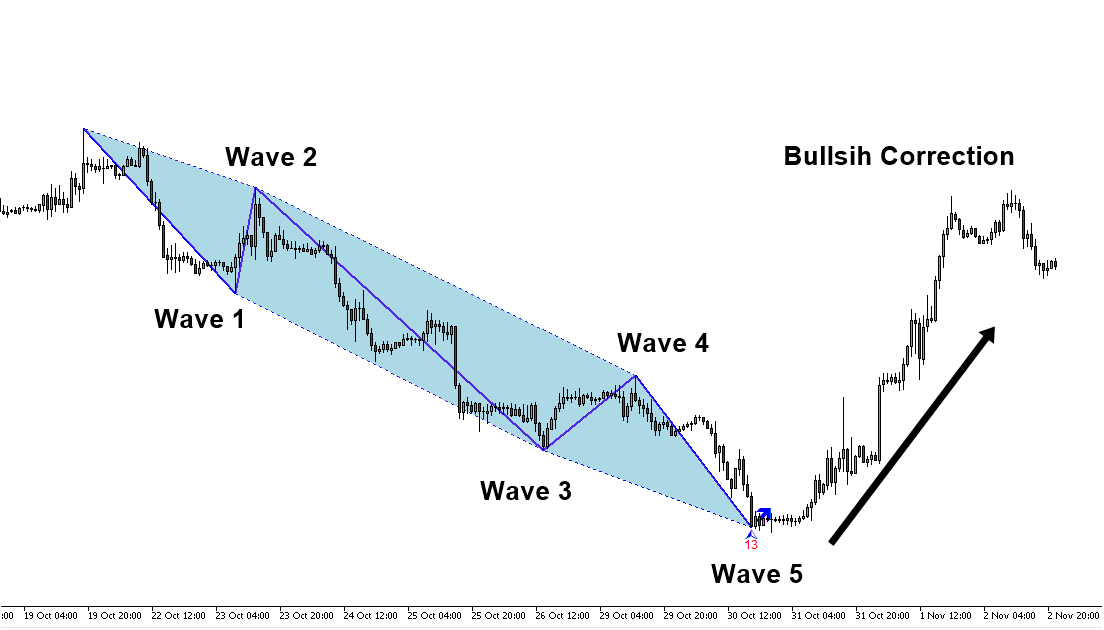

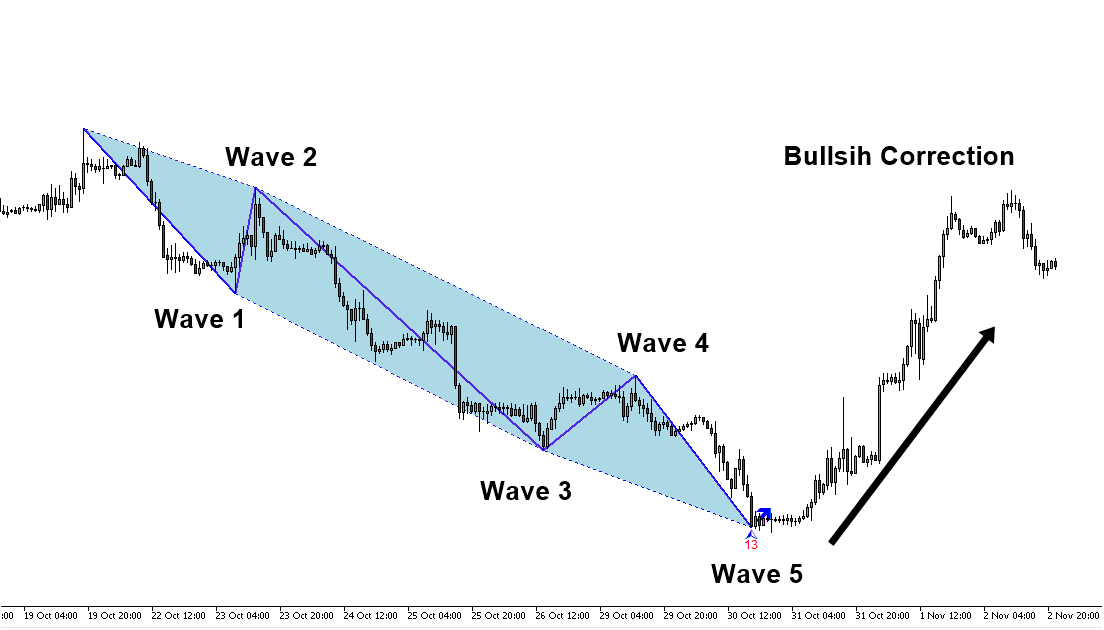

Profitable Patterns in Financial Market

Price is the data recorded by financial exchange. The financial exchange distributes this real time price to trader electronically during market hours. Then trader will make buy or sell decision depending on their perception of the latest price. If they feel the price is low, then they will buy the currency or stock. If they feel price is too high, then they will sell the currency or stock. Once thing we need to know is that diversified reactions exists about good buying and selling price. We can have millions of different opinions about 200 dollar stock price for Facebook today. Some people will think that 200 dollar is good price to buy and some people will think the opposite. Some people might be neutral. Next price of Facebook will be determined by trading volume of buy and sell orders. If buy-trading volume is dominating over the sell-trading volume, then price will go up. If sell-trading volume is dominating over the buy-trading volume, then price will go down. You can think that each price recorded is in fact the record of the crowd reaction.

For our analysis, financial exchange also records the series of price in regular time interval like hourly, daily, or weekly, etc. Sometimes they record tick-by-tick data. They electronically store these historical data and distribute them to traders. Then trader uses these historical data to draw chart for further analysis of the price. In modern electronic trading environment, it is very rare to make buy and sell decision without looking at chart. Price series contain complex information. If we want to find out any useful information from price series, then we need to work backwards from price series into whatever information we need to seek. Extracting useful information from price series typically requires some mathematical tools.

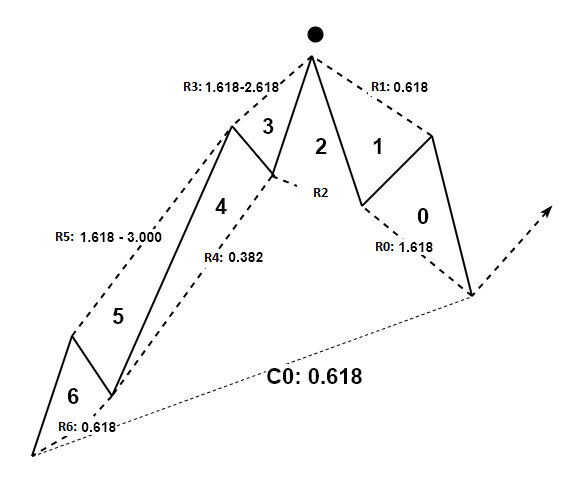

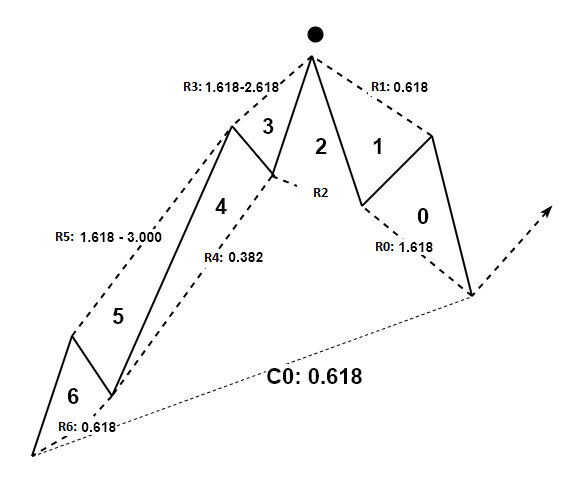

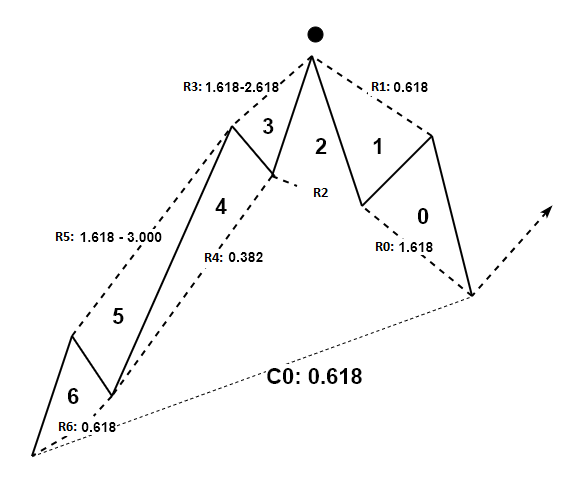

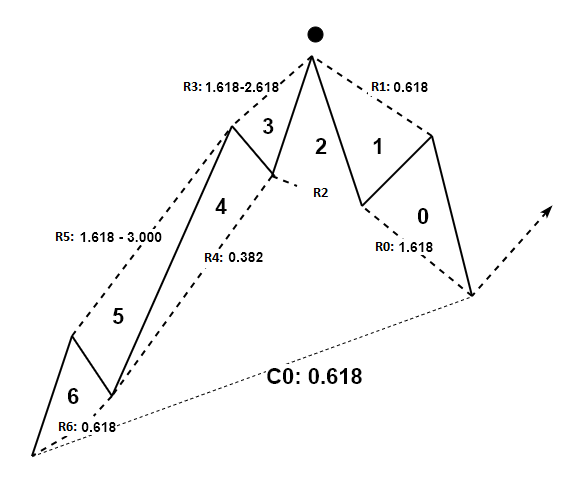

Depending on what is our question, we need to apply different tools to exam price series. For example, if you want to know the common statistics for Facebook stock price, then you can calculate the mean, median, and standard deviation of the price series. If you want to find out good cycles to trade, then you need to apply Fourier transformation or some sort, to extract the cycles of Facebook price series. Likewise, if we want to find out profitable patterns, then we need to apply Peak Trough transformation or some sort to the price series. When we apply Peak Trough Transformation, we turn price series into the infinitely repeating triangles, which are called Fractal wave. Typically, Zig Zag indicator and Renko chart are used to turn price series into fractal wave.

Fractal or Fractal wave is commonly observable in nature like snowflake, in tree leaves, in heartbeat rate, in coastal line. Hence, many traders believe that the identifying profitable patterns in price series are the same as spotting natural order. By definition, Fractal wave is infinitely repeating self-similar patterns in time domain. The main regularity in Fractal wave is the shape of the pattern. Typically, this shape of pattern is referenced for some geometric shapes like triangle, circle, square, etc. In Fractal wave, we can have both strict self-similar and loose self-similar patterns. If the repeating patterns have the same geometric shape and all individual patterns have matching parameters in that shape, we call this as strict self-similarity. If repeating patterns have the same geometric shape but majority of individual patterns have non-matching parameters in that shape, then we call this as loose self-similarity. Fractal wave in Forex and Stock market price series have triangle as the geometric shape. However, individual triangle can be wider, narrower, longer, and shorter than other triangles. Hence, Fractal Wave in Forex and Stock market data possess the loose self–similarity. Loose self-similarity does not mean that all the triangles are non-identical in shape. Even in loose self-similarity, we can have some triangles in identical shape or at least within allowed range in precision.

