Young Ho Seo / Profile

- Information

|

10+ years

experience

|

62

products

|

1171

demo versions

|

|

4

jobs

|

0

signals

|

0

subscribers

|

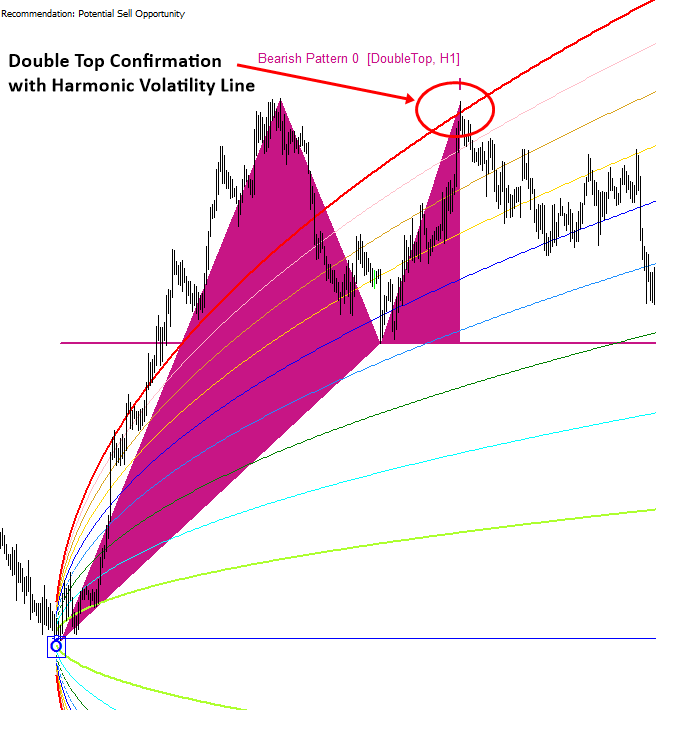

Harmonic Pattern Indicator - Repainting + Japanese Candlestick Pattern Scanner + Automatic Channel + Many more

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

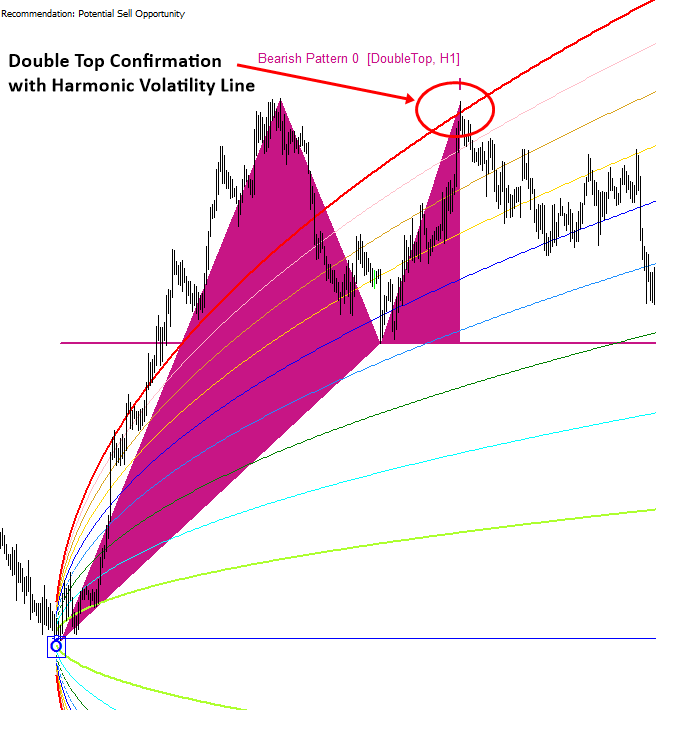

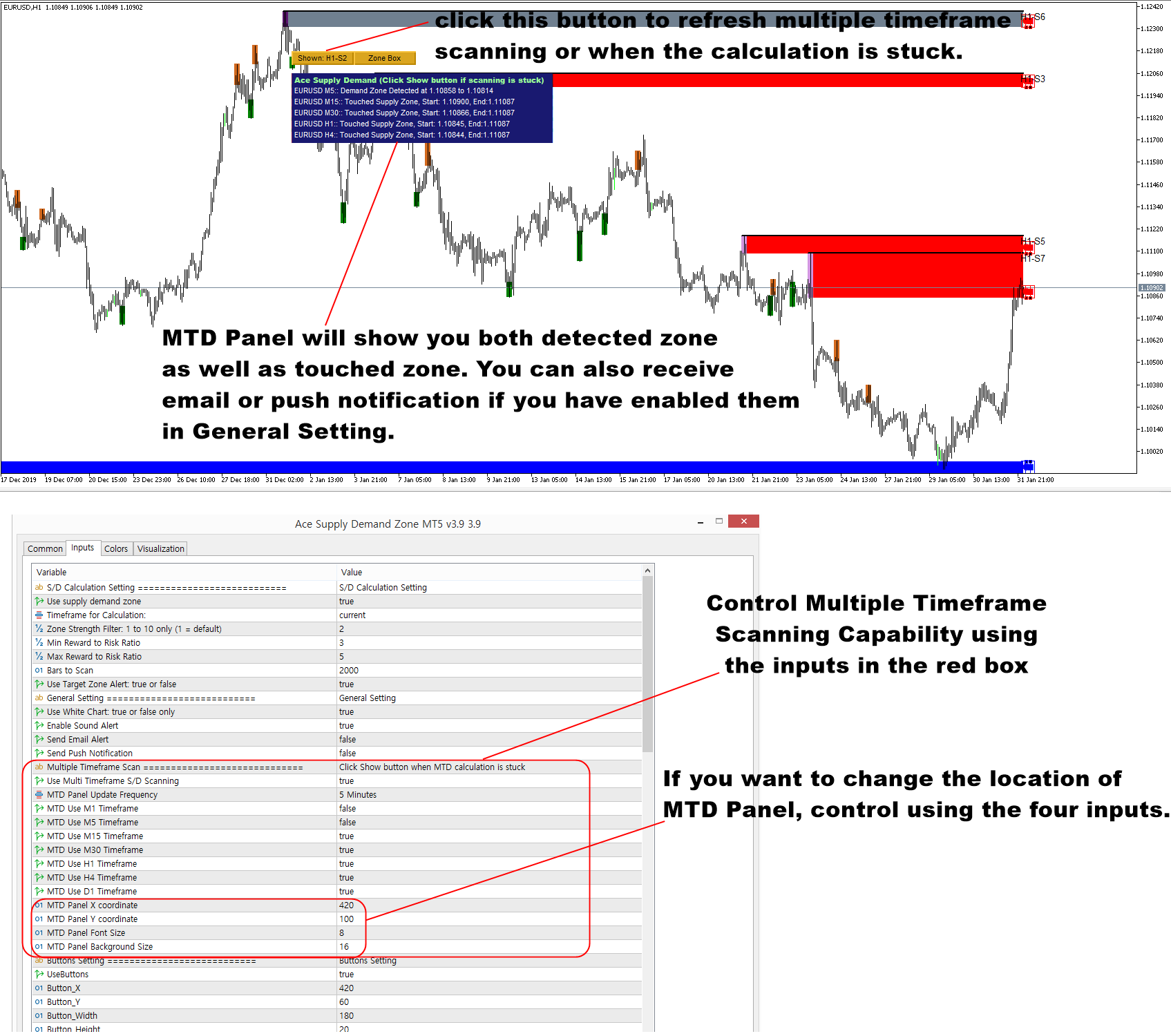

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

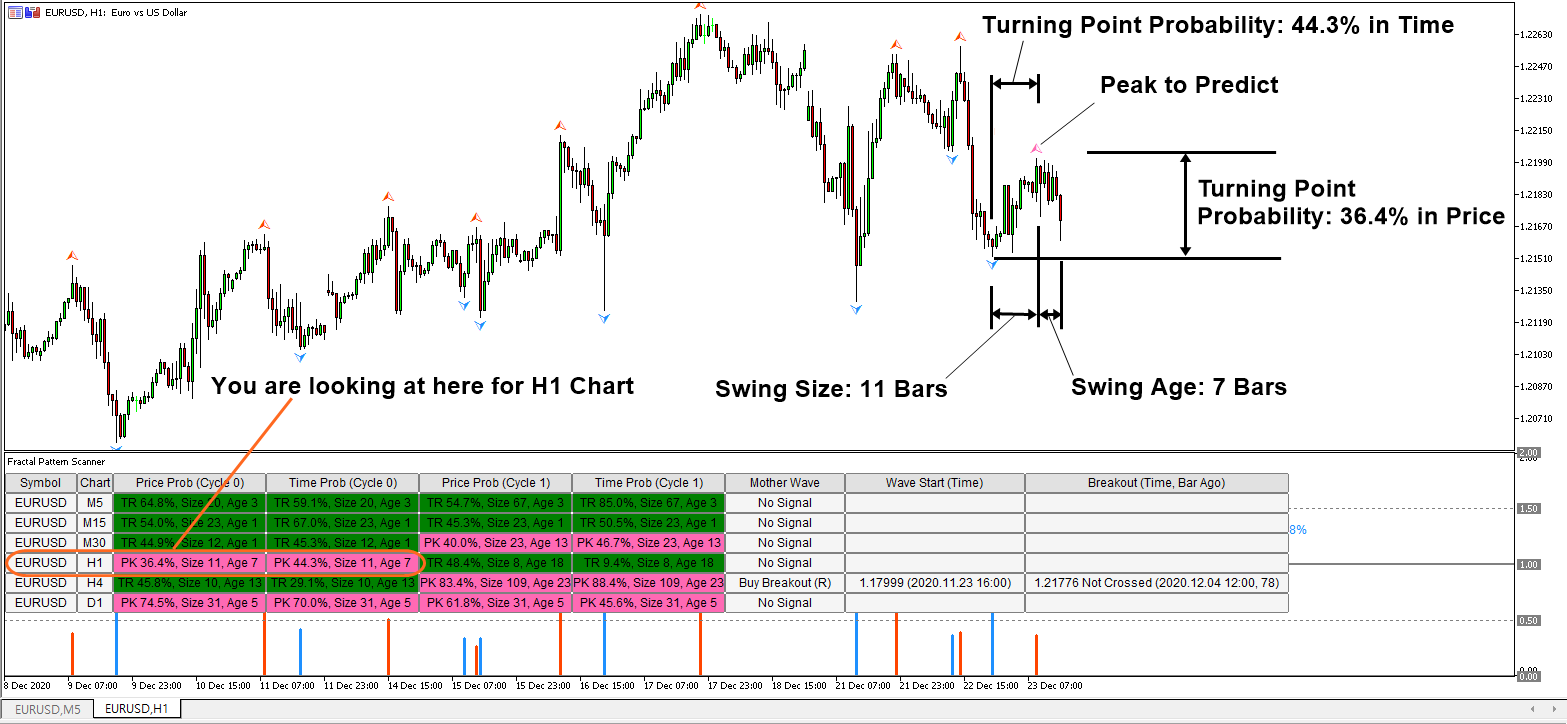

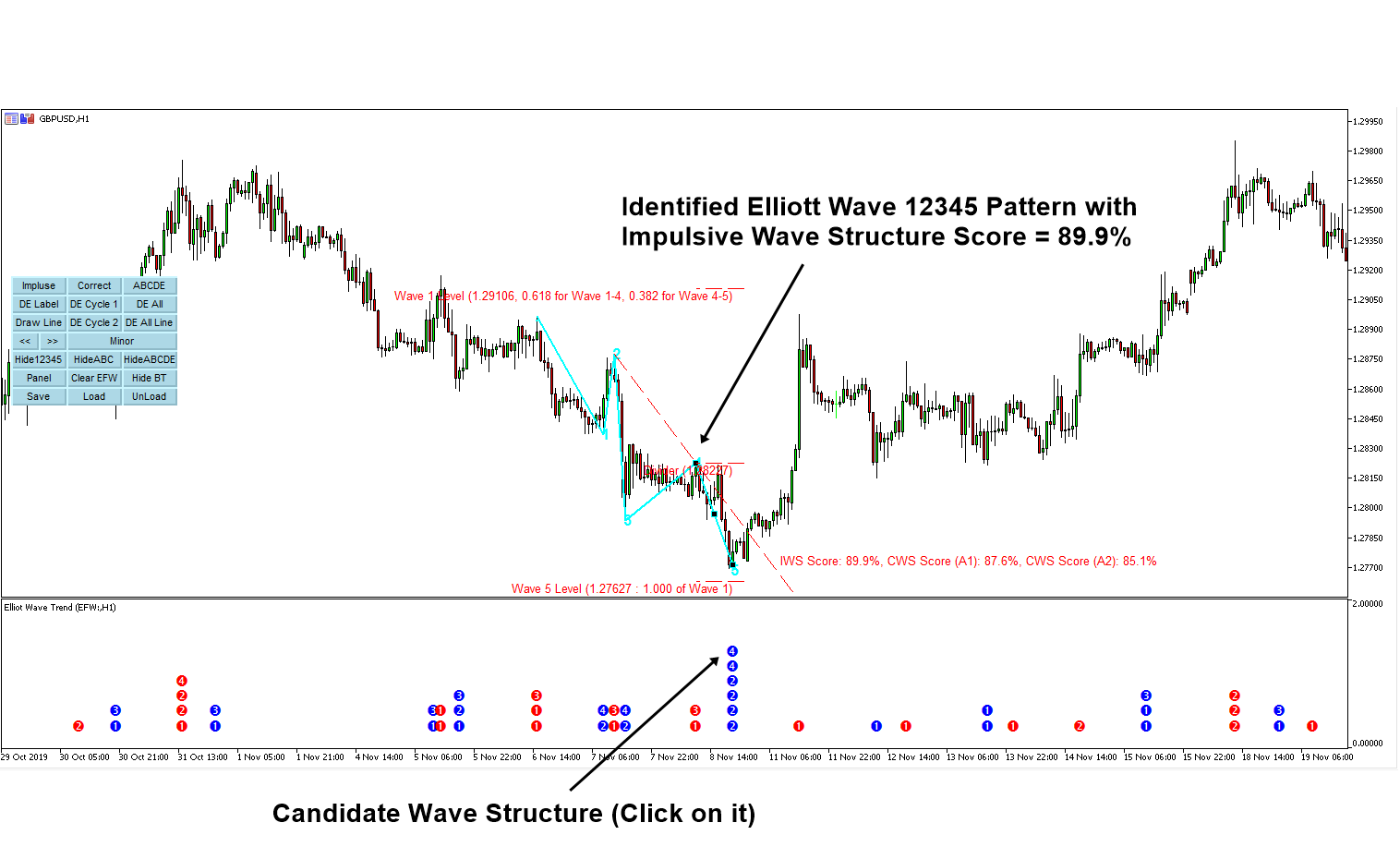

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

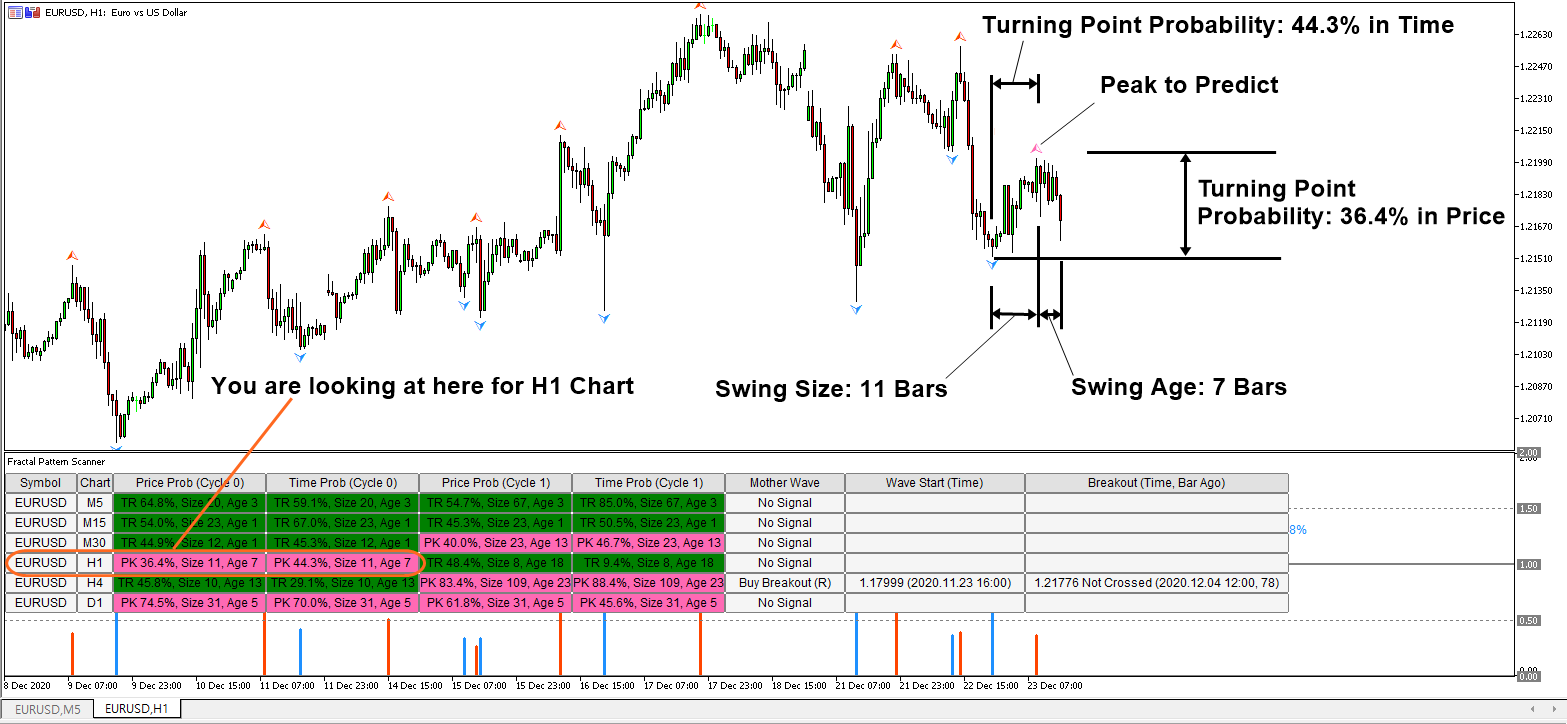

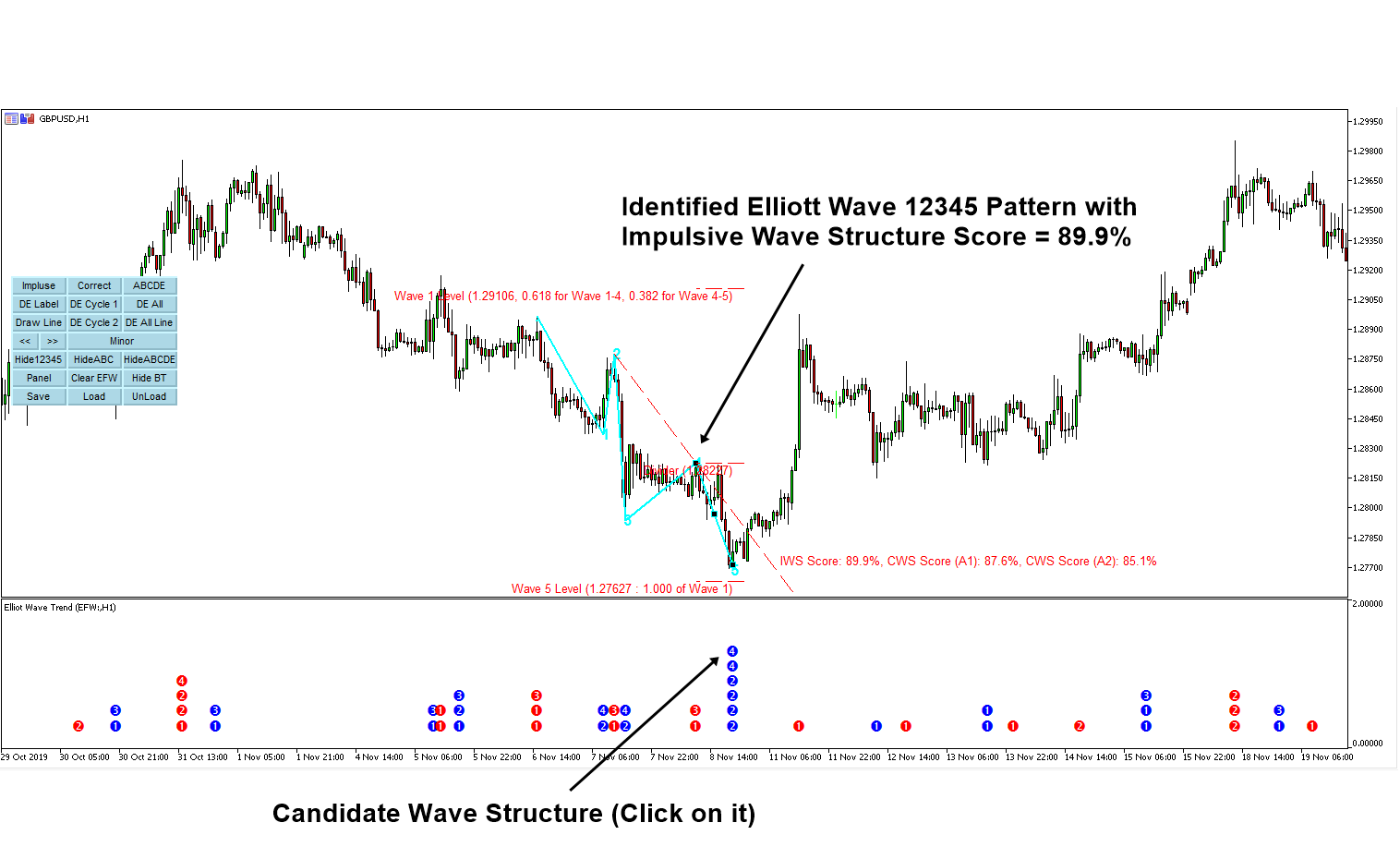

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Non Repainting and Non Lagging Harmonic Pattern Indicator – Customizable Harmonic + Japanese Candlestic Pattern Scanner + Advanced Channel + Many more

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Supply Demand Indicator – Multiple Timeframe Scanning Added + Non Repainting + Professional Indicator

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Momentum Indicator – Path to Volume Spread Analysis

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

Elliott Wave Indicator for the Power User

https://www.mql5.com/en/market/product/16479

https://www.mql5.com/en/market/product/16472

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

Forex Prediction - Turn Support and Resistance to the Advanced Strategy

https://www.mql5.com/en/market/product/49170

https://www.mql5.com/en/market/product/49169

https://algotrading-investment.com/portfolio-item/fractal-pattern-scanner/

MetaTrader 4 and MetaTrader 5 Product Page: https://www.mql5.com/en/users/financeengineer/seller#products

Free Forex Prediction with Fibonacci Analysis: https://algotrading-investment.com/2020/10/23/forex-prediction-with-fibonacci-analysis/

Free Harmonic Pattern Signal: https://algotrading-investment.com/2020/12/17/harmonic-pattern-signal-for-forex-market/

============================================================================================================================

Here are the trading education books. We recommend reading these books if you are a trader or investor in Forex and Stock market. In the list below, we put the easy to read book on top. Try to read the easy to read book first and try to read the harder book later to improve your trading and investment.

First Link = amazon.com, Second Link = Google Play Books, Third Link = algotrading-investment.com, Fourth Link = Google Books

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

https://www.amazon.com/dp/B09L55ZK4Z

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

https://books.google.co.kr/books/about?id=pHlMEAAAQBAJ

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

https://www.amazon.com/dp/B0993WZGZD

https://play.google.com/store/books/details?id=MME3EAAAQBAJ

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://books.google.co.kr/books/about?id=MME3EAAAQBAJ

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

https://www.amazon.com/dp/B0B2KZH87K

https://play.google.com/store/books/details?id=7KrQDwAAQBAJ

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://books.google.com/books/about?id=7KrQDwAAQBAJ

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

https://www.amazon.com/dp/B01MRI5LY6

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

http://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://books.google.com/books/about?id=8SbMDwAAQBAJ

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

https://www.amazon.com/dp/B073T3ZMBR

https://play.google.com/store/books/details?id=5prUDwAAQBAJ

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://books.google.com/books/about?id=5prUDwAAQBAJ

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

https://www.amazon.com/dp/B086YKM8BW

https://play.google.com/store/books/details?id=VJjiDwAAQBAJ

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://books.google.com/books/about?id=VJjiDwAAQBAJ

Trading Education Book 1 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1565534211

https://play.google.com/store/books/details?id=HTgqEAAAQBAJ

https://books.google.co.kr/books/about?id=HTgqEAAAQBAJ

https://www.scribd.com/book/505583892

https://www.kobo.com/ww/en/ebook/8J-Eg58EDzKwlpUmADdp2g

Trading Education Book 2 in Korean (Apple, Google Play Book, Google Book, Scribd, Kobo)

https://books.apple.com/us/book/id1597112108

https://play.google.com/store/books/details?id=shRQEAAAQBAJ

https://books.google.co.kr/books/about?id=shRQEAAAQBAJ

https://www.scribd.com/book/542068528

https://www.kobo.com/ww/en/ebook/X8SmJdYCtDasOfQ1LQpCtg

About Young Ho Seo

Young Ho Seo is an Engineer, Financial Trader, and Quantitative Developer, working on Trading Science and Investment Engineering since 2011. He is the creator of many technical indicators, price patterns and trading strategies used in the financial market. He is also teaching the trading practice on how to use the Supply Demand Analysis, Support, Resistance, Trend line, Fibonacci Analysis, Harmonic Pattern, Elliott Wave Theory, Chart Patterns, and Probability for Forex and Stock Market. His works include developing scientific trading principle and mathematical algorithm in the work of Benjamin Graham, Everette S. Gardner, Benoit Mandelbrot, Ralph Nelson Elliott, Harold M. Gartley, Richard Shabacker, William Delbert Gann, Richard Wyckoff and Richard Dennis. You can find his dedicated works on www.algotrading-investment.com . His life mission is to connect financial traders and scientific community for better understanding of this world and crowd behaviour in the financial market. He wrote many books and articles, which are helpful for understanding the technology and application behind technical analysis, statistics, time series forecasting, fractal science, econometrics, and artificial intelligence in the financial market.

If you are interested in our software and training, just visit our main website: www.algotrading-investment.com

Young Ho Seo

Great MetaTrader Indicator List

Here is the list of Great MetaTrader Indicators. Each technical indicator is designed to give you higher accuracy and better performance for trading in MetaTrader. The techncial indicators are based on Market Momentum, Harmonic Pattern, Elliott Wave, Chart Pattern, Support Resistance, Wave theory, Wyckoff Method, Pairs Trading and so on. We provide the short description and link to the product page for each MetaTrader indicator. We also include the link to Free MetaTrader indicators on the bottom of this page. Of course, all these MetaTarder Indicator can be found on mql5.com website too as well as our own website.

https://www.mql5.com/en/users/financeengineer/

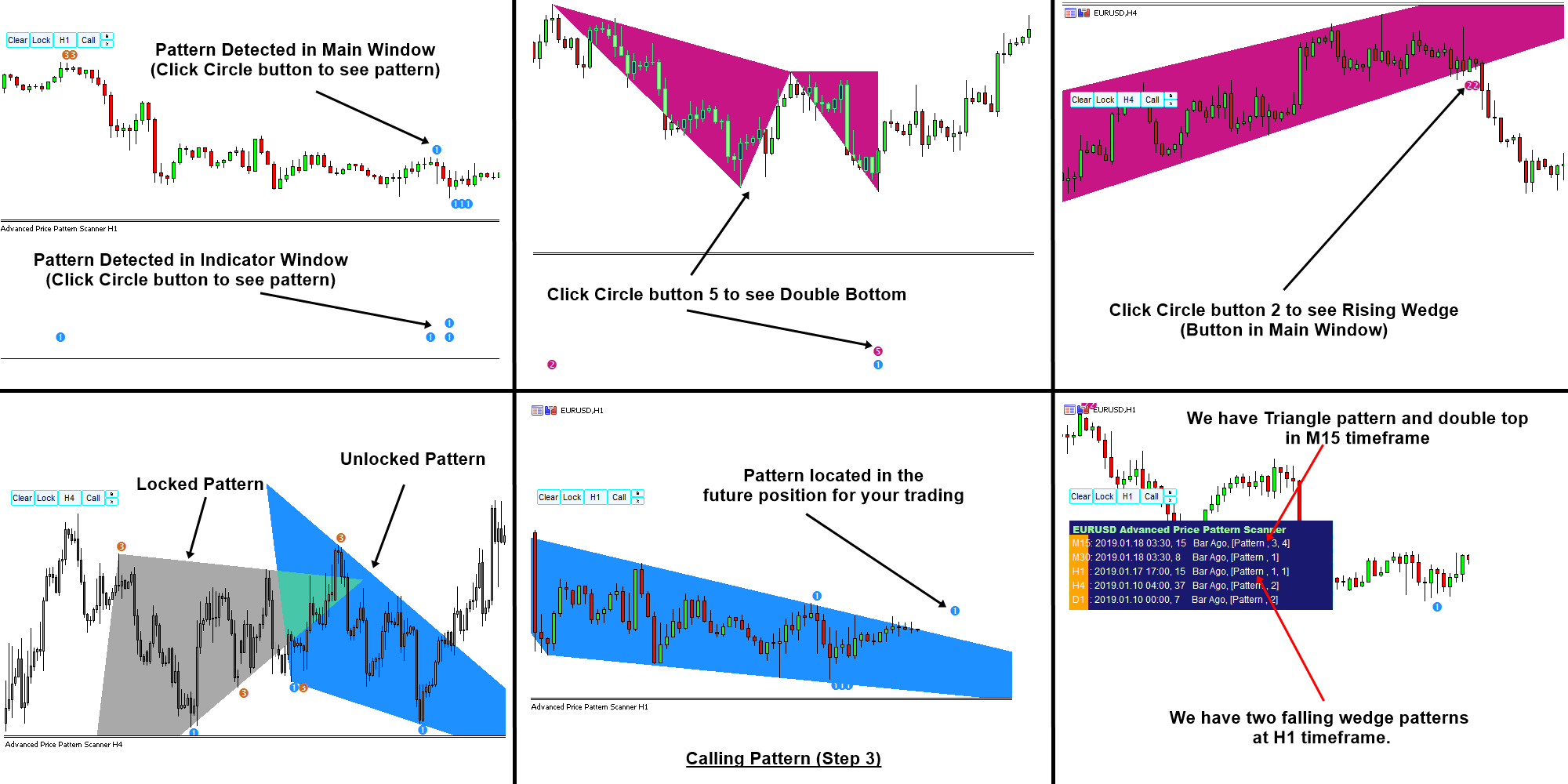

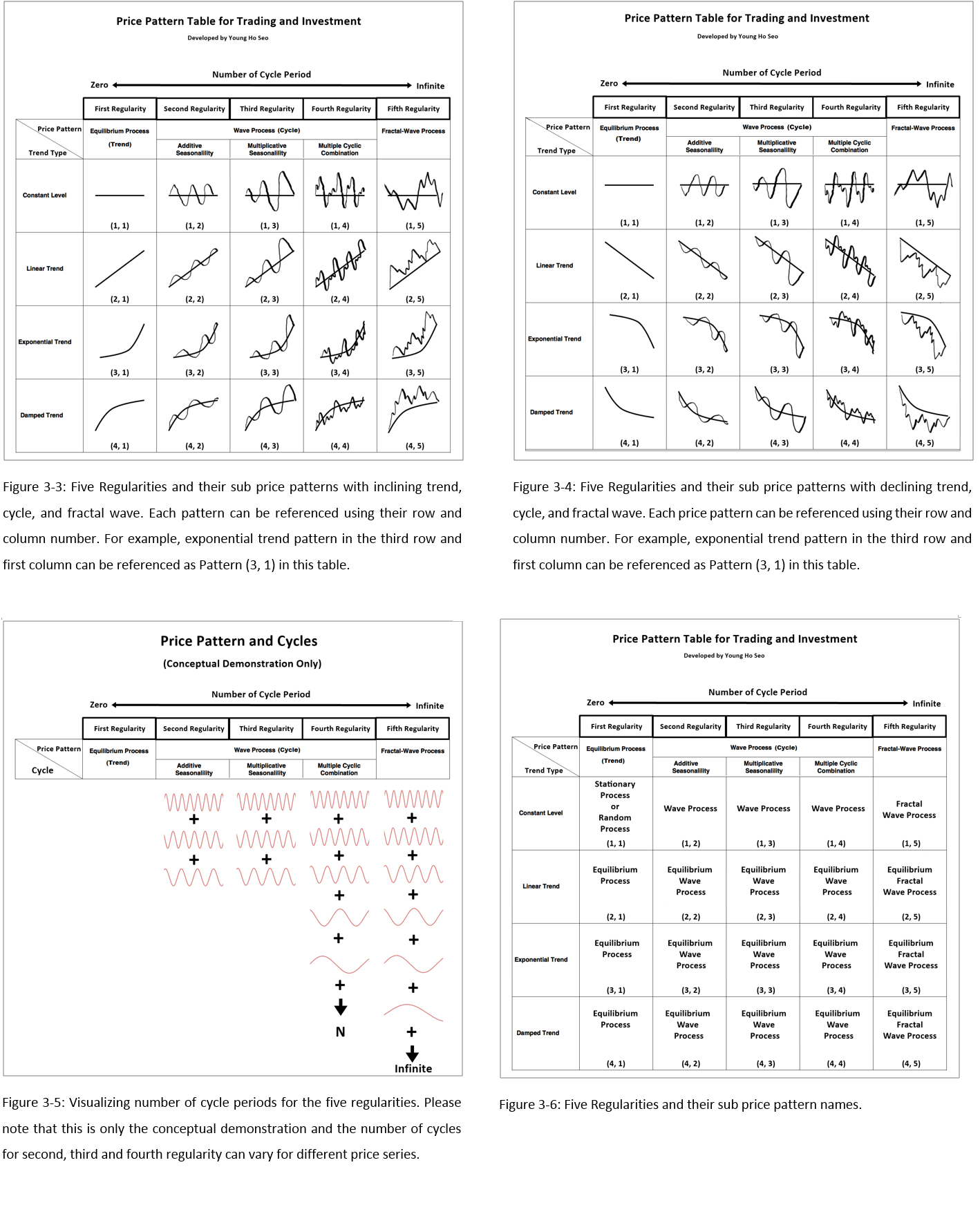

1. Chart Pattern MT

Chart Pattern Scanner for auto detection of Triangle, Rising Wedge, and Falling Wedge Pattern, Double Top and so on for MetaTrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/chart-pattern/

2. Harmonic Pattern Plus

Harmonic Pattern Indicator for Metatrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

3. Harmonic Pattern Scenario Planner

Harmonic Pattern Detection for Metatrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

4. X3 Chart Pattern Scanner

Non Repainting Harmonic Pattern and Elliott Wave Pattern Scanner for Metatrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