First important characteristic of fractal wave is the infinite scales. In theory, repeating triangles in forex and stock market can have infinite variation of scales from very small to extremely large triangles. For example, one day we can observe one triangle formed in thirty seconds but another triangle can be formed in thirty days. In our pattern study, scale is an independent factor from geometric shape. As long as triangles are identical in shape, or within allowed range in precision, triangle formed in thirty seconds is treated as identical to the triangle formed in thirty days, regardless of their size. For some practical example, Fibonacci price pattern with 61.8% retracement formed in twenty-candle bar in hourly timeframe is an identical pattern to the other 61.8% retracement pattern formed in thirty six candle bar in daily timeframe.

Second important characteristic about Fractal wave pattern is that many small pattern are jagged together to make bigger patterns. For example, in triangular fractal wave as in financial market, bigger triangle will be made from many small triangles. In our pattern study, we often seek this sort of jagged patterns for our trading opportunity. Especially, in Harmonic pattern, Elliott Wave patterns, and X3 patterns, this sort of jagged pattern are commonly utilized to find the profitable patterns with good success rate.

About this Article

This article is the part taken from the draft version of the Book: Profitable Chart Patterns in Forex and Stock Market: Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern. Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

You can also use Ace Supply Demand Zone Indicator in MetaTrader to accomplish your technical analysis. Ace Supply Demand Zone indicator is non repainting and non lagging supply demand zone indicator with a lot of powerful features built on.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Price is the data recorded by financial exchange. The financial exchange distributes this real time price to trader electronically during market hours. Then trader will make buy or sell decision depending on their perception of the latest price. If they feel the price is low, then they will buy the currency or stock. If they feel price is too high, then they will sell the currency or stock. Once thing we need to know is that diversified reactions exists about good buying and selling price. We can have millions of different opinions about 200 dollar stock price for Facebook today. Some people will think that 200 dollar is good price to buy and some people will think the opposite. Some people might be neutral. Next price of Facebook will be determined by trading volume of buy and sell orders. If buy-trading volume is dominating over the sell-trading volume, then price will go up. If sell-trading volume is dominating over the buy-trading volume, then price will go down. You can think that each price recorded is in fact the record of the crowd reaction.

For our analysis, financial exchange also records the series of price in regular time interval like hourly, daily, or weekly, etc. Sometimes they record tick-by-tick data. They electronically store these historical data and distribute them to traders. Then trader uses these historical data to draw chart for further analysis of the price. In modern electronic trading environment, it is very rare to make buy and sell decision without looking at chart. Price series contain complex information. If we want to find out any useful information from price series, then we need to work backwards from price series into whatever information we need to seek. Extracting useful information from price series typically requires some mathematical tools.

Depending on what is our question, we need to apply different tools to exam price series. For example, if you want to know the common statistics for Facebook stock price, then you can calculate the mean, median, and standard deviation of the price series. If you want to find out good cycles to trade, then you need to apply Fourier transformation or some sort, to extract the cycles of Facebook price series. Likewise, if we want to find out profitable patterns, then we need to apply Peak Trough transformation or some sort to the price series. When we apply Peak Trough Transformation, we turn price series into the infinitely repeating triangles, which are called Fractal wave. Typically, Zig Zag indicator and Renko chart are used to turn price series into fractal wave.

Fractal or Fractal wave is commonly observable in nature like snowflake, in tree leaves, in heartbeat rate, in coastal line. Hence, many traders believe that the identifying profitable patterns in price series are the same as spotting natural order. By definition, Fractal wave is infinitely repeating self-similar patterns in time domain. The main regularity in Fractal wave is the shape of the pattern. Typically, this shape of pattern is referenced for some geometric shapes like triangle, circle, square, etc. In Fractal wave, we can have both strict self-similar and loose self-similar patterns. If the repeating patterns have the same geometric shape and all individual patterns have matching parameters in that shape, we call this as strict self-similarity. If repeating patterns have the same geometric shape but majority of individual patterns have non-matching parameters in that shape, then we call this as loose self-similarity. Fractal wave in Forex and Stock market price series have triangle as the geometric shape. However, individual triangle can be wider, narrower, longer, and shorter than other triangles. Hence, Fractal Wave in Forex and Stock market data possess the loose self–similarity. Loose self-similarity does not mean that all the triangles are non-identical in shape. Even in loose self-similarity, we can have some triangles in identical shape or at least within allowed range in precision.

First important characteristic of fractal wave is the infinite scales. In theory, repeating triangles in forex and stock market can have infinite variation of scales from very small to extremely large triangles. For example, one day we can observe one triangle formed in thirty seconds but another triangle can be formed in thirty days. In our pattern study, scale is an independent factor from geometric shape. As long as triangles are identical in shape, or within allowed range in precision, triangle formed in thirty seconds is treated as identical to the triangle formed in thirty days, regardless of their size. For some practical example, Fibonacci price pattern with 61.8% retracement formed in twenty-candle bar in hourly timeframe is an identical pattern to the other 61.8% retracement pattern formed in thirty six candle bar in daily timeframe.

Second important characteristic about Fractal wave pattern is that many small pattern are jagged together to make bigger patterns. For example, in triangular fractal wave as in financial market, bigger triangle will be made from many small triangles. In our pattern study, we often seek this sort of jagged patterns for our trading opportunity. Especially, in Harmonic pattern, Elliott Wave patterns, and X3 patterns, this sort of jagged pattern are commonly utilized to find the profitable patterns with good success rate.

About this Article

This article is the part taken from the draft version of the Book: Profitable Chart Patterns in Forex and Stock Market: Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern. Full version of the book can be found from the link below:

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

You can also use Ace Supply Demand Zone Indicator in MetaTrader to accomplish your technical analysis. Ace Supply Demand Zone indicator is non repainting and non lagging supply demand zone indicator with a lot of powerful features built on.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Below is the landing page for Optimum Chart (Standalone Charting and Analytical Platform).

https://algotrading-investment.com/2019/07/23/optimum-chart/

Young Ho Seo

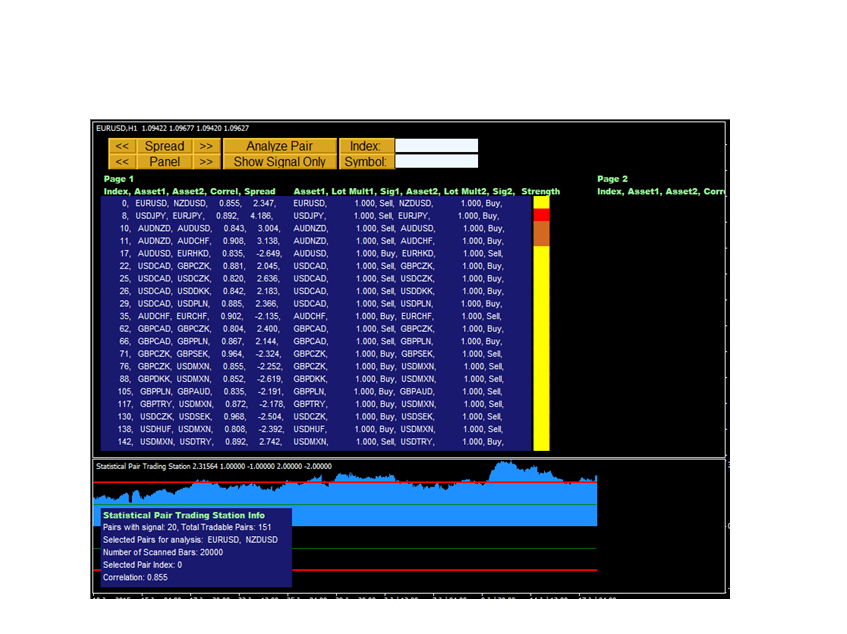

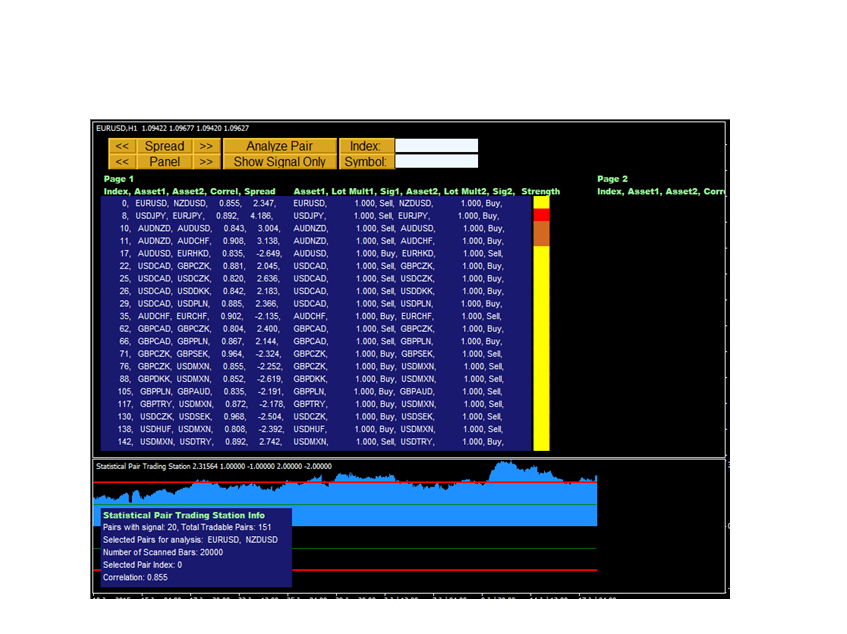

Manual For Pair Trading Station

Pair Trading Station is a powerful MetaTrader Indicator. Its decision making algorithm is based on Pairs trading (a.k.a Statistical arbitrage or spread analysis). This manual was written already few years ago for our Pair Trading Station. I think this is still very useful if your trading is based on correlation and spread. This is pdf manual, so please download it into your hard drive and read them. Below is the link to the pdf manual:

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

In addition, you can watch this YouTube Video titled as How to use Pairs Trading Station

https://youtu.be/fAE9pByxZDA

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

Pair Trading Station is a powerful MetaTrader Indicator. Its decision making algorithm is based on Pairs trading (a.k.a Statistical arbitrage or spread analysis). This manual was written already few years ago for our Pair Trading Station. I think this is still very useful if your trading is based on correlation and spread. This is pdf manual, so please download it into your hard drive and read them. Below is the link to the pdf manual:

https://algotrading-investment.com/2015/11/14/introduction-to-pair-trading-station_ati/

In addition, you can watch this YouTube Video titled as How to use Pairs Trading Station

https://youtu.be/fAE9pByxZDA

Here is the landing page for Pairs Trading Station in MetaTrader 4 and MetaTrader5.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

https://www.mql5.com/en/market/product/3303

https://www.mql5.com/en/market/product/3304

Young Ho Seo

Supply Demand Zone Indicator on MetaTrader 4

MetaTrader 4 is one of the most popular trading platform since 2010. It is accessible for free of charge for any trader from all over the world. We provide a range of powerful supply demand zone indicator particularly designed for MetaTrader 4 platform.

Here is the list of Advanced Supply Demand Zone Indicator. These supply and demand zone indicators are rich in features with many powerful features to help you to trade the right supply and demand zone to trading.

Mean Reversion Supply Demand on MetaTrader 4

Mean Reversion Supply Demand indicator is our earliest supply demand zone indicator and loved by many trader all over the world. It is great to trade with reversal and breakout. You can also fully setup your trading with stop loss and take profit target. Please note that Mean Reversion Supply Demand is the excellent tool but it is repainting supply demand zone indicator.

Below are the links to MetaTrader 4 version of the Mean Reversion Supply Demand indicator.

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand

Ace Supply Demand Zone Indicator on MetaTrader 4

Ace Supply Demand Zone indicator is our next generation supply demand zone indicator. It was built in non repainting and non lagging algorithm. On top of many powerful features, you can also make use of archived supply and demand zone in your trading to find more accurate trading opportunity. Ace Supply Demand Zone indicator is the non repainting supply demand zone indicator. If you prefer the non repainting indicator, then you must use Ace Supply Demand Zone Indicator.

Below are the links to MetaTrader 4 version of the Ace Supply Demand Zone indicator.

https://www.mql5.com/en/market/product/40076

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to accomplish the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

For your information, both indicators provides many powerful features to complete for your trading. You can also use this indicators together with Harmonic pattern and Elliott wave pattern indicators.

MetaTrader 4 is one of the most popular trading platform since 2010. It is accessible for free of charge for any trader from all over the world. We provide a range of powerful supply demand zone indicator particularly designed for MetaTrader 4 platform.

Here is the list of Advanced Supply Demand Zone Indicator. These supply and demand zone indicators are rich in features with many powerful features to help you to trade the right supply and demand zone to trading.

Mean Reversion Supply Demand on MetaTrader 4

Mean Reversion Supply Demand indicator is our earliest supply demand zone indicator and loved by many trader all over the world. It is great to trade with reversal and breakout. You can also fully setup your trading with stop loss and take profit target. Please note that Mean Reversion Supply Demand is the excellent tool but it is repainting supply demand zone indicator.

Below are the links to MetaTrader 4 version of the Mean Reversion Supply Demand indicator.

https://www.mql5.com/en/market/product/16851

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand

Ace Supply Demand Zone Indicator on MetaTrader 4

Ace Supply Demand Zone indicator is our next generation supply demand zone indicator. It was built in non repainting and non lagging algorithm. On top of many powerful features, you can also make use of archived supply and demand zone in your trading to find more accurate trading opportunity. Ace Supply Demand Zone indicator is the non repainting supply demand zone indicator. If you prefer the non repainting indicator, then you must use Ace Supply Demand Zone Indicator.

Below are the links to MetaTrader 4 version of the Ace Supply Demand Zone indicator.

https://www.mql5.com/en/market/product/40076

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. In terms of indicator operation, both mean reversion supply demand and ace supply demand zone indicator are similar. Hence, you can watch this YouTube Video to accomplish the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

For your information, both indicators provides many powerful features to complete for your trading. You can also use this indicators together with Harmonic pattern and Elliott wave pattern indicators.

Young Ho Seo

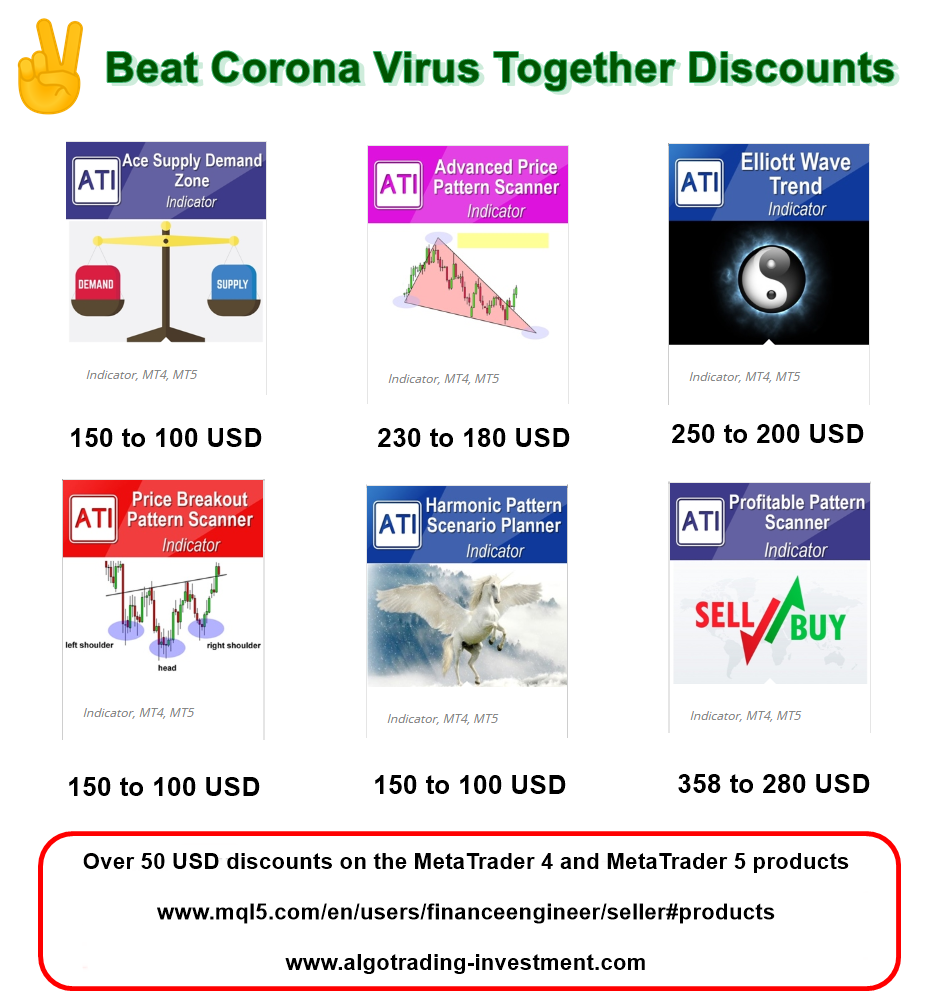

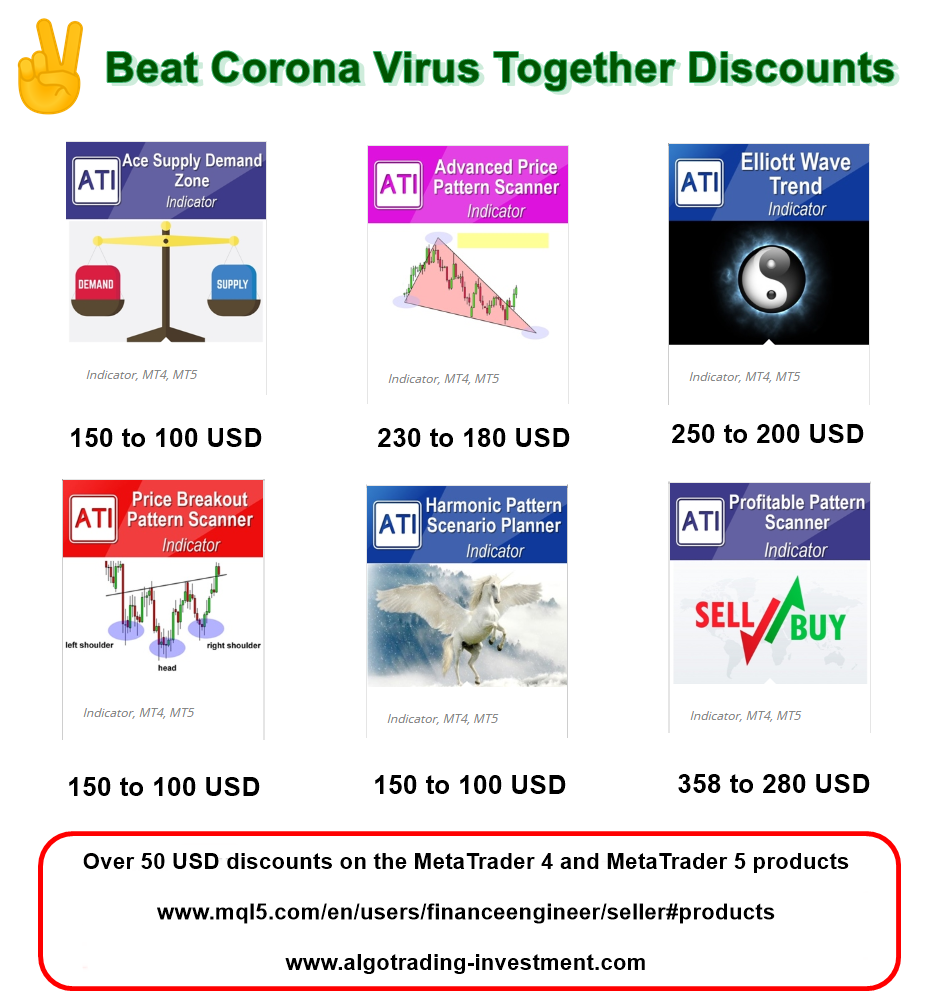

Beat Corona Virus Together Discounts for MetaTrader

Since December 2019, we have observed the loss of lives due to this COVID-19 pandemic. Apart from this, COVID-19 has severely demobilized the global economy. Many of the affected countries have undergone the complete lock down. Life after the COVID 19 is tough for the entire society. We never knew that this will last this long.

During this Covid19 pandemic, we hope everyone is safe and well from this Corona Virus Crisis. We know this affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Here are some simple tips for you to stay safe from this Covid19 Crysis.

Don’t touch your face – Avoid touching your eyes, nose and mouth.

Don’t cough or sneeze into your hands – Cover your mouth and nose with your elbow or tissue when coughing or sneezing. Dispose of used tissue immediately.

Keep your distance – Maintain a distance of at least 2 meter from people who are coughing or sneezing.

Wash, wash, wash your hands

Finally, care the loved one.