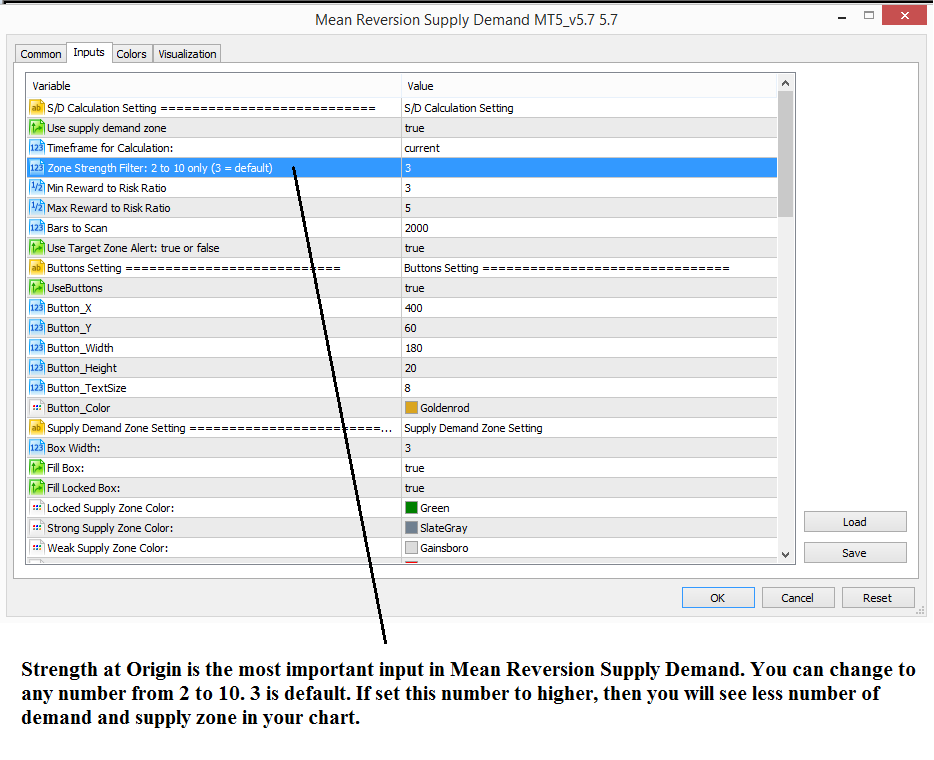

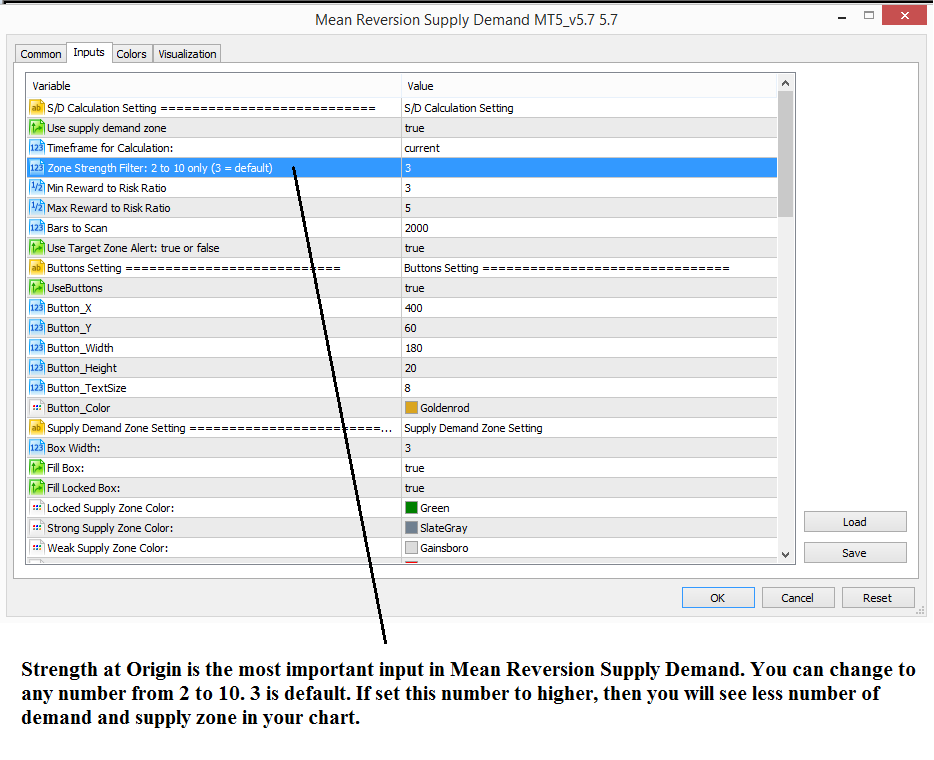

5. Mean Reversion Supply Demand

Supply/Demand Zone indicator to identify market equilibrium and inequilibrium on Metatrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

6. Price Breakout Pattern Scanner

Price Pattern Scanner to detect Triangle, Rising Wedge, and Falling Wedge Pattern, Double Top and so on for MetaTrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

7. Elliott Wave Trend

Elliott Wave Trend is a Elliott Wave indicator designed for turning point and trend analysis with Elliott Wave identification and prediction.

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

8. Excessive Momentum Indicator

Excessive Momentum Indicator is the momentum indicator designed to spot the slowing momentum directly from the chart.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

9. Precision Support Resistance

Precision Support Resistance is the Support and Resistance Indicator for MetaTrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/precision-support-resistance/

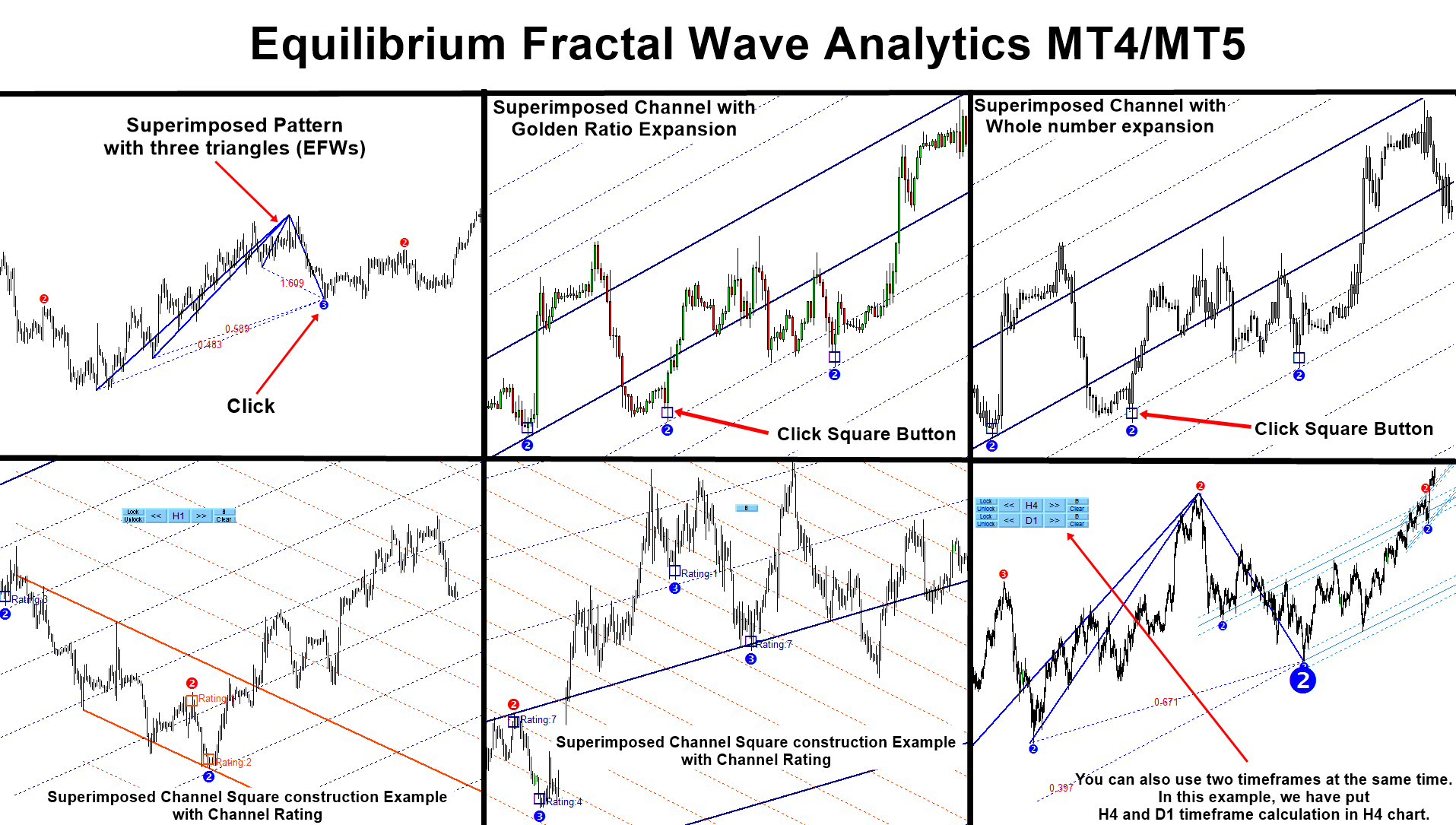

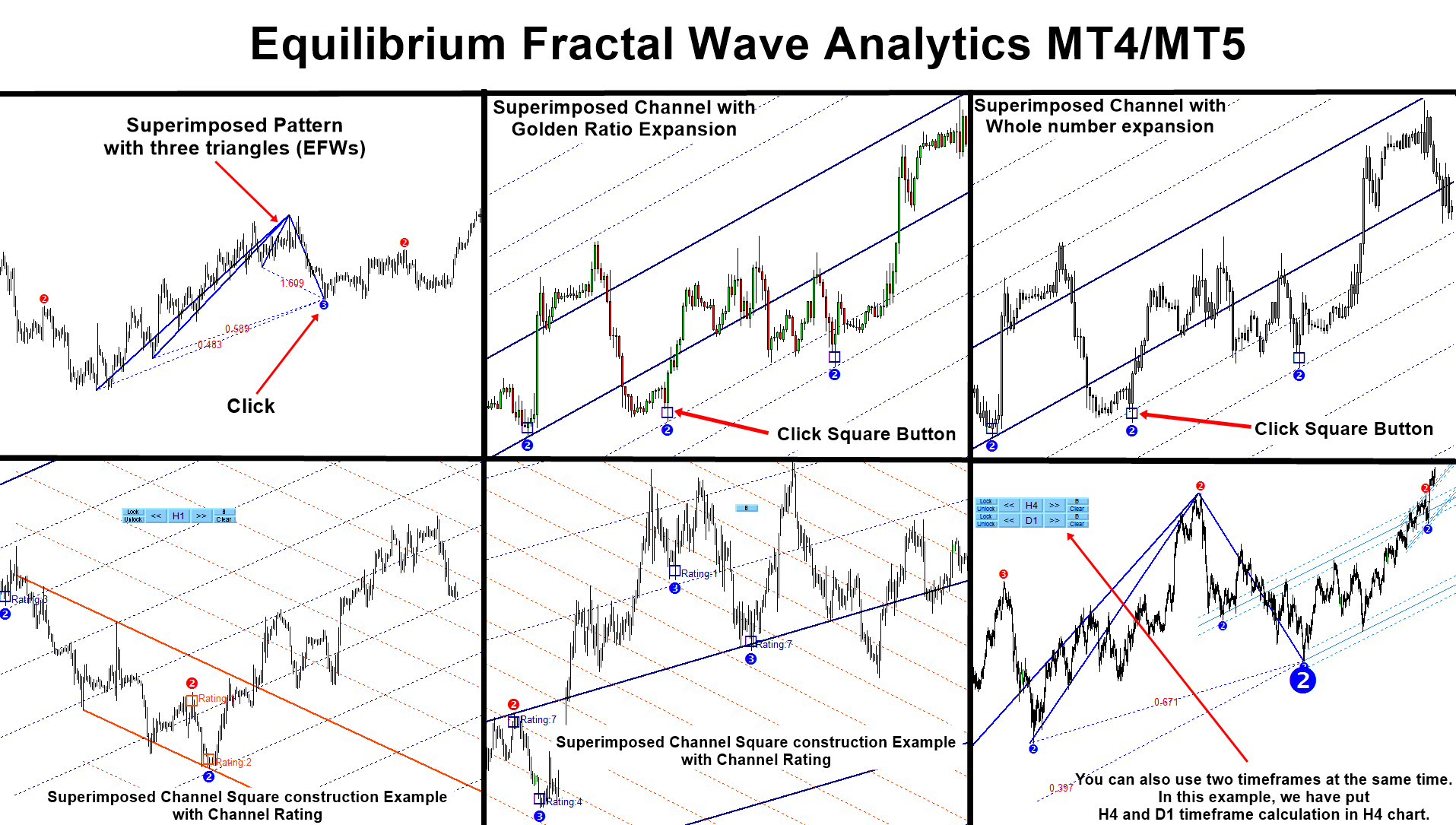

10. Equilibrium Fractal Wave Analytics

Equilibrium Fractal Wave Analytics is the Wave Indicator for MetaTrader (MT4/MT5) and it is based on Fractal Wave theory.

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

11. EFW Pattern Trader

EFW Pattern Trader is a Pattern Trader based on Harmonic Pattern and X3 Chart Pattern for Metatrader (MT4/MT5).

https://algotrading-investment.com/portfolio-item/efw-pattern-trader/

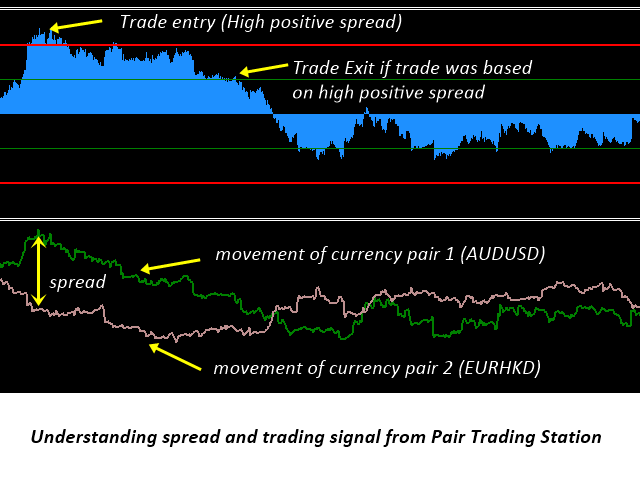

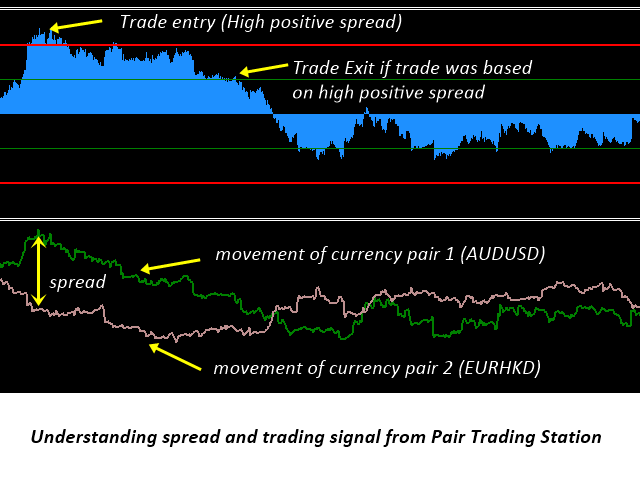

12. Pair Trading Station

Pair Trading Station is the Pairs Trading indicator for MetaTrader (MT4/MT5). It is based on Pairs Trading Strategy.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

13. Turning Point Detector

Turing Point Detector is the Turning Point Indicator for MetaTrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/turning-point-detector/

14. Volume Spread Pattern Indicator

Volume Spread Pattern Indicator is the Wyckoff Method Indicator for MetaTrader (MT4/MT5) with supply and demand logic.

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

15. Harmonic Volatility Indicator

Harmonic Volatility indicator is the Market Volatility indicator on MetaTrader (MT4/MT5) applying Fibonacci Patterns to Volatility.

https://algotrading-investment.com/portfolio-item/harmonic-volatility-indicator/

16. Other Free MetaTrader Indicators

You can also access the free MetaTrader indicators from below links:

https://algotrading-investment.com/product-category/free/

Here is the list of Great MetaTrader Indicators. Each technical indicator is designed to give you higher accuracy and better performance for trading in MetaTrader. The techncial indicators are based on Market Momentum, Harmonic Pattern, Elliott Wave, Chart Pattern, Support Resistance, Wave theory, Wyckoff Method, Pairs Trading and so on. We provide the short description and link to the product page for each MetaTrader indicator. We also include the link to Free MetaTrader indicators on the bottom of this page. Of course, all these MetaTarder Indicator can be found on mql5.com website too as well as our own website.

https://www.mql5.com/en/users/financeengineer/

1. Chart Pattern MT

Chart Pattern Scanner for auto detection of Triangle, Rising Wedge, and Falling Wedge Pattern, Double Top and so on for MetaTrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/chart-pattern/

2. Harmonic Pattern Plus

Harmonic Pattern Indicator for Metatrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

3. Harmonic Pattern Scenario Planner

Harmonic Pattern Detection for Metatrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

4. X3 Chart Pattern Scanner

Non Repainting Harmonic Pattern and Elliott Wave Pattern Scanner for Metatrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

5. Mean Reversion Supply Demand

Supply/Demand Zone indicator to identify market equilibrium and inequilibrium on Metatrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/mean-reversion-supply-demand/

6. Price Breakout Pattern Scanner

Price Pattern Scanner to detect Triangle, Rising Wedge, and Falling Wedge Pattern, Double Top and so on for MetaTrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

7. Elliott Wave Trend

Elliott Wave Trend is a Elliott Wave indicator designed for turning point and trend analysis with Elliott Wave identification and prediction.

https://algotrading-investment.com/portfolio-item/elliott-wave-trend/

8. Excessive Momentum Indicator

Excessive Momentum Indicator is the momentum indicator designed to spot the slowing momentum directly from the chart.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

9. Precision Support Resistance

Precision Support Resistance is the Support and Resistance Indicator for MetaTrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/precision-support-resistance/

10. Equilibrium Fractal Wave Analytics

Equilibrium Fractal Wave Analytics is the Wave Indicator for MetaTrader (MT4/MT5) and it is based on Fractal Wave theory.