Since December 2019, we have observed the loss of lives due to this COVID-19 pandemic. Apart from this, COVID-19 has severely demobilized the global economy. Many of the affected countries have undergone the complete lock down. Life after the COVID 19 is tough for the entire society. We never knew that this will last this long.

During this Covid19 pandemic, we hope everyone is safe and well from this Corona Virus Crisis. We know this affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

Here are some simple tips for you to stay safe from this Covid19 Crysis.

Don’t touch your face – Avoid touching your eyes, nose and mouth.

Don’t cough or sneeze into your hands – Cover your mouth and nose with your elbow or tissue when coughing or sneezing. Dispose of used tissue immediately.

Keep your distance – Maintain a distance of at least 2 meter from people who are coughing or sneezing.

Wash, wash, wash your hands

Finally, care the loved one.

Young Ho Seo

Harmonic Pattern Detection Indicator MT5

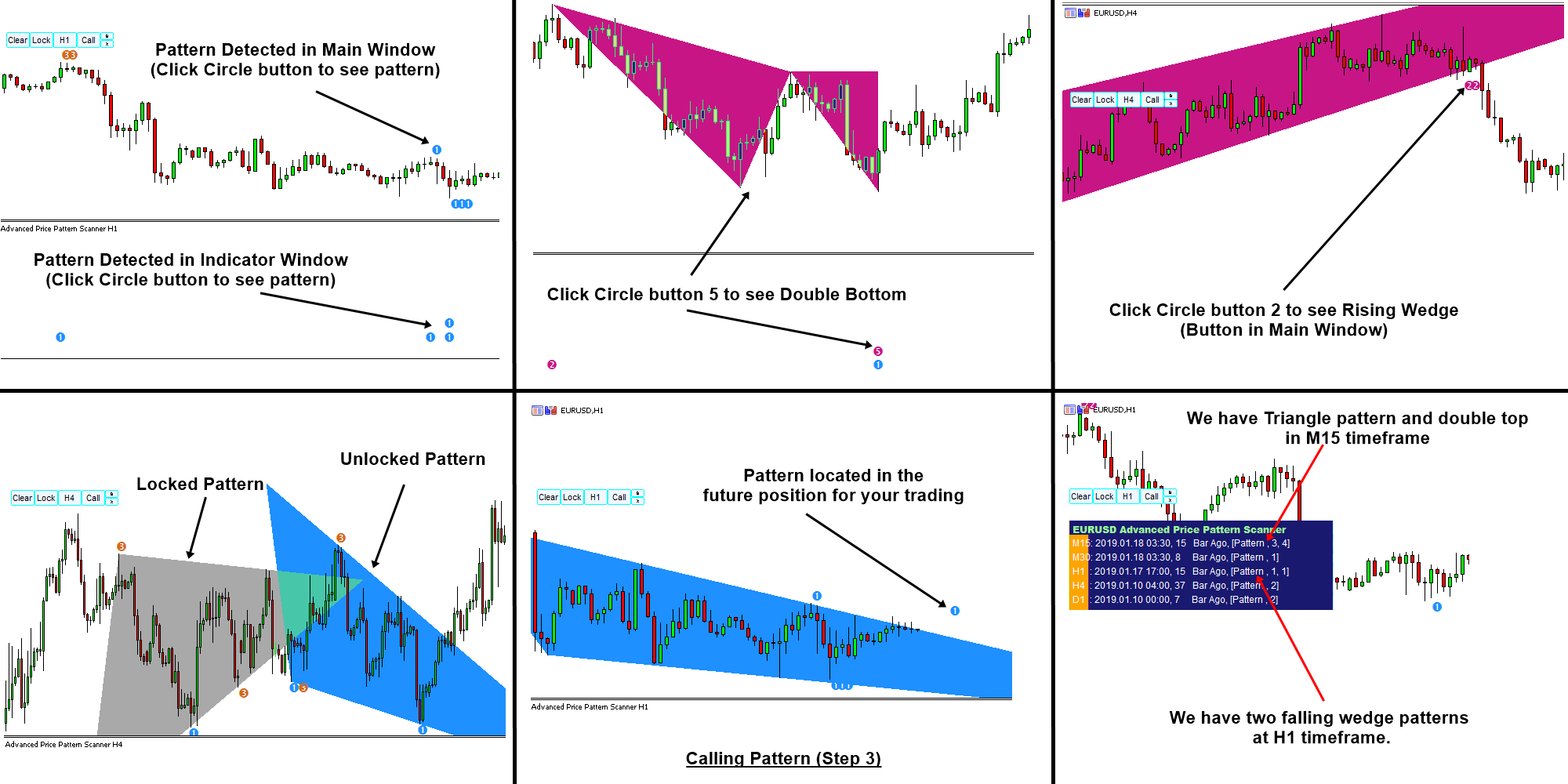

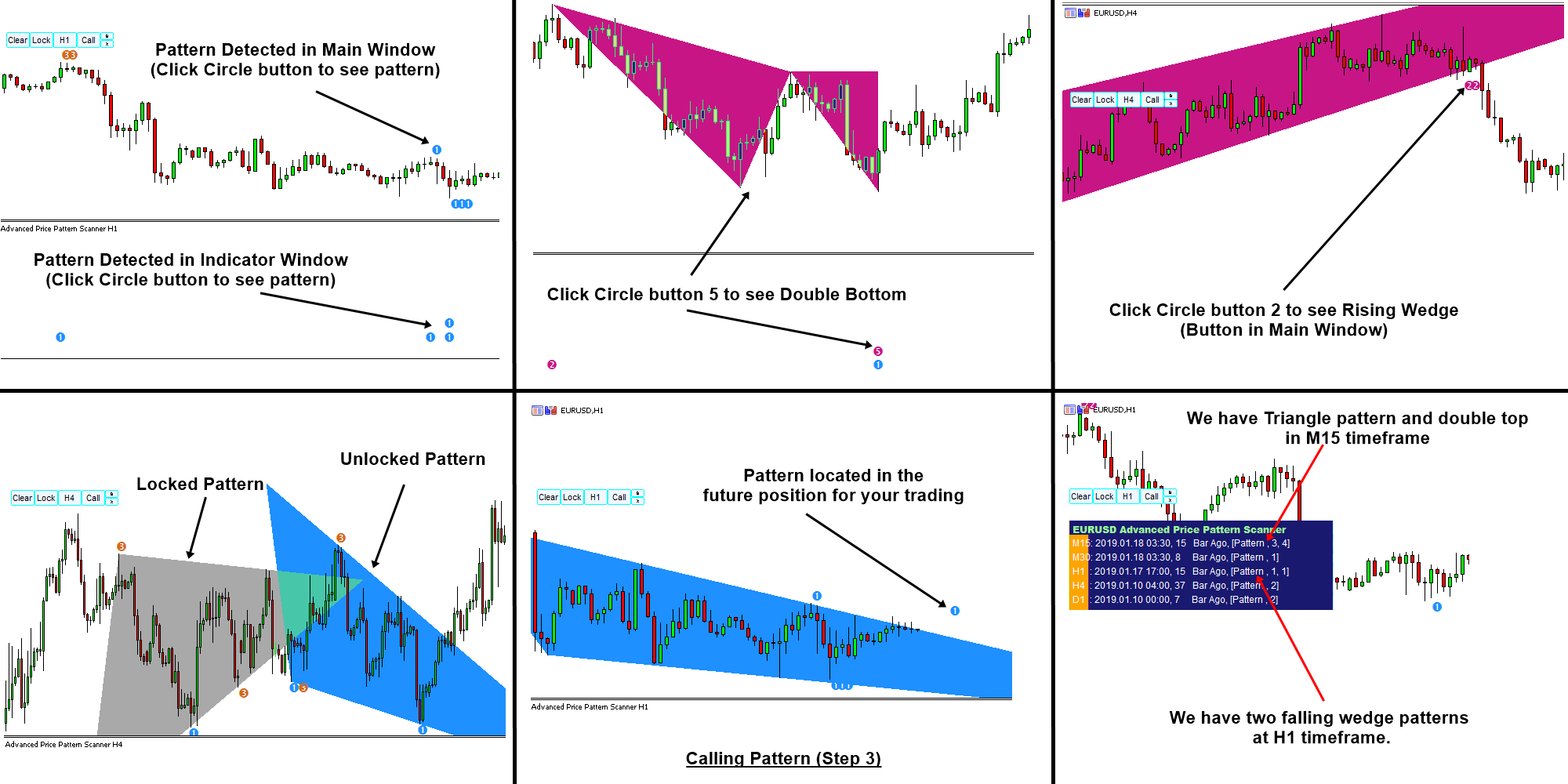

Harmonic Pattern Detection Indicator is the powerful tool to solve the puzzle of market geometry, which is often not solvable with technical indicators. How about automatic harmonic pattern detection for your trading ?

Not all the harmonic pattern detection indicators are the same. The main variations of Harmonic pattern indicators can be categorized as following four types. Users should understand the pros and cons of each variation to maximize their trading performance with harmonic patterns.

Type 1: Non lagging (fast signal) but repainting

option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint. This is almost considered as standard Harmonic Pattern Indicator. Even if they are repainting, harmonic pattern trader just accept it as it is. 99% of time, this is the harmonic pattern product you will get from the market whether they are free or paid one. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy.

Type 2: Lagging (slow signal) but non repainting

no option to enter at turning point (i.e. early signal). This type of indicator turns harmonic pattern indicator as slow as moving average cross over. It might be not overly attractive option for your trading. Indicator does not show the failed pattern. Hence, you can not use historical patterns to tune your strategy but last pattern does not repaint. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy. Probably about 1% of harmonic pattern indicator is this type.

Type 3: Detecting pattern at point C but repainting

option to enter at turning point. Indicator detect pattern too early and you have to wait quite bit of time until price move near the point D. In fact, price may not move near point D. You might just waste your time waiting for the pattern. Indicator does not show the failed pattern and last pattern can repaint. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy. Probably about 1% of harmonic pattern indicator is this type.

Type 4: Non lagging (fast signal) and non repainting

option to enter from turning point. At the same time, the pattern is not repainting. This is hybrid of all above three system and can be considered as the most powerful harmonic pattern indicator. You can trade live with this indicators and you can also use historical patterns to fine tune your strategy. With this indicator, you are complying perfectly with the statement “Trade What you See”.

To accomplish this post, you can read the full blog article about the types of Harmonic Pattern Indicator from the link below.

https://algotrading-investment.com/2019/03/03/harmonic-pattern-indicator-explained/

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

======================================================

MetaTrader 5 is the next generation trading platform developed by Meta Quote who developed MetaTrader 4. MetaTrader 5 is accessible for free of charge for any trader from all over the world. More and more brokers are now offering MetaTrader 5 trading options even including US based firms.

Here is the list of Harmonic Pattern Indicators for MetaTrader 4 and MetaTrader 5.

1. Harmonic Pattern Plus (2014)

Harmonic pattern plus is extremely good product for the price. With dozens of powerful features including Pattern Completion Interval, Potential Reversal Zone, Potential Continuation Zone, Automatic Stop loss and take profit sizing. This is type 1 harmonic pattern indicator.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

2. Harmonic Pattern Scenario Planner (2014)

With additional features of predicting future harmonic patterns, this is very tactical harmonic pattern indicator with advanced simulation capability on top of the powerful features of harmonic pattern plus. This is type 1 and type 3 harmonic pattern indicator.

Below are the Links to Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

3. X3 Chart Pattern Scanner (2019)

X3 Chart Pattern Scanner is next generation tools to trade with Harmonic pattern and Elliott Wave patterns in Forex market. With non repainting and non lagging algorithm, this tool can detect with advanced Harmonic Pattern, Elliott Wave Pattern, X3 Chart Pattern for your trading. As a bonus, it provides your Japanese candlestick patterns too. This is type 4 harmonic pattern indicator, which means that you can fine tune your strategy using historical patterns while you are trading the same patterns on live trading.

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Harmonic Pattern Detection Indicator is the powerful tool to solve the puzzle of market geometry, which is often not solvable with technical indicators. How about automatic harmonic pattern detection for your trading ?

Not all the harmonic pattern detection indicators are the same. The main variations of Harmonic pattern indicators can be categorized as following four types. Users should understand the pros and cons of each variation to maximize their trading performance with harmonic patterns.

Type 1: Non lagging (fast signal) but repainting

option to enter from turning point. Indicator does not show the failed pattern in chart and last pattern can repaint. This is almost considered as standard Harmonic Pattern Indicator. Even if they are repainting, harmonic pattern trader just accept it as it is. 99% of time, this is the harmonic pattern product you will get from the market whether they are free or paid one. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy.

Type 2: Lagging (slow signal) but non repainting

no option to enter at turning point (i.e. early signal). This type of indicator turns harmonic pattern indicator as slow as moving average cross over. It might be not overly attractive option for your trading. Indicator does not show the failed pattern. Hence, you can not use historical patterns to tune your strategy but last pattern does not repaint. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy. Probably about 1% of harmonic pattern indicator is this type.

Type 3: Detecting pattern at point C but repainting

option to enter at turning point. Indicator detect pattern too early and you have to wait quite bit of time until price move near the point D. In fact, price may not move near point D. You might just waste your time waiting for the pattern. Indicator does not show the failed pattern and last pattern can repaint. You can trade live with this indicators but historical patterns can not be used to fine tune your strategy. Probably about 1% of harmonic pattern indicator is this type.

Type 4: Non lagging (fast signal) and non repainting

option to enter from turning point. At the same time, the pattern is not repainting. This is hybrid of all above three system and can be considered as the most powerful harmonic pattern indicator. You can trade live with this indicators and you can also use historical patterns to fine tune your strategy. With this indicator, you are complying perfectly with the statement “Trade What you See”.

To accomplish this post, you can read the full blog article about the types of Harmonic Pattern Indicator from the link below.

https://algotrading-investment.com/2019/03/03/harmonic-pattern-indicator-explained/

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

======================================================

MetaTrader 5 is the next generation trading platform developed by Meta Quote who developed MetaTrader 4. MetaTrader 5 is accessible for free of charge for any trader from all over the world. More and more brokers are now offering MetaTrader 5 trading options even including US based firms.

Here is the list of Harmonic Pattern Indicators for MetaTrader 4 and MetaTrader 5.

1. Harmonic Pattern Plus (2014)

Harmonic pattern plus is extremely good product for the price. With dozens of powerful features including Pattern Completion Interval, Potential Reversal Zone, Potential Continuation Zone, Automatic Stop loss and take profit sizing. This is type 1 harmonic pattern indicator.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

2. Harmonic Pattern Scenario Planner (2014)

With additional features of predicting future harmonic patterns, this is very tactical harmonic pattern indicator with advanced simulation capability on top of the powerful features of harmonic pattern plus. This is type 1 and type 3 harmonic pattern indicator.

Below are the Links to Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

3. X3 Chart Pattern Scanner (2019)

X3 Chart Pattern Scanner is next generation tools to trade with Harmonic pattern and Elliott Wave patterns in Forex market. With non repainting and non lagging algorithm, this tool can detect with advanced Harmonic Pattern, Elliott Wave Pattern, X3 Chart Pattern for your trading. As a bonus, it provides your Japanese candlestick patterns too. This is type 4 harmonic pattern indicator, which means that you can fine tune your strategy using historical patterns while you are trading the same patterns on live trading.