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

11. EFW Pattern Trader

EFW Pattern Trader is a Pattern Trader based on Harmonic Pattern and X3 Chart Pattern for Metatrader (MT4/MT5).

https://algotrading-investment.com/portfolio-item/efw-pattern-trader/

12. Pair Trading Station

Pair Trading Station is the Pairs Trading indicator for MetaTrader (MT4/MT5). It is based on Pairs Trading Strategy.

https://algotrading-investment.com/portfolio-item/pair-trading-station/

13. Turning Point Detector

Turing Point Detector is the Turning Point Indicator for MetaTrader (MT4/MT5)

https://algotrading-investment.com/portfolio-item/turning-point-detector/

14. Volume Spread Pattern Indicator

Volume Spread Pattern Indicator is the Wyckoff Method Indicator for MetaTrader (MT4/MT5) with supply and demand logic.

https://algotrading-investment.com/portfolio-item/volume-spread-pattern-indicator/

15. Harmonic Volatility Indicator

Harmonic Volatility indicator is the Market Volatility indicator on MetaTrader (MT4/MT5) applying Fibonacci Patterns to Volatility.

https://algotrading-investment.com/portfolio-item/harmonic-volatility-indicator/

16. Other Free MetaTrader Indicators

You can also access the free MetaTrader indicators from below links:

https://algotrading-investment.com/product-category/free/

Young Ho Seo

Supply Demand Trading with Trendline

Introduction to Supply Demand Trading with Trendline

"Supply Demand Trading with Trendline" was formally known as the "Angled Supply Demand Zone Trading". Supply Demand Trading with Trendline is the advanced support and resistance trading in fact. The concept of "Supply Demand Trading with Trendline" was first developed by Young Ho Seo in 2019. In 2019, this technique was called "Angled Supply Demand Zone Trading". Hence, you can consider the supply demand trading with trendline and angled supply demand trading are identical. The essence of "Supply Demand Trading with Trendline" or "Angled Supply Demand Zone Trading" is to reuse the historical supply demand zones for some ingenious purpose. Please read this free article until to the end to master this trading strategy so that you can bring your trading skills to another level. As we have mentioned often, this trading strategy could be extra skills on top of the classic Supply Demand Trading.

If you are relying on trading income, good trading strategy is your workhorse for every day. Supply and demand zone concept is widely used among traders for several reasons. It is relatively simple to start with. In addition, it is effective in picking up the profitable moment. In fact, Supply and Demand zone is the extended concept from support and resistance at some points. The trading zone concept adds different values to our trading. For example, with zone, it is much easier to define our trading scenario and risk management than just simple price level from support and resistance. However, there is no perfect trading system in the world (i.e. being profitable and perfect is two different things). Of course, supply and demand zone concept has its own weakness too. For example, many traders still find it difficult to find good supply and demand zone to trade. Hence, some trader relies on the supply and demand indicator rather than the manual detection of the zone. Another difficulty is to find some good guide on how to trade with profits. It is difficult to find which online article is the genuine and profitable one.

You can continue to read full article here from the link below. This article will explains everything about "Supply Demand Trading with Trendline". It is free but informative article.

https://algotrading-investment.com/2019/07/04/angled-supply-demand-zone-trading-tutorial-1/

Note about Supply Demand Trading with Trendline

The good news about supply demand trading with trendline is that it does not alter the original concept of supply demand trading. However, it helps you to find more accurate supply and demand zone to trade. You can take the breakout through the angled line as the double confirmation of the direction of your supply and demand trading. Therefore, any supply and demand zone trader can use Angled supply demand trading on top of their typical trading setup. When you draw the angled line or trendline, you might take some guide from GANN’s FAN or GANN’s angle, but this is not compulsory. There are many ways you can draw the trendline using historical supply and demand zone. Please practice as it was shown in this article and then build up the logic and skill gradually.

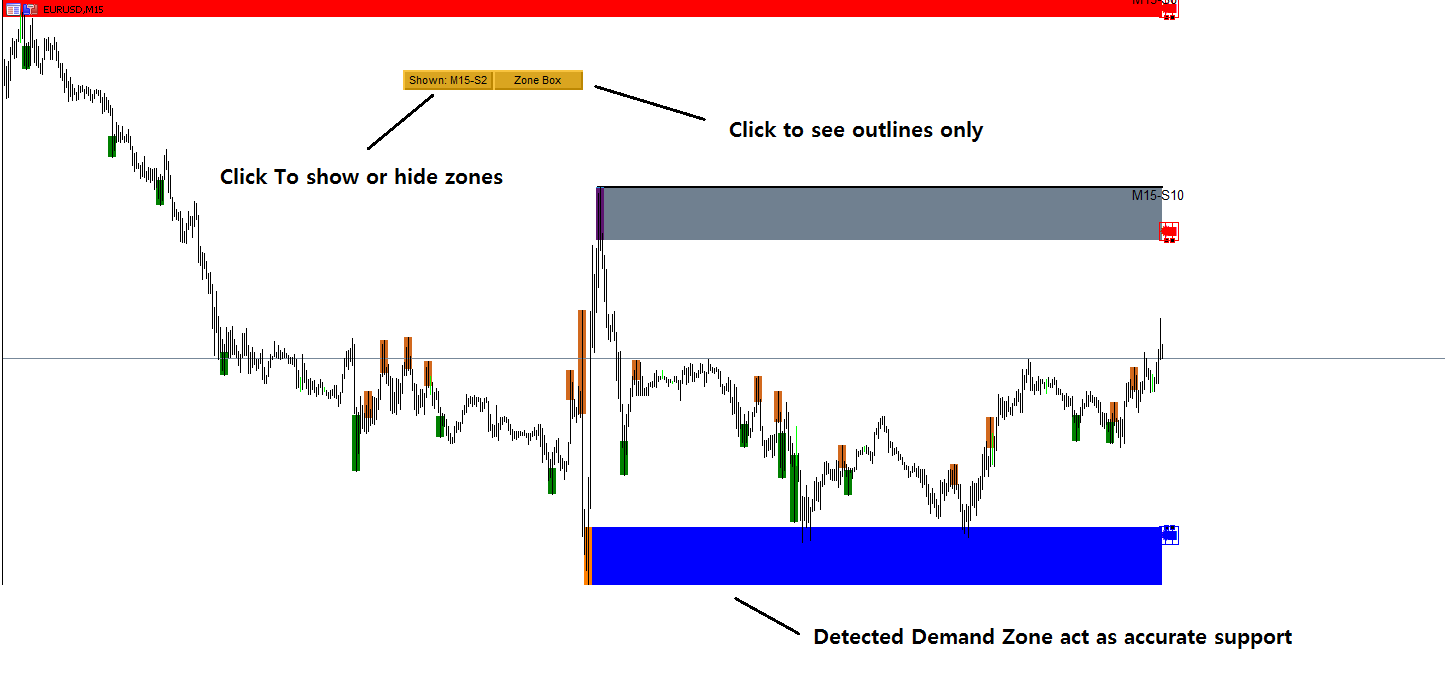

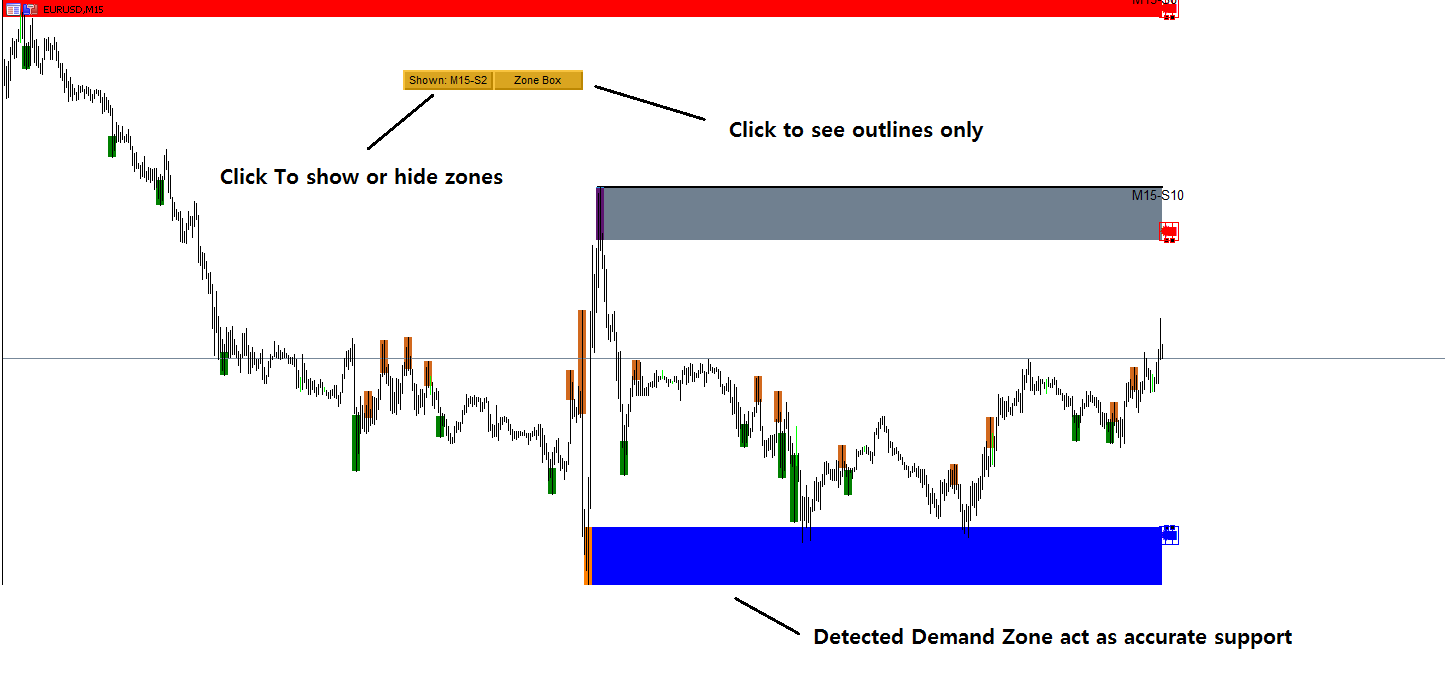

Supply and Demand Indicator

Ace Supply Demand Zone indicator was built upon non-repainting and non-lagging principle. It is multi-purpose Supply Demand Zone indicator for any level of trader. We especially built this Ace Supply Demand Zone indicator to improve the accuracy of supply and demand trading. This supply and deamnd indicator is available through several channels from below links.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Introduction to Supply Demand Trading with Trendline

"Supply Demand Trading with Trendline" was formally known as the "Angled Supply Demand Zone Trading". Supply Demand Trading with Trendline is the advanced support and resistance trading in fact. The concept of "Supply Demand Trading with Trendline" was first developed by Young Ho Seo in 2019. In 2019, this technique was called "Angled Supply Demand Zone Trading". Hence, you can consider the supply demand trading with trendline and angled supply demand trading are identical. The essence of "Supply Demand Trading with Trendline" or "Angled Supply Demand Zone Trading" is to reuse the historical supply demand zones for some ingenious purpose. Please read this free article until to the end to master this trading strategy so that you can bring your trading skills to another level. As we have mentioned often, this trading strategy could be extra skills on top of the classic Supply Demand Trading.

If you are relying on trading income, good trading strategy is your workhorse for every day. Supply and demand zone concept is widely used among traders for several reasons. It is relatively simple to start with. In addition, it is effective in picking up the profitable moment. In fact, Supply and Demand zone is the extended concept from support and resistance at some points. The trading zone concept adds different values to our trading. For example, with zone, it is much easier to define our trading scenario and risk management than just simple price level from support and resistance. However, there is no perfect trading system in the world (i.e. being profitable and perfect is two different things). Of course, supply and demand zone concept has its own weakness too. For example, many traders still find it difficult to find good supply and demand zone to trade. Hence, some trader relies on the supply and demand indicator rather than the manual detection of the zone. Another difficulty is to find some good guide on how to trade with profits. It is difficult to find which online article is the genuine and profitable one.

You can continue to read full article here from the link below. This article will explains everything about "Supply Demand Trading with Trendline". It is free but informative article.

https://algotrading-investment.com/2019/07/04/angled-supply-demand-zone-trading-tutorial-1/

Note about Supply Demand Trading with Trendline

The good news about supply demand trading with trendline is that it does not alter the original concept of supply demand trading. However, it helps you to find more accurate supply and demand zone to trade. You can take the breakout through the angled line as the double confirmation of the direction of your supply and demand trading. Therefore, any supply and demand zone trader can use Angled supply demand trading on top of their typical trading setup. When you draw the angled line or trendline, you might take some guide from GANN’s FAN or GANN’s angle, but this is not compulsory. There are many ways you can draw the trendline using historical supply and demand zone. Please practice as it was shown in this article and then build up the logic and skill gradually.

Supply and Demand Indicator

Ace Supply Demand Zone indicator was built upon non-repainting and non-lagging principle. It is multi-purpose Supply Demand Zone indicator for any level of trader. We especially built this Ace Supply Demand Zone indicator to improve the accuracy of supply and demand trading. This supply and deamnd indicator is available through several channels from below links.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Young Ho Seo