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

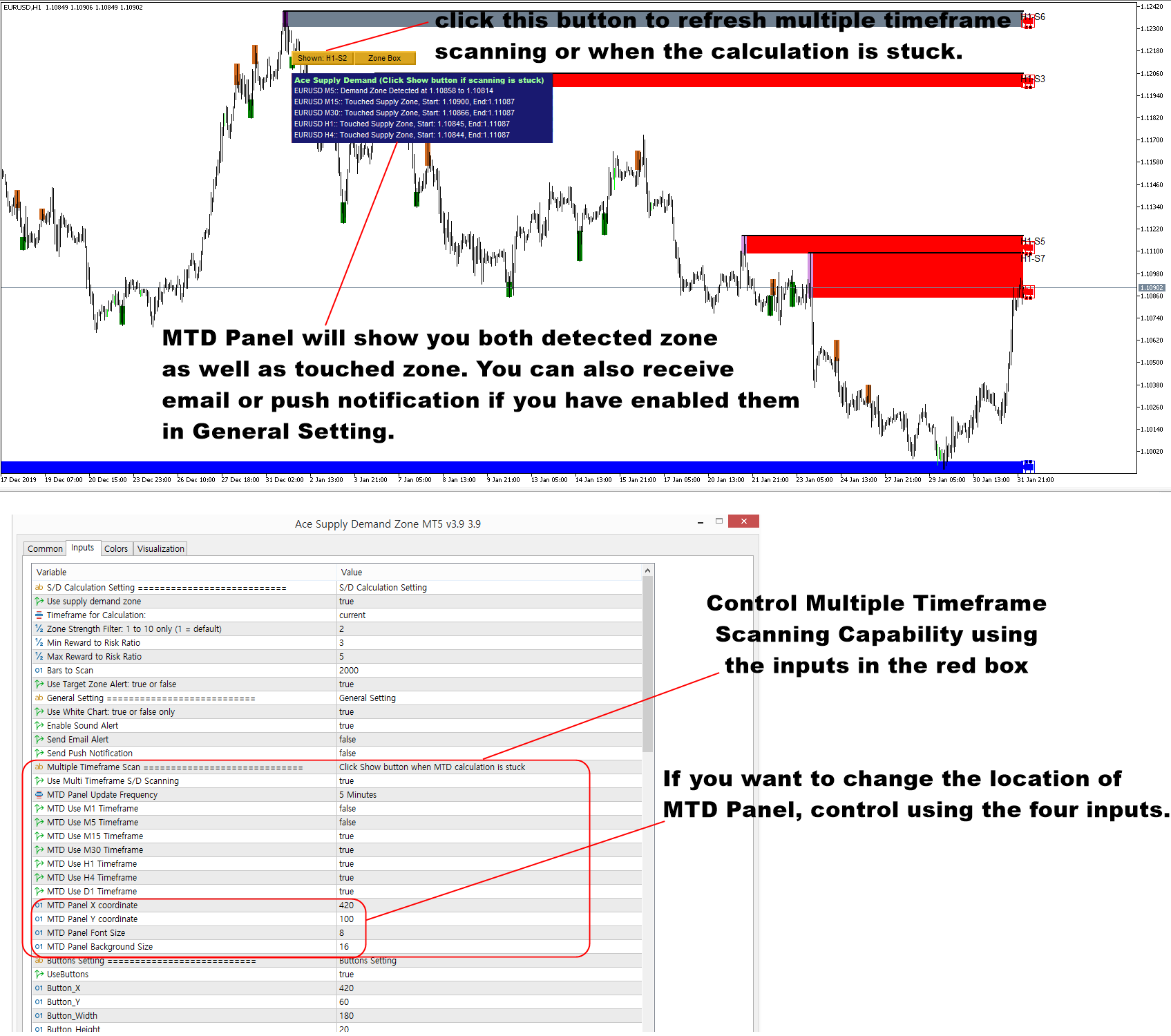

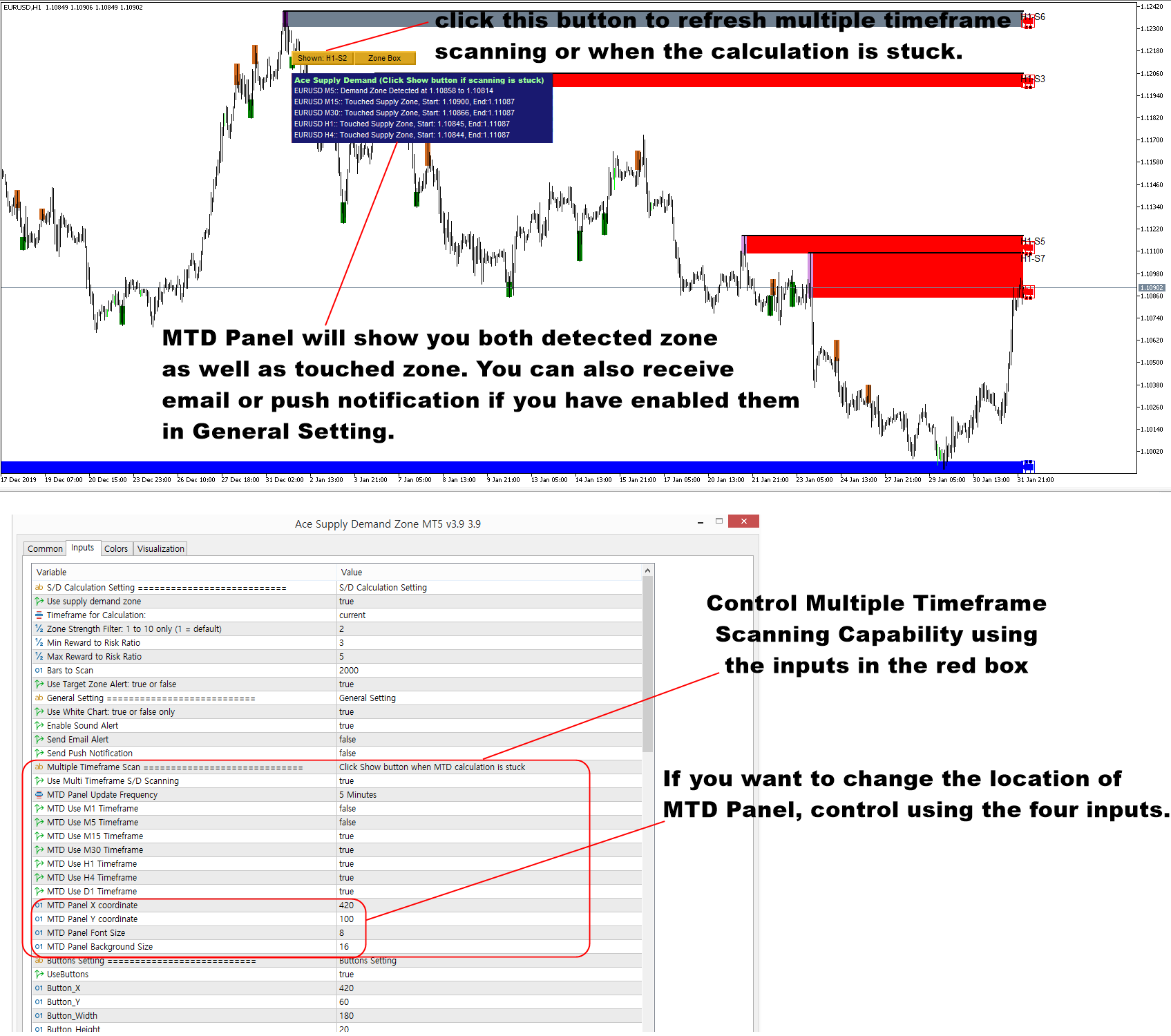

Scan Supply Demand Zone Across All Timeframe

In Ace Supply Demand Zone indicator, you can scan the supply and demand zone across all timeframe for your Forex trading. This is a powerful feature included in Ace Supply Demand Zone indicator. Controlling the Multiple Timeframe scanning is similar to our other MetaTrader products like Harmonic Pattern Plus or X3 Chart Pattern Scanner. You can control them from the inputs under the Multiple Timeframe Scanning. With the inputs, you can enable or disable multiple timeframe scanning. You can also choose to switch on or off specific timeframe from your dashboard. In addition, you can also control how frequently the indicator should scan. The default value for update frequency is M5 timeframe. However, you can use M1 for update frequency if you need to scan them more frequently.

If you enabled email or push notification in the inputs under General Setting, then you can also receive the alert for the detected supply and demand zone as well as the touched supply and demand zone. The thing you need to understand about multiple timeframe scanning is that it requires multiple computation too per each timeframe. The computation can be heavier up to 7 times or more when you enabled M1 to D1 timeframes. Hence, due to data loading issues, the calculation might be stuck sometimes. In that case, just click Show button to refresh all the calculation. Of course, it is possible to switch off the multiple timeframe scanning if you only want to trade one timeframe.

Ace Supply Demand Zone in MetaTrader 4 and MetaTrader 5

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Landing page for Ace Supply Demand Zone.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

In Ace Supply Demand Zone indicator, you can scan the supply and demand zone across all timeframe for your Forex trading. This is a powerful feature included in Ace Supply Demand Zone indicator. Controlling the Multiple Timeframe scanning is similar to our other MetaTrader products like Harmonic Pattern Plus or X3 Chart Pattern Scanner. You can control them from the inputs under the Multiple Timeframe Scanning. With the inputs, you can enable or disable multiple timeframe scanning. You can also choose to switch on or off specific timeframe from your dashboard. In addition, you can also control how frequently the indicator should scan. The default value for update frequency is M5 timeframe. However, you can use M1 for update frequency if you need to scan them more frequently.

If you enabled email or push notification in the inputs under General Setting, then you can also receive the alert for the detected supply and demand zone as well as the touched supply and demand zone. The thing you need to understand about multiple timeframe scanning is that it requires multiple computation too per each timeframe. The computation can be heavier up to 7 times or more when you enabled M1 to D1 timeframes. Hence, due to data loading issues, the calculation might be stuck sometimes. In that case, just click Show button to refresh all the calculation. Of course, it is possible to switch off the multiple timeframe scanning if you only want to trade one timeframe.

Ace Supply Demand Zone in MetaTrader 4 and MetaTrader 5

In addition, we provide the YouTube video for Ace Supply Demand Zone Indicator. Hence, you can watch this YouTube Video to learn the basic operation with the supply demand zone indicator.

YouTube “Supply Demand Zone Indicator”: https://youtu.be/lr0dthrU9jo

Landing page for Ace Supply Demand Zone.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

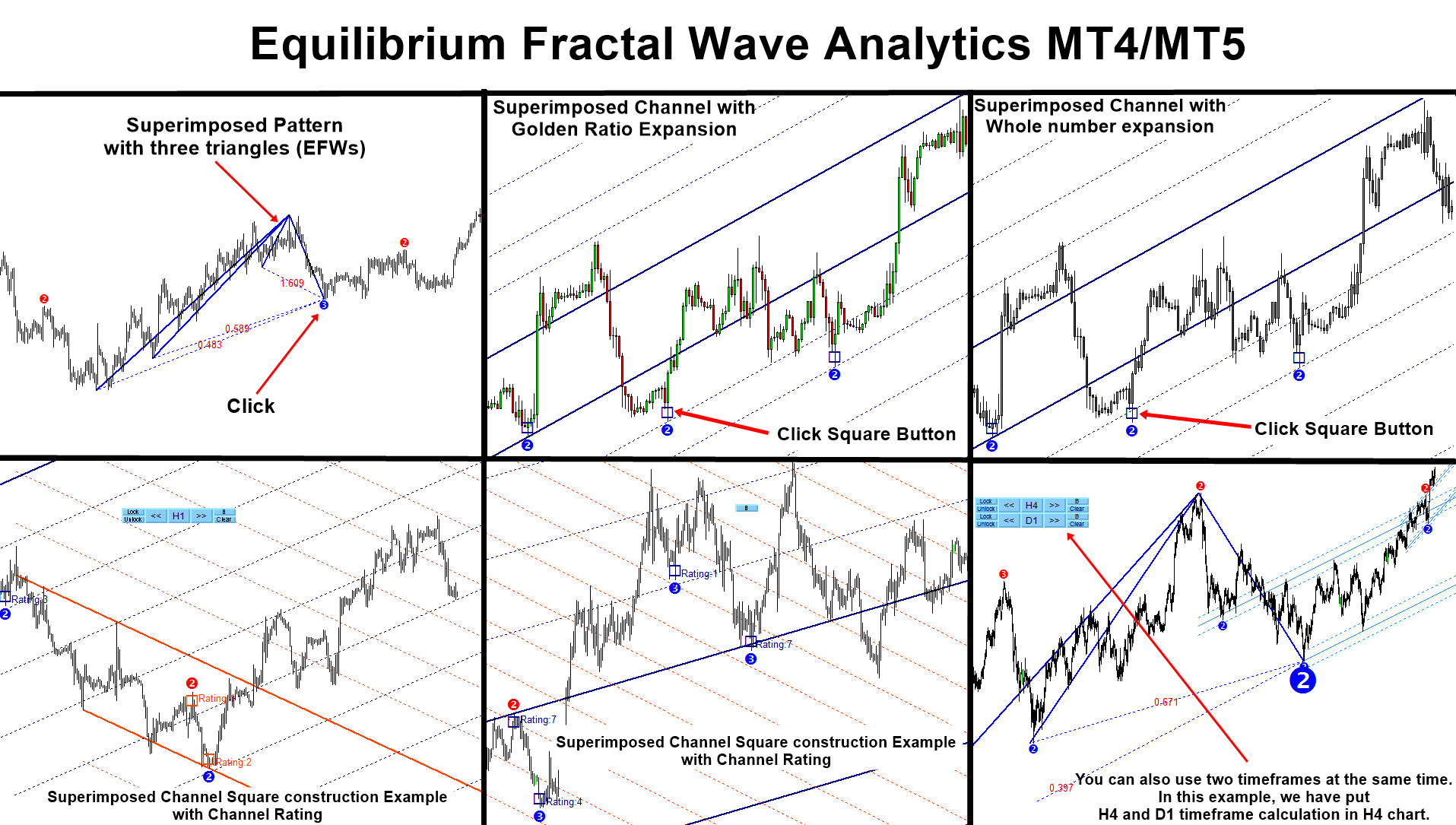

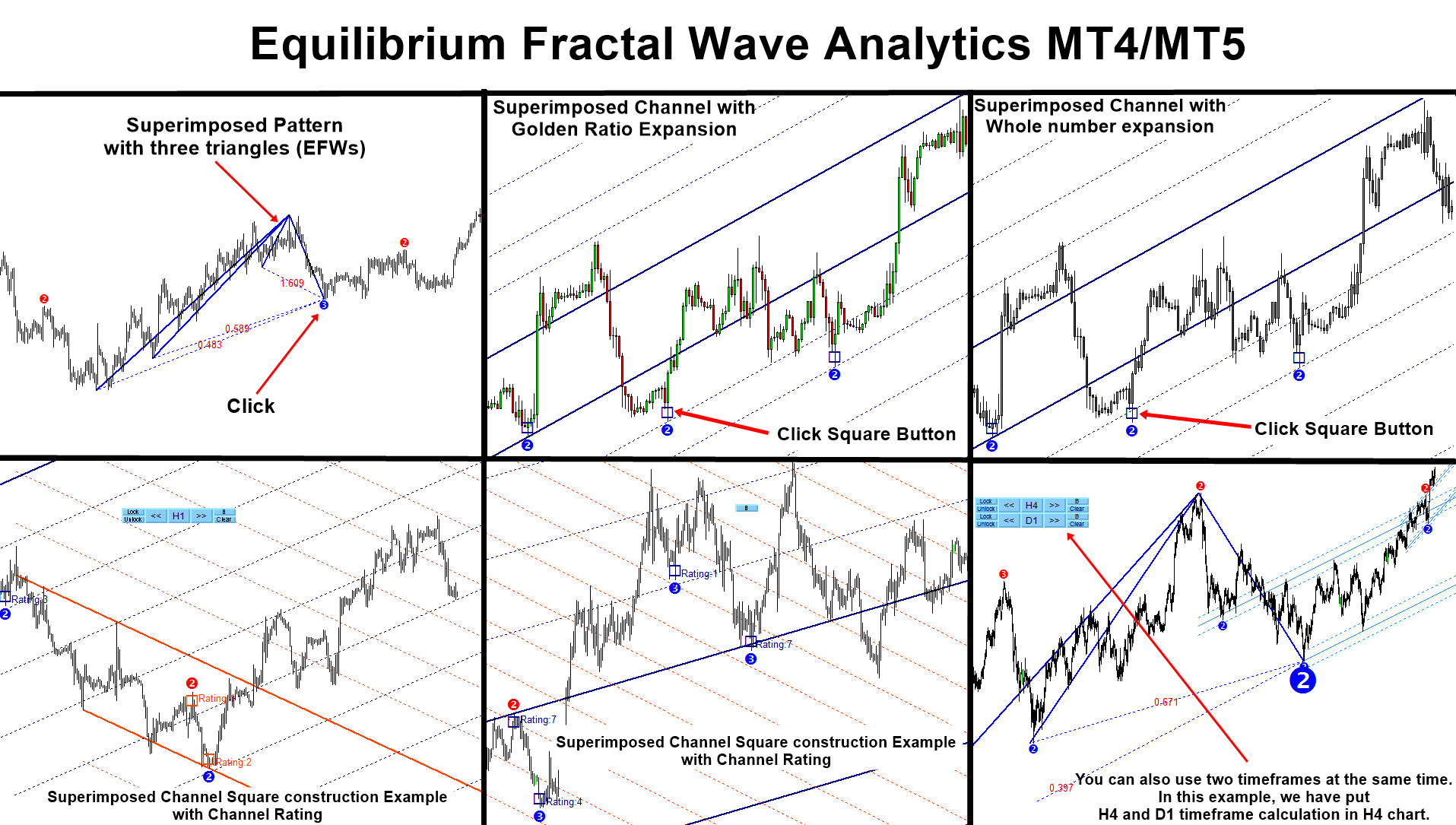

Introduction to Equilibrium Fractal Wave Analytics

EFW Analytics was designed to accomplish the statement “We trade because there are regularities in the financial market”. EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts including:

1. Equilibrium Fractal Wave Index: exploratory tool to support your trading logic to choose which ratio to trade

2. Superimposed Pattern Detection as turning point analysis

3. Superimposed Channel for market prediction with Golden ratio expansion

4. Superimposed Channel for market prediction with whole number expansion

5. Equilibrium Fractal Wave (EFW) Channel detection

6. Superimposed Channel Rating (Higher rating = higher predictive power)

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

EFW Analytics was designed to accomplish the statement “We trade because there are regularities in the financial market”. EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts including:

1. Equilibrium Fractal Wave Index: exploratory tool to support your trading logic to choose which ratio to trade

2. Superimposed Pattern Detection as turning point analysis

3. Superimposed Channel for market prediction with Golden ratio expansion

4. Superimposed Channel for market prediction with whole number expansion

5. Equilibrium Fractal Wave (EFW) Channel detection

6. Superimposed Channel Rating (Higher rating = higher predictive power)

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

Young Ho Seo

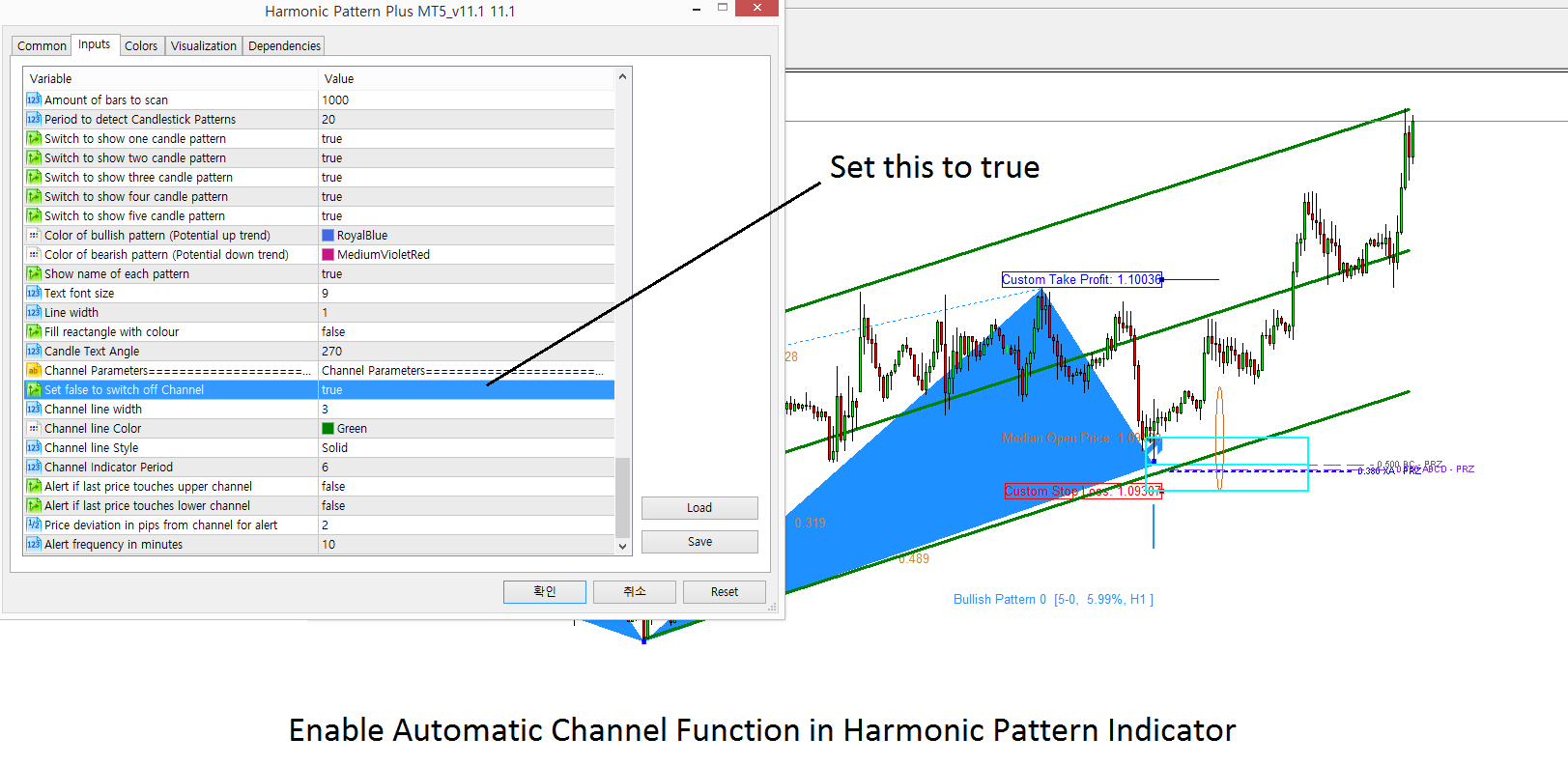

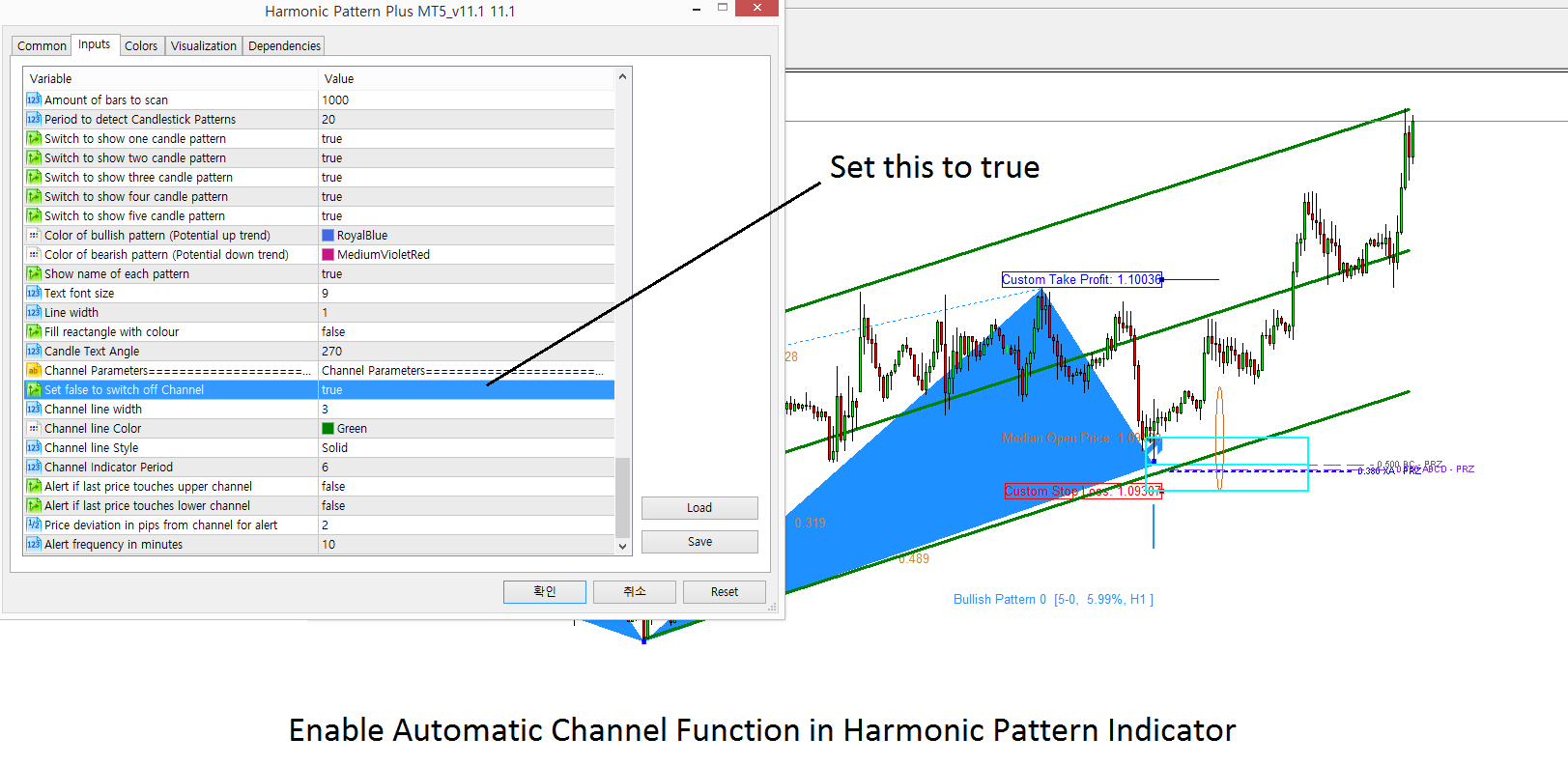

Enable Automatic Channel in Harmonic Pattern Indicator

We provided powerful automatic channel features in the Harmonic Pattern Indicator. To enable the automatic Channel Function, just set Use Channel = true under Channel Parameter inputs.

Together with Harmonic Pattern and Elliott Wave patterns, the provided automatic channel can be the great help for your trading. Enjoy this powerful features. This feature applies to Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner.