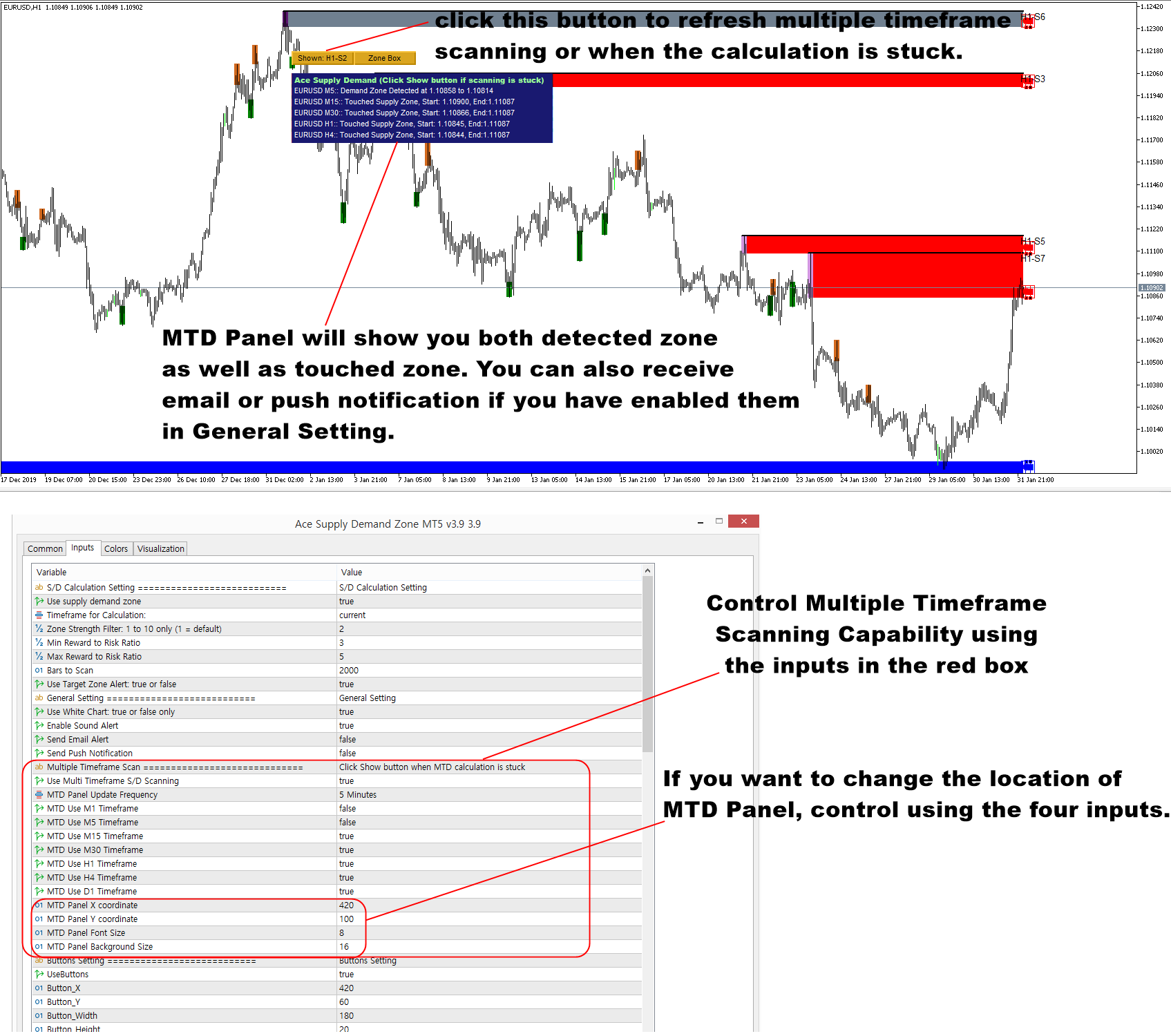

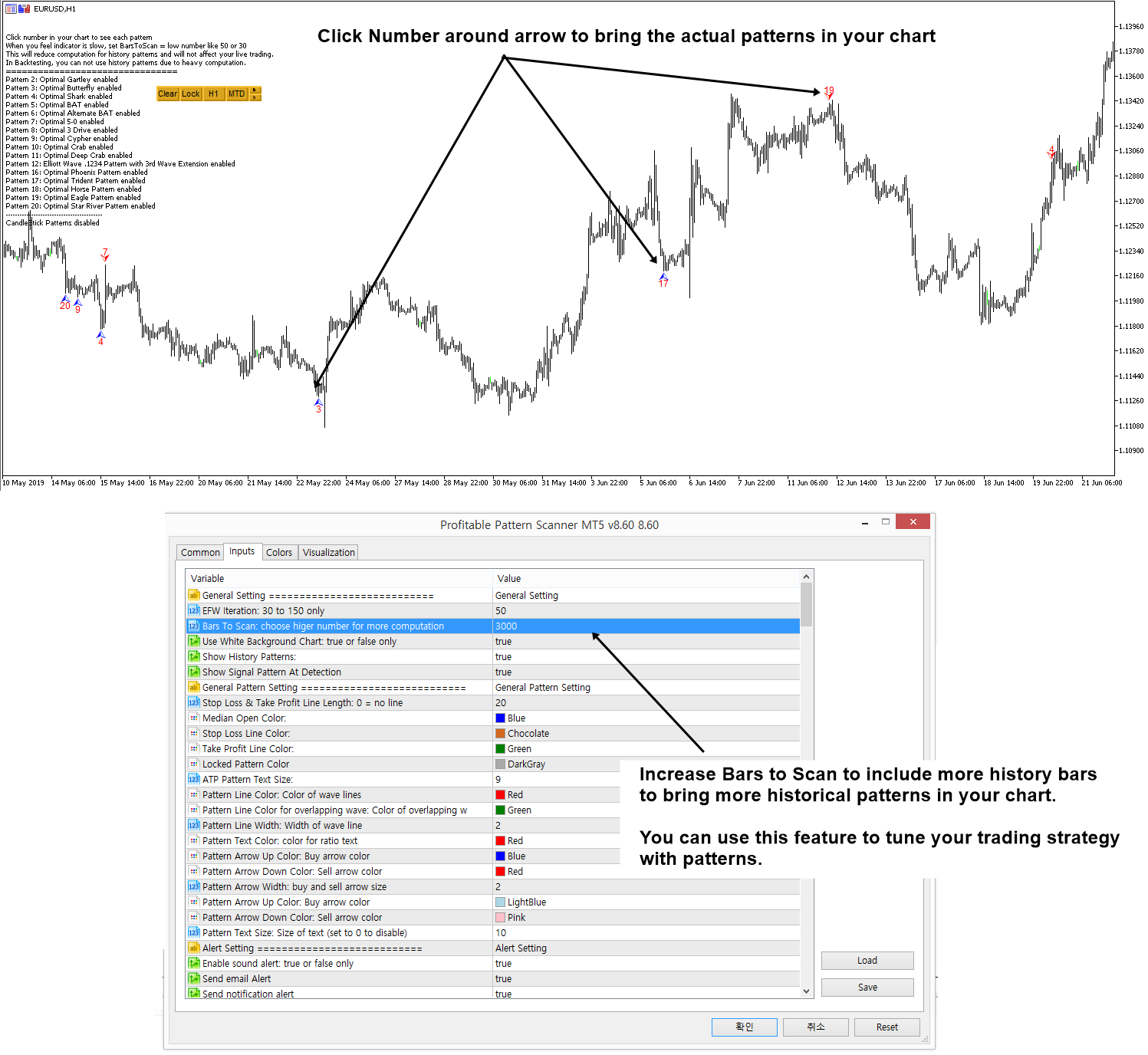

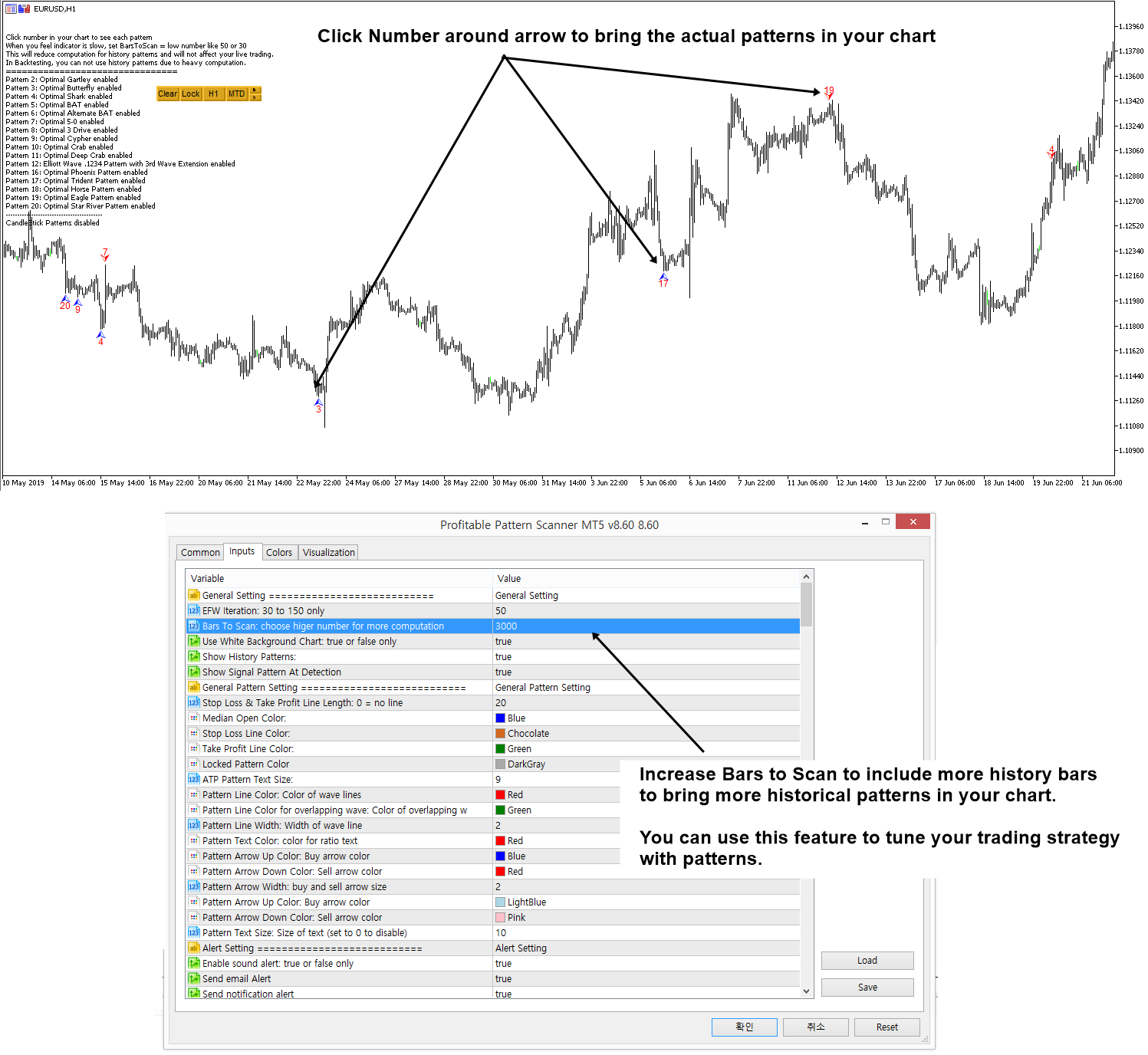

Showing Historical Patterns in X3 Chart Pattern Scanner

In trading, you get your profits as good as your tools and knowledge. X3 Chart Pattern Scanner is the superb Harmonic Pattern and Elliott Wave Pattern Indicator using the next generation pattern detection algorithm (The first Non Repainting + Non Lagging Harmonic pattern indicator.). To understand and to test your strategy, simply increase bars to scan to some higher number like 5000 or 10,000. Initially bars to scan is set to 250 to save some computation but you can increase as many as you can to just check your strategy. Screenshot shows how to do it.

1. Optimize your Strategy per symbol and per timeframe

As you can see, Harmonic Pattern and Elliott Wave pattern will perform differently per symbol and per timeframe. Hence, check history signals per symbol and per timeframe to optimize your strategy per symbol and per timeframe. While you are studying these patterns with Profitable Pattern scanner, you will gain more and more knowledge and skills for your trading.

2. Secondary Confirmation to improve your profits

To improve success rate, make sure that you are studying various indicators and filters together with the historical signal patterns in the scanner as secondary confirmation. In my opinion, you will gain practical knowledge within few weeks whereas other harmonic pattern trader takes typically 1 to 3 years to grab knowledge of harmonic pattern trading (and 2 to 4 years for Elliott wave trading). This is great advantage with this non repainting indicator.

3. Set Bars to Scan input = default in live trading to save computation

Another important note is that make the “Bars to Scan” input to 250 after you have finished your studying with historical signal patterns. If you leave Bars to Scan = 10,000, etc, this would be too heavy for your MetaTrader. For your live trading, set Bars to Scan = 250 or as small as possible. Since live trading results and historical signals are the same, you will not get lost anything even if you set Bars to Scan = 250 or other reasonably small number.

4. Simple and Easy to trade

Beside all this sophisticated technology running before your PC, trading with X3 Chart Pattern Scanner is easy and simple because of its non repainting features. Just study your charts and trade with what you see from your charts.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

In trading, you get your profits as good as your tools and knowledge. X3 Chart Pattern Scanner is the superb Harmonic Pattern and Elliott Wave Pattern Indicator using the next generation pattern detection algorithm (The first Non Repainting + Non Lagging Harmonic pattern indicator.). To understand and to test your strategy, simply increase bars to scan to some higher number like 5000 or 10,000. Initially bars to scan is set to 250 to save some computation but you can increase as many as you can to just check your strategy. Screenshot shows how to do it.

1. Optimize your Strategy per symbol and per timeframe

As you can see, Harmonic Pattern and Elliott Wave pattern will perform differently per symbol and per timeframe. Hence, check history signals per symbol and per timeframe to optimize your strategy per symbol and per timeframe. While you are studying these patterns with Profitable Pattern scanner, you will gain more and more knowledge and skills for your trading.

2. Secondary Confirmation to improve your profits

To improve success rate, make sure that you are studying various indicators and filters together with the historical signal patterns in the scanner as secondary confirmation. In my opinion, you will gain practical knowledge within few weeks whereas other harmonic pattern trader takes typically 1 to 3 years to grab knowledge of harmonic pattern trading (and 2 to 4 years for Elliott wave trading). This is great advantage with this non repainting indicator.

3. Set Bars to Scan input = default in live trading to save computation

Another important note is that make the “Bars to Scan” input to 250 after you have finished your studying with historical signal patterns. If you leave Bars to Scan = 10,000, etc, this would be too heavy for your MetaTrader. For your live trading, set Bars to Scan = 250 or as small as possible. Since live trading results and historical signals are the same, you will not get lost anything even if you set Bars to Scan = 250 or other reasonably small number.

4. Simple and Easy to trade

Beside all this sophisticated technology running before your PC, trading with X3 Chart Pattern Scanner is easy and simple because of its non repainting features. Just study your charts and trade with what you see from your charts.

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

https://www.mql5.com/en/market/product/41992

https://www.mql5.com/en/market/product/41993

Young Ho Seo

Trading Zone Extended From Support Resistance

Trading zone in technical analysis is the extended concept from the horizontal support and resistance. The zone is the great tool to decide your trading entry and exit as well as managing your risk and reward. Especially, when the zone is drawn around the significant peak and trough, the value for the trading zone is precious. When you use Harmonic Pattern or X3 Chart Pattern, the trading zone can be identified using the Pattern Completion Interval. The detailed process is well described in the Book: Guide to Precision Harmonic Pattern Trading (2016). When you use the supply demand analysis, the zone is identified from the base location. Especially, it is even better if the trading zone is non repainting. The non repainting zone become the powerful tool to decide the entry and exit for your trading because they stay in the location always as the reference.

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

The trading zone is useful if your trading strategy is based on predicting the market direction. In such a case, the trading zone can provide a sensible place for stop loss. Then you can scale up your take profit target according to your anticipated location. Even if your trading strategy is not based on predicting market direction, the trading zone is still useful. For example, let’s say that you never want to predict the market, but you want to react the market so that you will trade in the direction in which the price is pushed by crowd like support and resistance style. In this case, the trading zone acts like the horizontal support resistance. But the managing your reward and risk is much easier than other mean of support and resistance.

I used the word minimum stop loss instead of the stop loss because sometimes, you might need to make your stop loss slightly bigger than the actual zone. The margin for the stop loss will be depending on your reward to risk ratio. How this reward to risk system works is well described in the latest book: Technical Analysis in Forex and Stock Market (2021).

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

For your information, we also provide the MetaTrader 4 and MetaTrader 5 indicators that provide the non repainting trading zone. You can have a look at these automated scanner, which you can trade with the direction prediction strategy as well as the react to market strategy.

Here is the link to Ace Supply Demand Zone Indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Here is the link to X3 Chart Pattern Scanner for MetaTrader 4/ MetaTrader 5.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Trading zone in technical analysis is the extended concept from the horizontal support and resistance. The zone is the great tool to decide your trading entry and exit as well as managing your risk and reward. Especially, when the zone is drawn around the significant peak and trough, the value for the trading zone is precious. When you use Harmonic Pattern or X3 Chart Pattern, the trading zone can be identified using the Pattern Completion Interval. The detailed process is well described in the Book: Guide to Precision Harmonic Pattern Trading (2016). When you use the supply demand analysis, the zone is identified from the base location. Especially, it is even better if the trading zone is non repainting. The non repainting zone become the powerful tool to decide the entry and exit for your trading because they stay in the location always as the reference.

https://play.google.com/store/books/details?id=8SbMDwAAQBAJ

The trading zone is useful if your trading strategy is based on predicting the market direction. In such a case, the trading zone can provide a sensible place for stop loss. Then you can scale up your take profit target according to your anticipated location. Even if your trading strategy is not based on predicting market direction, the trading zone is still useful. For example, let’s say that you never want to predict the market, but you want to react the market so that you will trade in the direction in which the price is pushed by crowd like support and resistance style. In this case, the trading zone acts like the horizontal support resistance. But the managing your reward and risk is much easier than other mean of support and resistance.

I used the word minimum stop loss instead of the stop loss because sometimes, you might need to make your stop loss slightly bigger than the actual zone. The margin for the stop loss will be depending on your reward to risk ratio. How this reward to risk system works is well described in the latest book: Technical Analysis in Forex and Stock Market (2021).

https://play.google.com/store/books/details?id=pHlMEAAAQBAJ

For your information, we also provide the MetaTrader 4 and MetaTrader 5 indicators that provide the non repainting trading zone. You can have a look at these automated scanner, which you can trade with the direction prediction strategy as well as the react to market strategy.

Here is the link to Ace Supply Demand Zone Indicator for MetaTrader 4/MetaTrader 5.

https://www.mql5.com/en/market/product/40076

https://www.mql5.com/en/market/product/40075

https://algotrading-investment.com/portfolio-item/ace-supply-demand-zone/

Here is the link to X3 Chart Pattern Scanner for MetaTrader 4/ MetaTrader 5.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

Generating Income with Chart Patterns

Profitable Chart Patterns include Fibonacci Price Patterns, Harmonic Patterns, Elliott Wave, X3 Chart Patterns as well as many other tradable patterns.

Chart Patterns are the good buy and sell signal generator for trading. It provides you the early signal at the turning point. Unlike other technical indicator, you are not lagging with these patterns. Hence you can always move ahead of other trader.

In addition, it is useful because it is extremely easy to combine with other analysis technique in your trading decision. In this short book, we provide the details of these chart patterns in Forex market with some practical tutorials.

In this book below, we explain how to make the best use of Chart Patterns for your trading. What is even better, we have included the bonus chapter of support and resistance.

Website links: https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

Below is the Harmonic pattern, Elliott Wave patterns and X3 pattern detection tools developed for MetaTrader, the most popular Forex Trading platform.

1. Harmonic Pattern Plus

One of the first automated Harmonic Pattern detection tool released in 2014. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Because of affordable price, this harmonic pattern detection indicator is loved by many traders.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

2. Harmonic Pattern Scenario planner

It is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation. This is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Because of affordable price, this harmonic pattern detection indicator is loved by many traders.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

3. X3 Chart Pattern Scanner

X3 Chart Pattern is our next generation Chart Pattern Scanner. This is non-repainting and non-lagging Harmonic Pattern Indicator. On top of that, this tool can detect Elliott Wave Pattern and X3 Chart Patterns. It can detect over 20 Chart Patterns. The bonus is that you can also detect around 52 Japanese candlestick patterns.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Profitable Chart Patterns include Fibonacci Price Patterns, Harmonic Patterns, Elliott Wave, X3 Chart Patterns as well as many other tradable patterns.

Chart Patterns are the good buy and sell signal generator for trading. It provides you the early signal at the turning point. Unlike other technical indicator, you are not lagging with these patterns. Hence you can always move ahead of other trader.

In addition, it is useful because it is extremely easy to combine with other analysis technique in your trading decision. In this short book, we provide the details of these chart patterns in Forex market with some practical tutorials.

In this book below, we explain how to make the best use of Chart Patterns for your trading. What is even better, we have included the bonus chapter of support and resistance.

Website links: https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

Below is the Harmonic pattern, Elliott Wave patterns and X3 pattern detection tools developed for MetaTrader, the most popular Forex Trading platform.

1. Harmonic Pattern Plus

One of the first automated Harmonic Pattern detection tool released in 2014. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Because of affordable price, this harmonic pattern detection indicator is loved by many traders.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

2. Harmonic Pattern Scenario planner

It is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation. This is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Because of affordable price, this harmonic pattern detection indicator is loved by many traders.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

3. X3 Chart Pattern Scanner

X3 Chart Pattern is our next generation Chart Pattern Scanner. This is non-repainting and non-lagging Harmonic Pattern Indicator. On top of that, this tool can detect Elliott Wave Pattern and X3 Chart Patterns. It can detect over 20 Chart Patterns. The bonus is that you can also detect around 52 Japanese candlestick patterns.

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

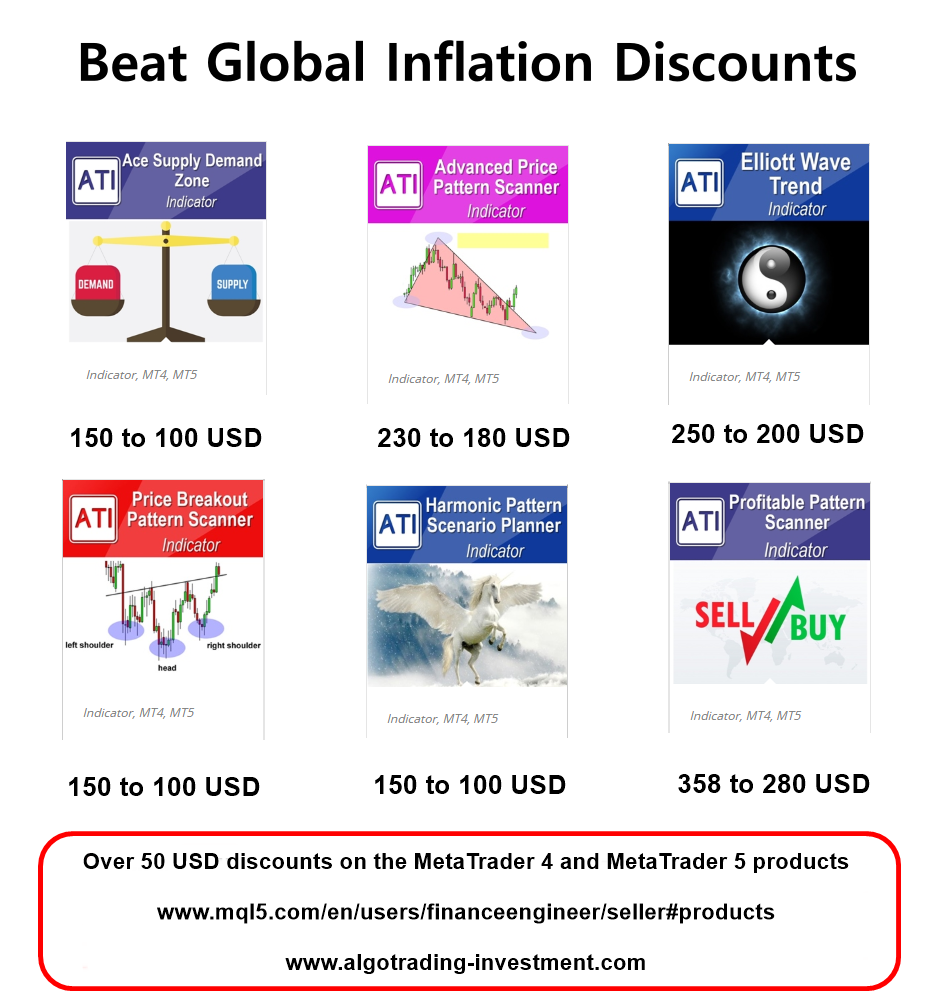

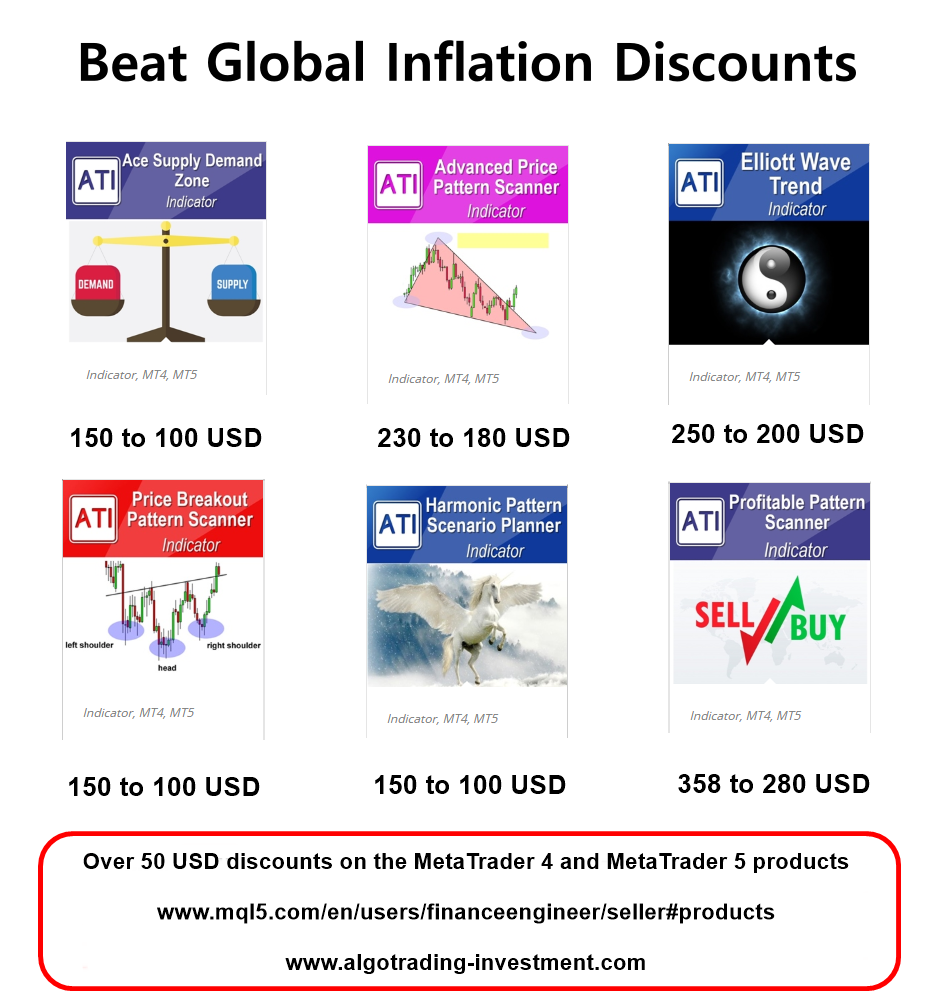

Beat Inflation Together Discounts for MetaTrader Indicator

Global Inflation, what now? We thought that we will enjoy some recovery from the COVID 19 crisis. However, soon there comes a serious economy crysis from the rising inflation. This affect the global economy increasing the uncertainity, inflation, and interest rate. This is not nice. Everything on the street are getting more and more expensive including energy, food, cloth, house and so on. We really deserve some good time after the two years of suffering from the Covid 19.

We know this global inflation affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products. So we provide special discounts for 12 MetaTrader products all together.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

On top of the special discounts for MetaTrader 4 and MetaTrader 5 products, we have another gift for you. We are selling all our Books in special discount price. All our books are currently selling in just 3 dollar at the discount. The original price was 9.99 dollar for each book. Hence, you save 6 dollar per a book. We will keep this discounted price for these books until this campaign lasts. Get them now when they are cheap. Get the good self education towards the day trading and technical analysis to achieve financial freedom.

Below we provide the title of the books at the discounted price.

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

Below we provide the link of the Books at the discounted price.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

Global Inflation, what now? We thought that we will enjoy some recovery from the COVID 19 crisis. However, soon there comes a serious economy crysis from the rising inflation. This affect the global economy increasing the uncertainity, inflation, and interest rate. This is not nice. Everything on the street are getting more and more expensive including energy, food, cloth, house and so on. We really deserve some good time after the two years of suffering from the Covid 19.

We know this global inflation affect the whole world. Hence, we provide 50 USD discounts on the six MetaTrader 4 and six MetaTrader 5 products. So we provide special discounts for 12 MetaTrader products all together.

Discounted price is shown in the screenshot for the following six products.

Ace Supply Demand Zone indicator

Advanced Price Pattern Scanner

Elliott Wave Trend

Price Breakout Pattern Scanner

Harmonic Pattern Scenario Planner

X3 Chart Pattern Scanner (=Profitable Pattern Scanner)

This discounted price is only available when you buy these products from mql5.com

The price will go back to the original price when the discounts ends. Please take the discounted price now while it last only.

https://www.mql5.com/en/users/financeengineer/seller#products

https://www.algotrading-investment.com/

On top of the special discounts for MetaTrader 4 and MetaTrader 5 products, we have another gift for you. We are selling all our Books in special discount price. All our books are currently selling in just 3 dollar at the discount. The original price was 9.99 dollar for each book. Hence, you save 6 dollar per a book. We will keep this discounted price for these books until this campaign lasts. Get them now when they are cheap. Get the good self education towards the day trading and technical analysis to achieve financial freedom.

Below we provide the title of the books at the discounted price.

Science Of Support, Resistance, Fibonacci Analysis, Harmonic Pattern, Elliott Wave and X3 Chart Pattern (In Forex and Stock Market Trading)

Profitable Chart Patterns in Forex and Stock Market (Fibonacci Analysis, Harmonic Pattern, Elliott Wave, and X3 Chart Pattern)

Guide to Precision Harmonic Pattern Trading (Mastering Turning Point Strategy for Financial Trading)

Scientific Guide to Price Action and Pattern Trading (Wisdom of Trend, Cycle, and Fractal Wave)

Predicting Forex and Stock Market with Fractal Pattern: Science of Price and Time

Technical Analysis in Forex and Stock Market (Supply Demand Analysis and Support Resistance)

Below we provide the link of the Books at the discounted price.

https://algotrading-investment.com/portfolio-item/science-of-support-resistance-fibonacci-analysis-harmonic-pattern/

https://algotrading-investment.com/portfolio-item/profitable-chart-patterns-in-forex-and-stock-market/

https://algotrading-investment.com/portfolio-item/guide-precision-harmonic-pattern-trading/

https://algotrading-investment.com/portfolio-item/scientific-guide-to-price-action-and-pattern-trading/

https://algotrading-investment.com/portfolio-item/predicting-forex-and-stock-market-with-fractal-pattern/

https://algotrading-investment.com/portfolio-item/technical-analysis-in-forex-and-stock-market/