Important Note to read

For your information, the provided channel are dynamic. As new bars are arrived in your chart, it will update the size of Standard deviation and 95% intervals in real time. Please bear this in your mind when you are using the provided channel. Another important note is that we provide Double Standard Deviation Channel for X3 Chart Pattern Scanner. This is the channel indicator specially tuned to work for Harmonic Pattern and X3 Pattern. It is more advanced Channel than the one shown in the screenshot below. In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

===============

Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

We provided powerful automatic channel features in the Harmonic Pattern Indicator. To enable the automatic Channel Function, just set Use Channel = true under Channel Parameter inputs.

Together with Harmonic Pattern and Elliott Wave patterns, the provided automatic channel can be the great help for your trading. Enjoy this powerful features. This feature applies to Harmonic Pattern Plus, Harmonic Pattern Scenario Planner and X3 Chart Pattern Scanner.

Important Note to read

For your information, the provided channel are dynamic. As new bars are arrived in your chart, it will update the size of Standard deviation and 95% intervals in real time. Please bear this in your mind when you are using the provided channel. Another important note is that we provide Double Standard Deviation Channel for X3 Chart Pattern Scanner. This is the channel indicator specially tuned to work for Harmonic Pattern and X3 Pattern. It is more advanced Channel than the one shown in the screenshot below. In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

===============

Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Using Harmonic Pattern Plus and X3 Chart Pattern Scanner Together

Harmonic Pattern Plus and X3 Chart Pattern Scanner are the great harmonic pattern detection indicator. Some trader asked me if they can use Harmonic Pattern Plus and X3 Chart Pattern Scanner together.

The short answer is yes. It is possible to combine them. Even though both indicators detect harmonic patterns, they are using completely different pattern detection algorithm. Harmonic pattern Plus uses the classic pattern detection algorithm whereas X3 Chart Pattern Scanner uses non repainting pattern detection algorithm (i.e. latest pattern detection technology).

There can be some overlapping in the detected patterns. However, many patterns can be detected in different timing. If both indicator detect the same patterns, then the patterns are often more accurate. At the same time, with non overlapping patterns, you have less chance to miss out the good signals.

When you want to use the channel function together with Harmonic Pattern, then use the channel function in X3 Chart Pattern Scanner because it is more advanced version. Of course, the same logic applies to Harmonic Pattern Scenario planner.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator (Repainting but non lagging)”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Link to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Harmonic Pattern Plus and X3 Chart Pattern Scanner are the great harmonic pattern detection indicator. Some trader asked me if they can use Harmonic Pattern Plus and X3 Chart Pattern Scanner together.

The short answer is yes. It is possible to combine them. Even though both indicators detect harmonic patterns, they are using completely different pattern detection algorithm. Harmonic pattern Plus uses the classic pattern detection algorithm whereas X3 Chart Pattern Scanner uses non repainting pattern detection algorithm (i.e. latest pattern detection technology).

There can be some overlapping in the detected patterns. However, many patterns can be detected in different timing. If both indicator detect the same patterns, then the patterns are often more accurate. At the same time, with non overlapping patterns, you have less chance to miss out the good signals.

When you want to use the channel function together with Harmonic Pattern, then use the channel function in X3 Chart Pattern Scanner because it is more advanced version. Of course, the same logic applies to Harmonic Pattern Scenario planner.

In addition, you can watch the YouTube Video to feel what is the automated harmonic pattern indicator like. For your information, we provides two YouTube videos with title and links below.

YouTube “Harmonic Pattern Indicator (Repainting but non lagging)”: https://youtu.be/CzYUwk5qeCk

YouTube “Non Repainting Non Lagging Harmonic Pattern Indicator”: https://youtu.be/uMlmMquefGQ

Link to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Volume Spread Analysis Indicator List

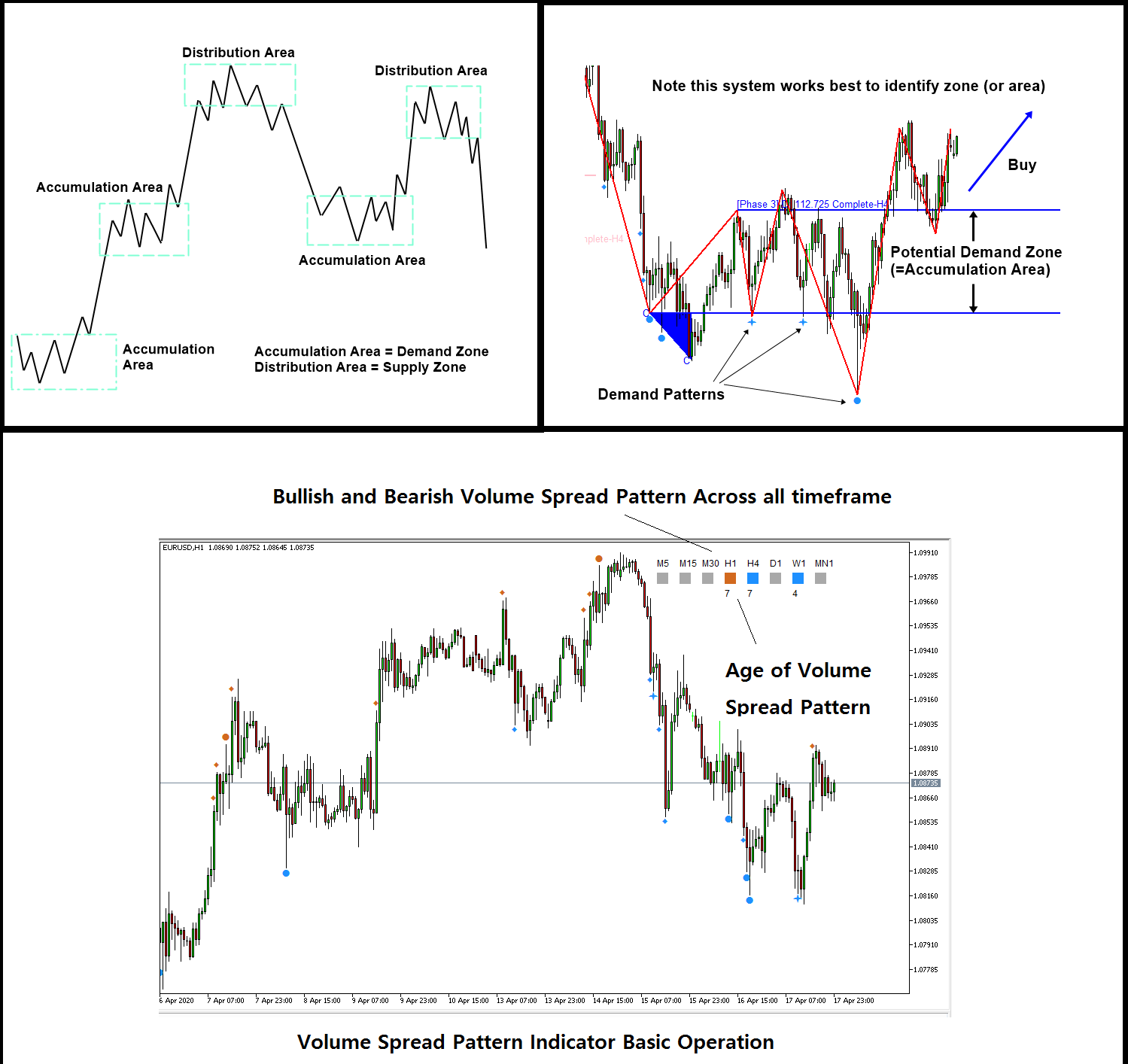

We provide three different Volume Spread Analysis indicators and volume based tools. Our volume spread analysis tools are the hybrid of volume spread analysis and signal processing theory.

These tools will help you to complete your trading decision with high precision. As long as you understand the concept of the Accumulation and Distribution area in the volume spread analysis, these tools will help you to predict the presence of Accumulation and Distribution area. Hence, you can predict the best trading opportunity.

Firstly, Volume Spread Pattern Indicator is the powerful volume spread analysis indicator that operated across multiple timeframe. Volume Spread Pattern Indicator will not only provide the bearish and bullish volume spread pattern in the current time frame but also it will detect the same patterns across all timeframe. You just need to open one chart and you will be notified bullish and bearish patterns in all timeframe in real time.

Here is the link to Volume Spread Pattern Indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Secondly, Volume Spread Pattern Detector is the light version of Volume Spread Pattern Indicator above. This is free tool with some limited features. However, Volume Spread Pattern Detector is used by thousands of traders. Especially, it works great with the support and resistance to confirm the turning point. This is free tool. Just grab one.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/

Both Volume Spread Pattern Indicator and Volume Spread Pattern Detector works well with Excessive Momentum indicator as Excessive Momentum indicator helps to detect the potential Accumulation and Distribution area automatically. Hence, if you are using Excessive Momentum Indicator, then you can use one between Volume Spread Pattern Indicator or Volume Spread Pattern Detector. In addition, we provide the YouTube video to accomplish the basic operations of Excessive Momentum Indicator.

YouTube Video (Excessive Momentum Indicator): https://youtu.be/oztARcXsAVA

YouTube Video (Excessive Momentum Indicator Explained): https://youtu.be/A4JcTcakOKw

Here is link to Excessive Momentum Indicator for MetaTrader 4 and MetaTrader 5.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Thirdly, we provide the volume Zone Oscillator. This is another useful free tool that utilizes the volume information for your trading. You can use these tools for volume spread analysis, Harmonic Pattern, Elliott Wave Pattern, X3 Price Pattern further. This is free tool. Just grab one.

https://algotrading-investment.com/portfolio-item/volume-zone-oscillator/

We provide three different Volume Spread Analysis indicators and volume based tools. Our volume spread analysis tools are the hybrid of volume spread analysis and signal processing theory.

These tools will help you to complete your trading decision with high precision. As long as you understand the concept of the Accumulation and Distribution area in the volume spread analysis, these tools will help you to predict the presence of Accumulation and Distribution area. Hence, you can predict the best trading opportunity.

Firstly, Volume Spread Pattern Indicator is the powerful volume spread analysis indicator that operated across multiple timeframe. Volume Spread Pattern Indicator will not only provide the bearish and bullish volume spread pattern in the current time frame but also it will detect the same patterns across all timeframe. You just need to open one chart and you will be notified bullish and bearish patterns in all timeframe in real time.

Here is the link to Volume Spread Pattern Indicator.

https://www.mql5.com/en/market/product/32961

https://www.mql5.com/en/market/product/32960

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

Secondly, Volume Spread Pattern Detector is the light version of Volume Spread Pattern Indicator above. This is free tool with some limited features. However, Volume Spread Pattern Detector is used by thousands of traders. Especially, it works great with the support and resistance to confirm the turning point. This is free tool. Just grab one.

https://www.mql5.com/en/market/product/28438

https://www.mql5.com/en/market/product/28439

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-detector/