Young Ho Seo

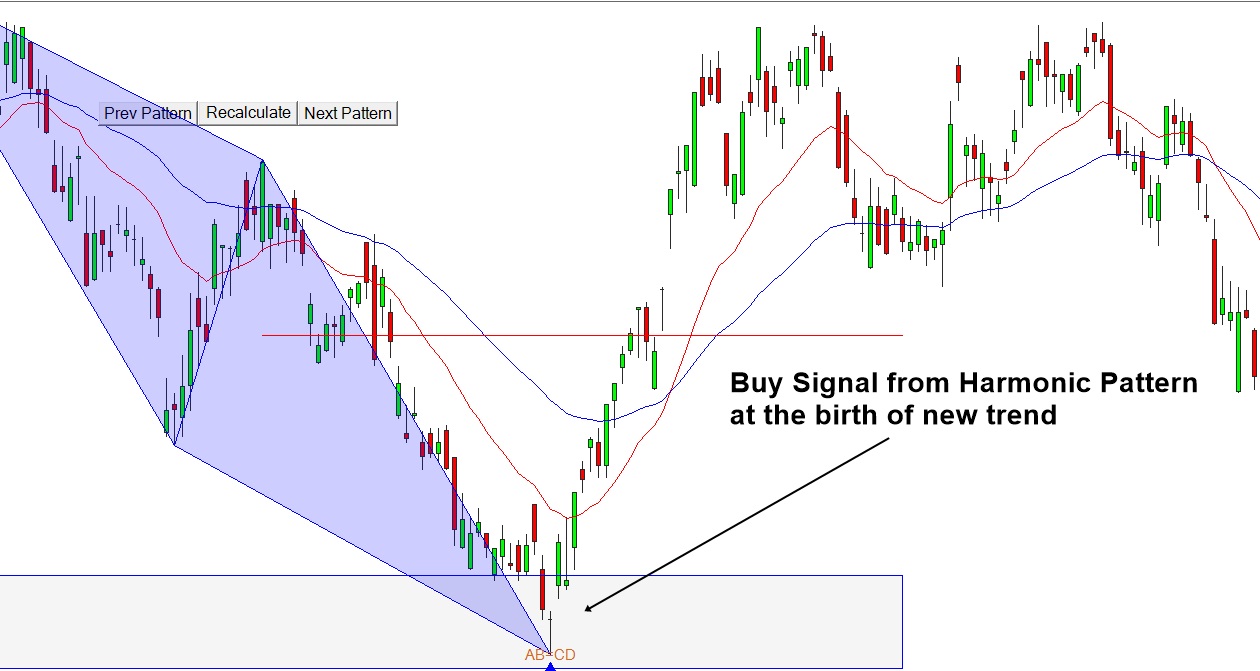

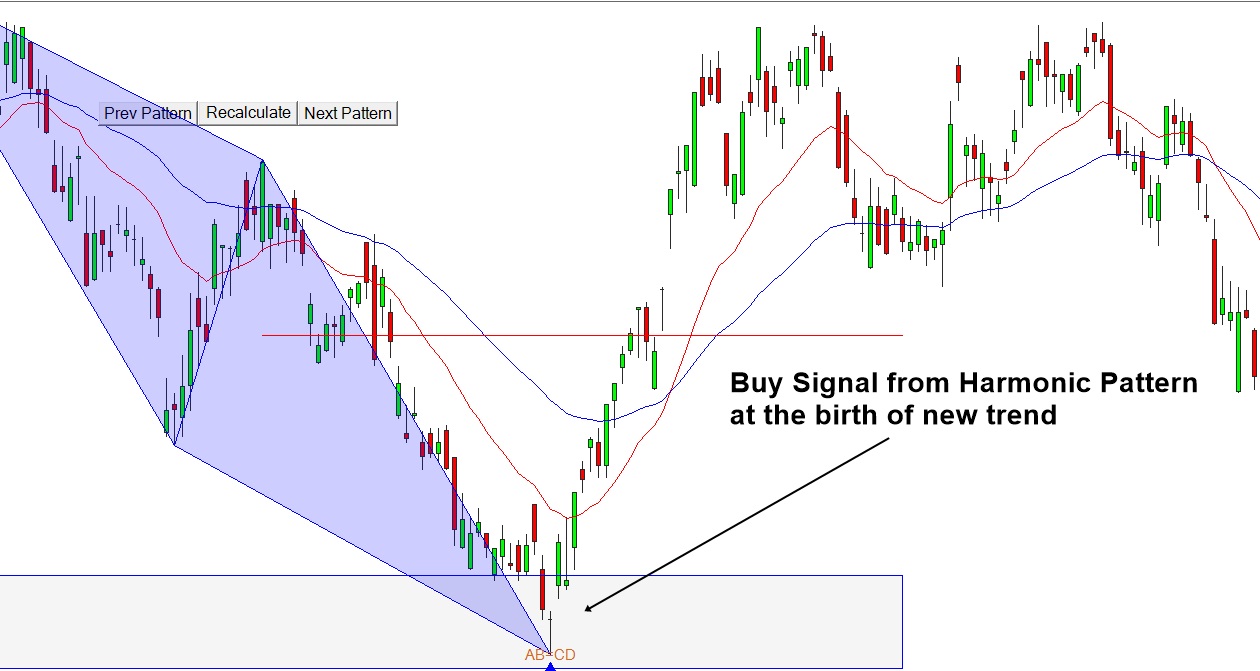

Harmonic Pattern – Turning Point and Trend

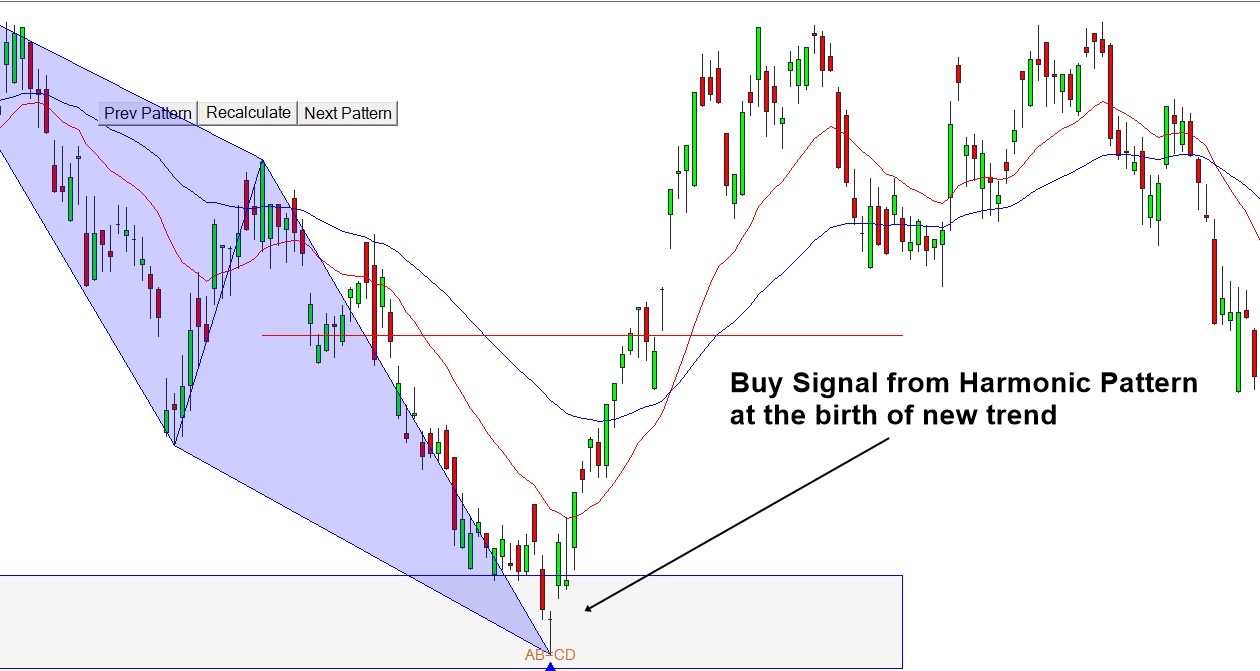

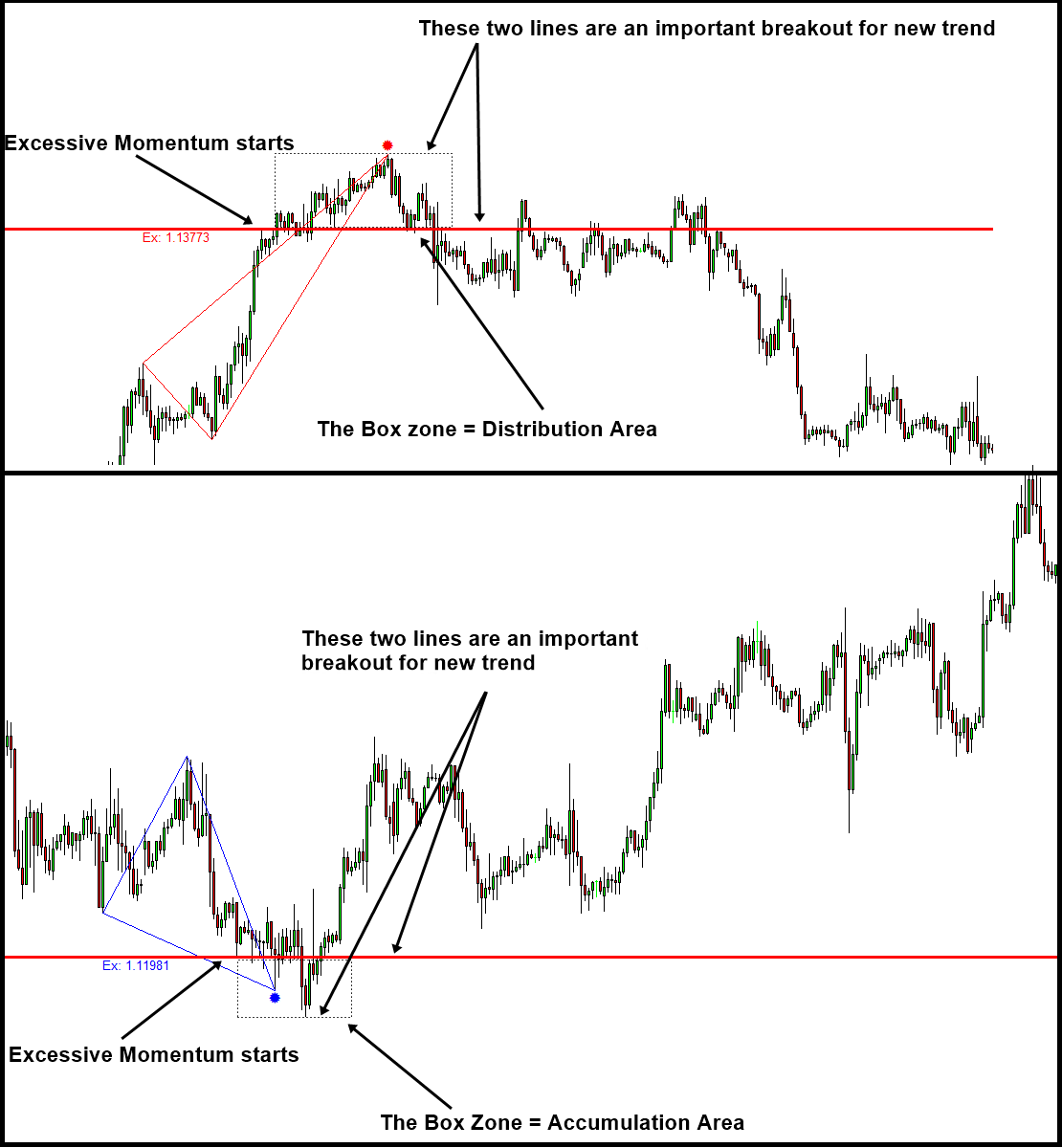

This article “Turning Point and Trend” tries to answer you on when to use Harmonic Pattern Trading in terms of the four market cycle including Birth, Growth, Maturity and Death. If you want to become profitable trader, then you need to decide when your capital to dive into the market. The best way is doing it with the market rhythm, i.e. the market cycle. This article will provide you the clear answer on how to tune your entry with the market. This is the first step for any trader in choosing their strategy in fact. You would also revise the pros and cons of the turning point strategy, semi turning point strategy and trend strategy.

https://algotrading-investment.com/2019/07/06/turning-point-and-trend/

Below are the list of automated Harmonic pattern Indicator developed for MetaTrader 4 and MetaTrader 5 platform.

Harmonic Pattern Plus

One of the first automated Harmonic Pattern detection tool released in 2014. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario planner

It is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation. This is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

Both Harmonic pattern plus and Harmonic Pattern Scenario planner are the excellent trading system at affordable cost. However, if you do not like repainting Harmonic pattern indicator, then we also provide the non repainting and non lagging harmonic pattern trading. Just check the X3 Chart Pattern Scanner below.

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

This article “Turning Point and Trend” tries to answer you on when to use Harmonic Pattern Trading in terms of the four market cycle including Birth, Growth, Maturity and Death. If you want to become profitable trader, then you need to decide when your capital to dive into the market. The best way is doing it with the market rhythm, i.e. the market cycle. This article will provide you the clear answer on how to tune your entry with the market. This is the first step for any trader in choosing their strategy in fact. You would also revise the pros and cons of the turning point strategy, semi turning point strategy and trend strategy.

https://algotrading-investment.com/2019/07/06/turning-point-and-trend/

Below are the list of automated Harmonic pattern Indicator developed for MetaTrader 4 and MetaTrader 5 platform.

Harmonic Pattern Plus

One of the first automated Harmonic Pattern detection tool released in 2014. It can detect 11 most popular harmonic patterns with well-defined trading entries and stops. Pattern Completion Interval, Potential Reversal Zone and Potential Continuation Zone are supported. In addition, other dozens of powerful features are added like Japanese candlestick detection, etc. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario planner

It is an advanced Harmonic Pattern indicator. On top of the features of Harmonic Pattern Plus, you can also predict future harmonic patterns through simulation. This is the tactical harmonic pattern tool designed for Professional harmonic pattern trader. Because of affordable price, this harmonic pattern detection indicator is loved by many traders. Please note that this is repainting and non lagging harmonic pattern trading system.

https://www.mql5.com/en/market/product/6240

https://www.mql5.com/en/market/product/6101

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

Both Harmonic pattern plus and Harmonic Pattern Scenario planner are the excellent trading system at affordable cost. However, if you do not like repainting Harmonic pattern indicator, then we also provide the non repainting and non lagging harmonic pattern trading. Just check the X3 Chart Pattern Scanner below.

Link to X3 Chart Pattern Scanner

https://www.mql5.com/en/market/product/41993

https://www.mql5.com/en/market/product/41992

https://algotrading-investment.com/portfolio-item/profitable-pattern-scanner/

Young Ho Seo

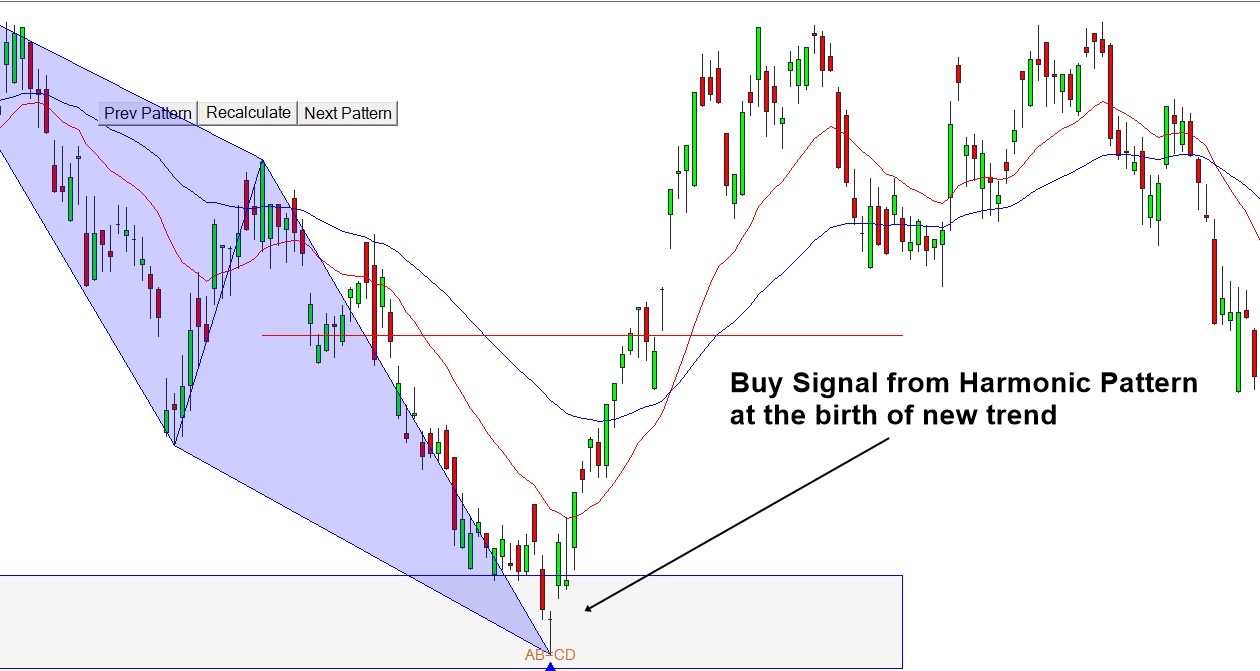

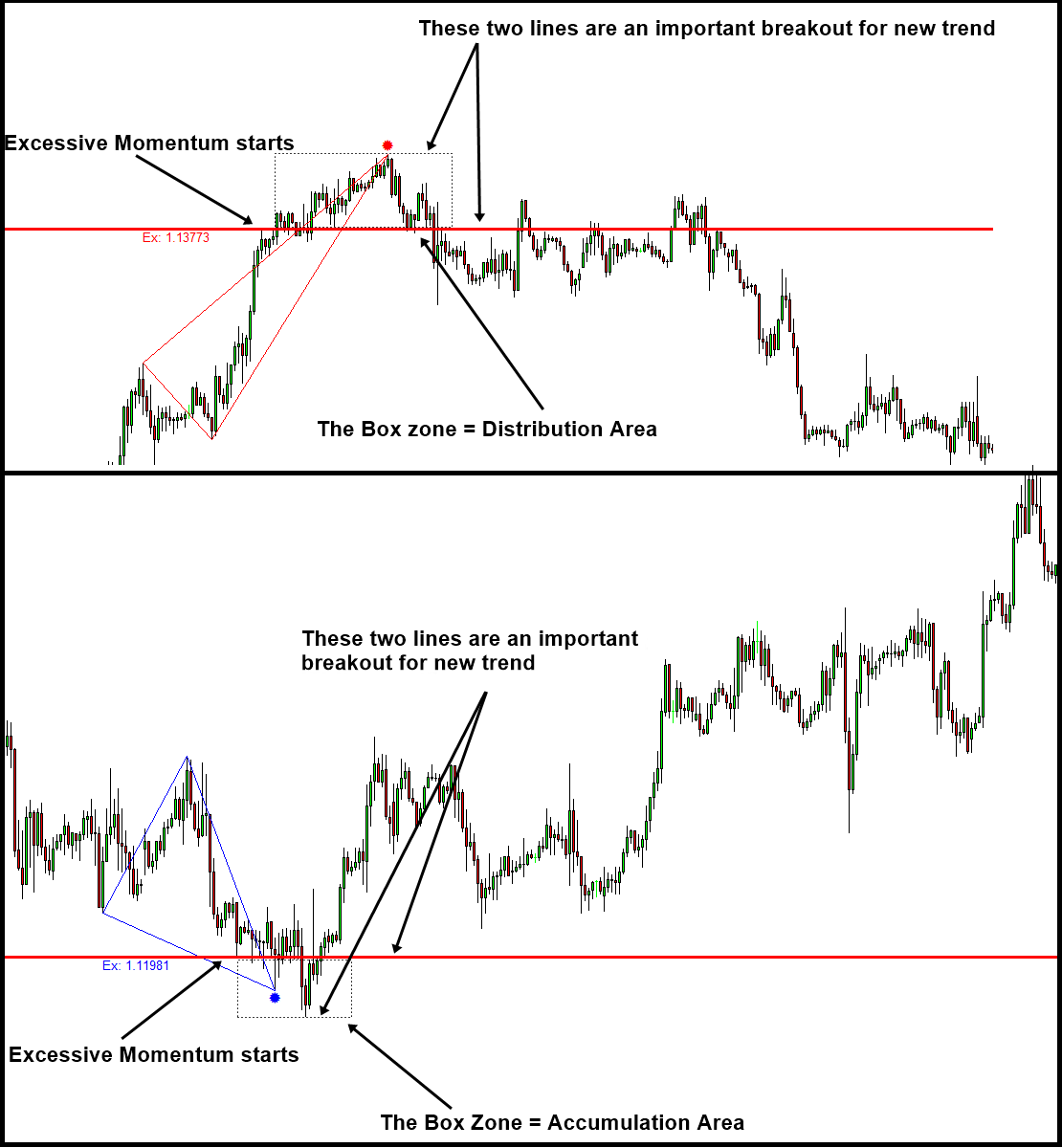

Winning Trading Logic – Detecting Supply and Demand Unbalance

As we have pointed out in our article, detecting the supply and demand unbalance is the most important key in making profits in Financial market. The excessive momentum indicator is the automated tool to detect these unbalance in supply and demand for your trading. With excessive momentum drawn in your chart, it is much easier to predict the timing of new trend and its direction.

Here is the insightful article explaining where the profits comes and how the profits are captured with the knowledge of excessive momentum. If you really want to make money in the market, must read this article. Reading does not cost you anything.

https://algotrading-investment.com/2018/10/29/introduction-to-excessive-momentum-trading/

This Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version). You can watch the YouTube videos to find more about the Excessive Momentum Indicator.

YouTube Video Momentum Indicator: https://youtu.be/oztARcXsAVA

Here is link to Excessive Momentum Indicator available on MetaTrader 4 and MetaTrader 5 platform.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

As we have pointed out in our article, detecting the supply and demand unbalance is the most important key in making profits in Financial market. The excessive momentum indicator is the automated tool to detect these unbalance in supply and demand for your trading. With excessive momentum drawn in your chart, it is much easier to predict the timing of new trend and its direction.

Here is the insightful article explaining where the profits comes and how the profits are captured with the knowledge of excessive momentum. If you really want to make money in the market, must read this article. Reading does not cost you anything.

https://algotrading-investment.com/2018/10/29/introduction-to-excessive-momentum-trading/

This Excessive Momentum Zone can be considered as either Accumulation or Distribution area in the Volume Spread Analysis. You can further find the symptoms of accumulation and distribution area using our Volume Spread Pattern Indicator (Paid and Advanced version) or Volume Spread Pattern Detector (Free and Light version). You can watch the YouTube videos to find more about the Excessive Momentum Indicator.

YouTube Video Momentum Indicator: https://youtu.be/oztARcXsAVA

Here is link to Excessive Momentum Indicator available on MetaTrader 4 and MetaTrader 5 platform.

https://algotrading-investment.com/portfolio-item/excessive-momentum-indicator/

https://www.mql5.com/en/market/product/30641

https://www.mql5.com/en/market/product/30621

Young Ho Seo

Introduction to Equilibrium Fractal Wave Analytics

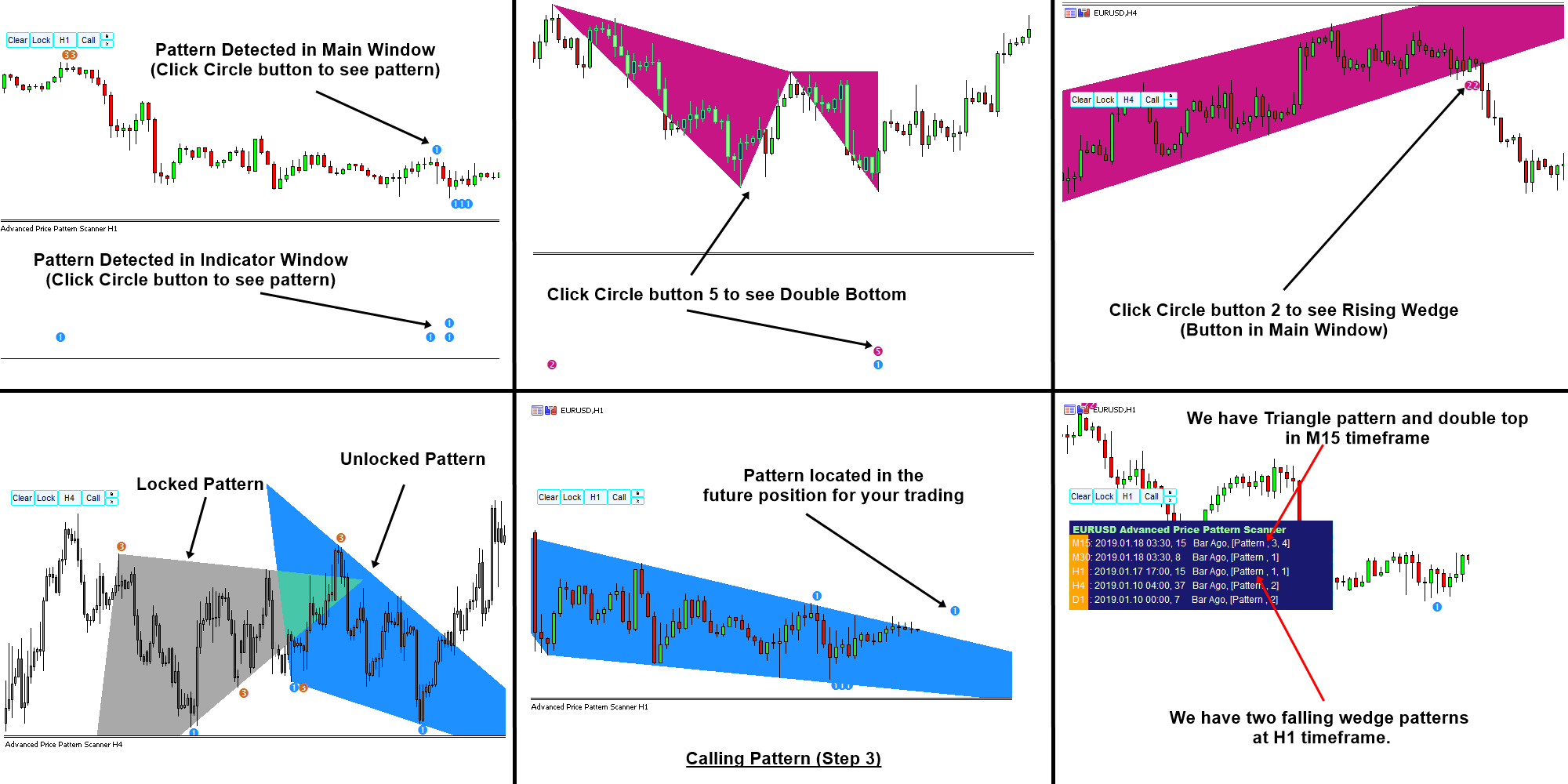

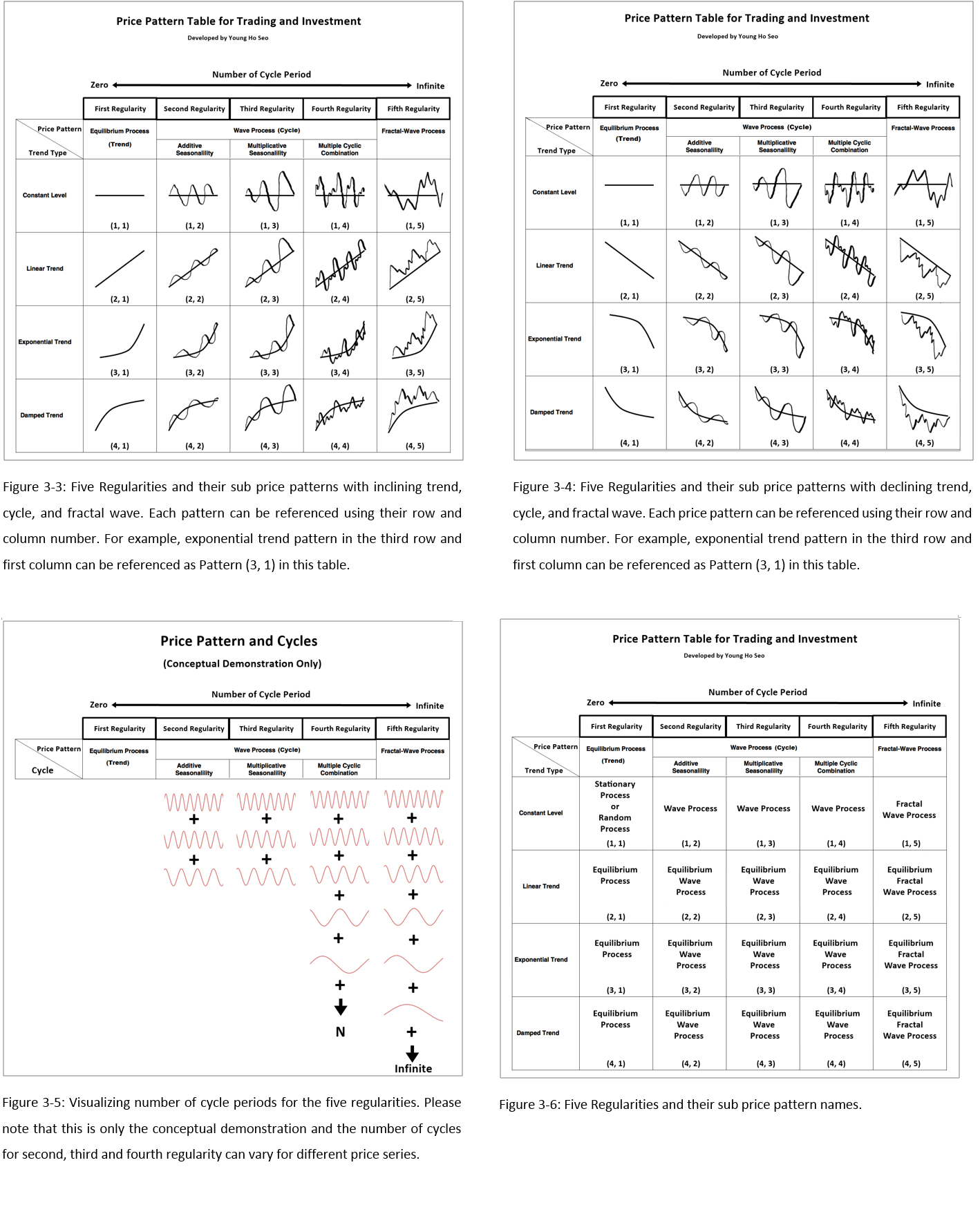

EFW Analytics was designed to accomplish the statement “We trade because there are regularities in the financial market”. EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts including:

1. Equilibrium Fractal Wave Index: exploratory tool to support your trading logic to choose which ratio to trade

2. Superimposed Pattern Detection as turning point analysis

3. Superimposed Channel for market prediction with Golden ratio expansion

4. Superimposed Channel for market prediction with whole number expansion

5. Equilibrium Fractal Wave (EFW) Channel detection

6. Superimposed Channel Rating (Higher rating = higher predictive power)

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

EFW Analytics was designed to accomplish the statement “We trade because there are regularities in the financial market”. EFW Analytics is a set of tools designed to maximize your trading performance by capturing the repeating fractal geometry, known as the fifth regularity in the financial market. The functionality of EFW Analytics consists of three parts including:

1. Equilibrium Fractal Wave Index: exploratory tool to support your trading logic to choose which ratio to trade

2. Superimposed Pattern Detection as turning point analysis

3. Superimposed Channel for market prediction with Golden ratio expansion

4. Superimposed Channel for market prediction with whole number expansion

5. Equilibrium Fractal Wave (EFW) Channel detection

6. Superimposed Channel Rating (Higher rating = higher predictive power)

EFW Analytics provide the graphic rich and fully visual trading styles. In default trading strategy, you will be looking at the combined signal from Superimposed pattern + EFW Channel or Superimposed pattern + Superimposed Channel. In addition, you can perform many more trading strategies in a reversal and breakout mode. You can also run two different timeframes in one chart to enforce your trading decision. Sound alert, email and push notification are built inside the indicator.

Below is the link to the EFW Analytics:

https://algotrading-investment.com/portfolio-item/equilibrium-fractal-wave-analytics/

https://www.mql5.com/en/market/product/27703

https://www.mql5.com/en/market/product/27702

Young Ho Seo

Japanese CandleStick Pattern with Price Pattern

Japanese candlestick pattern and price patterns like Triangle pattern, Falling Wedge, Rising Wedge, Double Top and Head and Shoulder patterns are often used to make buy and sell trading decision in Forex and Stock market. Have you ever thought using these two excellent patterns together for your trading ? Inside Price Breakout Pattern Scanner, you can access to the price patterns like Triangle, Falling Wedge, Rising Wedge, Double Top and Head and Shoulder patterns. At the same time, Japanese candle stick patterns are also built inside Price Breakout Pattern Scanner. This Japanese candlestick patterns are the kind of bonus feature for the trader who are using Price Breakout Pattern Scanner.

So what Japanese candlestick patterns can be detected with Price Breakout Pattern Scanner ? Including Doji Star, Hammer, Englufing, etc, you can asscess around 52 Japanese candlestick patterns. In Japanese candlestick inputs, you can switch on and off Candlestick pattern according to their type. For example, there are Japanese candlestick pattern made up from one candle bar, two candle bar, three candle bar, etc. You can switch on and off each according to your preference.

As a default setting, Pattern Name will be printed in chart. At the same time, you can bring your mouse over to each Japanese candlestick pattern to float pattern name in tool tip box (MT5 is more responsive than MT4 for this tool tip box) Alternatively, you can also change the angle of pattern name from horizontal to vertical or vice versa depending on your readability. In addition, we provide the YouTube Video for Price Breakout Pattern Scanner. With the video, you can see some basic operation of the price breakout pattern scanner. This video is applicable to both MetaTrader 4 and MetaTrader 5 platforms.

YouTube Video “How To Use Price Breakout Pattern Scanner”: https://www.youtube.com/watch?v=aKeSmi_Di2s

Here is the link to the Price Breakout Pattern Scanner.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Japanese candlestick pattern and price patterns like Triangle pattern, Falling Wedge, Rising Wedge, Double Top and Head and Shoulder patterns are often used to make buy and sell trading decision in Forex and Stock market. Have you ever thought using these two excellent patterns together for your trading ? Inside Price Breakout Pattern Scanner, you can access to the price patterns like Triangle, Falling Wedge, Rising Wedge, Double Top and Head and Shoulder patterns. At the same time, Japanese candle stick patterns are also built inside Price Breakout Pattern Scanner. This Japanese candlestick patterns are the kind of bonus feature for the trader who are using Price Breakout Pattern Scanner.

So what Japanese candlestick patterns can be detected with Price Breakout Pattern Scanner ? Including Doji Star, Hammer, Englufing, etc, you can asscess around 52 Japanese candlestick patterns. In Japanese candlestick inputs, you can switch on and off Candlestick pattern according to their type. For example, there are Japanese candlestick pattern made up from one candle bar, two candle bar, three candle bar, etc. You can switch on and off each according to your preference.

As a default setting, Pattern Name will be printed in chart. At the same time, you can bring your mouse over to each Japanese candlestick pattern to float pattern name in tool tip box (MT5 is more responsive than MT4 for this tool tip box) Alternatively, you can also change the angle of pattern name from horizontal to vertical or vice versa depending on your readability. In addition, we provide the YouTube Video for Price Breakout Pattern Scanner. With the video, you can see some basic operation of the price breakout pattern scanner. This video is applicable to both MetaTrader 4 and MetaTrader 5 platforms.

YouTube Video “How To Use Price Breakout Pattern Scanner”: https://www.youtube.com/watch?v=aKeSmi_Di2s

Here is the link to the Price Breakout Pattern Scanner.

https://www.mql5.com/en/market/product/4859

https://www.mql5.com/en/market/product/4858

https://algotrading-investment.com/portfolio-item/price-breakout-pattern-scanner/

Young Ho Seo

Turning Point and Trend

If you want to become the profitable trader, the first thing you need to understand is turning point and trend in the financial market. If you read many trading articles and books, you will find the diverse opinion over turning point and trend. Many people view turning point and trend as two separate subjects. However, it might be better to understand turning point and trend as two parts inside one body. Let us try to understand the trend. To do so, let us take human as an analogical example. We are born, we grow up, we become mature, and then we die. During this process, we can observe that there are four main stages. These four stages are universal across many creatures and objects observable in the earth.

Birth – Growth – Maturity – Death

Trend also goes through these four stages. Let us take an example in the financial market. For example, if we hear that Apple has some temporary problem in their smartphone supply line, this could stir up the Samsung’s Stock price because the demand for Samsung’s smart phone will be increased. Once this news is spread on the financial market, the upward trend will be born for Samsung’s stock price. At the beginning, this news could be known by few people. Later, more and more people could hear this news. Hence, Samsung’s stock price can build up upward momentum. However, this momentum will not last forever. Once people start to recognize that price rallied too high and some people start taking the profit by selling the stocks, the upward momentum can slow down. Especially, if we hear that Apple recovered the temporary problem in their smartphone supply line, the trend could die completely. As shown in this example, Birth, Growth, Maturity, and Death are the life cycle of trend.

Now let us revisit the definition of turning point and trend. Turning point is the beginning of new trend after the old trend died off. Hence, turning point strategy refers to the strategy that tries to pick up this new trend as early as possible. This sometimes involves picking up the turning point at the birth stage of the trend. In financial trading, trend strategy typically refers to the strategy that tries to pick up established trend during the growth stage. Most of trend strategy is in fact momentum strategy. When the growth of trend is strong, many technical indicators are designed to react on this strong growth. For example, if you trade on the buy signal when 20 moving average line crosses over the 50 moving average line, you do need strong upwards movement to lift the 20 moving average line over the 50 moving average line.

In contrast to this, in turning point strategy like Fibonacci price patterns, Harmonic patterns and Elliott wave patterns, we are looking for the newly born trend instead of the trend in growth stage. Hence, the main difference in turning point and trend strategy is when to enter during the life cycle of trend. Typically, we are seeking to enter near the birth of trend in the turning point strategy. In trend strategy, we are seeking to enter at the growth strategy of trend.

You can read full article here. This article explains everything about Turning Point and Trend.

https://algotrading-investment.com/2019/07/06/turning-point-and-trend/

YouTube Video About Turning Point and Trend

YouTube Link: https://youtu.be/mtqmOiN13lk

In addition, we will introduce two Harmonic Pattern Indicator including Harmonic Pattern Plus and Harmonic Pattern Scenario planner. These Harmonic Pattern Indicator is repainting. However, they provide tons of powerful features at affordable price. Hence, if you do not mind the repainting Harmonic Pattern Indicator, then you can use these two tools. In addition, you can use X3 Chart Pattern Scanner together with Harmonic Pattern Plus or Harmonic Pattern Scenario Planner.

Harmonic Pattern Plus (Type 1)

Harmonic pattern plus is extremely good product for the price. With dozens of powerful features including Pattern Completion Interval, Potential Reversal Zone, Potential Continuation Zone, Automatic Stop loss and take profit sizing.

Below are the Links to Harmonic Pattern Plus

https://www.mql5.com/en/market/product/4488

https://www.mql5.com/en/market/product/4475

https://algotrading-investment.com/portfolio-item/harmonic-pattern-plus/

Harmonic Pattern Scenario Planner (Type 1 + Predictive feature)

With additional features of predicting future harmonic patterns, this is very tactical harmonic pattern indicator with advanced simulation capability on top of the powerful features of harmonic pattern plus.

Below are the Links to Harmonic Pattern Scenario Planner

https://www.mql5.com/en/market/product/6101

https://www.mql5.com/en/market/product/6240

https://algotrading-investment.com/portfolio-item/harmonic-pattern-scenario-planner/

If you want to become the profitable trader, the first thing you need to understand is turning point and trend in the financial market. If you read many trading articles and books, you will find the diverse opinion over turning point and trend. Many people view turning point and trend as two separate subjects. However, it might be better to understand turning point and trend as two parts inside one body. Let us try to understand the trend. To do so, let us take human as an analogical example. We are born, we grow up, we become mature, and then we die. During this process, we can observe that there are four main stages. These four stages are universal across many creatures and objects observable in the earth.

Birth – Growth – Maturity – Death

Trend also goes through these four stages. Let us take an example in the financial market. For example, if we hear that Apple has some temporary problem in their smartphone supply line, this could stir up the Samsung’s Stock price because the demand for Samsung’s smart phone will be increased. Once this news is spread on the financial market, the upward trend will be born for Samsung’s stock price. At the beginning, this news could be known by few people. Later, more and more people could hear this news. Hence, Samsung’s stock price can build up upward momentum. However, this momentum will not last forever. Once people start to recognize that price rallied too high and some people start taking the profit by selling the stocks, the upward momentum can slow down. Especially, if we hear that Apple recovered the temporary problem in their smartphone supply line, the trend could die completely. As shown in this example, Birth, Growth, Maturity, and Death are the life cycle of trend.

Now let us revisit the definition of turning point and trend. Turning point is the beginning of new trend after the old trend died off. Hence, turning point strategy refers to the strategy that tries to pick up this new trend as early as possible. This sometimes involves picking up the turning point at the birth stage of the trend. In financial trading, trend strategy typically refers to the strategy that tries to pick up established trend during the growth stage. Most of trend strategy is in fact momentum strategy. When the growth of trend is strong, many technical indicators are designed to react on this strong growth. For example, if you trade on the buy signal when 20 moving average line crosses over the 50 moving average line, you do need strong upwards movement to lift the 20 moving average line over the 50 moving average line.

In contrast to this, in turning point strategy like Fibonacci price patterns, Harmonic patterns and Elliott wave patterns, we are looking for the newly born trend instead of the trend in growth stage. Hence, the main difference in turning point and trend strategy is when to enter during the life cycle of trend. Typically, we are seeking to enter near the birth of trend in the turning point strategy. In trend strategy, we are seeking to enter at the growth strategy of trend.

You can read full article here. This article explains everything about Turning Point and Trend.

https://algotrading-investment.com/2019/07/06/turning-point-and-trend/

YouTube Video About Turning Point and Trend

YouTube Link: https://youtu.be/mtqmOiN13lk

In addition, we will introduce two Harmonic Pattern Indicator including Harmonic Pattern Plus and Harmonic Pattern Scenario planner. These Harmonic Pattern Indicator is repainting. However, they provide tons of powerful features at affordable price. Hence, if you do not mind the repainting Harmonic Pattern Indicator, then you can use these two tools. In addition, you can use X3 Chart Pattern Scanner together with Harmonic Pattern Plus or Harmonic Pattern Scenario Planner.

Harmonic Pattern Plus (Type 1)